Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - ARO Liquidation, Inc. | ex99_3.htm |

| EX-99.1 - EXHIBIT 99.1 - ARO Liquidation, Inc. | ex99_1.htm |

| 8-K - AEROPOSTALE, INC. 8-K 12-17-2016 - ARO Liquidation, Inc. | form8k.htm |

Exhibit 99.2

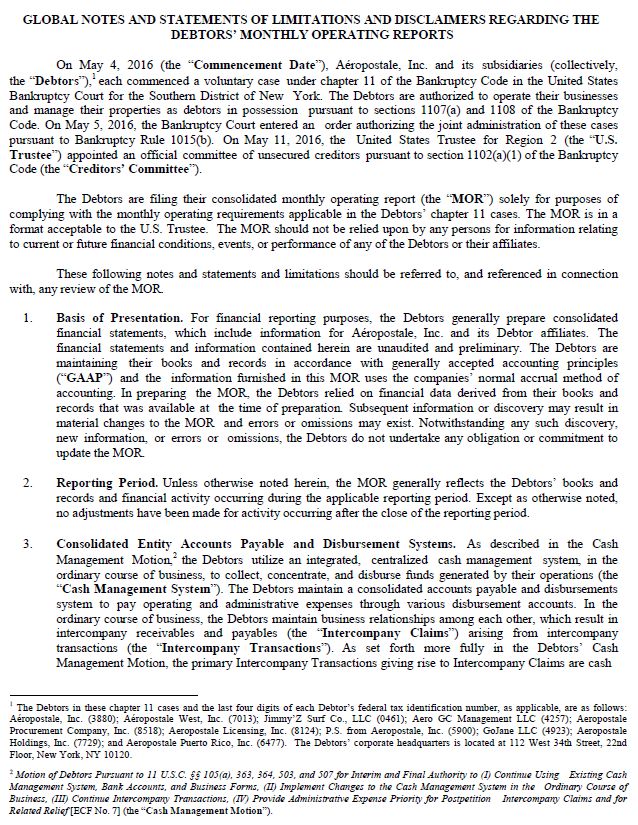

GLOBAL NOTES AND STATEMENTS OF LIMITATIONS AND DISCLAIMERS REGARDING THE DEBTORS’ MONTHLY OPERATING REPORTS On May 4, 2016 (the “Commencement Date”), Aéropostale, Inc. and its subsidiaries (collectively,the “Debtors”),1 each commenced a voluntary case under chapter 11 of the Bankruptcy Code in the United StatesBankruptcy Court for the Southern District of New York. The Debtors are authorized to operate their businessesand manage their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the BankruptcyCode. On May 5, 2016, the Bankruptcy Court entered an order authorizing the joint administration of these casespursuant to Bankruptcy Rule 1015(b). On May 11, 2016, the United States Trustee for Region2 (the “U.S.Trustee”) appointed an official committee of unsecured creditors pursuant to section 1102(a)(1) of the BankruptcyCode (the “Creditors’ Committee”). The Debtors are filing their consolidated monthly operating report (the “MOR”) solely for purposes ofcomplying with the monthly operating requirements applicable in the Debtors’ chapter 11 cases. The MOR is in aformat acceptable to the U.S. Trustee. The MOR should not be relied upon by any persons for information relatingto current or future financial conditions, events, or performance of any of the Debtors or their affiliates. These following notes and statements and limitations should be referred to, and referenced in connectionwith, any review of the MOR. 1. Basis of Presentation. For financial reporting purposes, the Debtors generally prepare consolidated financial statements, which include information for Aéropostale, Inc. and its Debtor affiliates. Thefinancial statements and information contained herein are unaudited and preliminary. The Debtors aremaintaining their books and records in accordance with generally accepted accounting principles(“GAAP”) and the information furnished in this MOR uses the companies’ normal accrual method ofaccounting. In preparing the MOR, the Debtors relied on financial data derived from their books andrecords that was available at the time of preparation. Subsequent information or discovery may result inmaterial changes to the MOR and errors or omissions may exist. Notwithstanding any such discovery,new information, or errors or omissions, the Debtors do not undertake any obligation or commitment toupdate the MOR. 2. Reporting Period. Unless otherwise noted herein, the MOR generally reflects the Debtors’ books and records and financial activity occurring during the applicable reporting period. Except as otherwise noted,no adjustments have been made for activity occurring after the close of the reporting period. 3. Consolidated Entity Accounts Payable and Disbursement Systems. As described in the Cash Management Motion,2 the Debtors utilize an integrated, centralized cash management system, in theordinary course of business, to collect, concentrate, and disburse funds generated by their operations (the“Cash Management System”). The Debtors maintain a consolidated accounts payable and disbursementssystem to pay operating and administrative expenses through various disbursement accounts. In theordinary course of business, the Debtors maintain business relationships among each other, which result in intercompany receivables and payables (the “Intercompany Claims”) arising from intercompany transactions (the “Intercompany Transactions”). As set forth more fully in the Debtors’ Cash Management Motion, the primary Intercompany Transactions giving rise to Intercompany Claims are cash 1 The Debtors in these chapter 11 cases and the last four digits of each Debtor’s federal tax identification number, as applicable, are as follows:Aéropostale, Inc. (3880); Aéropostale West, Inc. (7013); Jimmy’Z Surf Co., LLC (0461); Aero GC Management LLC (4257); AeropostaleProcurement Company, Inc. (8518); Aeropostale Licensing, Inc. (8124); P.S. from Aeropostale, Inc. (5900); GoJane LLC (4923); AeropostaleHoldings, Inc. (7729); and Aeropostale Puerto Rico, Inc. (6477). The Debtors’ corporate headquarters is located at 112 West 34th Street, 22ndFloor, New York, NY 10120. 2 Motion of Debtors Pursuant to 11 U.S.C. §§ 105(a), 363, 364, 503, and 507 for Interim and Final Authority to (I) Continue Using Existing CashManagement System, Bank Accounts, and Business Forms, (II) Implement Changes to the Cash Management System in the Ordinary Course ofBusiness, (III) Continue Intercompany Transactions, (IV) Provide Administrative Expense Priority for Postpetition Intercompany Claims and forRelated Relief [ECF No. 7] (the “Cash Management Motion”).

