Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MUFG Americas Holdings Corp | investorpresentation8kcove.htm |

MUFG Americas Holdings

Corporation

MUFG Americas Holdings Corporation

Investor Presentation for the Quarter Ended

December 31, 2016

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

This presentation describes activities of MUFG Americas Holdings Corporation and its consolidated subsidiaries (the Company) unless otherwise

specified. This presentation should be read in conjunction with the financial statements, notes and other information contained in the Company’s

most recent annual report on Form 10-K and Quarterly Reports on Forms 10-Q and in any subsequent filings with the Securities and Exchange

Commission (SEC).

The following appears in accordance with the Private Securities Litigation Reform Act. This presentation includes forward-looking statements that

involve risks and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts.

Often, they include the words “believe,” “continue,” “expect,” “target,” “anticipate,” “intend,” “plan,” “estimate,” “potential,” “ project,” or words of

similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” They may also consist of annualized amounts

based on historical interim period results. There are numerous risks and uncertainties that could and will cause actual results to differ materially

from those discussed in the Company’s forward-looking statements. Many of these factors are beyond the Company’s ability to control or predict

and could have a material adverse effect on the Company’s financial condition, and results of operations or prospects. For more information about

factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the SEC, including the discussions

under “Management’s Discussion & Analysis of Financial Condition and Results of Operations” and “Risk Factors” in the Company’s most recent

Annual Report on Form 10-K and Quarterly Reports on Forms 10-Q and in any subsequent filings with the SEC and available on the SEC’s

website at www.sec.gov. Any factor described above or in our SEC reports could, by itself or together with one or more other factors, adversely

affect our financial results and condition. All forward-looking statements contained herein are based on information available at the time of this

presentation, and the Company assumes no obligation to update any forward-looking statements.

This investor presentation includes additional capital ratios (tangible common equity and Common Equity Tier 1 capital (calculated under the Basel

III standardized approach on a fully phased-in basis)) to facilitate the understanding of the Company’s capital structure and for use in assessing

and comparing the quality and composition of the Company's capital structure to other financial institutions. These presentations should not be

viewed as a substitute for results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP financial measures

presented by other companies. Please refer to our separate reconciliation of non-GAAP financial measures in our earnings release dated

January 24, 2017 and our 10-K for the year ended December 31, 2016.

Forward-Looking Statements and Non-GAAP Financial Measures

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

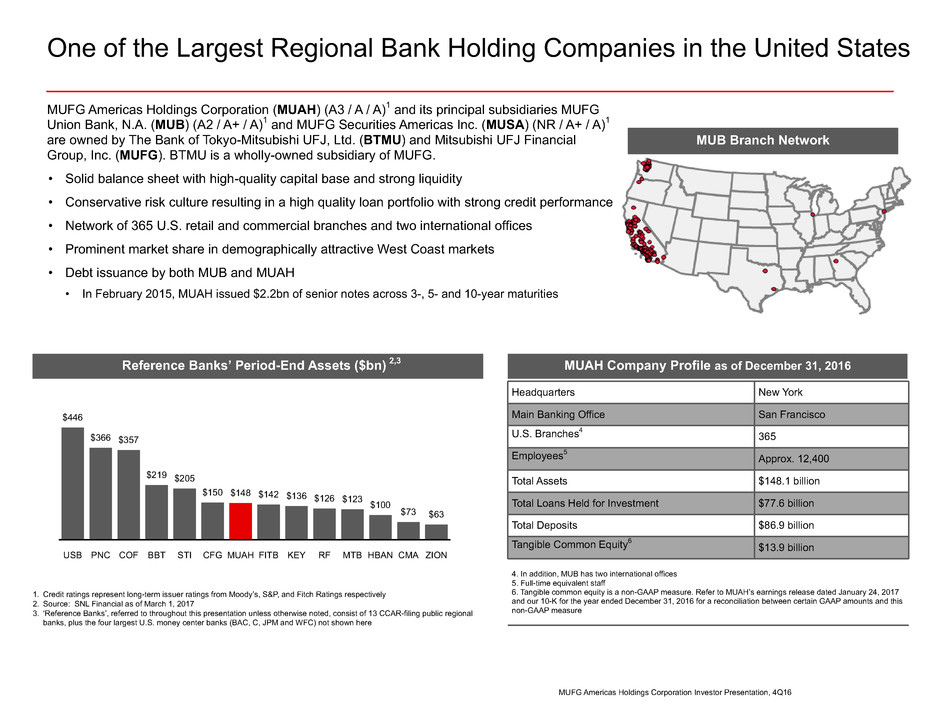

One of the Largest Regional Bank Holding Companies in the United States

Headquarters New York

Main Banking Office San Francisco

U.S. Branches4 365

Employees5 Approx. 12,400

Total Assets $148.1 billion

Total Loans Held for Investment $77.6 billion

Total Deposits $86.9 billion

Tangible Common Equity6 $13.9 billion

4. In addition, MUB has two international offices

5. Full-time equivalent staff

6. Tangible common equity is a non-GAAP measure. Refer to MUAH’s earnings release dated January 24, 2017

and our 10-K for the year ended December 31, 2016 for a reconciliation between certain GAAP amounts and this

non-GAAP measure

MUAH Company Profile as of December 31, 2016 Reference Banks’ Period-End Assets ($bn) 2,3

MUFG Americas Holdings Corporation (MUAH) (A3 / A / A)1 and its principal subsidiaries MUFG

Union Bank, N.A. (MUB) (A2 / A+ / A)1 and MUFG Securities Americas Inc. (MUSA) (NR / A+ / A)1

are owned by The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU) and Mitsubishi UFJ Financial

Group, Inc. (MUFG). BTMU is a wholly-owned subsidiary of MUFG.

• Solid balance sheet with high-quality capital base and strong liquidity

• Conservative risk culture resulting in a high quality loan portfolio with strong credit performance

• Network of 365 U.S. retail and commercial branches and two international offices

• Prominent market share in demographically attractive West Coast markets

• Debt issuance by both MUB and MUAH

• In February 2015, MUAH issued $2.2bn of senior notes across 3-, 5- and 10-year maturities

MUB Branch Network

1. Credit ratings represent long-term issuer ratings from Moody’s, S&P, and Fitch Ratings respectively

2. Source: SNL Financial as of March 1, 2017

3. ‘Reference Banks’, referred to throughout this presentation unless otherwise noted, consist of 13 CCAR-filing public regional

banks, plus the four largest U.S. money center banks (BAC, C, JPM and WFC) not shown here

USB PNC COF BBT STI CFG MUAH FITB KEY RF MTB HBAN CMA ZION

$446

$366 $357

$219 $205

$150 $148 $142 $136 $126 $123 $100

$73 $63

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

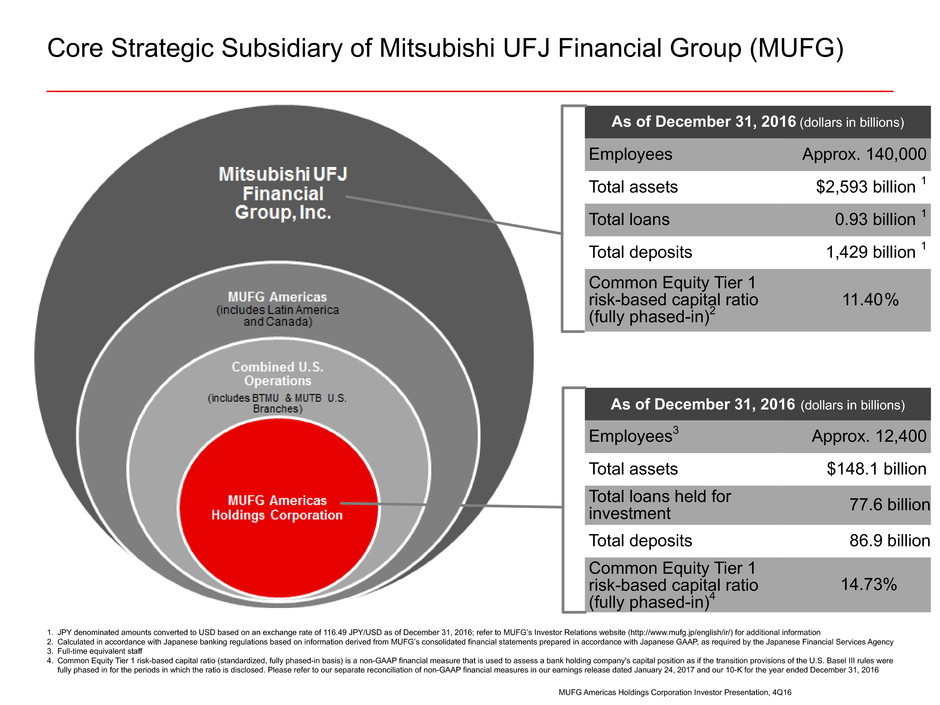

Core Strategic Subsidiary of Mitsubishi UFJ Financial Group (MUFG)

As of December 31, 2016 (dollars in billions)

Employees3 Approx. 12,400

Total assets $148.1 billion

Total loans held for

investment 77.6 billion

Total deposits 86.9 billion

Common Equity Tier 1

risk-based capital ratio

(fully phased-in)4

14.73%

As of December 31, 2016 (dollars in billions)

Employees Approx. 140,000

Total assets $2,593 billion 1

Total loans 0.93 billion 1

Total deposits 1,429 billion 1

Common Equity Tier 1

risk-based capital ratio

(fully phased-in)2

11.40%

1. JPY denominated amounts converted to USD based on an exchange rate of 116.49 JPY/USD as of December 31, 2016; refer to MUFG’s Investor Relations website (http://www.mufg.jp/english/ir/) for additional information

2. Calculated in accordance with Japanese banking regulations based on information derived from MUFG’s consolidated financial statements prepared in accordance with Japanese GAAP, as required by the Japanese Financial Services Agency

3. Full-time equivalent staff

4. Common Equity Tier 1 risk-based capital ratio (standardized, fully phased-in basis) is a non-GAAP financial measure that is used to assess a bank holding company's capital position as if the transition provisions of the U.S. Basel III rules were

fully phased in for the periods in which the ratio is disclosed. Please refer to our separate reconciliation of non-GAAP financial measures in our earnings release dated January 24, 2017 and our 10-K for the year ended December 31, 2016

