Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NAVISTAR INTERNATIONAL CORP | d348210dex991.htm |

| 8-K - 8-K - NAVISTAR INTERNATIONAL CORP | d348210d8k.htm |

Q1 2017 EARNINGS PRESENTATION March 7, 2017 Exhibit 99.2

Safe Harbor Statement and Other Cautionary Notes Information provided and statements contained in this presentation that are not purely historical are forward-looking statements within the meaning of the federal securities laws. Such forward-looking statements only speak as of the date of this presentation and Navistar International Corporation assumes no obligation to update the information included in this presentation. Such forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or similar expressions. These statements are not guarantees of performance or results and they involve risks, uncertainties, and assumptions. For a further description of these factors, see the risk factors set forth in our filings with the Securities and Exchange Commission, including our annual report on Form 10-K for the year ended October 31, 2016. Although we believe that these forward-looking statements are based on reasonable assumptions, there are many factors that could affect our results of operations and could cause actual results to differ materially from those in the forward-looking statements. All future written and oral forward-looking statements by us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained herein or referred to above. Except for our ongoing obligations to disclose material information as required by the federal securities laws, we do not have any obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events. The financial information herein contains audited and unaudited information and has been prepared by management in good faith and based on data currently available to the Company. Certain non-GAAP measures are used in this presentation to assist the reader in understanding our core manufacturing business. We believe this information is useful and relevant to assess and measure the performance of our core manufacturing business as it illustrates manufacturing performance. It also excludes financial services and other items that may not be related to the core manufacturing business or underlying results. Management often uses this information to assess and measure the underlying performance of our operating segments. We have chosen to provide this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results. The non-GAAP numbers are reconciled to the most appropriate GAAP number in the appendix of this presentation.

Q1 Recap – Good Start to 2017 Closed alliance with Volkswagen Truck & Bus Began delivering LT series trucks and unveiled A26 proprietary engine Awarded several new defense contracts Enhanced financial flexibility through capital market transactions Leading indicators suggest second half improvement On track with 2017 plan

Executing on our Strategy GROW THE CORE BUSINESS DRIVE OPERATIONAL EXCELLENCE BUILD NEW SOURCES OF REVENUE Goal: Steadily grow revenue and achieve profitability at all points of the cycle Further product cost reductions Lower used truck inventory balances Launched LT Series Unveiled A26 engine Began producing GM’s Cut-away G-van Surpassed 270,000 OCC subscribers Recent Accomplishments

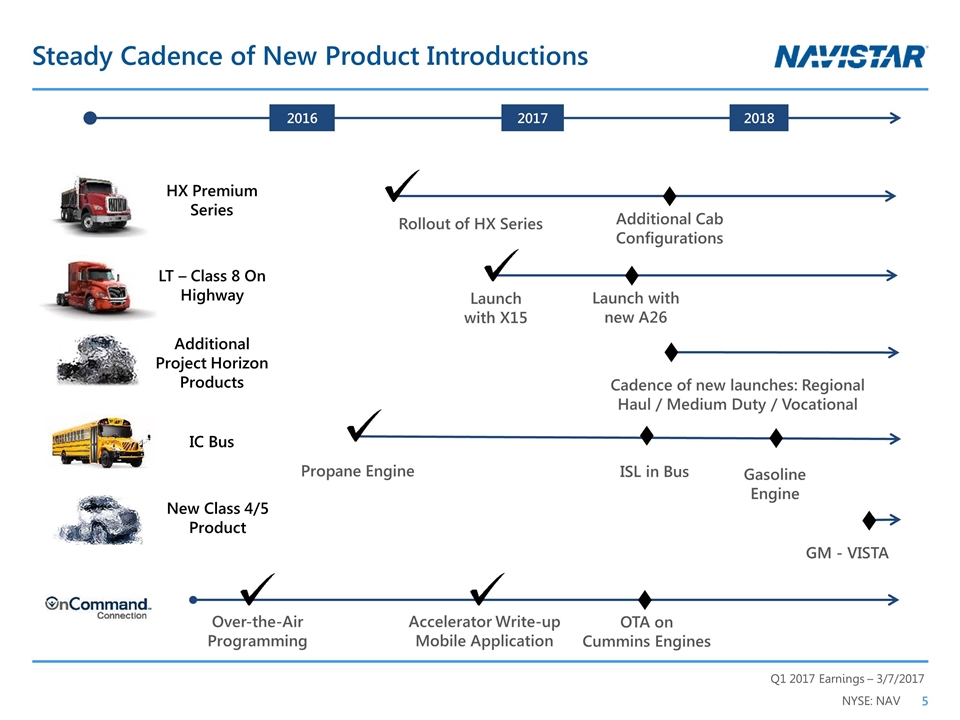

2016 Steady Cadence of New Product Introductions Launch with new A26 LT – Class 8 On Highway Launch with X15 Propane Engine IC Bus Gasoline Engine New Class 4/5 Product GM - VISTA HX Premium Series Additional Project Horizon Products Cadence of new launches: Regional Haul / Medium Duty / Vocational Over-the-Air Programming OTA on Cummins Engines Accelerator Write-up Mobile Application 2017 2018 ISL in Bus Rollout of HX Series ♦ ♦ ♦ ♦ Additional Cab Configurations ♦ ♦ ♦

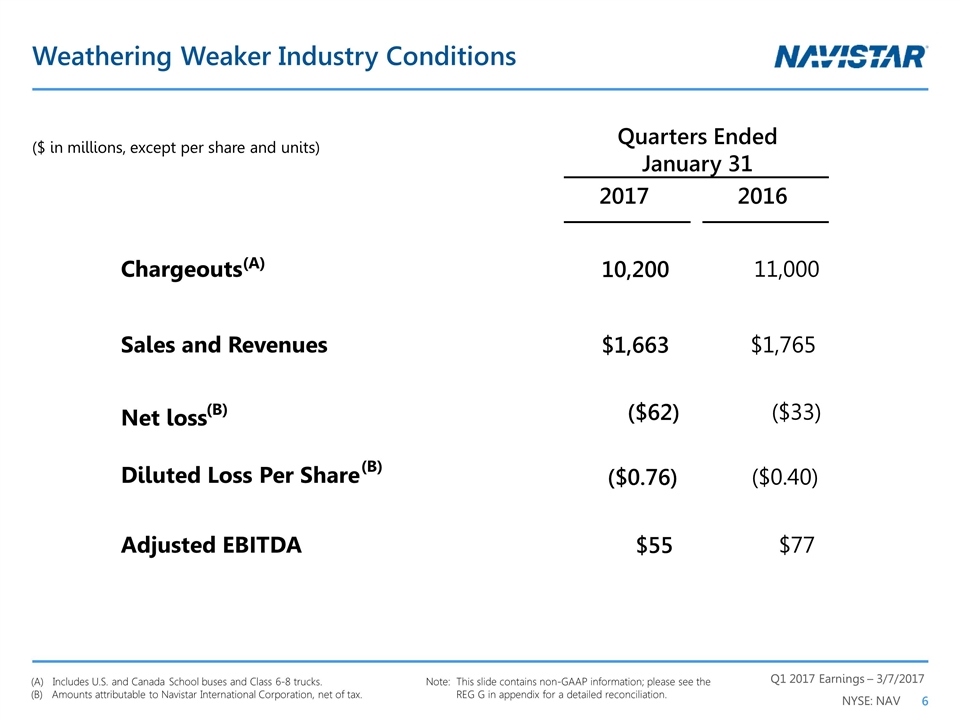

Weathering Weaker Industry Conditions Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation. (A) Includes U.S. and Canada School buses and Class 6-8 trucks. (B) Amounts attributable to Navistar International Corporation, net of tax. Chargeouts (A) 10,200 11,000 Sales and Revenues $1,663 $1,765 Net loss ($62) ($33) Diluted Loss Per Share ($0.76) ($0.40) Adjusted EBITDA $55 $77 Quarters Ended January 31 2017 2016 ($ in millions, except per share and units) (B) (B)

