Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - MINDBODY, Inc. | exhibit_322x12-31x2016.htm |

| EX-32.1 - EXHIBIT 32.1 - MINDBODY, Inc. | exhibit_321-12x31x2016.htm |

| EX-31.2 - EXHIBIT 31.2 - MINDBODY, Inc. | exhibit_312x12-31x2016.htm |

| EX-31.1 - EXHIBIT 31.1 - MINDBODY, Inc. | exhibit_311x12-31x2016.htm |

| EX-23.1 - EXHIBIT 23.1 - MINDBODY, Inc. | exhibit_231x12-31x2016.htm |

| EX-21.1 - EXHIBIT 21.1 - MINDBODY, Inc. | exhibit_211x12-31x2016.htm |

| EX-10.18 - EXHIBIT 10.18 - MINDBODY, Inc. | exhibit_1018x12-31x2016.htm |

| EX-10.3 - EXHIBIT 10.3 - MINDBODY, Inc. | exhibit_103x12-31x2016.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number 001-37453

MINDBODY, INC.

(Exact name of registrant as specified in its charter)

Delaware | 20-1898451 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

4051 Broad Street, Suite 220 San Luis Obispo, CA | 93401 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (877) 755-4279

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Class A Common Stock, par value $0.000004 per share | NASDAQ Stock Market LLC (NASDAQ Global Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | x | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of June 30, 2016 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of shares of Class A common stock and Class B common stock held by non-affiliates of the registrant was approximately $404,840,000.

As of February 24, 2017, the registrant had 33,211,750 shares of Class A common stock, and 7,651,713 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report on Form 10-K, to the extent not set forth herein, is incorporated by reference from the registrant’s definitive proxy statement relating to the registrant’s Annual Meeting of Stockholders to be held in 2017. Such definitive proxy statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates.

Table of Contents

Page | ||

F-1 | ||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern, among other things, our expectations, strategy, plans or intentions. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

• | our ability to attract and retain subscribers; |

• | our ability to deepen our relationships with existing subscribers; |

• | our business plan and beliefs and objectives for future operations, including regarding our pricing and pricing model; |

• | benefits associated with use of our products and services; |

• | our ability to develop or acquire new products and services, improve our existing products and services and increase the value of our products and services; |

• | the network effects associated with our business; |

• | our ability to increase our revenue and our revenue growth rate; |

• | our future financial performance, including expectations regarding trends in revenue, cost of revenue, operating expenses, other income and expenses, income taxes, subscriber growth, average monthly revenue per subscriber, payments volume, and dollar-based net expansion rate; |

• | our ability to further develop strategic relationships, including our ability to increase our revenue from our API and technology partners; |

• | our ability to strengthen and maintain our partnerships with our payment processors; |

• | our ability to achieve positive returns on investments; |

• | our plans to further invest in and grow our business, including investment in research and development, sales and marketing, the development of our customer support teams, and our data center infrastructure, and our ability to effectively manage our growth and associated investments; |

• | our ability to timely and effectively scale and adapt our existing technology; |

• | the sufficiency of our cash and cash equivalents and cash generated from operations to meet our working capital and capital expenditure requirements; |

• | the effects of seasonal trends on our operating results; |

• | the sufficiency of our efforts to remediate our past material weaknesses; |

• | our ability to attract and retain senior management, qualified employees and key personnel; |

• | our ability to successfully identify, acquire and integrate companies and assets; |

• | our ability to successfully enter new vertical and geographic markets and manage our international expansion; and |

• | our ability to maintain, protect and enhance our intellectual property and not infringe upon others’ intellectual property. |

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K. You should not rely upon forward-looking statements as predictions of future events. The outcomes of the events described in these forward-looking statements are subject to substantial risks, uncertainties and other factors described in Part I, Item 1A, Risk Factors, and elsewhere, in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

1

PART I

Item 1. Business.

Overview

We are the leading provider of cloud-based business management software for the wellness services industry and a growing consumer brand, with more than 60,000 local business subscribers on our platform in more than 130 countries and territories. These subscribers provide a variety of wellness services to over 30 million active consumers as of December 31, 2016. Our integrated software and payments platform helps business owners in the wellness services industry run, market and build their businesses. We also help consumers more easily discover, evaluate, engage and transact with these businesses via the web, social sites and mobile devices.

Our Vision

Our vision is to leverage technology to improve the wellness of the world.

The MINDBODY Solution

Our integrated cloud-based business management software and payments platform is specifically designed to engage both the supply and demand sides of the wellness services industry. Wellness encompasses multiple dimensions of a person’s well-being – physical, emotional, social, occupational and spiritual, among others. As a result, we include health and fitness, integrative health, salon and spa, fine arts and children’s activities as categories within the wellness services industry.

Integrated Software and Payments Platform

Our platform is continuously evolving to help our subscribers simplify the way they run their businesses, attract, engage and retain more consumers, increase their revenues, and focus more on what they love to do – improving people’s lives. We have developed this platform with powerful functionality that addresses key aspects of operating a wellness business, including:

• | Client Scheduling and Online Booking. Our subscribers can give their consumers the opportunity to book their next visit wherever and whenever it is most convenient, whether through subscribers’ websites, social media pages, or mobile applications like the MINDBODY app or the subscribers' own custom branded app. We offer robust features that enable all four different types of scheduling that wellness businesses typically encounter: |

◦ | Appointments. One-on-one appointments typically require preparation time before the appointment as well as off-boarding time after the appointment. Our software can manage practitioner availability as well as gaps between appointments in a time-efficient manner. |

◦ | Open classes. Open classes offer reserved or drop-in attendance on a first-come, first-served basis. Our software can transact at different price points, send automatic check-in and cancellation confirmations, and manage waitlists to optimize capacity utilization. |

◦ | Enrollments and workshops. Enrollments and workshops are pre-registered events or series of classes with the same group of attendees. Our software offers the ability to set separate pricing outside of pre-paid packages and track absences, make-ups and various payment plans. |

◦ | Resource scheduling. To effectively manage their day-to-day business, wellness service providers need to manage and allocate their equipment and facilities. Our software can easily track, manage and allocate equipment and facilities for the classes and services these businesses provide. |

• | Staff Management. With our staff and resource scheduling software features, subscribers can keep their entire staff schedule in one place, allowing them to manage staff availability, hours, substitutions, commissions and other compensation, all of which can be easily linked to payroll records. |

◦ | Staff Tracking. Subscribers can assign tasks, follow up and send notifications via the staff dashboard. By giving each staff member a unique login, subscribers can allow staff members to update their own availability on a single, unified schedule. Moreover, subscribers can have staff clock in and out through our platform so their work hours and gross wages can be tracked automatically. In addition, variable compensation including compensation based on classes and appointments delivered, or sales commissions earned, can be managed through our platform. |

