Attached files

| file | filename |

|---|---|

| 8-K - RBC CAPITAL MARKETS - INDEPENDENT BANK CORP | rbccapitalmarkets.htm |

RBC Capital Markets

Financial Institutions Conference

March 7, 2017

Robert Cozzone – Chief Financial Officer and Treasurer

Jonathan Nelson – SVP, Rockland Trust

Exhibit 99.1

(2)

Who We Are

• Main Sub: Rockland Trust

• Market: Eastern Massachusetts

• Loans: $6.0 B

• Deposits: $6.4 B

• $AUA: $2.9 B

• Market Cap: $1.8 B

• NASDAQ: INDB

(3)

Key Messages

• Lengthy track record of consistent, solid performance

• Robust loan and core deposit activity

• Growing fee revenue sources, esp. Investment Mgmt.

• Expanding footprint in growth markets

• Tangible book value steadily growing *

• Steadily improving operating efficiency

• Disciplined risk management culture

• Proven integrator of acquired banks

* See appendix A for reconciliation

(4)

Expanding Company Footprint

Rank 2016

1 23.5% 39%

Rank 2016

5 4.9% 18%

Rank 2016

3 12.3% 14%

Rank 2016

6 7.9% 12%

Rank 2016

19 1.2% 10%

Rank 2016

17 0.3% 4%

Rank 2016

2 19.7% 2%

Rank 2016

31 0.3% 1%

Suffolk County

Bristol County

Worcester County

Dukes County (MV)

Middlesex County

Norfolk County

% of

INDB Dep.Share

Barnstable County (Cape Cod)

Market

Plymouth County

Source: SNL Financial; Deposit/Market Share data as of October 20, 2016.

*Pro forma for pending Island Bancorp, Inc. acquisition

*

(5)

Recent Accomplishments

• Four consecutive years of record earnings

• Reached agreement to acquire Island Bancorp, Inc. of

Martha’s Vineyard

• Finalized acquisition of New England Bancorp, Inc. of

Cape Cod

• Capitalizing on expansion moves in vibrant Greater

Boston market

• Growth initiatives – new equipment leasing product, new

N. Quincy branch, expanded digital offerings

• Strong household growth rate

• Consistently high rankings in third party surveys

(6) $55.2

$59.9

$71.7 $80.4

2013 2014 2015 2016

Operating Earnings ($ Mil.)**

Strong Fundamentals Driving Performance

+13% CAGR

Diluted EPS

$2.18 $2.49 $2.50 $2.90

• Robust customer activity

• Core deposits up to 90%

• Fee revenues rising

• Low funding costs

• Low credit loss rates

• TBV steadily growing*

• Solid returns

• Accretive Acquisitions

Diluted EPS

$2.39 $2.50 $2.76 $3.04

* See appendix A for reconciliation

* *See appendix B for reconciliation

$50.3 $59.8

$65.0

$76.6

2013 2014 2015 2016

Net Income ($ Mil.)

+15% CAGR

(7)

