Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - CFO - Apyx Medical Corp | a201610-kexhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - CEO - Apyx Medical Corp | a201610-kexhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - CFO - Apyx Medical Corp | a201610-kexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - CEO - Apyx Medical Corp | a201610-kexhibit311.htm |

| EX-23.1 - EXHIBIT 23.1 - CONSENT OF FRAZIER & DEETER, LLC - Apyx Medical Corp | a201610-kexhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - SUBSIDIARIES OF REGISTRANT - Apyx Medical Corp | a201610-kexhibit211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016 |

or |

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____ |

Commission File Number: 0-12183 |

|

BOVIE MEDICAL CORPORATION |

(Exact name of registrant as specified in its charter) |

Delaware | 11-2644611 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

4 Manhattanville Road, Suite 106, Purchase, NY 10577

(Address of principal executive offices, zip code)

(914) 468-4009

(Issuer’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | Name of each Exchange on which registered | |

Common Stock, $.001 Par Value | NYSE MKT Market | |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes: o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes: o No ý

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes: ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes: ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer | o | Accelerated filer | o | |

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes: o No ý

The aggregate market value of the common stock held by non-affiliates computed by reference to the price at which the stock was sold, or the average bid and asked prices of such stock on the NYSE MKT exchange, as of June 30, 2016, the registrant’s most recently completed second fiscal quarter, was approximately $44.4 million.

As of March 6, 2017, 30,859,753 shares of the registrant’s $0.001 par value common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

December 31, 2016

Part I | Page | |||

Item 1 | ||||

Item 1A | ||||

Item 1B | ||||

Item 2 | ||||

Item 3 | ||||

Item 4 | ||||

Part II | ||||

Item 5 | ||||

Item 6 | ||||

Item 7 | ||||

Item 7A | ||||

Item 8 | ||||

Item 9 | ||||

Item 9A | ||||

Item 9B | ||||

Part III | ||||

Item 10 | ||||

Item 11 | ||||

Item 12 | ||||

Item 13 | ||||

Item 14 | ||||

Part IV | ||||

Item 15 | ||||

Signatures | ||||

i

BOVIE MEDICAL CORPORATION

Cautionary Notes Regarding “Forward-Looking” Statements

This report contains statements that we believe to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give our current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or similar words or the negative thereof. From time to time, we also may provide oral or written forward-looking statements in other materials we release to the public. Any or all of our forward-looking statements in this report and in any public statements we make could be materially different from actual results. They can be affected by assumptions we might make or by known or unknown risks or uncertainties. Consequently, we cannot guarantee any forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements. Investors should also understand that it is not possible to predict or identify all such factors and should not consider the risk factors discussed in Item 1A below to be a complete statement of all potential risks and uncertainties. Past performance is no guaranty of future results.

ii

BOVIE MEDICAL CORPORATION

PART I

ITEM 1. Business

General

Bovie Medical Corporation (“Company”, “Bovie Medical”, “we”, “us”, or “our”) was incorporated in 1982, under the laws of the State of Delaware and has its principal executive office at 4 Manhattanville Road, Suite 106, Purchase, NY 10577.

We are an energy-based medical device company specializing in developing, manufacturing and marketing a range of electrosurgical products and technologies, as well as related medical products used in doctor’s offices, surgery centers and hospitals worldwide. Our medical devices are marketed through Bovie’s own well-respected brands (Bovie®, IDS™, ICON™ and DERMTM) and on a private label basis to distributors throughout the world. The Company also leverages its expertise in the design, development and manufacturing of electrosurgical equipment by producing equipment for large, well-known medical device manufacturers through original equipment manufacturing (OEM) agreements, as well as start-up companies with the need for our energy based designs.

We are also the developer of J-Plasma; a patented helium-based plasma surgical product which we believe has the potential to be a transformational product for surgeons. J-Plasma has FDA clearance for the cutting, coagulation and ablation of soft tissue. The J-Plasma system consists of an electrosurgical generator unit (ESU), a handpiece and a supply of helium gas. Radiofrequency (RF) energy is delivered to the handpiece by the ESU and used to energize an electrode. When helium gas is passed over the energized electrode, a helium plasma is generated which allows for conduction of the RF energy from the electrode to the patient in the form of a precise helium plasma beam. The energy delivered to the patient via the helium plasma beam is very precise and cooler in temperature in comparison to other surgical energy modalities such as standard RF monopolar energy. J-Plasma has been the subject of ten white papers and has been cited therein for its clinical utility in gynecological and plastic surgery procedures.

Significant Subsidiaries

Aaron Medical Industries, Inc. is a wholly-owned Florida corporation based in Clearwater, Florida. It is principally engaged in the business of marketing our medical products.

Bovie Bulgaria, EOOD is a wholly-owned limited liability company incorporated under Bulgarian law, located in Sofia, Bulgaria. It is engaged in the business of engineering and manufacturing our electrosurgical and OEM products.

Industry

Healthcare reform has caused consolidation among providers, with hospitals merging, physician practices joining hospitals and institutions combining to form Accountable Care Organizations, to manage patients on an interdisciplinary basis. Although the medical device industry can be challenging and very competitive, we believe it will continue to have a positive, long-term growth trajectory with the number of surgical procedures performed increasing annually as a result of the aging “baby boomer” population and other healthcare trends. Additionally, we also anticipate a continued increase in minimally invasive surgical procedures due to ongoing advancements in technology coupled with continued overall pressure to reduce healthcare costs via a reduction in patient trauma and recovery time. Markets will also continue to provide growth opportunities for the medical device industry.

We believe that Bovie Medical has sustainable, competitive advantages in the medical device market for several reasons. We have a long history in electrosurgery. Our inspiration dates back to the first use of an electrosurgical generator in an operating room in the U.S. in 1926 where Dr. William T. Bovie was present. Thus, the Bovie name is recognized by surgeons the world over for having pioneered the electrosurgery field and is recognized for its outstanding product quality supported by strong engineering and research and development capabilities. This history equates to very strong recognition of the Bovie brand. We believe that our equipment and devices have and will continue to provide better experiences for patients at a lower cost to the healthcare system.

Business Strategy

Our objective is to achieve profitable, sustainable growth by increasing our market share in the advanced energy category, including the commercialization of products that have the potential to be transformational with respect to the results they produce for surgeons and patients. In order to achieve this objective, we plan to leverage our long history in the industry, along with the reputation for quality and reliability that the Bovie brand enjoys within the medical community. At the same time, we will expand our product offerings beyond radio frequency devices, move forward with research and developments projects aimed at creating value within our existing product portfolio and build our pipeline of new complementary products and utilize multiple channels to bring new and existing products to market.

1

BOVIE MEDICAL CORPORATION

We are working to build our position in advanced electrosurgical generators and disposables, which can be used in diversified niche markets with minimally invasive surgical instruments, while furthering our status as a pioneer in plasma technology and its various medical applications.

Our J-Plasma product initially received FDA clearance in 2012 and a CE mark in December, 2014, which enables us to sell the product in Europe. In 2014, we brought together a new management team and created and trained a direct sales force dedicated to J-Plasma. In 2015, we continued the commercialization process for J-Plasma with a multi-faceted strategy designed to accelerate adoption of the product. This strategy primarily involved deployment of a dedicated sales force, extending and customizing the J-Plasma product line and expanding the surgical specialties in which J-Plasma can become the “standard of care“ for certain procedures.

