Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - MAXWELL TECHNOLOGIES INC | mxwl12311610kex322.htm |

| EX-32.1 - EXHIBIT 32.1 - MAXWELL TECHNOLOGIES INC | mxwl12311610kex321.htm |

| EX-31.2 - EXHIBIT 31.2 - MAXWELL TECHNOLOGIES INC | mxwl12311610kex312.htm |

| EX-31.1 - EXHIBIT 31.1 - MAXWELL TECHNOLOGIES INC | mxwl12311610kex311.htm |

| EX-23.1 - EXHIBIT 23.1 - MAXWELL TECHNOLOGIES INC | mxwl12311610kex231.htm |

| EX-21.1 - EXHIBIT 21.1 - MAXWELL TECHNOLOGIES INC | mxwl12311610kex211.htm |

| EX-10.26 - EXHIBIT 10.26 - MAXWELL TECHNOLOGIES INC | mxwl12311610kex1026ewbamen.htm |

| EX-10.25 - EXHIBIT 10.25 - MAXWELL TECHNOLOGIES INC | mxwl12311610kex1025localiz.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15477

MAXWELL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

Delaware | 95-2390133 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3888 Calle Fortunada San Diego, California | 92123 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (858) 503-3300

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, par value $0.10 per share | Nasdaq Global Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Annual Report on Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of Common Stock held by non-affiliates as of June 30, 2016 based on the closing price of the common stock on the NASDAQ Global Market was $165,814,752.

The number of shares of the registrant’s Common Stock outstanding as of February 22, 2017, was 32,270,725 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the registrant’s annual meeting of stockholders (the “Proxy Statement”) are incorporated by reference in Part III of this Form 10-K to the extent stated herein. The Proxy Statement will be filed within 120 days of the registrant’s fiscal year ended December 31, 2016.

MAXWELL TECHNOLOGIES, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

For the fiscal year ended December 31, 2016

Page | ||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Unless the context otherwise requires, all references to “Maxwell,” “the Company,” “we,” “us,” and “our” refer to Maxwell Technologies, Inc. and its subsidiaries. All references to “Maxwell SA” refer to our Swiss Subsidiary, Maxwell Technologies, SA.

Some of the statements contained in this Annual Report on Form 10-K and incorporated herein by reference discuss our plans and strategies for our business or make other forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “may,” “could,” “will,” “continue,” “seek,” “should,” “would” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. These forward-looking statements reflect the current views and beliefs of our management; however, various risks, uncertainties and contingencies could cause our actual results, performance or achievements to differ materially from those expressed in, or implied by, our statements. Such risks, uncertainties and contingencies include, but are not limited to, the following:

• | dependence upon the sale of products to a small number of customers and vertical markets, some of which are heavily dependent on government funding or government subsidies which may or may not continue in the future; |

• | uncertainties related to the global geopolitical landscape and the recent elections in the United States; |

• | risks related to acquisitions and potential for unsuccessful integration of acquisitions; |

• | risk that our restructuring efforts may not be successful and that we may not be able to realize the anticipated cost savings and other benefits; |

• | our ability to obtain sufficient capital to meet our operating or other needs; |

• | downward pressures on product pricing from increased competition and potential shift in sales mix with respect to low margin and high margin business; |

• | our ability to manage and minimize the impact of unfavorable legal proceedings; |

• | risk that activist stockholders attempt to effect changes to our company which could adversely affect our corporate governance; |

• | risks related to our international operations including, but not limited to, our ability to adequately comply with the changing rules and regulations in countries where our business is conducted, our ability to oversee and control our foreign subsidiaries and their operations, our ability to effectively manage foreign currency exchange rate fluctuations arising from our international operations, and our ability to continue to comply with the U.S. Foreign Corrupt Practices Act as well as the anti-bribery laws of foreign jurisdictions; |

• | dependence upon the sale of products into Asia and Europe, where macroeconomic factors outside our control may adversely affect our sales; |

• | our ability to remain competitive and stimulate customer demand through successful introduction of new products, and to educate our prospective customers on the products we offer; |

• | successful acquisition, development and retention of key personnel; |

• | our ability to effectively manage our reliance upon certain suppliers of key component parts, specialty equipment and logistical services; |

• | our ability to manage product quality problems; |

• | our ability to protect our intellectual property rights and to defend claims against us; |

• | our ability to effectively identify, enter into, manage and benefit from strategic alliances; |

• | occurrence of a catastrophic event at any of our facilities; |

• | occurrence of a technology systems failure, network disruption, or breach in data security, and |

• | our ability to match production volume to actual customer demand. |

Many of these factors are beyond our control. Additionally, there can be no assurance that we will not incur new or additional unforeseen costs or risks in connection with the ongoing conduct of our business. Accordingly, any forward-looking statements included herein do not purport to be predictions of future events or circumstances and may not be realized.

