Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - RENT A CENTER INC DE | a2016exhibit322shortannual.htm |

| EX-32.1 - EXHIBIT 32.1 - RENT A CENTER INC DE | a2016exhibit321speeseannual.htm |

| EX-31.2 - EXHIBIT 31.2 - RENT A CENTER INC DE | a2016exhibit312shortannual.htm |

| EX-31.1 - EXHIBIT 31.1 - RENT A CENTER INC DE | a2016exhibit311speeseannual.htm |

| EX-23.1 - EXHIBIT 23.1 - RENT A CENTER INC DE | a2016exhibit231kpmgconsent.htm |

| EX-21.1 - EXHIBIT 21.1 - RENT A CENTER INC DE | a2016exhibit211subsidiaries.htm |

| EX-10.24 - EXHIBIT 10.24 - RENT A CENTER INC DE | a2016exhibit1024transition.htm |

| EX-10.14 - EXHIBIT 10.14 - RENT A CENTER INC DE | a2016exhibit1014loyaltyagr.htm |

| EX-10.11 - EXHIBIT 10.11 - RENT A CENTER INC DE | a2016exhibit1011-annualdir.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One) | |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

For the fiscal year ended December 31, 2016 or | ||||

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

Commission File No. 0-25370 | ||||

Rent-A-Center, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 45-0491516 | |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

5501 Headquarters Drive

Plano, Texas 75024

(Address, including zip code of registrant's

principal executive offices)

Registrant's telephone number, including area code: 972-801-1100

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Exchange on Which Registered | |

Common Stock, par value $0.01 per share | The Nasdaq Global Select Market, Inc. | |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Aggregate market value of the 51,850,190 shares of Common Stock held by non-affiliates of the registrant at the closing sales price as reported on The Nasdaq Global Select Market, Inc. on June 30, 2016 | $ | 636,720,333 | |

Number of shares of Common Stock outstanding as of the close of business on February 21, 2017: | 53,196,843 | ||

Documents incorporated by reference:

Portions of the definitive proxy statement relating to the 2017 Annual Meeting of Stockholders of Rent-A-Center, Inc. are incorporated by reference into Part III of this report.

.

TABLE OF CONTENTS

Page | ||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “seeks” or words of similar meaning, or future or conditional verbs, such as “will,” “should,” “could,” “may,” “aims,” “intends,” or “projects.” A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. These forward-looking statements are all based on currently available operating, financial and competitive information and are subject to various risks and uncertainties. Our actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this Annual Report on Form 10-K and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. Factors that could cause or contribute to these differences include, but are not limited to:

• | the general strength of the economy and other economic conditions affecting consumer preferences and spending; |

• | factors affecting the disposable income available to our current and potential customers; |

• | changes in the unemployment rate; |

• | difficulties encountered in improving the financial and operational performance of our business segments; |

• | our chief executive officer and chief financial officer transitions, including our ability to effectively operate and execute our strategies during the interim period and difficulties or delays in identifying and attracting a permanent chief executive officer and chief financial officer, each with the required level of experience and expertise; |

• | failure to manage our store labor and other store expenses; |

• | our ability to identify, develop and successfully execute strategic initiatives; |

• | disruptions caused by the implementation and operation of our new store information management system, including capacity-related outages; |

• | our ability to successfully market smartphones and related services to our customers; |

• | our ability to develop and successfully implement virtual or e-commerce capabilities; |

• | disruptions in our supply chain; |

• | limitations of, or disruptions in, our distribution network; |

• | rapid inflation or deflation in prices of our products; |

• | our ability to execute and the effectiveness of a store consolidation, including our ability to retain the revenue from customer accounts merged into another store location as a result of a store consolidation; |

• | our available cash flow; |

• | our ability to identify and successfully market products and services that appeal to our customer demographic; |

• | consumer preferences and perceptions of our brands; |

• | uncertainties regarding the ability to open new locations; |

• | our ability to acquire additional stores or customer accounts on favorable terms; |

• | our ability to control costs and increase profitability; |

• | our ability to retain the revenue associated with acquired customer accounts and enhance the performance of acquired stores; |

• | our ability to enter into new and collect on our rental or lease purchase agreements; |

• | the passage of legislation or adoption of regulations adversely affecting the rent-to-own industry; |

• | our compliance with applicable statutes or regulations governing our transactions; |

• | changes in interest rates; |

• | adverse changes in the economic conditions of the industries, countries or markets that we serve; |

1

• | information technology and data security costs; |

• | the impact of any breaches in data security or other disturbances to our information technology and other networks and our ability to protect the integrity and security of individually identifiable data of our customers and employees; |

• | changes in our stock price, the number of shares of common stock that we may or may not repurchase, and future dividends, if any; |

• | changes in estimates relating to self-insurance liabilities and income tax and litigation reserves; |

• | changes in our effective tax rate; |

• | fluctuations in foreign currency exchange rates; |

• | our ability to maintain an effective system of internal controls; |

• | the resolution of our litigation; and |

• | the other risks detailed from time to time in our reports to the Securities and Exchange Commission. |

2

PART I

Item 1. Business.

History of Rent-A-Center

Unless the context indicates otherwise, references to “we,” “us” and “our” refer to the consolidated business operations of Rent-A-Center, Inc., the parent, and any or all of its direct and indirect subsidiaries. For any references in this document to Note A through Note U, refer to the Notes to Consolidated Financial Statements in Item 8.

We are one of the largest rent-to-own operators in North America, focused on improving the quality of life for our customers by providing them the opportunity to obtain ownership of high-quality durable products, such as consumer electronics, appliances, computers (including tablets), smartphones, and furniture (including accessories), under flexible rental purchase agreements with no long-term obligation. We were incorporated in the State of Delaware in 1986, and our common stock is traded on the Nasdaq Global Select Market under the symbol "RCII."

Our principal executive offices are located at 5501 Headquarters Drive, Plano, Texas 75024. Our telephone number is (972) 801-1100 and our company website is www.rentacenter.com. We do not intend for information contained on our website to be part of this Annual Report on Form 10-K. We make available free of charge on or through our website our Annual Report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (the “SEC”). Additionally, we provide electronic or paper copies of our filings free of charge upon request.

The Rental Purchase Transaction

The rental purchase transaction is a flexible alternative for consumers to obtain use and enjoyment of brand name merchandise with no long-term obligation. Key features of the rental purchase transaction include:

Brand name merchandise. We offer well-known brands such as LG, Samsung, Sony and Vizio home electronics; Frigidaire, General Electric, LG, Samsung and Whirlpool appliances; Acer, Apple, Asus, Samsung and Toshiba computers and/or tablets; LG and Samsung smartphones; and Ashley, Powell and Standard furniture.

Convenient payment options. Our customers make payments on a weekly, semi-monthly or monthly basis in our stores, kiosks, online or by telephone. We accept cash, credit or debit cards. Rental payments are generally made in advance and, together with applicable fees, constitute our primary revenue source. Approximately 85% and 92% of our rental purchase agreements are on a weekly term in our Core U.S. rent-to-own stores and our Mexico segment, respectively. Payments are made in advance on a monthly basis in our Acceptance Now segment.

