Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Zayo Group Holdings, Inc. | zayo-20170301ex991f0cf16.htm |

| 8-K - 8-K - Zayo Group Holdings, Inc. | zayo-20170301x8k.htm |

EXHIBIT 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

by and among

ZAYO GROUP, LLC,

ZELMS, INC.,

ELECTRIC LIGHTWAVE PARENT, INC.

and

FORTIS ADVISORS LLC,

as the Equityholder Representative

Dated as of November 29, 2016

TABLE OF CONTENTS

|

|

Page |

|

|

Article I DEFINED TERMS |

1 | |

|

1.1 |

Definitions |

1 |

|

Article II PURCHASE AND SALE |

2 | |

|

2.1 |

The Merger |

2 |

|

2.2 |

Effects of the Merger |

2 |

|

2.3 |

Certificate of Incorporation and Bylaws |

2 |

|

2.4 |

Directors; Officers |

2 |

|

2.5 |

Subsequent Actions |

2 |

|

2.6 |

Conversion of Equity Interests |

3 |

|

2.7 |

Closing Payments. |

4 |

|

2.8 |

Stockholder Payments |

5 |

|

2.9 |

Closing Estimates |

6 |

|

2.10 |

Post-Closing Adjustment of Merger Consideration. |

7 |

|

2.11 |

Withholding Rights |

10 |

|

2.12 |

Equityholder Representative. |

10 |

|

2.13 |

Dissenting Shares |

13 |

|

Article III REPRESENTATIONS AND WARRANTIES |

14 | |

|

3.1 |

Representations and Warranties of the Company |

14 |

|

3.2 |

Representations and Warranties of the Buyer |

32 |

|

Article IV COVENANTS |

35 | |

|

4.1 |

Conduct of Business |

35 |

|

4.2 |

Regulatory and Other Approvals |

38 |

|

4.3 |

Access and Information |

40 |

|

4.4 |

Third Party Consents |

42 |

|

4.5 |

No Solicitation |

42 |

|

4.6 |

Financial Statements. |

43 |

|

4.7 |

Confidentiality. |

44 |

|

4.8 |

Tax Matters |

44 |

|

4.9 |

Buyer Financing Efforts. |

46 |

|

4.10 |

Company Financing Assistance. |

49 |

|

4.11 |

Shareholders’ Agreement; Stockholder Consent |

51 |

|

4.12 |

Takeover Statutes |

52 |

|

4.13 |

Incentive Plans |

52 |

|

4.14 |

Termination of Indebtedness |

52 |

|

4.15 |

Transaction Expense Statements and Releases |

53 |

|

4.16 |

Directors’ and Officers’ Indemnification and Insurance |

53 |

|

4.17 |

Employee Matters |

55 |

|

4.18 |

Representation and Warranty Policy |

56 |

|

4.19 |

Treatment of RSUs, Options and Warrants |

56 |

|

4.20 |

Bank Accounts |

56 |

(i)

|

Article V CONDITIONS PRECEDENT |

57 | |

|

5.1 |

Conditions to Each Party’s Obligation |

57 |

|

5.2 |

Conditions to Obligation of the Buyer |

57 |

|

5.3 |

Conditions to Obligations of the Company |

58 |

|

Article VI CLOSING |

58 | |

|

6.1 |

Closing |

58 |

|

6.2 |

Actions to Occur at Closing |

59 |

|

Article VII TERMINATION, AMENDMENT AND WAIVER |

60 | |

|

7.1 |

Termination |

60 |

|

7.2 |

Effect of Termination |

61 |

|

Article VIII INDEMNIFICATION |

61 | |

|

8.1 |

Survival of Representations, Warranties and Agreements |

61 |

|

8.2 |

Indemnification of the Buyer Indemnified Persons |

62 |

|

8.3 |

Indemnification of the Seller Indemnified Persons |

62 |

|

8.4 |

Limitations |

63 |

|

8.5 |

Third Party Claims |

65 |

|

8.6 |

Direct Claims |

66 |

|

8.7 |

Other Claims |

66 |

|

8.8 |

Indemnification Payment |

67 |

|

8.9 |

Remedies Not Affected by Investigation or Knowledge |

67 |

|

8.10 |

No Duplication of Remedies |

67 |

|

8.11 |

Escrow |

67 |

|

8.12 |

Sellers Release |

68 |

|

Article IX GENERAL PROVISIONS |

68 | |

|

9.1 |

Reasonable Efforts; Further Assurances |

68 |

|

9.2 |

Amendment and Modification |

69 |

|

9.3 |

Waiver of Compliance |

69 |

|

9.4 |

Severability |

69 |

|

9.5 |

Expenses and Obligations |

69 |

|

9.6 |

Parties in Interest |

69 |

|

9.7 |

Notices |

70 |

|

9.8 |

Counterparts |

71 |

|

9.9 |

Time |

71 |

|

9.10 |

Entire Agreement |

71 |

|

9.11 |

Public Announcements |

71 |

|

9.12 |

Attorneys’ Fees |

72 |

|

9.13 |

Assignment |

72 |

|

9.14 |

Rules of Construction |

72 |

|

9.15 |

Reserved |

73 |

|

9.16 |

Governing Law |

73 |

|

9.17 |

Waiver of Jury Trial |

74 |

|

9.18 |

Consent to Jurisdiction; Venue |

74 |

|

9.19 |

Enforcement |

74 |

|

9.20 |

Acknowledgement and Waiver |

75 |

(ii)

EXHIBITS

Exhibit ADefined Terms

Exhibit BForm of Letter of Transmittal

Exhibit CForm of Stockholder Consent

Exhibit D Form of Certificate of Merger

Exhibit EForm of Surviving Corporation Certificate of Incorporation

Exhibit FForm of Surviving Corporation Bylaws

SCHEDULES

Schedule A-1Adjustment Escrow Amount

Schedule A-2Transaction Expenses

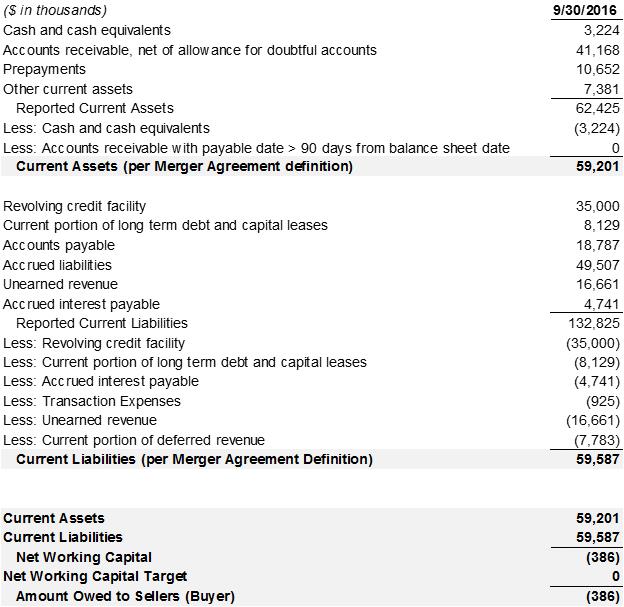

Schedule 2.9Sample Working Capital Calculation

Schedule 2.12Advisory Group

DISCLOSURE SCHEDULES

Schedule 3.1(a)(i) Organization; Good Standing and Other Matters

Schedule 3.1(a)(ii) Organization; Good Standing and Other Matters

Schedule 3.1(b)(ii) Capitalization – Stock Ownership

Schedule 3.1(b)(iii) Capitalization – Option Ownership

Schedule 3.1(b)(iv) Capitalization – RSU Ownership

Schedule 3.1(b)(v) Capitalization – Warrant Ownership

Schedule 3.1(c)(i) Capitalization of the Subsidiaries

Schedule 3.1(c)(ii) Capitalization of the Subsidiaries

Schedule 3.1(e)(i) No Conflict; Required Filings and Consents

Schedule 3.1(f)(i) Financial Statements

Schedule 3.1(f)(iii) Absence of Certain Changes or Events

Schedule 3.1(g)(iv) Compliance with Applicable Laws; Permits

Schedule 3.1(h) Litigation

Schedule 3.1(i) Insurance Coverage

Schedule 3.1(j)(i)(A) Real Property

Schedule 3.1(j)(i)(B) Real Property

Schedule 3.1(l) Liens

Schedule 3.1(m) Environmental Matters

Schedule 3.1(n) Taxes

Schedule 3.1(o)(i) Material Contracts

Schedule 3.1(o)(ii) Material Contracts – Validity

Schedule 3.1(p)(i) ERISA Compliance; Labor

Schedule 3.1(p)(ii) ERISA Compliance; Labor

Schedule 3.1(p)(iii) ERISA Compliance; Labor

Schedule 3.1(q) Intellectual Property

Schedule 3.1(r) Broker’s Commissions and Advisor Fees

(iii)

