Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Savara Inc | mstx-ex992_7.htm |

| 8-K - CURRENT REPORT, ITEMS 7.01, 8.01 AND 9.01 - Savara Inc | mstx-8k_20170306.htm |

Corporate presentation March 2017 Exhibit 99.1

Safe Harbor Statements Forward Looking Statements. Savara cautions you that statements in this presentation that are not a description of historical fact are forward-looking statements which may be identified by the use of words such as “expect,” “intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Such statements include, but are not limited to, statements regarding the sufficiency of the combined organization's resources to fund the advancement of any development program or the completion of any clinical trial; the nature, strategy and focus of the combined organization; the safety, efficacy and projected development timeline and commercial potential of any product candidates; and the market size or potential for any of our products. Savara may not actually achieve the proposed merger with Mast, or any plans or product development goals in a timely manner, if at all, or otherwise carry out the intentions or meet the expectations or projections disclosed in its forward-looking statements, and you should not place undue reliance on these forward-looking statements. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon Savara's current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, risks and uncertainties associated with the ability to consummate the proposed merger, the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations, the availability of sufficient resources for combined company operations and to conduct or continue planned clinical development programs, the timing and ability of Mast or Savara to raise additional equity capital to fund continued operations; the ability to successfully develop any of Savara's product candidates, and the risks associated with the process of developing, obtaining regulatory approval for and commercializing drug candidates that are safe and effective for use as human therapeutics. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Savara undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law. Additional Information about the Proposed Merger and Where to Find It. In connection with the proposed merger, Mast has filed relevant materials with the SEC, including a registration statement on Form S‑4 that contains a prospectus and a joint proxy statement. Investors and security holders of Mast and Savara are urged to read these materials when the registration statement becomes effective because they contain important information about Mast, Savara and the proposed merger. The joint proxy statement, prospectus, amendments and other relevant materials filed by Mast with the SEC, may be obtained free of charge at the SEC web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Mast by directing a written request to: Mast Therapeutics, Inc. 3611 Valley Centre Drive, Suite 500, San Diego, California 92130, Attn: Investor Relations. Investors and security holders are urged to read the joint proxy statement, amendments, prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed merger. Mast and its directors and executive officers and Savara and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Mast and Savara in connection with the proposed transaction. Information regarding the special interests of these directors and executive officers in the proposed merger are included in the joint proxy statement/prospectus referred to above.

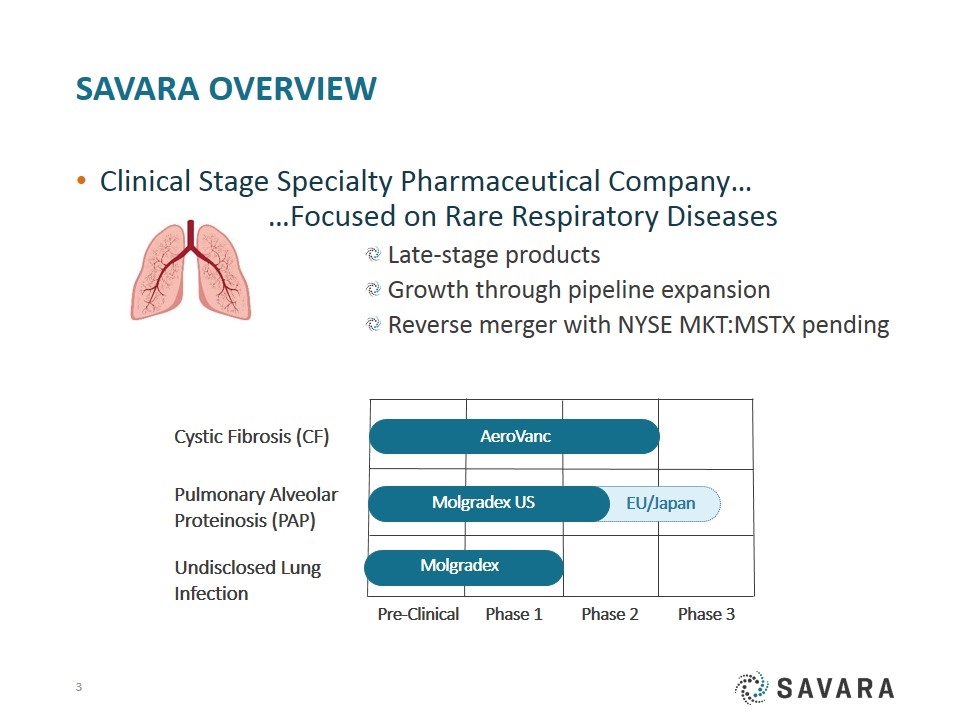

Savara Overview Clinical Stage Specialty Pharmaceutical Company… …Focused on Rare Respiratory Diseases Late-stage products Growth through pipeline expansion Reverse merger with NYSE MKT:MSTX pending Pre-Clinical AeroVanc Cystic Fibrosis (CF) Pulmonary Alveolar Proteinosis (PAP) Undisclosed Lung Infection Phase 1 Phase 2 Phase 3 EU/Japan Molgradex US Molgradex

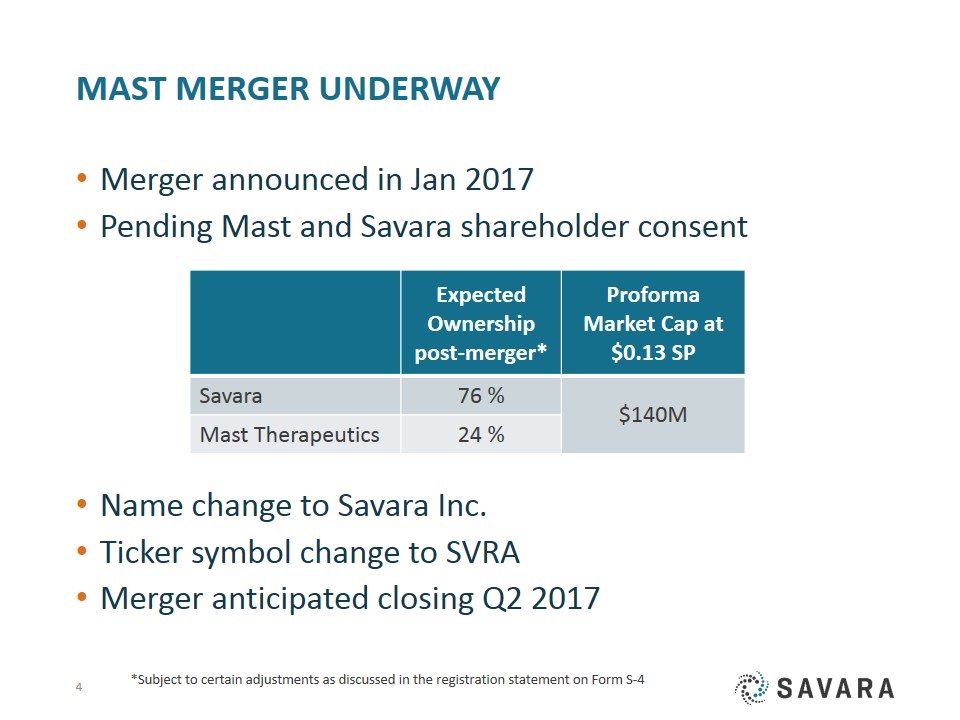

MAST Merger Underway Merger announced in Jan 2017 Pending Mast and Savara shareholder consent Name change to Savara Inc. Ticker symbol change to SVRA Merger anticipated closing Q2 2017 Expected Ownership post-merger* Proforma Market Cap at $0.13 SP Savara 76 % $140M Mast Therapeutics 24 % *Subject to certain adjustments as discussed in the registration statement on Form S-4

