Attached files

| file | filename |

|---|---|

| EX-31.2 - GARTNER INC | c87612_ex31-2.htm |

| EX-31.1 - GARTNER INC | c87612_ex31-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016 | ||

| OR | ||

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-14443

GARTNER, INC.

(Exact name of Registrant as Specified in its Charter)

| Delaware | 04-3099750 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) | |

| P.O. Box 10212 56 Top Gallant Road Stamford, CT |

06902-7700 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

| (203) 316-1111 | ||

| (Registrant’s Telephone Number, Including Area Code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class: | Name of Each Exchange on which Registered | |||

| Common Stock, par value $0.0005 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

As of June 30, 2016, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $7,771,510,947 based on the closing sale price as reported on the New York Stock Exchange.

The number of shares outstanding of the registrant’s common stock was 82,652,880 as of January 31, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Explanatory Note

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends Gartner, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2016, originally filed with the Securities and Exchange Commission, or SEC, on February 22, 2017 (the “Original Filing”). We are amending and refiling Part III to include information required by Items 10, 11, 12, 13 and 14. Accordingly, reference to the proxy statement for our annual meeting of stockholders on the cover page has been deleted.

In addition, pursuant to the rules of the SEC, we have also included as exhibits currently dated certifications required under Section 302 of The Sarbanes-Oxley Act of 2002. Because no financial statements are contained within this Amendment, we are not including certifications pursuant to Section 906 of The Sarbanes-Oxley Act of 2002. We are amending and refiling Part IV to reflect the inclusion of those certifications.

Except as described above, no other changes have been made to the Original Filing. Except as otherwise indicated herein, this Amendment continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events that occurred subsequent to the date of the Original Filing. The filing of this Annual Report on Form 10-K/A is not a representation that any statements contained in items of our Annual Report on Form 10-K other than Part III, Items 10 through 14, and Part IV are true or complete as of any date subsequent to the Original Filing.

| 2 |

GARTNER, INC.

AMENDMENT NO. 1

to

ANNUAL REPORT ON FORM 10-K/A

FOR THE PERIOD ENDED DECEMBER 31, 2016

TABLE OF CONTENTS

| 3 |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

DIRECTORS

Our Board of Directors, or Board, currently has ten directors who serve for annual terms. Our Chief Executive Officer, Eugene A. Hall, has an employment agreement with the Company that obligates the Company to include him on the slate of nominees to be elected to our Board during the term of the agreement. See Executive Compensation – Employment Agreements with Executive Officers included in Item 11 of this Annual Report on Form 10-K. There are no other arrangements between any director or nominee and any other person pursuant to which the director or nominee was selected. None of our directors or executive officers is related to another director or executive officer by blood, marriage or adoption.

Set forth below are the name, age, principal occupation for the last five years, public company board experience, selected additional biographical information and period of service as a director of the Company of each director, as well as a summary of each director’s experience, qualifications and background which, among other factors, support their respective qualifications to continue to serve on our Board.

| Michael J. Bingle, 44, director since 2004 |

Mr. Bingle is a Managing Partner and Managing Director of Silver Lake, a private equity firm that he joined in January 2000. Prior thereto, he was a principal with Apollo Management, L.P., a private equity firm, and an investment banker at Goldman, Sachs & Co. He is a former director of TD Ameritrade Holding and Virtu Financial Inc. |

| Mr. Bingle’s investing, investment banking and capital markets expertise, coupled with his extensive working knowledge of Gartner (a former Silver Lake portfolio company), its financial model and core financial strategies, provide valuable perspective and guidance to our Board and Compensation and Governance Committees. | |

| Peter E. Bisson, 59, director since August 2016 |

Mr. Bisson recently retired from McKinsey & Company where he last served as Director and Global Leader of the High Tech Practice. Mr. Bisson held a number of other leadership positions at McKinsey & Company, including chair of its knowledge committee, which guides the firm’s knowledge investment and communication strategies, member of the firm’s shareholders committee, and leader of the firm’s strategy and telecommunications practices. In more than 30 years at McKinsey & Company, Mr. Bisson advised a variety of multinational public companies in the technology-based products and services industry. Mr. Bisson is also a director of ADP. |

| Mr. Bisson’s experience includes advising clients on corporate strategy and M&A, design and execution of performance improvement programs and marketing and technology development, which qualifies him to serve as a director. | |

| Richard J. Bressler, 59, director since 2006 |

Mr. Bressler is President and Chief Financial Officer of iHeartMedia, Inc., and Chief Financial Officer of Clear Channel Outdoor Holdings, Inc. Prior to joining iHeartMedia, he served as Managing Director of Thomas H. Lee Partners, L.P., a Boston-based private equity firm, from 2006 to July 2013. He joined Thomas H. Lee Partners from his role as Senior Executive Vice President and Chief Financial Officer of Viacom Inc., where he managed all strategic, financial, business development and technology functions. Mr. Bressler has also served in various capacities with Time Warner Inc., including Chairman and Chief Executive Officer of Time Warner Digital Media and Executive Vice President and Chief Financial Officer of Time Warner Inc. Prior to joining Time Inc., he was a partner with the accounting firm of Ernst & Young. Mr. Bressler is currently a Director of iHeartMedia, Inc., and a former director of The Nielsen Company B.V. and Warner Music Group Corp. |

| Mr. Bressler qualifies as an audit committee financial expert, and his extensive financial and operational roles at large U.S. public companies bring a wealth of management, financial, accounting and professional expertise to our Board and Audit Committee. |

| 4 |

| Raul E. Cesan, 69, director since 2012 |

Mr. Cesan has been the Founder and Managing Partner of Commercial Worldwide LLC, an investment firm. Prior thereto, he spent 25 years at Schering – Plough Corporation, serving in various capacities of substantial responsibility: the President and Chief Operating Officer (from 1998 to 2001); Executive Vice President of Schering-Plough Corporation and President of Schering-Plough Pharmaceuticals (from 1994 – 1998); President of Schering Laboratories, U.S. Pharmaceutical Operations (from 1992 to 1994); and President of Schering – Plough International (from 1988 to 1992). Mr. Cesan is also a director of The New York Times Company. |

| Mr. Cesan’s extensive operational and international experiences provide valuable guidance to our Board and Compensation Committee. | |

| Karen E. Dykstra, 58, director since 2007 |

Ms. Dykstra served as Chief Financial and Administrative Officer from November 2013 to July 2015, and as Chief Financial Officer from September 2012 to November 2013, of AOL, Inc. From January 2007 until December 2010, Ms. Dykstra was a Partner of Plainfield Asset Management LLC (“Plainfield”), and she served as Chief Operating Officer and Chief Financial Officer of Plainfield Direct LLC, Plainfield’s business development company, from May 2006 to 2010, and as a director from 2007 to 2010. Prior thereto, she spent over 25 years with Automatic Data Processing, Inc., serving most recently as Chief Financial Officer from January 2003 to May 2006, and prior thereto as Vice President – Finance, Corporate Controller and in other capacities. Ms. Dykstra is a director of VMware, Inc. and Boston Properties, Inc., and a former director of Crane Co. and AOL, Inc. |

| Ms. Dykstra qualifies as an audit committee financial expert, and her extensive management, financial, accounting and oversight experience provide important expertise to our Board and Audit Committee. | |

| Anne Sutherland Fuchs, 69, director since July 1999 |

Ms. Fuchs served as Group President, Growth Brands Division, Digital Ventures, a division of J.C. Penney Company, Inc., from November 2010 until April 2012. She also served as Chair of the Commission on Women’s Issues for New York City during the Bloomberg Administration, a position she held from 2002 through 2013. Previously, Ms. Fuchs served as a consultant to companies on branding and digital initiatives, and as a senior executive with operational responsibility at LVMH Moët Hennessy Louis Vuitton, Phillips de Pury & Luxembourg and several publishing companies, including Hearst Corporation, Conde Nast, Hachette and CBS. Ms. Fuchs is also a director of Pitney Bowes Inc. |

