Attached files

| file | filename |

|---|---|

| EX-4.2 - EXHIBIT 4.2 - JELD-WEN Holding, Inc. | exhibit42amendedandrestate.htm |

| EX-32.1 - EXHIBIT 32.1 - JELD-WEN Holding, Inc. | exhibit321906cert.htm |

| EX-31.2 - EXHIBIT 31.2 - JELD-WEN Holding, Inc. | exhibit312mallard302cert.htm |

| EX-31.1 - EXHIBIT 31.1 - JELD-WEN Holding, Inc. | exhibit311beck302cert.htm |

| EX-23.1 - EXHIBIT 23.1 - JELD-WEN Holding, Inc. | exhibit231.htm |

| EX-10.30 - EXHIBIT 10.30 - JELD-WEN Holding, Inc. | exhibit1030sellingsharehol.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-K

____________________________

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 001-38000

____________________________

JELD-WEN Holding, Inc.

(Exact name of registrant as specified in its charter)

____________________________

Delaware (State or other jurisdiction of incorporation or organization) | 93-1273278 (I.R.S. Employer Identification No.) | |

440 S. Church Street, Suite 400

Charlotte, North Carolina 28202

(Address of principal executive offices, zip code)

(704) 378-5700

(Registrant’s telephone number, including area code)

____________________________

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock (par value $0.01 per share) | New York Stock Exchange | |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | o | |||

Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The registrant had 104,889,272 shares of Common Stock , par value $0.01 per share, issued and outstanding as of March 1, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

None

13109250.2

JELD-WEN HOLDING, Inc.

- Table of Contents –

Page No. | |

Part I. | |

Part II. | |

Item 5. Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | |

Part III. | |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | |

Part IV. | |

Item 16. Form 10-K Summary | |

2

Glossary of Terms

When the following terms and abbreviations appear in the text of this report, they have the meaning indicated below:

2015 Incremental Term Loans | $480 million incremental term loans borrowed under the Term Loan Facility in July 2015 |

2018 Annual Meeting | 2018 Annual Meeting of Shareholders |

401(k) Plan | JELD-WEN 401(k) Retirement Savings Plan |

ABL Facility | Our $300 million asset-based revolving credit facility, dated as of October 15, 2014 and as amended from time to time, with JWI and JELD-WEN of Canada, Ltd., as borrowers, the guarantors party thereto, a syndicate of lenders, and Wells Fargo Bank, National Association, as administrative agent |

Adjusted EBITDA | A supplemental non-GAAP financial measure of operating performance not based on any standardized methodology prescribed by GAAP that we define as net income (loss), as adjusted for the following items: income (loss) from discontinued operations, net of tax; gain (loss) on sale of discontinued operations, net of tax; equity earnings (loss) of non-consolidated entities; income tax benefit (expense); depreciation and amortization; interest expense, net; impairment and restructuring charges; gain (loss) on sale of property and equipment; share-based compensation expense; non-cash foreign exchange transaction/translation income (loss); other non-cash items; other items; and costs related to debt restructuring, debt refinancing, and the Onex Investment |

AICPA Practice Aid | American Institute of Certified Public Accountants Accounting & Valuation Guide, Valuation of Privately-Held-Company Equity Securities Issued as Compensation |

Amended Term Loans | November 2016 amendment to the Term Loan Facility provided for an incremental $375 million under our Term Loan Facility and (i) permitted a $400 million distribution, (ii) reduced the interest rate on the outstanding term loans, and (iii) conformed the terms of all outstanding term loans under the Term Loan Facility |

Aneeta | Aneeta Window Systems Pty. Ltd. |

ASC | Accounting Standards Codification |

ASU | Accounting Standards Update |

AUD | Australian Dollar |

Australia Senior Secured Credit Facility | Our senior secured credit facility, dated as of October 6, 2015 and as amended from time to time, with certain of our Australian subsidiaries, as borrowers, and Australia and New Zealand Banking Group Limited, as lender |

BBSY | Bank Bill Swap Bide rate |

Board | Our board of directors |

Breezway | Breezway Australia Pty. Ltd. |

Brexit | Referendum vote by the U.K. to exit the E.U. |

CAP | Cleanup Action Plan |

CD&A | Compensation Discussion & Analysis |

CHF LIBOR | Swiss Franc LIBOR interest rate |

CIBOR | Copenhagen Interbank rate |

Class B-1 Common Stock | Shares of our Class B-1 Common Stock, par value $0.01 per share, all of which was converted into shares of our common stock on February 1, 2017 |

CMI | CraftMaster Manufacturing Inc. |

COA | Consent Order and Agreement |

Code | U.S. Internal Revenue Code of 1986, as amended |

CODM | Chief operating decision maker |

Corporate Credit Facilities | Collectively, our ABL Facility and our Term Loan Facility |

Credit Facilities | Collectively, our Corporate Credit Facilities, our Australia Senior Secured Credit Facility, and our Euro Revolving Facility |

DGCL | Delaware General Corporation Law |

DKK | Danish Krone |

Dooria | Dooria AS |

EPA | U.S. Environmental Protection Agency |

3

ERISA | Employee Retirement Income Security Act of 1974, as amended |

ERP | Enterprise Resource Planning |

ESOP | JELD-WEN, Inc. Employee Stock Ownership and Retirement Plan |

E.U. | European Union |

EURIBOR | Euro interbank offered rate |

Euro Revolving Facility | Our €39 million revolving credit facility, dated as of January 30, 2015 and as amended from time to time, with JELD-WEN A/S, as borrower, Danske Bank A/S and Nordea |

Exchange Act | Securities Exchange Act of 1934, as amended |

FASB | Financial Accounting Standards Board |

FCPA | United States Foreign Corrupt Practices Act |

FIFO | First-in, first-out |

Form 10-K | This Annual Report on Form 10-K |

GAAP | Generally accepted accounting principles in the United States |

GHG | Greenhouse gasses |

Initial Term Loans | $775 million term loans borrowed under the Term Loan Facility in October 2014 |

IPO | The initial public offering of our shares, as further described in this Form 10-K |

ISO | Incentive stock options |

JELD-WEN | JELD-WEN Holding, Inc., together with its subsidiaries where the context requires, including JWI |

JEM | JELD-WEN Excellence Model |

JWA | JELD-WEN of Australia Pty. Ltd. |

JWI | JELD-WEN, Inc. |

Karona | Karona, Inc. |

KSOP | JELD-WEN, Inc. KSOP |

LaCantina | LaCantina Doors, Inc. |

LIBOR | London Interbank Offered Rate |

LIFO | Last-in, first-out |

MD&A | Management’s discussion and analysis of financial condition and results of operations |