By the end of 2016, we had 17 field-based selling professionals and a network of 18 independent manufacturing representatives, resulting in a total sales force of 35. This is a hospital based selling organization with its focus on the use of J-Plasma for operating room procedures.

Additionally, in 2015, we launched six new J-Plasma hand piece configurations and the Bovie Ultimate generator, which combines J-Plasma functionality with standard electrosurgery modes in one generator. In 2016, we launched our Precise 360 hand piece, which has an angled and rotating tip that enables surgeons to access structures that are difficult to reach using a straight laparoscopic device. The Precise 360 Handpiece was named “Innovation of the Year” by the Society of Laparoendoscopic Surgeons (SLS) at their annual meeting in September 2016. The Bovie Ultimate Generator received a similar recognition in both 2015 and 2014. As a result of our sales, marketing and product development initiatives in 2016, we have significantly increased the number of surgeons using the product, gained approvals for the sale of J-Plasma from Hospital Value Analysis Committees and signed agreements for the use of J-Plasma by the members of Group Purchasing Organizations that serve the medical community.

In order to assist us in leveraging J-Plasma’s precision and effectiveness in multiple surgical specialties, we launched a Medical Advisory Board in 2015 which is currently comprised of surgeons who are recognized leaders in urology, cardiovascular and cardiothoracic surgery. In 2016, we added an additional surgeon to this board from the GYN surgical specialty.

We are continuing to make substantial investments in the development and marketing of our J-Plasma technology for the long term benefit of the Company and its stakeholders and this may adversely affect our short term profitability and cash flow, particularly over the next 12 to 24 months. While we believe that these investments have the potential to generate additional revenues and profits in the future, there can be no assurance that J-Plasma will be successful or that such future revenues and profitability will be realized. From June of 2010 through December 31, 2015, we invested approximately $11.0 million in the development and marketing of our J-Plasma technology and an additional approximately $8.1 million in 2016, bringing the total investment to approximately $19.1 million since inception.

Company Products

We group our products into three main categories: electrosurgery, battery-operated cauteries and other products. Information regarding sales by product categories and related percentages can be found in our annual and quarterly reports filed with the SEC. We manufacture and market various medical products, both under private label and the Bovie brands (Bovie, IDS, ICON and DERM), to distributors worldwide. Additionally, Bovie has original equipment manufacturing (OEM) agreements with other medical device manufacturers. These OEM and private label arrangements and our use of the Bovie brands enable us to gain greater market share for the distribution of our products.

Electrosurgery Products

Electrosurgery is our largest product line and includes desiccators, generators, electrodes, electrosurgical pencils and various ancillary disposable products. These electrosurgical products are used during surgical procedures in gynecology, urology, plastic surgery, dermatology, veterinary and other surgical markets for the cutting and coagulation of tissue. It is estimated that electrosurgery is used in 80% of all surgical procedures. Our electrosurgery products fall under two categories, monopolar and bipolar. Monopolar products require the use of a grounding pad attached to the patient for the return of the electrical current, while bipolar products consist of two electrodes; one for the inbound current and one for the return current and therefore do not require the use of a grounding pad.

2

BOVIE MEDICAL CORPORATION

DERM101 and DERM 102

These effective and economical 10 watt high frequency desiccators provide a low wattage platform for minor in-office skin procedures. We designed these products specifically for family practice physicians, pediatricians and other general practitioners, enabling them to perform simple skin procedures in their offices instead of referring the patient to a specialist saving the patient time and providing additional revenue generating procedures for the physician.

DERM A942™, Bantam|Pro A952™ and Specialist|Pro A1250S

Bovie’s line of electrosurgical generators has been recently updated to provide a more modern look for today’s physician office with added features.

The new Bovie DERM A942 is a low powered 40-watt high frequency desiccator designed primarily for the dermatology and family practice physicians. These units are used mainly for removing skin lesions and growths as well as for coagulation in office-based procedures. The A942 is an upgrade from the previous version A940.

The Bovie Bantam|Pro A952 is a 50-watt high frequency desiccator with the added feature of a cut capacity for outpatient surgical procedures. In effect, the Bovie Bantam|Pro is two independent surgical devices in one small package. The Bantam|Pro replaces the Aaron A950 but with the added feature of Bovie NEM (neutral electrode monitoring), a safety feature that reduces the potential for alternate site burns. This unit is designed mainly for use in doctors’ offices and is used in a broad range of specialties including dermatology, gynecology, family practice, urology, plastic surgery and ophthalmology.

The Bovie Specialist|Pro A1250S is a 120-watt multipurpose electrosurgery generator. The unit features monopolar and bipolar functions with pad sensing. This product is considered to be ideally suited for office-based procedures in the specialties of gynecology, plastic surgery and urology.

Bovie Surgicenter|Pro A2350 - IDS210, Bovie OR|Pro A3350 - IDS310 and IDS400

To address market demand for more powerful electrosurgical generators, Bovie developed 200, 300 and 400-watt multipurpose digital electrosurgery generators designed for the rapidly expanding surgi-center market and the hospital outpatient and inpatient markets. This equipment includes digital hardware that enables very high parallel data processing throughout the operation or procedure. All data is sampled and processed digitally. For the first time in electrosurgery, generators are able to measure tissue impedance in real time (5,000 times a second) thanks to the utilization of digital technology. The design of these units is based on a digital feedback system. By using dedicated digital hardware in place of a general purpose controller for processing data, our equipment enables the power to be adjusted as the impedance varies, to deliver a consistent clinical effect.

Bovie Surgicenter|Pro A2350 and IDS210 are 200-watt generators that have the capability to be used in the majority of procedures performed today in surgi-center or outpatient settings. Although 200 watts is adequate to do most procedures in the operating room, 300 watts is considered the standard and believed to be what most hospitals and surgi-centers will require. To meet this requirement, we developed Bovie OR|Pro A3350 - IDS310. The Bovie OR|Pro and IDS310 incorporate the best features of the IDS 300 and upgrade its capabilities by providing additional bipolar options, including the 225-watt Bovie bipolar and an auto bipolar feature. The 300 watt units also offer the capability to utilize two pencils with simultaneous activation in fulguration mode. In addition, these newer models meet new standards required to sell these products in many of the global markets. The Bovie IDS 400 is a 400-watt generator designed primarily for sale in markets outside of the United States. These units feature both monopolar and bipolar functions, have pad and tissue sensing and include nine blended cutting setting.

Electrosurgical Disposables

Resistick™ II

Resistick II is a trademarked and proprietary coating that is applied to stainless steel that resist eschar (scab or scar tissue caused by burning) during surgery. We have experienced strong demand for this product since its introduction in 2011 and it represents our continued expansion of the Bovie line of electrosurgical disposables.

3

BOVIE MEDICAL CORPORATION

Disposable Laparoscopic Electrodes

We have introduced a line of disposable laparoscopic electrodes in Resistick coated and stainless steel for use by physicians from a broad group of specialties including gynecology, general surgery and urology. These electrodes are offered in J-hook, L-hook, needle, ball and spatula design and have an adapter included which makes these laparoscopic electrodes usable with a 3/32“ or 4mm plug.

