Attached files

Exhibit 10.4

AGREEMENT FOR PURCHASE AND SALE

LEGACY WESLEY VILLAGE APARTMENTS

THIS AGREEMENT FOR PURCHASE AND SALE (this "Agreement") is made and entered into as of December 29 , 2016 (the "Effective Date") by and between KBS LEGACY PARTNERS WESLEY LP, a Delaware limited partnership formerly known as KBS Legacy Partners Wesley LLC, a Delaware limited liability company, and KBS LEGACY PARTNERS WESLEY LAND LLC, a Delaware limited liability company (collectively, "Seller"), and BLUEROCK REAL ESTATE, LLC, a Delaware limited liability company ("Buyer"), with reference to the following:

A. Buyer desires to purchase from Seller, and Seller is prepared to sell to Buyer, the Property (as hereinafter defined) upon the terms and conditions set forth in this Agreement.

B. Subject to the terms and conditions of this Agreement, Seller shall sell, convey and assign to Buyer with no representation or warranty of any kind or nature whatsoever except as otherwise specifically provided herein, and Buyer shall purchase, all of Seller’s rights, title, interest and obligations in, to and under the following described property (all of which is hereinafter collectively referred to as the "Property"):

1. That certain real property located in the City of Charlotte, County of Mecklenburg, North Carolina commonly referred to as Wesley Village Apartments, as more particularly described on Exhibit "A" attached hereto, together with all rights and appurtenances pertaining to such real property, including, without limitation, all of Seller’s right, title and interest in and to (a) all minerals, oil, gas, and other hydrocarbon substances thereon; (b) all adjacent strips, streets, roads, alleys and rights-of-way, public or private, open or proposed; (c) all development rights, covenants, easements, privileges, and hereditaments, whether or not of record, and (d) all access, air, water, riparian, development, utility, and solar rights (the "Real Property");

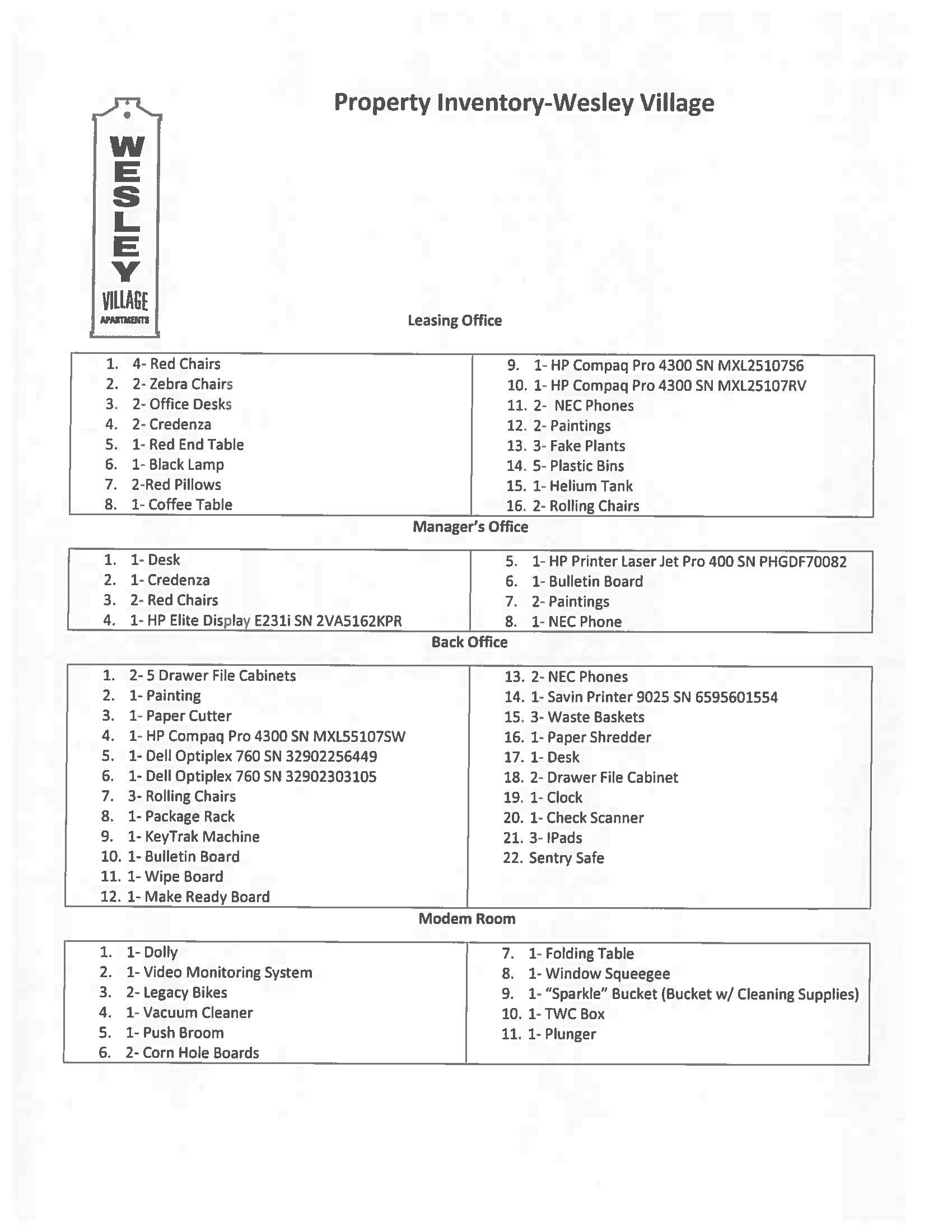

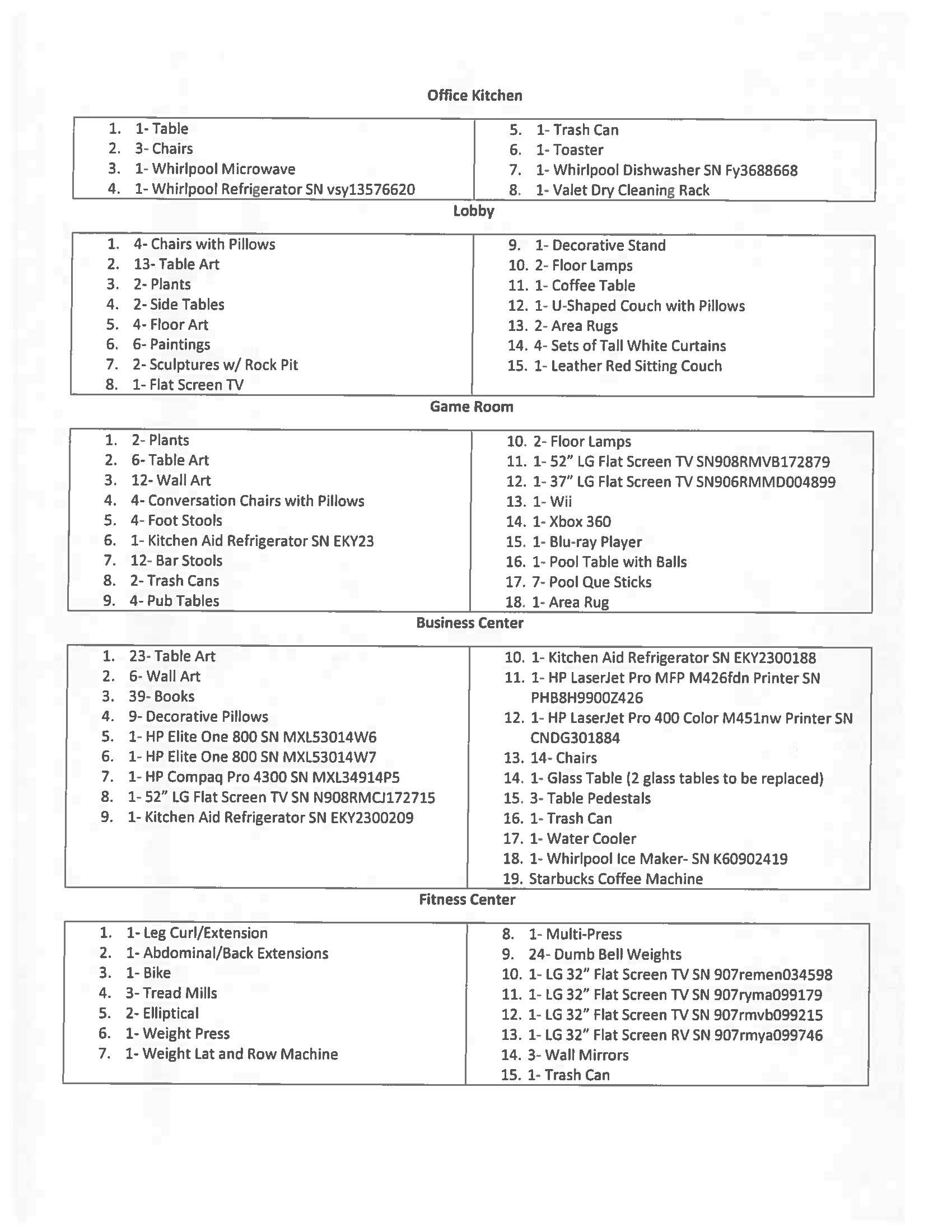

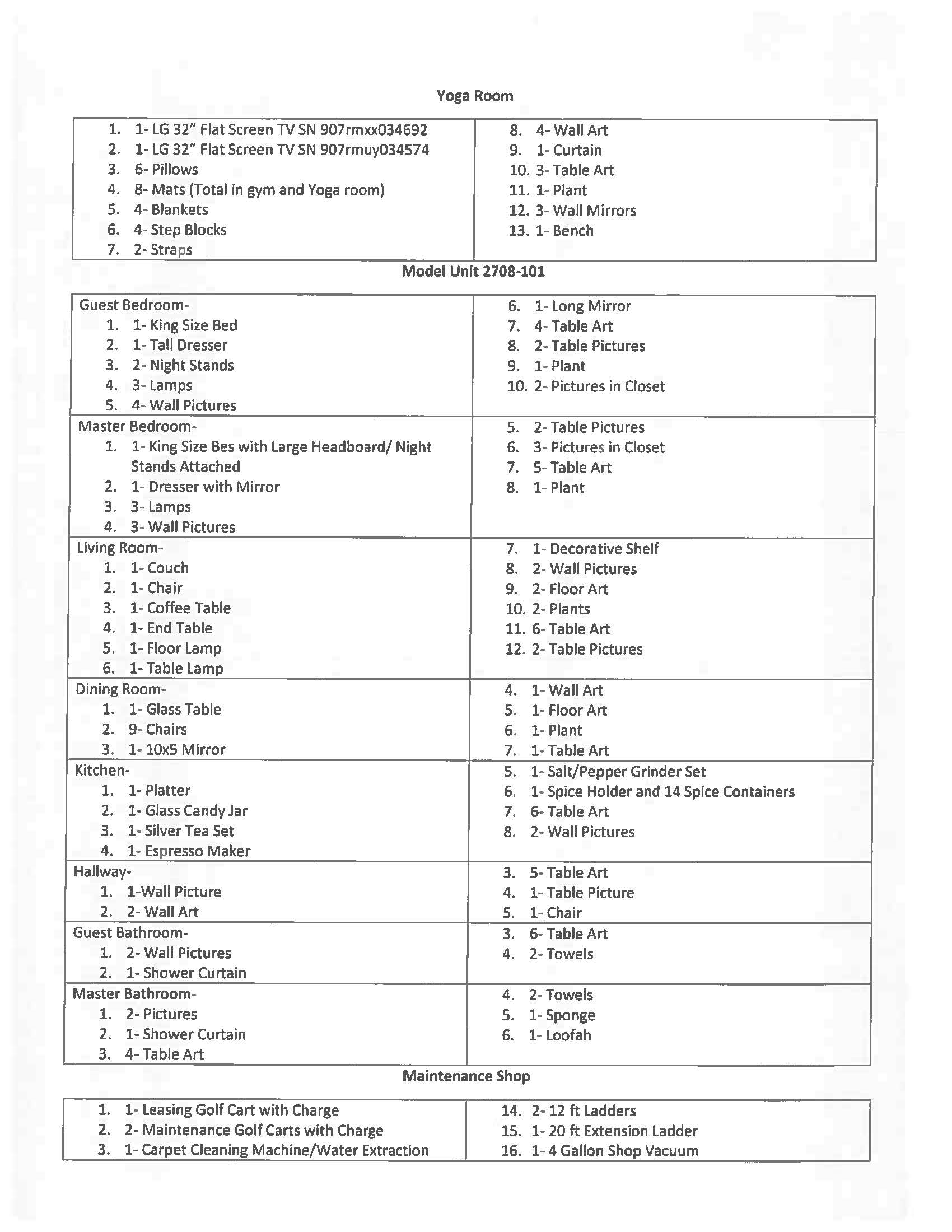

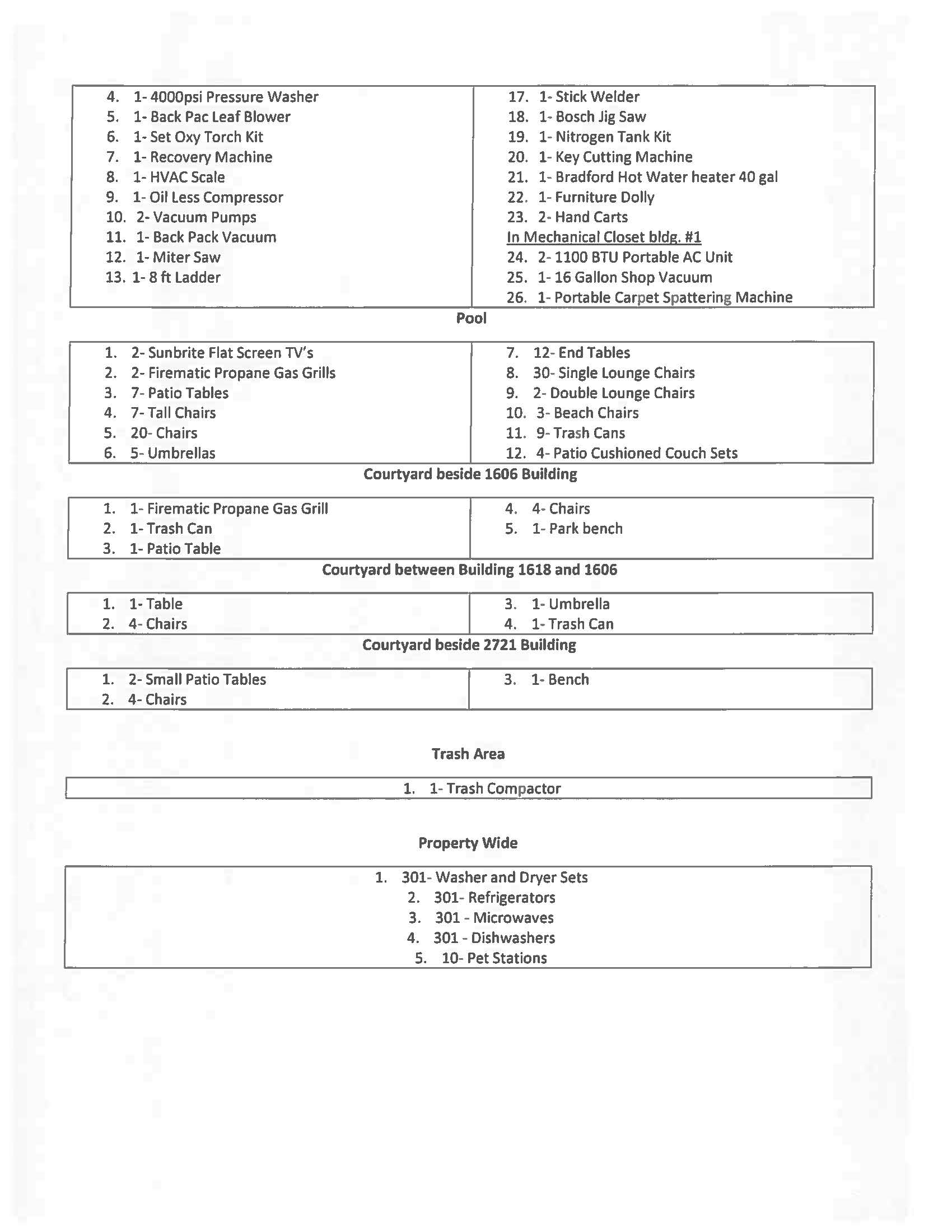

2. The personal property owned by Seller which is located on and used in connection with Seller's business operations on the Real Property as of the Closing Date (as hereinafter defined), which personal property in existence as of the Effective Date is listed on Exhibit "B" attached hereto, which personal property list shall be subject to modification for replacements or substitutions thereto arising out of normal wear and tear and ordinary usage in the ordinary course of Seller’s business operations on the Property prior to the Closing (as hereinafter defined) (collectively, the "Personal Property"), all improvements and fixtures presently located on the Real Property, including, without limitation, 301 apartment units, plus amenities, all other buildings and structures presently located on the Real Property, all apparatus, equipment and appliances used in connection with the Seller's operation or occupancy thereof, such as heating and air conditioning and mechanical systems and facilities used to provide any utility or fire safety services, parking services, refrigeration, ventilation, trash disposal, recreation or other services thereto but expressly excluding fixtures, equipment, appliances and personal property owned by tenants or anyone other than Seller (collectively, the "Improvements");

{00847420.10 46276-000125 }

1

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

3. All Assumed Service Contracts (as hereinafter defined in Subsection 2.5.2);

4. To the extent assignable, Seller’s right, title and interest in (a) all licenses, license agreements and other similar agreements with licensees or other persons or entities using any portion of the Real Property or Improvements other than any such agreements constituting Leases with residential tenants and other than any instruments evidenced in the Title Report (collectively, the “Licenses”), a current list of which is attached hereto as Exhibit “N”; (b) all permits, licenses, certificates of occupancy, if any, entitlements and governmental approvals to the extent such relate to the Real Property, Improvements, Personal Property, Leases, or Assumed Service Contracts (collectively, the “Permits”); (c) the Infrastructure Reimbursement Agreement dated August 20, 2008 between Seller, as assignee of Wesley Village Development, LP, and the City of Charlotte (the “IR Agreement”), (d) the name, “Wesley Village Apartments,” marks, other symbols and general intangibles that relate to the Real Property or the Improvements including any websites or URLs used solely in connection with the Property (other than the names KBS Legacy Partners Wesley LP, KBS Legacy Partners Wesley GP LLC, KBS Legacy Partners Wesley LLC, KBS Legacy Partners Wesley Land LLC, Legacy Partners Residential, Inc., Legacy Partners Residential LLC, Legacy Partners, Inc., Legacy Partners, Legacy or derivatives thereof, KBS Legacy Partners Properties LLC, KBS Legacy Partners Limited Partnership, and KBS Legacy Partners Apartment REIT; and (e) Warranties (collectively, the “Intangible Property”). For purposes hereof, “Warranties” shall mean any construction warranties from the contractors or subcontractors that were involved in the construction of the Improvements and manufacturer warranties and guaranties covering the Improvements and Personal Property to the extent such extend beyond the Closing Date, including, without limitation, roof, HVAC, water heater and window blind warranties; and