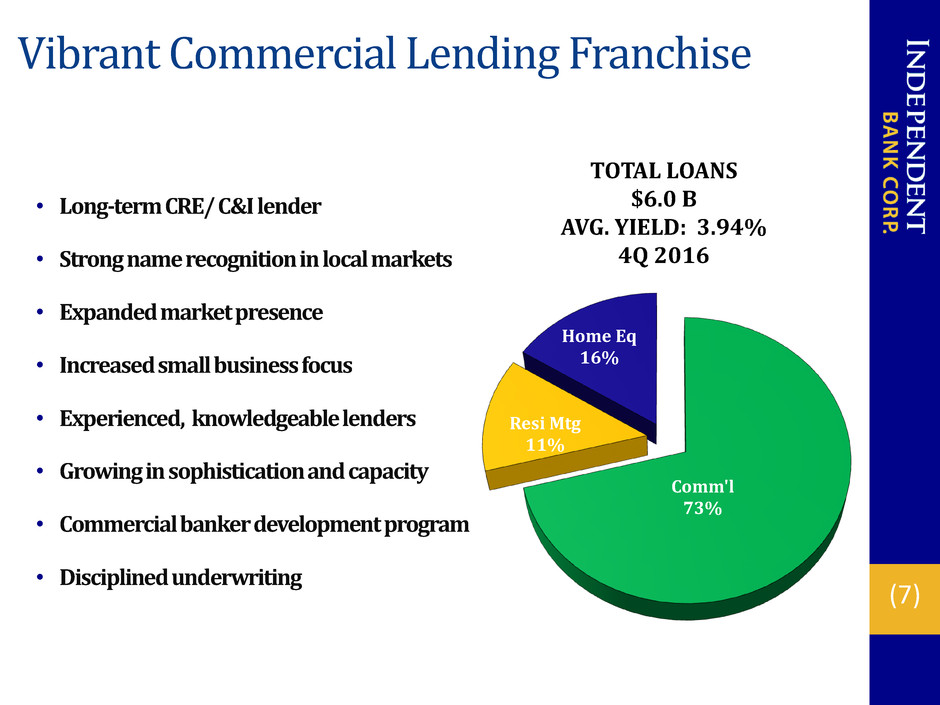

Vibrant Commercial Lending Franchise

TOTAL LOANS

$6.0 B

AVG. YIELD: 3.94%

4Q 2016

Comm'l

73%

Resi Mtg

11%

Home Eq

16%

• Long-term CRE/ C&I lender

• Strong name recognition in local markets

• Expanded market presence

• Increased small business focus

• Experienced, knowledgeable lenders

• Growing in sophistication and capacity

• Commercial banker development program

• Disciplined underwriting

(8)

Commercial Real Estate Diversification

*Includes 1-4 Family, Multifamily, Condos and Approved Land

Residential-Related*

31.0%

Commercial Buildings

19.0%

Office Buildings

10.5%

Industrial / Warehouse

9.1%

Hotels / Motels

8.4%

Strip Malls

3.7%

All Other

18.3%

Total Commercial Real Estate Portfolio by Property Type

Balance $3.3B

as of 12/31/16

(9)

C&I Diversification

Retail Trade

20.1%

Real Estate and Rental and

Leasing

17.3%

Wholesale Trade

12.6%

Manufacturing

10.5%

Construction

10.1%

Finance and Insurance

6.4%

Health Care and Social

Assistance

5.9%

Accommodation and Food

Services

3.9%

All Other (11 Sectors)

13.2%

C&I Loan Portfolio Composition

Balance $902.1M

as of 12/31/16

(10)

Low Cost Deposit Base

Demand

Deposits

32%

Money

Market

19%

Savings/Now

39%

CDs

10%

TOTAL DEPOSITS

$6.4 B

AVG. COST: 0.17%

4Q 2016

• Sizable demand deposit

component

• Valuable source of liquidity

• Relationship-based approach

• Excellent household growth

• Expanded digital access

• Growing commercial base

• Reducing higher cost deposits

CORE DEPOSITS: 90%

(11)

6.1

13.5

21.8

2006 2011 2016

Revenues

($ Mil.)

816

1,651

2,919

2006 2011 2016

AUAs

($ Mil.)

Investment Management :

Transformed Into High Growth Business

+258% +257%

• Successful business model

• Growing source of fee revenues

• Strong feeder business from Bank

• Expanding investment center locations

• Cross-sell opportunity in acquired bank markets

• Adding experienced professionals

(12)