AeroVanc Inhaled Vancomycin for MRSA in CF

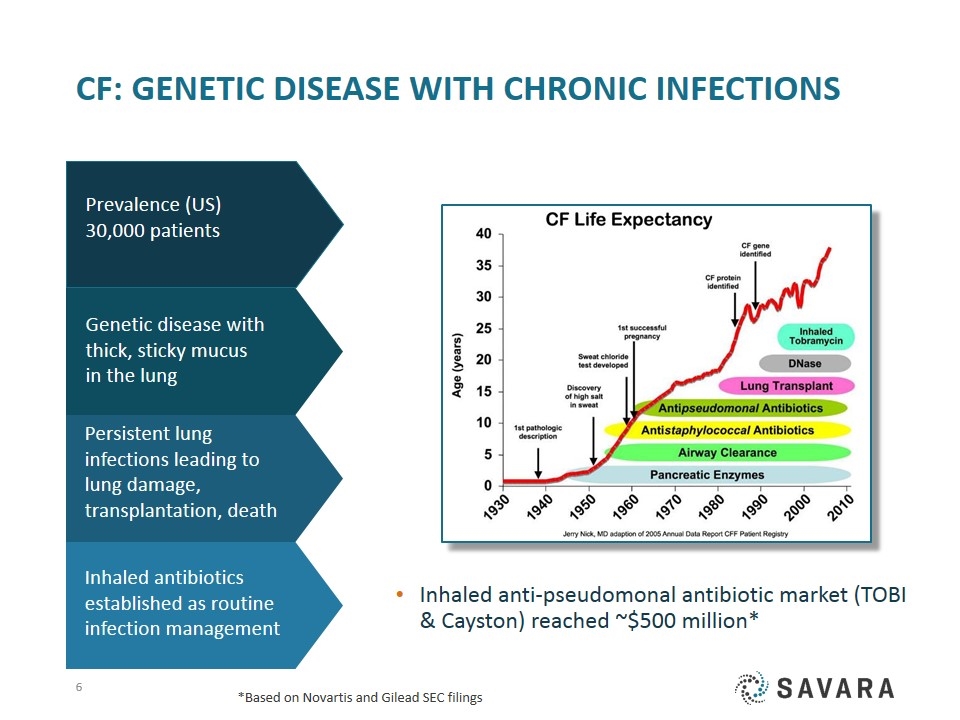

CF: Genetic disease with Chronic Infections Inhaled anti-pseudomonal antibiotic market (TOBI & Cayston) reached ~$500 million* Genetic disease with thick, sticky mucus in the lung Inhaled antibiotics established as routine infection management Persistent lung infections leading to lung damage, transplantation, death Prevalence (US) 30,000 patients *Based on Novartis and Gilead SEC filings

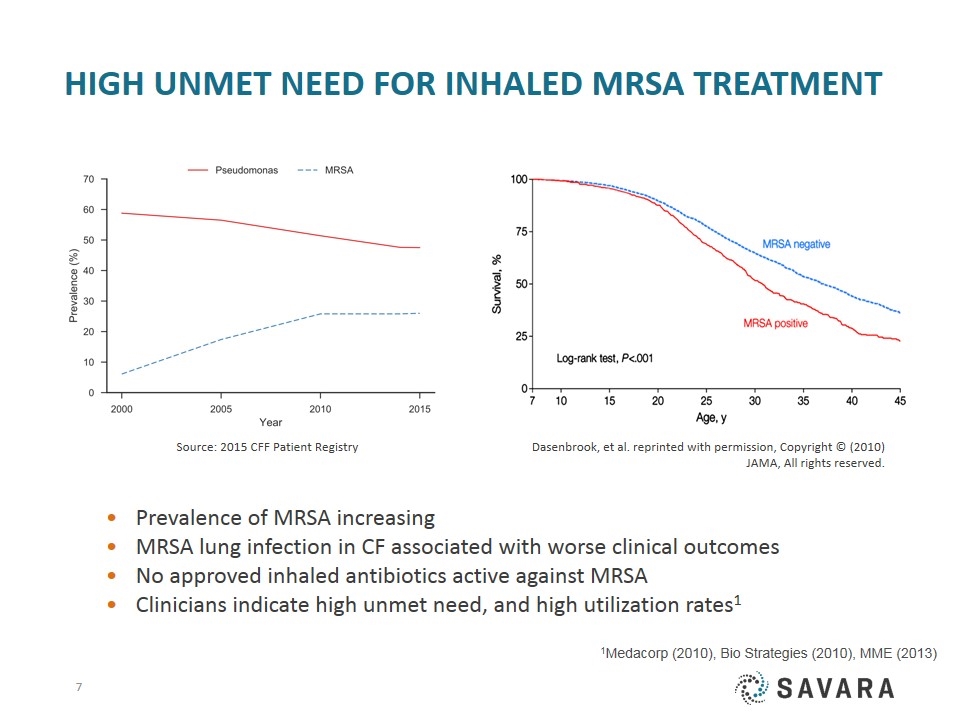

HIGH UNMET NEED for INHALED MRSA Treatment Prevalence of MRSA increasing MRSA lung infection in CF associated with worse clinical outcomes No approved inhaled antibiotics active against MRSA Clinicians indicate high unmet need, and high utilization rates1 Source: 2015 CFF Patient Registry Dasenbrook, et al. reprinted with permission, Copyright © (2010) JAMA, All rights reserved. 1Medacorp (2010), Bio Strategies (2010), MME (2013)