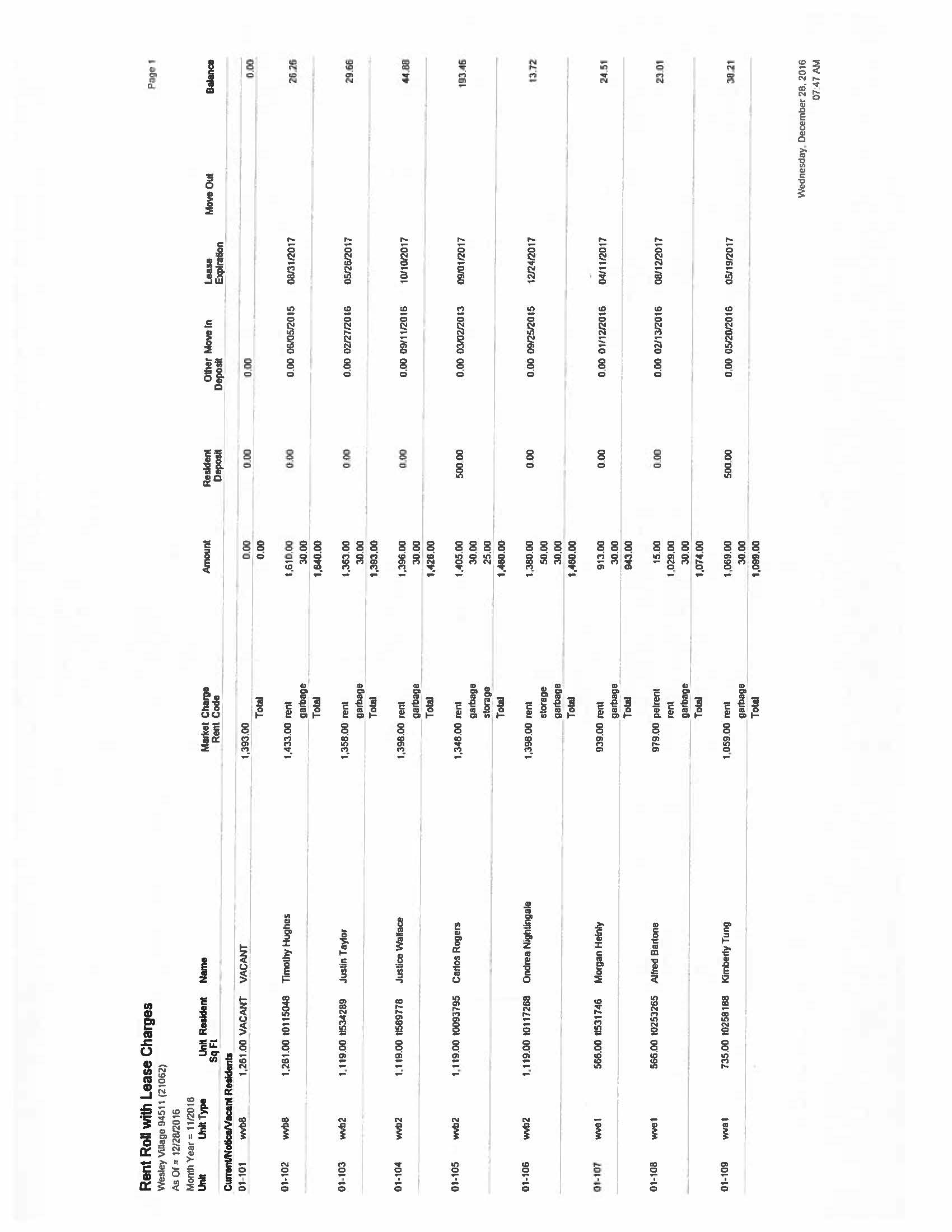

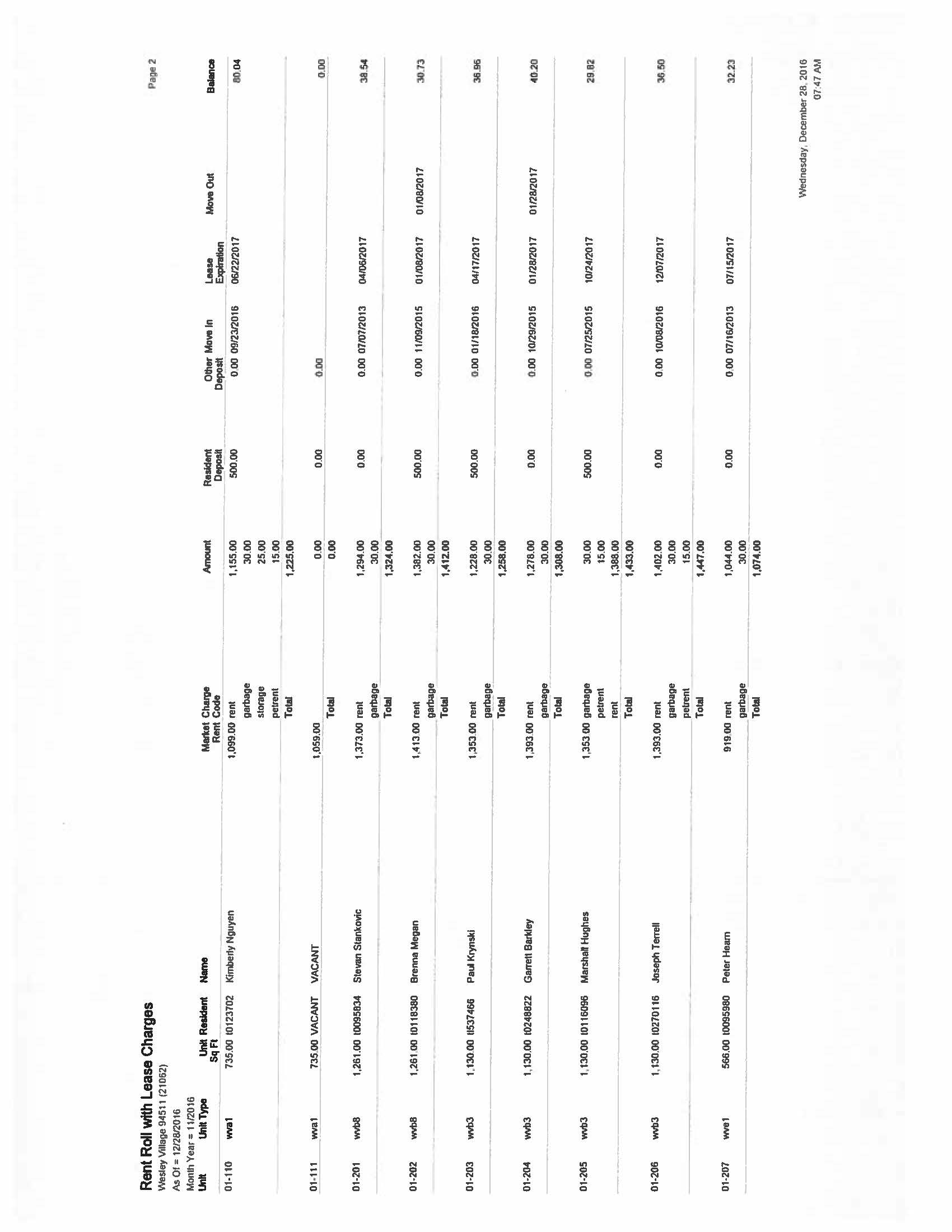

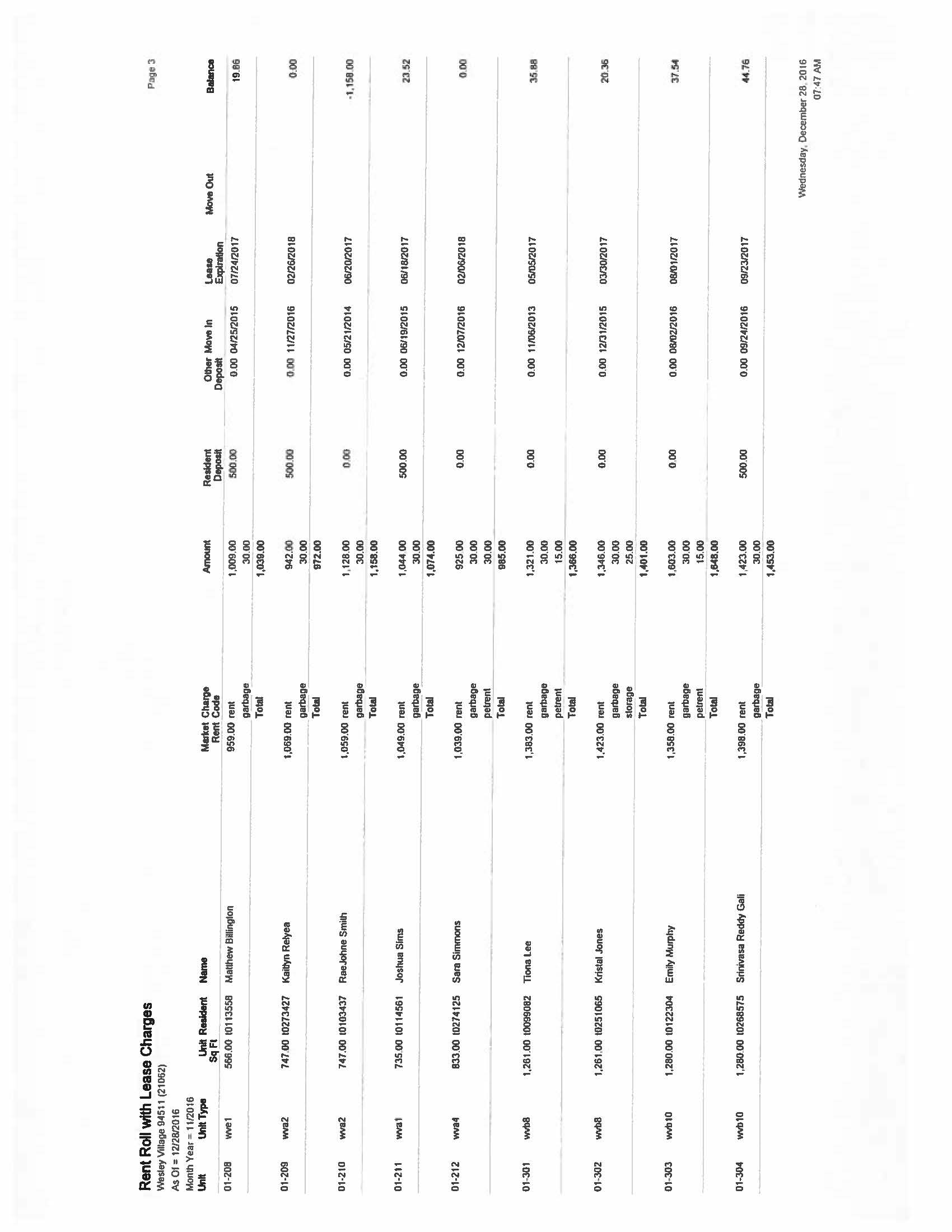

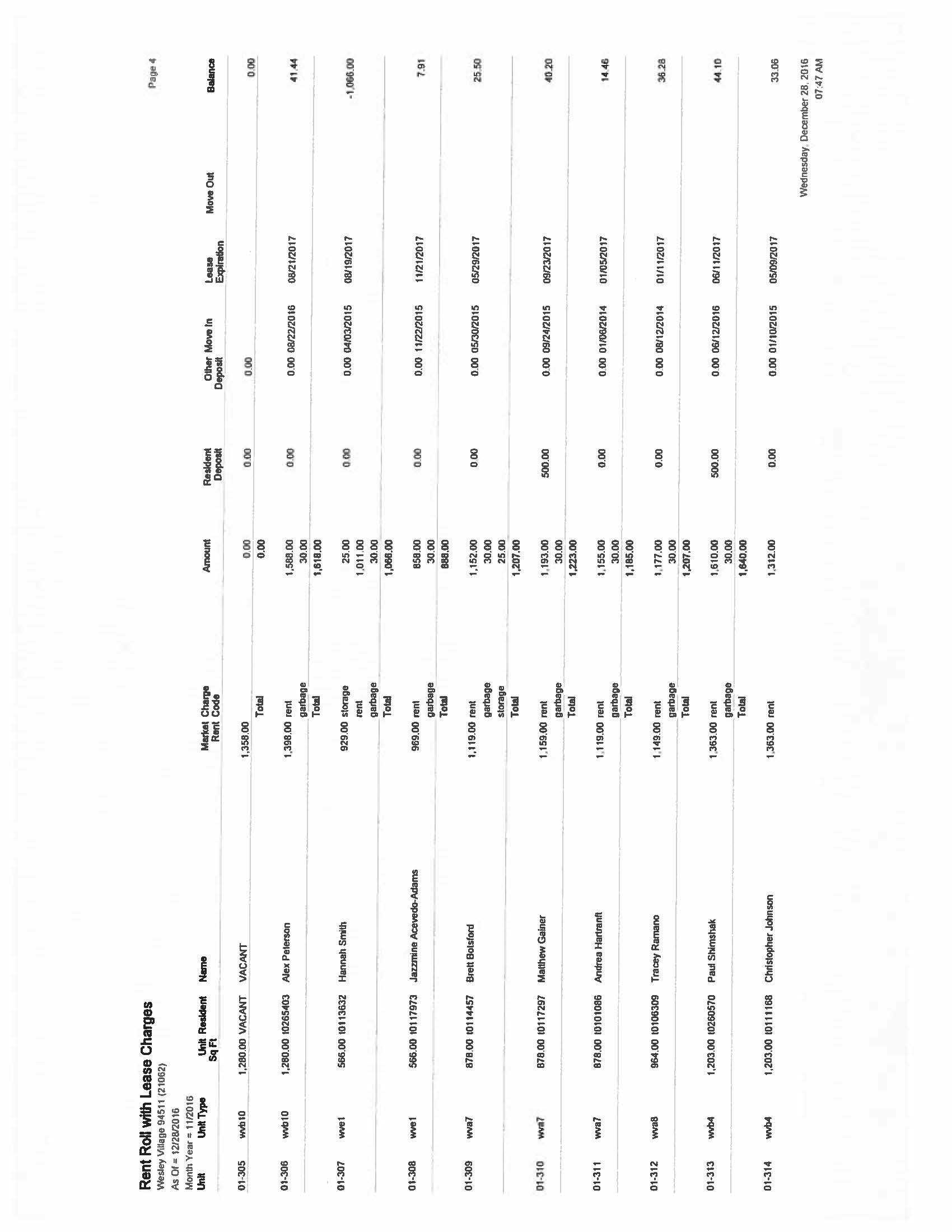

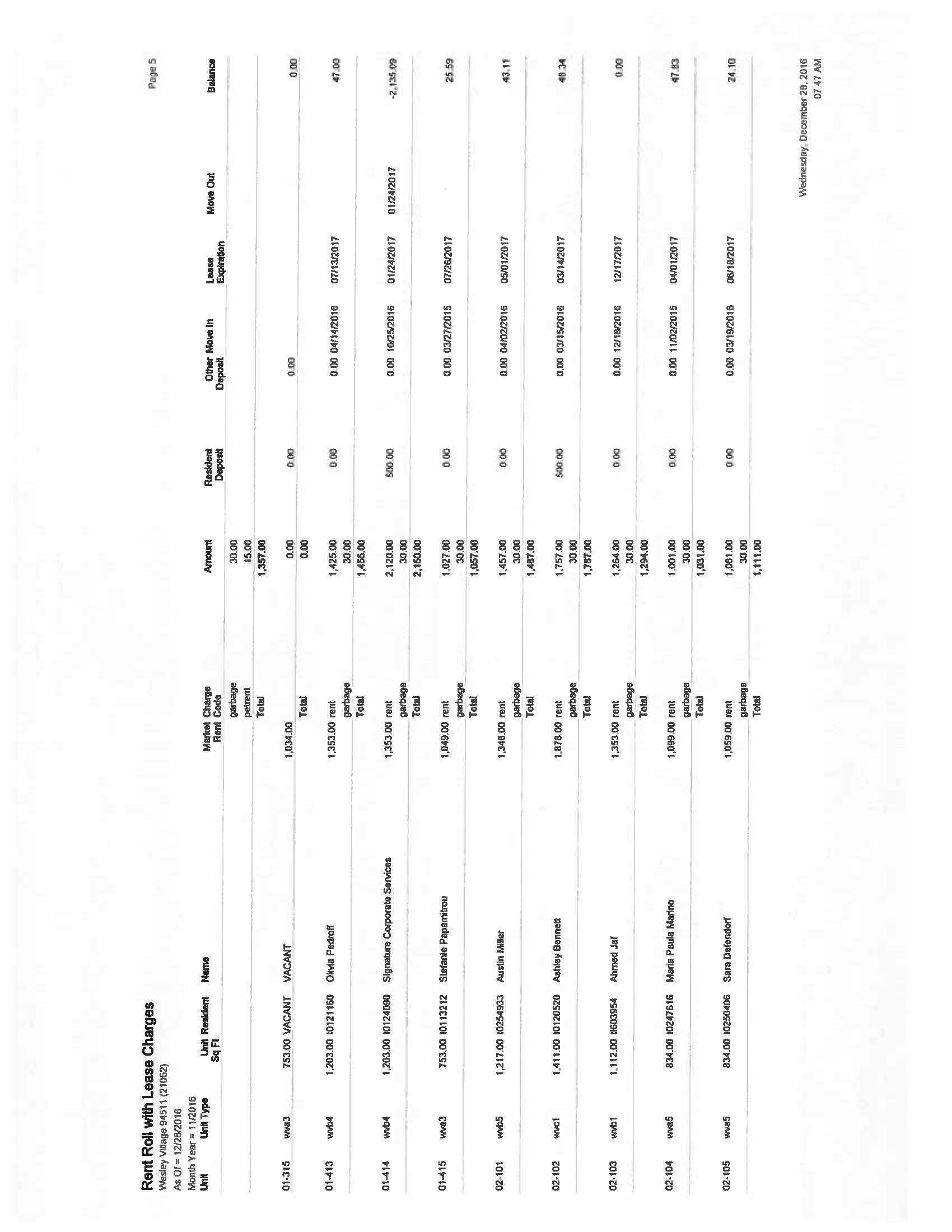

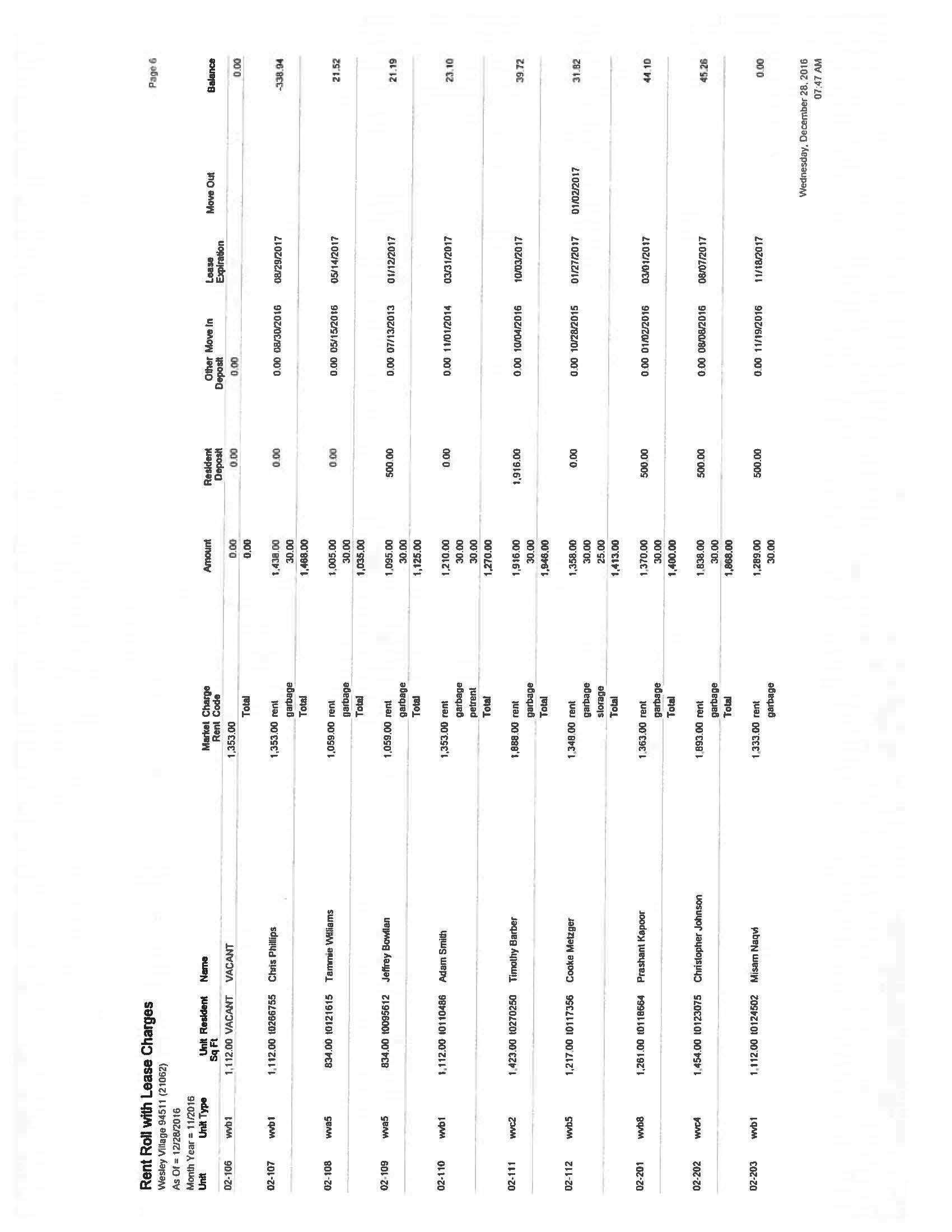

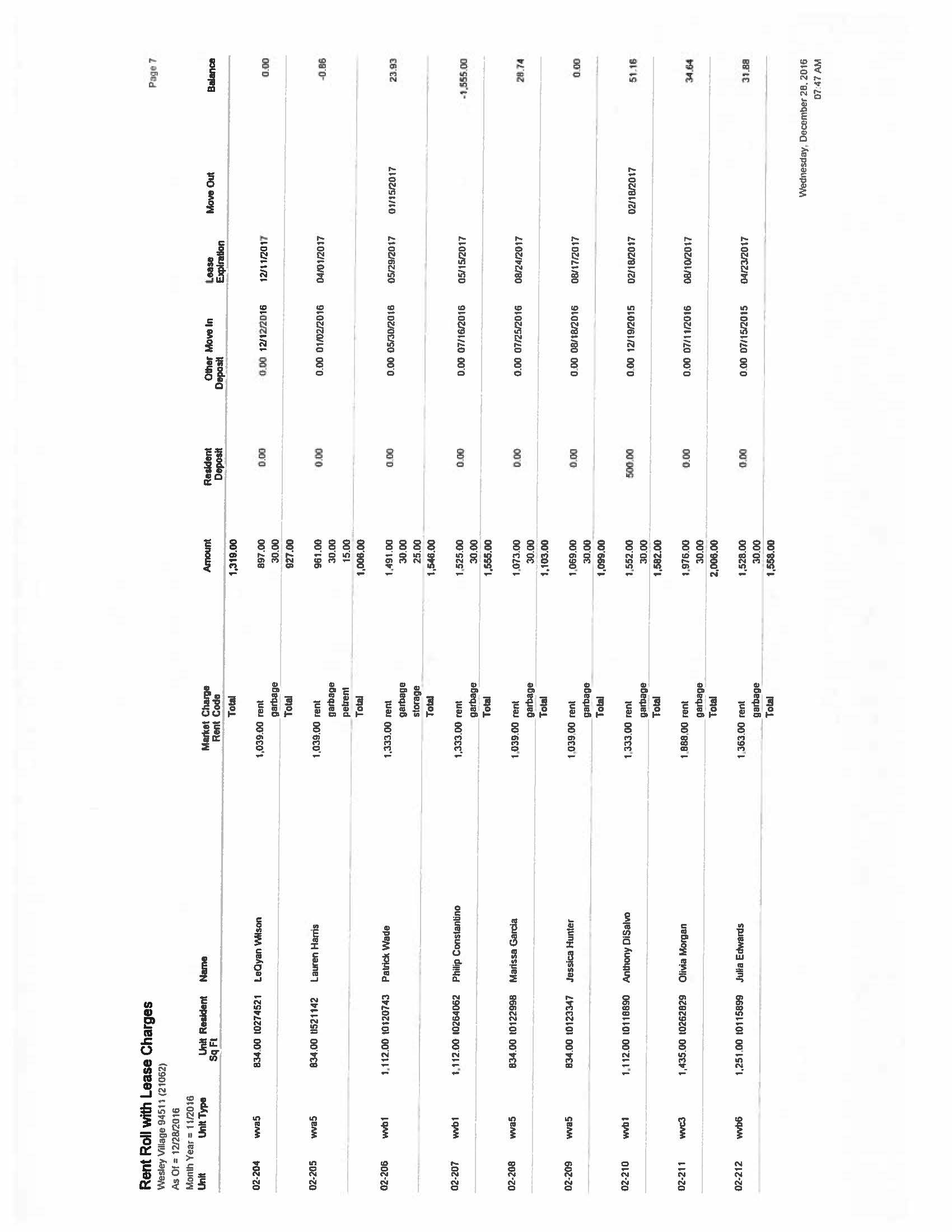

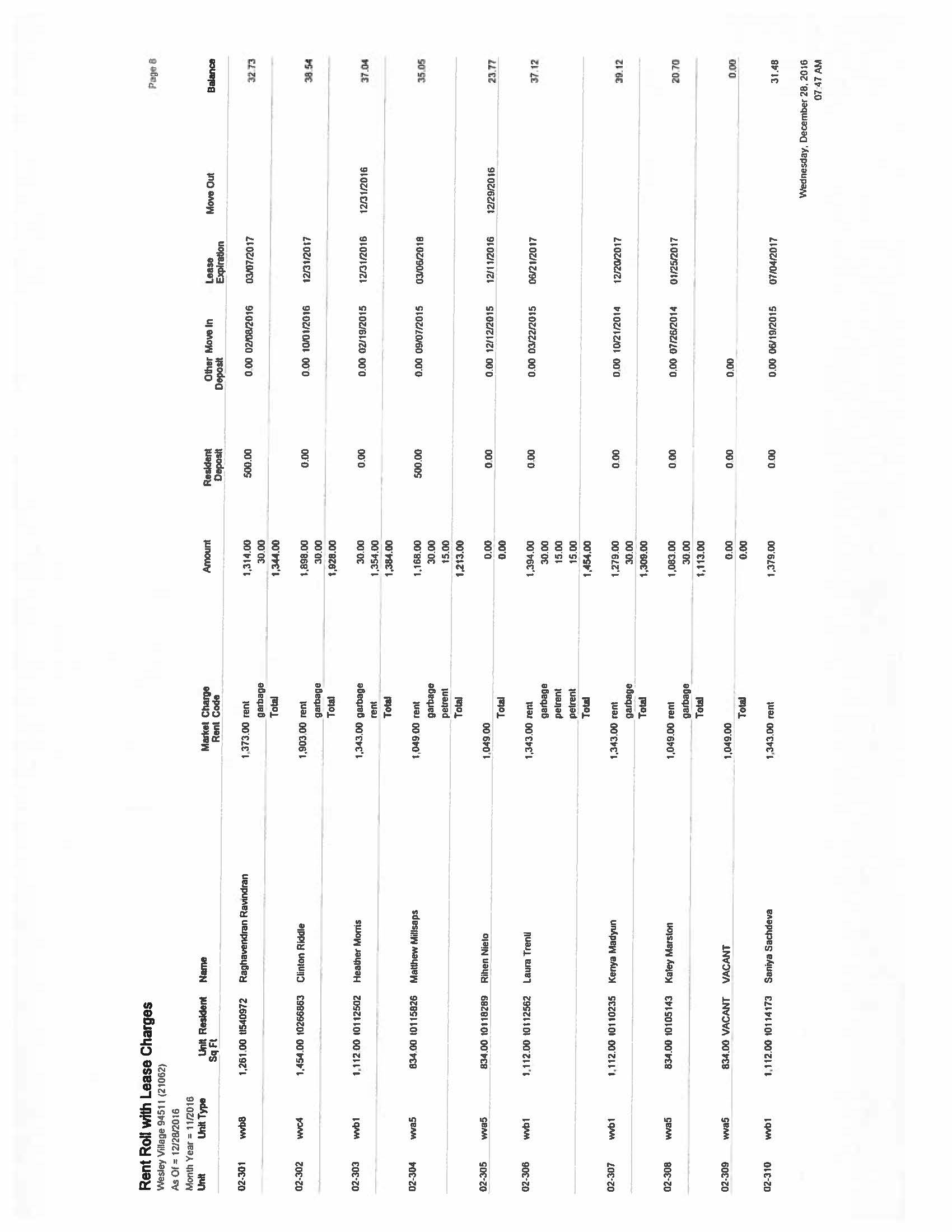

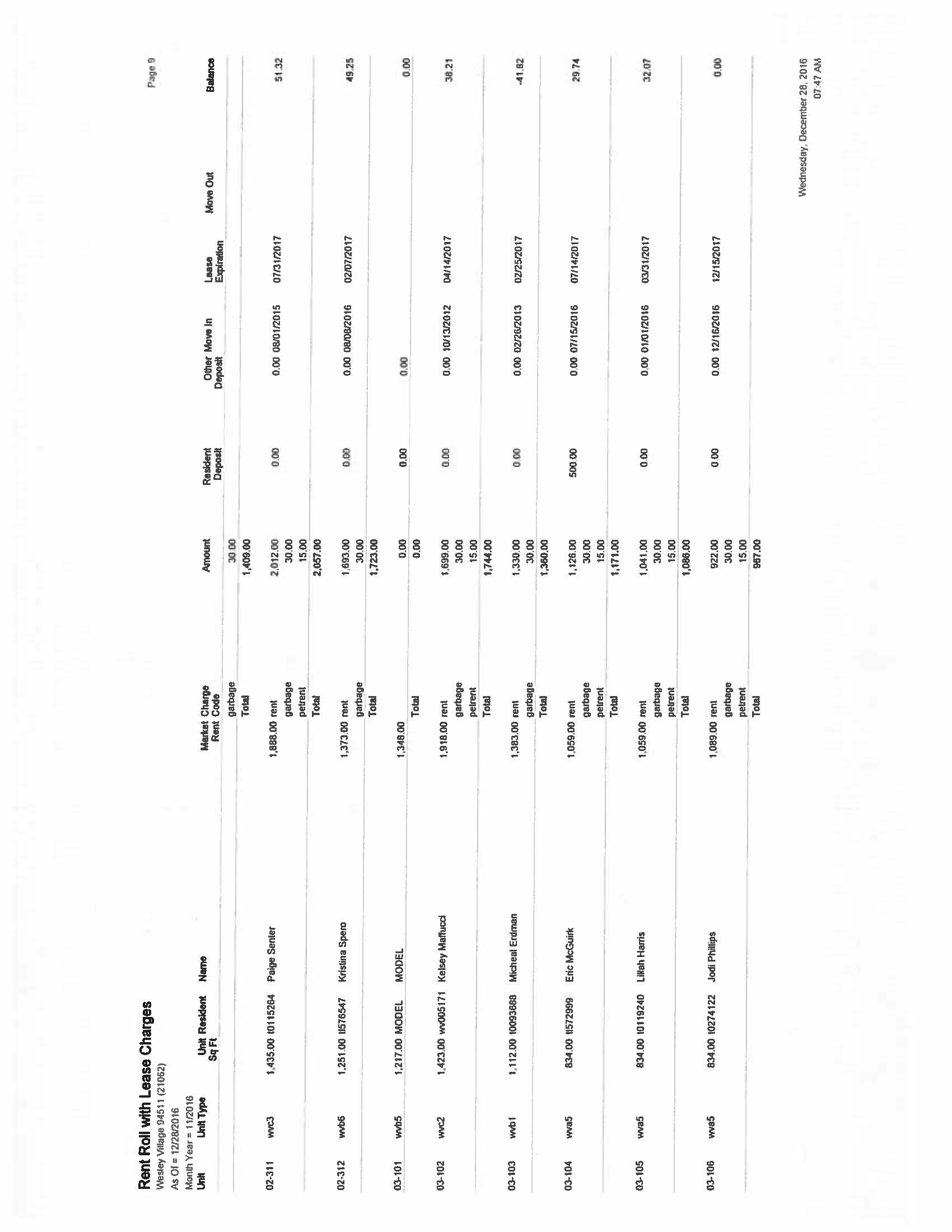

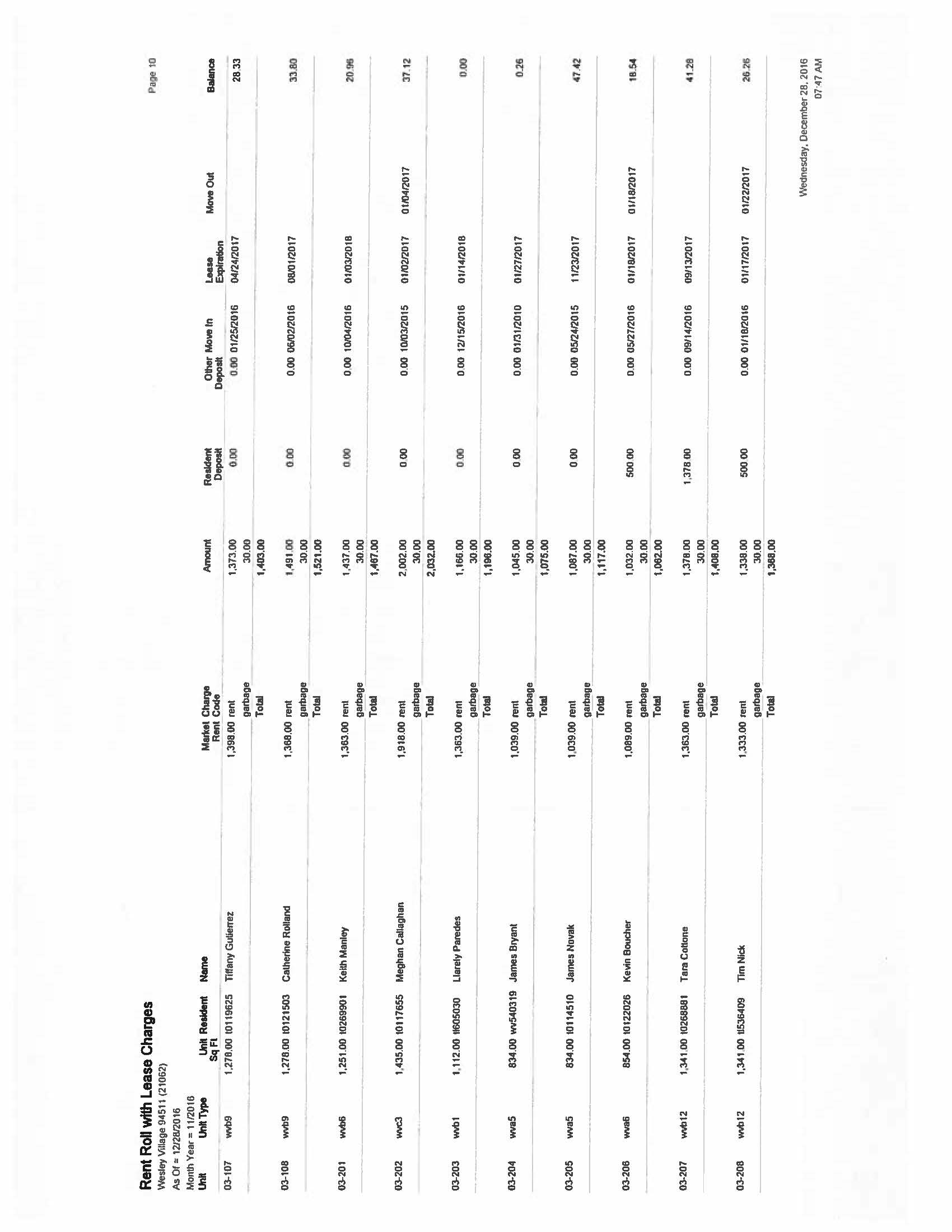

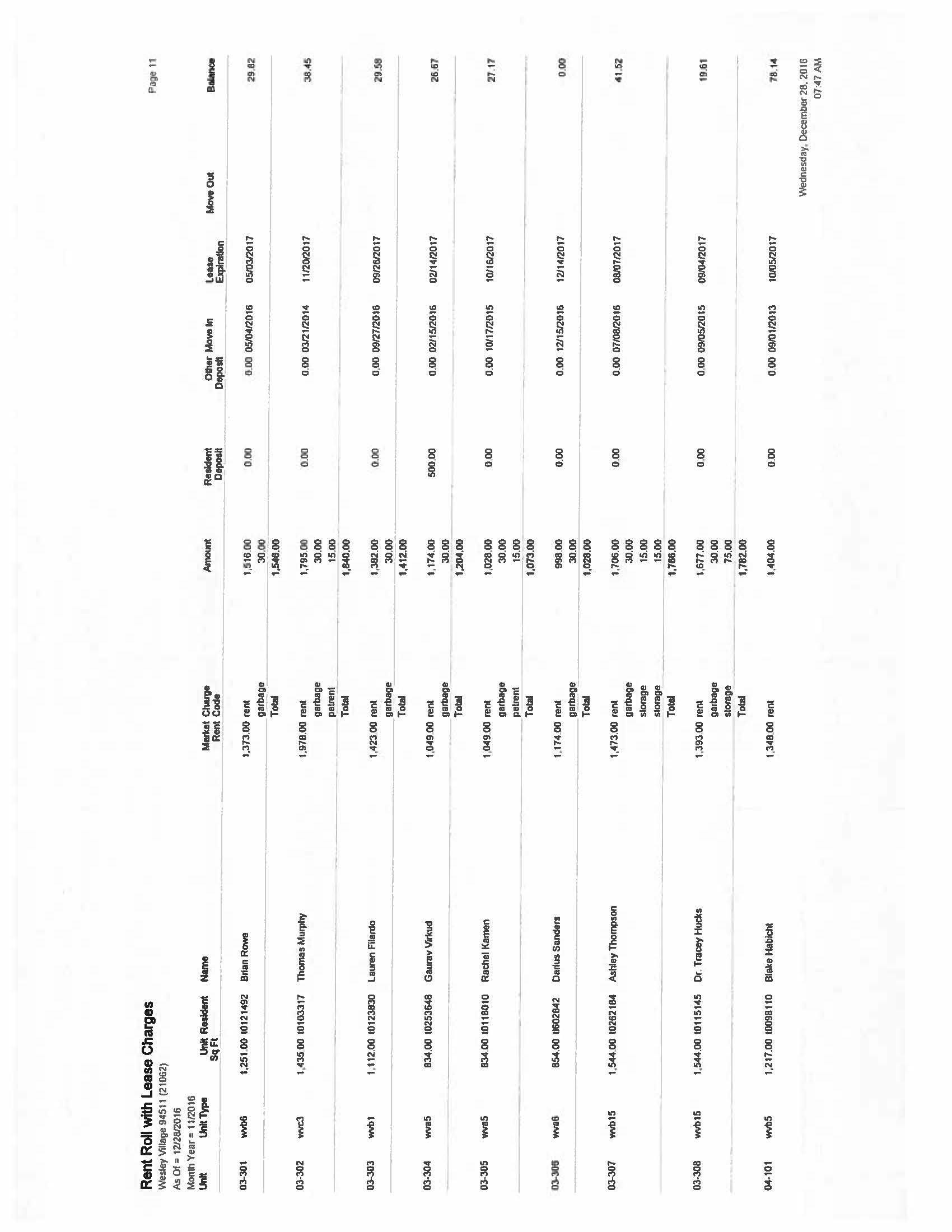

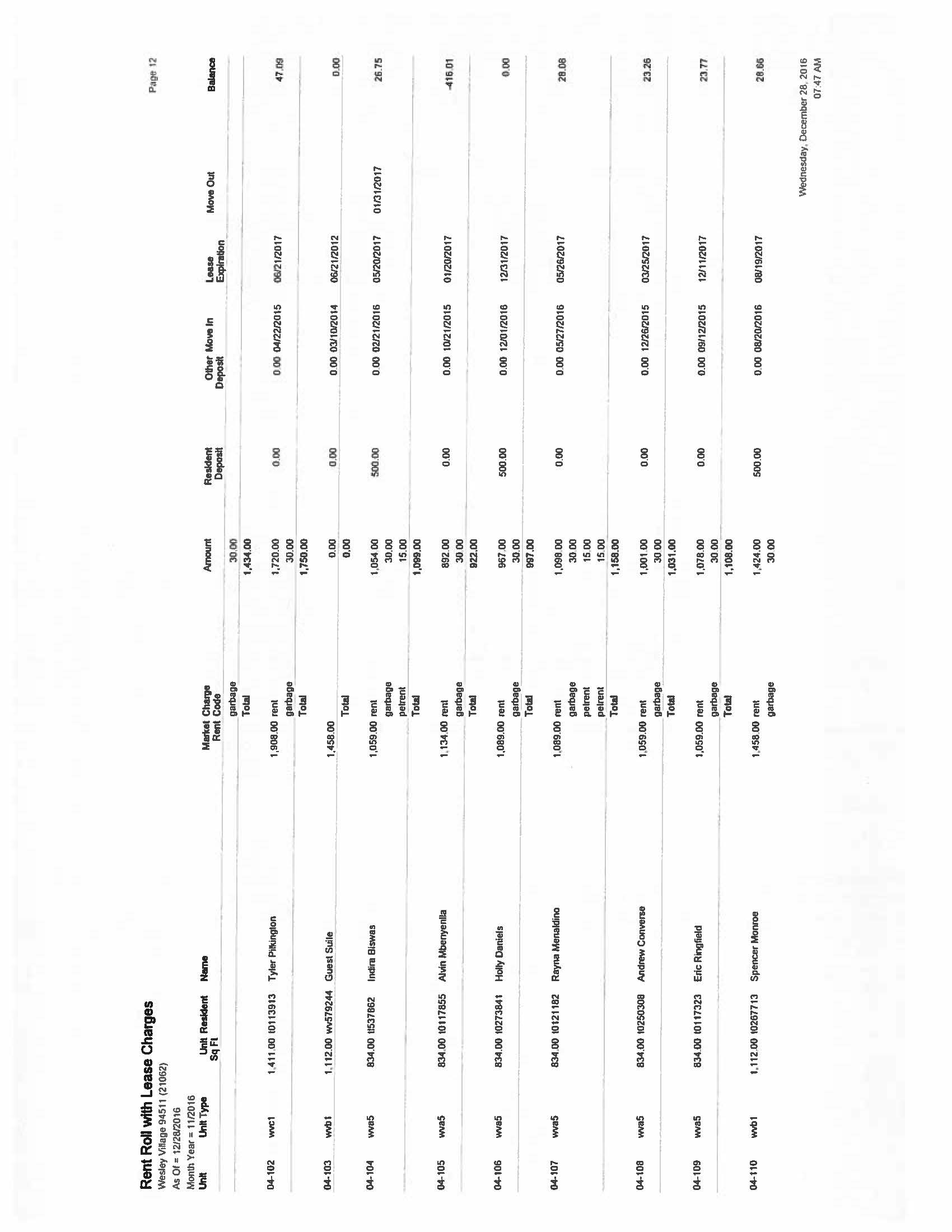

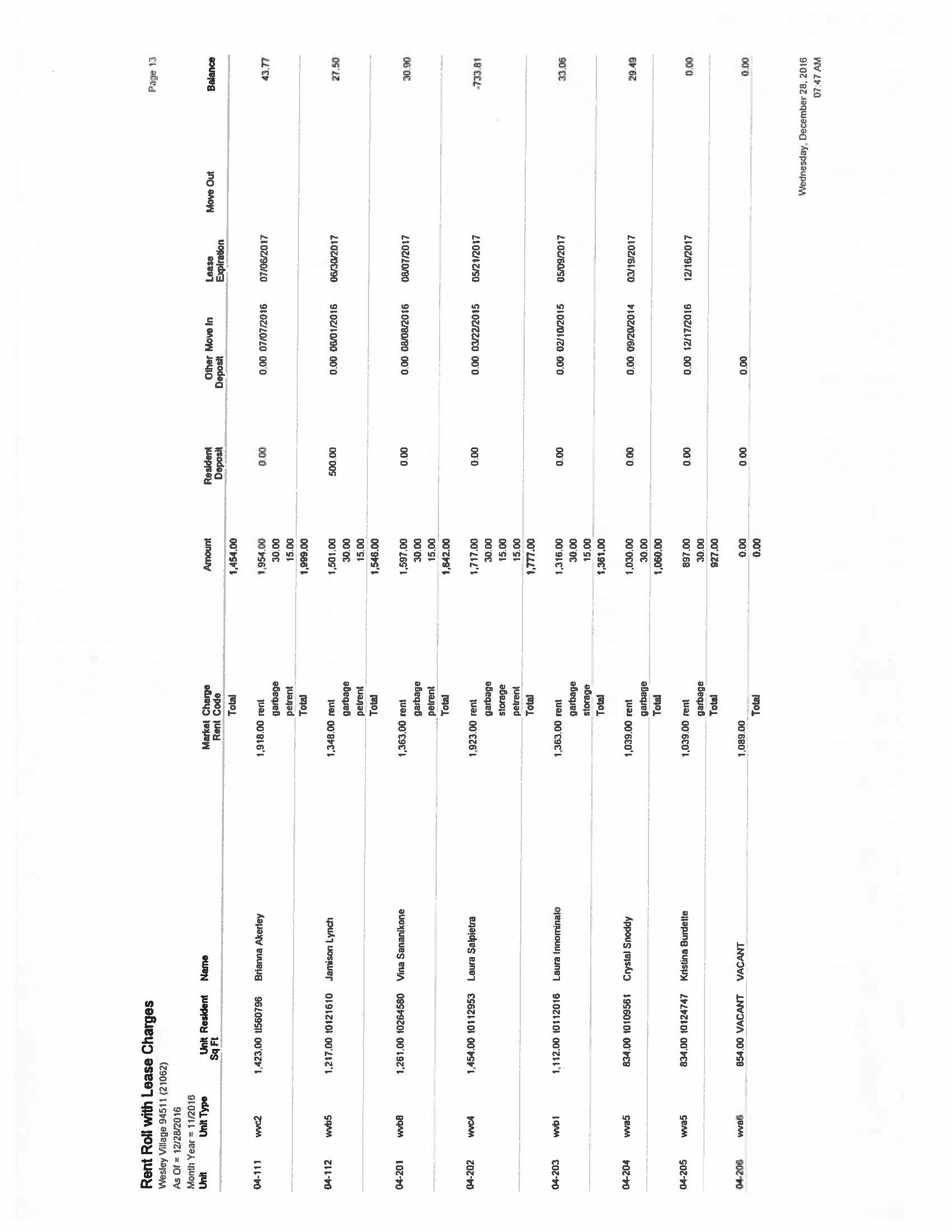

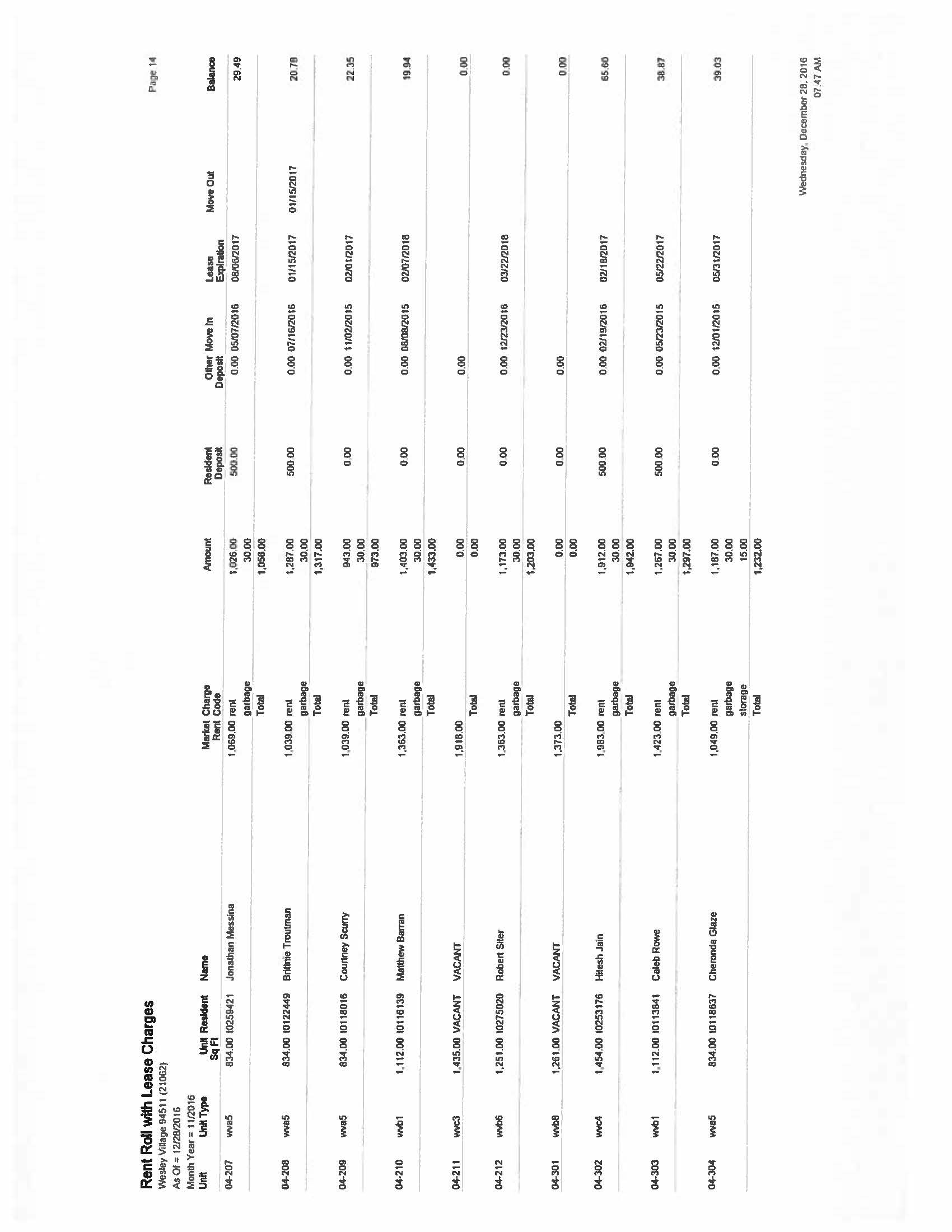

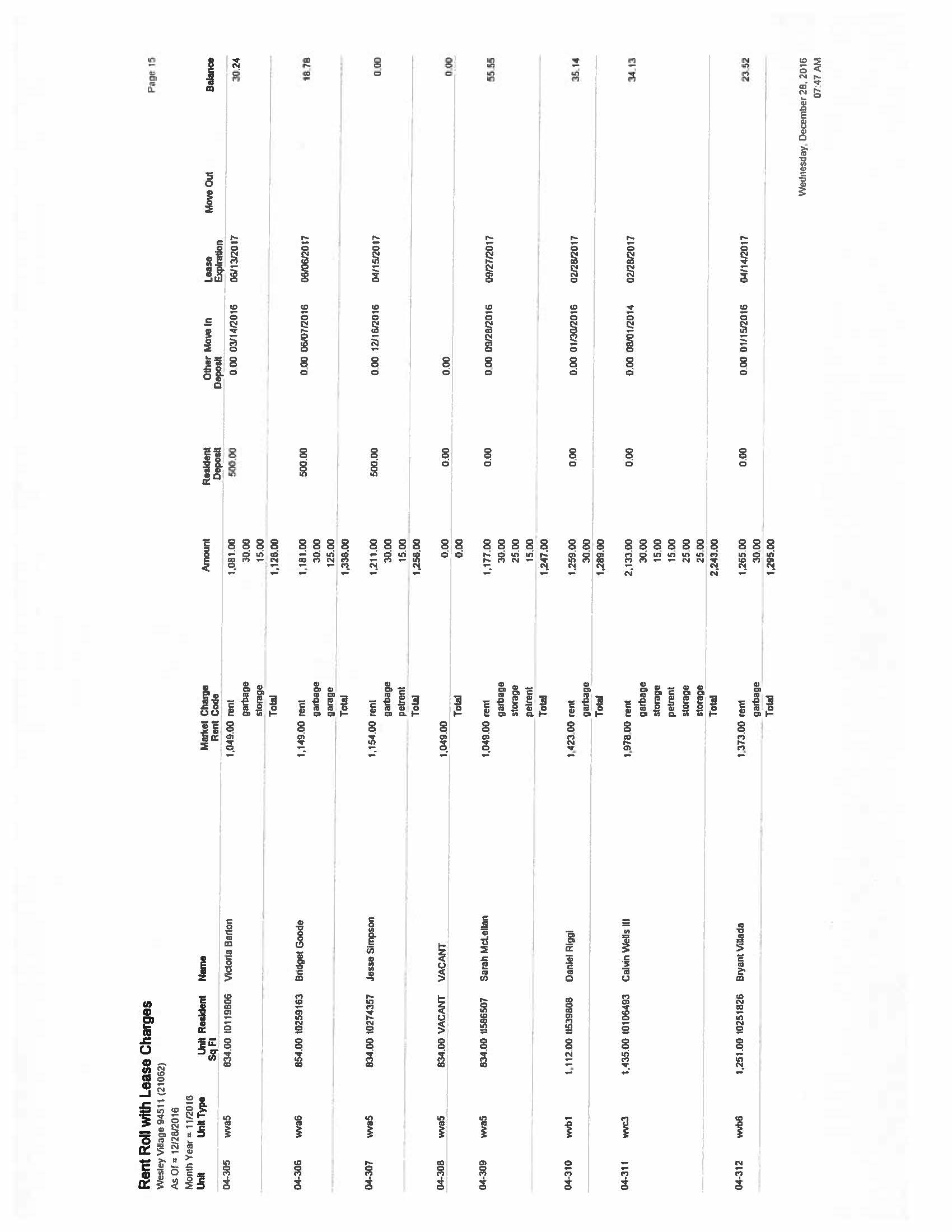

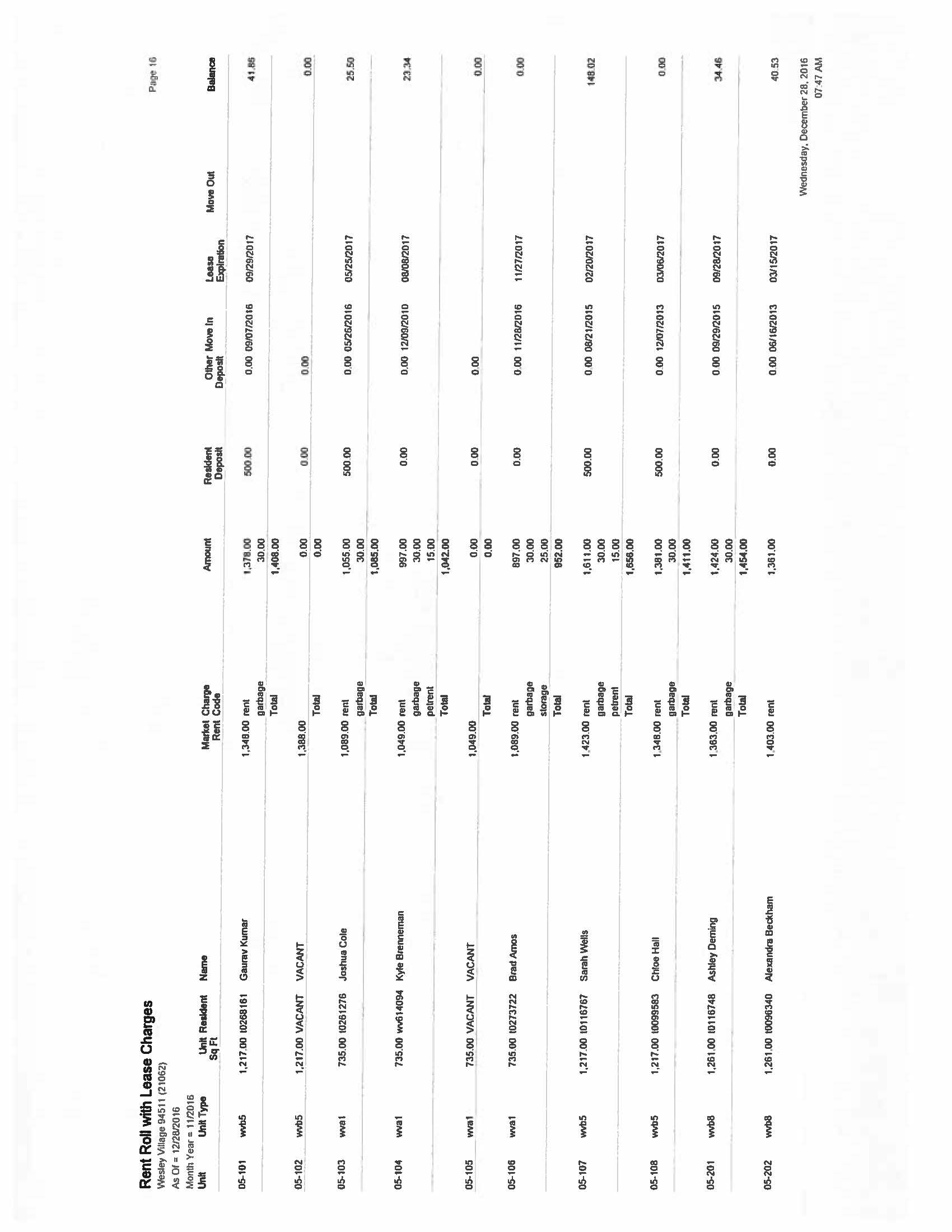

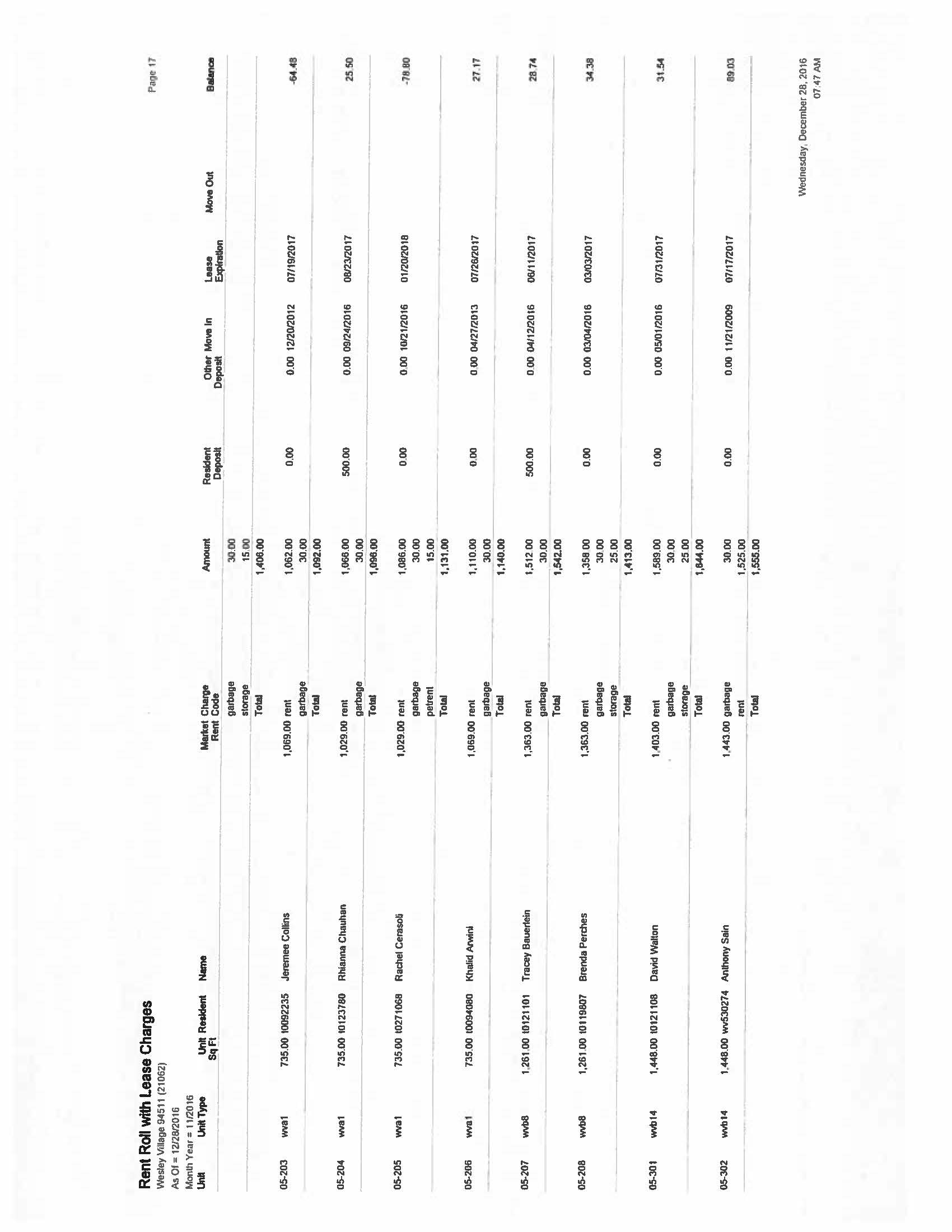

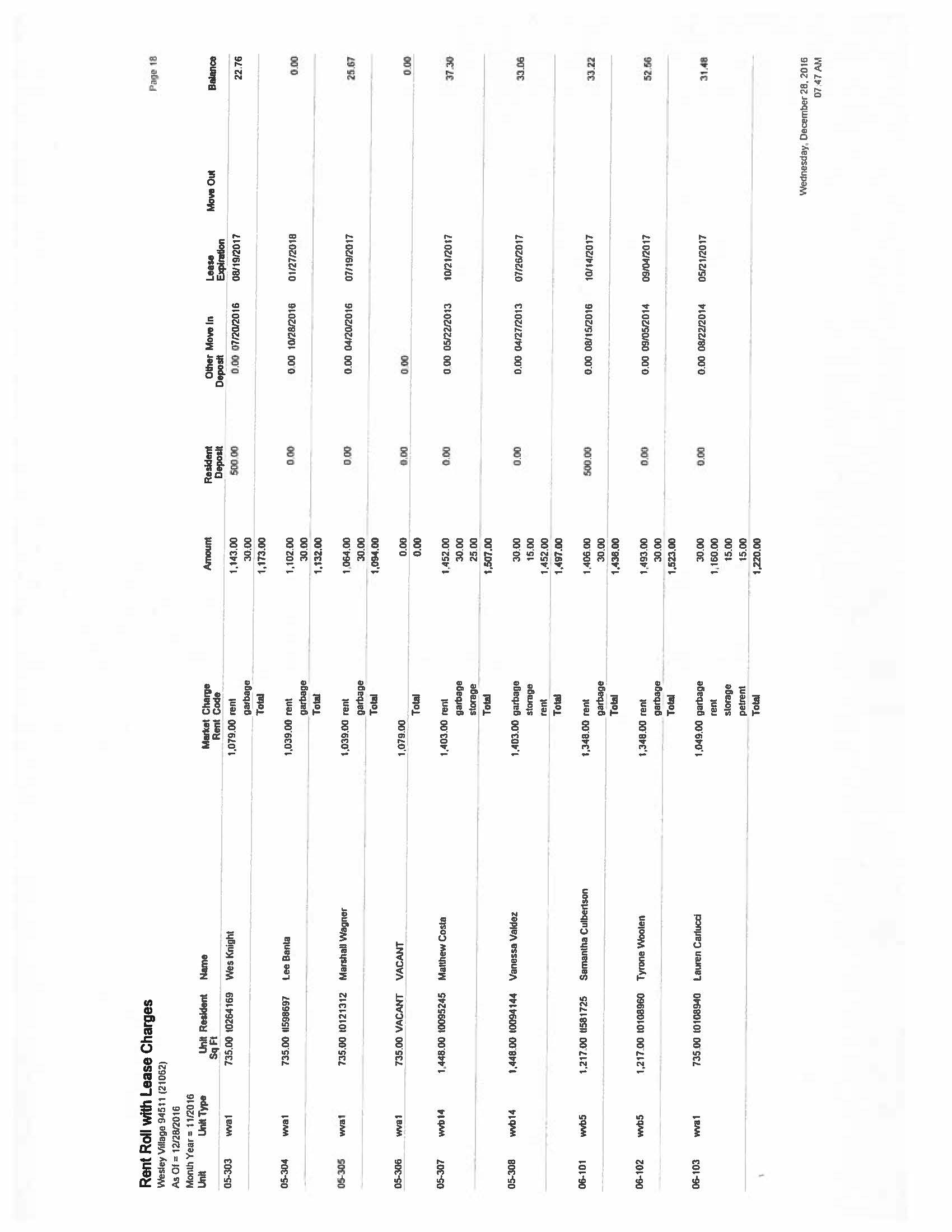

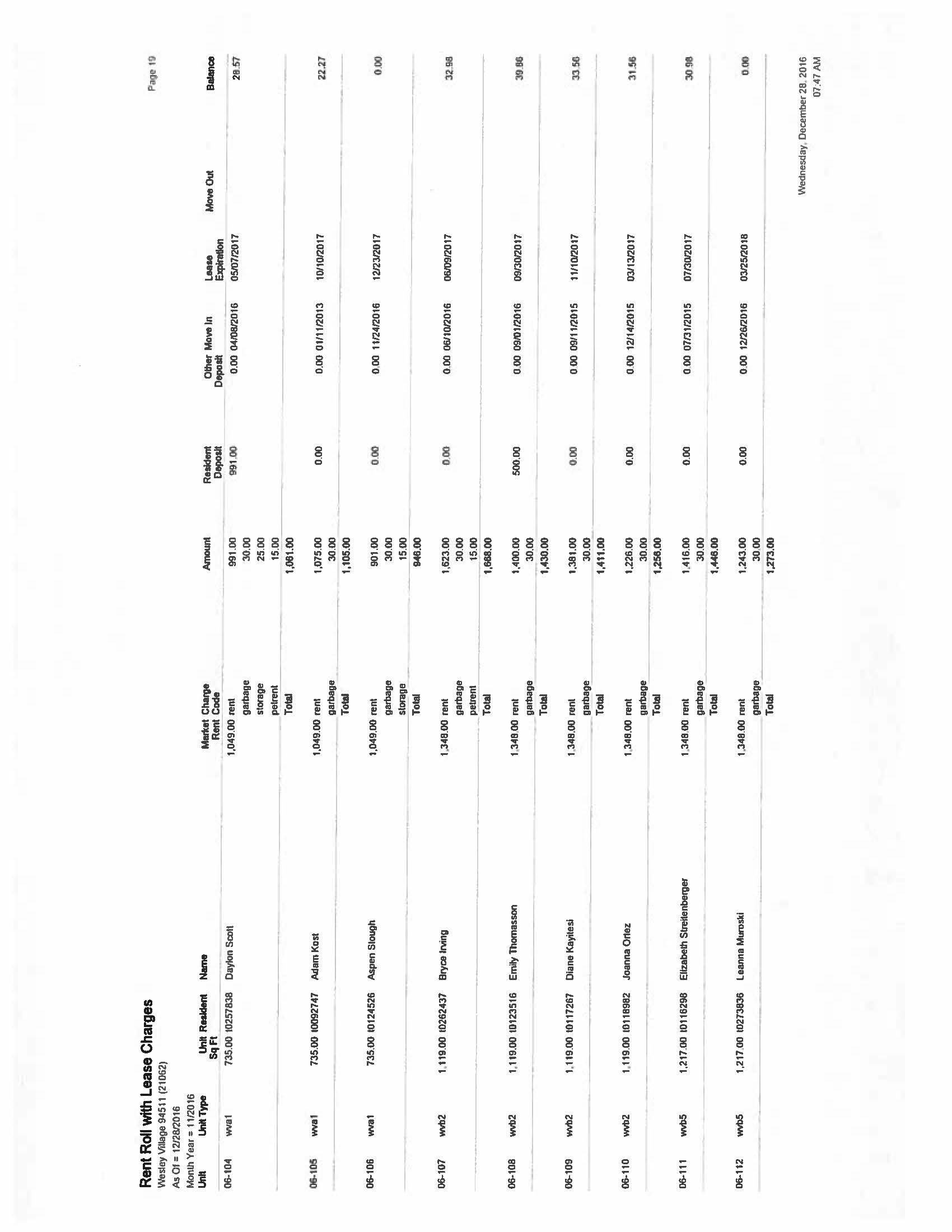

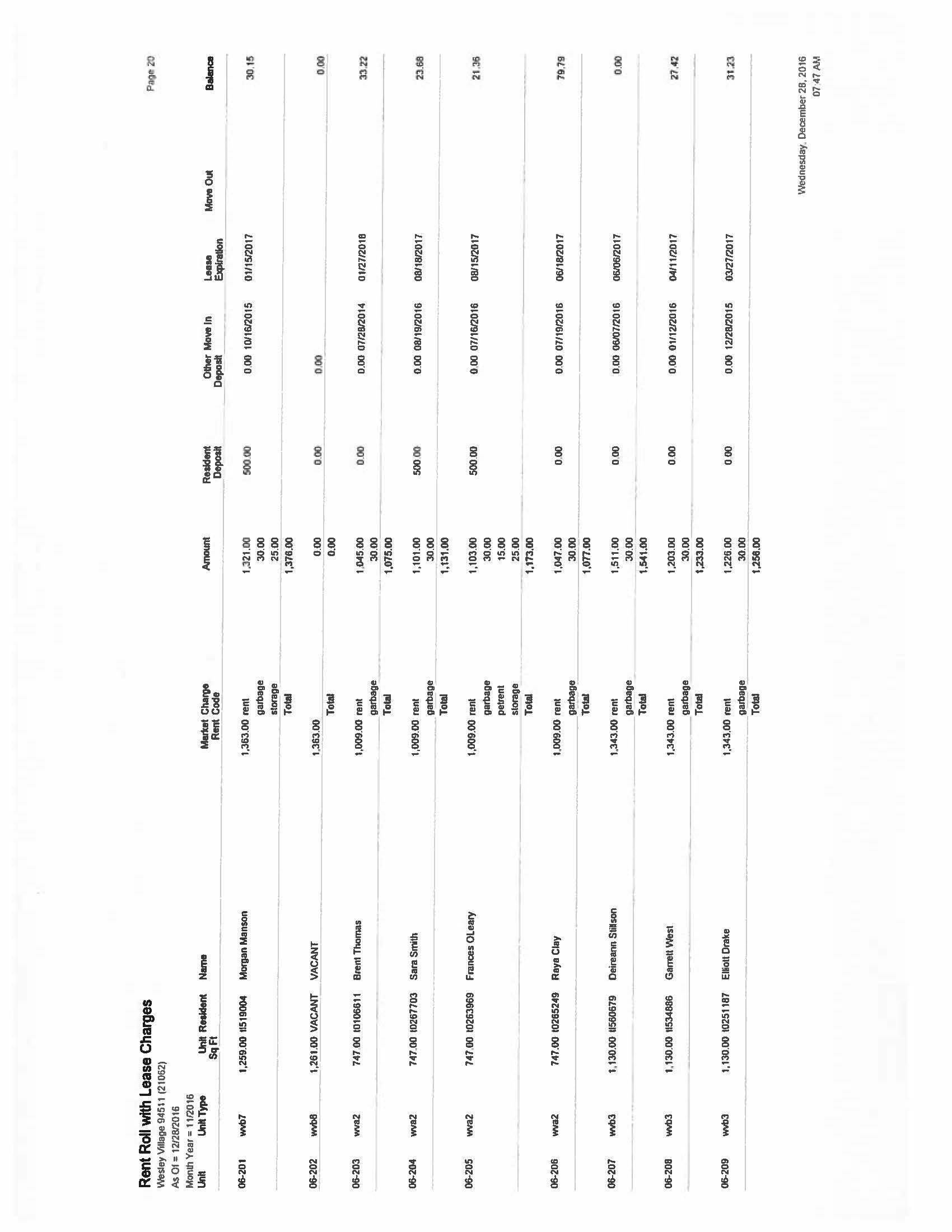

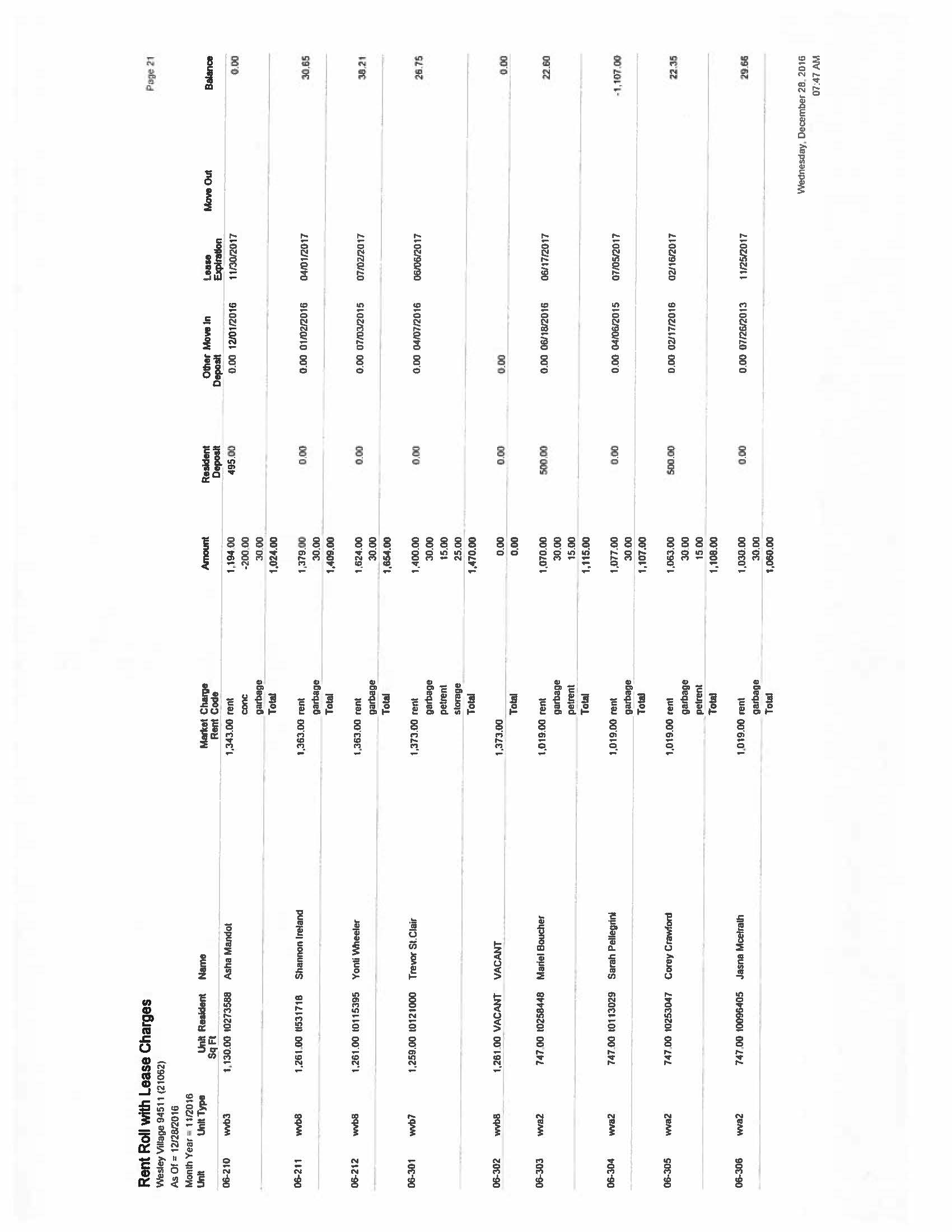

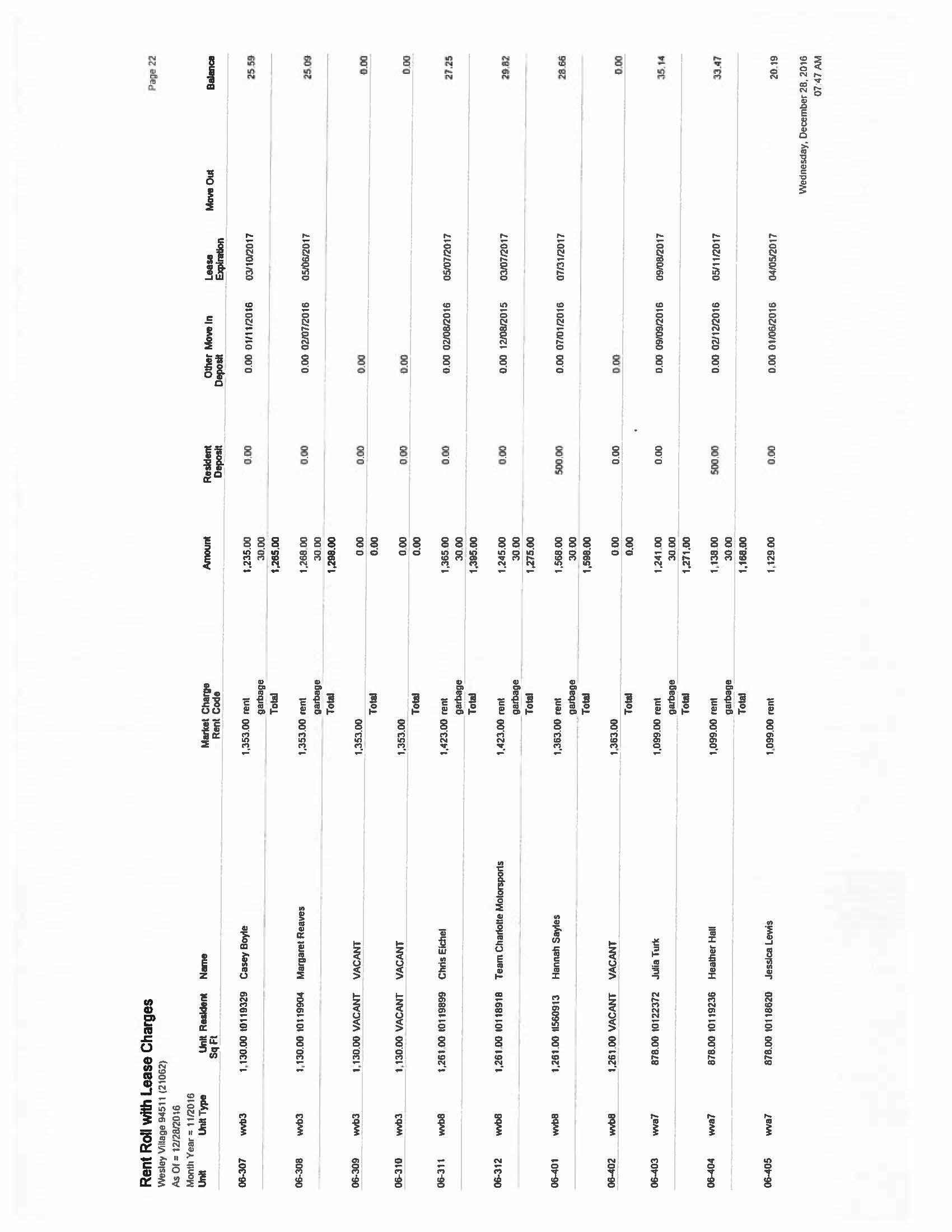

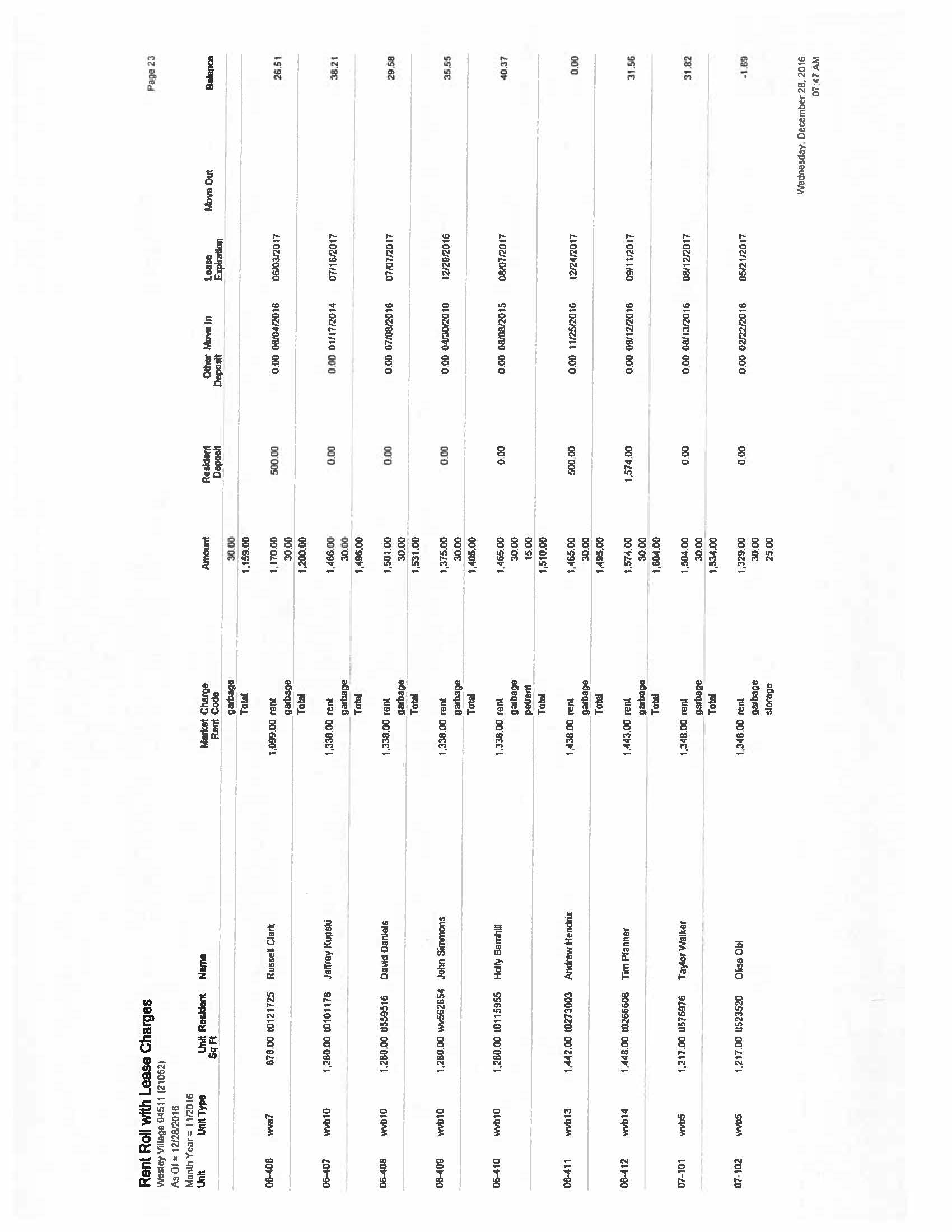

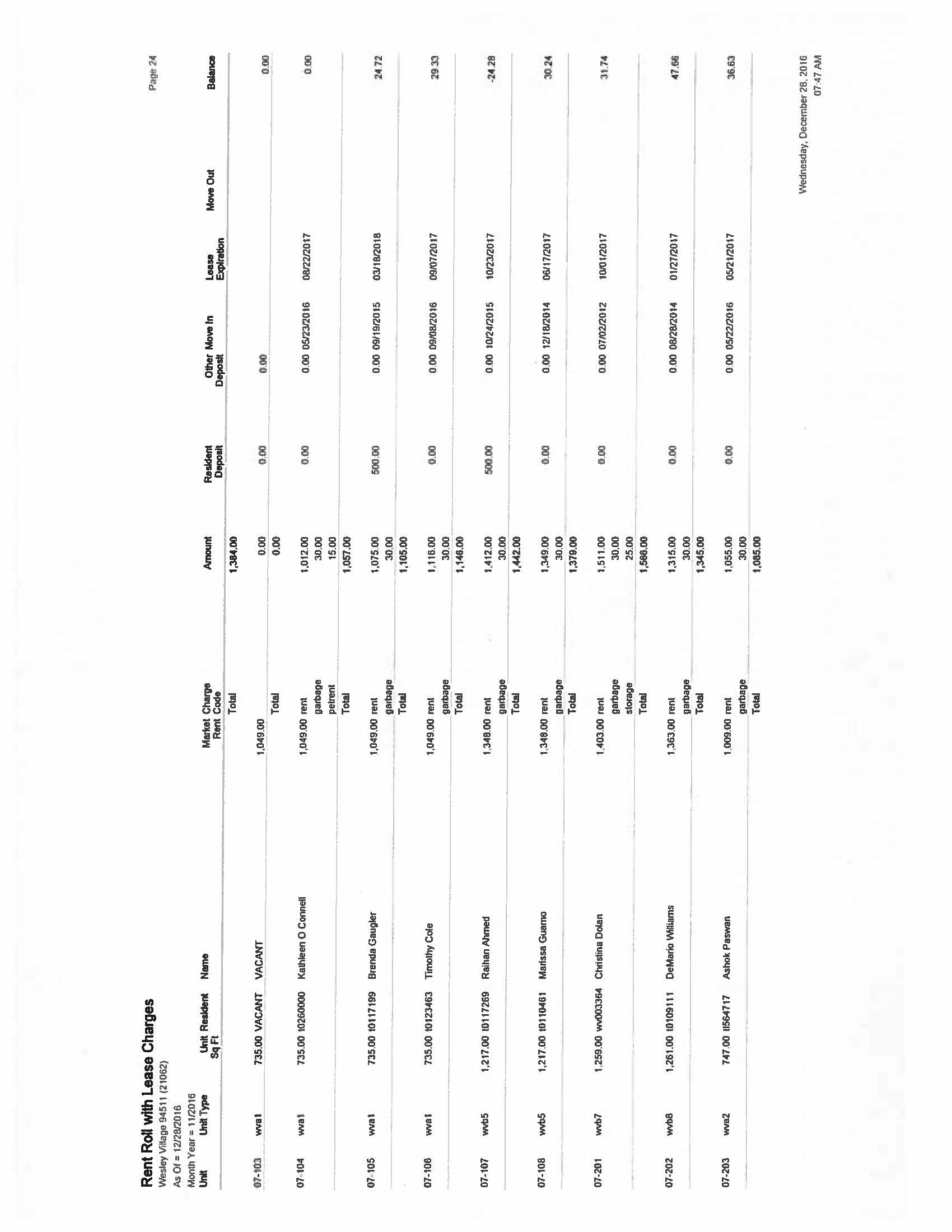

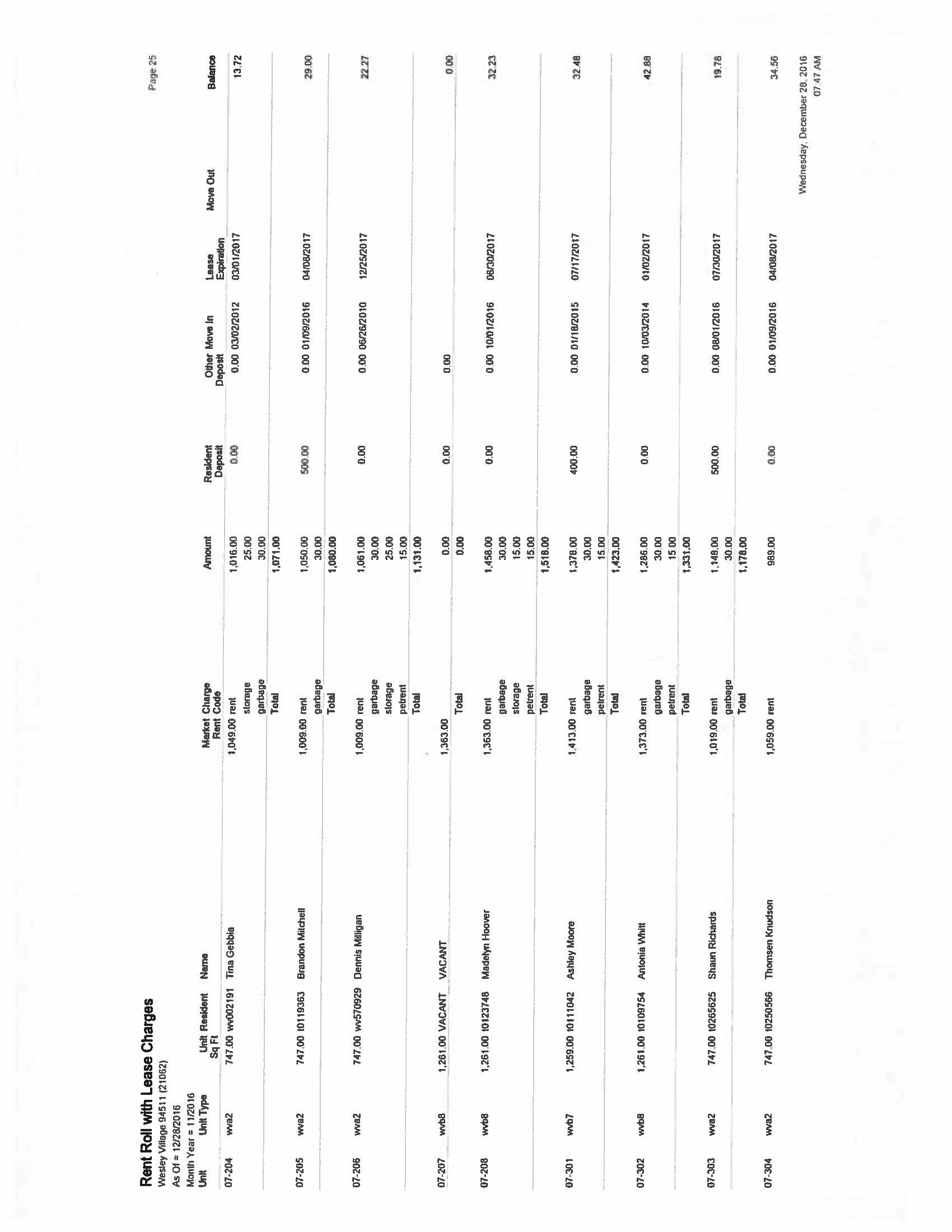

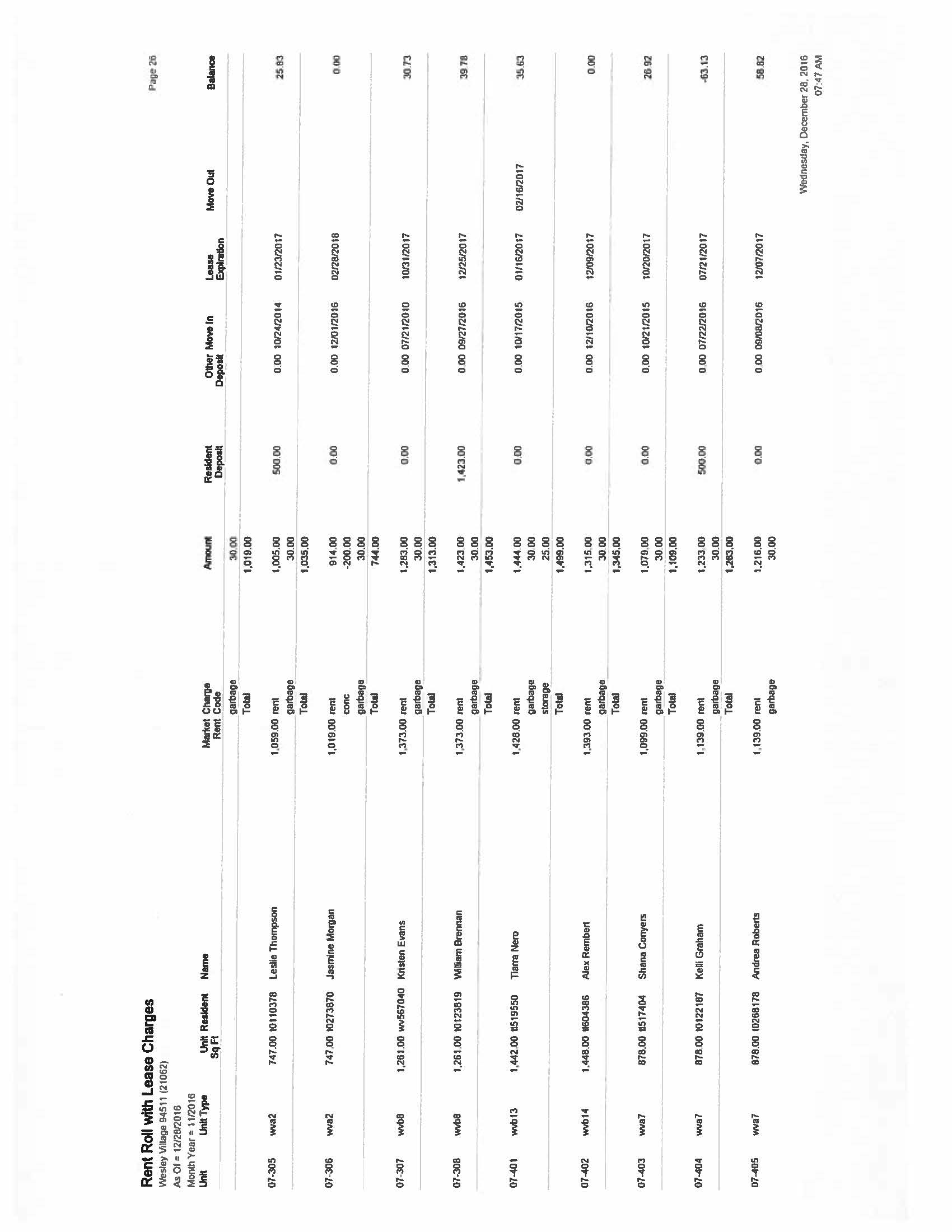

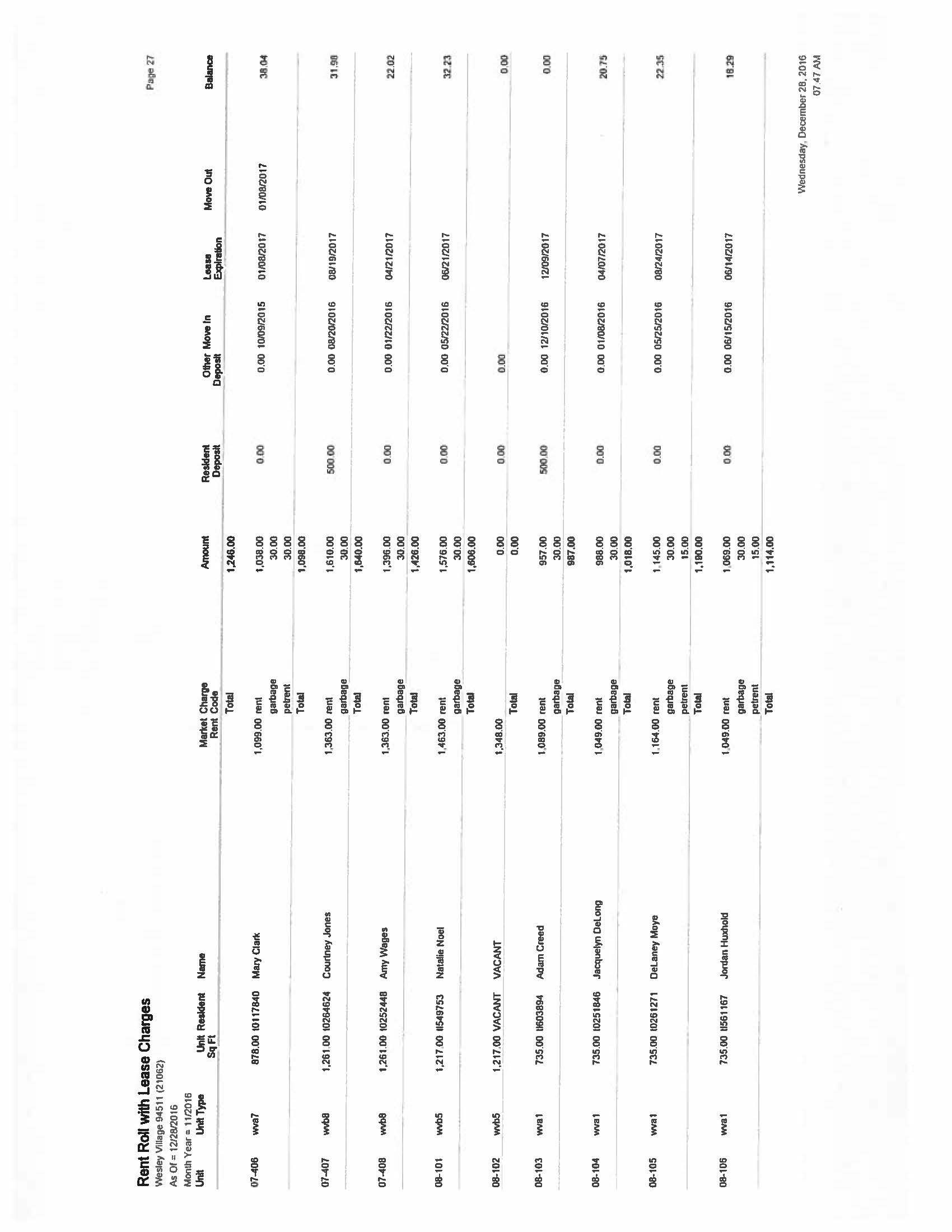

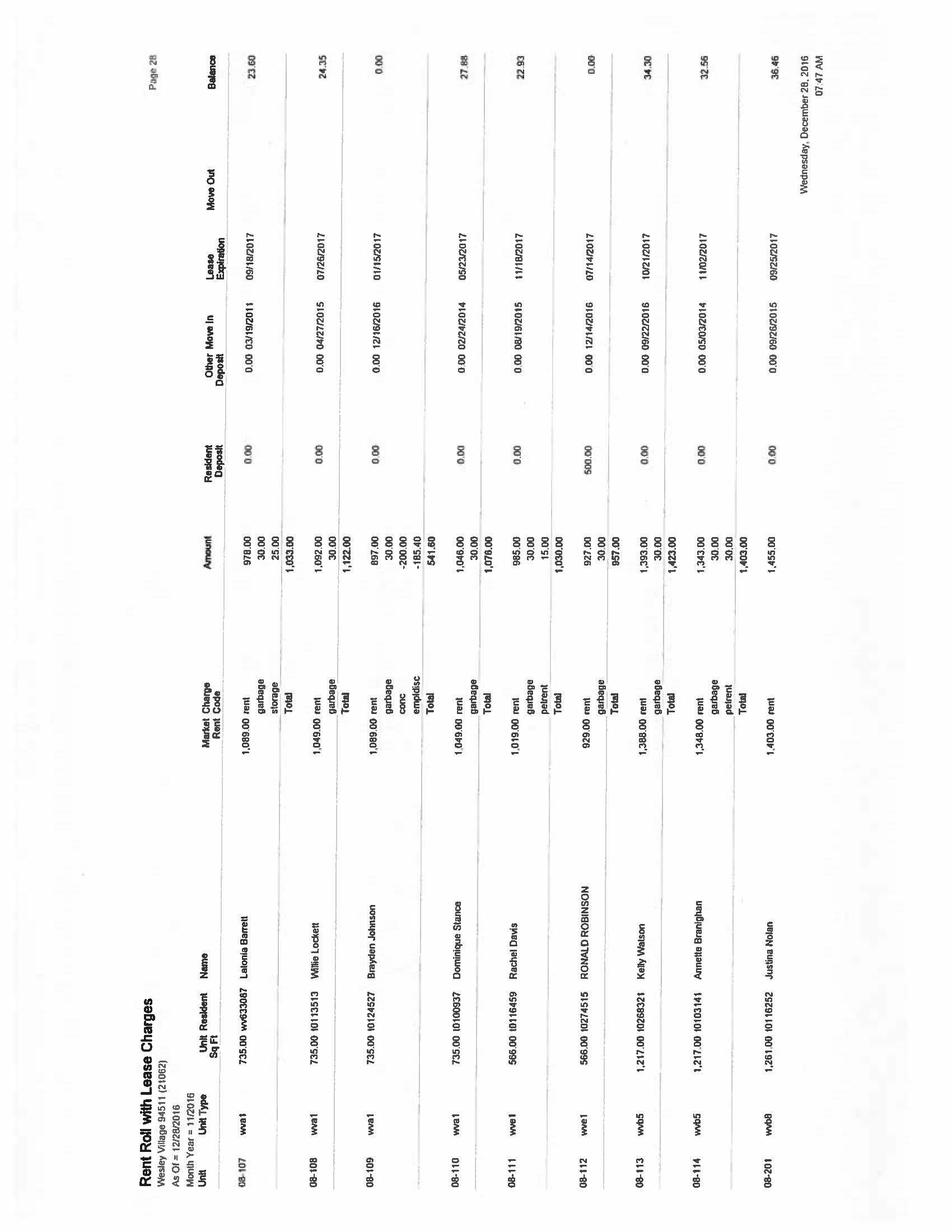

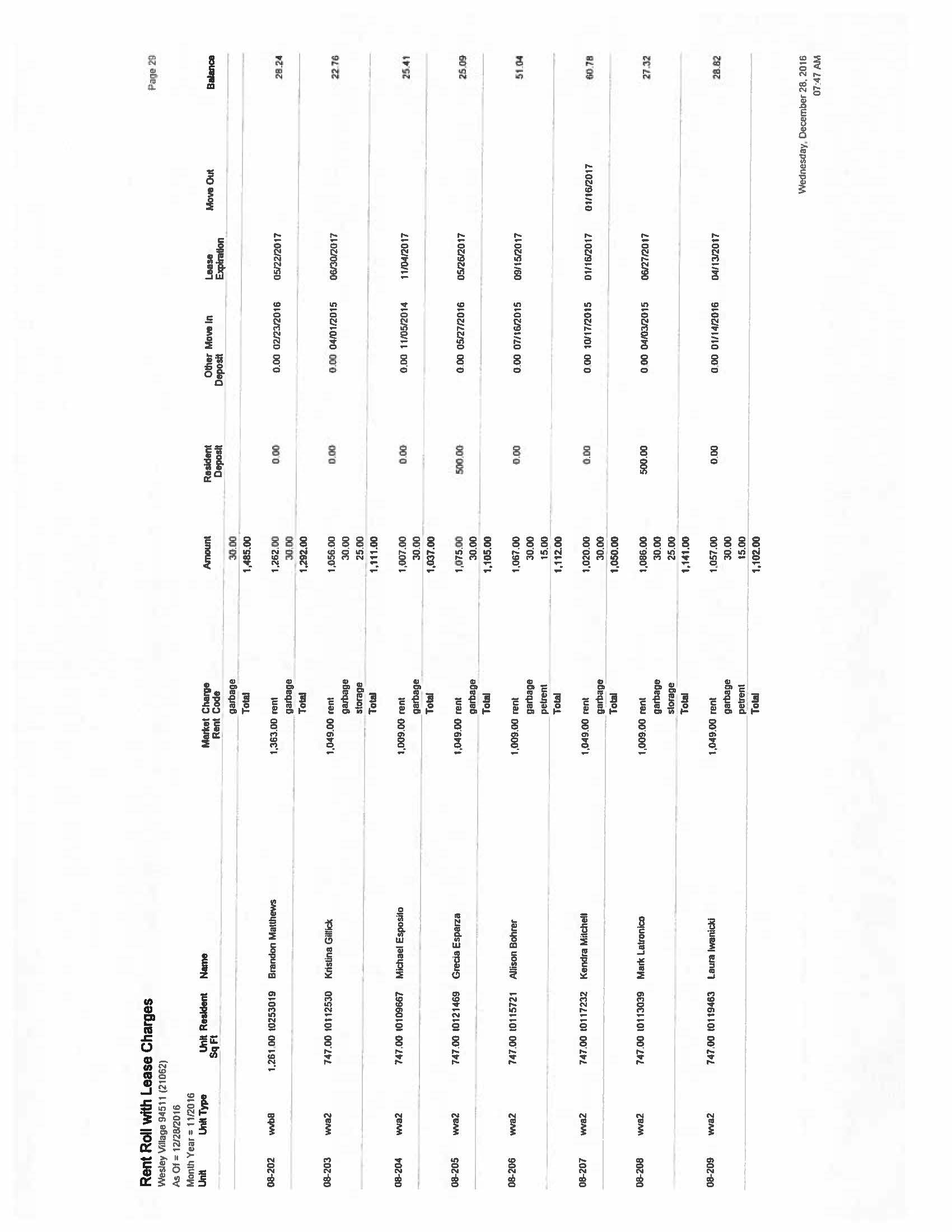

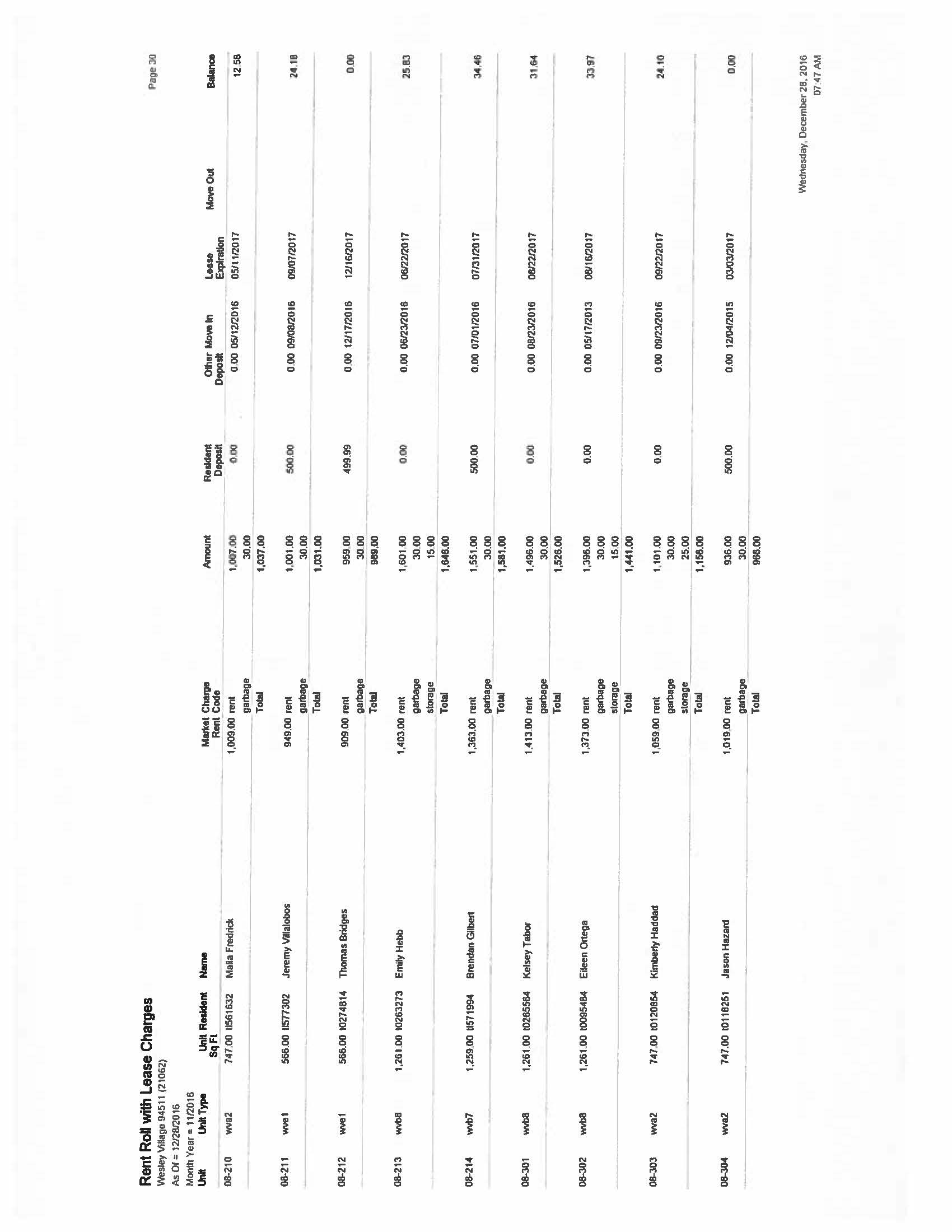

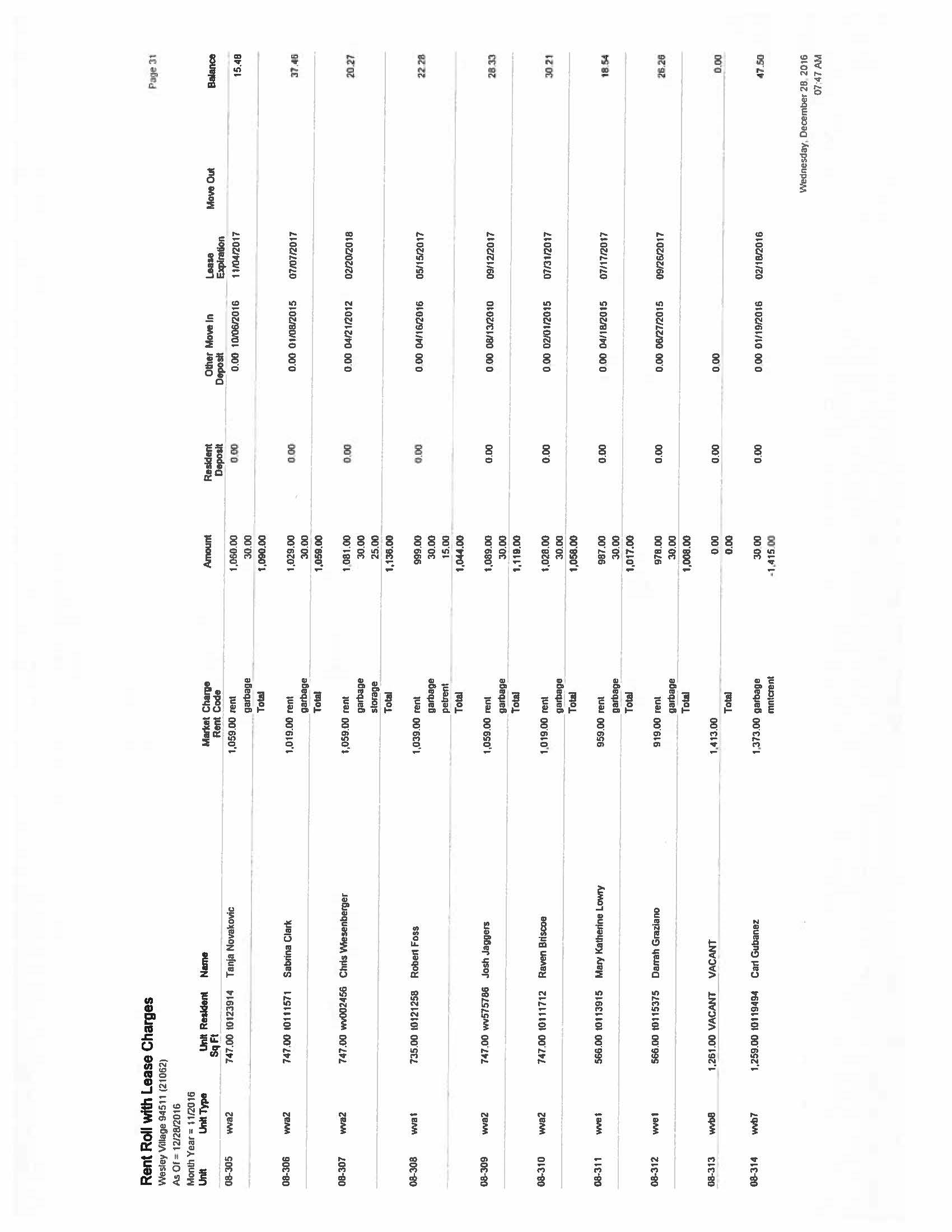

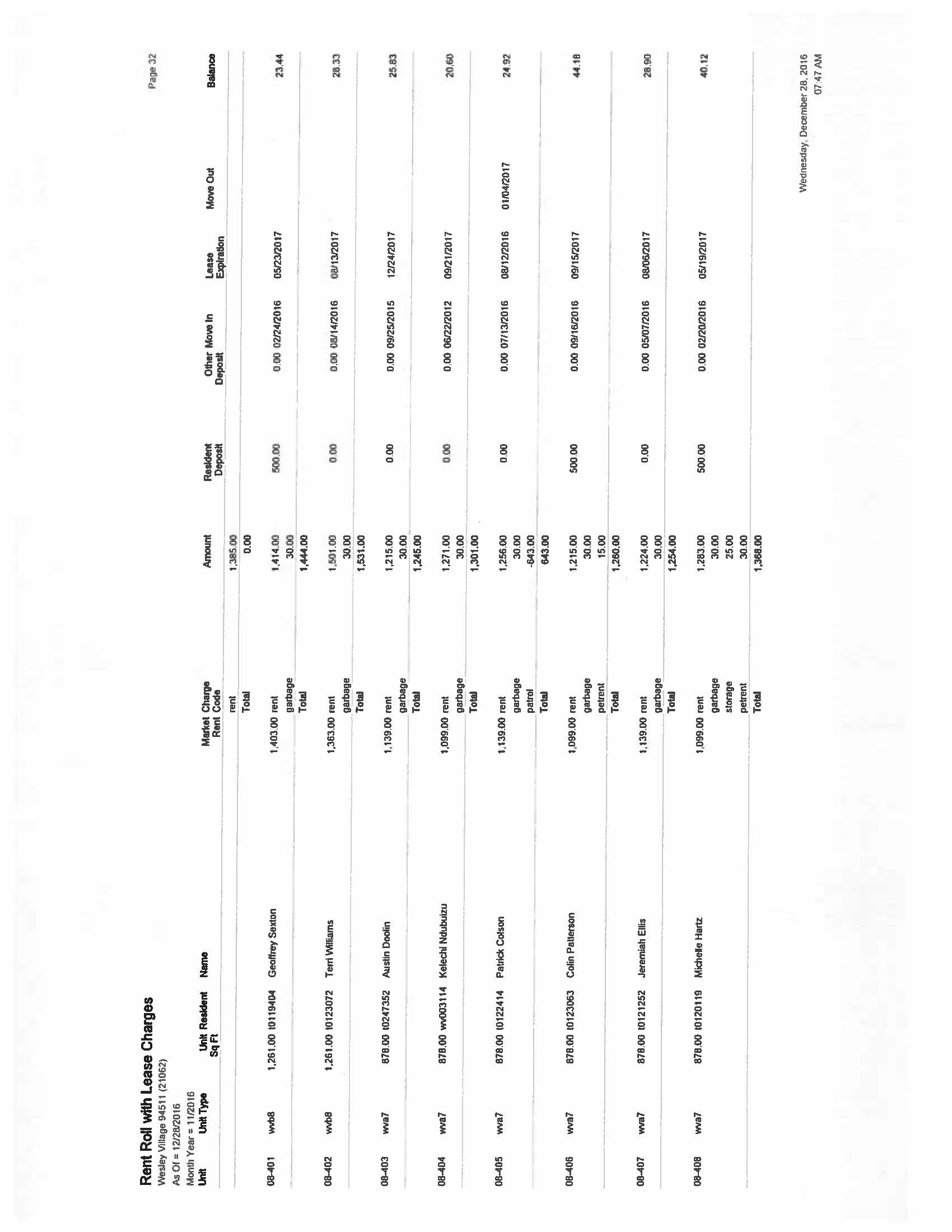

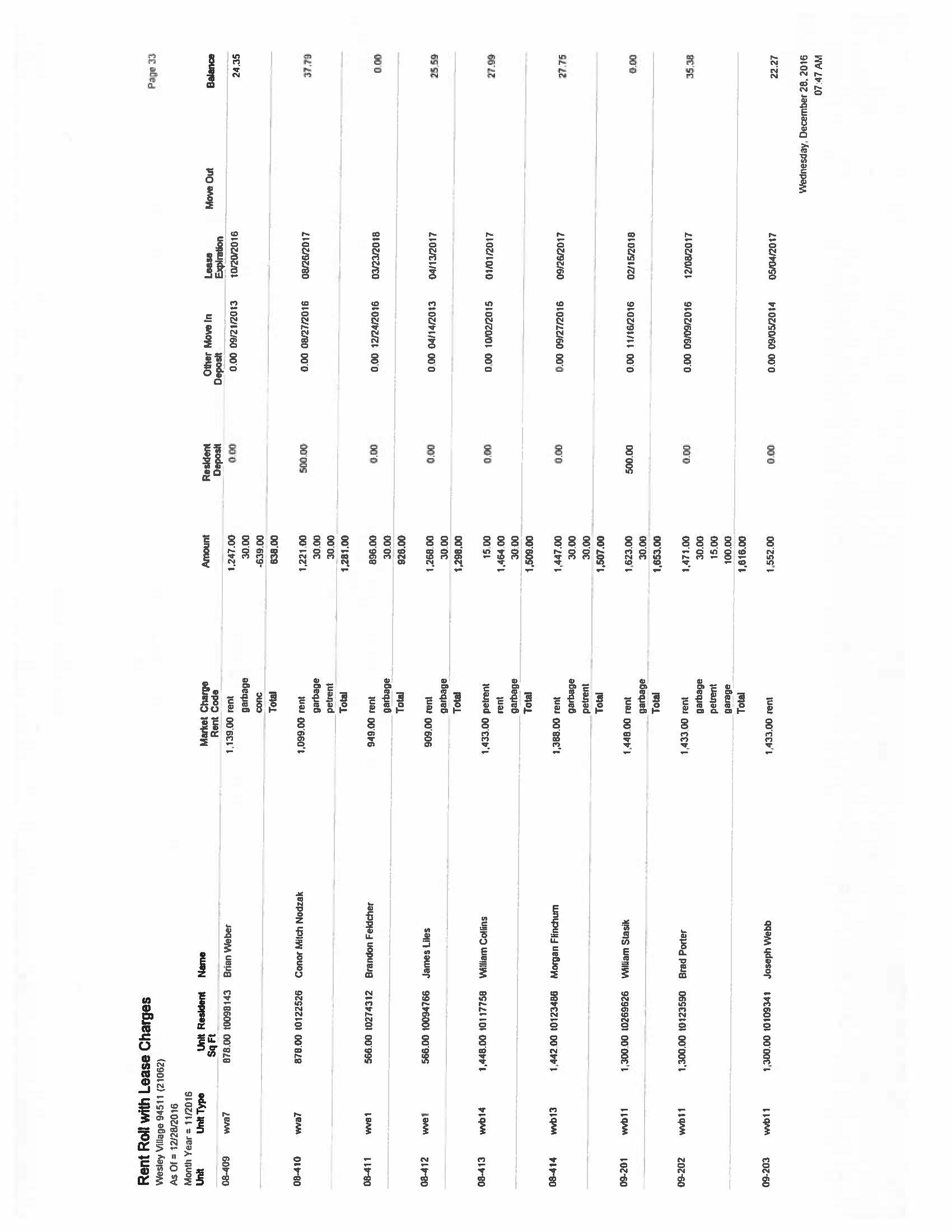