MIP | Management Incentive Plan |

NEO | Named Executive Officer |

NIBOR | Norwegian InterBank Offered Rate |

NM | Not meaningful |

NOL | Net operating loss |

NYSE | New York Stock Exchange |

Omnibus Equity Plan | JELD-WEN Holding, Inc. 2017 Omnibus Equity Plan |

PaDEP | Pennsylvania Department of Environmental Protection |

PBGC | U.S. Pension Benefit Guaranty Corporation |

PwC | PricewaterhouseCoopers LLC |

R&R | Repair and remodel |

RCW | Roderick C. Wendt |

RI/FS | Remedial Investigation and Feasibility Study |

RLW | Richard L. Wendt |

RLW Estate | The estate of Richard L. Wendt |

RLW Trust | The Richard Lester Wendt Revocable Living Trust |

RSU | Restricted stock units |

SAR | Stock appreciation rights |

Sarbanes-Oxley | Sarbanes-Oxley Act of 2002, as amended |

SEC | Securities and Exchange Commission |

4

Securities Act | Securities Act of 1933, as amended |

Series A Convertible Preferred Stock | Our Series A-1 Convertible Preferred Stock, par value $0.01 per share, Series A-2 Convertible Preferred Stock, par value $0.01 per share, Series A-3 Convertible Preferred Stock, par value $0.01 per share, and Series A-4 Convertible Preferred Stock, par value $0.01 per share, all of which was converted into shares of our common stock on February 1, 2017 |

SG&A | Selling, general, and administrative expenses |

Steves | Steves and Sons, Inc. |

STIBOR | Stockholm InterBank Offered Rate |

Stock Incentive Plan | Amended and Restated Stock Incentive Plan |

Term Loan Facility | Our term loan facility, dated as of October 15, 2014, with JWI, as borrower, the guarantors party thereto, a syndicate of lenders, and Bank of America, N.A., as administrative agent, under which we initially borrowed $775 million of term loans, as amended (i) on July 1, 2015 in connection with the borrowing of $480 million of incremental term loans and (ii) on November 1, 2016 in connection with the borrowing of $375 million of incremental term loans, and as further amended from time to time |

Trend | Trend Windows & Doors Pty. Ltd. |

U.K. | United Kingdom |

U.S. | United States of America |

WADOE | Washington State Department of Ecology |

CERTAIN TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This Form 10-K includes trademarks, trade names, and service marks owned by us. Our U.S. window and door trademarks include JELD-WEN®, AuraLast®, MiraTEC®, Extira®, LaCANTINATM, KaronaTM, ImpactGard®, JW®, Aurora®, IWP®, and True BLUTM. Our trademarks are either registered or have been used as a common law trademark by us. The trademarks we use outside the United States include the Stegbar®, Regency®, William Russell Doors®, Airlite®, TrendTM, The Perfect FitTM, Aneeta®, Breezway®, and Corinthian® marks in Australia, and Swedoor®, Dooria®, DANA®, and Alupan® in Europe. ENERGY STAR® is a registered trademark of the United States Environmental Protection Agency. This Form 10-K contains additional trademarks, trade names, and service marks of others, which are, to our knowledge, the property of their respective owners. Solely for convenience, trademarks, trade names, and service marks referred to in this Form 10-K appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names, and service marks. We do not intend our use of other parties’ trademarks, trade names, or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

5

FORWARD-LOOKING STATEMENTS

In addition to historical information, this Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts, included in this Form 10-K are forward-looking statements. You can generally identify forward-looking statements by our use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “seek”, or “should”, or the negative thereof or other variations thereon or comparable terminology. In particular, statements about the markets in which we operate, including growth of our various markets, and our expectations, beliefs, plans, strategies, objectives, prospects, assumptions, or future events or performance contained under the headings Item 1A- Risk Factors, Item 7- Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 1- Business are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates, and projections. While we believe these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed under the headings Item 1A- Risk Factors, Item 7- Management’s Discussion and Analysis of Financial Condition and Results of Operations, and Item 1- Business, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include:

• | negative trends in overall business, financial market and economic conditions, and/or activity levels in our end markets; |

•our highly competitive business environment;

•failure to timely identify or effectively respond to consumer needs, expectations or trends;

•failure to maintain the performance, reliability, quality, and service standards required by our customers;

•failure to implement our strategic initiatives, including JEM;

•acquisitions or investments in other businesses that may not be successful;

•declines in our relationships with and/or consolidation of our key customers;

• | increases in interest rates and reduced availability of financing for the purchase of new homes and home construction and improvements; |

•fluctuations in the prices of raw materials used to manufacture our products;

•delays or interruptions in the delivery of raw materials or finished goods;

•seasonal business and varying revenue and profit;

•changes in weather patterns;

•political, economic, and other risks that arise from operating a multinational business;

•exchange rate fluctuations;

•disruptions in our operations;

•manufacturing realignments and cost savings programs resulting in a decrease in short-term earnings;

•our new Enterprise Resource Planning system that we anticipate implementing in the future proving ineffective;

•security breaches and other cybersecurity incidents;

•increases in labor costs, potential labor disputes, and work stoppages at our facilities;

• | changes in building codes that could increase the cost of our products or lower the demand for our windows and doors; |

•compliance costs and liabilities under environmental, health, and safety laws and regulations;

•compliance costs with respect to legislative and regulatory proposals to restrict emission of GHGs;

6

• | lack of transparency, threat of fraud, public sector corruption, and other forms of criminal activity involving government officials; |

•product liability claims, product recalls, or warranty claims;

•inability to protect our intellectual property;

•loss of key officers or employees;

•pension plan obligations;

•our current level of indebtedness;

•risks associated with the material weaknesses that have been identified;

•Onex’ control of us; and

•other risks and uncertainties, including those listed under Item 1A- Risk Factors.

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this Form 10-K are not guarantees of future performance and our actual results of operations, financial condition, and liquidity, and the development of the industry in which we operate, may differ materially from the forward-looking statements contained in herein. In addition, even if our results of operations, financial condition, and liquidity, and events in the industry in which we operate, are consistent with the forward-looking statements contained in this Form10-K, they may not be predictive of results or developments in future periods.

Any forward-looking statement in this Form 10-K speaks only as of the date of this Form 10-K or as of the date such statement was made. We do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Unless the context requires otherwise, references in this Form 10-K to “we,” “us,” “our,” “the Company,” or “JELD-WEN” mean JELD-WEN Holding, Inc., together with our consolidated subsidiaries where the context requires, including our wholly owned subsidiary JWI.

7

Item 1 - Business.

Our Company

We are one of the world’s largest door and window manufacturers. We design, produce, and distribute an extensive range of interior and exterior doors, wood, vinyl, and aluminum windows, and related products for use in the new construction and R&R of residential homes and, to a lesser extent, non-residential buildings.