receipts activities, disbursement activities, inventory purchases, and expense allocations. Historically,Intercompany Claims are not settled by actual transfers of cash among the Debtors. Instead, the Debtorstrack all Intercompany Transactions in their accounting system, which concurrently are recorded on theapplicable Debtors’ balance sheets. The Debtors have attempted to identify disbursements on an individualDebtor basis. However, because the Debtors generally track and report their financial information on aconsolidated basis some errors may exist and adjustments in future reporting may be necessary. 4. Accuracy. The financial information disclosed herein was not prepared in accordance with federal or state securities laws or other applicable non-bankruptcy law or in lieu of complying with any periodic reportingrequirements thereunder. Persons and entities trading in or otherwise purchasing, selling, or transferringthe claims against or equity interests in the Debtors should evaluate this financial information in light of thepurposes for which it was prepared. The Debtors are not liable for and undertake no responsibility toindicate variations from securities laws or for any evaluations of the Debtors based on this financialinformation or any other information. 5. Debtor in Possession Financing. On August 12, 2015, the Bankruptcy Court entered the Final Order Pursuant to 11 U.S.C. §§ 105, 361, 362, 363 and 364 and Rules 2002, 4001, and 9014 of the Federal Rulesof Bankruptcy Procedure (I) Authorizing Incurrence by the Debtors of Postpetition Secured Indebtedness, (II) Granting Liens, and (III) Authorizing Use of Cash Collateral by the Debtors and Providing forAdequate Protection, and (IV) Modifying the Automatic Stay [ECF No. 298] (the“DIP Order”), whichapproved and authorized the Debtors to access up to $160,000,000 in postpetition financing and to providethe Debtors’ prepetition secured parties adequate protection on the terms and conditions set forth in theDIP Order. Please see the DIP Order for additional detail. Descriptions of the Debtors’ prepetitiondebt structure and the collateral relating to the bank debt are contained in the Declaration of David J.Dick Pursuant to Rule 1007-2 of the Local Bankruptcy Rules for the Southern District of New York [ECFNo. 4]. Reference to the applicable loan agreements and related documents is necessary for a completedescription of the collateral and the nature, extent, and priority of liens. 6. Payment of Prepetition Claims Pursuant to First Day Orders. Within the first two days of the Debtors’ chapter 11 cases, the Bankruptcy Court entered orders (the “First-Day Orders”) authorizing, but notdirecting, the Debtors to, among other things, pay certain prepetition (a) service fees and charges assessedby the Debtors’ banks and debit and credit card companies; (b) claims of warehousemen and miscellaneouslien claimants;(c) certain insurance obligations;(d) obligations to“critical vendors”;(e) customerprograms obligations; (f) employee wages, salaries, and related items, including employee benefit programsand independent contractor obligations; and (g) taxes and assessments. To the extent any payments weremade on account of such claims following the commencement of these chapter 11 cases pursuant to theauthority granted to the Debtors by the Bankruptcy Court under the First Day Orders, such paymentshave been included in the MOR unless otherwise noted. 7. Liabilities Subject to Compromise. Any amount classified as liabilities subject to compromise are estimates and are subject to future change and adjustment. 8. Reservation of Rights. The Debtors reserve all rights to amend or supplement the MOR in all respects, as may be necessary or appropriate. Nothing contained in this MOR shall constitute a waiver of any of theDebtors’ rights or an admission with respect to their chapter 11 cases.

