Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MARKET MOSAIC (MARCH 2017) - MOSAIC CO | a8-kmarketmosaicmarch2017.htm |

Michael R. Rahm

Vice President, Market and Strategic Analysis

Andy J. Jung

Director, Market and Strategic Analysis

Josh Paula

Market Analysis Manager

Dan Halonen

Market Analyst

Market Mosaic is a quarterly newsletter published

for our customers, suppliers and stakeholders by the

Market and Strategic Analysis group of The Mosaic

Company. Some issues assess the near term

outlook for agricultural and plant nutrient markets

while others take and in-depth look at a topic of

interest to our readers.

2017 Phosphate Outlook

– continued inside

For phosphate producers, 2017 is off to a good start. Prices and margins have

moved up sharply during what typically is a seasonally slow period, and fundamentals

continue to look positive heading into the upcoming application season.

Several developments are driving up prices. Global shipments of the leading

products are projected to post solid gains this year as a result of much leaner channel

inventories as well as strong agronomic and economic demand drivers. Sales are

off to a fast start this year because distributors who deferred purchases as prices

declined last year are now scrambling to cover large commitments as prices rise this

year. At the same time, Chinese export availability has declined due to a take-off of

domestic shipments as well as a drop in industry output. More recently, rain storms

and large swells have delayed peak shipments out of the large Jorf Lasfar facility in

Morocco. Finally, it looks like new capacity will not deliver material tonnage until later

this year or in 2018.

These developments have brought the global phosphate market into a much tighter

balance and have quickly turned sentiment. The key question now is: How long

will the current price momentum continue? This issue of Market Mosaic reviews

recent developments and recaps our near term outlook, highlighting the factors that

ultimately will answer this question.

Based on our analysis, we expect that the recent price momentum will continue

through the upcoming application season. Momentum could even accelerate

if shipping delays worsen, the application season breaks early, Chinese export

availability remains limited, and agricultural commodity prices hold up. The outlook

for the second half of this year looks less certain. At this point, however, the key

swing factors – Chinese exports, global shipments, and the start-up of new capacity –

look like they are tilting in favor of a continued tight supply/demand balance through

the end of this year

Recent Developments: Prices Take Off

After hitting bottom last December,

phosphate prices have surged higher,

especially since the beginning of

February. The price of DAP fob

NOLA barge traded at $345 per ton

at the end of February, up $55 from

its December low. The price of MAP

delivered Brazil flirted with $400 per

tonne at the same time, up $75 from

the end of last year, and the price of

DAP fob Chinese port spiked to $370

per tonne at the end of February, up

$80 from its December low.

Market Mosaic

March 2017

®

275

300

325

350

375

400

425

450

475

500

525

550

575

Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

$ Tonne DAP/MAP PricesPublished Weekly Spot Prices

DAP NOLA MAP Brazil DAP China

Source: Argus FMB

In our view, four factors are driving the recent price surge: a decline

in Chinese export availability, a rush of buying as distributors

scramble to cover large commitments in a rising market, a jump in

raw materials costs, and shipping delays from Jorf Lasfar.

