Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RAYMOND JAMES FINANCIAL INC | a8-k_1q17shareholdersletter.htm |

F I R S T Q U A R T E R2017

the HUMAN

connection

Dear Fellow Shareholders,

The first quarter ending December 31, 2016, proved to be

an eventful start to our fiscal year, as President Trump’s

unexpected victory propelled the domestic equity

markets to new records and resulted in a surge in U.S.

Treasury yields. Additionally, the Federal Reserve

increased its federal funds target rate by 25 basis points

in December. These factors, coupled with our strong

organic growth and the acquisitions of Alex. Brown and

3Macs in the preceding quarter, helped us achieve record

quarterly net revenues and our second best quarterly net

income. Record quarterly net revenues of $1.49 billion

increased 17% over the prior year’s fiscal first quarter and

2% over the preceding quarter. Quarterly net income of

$146.6 million, which included $12.7 million of

acquisition-related expenses associated with the

integration of the aforementioned acquisitions, improved

38% compared to the year-ago fiscal first quarter but

declined 15% from the record set in the preceding

quarter. Record quarterly net revenues were fueled by

record net revenues in the Private Client Group segment,

Asset Management segment and Raymond James Bank.

Higher revenues and a favorable tax rate during the

quarter contributed to the substantial year-over-year

increase in earnings. Meanwhile, soft investment banking

revenues and elevated legal reser ves caused the

sequential decline in earnings.

The pre-tax margin on net revenues for the quarter was

13.8%, up from 13.2% in last year’s fiscal first quarter. The

annualized return on equity for the quarter was 11.7%,

which compares favorably to 9.3% in the prior year’s

comparable quarter. Shareholders’ equity ended the

quarter at $5.1 billion, eclipsing $5 billion for the first time

and representing $35.55 of book value per share. We also

finished the quarter with records for several of our key

revenue drivers, including client asset s under

administration, financial assets under management and

net loans at Raymond James Bank.

Turning to our segment results, the Private Client Group

generated record quarterly net revenues of $1.04 billion,

a 19% annual increase, and quarterly pre-tax income of

$73.4 million, which was up 6% on a year-over-year basis but

down 31% compared to the immediately preceding

September quarter. The segment’s record net revenues and

year-over-year increase in pre-tax income were lifted by

strong organic growth, the benefit from higher short-term

interest rates, and the acquisitions of Alex. Brown and

3Macs, which closed during the second half of the preceding

quarter. The sequential decline in the segment’s pre-tax

income was largely attributable to $30 million of elevated

legal reserves. The Private Client Group continues to enjoy

exceptional retention of existing advisors as well as success

recruiting new advisors to our various affiliation options,

which along with market appreciation enabled the

segment’s client assets to achieve a record $585.6 billion,

reflecting a significant 24% increase over December 2015.

The Capital Markets segment generated quarterly net

revenues of $233.0 million and pre-tax income of $21.4

million. Quarterly net revenues in the segment were up 3%

compared to last year’s fiscal first quarter but down 18%

compared to the September 2016 quarter, as investment

banking revenues declined 42% sequentially. While the

weakness in investment banking revenues during the

quarter was largely due to the timing of closings and the

heightened market uncertainty surrounding the presidential

election, the industry continues to be challenged by

structural headwinds negatively impacting the equity

underwriting business. We are hopeful a more conducive

political and regulatory environment will make the public

equity markets more attractive for growth-oriented

companies seeking capital. The Fixed Income division

generated satisfactory results, especially considering the

spike in Treasury yields following the election, which were

aided by solid trading profits and institutional commissions

in December.

The Asset Management segment produced record quarterly

net revenues of $114.1 million and record quarterly pre-tax

income of $41.9 million, reflecting annual revenue growth of

14% and annual pre-tax income growth of 26%. Record

results in the Asset Management segment were bolstered

by attractive growth of financial assets under management,

which ended the quarter at a record $79.7 billion, up 17%

compared to December 2015. The growth of financial

assets under management is largely attributable to the net

addition of financial advisors in the Private Client Group

segment coupled with the increased utilization of

fee-based accounts.