| Ms. Fuchs’ executive management, content and branding skills plus operations expertise, her knowledge of government operations and government partnerships with the private sector, and her keen interest and knowledge of diversity, governance and executive compensation matters provide important perspective to our Board and its Governance and Compensation Committees. | |

| William O. Grabe, 78, director since 1993 | Mr. Grabe is an Advisory Director of General Atlantic LLC, a global private equity firm. Prior to joining General Atlantic in 1992, Mr. Grabe was a Vice President and Corporate Officer of IBM Corporation. Mr. Grabe is presently a director of Covisint Corporation, QTS Realty Trust, Inc. and Lenovo Group Limited. He is a former director of Infotech Enterprises Limited, Compuware Corporation and iGate Computer Systems Limited (f/k/a Patni Computer Systems Ltd.). |

| Mr. Grabe’s extensive senior executive experience, his knowledge of business operations and his vast knowledge of the global information technology industry have made him a valued member of the Board and Governance Committee. |

| 5 |

| Eugene A. Hall, 60, director since 2004 |

Mr. Hall is the Chief Executive Officer of Gartner. Prior to joining Gartner in 2004, Mr. Hall was a senior executive at Automatic Data Processing, Inc., a Fortune 500 global technology and service company, serving most recently as President, Employers Services Major Accounts Division, a provider of human resources and payroll services. Prior to joining ADP in 1998, Mr. Hall spent 16 years at McKinsey & Company, most recently as Director. |

| As Gartner’s CEO, Mr. Hall is responsible for developing and executing on the Company’s operating plan and business strategies in consultation with the Board of Directors and for driving Gartner’s business and financial performance, and is the sole management representative on the Board. | |

| Stephen G. Pagliuca, 62, director since 1990 |

Mr. Pagliuca is a Managing Director of Bain Capital Partners, LLC and is also a Managing Partner and an owner of the Boston Celtics basketball franchise. Mr. Pagliuca joined Bain & Company in 1982, and founded the Information Partners private equity fund for Bain Capital in 1989. Prior to joining Bain, Mr. Pagliuca worked as a senior accountant and international tax specialist for Peat Marwick Mitchell & Company in the Netherlands. Mr. Pagliuca is a former director of Burger King Holdings, Inc., HCA, Inc. (Hospital Corporation of America), Quintiles Transnational Corporation and Warner Chilcott PLC. |

| He has deep subject matter knowledge of Gartner’s history, the development of its business model and the global information technology industry, as well as financial and accounting matters. | |

| James C. Smith, 76, director since October 2002 and Chairman of the Board since 2004 |

Mr. Smith was Chairman of the Board of First Health Group Corp., a national health benefits company until its sale in 2004. He also served as First Health’s Chief Executive Officer from January 1984 through January 2002 and President from January 1984 to January 2001. |

| Mr. Smith’s long-time expertise and experience as the founder, senior-most executive and chairman of the board of a successful large public company provides a unique perspective and insight into management and operational issues faced by the Board, Audit Committee and our CEO. This experience, coupled with Mr. Smith’s personal leadership qualities, qualify him to continue to serve as Chairman of the Board. |

EXECUTIVE OFFICERS

Set forth below are the name, age, and other biographical information of each of our executive officers.

| Eugene A. Hall 60 |

Chief Executive Officer and director since 2004. Prior to joining Gartner, he was a senior executive at Automatic Data Processing, Inc., a Fortune 500 global technology and services company, serving most recently as President, Employers Services Major Accounts Division, a provider of human resources and payroll services. Prior to joining ADP in 1998, Mr. Hall spent 16 years at McKinsey & Company, most recently as Director. |

| Ken Davis 48 |

Senior Vice President, Business and IT Leaders, Products & Services since 2008. Previously at Gartner, he has served as Senior Vice President, End User Programs, High Tech & Telecom Programs, and Strategy, Marketing and Business Development. Prior to joining Gartner in 2005, Mr. Davis spent ten years at McKinsey & Company, where he was a partner assisting clients in the IT industry. |

| Alwyn Dawkins 50 |

Senior Vice President, Worldwide Events & Marketing since 2008. Previously at Gartner, he has served as Group Vice President, Asia/Pacific Sales, based in Sydney, Australia, and prior thereto, as Group Vice President, Gartner Events, where he held global responsibility for exhibit and sponsorship sales across the portfolio of Gartner events. Prior to joining Gartner in 2002, Mr. Dawkins spent ten years at Richmond Events, culminating in his role as Executive Vice President responsible for its North American business. |

| 6 |

| Mike Diliberto 51 |

Senior Vice President & Chief Information Officer since 2016. Previously, he served as CIO at Priceline, a leader in online travel and related services. Before joining Priceline, he held several senior technology positions at the online division of News Corp, where he was instrumental in establishing an online presence for News Corp brands such as Fox News, Fox Sports, TV Guide and Sky Sports, including launching the first major league baseball website. Previously, he held several leadership positions at Prodigy Services Company, one of the pioneering consumer-focused online services. |

| David Godfrey 45 |

Senior Vice President, Worldwide Sales since 2010. Previously at Gartner, he led North American field sales, and prior to this role, he led the Europe, Middle East and Africa (EMEA) and the Americas inside sales organizations. Before joining Gartner in 1999 as a sales executive, Mr. Godfrey spent seven years in business development at Exxon Mobil. |

| Robin Kranich 46 |

Senior Vice President, Human Resources since 2008. During her 22 years at Gartner, she has served as Senior Vice President, End User Programs; Senior Vice President, Research Operations and Business Development; Senior Vice President and General Manager of Gartner EXP; Vice President and Chief of Staff to Gartner’s president; and various sales and sales management roles. Prior to joining Gartner, Ms. Kranich was part of the Technology Advancement Group at Marriott International. |

| David McVeigh 47 |

Senior Vice President, New Markets Programs since August 2015. Prior to joining Gartner, he was a managing director at Hellman & Friedman LLC, an operating partner at Blackstone Group and a partner at McKinsey & Company. |

| Daniel S. Peale 44 |

Senior Vice President, General Counsel & Corporate Secretary since January 2016. Prior to joining Gartner in October 2015, he was a corporate and securities partner with the law firm of Wilson Sonsini Goodrich & Rosati in Washington, D.C., where he was in private practice for 15 years. |

| Craig W. Safian 48 |

Senior Vice President & Chief Financial Officer since June 2014. In his 14 years at Gartner, he has served as Group Vice President, Global Finance and Strategy & Business Development from 2007 until his appointment as CFO, and previously as Group Vice President, Strategy and Managing Vice President, Financial Planning and Analysis. Prior to joining Gartner, he held finance positions at Headstrong (now part of Genpact) and Bristol-Myers Squibb, and was an accountant for Friedman, LLP where he achieved CPA licensure. |

| Peter Sondergaard 52 |

Senior Vice President, Research since 2004. During his 28 years at Gartner, he has held various roles, including Head of Research for the Technology & Services Sector, Hardware & Systems Sector, Vice President and General Manager for Gartner Research EMEA. Prior to joining Gartner, Mr. Sondergaard was research director at International Data Corporation in Europe. |

| Chris Thomas 45 |

Senior Vice President, Executive Programs since April 2013. During his 15 years at Gartner, he has held various roles, including Group Vice President, Sales, leading the Americas IT, Digital Marketing and Global Supply Chain sales group; head of North America and Europe, Middle East and Africa (EMEA) Small and Medium Business sales organizations, and a number of other roles, including sales operations and field sales leadership. Before joining Gartner, he spent seven years in procurement, sales and marketing at Exxon Mobil. |

| Per Anders Waern 55 |

Senior Vice President, Gartner Consulting since 2008. Since joining Gartner in 1998, he has held senior consulting roles principally in EMEA, and served most recently as head of Gartner’s global core consulting team. Prior to joining Gartner, Mr. Waern led corporate IT strategy at Vattenfall in Sweden. |

| 7 |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who beneficially own more than 10% of our Common Stock to file reports of ownership and changes of ownership with the SEC and to furnish us with copies of the reports they file. To assist with this reporting obligation, the Company prepares and files ownership reports on behalf of its officers and directors pursuant to powers of attorney issued by the officer or director to the Company. Based solely on our review of these reports, or written representations from certain reporting persons, there were no late filings in 2016.

