Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION - SiriusPoint Ltd | form8-kinvestorpresentatio.htm |

For Information Purposes Only

Investor Presentation

MARCH 2017

For Information Purposes Only

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

2

Certain statements and information in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. The words “believe,” “anticipate,” “plan,” “intend,” “foresee,” “guidance,” “potential,” “expect,” “should,” “will” “continue,” “could,”

“estimate,” “forecast,” “goal,” “may,” “objective,” “predict,” “projection,” or similar expressions are intended to identify forward-looking statements

(including those contained in certain visual depictions) in this presentation. These forward-looking statements reflect the Company’s current

expectations and/or beliefs concerning future events. The Company has made every reasonable effort to ensure that the information, estimates,

forecasts and assumptions on which these statements are based are current, reasonable and complete. However, these forward-looking statements

are subject to a number of risks and uncertainties that may cause the Company’s actual performance to differ materially from that projected in such

statements. Although it is not possible to identify all of these risks and factors, they include, among others, the following: (i) fluctuation in results of

operations; (ii) more established competitors; (iii) losses exceeding reserves; (iv) downgrades or withdrawal of ratings by rating agencies; (v)

dependence on key executives; (vi) dependence on letter of credit facilities that may not be available on commercially acceptable terms; (vii) potential

inability to pay dividends; (viii) inability to service the Company’s indebtedness; (ix) limited cash flow and liquidity due to indebtedness; (x) unavailability

of capital in the future; (xi) fluctuations in market price of the Company’s common shares; (xii) dependence on clients’ evaluations of risks associated

with such clients’ insurance underwriting; (xiv) suspension or revocation of reinsurance licenses; (xiii) potentially being deemed an investment company

under United States federal securities law; (xv) potential characterization of Third Point Re and/or Third Point Reinsurance Company Ltd. as a passive

foreign investment company; (xvii) future strategic transactions such as acquisitions, dispositions, merger or joint ventures; (xvii) dependence on Third

Point LLC to implement the Company’s investment strategy; (xviii) termination by Third Point LLC of the investment management agreements; (xx) risks

associated with the Company’s investment strategy being greater than those faced by competitors; (xix) increased regulation or scrutiny of alternative

investment advisers affecting the Company’s reputation; (xxi) the Company potentially becoming subject to United States federal income taxation; (xxii)

the Company potentially becoming subject to United States withholding and information reporting requirements under the Foreign Account Tax

Compliance Act provisions; (xxiii) changes in Bermuda or other law regulation that may have an adverse impact on the Company's operations; and

(xxiv) other risks and factors listed under “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016

and other periodic and current disclosures filed with the U.S. Securities and Exchange Commission. All forward-looking statements speak only as of the

date made and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new

information, future events or otherwise.

This presentation may also contain non-GAAP financial information. The Company’s management uses this information in its internal analysis of

results and believes that this information may be informative to investors in gauging the quality of the Company’s financial performance, identifying

trends in our results and providing meaningful period-to-period comparisons. For additional information regarding these non-GAAP financial measures,

including any required reconciliations to the most directly comparable financial measure calculated according to GAAP, see the Appendix section of this

presentation.

For Information Purposes Only

OUR COMPANY

• Specialty property & casualty reinsurer based in Bermuda

• A- (Excellent) financial strength rating from A.M. Best Company

• Began operations in January 2012 and completed IPO in August 2013

• Investment portfolio managed by Third Point LLC

• Total return focused

– Flexible and opportunistic reinsurance underwriting

– Superior investment management

3

For Information Purposes Only

Year ended Year ended Year ended Year ended

December 31, 2016 December 31, 2015 December 31, 2014 December 31, 2013

Shareholders’ Equity $ 1.41 billion $ 1.38 billion $ 1.45 billion $ 1.39 billion

Diluted Book Value Per Share* $ 13.16 $ 12.85 $ 13.55 $ 13.12

Return on Beginning Shareholders’ Equity* 2.0 % (6.0 %) 3.6 % 23.4 %

Increase (Decrease) in Diluted Book Value Per

Share* 2.4 % (5.2 %) 3.3 % 20.5 %

Cumulative Growth in Diluted Book Value Per

Share from December 31, 2011*1 35.3 % 32.1 % 39.2 % 34.8 %

1 Diluted Book Value Per Share as of December 31, 2011 = $9.73

* Non-GAAP financial measure. There are no comparable GAAP measures.