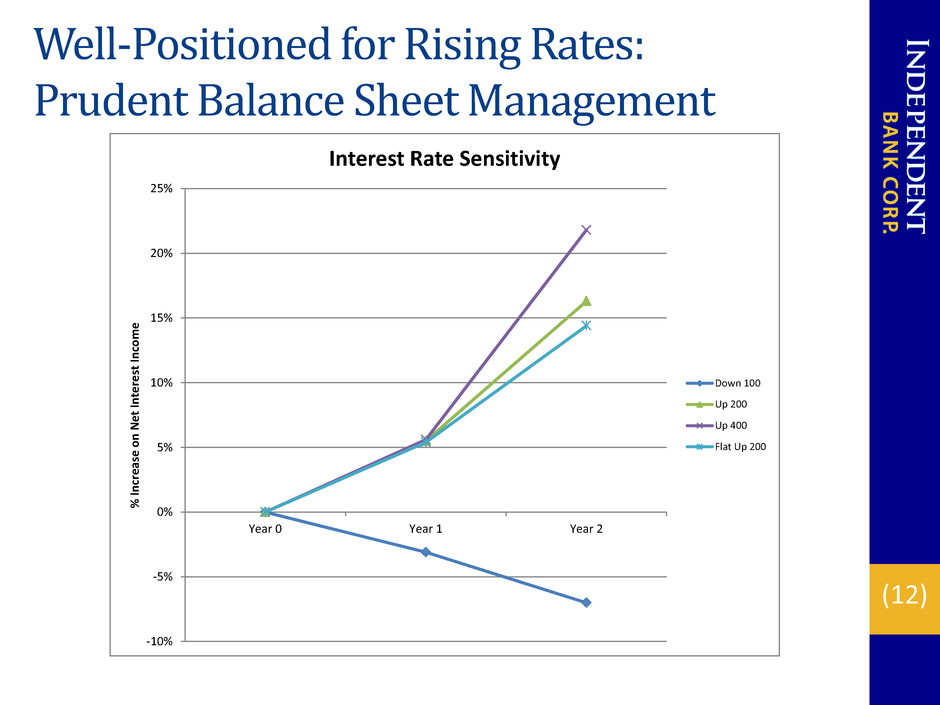

Well-Positioned for Rising Rates:

Prudent Balance Sheet Management

-10%

-5%

0%

5%

10%

15%

20%

25%

Year 0 Year 1 Year 2

%

In

cr

ease

o

n

N

et

In

te

re

st

In

co

m

e

Interest Rate Sensitivity

Down 100

Up 200

Up 400

Flat Up 200

(13)

Asset Quality: Well Managed

$34.7

$27.5 $27.7

$57.4

2013 2014 2015 2016

NPLs

($ Mil.)

NPL/Loan %

0.73% 0.55% 0.50% 0.96%

Peers 0.64%*

* Source: FFIEC Peer Group 2; $3-10 Billion in Assets, September 30, 2016

Incl. 90 days + overdue

$8.8 $8.5

$0.8

$0.3

2013 2014 2015 2016

Net Chargeoffs

($ Mil.)

customer

fraud

Loss Rate

19bp 18bp 1bp 1bp

Peers 10bp*

(14)

Strong Capital Position (period end)

$17.18

$19.18

$21.29

$23.45

2013 2014 2015 3Q16

Tangible Book Value*

+34%

* See appendix A for reconciliation

$24.85

$26.69

$29.40 $32.02

2013 2014 2015 3Q16

Book Value Per Share

+25%

• Strong internal capital generation

• No storehousing of excess capital

• No external equity raising

• No dividend cuts

(15)

Attentive to Shareholder Returns

$0.88 $0.96

$1.04

$1.16

2013 2014 2015 2016

Cash Dividends Declared Per Share

(16)

Sustaining Business Momentum

Business Line

• Expand Market Presence/Recruit Seasoned Lenders

• Grow Client Base

• Expand Specialty Products, e.g. ABL, Leasing

• Lender Development Programs

Commercial

• Continue to Drive Household Growth

• Expand Digital Offerings

• Optimize Branch Network

Retail Delivery

• Capitalize on Strong Market Demographics

• Continue Strong Branch/Commercial Referrals

• Expand COI Relationships

Investment Management

• Continue Aggressive H.E. Marketing

• Scalable Resi Mortgage Origination Platform

Consumer Lending

Focal Points

(17)

Expanded Presence in Vibrant Greater Boston

Long-Term Commercial Lender in Greater Boston

Central Bancorp

$357MM Deposits

10 Branches – Nov. 2012

Investment Management

and Commercial Lending

Center

October 2013

Peoples Federal

Bancshares

$432MM Deposits

8 Branches – Feb. 2015

(18)