CORPORATE GOVERNANCE

Code of Ethics and Code of Conduct

Gartner has adopted a CEO & CFO Code of Ethics which applies to our CEO, CFO, controller and other financial managers, and a Global Code of Conduct, which applies to all Gartner officers, directors and employees, wherever located. Annually, each officer, director and employee affirms compliance with the Global Code of Conduct. The current electronic printable copies of the full text of these codes can be found at the investor relations section of our website, located at www.investor.gartner.com under the “Corporate Governance” link. This information is also available in print to any stockholder who makes a written request to Investor Relations, Gartner, Inc., 56 Top Gallant Road, P.O. Box 10212, Stamford, CT 06904 - 2212.

DIRECTOR NOMINATIONS

There have been no material changes to the procedures by which security holders may recommend nominees to our board of directors since those procedures were described in our proxy statement for our 2016 annual meeting of stockholders.

AUDIT COMMITTEE

Gartner has a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act consisting of Ms. Dykstra and Messrs. Bressler and Smith. Our Board has determined that both Ms. Dykstra and Mr. Bressler qualify as audit committee financial experts, as defined by the rules of the SEC, and that all members have the requisite accounting or related financial management expertise and are financially literate as required by the NYSE corporate governance listing standards.

| ITEM 11. | EXECUTIVE COMPENSATION |

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion & Analysis, or “CD&A”, describes and explains the Company’s compensation philosophy and executive compensation program, as well as compensation awarded to and earned by, the following persons who were Named Executive Officers (“NEOs”) in 2016:

| Eugene A. Hall | Chief Executive Officer | |

| Craig W. Safian | Senior Vice President & Chief Financial Officer | |

| Per Anders Waern | Senior Vice President, Gartner Consulting | |

| David Godfrey | Senior Vice President, Sales | |

| Alwyn Dawkins | Senior Vice President, Events |

The CD&A is organized into three sections:

| · | The Executive Summary, which highlights the importance of our Contract Value (herein “CV”) metric, our 2016 corporate performance and our pay-for-performance approach and our compensation practices, all of which we believe are relevant to stockholders as they consider their votes on Proposal Two (advisory vote on executive compensation, or “Say-on-Pay”) | |

| · | The Compensation Setting Process for 2016 | |

| · | Other Compensation Policies and Information |

| 8 |

The CD&A is followed by the Compensation Tables and Narrative Disclosures, which report and describe the compensation and benefit amounts paid to our NEOs in 2016.

EXECUTIVE SUMMARY

Contract Value – A Unique Key Performance Metric for Gartner

| Total contract value (“CV”) represents the value attributable to all of our subscription-related contracts. It is calculated as the annualized value of all contracts in effect at a specific point in time, without regard to the duration of the contract. CV primarily includes research deliverables for which revenue is recognized on a ratable basis, and, commencing in 2016, includes other deliverables (primarily events tickets) for which revenue is recognized when the deliverable is utilized. |

Unique to the business of Gartner, Contract Value is our single most important performance metric. It focuses all of our executives on driving both short-term and long - term success for our business and stockholders.

Contract Value = Both Short-Term and Long-Term Measures of Success

| Short-Term | ü | Measures the value of all subscription research contracts in effect at a specific point in time |

| Long-Term | ü | Measures revenue that is highly likely to recur over a multi-year period |

Comparing CV year over year measures the short term growth of our business. More importantly, CV is also an appropriate measure of long – term performance due to the nature of our Research subscription business. Our Research business is our largest business segment (75% of 2016 gross revenues) with our highest margins (69% for 2016). Our Research enterprise client retention (84% in 2016) and retained contract value (104% enterprise wallet retention in 2016) are consistently very high. The combination of annual contracts and high renewal rates are predictive of revenue highly likely to recur over a 3 – 5 year period.

Accordingly, growing CV drives both short- term and long – term corporate performance and shareholder value due to these unique circumstances. As such, all Gartner executives and associates are focused at all times on growing CV. This, coupled with the fact that our investors are also focused on this metric, ensures that we are aligned on the long - term success of the Company.

Record 2016 Performance

2016 was another year of record achievements for Gartner:

| ü | CV, Revenue, EBITDA* and EPS* grew 14%, 14%, 10% and 24%, respectively, excluding the impact of foreign exchange where applicable | |

| ü | CV and Revenues ended the year at a record $1.93 billion and $2.44 billion, respectively | |

| ü | Five year CAGR for CV, EBITDA and EPS was 12%, 10% and 16%, respectively | |

| ü | Our Common Stock rose 11.4% in 2016, as compared to the S&P 500, which rose 9.5%, and NASDAQ Total Return, which rose 7.5% | |

| ü | Compound annual growth rates on our common stock were 11%, 12% and 24% on a 1, 3 and 5 year basis, out-performing the S&P 500 and NASDAQ Total Return indices for the corresponding periods |

*In the disclosure included in this Item 11, EBITDA refers to Normalized EBITDA, which represents operating income excluding depreciation, accretion on obligations related to excess facilities, amortization, stock-based compensation expense and acquisition-related adjustments. EPS refers to diluted EPS excluding acquisition adjustments.

| 9 |

Gartner 2016 Performance Charts (CV and EBITDA $ in millions)

The laser focus throughout our global organization on growing CV has resulted in a strong, sustained track record of growth across this measure, as well as EBITDA and EPS, over many years, as the following charts demonstrate.

| 10 |

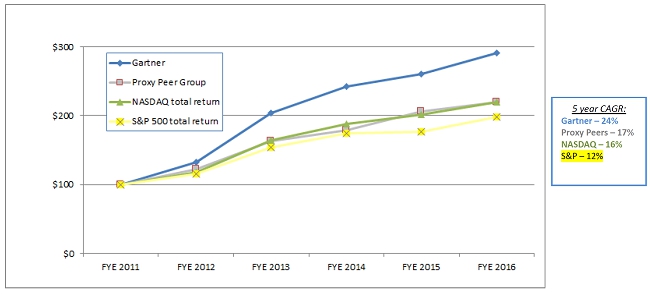

These strong results have fueled stock price growth which leads all comparison groups as follows:

Key Attribute of our Executive Compensation Program – Pay for Performance

Our executive compensation plan design has successfully motivated senior management to drive outstanding corporate performance since it was first implemented in 2006. It is heavily weighted towards incentive compensation.

Its key features are as follows:

| ü | 100% of executive equity awards and executive bonus awards are performance-based. | |

| ü | 70% of our executive equity awards, and 100% of our executive bonus awards are subject to forfeiture in the event the Company fails to achieve performance objectives established by our Compensation Committee. | |

| ü | 91% percent of our CEO’s target total compensation (77% in the case of our other NEOs) is in the form of incentive compensation (bonus and equity awards). | |

| ü | 81% of our CEO’s target total compensation (61% in the case of our other NEOs) is in the form of equity awards. | |

| ü | Earned equity awards may increase or decrease in value based upon stock price movement during the vesting period. |

| 11 |

Our Compensation Best Practices

Our compensation practices motivate our executives to achieve our operating plans and execute our corporate strategy without taking undue risks. These practices, which are consistent with “best practices” trends, include the following:

| ü | We have an independent Compensation Committee. | |

| ü | We have an independent compensation consultant that reports directly to the Compensation Committee. | |

| ü | We annually assess the Company’s compensation policies to ensure that the features of our program do not encourage undue risk. | |

| ü | All executive officers are “at will” employees and only our CEO has an employment agreement. | |

| ü | We have a clawback policy applicable to all executive incentive compensation (cash bonus and equity awards). | |

| ü | We have robust stock ownership guidelines for our directors and executive officers. | |

| ü | We have holding period requirements that require 50% of net after tax shares from all released equity awards to be held by a director or executive officer until stock ownership guidelines are satisfied. | |

| ü | We prohibit hedging and pledging transactions in company securities. | |

| ü | We do not provide excise tax gross up payments. | |

| ü | We encourage retention by having equity awards vest 25% per year over 4 years, commencing on the grant date anniversary. | |

| ü | The potential annual payout on incentive compensation elements is limited to 2 times target. | |

| ü | Our equity plan prohibits: |

| o | less than a 12 month vesting period on equity awards; | |

| o | repricing stock options and surrendering outstanding options for new options with a lower exercise price without stockholder approval; | |

| o | cash buyouts of underwater options or stock appreciation rights without stockholder approval; and | |

| o | granting options or stock appreciation rights with an exercise price less than the fair market value of the Company’s common stock on the date of grant. |

| ü | We do not grant equity awards during closed trading windows. |

COMPENSATION SETTING PROCESS FOR 2016

This discussion explains the objectives of the Company’s compensation policies; what the compensation program is designed to reward; each element of compensation and why the Company chooses to pay each element; how the Company determines the amount (and, where applicable, the formula) for each element to pay; and how each compensation element and the Company’s decisions regarding that element fit into the Company’s overall compensation objectives and affect decisions regarding other elements.