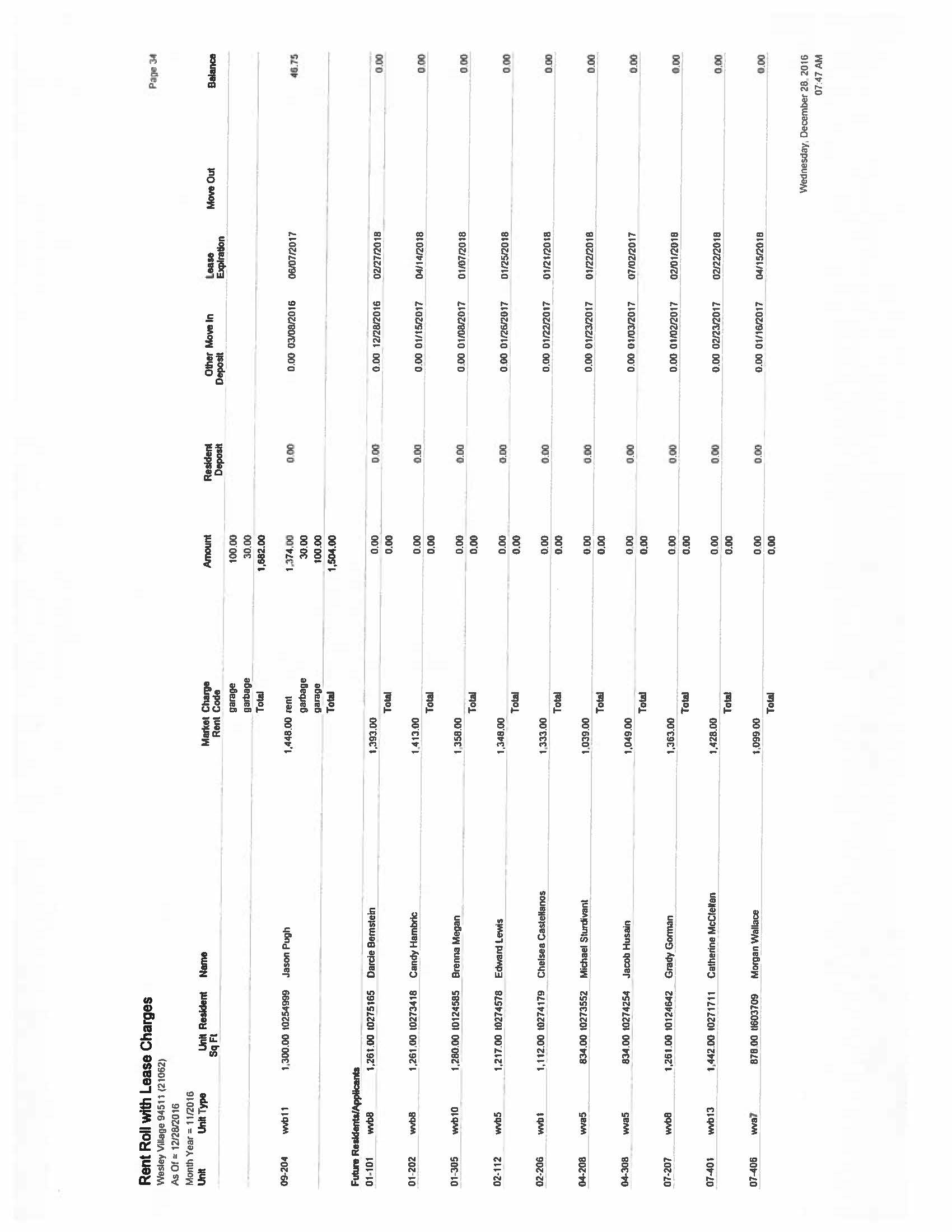

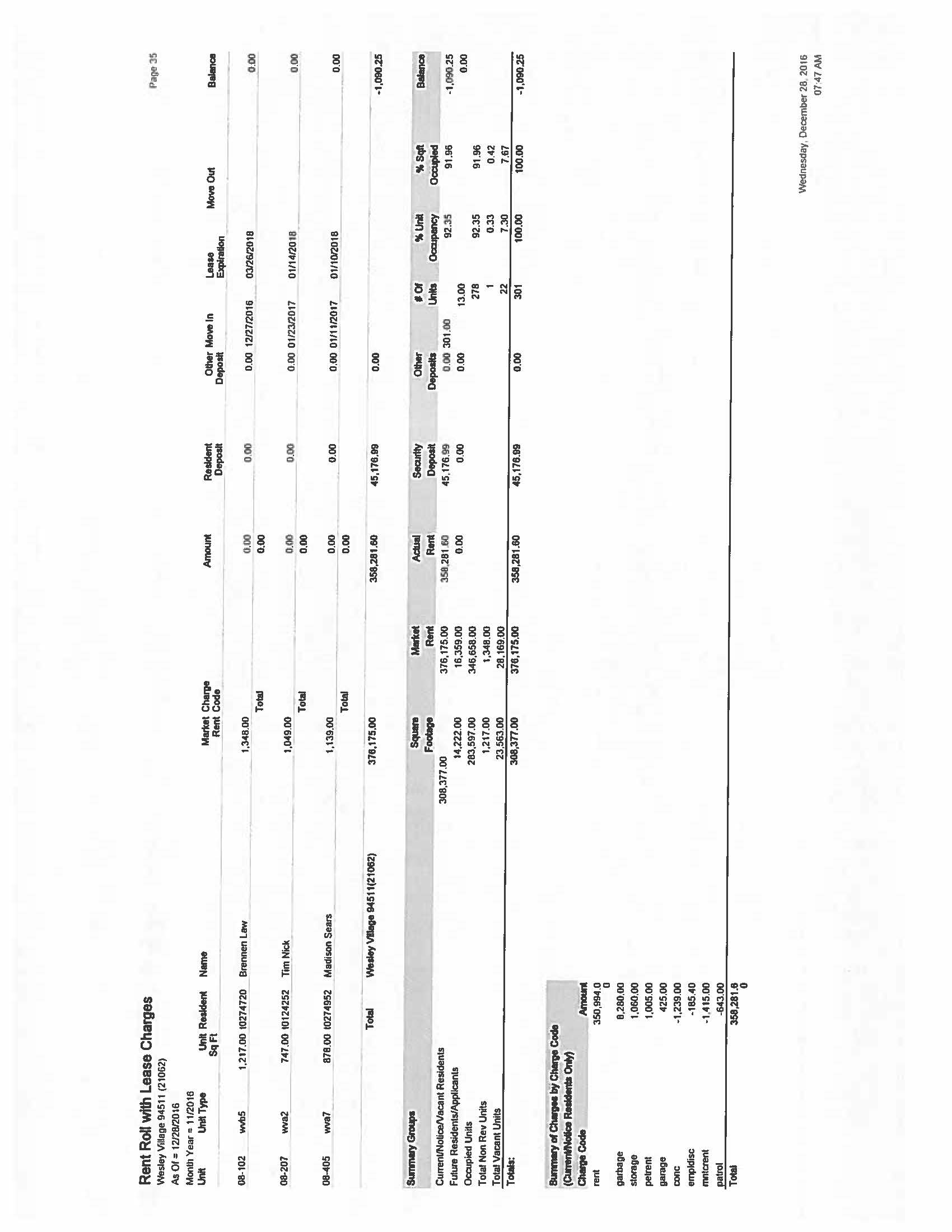

5. All leases for tenants of the Real Property and other leases or agreements (excluding any Assumed Service Contracts) with any persons or entities using or occupying the Real Property or the Improvements or any part thereof, including any amendments, exhibits, addenda and riders thereto, and guaranties thereof, which lease agreements reflect a possessory interest in any portion of the Real Property or the Improvements on or after the Closing Date (as hereinafter defined) (collectively, the "Leases"), and the balance as of the Closing Date of any refundable security deposits under the Leases. A current rent roll (“Rent Roll”) reflecting the Leases as of the Effective Date is attached hereto as Exhibit “J” identifying the leased premises for each Lease, the term of each Lease, the rental and other sums payable under each Leases and the amount of any security deposit held by Seller under each Lease.

NOW, THEREFORE, in consideration of the foregoing recitals and the mutual promises and agreements hereinafter contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Buyer hereby agree as follows:

ARTICLE 1

DEPOSIT

DEPOSIT

1.1 Buyer’s Earnest Money Deposit. On or prior to the date which is two (2) business days after the Effective Date, Buyer shall deliver the sum of FIVE HUNDRED THOUSAND

{00847420.10 46276-000125 }