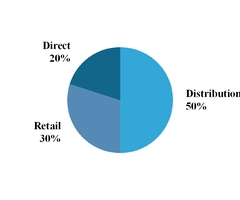

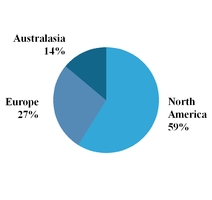

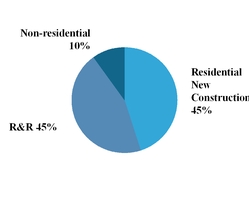

We market our products globally under the JELD-WEN brand, along with several market-leading regional brands such as Swedoor and DANA in Europe and Corinthian, Stegbar, and Trend in Australia. Our customers include wholesale distributors and retailers as well as individual contractors and consumers. As a result, our business is highly diversified by distribution channel, geography, and construction application, as illustrated in the charts below:

2016 Net Revenues $3,667 million |

Distribution Channel | Geography | Construction Application(1) | ||

(1) | Percentage of net revenues by construction application is a management estimate based on the end markets into which our customers sell. |

We operate 115 manufacturing facilities in 19 countries, located primarily in North America, Europe, and Australia. Our global manufacturing footprint is strategically sized and located to meet the delivery requirements of our customers. For many product lines, our manufacturing processes are vertically integrated, enhancing our range of capabilities, our ability to innovate, and our quality control, as well as providing us with supply chain, transportation, and working capital savings. We believe that our manufacturing network allows us to deliver our broad portfolio of products to a wide range of customers across the globe, improves our customer service, and strengthens our market positions.

Our History

We were founded in 1960 by Richard L. Wendt, when he, together with four business partners, bought a millwork plant in Oregon. The subsequent decades were a time of successful expansion and growth as we added different businesses and product categories such as interior doors, exterior steel doors, and vinyl windows. Our first overseas acquisition was Norma Doors in Spain in 1992 and since then we acquired or established numerous businesses in Europe, Australia, Asia, Canada, Mexico, and Chile, making us a truly global company.

In October 2011, certain funds managed by an affiliate of Onex Partners Manager LP and/or Onex Corporation, acquired a majority of JELD-WEN’s voting interests.

On February 1, 2017, we closed an IPO of 28,750,000 shares of our common stock at a public offering price of $23.00 per share. We sold 22,272,727 shares and Onex sold 6,477,273 shares from which we did not receive any proceeds. We received $472.8 million in proceeds, net of underwriting discounts, fees and commissions, from the shares sold by us. We used a portion of the net proceeds to us from the offering to repay $375 million of indebtedness outstanding under our Term Loan Facility. We will use remaining net proceeds to us for working capital and other general corporate purposes, including sales and marketing activities, general and administrative matters, and capital expenditures. We may also use a portion of the net proceeds to invest in or acquire complementary businesses, products, services, technologies, or other assets.

8

After completion of the IPO, Onex owns 59.9% of our outstanding common stock.

Our Products

We provide a broad portfolio of interior and exterior doors, windows, and related products, manufactured from a variety of wood, metal, and composite materials and offered across a full spectrum of price points. In the year ended December 31, 2016, our door sales accounted for 67% of net revenues, our window sales accounted for 24% of net revenues, and our other ancillary products and services accounted for 9% of net revenues.

Doors

We are a leading global manufacturer of residential doors. We offer a full line of residential interior and exterior door products, including patio doors and folding or sliding wall systems. Our non-residential door product offering is concentrated in Europe, where we are a leading non-residential door provider by net revenues in Germany, Austria, Switzerland, and Scandinavia. In order to meet the style, design, and durability needs of our customers across a broad range of price points, our product portfolio encompasses many types of materials, including wood veneer, composite wood, steel, glass, and fiberglass. Our interior and exterior residential door models generally retail at prices ranging from $30 to $40 for our most basic products to several thousand dollars for our high-end exterior doors. Our highest volume products include molded interior doors, which are made from two composite molded door skins joined by a wooden frame and filled with a hollow honey-cell core or other solid core materials. These low-cost doors are the most popular choice for interior residential applications in North America and also are prevalent in France and the U.K. In Europe, we also sell highly engineered non-residential doors, with features such as soundproofing, fire resistance, radiation resistance, and added security. We also manufacture stile and rail doors in our Southeast Asia manufacturing facilities, as well as in the U.S. through our recent acquisition of Karona. Additionally, we offer profitable value-added services in all of our markets, including pre-hanging and pre-finishing. These services are valued by labor constrained customers and allow us to capture more profit from the sale of our door products. Our newest door product offering includes folding and sliding wall systems through our recent acquisition of LaCantina, which closed in October 2015.

We manufacture our own composite molded skins for our interior door business. In the last several years, we have added significant door skin capacity into the North America market, primarily as a result of the opening of our facility in Dodson, Louisiana.

Windows

We are a leading global manufacturer of residential windows. We manufacture wood, vinyl, and aluminum windows in North America, wood and aluminum windows in Australia, and wood windows in the U.K. Our window product lines comprise a full range of styles, features, and energy-saving options in order to meet the varied needs of our customers in each of our regional end markets. For example, our high performance wood and vinyl windows with multi-pane glazing and superior energy efficiency properties are in greater demand in Canada and the northern U.S. By contrast, our lower-cost aluminum framed windows are popular in some regions of the southern U.S., while in coastal Florida certain local building codes require windows that can withstand the impact of debris propelled by hurricane-force winds. Wood windows are prevalent as a high-end option in all of our markets because they possess both insulating qualities and the beauty of natural wood. In North America our wood windows and patio doors include our proprietary AuraLast treatment, which is a unique water-based wood protection process that provides protection against wood rot and decay. We believe AuraLast is unique in its ability to penetrate and protect the wood through to the core, as opposed to being a shallow or surface-only treatment. Our newest window product offerings include sashless window systems through our recent acquisition of Aneeta, which closed in August 2015 and louver window systems through our acquisition of Breezway which closed in August 2016. Our windows typically retail at prices ranging from $100 to $200 for a basic vinyl window to over $1,000 for a custom energy-efficient wood window. We believe that our innovative energy-efficient windows position us to benefit from increasing environmental awareness among consumers and from changes in local building codes. In recognition of our expansive energy-efficient product line, we have been an ENERGY STAR partner since 1998.

Other Ancillary Products and Services

In certain regions, we sell a variety of other products that are ancillary to our door and window offerings, which we do not classify as door or window sales. These products include shower enclosures and wardrobes, moldings, trim board, lumber, cutstock, glass, staircases, hardware and locks, cabinets, and screens. Molded door skins sold to certain third-party manufacturers, as well as miscellaneous installation and other services, are also included in this category.

We sell molded door skins to certain customers pursuant to long-term contracts, and these customers in turn use the molded door skins to manufacture interior doors and compete directly against us in the marketplace. We have given notice of

9

termination of one of these contracts, pursuant to which that contract will expire at the end of its term. The counterparty to this agreement has asserted various claims against us and has filed a complaint on purported antitrust, breach of contract, breach of warranty, and tort grounds. We believe their claims lack merit and intend to defend vigorously against this action. For additional information, see Item 3 - Legal Proceedings.