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

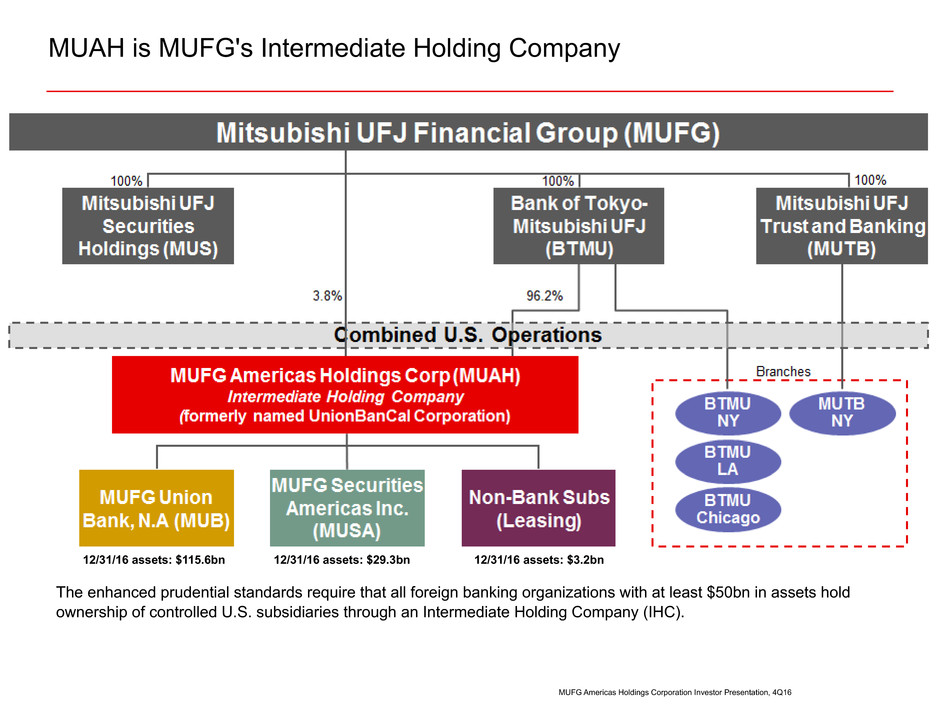

The enhanced prudential standards require that all foreign banking organizations with at least $50bn in assets hold

ownership of controlled U.S. subsidiaries through an Intermediate Holding Company (IHC).

MUAH is MUFG's Intermediate Holding Company

12/31/16 assets: $115.6bn 12/31/16 assets: $29.3bn 12/31/16 assets: $3.2bn

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

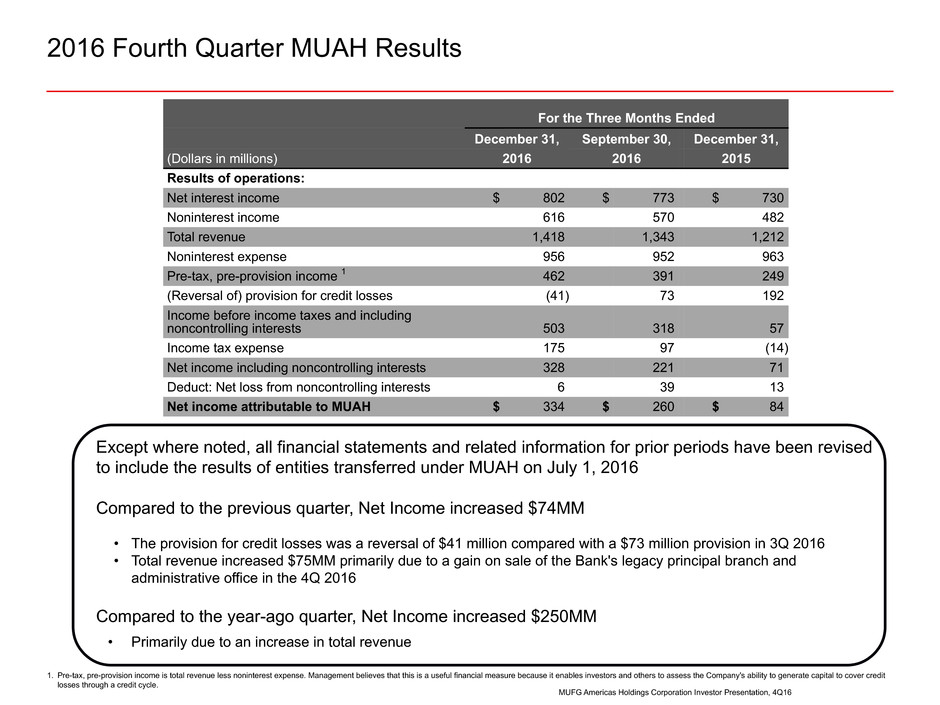

2016 Fourth Quarter MUAH Results

Except where noted, all financial statements and related information for prior periods have been revised

to include the results of entities transferred under MUAH on July 1, 2016

Compared to the previous quarter, Net Income increased $74MM

• The provision for credit losses was a reversal of $41 million compared with a $73 million provision in 3Q 2016

• Total revenue increased $75MM primarily due to a gain on sale of the Bank's legacy principal branch and

administrative office in the 4Q 2016

Compared to the year-ago quarter, Net Income increased $250MM

• Primarily due to an increase in total revenue

1. Pre-tax, pre-provision income is total revenue less noninterest expense. Management believes that this is a useful financial measure because it enables investors and others to assess the Company's ability to generate capital to cover credit

losses through a credit cycle.

For the Three Months Ended

December 31, September 30, December 31,

(Dollars in millions) 2016 2016 2015

Results of operations:

Net interest income $ 802 $ 773 $ 730

Noninterest income 616 570 482

Total revenue 1,418 1,343 1,212

Noninterest expense 956 952 963

Pre-tax, pre-provision income 1 462 391 249

(Reversal of) provision for credit losses (41) 73 192

Income before income taxes and including

noncontrolling interests 503 318 57

Income tax expense 175 97 (14)

Net income including noncontrolling interests 328 221 71

Deduct: Net loss from noncontrolling interests 6 39 13

Net income attributable to MUAH $ 334 $ 260 $ 84

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

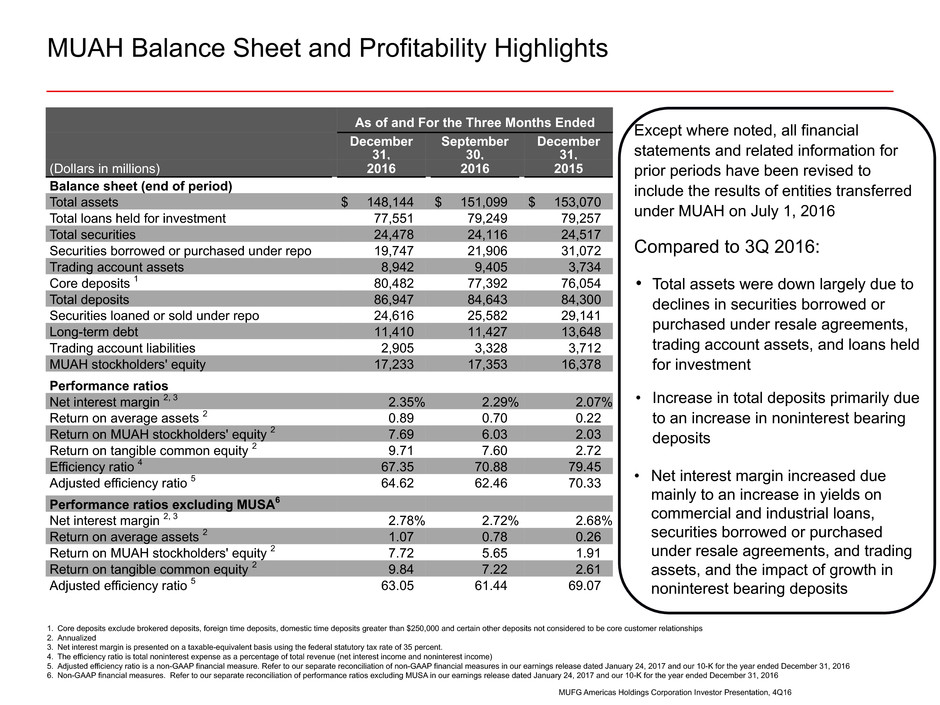

MUAH Balance Sheet and Profitability Highlights

1. Core deposits exclude brokered deposits, foreign time deposits, domestic time deposits greater than $250,000 and certain other deposits not considered to be core customer relationships

2. Annualized

3. Net interest margin is presented on a taxable-equivalent basis using the federal statutory tax rate of 35 percent.

4. The efficiency ratio is total noninterest expense as a percentage of total revenue (net interest income and noninterest income)

5. Adjusted efficiency ratio is a non-GAAP financial measure. Refer to our separate reconciliation of non-GAAP financial measures in our earnings release dated January 24, 2017 and our 10-K for the year ended December 31, 2016

6. Non-GAAP financial measures. Refer to our separate reconciliation of performance ratios excluding MUSA in our earnings release dated January 24, 2017 and our 10-K for the year ended December 31, 2016

Except where noted, all financial

statements and related information for

prior periods have been revised to

include the results of entities transferred

under MUAH on July 1, 2016

Compared to 3Q 2016:

• Total assets were down largely due to

declines in securities borrowed or

purchased under resale agreements,

trading account assets, and loans held

for investment

• Increase in total deposits primarily due

to an increase in noninterest bearing

deposits

• Net interest margin increased due

mainly to an increase in yields on

commercial and industrial loans,

securities borrowed or purchased

under resale agreements, and trading

assets, and the impact of growth in

noninterest bearing deposits

As of and For the Three Months Ended

December

31,

September

30,

December

31,

(Dollars in millions) 2016 2016 2015

Balance sheet (end of period)