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 Disbursements for the period 10/30/16 through 11/26/16 MOR-1 ($ in 000's) Total for Case Debtor Reporting Period Quarter to Date 16-11275 Aéropostale, Inc. $ 19,479 $ 44,112 16-11276 Aéropostale Procurement Co, Inc. 3,649 4,640 16-11277 Aéropostale West, Inc. 2,430 4,849 16-11278 Jimmy'Z Surf Co. LLC 0 0 16-11279 Aéro GC Management LLC 20 20 16-11280 Aéropostale Licensing, Inc. 28 30 16-11281 GoJane LLC 178 438 16-11282 P.S. from Aéropostale, Inc. 161 239 16-11283 Aéropostale Puerto Rico, Inc. 216 455 16-11285 Aéropostale Holdings, Inc. 0 0 $ 26,161 $ 54,782 Note: A portion of the disbursements from certain Debtors may be subject to allocations to, or reimbursementfrom, other Debtors.

In re Aéropostale, Inc., et al. Case No: Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 Bank Account Reconciliations MOR-1 (Unaudited) Case No. Debtor Bank Name Account No. Bank Balance 11/26/16 GL Balance 11/26/16 16-11275 Aéropostale Inc. Bank of America Utility Deposits ***0747 415,567.00 32,511,869.82 16-11275 Aéropostale Inc. Bank of America Texas Escrow ***7404 167,565.77 16-11275 Aéropostale Inc. Bank of America FFE ***7572 30,316,456.93 16-11275 Aéropostale Inc. Bank of America Profesional Fees Acquisition ***7857 1,367,503.35 16-11275 Aéropostale Inc. Bank of America Concentration Reconciliation ***8175 60,290.58 16-11276 Aéropostale Inc. Wells Fargo - Zumiez Escro ***7900 1,231,494.95 1,229,302.84 16-11277 Aéropostale Inc. Citibank ***1768 18,300,000.00 18,300,000.00 16-11278 Aéropostale Inc. Citibank ***2768 14,533,955.52 18,018,728.11 Total Cash and Cash Equivalents $ 66,392,834.10 $ 70,059,900.77 Note: All bank accounts are reconciled each period when statements are received. Difference between the GL and bank balances are either outstanding checks or reconciling itemstypically cleared in the following period. Copies of bank statements, disbursement journals and reconciliations are not attached to this Monthly Operating Report; however,the Debtors will provide further information to the U.S. Trustee upon request.

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 CONSOLIDATED STATEMENT OF OPERATIONS (Income Statement) MOR-2 (Unaudited - $ in 000's) Net sales $ 169,888 Cost of sales (including certain buying, occupancy and warehousing expenses) 157,738 Gross profit 12,149 Selling, general and administrative expenses 3,150 Profit (Loss) from operations 9,000 Interest expense 1,164 Profit (Loss) before income taxes 7,835 Income tax expense 87 Net income (loss) $ 7,748