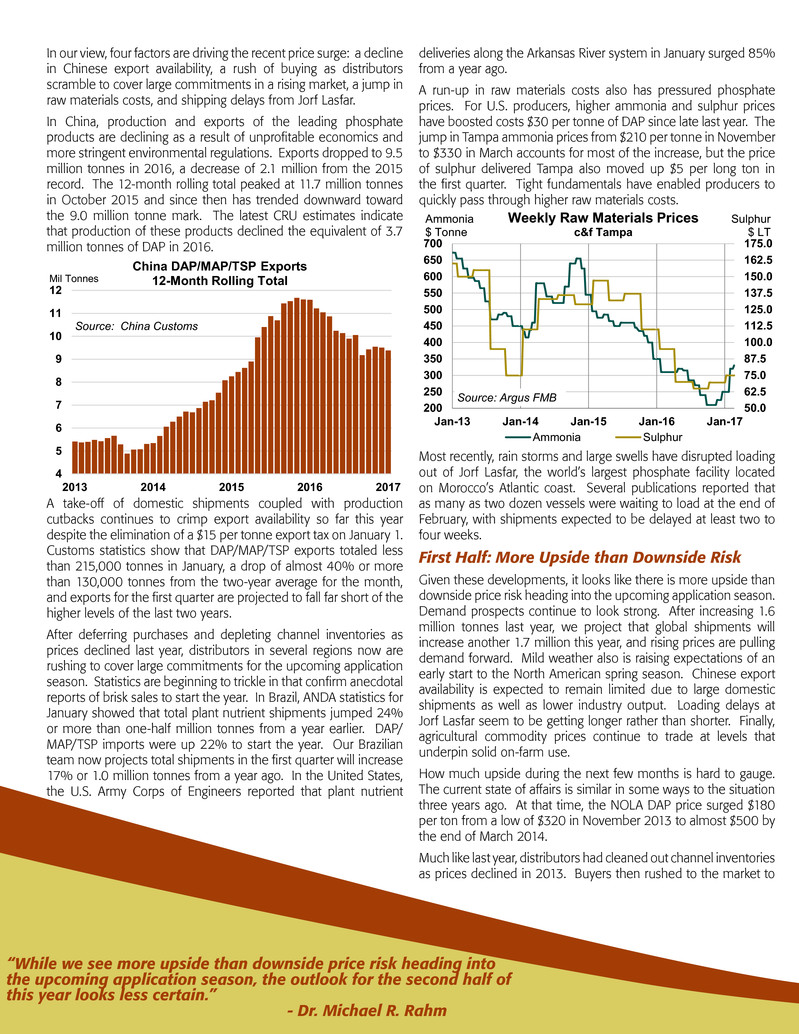

In China, production and exports of the leading phosphate

products are declining as a result of unprofitable economics and

more stringent environmental regulations. Exports dropped to 9.5

million tonnes in 2016, a decrease of 2.1 million from the 2015

record. The 12-month rolling total peaked at 11.7 million tonnes

in October 2015 and since then has trended downward toward

the 9.0 million tonne mark. The latest CRU estimates indicate

that production of these products declined the equivalent of 3.7

million tonnes of DAP in 2016.

A take-off of domestic shipments coupled with production

cutbacks continues to crimp export availability so far this year

despite the elimination of a $15 per tonne export tax on January 1.

Customs statistics show that DAP/MAP/TSP exports totaled less

than 215,000 tonnes in January, a drop of almost 40% or more

than 130,000 tonnes from the two-year average for the month,

and exports for the first quarter are projected to fall far short of the

higher levels of the last two years.

After deferring purchases and depleting channel inventories as

prices declined last year, distributors in several regions now are

rushing to cover large commitments for the upcoming application

season. Statistics are beginning to trickle in that confirm anecdotal

reports of brisk sales to start the year. In Brazil, ANDA statistics for

January showed that total plant nutrient shipments jumped 24%

or more than one-half million tonnes from a year earlier. DAP/

MAP/TSP imports were up 22% to start the year. Our Brazilian

team now projects total shipments in the first quarter will increase

17% or 1.0 million tonnes from a year ago. In the United States,

the U.S. Army Corps of Engineers reported that plant nutrient

deliveries along the Arkansas River system in January surged 85%

from a year ago.