2

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

DOLLARS ($500,000.00) in immediately available funds (the "Initial Earnest Money Deposit") to Madison Title Agency, LLC, National Title Services, 1125 Ocean Avenue, Lakewood, New Jersey 08701, Attention: Sydney Finelli ("Escrow Agent" or "Title Insurer"). Upon delivery of the Initial Earnest Money, TWO HUNDRED FIFTY THOUSAND DOLLARS ($250,000.00) (the “Non-Refundable Portion”) of the Initial Earnest Money Deposit shall be deemed non-refundable except in connection with (a) a default by Seller under this Agreement, (b) the termination of this Agreement in connection with a casualty or condemnation pursuant to Section 2.7 of this Agreement, (c) the election of Buyer to terminate this Agreement pursuant to Section 2.6.3 as evidenced by written notice to Seller delivered with respect to any Objectionable Title Matter or Mandatory Cure Item; provided, however, that with respect to any such termination that permits Buyer to obtain a refund of the Non-Refundable Portion, any such Objectionable Title Matter must involve either (1) a matter that will, in Buyer’s reasonable discretion, have a material effect on the Buyer’s ownership, use, financing or operation of the Property or the value of the Property or (2) a matter that has been objected to by Buyer’s lender, (d) the termination of this Agreement as a result of a failed