In re Aéropostale, Inc., et al. o. 16-11275 Debtors d: 10/30/16 - 11/26/16 STATEMENT OF OPERATIONS BY LEGAL ENTITY (Income Statement) MOR-2 (Unaudited - $ in 000's) Aero GC Aéropostale Consolidated Management Aéropostale Aéropostale PS from Procurement Jimmy'Z Surf Aéropostale Aéropostale Elimination U.S. Aéropostale, Inc. LLC West Puerto Rico Aéropostale Co. Co., LLC Licensing GoJane LLC Holdings Company (a) Companies Net sales Cost of sales (including certain buying, occupancy andwarehousing expenses) 1 2 3 $ 132,137 $ - $ 33,064 139,416 0 16,105 4 5 6 $ 2,471 $ 2,273 $ 85,273 1,264 1,485 84,680 7 9 10 78 98 $ - $ (57) $ - $ - $ (85,273) $ 169,888 0 (24) 84 0 (85,273) $ 157,738 Gross profit (7,279) 0 16,958 1,207 788 592 0 (33) (84) 0 0 $ 12,149 Selling, general and administrative expenses 2,875 0 174 5 75 20 0 (33) 34 0 0 $ 3,150 Profit (Loss) from operations (10,154) 0 16,784 1,202 713 573 0 (1) (118) 0 0 $ 9,000 Interest expense 1,164 0 0 0 0 0 0 0 0 0 0 $ 1,164 Profit (Loss) before income taxes (11,318) 0 16,784 1,202 713 573 0 (1) (118) 0 0 $ 7,835 Income tax expense 0 0 0 0 0 0 0 87 0 0 0 $ 87 Net income (loss) $ (11,318) $ - $ 16,784 $ 1,202 $ 713 $ 573 $0 $ (88) $ (118) $0 $ - $ 7,748 (a) Elimination Company is not a legal entity. It is included in the balance sheet to reflect entries to eliminate intercompany transactions to produce accurate consolidated financial statements.

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 BALANCE SHEET MOR-3 (Unaudited - $ in 000's) ASSETS CURRENT ASSETS Cash and Cash Equivalents $ 70,060 Merchandise Inventory - Prepaid Expenses 13,318 Tax Refunds Receivable 3,520 Other Current Assets 7,489 TOTAL CURRENT ASSETS $ 94,387 Fixtures, Equipment & Improvements (17) Intangibles 21,762 Investment in Subsidiary 92,733 Restricted Cash Non-Current - Deferred Financing 3,398 Other Assets 1,599 TOTAL ASSETS $ 213,862 LIABILITIES & SHAREHOLDERS' EQUITY CURRENT LIABILITIES Accounts Payable $ 47,754 Accrued Expense 115,587 Current Loan Payable 82,591 Crystal Loan Payble - Intercompany (1,820) TOTAL CURRENT LIABILITIES $ 244,112 Deferred Rent,Tenant Allowance 1,512 Retirement Benefit Plan Liability 6,288 Uncertain Tax Liability Reserves 2,093 Unearned Vendor Rebate 9,479 Other Non Current Liabilities 1,559 Non-Current Loan Payable 0 TOTAL LIABILTIES $ 265,043 SHAREHOLDERS' EQUITY Common Stock $ 817 Additional Paid-in-Capital 257,765 Other Comprehensive Income 1,186 Retained Earnings (307,184) Treasury Stock (3,765) TOTAL SHAREHOLDERS' EQUITY $ (51,181) TOTAL LIABILTIES & SHAREHOLDER EQUITY $ 213,862