No negative consequences. A customer may terminate a rental purchase agreement at any time without penalty.

No credit needed. Generally, we do not conduct a formal credit investigation of our customers. We verify a customer’s residence and sources of income. References provided by the customer are also contacted to verify certain information contained in the rental purchase order form.

Delivery & set-up included. We generally offer same-day or next-day delivery and installation of our merchandise at no additional cost to the customer in our rent-to-own stores. Our Acceptance Now locations rely on our third-party retail partners to deliver merchandise rented by the customer. Such third-party retail partners typically charge us a fee for delivery, which we pass on to the customer.

Product maintenance & replacement. We provide any required service or repair without additional charge, except for damage in excess of normal wear and tear. Repair services are provided through our network of service centers, the cost of which may be reimbursed by the vendor if the item is still under factory warranty. If the product cannot be repaired at the customer’s residence, we provide a temporary replacement while the product is being repaired. If the product cannot be repaired, we will replace it with a product of comparable quality, age and condition.

Lifetime reinstatement. If a customer is temporarily unable to make payments on a piece of rental merchandise and must return the merchandise, that customer generally may later re-rent the same piece of merchandise (or if unavailable, a substitute of comparable quality, age and condition) on the terms that existed at the time the merchandise was returned, and pick up payments where they left off without losing what they previously paid.

3

Flexible options to obtain ownership. Ownership of the merchandise generally transfers to the customer if the customer has continuously renewed the rental purchase agreement for a period of seven to 30 months, depending upon the product type, or exercises a specified early purchase option.

Our Growth Strategy

Beginning in 2013, we launched a multi-year program designed to transform and modernize our operations in order to improve the profitability of the Core U.S. segment while continuing to grow our Acceptance Now segment. This program was focused on building new competencies and capabilities through a variety of operational and infrastructure initiatives such as introducing a new labor model in our Core U.S. rent-to-own stores, formulating a customer-focused, value-based pricing strategy, developing a new sourcing and distribution model, implementing new technology into our Acceptance Now locations, and introducing e-commerce capabilities to our Core U.S. segment. Many of these initiatives are now complete.

We remain focused on strengthening our Core business while continuing to build upon Acceptance Now’s recent success with signing pilot agreements with two new national retailers representing a significant scale opportunity. We will continue to review strategic priorities and opportunities in both businesses to enhance value.

In order to position the Company for long-term growth and profitability, we are taking important steps to drive operational improvements, including:

• | achieving an optimal product mix by shifting to a higher concentration of the higher-end, aspirational products that our customers want, and which have always helped make Rent-A-Center a leader in the rent-to-own industry; |

• | providing a better value proposition and being more customer centric, which will help us extend average rental time, translating to happier, more loyal customers that return to us in the future; |

• | stabilizing our workforce by adding back a full-time co-worker to most of our stores, as we believe that investing in the frontline will improve customer satisfaction and business results; |

• | utilizing technology investments and new capabilities to enable or accelerate business strategies and find innovative, engaging ways to better serve customers; and |

• | implementing a streamlined collection process and enhancing customer service through employee training to reduce delinquencies and collection times. |

Our Operating Segments

We report four operating segments: Core U.S., Acceptance Now, Mexico, and Franchising. Additional information regarding our operating segments is presented in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in Item 7 of this Annual Report on Form 10-K, and financial information regarding these segments and revenues by geographic area are provided in Note S to the consolidated financial statements contained in this Annual Report on Form 10-K. Substantially all of our revenues for the past three years originated in the United States.

Core U.S.

Our Core U.S. segment is our largest operating segment, comprising approximately 70% of our consolidated net revenues for the year ended December 31, 2016. Approximately 79% of our business in this segment is from repeat customers.

At December 31, 2016, we operated 2,463 company-owned stores in the United States, Canada and Puerto Rico, including 45 retail installment sales stores under the names “Get It Now” and “Home Choice.” We routinely evaluate the markets in which we operate and will close, sell or merge underperforming stores.

Acceptance Now

Through our Acceptance Now segment, we generally provide an on-site rent-to-own option at a third-party retailer’s location. In the event a retail purchase credit application is declined, the customer can be introduced to an in-store Acceptance Now representative who explains an alternative transaction for acquiring the use and ownership of the merchandise. Because we neither require nor perform a formal credit investigation for the approval of the rental purchase transaction, applicants who meet certain basic criteria are generally approved. We believe our Acceptance Now program is beneficial for both the retailer and the consumer. The retailer captures more sales because we buy the merchandise directly from them and future rental payments are generally made at the retailer’s location. We believe consumers also benefit from our Acceptance Now program because they are able to obtain the products they want and need without the necessity of credit. The gross margins in this segment are lower than the gross margins in our Core U.S. segment because we pay retail for the product. Through certain retail partners, we offer our customers the option

4

to obtain ownership of the product at or slightly above the full retail price if they pay within 90 days. In some cases, the retailer provides us a rebate on the cost of the merchandise if the customer exercises this 90 day option.

Each Acceptance Now kiosk location typically consists of an area with a computer, desk and chairs. We occupy the space without charge by agreement with each retailer. Accordingly, capital expenditures with respect to a new Acceptance Now location are minimal, and any exit costs associated with the closure of an Acceptance Now location would also be immaterial on an individual basis. Our operating model is highly agile and dynamic because we can open and close locations quickly and efficiently.

We rely on our third-party retail partners to deliver merchandise rented by the customer. Such third-party retail partners typically charge us a fee for delivery, which we pass on to the customer. In the event the customer returns rented merchandise, we pick it up at no additional charge. Merchandise returned from an Acceptance Now kiosk location is offered for rent at one of our Core U.S. rent-to-own stores.

We intend to grow the Acceptance Now segment by increasing the number of our retail partners and the number of locations with our existing retail partners. As of December 31, 2016, we operated 1,431 staffed kiosk locations inside furniture and electronics retailers located in 40 states and Puerto Rico, and 478 virtual (direct) locations.

Mexico

Our Mexico segment currently consists of our company-owned rent-to-own stores in Mexico. At December 31, 2016, we operated 130 stores in this segment. The financial performance of our Mexico segment met our expectations in 2016 as a result of the operational initiatives implemented in 2015, and we are evaluating additional strategies for our operations in Mexico.

We are subject to the risks of doing business internationally as described under "Risk Factors."

Franchising

The stores in our Franchising segment use Rent-A-Center's, ColorTyme's or RimTyme's trade names, service marks, trademarks and logos, and operate under distinctive operating procedures and standards. Franchising's primary source of revenue is the sale of rental merchandise to its franchisees who, in turn, offer the merchandise to the general public for rent or purchase under a rent-to-own transaction.