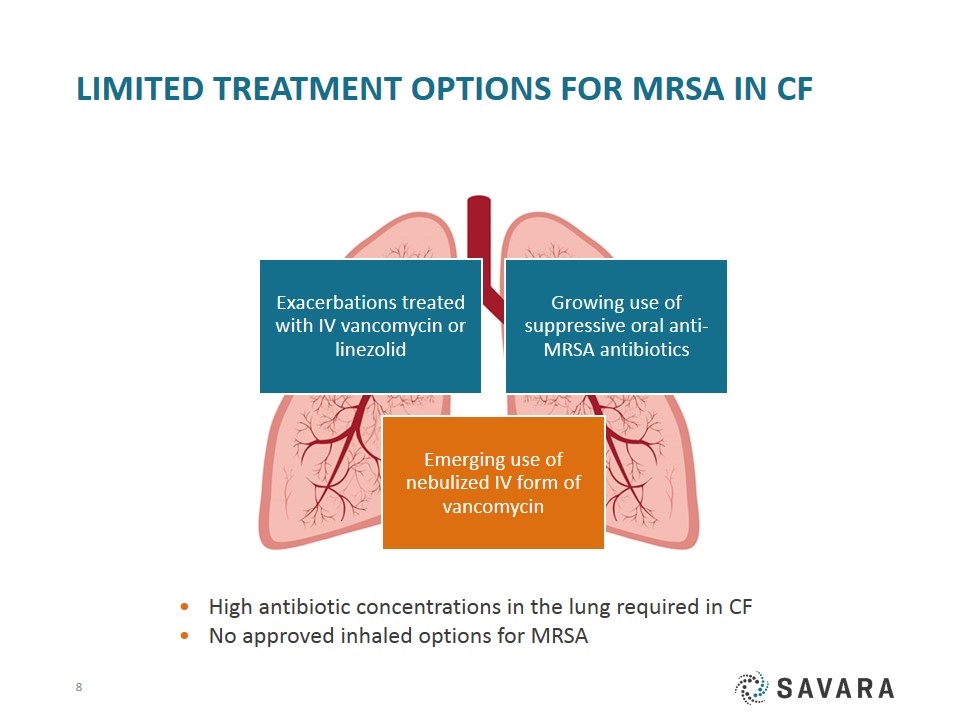

Limited Treatment Options for MRSA in CF High antibiotic concentrations in the lung required in CF No approved inhaled options for MRSA Exacerbations treated with IV vancomycin or linezolid Growing use of suppressive oral anti-MRSA antibiotics Emerging use of nebulized IV form of vancomycin

AeroVanc: First Inhaled MRSA Antibiotic Grants from CFF & NIH Inhaled Dry Powder Vancomycin Drug Directly to Site of Infection Reduced Systemic Toxicity Manufacturing at Commercial Scale Orphan & QIDP status (12 years exclusivity)

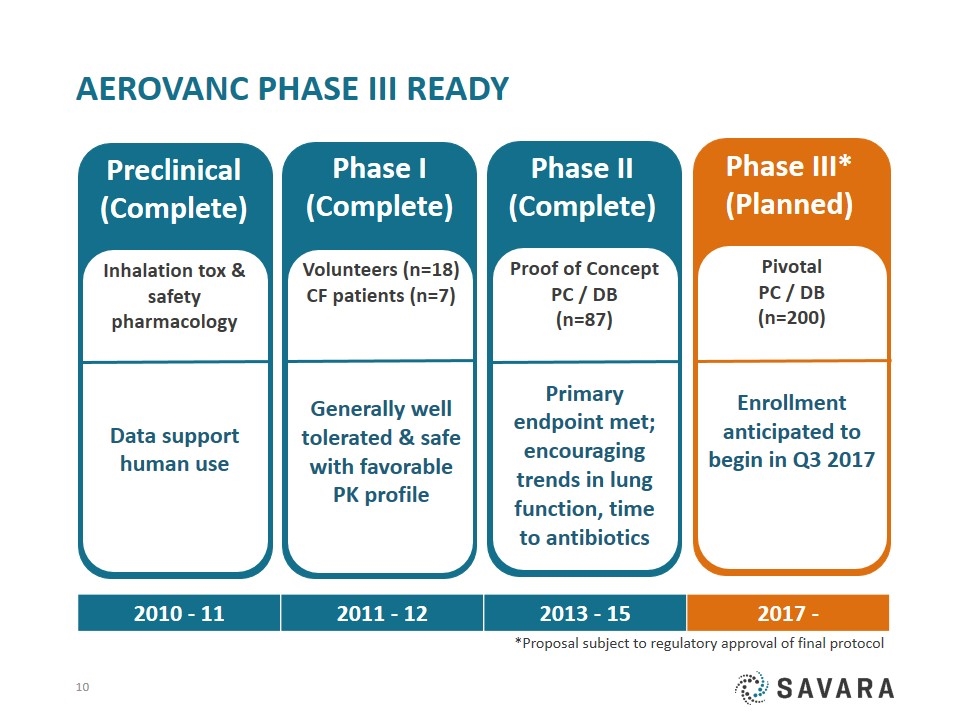

Pivotal PC / DB (n=200) Enrollment anticipated to begin in Q3 2017 Phase III* (Planned) AeroVanc Phase III ready Proof of Concept PC / DB (n=87) Primary endpoint met; encouraging trends in lung function, time to antibiotics Phase II (Complete) Phase I (Complete) Volunteers (n=18) CF patients (n=7) Generally well tolerated & safe with favorable PK profile Preclinical (Complete) Inhalation tox & safety pharmacology Data support human use 2010 - 11 2011 - 12 2013 - 15 2017 - *Proposal subject to regulatory approval of final protocol

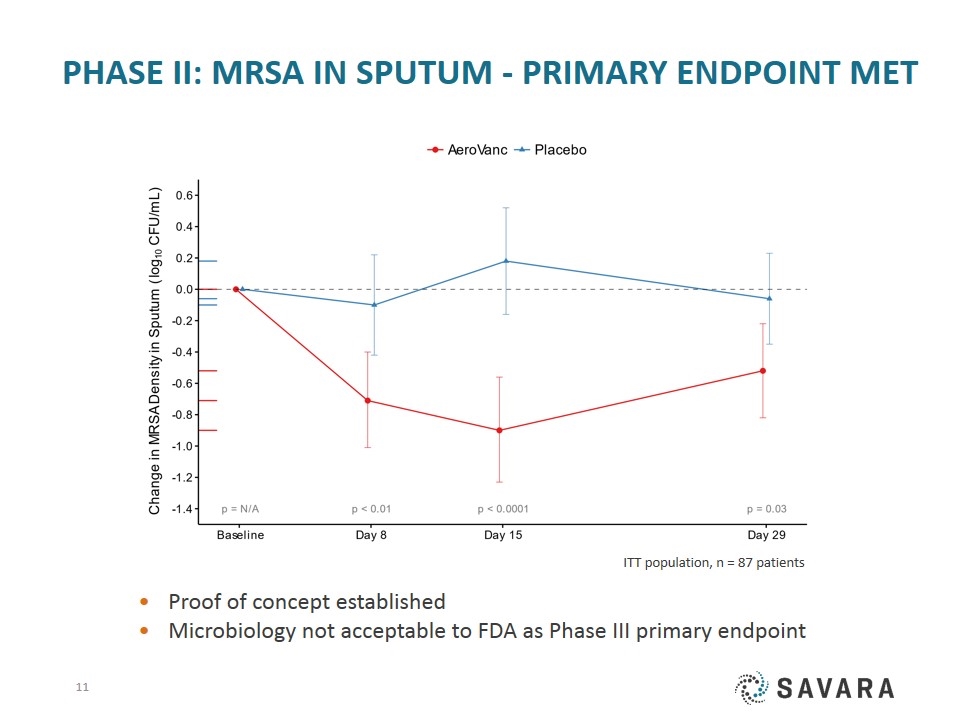

Phase II: MRSA in Sputum - Primary Endpoint Met ITT population, n = 87 patients Proof of concept established Microbiology not acceptable to FDA as Phase III primary endpoint