Total assets $ 148,144 $ 151,099 $ 153,070

Total loans held for investment 77,551 79,249 79,257

Total securities 24,478 24,116 24,517

Securities borrowed or purchased under repo 19,747 21,906 31,072

Trading account assets 8,942 9,405 3,734

Core deposits 1 80,482 77,392 76,054

Total deposits 86,947 84,643 84,300

Securities loaned or sold under repo 24,616 25,582 29,141

Long-term debt 11,410 11,427 13,648

Trading account liabilities 2,905 3,328 3,712

MUAH stockholders' equity 17,233 17,353 16,378

Performance ratios

Net interest margin 2, 3 2.35% 2.29% 2.07%

Return on average assets 2 0.89 0.70 0.22

Return on MUAH stockholders' equity 2 7.69 6.03 2.03

Return on tangible common equity 2 9.71 7.60 2.72

Efficiency ratio 4 67.35 70.88 79.45

Adjusted efficiency ratio 5 64.62 62.46 70.33

Performance ratios excluding MUSA6

Net interest margin 2, 3 2.78% 2.72% 2.68%

Return on average assets 2 1.07 0.78 0.26

Return on MUAH stockholders' equity 2 7.72 5.65 1.91

Return on tangible common equity 2 9.84 7.22 2.61

Adjusted efficiency ratio 5 63.05 61.44 69.07

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

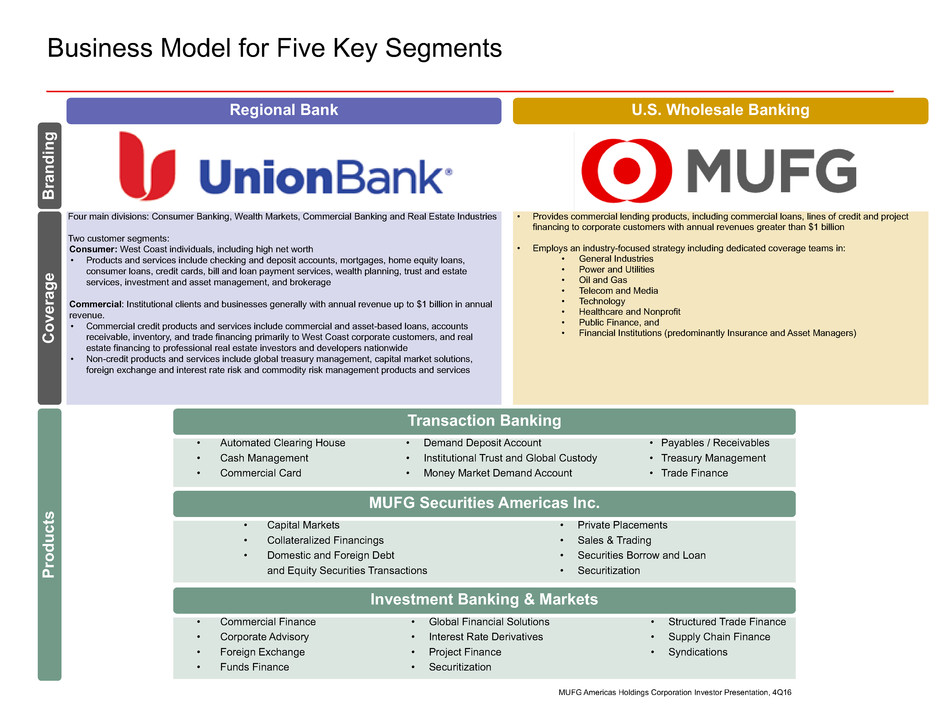

Business Model for Five Key Segments

Four main divisions: Consumer Banking, Wealth Markets, Commercial Banking and Real Estate Industries

Two customer segments:

Consumer: West Coast individuals, including high net worth

• Products and services include checking and deposit accounts, mortgages, home equity loans,

consumer loans, credit cards, bill and loan payment services, wealth planning, trust and estate

services, investment and asset management, and brokerage

Commercial: Institutional clients and businesses generally with annual revenue up to $1 billion in annual

revenue.

• Commercial credit products and services include commercial and asset-based loans, accounts

receivable, inventory, and trade financing primarily to West Coast corporate customers, and real

estate financing to professional real estate investors and developers nationwide

• Non-credit products and services include global treasury management, capital market solutions,

foreign exchange and interest rate risk and commodity risk management products and services

• Provides commercial lending products, including commercial loans, lines of credit and project

financing to corporate customers with annual revenues greater than $1 billion

• Employs an industry-focused strategy including dedicated coverage teams in:

• General Industries

• Power and Utilities

• Oil and Gas

• Telecom and Media

• Technology

• Healthcare and Nonprofit

• Public Finance, and

• Financial Institutions (predominantly Insurance and Asset Managers)

Regional Bank U.S. Wholesale Banking

Investment Banking & Markets

Transaction Banking

• Automated Clearing House

• Cash Management

• Commercial Card

MUFG Securities Americas Inc.

• Capital Markets

• Collateralized Financings

• Domestic and Foreign Debt

and Equity Securities Transactions

Coverag

e

Product

s

• Commercial Finance

• Corporate Advisory

• Foreign Exchange

• Funds Finance

• Global Financial Solutions

• Interest Rate Derivatives

• Project Finance

• Securitization

• Structured Trade Finance

• Supply Chain Finance

• Syndications

• Demand Deposit Account

• Institutional Trust and Global Custody

• Money Market Demand Account

Brandin

g

• Payables / Receivables

• Treasury Management

• Trade Finance

• Private Placements

• Sales & Trading

• Securities Borrow and Loan

• Securitization

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

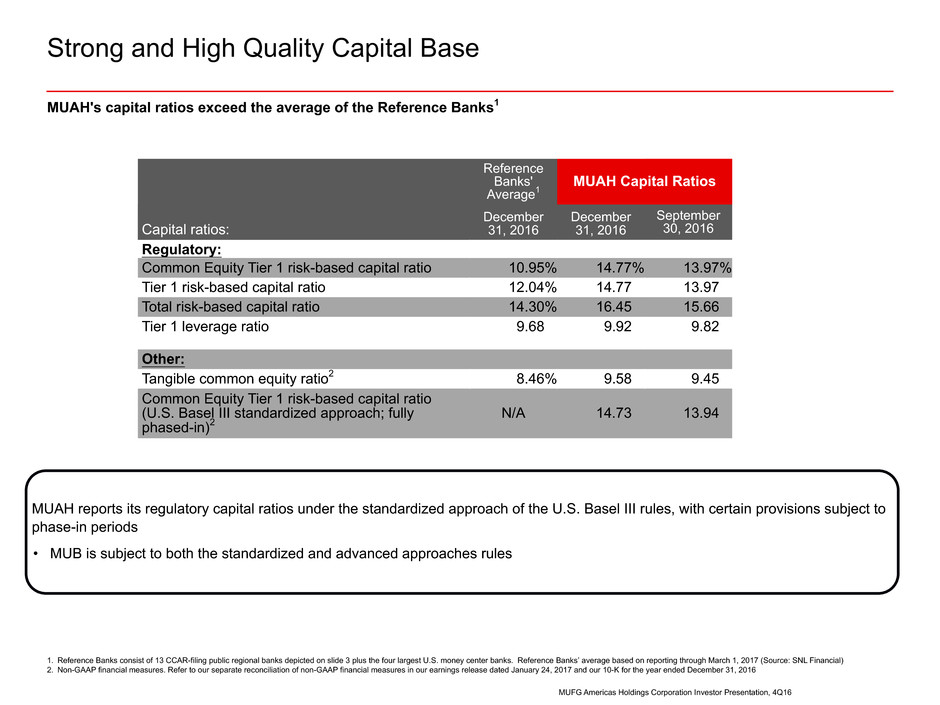

Strong and High Quality Capital Base

1. Reference Banks consist of 13 CCAR-filing public regional banks depicted on slide 3 plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through March 1, 2017 (Source: SNL Financial)

2. Non-GAAP financial measures. Refer to our separate reconciliation of non-GAAP financial measures in our earnings release dated January 24, 2017 and our 10-K for the year ended December 31, 2016

MUAH's capital ratios exceed the average of the Reference Banks1

MUAH reports its regulatory capital ratios under the standardized approach of the U.S. Basel III rules, with certain provisions subject to

phase-in periods

• MUB is subject to both the standardized and advanced approaches rules

Capital ratios:

Reference

Banks'

Average1

MUAH Capital Ratios

December

31, 2016

December

31, 2016

September

30, 2016

Regulatory:

Common Equity Tier 1 risk-based capital ratio 10.95% 14.77% 13.97%

Tier 1 risk-based capital ratio 12.04% 14.77 13.97

Total risk-based capital ratio 14.30% 16.45 15.66

Tier 1 leverage ratio 9.68 9.92 9.82

Other:

Tangible common equity ratio2 8.46% 9.58 9.45

Common Equity Tier 1 risk-based capital ratio

(U.S. Basel III standardized approach; fully

phased-in)2

N/A 14.73 13.94

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

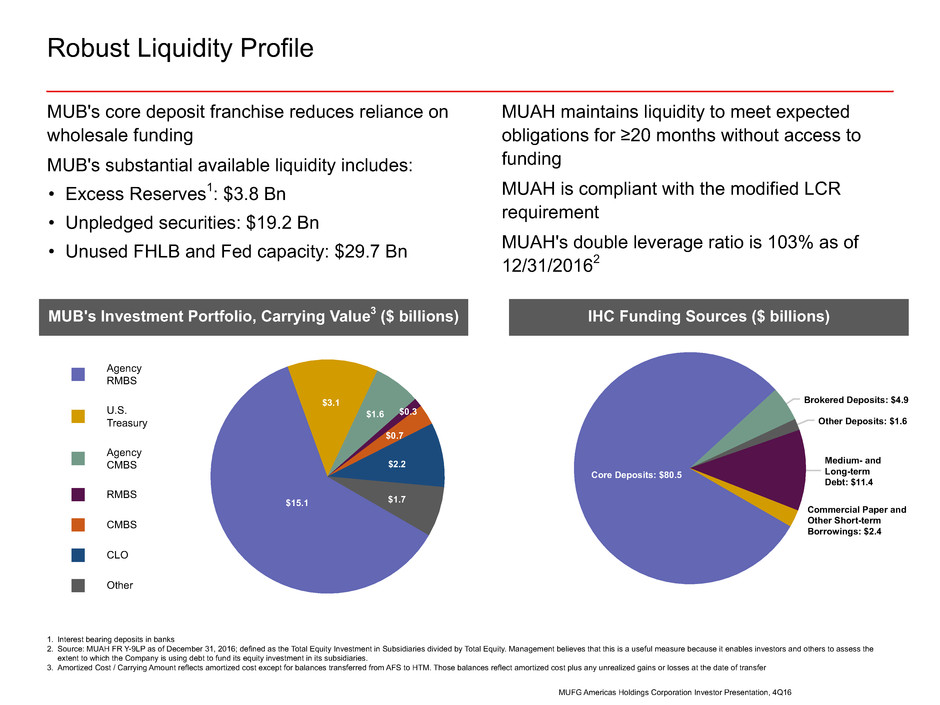

Core Deposits: $80.5

Brokered Deposits: $4.9

Other Deposits: $1.6

Medium- and

Long-term

Debt: $11.4

Commercial Paper and

Other Short-term

Borrowings: $2.4

Robust Liquidity Profile

MUB's core deposit franchise reduces reliance on

wholesale funding

MUB's substantial available liquidity includes:

• Excess Reserves1: $3.8 Bn

• Unpledged securities: $19.2 Bn

• Unused FHLB and Fed capacity: $29.7 Bn

1. Interest bearing deposits in banks

2. Source: MUAH FR Y-9LP as of December 31, 2016; defined as the Total Equity Investment in Subsidiaries divided by Total Equity. Management believes that this is a useful measure because it enables investors and others to assess the

extent to which the Company is using debt to fund its equity investment in its subsidiaries.

3. Amortized Cost / Carrying Amount reflects amortized cost except for balances transferred from AFS to HTM. Those balances reflect amortized cost plus any unrealized gains or losses at the date of transfer

IHC Funding Sources ($ billions)

MUAH maintains liquidity to meet expected

obligations for ≥20 months without access to

funding

MUAH is compliant with the modified LCR

requirement

MUAH's double leverage ratio is 103% as of

12/31/20162

Agency

RMBS

U.S.

Treasury

Agency

CMBS

RMBS

CMBS

CLO

Other

$15.1

$3.1

$1.6 $0.3

$0.7

$2.2

$1.7

MUB's Investment Portfolio, Carrying Value3 ($ billions)

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

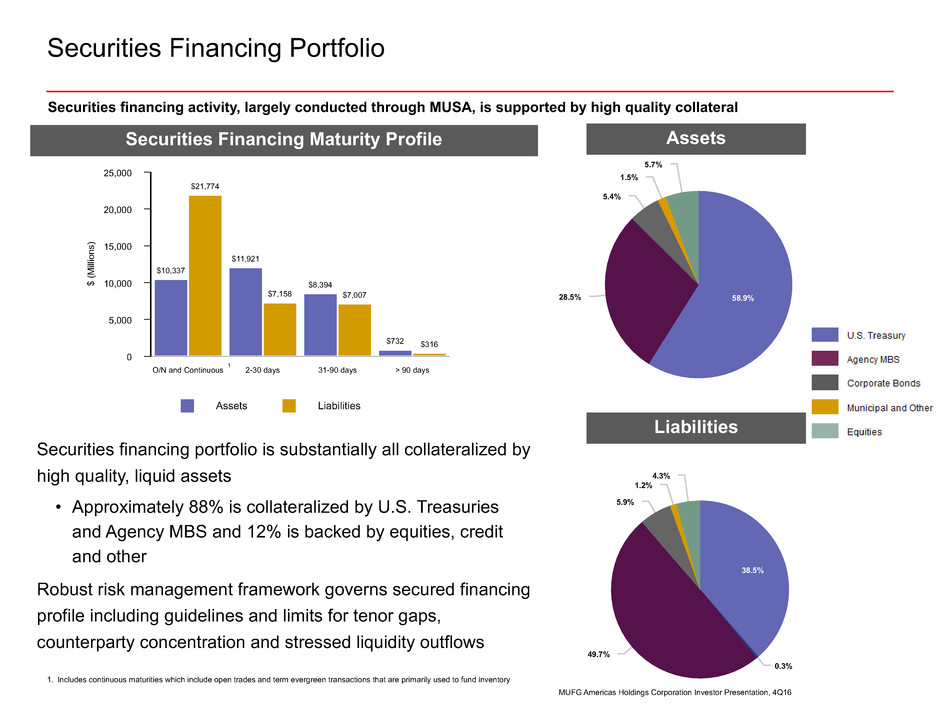

Securities Financing Maturity Profile

Securities Financing Portfolio

Assets Liabilities

25,000

20,000

15,000

10,000

5,000

0

$

(M

illi

on

s)

O/N and Continuous 2-30 days 31-90 days > 90 days

$10,337

$11,921

$8,394

$732

$21,774

$7,158 $7,007

$316

58.9%28.5%

5.4%

1.5%

5.7%

38.5%

0.3%

49.7%

5.9%

1.2%

4.3%

Assets

Liabilities

Securities financing portfolio is substantially all collateralized by

high quality, liquid assets

• Approximately 88% is collateralized by U.S. Treasuries

and Agency MBS and 12% is backed by equities, credit

and other

Robust risk management framework governs secured financing

profile including guidelines and limits for tenor gaps,

counterparty concentration and stressed liquidity outflows

Securities financing activity, largely conducted through MUSA, is supported by high quality collateral

1. Includes continuous maturities which include open trades and term evergreen transactions that are primarily used to fund inventory

1

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

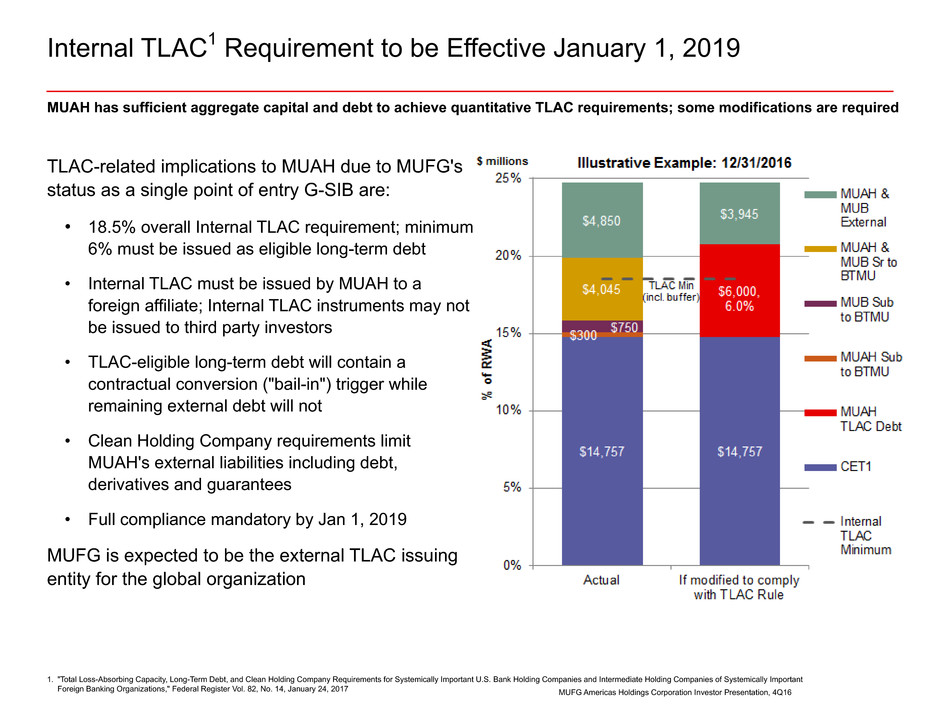

Internal TLAC1 Requirement to be Effective January 1, 2019

TLAC-related implications to MUAH due to MUFG's

status as a single point of entry G-SIB are:

• 18.5% overall Internal TLAC requirement; minimum

6% must be issued as eligible long-term debt

• Internal TLAC must be issued by MUAH to a

foreign affiliate; Internal TLAC instruments may not

be issued to third party investors

• TLAC-eligible long-term debt will contain a

contractual conversion ("bail-in") trigger while

remaining external debt will not

• Clean Holding Company requirements limit

MUAH's external liabilities including debt,

derivatives and guarantees

• Full compliance mandatory by Jan 1, 2019

MUFG is expected to be the external TLAC issuing

entity for the global organization

MUAH has sufficient aggregate capital and debt to achieve quantitative TLAC requirements; some modifications are required

1. "Total Loss-Absorbing Capacity, Long-Term Debt, and Clean Holding Company Requirements for Systemically Important U.S. Bank Holding Companies and Intermediate Holding Companies of Systemically Important

Foreign Banking Organizations," Federal Register Vol. 82, No. 14, January 24, 2017

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

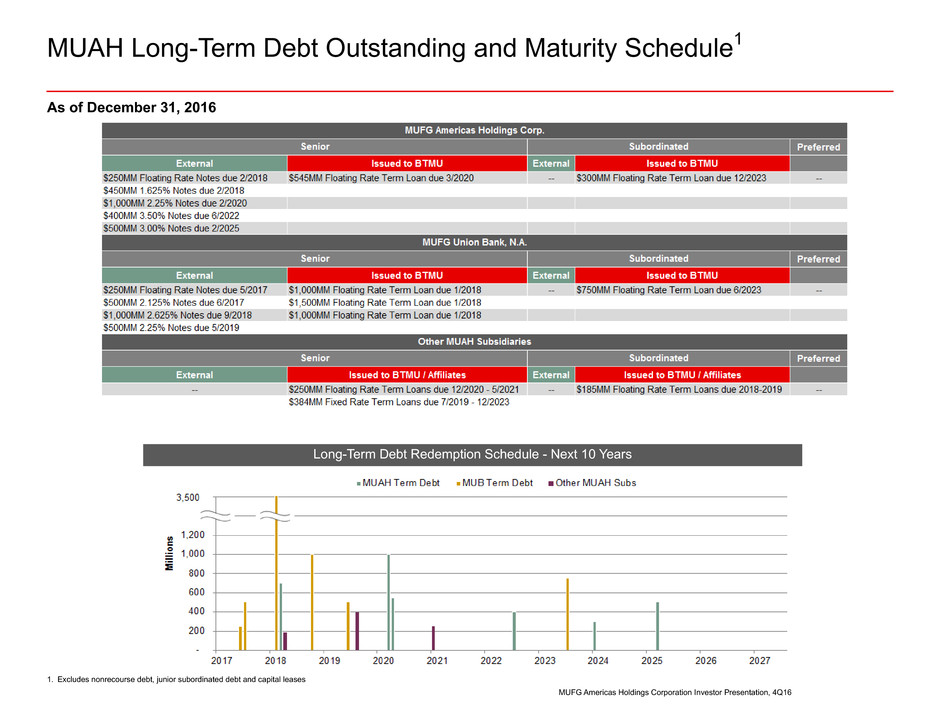

MUAH Long-Term Debt Outstanding and Maturity Schedule1

As of December 31, 2016

Long-Term Debt Redemption Schedule - Next 10 Years

1. Excludes nonrecourse debt, junior subordinated debt and capital leases

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

Average Quarterly Deposit Breakdown ($ billions)