Cauteries

Battery Operated Cauteries

Battery operated cauteries were originally designed for precise hemostasis (to stop bleeding) in ophthalmology. The current use of cauteries has been substantially expanded to include a broad range of applications. Battery operated cauteries are primarily sterile one-time use products. We have continued to improve our offering and recently had a patent issued covering our snap design cautery. It features a switch mechanism that dramatically reduces the potential for accidental activation. We manufacture one of the broadest lines of cauteries in the world, including but not limited to, a line of replaceable battery and replaceable tip cauteries, which are popular in veterinary and overseas markets.

Other Products

Battery Operated Medical Lights

We manufacture and market a variety of specialty lighting instruments for use in ophthalmology as well as distribute specialty lighting instruments for general surgery, hip replacement surgery and for the placement of endotracheal tubes in emergency and surgical procedures. We also manufacture and market physicians’ office use penlights used in physician offices.

Nerve Locator Stimulator

We manufacture a nerve locator stimulator primarily used for identifying motor nerves in hand and facial reconstructive surgery. This instrument is a sterile, self-contained, battery-operated unit, for one time use.

Growth Products

During 2016, Growth Products consisted of the J-Plasma line of products. Bovie’s J-Plasma technology utilizes a helium ionization process producing a stable thin focused beam of ionized gas that can be controlled in a wide range of temperatures and intensities, providing the surgeon greater control and predictability with minimal thermal damage to surrounding tissue. The development of this helium plasma generator also includes the design of a new proprietary handpiece.

In March 2015, we launched The Bovie Ultimate™ generator. The Bovie Ultimate is a high frequency electrosurgical generator that can be used for delivery of RF energy and/or helium gas plasma to cut, coagulate and ablate soft tissue during open and laparoscopic surgical procedures. The generator offers users monopolar, bipolar and J-Plasma features in a single generator. It has both FDA clearance and CE Mark.

J-Plasma Disposable Portfolio

We offer different hand pieces for open and laparoscopic procedures. The helium-based plasma generated from these devices have been shown to cause less thermal damage to tissue than CO2 laser, argon plasma and RF energy products currently available on the market. The technology has a general indication and can be used for cutting, coagulating and ablating soft tissue. The two primary specialties that are targeted in phase one of the product launch are gynecology and plastic surgery. However, given the wide range of tissue applications for J-Plasma, we are now engaged in ongoing development to create products for urology, cardiovascular and cardiothoracic procedures. The advantages of helium plasma continue to be studied throughout the medical and scientific communities. We believe that surgical applications are just one area of opportunity for this technology.

In March 2016, we expanded our offering of laparoscopic hand pieces by introducing the J-Plasma Precise™ 360 configurations to the market. The four new J-Plasma Precise 360 configurations include two new lengths with either a blade or needle electrode with an angled tip that can be rotated 360 degrees by the user. These new configurations expand the procedure base for J-Plasma by providing surgeons with the tools they need to access additional anatomic locations.

4

BOVIE MEDICAL CORPORATION

Research and Development and New Products

Our research and development activities are an essential component of our efforts to develop innovative products for introduction in the marketplace to drive sales growth. We continue to emphasize the development of proprietary products and product improvements to complement and expand our existing product lines. In 2016, we spent approximately $2.6 million in R&D versus approximately $2.2 million during 2015, an increase of approximately 21.2%. Bovie products introduced to the market in 2016 as a result of our internal research and development opportunities include: J-Plasma Precise 360 hand pieces, the PlazXact™ arthroscopic ablator, the A952 and DERM 942 office based electrosurgical generators, the RF-1254 4MHz electrosurgical generator, and multiple new electrosurgical generators for OEM customers.

Sales & Marketing

The majority of our core products are marketed through medical distributors, which distribute to more than 6,000 hospitals and to doctors and other healthcare facilities. New distributors are contacted through responses to our advertising in international and domestic medical journals and our presence at domestic and international trade shows. International sales represented approximately 12.5% of total revenues in 2016, compared to approximately 16.9% in 2015. The decrease in international sales as a percentage of revenue is due to the discontinuation of certain international relationships and product offerings versus an increase in domestic sales and channel partnerships in Growth Products. Management estimates our products have been sold in more than 150 countries through local dealers coordinated by sales and marketing personnel at our Clearwater, Florida facility.

Competition

We compete with numerous manufacturers and distributors of medical supplies and devices, many of which are large and well-established. With the exception of J-Plasma and endoscopic instrumentation, which are sold directly to the end-user under our own brand, many of our products are private labeled. The majority of the products in our core business are sold through distributors under the Bovie label. The balance is private labeled for major distributors who sell it under their own name. By having private labeled and branded distribution, we are able to increase our position in the marketplace and compete with much larger organizations. While our private label customers distribute products through their internal sales force, the majority of our products are sold through distributors which increase our sales potential and help level the playing field relative to our large competitors that sell direct. Domestically, we continue to believe that we have a substantial market share in the field of electrosurgical generator manufacturing through our Bovie branded and OEM units.

Our main competitors in electrosurgical and accessory markets are Valleylab (a division of Medtronic), Conmed and Erbe Electromedizine. In the battery-operated cautery market, our main competitor is Beaver Visitec and in the endoscopic instrumentation market, it is Ethicon (a division of Johnson and Johnson) and Covidien Surgical Solutions. Currently, we are the only company with helium-based plasma and retractable blade products. However, there are argon plasma competitors and CO2 laser competitors for our target market. We believe our competitive position did not change in 2016.

Intellectual Property

We rely on our intellectual property that we have developed or acquired over the years including patents, trade secrets, technical innovations and various licensing agreements to provide our future growth and build our competitive position. We have been issued 33 patents in the United States and 19 foreign patents. We have 17 pending patent applications in the United States and 9 pending foreign applications. Our intellectual property portfolio for the technology and products related to Growth products is included in these totals and continues to grow. Specific to Growth products, we have been issued 15 U.S. and five foreign patents and we have 14 U.S. and six foreign applications pending. As we continue to expand our intellectual property portfolio we believe it is critical for us to continue to invest in filing patent applications to protect our technology, inventions and improvements. However, we can give no assurance that competitors will not infringe on our patent rights or otherwise create similar or non-infringing competing products that are technically patentable in their own right.

5

BOVIE MEDICAL CORPORATION

Manufacturing and Suppliers

We are committed to producing the most technically advanced and highest quality products of their kind available on the market. We manufacture the majority of our products on our premises in Clearwater, Florida and at our facility located in Sofia, Bulgaria, which are certified under the ISO international quality standards and are subject to continuing regulation and routine inspections by the FDA to ensure compliance with regulations relating to our quality system, medical device complaint reporting and adherence to FDA restrictions on promotion and advertising. In addition, we are subject to regulations under the Occupational Safety and Health Act, the Environmental Protection Act and other federal, state and local regulations.

During the fourth quarter of 2015, we acquired all of the outstanding shares of Bovie Bulgaria, EOOD. Bovie Bulgaria operates a 16,000 square foot ISO13485 certified and FDA registered manufacturing facility located in the capital city of Sofia, which houses manufacturing, development and assembly operations.

We also have collaborative arrangements with three foreign suppliers under which we request the development of certain items and components, which we purchase pursuant to purchase orders. Our purchase order commitments are never more than one year in duration and are supported by our sales forecasts.

Customers

We sell the majority of our current products through major distributors which include Cardinal Health, Independent Medical Co-Op Inc. (IMCO), McKesson Medical Surgical, Inc., Medline, National Distribution and Contracting Inc. (NDC) and Owens & Minor and have manufacturing agreements for private label of certain products with these and others.