Raymond James Bank also generated record net revenues

and pre-tax income during the quarter. The bank’s net

revenues of $138.0 million grew a substantial 27% over last

year’s fiscal first quarter. Its pre-tax income of $104.1 million

jumped 58% during the same period. Record revenues and

earnings at the bank were driven by balanced loan growth,

continued improvement of the loan portfolio’s credit quality

and a relatively consistent net interest margin, which has

benefited from higher short-term interest rates. Net loans at

Raymond James Bank ended the quarter at a record $15.8

billion, representing an increase of 15% over December 2015

and 4% over September 2016. Despite this loan growth, the

bank actually generated a loan loss benefit of $1.0 million

for the quarter, as the substantial decline in criticized loans

during the quarter more than offset the upfront reserves

associated with new loan growth.

Total quarterly revenues in the Other segment were $15.5

million, which primarily consisted of $10.6 million in

valuation gains attributable to private equity investments

during the quarter. The effective tax rate for the quarter was

29.0%, as new accounting guidance for stock compensation

favorably impacted the quarter’s income tax expense by

approximately $18 million. We expect this new tax guidance

to continue impacting our effective tax rate, predominantly

in the first quarter of each fiscal year when the vast majority

of our restricted stock units vest.

In addition to our satisfactory financial results during the

first quarter of fiscal 2017, we also achieved several awards,

recognitions and accolades. A critical component of our

mission is to give back to the communities in which we live

and work. Therefore, we are very proud to be awarded first

place in the “Biggest Company” category in the 2016 Tampa

Bay Business Journal Philanthropy Awards.

In November 2016, Raymond James advisor Margaret

Starner was named to InvestmentNews’ list of the top 20

Women to Watch. In December 2016, 29 Raymond James

Financial Institutions Division advisors were named to Bank

Investment Consultant’s list of the Top 100 Bank Advisors.

Raymond James Investment Banking won three Deal of the

Year awards from the M&A Advisor: Cross Border Deal of the

Year ($500MM – $1B); Private Equity Deal of the Year

($500MM – $1B); and M&A Deal of the Year ($500MM – $1B).

Additionally, Raymond James won Investment Bank of the

Year, Medical Services & Materials Deal of the Year, and

Middle Market Deal of the Year at the M&A Atlas Awards.

As we write this letter, the Dow Jones Industrial Average is

hovering near record levels at approximately 20,000, as the

market is anticipating that the Trump administration will

swiftly implement political and regulatory changes that will

spur an acceleration of growth in our economy. We agree that

several of the contemplated changes, such as a decrease in

corporate tax rates and a measured reduction of regulations,

would stimulate economic growth. One expected change that

we are particularly focused on, as it would have a profound

impact on our industry and our clients, relates to the DOL

Fiduciary Rule. In February, President Trump signed an

executive order directing the DOL to further scrutinize the

rule. Shortly after the memo was issued, the DOL announced

that it is evaluating legal options to delay the rule’s April 2017

applicability date. From the outset, we have been deeply

concerned that this rule, while well-intentioned, would result

in unintended consequences that would ultimately hurt

investors by limiting choice and reducing access to

professional financial advice. Therefore, we are encouraged

by the Trump administration’s recent actions to reevaluate

the rule. We are hopeful the industry will develop a

replacement that ensures a uniform and client-focused

standard of conduct for all investors and all accounts.