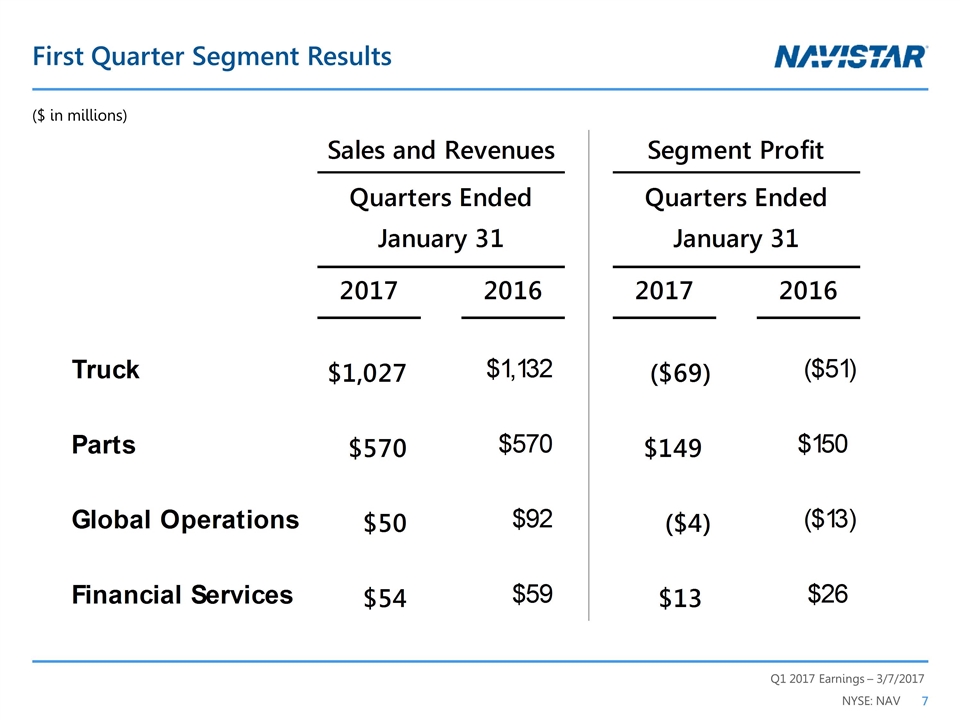

First Quarter Segment Results ($ in millions)

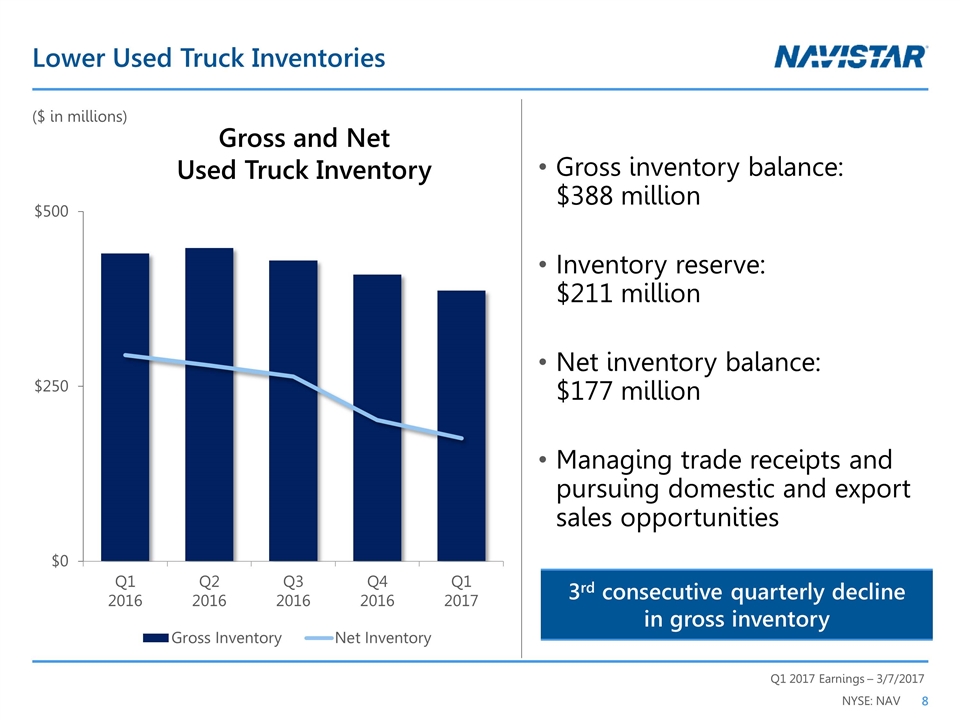

Lower Used Truck Inventories Gross inventory balance: $388 million Inventory reserve: $211 million Net inventory balance: $177 million Managing trade receipts and pursuing domestic and export sales opportunities Gross and Net Used Truck Inventory ($ in millions) 3rd consecutive quarterly decline in gross inventory

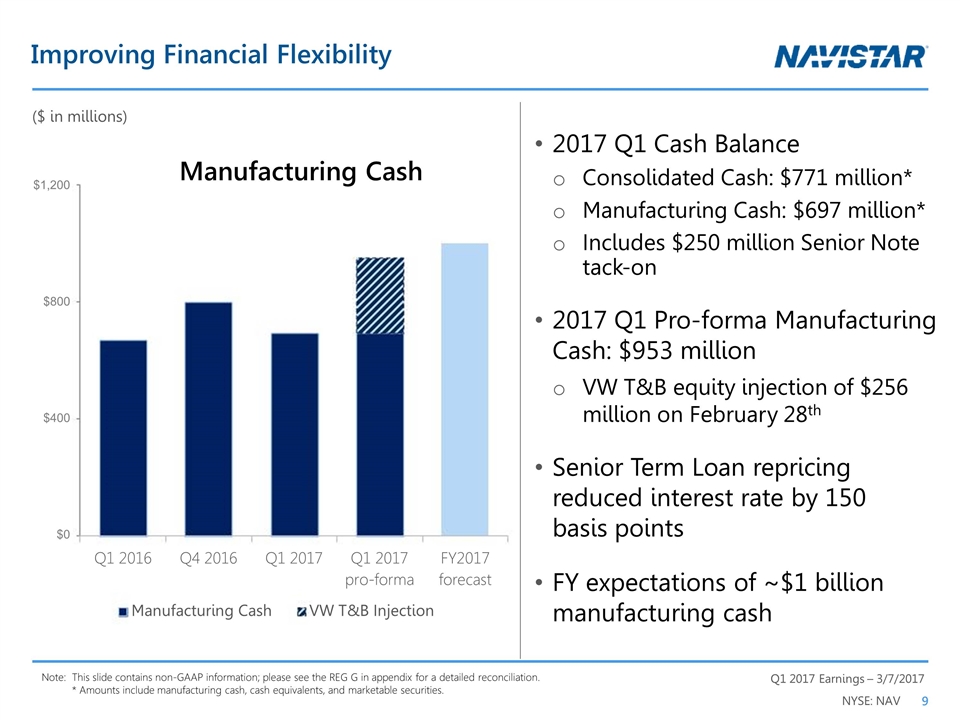

Improving Financial Flexibility 2017 Q1 Cash Balance Consolidated Cash: $771 million* Manufacturing Cash: $697 million* Includes $250 million Senior Note tack-on 2017 Q1 Pro-forma Manufacturing Cash: $953 million VW T&B equity injection of $256 million on February 28th Senior Term Loan repricing reduced interest rate by 150 basis points FY expectations of ~$1 billion manufacturing cash Manufacturing Cash ($ in millions) Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation. * Amounts include manufacturing cash, cash equivalents, and marketable securities.