The Objectives of the Company’s Compensation Policies

The objectives of our compensation policies are threefold:

| 12 |

| Ø | to attract, motivate and retain highly talented, creative and entrepreneurial individuals by paying market-based compensation; | |

| Ø | to motivate our executives to maximize the performance of our Company through pay-for-performance compensation components based on the achievement of corporate performance targets that are aggressive, but attainable, given economic conditions; and | |

| Ø | to ensure that, as a public company, our compensation structure and levels are reasonable from a stockholder perspective. |

What the Compensation Program Is Designed to Reward

Our guiding philosophy is that the more executive compensation is linked to corporate performance, the stronger the inducement is for management to strive to improve Gartner’s performance. In addition, we believe that the design of the total compensation package must be competitive with the marketplace from which we hire our executive talent in order to achieve our objectives and attract and retain individuals who are critical to our long-term success. Our compensation program for executive officers is designed to compensate individuals for achieving and exceeding corporate performance objectives. We believe this type of compensation encourages outstanding team performance (not simply individual performance), which builds stockholder value.

Both short-term and long-term incentive compensation is earned by executives only upon the achievement by the Company of certain measurable performance objectives that are deemed by the Compensation Committee and management to be critical to the Company’s short-term and long-term success. The amount of compensation ultimately earned will increase or decrease depending upon Company performance and the underlying price of our Common Stock (in the case of long-term incentive compensation).

Principal Compensation Elements and Objectives

To achieve the objectives noted above, we have designed executive compensation to consist of three principal elements:

| Base Salary | Ø | Pay competitive salaries to attract and retain the executive talent necessary to develop and implement our corporate strategy and business plan |

| Ø | Appropriately reflect responsibilities of the position, experience of the executive and marketplace in which we compete for talent | |

| Short-Term Incentive Compensation (cash bonuses) | Ø | Motivate executives to generate outstanding performance and achieve or exceed annual operating plan |

| Ø | Align compensation with results | |

| Long-Term Incentive Compensation (equity awards) | Ø | Induce enhanced performance and promote retention |

| Ø | Align executive rewards with long-term stock price appreciation | |

| Ø | Make executives stakeholders in the success of Gartner and thereby create alignment with stockholders |

How the Company Determines Executive Compensation

In General

The Company set aggressive performance goals in planning 2016 executive compensation. In order for our executives to earn target compensation, the Company needed to exceed double digit growth in two key performance metrics, as discussed below.

| 13 |

The Compensation Committee established performance objectives for short-term (bonus) and long-term (equity) incentive awards at levels that it believed would motivate performance and be adequately challenging. The target performance objectives were intended to compel the level of performance necessary to enable the Company to achieve its operating plan for 2016.

As in prior years, the short- and long-term incentive compensation elements provided executives with opportunities to increase their total compensation package based upon the over-achievement of corporate performance objectives; similarly, in the case of under-achievement of corporate performance objectives, the value of these incentive elements would fall below their target value (with the possibility of total forfeiture of the short-term element and 70% of the long-term element), and total compensation would decrease correspondingly. We assigned greater weight to the long-term incentive compensation element, as compared to the salary and short-term elements, in order to promote long-term decision-making that would deliver top corporate performance, align management to stockholder interests and retain executives. We believe that previously granted and unvested equity awards serve as a strong retention incentive.

Salary, short-term and long-term incentive compensation levels for executive officers (other than the CEO) are recommended by the CEO and are subject to approval by the Compensation Committee. In formulating his recommendation to the Compensation Committee, the CEO undertakes a performance review of these executives and considers input from human resources personnel at the Company, as well as benchmarking data from the compensation consultant and external market data (discussed below).

Salary, short-term and long-term incentive compensation levels for the CEO’s compensation are established by the Compensation Committee within the parameters of Mr. Hall’s employment agreement with the Company. In making its determination with respect to Mr. Hall’s compensation, the Compensation Committee evaluates his performance in conjunction with the Governance Committee and after soliciting additional input from the Chairman of the Board and other directors; considers input from the Committee’s compensation consultant; and reviews benchmarking data pertaining to CEO compensation practices at our proxy peer companies and general trends. See Employment Agreements with Executive Officers – Mr. Hall elsewhere in this Item 11 for a detailed discussion of Mr. Hall’s agreement.

Effect of Stockholder Advisory Vote on Executive Compensation, or Say on Pay

| 2016 Say on Pay Approval = 93.5% of shares voted, and 88.2% of outstanding shares |

The Board has resolved to present Say on Pay proposals to stockholders on an annual basis, respecting the sentiment of our stockholders as expressed in 2011. This year, we are asking our stockholders once again to indicate their preference for the frequency of Say on Pay proposals; however, the Company is committed to annual Say on Pay proposals. The Company and the Compensation Committee will consider the results on this year’s advisory Say on Pay proposal in future executive compensation planning activities. Over the past several years, stockholders have consistently strongly supported our executive compensation program.

Benchmarking and Peer Group

Executive compensation planning for 2016 began mid-year in 2015. Our Compensation Committee commissioned Exequity, an independent compensation consultant, to perform a competitive analysis of our executive compensation practices (the “Compensation Study”). Exequity’s findings were considered by the Compensation Committee and by management in planning our 2016 executive compensation program. The Compensation Study utilized market data provided by Aon Hewitt pertaining to 2015 compensation paid to individuals occupying senior executive positions at Gartner’s selected peer group of companies for executive compensation benchmarking purposes (the “Peer Group”).

The Compensation Committee reviews the Peer Group annually to ensure comparability based on Gartner’s operating characteristics, labor market relevance and defensibility. The 2016 competitive analysis compared Gartner’s target compensation to the Peer Group. The Peer Group comprised 14 publicly-traded high tech

| 14 |

companies that resemble Gartner in size (in terms of revenues and number of employees), have a similar business model and with whom Gartner competes for executive talent. Gartner ranked at the 36th percentile in revenues and 43rd percentile in market cap relative to the Peer Group. Peer Group companies included:

| Adobe Systems Incorporated | Intuit Inc. | ||

| Autodesk, Inc. | Moody’s Corporation | ||

| Cadence Design Systems, Inc. | Nuance Communications, Inc. | ||

| Citrix Systems, Inc. | PTC Inc. | ||

| The Dun & Bradstreet Corporation | salesforce.com, inc | ||

| Equifax Inc. | Synopsys, Inc. | ||

| IHS Market Ltd | Verisign, Inc. |

Management and the Compensation Committee concluded that the Peer Group, which remained unchanged from the prior year with the exception of the removal of three companies that no longer reported due to acquisitions or privatization, was appropriate for 2016 executive compensation planning purposes given their continued comparability to Gartner.

The Compensation Committee does not target NEO’s pay to a specified percentile, but rather reviews Peer Group market data at the 25th, 50th and 75th percentile for each element of compensation, including Base Salary, Target Total Cash (Base Salary, plus Target Bonus) and Target Total Compensation (Target Total Cash plus long-term incentives).