For a discussion of important risks associated with an investment in our securities, including factors that could cause actual results to differ materially from expectations referred to in the forward-looking statements, see Item 1A, Risk Factors, of this document. We do not have any obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

1

PART I

Item 1. | Business |

Introduction

Maxwell was incorporated under the name Maxwell Laboratories, Inc. in 1965. The Company made an initial public offering of common stock in 1983, and changed its name to Maxwell Technologies, Inc. in 1996. Today, we develop, manufacture and market energy storage and power delivery products for transportation, industrial, information technology and other applications. Our products are designed and manufactured to perform reliably with minimal maintenance for the life of the applications into which they are integrated. We believe that this “life-of-the-application” reliability gives our products a competitive advantage and enables them to command higher profit margins than commodity products. We focus on the following lines of high-reliability products and technologies:

• | Ultracapacitors: Ultracapacitors are energy storage devices that possess a unique combination of high power density, extremely long operational life and the ability to charge and discharge very rapidly. Our ultracapacitor cells, multi-cell packs and modules provide highly reliable energy storage and power delivery solutions for applications in multiple industries, including automotive, bus, rail and truck in transportation, grid energy storage and renewable wind energy solutions. Our recently developed lithium-ion capacitors are energy storage devices with the power characteristics of an ultracapacitor combined with enhanced energy storage capacity approaching that of a battery. They are uniquely designed to address a variety of applications in the rail, grid, and industrial markets where energy density and weight are differentiating factors. |

• | Dry Battery Electrode Technology: We believe our dry electrode technology has the potential to be a revolutionary technology within the battery industry with a substantial market opportunity, particularly for use in electric vehicles. By applying our proprietary and fundamental dry electrode manufacturing technology and trade secrets to batteries of varying chemistries, we believe we can create significant performance and cost benefits when compared with today’s state of the art wet electrode technology. |

• | High-Voltage Capacitors: Our CONDIS® high-voltage capacitors are designed and manufactured to perform reliably for decades in all climates. These products include grading and coupling capacitors and electric voltage transformers that are used to ensure the safety and reliability of electric utility infrastructure and other applications involving transport, distribution and measurement of high-voltage electrical energy. |

In April 2016, we sold substantially all assets and liabilities related to our radiation-hardened microelectronics product line. Our radiation-hardened microelectronic products for satellites and spacecraft included single board computers and components, such as high-density memory and data conversion modules.

General Product Line and Technology Overview

Ultracapacitors

Ultracapacitors enhance the efficiency and reliability of devices or systems that generate or consume electrical energy. They differ from other energy storage and power delivery products by combining rapid charge/discharge capabilities typically associated with film and electrolytic capacitors with energy storage capacity generally associated with batteries. Although batteries store significantly more electrochemical energy than ultracapacitors, they cannot charge and discharge as rapidly and efficiently as ultracapacitors. Conversely, although electrolytic capacitors can deliver bursts of high power very rapidly, they have limited energy storage capacity, and therefore cannot sustain power delivery as long as ultracapacitors. Also, unlike batteries, which store energy by means of a chemical reaction and experience gradual depletion of their energy storage and power delivery capability over hundreds to a few thousand charge/discharge cycles, ultracapacitors’ energy storage and power delivery mechanisms involve minimal chemical reactions, so they can be charged and discharged hundreds of thousands to millions of times in typical operating environments with negligible performance degradation. This ability to store energy, deliver bursts of power and perform reliably for many years, with little or no maintenance, makes ultracapacitors an attractive and efficient energy storage option for a wide range of energy-consuming and generating devices and applications.

Based on potential volumes, we believe that the transportation industry represents the largest current market opportunity for ultracapacitors. Transportation applications include braking energy recuperation and torque-augmentation systems for hybrid-electric buses, trucks, autos and electric rail vehicles, vehicle power network smoothing and stabilization, and engine starting systems for light and heavy duty trucks to support anti-idle laws for emissions reduction.

2

Our ultracapacitor products have become a standard and often preferred energy storage solution for transportation applications such as hybrid-electric transit buses and electric rail systems and industrial electronics applications such as wind energy, automated utility meters in smart grid systems and backup power for telecommunications and information technology installations.

The core of our technology is a proprietary, solvent-free, electrode manufacturing process. This high throughput roll-to-roll process produces high reliability electrode material with uniform thickness resulting in enhanced product performance and long term durability. The process enables a favorable cost position versus competitors. As part of our offerings, we market electrode material to other ultracapacitor manufacturers. We have licensed our proprietary cell architecture to manufacturers in China, Taiwan and Korea to expand and accelerate acceptance of ultracapacitor products in large and rapidly growing global markets.

Complementary to our ultracapacitor products, lithium-ion capacitors are energy storage devices, that due to their unique design, have more than three times the energy density, similar power density, and a similarly long cycle life compared with ultracapacitors, as well as very low self-discharge similar to lithium-ion batteries. Like ultracapacitors, lithium-ion capacitors have a variety of applications, such as short-range vehicles, rail, grid energy storage, and industrial, where higher energy density and/or fast charge are required. With their unique properties, we believe lithium-ion capacitor products can open up new market opportunities for us.

Dry Battery Electrode Technology

Our dry battery electrode technology leverages our core dry electrode process technology currently used to manufacture ultracapacitors. This unique electrode manufacturing process expands our core technology into batteries of varying chemistry with value-added performance features over wet-coated electrode technology at a reduced production cost. The performance differentiators afforded by dry coating technology are higher energy density, longer operating lifetime, high temperature operating robustness and higher charge/discharge rate capability. As a solvent-less process technology, dry electrode manufacturing is less costly and much more environmentally friendly. We believe that the investment in manufacturing equipment for dry processing is significantly less than wet coating technology, with much lower energy consumption as there is no need to use, remove and recapture solvent from electrode during fabrication. In addition to offering benefits over today’s battery chemistries, dry process technology enables electrode production using high energy density, liquid sensitive materials that are more encumbered by wet coating processes. We believe that these combined attributes of dry battery electrode manufacturing have the potential to meet the cost and performance requirements in the fast growing demand for vehicle electrification.

