Attached files

| file | filename |

|---|---|

| 8-K - CORENERGY INFRASTRUCTURE TRUST, INC 8-K 3-2-2017 - CorEnergy Infrastructure Trust, Inc. | form8k.htm |

Exhibit 99.1

Capital Link MLP Investing ForumJeff Fulmer, Senior Vice PresidentMarch 2, 2017 LISTED CORR NYSE

Disclaimer This presentation contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Although CorEnergy believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in CorEnergy’s reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Other than as required by law, CorEnergy does not assume a duty to update any forward-looking statement. In particular, any distribution paid in the future to our stockholders will depend on the actual performance of CorEnergy, its costs of leverage and other operating expenses and will be subject to the approval of CorEnergy’s Board of Directors and compliance with leverage covenants.

Diversification Across the Energy Value Chain

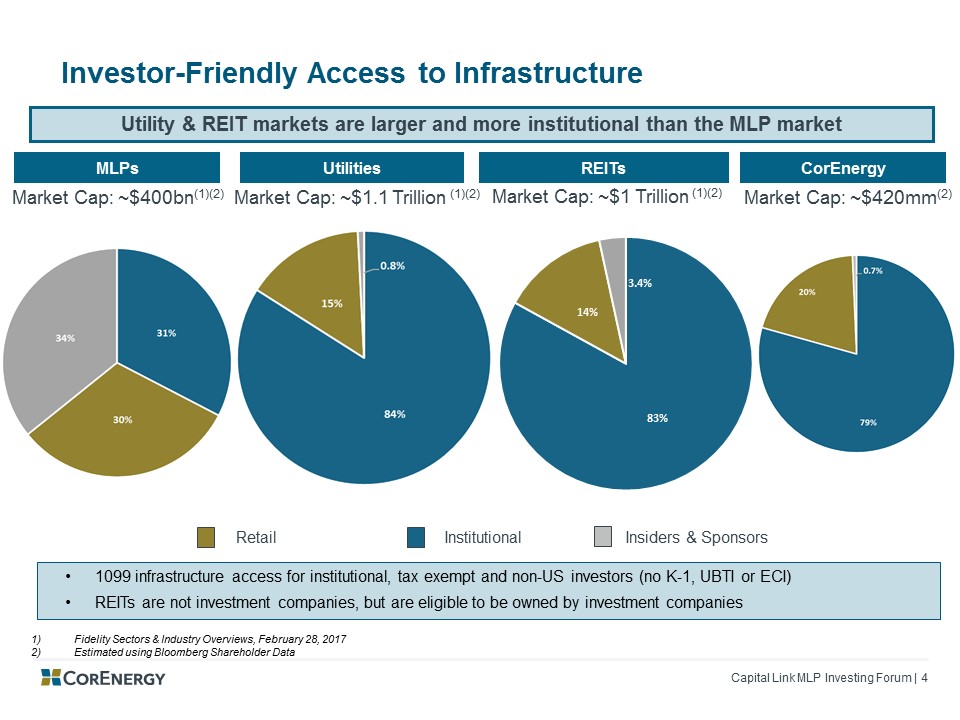

Investor-Friendly Access to Infrastructure Fidelity Sectors & Industry Overviews, February 28, 2017Estimated using Bloomberg Shareholder Data Market Cap: ~$1 Trillion (1)(2) Market Cap: ~$1.1 Trillion (1)(2) REITs Market Cap: ~$400bn(1)(2) MLPs Utilities Utility & REIT markets are larger and more institutional than the MLP market Market Cap: ~$420mm(2) CorEnergy Retail Institutional Insiders & Sponsors 1099 infrastructure access for institutional, tax exempt and non-US investors (no K-1, UBTI or ECI)REITs are not investment companies, but are eligible to be owned by investment companies

CorEnergy Strategy Withstanding Energy Market Volatility Since the beginning of 2015, over 114 North American energy companies have filed for bankruptcy, accounting for ~$74 billion of secured and unsecured debt1In April 2016, the parent companies of two CorEnergy tenants, Energy XXI Ltd and Ultra Petroleum Corp, filed Chapter 11GIGS tenant (EXXI subsidiary) remained outside of bankruptcy proceedings, EXXI exited bankruptcy in December 2016Pinedale LGS tenant (UPL subsidiary) is included in Chapter 11 reorganization, UPL has agreed to assume CORR’s lease (1) Haynes and Boone, LLP, Oil Patch Bankruptcy Monitor, December 22, 2016 CORR’s business strategy of contracting critical energy infrastructure assets under long-term triple-net leases has endured two bankruptcies

Our Leases Preserve Terminal Value Renewal Expectation CorEnergy contracts are based on fair value of assetsAll leases enable tenant to either purchase asset or renew lease at fair market valueIf parties cannot agree on a value, an arbitrator will decideSince tenant can purchase the asset or renew the lease at fair value, the tenant cannot hurt the asset value during the lease term without paying damagesAsset value is based on production estimates in tenant reserve report and market values for similar assets (such as MLPs)Same at initial purchase and renewal process CorEnergy can assert damages claims against actions taken during the term of the lease that devalue an asset, including the purchase or construction of replacement systems