At December 31, 2016, this segment franchised 229 stores in 31 states operating under the Rent-A-Center (152 stores), ColorTyme (39 stores) and RimTyme (38 stores) names. These rent-to-own stores primarily offer high quality durable products such as consumer electronics, appliances, computers, furniture and accessories, wheels and tires.

As franchisor, Franchising receives royalties of 2.0% to 6.0% of the franchisees’ monthly gross revenue and, generally, an initial fee up to $35,000 per new location.

The following table summarizes our locations allocated among these operating segments as of December 31:

2016 | 2015 | 2014 | ||||||

Core U.S. | 2,463 | 2,672 | 2,824 | |||||

Acceptance Now Staffed | 1,431 | 1,444 | 1,406 | |||||

Acceptance Now Direct | 478 | 532 | — | |||||

Mexico | 130 | 143 | 177 | |||||

Franchising | 229 | 227 | 187 | |||||

Total locations | 4,731 | 5,018 | 4,594 | |||||

The following discussion applies generally to all of our operating segments, unless otherwise noted.

Rent-A-Center Operations

Store Expenses

Our expenses primarily relate to merchandise costs and the operations of our stores, including salaries and benefits for our employees, occupancy expense for our leased real estate, advertising expenses, lost, damaged, or stolen merchandise, fixed asset depreciation, and other expenses.

As a result of the investment in new stores and kiosk locations and their growth curves, our quarterly earnings are impacted by how many new locations we opened during a particular quarter and the quarters preceding it.

5

Product Selection

Our Core U.S. and Mexico stores generally offer merchandise from five basic product categories: consumer electronics, appliances, computers (including tablets), smartphones, and furniture (including accessories). Although we seek to maintain sufficient inventory in our stores to offer customers a wide variety of models, styles and brands, we generally limit merchandise to prescribed levels to maintain strict inventory controls. We seek to provide a wide variety of high quality merchandise to our customers, and we emphasize products from name-brand manufacturers. Customers may request either new merchandise or previously rented merchandise. Previously rented merchandise is generally offered at a similar weekly or monthly rental rate as is offered for new merchandise, but with an opportunity to obtain ownership of the merchandise after fewer rental payments.

Consumer electronic products offered by our stores include high definition televisions, home theater systems, video game consoles and stereos. Appliances include refrigerators, freezers, washing machines, dryers, and ranges. We offer desktop, laptop, tablet computers and smartphones. Our furniture products include dining room, living room and bedroom furniture featuring a number of styles, materials and colors. Accessories include lamps and tables and are typically rented as part of a package of items, such as a complete room of furniture. Showroom displays enable customers to visualize how the product will look in their homes and provide a showcase for accessories.

The merchandise assortment may vary in our non-U.S. stores according to market characteristics and consumer demand unique to the particular country in which we are operating. For example, in Mexico, the appliances we offer are sourced locally, providing our customers in Mexico the look and feel to which they are accustomed in that product category.

Acceptance Now locations offer the merchandise available for sale at the applicable third-party retailer, primarily furniture and accessories, consumer electronics and appliances.

For the year ended December 31, 2016, furniture and accessories accounted for approximately 37% of our consolidated rentals and fees revenue, consumer electronic products for 22%, appliances for 16%, computers for 6%, smartphones for 4% and other products and services for 15%.

Product Turnover

On average, in the Core U.S. segment, a rental term of 15 months or exercising an early purchase option is generally required to obtain ownership of new merchandise. Product turnover is the number of times a product is rented to a different customer. On average, a product is rented (turned over) to three customers before a customer acquires ownership. Merchandise returned in the Acceptance Now segment is moved to a Core U.S. store where it is offered for rent. Ownership is attained in approximately 25% of first-time rental purchase agreements in the Core U.S. segment. The average total life for each product in our Core U.S. segment is approximately 18 months, which includes the initial rental period, all re-rental periods and idle time in our system. To cover the higher operating expenses generated by product turnover and the key features of rental purchase transactions, rental purchase agreements require higher aggregate payments than are generally charged under other types of purchase plans, such as installment purchase or credit plans.

Collections

Store managers use our management information system to track collections on a daily basis. If a customer fails to make a rental payment when due, store personnel will attempt to contact the customer to obtain payment and reinstate the agreement, or will terminate the account and arrange to regain possession of the merchandise. We attempt to recover the rental items as soon as possible following termination or default of a rental purchase agreement, generally by the seventh day. Collection efforts are enhanced by the personal and job-related references required of customers, the personal nature of the relationships between our employees and customers, and the availability of lifetime reinstatement. Currently, we track past due amounts using a guideline of seven days in our Core U.S. segment and 30 days in the Acceptance Now segment. These metrics align with the majority of the rental purchase agreements in each segment, since payments are generally made weekly in the Core U.S. segment and monthly in the Acceptance Now segment.

If a customer does not return the merchandise or make payment, the remaining book value of the rental merchandise associated with delinquent accounts is generally charged off on or before the 90th day following the time the account became past due in the Core U.S. segment, on or before the 150th day in the Acceptance Now segment and on or before the 60th day in the Mexico segment.

6

Management

Our executive management team has extensive rent-to-own or similar retail experience and has demonstrated the ability to grow and manage our business through their operational leadership and strategic vision. In addition, our regional and district managers have long tenures with us, and we have a history of promoting management personnel from within. We believe this extensive industry and company experience will allow us to effectively execute our growth strategies.

Purchasing

Our centralized inventory management organization utilizes a combination of automated and manual merchandise planning, forecasting and replenishment processes to determine appropriate inventory levels to maintain in our third-party distribution centers and company-owned stores. Inventory levels are monitored on a daily basis, and purchase orders are processed and sent to manufacturers and distributors on a weekly basis to replenish inventory housed in our third-party distribution centers. We use customized software solution that builds recommended store replenishment orders based on current store inventory levels, current store rental and return trends, seasonality, product needs, desired weeks of supply targets, and other key factors. Approved orders are then passed through an automated solution to our third party distribution center and furniture manufacturers and product ships to the stores. The replenishment system and associated processes allow us to retain tight control over our inventory, ensure assortment diversity in our stores and assists us in having the right products available at the right time.

In our Core U.S. and Mexico segments, we purchase our rental merchandise from a variety of suppliers. In 2016, approximately 12% of our merchandise purchases were attributable to Ashley Furniture Industries. No other brand accounted for more than 10% of merchandise purchased during these periods. We do not generally enter into written contracts with our suppliers that obligate us to meet certain minimum purchasing levels. Although we expect to continue relationships with our existing suppliers, we believe there are numerous sources of products available, and we do not believe the success of our operations is dependent on any one or more of our present suppliers.

In our Acceptance Now segment, we purchase the merchandise selected by the customer from the applicable third-party retailer at the time such customer enters into a rental purchase agreement with us.