condition set forth in Article 4 of this Agreement and (e) the termination of this Agreement as evidenced by written notice to Seller delivered as a result of any environmental condition affecting the Property which, in Buyer’s or Buyer’s acquisition lender’s sole discretion, affects the Buyer’s ownership, use, financing or operation of the Property (each, a “Full Refund Event”). On or prior to the Approval Date (as hereinafter defined in Section 2.5.3), Buyer shall have the right to terminate this Agreement in accordance with Section 2.5.3, in which case the Earnest Money Deposit shall be returned to Buyer (subject to deduction of the Non-Refundable Portion which shall be paid to the Seller unless Buyer’s election to terminate arises out of one or more of the Full Refund Events) and the parties shall have no further obligations hereunder except as otherwise provided herein. In the event that Buyer does not terminate this Agreement pursuant to the terms of Section 2.5.3, on or prior to the Approval Date Buyer shall deliver the additional sum of FIVE HUNDRED THOUSAND DOLLARS ($500,000.00) in immediately available funds (the "Additional Earnest Money Deposit") to Escrow Agent and the transaction contemplated by this Agreement shall proceed in accordance with the terms hereof. The Initial Earnest Money Deposit and the Additional Earnest Money Deposit shall be referenced herein as the "Earnest Money Deposit". The Earnest Money Deposit shall be held in accordance with the terms of this Agreement and shall be applied as a credit to the Purchase Price due to Seller at the Closing. In the event Buyer fails to timely deposit any portion of the Earnest Money Deposit as provided above, this Agreement shall immediately terminate. Escrow Agent shall deposit the Earnest Money Deposit in an interest-bearing account at a bank or other FDIC insured financial institution reasonably acceptable to Buyer and Seller. Provided Buyer has not terminated this Agreement pursuant to the terms of Section 2.5.3, after the Approval Date, the Earnest Money Deposit shall be non-refundable to Buyer except in the event that (i) Seller defaults under this Agreement, (ii) one or more of the conditions to Buyer’s obligations to close the purchase of the Property set forth in Article 4 of this Agreement is not satisfied or waived as provided therein, or (iii) as otherwise expressly provided herein. Upon execution of this Agreement, Buyer shall provide Escrow Agent with Buyer’s Federal tax identification number for reporting of any earnings on the Earnest Money Deposit. Any interest earned on the Earnest Money Deposit shall be excluded from the Earnest Money Deposit and shall remain the property of, and shall be remitted to, Buyer as of Closing or any earlier termination of this Agreement.