With many of our key revenue drivers at record levels,

we are well-positioned to continue delivering superior

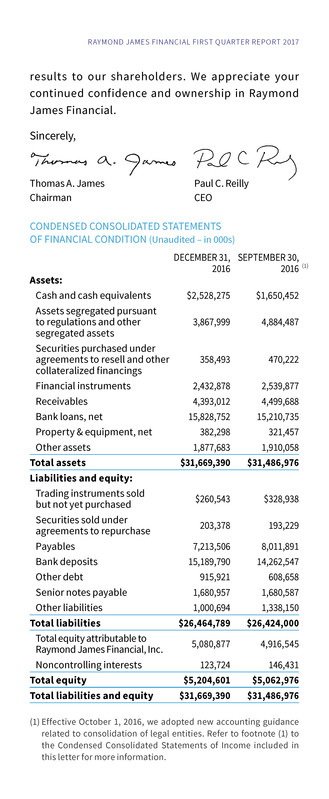

DECEMBER 31,

2016

SEPTEMBER 30,

2016

Assets:

Cash and cash equivalents $2,528,275 $1,650,452

Assets segregated pursuant

to regulations and other

segregated assets

3,867,999 4,884,487

Securities purchased under

agreements to resell and other

collateralized financings

358,493 470,222

Financial instruments 2,432,878 2,539,877

Receivables 4,393,012 4,499,688

Bank loans, net 15,828,752 15,210,735

Property & equipment, net 382,298 321,457

Other assets 1,877,683 1,910,058

Total assets $31,669,390 $31,486,976

Liabilities and equity:

Trading instruments sold

but not yet purchased $260,543 $328,938

Securities sold under

agreements to repurchase 203,378 193,229

Payables 7,213,506 8,011,891

Bank deposits 15,189,790 14,262,547

Other debt 915,921 608,658

Senior notes payable 1,680,957 1,680,587

Other liabilities 1,000,694 1,338,150

Total liabilities $26,464,789 $26,424,000

Total equity attributable to

Raymond James Financial, Inc. 5,080,877 4,916,545

Noncontrolling interests 123,724 146,431

Total equity $5,204,601 $5,062,976

Total liabilities and equity $31,669,390 $31,486,976

CONDENSED CONSOLIDATED STATEMENTS

OF FINANCIAL CONDITION (Unaudited – in 000s)

R AYMOND JAMES FINANCIAL FIRST QUARTER REPORT 2017

Sincerely,

Thomas A. James Paul C. Reilly

Chairman CEO

results to our shareholders. We appreciate your

continued confidence and ownership in Raymond

James Financial.

(1) Effective October 1, 2016, we adopted new accounting guidance

related to consolidation of legal entities. Refer to footnote (1) to

the Condensed Consolidated Statements of Income included in

this letter for more information.

(1)

(1) As a result of our October 1, 2016, adoption of the new

consolidation guidance, we deconsolidated a number of tax

credit fund variable interest entities (VIEs) that had been

previously consolidated. We determined that under the

new guidance, we are no longer deemed to be the primary

beneficiary of these VIEs. We applied the new consolidation

guidance on the full retrospective basis, meaning that we have

reflected the adjustments arising from this adoption as of the

beginning of our earliest comparative period presented. Certain

prior period amounts have been revised from those reported in

the prior periods to conform to the current presentation. There

was no net impact on our Condensed Consolidated Statements

of Income and Comprehensive Income for the prior year period

as the net change in revenues, interest and other expenses

was offset by the impact of the deconsolidation on the net loss

attributable to noncontrolling interests.

(2) Effective October 1, 2016, we adopted new accounting

guidance simplifying certain aspects of accounting for stock

compensation. Our adoption of the new stock compensation

simplification guidance impacts our determination of income

tax expense. Generally, the amount of compensation cost

recognized for financial reporting purposes varies from the

amount that can ultimately be deducted on the tax return for

share-based payment awards. Under the prior guidance, the

tax effects of deductions in excess of compensation expense

(“windfalls”), as well as the tax effect of any deficiencies

(“shortfalls”), were recorded in equity to the extent of

previously recognized windfalls, with any remaining shortfall

recorded in income tax expense. Under the new guidance,

all tax effects related to share-based payments are recorded

through tax expense in the periods during which the awards are

exercised or vest, as applicable. Under the transition provisions

of the new guidance, we have applied this new guidance

prospectively to excess tax benefits arising from vesting

after the October 1, 2016, adoption date. This new guidance

favorably impacted our current period income tax expense by

approximately $18 million.

