Attached files

Exhibit 10.25

DRUHERT OFFICE PARATEK PHARMA LSE

OFFICE LEASE

THE HERITAGE ON THE GARDEN

BOSTON, MASSACHUSETTS

PARATEK PHARMA, LLC.

|

ARTICLE |

|

SECTION |

|

CAPTION |

|

PAGE |

|

|

|

|

|

|

|

|

|

I. |

|

|

|

Basic Lease Provisions |

|

1 |

|

|

|

1.1 |

|

Introduction |

|

1 |

|

|

|

1.2 |

|

Basic Data |

|

1 |

|

II. |

|

|

|

Description of Premises and |

|

|

|

|

|

|

|

Appurtenant Rights; Term |

|

3 |

|

|

|

2.1 |

|

Location of Premises; Term |

|

3 |

|

|

|

2.2 |

|

Appurtenant Rights and Reservations |

|

4 |

|

III. |

|

|

|

Rent |

|

5 |

|

|

|

3.1 |

|

Fixed Rent |

|

5 |

|

IV. |

|

|

|

Use of Premises |

|

5 |

|

|

|

4.1 |

|

Permitted Use |

|

5 |

|

|

|

4.2 |

|

Alterations |

|

6 |

|

V. |

|

|

|

Assignment and Subletting |

|

7 |

|

|

|

5.1 |

|

Prohibition |

|

7 |

|

VI. |

|

|

|

Delivery of Premises and Responsibility |

|

|

|

|

|

|

|

for Repairs and Condition of Premises |

|

10 |

|

|

|

6.1 |

|

Delivery of Possession of Premises |

|

10 |

|

|

|

6.2 |

|

Plans and Specifications |

|

12 |

|

|

|

6.3 |

|

Preparation of Premises |

|

12 |

|

|

|

6.4 |

|

Repairs to be Made by Landlord |

|

13 |

|

|

|

6.5 |

|

Tenant's Agreement |

|

13 |

|

|

|

6.6 |

|

Floor Load - Heavy Machinery |

|

14 |

|

VII. |

|

|

|

Services to be Furnished by Landlord and Utility Charges |

|

15 |

|

|

|

7.1 |

|

Landlord's Services |

|

15 |

|

|

|

7.2 |

|

Payment of Utility Charges |

|

15 |

|

|

|

7.3 |

|

Energy Conservation |

|

16 |

|

VIII. |

|

|

|

Real Estate Taxes and Other Expenses |

|

16 |

|

|

|

8.1 |

|

Tenant's Share of Real Estate Taxes |

|

16 |

|

|

|

8.2 |

|

Tenant's Share of Operating Expenses |

|

19 |

|

IX. |

|

|

|

Indemnity and Public Liability Insurance |

|

24 |

|

|

|

9.1 |

|

Tenant's Indemnity |

|

24 |

|

|

|

9.2 |

|

Public Liability Insurance |

|

24 |

|

|

|

9.3 |

|

Tenant's Risk |

|

25 |

|

|

|

9.4 |

|

Injury Caused by Third Parties |

|

25 |

|

X. |

|

|

|

Landlord's Access to Premises |

|

26 |

|

|

|

10.1 |

|

Landlord's Right of Access |

|

26 |

|

|

|

10.2 |

|

Exhibition of Space to Prospective |

|

|

|

|

|

|

|

Tenants |

|

26 |

|

XI. |

|

|

|

Fire, Eminent Domain, Etc. |

|

26 |

|

|

|

11.1 |

|

Damage |

|

26 |

|

|

|

11.2 |

|

Substantial Damage |

|

26 |

|

|

|

11.3 |

|

Rent Abatement |

|

27 |

|

|

|

11.4 |

|

Damage to Commercial Unit |

|

28 |

|

|

|

11.5 |

|

Definition of Substantial Damage |

|

28 |

|

|

|

11.6 |

|

Taking |

|

28 |

|

|

|

11.7 |

|

Rent Abatement |

|

29 |

|

|

|

11.8 |

|

Award |

|

29 |

|

XII. |

|

|

|

Landlord's Remedies |

|

29 |

|

|

|

12.1 |

|

Events of Default |

|

29 |

|

|

|

12.2 |

|

Remedies |

|

31 |

|

|

|

12.3 |

|

Landlord's Default |

|

32 |

|

XIII. |

|

|

|

Miscellaneous Provisions |

|

33 |

|

|

|

13.1 |

|

Extra Hazardous Use |

|

33 |

|

|

|

13.2 |

|

Waiver |

|

33 |

|

|

|

13.3 |

|

Covenant of Quiet Enjoyment |

|

34 |

|

|

|

13.4 |

|

Notice to Mortgagee and Ground Lessor |

|

35 |

|

|

|

13.5 |

|

Assignment of Rents |

|

34 |

|

|

|

13.6 |

|

Mechanics' Liens |

|

36 |

|

|

|

13.7 |

|

No Brokerage |

|

36 |

|

|

|

13.8 |

|

Invalidity of Particular Provisions |

|

36 |

|

|

|

13.9 |

|

Provisions Binding, Etc. |

|

36 |

|

|

|

13.10 |

|

Recording |

|

36 |

|

|

|

13.11 |

|

Notices |

|

37 |

|

|

|

13.12 |

|

When Lease Becomes Binding |

|

37 |

|

|

|

13.13 |

|

Paragraph Headings |

|

37 |

|

|

|

13.14 |

|

Rights of Mortgagee |

|

37 |

|

|

|

13.15 |

|

Status Report |

|

38 |

|

|

|

13.16 |

|

Security Deposit; Tenant's Financial |

|

|

|

|

|

|

|

Condition |

|

38 |

|

|

|

13.17 |

|

Additional Remedies of Landlord |

|

39 |

|

|

|

13.18 |

|

Holding Over |

|

40 |

|

|

|

13.19 |

|

Non-Subrogation |

|

40 |

|

|

|

13.20 |

|

[INTENTIONALLY DELETED] |

|

40 |

|

|

|

13.21 |

|

Governing Law |

|

40 |

|

|

|

13.22 |

|

Definition of Additional Rent |

|

40 |

|

|

|

13.23 |

|

Landlord's Fees and Expenses |

|

41 |

|

XIV. |

|

|

|

Parking |

|

41 |

|

|

|

14.1 |

|

Parking Rights |

|

41 |

|

|

|

|

|

|

|

|

|

EXHIBITS |

|

A |

|

Plan Showing Tenant's Space |

|

|

|

|

|

B |

|

Description of Lot |

|

|

|

|

|

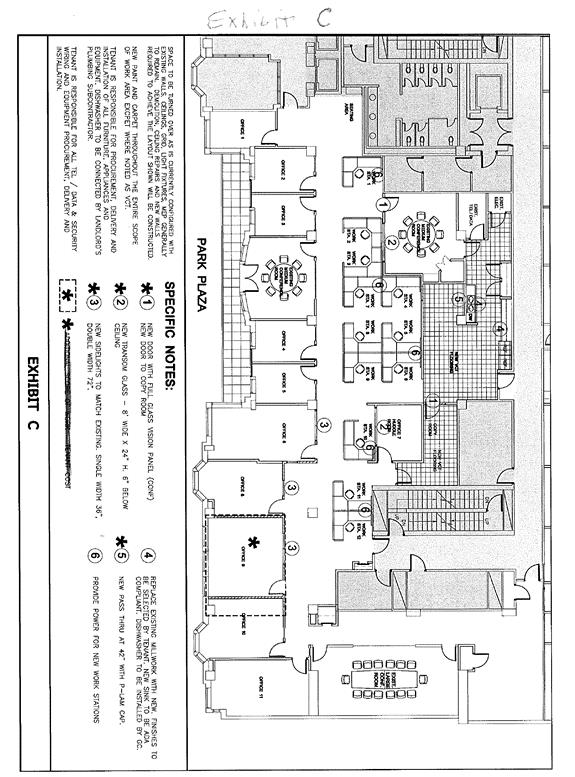

C |

|

Landlord's Work |

|

|

|

|

|

D |

|

Landlord's Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

Address for Payments |

|

|

THIS INSTRUMENT IS AN INDENTURE OF LEASE in which the Landlord and the Tenant are the parties hereinafter named, and which relates to space in the building (the “Building”) now known as The Heritage on The Garden, the office portion of which is now numbered 75 Park Plaza, and located at the southeasterly intersection of Arlington Street and Boylston Street in Boston, Massachusetts.