Schedule 3.1(s)(i) Network Facilities and Operations

Schedule 3.1(s)(iii) Network Facilities and Operations

Schedule 3.1(s)(iv) Network Facilities and Operations

Schedule 3.1(s)(v) Network Facilities and Operations

Schedule 3.1(s)(vi) Network Facilities and Operations

Schedule 3.1(s)(vii) Network Facilities and Operations

Schedule 3.1(t)(i) Transactions with Certain Persons

Schedule 3.1(t)(ii) Transactions with Certain Persons

Schedule 3.1(t)(iii) Transactions with Certain Persons

Schedule 4.1 Conduct of Business

Schedule 4.2(a) Specified Governmental Approvals

Schedule 4.4 Third Party Consents

Schedule 4.13(b)(i) Incentive Plans

Schedule 4.14 Payoff Indebtedness

(iv)

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of November 29, 2016, is made by and among Zayo Group, LLC, a Delaware limited liability company (“Buyer”), ZELMS, Inc., a Delaware corporation and direct, wholly owned subsidiary of Buyer (“Merger Sub”), Electric Lightwave Parent, Inc., a Delaware corporation (the “Company”) and Fortis Advisors LLC, a Delaware limited liability company, solely in its capacity as the initial Equityholder Representative hereunder.

PRELIMINARY STATEMENTS

|

A. The Boards of Directors of the Company and Merger Sub have each (i) determined that the merger of Merger Sub with and into the Company (the “Merger”) would be advisable and fair to, and in the best interests of, their respective stockholders, (ii) approved and declared advisable this Agreement and the transactions contemplated hereby, including, without limitation, the Merger, upon the terms and subject to the conditions set forth in this Agreement pursuant to the General Corporation Law of the State of Delaware (the “DGCL”), (iii) resolved to submit this Agreement to their respective stockholders for their approval of the adoption hereof, and (iv) recommended that their respective stockholders approve the adoption of this Agreement and the transactions contemplated hereby, including, without limitation, the Merger. |

|

B. Based on the recommendation of the Board of Directors of the Company that the Merger would be advisable and fair to, and in the best interests of, the Stockholders, as promptly as practicable following the execution and delivery of this Agreement, it is expected that the Stockholders holding more than 50% of the issued and outstanding shares of common stock, par value $0.001 per share, of the Company (the “Company Common Stock”) will execute and deliver a written consent and agreement substantially in the form attached as Exhibit C hereto pursuant to Section 228 of the DGCL, approving the adoption of this Agreement and the transactions contemplated hereby, including, without limitation, the Merger in accordance with Section 251 of the DGCL (the “Stockholder Consent”). |

|

C. Unless the context otherwise requires, all references in this Agreement to the Company shall refer to the Company together with its Subsidiaries. |

AGREEMENTS

NOW, THEREFORE, in consideration of the representations, warranties, covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and upon the terms and subject to the conditions hereinafter set forth, the parties hereto, intending to be legally bound hereby, agree as follows:

|

2.2 Effects of the Merger. The Merger shall have the effects provided for in this Agreement and in the applicable provisions of the DGCL. |

2

to take and do, in the name and on behalf of each of such corporations or otherwise, all such other actions and things as may be necessary or desirable to vest, perfect or confirm any and all right, title and interest in, to and under such rights, properties or assets in the Surviving Corporation or otherwise to carry out this Agreement. |

|

(a) Upon the terms and subject to the conditions of this Agreement, at the Effective Time, by virtue of the Merger and without any further action on the part of the Buyer, Merger Sub, the Company, any Stockholder or any holder of any shares of capital stock of Merger Sub: |

|

(i) Each Share issued and outstanding immediately prior to the Effective Time (other than Cancelled Shares and any Dissenting Shares) shall be converted into the right to receive the Per Share Merger Consideration, in cash, without interest and upon such conversion shall be cancelled and shall cease to exist; |

|

(ii) Each Share that is owned by the Buyer or Merger Sub immediately prior to the Effective Time shall automatically be cancelled and shall cease to exist, and no cash or other consideration shall be delivered or deliverable in exchange therefor; |

|

(iii) Each Share that is held in the treasury of the Company or owned by the Company or any of its wholly owned Subsidiaries immediately prior to the Effective Time shall automatically be cancelled and shall cease to exist, and no cash or other consideration shall be delivered or deliverable in exchange therefore (the Shares described in Section 2.6(a)(ii) and this Section 2.6(a)(iii), “Cancelled Shares”); and |

|

(b) Upon the terms and subject to the conditions set forth in this Agreement, at the Effective Time, by virtue of the Merger and without any further action on the part of the Buyer, Merger Sub, the Company or any holder of any In-the-Money Options or RSUs: |

|

(i) each In-the-Money Option (whether vested or unvested) issued and outstanding as of immediately prior to the Effective Time shall automatically be cancelled, and in consideration of such cancellation, shall automatically be converted into the right to receive an amount in cash equal to the product of (1) the number of Shares then subject to such In-the-Money Option and (2) the excess of the Closing Per Share Merger Consideration over the per Share exercise price of each such In-the-Money Option, together with any amounts that may be payable in respect of such In-the-Money Option from the Adjustment Escrow Fund, the Indemnity Escrow Fund, the Equity Representative Fund or pursuant to Section 2.10(g) at the respective times and subject to the contingencies specified in this Agreement and the Escrow Agreement, as applicable. The amounts described in this Section 2.6(b)(i) shall be deemed to have been paid in full satisfaction of all rights pertaining to such In-the-Money Options; and |

3

|

(ii) each RSU (whether vested or unvested) issued and outstanding as of immediately prior to the Effective Time, to the extent not a Waived RSU (as defined below), shall automatically be cancelled, and in consideration of such cancellation, shall be converted into the right to receive an amount in cash equal to the product of (1) the number of Shares subject to such RSU and (2) the Per Share Merger Consideration. The amounts described in this Section 2.6(b)(ii) shall be deemed to have been paid in full satisfaction of all rights pertaining to such RSUs. |

|

(c) Any In-the-Money Option irrevocably waived, surrendered and relinquished by the holder thereof at least two (2) hours prior to the Effective Time shall be defined for the purposes of this Agreement as a “Waived Option”. Any RSU waived and relinquished by the holder thereof at least two (2) hours prior to the Effective Time shall be defined for purposes of this Agreement as a “Waived RSU”. At the Effective Time, each Out-of-the-Money Option, each Waived Option and each Waived RSU shall be cancelled without consideration and shall be of no further force and effect. |

|

(d) As promptly as practicable after the date of this Agreement, the Company shall deliver to each holder of a Warrant a notice of the Merger consistent with the terms and conditions of the applicable Warrant and otherwise comply with the information requirements therein. At the Effective Time, by virtue of the Merger and without any further action on the part of Buyer, Merger Sub, the Company or any holder of Warrants, each Warrant shall be cancelled and extinguished at the Effective Time without any present or future right to receive any portion of the Total Merger Consideration. |

|

(a) Immediately after the Effective Time, the Buyer shall pay or deposit: |

|

(i) with the Escrow Agent for deposit into the Adjustment Escrow Fund, the Adjustment Escrow Amount; |

|

(ii) with the Escrow Agent for deposit into the Indemnity Escrow Fund, the Indemnity Escrow Amount; |

|

(iii) subject to the fulfillment of the conditions set forth in Section 2.8, to each Stockholder, the portion of the Closing Merger Consideration in which the Stockholder shall be entitled to as of the Closing pursuant to Section 2.6(a)(i); provided, that if any Stockholder has not satisfied the conditions set forth in Section 2.8(b), then the Buyer shall pay such Stockholder as promptly as practical after satisfaction of such conditions, but in no event prior to the Effective Time; |

|

(iv) with the Company, the portion of the Closing Merger Consideration to which the holders of In-the-Money Options and RSUs shall be entitled to as of the Closing pursuant to Section 2.6(b); |

|

(v) on behalf of the Company, the amount payable to each counterparty or holder of Payoff Indebtedness in order to fully discharge such Payoff Indebtedness and |