The result of the competitive analysis indicated that Gartner’s CEO and NEO Base Salary approximated the Peer Group median, Target Total Cash was below the Peer Group median and Target Total Compensation approximated the median of the Peer Group. As a result, in order to remain competitive in the market place and in light of Gartner’s philosophy to pay a greater percentage of total compensation in the form of performance-based compensation and, in particular, performance-based long-term incentive compensation, the Committee approved a 3% merit increase to base salary, a 5% increase in the short term incentive compensation (bonus) percentage and a 8% merit increase to the long-term incentive compensation award value for all NEOs (other than Mr. Safian). Mr. Safian is relatively new in his role of CFO, and as a result trailed the market median of the Peer Group in all elements of compensation, consistent with the Company’s philosophy of moving executives to fully competitive rates over two to three years. As such, in 2016 the Committee adjusted his compensation to more closely approximate the Peer Group median by increasing his base salary by 10%, increasing his bonus target by 5% and increasing his long-term incentive award by 18.6%.

In addition, the Compensation Committee annually reviews an analysis conducted by Exequity that evaluates the connection between Gartner’s executive pay and Company performance as measured by Total Shareholder Return and Shareholder Value against the relationship exhibited by Gartner’s peer companies. The analysis indicates that pay realized by Gartner’s NEOs is generally well aligned with proven financial results. Gartner has historically performed above its peer group median and has paid at or above median total compensation which is consistent with the Company’s pay-for-performance philosophy.

| 15 |

Executive Compensation Elements Generally

Pay Mix

The following pie charts illustrate the relative mix of target compensation elements for the NEOs in 2016. Long-term incentive compensation consists of performance-based restricted stock units (PSUs) and stock appreciation rights (SARs), and represents a majority of the compensation we pay to our NEOs – 81% to the CEO and 60% to all other NEOs. We allocate more heavily to long-term incentive compensation because we believe that it contributes to a greater degree to the delivery of top performance and the retention of employees than does cash and short-term compensation (bonus).

Base Salary

We set base salaries of executive officers when they join the Company or are promoted to an executive role, by evaluating the responsibilities of the position, the experience of the individual and the marketplace in which we compete for the executive talent we need. In addition, where possible, we consider salary information for comparable positions for members of our Peer Group or other available benchmarking data. In determining whether to award salary merit increases, we consider published projected U.S. salary increase data for the technology industry and general market, as well as available world-wide salary increase data. Mr. Hall’s salary increase is established each year by the Compensation Committee after completion of Mr. Hall’s performance evaluation for the preceding year.

Short-Term Incentive Compensation (Cash Bonuses)

All bonuses to executive officers are awarded pursuant to Gartner’s stockholder-approved Executive Performance Bonus Plan. This plan is designed to motivate executive officers to achieve goals relating to the performance of Gartner, its subsidiaries or business units, or other objectively determinable goals, and to reward them when those objectives are satisfied. We believe that the relationship between proven performance and the amount of short-term incentive compensation paid promotes, among executives, decision-making that increases stockholder value and promotes Gartner’s success. Bonuses awarded under this plan to eligible employees are designed to qualify as deductible performance-based compensation within the meaning of Code Section 162(m).

In 2016, bonus targets for all executive officers, including Mr. Hall, were based solely upon achievement of 2016 company-wide financial performance objectives (with no individual performance component). The financial objectives and weightings used for 2016 executive officer bonuses were:

2016 Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), which measures overall profitability from business operations (weighted 50%), on a foreign exchange neutral basis, and

Contract Value (CV) at December 31, 2016, which measures the long–term prospects of our business (weighted 50%), on a foreign exchange neutral basis.

| 16 |

As noted earlier, management and our Compensation Committee continue to believe that EBITDA and CV are the most significant measurements of profitability and long-term business growth for our Company, respectively. They have been successfully used for several years as performance metrics applicable to short-term incentive compensation that drive business performance and that motivate executive officers to achieve outstanding performance.

For 2016, each executive officer was assigned a bonus target that was expressed as a percentage of salary, varied from 50% to 100% of salary depending upon the executive’s level of responsibility and in most cases was 5% greater than the previous year. Salaries and bonuses were each increased by the amount of the merit increase. With respect to our NEOs, 2016 bonus targets, as a percentage of base salary, were 105% for Mr. Hall and 70% for each of Messrs. Safian, Waern, Godfrey and Dawkins. The maximum payout for 2016 bonus was 200% of target if the maximum level of EBITDA and CV were achieved; the minimum payout was $0 if minimum levels were not achieved.

The chart below describes the performance metrics applicable to our 2016 short–term incentive compensation element. As noted above, for this purpose actual results, measured on a foreign exchange neutral basis, were as follows:

| 2016 Performance Objective/ Weight | Target (100%) | Target Growth YOY | < Minimum (0%) | =/> Maximum (200%) | Actual (measured at 12/31/16) | Payout (% of Target) | Actual Growth YOY | |||||||||||||||||||||||

| 2016 EBITDA/50% | $458 million | 13.6 | % | $363 million | $480 million | $446 million | 90.3 | % | 10.7 | % | ||||||||||||||||||||

| 12/31/16 Contract Value/50% | $1,884 million | 11 | % | $1,527 million | $1,969 million | $1,930 million | 162.0 | % | 13.7 | % | ||||||||||||||||||||

In 2016, the Company exceeded both the EBITDA and CV target performance objectives. Since each objective was weighted 50%, based on these results, the Compensation Committee determined that earned cash bonuses for executive officers were 126.2% of target bonus amounts. These bonuses were paid in February 2017. See Summary Compensation Table – Non-Equity Incentive Plan Compensation elsewhere in this Item 11 for the amount of cash bonuses earned by our Named Executive Officers in 2016. While the Compensation Committee has discretion to eliminate or reduce a bonus award, it did not take any such action in 2016.

Long - Term Incentive Compensation (Equity Awards)

Promoting stock ownership is a key element of our compensation program philosophy. Stock-based incentive compensation awards –especially when they are assigned a combination of performance and time-based vesting criteria – induce enhanced performance, promote retention of executive officers and align executives’ personal rewards with long-term stock price appreciation, thereby integrating management and stockholder interests. We have evaluated different types of long-term incentives based on their motivational value, cost to the Company and appropriate share utilization under our stockholder-approved 2014 Long-Term Incentive Plan (“2014 Plan”) and have determined that stock-settled stock appreciation rights (“SARs”) and performance-based restricted stock units (“PSUs”) create the right balance of motivation, retention, alignment with stockholders and share utilization.

SARs permit executives to benefit from an increase in stock price over time. SAR value can be realized only after the SAR vests. Our SARs are stock-settled and may be exercised seven years from grant. When the SAR is exercised, the executive receives shares of our Common Stock equal in value to the aggregate appreciation in the price of our Common Stock from the date of grant to the exercise date for all SARs exercised. Therefore, SARs only have value to the extent the price of our Common Stock exceeds the grant price of the SAR. In this way, SARs motivate our executives to increase stockholder value and thus align their interests with those of our stockholders.

PSUs offer executives the opportunity to receive our Common Stock contingent on the achievement of performance goals and continued service over the vesting period. PSU recipients are eligible to earn a target fixed number of restricted stock units if and to the extent stipulated one-year performance goals are achieved. They can

| 17 |

earn more units if the Company over-performs (up to 200% of their target number of units), and they will earn fewer units (and potentially none) if the Company under-performs. Shares of Common Stock subject to earned PSU awards are released to the executive on the date they vest, or 25% per year over four years, commencing on the anniversary of the grant date, thereby encouraging executives to increase stockholder value while promoting executive retention over the long-term. Released shares have value even if our Common Stock price does not increase, which is not the case with SARs.

Consistent with weightings in prior years, 30% of each executive’s long-term incentive compensation award value was granted in SARs and 70% was granted in PSUs. PSUs deliver value utilizing fewer shares since the executive can earn the full share rather than just the appreciation in value over the grant price (as is the case with SARs). Additionally, the cost efficiency of PSUs enhances the Company’s ability to conservatively utilize the Plan share pool, which is why we convey a larger portion of the 2014 overall long-term incentive compensation value in PSUs rather than in SARs. For purposes of determining the number of SARs awarded, the allocated SAR award value is divided by the Black-Scholes-Merton valuation on the date of grant using assumptions appropriate on that date. For purposes of determining the target number of PSUs awarded, the allocated target PSU award value is divided by the closing price of our Common Stock on the date of grant as reported by the New York Stock Exchange.