The parties to this instrument hereby agree with each other as follows:

ARTICLE I

BASIC LEASE PROVISIONS

|

1.1 |

INTRODUCTION. As further supplemented in the balance of this instrument and its Exhibits, the following sets forth the basic terms of this Lease and, where appropriate, constitutes definitions of certain terms used in this Lease. |

|

1.2 |

BASIC DATA. |

|

|

Date: |

April 24, 2015 |

|

, |

|

|

|

|

|

|

|

|

|

Landlord: |

|

TDC Heritage LLC; a |

|

|

|

Delaware limited liability company |

|

|

|

|

|

Present Mailing Address |

|

c/o The |

|

|

|

Druker Company, Ltd. |

|

|

|

|

|

of Landlord: |

|

50 Federal |

|

|

|

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

Suite 1000 |

|

|

|

|

|

Boston, |

|

|

|

Massachusetts 02110 |

|

|

|

|

|

|

|

|

|

|

|

Tenant: |

|

Paratek Pharma, LLC. |

|

|

|

Present Mailing Address |

||

|

|

|

of Tenant: |

|

75 Kneeland Street |

|

|

|

Boston, Massachusetts 02111 |

|

|

|

|

|

|

|

|

|

|

|

Lease Term or Term: |

|

Forty-Eight (48) |

|

|

|

calendar months (plus the partial month, if any, immediately following the Rent Commencement Date as defined Section 2.1(b)). |

|

|

|

|

|

|

|

|

|

|

|

Anticipated Delivery Date: |

|

June 30, 2015 |

|

|

|

|

|

|

|

|

|

Rent Commencement |

|

|

|

|

|

Date: |

|

Sixty (60) |

|

|

|

days after the Commencement Date. |

||

|

Fixed Rent: |

|

|

For and with respect |

|

to the first twelve (12) calendar months, plus the partial month, if any, immediately following the Rent Commencement Date at the rate of $421,408.00 per annum, payable at the rate of $35,117.33 per calendar month and proportionately at such monthly rate for any partial month. |

|||

|

|

|

|

|

|

For and with respect to the next twelve (12) calendar months of the term of this lease at the rate of $429,512.00 per annum, payable at the rate of $35,792.67 per calendar month and proportionately at such monthly rate for any partial month. |

|||

|

|

|

|

|

|

For and with respect to the next twelve (12) calendar months of the term of this lease at the rate of $437,616.00 per annum, payable at the rate of $36,468.00 per calendar month and proportionately at such monthly rate for any partial month. |

|||

|

|

|

|

|

|

For and with respect to the next twelve (12) calendar months of the term of this lease at the rate of $445,720.00 per annum, payable at the rate of $37,143.33 per calendar month and proportionately at such monthly rate for any partial month. |

|||

|

Use: |

|

For executive, |

||

|

administrative and general offices only. |

||||

|

|

|

|

||

|

Description of Space: The portion of the |

||||

|

Building located on the 4th |

||||

|

|

||||

|

(herein the “Premises”) |

|

floor as shown on |

||

|

Exhibit A attached hereto consisting of approximately 8,104 square feet of floor area. |

||||

|

Tenant's Share: |

|

4.9% |

|

|

|

|

|

|

|

|

|

Base Tax Amount: |

The Taxes for the tax |

|

|

|

period ending June 30, 2015. |

|

|

|

|

|

|

|

Base Premises Operating |

|

||

|

|

|

|

|

|

|

|

Expenses: |

The sum of (x) The |

|

|

|

Tenant’s Commercial Expenses Share of the Commercial Operating Expenses and (y) the Tenant’s Office Expenses Share of the Office Operating Expenses, in each case, for and with respect to calendar year 2015. |

|

|

Lot: |

|

|

The parcel of land described on |

|

Exhibit B hereto. |

|

|

|

|

|

|

|

|

|

Security Deposit: |

|

$250,000.00. |

|

|

|

|

|

|

|

Guarantor: |

|

Paratek Pharmaceuticals, Inc., |

|

|

|

|

a Delaware corporation. |

|

|

|

|

|

|

|

Brokers: |

|

Cushman & Wakefield of Massachusetts, Inc. |

|

|

|

|

|

|

|

|

Parking Spaces: |

Three (3) parking |

|

|

|

spaces, consisting of one individual space and two tandem spaces. |

||

ARTICLE II

DESCRIPTION OF PREMISES

AND APPURTENANT RIGHTS; TERM

|

2.1 |

LOCATION OF PREMISES; TERM. (a) Landlord hereby demises and leases to Tenant, and Tenant hereby accepts from Landlord, the Premises identified in the foregoing portions of this Lease for and during the Lease Term. |

|

(b) The Lease Term shall begin on the earlier of (i) the date the Premises are conclusively deemed delivered to Tenant in accordance with Section 6.1 hereof or (ii) the date the Tenant commences its operations at the Premises (the “Commencement Date”). The Lease Term shall continue for the period set forth in Section 1.2 hereof, unless sooner terminated as hereinafter provided, and without any right of renewal or extension, except as expressly set forth in this Lease. After the Commencement Date, upon the request of either party, Landlord and Tenant shall enter unto an instrument confirming the Commencement Date. |

|

(c) Subject to delays from causes beyond the control of Landlord or caused by the action or inaction of the Tenant, Landlord shall use reasonable speed and diligence in the construction of the Building and shall use all reasonable efforts to deliver the Premises to Tenant for its occupancy on or before the Anticipated Delivery Date. Except as expressly set forth herein, the failure to deliver the Premises to Tenant for its occupancy by the Anticipated Delivery Date shall in no way affect the validity of this Lease or the obligations of Tenant hereunder nor shall the same be construed in any way to extend the term of this Lease. If the Premises are not deemed delivered to Tenant under Section 6.1 hereof by the date which is sixty (60) days after the Anticipated Delivery Date (extended to the extent of delays from causes resulting from the action or inaction of Tenant) then Tenant shall have the right to terminate this Lease by written notice to such effect given to the Landlord before the expiration ofsuch 60 day period. |

|

2.2 |

APPURTENANT RIGHTS AND RESERVATIONS. Tenant shall have, as appurtenant to the Premises, the exclusive right to use any terrace area directly bordering on the Premises which area is accessible only through the Premises as shown on the plan annexed hereto as Exhibit A (said terrace area is to be included as part of the Premises for all purposes hereunder) and the nonexclusive right to use and to permit its invitees to use in common with others, public or common lobbies, hallways, stairways, passenger and freight elevators and sanitary facilities in the Commercial Unit, but such rights shall always be subject to reasonable rules and regulations from time to time established by Landlord by suitable notice and to the right of Landlord to designate and change from time to time areas and facilities so to be used. |

|

Excepted and excluded from the Premises are the structural roof or ceiling, the structural floor and all perimeter walls of the Premises, except in each case the inner surfaces thereof, but the entry doors to the Premises are not excluded from the Premises and are a part thereof for all purposes; and Tenant agrees that Landlord shall have the right to place in the Premises (but in such manner as to reduce to a minimum interference with Tenant's use of the Premises) utility lines, pipes and the like to serve premises other than the Premises, and to replace, maintain and repair such utility lines, pipes and the like, in, over and upon the Premises. |

|

Tenant acknowledges that, in all events, Tenant is responsible for providing security to the Premises and its own personnel, and Tenant shall indemnify, defend with counsel of Landlord's selection, and save Landlord harmless from any claim for injury to person or damage to property asserted by any personnel, employee, guest, invitee or agent of Tenant which is suffered or occurs in or about the Premises or in or about the Building by reason of the act of an intruder or any other person in or about the Premises or the Building. |

ARTICLE III

RENT

|

3.1 |

FIXED RENT. Tenant agrees to pay to Landlord, without notice, demand, or off-set or deduction, except as set forth herein, on the Rent Commencement Date and thereafter, monthly, in advance, on the first day of each and every calendar month during the Lease Term, a sum equal to the monthly Fixed Rent specified in Section 1.2 hereof. Until further notice all payments of rent hereunder shall be sent in accordance with the rent payment direction attached as Exhibit F. |