Please see descriptions and reconciliations on slides 32 and 33

KEY METRICS

4

For Information Purposes Only

TOTAL RETURN BUSINESS MODEL DESIGNED TO DELIVER

SUPERIOR RETURNS

5

Opportunity for

Attractive Equity

Returns to

Shareholders

Over Time

Experienced

Underwriting

Team

Superior

Investment

Management

Stable Capital

Base

Underwriting

Profit

Investment

Return on Float1

Investment Return

on Capital

Exceptional Resources Optimal Deployment Outstanding Results + =

1 Float = holding premium until claims must be paid

For Information Purposes Only

EXPERIENCED SENIOR MANAGEMENT TEAM

6

Robert Bredahl

President & CEO

Dan Malloy

Chief Underwriting

Officer (Bermuda)

• EVP, Co-Head of Specialty Lines, Aon Benfield

• President & CEO, Stockton Reinsurance Ltd.

• President, Center Re Bermuda

John Berger

Chairman & CEO (U.S.)

• CEO, Reinsurance, Vice Chairman of the Board,

Alterra Capital Holdings Limited

• CEO & President, Harbor Point Limited

• CEO & President, Chubb Re, Inc.

• Strong business

relationships

• Expertise in writing all lines

of property, casualty &

specialty reinsurance

• Track record of capitalizing

on market opportunities

and producing strong

underwriting results

• Significant business-

building experience

Thomas Wafer

President (U.S.)

• Chairman Reinsurance, Alterra Capital

• CEO Reinsurance, Alterra Capital & President,

Alterra Re USA

• President, Harbor Point Re U.S.

• CEO, Aon Benfield Securities

• President, Aon Benfield Americas

• CEO, Benfield U.S. Inc. & CEO, Benfield Advisory

Christopher Coleman

Chief Financial Officer

• Portfolio Manager, Goldman Sachs

• SVP, Benfield Advisory

• Consultant, McKinsey & Co

Manoj Gupta

EVP Underwriting (U.S.)

• Chief Accounting Officer, Third Point Re

• CFO, Alterra Bermuda Limited

• Chief Accounting Officer, Harbor Point Limited

For Information Purposes Only

ORGANIZATIONAL STRUCTURE – KEY ENTITIES

7

Third Point Reinsurance Ltd.

(Holding Company)

Third Point Reinsurance

Company Ltd.

(Class 4 Insurer)

Third Point Re

Marketing (UK) Ltd.

(Marketing Company )

100% 100%

Third Point Re (UK)

Holdings Ltd.

(Intermediate Holding Company)

100%

Third Point Re (USA)

Holdings Inc.

(Intermediate Holding Company)

Third Point Reinsurance

(USA) Ltd.

(Class 4 Insurer)

100%

100%

For Information Purposes Only

FLEXIBLE & OPPORTUNISTIC UNDERWRITING STRATEGY

8

• Our total return model provides

crucial flexibility in today’s

market environment

• We leverage strong relationships

to access attractive opportunities

• We are the lead underwriter on

many of our transactions

• Limited property cat exposure

Target Best

Opportunities

For Information Purposes Only

TRADITIONAL QUOTA SHARES

9

• Non-standard auto

• Ex-wind homeowners

• General liability

Target Best

Opportunities

• We focus on lines of business

with volatility we believe is

typically lower than that of

most other reinsurance

companies

• We provide reinsurance

support to small and medium

size insurers seeking surplus

relief

• These transactions are

typically relationship-driven,

since reinsurance plays a key

role in the client’s capital

structure

For Information Purposes Only

OPPORTUNISTIC DEALS

10

• Our relationships allow us to

often be the first call for

many special situations

• We look for dislocated

markets and distressed

situations where higher risk-

adjusted returns may be

available

• We manage our downside

exposure with structural

features and contract terms

and conditions

• Mortgage

• Distressed situations

• Multi-line quota shares

Target Best

Opportunities

For Information Purposes Only

RESERVE COVERS

11

• Reserve covers provide clients

with reinsurance protection,

capital relief and potentially

enhanced investment returns

• Relationships are key –

decision-maker is typically the

client’s CEO or CFO

• Our team has a reputation for

sophisticated structuring to meet

each client’s specific needs

• Bermuda reinsurers

• Lloyds Syndicates

• U.S. Insurers

• Captives

Target Best

Opportunities

For Information Purposes Only

EVOLUTION OF OUR PORTFOLIO

• Portfolio of primarily Florida

carriers built from past

relationships. The portfolio now

also includes a Northeast carrier

• Identified Assignment of Benefits

(AOB) issue in Florida early, but

did not fully price for it

• Attempted to adjust ceding

commission on renewals, but the

market did not follow us

• Portfolio has decreased to $66

million from three clients, and is

likely to decrease further in 2017

12

Property (Homeowners) Premium

($ Millions)