Our Segments

We operate within the global market for residential and non-residential doors and windows with sales spanning 76 countries. While we operate globally, the markets for doors and windows are regionally distinct with suppliers manufacturing finished goods in proximity to their customers. Finished doors and windows are generally bulky, expensive to ship, and, in the case of windows, fragile. Designs and specifications of doors and windows also vary from country to country due to differing construction methods, building codes, certification requirements, and consumer preferences. Customers also demand short delivery times and can require special order customizations. We believe that we are well-positioned to meet the global demands of our customers due to our market leadership, strong brands, broad product line, and strategically located manufacturing and distribution facilities.

Our operations are managed and reported in three reportable segments, organized and managed principally by geographic region. Our reportable segments are North America, Europe and Australasia. We report all other business activities in Corporate and unallocated costs. Factors considered in determining the three reportable segments include the nature of business activities, the management structure accountable directly to the CODM for operating and administrative activities, the discrete financial information available and the information presented to the CODM.

North America

In our North America segment, we primarily compete in the market for residential doors and windows in the U.S. and Canada. We are the only manufacturer that offers a full line of interior and exterior door and window products, allowing us to offer a more complete solution to our customer base. We believe that our total market opportunity in North America is significantly larger and includes non-residential applications, other related building products, and value-added services. We believe that our leading position in the North American market will enable us to benefit from continued recovery in residential construction activity over the next several years.

Europe

The European market for doors is highly fragmented, and we have the only platform in the industry capable of serving nearly all European countries. In our Europe segment, we primarily compete in the market for residential and non-residential doors in Germany, the U.K., France, Austria, Switzerland, and Scandinavia. We believe that our total market opportunity in Europe is significantly larger and includes other European countries, other door product lines, related building products, and value-added services. Although construction activity in Europe has been slower to recover compared to construction activity in North America, new construction and R&R activity is expected to increase across Europe over the next several years.

Australasia

In our Australasia segment, we primarily compete in the market for residential doors and windows in Australia, where we hold a leading position by net revenues. We believe that our total market opportunity in the Australasia region is significantly larger and includes non-residential applications and other countries in the region, as well as other related building products, and value-added services. For example, we also sell a full line of shower enclosures and wardrobes throughout Australia.

Financial information regarding our segments is included in Note 20- Segment Information to our financial statements included in this Form 10-K.

Materials

Historically our sourcing function operated primarily in a regional, decentralized model. With our recent leadership transformation, we have increased our focus on making global sourcing a competitive advantage, as evidenced by our hiring in early 2016 of an experienced procurement executive to lead our global sourcing function. Under his leadership, our focus has been and will continue be on minimizing material costs through strategic global sourcing and value-added re-engineering of components. We believe leveraging our significant spending and the global nature of our purchases will allow us to achieve these goals.

10

We generally maintain a diversified supply base for the materials used in our manufacturing operations. Materials represented approximately 51% of our cost of sales in the year ended December 31, 2016. The primary materials used for our door business include wood, wood veneers, wood composites, steel, glass, internally produced door skins, fiberglass compound, and hardware, as well as petroleum-based products such as resin and binders. The primary materials for our window business include wood, wood components, glass, hardware, aluminum extrusions, and vinyl extrusions. Wood components for our window operations are sourced primarily from our own manufacturing plants, which allow us to improve margins and take advantage of our proprietary technologies such as our AuraLast wood treatment process.

We track commodities in order to understand our vendors’ costs, realizing that our costs are determined by the broader competitive market as well as by increases in the inputs to our vendors. In order to manage the risk in material costs, we develop strategic relationships with suppliers, routinely evaluate substitute components, develop new products, vertically integrate where applicable and seek alternative sources of supply from multiple vendors and often from multiple geographies.

Seasonality

In a typical year, our operating results are impacted by seasonality. Historically, peak season for home construction and remodeling in our North America and Europe segments, which represent the substantial majority of our revenues, generally corresponds with the second and third calendar quarters, and therefore our sales volume is usually higher during those quarters. Seasonal variations in operating results may be impacted by inclement weather conditions, such as cold or wet weather, which can delay construction projects.

Sales and Marketing

We actively market and sell our products directly to our customers around the world through our global sales force and indirectly through our marketing and branding initiatives. Our global sales force, which is organized and managed regionally, includes over 1,000 sales professionals. Our sales force focuses on building and maintaining relationships with key customers as well as managing customer supply needs and arranging in-store promotional initiatives. In North America, we also have a dedicated team that focuses on our large home center customers. We have recently made significant investments in tools and technologies to enhance the effectiveness of our sales force and improve ease of doing business. For example, we are in the process of deploying Salesforce.com on a global basis, which will provide us with a common global customer relationship management platform. In addition, we are in the process of simplifying our order entry process by implementing online configuration tools. We have introduced an electronic ordering system for easy order placement, and we intend to expand our online retail sales. Our new strategy also includes initiatives focused on expanding our market through the use of social media. To date, these initiatives have included hosting videos and increasing our presence on Facebook.

Consistent with our new pricing strategies, we have restructured the commission and incentive plans of our sales team to drive focus on achieving profitable growth. We have also invested significantly in our architectural sales force by adding staff and tools to increase the frequency with which our products are specified by architects. We believe these investments will increase sales force effectiveness, create pull-through demand, and optimize sales force productivity.

We believe that our broad product portfolio of both doors and windows in North America and Australasia is a competitive advantage as it allows us to cross-sell our door and window products to our end customers, many of whom find it more efficient to choose one supplier for their door and window needs on a given project. None of our primary competitors in these regions offer a similarly complete range of windows as well as interior and exterior doors.

Research and Development

Following a number of years during and after the global financial crisis of limited investment in new product development, a core element of our strategy is a renewed focus on innovation and the development of new products and technologies. We believe that leading the market in innovation will enhance demand for our products and allow us to sell a higher margin product mix. Our research and development efforts encompass new product development, derivative product development, as well as value added re-engineering of components in our existing products leading to reduced costs and manufacturing efficiencies. We have also designed a new governance process that prioritizes the most impactful projects and is expected to improve the efficiency and quality of our research and development efforts. The governance process is currently being deployed globally, such that we can leverage best practices from region to region. Additionally, a substantial driver of our 2015 and 2016 acquisition activity was increasing access to new and innovative products.

Although product specifications and certifications vary from country to country, the global nature of our operations allows us to leverage our global innovation capabilities and share new product designs across our markets. We believe that the global nature of our research and development capabilities is unique among our door and window competition. An example of global

11

sharing of innovation is the “soft close” door system, which is based on hardware originally designed and manufactured by our European operations that is now being offered in North America and Australia. Additionally, we have successfully launched new door designs into our North American and Australian markets that were originally developed in our European operations.