With respect to our Franchising segment, the franchise agreement requires the franchised stores to exclusively offer for rent or sale only those brands, types and models of products that Franchising has approved. The franchised stores are required to maintain an adequate mix of inventory that consists of approved products for rent as dictated by Franchising policy manuals. Franchising negotiates purchase arrangements with various suppliers it has approved, and franchisees purchase directly from those suppliers and from inventory housed in our third-party distribution centers.

Marketing

We promote our products and services through television and radio commercials, print advertisements, store telemarketing, digital display advertisements, direct email campaigns, social networks, paid and organic search, website and store signage. Our advertisements emphasize such features as product and name-brand selection, the opportunity to pay as you go without credit, long-term contracts or obligations, delivery and set-up at no additional cost, product repair and loaner services at no extra cost, lifetime reinstatement and multiple options to acquire ownership, including 90 day option pricing, an early purchase option or through a fixed number of payments. In addition, we promote the “RAC Worry-Free Guarantee®” to further highlight these aspects of the rental purchase transaction. We believe that by leveraging our advertising efforts to highlight the benefits of the rental purchase transaction, we will continue to educate our customers and potential customers about the rent-to-own alternative to credit as well as solidify our reputation as a leading provider of high-quality, branded merchandise and services.

Franchising has established national advertising funds for the franchised stores, whereby Franchising has the right to collect up to 3% of the monthly gross revenue from each franchisee as contributions to the fund. Franchising directs the advertising programs of the fund, generally consisting of television and radio commercials and print advertisements. Franchising also has the right to require franchisees to expend up to 3% of their monthly gross revenue on local advertising.

7

Industry & Competition

According to a report published by the Association of Progressive Rental Organizations in 2016, the $8.5 billion rent-to-own industry in the United States, Mexico and Canada consists of approximately 9,200 stores, serves approximately 4.8 million customers and approximately 83% of rent-to-own customers have household incomes between $15,000 and $50,000 per year. The rent-to-own industry provides customers the opportunity to obtain merchandise they might otherwise be unable to obtain due to insufficient cash resources or a lack of access to credit. We believe the number of consumers lacking access to credit is increasing. According to data released by the Fair Isaac Corporation on September 13, 2016, consumers in the “subprime” category (those with credit scores below 650) made up 31% of the United States population.

The rent-to-own industry is experiencing rapid change with the emergence of virtual and kiosk-based operations, such as our Acceptance Now business. These new industry participants are disrupting traditional rent-to-own stores by attracting customers and making the rent-to-own transaction more acceptable to potential customers. In addition, banks and consumer finance companies are developing products and services designed to compete for the traditional rent-to-own customer.

These factors are increasingly contributing to an already highly competitive environment. Our stores and kiosks compete with other national, regional and local rent-to-own businesses, including on-line only competitors, as well as with rental stores that do not offer their customers a purchase option. With respect to customers desiring to purchase merchandise for cash or on credit, we also compete with retail stores, online competitors, and non-traditional lenders. Competition is based primarily on convenience, store location, product selection and availability, customer service, rental rates and terms.

Seasonality

Our revenue mix is moderately seasonal, with the first quarter of each fiscal year generally providing higher merchandise sales than any other quarter during a fiscal year. Generally, our customers will more frequently exercise the early purchase option on their existing rental purchase agreements or purchase pre-leased merchandise off the showroom floor during the first quarter of each fiscal year, primarily due to federal income tax refunds. Furthermore, we tend to experience slower growth in the number of rental purchase agreements in the third quarter of each fiscal year when compared to other quarters throughout the year. We expect these trends to continue in the future.

Trademarks

We own various trademarks and service marks, including Rent-A-Center® and RAC Worry-Free Guarantee® that are used in connection with our operations and have been registered with the United States Patent and Trademark Office. The duration of our trademarks is unlimited, subject to periodic renewal and continued use. In addition, we have obtained trademark registrations in Mexico, Canada and certain other foreign jurisdictions. We believe we hold the necessary rights for protection of the trademarks and service marks essential to our business. The products held for rent in our stores also bear trademarks and service marks held by their respective manufacturers.

Franchising licenses the use of the Rent-A-Center and ColorTyme trademarks and service marks to its franchisees under the franchise agreement. Franchising owns various trademarks and service marks, including ColorTyme® and RimTyme®, that are used in connection with its operations and have been registered with the United States Patent and Trademark office. The duration of these marks is unlimited, subject to periodic renewal and continued use.

Employees

As of February 21, 2017, we had approximately 21,600 employees.

8

Government Regulation

Core U.S. & Acceptance Now

State Regulation. Currently, 46 states, the District of Columbia and Puerto Rico have rental purchase statutes that recognize and regulate rental purchase transactions as separate and distinct from credit sales. We believe this existing legislation is generally favorable to us, as it defines and clarifies the various disclosures, procedures and transaction structures related to the rent-to-own business with which we must comply. With some variations in individual states, most related state legislation requires the lessor to make prescribed disclosures to customers about the rental purchase agreement and transaction, and provides time periods during which customers may reinstate agreements despite having failed to make a timely payment. Some state rental purchase laws prescribe grace periods for non-payment, prohibit or limit certain types of collection or other practices, and limit certain fees that may be charged. Ten states limit the total rental payments that can be charged to amounts ranging from 2.0 times to 2.4 times the disclosed cash price or the retail value of the rental product. Five states limit the cash price of merchandise to amounts ranging from 1.56 to 2.5 times our cost for each item.

Although Minnesota has a rental purchase statute, the rental purchase transaction is also treated as a credit sale subject to consumer lending restrictions pursuant to judicial decision. Therefore, we offer our customers in Minnesota an opportunity to purchase our merchandise through an installment sale transaction in our Home Choice stores. We operate 17 Home Choice stores in Minnesota.

North Carolina has no rental purchase legislation. However, the retail installment sales statute in North Carolina expressly provides that lease transactions which provide for more than a nominal purchase price at the end of the agreed rental period are not credit sales under the statute. We operate 99 rent-to-own stores, and 82 and 73 Acceptance Now Staffed and Acceptance Now Direct locations, respectively, in North Carolina.

Courts in Wisconsin and New Jersey, which do not have rental purchase statutes, have rendered decisions which classify rental purchase transactions as credit sales subject to consumer lending restrictions. Accordingly, in Wisconsin, we offer our customers an opportunity to purchase our merchandise through an installment sale transaction in our Get It Now stores. In New Jersey, we have modified our typical rental purchase agreements to provide disclosures, grace periods, and pricing that we believe comply with the retail installment sales act. We operate 28 Get It Now stores in Wisconsin and 46 Rent-A-Center stores in New Jersey.

There can be no assurance as to whether new or revised rental purchase laws will be enacted or whether, if enacted, the laws would not have a material and adverse effect on us.

Federal Regulation. To date, no comprehensive federal legislation has been enacted regulating or otherwise impacting the rental purchase transaction. The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) does not regulate leases with terms of 90 days or less. Because the rent-to-own transaction is for a term of week to week, or at most, month to month, and established federal law deems the term of a lease to be its minimum term regardless of extensions or renewals, if any, we believe the rent-to-own transaction is not covered by the Dodd-Frank Act.