High-Voltage Capacitors

High-voltage grading and coupling capacitors and electronic voltage transformers are used mainly in the electric utility industry. Grading and coupling capacitors are key components of circuit breakers that prevent high-voltage arcing that can damage switches, step-down transformers and other equipment that transmits or distributes high-voltage electrical energy within electricity network infrastructure and also within high-voltage laboratories. Electronic voltage transformers measure voltage and power levels within electric utility infrastructure. The market for these products consists of expansion, upgrades and maintenance of existing infrastructure and new infrastructure installations in developing countries. Such initiatives are capital-intensive and frequently are subject to regulation, availability of government funding and prevailing economic conditions. North America has a large installed base of fragmented electric utility infrastructure, and has experienced power interruptions and supply problems. Utility deregulation, government budget deficits, and other factors have limited recent capital spending in what historically has been a very large market for utility infrastructure components. We believe that consolidation and changes in market dynamics will generate new opportunities. Projects to increase the availability of electrical energy in developing countries as well as infrastructure modernization and renovation in already developed countries may continue to increase demand for our high-voltage products and solutions in the years to come.

Radiation-Hardened Microelectronics

In April 2016, we sold substantially all assets and liabilities related to our radiation-hardened microelectronics product line. Our radiation-hardened microelectronic products for satellites and spacecraft included single board computers and components, such as high-density memory and data conversion modules.

3

Business Strategy

Our primary objective is to significantly increase our revenue and profit margins by leveraging our differentiating, proprietary “dry electrode technology” platform, and to diversify our business and ultimately position the Company for accelerated, profitable growth to create value for our shareholders. In order to accomplish this objective, we are focused on the following three strategic imperatives:

•First, to maintain or expand our leadership position and market share for our high-voltage product line, which provides foundational cash flow and the opportunity for steady long-term growth;

•Second, to narrow our ultracapacitor market focus and optimize our product portfolio investment. To date, ultracapacitors have required our most significant investment and we are focused on markets which will deliver the required diversification and scale to transition our business to higher, profitable growth opportunities in a large and growing market;

•Third, to leverage our differentiating, proprietary dry battery electrode technology to establish significant partnerships with industry leaders in automotive and energy storage. We believe this technology platform could accelerate the shift towards vehicle electrification and has the potential to unlock new applications with significant revenues opportunities in a potentially large market.

Starting with our high voltage product line, our strategy is to capitalize on a significant shift happening now in the global high voltage market. While these products address highly specialized applications, we are a technology leader in the market niches they serve, and thus are able to sell our products at attractive profit margins. To maintain and expand this competitive position, we are leveraging our technological expertise to develop new products that not only meet the demands of our current markets, but also address additional applications. Leveraging our market leadership, we intend to grow revenue over the next five years by capitalizing on these new products we have recently introduced and for which we are experiencing increasing demand. To meet this growing demand, we have recently embarked on a factory expansion which is expected to be completed in 2018. The continued foundational cash flow from this product line is critical for us to sustain and grow our investment engine and to sufficiently invest in our ultracapacitor product line and our differentiating dry battery electrode platform.

The second part of our strategy is to narrow our market focus and optimize our product portfolio investment for our ultracapacitor product line. Over the last year, we have made steady progress leveraging our core competencies and diversifying this product line as we transition to higher growth market opportunities in automotive, power grid, rail, and wind. We believe that our automotive business, which has contributed a modest, but historically consistent revenue stream, has the largest growth potential. Our power grid and rail markets are in nascent stages of growth and are expected to become more significant contributors to our revenue growth in the coming years. The wind market, while highly dependent on China government subsidy program changes, continues to be a major revenue contributor, but with a modest growth opportunity. For the China bus market, we have established a localized manufacturing partnership with CRRC-SRI to reduce our dependency on China government influences, thus positioning us for future revenue growth. Additionally, we have been focused on optimizing our ultracapacitor product portfolio, and expanding our addressable market and customer base. To that end, we are collaborating and partnering with key existing and prospective customers to develop ultracapacitor-based solutions for high-volume, high-value applications. We are constantly improving technical performance such as higher temperature capability, higher voltage levels and higher power density as well as increased reliability and ruggedness of our products for an extended application lifetime. We are focused on developing and acquiring system level know-how and application expertise to enable entire system solutions and support rapid product implementations in novel and emerging markets and applications. In order to develop new, innovative solutions and accelerate time-to-market for these solutions, we are establishing technical and commercial relationships with value added partners within our target market segments and applications, including value added distributors, solution level integrators and tier one suppliers.