ARTICLE IV

USE OF PREMISES

|

4.1 |

PERMITTED USE. Tenant agrees that the Premises shall be used and occupied by Tenant only for the purpose specified as the use thereof in Section 1.2 of this Lease, and for no other purpose or purposes. |

|

Tenant further agrees to conform to the following provisions during the entire Lease Term: |

|

(a) Tenant shall cause all freight (including furniture, fixtures and equipment used by Tenant in the occupancy of the Premises) to be delivered to or removed from the Building and the Premises in accordance with reasonable rules and regulations established by Landlord therefor, and in accordance with the Condominium Documents (as hereinafter defined), and Landlord may require that such deliveries or removals be undertaken during periods other than Normal Building Operating Hours; |

|

sketch of the sign to be placed on such entry doors. Without limitation, lettering on windows and window displays are expressly prohibited. Tenant will not install drapes, window blinds or other window coverings on exterior windows except for those approved by Landlord and in all events all such coverings shall be of a color approved by Landlord; |

|

(c) Tenant shall not perform any act or any practice which may injure the Premises, or any other part of the Building, or cause any offensive odors or loud noise, or constitute a nuisance or a menace to any other tenant or tenants or occupants or other persons in the Building, or be detrimental to the reputation or appearance of the Building. In no event may any cooking or food preparation be carried on in the Premises without Landlord's prior consent, nor may any vending machines be installed at the Premises except those expressly approved by Landlord; |

|

(d) Tenant shall conduct Tenant's business in the Premises in such a manner that Tenant's invitees shall not collect, line up or linger in the lobby or corridors of the Building, but shall be entirely accommodated within the Premises; |

|

(e) Tenant shall comply and shall cause all employees to comply with all rules and regulations from time to time established by Landlord by suitable notice, with the Condominium Documents and with the Land Disposition Agreement, dated June 26, 1986 by and among certain parties, including the Boston Redevelopment Authority and Landlord, as in effect from time to time (the “Land Disposition Agreement”). Landlord shall not, however, be responsible for the noncompliance with any such rules, regulations, Condominium Documents and Land Disposition Agreement by any other tenant or occupant of the Building. It is understood that this lease is subject and subordinate to the Condominium Documents and all rights of Tenant hereunder shall be exercised in accordance with the Condominium Documents; |

|

(f) Tenant shall not use the name of the Building directly or indirectly in connection with Tenant's business, except as a part of Tenant's address and directing visitors to Tenant’s location in the Building, and Landlord reserves the right to change the name of the Building at any time; |

|

(g) The Tenant shall not use, handle, store, release or discharge hazardous materials, oil, or hazardous wastes in the demised premises. |

|

mechanical, electrical or plumbing system of the Building. Tenant's work as described in Article VI and all other alterations made by Tenant shall be made in accordance with all applicable laws, in a good and first-class workmanlike manner and in accordance with the requirements of Landlord's insurers and Tenant's insurers. Without limitation, said Tenant's work as described in Article VI and all other alterations made by Tenant shall be performed in accordance with the provisions of this Article IV and of Article VI. Any contractor or other person undertaking any alterations of the Premises on behalf of Tenant shall be covered by Commercial General Liability and Workmen's Compensation insurance with coverage limits acceptable to Landlord and evidence thereof shall be furnished to Landlord prior to the performance by such contractor or person of any work in respect of the Premises. All work performed by Tenant in the Premises shall remain therein (unless Landlord directs Tenant to remove the same on termination) and, at termination, shall be surrendered as a part thereof, except for Tenant's usual trade furniture and equipment, if movable, installed prior to or during the Lease Term at Tenant's cost, which trade furniture and equipment Tenant may remove upon the termination of this Lease provided that Tenant is not then in default hereunder. Until such time as any such default is cured, Landlord shall have a security interest in such trade furniture and equipment. Tenant agrees to repair any and all damage to the Premises resulting from such removal (including removal of Tenant's improvements directed by Landlord) or, if Landlord so elects, to pay Landlord for the cost of any such repairs forthwith after billing therefor. Notwithstanding the foregoing, Tenant may, without Landlord’s prior consent or approval, make cosmetic alterations (i.e., any interior alterations that are non-structural and do not affect the Building systems) that do not exceed $10,000 per project. |

ARTICLE V

ASSIGNMENT AND SUBLETTING

|

Commercial Unit (or within the prior six (6) months has been so involved) or (d) the proposed assignee or sublessee is a governmental or quasi governmental agency or authority; and notwithstanding anything to the contrary herein, Landlord may withhold, in its sole discretion, its consent to a subletting of less than all the Premises. Any assignment of this Lease (which term shall include the sale or transfer of fifty percent (50%) or more of the stock in Tenant (other than in a Financing Transaction) as set forth below), or subletting of the whole or any part of the Premises (other than as permitted to a subsidiary or a controlling corporation as set forth below) by Tenant without Landlord's express consent shall be invalid, void and of no force or effect. In any case where Landlord shall consent to such assignment or subletting, the Tenant named herein shall remain fully liable for the obligations of Tenant hereunder, including, without limitation, the obligation to pay the Fixed Rent and other amounts provided under this Lease. Any such request shall set forth, in detail reasonably satisfactory to Landlord, the identification of the proposed assignee or sublessee, its financial condition and the terms on which the proposed assignment or subletting is to be made, including, without limitation, the rent or any other consideration to be paid in respect thereto and such request shall be treated as Tenant's warranty in respect of the information submitted therewith. |

|

|

|

For the avoidance of doubt, any sale of the capital stock of the Tenant in any transaction or series of related transactions the goal of which is to finance the ongoing business and operations of the Tenant and which involve professional investors who typically invest in businesses like Tenant (a “Financing Transaction”) shall not be deemed a sublease or assignment under this Article V, provided that the management of Tenant has not changed as a result of such a financing transaction.. |

|

now or hereafter enacted and providing a plan for a debtor to settle, satisfy or extend the time for the payment of debts. Tenant shall, upon demand, reimburse Landlord for the reasonable legal fees and expenses incurred by Landlord in processing any request to assign this Lease or to sublet all or any portion of the Premises up to a maximum of $2,500, whether or not Landlord agrees thereto, and if Tenant shall fail promptly so to reimburse Landlord, the same shall be a default in Tenant's monetary obligations under this Lease. |

|

Without limiting Landlord's discretion to grant or withhold its consent to any proposed assignment or subletting, if Tenant requests Landlord's consent to assign this Lease or sublet all or any portion of the Premises, Landlord shall have the option, exercisable by written notice to Tenant given within twenty-one (21) days after Landlord's receipt of such request, to terminate this Lease as of the date specified in such notice for the entire Premises, in the case of an assignment or subletting of the whole, and for the portion of the Premises, in the case of a subletting of a portion. In the event Landlord elects to exercise the foregoing recapture right, Tenant may, within five (5) days, elect to rescind its request to such assignment of subletting of the Premises and, if such rescission is timely exercised, Landlord’s recapture shall be ineffective and this Lease shall continue in full force and effect, but Tenant may make such rescission only one (1) time during any twelve (12) month period. In the event of termination in respect of a portion of the Premises, the portion so eliminated shall be delivered to Landlord on the date specified free and clear of all occupants and their effects, broom clean and in good order and condition in the manner provided in Section 4.2 at the end of the Lease Term and Tenant shall construct demising walls at Tenant's expense in accordance with specifications made by Landlord. To the extent necessary in Landlord's judgment, Landlord, at its own cost and expense, may have access to and may make modification to the Premises so as to make such portion delivered to Landlord a self-contained rental unit with access to common areas, elevators and the like. Fixed Rent, Tenant's Share and Tenant's Office Expenses Share and Tenant's Commercial Expenses Share (as hereinafter defined) shall be adjusted on a pro rata basis according to the extent of the Premises for which the Lease is terminated. Without limitation of the rights of Landlord hereunder in respect thereto, if there is any assignment of this Lease by Tenant for consideration or a subletting of the whole of the Premises by Tenant at a rent or other consideration which exceeds the rent payable hereunder by Tenant, or if there is a subletting of a portion of the Premises by Tenant at a rent in excess of the subleased portion's pro rata share of the rent payable hereunder by Tenant, then Tenant shall pay to Landlord, as additional rent, forthwith upon Tenant's receipt of the consideration (or the cash equivalent thereof) therefor, 50% of any such excess. The provisions of this paragraph shall apply to each and every assignment of the Lease and each and every subletting of all or a portion of the Premises, whether to a subsidiary or controlling corporation of the Tenant or any other person, firm or entity, in each case on the terms and conditions set forth herein. For the purposes of this Section 5.1, the term “rent” shall mean all Fixed Rent, additional rent or other payments and/or consideration payable by one party to another for the use and occupancy of all or a portion of the Premises. |