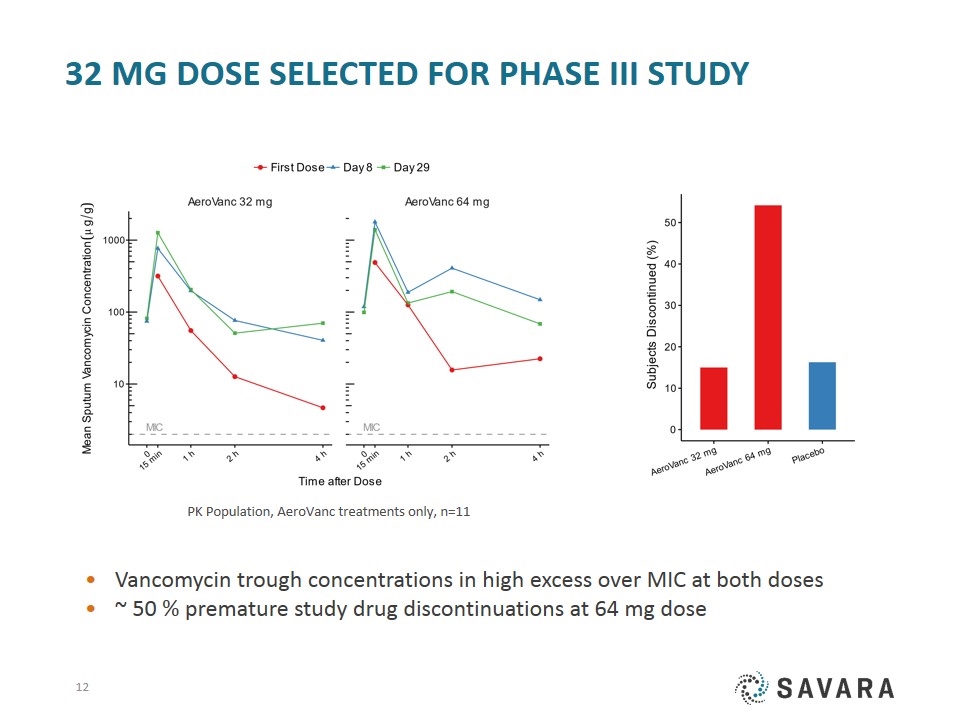

32 mg Dose Selected for Phase III Study Vancomycin trough concentrations in high excess over MIC at both doses ~ 50 % premature study drug discontinuations at 64 mg dose PK Population, AeroVanc treatments only, n=11

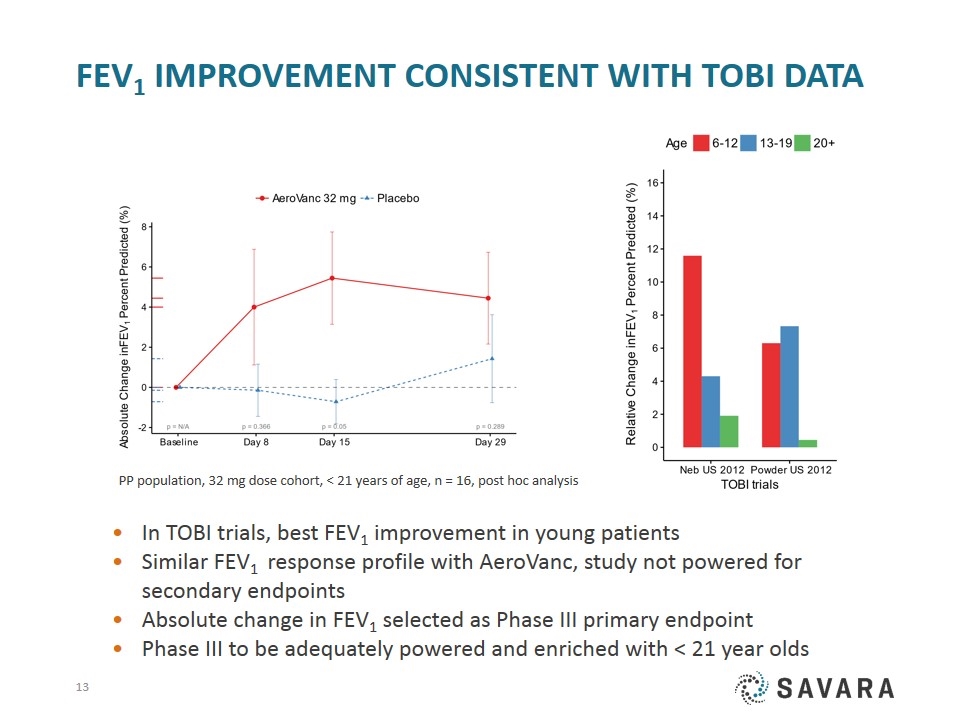

FEV1 Improvement Consistent with TOBI Data PP population, 32 mg dose cohort, < 21 years of age, n = 16, post hoc analysis In TOBI trials, best FEV1 improvement in young patients Similar FEV1 response profile with AeroVanc, study not powered for secondary endpoints Absolute change in FEV1 selected as Phase III primary endpoint Phase III to be adequately powered and enriched with < 21 year olds