4

The third part of our strategy is focused on our dry battery electrode technology, which has the potential to be a revolutionary technology with a large market opportunity, particularly in electric vehicles. As with ultracapacitors, our proprietary, high throughput manufacturing process for dry battery electrode produces highly reliable electrode material with uniform characteristics resulting in enhanced product performance and long term durability. We believe that lithium ion batteries are the key enabling technology for vehicle electrification, and as such, cost reduction and performance improvement have become critical targets for the world’s leading lithium ion battery manufacturers and automotive OEMs. By applying our proprietary, fundamental dry electrode manufacturing process and trade secrets to lithium ion batteries, we believe that we can create significant performance and cost benefits when compared to today’s state of the art technology. This innovation is only viable because of our leadership in ultracapacitor innovation, as well as our proprietary dry electrode manufacturing experience and evolution over many years. With the automotive industry shifting towards electrification, several large global players in the automotive and battery industries are independently evaluating our dry battery electrode technology as a potentially viable improvement to existing technology solutions. In 2016, we signed a joint development agreement with a leading global automotive OEM as well as a global tier one automotive supplier on a proof-of-concept to develop and validate pilot-volume dry battery electrode performance, which targets a specific electric vehicle platform expected to be released in approximately 2022. In experiments and testing to date, significant performance and cost advantages of our dry electrode manufacturing process compared with wet electrode technology have been identified and we are progressing on track with the remaining key milestones under this proof-of-concept, while the objective of the development effort still requires further validation of the viability and scalability in a fully commercialized electric vehicle system. We are also experiencing increased interest from additional large, brand name, global players in the energy storage and automotive industries regarding future joint development and commercialization efforts. Unlocking the value of this technology for our customers, our partners and our shareholders has become a key priority for Maxwell. Given recent successes in the proof-of-concept development activities and the increasing interest from global leaders in the automotive and energy storage markets, we have begun to shift more investment towards our dry battery electrode technology and anticipate broader development and commercialization collaborations as we complete the current proof-of-concept activities towards the end of 2017.

Products and Applications

Our products incorporate our know-how and proprietary energy storage and power delivery technologies at both the component and system levels for specialized, high-value applications that demand “life-of-the-application” reliability.

Ultracapacitors

Ultracapacitors, also known as electrochemical double-layer capacitors (“EDLC”) or supercapacitors, store energy electrostatically. Although ultracapacitors are electrochemical devices, minimal chemical reactions are involved in their energy storage mechanism. Their electrostatic energy storage mechanism is fully reversible, allowing ultracapacitors to be rapidly charged and discharged hundreds of thousands to millions of times with minimal performance degradation.

Compared with electrolytic capacitors, which have very low energy storage capacity and discharge power too rapidly for many power delivery applications, ultracapacitors have much greater energy storage capacity and can deliver energy over time periods ranging from fractions of a second to several minutes.

Compared with batteries, which require minutes or hours to fully charge or discharge, ultracapacitors discharge and recharge in as little as fractions of a second. Although ultracapacitors store only about five to ten percent as much electrical energy as a battery of comparable size, they can deliver or absorb electric energy up to 100 times more rapidly than batteries. Because they operate reliably through hundreds of thousands to millions of charge cycles, compared with only hundreds to a few thousand equivalent cycles for batteries, ultracapacitors have significantly higher lifetime energy throughput, which equates to significantly lower cost on a life cycle basis.

We link our ultracapacitor cells together in multi-cell modules to satisfy energy storage and power delivery requirements of varying voltages. Both individual cells and multi-cell products can be charged from any primary energy source, such as a battery, generator, fuel cell, solar panel, wind turbine or electrical outlet. Virtually any device or system whose intermittent peak power demands are greater than its average continuous power requirement is a candidate for an ultracapacitor-based energy storage and power delivery solution.

Our ultracapacitor products have significant advantages over batteries, including:

• | the ability to charge and discharge up to 100 times faster; |

• | significantly lower weight per unit of power delivery; |

• | higher charge/discharge turnaround efficiency, minimizing energy loss; |

• | the ability to operate reliably and continuously in extreme temperatures (-40º C to +65º C); |

5

• | minimal to no maintenance requirements; |

• | “life of the application” durability; and |

• | minimal environmental issues associated with disposal because they contain no heavy metals. |

With no moving parts and negligible chemical reactions involved in their energy storage mechanism, ultracapacitors provide a simple and highly reliable solution to buffer short-term mismatches between power available and power required. Additionally, ultracapacitors offer the advantage of storing energy in the same form in which it is used, as electricity.

Emerging applications, including electric power in vehicles, stabilization of renewable power including solar and wind, and highly reliable, maintenance-free, backup power for telecommunications, information technology and industrial installations, are creating significant opportunities for more efficient and reliable energy storage and power delivery products. In many applications, power demand varies widely from moment to moment, and peak power demand typically is much greater than the average power requirement. For example, automobiles require 10 times more power to accelerate than to maintain a constant speed, and forklifts require more power to lift a heavy pallet of material than to move from place to place within a warehouse.

Engineers historically have addressed transient peak power requirements by over-sizing the engine, battery or other primary energy source to satisfy all of a system’s power demands, including demands that occur infrequently and may last only fractions of a second. Sizing a primary power source to meet brief peak power requirements, rather than for average power requirements, is costly and inefficient. When a primary energy source is coupled with ultracapacitors, which can deliver or absorb brief bursts of high power on demand for periods of time ranging from fractions of a second to several minutes, the primary energy source can be smaller, lighter and less expensive.

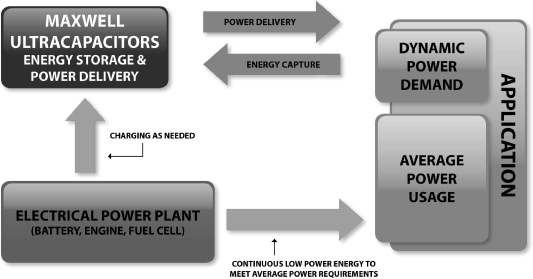

The following diagram depicts the separation of a primary energy storage source from a peak power delivery component to satisfy the requirements of a particular application. Components that enable this separation allow designers to optimize the size, efficiency and cost of the entire electrical power system.