0

50

100

150

200

2012 2013 2014 2015 2016

Calendar Year GPW

Underwriting Year GPW

Earned Premium

For Information Purposes Only

0

25

50

75

100

125

2012 2013 2014 2015 2016

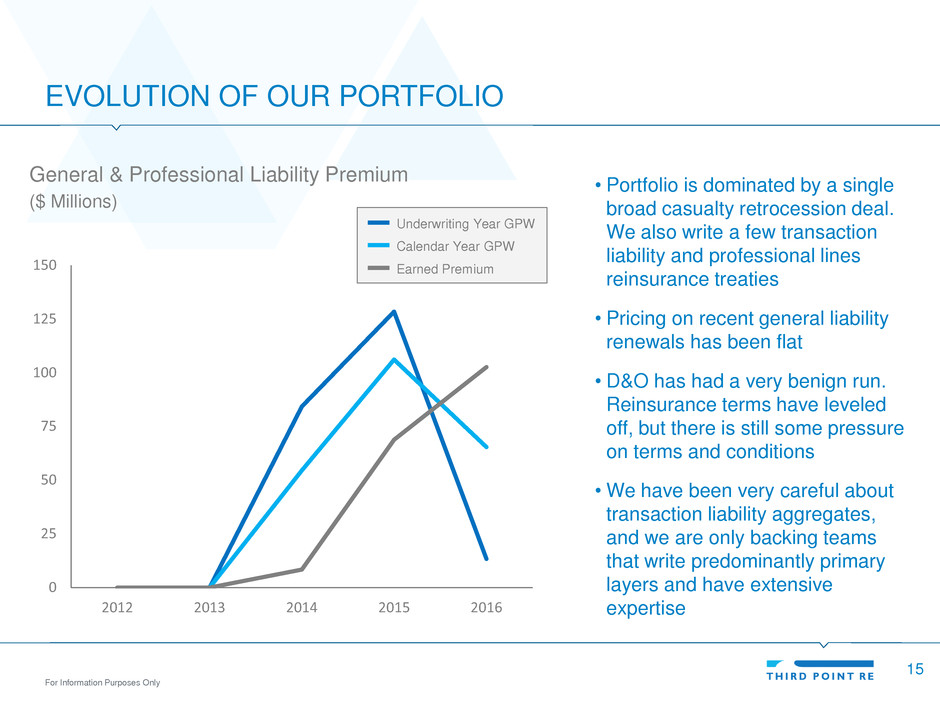

EVOLUTION OF OUR PORTFOLIO

• Portfolio includes mostly

California specialty writers and

MGAs

• Market conditions vary widely by

state, segment and carrier

• The portfolio has performed

reasonably well, though not as

well as originally expected (due

to underperformance of one

large contract)

• We will reduce this portfolio in

2017 if we cannot achieve

adequate pricing improvement

on renewals

13

Workers’ Compensation Premium

($ Millions)

Calendar Year GPW

Underwriting Year GPW

Earned Premium

For Information Purposes Only

EVOLUTION OF OUR PORTFOLIO

• Portfolio of MGA-driven

nonstandard auto business built

from past relationships

• Underlying rate increases not

enough to counter increasing loss

severity (due to more expensive

car parts) and frequency (due to

distracted driving and increased

miles driven)

• Re-oriented our approach to

focus on best-in-class

carriers/MGAs with the size and

differentiation to navigate difficult

market conditions

14

0

50

100

150

200

250

2012 2013 2014 2015 2016

Nonstandard Auto Premium

($ Millions)

Calendar Year GPW

Underwriting Year GPW

Earned Premium

For Information Purposes Only

0

25

50

75

100

125

150

2012 2013 2014 2015 2016

EVOLUTION OF OUR PORTFOLIO

• Portfolio is dominated by a single

broad casualty retrocession deal.

We also write a few transaction

liability and professional lines

reinsurance treaties

• Pricing on recent general liability

renewals has been flat

• D&O has had a very benign run.