2

◦ | Payroll. Subscribers have the ability to set compensation rates per class, per appointment, per hour, or as a percentage of consumer payment for each individual staff member, as well as track and add gratuities earned into the payroll report. Additionally, subscribers can offer commissions to their staff for retail sales or promotions. Payroll is calculated automatically and exported to any of several popular payroll service formats, including ADP, Paychex and Exact Payroll Services. |

• | Client Relationship Management. With our client relationship management features, subscribers have all of their consumer information in one place and can take advantage of powerful consumer relationship and marketing tools. Subscribers can securely store their consumers’ personal information in a unique profile and manage account, visit and purchase history for more effective service. Our platform also helps subscribers target new consumers, keep in touch with loyal members, and offer variable, targeted promotions and discounts. |

◦ | Client Tracking. Subscribers can maintain a comprehensive client profile, including contact information, photos, birthdays, preferences, purchase and visit histories, payment information and future schedules. Subscribers can also track the sales cycle and conversion of prospective clients. Clients can create and manage their own accounts with their preferred service providers, allowing them to browse products and services and make purchases from mobile devices and the web. |

◦ | The MINDBODY Network. Subscribers can opt in to this fee-based marketing platform (formerly the Marketing Platform) to feature their introductory offers (typically valid for a single-purchase) on the MINDBODY app and/or feature their services through third-party partner applications or websites, expanding their online presence to reach more prospective customers. |

◦ | Email Marketing. Subscribers can utilize our platform to send broad or targeted email marketing campaigns. They also have the option to sync to a third-party account with our platform, and create email lists that update automatically whenever client contact information changes in their site. |

◦ | Loyalty Programs. To reward consumers, subscribers can build a point-based client loyalty program, and set point values and minimum redemption requirements. |

◦ | Promotions. Subscribers can set up promotions to attract new consumers and give current ones an incentive to try something new. |

◦ | Automation. Subscribers can send automated text message alerts, push notifications and reminders to consumers about upcoming classes, appointments and more. Further automation examples include sending purchase receipts directly to consumers’ email addresses, receiving notifications when consumers book, confirm or cancel appointments, tracking online orders as they come in, and printing packing slips automatically as well as printing sign-in sheets for class, or using a tablet to set up a self-check-in station. |

◦ | Memberships. Subscribers can manage membership contracts and waivers, collect membership fees automatically through recurring payments, offer special discounts for products and services as well as create membership tiers to extend rewards and perks to their most loyal consumers. |

• | Integrated Payment Processing. We offer our subscribers integrated payment processing solutions with our software at competitive rates. The integration between point-of-sale and payment processing saves our subscribers time by eliminating the need for error-prone manual reconciliations. In addition, our integrated payments platform allows for convenient and secure storage of consumer credit card information, which allows for seamless online bookings, recurring membership payments through our business management software and online store purchases through our subscribers’ websites, the MINDBODY app or third-party partner sites included in the MINDBODY Network. |

• | Retail Point-of-Sale. Our point-of-sale capabilities help subscribers sell products and services, contracts and memberships, packages, workshops and store-branded gift cards. Our point-of-sale feature tracks product inventory levels and automatically issues purchase orders when product levels reach a re-order point. In addition, our point-of-sale capabilities can be used to track the cost of goods sold and gross margin for various products. |

3

◦ | Purchase Tracking. Subscribers can sell products and services as well as memberships, monthly contracts and packages that combine products and services at their place of business and online. Subscribers can securely store consumer billing information to facilitate quicker transactions. Payments for classes or appointments can be applied before or after consumer check-in, and before or after the session is complete. Our point-of-sale functionality allows the assignment of staff commissions to appropriate parties. |

◦ | Inventory. Subscribers can set inventory re-order points, automatically generate purchase orders and easily log arriving inventory. As a result, subscribers can more efficiently manage availability, calculate gross margin and monitor inventory shrinkage, among other benefits. |

◦ | Payments. Subscribers can accept several types of cash or non-cash equivalent payment methods, including ACH, debit and credit cards. They can also set up payment plans and schedule recurring payments automatically from securely stored credit cards on file. Our payments platform provides instant authorization and nightly settlement of credit card, debit card and ACH transactions. Once a sale is complete, staff can void, edit or return the sale, and all of these changes are recorded in an auditable fashion. All consumer payment information is protected behind PCI Level I Data Security Standards, the most rigorous credit card certification standard available. |

• | Analytics and Reporting. We track key information that helps subscribers achieve their business goals, including revenue growth, contribution margin of classes, consumer retention rates, referral sources, return on investment for consumer retention campaigns and practitioner performance based on consumer loyalty and reviews by class or type of service. Our platform also generates reports that help our subscribers allocate their resources, set budgets and measure their performance against goals. Subscribers are empowered to identify trends and opportunities for improvement in their businesses by leveraging the following analytics and marketing tools: |

◦ | Last Visit and No Return. Subscribers can pull the list of consumers who have not come back to the business for a given period of time designated by the subscriber. |

◦ | Best Sellers. Subscribers can view best-selling products and services, as well as profit margins. |

◦ | Cancellations and No Shows. Subscribers can check which consumers cancel or do not arrive for a scheduled visit, charge cancellation fees, or suspend consumer scheduling privileges. |

◦ | Referral Sources. Subscribers can gain valuable insights into their most effective marketing channels for attracting new consumers. |

◦ | Sales Forecast. Subscribers can forecast future sales revenue based on current prospects. |

◦ | Attendance with Revenue. Subscribers can break down revenue by each client visit, staff person, type of service and date. |

◦ | Attendance Analysis. Subscribers can compare consumer attendance levels across hours in a day as well as days in a week. |

◦ | Gross Margin. Subscribers can see the gross margin for each product and service. |

◦ | Promotions. Subscribers can tie every redeemed promotion code back to the client who used it, or analyze the overall success of any promotion effort. |

◦ | Account Balances. Subscribers can make account balance inquiries for any given consumer, and create a statement for consumers with negative balances. |

◦ | Retention. Subscribers can check client retention rate overall, or by individual staff member. |

◦ | Memberships and New Members. Subscribers can monitor consumer membership activity including new, renewing, canceling, active and inactive members as well as revenue associated with types of members. |

◦ | Commission. Subscribers can manage commissions earned by and payable to their staff. |

◦ | Transactions. Subscribers can sort all past transactions by what has settled, or is pending, voided, and returned. |

4

◦ | Client Acquisition Dashboard. At a glance, subscribers can attribute new consumers to various acquisition channels. Subscribers can track purchases made by these new consumers and how much revenue each consumer has generated since that first purchase. Subscribers can also track which consumers purchased specific intro offers as well as the reviews generated about their business in the MINDBODY app. |

• | Simple and Intuitive User Experience. We designed our business management software with a focus on developing a visually appealing interface that is simple, easy to use and meets the demands our subscribers have for modern web and mobile applications. Because we focus on a simple and intuitive user experience, our software platform requires little training and is easy to adopt for users across the entire organization, an important feature given the high employee turnover in the wellness services industry. At the same time, the intuitive interface of our platform is supported by complex underlying technology that powers efficient business management. |