ARTICLE VI

DELIVERY OF PREMISES AND

RESPONSIBILITY FOR REPAIRS AND

CONDITION OF PREMISES

|

Landlord’s Work has been completed in accordance with the specifications agreed to by the Landlord and Tenant (other than Punch List Items (as defined below), and (ii) the approval required for occupancy of the Premises shall be granted by the applicable authority of the City of Boston. Such facilities shall not be deemed to be unavailable if only minor or insubstantial details of construction, decoration or mechanical adjustments remain to be done or if such facilities are temporarily reduced or their availability temporarily delayed as a reasonable and necessary incident in connection with the opening of the Building. The Premises shall not be deemed to be unready for Tenant's occupancy or incomplete if only minor or insubstantial details of construction, decoration or mechanical adjustments (the “Punch List Items”) remain to be done in the Premises or any part thereof. If any delay in the availability of the Premises for occupancy is |

|

(i) due to special work (beyond that of the type, quality and quantity specified in Exhibit C), changes, alterations or additions required or made by Tenant in the layout or finish of the Premises or any part thereof; |

|

(ii) caused in whole or in part by Tenant through the delay of Tenant in submitting any plans and/or specifications, supplying information, approving plans, specifications or estimates, giving authorizations or otherwise; or |

|

(iii) caused in whole or in part by other delays and/or defaults on the part of Tenant or its contractors (the matters in these subsections i, ii and iii being sometimes referred to as “Tenant Delays”) |

|

then the Rent Commencement Date be deemed to occur on the date the Premises would have been ready except for Tenant Delays; provided however, Landlord shall still be responsible for the substantial completion of the Landlord’s Work. |

|

If as hereinabove provided the Premises are so deemed ready for Tenant's occupancy prior to the time they are actually ready for Tenant's occupancy, Tenant shall not (except with Landlord's consent) be entitled to take possession of the Premises for use as set forth herein until the Premises are in fact actually ready for such occupancy, notwithstanding the fact because the Premises shall have as above stated been deemed ready for such occupancy that the term hereof shall on that account have commenced. |

|

Any of Landlord's work in the Premises not fully completed on the commencement date of the term hereof shall thereafter be so completed with reasonable diligence by Landlord. |

|

6.3. |

PREPARATION OF PREMISES. |

|

(a) By Landlord. Except as may be otherwise approved in writing by the Landlord, all work necessary to prepare the Premises for Tenant's occupancy, including work to be performed at Tenant's expense, shall be performed by contractors employed by and paid by Landlord and shall be conducted in compliance with all applicable laws, rules, regulations and codes. |

|

(b) All of the Landlord’s Work shall be done at Landlord’s sole cost and expense, except that on the Commencement Date Tenant shall pay to Landlord $40,000.00 to reimburse Landlord for certain of such costs. |

|

(c) If any work including but not by way of limitation, installation of building equipment by the manufacturer or distributor thereof, shall be performed by contractors not employed by Landlord, Tenant shall take all reasonable measures to the end that such contractor shall cooperate in all ways with Landlord's contractors to avoid any delay to the work being performed by Landlord's contractors in the Premises or elsewhere in the Building or conflict in any other way with the performance of such work. |

|

(d) All materials and workmanship to be furnished and installed by Landlord shall be in accordance with the building standard as detailed and defined in Exhibit C. Tenant shall bear all other costs of preparing the Premises for its occupancy in accordance with the Plans including without limitation, the cost of substitutes for, or quantities in excess of, any items specified in Exhibit C, and such cost in the case of work performed by Landlord on behalf of Tenant, at Tenant's expense, shall be increased by 10% for Landlord's overhead. |

|

(e) Any actual additional cost to Landlord in connection with the completion of the Premises in accordance with the terms of this Lease (including Exhibit C) resulting from Tenant Delays shall be promptly paid by Tenant to Landlord. For the purposes of the next preceding sentence, the term “additional cost to Landlord” shall mean the cost over and above such cost as would have been the aggregate cost to Landlord of completing the Premises in accordance with the terms of this Lease and Exhibit C had there been no Tenant Delays, as such cost is determined by Landlord's architect. Nothing contained in this provision shall limit or qualify or prejudice any other covenants, agreements, terms, provisions and conditions contained in this Lease. |

|

(f) With Landlord's prior written consent, Tenant shall have the right to enter the Premises prior to the Commencement Date, without payment of rent, to perform such work or decoration as to be performed by, or under the direction or control of, Tenant. Such right of entry shall be deemed a license from Landlord to Tenant and any entry thereunder shall be at the risk of Tenant. |

|

(g) Tenant shall be conclusively deemed to have agreed that Landlord has performed all of its obligations under this Article VI unless not later than the end of the second calendar month next beginning after the Commencement Date, Tenant shall give Landlord written notice specifying the respects in which Landlord has not performed any such obligation. |

|

6.4 |

REPAIRS TO BE MADE BY LANDLORD. Except as otherwise provided in this Lease and to the extent the obligation to maintain the same is the responsibility of the Landlord under the Condominium Documents, Landlord agrees to keep in good order, condition and repair the common areas of the commercial portions of the Building (including, but not limited to, the base Building systems), insofar as any of the foregoing affects the Premises and any damage cause by Landlord’s negligence or willful misconduct subject to the provisions of Section 13.19. Landlord shall in no event be responsible to Tenant for the condition of glass in and about the Premises or for the doors leading to the Premises, or for any condition in the Premises or the Building caused by any act or neglect of Tenant or any contractor, agent, employee or invitee of Tenant, or anyone claiming by, through or under Tenant, or for any condition of the Building which is not the responsibility of the Landlord under the Condominium Documents. Landlord shall not be responsible to make any improvements or repairs to the Building or the Premises other than as expressed in this Section 6.4 unless otherwise expressly provided in this Lease. |

|

Landlord shall never be liable for any failure to make repairs which, under the provisions of this Section 6.4 or elsewhere in this Lease, Landlord has undertaken to make unless: (a) Tenant has given notice to Landlord of the need to make such repairs as a result of a condition in the Building or in the Premises requiring any repair for which Landlord is responsible; and (b) Landlord has failed to commence to make such repairs within a reasonable time after receipt of such notice if any repairs are, in fact, necessary. |

|

limitation, Tenant shall maintain and use the Premises in accordance with all applicable laws, ordinances, governmental rules and regulations, directions and orders of officers of governmental agencies having jurisdiction and in accordance with the requirements of Landlord's and/or Tenant's insurers, and shall, at Tenant's own expense, obtain and maintain in effect all permits, licenses and the like required by applicable law. Tenant shall not permit or commit any waste, and Tenant shall be responsible for the cost of repairs which may be made necessary by reason of damage to any areas in the Building, including the Premises, by Tenant, Tenant's contractors or Tenant's agents, employees or invitees, or anyone claiming by, through or under Tenant. Landlord may replace as needed any bulbs and ballasts in the Premises during the Lease Term at Tenant's cost and expense, or Landlord may require Tenant to replace the same, at Tenant's cost and expense. |

|

If repairs are required to be made by Tenant pursuant to the terms hereof, Landlord may demand that Tenant make the same forthwith, and if Tenant refuses or neglects to commence such repairs and complete the same with reasonable dispatch after such demand, Landlord may (but shall not be required to do so) make or cause such repairs to be made and shall not be responsible to Tenant for any loss or damage that may accrue to Tenant's stock or business by reason thereof. If Landlord makes or causes such repairs to be made, Tenant agrees that Tenant will forthwith, on demand, pay to Landlord the cost thereof, and if Tenant shall default in such payment, Landlord shall have the remedies provided for the nonpayment of rent or other charges payable hereunder. |