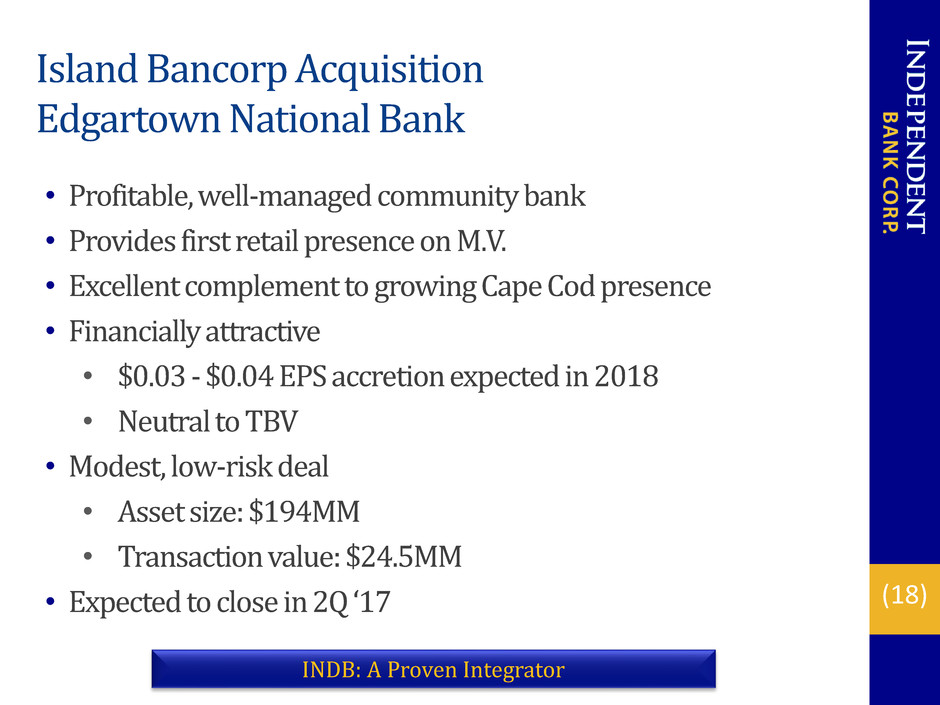

Island Bancorp Acquisition

Edgartown National Bank

• Profitable, well-managed community bank

• Provides first retail presence on M.V.

• Excellent complement to growing Cape Cod presence

• Financially attractive

• $0.03 - $0.04 EPS accretion expected in 2018

• Neutral to TBV

• Modest, low-risk deal

• Asset size: $194MM

• Transaction value: $24.5MM

• Expected to close in 2Q ‘17

INDB: A Proven Integrator

(19)

Building Franchise Value

Disciplined Acquisitions

Deal Value: $84.5MM

2% Core Dep. Premium*

Benjamin

Franklin Bancorp

Apr ‘09

$994mm Assets

$701mm Deposits

11 Branches

Deal Value: $52.0MM

8% Core Dep. Premium*

Central

Bancorp

Nov ‘12

$537mm Assets

$357mm Deposits

10 Branches

Deal Value: $40.3MM

8% Core Dep. Premium*

Mayflower

Bancorp

Nov’13

$243mm Assets

$219mm Deposits

8 Branches

$276 mm Assets

$176mm Deposits

Net 1 Branch

Deal Value: $41.7MM

12% Core Dep. Premium*

All Acquisitions Immediately Accretive

*Incl. CDs <$100k

Deal metrics based on closing price and actual acquired assets

New England Bancorp

Nov ‘16

Deal Value: $102.2 MM

17% Core Dep. Premium*

Slade’s Ferry

Bancorp

Mar ‘08

$630mm Assets

$411mm Deposits

9 Branches

Peoples Federal

Bancshares

Feb ’15

$640 mm Assets

$432mm Deposits

8 Branches

Deal Value: $141.8MM

10% Core Dep. Premium*

Island Bancorp

Q2 ‘17 (est.)

$194 mm Assets

$171mm Deposits

Net 4 Branches

Deal Value: $24.5MM

6% Core Dep. Premium*

(20)