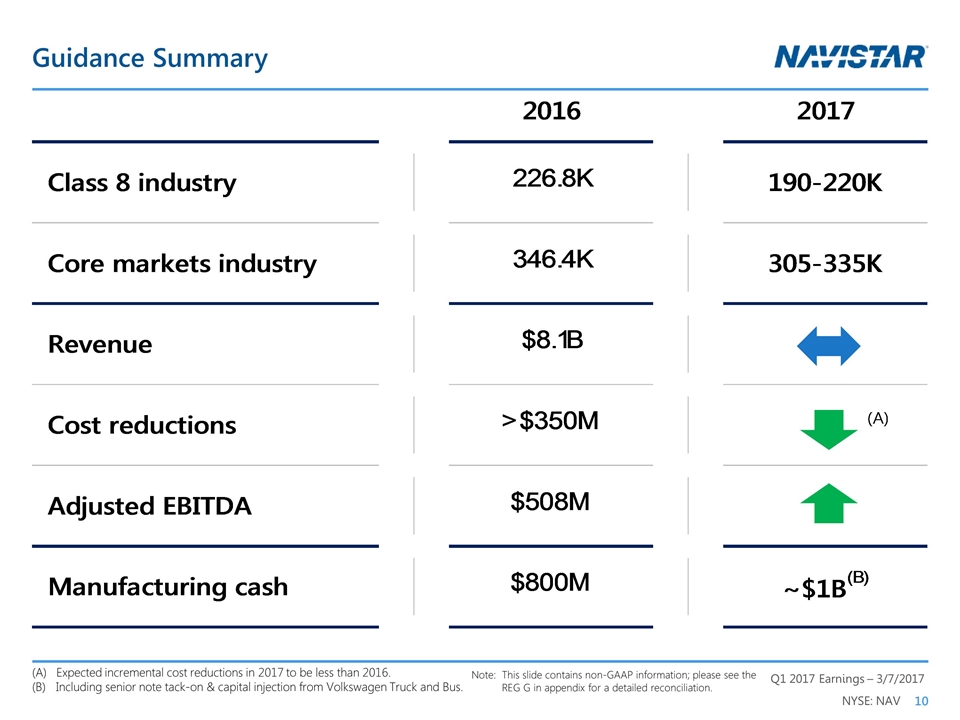

Guidance Summary (A) Expected incremental cost reductions in 2017 to be less than 2016. (B)Including senior note tack-on & capital injection from Volkswagen Truck and Bus. Note:This slide contains non-GAAP information; please see the REG G in appendix for a detailed reconciliation.

Appendix

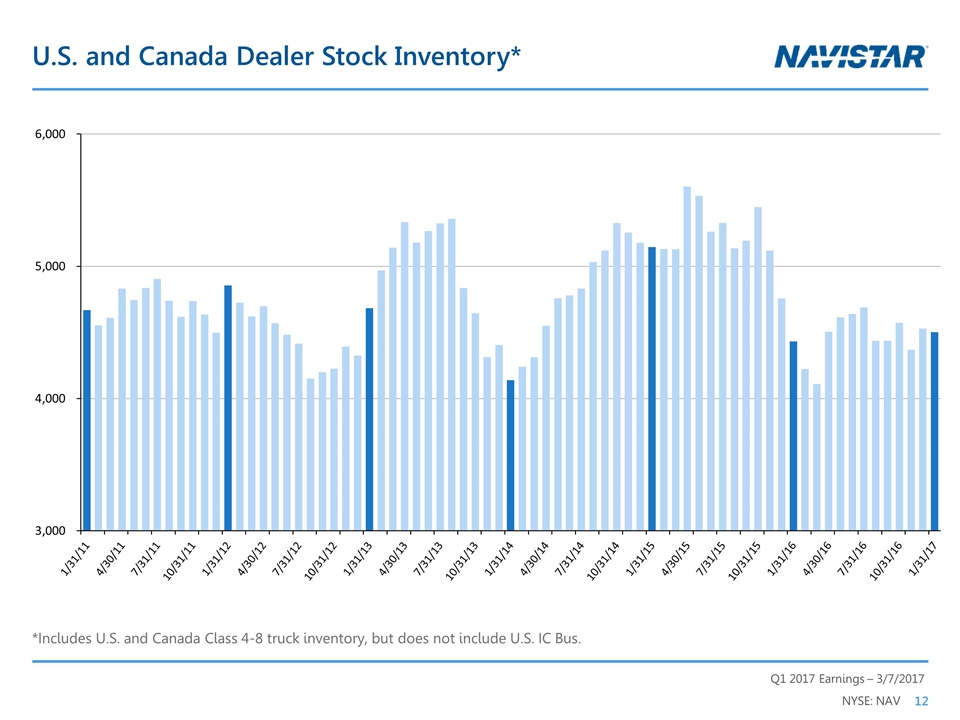

U.S. and Canada Dealer Stock Inventory* *Includes U.S. and Canada Class 4-8 truck inventory, but does not include U.S. IC Bus.

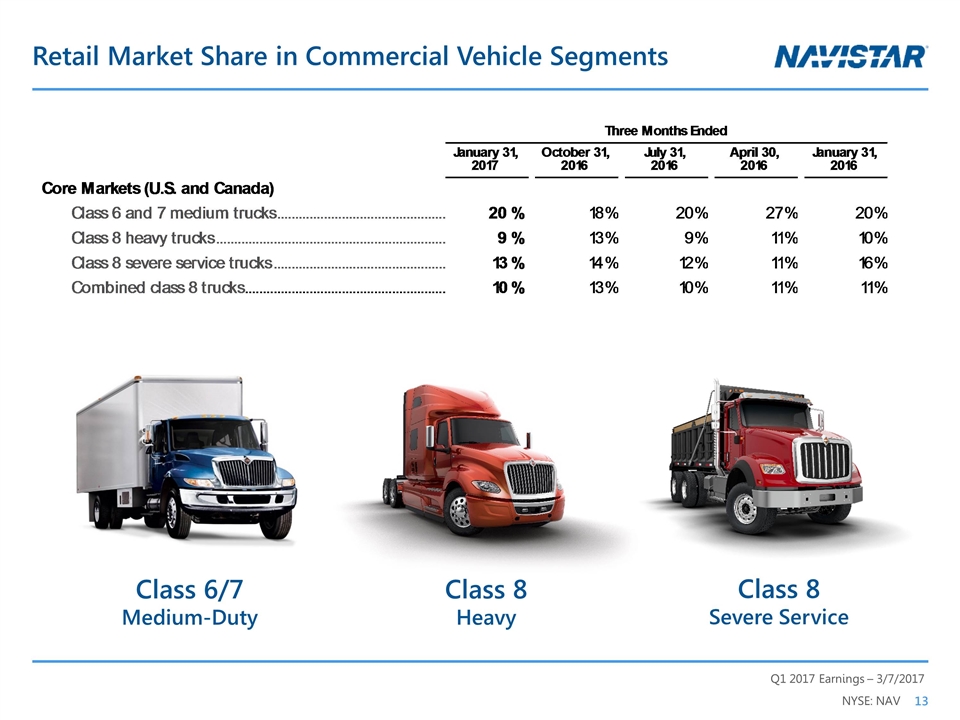

Retail Market Share in Commercial Vehicle Segments Class 6/7 Medium-Duty Class 8 Severe Service Class 8 Heavy