Customers

We sell our products worldwide to more than 20,000 customer locations. We have well-established relationships with numerous customers throughout the door and window distribution chain in each of our end markets, including retail home centers, wholesale distributors, and building product dealers that supply homebuilders, contractors, and consumers. Our wholesale customers include such industry leaders as BMC/Stock Building Supply, ProBuild/Builders First Source, American Building Supply, Saint-Gobain, and the Holzring group. Our home center customers include, among others, The Home Depot, Lowes, and Menards in North America; B&Q, Howdens, and Bauhaus in Europe; and Bunnings Warehouse in Australia. We have maintained relationships with the majority of our top ten customers for over 18 years and believe that the strength and tenure of our customer relationships is based on our ability to produce and deliver high-quality products quickly and in the desired volumes for a reasonable cost. Our top ten customers together accounted for approximately 37% of our gross revenues in the year ended December 31, 2016, and our largest customer, The Home Depot, accounted for approximately 17% of our gross revenues in the year ended December 31, 2016.

Competition

The door and window industry is highly competitive and includes a number of regional and international competitors. Competition is largely based on the functional and aesthetic quality of products, service quality, distribution capability and price. We believe that we are well-positioned in our industry due to our leading brands, our broad product lines, our consistently high product quality and service, our global manufacturing and distribution capabilities, and our extensive multi-channel distribution. For North American interior doors, our major competitors include Masonite and several smaller independent door manufacturers. For North American exterior doors, competitors include Masonite, Therma-Tru (a division of Fortune Brands), and Plastpro. The North American window market is highly fragmented, with sizable competitors including Anderson, Pella, Marvin, Ply-Gem, and Milgard (a division of Masco). The door manufacturers that we primarily compete with in our European markets include Huga, Prüm/Garant, Viljandi, Masonite, Keyor, and Herholz. The competitive landscape in Australia is varied across the door and window markets. In the Australian door market, Hume Doors is our primary competitor, while in the window, shower screen, and wardrobe markets we largely compete against a fragmented set of smaller companies.

Intellectual Property

We rely primarily on patent, trademark, copyright, and trade secret laws and contractual commitments to protect our intellectual property and other proprietary rights. Generally, registered trademarks have a perpetual life, provided that they are renewed on a timely basis and continue to be used properly as trademarks. We intend to maintain the trademark registrations listed below so long as they remain valuable to our business.

Our U.S. window and door trademarks include JELD-WEN, AuraLast, MiraTEC, Extira, LaCANTINA, Karona, ImpactGard, JW, Aurora, and IWP. Our trademarks are either registered or have long been used as a common law trademark by the Company. The trademarks we use outside the U.S. include the Stegbar, Regency, William Russell Doors, Airlite, Trend, The Perfect Fit, Aneeta, Breezway, and Corinthian marks in Australia, and Swedoor, Dooria, DANA, and Alupan in Europe.

Employees

As of December 31, 2016, we employed approximately 20,600 people. Of our total number of employees, approximately 10,700 are employed in operations included in our North America segment, approximately 6,000 are employed in operations included in our Europe segment, and approximately 3,900 are employed in operations included in our Australasia segment.

Two facilities in the U.S. are covered by collective bargaining agreements, which represent approximately 470 employees. Approximately 21% of our employees in Canada work at facilities covered by collective bargaining agreements. In total, approximately 1,100, or 11%, of our employees in the U.S. and Canada are unionized workers. As is common in Europe and Australia, the majority of our facilities there are covered by work councils and/or labor agreements. We believe we have satisfactory relationships with our employees and, to the extent applicable, with our organized labor unions.

Environmental Matters

The geographic breadth of our facilities and the nature of our operations subject us to extensive environmental, health, and safety laws and regulations in jurisdictions throughout the world. Such laws and regulations relate to, among other things, air emissions, the treatment and discharge of wastewater, the discharge of hazardous materials into the environment, the handling, storage, use and disposal of solid, hazardous and other wastes, worker health and safety, or otherwise relate to health, safety, and

12

protection of the environment. Many of our products are also subject to various laws and regulations such as building and construction codes, product safety regulations, and regulations and mandates related to energy efficiency.

The nature of our operations, which involve the handling, storage, use, and disposal of hazardous wastes, exposes us to the risk of liability and claims associated with contamination at our current and former facilities or sites where we have disposed of or arranged for the disposal of waste, or with the impact of our products on human health and safety and the environment. Laws and regulations with respect to the investigation and remediation of contaminated sites can impose joint and several liability for releases or threatened releases of hazardous materials upon statutorily defined parties, including us, regardless of fault or the lawfulness of the original activity or disposal. We have been subject to claims, including having been named as a potentially responsible party, in certain proceedings initiated pursuant to the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, and similar state and foreign laws, regulations, and statutes, and may be named a potentially responsible party in other similar proceedings in the future. Unforeseen expenditures or liabilities may arise in connection with such matters.

We have also been the subject of certain environmental regulatory actions by the EPA and state regulatory agencies in the U.S. and foreign governmental authorities in jurisdictions in which we operate, and are obligated to make certain expenditures in settlement of those actions. We do not expect expenditures for compliance with environmental laws and regulations to have a material adverse effect on our results of operations or competitive position. However, the discovery of a presently unknown environmental condition, changes in environmental requirements or their enforcement, or other unanticipated events, may give rise to unforeseen expenditures and liabilities which could be material.

For more information, see Item 1A - Risk Factors-Risks Relating to Our Business and Industry- We may be subject to significant compliance costs as well as liabilities under environmental, health, and safety laws and regulations, Item 1A - Risk Factors- Risks Relating to Our Business and Industry, Item 1A - Risk Factors- We may be subject to significant compliance costs with respect to legislative and regulatory proposals to restrict emissions of GHGs, and Item 3 - Legal Proceedings- Environmental Regulatory Actions.

Environmental Sustainability

We strive to conduct our business in a manner that is environmentally sustainable and demonstrates environmental stewardship. Toward that end, we pursue processes that are designed to minimize waste, maximize efficient utilization of materials, and conserve resources, including using recycled and reused materials to produce portions of our products. We continue to evaluate and modify our manufacturing and other processes on an ongoing basis to further reduce our impact on the environment. We believe it is important for our employees to share our commitment and we strive to recruit, educate, and train our employees in these values on an ongoing basis throughout their careers with us.