{00847420.10 46276-000125 }

3

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

1.2 Escrow Agent. Escrow Agent, by acceptance of any funds and/or documents deposited and/or delivered by Buyer or Seller hereunder, agrees to hold such funds and/or documents and disburse or deliver same only in accordance with the terms and conditions of this Agreement. If Escrow Agent is in doubt as to its duties or liabilities hereunder, it may continue to hold such funds and/or documents until the parties mutually agree to the disbursement or delivery thereof, or until an order or judgment of a court of competent jurisdiction shall determine the rights of the parties hereto. The Escrow Agent is a depository only and shall not be liable for any loss, damage or cost, including but not limited to attorneys’ fees and costs, which may be suffered by Seller and/or Buyer in connection with Escrow Agent’s action or inaction, except in the event that such loss, damage or cost was caused by Escrow Agent’s gross negligence or willful failure to perform its duties hereunder. In no circumstances shall the Escrow Agent be responsible or liable for the failure of any financial institution into which any funds deposited with Escrow Agent have been deposited, provided that any such fund deposit was not made in violation of the applicable provisions of this Agreement.

1.3 Independent Consideration. Contemporaneously with its delivery of the Initial Earnest Money Deposit, Buyer shall deliver to Escrow Agent additional funds in the amount of $100.00 (the "Independent Consideration"), which amount the parties have bargained for and agreed to as consideration for Seller's execution and delivery of this Agreement. The Independent Consideration is in addition to and independent of any other consideration or payment provided in this Agreement, shall be immediately released to Seller by the Escrow Agent upon receipt, is nonrefundable to Buyer, and shall be retained by Seller notwithstanding any other provision of this Agreement.

ARTICLE 2

PURCHASE PRICE, PAYMENT, CLOSING, INSPECTION, SURVEY AND TITLE

PURCHASE PRICE, PAYMENT, CLOSING, INSPECTION, SURVEY AND TITLE

2.1 Purchase and Sale. Seller agrees to assign and convey the Property to Buyer, and Buyer agrees to assume and purchase the Property from Seller, subject to and in accordance with all of the terms, covenants and conditions hereinafter set forth.

2.2 Purchase Price. The total purchase price for the Property shall be FIFTY-EIGHT MILLION DOLLARS ($58,000,000.00) (the "Purchase Price"), payable as set forth in Section 2.3 hereof.

2.3 Payment of Purchase Price. The Purchase Price shall be disbursed to Seller on the Closing Date pursuant to Seller’s wiring instructions, subject to the occurrence of the Closing and adjustment for any prorations and cost allocations specifically set forth herein.

2.4 Closing.

2.4.1 The closing of the sale of the Property in accordance with the terms of this Agreement (the "Closing") shall occur on February 28, 2017 (the “Closing Date”). At the Closing, Escrow Agent shall cause the Deed (as defined below) to be recorded in the Official Records of Mecklenburg County, North Carolina. The foregoing notwithstanding. Buyer and Seller acknowledge that it is likely that the Buyer will assign the Agreement to two separate

{00847420.10 46276-000125 }

4

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

assignees such that there will be two grantees and, in any such event, the applicable Seller will, notwithstanding the terms of Section 2.4.3, execute and deliver separate sets of conveyance and transfer documents to the applicable purchasing entity.

2.4.2 The Closing shall take place at the office of the Escrow Agent, or such other place as shall be mutually agreed upon by the parties hereto through the delivery of escrow instructions, it being understood that no physical attendance by the parties shall be required.

2.4.3 Seller shall deliver the following on or prior to the Closing Date to Escrow Agent to be held in escrow and delivered to Buyer upon the completion of the Closing, except for items (g), (h) and (j) which may, at Seller's option, remain at the leasing office of the Property to be released to Buyer upon the completion of the Closing and except for item (e) which shall be delivered by Seller directly to the tenants outside of escrow:

(a) One (1) Special Warranty Deed (the "Deed"), duly executed by Seller and acknowledged (in substantially the same form as that set forth in Exhibit "C" attached hereto); provided, however, the Deed covering Parcel 2 (as reflected in the legal description for the Real Property) will not contain the Restriction Against Condominium;

(b) One (1) Bill of Sale and Assignment (the "Bill of Sale"), duly executed by Seller, which conveys to Buyer all of Seller's right, title and interest in and to all of the Personal Property, and to the extent such is assignable by Seller, the Intangible Property, including the IR Agreement (as defined below). The Bill of Sale shall be in substantially the same form as that set forth on Exhibit "D" attached hereto;

(c) Three (3) of the Assignment and Assumption of Leases (the "Assignment of Leases") duly executed by Seller, which assigns to Buyer all of Seller's right, title and interest in and to all Leases and all rights and obligations related to any refundable security deposits under the Leases to the extent paid or credited to Buyer at Closing, in form substantially the same as set forth on Exhibit "E" attached hereto;

(d) Three (3) of the Assignment and Assumption of Contracts (the "Assignment of Contracts") duly executed by Seller, which assigns to Buyer all Assumed Service Contracts, in form substantially the same as set forth on Exhibit "F" attached hereto;

(e) One (1) Notice to the residential tenants of the Property informing them of the transfer of ownership of the Property and of Buyer's future liability for their security deposits in the form substantially the same as that set forth on Exhibit "G" attached hereto (the "Notice to Tenants");

(f) An affidavit, in the form of Exhibit "H", duly executed by Seller, (i) identifying Seller's United States taxpayer identification number for federal income tax purposes; and (ii) confirming that Seller is not a "foreign person" or a "disregarded entity" within the meaning of Section 1445, et seq., of the Internal Revenue Code of 1986, as amended (the "FIRPTA Affidavit");

(g) Each of the Leases and the Assumed Service Contracts, in original form if available or otherwise a true and complete copy thereof;

{00847420.10 46276-000125 }

5

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

(h) One (1) copy of the contents of each tenant file for current tenants of the Property;

(i) One (1) updated Rent Roll prepared within three (3) business days prior to the anticipated Closing Date (the "Updated Rent Roll"). The Updated Rent Roll may be delivered to the Escrow Agent via facsimile or other electronic means;

(j) All keys and security codes for the Property to the extent they are in the possession or control of Seller;

(k) A title certificate in the form of Exhibit “L” attached hereto to facilitate the issuance of any title insurance sought by Buyer in connection with the transactions contemplated hereby, but in no event shall Seller be obligated to provide any additional certificate, affidavit or indemnity in connection with such title insurance unless Seller has otherwise agreed pursuant to Section 2.6.3 to deliver same in connection with the Mandatory Cure Items or its election to cure any Objectionable Title Matter; and

(l) All such other documents duly executed by Seller as may be reasonably necessary to consummate the transaction contemplated herein, each in form reasonably acceptable to Seller (provided such documents do not increase in any material respect the costs to, or liability or obligations of, Seller in a manner not otherwise provided for herein), including such evidence as may be reasonably required by the Escrow Agent with respect to the authority of the person(s) executing the documents required to be executed by Seller on behalf of Seller and the items required under the Title Report to satisfy all of the requirements thereunder applicable to Seller.

2.4.4 Buyer shall deliver the following on or before the Closing Date to Escrow Agent to be held in escrow and disbursed or delivered to Seller at Closing:

(a) The Purchase Price which will be paid as set forth in Section 2.3 above;

(b) Three (3) of the Assignment of Leases, duly executed by Buyer;

(c) Three (3) of the Assignment of Contracts, duly executed by Buyer; and

(d) All such other documents duly executed by Buyer as may be reasonably necessary or desirable to consummate the transaction contemplated herein, each in form reasonably acceptable to Buyer (provided such documents do not increase in any material respect the costs to, or liability or obligations of, Buyer in a manner not otherwise provided herein), including such evidence as may be reasonably required by the Escrow Agent with respect to the authority of the person(s) executing the documents required to be executed by Buyer on behalf of Buyer and the items required under the Title Report to satisfy all of the requirements thereunder applicable to Buyer.

2.5 Inspection and Due Diligence.

{00847420.10 46276-000125 }

6

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

2.5.1 If Seller has not previously delivered or made available to Buyer the following, then not later than the date which is three (3) business days after the Effective Date, Seller will deliver or make available to Buyer through an electronic data site, or make available to Buyer by providing access to the same at the Property, copies of the documents and records regarding the Property listed below in this Section 2.5.1 to the extent such are in Seller’s possession or control and which are not legally privileged as reasonably determined by Seller (collectively, the "Property Materials"). The Property Materials are being delivered or made available to Buyer to facilitate Buyer’s Physical Inspections and Other Investigations (as such terms are hereafter defined) of the Property, and except as otherwise specifically provided in this Agreement, Seller makes no representations or warranties of any kind or nature whatsoever regarding the accuracy, completeness or thoroughness of such Property Materials:

(a) Copies of the Leases and contents of the tenant files for each current tenant;

(b) Copies of the Property’s operating statements for the year 2014, 2015 and 2016 through the end of the month prior to the Effective Date;

(c) A copy of the most recent ALTA survey of the Real Property and Improvements in Seller’s possession or control;

(d) Copies of the real property tax bills for the current and past two three years; and

(e) A copy of the Seller’s current title insurance policy for the Real Property;

(f) Service and operating leases and contracts regarding the use, maintenance and operation of the Property, together with any amendments or letter agreements relating thereto (collectively, the "Service Contracts"), which Service Contracts are identified on Exhibit "I" attached hereto; and

(g) The additional items set forth on Exhibit “M” attached hereto and incorporated herein.

2.5.2 Subject to the terms hereof, Buyer shall notify Seller in writing on or prior to the Approval Date of the Service Contracts which it elects to assume in connection with its purchase of the Property (the "Assumed Service Contracts"); provided, however, that Buyer shall be deemed to have elected to assume i) any Service Contract which has a termination date after the Closing Date and which cannot be terminated by Seller on thirty (30) days prior notice without the payment of a penalty or fee in excess of $5,000 and ii) any Service Contracts for which Buyer failed to deliver notice of its election not to assume on or prior to the Approval Date.

2.5.3 Buyer shall have from the Effective Date until 5:00 pm Pacific Time on the date which is thirty (30) days after the Effective Date (the "Approval Date"), and thereafter through Closing if the Agreement is not terminated in accordance with the terms of this Section 2.5.3, to inspect the Property and to make any other investigations set forth herein below. Subject to the rights of tenants in possession, Buyer and its agents, employees and contractors

{00847420.10 46276-000125 }

7

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

shall be afforded reasonable access to the Property during normal business hours, following at least two (2) business days' prior notice to Seller for in-unit inspections and following at least twenty four (24) hours prior notice to Seller for all other inspections, for the purpose of making such inspections and investigations which Buyer elects with respect to the physical condition of the Property, including, without limitation, soils and compaction studies, engineering and geotechnical studies, Americans with Disabilities Act ("ADA") compliance studies, OSHA compliance studies, inspections to confirm compliance with any state or local laws or ordinances related to public health and safety issues (including any applicable water conservation, seismic or smoke detector and sprinkler requirements), seismic tests, environmental studies (including, without limitation, surface and subsurface tests, borings, samplings and measurements) and a survey of the Property (collectively, the "Physical Inspections"). Notwithstanding the foregoing, any destructive or invasive testing or investigation related to the Physical Inspections shall require the prior written consent of Seller, which consent may be withheld in Seller's sole and absolute discretion. In any event, Buyer shall be solely responsible for any corrective or repair work necessitated by Buyer’s Physical Inspections and any such corrective or repair work shall be promptly undertaken by or on behalf of Buyer. Seller will have the right to have a representative of Seller accompany Buyer and Buyer’s representatives, agents, or assignees while they are on the Property; provided, however, that Seller’s election to not accompany Buyer (or failure to notify Buyer that Seller wishes to accompany Buyer) shall not delay or otherwise impact Buyer’s right to undertake such Physical Inspections or Other Investigations. Prior to any entry upon the Property, Buyer or Buyer’s third party consultants shall be required to provide to Seller current certificates of insurance evidencing that Buyer or the applicable third parties have in place commercial general liability insurance, including public liability and property damage insurance, in the amount of at least Two Million Dollars ($2,000,000), combined single limit for personal injuries or death of persons or property damage occurring in or about the Property. Such insurance shall: (i) name the Seller as an additional insured; (ii) specifically cover the liability assumed by Buyer under this Agreement; (iii) be issued by an insurance company reasonably acceptable to Seller; (iv) be primary and noncontributory with any insurance which may be carried by Seller; and (v) provide that said insurance shall not be cancelled or coverage changed unless fifteen (15) days' prior written notice shall have been given to Seller. Buyer shall deliver said certificates of insurance to Seller on or before entering the Property. In the event Buyer shall fail to procure and provide satisfactory evidence of such insurance, Seller may prohibit Buyer and its agents, employees and contractors from entering the Property. In addition to the Physical Inspections, Buyer may conduct any feasibility studies and other investigations of the Property which it desires or which would be deemed reasonable and prudent in connection with the acquisition of the Property (the "Other Investigations"), which Other Investigations may include without limitation the Property’s compliance with all applicable laws, codes, ordinances and regulations which relate to the use, operation and occupancy of the Property, any permit, zoning, land use and related matters, any proposed impositions, assessments or governmental regulations which may affect or do affect the Property, and any financial and economic assessments related to the Property (including operational matters) and the market area. Notwithstanding the foregoing, Buyer shall not contact any governmental authority having jurisdiction over the Property without Seller’s express written consent (which shall not be unreasonably withheld) other than (i) contacts with the applicable governmental agencies regarding the IR Agreement and the admission of the Property to the applicable North Carolina

{00847420.10 46276-000125 }

8

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

Brownfields program and (ii) ordinary contacts normally associated with routine due diligence examinations that do not involve any material discussions with governmental officials (except to the extent necessary to request records, discuss current zoning, development and easement matters affecting the Property or undertake routine inspections). Buyer shall not interfere with any tenant’s right to use or possession of the Property while conducting such Physical Inspections and Other Investigations of the Property and Buyer shall utilize its commercially reasonable best efforts to schedule all of its inspections of the interior of each apartment, retail or office unit at the same time. Seller shall reasonably cooperate with Buyer at no cost or liability to Seller in connection with such Physical Inspections and Other Investigations of the Property. In the event this Agreement is terminated for any reason other than Seller’s default, if requested by Seller and subject to reimbursement for the costs thereof in an amount not to exceed $35,000, Buyer shall promptly deliver, without any warranty regarding the contents thereof, to Seller copies of all third party physical inspection reports, plans, specifications, geotechnical and soils reports, surveys, engineering reports, environmental and other third party inspection reports prepared by or on behalf of Buyer in connection with the Physical Inspection and Other Investigations or Buyer's proposed development of the Property. Seller shall be responsible for working directly with the service provider with respect to any reliance letters at Seller's election.

Buyer shall notify Seller in writing, at its sole discretion, of its approval or disapproval of its Physical Inspections and Other Investigations of the Property on or prior to the Approval Date (the "Inspection Notice"). If Buyer’s Inspection Notice is timely delivered and unconditionally indicates Buyer’s approval of its Physical Inspections and Other Investigations of the Property, then the transaction contemplated by this Agreement shall proceed in accordance with the terms hereof and the Buyer shall be obligated to deposit the Additional Earnest Money Deposit in accordance with the terms of Section 1.1 hereof. If Buyer fails to timely deliver the Inspection Notice on or before the Approval Date, or if Buyer’s Inspection Notice does not unconditionally indicate Buyer’s approval of its Physical Inspections and Other Investigations of the Property, this Agreement shall immediately terminate, the Initial Earnest Money Deposit (after deducting the Non-Refundable Portion which shall be remitted to Seller unless the election to terminate arises out of one of the Full Refund Events set forth in Section 1.1, in which event the entire Initial Earnest Money Deposit shall be remitted to Buyer) shall be returned to Buyer and the rights and obligations of the parties hereunder, other than as otherwise expressly set forth in this Agreement, shall terminate.

2.5.4 Buyer agrees to indemnify, defend (with counsel reasonably acceptable to Seller) and hold Seller harmless from and against any and all damages, injury to property or people, claims, demands, losses, liabilities, liens, judgments, costs and expenses including, without limitation, reasonable attorneys fees and disbursements, arising out of the Physical Inspections or Other Investigations or out of the conduct of Buyer, its employees, agents, contractors and consultants in conducting its Physical Inspections and Other Investigations of the Property provided that Buyer will not be responsible for indemnifying, defending or holding harmless the Seller with respect to (a) the mere discovery or inadvertent disturbance of pre-existing conditions at the Property, including Hazardous Materials or mold or microorganisms, or any violation of Environmental Laws at the Property, unless exacerbated by Buyer, (b) defects in the Property, (c) noncompliance of the Property with applicable laws or (d) any matters caused by the negligence, gross negligence or willful misconduct of the Seller or its affiliates or the

{00847420.10 46276-000125 }

9

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

property manager. Such indemnification shall survive the Closing or termination of this Agreement.

2.6 Title and Survey Inspection. Promptly following the Effective Date, Buyer shall order and obtain (and provide Seller with a copy of), a preliminary title report or commitment for title insurance for the Property, together with copies of all documents affecting title referenced therein (the "Title Report"), which Title Report shall be issued by Title Insurer for purposes of issuing the Title Policy (as hereinafter defined) in the amount of the Purchase Price. Buyer may cause to be prepared at Buyer's expense, with a copy to be delivered to Seller, a new or updated ALTA survey of the Property (the "Survey").

2.6.1 On or prior to the date which is five (5) business days prior to the Approval Date (the "Title Review Deadline"), Buyer shall notify Seller in writing of Buyer's approval or disapproval of the state of title to the Property as reflected in the Title Report and the Survey (collectively, the "State of Title"). Any disapproval of any portion of the State of Title shall identify the objectionable matters set forth in the Title Report and/or the Survey. Failure to timely provide a notice of approval or disapproval of the State of Title as provided above shall be deemed approval thereof and a waiver by Buyer of any objection thereto. Notwithstanding anything herein to the contrary, Seller agrees to satisfy at Closing, and Buyer will not need to separately object to, any and all monetary liens and monetary encumbrances of any kind recorded against the Property; provided, however, with respect to any involuntary monetary liens or involuntary monetary encumbrances that affect the Property and that are not known to the Seller as of the Effective Date, Seller’s obligation to cure shall be limited to such involuntary monetary liens and involuntary monetary encumbrances that in the aggregate do not exceed $100,000 (the “Mandatory Cure Items”). The term "Permitted Exceptions" shall be defined herein as all matters which have been approved or deemed approved by Buyer in accordance with this Section 2.6.1 and Section 2.6.2 hereof, and those Objectionable Title Matters (as hereinafter defined) waived or deemed waived by Buyer pursuant to Section 2.6.3 hereof. The lien of any current real property taxes and assessments that are not yet due and payable, the lien of supplemental real property taxes relating to the sale of the Property to Buyer and the rights of parties in possession pursuant to the Leases shall be deemed approved by Buyer and shall therefore constitute Permitted Exceptions. In addition, if Buyer does not obtain the Survey prior to the Title Review Deadline, then Buyer shall be deemed to have approved any exceptions, encroachments, encumbrances or other matters that would have been disclosed by an accurate ALTA survey as of the Title Review Deadline and such matters shall therefore constitute Permitted Exceptions.

2.6.2 In the event any additional title exceptions (each an "Additional Exception") are reported or discovered by the Title Insurer or Buyer after the date of the Title Report, Buyer shall give Seller written notice of Buyer's objection, if any, to such Additional Exception on or prior to the later of the Title Review Deadline or five (5) business days after receipt of written notice of any such Additional Exception, but in no event later than the then scheduled Closing Date. Buyer shall only be entitled to object to those Additional Exceptions that (a) constitute a Mandatory Cure Item, or (b)(i) materially and adversely affect the value of the Property or Buyer's intended use of the Property, (ii) were not caused, created or consented to in writing by Buyer, (iii) were not previously reflected in the Title Report, and (iv) were not

{00847420.10 46276-000125 }

10

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

reflected on the Survey (or, if Buyer did not obtain the Survey prior to the Title Review Deadline, would not have been reflected in an updated ALTA Survey obtained prior to the Title Review Deadline). The failure of Buyer to give timely notice of objection to any Additional Exception (other than any Mandatory Cure Item which shall in all cases be satisfied whether or not the subject of an objection by Buyer) which Buyer is entitled to object to within the aforesaid time period shall be deemed approval by Buyer of such Additional Exception and a waiver by Buyer of any objection thereto. Any Additional Exceptions which Buyer is not entitled to object to shall be deemed approved by Buyer and constitute Permitted Exceptions.

2.6.3 In the event that Buyer delivers to Seller an appropriate written notice of objection pursuant to and in accordance with Section 2.6.1 and/or Section 2.6.2 above (each such expressly disapproved matter identified in any such notice being referenced herein as an "Objectionable Title Matter"), Seller, in its sole discretion, within three (3) business days after receipt of Buyer's notice of an Objectionable Title Matter (the "Cure Notice Period"), may advise Buyer in writing whether Seller will attempt to cure such Objectionable Title Matter. In the event that Seller elects to attempt to cure such Objectionable Title Matter, Seller shall have until the then scheduled Closing Date to effectuate such cure; provided, however, if Seller elects to attempt to cure an Additional Exception, the Closing Date shall be automatically extended until Seller completes the cure but in no event shall such extension extend beyond the date of Closing set forth in Section 2.4.1 above by more than fifteen (15) days if Buyer has rate locked its acquisition financing or thirty (30) days after the date for Closing set forth in Section 2.4.1 above if Buyer has not rate locked its acquisition financing and, in either such case, written notice of the need for such extension shall be provided to Buyer concurrently with any election to cure. If Seller determines in its sole discretion that it will be unable or unwilling to cure any Objectionable Title Matters which it elected to attempt to cure as provided above, Seller shall deliver written notice thereof to Buyer as soon as such determination is made but in no event later than the then scheduled Closing Date (each a "Notice of Inability to Cure").

In the event that Seller (a) advises Buyer in writing prior to the expiration of an applicable Cure Notice Period of its election not to cure an Objectionable Title Matter, or (b) fails to advise Buyer in writing prior to the expiration of an applicable Cure Notice Period that Seller will attempt to cure an Objectionable Title Matter (other than in the case of any Mandatory Cure Item, which shall in all events be satisfied), Buyer shall have the right, in Buyer's sole and absolute discretion, to provide written notice to Seller (the applicable notice deadline below being referred to as the "Waiver Notice Period"), within two (2) business days after Buyer's receipt of Seller's written notice for (a) above, or within two (2) business days after the expiration of the applicable Cure Notice Period for (b) above, that Buyer elects to either (i) waive the uncured Objectionable Title Matters without any adjustment to the Purchase Price (in each instance, a "Title Waiver Notice") and proceed with the Closing, or (ii) terminate this Agreement in which event the Earnest Money Deposit less the Non-Refundable Deposit (unless the election to so terminate arises out of a Full Refund Event, in which event the entire Earnest Money Deposit) will be returned to Buyer and the rights and obligations of the parties hereunder shall terminate, except as otherwise expressly set forth in this Agreement. In the event that Buyer fails to deliver a termination notice or a Title Waiver Notice during an applicable Waiver Notice Period, Buyer shall be deemed to have delivered a Title Waiver Notice. The foregoing notwithstanding, if Seller (i) does not cure any Mandatory Cure Item on or before Closing or (ii)

{00847420.10 46276-000125 }

11

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

delivers a Notice of Inability to Cure to Buyer (or otherwise fails to cure any matter which Seller elected to attempt to cure), Seller shall be deemed in default under this Agreement and Buyer shall have the rights set forth in Section 8.2 of this Agreement.

2.7 Damage, Destruction or Condemnation. If, before legal title or possession of the Property has been transferred to Buyer, any portion of the Property, which portion will cost $500,000 or more to restore, is damaged or destroyed without fault of Buyer, then Buyer shall have the option to either (i) terminate this Agreement, in which event the rights and obligations of the parties hereunder shall terminate except as otherwise expressly set forth in this Agreement, and Buyer shall be entitled to a return of the entire Earnest Money Deposit, or (ii) proceed with the purchase of the Property without any adjustment to the Purchase Price, in which latter case Seller shall provide Buyer with a credit equal to the amount of any deductible under the Seller’s insurance and assign to Buyer any amounts due from or pay to Buyer any amounts received from Seller's casualty insurance company as a result of the damage or destruction, excepting therefrom any amounts payable for lost rental or other income for any period prior to Closing. In the event such damage will cost less than $500,000 to restore, then the transaction shall proceed in accordance with (ii) above.

If, before legal title or possession of the Property has been transferred to Buyer, any portion of the Property with a value of $500,000 or more or any portion of the Property involving access to, or parking on, the Property which results in a violation of any existing zoning or other regulatory scheme is taken by eminent domain by any governmental entity, then Buyer shall have the option to either (a) terminate this Agreement, in which event the rights and obligations of the parties hereunder shall terminate except as otherwise expressly set forth in this Agreement, and Buyer shall be entitled to a return of the entire Earnest Money Deposit, or (b) proceed with the purchase of the Property without any adjustment to the Purchase Price, in which latter case Seller shall assign to Buyer any amounts due from or pay to Buyer any amounts received from any governmental entity as a result of the taking. In the event both (i) the portion of the Property which is taken has a value of less than $500,000 and (ii) no portion of the Property involving access to, or parking on, the Property which results in a violation of any existing zoning or other regulatory scheme is taken, then the transaction shall proceed in accordance with (b) above.