Reinsurance terms have leveled

off, but there is still some pressure

on terms and conditions

• We have been very careful about

transaction liability aggregates,

and we are only backing teams

that write predominantly primary

layers and have extensive

expertise

15

General & Professional Liability Premium

($ Millions)

Calendar Year GPW

Underwriting Year GPW

Earned Premium

For Information Purposes Only

0

25

50

75

100

125

150

175

200

225

250

2012 2013 2014 2015 2016

EVOLUTION OF OUR PORTFOLIO

• Portfolio is primarily quota

share contracts of Lloyds

entities

• Portfolio is dominated by a

large, global auto warranty and

physical damage deal that has

been non-renewed

• This contract has performed

below expectations due to poor

results on several underlying

programs

16

Multi-Line Premium

($ Millions)

Calendar Year GPW

Underwriting Year GPW

Earned Premium

For Information Purposes Only

EVOLUTION OF OUR PORTFOLIO

• Portfolio includes political risk, trade

credit, structured credit, surety, title,

residual value and mortgage.

• Mortgage reinsurance is the majority

of the portfolio. Exposure is written

as reinsurance of the private

mortgage insurers, and one

retrocession deal (which includes

GSE exposure)

• We believe pricing and terms &

conditions of mortgage risk have

held up well due to rapidly increasing

demand

• Traditional credit and political risk

insurance is highly competitive. We

favor market leads with the capacity

and expertise to transact in less

commoditized areas

17

0

25

50

75

100

125

2012 2013 2014 2015 2016

Credit & Financial Lines Premium

($ Millions)

Calendar Year GPW

Underwriting Year GPW

Earned Premium

For Information Purposes Only

DIVERSIFIED PREMIUM BASE

Gross Premium Written Since

Inception1 by Type of Transaction

Gross Premium Written Since

Inception1 by Line of Business

1As of 12/31/2016

Note: All figures are for P&C Segment only

18

For Information Purposes Only

REINSURANCE RISK MANAGEMENT

19

• Reinsurance business plan complements our investment management

strategy: no property catastrophe excess treaties on rated balance sheet and

premium and asset leverage (see slide 20) lower than peer group

• Company-wide focus on risk management

• Robust underwriting and operational controls

Risk

Management

Culture

Holistic Risk

Control

Framework

• Measure use of risk capital using internally-developed capital model, A.M. Best

BCAR model and Bermuda Monetary Authority BSCR model

• Developed a comprehensive Risk Register that we believe is appropriate for

our business model

• Instituted a Risk Appetite Statement that governs overall sensitivities in

underwriting, investment, and enterprise portfolio

Ongoing

Risk

Oversight

• Own Risk Self Assessment (ORSA) report produced quarterly and provided to

management / Board of Directors

• Provides management with meaningful statistics on our current capital

requirement and comparisons to our risk appetite statement

• Growing in scope

For Information Purposes Only

100

150

200

250

300

20 40 60 80 100

REINSURANCE RISK MANAGEMENT (CONT’D)

20

• Low premium leverage and

asset leverage compared to

peer group

• Limited legacy reserves

• Limited catastrophe risk

Bermuda Reinsurer Leverage Metrics

(Percent)

Premium to Equity

In

ve

st

ed

A

ss

et

s

to

E

qu

ity

TPRE

Source: Dowling & Co; As of 12/31/2016; “Premium to Equity” = Trailing 12 months’ net premium written divided by

shareholders’ equity; “Invested Assets to Equity” = Invested assets and cash divided by shareholders’ equity; Peer

group = ACGL, AGII, AWH, AXS, RE, XL, AHL, ENH, GLRE, LRE, PRE, RNR, VR

For Information Purposes Only

MARKET-LEADING INVESTMENT MANAGEMENT

BY THIRD POINT LLC

21

• Third Point LLC owned and

led by Daniel S. Loeb

• 18.9% net annualized returns

for Third Point Partners LP

since inception in 19951

• 10.1% net annualized return

on TPRE managed account

since inception (Jan. 1, 2012)

• Risk-adjusted returns driven

by security selection and

lower volatility

Notes: For Third Point Partners L.P. after fees, expenses and incentive allocation; Past performance is not necessarily indicative of future results; all investments involve risk including the loss of principal; The historical performance of Third Point Partners L.P. (i) for the years 2001 through December 31, 2015 reflects the total return after incentive

allocation for each such year as included in the audited statement of financial condition of Third Point Partners L.P. for those years and (ii) for the years 1995 through 2000 reflects the total return after incentive allocation for each such year as reported by Third Point Partners L.P. Total return after incentive allocation for the years 2001 through June