|

6.6 |

FLOOR LOAD - HEAVY MACHINERY. Tenant shall not place a load upon any floor in the Premises exceeding the lesser of (a) the floor load per square foot of area which such floor was designed to carry as certified by Landlord's architect and (b) the floor load per square foot of area which is allowed by law. Landlord reserves the right to prescribe the weight and position of all business machines and mechanical equipment, including scales, which shall be placed so as to distribute the weight. Business machines and mechanical equipment shall be placed and maintained by Tenant at Tenant's expense in settings sufficient, in Landlord's judgment, to absorb and prevent vibration, noise and annoyance. Tenant shall not move any safe, heavy machinery, heavy equipment, freight, bulky matter or fixtures into or out of the Building without Landlord's prior consent. |

|

If such safe, machinery, equipment, freight, bulky matter or fixtures requires special handling, Tenant agrees to employ only persons holding a Master Rigger's License to do said work, and that all work in connection therewith shall comply with applicable laws and regulations. Any such moving shall be at the sole risk and hazard of Tenant and Tenant will exonerate, indemnify and save Landlord harmless against and from any liability, loss, injury, claim or suit resulting directly or indirectly from such moving. Tenant shall schedule such moving at such times as Landlord shall require for the convenience of the normal operations of the Building. |

ARTICLE VII

SERVICES TO BE FURNISHED BY LANDLORD AND UTILITY

CHARGES

|

7.1 |

LANDLORD'S SERVICES. Landlord covenants during the Lease Term during Normal Building Operating Hours: |

|

(1) to provide heating and air-conditioning in the Premises during the normal heating and air-conditioning seasons; |

|

|

(2) to furnish cold water for ordinary toilet, lavatory and drinking purposes. If Tenant requires water for any other purpose, including without limitation, in connection with the business conducted in the Premises, Tenant shall pay the Landlord a fair and equitable charge therefor determined by Landlord to reimburse Landlord for the cost of such water and related sewer use charge (including a charge to reimburse Landlord for the cost of metering Tenant's usage); |

|

(3) to furnish non-exclusive passenger elevator service; |

|

(4) to provide non-exclusive freight elevator service, subject to scheduling by Landlord; |

|

(5) to furnish, through Landlord's employees or independent contractors, the cleaning services listed in Exhibit D, if any; and |

|

(6) to furnish, through Landlord's employees or independent contractors, additional Building operation services (additional in terms of quality and/or quantity to those otherwise required to be provided to Tenant hereunder) upon reasonable advance request of Tenant at rates from time to time established by Landlord (currently $45 per hour, but subject to change) to be paid by Tenant provided the same may be reasonably and conveniently provided by Landlord. Tenant hereby agrees to pay to Landlord the cost of such services as additional rent upon demand by Landlord. |

|

when monthly Fixed Rent is next due and thereafter on Landlord's demand, an amount reasonably estimated by Landlord to be sufficient to discharge any such lien in the event of a further failure of Tenant to pay any such electric charges when due. Landlord shall hold the amounts from time-to-time deposited under this Section 7.2 as security for payment of such electric charges and may, without limitation of remedies on account of Tenant's failure to make any subsequent payment of electric charges, use such amounts for such payments. Such amount or such portion thereof as shall be unexpended at the expiration of this Lease shall, upon full performance of all Tenant's obligations hereunder, be repaid to Tenant without interest. |

|

If the Premises are not separately metered, Tenant shall pay to Landlord, within ten (10) days after Landlord's statement therefor is delivered to Tenant (which shall include reasonable documentation of how such amount was calculated), Tenant's pro rata share (as determined by Landlord) of electric charges for the period in question in respect of such areas of the Building which include the Premises. Landlord reserves the right to require Tenant to install, at Tenant's cost and expense, a separate electric meter for the Premises in the event Landlord determines that Tenant's use of electricity exceeds, on a per square foot basis, the use of electricity by other occupants of the area involved. |

|

7.3. |

ENERGY CONSERVATION. Notwithstanding anything to the contrary in this ARTICLE VII or elsewhere in this Lease, Landlord shall have the right to institute such policies, programs and measures as may be necessary or desirable, in Landlord's discretion, for the conservation and/or preservation of energy or energy related services, or as may be required to comply with any applicable codes, rules and regulations, whether mandatory or voluntary. |

ARTICLE VIII

REAL ESTATE TAXES AND OTHER EXPENSES

|

8.1 |

TENANT'S SHARE OF REAL ESTATE TAXES. |

|

(a) For the purposes of this Section: |

|

(i) The term “Tax Period” shall mean the period during which Taxes (as hereinafter defined) are required to be paid under applicable law. Thus, under the law presently in effect in the Commonwealth of Massachusetts, Tax Period means the period from July 1 of a calendar year to June 30 of the subsequent calendar year. Suitable adjustment in the determination of Tenant's obligation under this Section 8.1 shall be made in the computation for any Tax Period which is greater than or less than twelve (12) full calendar months. |

|

(iii) The term “Taxes” shall mean all real estate taxes and assessments (which term, for purposes of this provision, shall include water and sewer use charges), special or otherwise, levied or assessed upon or with respect to the Commercial Unit or any part thereof and all ad valorem taxes for any personal property of Landlord used in connection therewith. Should the Commonwealth of Massachusetts, or any political subdivision thereof, or any other governmental authority having jurisdiction over the Commercial Unit, (1) impose a tax, assessment, charge or fee, which Landlord shall be required to pay, by way of substitution for or as a supplement to such real estate taxes and ad valorem personal property taxes, or (2) impose an income or franchise tax or a tax on rents in substitution for or as a supplement to a tax levied against the Commercial Unit or any part thereof and/or the personal property used in connection with the Commercial Unit or any part thereof, all such taxes, assessments, fees or charges (hereinafter defined as “in lieu of taxes”) shall be deemed to constitute Taxes hereunder. Taxes shall also include, in the year paid, all fees and costs incurred by Landlord in seeking to obtain a reduction of, or a limit on the increase in, any Taxes, regardless of whether any reduction or limitation is obtained. Except as hereinabove provided with regard to “in lieu of taxes”, Taxes shall not include any inheritance, estate, succession, transfer, gift, franchise, net income or capital stock tax. |

|

(b) Beginning on the Rent Commencement Date, in the event that the Taxes imposed with respect to the Commercial Unit shall be greater during any Tax Period than the Base Tax Amount: |

|

(i) Tenant shall pay to Landlord, as additional rent, Tenant's Share of the amount by which the Taxes imposed with respect to the Commercial Unit for such Tax Period exceed the Base Tax Amount, apportioned for any fraction of a Tax Period contained within the Term, and |

|

(ii) Landlord shall submit to Tenant a statement setting forth the amount of such additional rent, and within ten (10) days after the delivery of such statement (whether or not such statement shall be timely), Tenant shall pay to Landlord the payment required under subparagraph (i) above. So long as Taxes shall be payable in installments under applicable law, Landlord may submit such statements to Tenant in similar installments. The failure by Landlord to send any statement required by this subparagraph shall not be deemed to be a waiver of Landlord’s right to send such statement. |

|

(c) Tenant's payment in respect of increases in Taxes shall be equitably adjusted for and with respect to any portion of the Term which does not include an entire Tax Period. |