Environmental Regulatory Actions

In 2008, we entered into an Agreed Order with the WADOE to assess historic environmental contamination and remediation feasibility at our former manufacturing site in Everett, Washington. As part of this agreement, we also agreed to develop a CAP arising from the feasibility assessment. We are currently working with WADOE to finalize our RI/FS, and, once final, we will develop the CAP. We estimate the remaining cost to complete our RI/FS and develop the CAP at $0.5 million, which we have fully accrued. However, because we cannot at this time reasonably estimate the cost associated with any remedial action we would be required to undertake, we have not provided accruals for any remedial actions in our consolidated financial statements. Non-Core Everett LLC, a subsidiary of the Company, also received notice of a natural resource damage claim from the Port Gardner and Snohomish River Trustee Council in connection with this site. In September 2015 we entered into a settlement agreement pursuant to which we will pay $1.2 million to settle the claim. Of the $1.2 million, a prior insurance carrier of the site has agreed to fund $1.0 million of the settlement. All amounts related to the settlement are fully accrued and we do not expect to incur any significant further loss related to the settlement of this matter. However, should extensive remedial action be required in the future (and if insurance coverage is unavailable or inadequate), the costs associated with this site could have a material adverse effect on our results of operations and cash flows.

In 2015, we entered into a COA with the PaDEP to remove a pile of wood fiber waste from our site in Towanda, Pennsylvania, which we acquired in connection with our acquisition of CMI in 2013, by using it as fuel for a boiler at that site. The COA replaced a 1995 Consent Decree between CMI’s predecessor Masonite, Inc. and PaDEP. Under the COA, we are required to achieve certain periodic removal objectives and ultimately remove the entire pile by August 31, 2022. There are currently $10.7 million in bonds posted in connection with these obligations. If we are unable to remove this pile by August 31, 2022, then the bonds will be forfeited and we may be subject to penalties by PaDEP. We currently anticipate meeting all applicable removal deadlines; however, if our operations at this site decrease and we burn less fuel than currently anticipated then we may not be able to meet such deadlines.

13

Available Information

Our Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Exchange Act, are filed with the SEC. We are subject to the informational requirements of the Exchange Act and file or furnish reports, proxy statements and other information with the SEC. Such reports and other information filed by us with the SEC are available free of charge on our website at investors.jeld-wen.com when such reports are made available on the SEC’s website. The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

Item 1A - Risk Factors.

You should carefully consider each of the following risk factors, as well as other information contained in this Form 10-K in evaluating our Company and our business. If any of the following risks occur, our business, results of operations, and financial condition may be materially adversely affected.

Risks Relating to Our Business and Industry

Negative trends in overall business, financial market and economic conditions, and/or activity levels in our end markets may reduce demand for our products, which could have a material adverse effect on our business, financial condition, and results of operations.

Negative trends in overall business, financial market, and economic conditions globally or in the regions where we operate may reduce demand for our doors and windows, which is tied to activity levels in the R&R and new residential and non-residential construction end markets. In particular, the following factors may have a direct impact on our business in the regions where our products are marketed and sold:

• | the strength of the economy; |

• | employment rates and consumer confidence and spending rates; |

• | the availability and cost of credit; |

• | the amount and type of residential and non-residential construction; |

• | housing sales and home values; |

• | the age of existing home stock, home vacancy rates, and foreclosures; |

• | interest rate fluctuations for our customers and consumers; |

• | volatility in both debt and equity capital markets; |

• | increases in the cost of raw materials or any shortage in supplies or labor; |

• | the effects of governmental regulation and initiatives to manage economic conditions; |

• | geographical shifts in population and other changes in demographics; and |

• | changes in weather patterns. |

The global economy recently endured a significant and prolonged recession that had a substantial negative effect on sales across our end markets. In particular, beginning in mid-2006 and continuing through late-2011, the U.S. residential and non-residential construction industry experienced one of the most severe downturns of the last 40 years. While cyclicality in our new residential and non-residential construction end markets is moderated to a certain extent by R&R activity, much R&R spending is discretionary and can be deferred or postponed entirely when economic conditions are poor. We experienced sales declines in all of our end markets during this recent economic downturn.

Although conditions in the U.S. have improved in recent years, there can be no assurance that this improvement will be sustained in the near or long-term. Moreover, uncertain economic conditions continue in our Australasia segment and certain countries in our Europe segment. Negative business, financial market, and economic conditions globally or in the regions where

14

we operate may materially and adversely affect demand for our products, and our business, financial condition, and results of operations could be materially negatively impacted as a result.

We operate in a highly competitive business environment. Failure to compete effectively could cause us to lose market share and/or force us to reduce the prices we charge for our products. This competition could have a material adverse effect on our business, financial condition, and results of operations.

We operate in a highly competitive business environment. Some of our competitors may have greater financial, marketing, and distribution resources and may develop stronger relationships with customers in the markets where we sell our products. Some of our competitors may be less leveraged than we are, providing them with more flexibility to invest in new facilities and processes and also making them better able to withstand adverse economic or industry conditions.

In addition, some of our competitors, regardless of their size or resources, may choose to compete in the marketplace by adopting more aggressive sales policies, including price cuts, or by devoting greater resources to the development, promotion, and sale of their products. This could result in our loss of customers and/or market share to these competitors or being forced to reduce the prices at which we sell our products to remain competitive.

As a result of competitive bidding processes, we may have to provide pricing concessions to our significant customers in order for us to keep their business. Reduced pricing would result in lower product margins on sales to those customers. There is no guarantee that a reduction in prices would be offset by sufficient gains in market share and sales volume to those customers.

The loss of, or a reduction in orders from, any significant customers, or decreases in the prices of our products, could have a material adverse effect on our business, financial condition, and results of operations.

We may not identify or effectively respond to consumer needs, expectations, or trends in a timely fashion, which could adversely affect our relationship with customers, our reputation, the demand for our brands, products, and services, and our market share.

The quantity, type, and prices of products demanded by consumers and our customers have shifted over time. For example, demand has increased for multi-family housing units such as apartments and condominiums, which typically require fewer of our products, and we are experiencing growth in certain channels for products with lower price points. In certain cases, these shifts have negatively impacted our sales and/or our profitability. Also, we must continually anticipate and adapt to the increasing use of technology by our customers. Recent years have seen shifts in consumer preferences and purchasing practices and changes in the business models and strategies of our customers. Consumers are increasingly using the internet and mobile technology to research home improvement products and to inform and provide feedback on their purchasing and ownership experience for these products. Trends towards online purchases could impact our ability to compete as we currently sell a significant portion of our products through retail home centers, wholesale distributors, and building products dealers.

Accordingly, the success of our business depends in part on our ability to maintain strong brands, and identify and respond promptly to evolving trends in demographics, consumer preferences, and expectations and needs, while also managing inventory levels. It is difficult to successfully predict the products and services our customers will demand. Even if we are successful in anticipating consumer preferences, our ability to adequately react to and address those preferences will in part depend upon our continued ability to develop and introduce innovative, high-quality products and acquire or develop the intellectual property necessary to develop new products or improve our existing products. There can be no assurance that the products we develop, even those to which we devote substantial resources, will be successful. While we continue to invest in innovation, brand building, and brand awareness, and intend to increase our investments in these areas in the future, these initiatives may not be successful. Failure to anticipate and successfully react to changing consumer preferences could have a material adverse effect on our business, financial condition, and results of operations.