30, 2016 is based on the net asset value for all limited partners of Third Point Partners L.P. taken as a whole, some of whom pay no incentive allocation or management fees, whereas total return after incentive allocation for the years 1995 through 2000 is based on the net asset value for only those limited partners of Third Point Partners L.P. that

paid incentive allocation and management fees. In each case, results are presented net of management fees, brokerage commissions, administrative expenses, and accrued performance allocation, if any, and include the reinvestment of all dividends, interest, and capital gains; The illustrative return is calculated as a theoretical investment of

$1,000 in Third Point Partners, L.P. at inception relative to the same theoretical investment in two hedge fund indices designed to track performance of certain “event-driven” hedge funds over the same period of time. All references to the Dow Jones Credit Suisse HFI Event Driven Index (“DJ-CS HFI”) and HFRI Event-Driven Total Index (“HFRI”)

reflect performance calculated through June 30, 2016. The DJ-CS HFI is an asset-weighted index and includes only funds, as opposed to separate accounts. The DJ-CS HFI uses the Dow Jones Credit Suisse database and consists only of event driven funds deemed to be “event-driven” by the index and that have a minimum of $50 million in

assets under management, a minimum of a 12-month track record, and audited financial statements. The HFRI consists only of event driven funds with a minimum of $50 million in assets under management or a minimum of a 12-month track record. Both indices state that returns are reported net of all fees and expenses. While Third Point Partners

L.P. has been compared here with the performance of well-known and widely recognized indices, the indices have not been selected to represent an appropriate benchmark for Third Point Partners L.P., whose holdings, performance and volatility may differ significantly from the securities that comprise the indices.

1From formation of Third Point Partners L.P. in June 1995 through February 2017.

Illustrative Net Return Since Inception

(June 1995 = $1,000)

For Information Purposes Only

RELATIONSHIP WITH THIRD POINT LLC

22

• Exclusive relationship through 2021, followed by successive 3-year terms on

renewal

• Investments are managed on substantially the same basis as the main Third

Point LLC hedge funds

• We pay a 1.5% management fee and 20% performance allocation. The

performance allocation is subject to a standard high water mark

Investment

Management

Agreement

Risk

Management

• Restrictions on leverage, position concentrations and illiquid, private

investments

• Key man and performance termination provisions

• Allowed to diversify portfolio to address concerns of A.M. Best or regulator

Liquidity • Investments are held in a separate account – Third Point Re has full ownership

of investment portfolio to provide liquidity for claims and expenses

• More than 95% of investments are within FAS 157 Levels 1 & 21

• Separate account may be used at any time to pay claims and expenses

1 As of December 31, 2016

For Information Purposes Only

THIRD POINT LLC PORTFOLIO RISK MANAGEMENT

23

• Portfolio diversification across industries,

geographies, asset classes and strategies

• Highly liquid portfolio – investment manager

can dynamically shift exposures depending

on macro/market developments

• Security selection with extensive diligence

process

• Approach includes index and macro

hedging and tail risk protection

• Institutional platform with robust investment

and operational risk management

procedures

For Information Purposes Only

GROSS PREMIUM WRITTEN

Total Gross Written Premium

• Robust growth since inception

• Broad range of lines of

business and distribution

sources (brokers)

• We may reduce premium in

2017 given challenging

market conditions

24

($ Millions)

190

402

613

702

617

2012 2013 2014 2015 2016

For Information Purposes Only

DIFFICULT REINSURANCE MARKET CONDITIONS

P&C Segment Combined Ratio

• Our potential to produce a

sub-100% combined ratio

will be limited until market

conditions improve

• We do not write property

catastrophe business,

which many reinsurers

have benefited from

*Inception to Date (“ITD“) - P&C segment combined ratio from 1/1/2012 to 12/31/2016

25

(Percent)