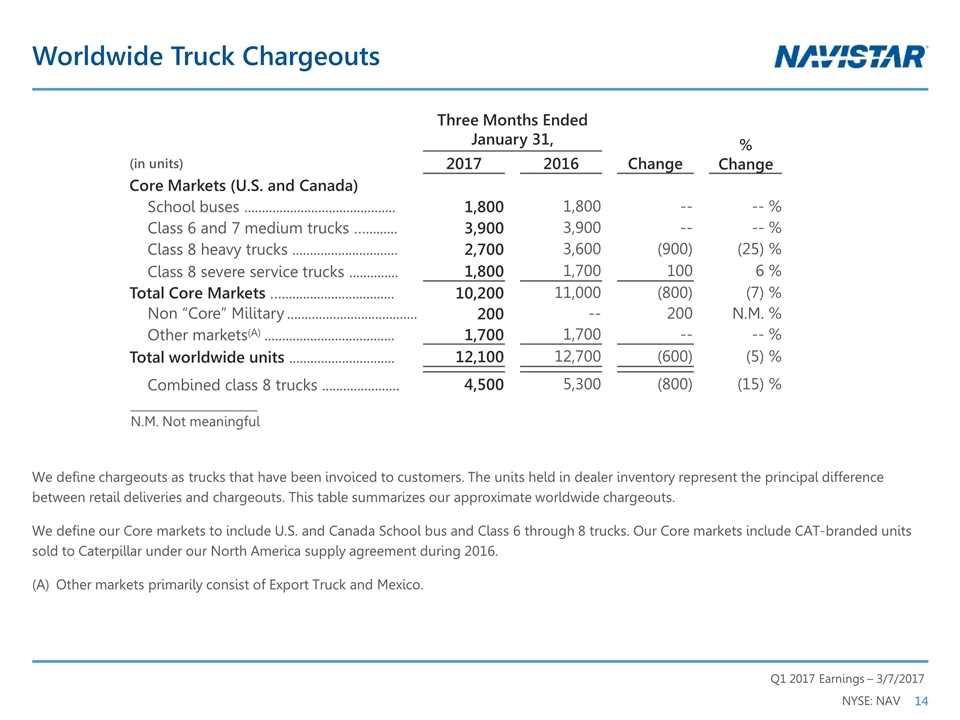

Worldwide Truck Chargeouts We define chargeouts as trucks that have been invoiced to customers. The units held in dealer inventory represent the principal difference between retail deliveries and chargeouts. This table summarizes our approximate worldwide chargeouts. We define our Core markets to include U.S. and Canada School bus and Class 6 through 8 trucks. Our Core markets include CAT-branded units sold to Caterpillar under our North America supply agreement during 2016. Other markets primarily consist of Export Truck and Mexico. Three Months Ended January 31, % Change (in units) 2017 2016 Change Core Markets (U.S. and Canada) School buses ........................................... 1,800 1,800 -- -- % Class 6 and 7 medium trucks …......... 3,900 3,900 -- -- % Class 8 heavy trucks .............................. 2,700 3,600 (900) (25) % Class 8 severe service trucks .............. 1,800 1,700 100 6 % Total Core Markets …................................ 10,200 11,000 (800) (7) % Non “Core” Military ..................................... 200 -- 200 N.M. % Other markets(A) ..................................... 1,700 1,700 -- -- % Total worldwide units .............................. 12,100 12,700 (600) (5) % Combined class 8 trucks ...................... 4,500 5,300 (800) (15) % ______________________ N.M. Not meaningful

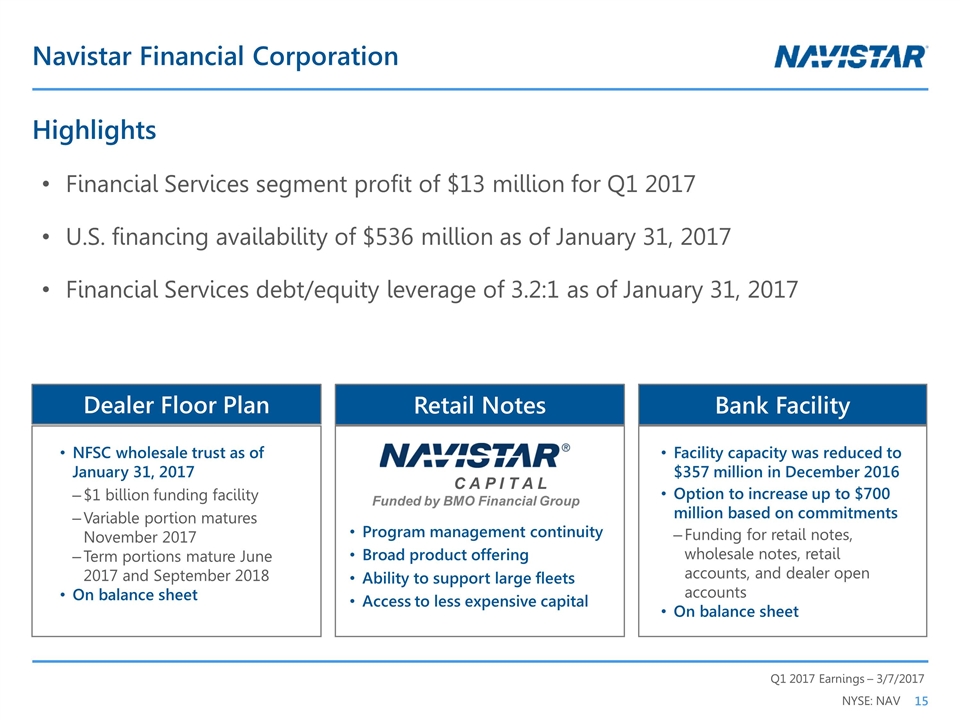

Navistar Financial Corporation Highlights Financial Services segment profit of $13 million for Q1 2017 U.S. financing availability of $536 million as of January 31, 2017 Financial Services debt/equity leverage of 3.2:1 as of January 31, 2017 Retail Notes Bank Facility Dealer Floor Plan Facility capacity was reduced to $357 million in December 2016 Option to increase up to $700 million based on commitments Funding for retail notes, wholesale notes, retail accounts, and dealer open accounts On balance sheet NFSC wholesale trust as of January 31, 2017 $1 billion funding facility Variable portion matures November 2017 Term portions mature June 2017 and September 2018 On balance sheet Program management continuity Broad product offering Ability to support large fleets Access to less expensive capital C A P I T A L Funded by BMO Financial Group

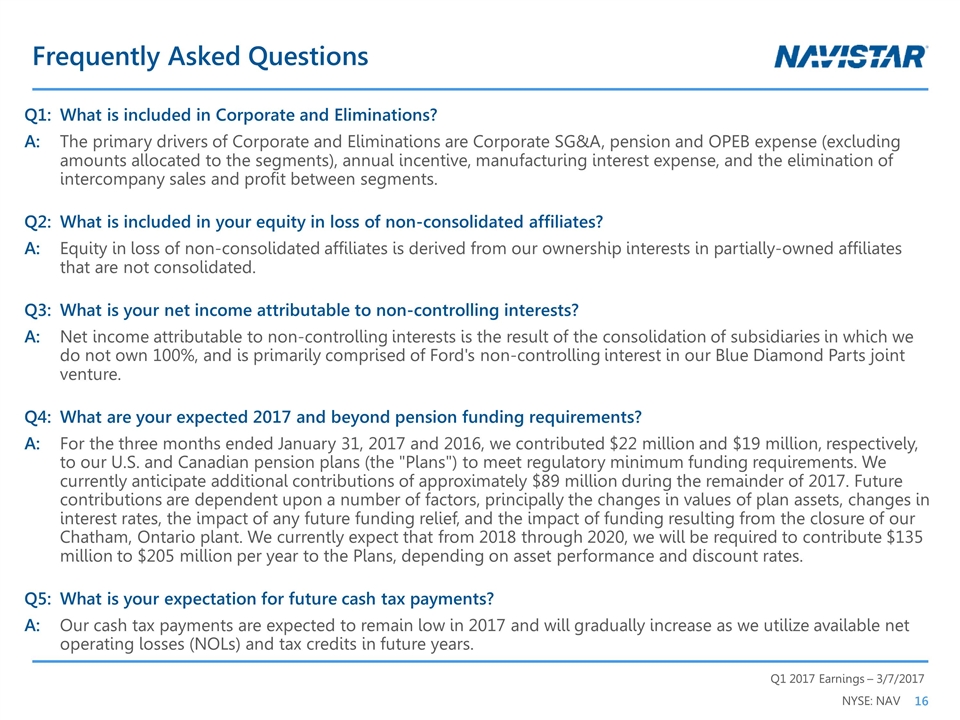

Frequently Asked Questions Q1: What is included in Corporate and Eliminations? A:The primary drivers of Corporate and Eliminations are Corporate SG&A, pension and OPEB expense (excluding amounts allocated to the segments), annual incentive, manufacturing interest expense, and the elimination of intercompany sales and profit between segments. Q2: What is included in your equity in loss of non-consolidated affiliates? A:Equity in loss of non-consolidated affiliates is derived from our ownership interests in partially-owned affiliates that are not consolidated. Q3: What is your net income attributable to non-controlling interests? A:Net income attributable to non-controlling interests is the result of the consolidation of subsidiaries in which we do not own 100%, and is primarily comprised of Ford's non-controlling interest in our Blue Diamond Parts joint venture. Q4:What are your expected 2017 and beyond pension funding requirements? A: For the three months ended January 31, 2017 and 2016, we contributed $22 million and $19 million, respectively, to our U.S. and Canadian pension plans (the "Plans") to meet regulatory minimum funding requirements. We currently anticipate additional contributions of approximately $89 million during the remainder of 2017. Future contributions are dependent upon a number of factors, principally the changes in values of plan assets, changes in interest rates, the impact of any future funding relief, and the impact of funding resulting from the closure of our Chatham, Ontario plant. We currently expect that from 2018 through 2020, we will be required to contribute $135 million to $205 million per year to the Plans, depending on asset performance and discount rates. Q5:What is your expectation for future cash tax payments? A:Our cash tax payments are expected to remain low in 2017 and will gradually increase as we utilize available net operating losses (NOLs) and tax credits in future years.