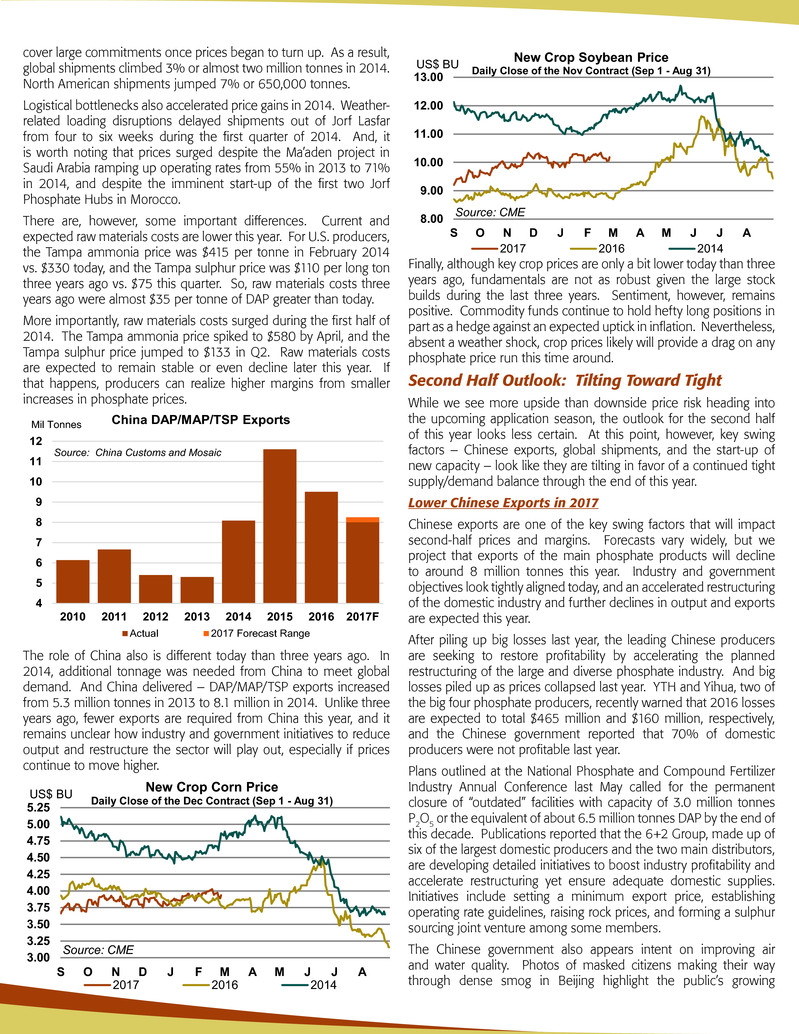

A run-up in raw materials costs also has pressured phosphate

prices. For U.S. producers, higher ammonia and sulphur prices

have boosted costs $30 per tonne of DAP since late last year. The

jump in Tampa ammonia prices from $210 per tonne in November

to $330 in March accounts for most of the increase, but the price

of sulphur delivered Tampa also moved up $5 per long ton in

the first quarter. Tight fundamentals have enabled producers to

quickly pass through higher raw materials costs.

Most recently, rain storms and large swells have disrupted loading

out of Jorf Lasfar, the world’s largest phosphate facility located

on Morocco’s Atlantic coast. Several publications reported that

as many as two dozen vessels were waiting to load at the end of

February, with shipments expected to be delayed at least two to

four weeks.

First Half: More Upside than Downside Risk

Given these developments, it looks like there is more upside than

downside price risk heading into the upcoming application season.

Demand prospects continue to look strong. After increasing 1.6

million tonnes last year, we project that global shipments will

increase another 1.7 million this year, and rising prices are pulling

demand forward. Mild weather also is raising expectations of an

early start to the North American spring season. Chinese export

availability is expected to remain limited due to large domestic

shipments as well as lower industry output. Loading delays at

Jorf Lasfar seem to be getting longer rather than shorter. Finally,

agricultural commodity prices continue to trade at levels that

underpin solid on-farm use.

How much upside during the next few months is hard to gauge.

The current state of affairs is similar in some ways to the situation

three years ago. At that time, the NOLA DAP price surged $180

per ton from a low of $320 in November 2013 to almost $500 by

the end of March 2014.

Much like last year, distributors had cleaned out channel inventories

as prices declined in 2013. Buyers then rushed to the market to

“While we see more upside than downside price risk heading into

the upcoming application season, the outlook for the second half of

this year looks less certain.”

- Dr. Michael R. Rahm

50.0

62.5

75.0

87.5

100.0

112.5

125.0

137.5

150.0

162.5

175.0

200

250

300

350

400

450

500

550

600

650

700

Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

Sulphur

$ LT

Ammonia

$ Tonne

Weekly Raw Materials Prices

c&f Tampa

Ammonia Sulphur

Source: Argus FMB

4

5

6

7

8

9

10

11

12

2013 2014 2015 2016 2017

Mil Tonnes

Source: China Customs

China DAP/MAP/TSP Exports

12-Month Rolling Total

cover large commitments once prices began to turn up. As a result,

global shipments climbed 3% or almost two million tonnes in 2014.

North American shipments jumped 7% or 650,000 tonnes.

Logistical bottlenecks also accelerated price gains in 2014. Weather-

related loading disruptions delayed shipments out of Jorf Lasfar

from four to six weeks during the first quarter of 2014. And, it

is worth noting that prices surged despite the Ma’aden project in

Saudi Arabia ramping up operating rates from 55% in 2013 to 71%

in 2014, and despite the imminent start-up of the first two Jorf

Phosphate Hubs in Morocco.

There are, however, some important differences. Current and

expected raw materials costs are lower this year. For U.S. producers,

the Tampa ammonia price was $415 per tonne in February 2014

vs. $330 today, and the Tampa sulphur price was $110 per long ton

three years ago vs. $75 this quarter. So, raw materials costs three

years ago were almost $35 per tonne of DAP greater than today.

More importantly, raw materials costs surged during the first half of

2014. The Tampa ammonia price spiked to $580 by April, and the

Tampa sulphur price jumped to $133 in Q2. Raw materials costs

are expected to remain stable or even decline later this year. If

that happens, producers can realize higher margins from smaller

increases in phosphate prices.