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 BALANCE SHEET MOR-3 (Unaudited - $ in 000's) Aéropostale Aero GC Aéropostale Aéropostale PS from Procurement Jimmy'Z Surf Aéropostale GoJane Aéropostale Elimination Consolidated Aéropostale, Inc. Management LLC West Puerto Rico Aéropostale Co. Co., LLC Licensing LLC Holdings Company (a) U.S. Companies 1 2 3 4 5 6 7 9 10 78 98 ASSETS CURRENT ASSETS Cash and Cash Equivalents $ 70,060 $ - $ - $ - $ - $ - $ - $ - $ 70,060 Merchandise Inventory 138,689 33,870 2,560 1,849 1,618 1 1,256 (179,843) $ - Prepaid Expenses 11,229 228 36 12 504 1,309 $ 13,318 Prepaid Taxes 3,401 119 $ 3,520 Other Current Assets 374 338 7,012 1,500 2,813 3,270 6,045 666 (14,529) $ 7,489 TOTAL CURRENT ASSETS $ 223,753 $ 566 $ 40,882 $ 4,215 $ 4,674 $ 5,392 $ 1 $ 7,354 $ 1,922 $ (194,372) $ 94,387 Fixtures, Equipment & Improvements (17) (2) 2 $ (17) Intangibles 21,762 $ 21,762 Investment in Subsidiary 153,447 23,145 32,575 92,733 (209,167) $ 92,733 Restricted Cash Non-Current $ - Deferred Financing 3,398 $ 3,398 Other Assets 1,300 25 37 12 225 $ 1,599 TOTAL ASSETS $ 381,881 $ 566 $ 64,050 $ 4,252 $ 37,261 $ 5,617 $ 1 $ 7,354 $ 23,686 $ 92,733 $ (403,539) $ 213,862 LIABILITIES & SHAREHOLDERS' EQUITY CURRENT LIABILITIES Accounts Payable 31,069 27 210,839 191 (194,372) $ 47,754 Accrued Expense 91,135 13,292 2,854 594 883 5,809 70 350 553 47 $ 115,587 Current Loan Payable 82,591 $ 82,591 Crystal Loan Payble $ - Intercompany 957,532 (45,507) (523,673) 2,566 222,346 (545,804) 59,127 (117,601) (10,807) 1 $ (1,820) TOTAL CURRENT LIABILITIES $ 1,162,327 $ (32,215) $ (520,819) $ 3,160 $ 223,256 $ (329,156) $ 59,197 $ (117,251) $ (10,063) $ 1 $ (194,325) $ 244,112 Deferred Rent,Tenant Allowance 1,259 (330) 2 581 $ 1,512 Retirement Benefit Plan Liabilities 6,288 $ 6,288 Uncertain Tax Liability Reserves 76 2,017 $ 2,093 Unearned Vendor Rebate 9,479 $ 9,479 Other Non Current Liabilities 61,011 (59,628) 176 $ 1,559 Non-Current Loan Payable 0 TOTAL LIABILTIES $ 1,230,961 $ (32,215) $ (578,760) $ 3,160 $ 223,258 $ (319,677) $ 59,197 $ (117,075) $ (9,482) $ 1 $ (194,325) $ 265,043 SHAREHOLDERS' EQUITY Common Stock 816 1 $ 817 Additional Paid-in-Capital 257,766 25,134 3,001 32,576 23,145 1 1 32,575 92,733 (209,167) $ 257,765 Other Comprehensive Income 1,186 $ 1,186 Retained Earnings (1,105,083) 32,781 617,675 (1,909) (218,573) 302,149 (59,197) 124,428 593 (1) (47) $ (307,184) Treasury Stock (3,765) $ (3,765) TOTAL SHAREHOLDERS' EQUITY $ (849,080) $ 32,781 $ 642,810 $ 1,092 $ (185,997) $ 325,294 $ (59,196) $ 124,429 $ 33,168 $ 92,732 $ (209,214) $ (51,181) TOTAL LIABILTIES & SHAREHLD EQUITY $ 381,881 $ 566 $ 64,050 $ 4,252 $ 37,261 $ 5,617 $ 1 $ 7,354 $ 23,686 $ 92,733 $ (403,539) $ 213,862 - - - - - - - - - - - - (a) Elimination Company is not a legal entity. It is included in the balance sheet to reflect entries to eliminate intercompany transactions to produce accurate consolidated financial statements.

In re Aeropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 STATEMENT OF CASH FLOWS MOR-3 Due to the complexity of the sale of substantially all of the Debtors’ assets, the Debtors continue to reconcile the generalledger accounts and update the financial reporting. The Debtors will modify the financial statements as needed.