• | Branded web. Our branded web solution (formerly HealCode) gives our subscribers the ability to embed their MINDBODY class and appointment schedules within their web and social sites, creating a seamless and branded online experience for their customers. |

• | Mobility. Our platform enables our subscribers to manage their operations anytime and anywhere via a number of mobile devices and operating systems, including Mac, iOS, Android and Windows. |

◦ | MINDBODY Express. MINDBODY Express is our native business-subscriber facing mobile app that enhances our core offering by allowing our subscribers to easily run their business, book consumers and sell products and services while on the go. |

◦ | Branded Mobile App. Our branded mobile app offering (formerly MINDBODY Engage) allows our subscribers to have their own native apps to create a unique branded experience for their consumers. |

◦ | MINDBODY Class Check-In. The MINDBODY Class Check-In app helps our subscribers create a better consumer experience at the front desk. Consumers can check themselves into class, freeing up front desk staff to help others and making it possible for instructors to start classes faster. |

• | Social Integration. Our platform integrates with popular social networks like Facebook and Twitter. As an example, our platform allows our subscribers to publish schedules on their Facebook page, enabling consumers to directly book appointments and classes with them via Facebook. |

• | Dynamic Cloud-Based Architecture. Our software platform is powered by a dynamic cloud-based architecture that allows our subscribers to manage their operations as efficiently as possible, while requiring low upfront investment and no maintenance. This architecture allows for automatic software updates and rapid launch of new product features while also allowing our platform to easily scale with subscribers as their businesses grow. |

• | Open Platform for Third-Party Application Development. We have built an open and extensible platform with an application programming interface, or API, that offers developers access to our inventory of classes, payments and scheduling capabilities. Approved developers can pull information from and post data to our platform and use that capability to create a variety of unique applications with custom interfaces. |

• | Integration with Other Cloud-based Partners. Our platform can be integrated with other cloud-based software that our subscribers may be using for critical business management tasks to extend the capabilities of our platform within a variety of focus areas such as automation, marketing, accounting, mobile and social. |

• | Security and Compliance. We have consistently passed our Level I Payment Card Industry Data Security Standard, or PCI DSS, audits, indicating our compliance with the most rigorous level of credit card security standard available. In addition, we, in certain instances, collect, access, use, maintain and/or transmit protected health information in connection with providing services to subscribers who are subject to the requirements of the Health Insurance Portability and Accountability Act, or HIPAA. Our platform is engineered to provide high reliability and availability. We continually monitor our infrastructure for any sign of failure or pending failure and we take preemptive action to minimize or prevent downtime. We maintain the reliability of our service by utilizing redundant network infrastructure, clusters that tolerate failure of individual nodes, and deploying high availability server pairs. We also implement various disaster recovery measures, including full replication of hardware and data in our geographically distinct data centers, to minimize data loss in the event of a data center disaster. |

5

The MINDBODY App

The MINDBODY app is our consumer-facing mobile app that lets consumers have a unified account with a single login to manage all aspects of their wellness activities with multiple MINDBODY subscribers. Consumers can discover local wellness services using a geo-located map function, view class and appointment descriptions, schedules and real-time availability, read practitioner biographies and user reviews written by consumers who have actually received the service, and then book and pay for their desired services in a few taps from their mobile devices. Through the app, consumers can also receive appointment reminders and check in to classes before they arrive, receive real-time updates regarding changes in class schedules and access their account profile to review their class visit and payment history. The MINDBODY app also surfaces our subscribers’ introductory offers through a recommendation engine that considers a user’s prior history and preferences, and uses their location to make targeted recommendations.

The MINDBODY Network

The MINDBODY Network is a fee-based marketing platform that connects our subscribers with local consumers via the MINDBODY app and third-party partner applications or websites. Subscribers who opt in to the MINDBODY Network receive greater exposure through additional promotion of their intro offers or deals on various screens throughout the MINDBODY app, as well as featured placement on third-party partner apps and/or websites.

MINDBODY API Platform and Partner Ecosystem

We have enabled a rich partner ecosystem that extends the value of our software and payments platform in powerful ways. Our partners have built applications that supplement our capabilities in areas such as marketing automation, accounting, loyalty, mobile and social interactions. Several of these partners have created significant consumer-facing businesses that rely on our unique inventory of classes, scheduling and payments capabilities. All of this is enabled by our APIs, to which we grant access to approved developers and partners. We also integrate with partners that provide email marketing, customer survey, events management and other functionality to augment the capabilities of our platform for the benefit of our subscribers.

6

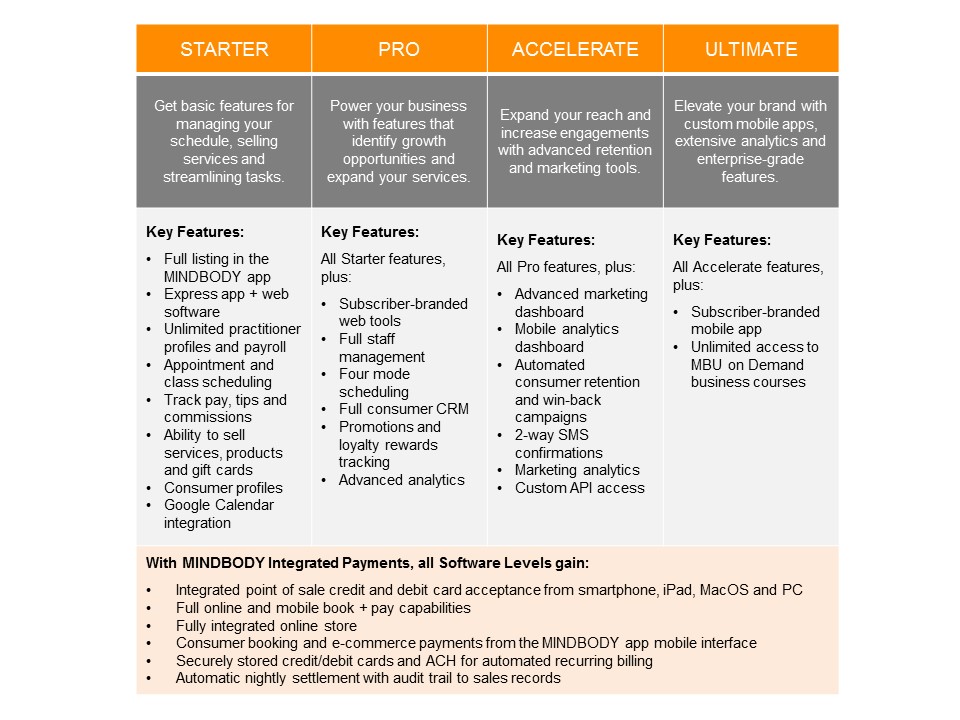

Software Subscription Levels

Because each of our subscribers is unique and at a different stage of their respective professional journey, our software subscriptions are provided on a tiered pricing model based upon different software functionality levels—Starter, Pro, Accelerate and Ultimate. Each of these levels has been carefully crafted to meet our subscribers’ differing needs and levels of complexity, giving them appropriate functionality to optimize their business.