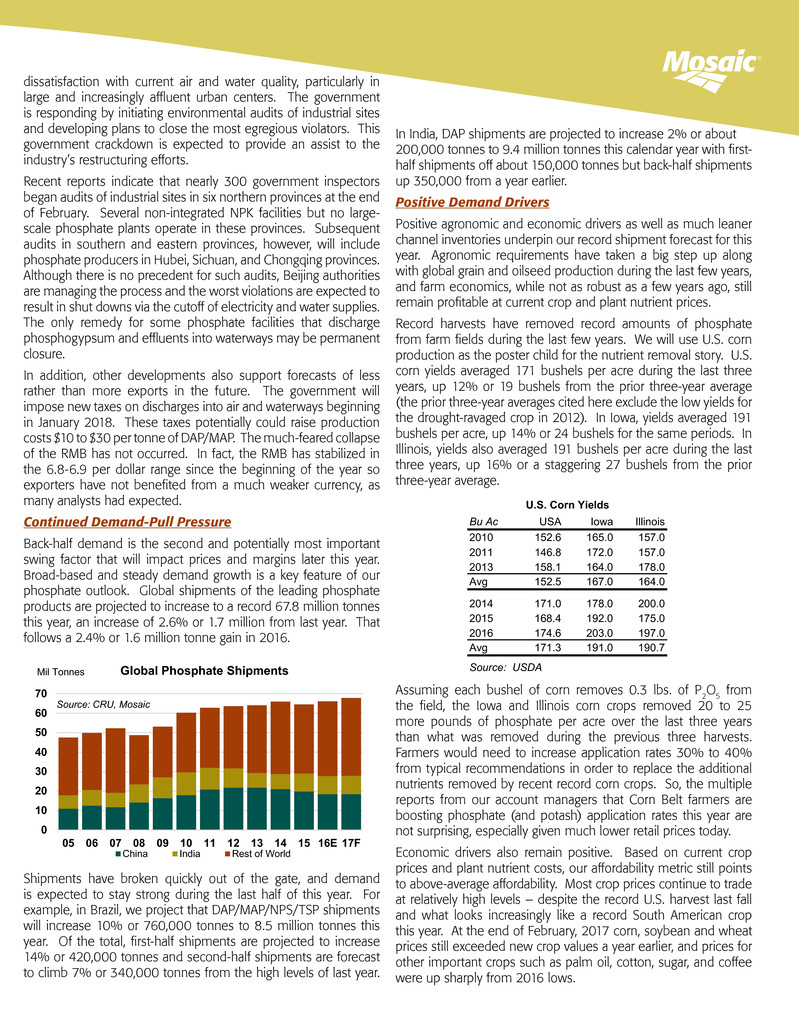

The role of China also is different today than three years ago. In

2014, additional tonnage was needed from China to meet global

demand. And China delivered – DAP/MAP/TSP exports increased

from 5.3 million tonnes in 2013 to 8.1 million in 2014. Unlike three

years ago, fewer exports are required from China this year, and it

remains unclear how industry and government initiatives to reduce

output and restructure the sector will play out, especially if prices

continue to move higher.

Finally, although key crop prices are only a bit lower today than three

years ago, fundamentals are not as robust given the large stock

builds during the last three years. Sentiment, however, remains

positive. Commodity funds continue to hold hefty long positions in

part as a hedge against an expected uptick in inflation. Nevertheless,

absent a weather shock, crop prices likely will provide a drag on any

phosphate price run this time around.

Second Half Outlook: Tilting Toward Tight

While we see more upside than downside price risk heading into

the upcoming application season, the outlook for the second half

of this year looks less certain. At this point, however, key swing

factors – Chinese exports, global shipments, and the start-up of

new capacity – look like they are tilting in favor of a continued tight

supply/demand balance through the end of this year.

Lower Chinese Exports in 2017

Chinese exports are one of the key swing factors that will impact

second-half prices and margins. Forecasts vary widely, but we

project that exports of the main phosphate products will decline

to around 8 million tonnes this year. Industry and government

objectives look tightly aligned today, and an accelerated restructuring

of the domestic industry and further declines in output and exports

are expected this year.

After piling up big losses last year, the leading Chinese producers

are seeking to restore profitability by accelerating the planned

restructuring of the large and diverse phosphate industry. And big

losses piled up as prices collapsed last year. YTH and Yihua, two of

the big four phosphate producers, recently warned that 2016 losses

are expected to total $465 million and $160 million, respectively,

and the Chinese government reported that 70% of domestic

producers were not profitable last year.

Plans outlined at the National Phosphate and Compound Fertilizer

Industry Annual Conference last May called for the permanent

closure of “outdated” facilities with capacity of 3.0 million tonnes

P2O5 or the equivalent of about 6.5 million tonnes DAP by the end of

this decade. Publications reported that the 6+2 Group, made up of

six of the largest domestic producers and the two main distributors,

are developing detailed initiatives to boost industry profitability and

accelerate restructuring yet ensure adequate domestic supplies.

Initiatives include setting a minimum export price, establishing

operating rate guidelines, raising rock prices, and forming a sulphur

sourcing joint venture among some members.