From time to time, we have supported legislation introduced in Congress that would regulate the rental purchase transaction. While both beneficial and adverse legislation may be introduced in Congress in the future, any adverse federal legislation, if enacted, could have a material and adverse effect on us.

Mexico and Canada

No comprehensive legislation regulating the rent-to-own transaction has been enacted in Mexico or Canada. We use substantially the same rental purchase transaction in those countries as in the U.S. stores, but with such additional provisions as we believe may be necessary to comply with such country’s specific laws and customs.

9

Item 1A. Risk Factors.

You should carefully consider the risks described below before making an investment decision. We believe these are all the material risks currently facing our business. Our business, financial condition or results of operations could be materially adversely affected by these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. You should also refer to the other information included in this Annual Report on Form 10-K, including our consolidated financial statements and related notes.

Our success depends on the effective implementation and continued execution of our strategies.

Our Core U.S. store base is mature and our Acceptance Now business operates in an intensively competitive environment. We recently completed a multi-year program designed to address these dynamics by transforming and modernizing our operations in order to improve the profitability of the Core U.S. segment while continuing to grow profitably our Acceptance Now segment. We remain focused on strengthening our Core business while continuing to build upon Acceptance Now's recent success with signing pilot agreements with two new national retailers representing a significant scale opportunity. We will continue to review strategic priorities and opportunities in both businesses to enhance value.

In order to position the Company for long-term growth and profitability, we are taking important steps to drive operational improvements, including:

• | achieving an optimal product mix by shifting to a higher concentration of the higher-end, aspirational products that our customers want, and which have always helped make Rent-A-Center a leader in the rent-to-own industry; |

• | providing a better value proposition and being more customer centric, which will help us extend average rental time, translating to happier, more loyal customers that return to us in the future; |

• | stabilizing our workforce by adding back a full-time co-worker to most of our stores, as we believe that investing in the frontline will improve customer satisfaction and business results; |

• | utilizing technology investments and new capabilities to enable or accelerate business strategies and find innovative, engaging ways to better serve customers; and |

• | implementing a streamlined collection process and enhancing customer service through employee training to reduce delinquencies and collection times. |

There is no assurance that we will be able to implement and execute these strategic initiatives in accordance with our expectations. Higher costs or failure to achieve targeted results associated with the implementation of such new programs or initiatives could adversely affect our results of operations or negatively impact our ability to successfully execute future strategies, which may result in an adverse impact on our business and financial results.

We are highly dependent on the financial performance of our Core U.S. operating segment.

Our financial performance is highly dependent on our Core U.S. segment, which comprised approximately 70% of our consolidated net revenues for the year ended December 31, 2016. Any significant decrease in the financial performance of the Core U.S. segment may also have a material adverse impact on our ability to implement our growth strategies.

We are in a management transition period in which the individuals serving as both our chief executive officer and chief financial officer are acting in interim roles. We may not be able to effectively operate and execute our strategies during this interim period and may encounter difficulties or delays in identifying and attracting a permanent chief executive officer and chief financial officer, each with the required level of experience and expertise.

On December 2, 2016, Guy J. Constant resigned as Executive Vice President - Finance, Chief Financial Officer & Treasurer of the Company, and Maureen B. Short was named as Interim Chief Financial Officer. On January 9, 2017, Robert D. Davis resigned as Chief Executive Officer and a director of the Company. On that date, our founder, former chief executive officer, and Chairman of the Board, Mark E. Speese, was named as Interim Chief Executive Officer. We are in the process of searching for a permanent chief executive officer and chief financial officer. However, if we are unsuccessful in appointing a chief executive officer and a chief financial officer each with the required level of experience and expertise in a timely manner, our operations and business strategies could be materially and adversely affected. Any significant leadership change or executive management transition creates uncertainty, involves inherent risk, and may involve a diversion of resources and management attention, be disruptive to our daily operations or impact public or market perception, any of which could negatively impact our ability to operate effectively or execute our strategies and result in a material adverse impact on our business, financial condition, results of operations or cash flows.

Our ability to attract and retain key employees may be adversely impacted by the recent executive departures and resulting management transition, and our recent financial results.

Executive leadership transitions can be inherently difficult to manage and may cause disruption to our business. As a result of the recent changes in our executive management team, our existing management team has taken on substantially more responsibility,

10

which has resulted in greater workload demands and could divert their attention away from other key areas of our business. In addition, management transition inherently causes some loss of institutional knowledge, which can negatively affect strategy and execution, and our results of operations and financial condition could suffer as a result.

Our future success depends in large part upon our ability to attract and retain key management executives and other key employees. In order to attract and retain executives and other key employees in a competitive marketplace, we must provide a competitive compensation package, including cash and equity compensation. Because of our lower than expected operating results for the year ended December 31, 2016, our senior management did not earn any amounts under the annual cash incentive plan for 2016, and salary increases and future cash incentive compensation opportunities could be limited. In addition, our long-term incentive program includes equity awards in the form of stock options and restricted stock units. Any prolonged inability to provide salary increases or cash incentive compensation opportunities, or if the anticipated value of such equity awards does not materialize or our equity compensation otherwise ceases to be viewed as a valuable benefit, our ability to attract, retain and motivate executives and key employees could be weakened. In addition the uncertainty and operational disruptions caused by the management changes and related transitions could result in additional key employees deciding to leave the Company. If we are unable to retain, attract and motivate talented employees with the appropriate skill sets, we may not achieve our objectives and our results of operations could be adversely impacted.

Failure to effectively manage our costs could have a material adverse effect on our profitability.

Certain elements of our cost structure are largely fixed in nature. Consumer spending remains uncertain, which makes it more challenging for us to maintain or increase our operating income in the Core U.S. segment. The competitiveness in our industry and increasing price transparency means that the focus on achieving efficient operations is greater than ever. As a result, we must continuously focus on managing our cost structure. Failure to manage our labor and benefit rates, advertising and marketing expenses, operating leases, charge-offs due to customer stolen merchandise, other store expenses or indirect spending could materially adversely affect our profitability.

Our Acceptance Now segment depends on the success of our third-party retail partners and our continued relationship with them.

Our Acceptance Now segment revenues depend in part on the ability of unaffiliated third-party retailers to attract customers. The failure of our third-party retail partners to maintain quality and consistency in their operations and their ability to continue to provide products and services, or the loss of the relationship with any of these third-party retailers and an inability to replace them, could cause our Acceptance Now segment to lose customers, substantially decreasing the revenues and earnings of our Acceptance Now segment. This could adversely affect our financial results. In 2016, approximately 73% of the total revenue of the Acceptance Now segment originated at our Acceptance Now kiosks located in stores operated by six retail partners. We may be unable to continue growing the Acceptance Now segment if we are unable to find third-party retailers willing to partner with us or if we are unable to enter into agreements with third-party retailers acceptable to us.