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 MOR-4 STATUS OF POST-PETITION TAXES Amount Federal Beginning Tax Amount Withheld Amount Paid Date Paid Accrued Ending Tax Withholding: Aéropostale, Inc. $0 $ 944,607 $ 944,607 11/4,11/11,11/18,11/25 $0 Aéropostale West 0 196,939 196,939 11/11,11/25 $0 PS from Aéropostale 0 - - 11/11,11/25 $0 Licensing 0 2,927 2,927 11/11,11/25 $0 Procurement 0 198,481 198,481 11/11,11/25 $0 Aéropostale Puerto Rico 0 - - 11/11,11/25 $0 GoJane LLC 0 95 95 11/11,11/25 $0 FICA-Employee Aéropostale, Inc. 0 661,685 661,685 11/4,11/11,11/18,11/25 $0 Aéropostale West 0 167,832 167,832 11/11,11/25 $0 PS from Aéropostale 0 11/11,11/25 $0 Licensing 0 1,635 1,635 11/11,11/25 $0 Procurement 0 54,447 54,447 11/11,11/25 $0 Aéropostale Puerto Rico 0 9,612 9,612 11/11,11/25 $0 GoJane LLC 0 64 64 11/11,11/25 $0 FICA-Employer Aéropostale, Inc. 0 658,658 658,658 11/4,11/11,11/18,11/25 $0 Aéropostale West 0 167,832 167,832 11/11,11/25 $0 PS from Aéropostale 0 11/11,11/25 $0 Licensing 0 1,635 1,635 11/11,11/25 $0 Procurement 0 52,166 52,166 11/11,11/25 $0 Aéropostale Puerto Rico 0 9,612 9,612 11/11,11/25 $0 GoJane LLC 0 64 64 11/11,11/25 $0 Unemployment Aéropostale, Inc. 0 19,820 19,820 11/4,11/11,11/18,11/25 $0 Aéropostale West 0 5,868 5,868 11/11,11/25 $0 PS from Aéropostale 0 11/11,11/25 $0 Licensing 0 15 15 11/11,11/25 $0 Procurement 0 77 77 11/11,11/25 $0 Aéropostale Puerto Rico 0 312 312 11/11,11/25 $0 GoJane LLC 0 - 11/11,11/25 $0 Income Other:_____________ Total Federal Taxes $0 $ 3,154,383 $ 3,154,383 $0 $0

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 MOR-4 STATUS OF POST-PETITION TAXES Amount State and Local Beginning Tax Amount Withheld Amount Paid Date Paid Accrued Ending Tax Withholding - Employee Aéropostale, Inc. 0 265,601 265,601 11/4,11/11,11/18,11/25 $0 Aéropostale West 0 55,042 55,042 11/11,11/25 $0 PS from Aéropostale 0 11/11,11/25 $0 Licensing 0 1,168 1,168 11/11,11/25 $0 Procurement 0 75,904 75,904 11/11,11/25 $0 Aéropostale Puerto Rico 0 4,975 4,975 11/11,11/25 $0 GoJane LLC 0 19 19 11/11,11/25 $0 Withholding - Employer Aéropostale, Inc. 0 54,675 54,675 11/4,11/11,11/18,11/25 $0 Aéropostale West 0 163,888 163,888 11/11,11/25 $0 PS from Aéropostale 0 11/11,11/25 $0 Licensing 0 127 127 11/11,11/25 $0 Procurement 0 6,426 6,426 11/11,11/25 $0 Aéropostale Puerto Rico 0 2,299 2,299 11/11,11/25 $0 GoJane LLC 0 5,251 5,251 11/11,11/25 $0 Sales Tax: Aéropostale, Inc. 2,945,363 7,600,471 3,483,222 11/18 6,821 $ 7,069,433 Aéropostale West - 2,712,487 2,712,487 11/18 $ - Aéropostale Puerto Rico 179,161 283,833 297,189 11/18 $ 165,805 PS from Aéropostale (0) 95,096 51,264 11/18 - $ 43,832 GoJane LLC 4,557 146 4,703 11/18 $ (0) Excise Unemployment (a)Real Property (b)Personal Property Aéropostale, Inc. 731,651 166,225 $ 565,426 Aéropostale West (0) $ (0) Aéropostale Puerto Rico 108,043 $ 108,043 PS from Aéropostale 65,509 3,564 $ 61,945 Other:_____________ Total State and Local $4,034,283 $ 11,327,408 $ 7,354,029 $213,460 $6,821 $ 8,014,483 Total Taxes $ 4,034,283 $ 14,481,791 $ 10,508,412 $ 213,460 $ 6,821 $ 8,014,483 Note: Postpetition taxes for the Debtors, which are not subject to dispute or reconciliation, and are authorized to bepaid under the relief granted by the Bankruptcy Court are current. There are no national tax disputes or reconciliations. (a) Included with State Withholding (b) Debtor does not own any real property