The Chinese government also appears intent on improving air

and water quality. Photos of masked citizens making their way

through dense smog in Beijing highlight the public’s growing

3.00

3.25

3.50

3.75

4.00

4.25

4.50

4.75

5.00

5.25

S O N D J F M A M J J A

US$ BU New Crop Corn PriceDaily Close of the Dec Contract (Sep 1 - Aug 31)

2017 2016 2014

Source: CME

8.00

9.00

10.00

11.00

12.00

13.00

S O N D J F M A M J J A

US$ BU New Crop Soybean PriceDaily Close of the Nov Contract (Sep 1 - Aug 31)

2017 2016 2014

Source: CME

4

5

6

7

8

9

10

11

12

2010 2011 2012 2013 2014 2015 2016 2017F

Mil Tonnes

Source: China Customs and Mosaic

China DAP/MAP/TSP Exports

Actual 2017 Forecast Range

dissatisfaction with current air and water quality, particularly in

large and increasingly affluent urban centers. The government

is responding by initiating environmental audits of industrial sites

and developing plans to close the most egregious violators. This

government crackdown is expected to provide an assist to the

industry’s restructuring efforts.

Recent reports indicate that nearly 300 government inspectors

began audits of industrial sites in six northern provinces at the end

of February. Several non-integrated NPK facilities but no large-

scale phosphate plants operate in these provinces. Subsequent

audits in southern and eastern provinces, however, will include

phosphate producers in Hubei, Sichuan, and Chongqing provinces.

Although there is no precedent for such audits, Beijing authorities

are managing the process and the worst violations are expected to

result in shut downs via the cutoff of electricity and water supplies.

The only remedy for some phosphate facilities that discharge

phosphogypsum and effluents into waterways may be permanent

closure.

In addition, other developments also support forecasts of less

rather than more exports in the future. The government will

impose new taxes on discharges into air and waterways beginning

in January 2018. These taxes potentially could raise production

costs $10 to $30 per tonne of DAP/MAP. The much-feared collapse

of the RMB has not occurred. In fact, the RMB has stabilized in

the 6.8-6.9 per dollar range since the beginning of the year so

exporters have not benefited from a much weaker currency, as

many analysts had expected.

Continued Demand-Pull Pressure

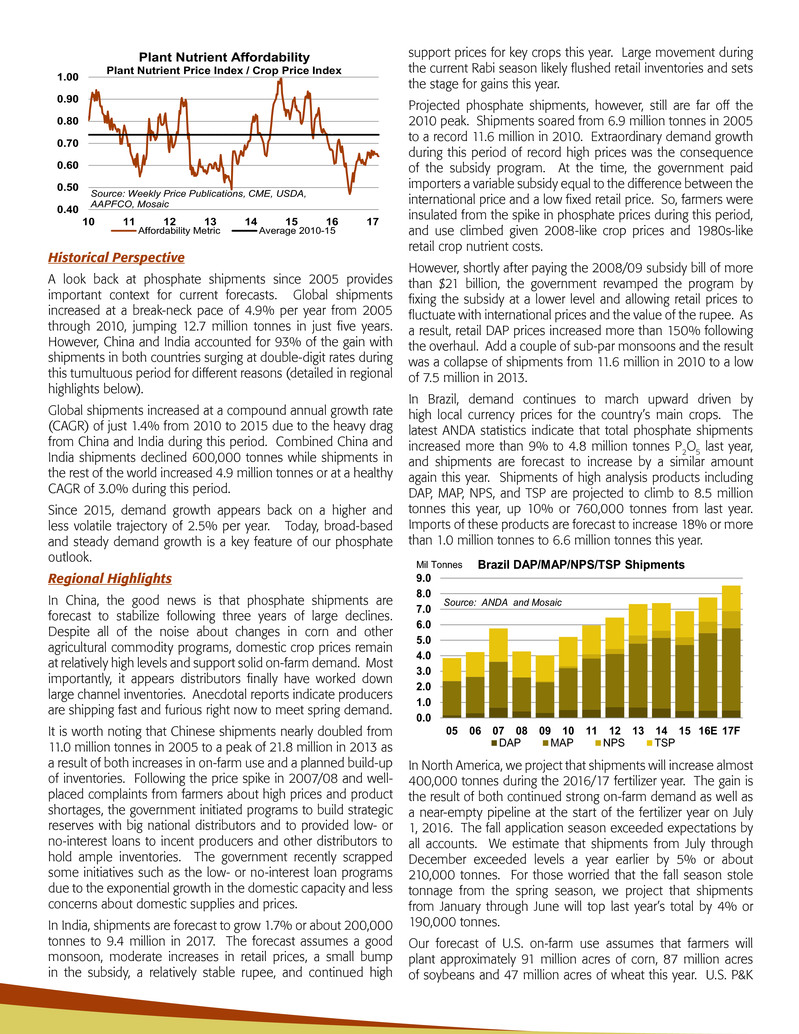

Back-half demand is the second and potentially most important

swing factor that will impact prices and margins later this year.

Broad-based and steady demand growth is a key feature of our

phosphate outlook. Global shipments of the leading phosphate

products are projected to increase to a record 67.8 million tonnes

this year, an increase of 2.6% or 1.7 million from last year. That

follows a 2.4% or 1.6 million tonne gain in 2016.