129.7

107.5

102.2 104.7

108.5 106.8

2012 2013 2014 2015 2016 ITD*

For Information Purposes Only

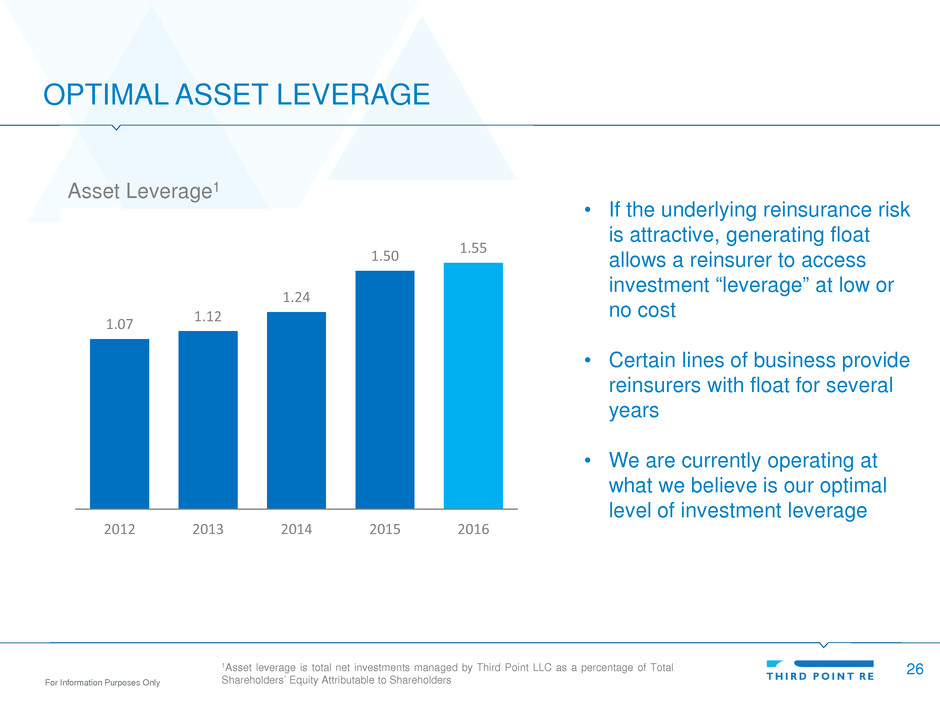

1.07 1.12

1.24

1.50 1.55

2012 2013 2014 2015 2016

OPTIMAL ASSET LEVERAGE

Asset Leverage1

• If the underlying reinsurance risk

is attractive, generating float

allows a reinsurer to access

investment “leverage” at low or

no cost

• Certain lines of business provide

reinsurers with float for several

years

• We are currently operating at

what we believe is our optimal

level of investment leverage

1Asset leverage is total net investments managed by Third Point LLC as a percentage of Total

Shareholders’ Equity Attributable to Shareholders

26

For Information Purposes Only

RETURNS SINCE INCEPTION

Return on Beginning Shareholders’ Equity1

• We believe we have reached

scale in our underwriting

operation

• We believe that we are well-

positioned to out-perform in

a challenging underwriting

environment

1Non-GAAP financial measure. There is no comparable GAAP measure.

Please see description and reconciliation on slides 32 and 33.

27

(Percent)

13.0

23.4

3.6

-6.0

2.0

2012 2013 2014 2015 2016

For Information Purposes Only

TOTAL RETURN BUSINESS MODEL DESIGNED TO DELIVER

SUPERIOR RETURNS

28

Opportunity for

Attractive Equity

Returns to

Shareholders

Over Time

Experienced

Underwriting

Team

Superior

Investment

Management

Stable Capital

Base

Underwriting

Profit

Investment

Return on Float1

Investment Return

on Capital

Exceptional Resources Optimal Deployment Outstanding Results + =

1 Float = holding premium until claims must be paid

For Information Purposes Only

29

APPENDIX

For Information Purposes Only

Condensed Consolidated Income Statement ($000s)

Years Ended

12/31/2016 12/31/2015 12/31/2014 12/31/2013

Net premiums earned $ 590,190 $ 602,824 $ 444,532 $ 220,667

Net investment income (loss)(1) 98,825 (28,074 ) 85,582 258,125

Total revenues 689,015 574,750 530,114 478,792

Loss and loss adjustment expenses incurred, net 395,932 415,191 283,147 139,812

Acquisition costs, net 222,150 191,216 137,206 67,944

General and administrative expenses 39,367 46,033 40,008 33,036

Other expenses(1) 8,387 8,614 7,395 4,922

Interest expense 8,231 7,236 — —

Foreign exchange gains (19,521 ) (3,196 ) — —

Total expenses 654,546 665,094 467,756 245,714

Income (loss) before income tax (expense) benefit 34,469 (90,344 ) 62,358 233,078

Income tax (expense) benefit (5,593 ) 2,905 (5,648 ) —

Income (loss) including non-controlling interests 28,876 (87,439 ) 56,710 233,078

(Income) loss attributable to non-controlling interests (1,241 ) 49 (6,315 ) (5,767 )

Net income (loss) $ 27,635 $ (87,390 ) $ 50,395 $ 227,311

Selected Income Statement Ratios(2)

Loss ratio 67.1 % 68.9 % 65.5 % 65.7 %

Acquisition cost ratio 37.6 % 31.7 % 31.5 % 31.5 %

Composite ratio 104.7 % 100.6 % 97.0 % 97.2 %

General and administrative expense ratio 3.8 % 4.1 % 5.2 % 10.3 %

Combined ratio 108.5 % 104.7 % 102.2 % 107.5 %

Net investment return(3) 4.2 % (1.6 )% 5.1 % 23.9 %

Highlights

• Generated $2.525 billion of

gross premiums written from

inception to date.