(3) The Other segment includes the results of our principal capital

and private equity activities as well as certain corporate

overhead costs of Raymond James Financial, including the

interest costs on our public debt, and the acquisition and

integration costs associated with certain acquisitions.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts)

CONSOLIDATED RESULTS BY SEGMENT (unaudited – in 000s)

Revenues:

Private Client Group $ 1,043,316 $ 874,445

Capital Markets 236,982 228,978

Asset Management 114,096 100,238

Raymond James Bank 144,517 112,726

Other (3) 15,459 4,400

Intersegment eliminations (25,602) (19,930)

Total revenues $ 1,528,768 $ 1,300,857

Pre-tax income (loss) (excluding noncontrolling interests):

Private Client Group $ 73,358 $ 69,140

Capital Markets 21,444 25,168

Asset Management 41,909 33,366

Raymond James Bank 104,121 65,865

Other (3) (34,453) (25,201)

Pre-tax income (excluding noncontrolling interests) $ 206,379 $ 168,338

Three Months Ended

December 31, 2016 December 31, 2015

Revenues:

Securities commissions and fees $ 984,385 $ 849,662

Investment banking 61,425 57,553

Investment advisory and related administrative fees 108,243 98,602

Interest 182,782 142,472

Account and service fees 148,791 116,823

Net trading profit 20,555 22,169

Other 22,587 13,576

Total revenues 1,528,768 1,300,857

Interest expense (35,966) (26,699)

Net revenues 1,492,802 1,274,158

Non-interest expenses:

Compensation, commissions and benefits 1,006,467 866,398

Communications and information processing 72,161 72,138

Occupancy and equipment costs 46,052 41,789

Clearance and floor brokerage 12,350 9,996

Business development 35,362 40,624

Investment sub-advisory fees 19,295 14,554

Bank loan loss provision (1,040) 13,910

Acquisition-related expenses 12,666 1,872

Other 81,974 42,804

Total non-interest expenses 1,285,287 1,104,085

Income including noncontrolling interests and before provision for income taxes 207,515 170,073

Provision for income taxes 59,812 62,009

Net income including noncontrolling interests 147,703 108,064

Net loss attributable to noncontrolling interests 1,136 1,735

Net income attributable to Raymond James Financial, Inc. $ $146,567 $ $106,329

Net income per common share – diluted $ 1.00 $ 0.73

Weighted-average common and common equivalent

shares outstanding – diluted 145,675

146,141

(1)

(1)

(2)

International Headquarters:

The Raymond James Financial Center

880 Carillon Parkway // St. Petersburg, FL 33716

800.248.8863 // raymondjames.com

© 2017 Raymond James Financial

Raymond James® is a registered trademark of Raymond James Financial, Inc.

16-Fin-Rep-0039 KM 2/17

Stock Traded: NEW YORK STOCK EXCHANGE

Stock Symbol: RJF

corporate profile

Raymond James Financial, Inc. (NYSE: RJF) is a leading

diversified financial services company providing

private client, capital markets, asset management,

banking and other services to individuals, corporations

and municipalities. Its three principal wholly owned

broker/dealers, Raymond James & Associates,

Raymond James Financial Services and Raymond

James Ltd., have approximately 7,100 financial advisors

serving approximately 3 million client accounts in more

than 2,900 locations throughout the United States,

Canada and overseas. Total client assets are

approximately $622 billion. Public since 1983, the firm

has been listed on the New York Stock Exchange since

1986 under the symbol RJF. Additional information is

available at raymondjames.com.