Peak Power Application Model

Although batteries remain the most widely used component for both energy storage and peak power delivery, flywheels, ultracapacitors and more advanced batteries now enable system designers to separate and optimize these functions. Based in part on our ultracapacitor products’ declining cost, high performance and “life-of-the-application” durability, they are becoming a preferred solution for many energy storage and power delivery applications.

6

We offer our ultracapacitor cells with capacitances ranging from 1 to 3,400 farads. Applications such as hybrid-electric bus, truck and auto drive trains, electric rail systems, renewables stabilization and uninterruptible power supply systems require integrated energy storage systems consisting of up to hundreds of ultracapacitor cells. To facilitate adoption of ultracapacitors for these larger systems, we have developed integration technologies, including proprietary electrical balancing and thermal management systems and interconnect technologies. We hold patents for certain of these technologies. We offer a broad range of standard multi-cell modules. Our current standard multi-cell products each incorporate from 6 to 60 of our cells to provide “plug and play” solutions for applications requiring from 16 to 160 volts, and these modules are designed to be linked together for higher voltage and higher power applications.

High-Voltage Capacitors

Electric utility infrastructure includes switches, circuit breakers, step-down transformers and measurement instruments that transmit, distribute and measure high-voltage electrical energy. High-voltage capacitors are used to protect these systems from high-voltage arcing. With operational lifetimes measured in decades, these applications require high reliability and durability.

Under our CONDIS® line of high-voltage capacitor products, Maxwell has more than 100 years of experience in this industry, and is the world’s largest producer of such products for use in utility infrastructure. Engineers with specific expertise in high-voltage systems develop, design and test our high-voltage capacitor products in our development and production facility in Rossens, Switzerland. Our high-voltage capacitors are produced through a proprietary assembly and automated winding and drying process to ensure consistent quality and reliability. We are continuously upgrading and expanding our high-voltage capacitor production facility and high end laboratory which has resulted in a doubling of our output capacity and significant shortening order-to-delivery intervals.

We sell our high-voltage capacitor products to large systems integrators, which install and service power plants and electrical utility infrastructure worldwide.

Manufacturing

Our internal manufacturing operations are conducted in production facilities located in Peoria, Arizona and Rossens, Switzerland. We have made substantial capital investments to outfit and expand our internal production facilities and incorporate mechanization and automation techniques and processes. We have trained our manufacturing personnel in advanced operational techniques, added information technology infrastructure and implemented new business processes and systems to increase our manufacturing capacity and improve efficiency, planning and product quality. Our ultracapacitor electrode material is currently produced exclusively at our Peoria facility. We outsource the assembly of our 60 mm diameter large cell ultracapacitors, and subsequently, assembly of large cell-based multi-cell modules to Belton Technology Group (“Belton”), a contract manufacturer with operations in Shenzhen, China. In 2010, we outsourced assembly of our mid-size D-cell ultracapacitor products and D-cell-based multi-cell modules to Tianjin Lishen Battery Joint-Stock Co. Ltd. (“Lishen”), one of China’s largest producers of lithium-ion batteries, based in Tianjin. We believe that we have sufficient capacity to meet near-term demand for all of our product lines.

Ultracapacitors

We produce electrode material for our own ultracapacitor products, and for sale to other ultracapacitor manufacturers such as Yeong-Long Technologies Co., Ltd. (“YEC”) at our Peoria facility. In 2013, we completed a major electrode capacity expansion in our Peoria facility. This facility gives us sufficient capacity to support both our current ultracapacitor production requirements and external electrode demand in the near term. As demand increases, additional increments of electrode production capacity can be added within a year through the utilization of established equipment vendors.

We also produce our engine start module on production lines in our Peoria facility. As noted above, we have outsourced assembly of all other cell types and multi-cell modules to contract manufacturers in Asia. To increase reliability, reduce cost, simplify assembly and facilitate automation, we have designed our ultracapacitor products to incorporate lower-cost materials and to reduce both the number of parts in a finished cell and the number of manufacturing process steps required to produce them. We intend to continue using outsourced cell and module assembly in countries with cost efficient value added services, but plan to continue to produce our proprietary electrode material only in internal production facilities to ensure the continued protection of our intellectual property.

7

High-Voltage Capacitors

We produce our high-voltage grading and coupling capacitors and electronic voltage transformers in our Rossens, Switzerland facility. We believe we are the only high-voltage capacitor producer that manufactures its products with stacking, assembly and automated winding processes. This enables us to produce consistent, high quality and highly reliable products, and gives us sufficient capacity to satisfy anticipated global customer demand. We operate the assembly portion of the manufacturing process using a “just-in-time” design, allowing us to increase production capacity without adding direct labor, and significantly shortening order-to-delivery intervals.

Suppliers

We generally purchase components and materials, such as carbon powder, certain electronic components, dielectric materials, and ceramic insulators from a variety of suppliers. For certain products, we rely on a limited number of suppliers or a single supplier for a number of reasons, including notably, the cost effectiveness of doing business with a single supplier. Although we believe there are alternative sources for some of the components and materials that we currently obtain from a single source, there can be no assurance that we will be able to identify and qualify alternative suppliers in a timely and cost effective manner. Therefore, for certain critical components, we utilize mitigation strategies such as, for example, maintaining an inventory of safety stock on site at our respective manufacturing locations in an effort to minimize the impact of an unforeseen disruption in supply from these outside parties.