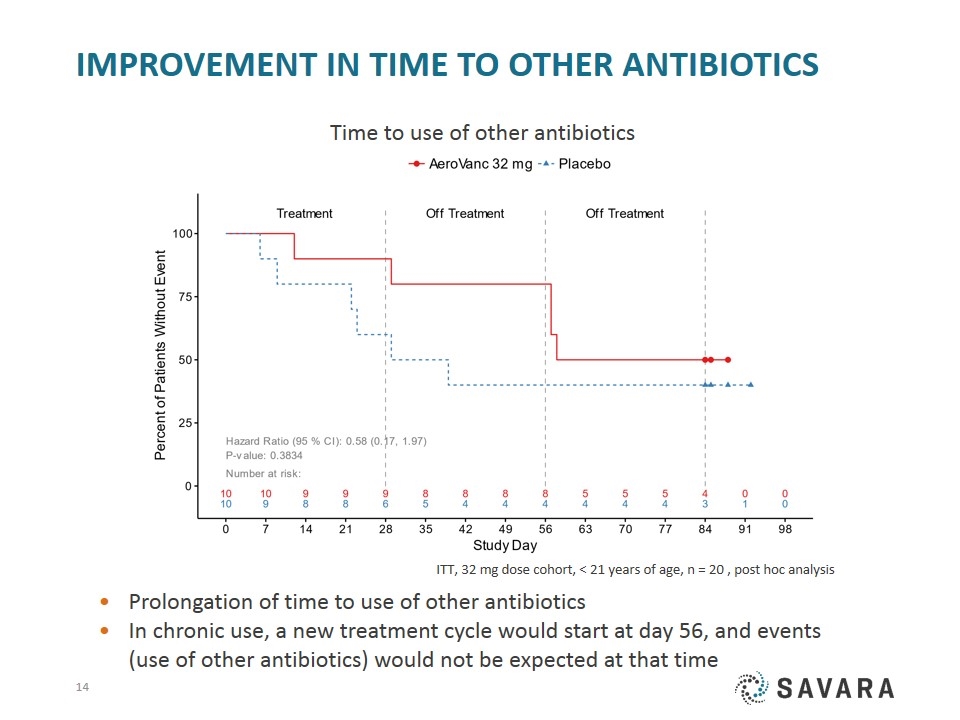

Improvement in Time to other antibiotics ITT, 32 mg dose cohort, < 21 years of age, n = 20 , post hoc analysis Prolongation of time to use of other antibiotics In chronic use, a new treatment cycle would start at day 56, and events (use of other antibiotics) would not be expected at that time Time to use of other antibiotics

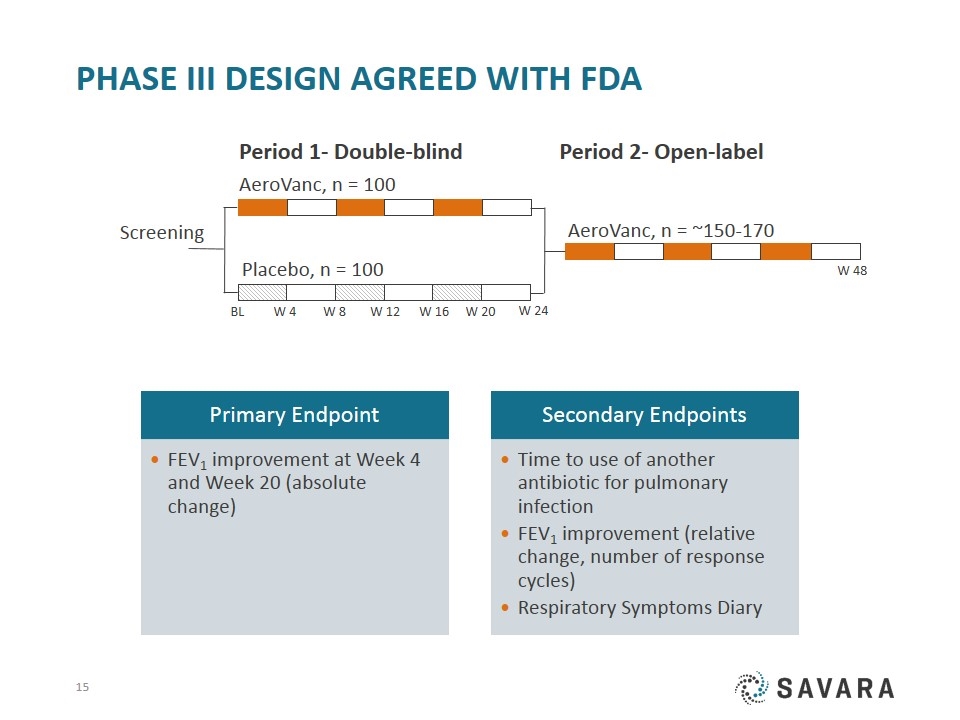

Phase III design agreed with FDA Screening Period 1- Double-blind Period 2- Open-label BL Placebo, n = 100 AeroVanc, n = 100 W 8 W 12 W 24 W 16 W 20 W 4 AeroVanc, n = ~150-170 W 48 FEV 1 improvement (relative change, number of response cycles) FEV 1 improvement at Week 4 and Week 20 (absolute change) Respiratory Symptoms Diary Time to use of another antibiotic for pulmonary infection Secondary Endpoints Primary Endpoint

Molgradex Inhaled GM-CSF for Autoimmune Pulmonary Alveolar Proteinosis (aPAP)

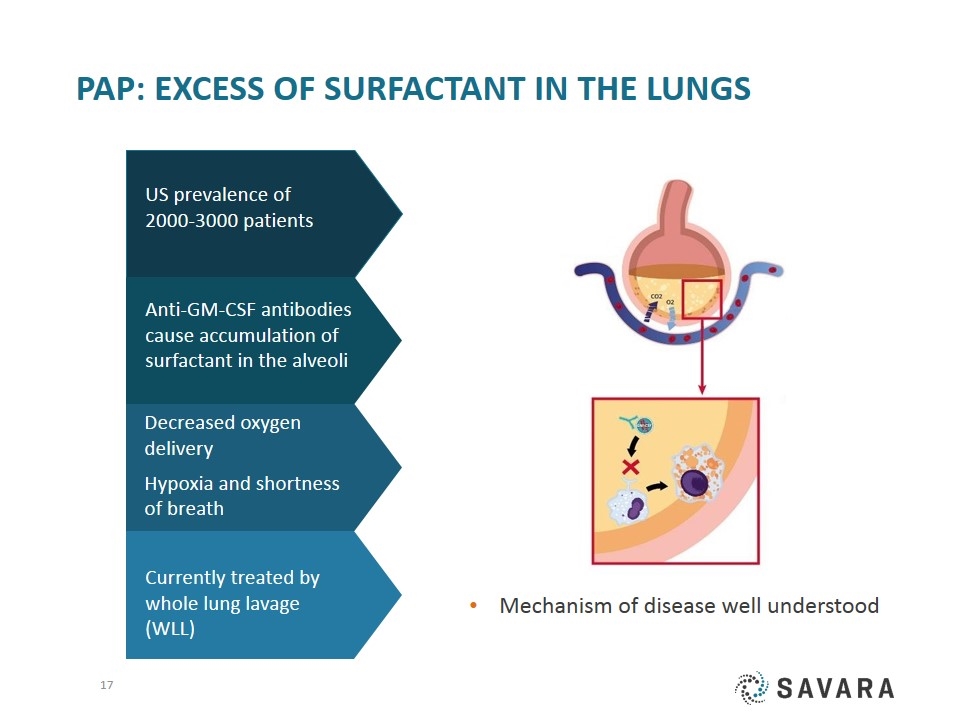

PAP: excess of surfactant in the Lungs Anti-GM-CSF antibodies cause accumulation of surfactant in the alveoli Currently treated by whole lung lavage (WLL) Decreased oxygen delivery Hypoxia and shortness of breath US prevalence of 2000-3000 patients Mechanism of disease well understood