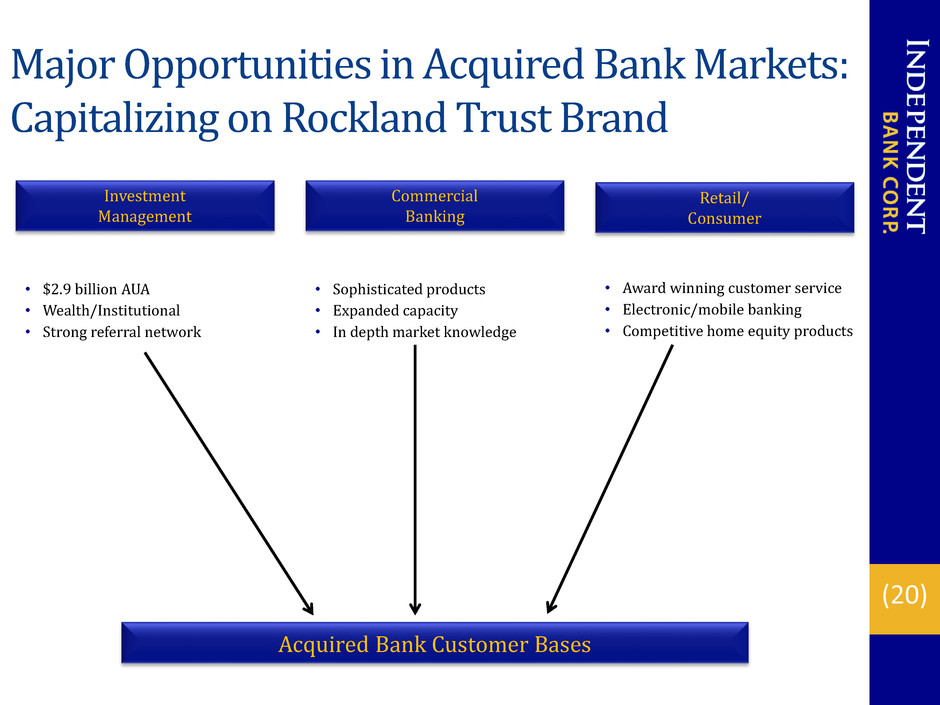

Major Opportunities in Acquired Bank Markets:

Capitalizing on Rockland Trust Brand

Investment

Management

Commercial

Banking

Retail/

Consumer

• $2.9 billion AUA

• Wealth/Institutional

• Strong referral network

• Sophisticated products

• Expanded capacity

• In depth market knowledge

• Award winning customer service

• Electronic/mobile banking

• Competitive home equity products

Acquired Bank Customer Bases

(21)

Optimizing Retail Delivery Network

In the past twelve months we have:

• Acquired specialized analytics software/location model

• Shifted branch distribution

• Closed/consolidated 4

• Opened 1

• Redesigned 3

• Contracted ATM site in downtown Boston

• Implemented in-branch transaction balancing

• Transitioned to instant-issue debit cards

• Introduced SecurLOCK feature for misplaced cards

• Implemented Apple, Android and Samsung Pay

• Allowed for electronic scans of customer identification

(22)

INDB Investment Merits

• High quality franchise in attractive markets

• Strong organic business volumes

• Growing brand recognition

• Operating platform that can be leveraged further

• Capitalizing on in-market consolidation opportunities

• Diligent stewards of shareholder capital

• Grounded management team

• Positioned to grow, build, and acquire to drive long-term value

creation

(23)

Appendix A

The following table reconciles Book Value per share, which is a GAAP based measure to Tangible Book Value per share, which

is a non-GAAP based measure. It also reconciles the ratio of Equity to Assets, which is a GAAP based measure, to Tangible

Equity to Tangible Assets, a non-GAAP measure, for the dates indicated:

2013 2014 2015 2016

(Dollars in thousands, except share and per share data)

Tangible common equity

Stockholders' equity (GAAP) $ 591,540 $ 640,527 $ 771,463 $ 864,690 (a)

Less: Goodwill and other intangibles 182,642 180,306 212,909 231,374

Tangible common equity 408,898 460,221 558,554 633,316 (b)

Tangible assets

Assets (GAAP) 6,098,869 6,364,318 7,209,469 7,709,375 (c)

Less: Goodwill and other intangibles 182,642 180,306 212,909 231,374

Tangible assets 5,916,227 6,184,012 6,996,560 7,478,001 (d)

Common shares 23,805,984 23,998,738 26,236,352 27,005,813 (e)

Common equity to assets ratio (GAAP) 9.70 % 10.06 % 10.70 % 11.22 % (a/c)

Tangible common equity to tangible assets

ratio (Non-GAAP)

6.91 % 7.44 % 7.98 % 8.47 % (b/d)

Book Value per share (GAAP) $ 24.85 $ 26.69 $ 29.40 $ 32.02 (a/e)

Tangible book value per share (Non-GAAP) $ 17.18 $ 19.18 $ 21.29 $ 23.45 (b/e)

(24)