4

terminate all applicable obligations and liabilities of the Company and any of its Affiliates related thereto, as specified in the Debt Payoff Letters and in accordance with this Agreement; |

|

(vi) on behalf of the Company, the amount payable to each Person who is owed a portion of the Estimated Transaction Expenses, as specified in the Transaction Expenses Payoff Instructions and in accordance with this Agreement; and |

|

(vii) to the Equityholder Representative, the Equityholder Representative Fund Amount; |

provided, that all payments made under this Section 2.7(a) shall be made by wire transfer of immediately available funds in United States dollars to such account as may be designated to the payor by the payee in writing at least two (2) Business Days prior to the applicable payment date.

|

(b) As promptly as practicable after the Effective Time, but in any event no later than the second regularly scheduled Company payroll date occurring on or after the Closing Date, and as part of the Total Merger Consideration, the Surviving Corporation shall, in exchange for the In-the-Money Options and the RSUs make the payment utilizing the Company’s payroll system in respect of each such In-the-Money Option or RSU to which each holder thereof is entitled as specified in Section 2.6(b). |

|

(a) Reasonably promptly after the date hereof, the Company shall mail to each Stockholder of record holding a Certificate and to each Stockholder holding Shares in book-entry form (“Book-Entry Shares”), and, in each case, whose Shares will be converted into the right to receive the consideration described in Section 2.6(a)(i), (i) a letter of transmittal substantially in the form attached as Exhibit B hereto and (ii) instructions for use in effecting the surrender of Certificates or Book-Entry Shares in exchange for payment therefor. Upon proper surrender of any such Certificate or Book-Entry Share for cancellation to the Buyer in accordance with the surrender instructions, together with such completed letter of transmittal duly executed, the holder of such Certificate or Book-Entry Share shall be entitled to receive in exchange therefor (as and when payable pursuant to the terms of this Agreement), an amount in cash equal to (A) the Per Share Merger Consideration multiplied by (B) the number of Shares formerly represented by such Certificate or Book-Entry Share, as applicable, without interest, and such Certificate or Book-Entry Share, as applicable, shall, upon such surrender, be cancelled. |

|

(b) As promptly as practicable after receipt of the letter of transmittal, and in no event later than five (5) Business Days prior to the Closing, each Stockholder shall surrender its Certificate or Book-Entry Share for cancellation to the Buyer in accordance with the surrender instructions, together with its letter of transmittal duly executed; provided, that a Stockholder’s failure to make timely surrender of its Certificate or Book-Entry Share in accordance with the surrender instructions and delivery of the letter of transmittal to the Buyer shall only impact the timing of the payment to such Stockholder pursuant to Section 2.7(a)(iii) and shall not impact such Stockholder’s entitlement to payment. |

5

|

(c) If payment in respect of any Certificate is to be made to a Person other than the Person in whose name such Certificate is registered, it shall be a condition of payment that the Certificate so surrendered shall be properly endorsed or shall otherwise be in proper form for transfer, that the signatures on such Certificate or any related stock power shall be properly guaranteed and that the Person requesting such payment shall have established to the satisfaction of the Buyer that any transfer and other similar Taxes required by reason of such payment to a Person other than the registered holder of such Certificate have been paid or are not applicable. Until surrendered in accordance with the provisions of this Section 2.8, any Certificate (other than Certificates representing Cancelled Shares or Dissenting Shares) shall be deemed, at any time after the Effective Time, to represent only the right to receive the Per Share Merger Consideration payable with respect to the Shares represented thereby, in cash, without interest. |

|

(d) At the Effective Time, the stock transfer books of the Company shall be closed and there shall be no further registration of transfers of any shares of capital stock thereafter on the records of the Company. If, after the Effective Time, a Certificate (other than one representing Cancelled Shares or Dissenting Shares) is presented to the Surviving Corporation, it shall be cancelled and exchanged as provided in this Section 2.8. |

|

(e) All cash paid upon conversion of the Shares in accordance with the terms of this Article II and all cash deposited with the Escrow Agent and the Equityholder Representative pursuant to this Article II shall be deemed to have been paid in full satisfaction of all rights pertaining to such Shares. From and after the Effective Time, the holders of Certificates shall cease to have any rights with respect to Shares represented thereby, except as otherwise provided herein or by Applicable Law. |

|

(g) Prior to the Closing, each of Buyer and the Company shall use commercially reasonable efforts to coordinate with the Company’s transfer agent with respect to shares of Company Common Stock and take such actions as are required to give effect to the provisions of this Section 2.8. |

|

(a) At least five (5) Business Days prior to the anticipated Closing Date, the Company shall in good faith prepare, or cause to be prepared, and deliver to the Buyer a written statement (the “Preliminary Closing Statement”) that shall include and set forth (i) a consolidated balance sheet of the Company and its Subsidiaries, as of the Measurement Time (the “Preliminary Closing Balance Sheet”) in accordance with the sample calculation worksheet set forth on Schedule 2.9, (ii) a good-faith estimate of (A) Net Working Capital based on the Preliminary Closing Balance Sheet (the “Estimated Net Working Capital”), (B) Indebtedness (the “Estimated |

6

Indebtedness”), (C) Cash (the “Estimated Cash”) and (D) unpaid Transaction Expenses (the “Estimated Transaction Expenses”), in each case, as of the Measurement Time, before taking into account the payments contemplated herein, and (iii) on the basis of the foregoing, a calculation of the Closing Merger Consideration, the Per Share Merger Consideration and the payments due hereunder to each Seller. |

|

(b) All calculations of the Estimated Net Working Capital, Indebtedness, Cash, Transaction Expenses, Closing Merger Consideration, the Per Share Merger Consideration and the payments due hereunder to each Seller shall be accompanied by a certificate signed by the Chief Financial Officer of the Company, acting in such capacity, certifying that such estimates were prepared in good faith in accordance with this Agreement. |

|

(a) Within sixty (60) days after the Closing Date, the Surviving Corporation shall in good faith prepare and deliver to the Equityholder Representative (on behalf of the Sellers) a written statement (the “Final Closing Statement”) that shall include and set forth (i) a consolidated balance sheet of the Company and its Subsidiaries, as of the Measurement Time (the “Closing Balance Sheet”) in accordance with the sample calculation worksheet set forth in Schedule 2.9 and (ii) a calculation of the actual (A) Net Working Capital (the “Closing Net Working Capital”), (B) Indebtedness (the “Closing Indebtedness”), (C) Cash (the “Closing Cash”), and (D) unpaid Transaction Expenses (the “Closing Transaction Expenses”), in each case, as of the Measurement Time before giving effect to the payments contemplated herein, and (iii) on the basis of the foregoing, a calculation of the Merger Consideration. |

|

(b) The Final Closing Statement shall become final and binding on the thirtieth (30th) day following delivery thereof, unless prior to the end of such period, the Equityholder Representative delivers to the Buyer written notice of its disagreement (a “Notice of Disagreement”) specifying the nature and amount of any dispute as to the Merger Consideration, as set forth in the Final Closing Statement. The Equityholder Representative shall be deemed to have agreed with all items and amounts included in the calculation of the Merger Consideration, as set forth in the Final Closing Statement that are not specifically referenced in the Notice of Disagreement, and such items and amounts shall not be subject to review in accordance with Section 2.10(c). Any Notice of Disagreement may reference only disagreements (x) based on mathematical errors or (y) regarding whether the Merger Consideration, or the components thereof, as reflected on the Final Closing Statement, were calculated in accordance with this Section 2.10. |