During 2016, J-Plasma was named as an Innovative Technology by Vizient, the largest group purchasing organization (GPO) in the United States. In 2015, we signed long-term agreements with three GPO's and believe that partnering with GPO’s is critical to our sales efforts and J-Plasma commercialization efforts.

Backlog

The value of unshipped factory orders is not material.

Employees

At December 31, 2016, we had 217 full-time employees world-wide, of whom 6 were executive officers, 35 supervisory personnel, 17 sales personnel and 159 technical support, administrative and production employees. None of our current employees are covered by a collective bargaining agreement and we have never experienced a work stoppage. We consider our employee relations to be good.

6

BOVIE MEDICAL CORPORATION

ITEM 1A. Risk factors

In addition to risks and uncertainties in the ordinary course of business, important risk factors that may affect us are discussed below. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations.

Risks Related to Our Industry

The medical device industry is highly competitive and we may be unable to compete effectively.

The medical device industry is highly competitive. Many competitors in this industry are well-established, do a substantially greater amount of business and have greater financial resources and facilities than we do.

Domestically, we believe we rank third in the number of units sold in the field of electrosurgical generator manufacturing and we sell our products and compete with other manufacturers in various ways. In addition to advertising, attending trade shows and supporting our distribution channels, we strive to enhance product quality and functionality, improve user friendliness and expand product exposure.

We have also invested and continue to invest, substantial resources to develop and monetize our J-Plasma technology. If we are unable to gain acceptance in the marketplace of J-Plasma, our business and results of operations may be materially and adversely affected. From June of 2010 through December 31, 2016, we have invested approximately $19.1 million in the development and marketing of our J-Plasma technology.

We also compete by private labeling our products for major distributors under their label. This allows us to increase our position in the marketplace and thereby compete from two different approaches, our Bovie label and our customers’ private label. Our private label customers distribute our products under their name through their internal sales force. We believe our main competitors do not private label their products.

Lastly, at this time, we sell the majority of our products through distributors. Many of the companies we compete with sell direct, thus competing directly with distributors they sometimes use.

Our industry is highly regulated by the U.S. Food and Drug Administration and international regulatory authorities, as well as other governmental, state and federal agencies which have substantial authority to establish criteria which must be complied with in order for us to continue in operation.

United States

Our products and research and development activities are subject to regulation by the FDA and other regulatory bodies. FDA regulations govern, among other things, the following activities:

•Product development

•Product testing

•Product labeling

•Product storage

•Pre-market clearance or approval

•Advertising and promotion

•Product traceability and

•Product indications.

In the United States, medical devices are classified on the basis of control deemed necessary to reasonably ensure the safety and effectiveness of the device. Class I devices are subject to general controls. These controls include registration and listing, labeling, pre-market notification and adherence to the FDA Quality System Regulation. Class II devices are subject to general and special controls. Special controls include performance standards, post market surveillance, patient registries and FDA guidelines. Class III devices are those which must receive pre-market approval by the FDA to ensure their safety and effectiveness. Currently, we only manufacture Class I and Class II devices. Pre-market notification clearance must be obtained for some Class I and most Class II devices when the FDA does not require pre-market approval. All of our products have been cleared by, or are exempt from, the pre-market notification process.

7

BOVIE MEDICAL CORPORATION

A pre-market approval application is required for most Class III devices. A pre-market approval application must be supported by valid scientific evidence to demonstrate the safety and effectiveness of the device. The pre-market approval application typically includes:

•Results of bench and laboratory tests, animal studies and clinical studies

•A complete description of the device and its components; and

• | A detailed description of the methods, facilities and controls used to manufacture the device and proposed labeling. |

The pre-market approval process can be expensive, uncertain and lengthy. A number of devices for which pre-market approval has been sought by other companies have never been approved for marketing.

International Regulation

To market products in the European Union, our products must bear the “CE” mark. Manufacturers of medical devices bearing the CE mark have gone through a conformity assessment process that assures that products are manufactured in compliance with a recognized quality system and to comply with the European Medical Devices Directive.

Each device that bears a CE mark has an associated technical documentation that includes a description of the following:

•Description of the device and its components,

•A Summary of how the device complies with the essential requirements of the medical devices directive,

•Safety (risk assessment) and performance of the device,

•Clinical evaluations with respect to the device,

•Methods, facilities and quality controls used to manufacture the device and

•Proposed labeling for the device.

Manufacturing and distribution of a device is subject to ongoing surveillance by the appropriate regulatory body to ensure continued compliance with quality system and reporting requirements.

We began CE marking of devices for sale in the European Union in 1999. In addition to the requirement to CE mark, each member country of the European Union maintains the right to impose additional regulatory requirements.

Outside of the European Union, regulations vary significantly from country to country. The time required to obtain approval to market products may be longer or shorter than that required in the United States or the European Union. Certain European countries outside of the European Union do recognize and give effect to the CE mark certification. We are permitted to market and sell our products in those countries.

If we are unable to successfully introduce new products or fail to keep pace with competitive advances in technology, our business, financial condition and results of operations could be adversely affected. In addition, our research and development efforts rely upon investments and alliances and we cannot guarantee that any previous or future investments or alliances will be successful.

Our research and development activities are an essential component of our efforts to develop new and innovative products for introduction in the marketplace. New and improved products play a critical role in our sales growth. We continue to place emphasis on the development of proprietary products, such as our J-Plasma technology, and product improvements to complement and expand our existing product lines. We maintain close working relationships with physicians and medical personnel in hospitals and universities who assist in product research and areas of development. Our research and development activities are primarily conducted internally and are expensed as incurred. These expenses include direct expenses for wages, materials and services associated with the development of our products net of any reimbursements from customers. Research and development expenses do not include any portion of general and administrative expenses. Our research and development activities are conducted at our Clearwater, Florida and Sofia, Bulgaria facilities. We expect to continue making future investments to enable us to develop and market new technologies and products to further our strategic objectives and strengthen our existing business. However, we cannot guarantee that any of our previous or future investments in both facilities will be successful or that our new products such as J-Plasma and PlazXact arthroscopic ablator, will gain market acceptance, the failure of which would have a material adverse effect on our business and results of operations.

8

BOVIE MEDICAL CORPORATION

The amount expended by us on research and development of our products during the years 2016, 2015 and 2014, totaled approximately $2.6 million, $2.2 million and $1.4 million, respectively. During the past three years, we invested substantial resources in the development and marketing of our Growth product technology. We have not incurred any direct costs relating to environmental regulations or requirements. For 2017, we expect to invest 6.5% to 7.0% of revenue for research and development activities.

Even if we are successful in developing and obtaining approval for our new product candidates, there are various circumstances that could prevent the successful commercialization of the products.

Our ability to successfully commercialize our products will depend on a number of factors, any of which could delay or prevent commercialization, including:

• | the regulatory approvals of our new products are delayed or we are required to conduct further research and development of our products prior to receiving regulatory approval; |

• | we are unable to build a sales and marketing group to successfully launch and sell our new products; |

• | we are unable to raise the additional funds needed to successfully develop and commercialize our products or acquire additional products for growth; |

• | we are required to allocate available funds to litigation matters; |

• | we are unable to manufacture the quantity of product needed in accordance with current good manufacturing practices to meet market demand, or at all; |

• | our product is determined to be ineffective or unsafe following approval and is removed from the market or we are required to perform additional research and development to further prove the safety and effectiveness of the product before re-entry into the market; |

• | competition from other products or technologies prevents or reduces market acceptance of our products; |

• | we do not have and cannot obtain the intellectual property rights needed to manufacture or market our products without infringing on another company’s patents; or |

• | we are unsuccessful in defending against patent infringement or other intellectual property rights, claims that could be brought against us, our products or technologies; |

The failure to successfully acquire or develop and commercialize new products will have a material and adverse effect on the future growth of our business, financial condition and results of operations.