Deposit Trends

1. Source: FDIC Summary of Deposits as of June 30, 2016

Average deposit balances have been steady over the last year

Transaction & Money Market Savings Time Noninterest Bearing

4Q15 3Q16 4Q16

38 38 40

6 6 6

8 7 6

33 34 35

Deposits1

Metropolitan Statistical Area (MSA) / State Rank Share (%)

Santa Maria-Santa Barbara, CA 2 18.6

San Diego-Carlsbad, CA 4 14.1

Los Angeles-Long Beach-Anaheim, CA 4 10.0

Fresno, CA 4 7.6

Oxnard-Thousand Oaks-Ventura, CA 5 6.2

Salinas, CA 5 9.6

Riverside-San Bernardino-Ontario, CA 6 4.5

Sacramento--Roseville--Arden-Arcade, CA 6 4.5

San Francisco-Oakland-Hayward, CA 7 3.4

Seattle-Tacoma-Bellevue, WA 8 2.8

San Jose-Sunnyvale-Santa Clara, CA 9 2.5

California Total 4 6.4

Washington Total 13 2.0

878585

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

Earning Asset Mix 4Q 2016

MUB's loan mix is balanced between residential and commercial; MUSA contributes trading and securities financing assets

1. Average balance for the quarter ended December 31, 2016. May not total 100% due to rounding.

2. Period-end total loans held for investment, including all nonperforming loans and purchased credit-impaired loans

Loan Portfolio Composition 2Earning Asset Mix 1

Securities: 17.6%

Cash and

equivalents:

3.2%

Securities Purchased

under Repo and

Securities Borrowed:

15.9%

Trading Assets &

Other: 5.8%

Commercial &

Industrial: 32.8%

Commercial

Mortgage: 18.8%

Construction: 3.0%

Lease Financing:

2.4%

Residential Mortgage:

38.6%

Home Equity & Other

Consumer: 4.5%

Loans2: 59.1%

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

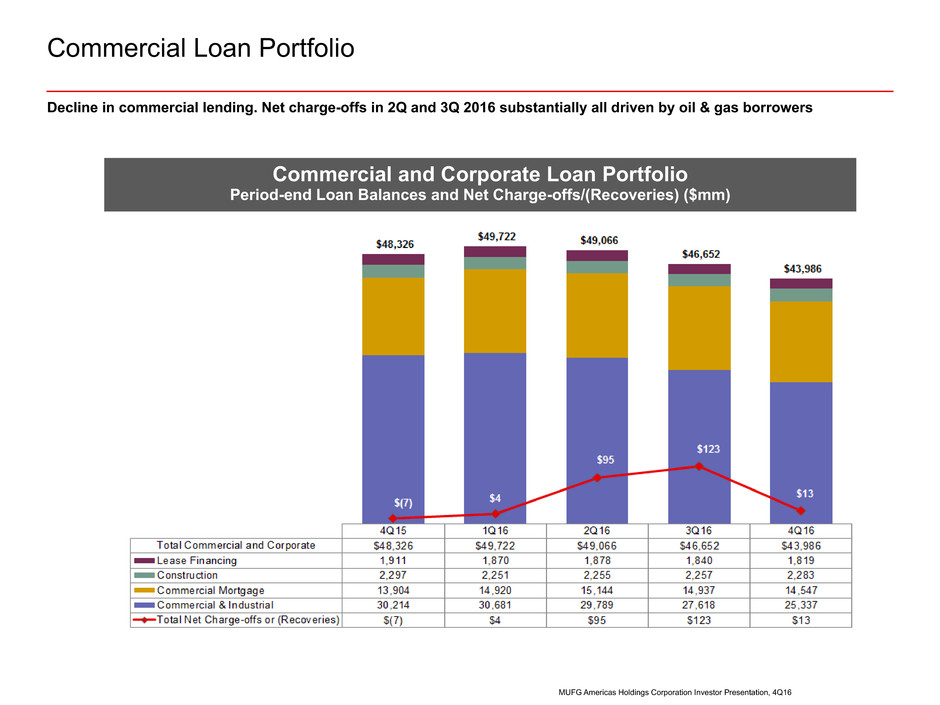

Commercial Loan Portfolio

Decline in commercial lending. Net charge-offs in 2Q and 3Q 2016 substantially all driven by oil & gas borrowers

Commercial and Corporate Loan Portfolio

Period-end Loan Balances and Net Charge-offs/(Recoveries) ($mm)

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

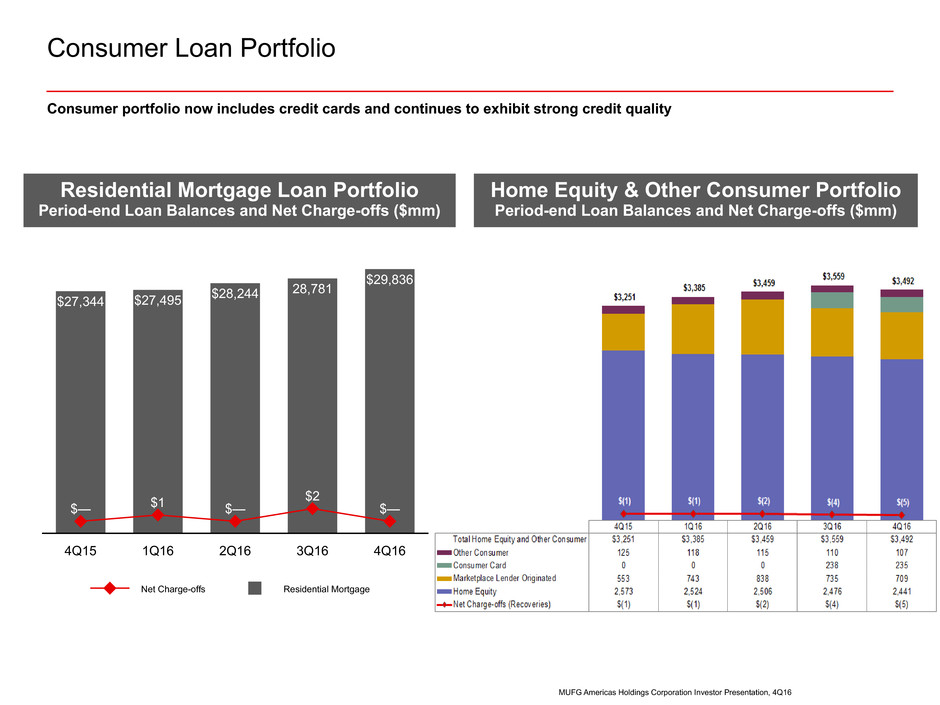

Consumer Loan Portfolio

Consumer portfolio now includes credit cards and continues to exhibit strong credit quality

Home Equity & Other Consumer Portfolio

Period-end Loan Balances and Net Charge-offs ($mm)

Residential Mortgage Loan Portfolio

Period-end Loan Balances and Net Charge-offs ($mm)

Net Charge-offs Residential Mortgage

4Q15 1Q16 2Q16 3Q16 4Q16

$— $1 $—

$2

$—

$27,344 $27,495 $28,244

28,781

$29,836

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

Loans Securities

Securities Purchased under Repo and Borrowed Trading Assets & Other

Cash and Equiv.

4Q15 1Q16 2Q16 3Q16 4Q16

$80 $80 $82 $80 $79

$24 $24 $23 $24 $24

$32 $32 $24 $21 $22

$4 $4

$6 $7 $8

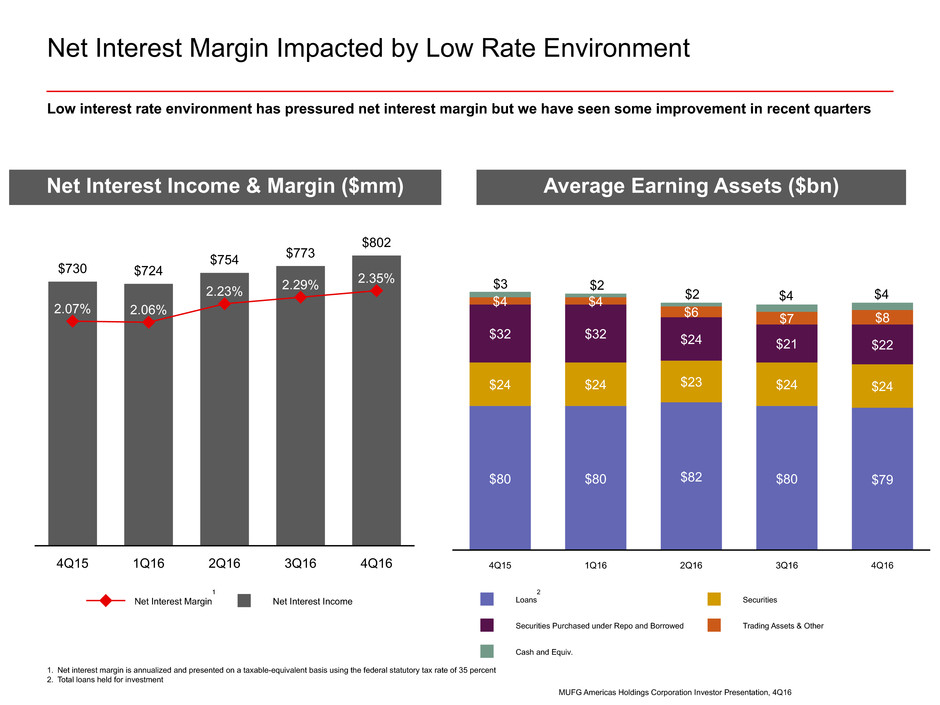

Net Interest Margin Impacted by Low Rate Environment

Low interest rate environment has pressured net interest margin but we have seen some improvement in recent quarters