2.8 Closing Costs.

2.8.1 Buyer’s Costs. Buyer will pay the following costs and expenses in connection with the transactions contemplated in this Agreement:

(i) All title insurance premiums for the Title Policy (other than any premiums for any endorsements obtained by or on behalf of Seller to cure any Objectionable Title Matter or Mandatory Cure Item that Seller has elected or is required to cure, which shall be at the cost of the Seller) and any lender’s title policy; any costs incurred in connection with the Survey; all search and title examination related costs; recording fees incurred in connection with the recording of the Deed; fifty percent (50%) of the escrow fees charged by the Escrow Agent; and

{00847420.10 46276-000125 }

12

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

(ii) Any and all costs, fees and expenses of Buyer’s attorneys, advisors and consultants incurred in connection with the preparation, review and negotiation of this Agreement and the transactions and the Closing contemplated herein (including any and all costs associated with Buyer’s financing of the Property), and the costs fees and expenses of Buyer’s Physical Inspections and Other Investigations of the Property and any other due diligence related activities.

2.8.2 Seller’s Costs. Seller will pay the following costs and expenses in connection with the transactions contemplated in this Agreement:

(i) All transfer taxes, transfer fees, excise taxes, stamp fees, or similar taxes incurred in connection with the transfer of the Property; any premiums for any endorsements obtained by or on behalf of Seller to cure any Objectionable Title Matter or Mandatory Cure Item that Seller has elected or is required to cure; fifty percent (50%) of any escrow fees charged by the Escrow Agent; and

(ii) Any and all costs and fees of Seller’s attorneys and/or advisors incurred in connection with the preparation, review and the negotiation of this Agreement and the transactions and the Closing contemplated herein.

2.9 Prorations. All prorations and adjustments shall be made as of the Closing Date based on the actual number of days in the month of Closing and Buyer shall be deemed the owner of the Property on the Closing Date for proration purposes. Except as otherwise provided below, any proration which must be estimated at Closing, and any erroneous prorations or omitted prorations, shall be reprorated and finally adjusted as soon as practicable but in no event later than ninety (90) days after the Closing Date (or in the case of any real property or personal property taxes, no later than thirty (30) days after the then current bill therefor is rendered), with any refunds payable to Seller or Buyer to be made as soon as practicable; otherwise, all prorations shall be final. The terms of this Section 2.9 shall expressly survive Closing.

2.9.1 Rents due or paid under the Leases shall be prorated to the Closing Date based upon rents actually collected for the month of Closing as reflected on the Updated Rent Roll or any revision thereof. After the Closing, Seller may continue to pursue collection of any delinquent rents applicable to the period on or prior to the Closing Date if the collection activities related thereto were commenced prior to the Closing or the tenant no longer resides at or occupies any portion of the Property, but not otherwise. Rents allocable to the period prior to the Closing Date will be the property of Seller and rents allocable to the period from and after the Closing Date will be the property of Buyer. With respect to any delinquent rent, Buyer shall include such rent in its regular billing and pay to Seller any rent actually collected within ninety (90) days following the Closing Date which is applicable to the period preceding the Closing Date; provided, however, it is understood and agreed that all rent collected by Buyer shall be applied (a) first to any rent then owed by the applicable tenant which accrued from and after the Closing Date, and (b) then to unpaid rent of such tenant which accrued prior to the Closing Date with offset for the reasonable allocation of any collection costs related thereto. In the event any rent is paid by tenants under the Leases directly to Seller after Closing, Seller shall pay Buyer any such rent which is applicable to the period from and after the Closing Date. Buyer shall have no obligation to pay Seller any rent collected by Buyer after the date which is ninety (90)

{00847420.10 46276-000125 }

13

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

days after the Closing Date, and Buyer shall be under no obligation to collect or pursue unpaid rent.

2.9.2 Seller’s insurance policies will not be assigned to Buyer. Accordingly, Buyer shall secure its own casualty insurance effective as of the Closing Date, and Seller shall be entitled to any unearned premium of any existing policy as of the Closing Date.

2.9.3 Water, electric, telephone and all other utility and fuel charges to the extent not billed directly to tenants of the Property shall be prorated ratably on the basis of the last ascertainable bills (and reprorated in accordance herewith upon receipt of the actual bills and invoices) unless final meter readings and final billing can be obtained. Seller shall also be entitled to pursue and retain any applicable refunds of security deposits paid by or on behalf of Seller to any utility companies. Buyer shall be solely responsible for making any deposits and arrangements required for utilities and other services to continue to serve the Property after the Closing.

2.9.4 Any assessments affecting the Property which are not delinquent shall be prorated as of the Closing Date based upon the latest data available.

2.9.5 Real property and personal property taxes for the year of Closing shall be prorated on an accrual basis as of the Closing Date on the basis of actual bills therefor if available. If such bills are not available, then such taxes and other charges shall be prorated on the basis of the most currently available tax bills and, thereafter, promptly re-prorated upon the availability of actual bills for the applicable period. Any and all rebates or reductions in taxes received subsequent to Closing for the calendar year in which Closing occurs, net of costs of obtaining the same (including without limitation reasonable attorneys’ fees) and net of any amounts due to tenants, shall be prorated as of the Closing Date, when received. The current installment of all special assessments, if any, which are a lien against the Property at the time of Closing and which are being or may be paid in installments shall be prorated as of the Closing Date.

2.9.6 All costs and expenses of maintaining and operating the Property which have been incurred prior to the Closing Date shall be paid by Seller and all costs and expenses of maintaining and operating the Property on and after the Closing Date shall be paid by Buyer. All prepaid costs and expenses of operating the Property which have accrued as of the Closing Date, but which are allocable to the operation of the Property from and after the Closing Date, shall be adjusted as a credit for the Seller as of the Closing Date.

2.9.7 Portions of advance rentals, if any, paid by any tenant under any of the Leases which are applicable to periods after the Closing Date shall be transferred to Buyer at the Closing.

2.9.8 An amount equal to the remaining balance as of the Closing Date of all refundable security deposits paid by tenants of the Property (including pet deposits and similar fees) pursuant to the Leases, including any interest owed thereon (if applicable), the responsibility for which will be assumed by Buyer at the Closing, shall be credited to Buyer at the Closing.

{00847420.10 46276-000125 }

14

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

2.9.9 Fees and charges under the Assumed Service Contracts, excluding any prepaid door fees, marketing fees or similar amounts, shall be prorated at the Closing.

2.10 Covenants of Seller Prior to Closing. During the period from the Effective Date until the earlier of (a) the Closing, or (b) the termination of this Agreement, Seller shall, in addition to the covenants set forth elsewhere in this Agreement:

(a) Maintain any existing insurance coverage for the Improvements;

(b) Not permit or suffer to exist any new encumbrance, charge or lien (excluding the Permitted Exceptions) against the Property unless such encumbrance, charge or lien is a Lease or has been approved in writing by Buyer, or unless such encumbrance, charge or lien will be removed by Seller prior to the Closing or is otherwise permitted hereunder;

(c) Other than Leases, not, without Buyer’s prior written consent (not to be unreasonably withheld, conditioned or delayed), enter into any new Service Contracts affecting the Property, or amend any existing Service Contracts affecting the Property, which cannot be canceled upon thirty (30) days prior notice or terminated at the Closing without penalty;

(d) Continue to operate and maintain the Property in substantially the same manner in which the Property is currently operated and maintained, including the leasing of vacant apartments and the renewal of existing Leases based on Seller’s current practices and subject to market conditions; provided, however, any new Leases or renewals of existing Leases executed by Seller after the Approval Date shall be on the form provided to Buyer without material modification for a term of no less than six (6) months (other than month-to-month extensions of existing Leases) and not more than 15 months and consistent with Yieldstar rents; provided further, however, in no event shall Seller grant more than one (1) month free rent concession for any new Lease (to be taken up front and not amortized over the course of the Lease);

(e) Promptly after receipt, Seller shall provide Buyer with copies of any written notices that Seller receives with respect to (i) any special assessments or proposed increases in the valuation of the Property; (ii) any condemnation or eminent domain proceedings affecting the Property; or (iii) any violation of any Environmental Law or any zoning, health, fire, safety or other law, regulation or code applicable to the Property. In addition, Seller shall deliver or cause to be delivered to Buyer, promptly upon receipt thereof by Seller, copies of any written notices of default given or received by Seller under any of the Service Contracts or Leases;

(f) Seller will advise Buyer promptly of any litigation, arbitration proceeding or administrative hearing that materially affects Seller or the Property and that is instituted after the Effective Date and prior to the Closing Date of which Seller has actual knowledge;

{00847420.10 46276-000125 }

15

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

(g) Seller will not settle, compromise, withdraw or terminate any real estate tax appeal or proceeding affecting the Property other than any relating solely to periods prior to calendar year 2017 (which Seller retains the full and unfettered right to settle or compromise, and any refunds applicable to such period shall belong solely to Seller); and

(h) Seller shall either i) "make ready" each vacant apartment unit in the Property which is vacant five or more days prior to the Closing Date or ii) provide Buyer with a credit against the Purchase Price in the amount of $750 for each such unit that is not in "make ready" condition in accordance with this subsection. A formerly occupied vacant apartment unit shall be “make ready” if its condition is consistent with the condition of vacant units currently being marketed to and accepted for rental by tenants of comparable vacant apartment units in the Property, including the existence of appliances of similar quality as contained in such other units that are in working condition. Buyer shall inspect each vacant apartment unit prior to the Closing to determine if such is in “make ready” condition and Seller, after the Closing, shall have no obligation related to any unit which was not in “make ready” condition as of Closing.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

REPRESENTATIONS AND WARRANTIES

3.1 Seller’s Representations and Warranties. As of the Effective Date and effective through and as of the Closing Date, Seller hereby represents, warrants and covenants to Buyer the following, unless otherwise disclosed in writing to Buyer on or before the Effective Date (which warranties, representations and covenants shall survive the Closing subject to Section 3.3 below):

3.1.1 Each party constituting Seller is validly formed and duly authorized as a limited liability company and in good standing under the laws of the State of Delaware, and has full power and authority, to enter into and perform this Agreement in accordance with its terms; all proceedings required to be taken by or on behalf of Seller to authorize it to make, deliver and carry out the terms of this Agreement have been duly and properly taken, and the individual executing this Agreement on behalf of Seller has the legal power, right and actual authority to bind Seller to the terms and conditions of this Agreement;

3.1.2 This Agreement is a valid and binding obligation of Seller, enforceable against Seller in accordance with its terms, subject to the effect of applicable bankruptcy, insolvency, reorganization, or other similar laws affecting the rights of creditors generally;

3.1.3 There are no actions, suits, litigation or proceedings pending or, to Seller’s actual knowledge, threatened, which would adversely affect Buyer or the Property (other than possible unlawful detainer actions) or affect the right, power or authority of Seller to enter into and perform this Agreement in accordance with its terms, or which question the validity or enforceability of this Agreement or of any action taken by Seller under this Agreement, in any court or before any governmental authority, domestic or foreign (including, but not limited to, any pending claims by the tenants or any guests or invitees);

{00847420.10 46276-000125 }

16

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

3.1.4 The execution of and entry into this Agreement, and the execution and delivery of the documents and instruments to be executed and delivered by Seller on the Closing Date, and the performance by Seller of Seller’s duties and obligations under this Agreement and of all other acts necessary and appropriate for the consummation of the transactions contemplated by and provided for in this Agreement are not in violation of any contract, agreement or other instrument to which Seller is a party or to which the Property is subject, any judicial order or judgment of any nature by which Seller is bound or to which the Property is subject, or Seller’s organizational documents;

3.1.5 Seller has no actual knowledge, and has received no formal written notice from any governmental authorities, that eminent domain proceedings for the condemnation of the Property or any portion thereof are pending or threatened; and

3.1.6 Seller has not engaged in any dealings or transactions, directly or indirectly, (i) in contravention of any U.S., international or other money laundering regulations or conventions, including, without limitation, the United States Bank Secrecy Act, the United States Money Laundering Control Act of 1986, the United States International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001, Trading with the Enemy Act (50 U.S.C. §1 et seq., as amended), or any foreign asset control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended) or any enabling legislation or executive order relating thereto, or (ii) in contravention of Executive Order No. 13224 dated September 24, 2001 issued by the President of the United States (Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), as may be amended or supplemented from time to time (the "Anti-Terrorism Order") or on behalf of terrorists or terrorist organizations, including those persons or entities that are included on any relevant lists maintained by the United Nations, North Atlantic Treaty Organization, Organization of Economic Cooperation and Development, Financial Action Task Force, U.S. Office of Foreign Assets Control, U.S. Securities & Exchange Commission, U.S. Federal Bureau of Investigation, U.S. Central Intelligence Agency, U.S. Internal Revenue Service, or any country or organization, all as may be amended from time to time. Seller (i) is not and will not be conducting any business or engaging in any transaction with any person appearing on the U.S. Treasury Department’s Office of Foreign Assets Control list of restrictions and prohibited persons, or (ii) is not a person described in section 1 of the Anti-Terrorism Order, and Seller has not engaged in any dealings or transactions, or otherwise been associated with any such person.

3.1.7 No bankruptcy, insolvency, reorganization or similar action or proceeding, whether voluntary or involuntary, is pending, or, to Seller’s knowledge, threatened, against Seller.

3.1.8 Except for the Service Contracts referenced on Exhibit “I”, there are no current material contracts of employment, parking, maintenance, commission, management, service, or supply in effect and entered into by Seller which will affect the Property after Closing. Seller has provided (or will provide in accordance with Section 2.5.1) Buyer with true, correct and complete copies, in all material respects, of all Service Contracts, including all amendments and modifications thereof. Neither Seller nor, to Seller’s knowledge, any other party

{00847420.10 46276-000125 }

17

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

is in material default in the performance of its respective obligations under any Service Contract material to the operation of the Property.

3.1.9 Seller has no employees.

3.1.10 The Rent Roll attached as Exhibit “J” is the rent roll maintained by Seller and relied on by Seller for internal administration and accounting purposes. To Seller’s knowledge, the Leases and tenant lease files available for review by Buyer are true and complete copies of the actual Leases and current tenant lease files in Seller's or its property manager's possession, and represent all such documents in Seller’s or its property manager’s possession. To Seller’s knowledge, there are no written or oral promises, understandings or commitments between Seller and any tenant under the Leases that would be binding on Buyer other than as set forth in such copies of the Leases and the tenant lease files made available to Buyer.

3.1.11 To Seller's knowledge, Seller has not received written notice from any governmental authority of any material violation of any federal or municipal laws, ordinances, orders, regulations and requirements affecting the Property or any portion thereof (including the conduct of business operations thereon) which are unresolved.

3.1.12 To Seller’s knowledge, Seller has not received written notice relating to any violation of Environmental Laws relating to the Property or the presence of any Hazardous Materials in violation of Environmental Laws on the Property or any property adjacent thereto from any governmental authority. As used herein, "Environmental Laws" means all federal, state and local statutes, codes, regulations, rules, ordinances, orders, standards, permits, licenses, policies and requirements (including consent decrees, judicial decisions and administrative orders) relating to the protection, preservation, remediation or conservation of the environment or worker health or safety, all as amended or reauthorized, or as hereafter amended or reauthorized, including without limitation, the Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA"), 42 U.S.C. § 9601, et seq., the Resource Conservation Recovery Act of 1976 ("RCRA"), 42 U.S.C. § 6901, et seq., the Emergency Planning and Community Right-to-Know Act, 42 U.S.C. § 11001, et seq., the Clean Air Act, 42 U.S.C. § 7401, et seq., the Federal Water Pollution Control Act, 33 U.S.C. § 1251, et seq., the Toxic Substances Control Act, 15 U.S.C. § 2601, et seq., the Safe Drinking Water Act, 42 U.S.C. § 300f, et seq., the Atomic Energy Act ("AEA"), 42 U.S.C. § 2012, et seq., the Occupational Safety and Health Act, 29 U.S.C. § 651, et seq., and the Hazardous Materials Transportation Act, 49 U.S.C. § 1802, et seq. As used herein, "Hazardous Materials" means (1) "hazardous substances," as defined by CERCLA; (2) "hazardous wastes," as defined by RCRA; (3) any radioactive material, including, without limitation, any source, special nuclear or by-product material, as defined by AEA; (4) asbestos in any form or condition; (5) polychlorinated biphenyls; and (6) any other material, substance or waste to which liability or standards of conduct may be imposed under any Environmental Laws.

3.1.13 The operating statements for the Property delivered to Buyer are the operating statements relied on by Seller for internal administration and accounting purposes.

3.1.14 The copy of the IR Agreement delivered to Buyer is a true and complete

{00847420.10 46276-000125 }

18

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

copy of the IR Agreement relied on by Seller for internal administration and accounting purposes.

All references in this Section 3.1 to "Seller’s actual knowledge", "Seller's knowledge" or words of similar import shall refer only to the best actual knowledge of Guy K. Hays (the "Designated Representative"), without any duty to review or investigate the matters to which such knowledge or the absence thereof pertains, including without limitation the information contained in the Property Materials or in the project’s or the Designated Representative’s files, and with no imputed knowledge whatsoever, whether from any other partner, officer, member, shareholder, agent or employee of Seller, or Seller’s members (or the members thereof) or any affiliate thereof or any consultant or agent of Seller or any other party whatsoever. There shall be no personal liability on the part of the Designated Representative arising out of any representations or warranties made herein. In the event that, on or prior to the Closing, Buyer discovers a breach of any warranty, representation or covenant made in this Agreement by Seller, then within five (5) days after learning of such breach (but not later than the Closing Date), Buyer shall notify Seller in writing of such breach. Within five (5) days after receipt of written notice from Buyer of any such breach (but not later than the Closing Date), Seller shall notify Buyer in writing of Seller's election: (i) not to cure such breach; or (ii) to attempt to cure such breach within ten (10) days of receipt of Buyer's notice, and, if necessary, the Closing will be extended accordingly (but in no event in excess of fifteen (15) days if Buyer has rate locked its acquisition financing or thirty (30) days if Buyer has not rate locked its financing). If Buyer first discovers any such breach less than three (3) days before the Closing Date, the Closing Date will, at Buyer’s election, be extended as necessary to permit Buyer to have a period of three (3) business days to make the election above. If Seller elects not to cure such breach, or if Seller fails to so cure all breaches by the Closing Date (as the Closing Date may have been extended in accordance herewith), then Buyer shall have the option to either: (a) terminate this Agreement by written notice to Seller in which event i) the entire Earnest Money Deposit shall be returned to Buyer, ii) if the circumstances which caused the breach occurred or became known to Seller prior to the Effective Date or were within Seller’s control, the Buyer shall be reimbursed for its Due Diligence Expenses (as hereafter defined) up to a maximum aggregate amount of $100,000, and iii) the rights and obligations of the parties hereunder shall terminate except as otherwise expressly set forth in this Agreement; or (b) elect to waive such breach and proceed to close subject to such breach without any adjustment to the Purchase Price and subject to the terms of Section 3.3 below; provided that, if Buyer fails to notify Seller of its election under the preceding clause (a) or (b) on or prior to the Closing Date (as the Closing Date may have been extended in accordance herewith), Buyer shall be deemed to have made the election under clause (b). If, after Closing, Buyer discovers a breach of a warranty, representation or covenant made by Seller of which Buyer did not have knowledge or constructive knowledge prior to the Closing, Buyer shall notify Seller in writing of the specifics of such breach and Buyer shall have the right to pursue all remedies available at law or equity, subject to Section 3.3 below.

3.2 Buyer’s Representations and Warranties. As of the Effective Date and effective through the Closing Date, Buyer hereby represents, warrants, covenants and agrees (which warranties, representations, covenants and agreements shall survive the Closing subject to Section 3.3 below) to and for the benefit of Seller as follows:

{00847420.10 46276-000125 }

19

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

3.2.1 Buyer is a validly formed and duly authorized legal entity in good standing in its state of formation and is or will as of Closing be qualified to business in the State of North Carolina;

3.2.2 Buyer has the full power and authority to enter into and perform this Agreement in accordance with its terms, to consummate the transactions contemplated hereby and to execute and deliver all documents and instruments to be delivered by Buyer hereunder;

3.2.3 All requisite action (corporate, trust, partnership or otherwise) has been taken or obtained by Buyer in connection with the entering into of this Agreement and the consummation of the transactions contemplated hereby, or shall have been taken prior to the Closing Date;

3.2.4 The documents and instruments to be delivered by Buyer hereunder shall constitute the valid and legally binding obligations of Buyer, enforceable in accordance with their terms subject to the effect of applicable bankruptcy, insolvency, reorganization, or other similar laws affecting the rights of creditors generally, and Buyer (a) has not filed for and/or is not subject to any bankruptcy, reorganization or receivership proceeding or similar law affecting the rights of creditors generally, and (b) is not currently insolvent or at risk of becoming insolvent;

3.2.5 The individual(s) executing this Agreement and the documents contemplated hereunder on behalf of Buyer has/have the legal power, right and actual authority to bind Buyer to the terms and conditions of this Agreement and such documents without any additional signatories required hereto or thereto; and

3.2.6 Neither Buyer nor any of its affiliates or constituents nor, to the best of Buyer’s knowledge, any brokers or other agents of same, have engaged in any dealings or transactions, directly or indirectly, (i) in contravention of any U.S., international or other money laundering regulations or conventions, including, without limitation, the United States Bank Secrecy Act, the United States Money Laundering Control Act of 1986, the United States International Money Laundering Abatement and Anti-Terrorist Financing Act of 2001, Trading with the Enemy Act (50 U.S.C. §1 et seq., as amended), or any foreign asset control regulations of the United States Treasury Department (31 CFR, Subtitle B, Chapter V, as amended) or any enabling legislation or executive order relating thereto, or (ii) in contravention of the Anti-Terrorism Order or on behalf of terrorists or terrorist organizations, including those persons or entities that are included on any relevant lists maintained by the United Nations, North Atlantic Treaty Organization, Organization of Economic Cooperation and Development, Financial Action Task Force, U.S. Office of Foreign Assets Control, U.S. Securities & Exchange Commission, U.S. Federal Bureau of Investigation, U.S. Central Intelligence Agency, U.S. Internal Revenue Service, or any country or organization, all as may be amended from time to time. Neither Buyer nor any of its affiliates or constituents nor, to the best of Buyer’s knowledge, any brokers or other agents of same, (i) are or will be conducting any business or engaging in any transaction with any person appearing on the U.S. Treasury Department’s Office of Foreign Assets Control list of restrictions and prohibited persons, or (ii) are a person described in section 1 of the Anti-

{00847420.10 46276-000125 }

20

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc

Terrorism Order, and to the best of Buyer’s knowledge neither Buyer nor any of its affiliates have engaged in any dealings or transactions, or otherwise been associated with any such person.

3.3 Survival of Representations and Warranties. Notwithstanding anything to the contrary, all agreements, representations and warranties made in this Agreement herein shall not be impaired by any investigation or other act of Buyer or Seller and shall not be merged into the documents executed and delivered at Closing, but rather, except for Article 6, Sections 2.5.4, 3.4, 7.4 and 7.16 which shall survive indefinitely, shall survive the Closing for nine (9) months following the Closing Date. Any claim by one party hereto against the other for the breach of any agreement, representation or warranty contained herein not made within the foregoing nine (9) month period will be forever barred.

3.3.1 Notwithstanding anything in this Agreement to the contrary, if the Closing occurs, Buyer hereby expressly waives, relinquishes and releases any right or remedy available to it at law, in equity or under this Agreement as the result of any of Seller’s representations or warranties being untrue, inaccurate or incorrect if (a) Buyer knew that such representation or warranty was untrue, inaccurate or incorrect at the time of the Closing, or (b) Buyer’s actual damages are reasonably estimated to aggregate less than Twenty Five Thousand Dollars ($25,000).

3.3.2 Notwithstanding any provision to the contrary contained in this Agreement or any documents executed by Seller pursuant hereto or in connection herewith, the maximum aggregate liability of the Seller, and the maximum aggregate amount which may be awarded to and collected by Buyer, in connection with the breach of any representations, warranties or covenants contained herein for which a claim is timely made (as determined under this Agreement) by Buyer shall not exceed Five Hundred Eighty Thousand Dollars ($580,000).

3.4 AS-IS.

3.4.1 Buyer represents that it is a sophisticated real estate investor and owner of real property and will conduct its own due diligence and investigations regarding the Property and Buyer’s intended uses thereof as provided for in this Agreement. Buyer further represents and acknowledges that this Agreement provides Buyer with sufficient time and opportunity to complete the Physical Inspections and Other Investigations of the Property, to review the Property Materials and to conduct any related due diligence of the Property which Buyer or its consultants or agents deem necessary and appropriate for Buyer to fully and completely evaluate the physical, environmental and economic condition of the Property and the Property's suitability for Buyer’s intended use. Buyer is purchasing the Property solely in reliance upon Buyer’s own due diligence and investigation of the Property, including the Physical Inspections and Other Investigations of the Property, and fully and completely represents, acknowledges, understands and agrees that, except for Seller representations and warranties expressly set forth in Section 3.1 of this Agreement, Buyer is not relying upon any representations, warranties or statements of any kind or nature whatsoever, whether oral or written, express or implied, that Seller, any direct or indirect constituent partner, member or shareholder of Seller, or any officer, director, shareholder, employee, agent, representative, broker, servant, successor, assign, affiliate or subsidiary of any of them, or any other person or entity acting on behalf of Seller or any such other party for whom Seller or such other party may be held legally responsible (collectively, the "Released Parties"),

{00847420.10 46276-000125 }

21

F:\71018.005\Purchase Agreement\Purchase Agreement – Wesley Village v8.doc