The success of our business is dependent on factors affecting consumer spending that are not under our control.

Consumer spending is affected by general economic conditions and other factors including levels of employment, disposable consumer income, prevailing interest rates, consumer debt and availability of credit, costs of fuel, inflation, recession and fears of recession, war and fears of war, pandemics, inclement weather, tax rates and rate increases, timing of receipt of tax refunds, consumer confidence in future economic conditions and political conditions, and consumer perceptions of personal well-being and security. Unfavorable changes in factors affecting discretionary spending could reduce demand for our products and services resulting in lower revenue and negatively impacting the business and its financial results.

If we are unable to compete effectively with the growing e-commerce sector, our business and results of operations may be materially adversely affected.

With the continued expansion of Internet use, as well as mobile computing devices and smartphones, competition from the e-commerce sector continues to grow. We have launched virtual capabilities within our Acceptance Now and Core U.S. segments. There can be no assurance we will be able to grow our e-commerce business in a profitable manner. Certain of our competitors, and a number of e-commerce retailers, have established e-commerce operations against which we compete for customers. It is possible that the increasing competition from the e-commerce sector may reduce our market share, gross margin, and operating margin, and may materially adversely affect our business and results of operations in other ways.

Disruptions in our supply chain and other factors affecting the distribution of our merchandise could adversely impact our business.

Any disruption in the operation of our distribution centers could result in our inability to meet our customers’ expectations, higher costs, an inability to stock our stores or longer lead time associated with distributing merchandise. Any such disruption within our

11

supply chain network, including damage or destruction to one of our five regional distribution centers, could result in decreased net sales, increased costs and reduced profits.

Our debt agreements impose restrictions on us which may limit or prohibit us from engaging in certain transactions. If a default were to occur, our lenders could accelerate the amounts of debt outstanding, and holders of our secured indebtedness could force us to sell our assets to satisfy all or a part of what is owed.

Covenants under our senior credit facilities and the indenture governing our outstanding senior unsecured notes restrict our ability to pay dividends and engage in various operational matters. In addition, covenants under our senior credit facilities require us to maintain specified financial ratios. Our ability to meet these financial ratios may be affected by events beyond our control. These restrictions could limit our ability to obtain future financing, make needed capital expenditures or other investments, repurchase our outstanding debt or equity, pay dividends, withstand a future downturn in our business or in the economy, dispose of operations, engage in mergers, acquire additional stores or otherwise conduct necessary corporate activities. Various transactions that we may view as important opportunities, are also subject to the consent of lenders under the senior credit facilities, which may be withheld or granted subject to conditions specified at the time that may affect the attractiveness or viability of the transaction.

If a default were to occur, the lenders under our senior credit facilities could accelerate the amounts outstanding under the credit facilities. In addition, the lenders under these agreements could terminate their commitments to lend to us. If the lenders under these agreements accelerate the repayment of borrowings, we may not have sufficient liquid assets at that time to repay the amounts then outstanding under our indebtedness or be able to find additional alternative financing. Even if we could obtain additional alternative financing, the terms of the financing may not be favorable or acceptable to us.

The existing indebtedness under our senior credit facilities is secured by substantially all of our assets. Should a default or acceleration of this indebtedness occur, the holders of this indebtedness could sell the assets to satisfy all or a part of what is owed.

Our current insurance program may expose us to unexpected costs and negatively affect our financial performance.

Our insurance coverage is subject to deductibles, self-insured retentions, limits of liability and similar provisions that we believe are prudent based on our operations. Because we self-insure a significant portion of expected losses under our workers' compensation, general liability, vehicle and group health insurance programs, unanticipated changes in any applicable actuarial assumptions and management estimates underlying our recorded liabilities for these losses, including potential increases in medical and indemnity costs, could result in materially different amounts of expense than expected under these programs. This could have a material adverse effect on our financial condition and results of operations.

Our operations in Mexico are subject to political or regulatory changes and significant changes in the economic environment and other concerns.

We opened our first store in Mexico in October 2010, and operated 130 stores in Mexico as of December 31, 2016. Changes in the business, regulatory or political climate in Mexico could adversely affect our operations there. Mexico is also subject to certain potential risks and uncertainties that are beyond our control, such as violence, social unrest, enforcement of property rights and public safety and security that could restrict or eliminate our ability to open new or operate some or all of our locations in Mexico, or significantly reduce customer traffic or demand. In addition, our assets, investments in, earnings from and dividends from our Mexican subsidiaries must be translated to U.S. dollars from the Mexican peso. Accordingly, we are exposed to risks associated with fluctuations of the exchange rate for the Mexican peso which may have an impact on our future costs or on future cash flows from our Mexico operations, and could adversely affect our financial performance.

Failure to improve our financial performance in Mexico could result in our taking actions that may change or impact our projected results in the future.

We are pursuing several operational initiatives designed to improve the financial performance of our operations in Mexico. If we are unable to achieve an acceptable level of profitability in Mexico, we will consider all available alternatives for our operations in Mexico, some of which may change or impact our projected results in the future.

Our transactions are regulated by and subject to the requirements of various federal and state laws and regulations, which may require significant compliance costs and expose us to litigation. Any negative change in these laws or the passage of unfavorable new laws could require us to alter our business practices in a manner that may be materially adverse to us.

Currently, 46 states, the District of Columbia and Puerto Rico have passed laws that regulate rental purchase transactions as separate and distinct from credit sales. One additional state has a retail installment sales statute that excludes leases, including rent-to-own transactions, from its coverage if the lease provides for more than a nominal purchase price at the end of the rental period. The specific rental purchase laws generally require certain contractual and advertising disclosures. They also provide varying levels of substantive consumer protection, such as requiring a grace period for late fees and contract reinstatement rights in the event the

12

rental purchase agreement is terminated. The rental purchase laws of ten states limit the total amount that may be charged over the life of a rental purchase agreement and the laws of five states limit the cash prices for which we may offer merchandise.

Similar to other consumer transactions, our rental purchase transaction is also governed by various federal and state consumer protection statutes. These consumer protection statutes, as well as the rental purchase statutes under which we operate, provide various consumer remedies, including monetary penalties, for violations. In our history, we have been the subject of litigation alleging that we have violated some of these statutory provisions.

Although there is currently no comprehensive federal legislation regulating rental purchase transactions, adverse federal legislation may be enacted in the future. From time to time, both favorable and adverse legislation seeking to regulate our business has been introduced in Congress. In addition, various legislatures in the states where we currently do business may adopt new legislation or amend existing legislation that could require us to alter our business practices in a manner that could have a material adverse effect on our business, financial condition and results of operations.

Our reputation, ability to do business and operating results may be impaired by improper conduct by any of our employees, agents or business partners.