7

|

(c) During the fifteen (15) day period following delivery of a Notice of Disagreement by the Equityholder Representative to the Buyer, the parties in good faith shall seek to resolve in writing any differences that they may have with respect to the calculation of the Merger Consideration. Any disputed items resolved in writing between the Equityholder Representative and the Buyer within such fifteen (15) day period shall be final and binding with respect to such items, and if the Equityholder Representative and the Buyer agree in writing on the resolution of each disputed item specified by the Equityholder Representative in the Notice of Disagreement and the amount of the Merger Consideration, the amount so determined shall be final and binding on the parties for all purposes hereunder and shall not be subject to appeal or further review. If the Equityholder Representative and the Buyer have not resolved all such differences by the end of such fifteen (15) day period, the Equityholder Representative and the Buyer shall submit, in writing, to a nationally recognized independent public accounting firm (the “Independent Accounting Firm”), their briefs detailing their views as to the correct nature and amount of each item remaining in dispute and the amount of the Merger Consideration (including a reasonably detailed calculation thereof), and the Independent Accounting Firm shall make a written determination as to each such disputed item and the amount of the Merger Consideration, which determination shall be final and binding on the parties for all purposes hereunder. The Independent Accounting Firm shall consider only those items and amounts in the Equityholder Representative’s and the Buyer’s respective calculations of the Merger Consideration that are identified as being items and amounts to which the Equityholder Representative and the Buyer have been unable to agree. In resolving any disputed item, the Independent Accounting Firm shall limit its determination to whether the Buyer’s proposed amount for such item in the Notice of Disagreement or the Equityholder Representative’s proposed amount for such item in the Notice of Disagreement is calculated more nearly in accordance with this Agreement. |

|

(d) The Independent Accounting Firm shall be Ernst & Young LLP or, if such firm is unable or unwilling to act, such other nationally recognized independent public accounting firm as shall be agreed in writing by the Equityholder Representative (on behalf of the Sellers) and the Buyer. The Equityholder Representative and the Buyer shall use their commercially reasonable efforts to cause the Independent Accounting Firm to render a written decision resolving the matters submitted to it as promptly as practicable, and in any event within thirty (30) days following the submission thereof. In acting under this Agreement, the Independent Accounting Firm will be entitled to the privileges and immunities of an arbitrator. |

|

(e) The costs of any dispute resolution pursuant to this Section 2.10, including the fees and expenses of the Independent Accounting Firm and of any enforcement of the determination thereof, shall be borne by the Equityholder Representative (on behalf of the Sellers) and the Buyer in inverse proportion as they may prevail on the matters resolved by the Independent Accounting Firm, which proportionate allocation shall be calculated on an aggregate basis based on the relative dollar values of the amounts in dispute and shall be determined by the Independent Accounting Firm at the time the determination of such firm is rendered on the merits of the matters submitted. The fees and disbursements of the Representatives of each party incurred in connection with the preparation or review of the Final Closing Statement and preparation or review of any Notice of Disagreement, as applicable, shall be borne by such party. |

8

|

(f) The Company shall, during the period prior to the Closing Date, and the Buyer, during the period from and after the date of delivery of the Final Closing Statement through the resolution of any adjustment to the Closing Merger Consideration contemplated by this Section 2.10 shall cause the Surviving Corporation to, afford the Buyer or the Equityholder Representative, as the case may be, and their respective Representatives reasonable access, during normal business hours and upon reasonable prior notice, to the personnel, properties, books and records of the Company or the Surviving Corporation, as the case may be, and its Subsidiaries and to any other information reasonably requested for purposes of preparing and reviewing the calculations contemplated by this Section 2.10. Each party shall authorize its accountants to disclose work papers generated by such accountants in connection with preparing and reviewing the calculation of the Closing Merger Consideration as specified in this Section 2.10; provided that such accountants shall not be obligated to make any work papers available except in accordance with such accountants’ disclosure procedures and then only after the non-client party has signed an agreement relating to access to such work papers in form and substance acceptable to such accountants. |

|

(g) The Closing Merger Consideration shall be adjusted, upwards or downwards, as follows: |

|

(i) For the purposes of this Agreement, the “Net Adjustment Amount” means an amount, which may be positive or negative, equal to (A) the Merger Consideration as finally determined pursuant to this Section 2.10 minus (B) the Closing Merger Consideration; |

|

(iii) If the Net Adjustment Amount is negative (in which case the “Net Adjustment Amount” for purposes of this clause (iii) shall be deemed to be equal to the absolute value of such amount), (A) the Buyer and the Equityholder Representative shall deliver a joint written notice to the Escrow Agent specifying the Net Adjustment Amount, and the Escrow Agent shall pay the Net Adjustment Amount out of the Adjustment Escrow Fund to the Buyer in |

9

accordance with the terms of the Escrow Agreement. If the Adjustment Escrow Fund is insufficient to cover the entire amount payable to the Buyer pursuant hereto, the deficiency shall be recovered from the Indemnity Escrow Fund and neither the Equityholder Representative nor any Seller shall be entitled to object to such claim against the Indemnity Escrow Fund; provided, however, that for the avoidance of doubt, in no event shall Buyer be entitled to seek recovery of all or any portion of the Net Adjustment Amount directly from the Sellers. In the event the amount of funds in the Adjustment Escrow Fund exceeds the Net Adjustment Amount, then the Escrow Agent, after paying the Net Adjustment Amount to the Buyer as provided herein, shall pay (I) the portion of each former Stockholder’s Fully Diluted Percentage of the remaining amount of funds in the Adjustment Escrow Fund attributable to Shares (as opposed to In-the-Money Options or RSUs) previously held by such former Stockholder, subject to Section 2.8, to such former Stockholder as soon as practicable and (II) the portion of each former holder’s Fully Diluted Percentage of the remaining amount of funds in the Adjustment Escrow Fund attributable to In-the-Money Options or RSUs (as opposed to Shares) previously held by such former holder to the Surviving Corporation for delivery to such former holder of In-the-Money Options and RSUs through the Surviving Corporation’s payroll system. |

10

|

(a) By the approval of this Agreement pursuant to the DGCL, the Stockholder Consent and the Letters of Transmittal, the Sellers irrevocably appoint and constitute Fortis Advisors LLC as exclusive agent, proxy and attorney-in-fact, with full power of substitution, to act on behalf of the Stockholders for certain limited purposes, as specified herein (the “Equityholder Representative”), including the full power and authority to act on the Stockholders’ behalf as provided in Section 2.12(b). The Sellers, by approving this Agreement pursuant to the Stockholder Consent, further agree that such agency, proxy and attorney-in-fact, powers, immunities and rights of indemnification granted to the Equityholder Representative Group hereunder are (i) are coupled with an interest, are therefore irrevocable without the consent of the Equityholder Representative, except as provided in Section 2.12(c), (ii) shall be binding upon the successors, heirs, executors, administers and legal representatives of each Seller and shall not be affected by, and shall survive, the death, incapacity, bankruptcy, dissolution or liquidation of any Seller and (iii) shall survive the delivery of an assignment by any Seller of the whole or any fraction of his, her or its interest in the Adjustment Escrow Fund, the Indemnity Escrow Fund and the Equityholder Representative Fund. All decisions, actions, consents and instructions by the Equityholder Representative shall be binding upon all of the Sellers and such Seller’s successors as if expressly confirmed and ratified in writing by such Seller, and no Seller shall have the right to object to, dissent from, protest or otherwise contest any such decision, action, consent or instruction. The Escrow Agent and the Buyer Parties shall be entitled to rely on any decision, action, consent or instruction of the Equityholder Representative as being the decision, action, consent or instruction of the Stockholders, and the Escrow Agent and the Buyer Parties are hereby relieved from any liability to any Person for acts done by them in accordance with any such decision, act, consent or instruction. The Equityholder Representative shall be entitled to: (i) rely upon any signature believed by it to be genuine, and (ii) reasonably assume that a signatory has proper authorization to sign on behalf of the applicable Seller or other party. |

|

(b) The Equityholder Representative shall have such powers and authority as are necessary to carry out the functions assigned to it under this Agreement. Without limiting the generality of the foregoing, the Equityholder Representative shall have full power, authority and discretion to (i) consummate the transactions contemplated under this Agreement and the Escrow Agreement (including pursuant to Section 2.10 hereof); (ii) from and after the Closing, negotiate disputes arising under, or relating to, this Agreement (including pursuant to Article VIII hereof) and the Escrow Agreement; and (iii) from and after the Closing, execute and deliver any amendment or waiver to this Agreement or the Escrow Agreement; and (iv) from and after the Closing, take all other actions to be taken by or on behalf of the Sellers in connection with this Agreement (including pursuant to Section 2.10 and Article VIII hereof) and the Escrow Agreement. The Equityholder Representative shall have no duties or obligations hereunder to the Sellers, including any fiduciary duties, except those set forth herein, and such duties and obligations shall be determined solely by the express provisions of this Agreement. |

|

(c) The Equityholder Representative may resign at any time, and may be removed for any reason or no reason by the vote or written consent of Sellers holding a majority of the aggregate Fully Diluted Share Number as of the Effective Time (the “Majority Sellers”). In the event of the death, incapacity, resignation or removal of the Equityholder Representative, a new Equityholder Representative shall be appointed by the vote or written consent of the Majority Sellers and such replacement Equityholder Representative must be duly appointed prior to the |