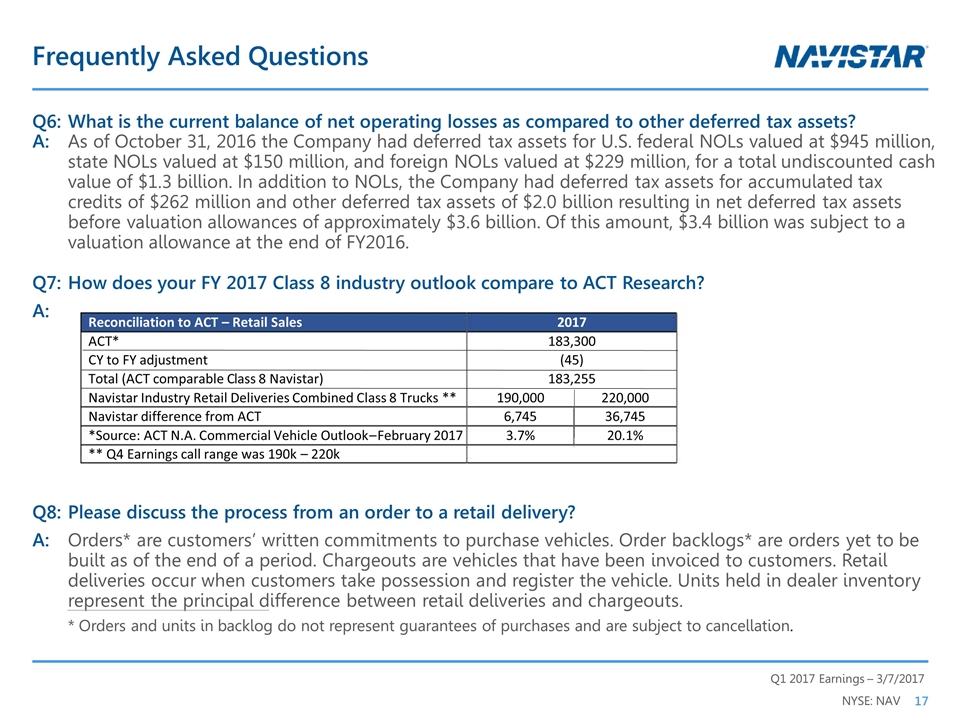

Frequently Asked Questions Q6:What is the current balance of net operating losses as compared to other deferred tax assets? A: As of October 31, 2016 the Company had deferred tax assets for U.S. federal NOLs valued at $945 million, state NOLs valued at $150 million, and foreign NOLs valued at $229 million, for a total undiscounted cash value of $1.3 billion. In addition to NOLs, the Company had deferred tax assets for accumulated tax credits of $262 million and other deferred tax assets of $2.0 billion resulting in net deferred tax assets before valuation allowances of approximately $3.6 billion. Of this amount, $3.4 billion was subject to a valuation allowance at the end of FY2016. Q7:How does your FY 2017 Class 8 industry outlook compare to ACT Research? A: Q8:Please discuss the process from an order to a retail delivery? A: Orders* are customers’ written commitments to purchase vehicles. Order backlogs* are orders yet to be built as of the end of a period. Chargeouts are vehicles that have been invoiced to customers. Retail deliveries occur when customers take possession and register the vehicle. Units held in dealer inventory represent the principal difference between retail deliveries and chargeouts. * Orders and units in backlog do not represent guarantees of purchases and are subject to cancellation. Reconciliation to ACT – Retail Sales 2017 ACT* 183,300 CY to FY adjustment (45) Total (ACT comparable C l ass 8 Navistar) 183,255 Navistar Industry Retail Deliveries Combined Class 8 Trucks ** 190,000 220,000 Navistar difference from ACT 6,745 36,745 *Source: ACT N.A. Commercial Vehicle Outlook – February 2017 3.7% 20.1% ** Q4 Earnings call range was 190k – 220k

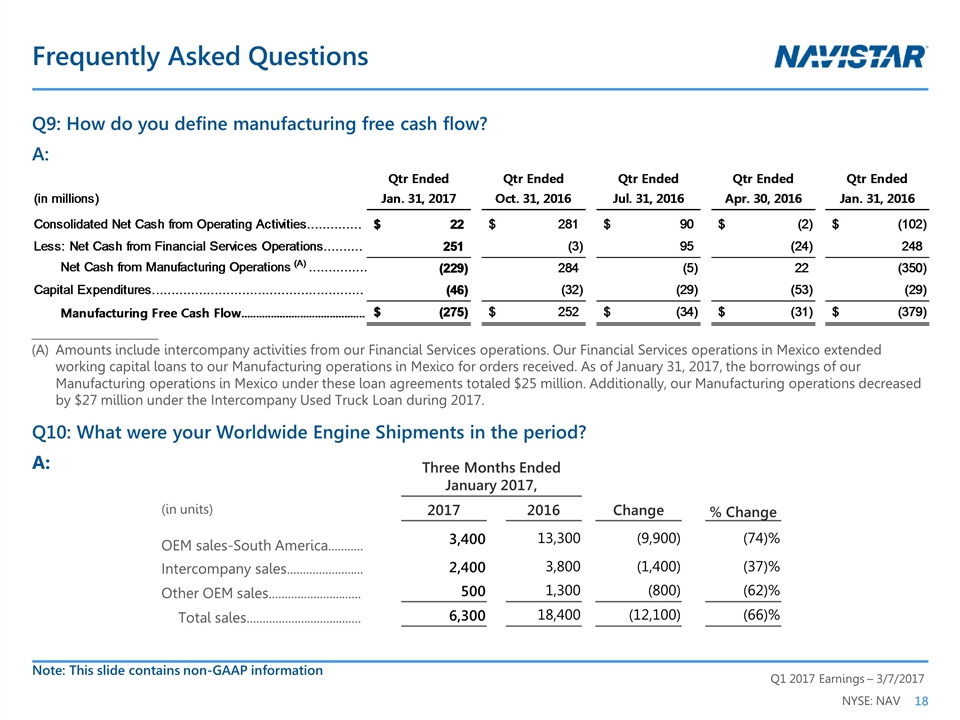

Three Months Ended January 2017, % Change (in units) 2017 2016 Change OEM sales-South America........... 3,400 13,300 (9,900) (74)% Intercompany sales........................ 2,400 3,800 (1,400) (37)% Other OEM sales............................. 500 1,300 (800) (62)% Total sales.................................... 6,300 18,400 (12,100) (66)% Frequently Asked Questions Q9: How do you define manufacturing free cash flow? A: Q10: What were your Worldwide Engine Shipments in the period? A: ______________________ Amounts include intercompany activities from our Financial Services operations. Our Financial Services operations in Mexico extended working capital loans to our Manufacturing operations in Mexico for orders received. As of January 31, 2017, the borrowings of our Manufacturing operations in Mexico under these loan agreements totaled $25 million. Additionally, our Manufacturing operations decreased by $27 million under the Intercompany Used Truck Loan during 2017. Note: This slide contains non-GAAP information Qtr Ended Qtr Ended Qtr Ended Qtr Ended Qtr Ended (in millions) Jan. 31, 2017 Oct. 31, 2016 Jul. 31, 2016 Apr. 30, 2016 Jan. 31, 2016 Consolidated Net Cash from Operating Activities $22 $281 $90 $-2 $-,102 Less: Net Cash from Financial Services Operations 251 -3 95 -24 248 Net Cash from Manufacturing Operations (A) ..................... -,229 284 -5 22 -,350 Capital Expenditures -46 -32 -29 -53 -29 Manufacturing Free Cash Flow $-,275 $252 $-34 $-31 $-,379