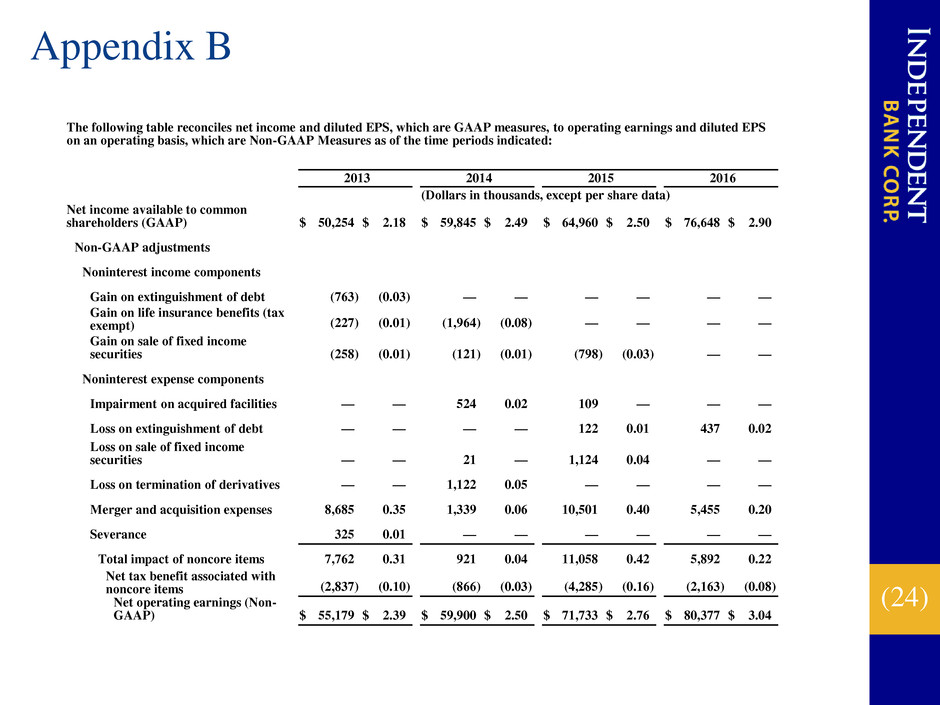

Appendix B

The following table reconciles net income and diluted EPS, which are GAAP measures, to operating earnings and diluted EPS

on an operating basis, which are Non-GAAP Measures as of the time periods indicated:

2013 2014 2015 2016

(Dollars in thousands, except per share data)

Net income available to common

shareholders (GAAP) $ 50,254 $ 2.18 $ 59,845 $ 2.49 $ 64,960 $ 2.50 $ 76,648 $ 2.90

Non-GAAP adjustments

Noninterest income components

Gain on extinguishment of debt (763 ) (0.03 ) — — — — — —

Gain on life insurance benefits (tax

exempt) (227 ) (0.01 ) (1,964 ) (0.08 ) — — — —

Gain on sale of fixed income

securities (258 ) (0.01 ) (121 ) (0.01 ) (798 ) (0.03 ) — —

Noninterest expense components

Impairment on acquired facilities — — 524 0.02 109 — — —

Loss on extinguishment of debt — — — — 122 0.01 437 0.02

Loss on sale of fixed income

securities — — 21 — 1,124 0.04 — —

Loss on termination of derivatives — — 1,122 0.05 — — — —

Merger and acquisition expenses 8,685 0.35 1,339 0.06 10,501 0.40 5,455 0.20

Severance 325 0.01 — — — — — —

Total impact of noncore items 7,762 0.31 921 0.04 11,058 0.42 5,892 0.22

Net tax benefit associated with

noncore items (2,837 ) (0.10 ) (866 ) (0.03 ) (4,285 ) (0.16 ) (2,163 ) (0.08 )

Net operating earnings (Non-

GAAP) $ 55,179 $ 2.39 $ 59,900 $ 2.50 $ 71,733 $ 2.76 $ 80,377 $ 3.04

(25)

NASDAQ Ticker: INDB

www.rocklandtrust.com

Robert Cozzone – CFO & Treasurer

Shareholder Relations:

(781) 982-6737

Statements contained in this presentation that are not historical facts are “forward-looking

statements” that are subject to risks and uncertainties which could cause actual results to differ

materially from those currently anticipated due to a number of factors, which include, but are not

limited to, factors discussed in documents filed by the Company with the Securities and Exchange

Commission from time to time.