Marketing and Sales

We market and sell our products worldwide through both direct and indirect sales channels for incorporation by integrators and OEM customers into a wide range of end products. Because the introduction of products based on emerging technologies requires customer acceptance of new and unfamiliar technical approaches, and because many OEM customers have rigorous vendor qualification processes, the design-in process and initial sale of our products often takes months or even years.

Our principal marketing strategy is to identify applications for which our products and technology offer a compelling value proposition, to become a preferred vendor on the basis of service and price, and to negotiate supply agreements that enable us to establish long-term relationships with key OEM and integrator customers. To optimize our go-to-market strategy and tailor our products to end user application, we organized our marketing team into two specialized ultracapacitor product line teams. One team supports Automotive and Transportation market segments which require highly rugged and robust products with very stringent automotive qualification requirements and solid change management. The other team supports all Green Infrastructure applications such as grid energy storage, wind power and other more stationary applications that require very cost sensitive products with very high service lifetimes and often very complex systems solutions. Our marketing efforts strive to develop application specific product portfolios and solutions for our Automotive & Transportation and Green Infrastructure market segments. As these design-in sales tend to be technical and engineering-intensive, we organize market-specific teams composed of sales, applications engineering and other technical and operational personnel to work closely with our customers across multiple disciplines to satisfy their requirements for form, fit, function and environmental needs. As time-to-market often is a primary motivation for our customers to use our products, the initial sale and design-in process typically evolves into ongoing account management to ensure on-time delivery, responsive technical support and value added problem-solving.

We design and conduct discrete marketing programs intended to position and promote each of our product lines. These include trade shows, seminars, advertising, product publicity, distribution of product literature, internet websites and social media. We utilize marketing communications specialists to develop and implement our marketing programs, design and develop marketing materials, negotiate advertising media purchases, write and place product press releases and manage our marketing websites.

We also have an alliance with YEC to assemble and market small cell ultracapacitor products. In addition, we sell electrode material to YEC, both for Maxwell-branded products and for incorporation into YEC’s own ultracapacitor products.

Competition

Each of our product lines has competitors, some of whom have longer operating histories, significantly greater financial, technical, marketing and other resources, greater name recognition and larger installed customer bases than we have. In some of the target markets for our emerging technologies, we face competition both from products utilizing well-established, existing technologies and other novel or emerging technologies.

8

Ultracapacitors

Our ultracapacitor products have two types of competitors: other ultracapacitor suppliers and purveyors of energy storage and power delivery solutions based on batteries or other technologies. Although a number of companies are developing ultracapacitor products and technology, our principal competitors in the supply of ultracapacitor or supercapacitor products are Panasonic, a division of Matsushita Electric Industrial Co., Ltd., NessCap Co., Ltd., LS Mtron, a unit of LS Cable, Supreme Power Solutions Co., Ltd., Vina Technology Company, Ltd., Samxon, a unit of Man Yue Technology Holdings, Ltd., Skeleton Technologies, Yunasko, Ltd., and Ioxus, Inc. The key competitive factors in the ultracapacitor industry are price, performance (energy stored and power delivered per unit volume), durability and reliability, operational lifetime and overall breadth of product offerings. We believe that our ultracapacitor products and electrode material compete favorably with respect to all of these competitive factors. However, the hybrid transit vehicle market for ultracapacitors in China, a region which has historically represented a significant portion of our sales, has recently become more competitive with respect to pricing which has caused us to lower our prices to remain competitive. In addition, the recent increase in the number of competitors in the hybrid transit vehicle market in China along with government subsidy program requirements regarding localization may drive down our market share.

Ultracapacitors also compete with products based on other technologies, including advanced batteries in power quality and peak power applications, as well as with flywheels, thermal storage and batteries in backup energy storage applications. We believe that the durability, long life, performance and value of ultracapacitors gives them a competitive advantage over these alternative choices in many applications. In addition, integration of ultracapacitors with some of these competing products may provide optimized solutions that neither product can provide by itself. For example, tier 1 auto parts supplier Continental AG designed a combined solution incorporating ultracapacitors with a battery for engine starting in a start-stop-idle elimination system for “micro hybrid” autos which was introduced in 2010 and installed in approximately two million cars by French automaker PSA Peugeot Citroen and was more recently introduced by General Motors for several models under the Cadillac brand.

High-Voltage Capacitors

Maxwell’s CONDIS® line of high-voltage capacitor products, is the world’s largest producer of high-voltage capacitors for use in electric utility infrastructure. Our principal competitors in the high-voltage capacitor markets are in-house production groups of certain of our customers and other independent manufacturers, such as the Coil Product Division of Trench Limited in Canada and Europe and Hochspannungsgeräte Porz GmbH in Germany. We believe that we compete favorably, both as a consistent supplier of highly reliable high-voltage capacitors, and in terms of our expertise in high-voltage systems design. Over the last ten years, our largest customer has transitioned from producing its grading and coupling capacitors internally to outsourcing substantially all of its requirements to us.

Research and Development

We maintain active research and development programs to improve existing products and to develop new products. For the year ended December 31, 2016, our research and development expenditures totaled approximately $20.9 million, compared with $24.7 million and $26.3 million in the years ended December 31, 2015 and December 31, 2014, respectively. In general, we focus our research and product development activities on:

• | designing and producing products that perform reliably for the life of the application or systems into which they are integrated; |

• | designing efficient manufacturing with low scrap rates to achieve improved profit margins and to enable us to reduce prices to allow our products to penetrate new and price-sensitive applications; |

• | designing our products to have superior technical performance; |

• | designing our products to be compact and light; and |

• | designing new products that provide novel solutions to expand our market opportunities. |

Most of our current research, development and engineering activities are focused on electrode fabrication and material science, including activated carbon, electrolyte, electrically conductive materials, dielectric materials and ceramics to reduce cost and improve performance, reliability and ease of manufacturing. Additional efforts are focused on product design and manufacturing processes for high-volume manufacturing.