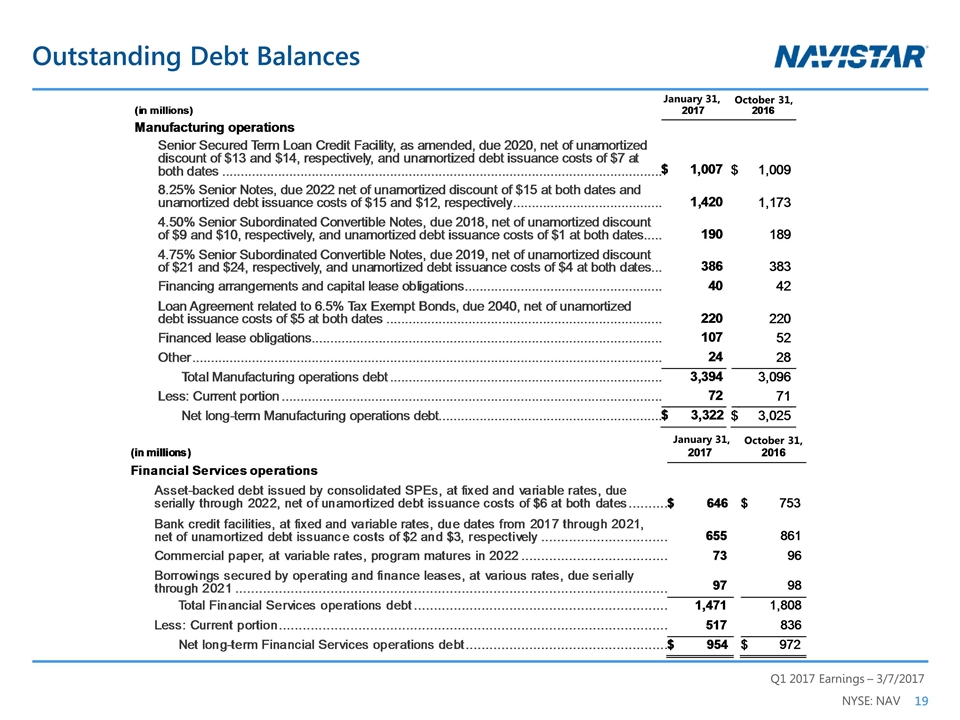

Outstanding Debt Balances January 31, October 31, January 31, October 31,(in millions)20172016Manufacturing operationsSenior Secured Term Loan Credit Facility, as amended, due 2020, net of unamortized discount of $13 and $14, respectively, and unamortized debt issuance costs of $7 at both dates$ 1,007$1,0098.25% Senior Notes, due 2022 net of unamortized discount of $15 at both dates and unamortized debt issuance costs of $15 and $12, respectively 1,4201,1734.50% Senior Subordinated Convertible Notes, due 2018, net of unamortized discount of $9 and $10, respectively, and unamortized debt issuance costs of $1 at both dates 1901894.75% Senior Subordinated Convertible Notes, due 2019, net of unamortized discount of $21 and $24, respectively, and unamortized debt issuance costs of $4 at both dates 386383Financing arrangements and capital lease obligations 4042Loan Agreement related to 6.5% Tax Exempt Bonds, due 2040, net of unamortized debt issuance costs of $5 at both dates 220220Financed lease obligations 10752Other 2428Total Manufacturing operations debt 3,3943,096Less: Current portion 7271Net long-term Manufacturing operations debt$3,322$3,025(in millions)20172016Financial Services operationsAsset-backed debt issued by consolidated SPEs, at fixed and variable rates, due serially through 2022, net of unamortized debt issuance costs of $6 at both dates$ 646$753Bank credit facilities, at fixed and variable rates, due dates from 2017 through 2021, net of unamortized debt issuance costs of $2 and $3, respectively 655861Commercial paper, at variable rates, program matures in 2022 7396Borrowings secured by operating and finance leases, at various rates, due serially through 2021 9798Total Financial Services operations debt 1,4711,808Less: Current portion 517836Net long-term Financial Services operations debt$ 954$972

SEC Regulation G Non-GAAP Reconciliation SEC Regulation G Non-GAAP Reconciliation: The financial measures presented below are unaudited and not in accordance with, or an alternative for, financial measures presented in accordance with U.S. generally accepted accounting principles ("GAAP"). The non-GAAP financial information presented herein should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP and are reconciled to the most appropriate GAAP number below. Earnings (loss) Before Interest, Income Taxes, Depreciation, and Amortization (“EBITDA”): We define EBITDA as our consolidated net income (loss) attributable to Navistar International Corporation, net of tax, plus manufacturing interest expense, income taxes, and depreciation and amortization. We believe EBITDA provides meaningful information to the performance of our business and therefore we use it to supplement our GAAP reporting. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results. Adjusted EBITDA: We believe that adjusted EBITDA, which excludes certain identified items that we do not consider to be part of our ongoing business, improves the comparability of year to year results, and is representative of our underlying performance. Management uses this information to assess and measure the performance of our operating segments. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the below reconciliations, and to provide an additional measure of performance. Manufacturing Cash, Cash Equivalents, and Marketable Securities: Manufacturing cash, cash equivalents, and marketable securities represents the Company’s consolidated cash, cash equivalents, and marketable securities excluding cash, cash equivalents, and marketable securities of our financial services operations. We include marketable securities with our cash and cash equivalents when assessing our liquidity position as our investments are highly liquid in nature. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of our ability to meet our operating requirements, capital expenditures, equity investments, and financial obligations. Structural Cost consists of Selling, general and administrative expenses and Engineering and product development costs. Free Cash Flow consists of Net cash from operating activities and Capital Expenditures.