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 MOR-4 SUMMARY OF UNPAID POST-PETITION DEBTS Number of Days Past Due Current 0-30 31-60 61-90 Over 91 Total Accounts Payable $ 28,445 $1,089,630 $1,867,524 $6,176,141 $880,942 $ 10,042,682 Wages Payable 0 0 0 0 0 $ - Taxes Payable 8,014,483 0 0 0 0 $ 8,014,483 Rent/Leases Building 0 0 0 0 $ - Rent/Leases Equipment 0 0 0 0 0 $0 Secured Debt/Adequate 0 0 0 0 0 $0 Protection Payments 0 0 0 0 0 $0 Professional Fees (a) Amounts Due to Insiders 0 0 0 0 0 $0 Other:______________ 0 0 0 0 0 $0 Total Post-petition Debts $ 8,042,928 $1,089,630 $1,867,524 $6,176,141 $880,942 $ 18,057,165

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 MOR-5 Unaudited Reporting period: 7/31/16 through 8/27/16 ACCOUNTS RECEIVABLE RECONCILIATION AND AGING Accounts Receivable Reconcilation Amount 9.00 2.00 Total Accounts Receivable at the beginning of reporting period $ 7,207,922 7748694.00 452772.00 Plus: Amounts billed during the period (141,677) 1086364.00 451814.00 Less: Amounts collected during the period (723,235) -692702.00 -494478.00 Total Accounts Receivable at the end of the reporting period $ 6,343,010 8142355.00 410108.00 Accounts Receivable Aging 0-30 31-60 61-90 Over 91 Total 0 - 30 days old 2,774,055 2,774,055 31 - 60 days old 2,517,409 2,517,409 61 - 90 days old 487,538 487,538 91+ days old 1,348,379 1,348,379 Total Accounts Receivable 0 Less: Bad Debts (Amounts considered uncollectible) (784,371) (784,371) Net Accounts Receivable $2,774,055 $2,517,409 $487,538 $564,008 $6,343,010 Note: Credit card receivables are recorded in MOR-1 with cash and cash-equivalent balance. TAXES RECONCILIATION AND AGING Taxes Payable 0-30 31-60 61-90 Over 91 Total Total Taxes Payable $ 8,014,483 $ 8,014,483

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 PAYMENTS TO INSIDERS AND PROFESSIONALS MOR-6 INSIDERS1,2 NAME TYPE OF PAYMENT AMOUNT PAID TOTAL PAID TO DATE Multiple Salary 229,615 1,722,115 Multiple Auto Allowance 2,615 19,615 TOTAL PAYMENTS TO INSIDERS $232,231 $1,741,731 PROFESSIONALS3 DATE OF COURT ORDER AUTHORIZING TOTAL INCURRED & NAME PAYMENT AMOUNT APPROVED AMOUNT PAID TOTAL PAID UNPAID* Weil, Gotshal & Manges 6/13/2016 $ 1,387,874 $ - $ 10,045,168 $ 3,784,613 Prime Clerk 6/13/2016 51,958 - 1,100,125 59,248 Stifel 6/13/2016 - - 4,254,287 1,040,000 Province 6/13/2016 184,273 - 967,159 423,315 FTI 6/13/2016 1,945,467 - 1,342,970 2,268,497 Pachuslski Stang Ziehl & Jones 6/13/2016 63,398 - 962,657 278,505 Deloitte 6/13/2016 265,409 - 30,651 272,955 Hilco IP Services 6/13/2016 - - 100,000 5,167 Development Specialists, Inc. 10/13/2016 311,524 - 217,913 311,524 TOTAL PAYMENTS TO PROFESSIONALS $ 4,209,903 $ - $ 19,020,930 $ 8,443,825 DIP FINANCING / PREPETITION (ABL LENDER) ADDITIONAL NAME OF CREDITOR INITIAL DRAW DRAWS PAID DOWN ENDING BALANCE FEES PAID Crystal Finance (DIP Agent) $ 84,247,910 $ 494,973,406 $ (579,221,316) $ (0) $ 9,924,086 Schulte Roth (DIP Legal) 236,350 Proskauer (DIP Legal) 1,972,069 TOTAL $ 84,247,910 $ 494,973,406 $ (579,221,316) $ (0) $ 12,132,505 1Represents payments made by the Debtors to persons considered to be "insiders" under the Bankruptcy Code during the reporting period.The total is shown on a cash basis, reflecting the actual amounts received, net of any applicable taxes, withholdings or other deductions.The total includes regular payroll, fees and expense reimbursements. 2Persons included as "insiders" have been included for informational purposes only. The Debtors do not concede or take any position with respect to: (a) such person's influence over the control of the Debtors; (b) the management responsibilities or functions of such individual; (c) the decision-makingor corporate authority of such individual; or (d) whether such individual could successfully argue that he or she is not an "insider" under applicablelaw, including, without limitation, the federal securities laws or with respect to any theories of liability or for any other purpose. Further, the inclusionof a party as an "insider" is not an acknowledgement or concession that such party is an "insider" under applicable bankruptcy law. 3On June 3, 2016, the Bankruptcy Court entered the order establishing procedures for interim compensation and reimbursement ofexpenses of professionals (ECF No. 251). Any payments made by the Debtors to estate professionals will be in accordancewith the terms and conditions set forth therein.