|

(d) If Tenant is obligated to pay any additional rent as aforesaid with respect to any Tax Period or fraction thereof during the Term, then Tenant shall pay, as additional rent, on the first day of each month of the next ensuing Tax Period, estimated monthly tax escalation payments in an amount from time to time estimated by Landlord to be sufficient to provide Landlord, in the aggregate, a sum equal to Tenant's Share of the Taxes in excess of the Base Tax Amount, ten (10) days, at least, before the day on which payments on account of Taxes by Landlord would become delinquent. Estimated monthly tax escalation payments for each ensuing Tax Period shall be made retroactively to the first day of the Tax Period in question. Following the close of each Tax Period for and with respect to which Tenant is obligated to pay any additional rent as aforesaid, Landlord shall submit the statement set forth in paragraph (b)(ii) of this Section 8.1 and in the event the total of the estimated monthly tax escalation payments theretofore made by Tenant to Landlord for such Tax Period does not equal Tenant's Share of the Taxes in excess of the Base Tax Amount for such Tax Period, Tenant shall pay any deficiency to Landlord as shown by such statement within ten (10) days after the delivery of such statement (whether or not such statement shall be timely). If the total of the estimated monthly tax escalation payments paid by Tenant during such Tax Period exceed the actual amount of Tenant's Share of the Taxes in excess of the Base Tax Amount for said Tax Period, Landlord shall credit the amount of such overpayment against subsequent obligations of Tenant for additional rent under this Lease (or refund such overpayment if the Term has ended and Tenant has no further obligations to Landlord under the Lease). |

|

(e) When the applicable tax bill is not available prior to the end of the Term, then a tentative computation shall be made by Landlord on the basis of the Taxes for the next prior Tax Period, with a final adjustment to be made between Landlord and Tenant promptly after Landlord shall have received the applicable tax bill. |

|

(f) Payments by Tenant to Landlord on account of Taxes shall not be considered as being held in trust, in escrow or the like, by Landlord; it being the express intent of Landlord and Tenant that Tenant shall in no event be entitled to receive interest upon, or any payments on account of earnings or profits derived from, such payments by Tenant to Landlord. Landlord shall have the same rights and remedies for the non-payment by Tenant of any amounts due on account of such Taxes as Landlord has hereunder for the failure of Tenant to pay the Fixed Rent. |

|

(g) It is understood that the foregoing provisions of this Section 8.1 are predicated upon the inclusion of the Premises as part of a single Commercial Unit within the Condominium and with the continued existence of the Condominium. If at any time during the Lease Term the Building and Lot are not taxed on a Condominium basis, then during such time for the purposes of this Section 8.1 “Taxes” shall mean the product of (i) such taxes, assessments, payments, charges, fees and costs of the type described in subsection (a) of this Section 8.1 assessed against the Building and Lot and the personal property of Landlord therein multiplied by (ii) the percentage interest of the Commercial Unit in the Condominium as set forth in the Condominium Documents. Should the Commercial Unit be divided into more than one condominium unit within the Condominium then the Base Tax Amount and the Tenant's Share shall be adjusted to take into account such division as reflected by the applicable percentage interest in the Condominium of the unit in which the Premises are located and the proportionate area of the Premises in such unit, and the Tenant shall pay its share of the increase in Taxes in respect of the unit in which the Premises are located over and above the Base Tax Amount as determined for such unit. |

|

8.2 |

TENANT'S SHARE OF OPERATING EXPENSES. |

|

(a) For the purposes of this Section: |

|

(i) The term “Operating Year” shall mean each successive fiscal year (as adopted by Landlord) in which any part of the Term of this Lease shall fall. |

|

B. Principal or interest payments on loans secured by mortgages or trust deeds on the Commercial Unit and/or on the Building and/or Lot; |

|

C. Any portion of such common expenses incurred in the maintenance and operation of the below-grade parking garage facilities of the Condominium; and |

|

D. Such of the foregoing expenses which are paid or incurred by Landlord (i) for cleaning and maintaining the premises in the Commercial Unit devoted solely to office uses, (ii) in furnishing security services exclusively for the benefit of said office premises, and (iii) in furnishing heating, ventilating and air-conditioning to and exclusively for the benefit of said office premises, (however, the expenses, relating to the cooling tower and condenser water system and other services, systems and equipment serving or for the benefit of both said office premises and the retail and service portions of the Commercial Unit shall be included in Commercial Operating Expenses), and (iv) such other services which are provided exclusively to and for the benefit of the office portion of the Commercial Unit. Such expenses being excluded from “Commercial Operating Expenses” under this subsection D are hereinafter sometimes referred to as “Office Operating Expenses”. |

|

(iii) The term “Tenant's Commercial Expenses Share” shall mean the fraction, the numerator of which is 8,104 (being the agreed upon gross leaseable floor area of the Premises), and the denominator of which is the greater of (i) the total square footage of leased floor area |

|

within the Commercial Unit as of the first day of the calendar year to which the costs and expenses relate and (ii) ninety-five percent (95%) of the total gross leaseable floor area within the Commercial Unit as of the first day of such calendar year to which such costs and expenses relate. |

|

(v) There shall be excluded from the denominator of any such fraction in subsections (iii) and (iv) above one-half (1/2) of the gross leasable floor area of all space in the Commercial Unit below the first (street floor) level. |

|

If less than 95% of the Commercial Unit's rentable area shall have been occupied by tenant(s) at any time during any Operating Year, Commercial Operating Expenses and Office Operating Expenses (to the extent applicable) shall be determined for such Operating Year to be an amount equal to the like expense which would normally be expected to be incurred had such occupancy been 95% throughout such Operating Year. |

|

(b) After the expiration of each Operating Year, Landlord shall furnish Tenant with a statement setting forth the Tenant's Commercial Expenses Share of the Commercial Operating Expenses for such Operating Year and the Tenant's Office Expenses Share of the Office Operating Expenses for such year. Such statement shall be accompanied by a computation of the amount, if any, of the additional rent payable to Landlord pursuant to this Section. |

|

(c) In the event the total of (i) the Tenant's Commercial Expenses Share of the Commercial Operating Expenses during any Operating Year and (ii) the Tenant's Office Expenses Share of the Office Operating Expenses for such year shall exceed the Base Premises Operating Expenses, then beginning on the Rent Commencement Date, Tenant shall pay to Landlord, as additional rent, an amount equal to such excess. |

|

(d) Said additional rent shall, with respect to the Operating Years in which the Rent Commencement Date and end of the Term of this Lease fall, be adjusted to that proportion thereof as the portion of the Term of this Lease falling within such Operating Year bears to the full Operating Year. If Landlord shall change its fiscal year, appropriate adjustment shall be made for any Operating Year less than twelve months which may result. |

|

(f) If with respect to any Operating Year or fraction thereof during the Term, Tenant is obligated to pay any additional rent in respect of increases in such operating expenses as aforesaid, then Tenant shall pay, as additional rent, on the first day of each month of the next ensuing Operating Year, estimated monthly operating escalation payments in an amount from time to time estimated by Landlord to be sufficient to cover, in the aggregate, a sum equal to the excess of (i) the total of (x) Tenant's Commercial Expenses Share of the Commercial Operating Expenses and (y) Tenant's Office Expenses Share of the Office Operating Expenses over (ii) the Base Premises Operating Expenses for the next ensuing Operating Year. Estimated monthly operating escalation payments for each ensuing Operating Year shall be made retroactively to the first day of the Operating Year in question. If the estimated monthly operating escalation payments theretofore made for such Operating Year by Tenant are greater than the amount due as additional rent in respect thereof according to the statement furnished Tenant by Landlord pursuant to paragraph (b) of this Section 8.2, Landlord shall credit the amount of such overpayment against subsequent obligations of Tenant for additional rent under this Lease (or refund such overpayment if the Term has ended and Tenant has no further obligation to Landlord under the Lease); but if such amount due as such additional rent for said Operating Year is greater than the estimated monthly operating escalation payments theretofore made on account of such period, Tenant shall make suitable payment to Landlord within the time set forth in paragraph (e) of this Section 8.2. |

|

(g) Tenant acknowledges that if Landlord is not furnishing any particular work or service, the cost of which, if performed by Landlord, would be included in either Commercial or Office Operating Expenses, to any tenant who has undertaken to perform such work or service in lieu of the performance thereof by Landlord, such operating expenses shall be deemed for purposes of determining such operating expenses under this Section to be increased by an amount equal to the additional operating expenses which would reasonably have been incurred during such period by Landlord if it had at its own expense furnished such work or service to such tenant. |

|

add to, subtract from, lease, license, relocate and/or otherwise use (temporarily and/or permanently), any improvements, kiosks or other structures, parking areas, sidewalks or other such common areas of facilities anywhere upon or within the Commercial Unit for office, retail, or such other purposes as the Landlord shall determine. Nothing herein shall limit the right of the Landlord to change the use to which any part of the Commercial Unit or any other portions of the Building will be used from the purposes specified herein or as originally specified in the Condominium Documents. |

|

|

(i) |

Upon at least thirty (30) days’ advance notice and during normal business hours, Tenant shall have the right to audit Landlord’s books and records regarding the calculation of Operating Expenses and Taxes and the allocation of Tenant’s share of same. Tenant shall be able to hire an independent auditor to conduct such audit (provided the compensation of such auditor shall not be on a contingency basis). Tenant shall only audit each calendar year once. Tenant shall maintain the confidentiality of any information obtained as the result of such audit. |