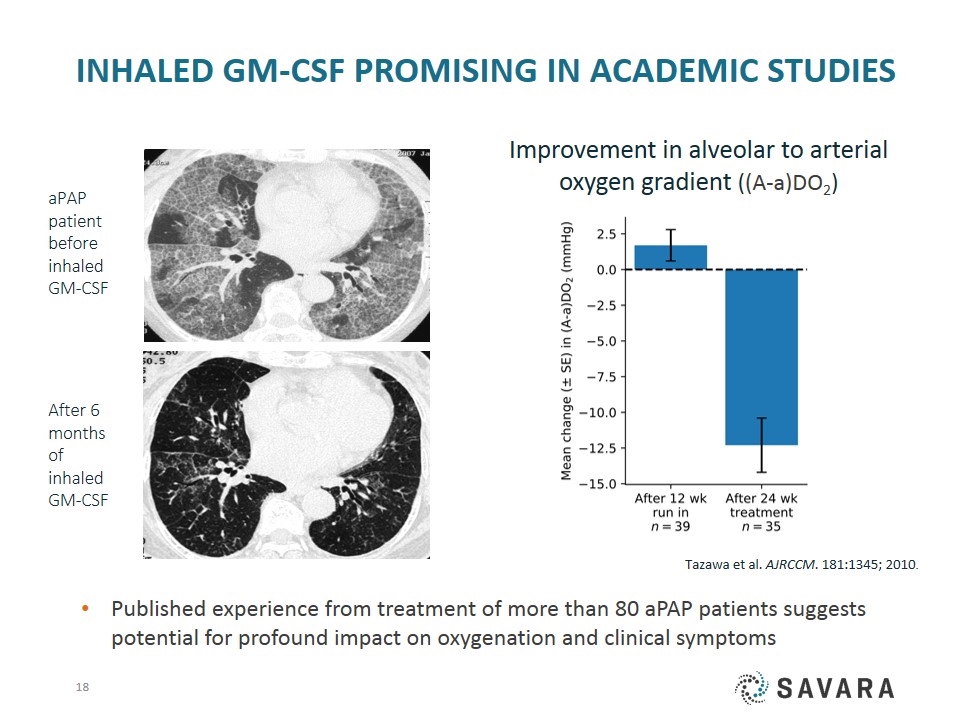

Inhaled GM-CSF Promising in academic studies aPAP patient before inhaled GM-CSF After 6 months of inhaled GM-CSF Improvement in alveolar to arterial oxygen gradient ((A-a)DO2) Published experience from treatment of more than 80 aPAP patients suggests potential for profound impact on oxygenation and clinical symptoms Tazawa et al. AJRCCM. 181:1345; 2010.

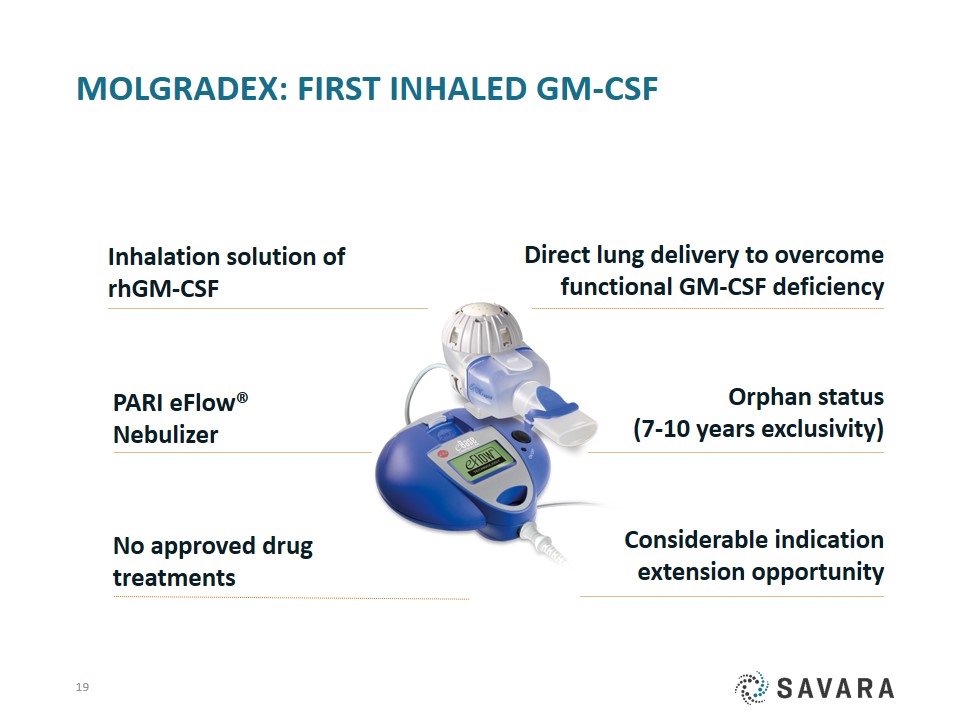

Molgradex: First Inhaled GM-CSF Direct lung delivery to overcome functional GM-CSF deficiency Inhalation solution of rhGM-CSF PARI eFlow® Nebulizer No approved drug treatments Considerable indication extension opportunity Orphan status (7-10 years exclusivity)