• Interest expense relates to

2015 debt issuance.

• Income tax (expense)

benefit relates to U.S.

operations and withholding

taxes on investment

portfolio.

• FX primarily due to the

revaluation of GBP loss

reserves.

(1) Prior to 2014, changes in estimated fair value of embedded derivatives were recorded in net investment income. As these embedded derivatives have become more prominent, the presentation has been modified and changes

in the estimated fair value of embedded derivatives are now recorded in other expenses in the consolidated statements of income. In addition, fixed interest crediting features on these contracts that were recorded in net investment

income are now classified in other expenses in the condensed consolidated statements of income.

(2) Underwriting ratios are for the property and casualty reinsurance segment only; Underwriting ratios are calculated by dividing the related expense by net premiums earned.

(3) Net investment return represents the return on our investments managed by Third Point LLC, net of fees.

KEY FINANCIAL HIGHLIGHTS

30

For Information Purposes Only

Selected Balance Sheet Data ($000s)

As of

12/31/2016 12/31/2015 12/31/2014 12/31/2013

Total assets $ 3,895,644 $ 3,545,108 $ 2,582,580 $ 2,159,890

Total liabilities 2,445,919 2,149,225 1,300,532 649,494

Total shareholders’ equity 1,449,725 1,395,883 1,552,048 1,510,396

Non-controlling interests (35,674 ) (16,157 ) (100,135 ) (118,735 )

Shareholders' equity attributable to shareholders $ 1,414,051 $ 1,379,726 $ 1,451,913 $ 1,391,661

Investments ($000s)

As of

12/31/2016 12/31/2015 12/31/2014 12/31/2013

Total net investments managed by Third Point LLC $ 2,191,559 $ 2,062,823 $ 1,802,184 $ 1,559,442

Selected Balance Sheet Metrics

Years Ended

12/31/2016 12/31/2015 12/31/2014 12/31/2013

Diluted book value per share*

$ 13.16 $ 12.85 $ 13.55 $ 13.12

Growth in diluted book value per share*

2.4 % (5.2 )% 3.3 % 20.5 %

Return on beginning shareholders’ equity*

2.0 % (6.0 )% 3.6 % 23.4 %

Highlights

• $286.0 million of capital

raised with 2013 IPO.

• $115.0 million of debt issued

in 2015.

• $596 million of float* as of

12/31/16.

• 56.9% cumulative net

investment return through

December 31, 20161.

* Non-GAAP financial measure. There is no comparable GAAP measure. Please see descriptions and reconciliations on slides 32 and 33.

1Cumulative net investment return represents the cumulative return on our investments managed by Third Point LLC, net of fees. The cumulative net investment return on investments managed by

Third Point LLC is the percentage change in value of a dollar invested from January 1, 2012 to December 31, 2016 on our investment managed by Third Point LLC, net of non-controlling interests.

The stated return is net of withholding taxes, which are presented as a component of income tax (expense) benefit in our consolidated statements of income (loss). Net investment return is the key

indicator by which we measure the performance of Third Point LLC, our investment manager.

KEY FINANCIAL HIGHLIGHTS (con't)

31

For Information Purposes Only

NON-GAAP MEASURES & OTHER FINANCIAL METRICS

($000s, Except Share and per Share Amounts)

As of

12/31/2016 12/31/2015 12/31/2014 12/31/2013

Basic diluted book value per share numerator:

Total shareholders' equity $ 1,449,725 $ 1,395,883 $ 1,552,048 $ 1,510,396

Less: non-controlling interests (35,674 ) (16,157 ) (100,135 ) (118,735 )

Shareholders' equity attributable to shareholders 1,414,051 1,379,726 1,451,913 1,391,661

Effect of dilutive warrants issued to founders and an advisor 46,512 46,512 46,512 46,512

Effect of dilutive stock options issued to directors and employees 52,930 58,070 61,705 101,274

Diluted book value per share numerator: $ 1,513,493 $ 1,484,308 $ 1,560,130 $ 1,539,447

Basic and fully diluted book value per share denominator:

Issued and outstanding shares, net of treasury shares 104,173,748 104,256,745 103,397,542 103,264,616