11

effectiveness of any resignation or removal of the Equityholder Representative. Notice of such vote or a copy of the written consent appointing such new Equityholder Representative shall be sent to the Buyer and, after the Effective Time, to the Surviving Corporation, such appointment to be effective upon the later of the date indicated in such consent or the date such consent is received by the Buyer and, after the Effective Time, the Surviving Corporation; provided, that until such notice is received, the Buyer, Merger Sub and the Surviving Corporation, as applicable, shall be entitled to rely on the decisions, actions, consents and instructions of the prior Equityholder Representative as described in Section 2.12(a). The immunities and rights to indemnification granted to the Equityholder Representative Group shall survive the resignation or removal of the Equityholder Representative or any member of the Advisory Group and the Closing and/or any termination of this Agreement and the Escrow Agreement. |

|

(d) The Equityholder Representative shall hold the Equityholder Representative Fund Amount in a segregated account (the “Equityholder Representative Fund”). The Equityholder Representative Fund shall be used for the purpose of paying directly or reimbursing the Equityholder Representative for all reasonably documented expenses, disbursements and advances (including fees and disbursements of its counsel, experts and other agents and consultants) incurred by the Equityholder Representative in such capacity (including such expenses as that are to be borne by the Equityholder Representative on behalf of the Sellers under this Agreement); provided, that, other than the payment contemplated under Section 2.7(a)(vii), neither the Buyer nor the Company shall have any monetary obligation or liability to the Equityholder Representative. The Equityholder Representative is not providing any investment supervision, recommendations or advice and shall have no responsibility or liability for any loss of principal of the Equityholder Representative Fund other than as a result of its gross negligence or willful misconduct. The Equityholder Representative is not acting as a withholding agent or in any similar capacity in connection with the Equityholder Representative Fund, and has no tax reporting or income distribution obligations. The Sellers will not receive any interest on the Equityholder Representative Fund and assign to the Equityholder Representative any such interest. |

|

(e) In the event the Equityholder Representative Fund is insufficient to satisfy the expenses of the Equityholder Representative, following the Expiration Date and prior to the final distribution from the Indemnity Escrow Fund to the Sellers of any amounts thereof in accordance with this Agreement and the Escrow Agreement, the Equityholder Representative shall have the right to recover its unpaid expenses from any remaining portion of the Indemnity Escrow Fund that is then distributable to the Sellers. Immediately prior to the Survival Date, and from time to time thereafter for so long as any amounts remain in the Indemnity Escrow Fund, the Equityholder Representative shall deliver to Buyer and the Escrow Agent a certificate setting forth its unpaid expenses and upon receipt of such certificate, the Escrow Agent shall pay such unpaid expenses to the Equityholder Representative up to the amount of any distributions from the Indemnity Escrow Fund to be made to the Sellers in accordance with this Agreement and the Escrow Agreement. Notwithstanding the foregoing, and for the avoidance of doubt, the Equityholder Representative’s right to recover its expenses under this Section 2.12(e) shall not impair Buyer’s right to recover from the Indemnity Escrow Fund pursuant to Article VIII and the Escrow Agreement and no funds subject to a pending or unsatisfied claim shall be distributed to the Equityholder Representative. The Sellers acknowledge that the Equityholder Representative |

12

shall not be required to expend or risk its own funds or otherwise incur any financial liability in the exercise or performance of any of its powers, rights, duties or privileges or pursuant to this Agreement, the Escrow Agreement or the transactions contemplated hereby or thereby. |

|

(f) The Company and certain representatives of the Sellers have entered into an engagement agreement (the “Representative Engagement Agreement”) with the Equityholder Representative to provide direction to the Equityholder Representative in connection with its services under this Agreement, the Escrow Agreement and the Representative Engagement Agreement (such representatives, the “Advisory Group”). It is acknowledged and agreed that the Advisory Group to the Equityholder Representative shall initially be the individuals set forth on Schedule 2.12. Neither the Equityholder Representative nor its members, managers, directors, officers, contractors, agents and employees nor any member of the Advisory Group (collectively, the “Equityholder Representative Group”), shall be liable to any Seller for any action or failure to act in connection with the acceptance or administration of the Equityholder Representative Group’s responsibilities hereunder, under the Escrow Agreement or under the Representative Engagement Agreement, unless and only to the extent such action or failure to act constitutes gross negligence or willful misconduct. At such time as the Equityholder Representative determines that it will not incur any further expenses in its capacity as such, the Equityholder Representative shall pay (I) the portion of each former Stockholder’s Fully Diluted Percentage of the remaining amount of funds in the Equityholder Representative Fund attributable to Shares (as opposed to In-the-Money Options or RSUs) previously held by such former Stockholder to the Surviving Corporation for distribution to such former Stockholder, subject to Section 2.8, and (II) the portion of each former holder’s Fully Diluted Percentage of the remaining amount of funds in the Equityholder Representative Fund attributable to In-the-Money Options or RSUs (as opposed to Shares) previously held by such former holder to the Surviving Corporation for delivery to such former holder of In-the-Money Options and RSUs through the Surviving Corporation’s payroll system. Notwithstanding the foregoing, promptly upon the distribution of the Adjustment Escrow Fund pursuant to Section 2.10(g), the Equityholder Representative shall pay any amounts remaining in the Equityholder Representative Fund in excess of $250,000 to the Surviving Corporation for distribution to the former Stockholder’s and former holders of In-the Money Options and RSUs in according with the foregoing sentence. |

|

(g) By the approval of this Agreement pursuant to the DGCL, the Stockholder Consent and the Letters of Transmittal, each Seller hereby, jointly and severally, agrees to indemnify, defend and hold harmless the Equityholder Representative Group from and against any losses, liabilities, expenses (including reasonable attorneys’ fees and costs, costs of other skilled professionals and costs in connection with seeking recovery from insurers), judgments, fines, settlements and amounts incurred by such Persons arising out of actions taken or omitted to be taken in the Equityholder Representative’s capacity as the Equityholder Representative (except for those arising out of the Equityholder Representative’s gross negligence or willful misconduct), including the costs and expenses of investigation and defense of claims (collectively, the “Representative Expenses”). |

13

and who complies in all respects with, the provisions of Section 262 of the DGCL (any such shares being referred to herein as “Dissenting Shares”) shall not be converted into the right to receive the Per Share Merger Consideration as provided in Section 2.6(a). Holders of Dissenting Shares shall be entitled to receive payment of the fair value of such shares as shall be determined in accordance with the provisions of Section 262 of the DGCL. If, after the Effective Time, any such holder fails to perfect or effectively waives, withdraws or otherwise loses the right to appraisal under Section 262 of the DGCL, then the right of such holder to be paid the fair value of such holder’s Dissenting Shares under Section 262 of the DGCL shall cease and such Dissenting Shares shall thereupon be deemed to have been converted into and to have become, as of the Effective Time, the right to receive the Per Share Merger Consideration in accordance with Section 2.6(a), payable without interest. |