Subscriber Services and Support

We have multiple teams within our customer support organization dedicated to maintaining a high level of subscriber satisfaction, including onboarding, data conversion and import, direct technical support, self-service, client care and client success. Our operations are structured with the subscriber experience in mind, and we strive to create a smooth process for our subscribers. We believe that providing a premium level of support to our subscribers is critical to enhancing our brand as a superior provider of business management software for the wellness services industry.

• | Subscriber Onboarding. We typically board new subscribers with live training sessions delivered via telephone and web conference. These trainings are supplemented by self-service setup checklists, online help materials and webinars. |

• | Ongoing Subscriber Support. Inclusive with our base subscription fees, we offer 24/7 customer service and support via phone, chat, emails, and self-help knowledge centers. All customer service and support is provided by our in-house personnel who are invested in MINDBODY’s core values and closely connected to our Product, Technology and Experience team. We have not outsourced our customer service. |

• | Professional Services. Our premium support services enable subscribers to access dedicated, advanced product and business operations support from software and business experts. This service is usually chosen by our higher-end small businesses and multi-location chains or franchises. |

7

• | MINDBODY University. MINDBODY University is a multi-day advanced subscriber education event held multiple times per year in various destination locations around the world (e.g., London, New York, San Diego and Sydney). This high-impact business conference teaches advanced software skills and best business practices that help subscribers increase revenues and improve their bottom line. In addition, for a monthly fee (included with the Ultimate software tier), subscribers have unlimited, online access to recorded business management material derived from our MINDBODY University courses. |

• | BOLD Conference. We provide our subscribers with a two-day annual user conference where they can learn best business practices and participate in networking opportunities designed to help fuel their business growth and success. Program sessions typically include key topics needed to thrive within the competitive wellness industry market – from the latest trends in consumer marketing and social media, to selling strategies and strategic business partnerships – taught by MINDBODY team members, industry experts and fellow MINDBODY subscribers. |

• | Hardware & Merchandise. We offer point-of-sale hardware, such as cash drawers, receipt printers and bar code scanners, as well as branded key chain tags and gift cards our subscribers may require. We also offer smartphone and tablet credit card readers. |

Key Benefits to MINDBODY’s Constituents

Benefits to subscribers and wellness practitioners:

• | Simplified Operations. Our business management software and payments platform allows subscribers and practitioners to streamline and simplify their operations. MINDBODY automates a large number of time-consuming workflows, thus reducing the administrative effort and time subscribers and their employees need to invest in business operations. |

• | Greater Focus on Clients. By simplifying the operations of wellness businesses, we enable subscribers and practitioners to focus on their clients. In addition, our analytical tools provide critical insights that help subscribers focus on optimizing their business and achieving their goals. |

• | Increased Growth in Client Base and Revenue. We help our subscribers increase their consumer base by taking advantage of a free listing on the MINDBODY app, making them visible to a larger pool of consumers. Subscribers who choose to opt in to the fee-based MINDBODY Network receive greater exposure through additional promotion of their introductory offers or deals on various screens throughout the app, as well as featured placement on third-party partner apps and/or websites. Moreover, by having the ability to send reminders, promotions and special offers via email, text, push or in-app notifications to consumers based on a record of their past interactions, subscribers can increase their consumer engagement and loyalty. We also help subscribers sell their products and services through a variety of channels – an online store, their website, social sites, or the MINDBODY Network, thus helping them to increase their revenue opportunities. |

Benefits to consumers:

• | Convenient Single Interface for a Variety of Wellness Services. We offer consumers a single platform to discover, evaluate and book wellness services. Our subscribers include a large variety of wellness businesses such as fitness studios, yoga, Pilates, massage, salons, and spas. We provide convenient “one-stop-shop” access to our subscribers’ wellness services through a variety of interfaces, including subscriber websites, social media sites, and branded apps, as well as searchable platforms like the MINDBODY app and third-party sites. In addition, reviews on our platform can only be written by consumers who have actually participated in a class or used a service. As a result, consumers are able to access credible reviews that provide a basis for informed decisions. |

• | Time Savings and a Higher Engagement in Wellness Activities. We believe that our platform saves consumers time that would otherwise be required to perform online searches, browse through numerous websites and make phone calls to schedule or manage their desired wellness services. We also believe that our ability to allow consumers to more easily manage their wellness routine and consume more wellness services on a regular basis, increases their engagement in wellness activities. |

• | Ability to Track Personal Health Data with Each Wellness Activity. New technologies, including third-party wearable fitness trackers, and mobile apps within the health and fitness category, enable consumers to track various aspects of their health and fitness. As part of this trend, the MINDBODY app offers consumers the ability to track their personal health data, and to monitor the effectiveness of their wellness activities. With the MINDBODY app, consumers can access their wellness activity history, such as class attendance frequency and class duration, as well as personal activity data tracked by integrated wearable devices. |

8

Competition

The market for business management software and payments solutions for wellness businesses is highly competitive, fragmented and rapidly evolving due to technological innovations. We believe our competitors fall into the following primary categories:

• | On-premise software providers and small cloud-based providers that typically focus on a specific vertical within the wellness services industry; |

• | Cloud-based software providers that offer generic scheduling tools with minimal customization by vertical; and |

• | Payments services providers that offer basic scheduling tools. |

In addition, for some small to medium-sized organizations, we compete with basic productivity tools that these organizations have adapted for scheduling and business management uses, including desktop applications (e.g., Microsoft Office, Google Docs), pen and paper, and spreadsheet tools for tracking and management purposes.

The principal competitive factors in our market include:

• | Industry expertise |

• | Depth of product functionality and ease of use |

• | Brand recognition and reputation |

• | Ability to drive consumer demand via a large and rapidly growing consumer network |

• | 24/7 customer service |

• | Price, especially for entry-level products |

• | Product extensibility via APIs |

• | Partnerships and integrations with major consumer brands |

• | Integration with mobile devices |

• | Payment processing integration |

• | Marketing capabilities and analytics |

• | Strong company culture |

• | Security and reliability |

• | Global presence |

We believe that we compete favorably on the factors described above. However, some of our competitors have greater financial, technical and other resources, greater name recognition and larger sales and marketing budget; therefore, we may not always compare favorably with respect to some or all of the factors above.

Our Technology

We have developed our proprietary technology platform over the last decade, with a focus on delivering industry-leading breadth and flexibility of functionality. Our platform is built API-first with a service-oriented multi-tenant architecture, making it fully extensible to our business and consumer web and mobile applications, as well as complementary technology partner integrations. Maintaining the integrity and security of our technology platform is mission critical to our business and our subscribers’ success.