ARTICLE IX

INDEMNITY AND PUBLIC LIABILITY INSURANCE

|

9.1 |

TENANT'S INDEMNITY. To the maximum extent this agreement may be made effective according to law, and exepting claims resulting from Landlord’s negligence or willful misconduct, Tenant agrees to indemnify and save harmless Landlord from and against all claims of whatever nature arising from any act, omission or negligence of Tenant, or Tenant's contractors, licensees, invitees, agents, servants or employees, or arising from any accident, injury or damage whatsoever caused to any person, or to the property of any person, occurring after the commencement of construction work by Tenant, and until the end of the Lease Term and thereafter, so long as Tenant is in occupancy of any part of the Premises, within the Premises, or arising from any accident, injury or damage occurring outside of the Premises, where such accident, damage or injury results or is claimed to have resulted from an act or omission on the part of Tenant or Tenant's agents, employees, independent contractors or invitees. |

|

This indemnity and hold harmless agreement shall include indemnity against all costs, expenses and liabilities incurred in or in connection with any such claim or proceeding brought thereon, and the defense thereof. |

|

time in the jurisdiction in which the Premises are located. The minimum limits of liability of such insurance shall be $3 million per occurrence, Bodily Injury Liability (including death), and $1,000,000 per occurrence, Property Damage Liability, or shall be for such higher limits, if directed by Landlord, as are customarily carried in that area in which the Building is located upon first class office buildings. Such insurance shall be on an occurrence form and non-contributory. |

|

The policy shall also include, but shall not be limited to, the following extensions of coverage: |

|

(i) Contractual Liability, covering Tenant's liability assumed under this Lease; |

|

(ii) Personal Injury Liability in the amount of $3 million annual aggregate, expressly deleting the exclusion relating to contractual assumptions of liability; |

|

(iii) Civil Assault and Battery coverage. |

|

Tenant further agrees to maintain a Workers' Compensation and Employers' Liability Insurance policy. The limit of liability as respects Employers' Liability coverage shall be no less than $100,000 per accident. |

|

Except for Workers' Compensation and Employers' Liability coverage, Tenant agrees that Landlord (and such other persons as are in privity of estate with Landlord as may be set out in notice from time to time) are named as additional insureds. Further, all policies shall be noncancellable with respect to Landlord and Landlord's said designees without 30 days' prior written notice to Landlord. A duplicate original or a Certificate of Insurance evidencing the above agreements shall be delivered to Landlord upon the execution of this Lease. |

|

9.3 |

TENANT'S RISK. To the maximum extent this agreement may be made effective according to law, Tenant agrees to use and occupy the Premises and to use such other portions of the Building as Tenant is herein given the right to use at Tenant's own risk; and Landlord shall have no responsibility or liability for any loss of or damage to fixtures or other personal property of Tenant for any reason whatsoever. The provisions of this Section shall be applicable from and after the execution of this Lease and until the end of the Lease Term, and during such further period as Tenant may use or be in occupancy of any part of the Premises or of the Building. |

|

acts or omissions of persons occupying adjoining premises or any part of the premises adjacent to or connecting with the Premises or any part of the Building, or otherwise or for any loss or damage resulting to Tenant or those claiming by, through or under Tenant, or its or their property, from the breaking, bursting, stopping or leaking of electric cables and wires, water, gas, sewer or steam pipes, and from roof leaks and the like. |

ARTICLE X

LANDLORD'S ACCESS TO PREMISES

|

10.1 |

LANDLORD'S RIGHT OF ACCESS. Landlord shall have the right to enter the Premises upon reasonable advance notice, except in case of an emergency, at all reasonable business hours and after normal business hours for the purpose of inspecting or making repairs to the same, and Landlord shall also have the right to make access upon reasonable advance notice available at all reasonable hours to prospective or existing mortgagees or purchasers of any part of the Building. Tenant shall have the right to have one of its personnel accompany any visitors on the Premises. |

|

10.2 |

EXHIBITION OF SPACE TO PROSPECTIVE TENANTS. For a period of nine (9) months prior to the expiration of the Lease Term, Landlord may have reasonable access to the Premises upon reasonable advance written notice, at all reasonable hours for the purpose of exhibiting the same to prospective tenants, and may post suitable notice on the Premises advertising the same for rent. Tenant shall have the right to have one of its personnel accompany any visitors on the Premises. |

ARTICLE XI

FIRE, EMINENT DOMAIN, ETC.

|

11.1 |

DAMAGE. In case during the term hereof the Premises shall be partially damaged (as distinguished from “substantially damaged”, as that term is hereinafter defined) by fire or other casualty, the Landlord shall forthwith proceed to repair such damage and restore the Premises at its cost (and not at Tenant's expense), to substantially their condition at the time of such damage, but the Landlord shall not be responsible for any delay which may result from any cause beyond the Landlord's reasonable control. Nothing contained in this Article XI shall require Landlord to restore any damage to Tenant’s fixtures, furniture, other personal property or improvements. |

|

such damage and the determination of the net amount of insurance proceeds available to the Landlord, expend so much as may be necessary of such net amount to restore, at its cost (and not at Tenant's expense) (consistent, however, with zoning laws and building codes then in existence), the Premises (and not at Tenant's expense) to substantially the condition in which such portion of the Premises was in at the time of such damage, except as hereinafter provided, but the Landlord shall not be responsible for delay which may result from any cause beyond the reasonable control of the Landlord. Should the net amount of insurance proceeds available to the Landlord be insufficient to cover the cost of restoring the Premises, in the reasonable estimate of the Landlord, the Landlord may, but shall have no obligation to, supply the amount of such insufficiency and restore the Premises with all reasonable diligence or the Landlord may terminate this lease by giving notice to the Tenant not later than a reasonable time after the Landlord has determined the estimated net amount of insurance proceeds available to the Landlord and the estimated cost of such restoration. In case of substantial damage or destruction, as a result of a risk which is not covered by the Landlord's insurance, the Landlord shall likewise be obligated to rebuild the Premises, all as aforesaid, unless the Landlord, within a reasonable time after the occurrence of such event, gives written notice to the Tenant of the Landlord's election to terminate this lease. |

|

However, if the Premises shall be substantially damaged or destroyed by fire, windstorm, or otherwise within the last year of the term of this Lease or if the Premises cannot be restored for occupancy by Tenant within 270 days following the date of such casualty, either party shall have the right to terminate this lease, provided that notice thereof is given to the other party not later than sixty (60) days after such damage or destruction. If said right of termination is exercised, this lease and the term hereof shall cease and come to an end as of the date of said damage or destruction. |

|

Unless this lease is terminated as provided in this Section 11.2, or in Section 11.4, if the Premises shall be damaged or destroyed by fire or other casualty, then the Tenant shall (i) repair and restore all portions of the Premises not required to be restored by the Landlord pursuant to this Article XI to substantially the condition which such portions of the Premises were in at the time of such casualty, (ii) equip the Premises with trade fixtures and all personal property necessary or proper for the operation of the Tenant's business, and (iii) open for business in the Premises -- as soon thereafter as possible. |

|

damage and ending with the completion by the Landlord of such work of repair and/or reconstruction as the Landlord is obligated to do. In the event of termination of this lease pursuant to this Article XI, this lease and the term hereof shall cease and come to an end as of the date of such damage or destruction. |