In addition, our competitors could introduce new or improved products that would replace or reduce demand for our products, or create new proprietary designs and/or changes in manufacturing technologies that may render our products obsolete or too expensive for efficient competition in the marketplace. Our failure to competitively respond to changing consumer and customer trends, demands, and preferences could cause us to lose market share, which could have a material adverse effect on our business, financial condition, and results of operations.

15

Failure to maintain the performance, reliability, quality, and service standards required by our customers, or to timely deliver our products, could have a material adverse effect on our business, financial condition, and results of operations.

If our products have performance, reliability, or quality problems, our reputation and brand equity, which we believe is a substantial competitive advantage, could be materially adversely affected. We may also experience increased and unanticipated warranty and service expenses. Furthermore, we manufacture a significant portion of our products based on the specific requirements of our customers, and delays in providing our customers the products and services they specify on a timely basis could result in reduced or canceled orders and delays in the collection of accounts receivable. Additionally, claims from our customers, with or without merit, could result in costly and time-consuming litigation that could require significant time and attention of management and involve significant monetary damages that could have a material adverse effect on our business, financial condition, and results of operations.

We are in the early stages of implementing strategic initiatives, including JEM. If we fail to implement these initiatives as expected, our business, financial condition, and results of operations could be adversely affected.

Our future financial performance depends in part on our management’s ability to successfully implement our strategic initiatives, including JEM. We have implemented many of these initiatives in North America and are beginning to implement them in Europe and Australasia. We cannot assure you that we will be able to continue to successfully implement these initiatives and related strategies throughout the geographic regions in which we operate or be able to continue improving our operating results. Similarly, these initiatives, even if implemented in all of our geographic regions, may not produce similar results. Any failure to successfully implement these initiatives and related strategies could adversely affect our business, financial condition, and results of operations. We may, in addition, decide to alter or discontinue certain aspects of our business strategy at any time.

We may make acquisitions or investments in other businesses which may involve risks or may not be successful.

Generally, we seek to acquire businesses that broaden our existing product lines and service offerings or expand our geographic reach. There can be no assurance that we will be able to identify suitable acquisition candidates or that our acquisitions or investments in other businesses will be successful. These acquisitions or investments in other businesses may also involve risks, many of which may be unpredictable and beyond our control, and which may have a material adverse effect on our business, financial condition, and results of operations, including risks related to:

• | the nature of the acquired company’s business; |

• | any acquired business not performing as well as anticipated; |

• | the potential loss of key employees of the acquired company; |

• | any damage to our reputation as a result of performance or customer satisfaction problems relating to an acquired business; |

• | the failure of our due diligence procedures to detect material issues related to the acquired business, including exposure to legal claims for activities of the acquired business prior to the acquisition; |

• | unexpected liabilities resulting from the acquisition for which we may not be adequately indemnified; |

• | our inability to enforce indemnification and non-compete agreements; |

• | the integration of the personnel, operations, technologies, and products of the acquired business, and establishment of internal controls, including the implementation of our enterprise resource planning system, into the acquired company’s operations; |

• | our failure to achieve projected synergies or cost savings; |

• | our inability to establish uniform standards, controls, procedures, and policies; |

• | the diversion of management attention and financial resources; and |

• | any unforeseen management and operational difficulties, particularly if we acquire assets or businesses in new foreign jurisdictions where we have little or no operational experience. |

Our inability to achieve the anticipated benefits of acquisitions and other investments could materially and adversely affect our business, financial condition, and results of operations.

16

In addition, the means by which we finance an acquisition may have a material adverse effect on our business, financial condition, and results of operations, including changes to our equity, debt, and liquidity position. If we issue convertible preferred or common stock to pay for an acquisition, the ownership percentage of our existing shareholders may be diluted. Using our existing cash may reduce our liquidity. Incurring additional debt to fund an acquisition may result in higher debt service and a requirement to comply with additional financial and other covenants, including potential restrictions on future acquisitions and distributions.

A decline in our relationships with our key customers or the amount of products they purchase from us, or a decline in our key customers’ financial condition, could have a material adverse effect on our business, financial condition, and results of operations.

Our business depends on our relationships with our key customers, which consist mainly of wholesale distributors and retail home centers. Our top ten customers together accounted for approximately 37% of our gross revenues in the year ended December 31, 2016, and our largest customer, The Home Depot, accounted for approximately 17% of our gross revenues in the year ended December 31, 2016. Although we have established and maintain significant long-term relationships with our key customers, we cannot assure you that all of these relationships will continue or will not diminish. We generally do not enter into long-term contracts with our customers and they generally do not have an obligation to purchase products from us. Accordingly, sales from customers that have accounted for a significant portion of our sales in past periods, individually or as a group, may not continue in future periods, or if continued, may not reach or exceed historical levels in any period. For example, certain of our large customers perform periodic line reviews to assess their product offering, which have, in the past and may in the future lead to loss of business and pricing pressures. Some of our large customers may also experience economic difficulties or otherwise default on their obligations to us. Furthermore, our pricing optimization strategy, which requires maintaining pricing discipline in order to improve profit margins, has in the past and may in the future lead to the loss of certain customers, including key customers, who do not agree to our pricing terms. The loss of, or a diminution in our relationship with any of our largest customers could lower our sales volumes, which could increase our costs and lower our profitability. This could have a material adverse effect on our business, financial condition, and results of operations.

Certain of our customers may expand through consolidation and internal growth, which may increase their buying power. The increased size of our customers could have a material adverse effect our business, financial condition, and results of operations.

Certain of our significant customers are large companies with strong buying power, and our customers may expand through consolidation or internal growth. Consolidation could decrease the number of potential significant customers for our products and increase our reliance on key customers. Further, the increased size of our customers could result in our customers seeking more favorable terms, including pricing, for the products that they purchase from us. Accordingly, the increased size of our customers may further limit our ability to maintain or raise prices in the future. This could have a material adverse effect our business, financial condition, and results of operations.

We are subject to the credit risk of our customers.

We are subject to the credit risk of our customers because we provide credit to our customers in the normal course of business. All of our customers are sensitive to economic changes and to the cyclical nature of the building industry. Especially during protracted or severe economic declines and cyclical downturns in the building industry, our customers may be unable to perform on their payment obligations, including their debts to us. Any failure by our customers to meet their obligations to us may have a material adverse effect on our business, financial condition, and results of operations. In addition, we may incur increased expenses related to collections in the future if we find it necessary to take legal action to enforce the contractual obligations of a significant number of our customers.

Increases in interest rates used to finance home construction and improvements, such as mortgage and credit card interest rates, and the reduced availability of financing for the purchase of new homes and home construction and improvements, could have a material adverse impact on our business, financial condition, and results of operations.