• | Reliable. Our platform is engineered to provide high reliability and availability. Our agreements with subscribers typically provide for a limited warranty relating to service level commitments. In certain circumstances, our subscribers may be eligible for credits if we are unable to meet these service level commitments. Our infrastructure is hosted in two dual redundant Tier 4 (the highest rating available) data centers separately located in North America. Our network operations center provides 24/7 monitoring of hundreds of sensors on all systems, including global synthetic and real user monitoring to ensure we have complete visibility into our platform and are able to instantly respond to any potential service issue. |

• | Secure. Our platform hosts a large quantity of subscriber data and processes a large volume of business-to-consumer transactions. We therefore maintain a comprehensive security program designed to help safeguard the confidentiality, integrity and availability of our subscribers’ data, which includes both organizational and technical control measures. Our platform includes a host of third-party encryption, malware prevention, firewall and intrusion detection, data loss detection and patch management technologies to protect and maintain all systems. We routinely audit and review our security program. In addition, we regularly obtain third-party security audits of our technical operations and procedures covering data security to include the PCI-DSS, as well as Statement on Standards for Attestation Engagements No. 16, or SSAE 16, and Service Organizations Controls 2, or SOC 2, Type I Attestation. |

9

• | Scalable. We have developed a robust and scalable platform that processes millions of queries per day. By leveraging best-in-breed technology components, server virtualization, and a service-oriented architecture, we believe we can seamlessly scale our compute and storage capacity. |

Our Subscribers

We have a diverse subscriber base with over 60,000 subscribers located in over 130 countries and territories across a variety of industries within the wellness services industry. No single subscriber represented more than 10% of our total revenue in any of fiscal 2016, 2015 or 2014.

Our Culture and Employees

Our company and employees share an exceptional corporate culture that is built upon a detailed set of core values that are reinforced throughout the company through new hire orientation, monthly corporate wellness initiatives and annual performance appraisals. Our employees thrive in a nurturing environment that is driven by innovation, passion for health and wellness and dedication towards excellent subscriber experience.

As of December 31, 2016, we had 1,350 employees. None of our employees is represented by a labor organization or is a party to any collective bargaining arrangement. We have never had a work stoppage, and we consider our relationship with our employees to be good.

Sales and Marketing

We deploy a direct sales approach driven by an outbound tele-sales team located primarily in San Luis Obispo, California with several regional offices throughout the United States, and locations in the United Kingdom and Australia. Our sales team qualifies and manages prospective and current subscribers, aiming to initiate, retain, and expand their use of our platform over time. Our sales team partners with sales operations specialists to provide consultation and product demonstration to prospects to accelerate the onboarding of new subscribers.

Our marketing efforts are focused on generating awareness of our platform, creating sales leads, establishing and promoting our brand, and cultivating a community of successful and vocal subscribers and consumers. We utilize both online and offline marketing initiatives, including search engine and email marketing, online display and print advertising, participation in trade shows, events and conferences, permission marketing, social media and media outreach, and strategic partnerships and endorsements.

Our sales prospecting, lead qualification and lead development functions are performed by sales development representatives, and sales associates of which the majority work part-time schedules. Our sales and marketing headcount as of December 31, 2016 was 493. Our sales and marketing expenses were $56.5 million, $46.3 million and $30.9 million for the years ended December 31, 2016, 2015 and 2014, respectively.

Research and Development

Our research and development organization is responsible for the ideation, research, design, development and testing of all aspects of our platform. To create a roadmap that meets the needs of our subscribers, we emphasize collaboration during the development process. Subscribers provide direct input through dialog with our customer support, product management, and user experience teams, as well as our community forum and feature utilization data. We deploy new features, functionality, and technologies for our platform through monthly software releases or updates to minimize disruption and deliver continuous improvement.

As of December 31, 2016, we had 222 employees in our research and development organization, which is based primarily in San Luis Obispo, California. Our research and development expenses were $30.3 million, $23.1 million, and $16.2 million, for the years ended December 31, 2016, 2015 and 2014, respectively.

Intellectual Property

We rely on a combination of trade secret, copyright, and trademark laws, a variety of contractual arrangements, such as license agreements, assignment agreements, confidentiality and non-disclosure agreements, and confidentiality procedures and technical measures to gain rights to and protect the intellectual property used in our business.

10

We have also developed a patent program and a strategy to identify, apply for, and secure patents for innovative aspects of our platform and technology. We have seven U.S. patent applications pending. We also have six pending patent applications in jurisdictions outside of the United States. We intend to pursue additional patent protection to the extent we believe it would be beneficial and cost-effective.

We actively pursue registration of our trademarks, logos, service marks, and domain names in the United States and in other key jurisdictions. We are the registered holder of a variety of U.S. and international domain names that include the term MINDBODY and similar variations. We use several trademarks or registered trademarks for our products and services, including “MINDBODY,” and several logos and images, such as the Enso logo, as well as the slogans “LOVE YOUR BUSINESS,” “BOOK YOUR BEST DAY. EVERY DAY." and "CONNECTING THE WORLD OF WELLNESS."

We also rely on certain intellectual property rights that we license from third parties, including under certain open source licenses. Though such third-party technologies may not continue to be available to us on commercially reasonable terms, we believe that alternative technologies would be available to us, if needed.

Our policy is to require employees and independent contractors to sign agreements assigning to us any inventions, trade secrets, works of authorship, developments and other processes generated by them on our behalf and agreeing to protect our confidential information. All of our key employees and contractors have done so. In addition, we generally enter into confidentiality agreements with our vendors and subscribers. We also control and monitor access to, and distribution of, our software, documentation, and other proprietary information.

Despite our precautions, it may be possible for unauthorized third parties to copy our products and use information that we regard as proprietary to create products and services that compete with ours.

Some license provisions protecting against unauthorized use, copying, transfer and disclosures of our products may be unenforceable under the laws of certain jurisdictions and foreign countries. In addition, the laws of some countries do not protect proprietary rights to as great of an extent as the laws of the United States, and many foreign countries do not enforce these laws as diligently as government agencies and private parties in the United States. To the extent that we expand our international activities, our exposure to unauthorized copying and use of our products and misappropriation of our proprietary information may increase.

We expect that software and other solutions in our industry may be increasingly subject to third-party infringement claims as the number of competitors grows and the functionality of products in different industry segments overlap.

Seasonality

We believe there are significant seasonal factors that may cause us to record higher revenue in some quarters compared with others. We believe this variability is largely due to our focus on the wellness services industry, as many of our subscribers experience an increase in demand for their services in the first quarter of each year due to their consumers becoming more motivated to pursue health and fitness goals in the new year. However, this seasonality may not be fully evident in our historical business performance because of our significant growth. If our revenue growth rate slows, we expect that the seasonality in our business may become more pronounced and may cause our operating results to fluctuate in the future.