Our operations in the U.S. and abroad are subject to certain laws generally prohibiting companies and their intermediaries from making improper payments to government officials for the purpose of obtaining or retaining business, such as the U.S. Foreign Corrupt Practices Act, and similar anti-bribery laws in other jurisdictions. Our employees, contractors or agents may violate the policies and procedures we have implemented to ensure compliance with these laws. Any such improper actions could subject us to civil or criminal investigations in the U.S. and in other jurisdictions, could lead to substantial civil and criminal, monetary and non-monetary penalties, and related shareholder lawsuits, could cause us to incur significant legal fees, and could damage our reputation.

We may be subject to legal proceedings from time to time which seek material damages. The costs we incur in defending ourselves or associated with settling any of these proceedings, as well as a material final judgment or decree against us, could materially adversely affect our financial condition by requiring the payment of the settlement amount, a judgment or the posting of a bond.

In our history, we have defended class action lawsuits alleging various regulatory violations and have paid material amounts to settle such claims. Significant settlement amounts or final judgments could materially and adversely affect our liquidity and capital resources. The failure to pay any material judgment would be a default under our senior credit facilities and the indenture governing our outstanding senior unsecured notes.

Our operations are dependent on effective information management systems. Failure of these systems could negatively impact our business, financial condition and results of operations.

We utilize integrated information management systems. The efficient operation of our business is dependent on these systems to effectively manage our financial and operational data. The failure of our information management systems to perform as designed, loss of data or any interruption of our information management systems for a significant period of time could disrupt our business. If the information management systems sustain repeated failures, we may not be able to manage our store operations, which could have a material adverse effect on our business, financial condition and results of operations.

We are currently investing in new information management technology and systems and implementing modifications and upgrades to existing systems to support our growth plan. These investments include replacing legacy systems, making changes to existing systems, building redundancies, and acquiring new systems and hardware with updated functionality. We are taking appropriate actions to ensure the successful implementation of these initiatives, including the testing of new systems and the transfer of existing data, with minimal disruptions to the business. These efforts may take longer and may require greater financial and other resources than anticipated, may cause distraction of key personnel, may cause disruptions to our existing systems and our business, and may not provide the anticipated benefits. The disruption in our information management systems, or our inability to improve, upgrade, integrate or expand our systems to meet our evolving business requirements, could impair our ability to achieve critical strategic initiatives and could materially adversely impact our business, financial condition and results of operations.

In the third quarter of 2016, we experienced unexpected capacity-related system outages of our new store information management system in our Core U.S. stores which negatively impacted our third quarter operating results. In the fourth quarter of 2016, we implemented software releases to improve stability and added hardware to help mitigate over-utilization issues. As a result, we did not experience any additional capacity-related outages in the fourth quarter of 2016.

If we fail to protect the integrity and security of customer and employee information, we could be exposed to litigation or regulatory enforcement and our business could be adversely impacted.

We collect and store certain personal information provided to us by our customers and employees in the ordinary course of our business. Despite instituted safeguards for the protection of such information, we cannot be certain that all of our systems are

13

entirely free from vulnerability to attack. Computer hackers may attempt to penetrate our network security and, if successful, misappropriate confidential customer or employee information. In addition, one of our employees, contractors or other third party with whom we do business may attempt to circumvent our security measures in order to obtain such information, or inadvertently cause a breach involving such information. Loss of customer or employee information could disrupt our operations, damage our reputation, and expose us to claims from customers, employees, regulators and other persons, any of which could have an adverse effect on our business, financial condition and results of operations. In addition, the costs associated with information security, such as increased investment in technology, the costs of compliance with privacy laws, and costs incurred to prevent or remediate information security breaches, could adversely impact our business.

A change of control could accelerate our obligation to pay our outstanding indebtedness, and we may not have sufficient liquid assets at that time to repay these amounts.

Under our senior credit facilities, an event of default would result if a third party became the beneficial owner of 35.0% or more of our voting stock or upon certain changes in the constitution of Rent-A-Center’s Board of Directors. As of December 31, 2016, $191.8 million was outstanding under our senior credit facilities.

Under the indenture governing our outstanding senior unsecured notes, in the event of a change in control, we may be required to offer to purchase all of our outstanding senior unsecured notes at 101% of their original aggregate principal amount, plus accrued interest to the date of repurchase. A change in control also would result in an event of default under our senior credit facilities, which would allow our lenders to accelerate indebtedness owed to them.

If a specified change in control occurs and the lenders under our debt instruments accelerate these obligations, we may not have sufficient liquid assets to repay amounts outstanding under these agreements.

Rent-A-Center's organizational documents and our debt instruments contain provisions that may prevent or deter another group from paying a premium over the market price to Rent-A-Center's stockholders to acquire its stock.

Rent-A-Center’s organizational documents contain provisions that classify its Board of Directors, authorize its Board of Directors to issue blank check preferred stock and establish advance notice requirements on its stockholders for director nominations and actions to be taken at meetings of the stockholders. In addition, as a Delaware corporation, Rent-A-Center is subject to Section 203 of the Delaware General Corporation Law relating to business combinations. Our senior credit facilities and the indentures governing our senior unsecured notes each contain various change of control provisions which, in the event of a change of control, would cause a default under those provisions. These provisions and arrangements could delay, deter or prevent a merger, consolidation, tender offer or other business combination or change of control involving us that could include a premium over the market price of Rent-A-Center’s common stock that some or a majority of Rent-A-Center’s stockholders might consider to be in their best interests.

Rent-A-Center is a holding company and is dependent on the operations and funds of its subsidiaries.

Rent-A-Center is a holding company, with no revenue generating operations and no assets other than its ownership interests in its direct and indirect subsidiaries. Accordingly, Rent-A-Center is dependent on the cash flow generated by its direct and indirect operating subsidiaries and must rely on dividends or other intercompany transfers from its operating subsidiaries to generate the funds necessary to meet its obligations, including the obligations under the senior credit facilities. The ability of Rent-A-Center’s subsidiaries to pay dividends or make other payments to it is subject to applicable state laws. Should one or more of Rent-A-Center’s subsidiaries be unable to pay dividends or make distributions, its ability to meet its ongoing obligations could be materially and adversely impacted.

Our stock price is volatile, and you may not be able to recover your investment if our stock price declines.

The price of our common stock has been volatile and can be expected to be significantly affected by factors such as:

• | our ability to meet market expectations with respect to the growth and profitability of each of our operating segments; |

• | quarterly variations in our results of operations, which may be impacted by, among other things, changes in same store sales or when and how many locations we acquire or open; |

• | quarterly variations in our competitors’ results of operations; |

• | changes in earnings estimates or buy/sell recommendations by financial analysts; and |

• | the stock price performance of comparable companies. |

In addition, the stock market as a whole historically has experienced price and volume fluctuations that have affected the market price of many specialty retailers in ways that may have been unrelated to these companies' operating performance.

14

Failure to achieve and maintain effective internal controls could have a material adverse effect on our business and stock price.