In 2016, we also focused on lithium ion battery electrode development. The principal objective of our lithium ion battery electrode development activities is to demonstrate the ability of our dry electrode fabrication process to manufacture high volume lithium ion electrode at lower cost and improved performance relative to our competition.

9

Ultracapacitors

The principal focus of our ultracapacitor development activities is to increase power and energy density, reduce internal resistance, extend operational life and reduce manufacturing cost. Our ultracapacitor designs focus on low-cost, high-capacity cells in standard sizes ranging from 1 to 3,400 farads, and corresponding multi-cell modules based on various form factors.

High-Voltage Capacitors

The principal focus of our high-voltage capacitor development efforts is to enhance performance and reliability while reducing the size, weight and manufacturing cost of our products. We also are directing our design efforts to develop high-voltage capacitors for additional applications and solutions.

Intellectual Property

We place a strong emphasis on inventing, protecting and exploiting proprietary technologies, processes and designs which bring intrinsic value and uniqueness to our product portfolio. We place a high priority on obtaining patents to provide the broadest and strongest possible protection for our products, technologies and other strategic initiatives. Our continued success will depend in part on our ability to protect our existing patents and to secure patent protection on developing technologies. As of December 31, 2016, we held 71 issued U.S. patents and 22 published pending U.S. patent applications which relate to our core technologies, processes and designs. Of these issued patents, 65 relate to our ultracapacitor products and technology and 6 relate to our high-voltage capacitor products and technology.

Our pending and any future patent applications may not survive the challenges of patent prosecution in the jurisdictions in which we file throughout the world; however, our strategy is to focus on countries generating revenue as well as markets which we deem key to our business strategies and objectives. We routinely seek patent protection in the United States and the principal countries of Europe and Asia. At present, we do not rely on licenses from any third parties to produce our products.

Our existing patent portfolios and pending patent applications relate primarily to:

Ultracapacitors

• | compositions of the electrode, including its formulation, design and fabrication techniques; |

• | materials science associated with raw material components; |

• | physical cell package designs as well as the affiliated processes used in cell assembly; |

• | cell-to-cell and module-to-module interconnect technologies that minimize equivalent series resistance and enhance the functionality, performance and longevity of ultracapacitor products including system level electronics; and |

• | module and system designs that facilitate applications of ultracapacitor technology. |

High-Voltage Capacitors

• | physical cell package designs as well as the affiliated processes used in cell assembly; |

• | component selection to enable compliance with environmental regulations with minimal sacrifice to product performance; and |

• | manufacture of capacitors in a manner which significantly reduces exposure of internal components to impurities, moisture and other undesirable materials in an effort to avoid longer manufacturing times and reduced performance characteristics without these technical advancements. |

Historically, our high-voltage capacitor products have been based on our know-how and trade secrets rather than on patents. We filed our first patent application covering our high-voltage capacitor technology in 2003, and we continue to pursue patent protection in addition to trade secret protection of certain aspects of our products’ design and production.

While our primary strategy for protecting our proprietary technologies, processes and designs is related to obtaining patents, we also apply for trademark registrations which identify us as the source of the products. Additionally, we promote our technologies, processes and designs in association with these registered trademarks to further distinguish our products from those of our competitors. As of December 31, 2016, we had five formal trademark registrations within the U.S.

10

Establishing and protecting proprietary products and technologies is a key element of our corporate strategy. Although we attempt to protect our intellectual property rights through patents, trademarks, copyrights, trade secrets and other measures, there can be no assurance that these steps will be adequate to prevent infringement, misappropriation or other misuse by third parties, or will be adequate under the laws of some foreign countries, which may not protect our intellectual property rights to the same extent as do the laws of the U.S.

We use employee and third-party confidentiality and nondisclosure agreements to protect our trade secrets and unpatented know-how. We require each of our employees to enter into a proprietary rights and nondisclosure agreement in which the employee agrees to maintain the confidentiality of all our proprietary information and, subject to certain exceptions, to assign to us all rights in any proprietary information or technology made or contributed by the employee during his or her employment with us. In addition, we regularly enter into nondisclosure agreements with third parties, such as potential product development partners and customers, to protect any information disclosed in the pursuit of securing possible fruitful business endeavors.

Financial Information by Geographic Areas

Years ended December 31, | |||||||||||||||||||||

2016 | 2015 | 2014 | |||||||||||||||||||

Amount | Percent | Amount | Percent | Amount | Percent | ||||||||||||||||

Revenue from external customers located in(1): | (Dollars in thousands) | ||||||||||||||||||||

China | $ | 48,191 | 40 | % | $ | 87,856 | 53 | % | $ | 89,143 | 48 | % | |||||||||

United States | 12,041 | 10 | % | 20,836 | 12 | % | 23,758 | 13 | % | ||||||||||||

Germany | 12,854 | 10 | % | 13,972 | 8 | % | 16,384 | 9 | % | ||||||||||||

All other countries (1) | 48,158 | 40 | % | 44,708 | 27 | % | 57,301 | 30 | % | ||||||||||||

Total | $ | 121,244 | 100 | % | $ | 167,372 | 100 | % | $ | 186,586 | 100 | % | |||||||||