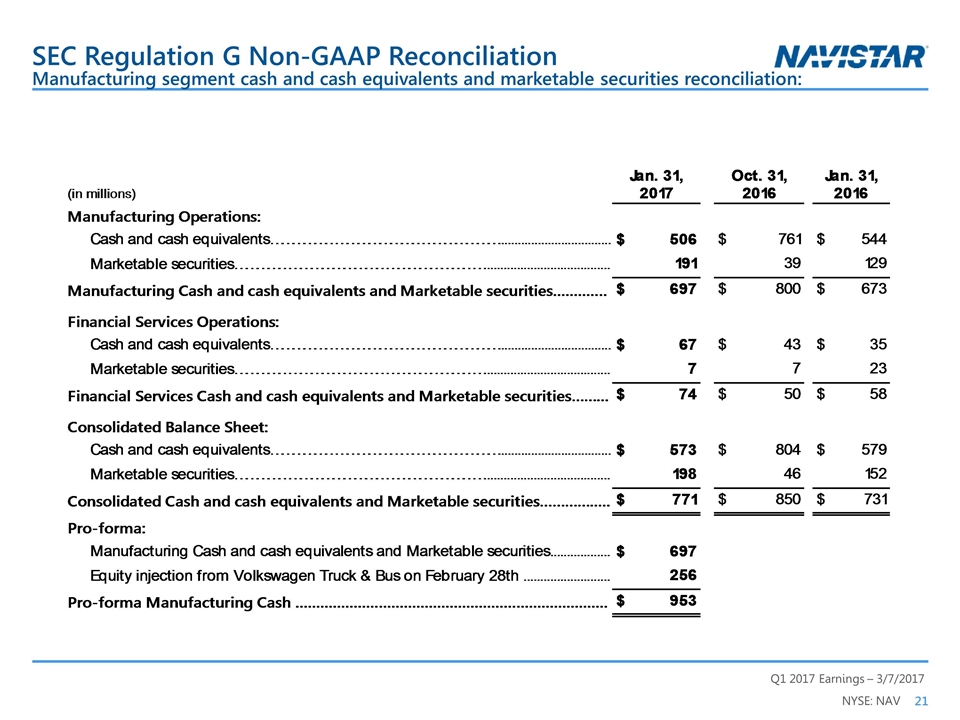

Manufacturing segment cash and cash equivalents and marketable securities reconciliation: SEC Regulation G Non-GAAP Reconciliation Jan. 31, Oct. 31, Jan. 31, Oct. 31, Oct. 31, (in millions) 2017 2016 2016 2014 2013 Manufacturing Operations: Cash and cash equivalents……………………………………………………… $ 506 $ 761 $ 544 583 $ 440 $ 727 Marketable securities…………………………………………………………… 191 39 129 578 796 Manufacturing Cash and cash equivalents and Marketable securities.. $ 697 $ 800 $ 673 733 $ 1,018 $ 1,523 Financial Services Operations: Cash and cash equivalents……………………………………………………… $ 67 $ 43 $ 35 37 $ 57 $ 28 Marketable securities…………………………………………………………… 7 7 23 27 34 Financial Services Cash and cash equivalents and Marketable securities…… $ 74 $ 50 $ 58 62 $ 84 $ 62 Consolidated Balance Sheet: Cash and cash equivalents……………………………………………………… $ 573 $ 804 $ 579 620 $ 497 $ 755 Marketable securities…………………………………………………………… 198 46 152 605 830 Consolidated Cash and cash equivalents and Marketable securities………… $ 771 $ 850 $ 731 795 $ 1,102 $ 1,585 Pro-forma: Manufacturing Cash and cash equivalents and Marketable securities $ 697 $ 1152 Equity injection from Volkswagen Truck & Bus on February 28th 256 30 Pro-forma Manufacturing Cash $ 953 $ 1,182 Cash and cash equivalents……………………………………………………… $ 28 $ 51 $ 51 $ 60 Marketable securities…………………………………………………………… 20 20 20 455 Financial Services Cash and cash equivalents and Marketable securities…… $ 48 $ 71 $ 71 $ 515 Consolidated Balance Sheet: Cash and cash equivalents……………………………………………………… $ 725 $ 51 $ 51 $ 1212 Marketable securities…………………………………………………………… 276 20 20 485 Consolidated Cash and cash equivalents and Marketable securities………… $ 1,001 $ 71 $ 71 $ 1,697