Both SARs and PSUs vest 25% per year commencing one (1) year from grant and on each anniversary thereof, subject to continued service on the vesting date. We believe that this vesting schedule effectively focuses our executives on delivering long-term value growth for our stockholders and drives retention. The maximum payout for 2016 PSUs was 200% of target if the maximum level of CV was achieved; the PSUs are subject to forfeiture if minimum levels are not achieved.

The Compensation Committee approved CV (measured at December 31, 2016) as the performance measure underlying PSUs awarded in 2016. As noted earlier, we continue to believe that CV is the best performance metric to measure the long–term prospects of our business. At the present time, most of these contracts have multi – year terms. For this reason, CV growth continues to be predictive of future revenue for the PSU award.

The chart below describes the performance metrics applicable to the PSU portion of our 2016 long–term incentive compensation element measured on a foreign exchange neutral basis:

| 2016 Performance Objective/Weight | Target (100%) | Target Growth YOY | <Minimum (0%) | Maximum (200%) | Actual (measured at 12/31/16) | Payout (% of Target) | Actual Growth YOY | |||||||||||||||||||||||

| Contract Value/100% | $1,884 million | 11 | % | $1,527 million | $1,969 million | $1,930 million | 162.0 | % | 13.7 | % | ||||||||||||||||||||

As noted above, in 2016 actual CV was $1,930 million, exceeding the target amount. Based on this, the Compensation Committee determined that 162.0% of the target number of PSUs would be awarded. The PSUs were adjusted by this factor in February 2017 after certification of the achievement of this performance measure by the Compensation Committee, and 25% of the adjusted awards vested on the first anniversary of the grant date. See Grants of Plan-Based Awards Table – Possible Payouts Under Equity Incentive Plan Awards and accompanying footnotes elsewhere in this Item 11 for the actual number of SARs and PSUs awarded to our Named Executive Officers in 2016.

No performance objectives for any PSU intended to qualify under Code Section 162(m) (i.e., awards to executive officers) may be modified by the Committee. While the Committee does have discretion to modify other aspects of the awards (subject to the terms of the Plan), no modifications were made in 2016.

Additional Compensation Elements

We maintain a non-qualified deferred compensation plan for our highly compensated employees, including our executive officers, to assist eligible participants with retirement and tax planning by allowing them to defer compensation in excess of amounts permitted to be deferred under our 401(k) plan. This plan allows eligible

| 18 |

participants to defer up to 50% of base salary and/or 100% of bonus to a future period. In addition, as a further inducement to participation in this plan, the Company presently matches contributions by executive officers, subject to certain limits. For more information concerning this plan, see Non-Qualified Deferred Compensation Table and accompanying narrative and footnotes elsewhere in this Item 11.

In order to further achieve our objective of providing a competitive compensation package with great retention value, we provide various other benefits to our executive officers that we believe are typically available to, and expected by, persons in senior business roles. Our basic executive perquisites program includes 35 days paid time off (PTO) annually, severance and change in control benefits (discussed below) and relocation services where necessary due to a promotion. Mr. Hall’s perquisites, severance and change in control benefits are governed by his employment agreement with the Company, which is discussed in detail under Employment Agreements With Executive Officers – Mr. Hall elsewhere in this Item 11. For more information concerning perquisites, see Other Compensation Table and accompanying footnotes elsewhere in this Item 11.

OTHER COMPENSATION POLICIES AND INFORMATION

Executive Stock Ownership and Holding Period Guidelines

In order to align management and stockholder interests, the Company has adopted stock ownership guidelines for our executive officers as follows: the CEO is required to hold shares of Common Stock with a value at least equal to six (6) times his base salary, and all other executive officers are required to hold shares of Common Stock with a value at least equal to three (3) times their base salary. For purposes of computing the required holdings, officers may count shares directly held, as well as vested and unvested restricted stock units and PSUs, but not options or SARs.

Additionally, the Company imposes a holding period requirement on our executive officers. If an executive officer of the Company is not in compliance with the stock ownership guidelines, the executive is required to maintain ownership of at least 50% of the net after-tax shares of common stock acquired from the Company pursuant to any equity-based awards – PSUs and SARs - received from the Company, until such individual’s stock ownership requirement is met. At December 31, 2016, our CEO and all other executive officers were in compliance with these guidelines.

Clawback Policy

The Company has adopted a clawback policy which provides that the Board of Directors (or a committee thereof) may seek recoupment to the Company from a current or former executive officer of the Company who engages in fraud, omission or intentional misconduct that results in a required restatement of any financial reporting under the securities or other laws, and that the cash-based or equity-based incentive compensation paid to the officer exceeds the amount that should have been paid based upon the corrected accounting restatement, resulting in an excess payment. Recoupment includes the reimbursement of any cash-based incentive compensation (bonuses) paid to the Executive, cancellation of vested and unvested performance-based restricted stock units, stock options and stock appreciation rights, and reimbursement of any gains realized on the sale of released stock unit awards and the exercise of stock options or stock appreciation rights and subsequent sale of underlying shares

Pursuant to the Dodd-Frank Act, the SEC has issued proposed rules applicable to the national securities exchanges (including the NYSE on which our Common Stock is listed for trading) prohibiting the listing of any security of an issuer that does not provide for the recovery of erroneously awarded incentive-based compensation where there has been an accounting restatement. We are awaiting adoption of the final SEC rules on this matter, at which time we will determine whether an amendment to our policy is necessary.

Hedging and Pledging Policies

The Company’s Insider Trading Policy prohibits all executive officers and directors from engaging in any short selling, hedging and/or pledging transactions with respect to Company securities.

| 19 |

Accounting and Tax Impact

In setting compensation, the Compensation Committee and management consider the potential impact of Code Section 162(m), which precludes a public corporation from deducting on its corporate income tax return individual compensation in excess of $1 million for its chief executive officer or any of its three other highest-paid officers (other than the chief financial officer). Section 162(m) also provides for certain exemptions to this limitation, specifically compensation that is performance-based (within the meaning of Section 162(m)) and issued under a stockholder-approved plan. Our 2016 short-term incentive (bonus) awards were performance-based and were made pursuant to our stockholder-approved Executive Performance Bonus Plan and, therefore, are deductible under Section 162(m). The PSU component of the 2016 long–term incentive award was performance-based and issued under the 2014 Plan, which has been approved by stockholders and, therefore, is deductible under Section 162(m). Although the Compensation Committee endeavors to maximize deductibility of compensation under Section 162(m), it maintains the discretion in establishing compensation elements to approve compensation that may not be deductible under Section 162(m), if the Committee believes the compensation element to be necessary or appropriate under the circumstances.

Grant of Equity Awards

The Board of Directors has a formal policy with respect to the grant of equity awards under our equity plans. Under our 2014 Long Term Incentive Plan, equity awards may include stock options, stock appreciation rights (SARs), restricted stock awards (RSAs), restricted stock units (RSUs) and performance-based restricted stock units (PSUs). The Committee may not delegate its authority with respect to Section 16 persons, nor in any other way which would jeopardize the plan’s qualification under Code Section 162(m) or Exchange Act Rule 16b-3. Accordingly, our policy specifies that all awards to our Section 16 executive officers must be approved by the Compensation Committee on or prior to the award grant date, and that all such awards will be made and priced on the date of Compensation Committee approval, except in the case of new hires, which is discussed below.

Our equity plan provides for a minimum vesting period of 12 months on all equity awards, subject to certain limited exceptions. It also prohibits the repricing of stock options and the surrender of any outstanding option to the Company as consideration for the grant of a new option with a lower exercise price without stockholder approval. It also prohibits the granting of options with an exercise price less than the fair market value of the Company’s common stock on the date of grant, and a cash buyout of out-of-the-money options or SARs without stockholder approval.