Except as set forth on the Disclosure Schedule, as of the date of this Agreement and as of the Closing Date (except to the extent such representations and warranties speak expressly as of an earlier date), the Company hereby represents and warrants to the Buyer and Merger Sub as follows:

|

(a) Organization; Good Standing and Other Matters. |

|

(i) Each of the Company and its Subsidiaries is duly organized, validly existing and in good standing under the laws of its respective jurisdiction of incorporation or organization as set forth on Disclosure Schedule 3.1(a)(i), has all requisite power and authority to own, lease and operate its properties and to carry on its business as now being conducted. Each of the Company and its Subsidiaries is duly qualified and in good standing to conduct business as a foreign corporation or limited liability company in each jurisdiction in which the business it is conducting, or the operation, ownership or leasing of its properties, makes such qualification necessary, except where the failure to be so qualified or in good standing would not have a Material Adverse Effect. The Company’s certificate of incorporation and bylaws and its Subsidiaries’ respective certificates of incorporation and bylaws, or other comparable organizational documents, as in effect on the date of this Agreement are in full force and effect. The Company is not in violation, in any material respect, of any of the provisions of its certificate of incorporation or bylaws and none of the Subsidiaries of the Company are in violation, in any material respect, of any of the provisions of their certificates of incorporation, bylaws or equivalent organizational documents. The Company does not own any assets nor does it have any operations, other than its ownership of 100% of the equity interest of Electric Lightwave Communications, Inc., an Oregon corporation. The Company has delivered or otherwise made available to Buyer or its Representatives true, correct and complete copies of the Company’s certificate of incorporation and bylaws, or other comparable organizational documents, as in effect on the date of this Agreement. |

|

(ii) Except as set forth on Disclosure Schedule 3.1(a)(ii), the Company has delivered or otherwise made available to Buyer or its Representatives true, correct and complete copies, in all material respects, of (A) the Company’s Subsidiaries’ respective certificates |

14

of incorporation and bylaws, or other comparable organizational documents, as in effect on the date of this Agreement, (B) the approved minutes of the Company and its Subsidiaries with respect to the period from January 1, 2015 through the date of this Agreement (other than with respect to meetings convened in respect of the transactions contemplated by this Agreement) and (C) equity transfer records or other comparable ownership records of the Company and its Subsidiaries with respect to the period from January 1, 2009 through the date of this Agreement. Such minutes reflect the meetings of the stockholders or members of the Company and its Subsidiaries and of their respective boards of directors or managers that occurred during such period, and accurately reflect the events of and actions taken at such meetings in all material respects. Except as set forth on Disclosure Schedule 3.1(a)(ii), such equity transfer records or ownership records accurately reflect all issuances, transfers and cancellations of the Shares, or other comparable ownership interests of the Company’s Subsidiaries. All Subsidiaries of the Company, their respective jurisdictions of incorporation or organization and their respective jurisdictions where qualified to do business are set forth on Disclosure Schedule 3.1(a)(i). Copies of applicable Option award agreements and RSU award agreements have been provided to the Buyer on or prior to the date of this Agreement. |

|

(b) Capitalization of the Company. |

|

(i) The authorized capital stock of the Company consists of (i) 700,000,000 shares of Company Common Stock, of which 100,328,537 shares of Company Common Stock, constituting the Shares, are issued and outstanding, and (ii) 10,000,000 shares of preferred stock of the Company, par value $0.001 per share, of which zero (0) shares are issued and outstanding. |

|

(ii) Disclosure Schedule 3.1(b)(ii) sets forth a complete and accurate list of all record holders of the issued and outstanding capital stock of the Company, indicating the respective number of Shares held. |

|

(iii) Disclosure Schedule 3.1(b)(iii) sets forth the names of all Persons holding any Option, together with the number of Shares under each such Option held, the relevant exercise price(s), vesting date(s) and number of Options vesting on each such date, and expiration date(s) thereof. All Options have been issued in all material respects in accordance with the Incentive Plan. |

|

(iv) Disclosure Schedule 3.1(b)(iv) sets forth the names of all Persons holding any RSU, together with the number of Shares under each such RSU held, and the relevant vesting date(s) and number of RSUs vesting on each such date, and expiration date(s) thereof. All RSUs have been issued in all material respects in accordance with the Incentive Plan. |

|

(v) Disclosure Schedule 3.1(b)(v) sets forth the names of all Persons holding any Warrant, together with the number of Warrants thus held, the number of Shares issuable upon exercise of each Warrant and the relevant exercise price. All such Warrants will expire by virtue of the Merger without any further action on the part of the Buyer, Merger Sub, the Company or any holder of such Warrants, with no consideration becoming due or payable in |

15

respect thereof. All Warrants have been issued pursuant to the forms of warrant agreement provided to the Buyer on or prior to the date of this Agreement (the “Warrant Agreements”). |

|

(vi) No bonds, debentures, notes or other instruments or evidence of Indebtedness having the right to vote (or convertible into, or exercisable or exchangeable for, securities having the right to vote) on any matters on which the Stockholders may vote are issued or outstanding. Except for the Shares, Options, RSUs and Warrants and except as set forth on Disclosure Schedules 3.1(b)(iii), 3.1(b)(iv) and 3.1(b)(v), the Company has not agreed to issue any (a) securities, equity, ownership or voting interests; (b) securities or instruments convertible into or exchangeable for any securities, equity, ownership or voting interests; or (c) equity-equivalents, earnings, profits or revenue-based or equity-based rights. The Shares have been duly authorized and validly issued, are fully paid and nonassessable, and were issued in compliance with all applicable federal and state securities laws. Except as set forth in Disclosure Schedules 3.1(b)(iii), 3.1(b)(iv) and 3.1(b)(v) and except for the rights granted to the Buyer and Merger Sub under this Agreement, there are no outstanding obligations of the Company to issue, sell, transfer, repurchase or redeem any securities, equity, ownership or voting interests in the Company, or any securities or instruments convertible into or exchangeable for or that otherwise give rights with respect to securities, equity, ownership or voting interests in the Company, or that relate to the holding, voting or disposition thereof. No Shares have been issued in violation of any rights, agreements, commitments or arrangements under Applicable Law, the certificate of incorporation or bylaws of the Company or any Contract to which the Company is a party or by which it is bound. |

|

(vii) As of the Closing Date, the treatment of the Options and RSUs pursuant to Article II of this Agreement will be (a) in accordance with the provisions of the Incentive Plan and (b) in full satisfaction of any rights or entitlements of the holders of Options or RSUs under the Incentive Plan, as applicable. The Incentive Plan is the only equity- or incentive-based compensation plan of the Company or its Subsidiaries under which any incentive awards are outstanding. |

|

(c) Capitalization of the Subsidiaries. Except as set forth on Disclosure Schedule 3.1(c)(i), the Company directly or indirectly is the record and beneficial owner of all issued and outstanding shares of capital stock or other voting securities of each direct or indirect Subsidiary of the Company listed on Disclosure Schedule 3.1(c)(ii) and such ownership is free and clear of all Liens. Each outstanding share of capital stock or other voting securities of each such Subsidiary has been duly authorized, validly issued, fully paid and nonassessable and no shares of capital stock or other voting securities of any such Subsidiary have been issued in violation of any preemptive or similar rights. No shares of capital stock or other voting securities of any such Subsidiary are reserved for issuance, and there are no Contracts, agreements, commitments or arrangements obligating any such Subsidiary to issue, deliver, sell, purchase, redeem or acquire, or cause to be issued, delivered, sold, purchased, redeemed or acquired, any shares of capital stock or other voting securities, or obligating any such Subsidiary to grant, extend, or enter into any option, warrant, call, right, commitment or agreement of any kind to acquire any shares of, or any securities that are convertible into or exchangeable for any shares of, capital stock or other voting securities of such Subsidiary. All of the aforesaid shares or other equity or ownership interests have been offered, sold and delivered by the Company or a Subsidiary of the Company in compliance with all applicable federal and state securities laws. Neither the Company nor any of |