Our international operations subject us to foreign currency fluctuations and other risks associated with operating in foreign countries.

We operate internationally and enter into transactions denominated in foreign currencies. To date, we have not hedged our exposure to changes in foreign currency exchange rates and as a result, we are subject to foreign currency transaction and translation gains and losses. We purchase goods and services in U.S. dollars and Euros. Foreign exchange risk is managed primarily by satisfying foreign denominated expenditures with cash flows or assets denominated in the same currency therefore we are subject to some foreign currency fluctuation risk. Our currency value fluctuations were not material for 2016. In addition, political changes or instability throughout the world could adversely affect our business internationally.

Our operations and cash flows may be adversely impacted by healthcare reform legislation.

The Patient Protection and Affordable Care Act and Health Care and Education Affordability Reconciliation Act were enacted into law in the U.S. in March 2010. Among other initiatives, this legislation imposes a 2.3% excise tax on domestic sales of class I, II and III medical devices beginning in 2013. The Consolidated Appropriations Act, 2016, signed into law on Dec. 18, 2015, includes a two year moratorium on the medical device excise tax imposed by Internal Revenue Code section 4191. Thus, the medical device excise tax does not apply to the sale of a taxable medical device by the manufacturer, producer, or importer of the device during the period beginning on Jan. 1, 2016 and ending on Dec. 31, 2017. Substantially all of our products are class I or class II medical devices and in 2016 we paid no federal excise tax and 2015 we paid $0.5 million. As approximately 87.5% of our 2016 sales were derived in the U.S., we cannot predict if any additional regulations will be implemented at the federal or state level, or the effect of any future legislation or regulation in the U.S. or internationally.

We are aware that the Affordable Care Act is under review by Congress and the potential impact of any actions, which may be taken by Congress is unknown.

9

BOVIE MEDICAL CORPORATION

Our operations may experience higher costs to produce our products as a result of changes in prices for oil, gasoline and other commodities.

We use plastics and other petroleum-based materials along with precious metals contained in electronic components as raw materials in many of our products. Prices of oil and gasoline also significantly affect our costs for freight and utilities. Oil, gasoline and precious metal prices are volatile and may increase, resulting in higher costs to produce and distribute our products. Due to the highly competitive nature of the healthcare industry and the cost-containment efforts of our customers we may be unable to pass along cost increases through higher prices. If we are unable to fully recover these costs through price increases or offset through other cost reductions, our results of operations could be materially and adversely affected.

Our manufacturing facilities are located in Clearwater, Florida and Sophia, Bulgaria and could be affected due to multiple weather risks. Specifically, in Clearwater, Florida from hurricanes, physical changes in the planet due to climate change and similar phenomena.

Our manufacturing facilities are located in Clearwater, Florida and Sophia, Bulgaria and could be affected by multiple weather risks. Most notably hurricanes in Clearwater, Florida. Although we carry property and casualty insurance and business interruption insurance, future possible disruptions of operations or damage to property, plant and equipment due to hurricanes or other weather risks could result in impaired production and affect our ability to meet our commitments to our customers and impair important business relationships, the loss of which could adversely affect our operations and profitability. We do however maintain a backup generator at our Clearwater facility and a disaster recovery plan is in place to help mitigate this risk.

We do not produce hazardous materials or emissions that would adversely impact the environment. We do however, have air conditioning units and consume electricity which could be impacted by climate change in the form of increased rates. However, we do not believe the increase in expense from any rate increases, as a percentage of sales, would be material in the near term.

Risks Relating to Our Business

We have historically done a substantial amount of business with seven of our top ten customers, who are also major distributors of our product, which as a group have produced substantial revenues for our Company. Loss of business from a major customer will likely materially and adversely affect our business.

We manufacture the majority of our products on our premises in Clearwater, Florida and in Sofia, Bulgaria. Labor-intensive sub-assemblies and labor-intensive products may be out-sourced to our specification. Although we sell through distributors, we market our products through national trade journal advertising, direct mail, distributor sales representatives and trade shows, under the Bovie name and private label. Major distributors include Cardinal Health, Independent Medical Co-Op Inc. (IMCO), McKesson Medical Surgical, Inc., Medline, National Distribution and Contracting Inc. (NDC) and Owens & Minor. If any of these distributor relationships are terminated or not replaced, our revenue from the territories served by these distributors could be adversely affected.

We are also dependent on OEM customers who have no legal obligation to purchase products from us. Should such customers fail to give us purchase orders for the product after development, our future business and value of related assets could be negatively affected. Furthermore, no assurance can be given that such customers will give sufficient high priority to our products. Finally, disagreements or disputes may arise between us and our customers, which could adversely affect production and sales of our products.

We rely on certain suppliers and manufacturers for raw materials and other products and are vulnerable to fluctuations in the availability and price of such products and services.

Fluctuations in the price, availability and quality of the raw materials we use in our manufacturing could have a negative effect on our cost of sales and our ability to meet the demands of our customers. Inability to meet the demands of our customers could result in the loss of future sales.

In addition, the costs to manufacture our products depend in part on the market prices of the raw materials used to produce them. We may not be able to pass along to our customers all or a portion of our higher costs of raw materials due to competitive and marketing pressures, which could decrease our earnings and profitability.

10

BOVIE MEDICAL CORPORATION

We also have collaborative arrangements with three key foreign suppliers under which we request the development of certain items and components and we purchase them pursuant to purchase orders. Our purchase order commitments are never more than one year in duration and are supported by our sales forecasts. The majority of our raw materials are purchased from sole-source suppliers. While we believe we could ultimately procure other sources for these components, should we experience any significant disruptions in this key supply chain, there are no assurances that we could do so in a timely manner which could render us unable to meet the demands of our customers, resulting in a material and adverse effect on our business and operating results.

If we are unable to protect our patents or other proprietary rights, or if we infringe on the patents or other proprietary rights of others, our competitiveness and business prospects may be materially damaged.

We have been issued 33 patents in the United States and 19 foreign patents. We have 17 pending patent applications in the United States and 9 pending foreign applications. Our intellectual property portfolio for the technology and products related to Growth products are included in these totals and continues to grow. Specific to Growth products, we have been issued 15 U.S. and 5 foreign patents and we have 14 U.S. and 6 foreign applications pending. We intend to continue to seek legal protection, primarily through patents, for our proprietary technology. Seeking patent protection is a lengthy and costly process and there can be no assurance that patents will be issued from any pending applications, or that any claims allowed from existing or pending patents will be sufficiently broad or strong to protect our proprietary technology. There is also no guarantee that any patents we hold will not be challenged, invalidated or circumvented, or that the patent rights granted will provide competitive advantages to us. Our competitors have developed and may continue to develop and obtain patents for technologies that are similar or superior to our technologies. In addition, the laws of foreign jurisdictions in which we develop, manufacture or sell our products may not protect our intellectual property rights to the same extent as do the laws of the United States.