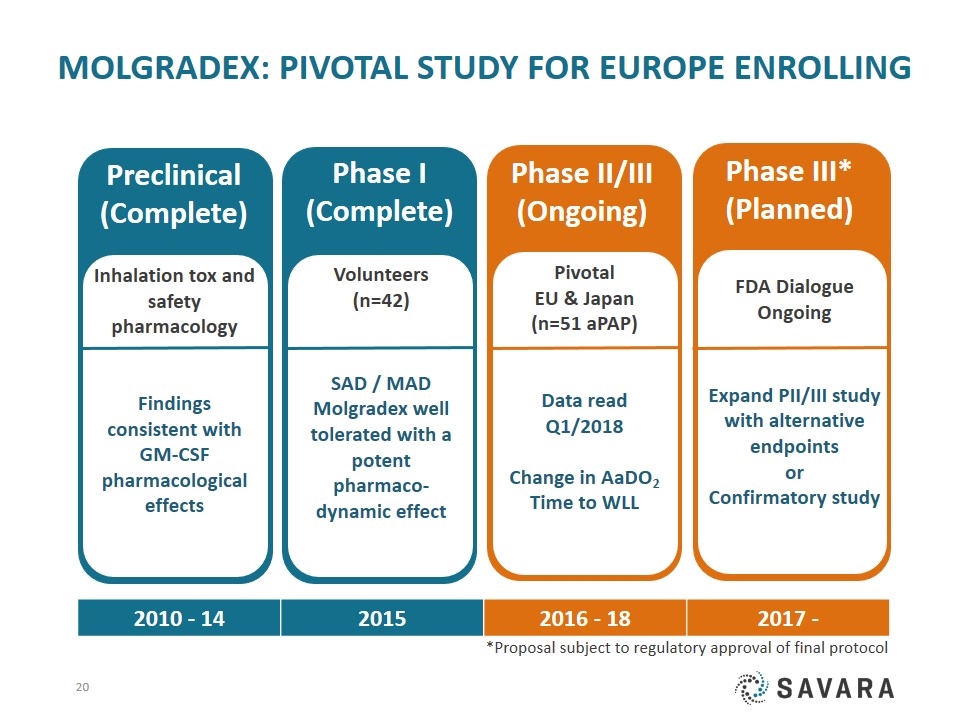

FDA Dialogue Ongoing Expand PII/III study with alternative endpoints or Confirmatory study Phase III* (Planned) Molgradex: PIVOTAL study for Europe Enrolling Pivotal EU & Japan (n=51 aPAP) Data read Q1/2018 Change in AaDO2 Time to WLL Phase II/III (Ongoing) Phase I (Complete) Volunteers (n=42) SAD / MAD Molgradex well tolerated with a potent pharmaco-dynamic effect Preclinical (Complete) Inhalation tox and safety pharmacology Findings consistent with GM-CSF pharmacological effects 2010 - 14 2015 2016 - 18 2017 - *Proposal subject to regulatory approval of final protocol

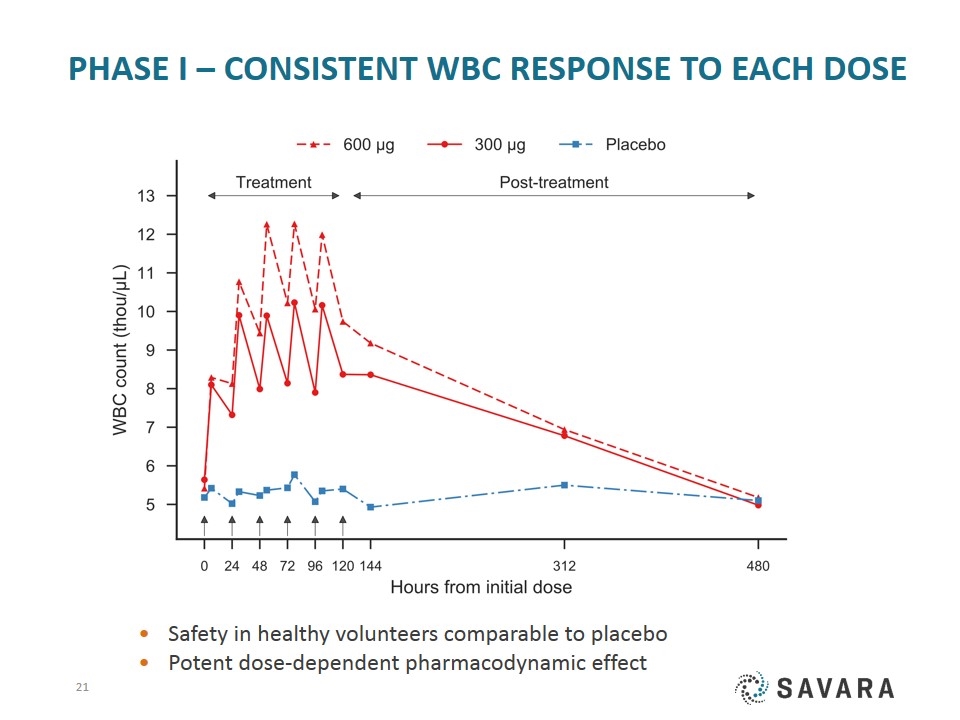

Phase I – consistent WBC response to each dose Safety in healthy volunteers comparable to placebo Potent dose-dependent pharmacodynamic effect

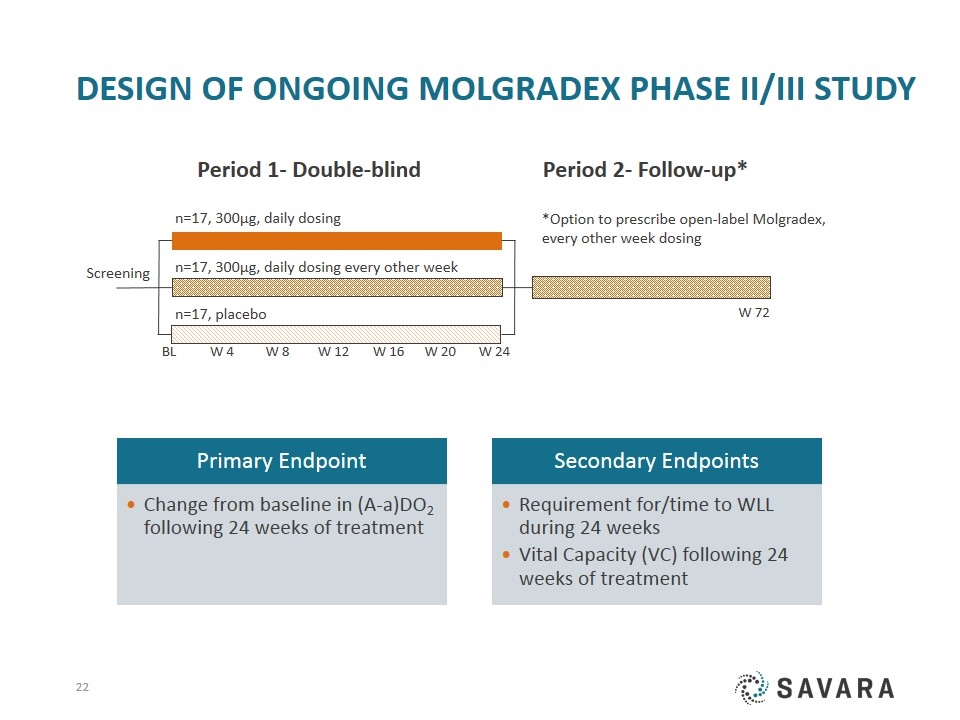

Design OF Ongoing Molgradex Phase II/III Study Screening BL n=17, 300µg, daily dosing Period 1- Double-blind W 8 W 12 W 24 W 16 W 20 W 4 Period 2- Follow-up* n=17, 300µg, daily dosing every other week n=17, placebo W 72 *Option to prescribe open-label Molgradex, every other week dosing Primary Endpoint Secondary Endpoints Vital Capacity (VC) following 24 weeks of treatment Requirement for/time to WLL during 24 weeks Change from baseline in (A-a)DO 2 following 24 weeks of treatment