16

its Subsidiaries directly or indirectly owns any equity, partnership, membership or similar interest in, or any interest convertible into, exercisable for the purchase of or exchangeable for any such equity, partnership, membership or similar interest, or is under any current or prospective obligation to form or participate in, provide funds to, make any loan, capital contribution or other investment in, or assume any liability or obligation of, any Person. |

|

(d) Authority. |

|

(i) The Company has the full corporate power and authority to execute and deliver this Agreement and the other Transaction Documents to which it is or will be a party and, subject to the approval of the adoption of this Agreement by the holders of a majority of the outstanding Shares entitled to vote thereon, to perform its obligations hereunder and thereunder and to consummate the transactions contemplated herein and therein. The execution, delivery and performance of this Agreement and the other Transaction Documents to which the Company is or will be a party by the Company and the consummation by the Company of the transactions contemplated herein and therein have been duly and validly authorized and declared advisable by the Board of Directors of the Company. Except for the approval of the adoption of this Agreement by the holders of a majority of the outstanding Shares entitled to vote thereon, no other corporate proceedings on the part of the Company or any Subsidiary of the Company are necessary to authorize the execution, delivery or performance of this Agreement or any Transaction Documents to which it is or will be a party, for the Company to perform its obligations hereunder and thereunder, or for the Company to consummate the transactions contemplated herein and therein. The affirmative vote of Sellers representing a majority of the outstanding Shares is the only vote of the holders of any securities of the Company or any of its Subsidiaries necessary to approve and adopt this Agreement, the Merger and the other transactions contemplated hereby, and the execution of the Stockholder Consent by Sellers representing a majority of the outstanding Shares will constitute such approval. This Agreement and each of the other Transaction Documents to which the Company is or will be a party has been, or upon execution and delivery thereof will be, duly and validly executed and delivered by the Company and, assuming that this Agreement and the other Transaction Documents to which the Company is or will be a party constitute the valid and binding agreement of the other parties hereto and thereto, constitute, or upon execution and delivery will constitute, the valid and binding obligations of the Company enforceable against the Company in accordance with their respective terms and conditions, except that the enforcement hereof and thereof may be limited by (i) applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar laws now or hereafter in effect relating to creditors’ rights generally and (ii) general principles of equity (regardless of whether enforceability is considered in a proceeding at law or in equity). |

|

(ii) The Board of Directors of the Company, at a meeting duly called and held at which all directors of the Company were present, duly and unanimously (with one abstention) adopted resolutions (A) determining that the terms of this Agreement, and the transactions contemplated hereby, including, without limitation, the Merger, are fair to and in the best interests of the Company’s stockholders, (B) approving and declaring advisable this Agreement and the transactions contemplated hereby, including, without limitation, the Merger, (C) directing that this Agreement be submitted to the stockholders of the Company for their approval of the adoption hereof and (D) resolving to recommend that the Company’s stockholders |

17

approve the adoption of this Agreement and the transactions contemplated hereby, including, without limitation, the Merger, which resolutions have not been subsequently rescinded, modified or withdrawn in any way. |

|

(e) No Conflict; Required Filings and Consents. |

|

(i) Except as set forth in Disclosure Schedule 3.1(e)(i) (collectively, the “Company Approvals”), the execution, delivery and performance by the Company of this Agreement and each of the other Transaction Documents to which it is or will be a party do not, and the consummation by the Company of the transactions contemplated herein and therein do not and will not: |

|

(A) violate, conflict with, or result in any breach of any provision of the Company’s certificate of incorporation or bylaws, or its Subsidiaries’ respective certificates of incorporation or bylaws, or other similar organizational documents; |

|

(B) violate, conflict with or result in a violation or breach of, or constitute a default (or an event that, with or without due notice or lapse of time or both, would become a default) under, require any consent of or notice to any Person pursuant to, give to others any right of termination, amendment, modification, acceleration or cancellation of, allow the imposition of any fees or penalties, require the offering or making of any payment or redemption, give rise to any increased, guaranteed, accelerated or additional rights or entitlements of any Person or otherwise adversely affect any rights of the Company or any of its Subsidiaries under, or result in the creation of any Lien, other than Permitted Liens, on any property, asset or right of the Company or any of its Subsidiaries pursuant to the terms conditions or provisions of any Material Contract listed on Disclosure Schedule 3.1(o)(i) (but, for the avoidance of doubt, excluding any Contracts included in the Data Room but not specifically set forth on Disclosure Schedule 3.1(o)(i)); |

|

(C) violate any Applicable Law (including the Communications Laws) binding upon the Company or any of its Subsidiaries or by which or to which a material portion of the Company’s or any of its Subsidiaries’ respective assets is bound, except to the extent the foregoing would not be material to the Company and its Subsidiaries, taken as a whole; or |

|

(D) violate any material Company Permit. |

|

(ii) Assuming all Company Approvals have been obtained, (A) no consent of any Governmental Authority is required by the Company or any of its Subsidiaries in connection with the execution, delivery and performance by the Company of this Agreement and the other Transaction Documents to which the Company or any of its Subsidiaries is a party or the consummation of the transactions contemplated herein or therein and (B) none of the Company nor any of its Subsidiaries is required to file, seek or obtain any notice, registration, authorization, approval, order, certificate, waiver, permit or consent of or with any Governmental Authority in connection with the execution, delivery and performance by the Company of this Agreement and each of the Transaction Documents to which the Company will be a party or the consummation of the transactions contemplated hereby or thereby or in order to prevent the termination of any right, |

18

privilege, license or qualification of the Company, except for (i) any filings required to be made under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), (ii) the filing of the Certificate of Merger with the Secretary of State of the State of Delaware and (iii) Specified Governmental Approvals. |

|

(f) Financial Statements; Absence of Certain Changes or Events. |

|

(i) Set forth on Disclosure Schedule 3.1(f)(i) is a copy of (A) the audited consolidated balance sheets of the Company and its Subsidiaries as of December 31, 2014 and 2015, together with the audited consolidated statements of operations and comprehensive loss, cash flows and shareholders’ deficit of the Company and its Subsidiaries for the years then ended, and the related notes thereto, and (B) the unaudited consolidated balance sheet of the Company and its Subsidiaries (the “Consolidated Balance Sheet”) as of September 30, 2016 (the “Consolidated Balance Sheet Date”), together with the related unaudited consolidated statements of operations and comprehensive loss, cash flows and shareholders’ deficit of the Company and its Subsidiaries for the nine-month period then ended (such audited and unaudited financial statements collectively being referred to herein as the “Consolidated Financial Statements”). The Consolidated Financial Statements, together with the notes thereto, (i) have been prepared in accordance with GAAP (except that the unaudited Consolidated Financial Statements do not contain all notes required by GAAP and are subject to normal year-end audit adjustments) applied on a consistent basis throughout the periods covered thereby (except to the extent disclosed therein or required by changes in GAAP), (ii) are correct and complete in all material respects and (iii) fairly present, in all material respects, the consolidated financial position of the Company and its Subsidiaries at the dates thereof and the consolidated results of the operations and cash flows of the Company and its Subsidiaries for the respective periods indicated. |

|

(ii) Neither the Company nor any of its Subsidiaries has any liability or obligation of any nature, whether accrued, absolute, contingent or otherwise, whether known or unknown and whether or not required by GAAP to be reflected in the Consolidated Balance Sheet or disclosed in the notes thereto, except (A) for liabilities and obligations incurred in the ordinary course of business consistent with past practice that are not, individually or in the aggregate, material to the Company or any of its Subsidiaries, taken as a whole and (B) to the extent adequately reflected on or reserved against in the Consolidated Financial Statements. |

|

(iii) Except as set forth on Disclosure Schedule 3.1(f)(iii), or as provided in or contemplated by this Agreement or the other Transaction Documents, since December 31, 2015, (A) the Company and each of its Subsidiaries have conducted their respective businesses in all material respects in the ordinary course of business and consistent with past practices of the Company, (B) there has not been any change or development that, individually, or in the aggregate has had or is reasonably likely to have a Material Adverse Effect, (C) none of the Company and its Subsidiaries has suffered any material loss, damage, destruction or other casualty affecting any of its properties or assets, whether or not covered by insurance and (D) none of the Company and its Subsidiaries has taken any action that, if taken after the date of this Agreement, would constitute a breach of any of the covenants set forth in Section 4.1(e), (g), (j), (k), (l), (o), (t), (v) or (w). |

|

(g) Compliance with Applicable Laws; Permits. |

19

|

(i) Since December 31, 2013, each of the Company and its Subsidiaries has materially complied with, is in material compliance with, and has operated its business and maintained its assets in material compliance with, all Applicable Laws (including the Communications Laws). |

|

(ii) To the Knowledge of the Company, no investigation or review by any Governmental Authority with respect to the Company or any of its Subsidiaries is pending or threatened. |

|

(iii) Each of the Company and its Subsidiaries holds all material permits, licenses, variances, exemptions, orders, franchises and approvals of all Governmental Authorities necessary for the lawful conduct of its business, including any material FCC Licenses and PUC Licenses (the “Company Permits”). The Company and its Subsidiaries are in material compliance with the terms of the Company Permits. No suspension, cancellation, modification, revocation or nonrenewal of any Company Permit is pending or, to the Knowledge of the Company, threatened. No Company Permit is held in the name of any employee, officer, director, stockholder, agent, Person or otherwise on behalf of the Company. |