Asset Value Review CorEnergy EstimateUltra Petroleum Company Filings & PresentationsEnergy XXI Filings & Presentations

CorEnergy Per Diluted Common Share Financial Metrics (1) The Company provides non-GAAP performance measures utilized by REITs, including NAREIT Funds From Operations (“NAREIT FFO”), Funds from Operations (“FFO”) and Adjusted Funds from Operations (“AFFO”). Due to legacy investments that we hold, we have historically presented a measure of FFO derived by further adjusting NAREIT FFO for distributions received from investment securities, income tax expense, net, and net distributions and dividend income. Management uses AFFO as a measure of long-term sustainable operational performance. See slides 16 to 18 for a reconciliation of NAREIT FFO, FFO and AFFO, as presented, to Net income attributable to CorEnergy common stockholders. Net Income to Common Shareholders Adjusted Funds from Operations1 Dividends to Common Shareholders NAREIT Funds from Operations1 Funds from Operations1 AFFO adjusts for the provision of loan loss, net of taxes attributed to the Black Bison & Four Wood Financing Notes in 1Q16

Flexible Financing Capabilities Support Active Deal Pipeline Financing Optionality $60 million of available liquidity(1)Bank DebtConvertible DebtPreferred EquityCommon EquityCo-Investor One to Two AcquisitionsSize Range of $50-250 Million Active Deal Pipeline As of December 31, 2016

Durable Revenues + Low Leverage = Dividend Stability Lease payments produce predictable cash flowsAssets are critical to tenant revenue productionLease expense is an operating cost (not a financing cost)Lease payments are made during bankruptcyResults in utility-like consistency of revenue for CORRConservative leverage profile & multiple capital sourcesWe believe the $3.00 annualized dividend is a sustainable payout, pending outcomes of the bankruptcy process & MoGas rate reductionDividends are based solely on minimum rentsCorEnergy retains debt repayment and reinvestment capital prior to dividend paymentPotential upside from portfolio growth and participating rents Energy REIT provided a new business model in 2012: Investor-friendly access to infrastructure assets

APPENDIX

Pinedale LGS Case Study $228 million asset, acquired with Prudential as a co-investor150 miles of pipeline, 107 receipt points, 4 above-ground facilitiesCritical to operation of Ultra Petroleum’s Pinedale natural gas field15-year triple-net lease; rent $20 million per year + participating features Pinedale Liquids Gathering System

Grand Isle Gathering System Case Study ~$250 million critical midstream infrastructure in the Gulf of Mexico153 miles of undersea pipeline and terminal with separation, SWD and storage facilitiesEssential system to transport crude oil and produced water for large proven reservesTriple-net operating lease with Energy XXI subsidiary – average minimum rent of ~$40 million

Portland Terminal: MLP as Tenant 39-acre terminal to receive, store and deliver heavy and refined petroleum products84 tanks with 1.5 million barrels of storage capacity; loading for ships, rail and trucksTriple-net operating lease with Arc Terminals; 15-year initial term, 5-year renewals Acquired for $40 million and financed $10 million in expansion projects

MoGas Interstate Pipeline: LDCs as Customers 263-mile pipeline connecting natural gas supplies to Missouri utilitiesCritical pipeline with 97% of revenues from firm transportation contractsHeld as taxable company; subject to intercompany mortgage$125 million financed through issuance of new equity and preferred

Non-GAAP Financial Metrics: FFO/AFFO Reconciliation

Non-GAAP Financial Metrics: FFO/AFFO Reconciliation Based on the economic return to CorEnergy resulting from the sale of our 40 percent undivided interest in EIP, we determined that it was appropriate to eliminate the portion of EIP lease income attributable to return of capital, as a means to more accurately reflect the EIP lease revenue contribution to CorEnergy-sustainable AFFO. CorEnergy believes that the portion of the EIP lease revenue attributable to return of capital, unless adjusted, overstates CorEnergy's distribution-paying capabilities and is not representative of sustainable EIP income over the life of the lease. The Company completed the sale of EIP on April 1, 2015.

Non-GAAP Financial Metrics: FFO/AFFO Reconciliation The number of weighted average diluted shares represents the total diluted shares for periods when the Convertible Notes were dilutive in the per share amounts presented. For periods presented without per share dilution, the number of weighted average diluted shares for the period is equal to the number of weighted average basic shares presented.

Non-GAAP Financial Metrics: Fixed-Charges Ratio Fixed charges consist of interest expense, as defined under U.S. generally accepted accounting principles, on all indebtednessThis line represents the amount of preferred stock dividends accumulated as of December 31, 2016.