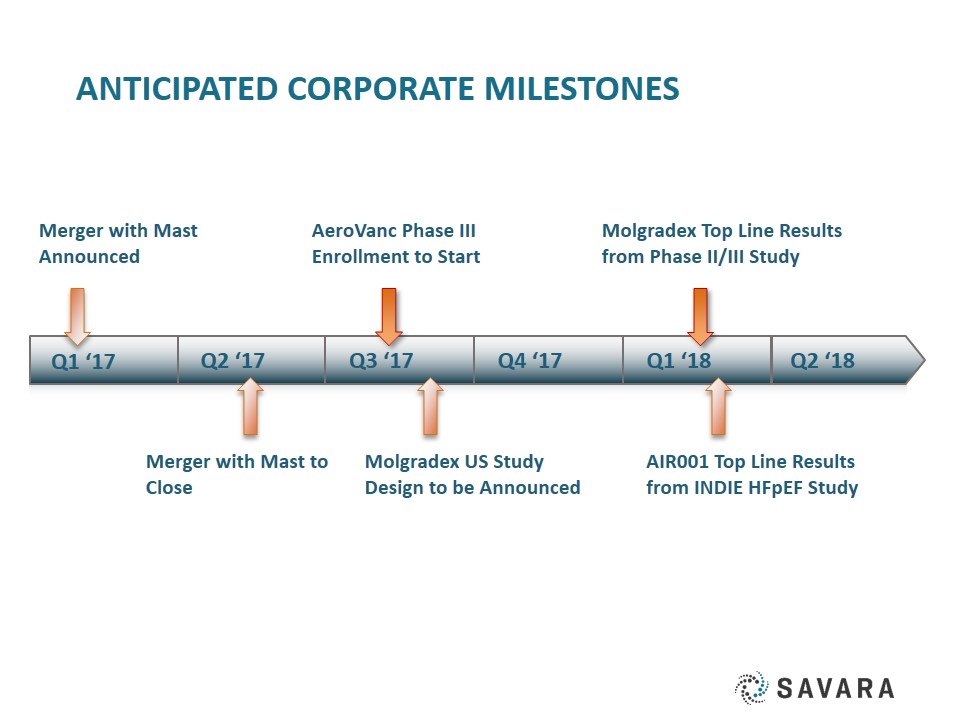

Anticipated Corporate milestones Q2 ‘17 Q3 ‘17 Q4 ‘17 Q1 ‘18 Q1 ‘17 Q2 ‘18 Merger with Mast Announced AeroVanc Phase III Enrollment to Start Molgradex Top Line Results from Phase II/III Study Merger with Mast to Close Molgradex US Study Design to be Announced AIR001 Top Line Results from INDIE HFpEF Study

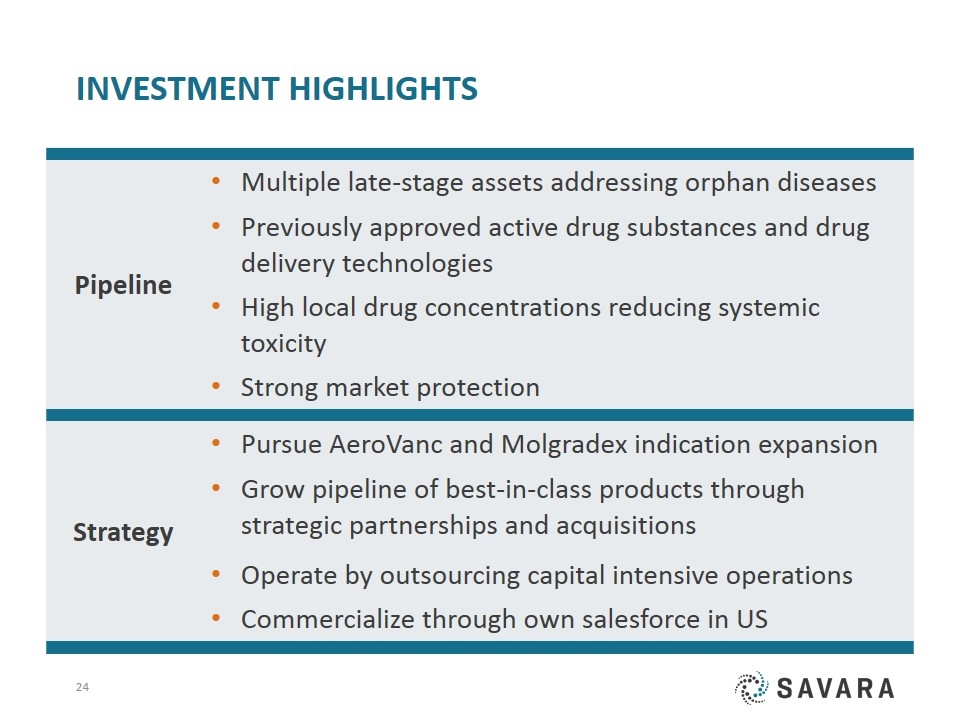

Investment Highlights Pipeline Multiple late-stage assets addressing orphan diseases Previously approved active drug substances and drug delivery technologies High local drug concentrations reducing systemic toxicity Strong market protection Strategy Pursue AeroVanc and Molgradex indication expansion Grow pipeline of best-in-class products through strategic partnerships and acquisitions Operate by outsourcing capital intensive operations Commercialize through own salesforce in US

Management & Advisors Executive Team Rob Neville, CEO Serial entrepreneur / Evity exit $100M / Series A lead investor Dr. Taneli Jouhikainen, COO Serial drug developer / 10+ license deals / public company and IPO experience / 20 yrs. in pharma mgmt. David Lowrance, CPA 15 years biotech / pharma, public company and IPO experience Dr. Cecilia Ganslandt, Medical Serial drug developer / 20 yrs. in pharma mgmt. Dr. John Lord, Pharm Dev Ex-Nektar / Exubera program mgr. / 20 yrs. in pharm dev Mette Vinge, Regulatory Ex-Pfizer & Takeda / 14 yrs. in regulatory Dr. Inge Tarnow, Non-clinical Ex- Actelion / 12 yrs. in Academia / Professor in Veterinary Science Board of Directors Nevan Elam CEO Antriabio, Former head of Nektar Inhalation Rick Hawkins CEO Lumos, Founder and former CEO Pharmaco Joe McCracken Former global head of BD Roche Yuri Pikover 37 Technology Ventures Rob Neville Two Mast Directors (upon closing) Clinical Advisors Dr. Elliott Dasenbrook Dr. Patrick Flume Dr. Michael Konstan Dr. Felix Ratjen Dr. Bruce Trapnell Dr. Francesco Bonella Dr. Cliff Morgan Dr. Yoshikazu Inoue

THANK YOU!