Shipments have broken quickly out of the gate, and demand

is expected to stay strong during the last half of this year. For

example, in Brazil, we project that DAP/MAP/NPS/TSP shipments

will increase 10% or 760,000 tonnes to 8.5 million tonnes this

year. Of the total, first-half shipments are projected to increase

14% or 420,000 tonnes and second-half shipments are forecast

to climb 7% or 340,000 tonnes from the high levels of last year.

In India, DAP shipments are projected to increase 2% or about

200,000 tonnes to 9.4 million tonnes this calendar year with first-

half shipments off about 150,000 tonnes but back-half shipments

up 350,000 from a year earlier.

Positive Demand Drivers

Positive agronomic and economic drivers as well as much leaner

channel inventories underpin our record shipment forecast for this

year. Agronomic requirements have taken a big step up along

with global grain and oilseed production during the last few years,

and farm economics, while not as robust as a few years ago, still

remain profitable at current crop and plant nutrient prices.

Record harvests have removed record amounts of phosphate

from farm fields during the last few years. We will use U.S. corn

production as the poster child for the nutrient removal story. U.S.

corn yields averaged 171 bushels per acre during the last three

years, up 12% or 19 bushels from the prior three-year average

(the prior three-year averages cited here exclude the low yields for

the drought-ravaged crop in 2012). In Iowa, yields averaged 191

bushels per acre, up 14% or 24 bushels for the same periods. In

Illinois, yields also averaged 191 bushels per acre during the last

three years, up 16% or a staggering 27 bushels from the prior

three-year average.

Assuming each bushel of corn removes 0.3 lbs. of P2O5 from

the field, the Iowa and Illinois corn crops removed 20 to 25

more pounds of phosphate per acre over the last three years

than what was removed during the previous three harvests.

Farmers would need to increase application rates 30% to 40%

from typical recommendations in order to replace the additional

nutrients removed by recent record corn crops. So, the multiple

reports from our account managers that Corn Belt farmers are

boosting phosphate (and potash) application rates this year are

not surprising, especially given much lower retail prices today.

Economic drivers also remain positive. Based on current crop

prices and plant nutrient costs, our affordability metric still points

to above-average affordability. Most crop prices continue to trade

at relatively high levels – despite the record U.S. harvest last fall

and what looks increasingly like a record South American crop

this year. At the end of February, 2017 corn, soybean and wheat

prices still exceeded new crop values a year earlier, and prices for

other important crops such as palm oil, cotton, sugar, and coffee

were up sharply from 2016 lows.

®

0

10

20

30

40

50

60

70

05 06 07 08 09 10 11 12 13 14 15 16E 17F

Global Phosphate Shipments

China India Rest of World

Mil Tonnes

Source: CRU, Mosaic

Bu Ac USA Iowa Illinois

2010 152.6 165.0 157.0

2011 146.8 172.0 157.0

2013 158.1 164.0 178.0

Avg 152.5 167.0 164.0

2014 171.0 178.0 200.0

2015 168.4 192.0 175.0

2016 174.6 203.0 197.0

Avg 171.3 191.0 190.7

Source: USDA

U.S. Corn Yields

Historical Perspective

A look back at phosphate shipments since 2005 provides

important context for current forecasts. Global shipments

increased at a break-neck pace of 4.9% per year from 2005

through 2010, jumping 12.7 million tonnes in just five years.

However, China and India accounted for 93% of the gain with

shipments in both countries surging at double-digit rates during

this tumultuous period for different reasons (detailed in regional

highlights below).

Global shipments increased at a compound annual growth rate

(CAGR) of just 1.4% from 2010 to 2015 due to the heavy drag

from China and India during this period. Combined China and

India shipments declined 600,000 tonnes while shipments in

the rest of the world increased 4.9 million tonnes or at a healthy

CAGR of 3.0% during this period.

Since 2015, demand growth appears back on a higher and

less volatile trajectory of 2.5% per year. Today, broad-based

and steady demand growth is a key feature of our phosphate

outlook.

Regional Highlights

In China, the good news is that phosphate shipments are

forecast to stabilize following three years of large declines.

Despite all of the noise about changes in corn and other

agricultural commodity programs, domestic crop prices remain

at relatively high levels and support solid on-farm demand. Most

importantly, it appears distributors finally have worked down

large channel inventories. Anecdotal reports indicate producers

are shipping fast and furious right now to meet spring demand.

It is worth noting that Chinese shipments nearly doubled from

11.0 million tonnes in 2005 to a peak of 21.8 million in 2013 as

a result of both increases in on-farm use and a planned build-up

of inventories. Following the price spike in 2007/08 and well-

placed complaints from farmers about high prices and product

shortages, the government initiated programs to build strategic

reserves with big national distributors and to provided low- or

no-interest loans to incent producers and other distributors to

hold ample inventories. The government recently scrapped

some initiatives such as the low- or no-interest loan programs

due to the exponential growth in the domestic capacity and less

concerns about domestic supplies and prices.