1. Net interest margin is annualized and presented on a taxable-equivalent basis using the federal statutory tax rate of 35 percent

2. Total loans held for investment

Average Earning Assets ($bn)Net Interest Income & Margin ($mm)

2

1

Net Interest Margin Net Interest Income

4Q15 1Q16 2Q16 3Q16 4Q16

2.07% 2.06%

2.23% 2.29%

2.35%

$730 $724

$754 $773

$802

1

$4$4$2

$2$3

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

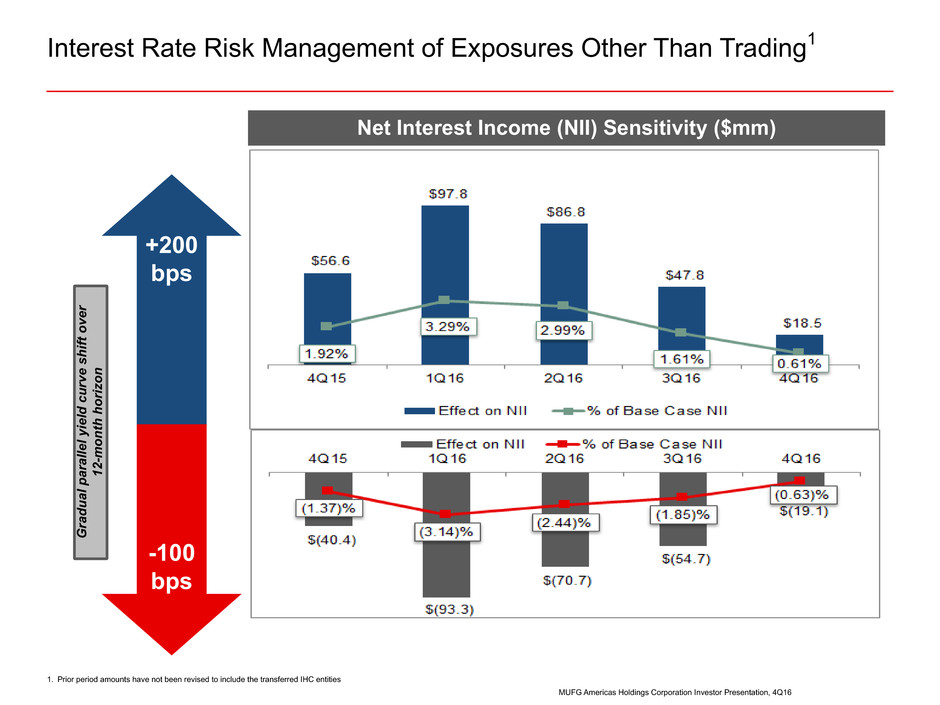

Interest Rate Risk Management of Exposures Other Than Trading1

Net Interest Income (NII) Sensitivity ($mm)

+200

bps

-100

bps

Gradual parallel yield curve shift ove

r

12-month horizo

n

1. Prior period amounts have not been revised to include the transferred IHC entities

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

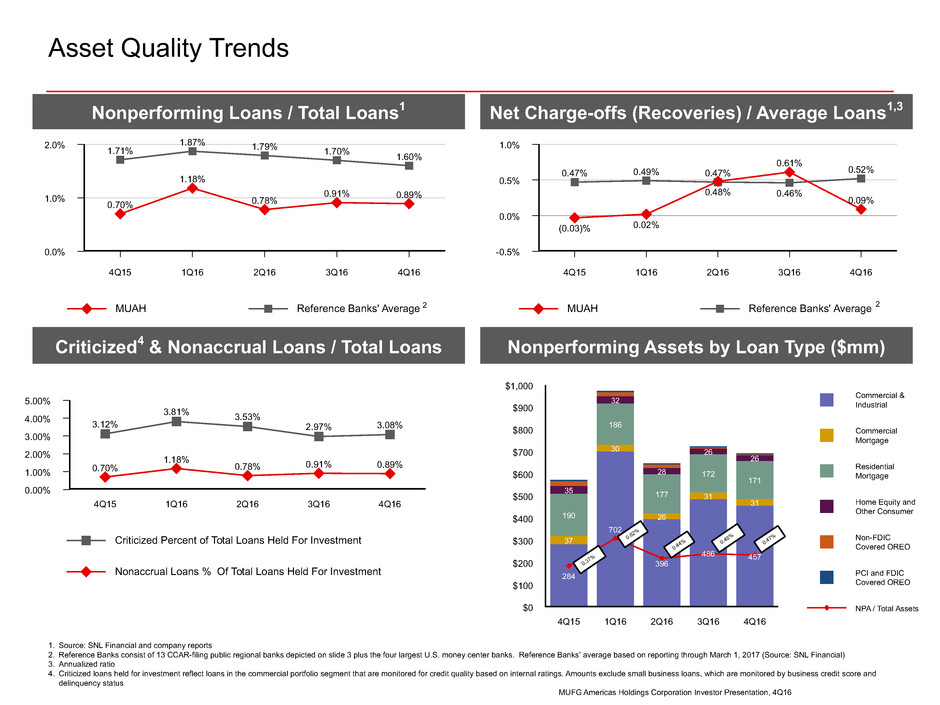

MUAH Reference Banks' Average

2.0%

1.0%

0.0%

4Q15 1Q16 2Q16 3Q16 4Q16

0.70%

1.18%

0.78%

0.91% 0.89%

1.71%

1.87% 1.79% 1.70% 1.60%

Asset Quality Trends

Nonperforming Assets by Loan Type ($mm)

Net Charge-offs (Recoveries) / Average Loans1,3Nonperforming Loans / Total Loans1

Criticized4 & Nonaccrual Loans / Total Loans

1. Source: SNL Financial and company reports

2. Reference Banks consist of 13 CCAR-filing public regional banks depicted on slide 3 plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through March 1, 2017 (Source: SNL Financial)

3. Annualized ratio

4. Criticized loans held for investment reflect loans in the commercial portfolio segment that are monitored for credit quality based on internal ratings. Amounts exclude small business loans, which are monitored by business credit score and

delinquency status

MUAH Reference Banks' Average

1.0%

0.5%

0.0%

-0.5%

4Q15 1Q16 2Q16 3Q16 4Q16

(0.03)% 0.02%

0.48%

0.61%

0.09%

0.47% 0.49% 0.47%

0.46%

0.52%

Criticized Percent of Total Loans Held For Investment

Nonaccrual Loans % Of Total Loans Held For Investment

5.00%

4.00%

3.00%

2.00%

1.00%

0.00%

4Q15 1Q16 2Q16 3Q16 4Q16

3.12%

3.81% 3.53%

2.97% 3.08%

0.70%

1.18%

0.78% 0.91% 0.89%

Commercial &

Industrial

Commercial

Mortgage

Residential

Mortgage

Home Equity and

Other Consumer

Non-FDIC

Covered OREO

PCI and FDIC

Covered OREO

NPA / Total Assets

$1,000

$900

$800

$700

$600

$500

$400

$300

$200

$100

$0

4Q15 1Q16 2Q16 3Q16 4Q16

284

702

396

486 457

37

30

26

31

31

190

186

177

172

171

35

32

28

26

26

2 2

0.48

%

0.44

%

0.62

%

0.37

%

0.47

%

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

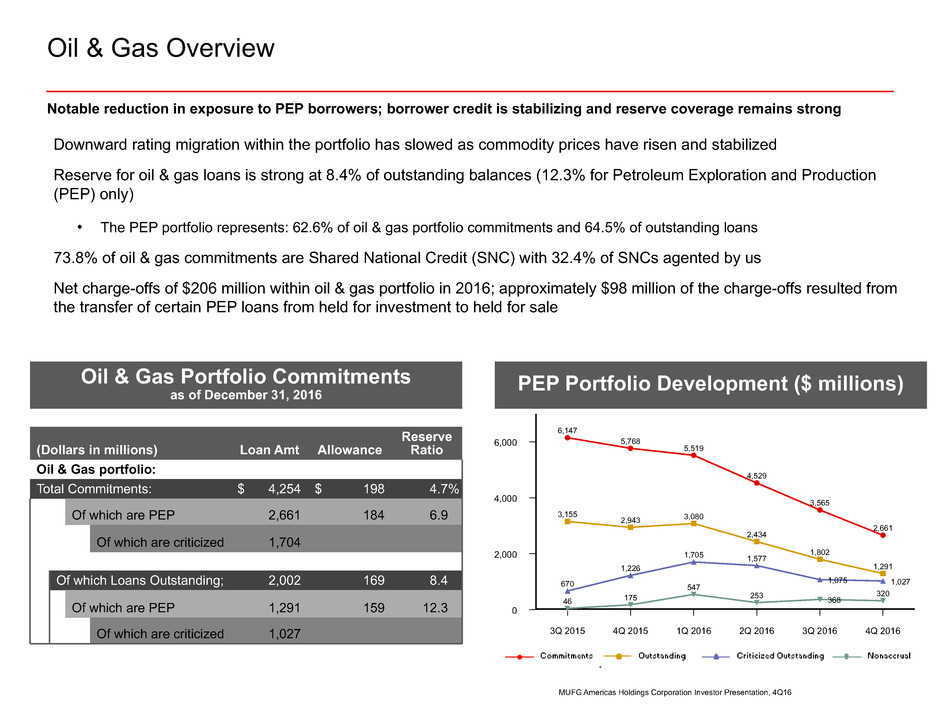

Downward rating migration within the portfolio has slowed as commodity prices have risen and stabilized