Consistent with the equity plan, the Compensation Committee annually approves a delegation of authority to the CEO to make equity awards under our equity Plan to Gartner employees (other than Section 16 reporting persons) on account of new hires, retention or promotion without the approval of the Compensation Committee. In 2016, the delegation of authority specified a maximum grant date award value of $500,000 per individual, and a maximum aggregate grant date award value of $2,000,000 for the calendar year. For purposes of this computation, in the case of RSAs, RSUs and PSUs, value is calculated based upon the fair market value (defined as the closing price on the date of grant as reported by the New York Stock Exchange) of a share of our Common Stock, multiplied by the number of RSAs, RSUs or PSUs awarded. In the case of options and SARs, the grant date value of the award will be the Black-Scholes-Merton calculation of the value of the award using assumptions appropriate on the award date. Any awards made under the CEO-delegated authority are reported to the Compensation Committee at the next regularly scheduled committee meeting.

As discussed above, the structure and value of annual long-term incentive awards comprising the long-term incentive compensation element of our compensation package to executive officers are established and approved by the Compensation Committee in the first quarter of each year. The specific terms of the awards (number of PSUs and SARs and related performance criteria) are determined, and the awards are approved and made, on the same date and after the release of the Company’s prior year financial results.

It is the Company’s policy not to make equity awards to executive officers prior to the release of material non-public information. The 2016 incentive awards to executive officers were approved by the Compensation Committee and made on February 8, 2016, after release of our 2015 financial results. Generally speaking, awards for newly hired executives that are given as an inducement to joining the Company are made on the 15th or 30th day of the month first following the executive’s start date (and after approval by the Compensation Committee), and retention and promotion awards are made on the 15th or 30th day of the month first following the date of Compensation Committee approval; however, we may delay making these awards pending the release of material non-public information.

| 20 |

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of Directors of Gartner, Inc. has reviewed and discussed the Compensation Discussion and Analysis with management. Based upon this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016.

Compensation Committee of the Board of Directors

Anne Sutherland Fuchs

Michael J. Bingle

Raul E. Cesan

March 6, 2017

The foregoing compensation committee report shall not be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, and shall not otherwise be deemed filed under these acts, except to the extent we specifically incorporate by reference into such filings.

| 21 |

COMPENSATION TABLES AND NARRATIVE DISCLOSURES

All compensation data contained in this section is stated in U.S. Dollars.

Summary Compensation Table

This table describes compensation earned by our CEO, CFO and next three most highly compensated executive officers (collectively, the “Named Executive Officers” or “NEOs”) in the years indicated. As you can see from the table and consistent with our compensation philosophy discussed above, long-term incentive compensation in the form of equity awards comprises a significant portion of total compensation.

| Name and Principal Position | Year | Base Salary (1) | Stock Awards (2) | Option Awards (2) | Non-Equity Incentive Plan Compensation (1), (3) | All Other Compensation (4) | Total | ||||||||||||||||

| Eugene A. Hall, Chief Executive Officer (PEO) (5) | 2016 | $ | 901,584 | $ | 5,608,763 | $ | 2,403,764 | $ | 1,203,451 | $ | 141,364 | $ | 10,258,926 | ||||||||||

| 2015 | 875,324 | 5,193,290 | 2,225,705 | 1,215,044 | 135,844 | 9,645,207 | |||||||||||||||||

| 2014 | 847,831 | 4,721,176 | 2,023,365 | 1,273,821 | 115,034 | 8,981,227 | |||||||||||||||||

| Craig W. Safian, SVP & Chief Financial Officer (PFO) | 2016 | 503,260 | 999,949 | 428,561 | 454,951 | 54,712 | 2,441,433 | ||||||||||||||||

| 2015 | 457,402 | 842,783 | 361,205 | 419,223 | 28,239 | 2,108,852 | |||||||||||||||||

| 2014 | 409,869 | 949,977 | — | 321,216 | 11,349 | 1,692,411 | |||||||||||||||||

| Per Anders Waern, SVP, Gartner Consulting | 2016 | 448,115 | 834,385 | 357,588 | 398,769 | 59,569 | 2,098,426 | ||||||||||||||||

| 2015 | 435,063 | 772,577 | 331,090 | 392,545 | 50,480 | 1,981,755 | |||||||||||||||||

| 2014 | 418,531 | 702,314 | 300,999 | 379,877 | 41,991 | 1,843,712 | |||||||||||||||||

| David Godfrey, SVP, Sales | 2016 | 448,115 | 834,385 | 357,588 | 398,769 | 54,742 | 2,093,599 | ||||||||||||||||

| Alwyn Dawkins, SVP, Events | 2016 | 448,115 | 834,385 | 357,588 | 398,769 | 54,065 | 2,092,922 | ||||||||||||||||

| 2015 | 435,063 | 772,577 | 331,090 | 392,545 | 50,637 | 1,981,912 | |||||||||||||||||

| 2014 | 418,531 | 702,314 | 300,999 | 379,877 | 41,571 | 1,843,292 | |||||||||||||||||

(1) All NEOs elected to defer a portion of their 2016 salary and/or 2016 bonus under the Company’s Non-Qualified Deferred Compensation Plan. Amounts reported include the 2016 deferred portion, and accordingly does not include amounts, if any, released in 2016 from prior years’ deferrals. See Non-Qualified Deferred Compensation Table elsewhere in this Item 11.

(2) Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for performance restricted stock units, or PSUs (Stock Awards) and stock-settled stock appreciation rights, or SARs (Option Awards) granted to Messrs. Hall, Safian, Waern, Godfrey and Dawkins. The value reported for the PSUs is based upon the probable outcome of the performance objective as of the grant date, which is consistent with the grant date estimate of the aggregate compensation cost to be recognized over the service period, excluding the effect of forfeitures, for the target grant date award value. The potential maximum value of the PSUs, assuming attainment of the highest level of the performance conditions, is 200% of the target value, and all PSUs and SARs are subject to forfeiture. There were no forfeitures in 2016. See also Note 8 – Stock-Based Compensation - in the Notes to Consolidated Financial Statements contained in our Annual Report on Form 10-K for the year ended December 31, 2016 for additional information.

(3) Represents performance-based cash bonuses earned at December 31 of the applicable year and paid in the following February. See footnote (1) to Grants of Plan-Based Awards Table elsewhere in this Item 11 for additional information.

(4) See Other Compensation Table elsewhere in this Item 11for additional information.

(5) Mr. Hall is a party to an employment agreement with the Company. See Employment Agreements With Executive Officers – Mr. Hall elsewhere in this Item 11.

| 22 |

Other Compensation Table

This table describes each component of the All Other Compensation column in the Summary Compensation Table.

| Name | Year | Company Match Under Defined Contribution Plans (1) | Company Match Under Non-qualified Deferred Compensation Plan (2) | Other (3) | Total | |||||

| Eugene A. Hall | 2016 | 7,200 | 75,951 | 58,213 | 141,364 | |||||

| 2015 | 7,200 | 78,766 | 49,878 | 135,844 | ||||||

| 2014 | 7,000 | 60,563 | 47,471 | 115,034 | ||||||

| Craig W. Safian | 2016 | 7,200 | 28,841 | 18,671 | 54,712 | |||||

| 2015 | 7,200 | 11,096 | 9,943 | 28,239 | ||||||

| 2014 | 7,000 | — | 4,349 | 11,349 | ||||||

| Per Anders Waern | 2016 | 7,200 | 25,674 | 26,695 | 59,569 | |||||

| 2015 | 7,200 | 25,398 | 17,882 | 50,480 | ||||||

| 2014 | 7,000 | 19,495 | 15,496 | 41,991 | ||||||

| David Godfrey | 2016 | 7,200 | 25,674 | 21,868 | 54,742 | |||||

| Alwyn Dawkins | 2016 | 7,200 | 25,674 | 21,191 | 54,065 | |||||

| 2015 | 7,200 | 25,398 | 18,039 | 50,637 | ||||||

| 2014 | 7,000 | 19,495 | 15,076 | 41,571 |

(1) Represents the Company’s 4% matching contribution in all years to the Named Executive Officer’s 401(k) account (subject to limitations).