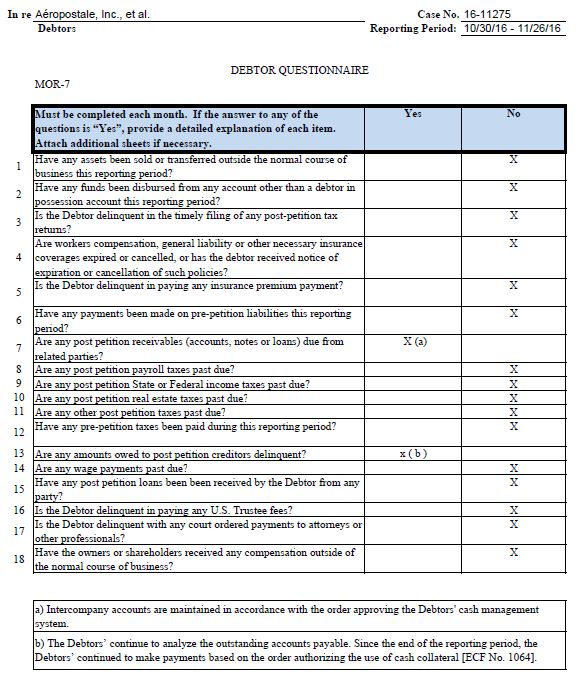

In re Aéropostale, Inc., et al. Case No. 16-11275 Debtors Reporting Period: 10/30/16 - 11/26/16 DEBTOR QUESTIONNAIRE MOR-7 Must be completed each month. If the answer to any of the Yes No questions is “Yes”, provide a detailed explanation of each item.Attach additional sheets if necessary. 1 2 3 Have any assets been sold or transferred outside the normal course of Xbusiness this reporting period? Have any funds been disbursed from any account other than a debtor in Xpossession account this reporting period? Is the Debtor delinquent in the timely filing of any post-petition tax Xreturns? Are workers compensation, general liability or other necessary insurance X 4 coverages expired or cancelled, or has the debtor received notice of expiration or cancellation of such policies? 5 6 7 Is the Debtor delinquent in paying any insurance premium payment? X Have any payments been made on pre-petition liabilities this reporting Xperiod? Are any post petition receivables (accounts, notes or loans) due from X (a)related parties? 8 Are any post petition payroll taxes past due? X 9 Are any post petition State or Federal income taxes past due? X 10 Are any post petition real estate taxes past due? X 11 Are any other post petition taxes past due? X 12 Have any pre-petition taxes been paid during this reporting period? X 13 Are any amounts owed to post petition creditors delinquent? x ( b ) 14 Are any wage payments past due? X 15 Have any post petition loans been been received by the Debtor from any Xparty? 16 Is the Debtor delinquent in paying any U.S. Trustee fees? X 17 18 Is the Debtor delinquent with any court ordered payments to attorneys or Xother professionals? Have the owners or shareholders received any compensation outside of Xthe normal course of business? a) Intercompany accounts are maintained in accordance with the order approving the Debtors' cash managementsystem. b) The Debtors’ continue to analyze the outstanding accounts payable. Since the end of the reporting period, theDebtors’ continued to make payments based on the order authorizing the use of cash collateral [ECF No. 1064].