Reserve for oil & gas loans is strong at 8.4% of outstanding balances (12.3% for Petroleum Exploration and Production

(PEP) only)

• The PEP portfolio represents: 62.6% of oil & gas portfolio commitments and 64.5% of outstanding loans

73.8% of oil & gas commitments are Shared National Credit (SNC) with 32.4% of SNCs agented by us

Net charge-offs of $206 million within oil & gas portfolio in 2016; approximately $98 million of the charge-offs resulted from

the transfer of certain PEP loans from held for investment to held for sale

Oil & Gas Overview

PEP Portfolio Development ($ millions)Oil & Gas Portfolio Commitmentsas of December 31, 2016

Notable reduction in exposure to PEP borrowers; borrower credit is stabilizing and reserve coverage remains strong

(Dollars in millions) Loan Amt Allowance

Reserve

Ratio

Oil & Gas portfolio:

Total Commitments: $ 4,254 $ 198 4.7%

Of which are PEP 2,661 184 6.9

Of which are criticized 1,704

Of which Loans Outstanding; 2,002 169 8.4

Of which are PEP 1,291 159 12.3

Of which are criticized 1,027

6,000

4,000

2,000

0

3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

6,147

5,768

5,519

4,529

3,565

2,661

3,155

2,943 3,080

2,434

1,802

1,291

670

1,226

1,705 1,577

1,075 1,027

46 175

547

253 368

320

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

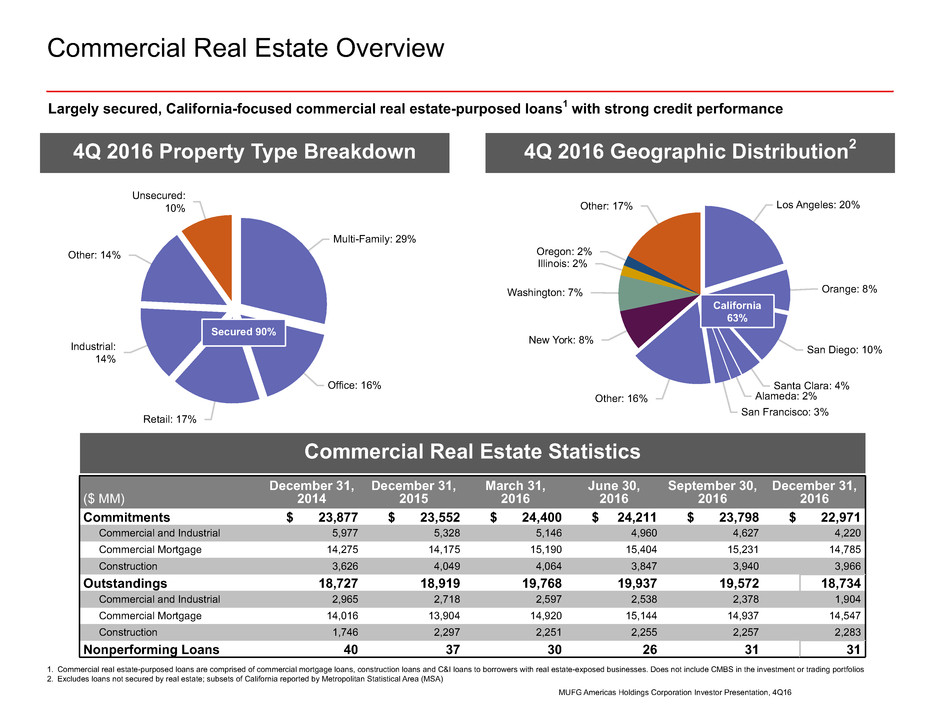

Commercial Real Estate Overview

4Q 2016 Geographic Distribution24Q 2016 Property Type Breakdown

Multi-Family: 29%

Office: 16%

Retail: 17%

Industrial:

14%

Other: 14%

Unsecured:

10%

Secured 90%

Los Angeles: 20%

Orange: 8%

San Diego: 10%

Santa Clara: 4%

Alameda: 2%

San Francisco: 3%

Other: 16%

New York: 8%

Washington: 7%

Illinois: 2%

Oregon: 2%

Other: 17%

Commercial Real Estate Statistics

($ MM)

December 31,

2014

December 31,

2015

March 31,

2016

June 30,

2016

September 30,

2016

December 31,

2016

Commitments $ 23,877 $ 23,552 $ 24,400 $ 24,211 $ 23,798 $ 22,971

Commercial and Industrial 5,977 5,328 5,146 4,960 4,627 4,220

Commercial Mortgage 14,275 14,175 15,190 15,404 15,231 14,785

Construction 3,626 4,049 4,064 3,847 3,940 3,966

Outstandings 18,727 18,919 19,768 19,937 19,572 18,734

Commercial and Industrial 2,965 2,718 2,597 2,538 2,378 1,904

Commercial Mortgage 14,016 13,904 14,920 15,144 14,937 14,547

Construction 1,746 2,297 2,251 2,255 2,257 2,283

Nonperforming Loans 40 37 30 26 31 31

California

63%

Largely secured, California-focused commercial real estate-purposed loans1 with strong credit performance

1. Commercial real estate-purposed loans are comprised of commercial mortgage loans, construction loans and C&I loans to borrowers with real estate-exposed businesses. Does not include CMBS in the investment or trading portfolios

2. Excludes loans not secured by real estate; subsets of California reported by Metropolitan Statistical Area (MSA)

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

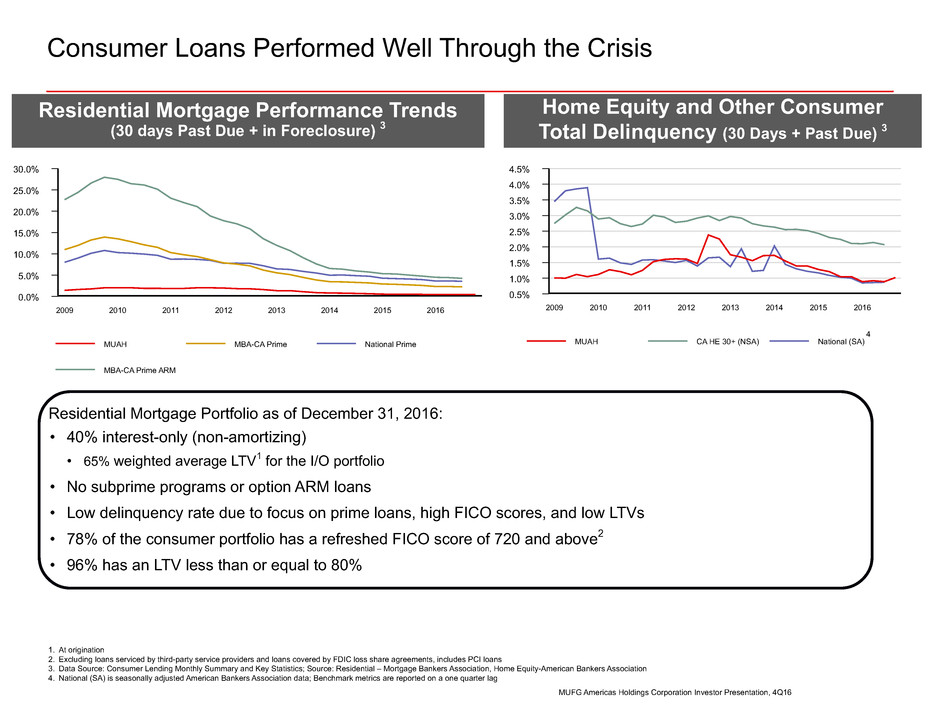

Consumer Loans Performed Well Through the Crisis

1. At origination

2. Excluding loans serviced by third-party service providers and loans covered by FDIC loss share agreements, includes PCI loans

3. Data Source: Consumer Lending Monthly Summary and Key Statistics; Source: Residential – Mortgage Bankers Association, Home Equity-American Bankers Association

4. National (SA) is seasonally adjusted American Bankers Association data; Benchmark metrics are reported on a one quarter lag

Residential Mortgage Performance Trends

(30 days Past Due + in Foreclosure) 3

Home Equity and Other Consumer

Total Delinquency (30 Days + Past Due) 3

Residential Mortgage Portfolio as of December 31, 2016:

• 40% interest-only (non-amortizing)

• 65% weighted average LTV1 for the I/O portfolio

• No subprime programs or option ARM loans

• Low delinquency rate due to focus on prime loans, high FICO scores, and low LTVs

• 78% of the consumer portfolio has a refreshed FICO score of 720 and above2

• 96% has an LTV less than or equal to 80%

MUAH MBA-CA Prime National Prime

MBA-CA Prime ARM

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

2009 2010 2011 2012 2013 2014 2015 2016

MUAH CA HE 30+ (NSA) National (SA)