Segments

We have one operating and reporting segment consisting of various products and services that are all related to our integrated cloud-based business management software and payments platform for the wellness services industry. For our revenue, net loss and total assets, see our Consolidated Financial Statements included in Part IV, Item 15 of this Annual Report on 10-K.

Geographic Information

Financial information about geographic areas is set forth in Note 12 of the Notes to Consolidated Financial Statements included in Part IV, Item 15 of this Annual Report on Form 10-K. For a discussion of the risks attendant to foreign operations, see the information in Part 1, Item 1A: “Risk Factors” under the caption “Our international sales and operations subject us to additional risks that can adversely affect our business, operating results and financial condition.”

11

Government Regulation

Our business is subject to extensive, complex and rapidly changing federal and state laws and regulations.

HIPAA, Privacy and Data Security Regulations

In connection with providing online scheduling services for certain subscribers, we may be subject to specific compliance obligations under privacy and data security laws, including but not limited to the Health Insurance Portability and Accountability Act of 1996, or HIPAA, and similar state laws that govern the collection, use, protection, and disclosure of personally identifiable information. HIPAA imposes specific requirements regarding data privacy and security on covered entities (providers, health plans and health care clearinghouses); business associates (entities that may perform services for covered entities, pursuant to which they may access personal information); and business associates’ subcontractors, including us. We are therefore required to adopt certain practices and enter into certain contracts agreeing to protect personal information in specific ways. There may be civil and criminal penalties, as well as contractual ramifications, for violating HIPAA.

Corporate Information

We were organized as a California limited liability company in February 2001 and converted into a California corporation in October 2004. We were reincorporated in Delaware in March 2015. Our principal executive offices are located at 4051 Broad Street, Suite 220, San Luis Obispo, California 93401, and our telephone number is (877) 755-4279. Our website address is https://www.mindbodyonline.com, and our investor relations website is investors.mindbodyonline.com. Information contained on, or that can be accessed through, our website, does not constitute part of and is not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our website are intended to be inactive textual references only.

Unless expressly indicated or the context requires otherwise, the terms “MINDBODY,” “company,” “we,” “us,” and “our” in this Annual Report on Form 10-K refer to MINDBODY, Inc., a Delaware corporation, and, where appropriate, its wholly owned subsidiaries. The Enso design logo, “MINDBODY,” as well as the slogans “LOVE YOUR BUSINESS,” “BOOK YOUR BEST DAY. EVERY DAY.” and "CONNECTING THE WORLD OF WELLNESS" are trademarks or registered trademarks of MINDBODY. Other trademarks and trade names referred to in this Annual Report on Form 10-K are the property of their respective owners. Except as set forth above and solely for convenience, the trademarks and tradenames in this Annual Report on Form 10-K are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering, (ii) the last day of the first fiscal year in which our annual gross revenue is $1 billion or more, (iii) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities or (iv) the date on which we are deemed to be a “large accelerated filer” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act,” and references herein to “emerging growth company” are intended to have the meaning associated with it in the JOBS Act.

Available Information

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act. The public may obtain these filings at the Securities and Exchange Commission’s, or SEC, Public Reference Room at 100 F Street, NE, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information that we file with the SEC electronically. We make available on our website, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

We webcast our earnings calls and certain events we participate in or host with members of the investment community on our investor relations page of our website located at investors.mindbodyonline.com. Press releases and corporate governance information, including our board committee charters, code of business conduct and ethics, and corporate governance guidelines, are also available on the investor relations page of our website.

12

Executive Officers of MINDBODY

The following table provides information regarding our executive officers as of February 24, 2017:

Name | Age | Position | ||

Richard Stollmeyer | 51 | President, Chief Executive Officer and Chairman of the Board of Directors | ||

Brett White | 54 | Chief Financial Officer and Chief Operating Officer | ||

Kimberly Lytikainen | 50 | Chief Legal Officer, Secretary and Compliance Officer | ||

Kunal Mittal | 38 | Chief Technology Officer | ||

Bradford Wills | 40 | Chief Strategy Officer | ||

Richard Stollmeyer. Mr. Stollmeyer is one of our founders and has served as our President and Chief Executive Officer and as Chairman of our board of directors since October 2004. Mr. Stollmeyer holds a B.S. degree in Political Science and Russian Language, with a concentration in International Relations, from the United States Naval Academy.

Brett White. Mr. White has served as our Chief Financial Officer since July 2013 and our Chief Operating Officer since July 2016. From January 2008 to July 2013, Mr. White served as Chief Financial Officer at Meru Networks, Inc., a provider of Wi-Fi solutions. From November 2005 to December 2007, Mr. White served as Chief Financial Officer at Fortinet, Inc., a provider of network security solutions. Mr. White holds a B.A. degree in Business Economics from the University of California, Santa Barbara.

Kimberly Lytikainen. Ms. Lytikainen has served as our Chief Legal Officer since January 2017, our corporate Secretary since March 2015, and our Compliance Officer since June 2015. Ms. Lytikainen previously served as our General Counsel from July 2014 through December 2016. From June 2013 to July 2014, Ms. Lytikainen served as Associate General Counsel at Pivotal Software, Inc., a provider of computer software and services. From April 2006 to June 2013, Ms. Lytikainen served as Vice President, Assistant General Counsel at NVIDIA Corporation, a visual computing company. Ms. Lytikainen holds a B.A. degree in Political Science and Government from Florida State University, and a J.D. degree from Loyola Law School, Loyola Marymount University.

Kunal Mittal. Mr. Mittal has served as our Chief Technology Officer since June 2016. From November 2015 to May 2016, Mr. Mittal served as our Senior Vice President of Technology. From July 2008 to November 2015, Mr. Mittal served as Executive Director of Enterprise Technologies at Sony Pictures Entertainment Inc., a global entertainment company. Mr. Mittal holds a B.S. degree in Computer Science from Beloit College and an M.S. degree in Software Engineering from Walden University.

Bradford Wills. Mr. Wills has served as our Chief Strategy Officer since November 2014. From May 2013 to November 2014, Mr. Wills served as our Senior Vice President of Corporate Development. From July 2006 to May 2013, Mr. Wills served as Vice President, Corporate Development, Mergers and Acquisitions at Active Network, a software-as-a-service company. Mr. Wills holds a B.S. degree in Finance and International Business from Georgetown University and an M.B.A. degree from the University of Texas at Austin.

Item 1A. Risk Factors

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the following risks, together with all of the other information contained in this Annual Report on Form 10-K, including our financial statements and related notes, before making a decision to invest in our Class A common stock. Any of the following risks could have a material adverse effect on our business, operating results, and financial condition and could cause the trading price of our Class A common stock to decline, which would cause you to lose all or part of your investment.