In India, shipments are forecast to grow 1.7% or about 200,000

tonnes to 9.4 million in 2017. The forecast assumes a good

monsoon, moderate increases in retail prices, a small bump

in the subsidy, a relatively stable rupee, and continued high

support prices for key crops this year. Large movement during

the current Rabi season likely flushed retail inventories and sets

the stage for gains this year.

Projected phosphate shipments, however, still are far off the

2010 peak. Shipments soared from 6.9 million tonnes in 2005

to a record 11.6 million in 2010. Extraordinary demand growth

during this period of record high prices was the consequence

of the subsidy program. At the time, the government paid

importers a variable subsidy equal to the difference between the

international price and a low fixed retail price. So, farmers were

insulated from the spike in phosphate prices during this period,

and use climbed given 2008-like crop prices and 1980s-like

retail crop nutrient costs.

However, shortly after paying the 2008/09 subsidy bill of more

than $21 billion, the government revamped the program by

fixing the subsidy at a lower level and allowing retail prices to

fluctuate with international prices and the value of the rupee. As

a result, retail DAP prices increased more than 150% following

the overhaul. Add a couple of sub-par monsoons and the result

was a collapse of shipments from 11.6 million in 2010 to a low

of 7.5 million in 2013.

In Brazil, demand continues to march upward driven by

high local currency prices for the country’s main crops. The

latest ANDA statistics indicate that total phosphate shipments

increased more than 9% to 4.8 million tonnes P2O5 last year,

and shipments are forecast to increase by a similar amount

again this year. Shipments of high analysis products including

DAP, MAP, NPS, and TSP are projected to climb to 8.5 million

tonnes this year, up 10% or 760,000 tonnes from last year.

Imports of these products are forecast to increase 18% or more

than 1.0 million tonnes to 6.6 million tonnes this year.

In North America, we project that shipments will increase almost

400,000 tonnes during the 2016/17 fertilizer year. The gain is

the result of both continued strong on-farm demand as well as

a near-empty pipeline at the start of the fertilizer year on July

1, 2016. The fall application season exceeded expectations by

all accounts. We estimate that shipments from July through

December exceeded levels a year earlier by 5% or about

210,000 tonnes. For those worried that the fall season stole

tonnage from the spring season, we project that shipments

from January through June will top last year’s total by 4% or

190,000 tonnes.

Our forecast of U.S. on-farm use assumes that farmers will

plant approximately 91 million acres of corn, 87 million acres

of soybeans and 47 million acres of wheat this year. U.S. P&K

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

05 06 07 08 09 10 11 12 13 14 15 16E 17F

Brazil DAP/MAP/NPS/TSP Shipments

DAP MAP NPS TSP

Mil Tonnes

Source: ANDA and Mosaic

0.40

0.50

0.60

0.70

0.80

0.90

1.00

10 11 12 13 14 15 16 17

Plant Nutrient Affordability

Plant Nutrient Price Index / Crop Price Index

Affordability Metric Average 2010-15

Source: Weekly Price Publications, CME, USDA,

AAPFCO, Mosaic

average application rates are expected to increase on corn and

soybeans due to large withdrawals during the last three years

and the low cost of replacing or building soil phosphorus levels.

While China, India, Brazil and North America capture most of

the headlines, several other regions such as Africa, Argentina,

Central America, the former Soviet Union, Turkey, Pakistan, and

Southeast Asia also registered impressive gains last year. In

Argentina, phosphate shipments doubled from the depressed

level in 2015 and bested the previous high-water mark set way

back in 2007. Argentine farmers planted and fertilized more

area in response to much-improved farm economics resulting

from a weaker peso and the elimination of the 35% tax on

corn and wheat exports. Pakistan, Thailand and Vietnam each

set phosphate shipment records last year yet ended recent

application seasons with low inventories. In Russia, plant

nutrient demand is booming along with agricultural production

due to the combination of generally favorable weather and the

highly depreciated ruble. Turkey imported 1.2 million tonnes of

the leading phosphate products last year, up 132% from 2015

and 200,000 tonnes more than the previous peak.

No Material New Supplies Until Later This Year

Finally, when and how quickly new capacity starts up is

expected to impact prices and margins one way or another later

this year. OCP is scheduled to begin commissioning its third

Jorf Phosphate Hub (JPH III) in the first quarter and its fourth

hub (JPH IV) before the end of the year. The Ma’aden Wa’ad

al Shamal Phosphate Company (MWSPC) joint venture in Saudi

Arabia also is expected to start up later this year.