|

11.4. |

DAMAGE TO COMMERCIAL UNIT. If, however, the Commercial Unit shall be substantially damaged or destroyed by fire or casualty, irrespective of whether or not the Premises are damaged or destroyed, the Landlord shall promptly restore or cause to be restored, to the extent originally constructed by the Landlord (consistent, however, with zoning laws and building codes then in existence), the Commercial Unit to substantially the condition thereof at the time of such damage (except that nothing herein shall require the Landlord to restore any improvements by any tenant or any furniture, fixtures, furnishings or other personal property of any tenant), unless the Landlord, within a reasonable time after such loss, gives notice to the Tenant of the Landlord's election to terminate this lease. If the Landlord shall give such notice, then anything to this Article XI to the contrary notwithstanding this lease shall terminate as of the date of such notice with the same force and effect as if such date were the date originally established as the expiration date hereof. |

|

11.5. |

DEFINITION OF SUBSTANTIAL DAMAGE. The terms “substantially damaged” and “substantial damage”, as used in this Article, shall have reference to damage of such a character as cannot reasonably be expected to be repaired or the Premises restored within thirty (30) days from the time that such repair or restoration work would be commenced. |

|

the Landlord may, but shall not be obligated to, supply the amount of such insufficiency and restore the Premises as above provided, with all reasonable diligence, or terminate this lease. Where the Tenant has not already exercised any right of termination accorded to it under the foregoing portion of this paragraph, the Landlord shall notify the Tenant of the Landlord's election not later than ninety (90) days after the final determination of the amount of the award. Further, if so much of the Commercial Unit shall be so taken that continued operation of the Commercial Unit as operated prior to the taking would be uneconomic in the Landlord's judgment or prohibited by zoning or other applicable law or by or pursuant to applicable provisions of the Condominium Documents or the Land Disposition Agreement, the Landlord shall have the right to terminate this lease by giving notice to the Tenant of the Landlord's desire so to do not later than thirty (30) days after the effective date of such taking. |

|

11.7. |

RENT ABATEMENT. In the event of any such taking of the Premises, the Fixed Rent or a fair and just proportion thereof, according to the nature and extent of the damage sustained, shall be suspended or abated. |

|

11.8 |

AWARD. Landlord shall have and hereby reserves and accepts, and Tenant hereby grants and assigns to Landlord, all rights to recover for damages to the Building and the Lot and any part thereof (but not for any of Tenant’s furniture, fixture, equipment or improvements to the Premises), and the leasehold interest hereby created, and to compensation accrued or hereafter to accrue by reason of such taking, damage or destruction, as aforesaid, and by way of confirming the foregoing, Tenant hereby grants and assigns, and covenants with Landlord to grant and assign to Landlord all rights to such damages or compensation. Nothing contained herein shall be construed to prevent Tenant from prosecuting in any condemnation proceedings a claim for the value of any Tenant's usual trade fixtures installed in the Premises by Tenant at Tenant's expense and for relocation expenses, provided that such action shall not affect the amount of compensation otherwise recoverable by Landlord from the taking authority. |

ARTICLE XII

LANDLORD'S REMEDIES

|

12.1 |

EVENTS OF DEFAULT. Any one of the following shall be deemed to be an “Event of Default”: |

|

A. Failure on the part of Tenant to pay Fixed Rent, additional rent or other charges for which provision is made herein on or before the date on which the same become due and payable and such failure continues for three (3) days after Landlord has sent to Tenant notice of such default. |

|

B. With respect to a non-monetary default under this Lease, failure of Tenant to cure the same within thirty (30) days following notice from Landlord to Tenant of such default. Notwithstanding the thirty (30) day cure period provided in the preceding sentence, Tenant shall be obligated to commence forthwith and to complete as soon as possible the curing of such default; and if Tenant fails so to do, the same shall be deemed to be an Event of Default. |

|

However, if: (i) Landlord shall have sent to Tenant a notice of such default, even though the same shall have been cured and this Lease not terminated; and (ii) during the twelve (12) month period in which said notice of default has been sent by Landlord to Tenant, Tenant thereafter shall default in any non-monetary matter - the same shall be deemed to be an Event of Default upon Landlord giving the Tenant written notice thereof, and Tenant shall have no grace period within which to cure the same. |

|

C. The commencement of any of the following proceedings, with such proceeding not being dismissed within sixty (60) days after it has begun: (i) the estate hereby created being taken on execution or by other process of law; (ii) Tenant being judicially declared bankrupt or insolvent according to law; (iii) an assignment being made of the property of Tenant for the benefit of creditors; (iv) a receiver, guardian, conservator, trustee in involuntary bankruptcy or other similar officer being appointed to take charge of all or any substantial part of Tenant's property by a court of competent jurisdiction; or (v) a petition being filed for the reorganization of Tenant under any provisions of the Bankruptcy Code now or hereafter enacted. |

|

D. Tenant filing a petition for reorganization or for rearrangements under any provisions of the Bankruptcy Code now or hereafter enacted, and providing a plan for a debtor to settle, satisfy or to extend the time for the payment of debts. |

|

E. Execution by Tenant of an instrument purporting to assign Tenant's interest under this Lease or sublet the whole or a portion of the Premises to a third party without Tenant having first obtained Landlord's prior express consent to said assignment or subletting. |

|

F. The Tenant vacating or abandoning the Premises. |

|

12.2 |

REMEDIES. Should any Event of Default occur then, notwithstanding any license of any former breach of covenant or waiver of the benefit hereof or consent in a former instance, Landlord lawfully may, in addition to any remedies otherwise available to Landlord, immediately or at any time thereafter, and without demand or notice, enter into and upon the Premises or any part thereof in the name of the whole and repossess the same as of Landlord's former estate, and expel Tenant and those claiming by, through or under it and remove its or their effects (forcibly if necessary) without being deemed guilty of any manner of trespass, and without prejudice to any remedies which might otherwise be used for arrears of rent or preceding breach of covenant and/or Landlord may send notice to Tenant terminating the Term of this Lease; and upon the first to occur of: (i) entry as aforesaid; or (ii) the fifth (5th) day following the mailing of such notice of termination, the Term of this Lease shall terminate, but Tenant shall remain liable for all damages as provided for herein. |

|

damages in accordance with immediately preceding sentence, the total rent shall be computed by assuming that Tenant's payments in respect of increases in Taxes and operating expenses would be, for the balance of the unexpired term, the amount thereof (if any), respectively, for the immediately preceding Tax Period or fiscal year, as the case may be, payable by Tenant to Landlord. |

If this Lease shall be guaranteed on behalf of Tenant, all of the foregoing provisions of this Article with respect to bankruptcy of Tenant, etc., shall be deemed to read “Tenant or the guarantor hereof”.

|

In the event of any breach or threatened breach by Tenant of any of the agreements, terms, covenants or conditions contained in this Lease, Landlord shall be entitled to enjoin such breach or threatened breach and shall have the right to invoke any right or remedy allowed at law or in equity or by statute or otherwise as though reentry, summary proceedings, and other remedies were not provided for in this Lease. |

|

Each right and remedy of Landlord provided for in this Lease shall be cumulative and shall be in addition to every other right or remedy provided for in this Lease not now or hereafter existing at law or in equity or by statute or otherwise, and the exercise or beginning of the exercise by Landlord of any one or more of the rights or remedies provided for in this Lease or now or hereafter existing at law or in equity or by statute or otherwise shall not preclude the simultaneous or later exercise by Landlord of any or all other rights or remedies provided for in this Lease or now or hereafter existing at law or in equity or by statute or otherwise. |

|

If any payment of rent or any other payment payable hereunder by Tenant to Landlord shall not be paid when due, the same shall bear interest from the date when the same was payable until the date paid at the lesser of (a) twelve (12%) per annum, compounded monthly, or (b) the highest lawful rate of interest which Landlord may charge to Tenant without violating any applicable law. Such interest shall constitute additional rent payable hereunder and be payable upon demand therefor by Landlord. |

|

Each of Landlord and Tenant hereby waives right to jury trial in the case of any litigation relating to this Lease. |

|

Without limiting any of Landlord's rights and remedies hereunder, and in addition to all other amounts Tenant is otherwise obligated to pay, it is expressly agreed that Landlord shall be entitled to recover from Tenant all costs and expenses, including reasonable attorneys' fees incurred by Landlord in enforcing this Lease from and after Tenant's default. |

|