Effect of dilutive warrants issued to founders and an advisor 4,651,163 4,651,163 4,651,163 4,651,163

Effect of dilutive stock options issued to directors and employees 5,274,333 5,788,391 6,151,903 8,784,961

Effect of dilutive restricted shares issued to employees 878,529 837,277 922,610 657,156

Diluted book value per share denominator: 114,977,773 115,533,576 115,123,218 117,357,896

Basic book value per share $ 13.57 $ 13.23 $ 14.04 $ 13.48

Diluted book value per share $ 13.16 $ 12.85 $ 13.55 $ 13.12

Book value per share and diluted book value per share

Book value per share and diluted book value per share are non-GAAP financial measures and there are no comparable GAAP measures. Book value per

share is calculated by dividing shareholders’ equity attributable to shareholders by the number of issued and outstanding shares at period end, net of

treasury shares. Diluted book value per share represents book value per share combined with the impact from dilution of all in-the-money share options

issued, warrants and unvested restricted shares outstanding as of any period end. For unvested restricted shares with a performance condition, we

include the unvested restricted shares for which we consider vesting to be probable. Change in book value per share is calculated by taking the change

in book value per share divided by the beginning of period book value per share. Change in diluted book value per share is calculated by taking the

change in diluted book value per share divided by the beginning of period diluted book value per share. We believe that long-term growth in diluted book

value per share is the most important measure of our financial performance because it allows our management and investors to track over time the value

created by the retention of earnings. In addition, we believe this metric is used by investors because it provides a basis for comparison with other

companies in our industry that also report a similar measure. The following table sets forth the computation of basic and diluted book value per share as

of December 31, 2016, 2015, 2014 and 2013:

32

For Information Purposes Only

NON-GAAP MEASURES & OTHER FINANCIAL METRICS

($000s)

Years ended

12/31/2016 12/31/2015 12/31/2014 12/31/2013

Net income (loss) $ 27,635 $ (87,390 ) $ 50,395 $ 227,311

Shareholders' equity attributable to shareholders -beginning of year 1,379,726 1,451,913 1,391,661 868,544

Impact of weighting related to shareholders’ equity from shares repurchased (4,363 ) — — —

Impact of weighting related to shareholders' equity from IPO — — — 104,502

Adjusted shareholders' equity attributable to shareholders - beginning of year $ 1,375,363 $ 1,451,913 $ 1,391,661 $ 973,046

Return on beginning shareholders' equity 2.0 % (6.0 )% 3.6 % 23.4 %

Return on beginning shareholders’ equity

Return on beginning shareholders’ equity as presented is a non-GAAP financial measure. Return on beginning shareholders’ equity is calculated by

dividing net income by the beginning shareholders’ equity attributable to shareholders. We believe that return on beginning shareholders’ equity is an

important measure because it assists our management and investors in evaluating the Company’s profitability. For the years ended December 31, 2013

and December 31, 2014, we have adjusted the beginning shareholders’ equity for the impact of the issuance of shares in our IPO on a weighted average

basis. This adjustment lowers the stated return on beginning shareholders’ equity attributable to shareholders. For the year ended December 31, 2016,

we have also adjusted the beginning shareholders’ equity for the impact of the shares repurchased on a weighted average basis. This adjustment

increased the stated returns on beginning shareholders’ equity.

Insurance float

In an insurance or reinsurance operation, float arises because premiums and proceeds associated with deposit accounted reinsurance contracts are

collected before losses are paid. In some instances, the interval between premium receipts and loss payments can extend over many years. During this

time interval, insurance and reinsurance companies invest the premiums received and seek to generate investment returns. Float is not a concept

defined by U.S. GAAP and therefore, there are no comparable U.S. GAAP measures. Float, as a result, is considered to be a non-GAAP measure. We

believe that net investment income generated on float is an important consideration in evaluating the overall contribution of our property and casualty

reinsurance operation to our consolidated results. It is also explicitly considered as part of the evaluation of management’s performance for the purposes

of incentive compensation.

Net investment return on investments managed by Third Point LLC

Net investment return represents the return on our investments managed by Third Point LLC, net of fees. The net investment return on investments

managed by Third Point LLC is the percentage change in value of a dollar invested over the reporting period on our investment assets managed by Third

Point LLC, net of non-controlling interests. The stated return is net of withholding taxes, which are presented as a component of income tax (expense)

benefit in our consolidated statements of income (loss). Net investment return is the key indicator by which we measure the performance of Third Point

LLC, our investment manager.

33