We do not expect that these projects will have a material impact

on the supply/demand balance this year. The net impact of

JPH III may be muted if OCP still is retrofitting other phosphoric

acid plants to run on wet rather than dry rock. And, if history is

any guide, ramp-ups of massive greenfield phosphate projects

typically take longer than most analysts expect.

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are

not limited to, statements about our proposed acquisition of the global phosphate and potash operations of Vale S.A. (“Vale”) conducted through Vale Fertilizantes

S.A. (the “Transaction”) and the anticipated benefits and synergies of the proposed Transaction, other proposed or pending future transactions or strategic plans

and other statements about future financial and operating results. Such statements are based upon the current beliefs and expectations of The Mosaic Company’s

management and are subject to significant risks and uncertainties. These risks and uncertainties include but are not limited to risks and uncertainties arising from the

possibility that the closing of the proposed Transaction may be delayed or may not occur, including delays or risks arising from any inability to obtain governmental

approvals of the Transaction on the proposed terms and schedule, any inability of Vale to achieve certain other specified regulatory and operational milestones or to

successfully complete the transfer of the Cubatão business to Vale and its affiliates in a timely manner, and the ability to satisfy any of the other closing conditions; our

ability to secure financing, or financing on satisfactory terms and in amounts sufficient to fund the cash portion of the purchase price without the need for additional

funds from other liquidity sources; difficulties with realization of the benefits of the proposed Transaction, including the risks that the acquired business may not

be integrated successfully or that the anticipated synergies or cost or capital expenditure savings from the Transaction may not be fully realized or may take longer

to realize than expected, including because of political and economic instability in Brazil or changes in government policy in Brazil; the predictability and volatility

of, and customer expectations about, agriculture, fertilizer, raw material, energy and transportation markets that are subject to competitive and other pressures and

economic and credit market conditions; the level of inventories in the distribution channels for crop nutrients; the effect of future product innovations or development

of new technologies on demand for our products; changes in foreign currency and exchange rates; international trade risks and other risks associated with Mosaic’s

international operations and those of joint ventures in which Mosaic participates, including the risk that protests against natural resource companies in Peru extend to

or impact the Miski Mayo mine, the ability of the Wa’ad Al Shamal Phosphate Company (also known as MWSPC) to obtain additional planned funding in acceptable

amounts and upon acceptable terms, the timely development and commencement of operations of production facilities in the Kingdom of Saudi Arabia, the future

success of current plans for MWSPC and any future changes in those plans; difficulties with realization of the benefits of our long term natural gas based pricing

ammonia supply agreement with CF Industries, Inc., including the risk that the cost savings initially anticipated from the agreement may not be fully realized over its

term or that the price of natural gas or ammonia during the term are at levels at which the pricing is disadvantageous to Mosaic; customer defaults; the effects of

Mosaic’s decisions to exit business operations or locations; changes in government policy; changes in environmental and other governmental regulation, including

expansion of the types and extent of water resources regulated under federal law, carbon taxes or other greenhouse gas regulation, implementation of numeric

water quality standards for the discharge of nutrients into Florida waterways or efforts to reduce the flow of excess nutrients into the Mississippi River basin, the Gulf

of Mexico or elsewhere; further developments in judicial or administrative proceedings, or complaints that Mosaic’s operations are adversely impacting nearby farms,

business operations or properties; difficulties or delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or increased

financial assurance requirements; resolution of global tax audit activity; the effectiveness of Mosaic’s processes for managing its strategic priorities; adverse weather

conditions affecting operations in Central Florida, the Mississippi River basin, the Gulf Coast of the United States or Canada, and including potential hurricanes,

excess heat, cold, snow, rainfall or drought; actual costs of various items differing from management’s current estimates, including, among others, asset retirement,

environmental remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the costs of the MWSPC, its existing or future

funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s available cash and liquidity, and increased leverage, due to its use of cash and/

or available debt capacity to fund financial assurance requirements and strategic investments; brine

inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents

and disruptions involving Mosaic’s operations, including potential mine fires, floods, explosions, seismic

events, sinkholes or releases of hazardous or volatile chemicals; and risks associated with cyber security,

including reputational loss, as well as other risks and uncertainties reported from time to time in The

Mosaic Company’s reports filed with the Securities and Exchange Commission. Actual results may differ

from those set forth in the forward-looking statements.

Copyright © 2017. The Mosaic Company. All rights reserved..

The Mosaic Company

Atria Corporate Center, Suite E490

3033 Campus Drive

Plymouth, MN 55441

(800) 918-8270

(763) 577-2700

®

0.00

0.25

0.50

0.75

1.00

1.25

1.50

05 06 07 08 09 10 11 12 13 14 15 16E 17F

Argentina DAP/MAP/NPS/TSP Shipments

DAP MAP NPS TSP

Mil Tonnes

Source: CRU and Mosaic