Our performance depends in part upon consumers having the ability to access third-party financing for the purchase of new homes and buildings and R&R of existing homes and other buildings. The ability of consumers to finance these purchases is affected by the interest rates available for home mortgages, credit card debt, lines of credit, and other sources of third-party financing. Currently, interest rates in the majority of the regions where we market and sell our products are near historic lows and will likely increase in the future. The U.S. Federal Reserve recently raised the federal funds rate for the first time in 10 years in December 2015 and again in December 2016, and has announced its intention to raise the federal funds rate three times in 2017. An increase in the federal funds rate could cause an increase in future interest rates applicable to mortgages, credit card debt, and

17

other sources of third-party financing. If interest rates increase and, consequently, the ability of prospective buyers to finance purchases of new homes or home improvement products is adversely affected, our business, financial condition, and results of operations may be materially and adversely affected.

In addition to increased interest rates, the ability of consumers to procure third-party financing is impacted by such factors as new and existing home prices, high unemployment levels, high mortgage delinquency and foreclosure rates, and lower housing turnover. Adverse developments affecting any of these factors could result in the imposition of more restrictive lending standards by financial institutions and reduce the ability of some consumers to finance home purchases or R&R expenditures.

Prices of the raw materials we use to manufacture our products are subject to fluctuations, and we may be unable to pass along to our customers the effects of any price increases.

We use wood, glass, vinyl and other plastics, fiberglass and other composites, aluminum, steel and other metals, as well as hardware and other components to manufacture our products. Materials represented approximately 51% of our cost of sales in the year ended December 31, 2016. Prices for our materials fluctuate for a variety of reasons beyond our control, many of which cannot be anticipated with any degree of reliability. Our most significant raw materials include vinyl extrusions, glass, and aluminum, each of which has been subject to periods of rapid and significant fluctuations in price. The reasons for these fluctuations include, among other things, variable worldwide supply and demand across different industries, speculation in commodities futures, general economic or environmental conditions, labor costs, competition, import duties, tariffs, worldwide currency fluctuations, freight, regulatory costs, and product and process evolutions that impact demand for the same materials.

For example, an increase in oil prices may affect the direct cost of materials derived from petroleum, most particularly vinyl. As another example, many consumers demand certified sustainably harvested wood products as concerns about deforestation have become more prevalent. Certified sustainably harvested wood historically has not been as widely available as non-certified wood, which results in higher prices for sustainably harvested wood. As more consumers demand certified sustainably harvested wood, the price of such wood may increase due to limited supply.

We have short-term supply contracts with certain of our largest suppliers that limit our exposure to short term fluctuations in prices of our materials, but we are susceptible to longer-term fluctuations in prices. We generally do not hedge against commodity price fluctuations. Significant increases in the prices of raw materials for finished goods, including as a result of significant or protracted material shortages, may be difficult to pass through to customers and may negatively impact our profitability and net revenues. We may attempt to modify products that use certain raw materials, but these changes may not be successful.

Our business may be affected by delays or interruptions in the delivery of raw materials, finished goods, and certain component parts. A supply shortage or delivery chain interruption could have a material adverse effect on our business, financial condition, and results of operations.

We rely upon regular deliveries of raw materials, finished goods, and certain component parts. For certain raw materials that are used in our products, we depend on a single or limited number of suppliers for our materials, and we typically do not have long-term contracts with our suppliers. If we are not able to accurately forecast our supply needs, our limited number of suppliers may make it difficult to quickly obtain additional raw materials to respond to shifting or increased demand. In addition, a supply shortage could occur as a result of unanticipated increases in market demand, difficulties in production or delivery, financial difficulties, or catastrophic events in the supply chain. Furthermore, because our products and the components of some of our products are subject to regulation, changes to these regulations could cause delays in delivery of raw materials, finished goods, and certain component parts.

Until we can make acceptable arrangements with alternate suppliers, any interruption or disruption could impact our ability to ship orders on time and could idle some of our manufacturing capability for those products. This could result in a loss of revenues, reduced margins, and damage to our relationships with customers, which could have a material adverse effect on our business, financial condition, and results of operations.

Our business is seasonal and revenue and profit can vary significantly throughout the year, which may adversely impact the timing of our cash flows and limit our liquidity at certain times of the year.

Our business is seasonal, and our net revenues and operating results vary significantly from quarter to quarter based upon the timing of the building season in our markets. Our sales typically follow seasonal new construction and R&R industry patterns. The peak season for home construction and R&R activity in the majority of the geographies where we market and sell our products generally corresponds with the second and third calendar quarters, and therefore our sales volume is typically higher during those

18

quarters. Our first and fourth quarter sales volumes are generally lower due to reduced R&R and new construction activity as a result of less favorable climate conditions in the majority of our geographic end markets. Failure to effectively manage our inventory in anticipation of or in response to seasonal fluctuations could negatively impact our liquidity profile during certain seasonal periods.

Changes in weather patterns, including as a result of global climate change, could significantly affect our financial results or financial condition.

Weather patterns may affect our operating results and our ability to maintain our sales volume throughout the year. Because our customers depend on suitable weather to engage in construction projects, increased frequency or duration of extreme weather conditions could have a material adverse effect on our financial results or financial condition. For example, unseasonably cool weather or extraordinary amounts of rainfall may decrease construction activity, thereby decreasing our sales. Also, we cannot predict the effects that global climate change may have on our business. In addition to changes in weather patterns, it might, for example, reduce the demand for construction, destroy forests (increasing the cost and reducing the availability of wood products used in construction), and increase the cost and reduce the availability of raw materials and energy. New laws and regulations related to global climate change may also increase our expenses or reduce our sales.

We are exposed to political, economic, and other risks that arise from operating a multinational business.

We have operations in North America, South America, Europe, Australia, and Asia. In the year ended December 31, 2016, our North America segment accounted for approximately 59% of net revenues, our Europe segment accounted for approximately 27% of net revenues, and our Australasia segment accounted for approximately 14% of our net revenues. Further, certain of our businesses obtain raw materials and finished goods from foreign suppliers. Accordingly, our business is subject to political, economic, and other risks that are inherent in operating in numerous countries.

These risks include:

• | the difficulty of enforcing agreements and collecting receivables through foreign legal systems; |

• | trade protection measures and import or export licensing requirements; |

• | the imposition of tariffs or other restrictions; |

• | required compliance with a variety of foreign laws and regulations, including the application of foreign labor regulations; |

• | tax rates in foreign countries and the imposition of withholding requirements on foreign earnings; |

• | difficulty in staffing and managing widespread operations; and |

• | changes in general economic and political conditions in countries where we operate, including as a result of the impact of Brexit. |

The success of our business depends in part on our ability to anticipate and effectively manage these and other risks. We cannot assure you that these and other factors will not have a material adverse effect on our international operations or ultimately on our global business, financial condition, and results of operations.

Brexit could have a material adverse effect on our business, financial condition, and results of operations.