Adverse outcomes in current or future legal disputes regarding patent and other intellectual property rights could result in the loss of our intellectual property rights, subject us to significant liabilities to third parties, require us to seek licenses from third parties on terms that may not be reasonable or favorable to us, prevent us from manufacturing, importing or selling our products, or compel us to redesign our products to avoid infringing third parties’ intellectual property. As a result, our product offerings may be delayed and we may be unable to meet customers’ requirements in a timely manner. Regardless of the merit of any related legal proceeding, we have incurred in the past and may be required to incur in the future substantial costs to prosecute, enforce or defend our intellectual property rights. Even in the absence of infringement by our products of third parties’ intellectual property rights, or litigation related to trade secrets, we have elected in the past and may in the future elect to enter into settlements to avoid the costs and risks of protracted litigation and the diversion of resources and management’s attention. However, if the terms of settlements entered into with certain of our competitors are not observed or enforced, we may suffer further costs and risks. Any of these circumstances could have a material adverse effect on our business, financial condition and resources or results of operations.

Our ability to develop intellectual property depends in large part on hiring, retaining and motivating highly qualified design and engineering staff with the knowledge and technical competence to advance our technology and productivity goals. To protect our trade secrets and proprietary information, generally we have entered into confidentiality agreements with our employees, as well as with consultants and other parties. If these agreements prove inadequate or are breached, our remedies may not be sufficient to cover our losses.

We have been and may in the future become subject to litigation proceedings that could materially and adversely affect our business.

Other Litigation

In addition to the litigation risks and proceedings mentioned below, from time to time we may become subject to legal claims or proceedings related to securities, employment, customer or third party contracts, environmental regulations, or other matters. The costs involved in defending these claims could be substantial, which have had an adverse effect on our profitability. In addition, if other claims are asserted against us, we may be required to defend against such claims, or deem it necessary or advisable to initiate a legal proceeding to protect our rights, the expense and distraction of such a claim or proceeding, whether or not resolved in our favor, could materially and adversely affect our business, financial condition and operating results. Further, if a claim or proceeding were resolved against us or if we were to settle any such dispute, we may be required to pay damages and costs or refrain from certain activities, any of which could have a material adverse impact on our business, financial condition and operating results.

11

BOVIE MEDICAL CORPORATION

Product Liability Litigation

Although we carry liability insurance, due to the nature of our products and their use by professionals, we are subject to litigation from persons who claim injury during medical procedures in hospitals, physician’s offices or in clinics and defending such litigation is expensive, disruptive, time consuming and could adversely affect our business. We currently maintain product liability insurance with combined coverage limits of $10 million on a claims-made basis. There is no assurance that this coverage will be adequate to protect us from any possible liabilities (individually or in the aggregate) we might incur in connection with the sale or testing of our products. In addition, we may need increased product liability coverage as additional products are commercialized. This insurance is expensive and in the future may not be available on acceptable terms, if at all.

While it is our policy not to promote off-label unapproved use of our products, and we train our personnel to caution against such use, if health care professionals in their discretion use our products in such a manner, we may be exposed to risk of litigation.

Intellectual Property Litigation or Trade Secrets

We have in the past, experienced certain allegations of infringement of intellectual property rights and use of trade secrets and may receive other such claims, with or without merit, in the future. Previously, claims of infringement of intellectual property rights have sometimes evolved into litigation against us and they may continue to do so in the future. It is inherently difficult to assess the outcome of litigation. Although we believe we have had adequate defenses to these claims and that the outcome of the litigation will not have a material adverse impact on our business, financial condition, or results of operations, there can be no assurances that we will prevail. Any such litigation could result in substantial cost to us, significantly reduce our cash resources and create a diversion of the efforts of our technical and management personnel, which could have a material and adverse effect on our business, financial condition and operating results. If we are unable to successfully defend against such claims, we could be prohibited from future sales of the allegedly infringing product or products, which could materially and adversely affect our future growth.

Our business is subject to the potential for defects or failures associated with our products which could lead to recalls or safety alerts and negative publicity.

Manufacturing flaws, component failures, design defects, off-label uses or inadequate disclosure of product-related information could result in an unsafe condition or the injury or death of a patient. These problems could lead to a recall of, or issuance of a safety alert relating to our products and result in significant costs and negative publicity. Due to the strong name recognition of our brands, an adverse event involving one of our products could result in reduced market acceptance and demand for all products within that brand and could harm our reputation and our ability to market our products in the future. In some circumstances, adverse events arising from or associated with the design, manufacture or marketing of our products could result in the suspension or delay of our current regulatory reviews of our applications for new product approvals. We also may undertake voluntarily to recall products or temporarily shut down certain production lines based on internal safety and quality monitoring and testing data. Any of the foregoing problems could disrupt our business and have a material adverse effect on our business, results of operations, financial condition and cash flows.

We have incurred and may in the future incur impairments to our long-lived assets.

We review our long-lived assets, including intangible assets, for impairment annually or more frequently if events or changes in circumstances indicate that the carrying amount of these assets may not be recoverable. Additionally, if in any period our stock price decreases to the point where our fair value, as determined by our market capitalization, is less than the book value of our assets, this could also indicate a potential impairment and we may be required to record an impairment charge in that period which could adversely affect our results of operations.

Our valuation methodology for assessing impairment requires management to make judgments and assumptions based on historical experience and to rely heavily on projections of future operating performance. We operate in highly competitive environments and projections of future operating results and cash flows may vary significantly from actual results. Additionally, if our analysis indicates potential impairment to a long-lived intangible asset, we may be required to record additional charges to earnings in our financial statements, which could negatively impact our results of operations.

12

BOVIE MEDICAL CORPORATION

Risks Related to Our Stock

The market price of our stock has been and may continue to be highly volatile.

Our common stock is listed on the NYSE MKT Market under the ticker symbol “BVX”. The market price of our stock has been and may continue to be highly volatile and announcements by us or by third parties may have a significant impact on our stock price. These announcements may include:

•our listing status on the NYSE MKT Market;

•our operating results falling below the expectations of public market analysts and investors;

•developments in our relationships with or developments affecting our major customers;

•negative regulatory action or regulatory non-approval with respect to our new products;

•government regulation, governmental investigations, or audits related to us or to our products;

•developments related to our patents or other proprietary rights or those of our competitors and

•changes in the position of securities analysts with respect to our stock.

The stock market has from time to time experienced extreme price and volume fluctuations, which have particularly affected the market prices for the medical technology sector companies and which have often been unrelated to their operating performance. These broad market fluctuations may adversely affect the market price of our common stock.

Historically, when the market price of a stock has been volatile, holders of that stock have often instituted securities class action litigation against the company that issued the stock. If any of our stockholders brought a lawsuit against us, we could incur substantial costs defending the lawsuit. The lawsuit could also divert the time and attention of our management.

In addition, future sales by existing stockholders, warrant holders receiving shares upon the exercise of warrants, or any new stockholders receiving our shares in any financing transaction may lower the price of our common stock, which could result in losses to our stockholders. Future sales of substantial amounts of common stock in the public market, or the possibility of such sales occurring, could adversely affect prevailing market prices for our common stock or our future ability to raise capital through an offering of equity securities. Substantially all of our common stock is freely tradable in the public market without restriction under the Securities Act, unless these shares are held by our “affiliates”, as that term is defined in Rule 144 under the Securities Act.