13

Risks Related to Our Business

We have a history of losses, and we may not achieve or maintain profitability in the future. In addition, our revenue growth rate may not sustain the levels experienced in recent years.

We have incurred a net loss in each year since our inception, including a net loss of $23.0 million, $36.1 million and $24.6 million in the years ended December 31, 2016, 2015 and 2014, respectively. For the years ended December 31, 2016, 2015 and 2014, our revenue was $139.0 million, $101.4 million and $70.0 million, respectively, representing a 37% and 45% growth rate, respectively. Our historical revenue growth rates are not necessarily indicative of future growth, and we may not achieve similar revenue growth rates in future periods.

We have expended and expect to continue to expend financial and other resources on, among other things:

• | continuing the development of our platform, including investments in our research and development team, the development or acquisition of new products, features and functionality, and improvements to the scalability, availability and security of our platform; |

• | expenses related to international expansion in an effort to increase our subscriber base; |

• | improving our technology infrastructure and hiring additional employees for our sales, operations and customer support teams; |

• | sales and marketing expenses, including personnel and lead generation expenses; |

• | general and administrative expenses, including legal, accounting and other expenses related to being a public company; and |

• | strategic acquisitions. |

If we expend more resources on growing our business than currently anticipated or if we encounter unforeseen operating expenses, difficulties, complications, and other unknown factors, we may not be able to achieve or sustain profitability and our operating results and business would be harmed.

If we fail to increase market acceptance of our platform, enhance and adapt this platform to changing market dynamics and subscriber preferences, or keep pace with technological developments, our business, results of operations, financial condition and growth prospects would be adversely affected.

We derive, and expect to continue to derive, a majority of our revenue and cash inflows from our integrated cloud-based business management software and payments platform for the wellness services industry. As such, market acceptance of this platform is critical to our success. Our ability to attract new subscribers and increase revenue from existing subscribers depends in part on our ability to enhance and improve our existing platform and to introduce new features, products and services, including features, products and services designed for a mobile user environment. Demand for our platform is affected by a number of factors, many of which are beyond our control, such as the timing of development and release of new products, features and functionality by our competitors, technological change and growth or contraction in our addressable market.

To grow our business, we must develop features, products and services that reflect the changing nature of business management software and expand beyond our core scheduling and point-of-sale functionality to other areas of managing relationships with our subscribers, as well as their relationships with their consumers. For example, in 2013, we expanded our platform to include MINDBODY Connect (now the MINDBODY app), and in 2015, we introduced the MINDBODY Marketing Platform (now the MINDBODY Network), and began providing automated marketing functionality with our higher-priced subscriptions. The success of these and any other enhancements to our platform depends on several factors, including timely completion, adequate quality testing and sufficient subscriber or consumer demand. Any new feature, product or service that we develop may not be introduced in a timely or cost-effective manner, may contain defects or may not achieve the market acceptance necessary to generate sufficient revenue. If we are unable to successfully develop new features, products or services, meet the demands of our subscribers for features, products and services that meet their business needs and are easy to use and deploy, or enhance our existing platform to meet subscriber requirements, our ability to achieve widespread market acceptance of our platform will be undermined, and our business, results of operations, financial condition and growth prospects will be adversely affected.

14

In addition, because our platform is available over the Internet, we need to continuously modify and enhance our platform to keep pace with changes in Internet-related hardware, software, communications and database technologies and standards. If we are unable to respond in a timely and cost-effective manner to these rapid technological developments and changes in standards, our platform may become less marketable, less competitive, or obsolete, and our operating results will be harmed. If new technologies emerge that are able to deliver competitive products and applications at lower prices, more efficiently, more conveniently or more securely, such technologies could adversely impact our ability to compete. Our platform must also integrate with a variety of network, hardware, mobile, and software platforms and technologies, and we need to continuously modify and enhance our products and services to adapt to changes and innovation in these technologies. Any failure of our platform to operate effectively with future infrastructure platforms and technologies could reduce the demand for our platform. If we are unable to respond to these changes in a cost-effective manner, our platform may become less marketable, less competitive or obsolete, and our operating results may be adversely affected.

Our business depends substantially on our subscribers renewing their subscriptions to our platform. Any decline in the rate at which subscribers renew their subscriptions would harm our future operating results.

The vast majority of our subscription revenue is derived from subscriptions to our platform that have monthly terms. For us to maintain or improve our operating results, it is important that our subscribers renew their subscriptions each month. Our retention rate may decline or fluctuate as a result of a number of factors, including our subscribers’ satisfaction with our platform, our customer support, our prices, the prices of competing software systems, system uptime, network performance, data breaches, mergers and acquisitions affecting our subscriber base, the effects of global economic conditions and the strength of our subscribers' businesses. If our subscribers do not renew their subscriptions or renew but shift to lower priced software subscriptions, our revenue may decline and we may not realize improved operating results from our subscriber base.

If our network or computer systems are breached or unauthorized access to subscriber or consumer data is otherwise obtained, our platform may be perceived as insecure, we may lose existing subscribers or fail to attract new subscribers, and we may incur significant liabilities.

Use of our platform involves the storage, transmission and processing of our subscribers’ proprietary data, including personal or identifying information regarding their consumers or employees. Unauthorized access to or security breaches of our platform could result in the loss of data, loss of intellectual property or trade secrets, loss of business, reputational damage, regulatory investigations and orders, litigation, indemnity obligations, damages for contract breach, penalties for violation of applicable laws, regulations, or contractual obligations, and significant fees and other monetary payments for remediation.

If any unauthorized access to our systems or data or any other security breach occurs, or is believed to have occurred, our reputation and brand could be damaged, we could be required to expend significant capital and other resources to alleviate problems caused by such actual or perceived breaches and remediate our systems, we could be exposed to a risk of loss, litigation or regulatory action and possible liability, some or all of which may not be covered by insurance, and our ability to operate our business may be impaired. If subscribers believe that our platform does not provide adequate security for the storage of personally identifiable or other sensitive information or its transmission over the Internet, our business will be harmed. Subscribers’ concerns about security, privacy, or data protection may deter them from using our platform for activities that involve personal or other sensitive information. Additionally, actual, potential or anticipated attacks may cause us to incur increasing costs, including costs to deploy additional personnel and protection technologies, train employees and engage third-party experts and consultants. Our errors and omissions insurance policies covering certain security and privacy damages and claim expenses may not be sufficient to compensate for all potential liability. Although we maintain cyber liability insurance, we cannot be certain that our coverage will be adequate for liabilities actually incurred or that insurance will continue to be available to us on economically reasonable terms, or at all.

Because the techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not identified until they are launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. We may also experience security breaches that may remain undetected for extended periods of time.

Because data security is a critical competitive factor in our industry, we make statements in our privacy policies and terms of service, through our certifications to privacy standards, and in our marketing materials, describing the security of our platform, including descriptions of certain security measures we employ. Should any of these statements be untrue, become untrue, or be perceived to be untrue, even if through circumstances beyond our reasonable control, we may face claims, including claims of unfair or deceptive trade practices, brought by the U.S. Federal Trade Commission, state, local or foreign regulators or private litigants.