Effective internal controls are necessary for us to provide reliable financial reports. If we cannot provide reliable financial reports, our brand and operating results could be harmed. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

While we continue to evaluate and improve our internal controls, we cannot be certain that these measures will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

If we fail to maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Failure to achieve and maintain an effective internal control environment could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

15

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

We lease space for substantially all of our Core U.S. and Mexico stores and certain support facilities under operating leases expiring at various times through 2023. Most of our store leases are five year leases and contain renewal options for additional periods ranging from three to five years at rental rates adjusted according to agreed-upon formulas. Store sizes average approximately 4,700 square feet. Approximately 75% of each store’s space is generally used for showroom space and 25% for offices and storage space. Our Acceptance Now kiosks occupy space without charge in the retailer's location with no lease commitment.

We believe suitable store space generally is available for lease and we would be able to relocate any of our stores or support facilities without significant difficulty should we be unable to renew a particular lease. We also expect additional space is readily available at competitive rates to open new stores or support facilities, as necessary.

We own the land and building in Plano, Texas, in which our corporate headquarters is located. The land and improvements are pledged as collateral under our senior credit facilities.

Item 3. Legal Proceedings.

From time to time, we, along with our subsidiaries, are party to various legal proceedings arising in the ordinary course of business. We reserve for loss contingencies that are both probable and reasonably estimable. We regularly monitor developments related to these legal proceedings, and review the adequacy of our legal reserves on a quarterly basis. We do not expect these losses to have a material impact on our consolidated financial statements if and when such losses are incurred.

We are subject to unclaimed property audits by states in the ordinary course of business. A comprehensive multi-state unclaimed property audit is currently in progress. The property subject to review in this audit process includes unclaimed wages, vendor payments and customer refunds. State escheat laws generally require entities to report and remit abandoned and unclaimed property to the state. Failure to timely report and remit the property can result in assessments that could include interest and penalties, in addition to the payment of the escheat liability itself. We routinely remit escheat payments to states in compliance with applicable escheat laws. Management believes it is too early to determine the ultimate outcome of this audit, as our remediation efforts are still in process and there have been recent developments in escheat laws which may be applicable to this matter.

Alan Hall, et. al. v. Rent-A-Center, Inc., et. al.; James DePalma, et. al. v. Rent-A-Center, Inc., et. al. On December 23, 2016, a putative class action was filed against us and certain of our former officers by Alan Hall in federal court in Sherman, Texas. The complaint alleges that the defendants violated Section 10(b) and/or Section 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder by issuing false and misleading statements and omitting material facts regarding our business, operations and prospects during the period covered by the complaint. The complaint purports to be brought on behalf of all purchasers of our common stock from July 27, 2015, through October 10, 2016, and seeks damages in unspecified amounts. A complaint filed by James DePalma also in Sherman, Texas alleging similar claims was consolidated by the court into the Hall matter. We believe that these claims are without merit and intend to vigorously defend ourselves. However, we cannot assure you that we will be found to have no liability in this matter.

Item 4. Mine Safety Disclosures.

Not applicable.

16

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock has been listed on the Nasdaq Global Select Market® and its predecessors under the symbol “RCII” since January 25, 1995, the date we commenced our initial public offering. The following table sets forth, for the periods indicated, the high and low sales price per share of our common stock as reported, and the quarterly cash dividend declared per share on our common stock.

2016 | High | Low | Cash Dividends Declared | ||

Fourth Quarter | $13.16 | $8.00 | $0.08 | ||

Third Quarter | $13.73 | $10.20 | $0.08 | ||

Second Quarter | $15.94 | $11.21 | $0.08 | ||

First Quarter | $16.37 | $9.76 | $0.08 | ||

2015 | High | Low | Cash Dividends Declared | ||

Fourth Quarter | $26.26 | $14.69 | $0.24 | ||

Third Quarter | $29.66 | $23.68 | $0.24 | ||

Second Quarter | $33.59 | $25.13 | $0.24 | ||

First Quarter | $37.23 | $26.47 | $0.24 | ||

As of February 21, 2017, there were approximately 38 record holders of our common stock.

Future decisions to pay cash dividends on our common stock continue to be at the discretion of our Board of Directors and will depend on a number of factors, including future earnings, capital requirements, contractual restrictions, financial condition, future prospects and any other factors our Board of Directors may deem relevant. Cash dividend payments are subject to certain restrictions in our debt agreements. Please see Note I and Note J to the consolidated financial statements for further discussion of such restrictions.

Under our current common stock repurchase program, our Board of Directors has authorized the purchase, from time to time, in the open market and privately negotiated transactions, up to an aggregate of $1.25 billion of Rent-A-Center common stock. As of December 31, 2016, we had purchased a total of 36,994,653 shares of Rent-A-Center common stock for an aggregate purchase price of $994.8 million under this common stock repurchase program. No shares were repurchased during 2016 and 2015.

17

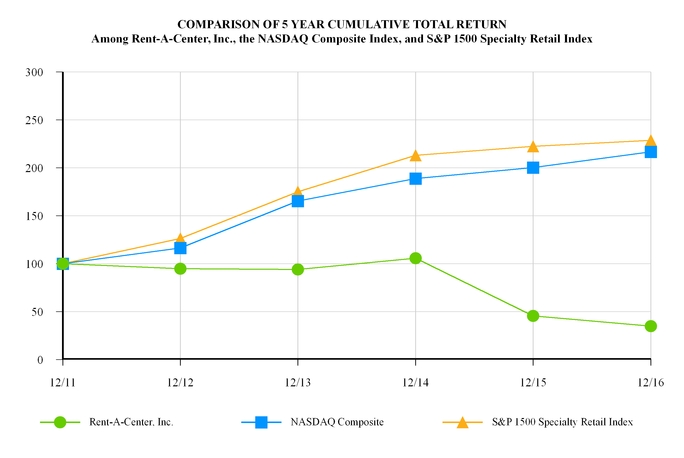

Stock Performance Graph

The following chart represents a comparison of the five year total return of our common stock to the NASDAQ Composite Index and the S&P 1500 Specialty Retail Index. We selected the S&P 1500 Specialty Retail Index for comparison because we use this published industry index as the comparator group to measure our relative total shareholder return for purposes of determining vesting of performance stock units granted under our long-term incentive compensation program. The graph assumes $100 was invested on December 31, 2011, and dividends, if any, were reinvested for all years ending December 31.

18

Item 6. Selected Financial Data.

The selected financial data presented below for the five years ended December 31, 2016, have been derived from our audited consolidated financial statements. The historical financial data are qualified in their entirety by, and should be read in conjunction with, the consolidated financial statements and the notes thereto, the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other financial information included in this report.

Year Ended December 31, | |||||||||||||||||||

(In thousands, except per share data) | 2016 | 2015(1) | 2014 | 2013 | 2012 | ||||||||||||||

Consolidated Statements of Operations | |||||||||||||||||||

Revenues | |||||||||||||||||||

Store | |||||||||||||||||||

Rentals and fees | $ | 2,500,053 | $ | 2,781,315 | $ | 2,745,828 | (8) | $ | 2,695,895 | $ | 2,653,925 | ||||||||