(2) Represents the Company’s matching contribution to the executive’s contributions to our Non-Qualified Deferred Compensation Plan. See Non-Qualified Deferred Compensation Table elsewhere in this Item 11 for additional information.

(3) In addition to specified perquisites and benefits, includes other perquisites and personal benefits provided to the executive, none of which individually exceeded the greater of $25,000 or 10% of the total amount of perquisites and personal benefits for the executive. In 2016, includes a car allowance of $29,204 received by Mr. Hall per the terms of his employment agreement.

Grants of Plan-Based Awards Table

This table provides information about awards made to our Named Executive Officers in 2016 pursuant to non-equity incentive plans (our short-term incentive cash bonus program) and equity incentive plans (performance restricted stock units (PSUs), restricted stock units (RSUs) and stock appreciation rights (SARs) awards comprising long-term incentive compensation under our 2014 Plan).

| 23 |

| Possible Payouts Under Non- | Possible Payouts Under Equity | Exercise | Grant | |||||||||||||||

| Equity Incentive Plan Awards (1) | Incentive Plan Awards (2) | or Base | Date Fair | |||||||||||||||

| Price of | Value of | |||||||||||||||||

| Option | Stock and | |||||||||||||||||

| Awards | Option | |||||||||||||||||

| Grant | Threshold | Target | Maximum | Threshold | Target | Maximum | ($/Sh) | Awards | ||||||||||

| Name | Date | ($) | ($) | ($) | (#) | (# ) | (#) | ($)(3) | ($)(4) | |||||||||

| Eugene A. Hall | 2/8/16 | — | — | — | 0 | 70,057 PSUs | 140,114 | — | 5,608,763 | |||||||||

| 2/8/16 | — | — | — | — | 145,703 SARs | — | 80.06 | 2,403,764 | ||||||||||

| — | 0 | 953,607 | 1,902,2145 | — | — | — | — | — | ||||||||||

| Craig W. Safian | 2/8/16 | — | — | — | 0 | 12,490 PSUs | 24,980 | — | 999,949 | |||||||||

| 2/8/16 | — | — | — | — | 25,977 SARs | — | 80.06 | 428,561 | ||||||||||

| — | 0 | 360,500 | 721,000 | — | — | — | — | — | ||||||||||

| Per Anders Waern | 2/8/16 | — | — | — | 0 | 10,422 PSUs | 20,844 | 834,385 | ||||||||||

| 2/8/16 | — | — | — | — | 21,675 SARs | 80.06 | 357,588 | |||||||||||

| — | 0 | 315,981 | 631,962 | — | — | — | — | — | ||||||||||

| David Godfrey | 2/8/16 | — | — | — | 0 | 10,422 PSUs | 20,844 | 834,385 | ||||||||||

| 2/8/16 | — | — | — | — | 21,675 SARs | 80.06 | 357,588 | |||||||||||

| — | 0 | 315,981 | 631,962 | — | — | — | — | — | ||||||||||

| Alwyn Dawkins | 2/8/16 | — | — | — | 0 | 10,422 PSUs | 20,844 | 834,385 | ||||||||||

| 2/8/16 | — | — | — | — | 21,675 SARs | 80.06 | 357,588 | |||||||||||

| — | 0 | 315,981 | 631,962 | — | — | — | — | — | ||||||||||

(1) Represents cash bonuses that could have been earned in 2016 based solely upon achievement of specified financial performance objectives for 2016 and ranging from 0% (threshold) to 200% (maximum) of target (100%). Bonus targets (expressed as a percentage of base salary) were 105% for Mr. Hall, and 70% for each of Messrs. Safian, Waern, Godfrey and Dawkins. Performance bonuses earned in 2016 and paid in February 2017 were adjusted to 126.2% of their target bonus and are reported under Non-Equity Incentive Plan Compensation in the Summary Compensation Table. See Short-Term Incentive Compensation (Cash Bonuses) in the Compensation Discussion and Analysis included in this Item 11 for additional information.

(2) Represents the number of performance-based Restricted Stock Units (PSUs) and stock-settled Stock Appreciation Rights (SARs) awarded on February 8, 2016 under our 2014 Plan. The target number of PSUs (100%) originally awarded on that date was subject to adjustment ranging from 0% (threshold) to 200% (maximum) based solely upon achievement of an associated financial performance objective, and was adjusted to 162.0% of target in February 2017. The adjusted number of PSUs awarded was: Mr. Hall – 113,942; Mr. Safian – 20,233; and Messrs. Waern, Godfrey and Dawkins – 16,883). The PSUs, SARs and RSUs vest 25% per year commencing one year from grant, subject to continued employment on the vesting date except in the case of death, disability and retirement. See Long-Term Incentive Compensation (Equity Awards) in the Compensation Discussion and Analysis included in this Item 11 for additional information.

(3) Represents the closing price of our Common Stock on the New York Stock Exchange on the grant date.

(4) See footnote (2) to the Summary Compensation Table included in this Item 11.

Employment Agreements with Executive Officers

Only our Chief Executive Officer, Mr. Hall, is a party to a long-term employment agreement with the Company.

Mr. Hall – Employment Agreement

The Company and Mr. Hall are parties to an Amended and Restated Employment Agreement pursuant to which Mr. Hall has agreed to serve as chief executive officer of the Company and is entitled to be nominated to the board of directors (the “CEO Agreement”) until December 31, 2021. The CEO Agreement provides for automatic one year renewals commencing on January 1, 2022, and continuing each year thereafter, unless either party provides the other with at least 60 days prior written notice of an intention not to extend the term.

Under the CEO Agreement, Mr. Hall is entitled to the following annual compensation components:

| 24 |

| Component | Description | |

| Base Salary | Ø | $908,197, subject to adjustment on an annual basis by the Compensation Committee |

| Target Bonus | Ø | 105% of annual base salary (target), adjusted for achievement of specified Company and individual objectives |

| Ø | The actual bonus paid may be higher or lower than target based upon over - or under - achievement of objectives, subject to a maximum actual bonus of 210% of base salary | |

| Long – term incentive award | Ø | Aggregate annual value on the date of grant at least equal to $9,874,375 minus the sum of base salary and target bonus for the year of grant (the “Annual Incentive Award”) |

| Ø | The Annual Incentive Award will be 100% unvested on the date of grant, and vesting will depend upon the achievement of performance goals to be determined by the Compensation Committee | |

| Ø | The terms and conditions of each Annual Incentive Award will be determined by the Compensation Committee, and will be divided between restricted stock units (RSUs) and stock appreciation rights (SARs) | |

| Ø | The number of RSUs initially granted each year will be based upon the assumption that specified Company objectives set by the Compensation Committee will be achieved, and may be adjusted so as to be higher or lower than the number initially granted for over- or under- achievement of such specified Company objectives

| |

| Other | Ø | Car allowance

|

| Ø | All benefits provided to senior executives, executives and employees of the Company generally from time to time, including medical, dental, life insurance and long-term disability

| |

| Ø | Entitled to be nominated for election to the Board |

| 25 |

Termination and Related Payments – Mr. Hall

Involuntary or Constructive Termination (no Change in Control)

Mr. Hall’s employment is at will and may be terminated by him or us upon 60 days’ notice. If we terminate Mr. Hall’s employment involuntarily (other than within 24 months following a Change In Control (defined below)) and without Business Reasons (as defined in the CEO Agreement) or a Constructive Termination (as defined in the CEO Agreement) occurs, or if the Company elects not to renew the CEO Agreement upon its expiration and Mr. Hall terminates his employment within 90 days following the expiration of the CEO Agreement, then Mr. Hall will be entitled to receive the following benefits:

| Component | Description | |

| Base Salary | Ø | accrued base salary and unused paid time off (“PTO”) through termination |

| Ø | 36 months continued base salary paid pursuant to normal payroll schedule | |

| Short-Term Incentive Award (Bonus) |

Ø | earned but unpaid bonus |