15

Because our platform can be used to collect and store personal information, domestic and international privacy and data security concerns could result in additional costs and liabilities to us or inhibit sales of our platform.

Personal privacy, information security, and data protection are significant issues in the United States, Europe and many other jurisdictions where we offer our platform. The regulatory framework for privacy, security, and data protection issues worldwide is rapidly evolving and is likely to remain uncertain for the foreseeable future. The U.S. federal and various state and foreign governments have adopted or proposed limitations on, or requirements regarding, the collection, distribution, use, security and storage of personally identifiable information and other data relating to individuals, and the Federal Trade Commission and numerous state attorneys general are applying federal and state consumer protection laws to enforce regulations related to the online collection, use and dissemination of personally identifiable information and other data. Some of these requirements include obligations on companies to notify individuals of security breaches involving particular personal information, which could result from breaches experienced by us or our service providers. Even though we may have contractual protections with our service providers, notifications related to a security breach could impact our reputation, harm customer confidence, hurt our sales and expansion into new markets or cause us to lose existing customers.

Further, many foreign countries and governmental bodies, including the European Union and Canada, have laws and regulations concerning the collection and use of personally identifiable information obtained from their residents or by businesses operating within their jurisdiction. Laws and regulations in these jurisdictions apply broadly to the collection, use, storage, disclosure and security of data that identifies or may be used to identify or locate an individual, such as names, email addresses and, in some jurisdictions, Internet Protocol, or IP, addresses. These laws and regulations often are more restrictive than those in the United States and, at least with respect to the European Union, remain in flux. For example, with regard to data transfers of personal data from our European employees and customers to the United States, we have historically relied on our adherence to the U.S. Department of Commerce’s Safe Harbor Privacy Principles and compliance with the U.S.-EU and U.S.-Swiss Safe Harbor Frameworks, which established means for legitimizing the transfer of personal data by U.S. companies doing business in Europe from the European Economic Area to the United States. In October 2015, the European Court of Justice invalidated the U.S.-EU Safe Harbor framework. In July 2016, the European Union and the United States announced the adoption of a new framework for legitimizing trans-Atlantic data flows, the EU-U.S. Privacy Shield. In September 2016, we self-certified with the U.S. Department of Commerce under the EU-U.S. Privacy Shield as a replacement to the now invalid EU-U.S. Safe Harbor Framework. Notwithstanding this certification, uncertainty remains as to whether the EU-U.S. Privacy Shield and other legal mechanisms for the lawful transfer of data from the European Union to the United States will withstand legal challenges, whether from national regulators or private parties. If our privacy and data policies and practices, are, or are perceived to be, insufficient or if our customers have concerns regarding the transfer of data from the European Union to the United States, customer demand for our platform could decline and our business could be negatively impacted.

We also expect that there will continue to be new proposed laws, regulations and industry standards concerning privacy, data protection and information security in the United States, the European Union and other jurisdictions, and we cannot yet determine the impact such future laws, regulations and standards may have on our business. For example, in April 2016, the EU Parliament adopted the General Data Protection Regulation, or GDPR, which, among other things, imposes more stringent data protection requirements and provides for greater penalties for noncompliance and is expected to take effect in May 2018. Future laws, regulations, standards and other obligations, and changes in the interpretation of existing laws, regulations, standards and other obligations could impair our or our subscribers’ ability to collect, use or disclose information relating to consumers, which could decrease demand for our platform, increase our costs and impair our ability to maintain and grow our subscriber base and increase our revenue. New laws (including, among others, the GDPR), amendments to or re-interpretations of existing laws and regulations, industry standards, contractual obligations and other obligations may require us to incur additional costs and restrict our business operations. In view of new or modified federal, state or foreign laws and regulations, industry standards, contractual obligations and other legal obligations, or any changes in their interpretation, we may find it necessary or desirable to fundamentally change our business activities and practices or to expend significant resources to modify our software or platform and otherwise adapt to these changes. Any failure or perceived failure by us to comply with federal, state or foreign laws or regulations, industry standards or other legal obligations, or any actual or suspected security incident, whether or not resulting in unauthorized access to, or acquisition, release or transfer of personally identifiable information or other data, may result in governmental enforcement actions and prosecutions, private litigation, fines and penalties or adverse publicity and could cause our subscribers to lose trust in us, which could have an adverse effect on our reputation and business. We may be unable to make such changes and modifications in a commercially reasonable manner or at all, and our ability to develop new products and features could be limited. Moreover, following a referendum in June 2016 in which voters in the United Kingdom approved an exit from the European Union, it is expected that the U.K. government will initiate a process to leave the European Union. The impact of the foregoing on data and privacy regulations in the United Kingdom remains uncertain. Any of these developments could harm our business, financial condition and results of operations. Furthermore, the costs of compliance with, and other burdens imposed by, the laws, regulations, and policies that are applicable to the businesses of our subscribers may limit the use and adoption of, and reduce the overall demand for, our platform. Privacy, information security, and data protection concerns, whether valid or not valid, may inhibit market adoption of our platform, particularly in certain industries and foreign countries.

16

We are subject to a number of legal requirements, industry standards and contractual obligations regarding security, data protection, and privacy and any failure to comply with these requirements, obligations or standards could have an adverse effect on our reputation, business, financial condition and operating results.

As a service provider to our subscribers, we must comply with a number of data protection, security, privacy and other government- and industry-specific requirements, including those that require companies to notify individuals of data security incidents involving certain types of personal data. For example, our solutions must conform, in certain circumstances, to requirements set forth in HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act, and the regulations promulgated thereunder, which collectively govern the privacy and security of protected health information. Through the provision of online scheduling services to certain of our clients, we may collect, access, use, maintain and transmit protected health information in ways that may be subject to certain of these laws and regulations. Any inability to adequately address privacy and security concerns, even if unfounded, or comply with applicable laws, regulations, policies, industry standards, contractual obligations or other legal obligations could result in additional cost and liability to us, damage our reputation, inhibit sales and adversely affect our business.

HIPAA applies to covered entities (e.g., health plans, health care clearinghouses and most health care providers) and to “business associates” of covered entities, which include individuals and entities that provide services for or on behalf of covered entities pursuant to which the service providers may access protected health information, as well as subcontractors of business associates who may access such information. Because certain subscribers that are HIPAA-covered entities or HIPAA-business associates may receive and transmit protected health information through our platform, we may be considered to be a business associate or a subcontractor to business associates with respect to these subscribers. Therefore, under the current HIPAA regulations promulgated by the U.S. Department of Health and Human Services, if we experience a breach of patient information, the liability rules for business associates and business associates’ subcontractors could result in substantial financial and reputational harm to our business.