|

(iv) Set forth on Disclosure Schedule 3.1(g)(iv) are (a) all approvals, authorizations, certificates, registrations and licenses relating to the business or the Company that have been issued by the FCC (the “FCC Licenses”) and (b) all approvals, authorizations, certificates, registrations and licenses relating to the Business or the Company that have been issued by the state public service, public utility and similar state regulatory commissions or similar state regulatory bodies (the “PUCs”) and any local Governmental Authority, if any (the “PUC Licenses” and collectively with the FCC Licenses, the “Telecommunications Licenses”). Neither the Company nor any of its Subsidiaries offers or provides services under the Network or owns Network Fiber and Network Equipment within the United States other than pursuant to the Telecommunications Licenses, except to the extent that such services or ownership are not regulated by the FCC or any state PUC. |

|

(v) All Telecommunications Licenses are held by the Company or its Subsidiaries. The Company or its Subsidiaries hold all material approvals, authorizations, certificates, registrations and licenses, including all FCC Licenses and PUC Licenses, and all other material regulatory permits, approvals, licenses and other authorizations, including franchises, ordinances and other agreements granting access to public rights of way, issued or granted to the Company by the FCC, a PUC or other federal, state or local Governmental Authority regulating competition and telecommunications businesses and facilities that are required for the Company to conduct the Business as currently conducted or to own the Network. Each Telecommunications License is valid and in full force and effect in accordance with its terms and has not been suspended, revoked, cancelled, terminated or adversely modified and there is no outstanding notice of suspension, revocation, cancellation, termination or modification or, to the Knowledge of the Company, any threatened suspension, revocation, cancellation, termination or modification in connection therewith. None of the Telecommunications Licenses is subject to any pending regulatory proceeding (other than those affecting the telecommunications industry generally) or judicial review before a Governmental Authority. To the Knowledge of the Company, there has occurred no event, condition or circumstance (other than those affecting the telecommunications |

20

industry generally) that would preclude any Telecommunications License from being renewed in the ordinary course (to the extent that such Telecommunications License expires and is renewable by its terms) or that would prevent or materially delay the consummation of the transactions contemplated by this Agreement or the Transaction Documents. The Company is in material compliance with each of the Telecommunications Licenses and has fulfilled and performed all of its material obligations with respect thereto, including timely submitting all material reports, notifications and applications required by applicable Communications Laws, and the timely payment of all material regulatory fees, assessments and contributions; provided, that, for purposes of the foregoing, “material reports” include FCC Forms 499A and 499Q and “material regulatory fees, assessments and contributions” include FCC regulatory fees and all contributions to support Federal universal service, interstate Telecommunication Relay Service, the administration of the North American Numbering Plan, and the shared costs of local number portability administration. |

|

(h) Absence of Litigation. Except as set forth on Disclosure Schedule 3.1(h), there is no claim, action, suit, inquiry, judicial or administrative proceeding, grievance or arbitration pending or, to the Knowledge of the Company, threatened against the Company or any of its Subsidiaries by or before any arbitrator or Governmental Authority, nor, to the Knowledge of the Company, are there any investigations relating to the Company or any of its Subsidiaries pending or threatened by or before any arbitrator or any Governmental Authority. There is no claim, action, suit, inquiry, judicial or administrative proceeding, grievance or arbitration by the Company or any of its Subsidiaries pending, or which the Company or any of its Subsidiaries has commenced preparations to initiate, against any other Person. |

|

(i) Insurance. Set forth on Disclosure Schedule 3.1(i), is a true, correct and complete list of all insurance policies for workers’ compensation, title, fire, general liability, fiduciary liability, directors’ and officers’ liability, malpractice liability, theft and other forms of property and casualty currently maintained by the Company and all fidelity bonds, in each case, that are material to the Company. Except for policies that have been, or are scheduled to be, terminated in the ordinary course of business and consistent with past practices of the Company, each of the insurance policies set forth on Disclosure Schedule 3.1(i) is in full force and effect. |

|

(j) Real Property. |

|

(i) Disclosure Schedule 3.1(j)(i)(A) sets forth a true and complete list of all Owned Real Property. Disclosure Schedule 3.1(j)(i)(B) sets forth a true and complete list of all Leased Real Property (each of the foregoing, a “Lease” and collectively, the “Leases”), other than leases or licenses of Leased Real Property that relate to leased or licensed space of less than 1,000 square feet. Each of the Company and its Subsidiaries has (i) good and marketable title in fee simple to all Owned Real Property and (ii) a valid leasehold interest in all Leased Real Property, in each case, free and clear of all Liens except Permitted Liens. No parcel of Owned Real Property or Leased Real Property is subject to any governmental decree or order to be sold or is being condemned, expropriated, re-zoned or otherwise taken by any public authority with or without payment of compensation therefore, nor, to the Knowledge of the Company, has any such condemnation, expropriation or taking been proposed. All Leases and all amendments and modifications thereto are in full force and effect, which may include Leases that have not been formally extended or renewed in writing, are informally ongoing, or currently in effect on a month- |

21

to-month or other periodic basis, and there exists no material default under any such Lease by the Company, any of its Subsidiaries or, to the Knowledge of the Company, any other party thereto, nor any event which, with notice or lapse of time or both, would constitute a material default thereunder by the Company, any of its Subsidiaries or, to the Knowledge of the Company, any other party thereto. |

|

(ii) There are no contractual or legal restrictions that preclude or restrict the ability to use in any material respect any Owned Real Property or Leased Real Property by the Company or any of its Subsidiaries for the current use of such real property. There are no material latent defects or material adverse physical conditions affecting the Owned Real Property or Leased Real Property. All plants, warehouses, distribution centers, structures and other buildings on the Owned Real Property or Leased Real Property are adequately maintained and are in good operating condition and repair in all material respects for the requirements of the business of the Company and its Subsidiaries as currently conducted. |

|

(k) Tangible Property. The Company has good title to, or holds pursuant to valid and enforceable leases, all the tangible properties and assets of the Company (excluding any Real Property) that are material to the conduct of the business of the Company, including the Network Fiber and the Network Equipment, as it is currently conducted, with only such exceptions as constitute Permitted Liens. The Network Fiber and the Network Equipment are (i) adequate to conduct the principal network operations of the business of the Company in the manner currently conducted by the Company, and (ii) in the case of tangible properties and assets of the Company, in sufficiently good operating condition (except for ordinary wear and tear) to allow the business of the Company to be operated in the ordinary course of business and consistent with past practices of the Company. |

|

(l) Liens and Encumbrances. All of the material assets of the Company and its Subsidiaries are free and clear of all Liens except for Permitted Liens. |

|

(m) Environmental Matters. Except as set forth on Disclosure Schedule 3.1(m), the Company and its Subsidiaries have complied in all material respects with all Environmental Laws. No judicial proceedings are pending or, to the Knowledge of the Company, threatened against the Company or any of its Subsidiaries alleging the violation of any Environmental Law. All permits, registrations, licenses and authorizations required to be obtained or filed by the Company or any of its Subsidiaries under any Environmental Law in connection with the Company’s or any of its Subsidiaries’ operations, including those activities relating to the generation, use, storage, treatment, disposal, release or remediation of Hazardous Substances, have been duly obtained or filed, and the Company and each of its Subsidiaries is in material compliance with the terms and conditions of all such permits, registrations, licenses and authorizations. |

|

(n) Taxes. Except as set forth on Disclosure Schedule 3.1(n): |

|

(i) The Company has timely filed all income Tax Returns and other material Tax Returns and reports required to be filed by it, all Taxes shown as due thereon have been paid or reserved for and any requests for extensions to file such Tax Returns or reports have been timely filed, granted and have not expired, except, in each case, to the extent that such failures |

22

to file, to pay or to have extensions granted that remain in effect individually or in the aggregate have not had and would not reasonably be expected to have a Material Adverse Effect. The Tax Returns filed by the Company are complete and accurate in all material respects, and all Taxes required to be reflected in any Tax Return were properly reflected therein in all material respects. All material Taxes required to be withheld by the Company have been withheld and have been (or will be) duly and timely paid to the proper Tax authority. |

|

(ii) There are no Liens for Taxes upon any of the Company assets, other than Permitted Liens. |

|