We have no present intention to pay dividends on our common stock and, even if we change that policy, we may be unable to pay dividends on our common stock.

We currently do not anticipate paying any dividends on our common stock in the foreseeable future. We currently intend to retain future earnings, if any, to finance operations and invest in our business. Any declaration and payment of future dividends to holders of our common stock will be at the discretion of our board of directors and will depend on many factors, including our financial condition, earnings, capital requirements, level of indebtedness, statutory and contractual restrictions applying to the payment of dividends and other considerations that our board of directors deems relevant.

If we change that policy and commence paying dividends, we will not be obligated to continue paying those dividends and our stockholders will not be guaranteed, or have contractual or other rights, to receive dividends. If we commence paying dividends in the future, our board of directors may decide, in its discretion, at any time, to decrease the amount of dividends, otherwise modify or repeal the dividend policy or discontinue entirely the payment of dividends. Under the Delaware law, our board of directors may not authorize the payment of a dividend unless it is either paid out of our statutory surplus.

The low trading volume of our common stock may adversely affect the price of our shares and their liquidity.

Although our common stock is listed on the NYSE MKT exchange, our common stock has experienced low trading volume. Limited trading volume may subject our common stock to greater price volatility and may make it difficult for investors to sell shares at a price that is attractive to them.

13

BOVIE MEDICAL CORPORATION

We may in the future seek to raise funds through equity offerings, which could have a dilutive effect on our common stock.

In the future we may determine to raise capital through offerings of our common stock, securities convertible into our common stock or rights to acquire these securities or our common stock. For instance, we are authorized to issue up to 40,000,000 shares of common stock and up to 10,000,000 shares of preferred stock, of which 3,588,139 shares have been designated as Series B Convertible Preferred Stock. The result of sales of such securities, or the conversion of the Series B Convertible Preferred Stock into shares of common stock, the exercise of warrants issued in connection with such offering or the triggering of anti-dilution provisions in such securities would ultimately be dilutive to our common stock by increasing the number of shares outstanding. We cannot predict the effect this dilution may have on the price of our common stock. In addition, the shares of preferred stock may have rights which are senior or superior to those of the common stock, such as rights relating to voting, the payment of dividends, redemption or liquidation.

Exercise of warrants and options issued by us will dilute the ownership interest of existing stockholders.

As of December 31, 2016, the warrants issued by us in December 2013 were exercisable for up to approximately 94,375 shares of our common stock, representing approximately 0.3% of our outstanding common stock.

As of December 31, 2016, our outstanding stock options to our employees, officers, directors and consultants amounted to approximately 3,752,209 shares of our common stock, representing approximately 12.2% of our outstanding common stock.

The exercise of some or all of our warrants and stock options will dilute the ownership interests of existing stockholders. Any sales in the public market of the common stock issuable upon such conversion or exercise could adversely affect prevailing market prices of our common stock.

ITEM 1B. Unresolved Staff Comments

There are no outstanding unresolved comments from the staff of the Securities and Exchange Commission.

ITEM 2. Properties

Bovie currently maintains a 60,000 square foot facility which consists of office, warehousing, manufacturing and research space located at 5115 Ulmerton Rd., Clearwater, Florida. Monthly principal and interest payments relating to the purchase of this facility are approximately $29,000 per month.

In October, 2015, through our Bulgaria acquisition, we acquired a lease for 16,000 square feet of office, warehousing and manufacturing facilities located in Sofia, Bulgaria. The rental cost of the facility is approximately $4,333 per month.

In March 2014, we signed a lease for offices located in Purchase, New York. The lease is for 3,650 square feet of office space with a monthly cost of approximately $9,277 per month. This facility presently houses our executive offices.

ITEM 3. Legal Proceedings

Not Applicable.

Other Matters

In the normal course of business, we are subject, from time to time, to legal proceedings, lawsuits and claims. Such matters are subject to many uncertainties and outcomes are not predictable with assurance. If any of these matters arise in the future, it could affect the operating results of any one or more quarters.

ITEM 4. Mine Safety Disclosures

Not Applicable.

14

BOVIE MEDICAL CORPORATION

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock currently is traded on the NYSE MKT. The table shows the reported high and low bid prices for the common stock during each quarter of the last eight respective quarters. These prices do not represent actual transactions and do not include retail markups, markdowns or commissions.

2016 | 2015 | ||||||||||

High | Low | High | Low | ||||||||

4th Quarter | 5.55 | 3.50 | 2.19 | 1.77 | |||||||

3rd Quarter | 5.21 | 1.68 | 2.80 | 1.95 | |||||||

2nd Quarter | 1.97 | 1.56 | 3.59 | 2.35 | |||||||

1st Quarter | 2.44 | 1.60 | 4.01 | 2.20 | |||||||

On March 6, 2017, the closing bid for our common stock as reported by the NYSE MKT exchange was $3.14 per share. As of March 6, 2017, we had 605 stockholders of record. Since many stockholders choose to hold their shares under the name of their brokerage firm, we estimate that the actual number of stockholders was over 3,500 shareholders.

Securities Authorized for Issuance Under Equity Compensation Plans

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (b) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (a)) (c) | |||||||

Equity compensation plans approved by security holders | 2,019,922 | $ | 2.19 | 730,078 | |||||

Equity compensation plans not approved by security holders (1) | 1,732,287 | $ | 4.03 | — | |||||

Total | 3,752,209 | $ | 3.04 | 730,078 | |||||

Dividend Policy

We have never declared or paid any cash dividends on our common stock and we currently do not anticipate paying cash dividends in the foreseeable future. We currently expect to retain any future earnings to fund the operation and expansion of our business.

15

BOVIE MEDICAL CORPORATION

Five Year Performance Graph

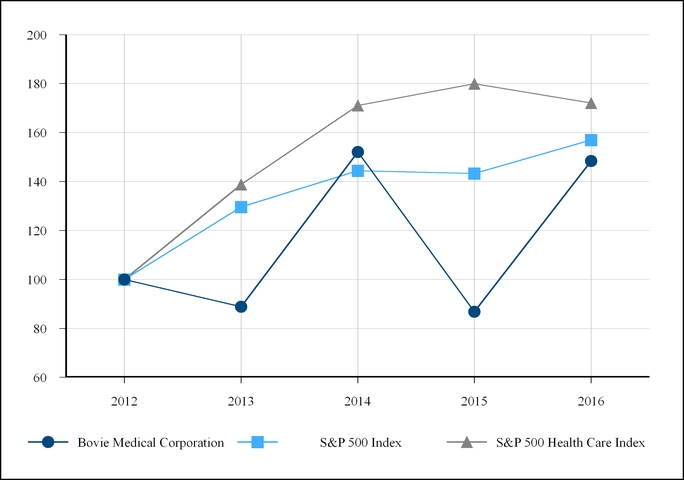

The following line graph compares the cumulative total return of our common shares with the cumulative total return of the Standard & Poor’s Composite 500 Stock Index (the "S&P 500 Index") and the Standard & Poor's Composite 500 Healthcare Sector Index (the "S&P 500 Healthcare Index"). The line graph assumes, in each case, an initial investment of $100 on December 31, 2012, based on the market prices at the end of each fiscal year through and including December 31, 2016, and reinvestment of dividends.