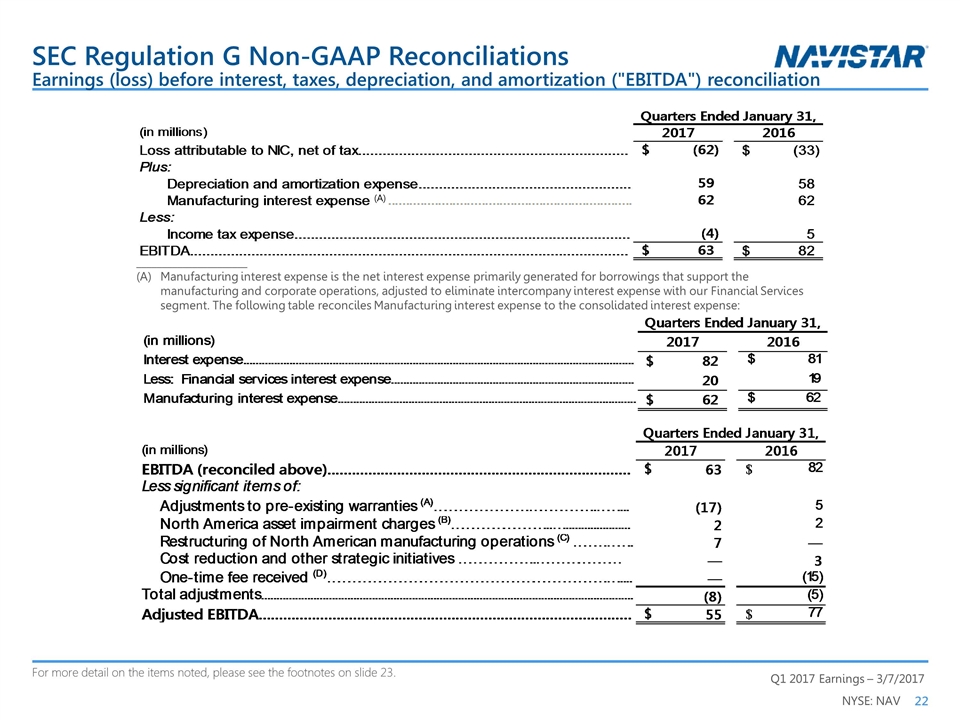

SEC Regulation G Non-GAAP Reconciliations ______________________ (A) Manufacturing interest expense is the net interest expense primarily generated for borrowings that support the manufacturing and corporate operations, adjusted to eliminate intercompany interest expense with our Financial Services segment. The following table reconciles Manufacturing interest expense to the consolidated interest expense: For more detail on the items noted, please see the footnotes on slide 23. Earnings (loss) before interest, taxes, depreciation, and amortization ("EBITDA") reconciliation (A) Quarters Ended January 31, (in millions) 2017 2016 EBITDA (reconciled above) $ 63 $ 82 Less significant items of: Adjustments to pre-existing warranties (A)……………………….………………..…….... -17 5 North America asset impairment charges (B)………………………...…...................... 2 2 Restructuring of North American manufacturing operations (C) ……….…….. 7 — Cost reduction and other strategic initiatives …………………..…………………… — 3 One-time fee received (D)……………………………………………………………………….…..... — -15 Total adjustments -8 -5 Adjusted EBITDA $ 55 $ 77 Quarters Ended January 31, (in millions) 2017 2016 2013 Loss attributable to NIC, net of tax $ -62 $ -33 $ Plus: Depreciation and amortization expense 59 58 Manufacturing interest expense (A)…………………………………………………..………….... 62 62 Less: Income tax expense -4 5 EBITDA $ 63 $ 82 $ Quarters Ended April 30, (in millions) 2015 Interest expense ……………………………………………………………….. 75 Less: Financial services interest expense ………………………………….. 18 Manufacturing interest expense ……………………..……………………… 57 Quarters Ended April 30, (in millions) 2015 EBITDA (reconciled above) …......…………………………………… $85 Less significant items of: Adjustments to pre-existing warranties(A) ………………………...... 18 Restructuring charges(D) ………………………………...….………… 2 Asset impairment charges(C) ………...……………………………….. 1 Gain on settlement(E) ………………………………………………….. -10 Brazil truck business actions(F) …….....……………………………… 6 match below Total adjustments 17 Adjusted EBITDA …......………………………………………….....…… $102 Quarters Ended April 30, (in millions) 2015 Expense (income): Adjustments to pre-existing warranties(A) $18 Accelerated depreciation(B) 12 Asset impairment charges(C) 1 Other restructuring charges and strategic initiatives(D) 2 Gain on settlement(E) -10 Brazil truck business actions(F) 6 Brazilian tax adjustments(G) — (A) Adjustments to pre-existing warranties reflect changes in our estimate of warranty costs for products sold in prior periods. Such adjustments typically occur when claims experience deviates from historic and expected trends. Our warranty liability is generally affected by component failure rates, repair costs, and the timing of failures. Future events and circumstances related to these factors could materially change our estimates and require adjustments to our liability. In addition, new product launches require a greater use of judgment in developing estimates until historical experience becomes available. (B) In the first and second quarter of 2015, the Truck segment recognized charges of $13 million and $12 million, respectively, for the acceleration of depreciation of certain assets related to the foundry facilities. (C) In the second quarter and first half of 2015, the Company concluded it had a triggering event related to certain operating leases, as a result, the Truck segment recorded $1 million and $7 million, respectively, of asset impairment charges. In the second quarter of 2014, we recognized a non-cash charge of $149 million for the impairment of certain intangible assets of our Brazilian engine reporting unit. Due to slower than expected growth in the Brazilian economy causing declines in actual and forecasted results, we tested the goodwill of our Brazilian engine reporting unit and trademark for potential impairment. As a result, we determined that the entire $142 million balance of goodwill and $7 million of trademark were impaired. Additionally, in the first quarter of 2014, the Company concluded it had a triggering event related to potential sales of assets requiring assessment of impairment for certain intangible and long-lived assets in the Truck segment. As a result, the Truck segment recognized asset impairment charges of $18 million. (D) In the second quarter of 2014, we incurred restructuring charges of $8 million related to cost reduction actions that included a reduction-in-force in the U.S. (E) In the second quarter of 2015, the Global Operations segment recognized a $10 million gain resulting from a customer settlement, which includes an offsetting restructuring charge of $4 million. (F) In the second quarter and first half of 2015 our Global Operations segment recorded $6 million in inventory charges to right size the Brazil Truck business. (G) During the second quarter of 2014, our evaluation of the realizability of our Brazilian deferred tax assets resulted in a determination that a valuation allowance was required, due to a deterioration of operating performance in Brazil, an increase in net operating loss carryforwards, and the impairment of certain Brazilian intangible assets. As a result, we recorded a net expense of $29 million related to establishment of the valuation allowance and tax impact from the impairment of certain intangible assets. The above items, except for the Brazilian tax adjustments, did not have a material impact on taxes due to the valuation allowances on our U.S. deferred tax assets, which was established in the fourth quarter of 2012. Quarters Ended April 30, (in millions) 2015 Loss from continuing operations attributable to NIC, net of tax ………… $ -64 Plus: Depreciation and amortization expense ……………………………….. 74 Manufacturing interest expense(A) ………………………………….…. 57 Less: Income tax benefit (expense) …………………………………………… -18 EBITDA ………………………………………………………………………… $ 85 Quarters Ended January 31, (in millions) 2017 2016 Interest expense $ 82 $ 81 Less: Financial services interest expense 20 19 Manufacturing interest expense $ 62 $ 62 Quarters Ended April 30, (in millions) 2015 EBITDA (reconciled above) …......…………………………………… $85 Less significant items of: Adjustments to pre-existing warranties(A) ………………………...... 18 Restructuring charges(D) ………………………………...….………… 2 Asset impairment charges(C) ………...……………………………….. 1 Gain on settlement(E) ………………………………………………….. -10 Brazil truck business actions(F) …….....……………………………… 6 Total adjustments 17 Adjusted EBITDA …......………………………………………….....…… $102 Quarters Ended April 30, (in millions) 2015 Expense (income): Adjustments to pre-existing warranties(A) $18 Accelerated depreciation(B) 12 Asset impairment charges(C) 1 Other restructuring charges and strategic initiatives(D) 2 Gain on settlement(E) -10 Brazil truck business actions(F) 6 Brazilian tax adjustments(G) — (A) Adjustments to pre-existing warranties reflect changes in our estimate of warranty costs for products sold in prior periods. Such adjustments typically occur when claims experience deviates from historic and expected trends. Our warranty liability is generally affected by component failure rates, repair costs, and the timing of failures. Future events and circumstances related to these factors could materially change our estimates and require adjustments to our liability. In addition, new product launches require a greater use of judgment in developing estimates until historical experience becomes available. (B) In the first and second quarter of 2015, the Truck segment recognized charges of $13 million and $12 million, respectively, for the acceleration of depreciation of certain assets related to the foundry facilities. (C) In the second quarter and first half of 2015, the Company concluded it had a triggering event related to certain operating leases, as a result, the Truck segment recorded $1 million and $7 million, respectively, of asset impairment charges. In the second quarter of 2014, we recognized a non-cash charge of $149 million for the impairment of certain intangible assets of our Brazilian engine reporting unit. Due to slower than expected growth in the Brazilian economy causing declines in actual and forecasted results, we tested the goodwill of our Brazilian engine reporting unit and trademark for potential impairment. As a result, we determined that the entire $142 million balance of goodwill and $7 million of trademark were impaired. Additionally, in the first quarter of 2014, the Company concluded it had a triggering event related to potential sales of assets requiring assessment of impairment for certain intangible and long-lived assets in the Truck segment. As a result, the Truck segment recognized asset impairment charges of $18 million. (D) In the second quarter of 2014, we incurred restructuring charges of $8 million related to cost reduction actions that included a reduction-in-force in the U.S. (E) In the second quarter of 2015, the Global Operations segment recognized a $10 million gain resulting from a customer settlement, which includes an offsetting restructuring charge of $4 million. (F) In the second quarter and first half of 2015 our Global Operations segment recorded $6 million in inventory charges to right size the Brazil Truck business. (G) During the second quarter of 2014, our evaluation of the realizability of our Brazilian deferred tax assets resulted in a determination that a valuation allowance was required, due to a deterioration of operating performance in Brazil, an increase in net operating loss carryforwards, and the impairment of certain Brazilian intangible assets. As a result, we recorded a net expense of $29 million related to establishment of the valuation allowance and tax impact from the impairment of certain intangible assets. The above items, except for the Brazilian tax adjustments, did not have a material impact on taxes due to the valuation allowances on our U.S. deferred tax assets, which was established in the fourth quarter of 2012.

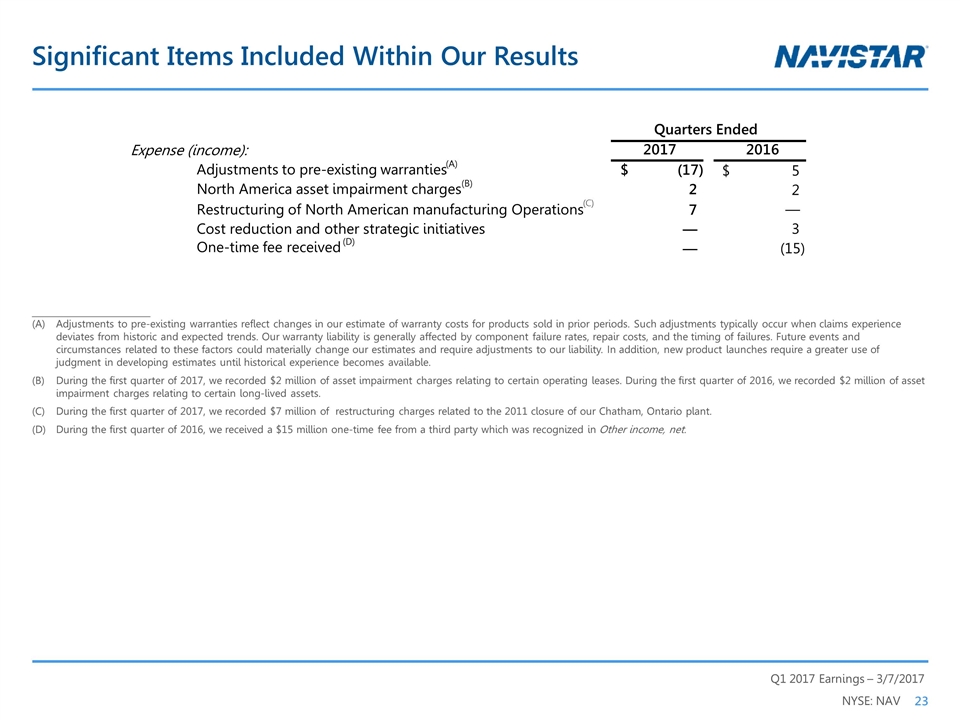

______________________ Adjustments to pre-existing warranties reflect changes in our estimate of warranty costs for products sold in prior periods. Such adjustments typically occur when claims experience deviates from historic and expected trends. Our warranty liability is generally affected by component failure rates, repair costs, and the timing of failures. Future events and circumstances related to these factors could materially change our estimates and require adjustments to our liability. In addition, new product launches require a greater use of judgment in developing estimates until historical experience becomes available. During the first quarter of 2017, we recorded $2 million of asset impairment charges relating to certain operating leases. During the first quarter of 2016, we recorded $2 million of asset impairment charges relating to certain long-lived assets. During the first quarter of 2017, we recorded $7 million of restructuring charges related to the 2011 closure of our Chatham, Ontario plant. During the first quarter of 2016, we received a $15 million one-time fee from a third party which was recognized in Other income, net. Significant Items Included Within Our Results Expense (income): 2017 2016 Adjustments to pre-existing warranties (A) (17) $ 5 $ North America asset impairment charges (B) 2 2 Restructuring of North American manufacturing Operations (C) 7 — Cost reduction and other strategic initiatives — 3 One-time fee received (D) — (15) Quarters Ended