4.5%

4.0%

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

2009 2010 2011 2012 2013 2014 2015 2016

4

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

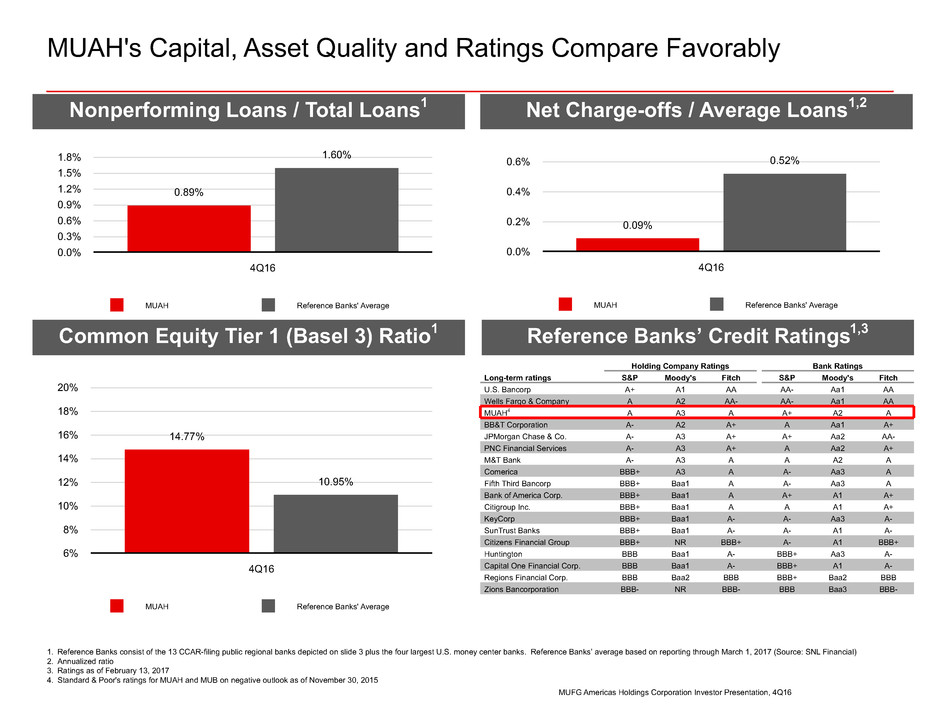

MUAH's Capital, Asset Quality and Ratings Compare Favorably

1. Reference Banks consist of the 13 CCAR-filing public regional banks depicted on slide 3 plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through March 1, 2017 (Source: SNL Financial)

2. Annualized ratio

3. Ratings as of February 13, 2017

4. Standard & Poor's ratings for MUAH and MUB on negative outlook as of November 30, 2015

Net Charge-offs / Average Loans1,2Nonperforming Loans / Total Loans1

Common Equity Tier 1 (Basel 3) Ratio1 Reference Banks’ Credit Ratings1,3

MUAH Reference Banks' Average

1.8%

1.5%

1.2%

0.9%

0.6%

0.3%

0.0%

4Q16

0.89%

1.60%

MUAH Reference Banks' Average

20%

18%

16%

14%

12%

10%

8%

6%

4Q16

14.77%

10.95%

Holding Company Ratings Bank Ratings

Long-term ratings S&P Moody's Fitch S&P Moody's Fitch

U.S. Bancorp A+ A1 AA AA- Aa1 AA

Wells Fargo & Company A A2 AA- AA- Aa1 AA

MUAH4 A A3 A A+ A2 A

BB&T Corporation A- A2 A+ A Aa1 A+

JPMorgan Chase & Co. A- A3 A+ A+ Aa2 AA-

PNC Financial Services A- A3 A+ A Aa2 A+

M&T Bank A- A3 A A A2 A

Comerica BBB+ A3 A A- Aa3 A

Fifth Third Bancorp BBB+ Baa1 A A- Aa3 A

Bank of America Corp. BBB+ Baa1 A A+ A1 A+

Citigroup Inc. BBB+ Baa1 A A A1 A+

KeyCorp BBB+ Baa1 A- A- Aa3 A-

SunTrust Banks BBB+ Baa1 A- A- A1 A-

Citizens Financial Group BBB+ NR BBB+ A- A1 BBB+

Huntington BBB Baa1 A- BBB+ Aa3 A-

Capital One Financial Corp. BBB Baa1 A- BBB+ A1 A-

Regions Financial Corp. BBB Baa2 BBB BBB+ Baa2 BBB

Zions Bancorporation BBB- NR BBB- BBB Baa3 BBB-

MUAH Reference Banks' Average

0.6%

0.4%

0.2%

0.0%

4Q16

0.09%

0.52%

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

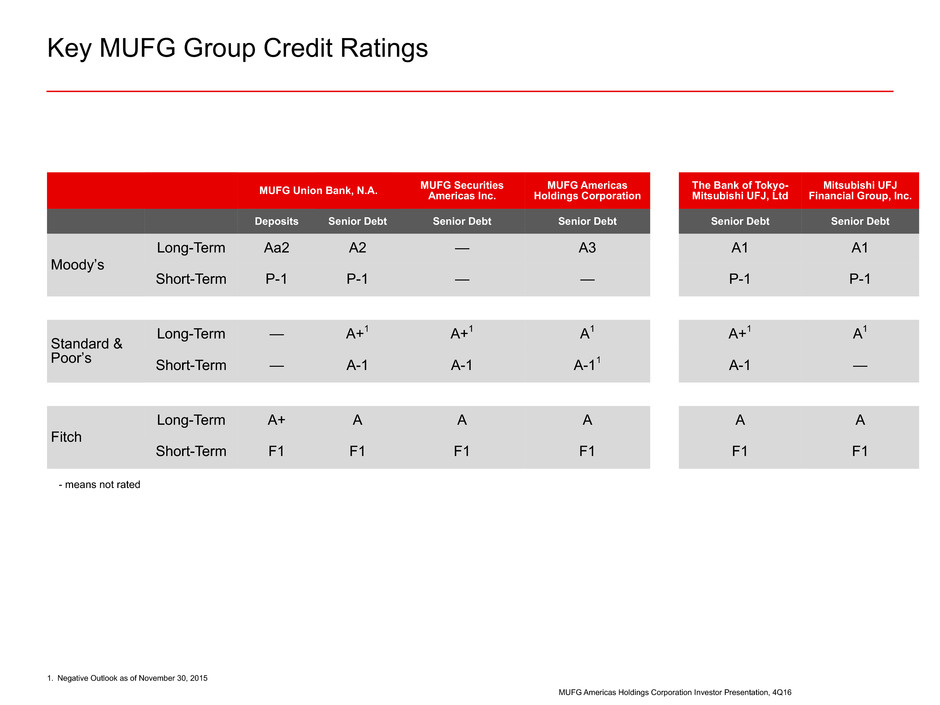

Key MUFG Group Credit Ratings

- means not rated

1. Negative Outlook as of November 30, 2015

MUFG Union Bank, N.A. MUFG SecuritiesAmericas Inc.

MUFG Americas

Holdings Corporation

The Bank of Tokyo-

Mitsubishi UFJ, Ltd

Mitsubishi UFJ

Financial Group, Inc.

Deposits Senior Debt Senior Debt Senior Debt Senior Debt Senior Debt

Moody’s

Long-Term Aa2 A2 — A3 A1 A1

Short-Term P-1 P-1 — — P-1 P-1

Standard &

Poor’s

Long-Term — A+1 A+1 A1 A+1 A1

Short-Term — A-1 A-1 A-11 A-1 —

Fitch

Long-Term A+ A A A A A

Short-Term F1 F1 F1 F1 F1 F1

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

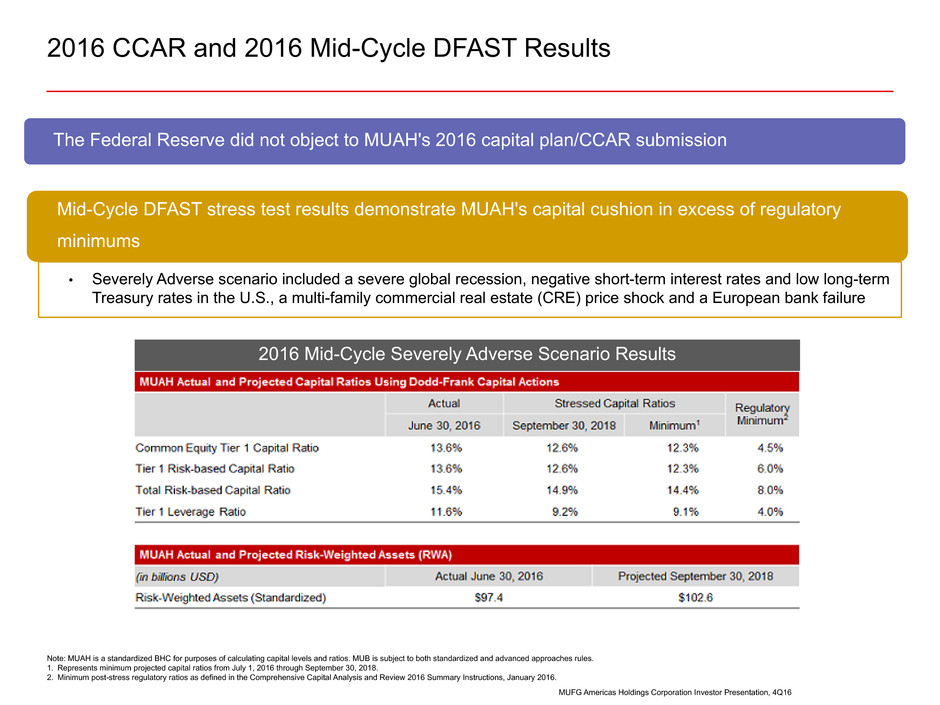

2016 CCAR and 2016 Mid-Cycle DFAST Results

The Federal Reserve did not object to MUAH's 2016 capital plan/CCAR submission

2016 Mid-Cycle Severely Adverse Scenario Results

Mid-Cycle DFAST stress test results demonstrate MUAH's capital cushion in excess of regulatory

minimums

• Severely Adverse scenario included a severe global recession, negative short-term interest rates and low long-term

Treasury rates in the U.S., a multi-family commercial real estate (CRE) price shock and a European bank failure

Note: MUAH is a standardized BHC for purposes of calculating capital levels and ratios. MUB is subject to both standardized and advanced approaches rules.

1. Represents minimum projected capital ratios from July 1, 2016 through September 30, 2018.

2. Minimum post-stress regulatory ratios as defined in the Comprehensive Capital Analysis and Review 2016 Summary Instructions, January 2016.

MUFG Americas Holdings Corporation Investor Presentation, 4Q16

Conclusion

MUAH, MUB and MUSA carry solid credit ratings and benefit from the ownership of MUFG, one of the

world’s largest financial organizations

Strong local management team with a majority of independent board members

Solid balance sheet with high-quality capital base and strong liquidity

Conservative risk culture resulting in a high quality loan portfolio with historically strong credit

performance

There are many risks facing the banking industry and MUAH; please refer to the Risk Factors on pages

18-33 of our Form 10-K for the year ended December 31, 2016.

Contacts

Mimi Mengis Doug Lambert

Managing Director Director

415-765-3182 415-765-3180

mimi.mengis@unionbank.com doug.lambert@unionbank.com