December 31, | ||||||||||||||

2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||

Bovie Medical Corporation | 100.00 | 88.84 | 152.06 | 86.77 | 148.34 | |||||||||

S&P 500 Index | 100.00 | 129.60 | 144.36 | 143.31 | 156.97 | |||||||||

S&P 500 Health Care Index | 100.00 | 138.74 | 171.07 | 179.98 | 172.13 | |||||||||

16

BOVIE MEDICAL CORPORATION

ITEM 6. Selected Financial Data

The following selected consolidated financial data (presented in thousands, except per share amounts and employee data) are derived from our consolidated financial statements. This data should be read in conjunction with the consolidated financial statements and notes thereto and with Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

Sales | $ | 36,627 | $ | 29,520 | $ | 27,681 | $ | 23,660 | $ | 27,671 | |||||||||

Cost of sales | 18,712 | 16,963 | 18,689 | 14,462 | 16,338 | ||||||||||||||

Gross profit | 17,915 | 12,557 | 8,992 | 9,198 | 11,333 | ||||||||||||||

Other costs and expenses: | |||||||||||||||||||

Research and development | 2,618 | 2,160 | 1,416 | 1,260 | 1,329 | ||||||||||||||

Professional services | 1,486 | 1,484 | 1,016 | 1,835 | 1,439 | ||||||||||||||

Salaries and related costs | 9,038 | 7,482 | 5,723 | 3,992 | 3,178 | ||||||||||||||

Selling, general and administrative | 8,565 | 8,417 | 6,686 | 5,777 | 4,341 | ||||||||||||||

Total other costs and expenses | 21,707 | 19,543 | 14,841 | 12,864 | 10,287 | ||||||||||||||

(Loss) income from operations | (3,792 | ) | (6,986 | ) | (5,849 | ) | (3,666 | ) | 1,046 | ||||||||||

Interest expense, net | (158 | ) | (158 | ) | (151 | ) | (237 | ) | (232 | ) | |||||||||

Investor warrants issuance cost | — | — | — | (664 | ) | — | |||||||||||||

Fee associated with refinance | — | — | — | (543 | ) | — | |||||||||||||

Change in fair value of derivative liabilities, net | 64 | 1,799 | (7,285 | ) | (842 | ) | 20 | ||||||||||||

Total other (expense) income, net | (94 | ) | 1,641 | (7,436 | ) | (2,286 | ) | (212 | ) | ||||||||||

(Loss) income before income taxes | (3,886 | ) | (5,345 | ) | (13,285 | ) | (5,952 | ) | 834 | ||||||||||

Income tax expense (benefit) | 64 | 25 | 3,997 | (1,613 | ) | 217 | |||||||||||||

Net (loss) income | $ | (3,950 | ) | $ | (5,370 | ) | $ | (17,282 | ) | $ | (4,339 | ) | $ | 617 | |||||

Accretion on convertible preferred stock | — | (222 | ) | (932 | ) | (39 | ) | — | |||||||||||

Gain on conversion of warrants and preferred shares, net | — | 13,956 | — | — | — | ||||||||||||||

Deemed dividend on conversion beneficial conversion feature | — | — | — | (2,616 | ) | — | |||||||||||||

Net (loss) income attributable to common shareholders | $ | (3,950 | ) | $ | 8,364 | $ | (18,214 | ) | $ | (6,994 | ) | $ | 617 | ||||||

(Loss) income per share attributable to common shareholders | |||||||||||||||||||

Basic | $ | (0.14 | ) | $ | 0.34 | $ | (1.03 | ) | $ | (0.40 | ) | $ | 0.04 | ||||||

Diluted | $ | (0.15 | ) | $ | 0.24 | $ | (1.03 | ) | $ | (0.40 | ) | $ | 0.03 | ||||||

Balance Sheet Information: | |||||||||||||||||||

Cash and restricted cash | $ | 15,235 | $ | 12,644 | $ | 6,632 | $ | 7,924 | $ | 4,162 | |||||||||

Working capital | $ | 21,267 | $ | 17,921 | $ | 11,599 | $ | 16,910 | $ | 14,322 | |||||||||

Total assets | $ | 35,110 | $ | 31,448 | $ | 24,833 | $ | 33,176 | $ | 28,183 | |||||||||

Long-term liabilities | $ | 3,615 | $ | 3,923 | $ | 16,373 | $ | 8,934 | $ | 3,366 | |||||||||

Total stockholders' equity | $ | 26,223 | $ | 23,404 | $ | 1,504 | $ | 19,071 | $ | 22,895 | |||||||||

17

BOVIE MEDICAL CORPORATION

MANAGEMENT'S DISCUSSION AND ANAYLSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis in conjunction with our financial statements and related notes contained elsewhere in this report. This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors discussed in this report and those discussed in other documents we file with the SEC. In light of these risks, uncertainties and assumptions, readers are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements represent beliefs and assumptions as of the date of this report. While we may elect to update forward-looking statements and at some point in the future, we specifically disclaim any obligation to do so, even if our estimates change. Past performance does not guarantee future results.

Executive Level Overview

We are an energy-based medical device company specializing in developing, manufacturing and marketing a range of electrosurgical products and technologies, as well as related medical products used in doctor’s offices, surgery centers and hospitals worldwide. Our medical products include a wide range of devices including electrosurgical generators and accessories, cauteries, medical lighting, nerve locators and other products.

We internally divide our operations into three product lines; electrosurgery products, battery-operated cauteries and other products. The electrosurgical line includes electrosurgical products which include desiccators, generators, electrodes, electrosurgical pencils and various ancillary disposable products. These products are used in surgery for the cutting and coagulation of tissue. Battery-operated cauteries are used for precise hemostasis (to stop bleeding) in ophthalmology and in other fields. Our other revenues are derived from nerve locators, disposable and reusable penlights, medical lighting, license fees, development fees and other miscellaneous income.

The majority of our core products are marketed through medical distributors, which distribute to more than 6,000 hospitals, and to doctors and other healthcare facilities. New distributors are contacted through responses to our advertising in international and domestic medical journals and our presence at domestic and international trade shows. International sales represented approximately 12.5% of total revenues in 2016, 16.9% in 2015 and 15.8% in 2014. Management estimates our products have been sold in more than 150 countries through local dealers coordinated by sales and marketing personnel at the Clearwater, Florida facility.

On November 10, 2016, we entered into an underwriting agreement (the “Underwriting Agreement”) with certain selling stockholders of the Company (the “Selling Stockholders”) and Piper Jaffray & Co. (the “Underwriter”) relating to public offerings of our common stock, par value $0.001 per share at a public offering price of $4.00 per share. We made a primary offering of 1,625,000 shares and a secondary offering of 1,625,000 shares by the Selling Stockholders.

Our net proceeds from the sale of the shares, after deducting the Underwriter’s discounts and commissions and estimated offering expenses payable by us, were approximately $5.8 million. The offerings closed on November 16, 2016.

In March 2015, we completed an underwritten public offering of approximately 5,219,000 shares of common stock, par value $0.001 per share at a price to the public of $2.50 per share, resulting in net proceeds of approximately $11.5 million, after deducting underwriting discounts and commissions and offering expenses. We used the proceeds from the offering for operating costs, capital expenditures and for general corporate purposes, including working capital. Craig-Hallum Capital Group LLC (“Craig-Hallum”) acted as the sole managing underwriter for the offering.