_________________________

(1) | Location is determined by shipment destination |

(2) | Revenue from external customers located in countries included in “All other countries” does not individually comprise more than 10% of total revenue for any of the years presented. |

Years ended December 31, | |||||||||||||||||||||

2016 | 2015 | 2014 | |||||||||||||||||||

Amount | Percent | Amount | Percent | Amount | Percent | ||||||||||||||||

Long-lived assets: | (Dollars in thousands) | ||||||||||||||||||||

United States | $ | 19,267 | 74 | % | $ | 22,267 | 69 | % | $ | 28,013 | 72 | % | |||||||||

China | 1,477 | 6 | % | 4,148 | 13 | % | 4,991 | 13 | % | ||||||||||||

Switzerland | 5,376 | 20 | % | 6,021 | 18 | % | 5,663 | 15 | % | ||||||||||||

Total | $ | 26,120 | 100 | % | $ | 32,436 | 100 | % | $ | 38,667 | 100 | % | |||||||||

Revenue by Product Line:

Years ended December 31, | |||||||||||||||||||||

2016 | 2015 | 2014 | |||||||||||||||||||

Amount | Percent | Amount | Percent | Amount | Percent | ||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||

Ultracapacitors | $ | 71,491 | 59 | % | $ | 114,525 | 68 | % | $ | 135,637 | 73 | % | |||||||||

High-voltage capacitors | 45,177 | 37 | % | 41,718 | 25 | % | 40,361 | 21 | % | ||||||||||||

Microelectronic products (1) | 4,576 | 4 | % | 11,129 | 7 | % | 10,588 | 6 | % | ||||||||||||

Total | $ | 121,244 | 100 | % | $ | 167,372 | 100 | % | $ | 186,586 | 100 | % | |||||||||

_________________________

(1) | The microelectronics product line was sold in April 2016. |

11

Risks Attendant to Foreign Operations and Dependence

We have substantial operations in Switzerland, and we derive a significant portion of our revenue from sales to customers located outside the U.S. We expect our international sales to continue to represent a significant amount of our future revenue. As a result, our business will continue to be subject to certain risks, such as those imposed by domestic laws and regulations related to topics such as export controls and interactions with foreign officials as well as foreign government regulations, including, notably, changes in tax laws, tax treaties, tariffs and freight rates. To the extent that we are unable to respond effectively to political, economic and other conditions in the countries where we operate and do business, our results of operations and financial condition could be materially adversely affected. Some of our business partners also have international operations and are subject to the risks described above. Even if we are able to successfully manage the risks of international operations, our business may be adversely affected if our business partners are not able to successfully manage these risks as well.

Having substantial international operations also increases the complexity of managing our financial reporting and internal controls and procedures. Additionally, as a result of our extensive international operations and significant revenue generated outside the U.S., the dollar amount of our current and future revenue, expenses and debt may be materially affected by fluctuations in foreign currency exchange rates. Similarly, assets and liabilities of our Swiss subsidiary that are not denominated in its functional currency are subject to effects of currency fluctuations, which may affect our reported earnings. Also, changes in the mix of income from our domestic and foreign operations, expiration of tax holidays and changes in tax laws and regulations could increase our tax expense. If we are unable to manage these risks effectively, it could impair our ability to achieve our targets for revenue and profitability.

As a result of our status as a publicly traded company within the U.S., we are subject to the U.S. Foreign Corrupt Practices Act (“FCPA”), which prohibits companies from making improper payments to foreign officials for the purpose of obtaining or retaining business. Additionally, as a result of our international operations, we could also be subject to the anti-bribery laws of other jurisdictions which vary slightly from jurisdiction to jurisdiction and may be different than the FCPA. If we fail to comply with anti-bribery laws and regulations, we could be subject to civil and/or criminal penalties as well as expenses related to any internal investigation.

Backlog

Product backlog as of December 31, 2016 was approximately $11.4 million, compared with $18.1 million as of December 31, 2015. Backlog consists of firm orders for products that will be delivered within 12 months. The actual amount of backlog at any particular time may not be a meaningful indicator of future business prospects as this amount is impacted by a number of factors including potential cancellations of orders by our customers.

Significant Customers

No customers accounted for 10% or more of total revenue in the year ended December 31, 2016. One customer, Shenzhen Xinlikang Supply China Management Co. Ltd., accounted for 19% and 20% of total revenue in the years ended December 31, 2015 and 2014, respectively.

Government Regulation

Due to the nature of our operations, including, notably, the use of hazardous substances in some of our manufacturing and research and development activities, we are subject to stringent federal, state and local laws, rules, regulations and policies governing workplace safety and environmental protection. These include the use, generation, manufacture, storage, air emission, effluent discharge, handling and disposal of certain materials and wastes. In the course of our historical operations, materials or wastes may have spilled or been released from properties owned or leased by us or on or under other locations where these materials and wastes have been taken for disposal. These properties and the materials and wastes spilled, released, or disposed thereon are subject to environmental laws which may impose strict liability, without regard to fault of the original conduct, for remediation of contamination resulting from such releases. Under such laws and regulations, we could be required to remediate previously spilled, released, or disposed substances or wastes, or to make capital improvements to prevent future contamination. Failure to comply with such laws and regulations also could result in the assessment of substantial administrative, civil and criminal penalties and even the issuance of injunctions restricting or prohibiting our activities. It is also possible that implementation of stricter environmental laws and regulations in the future could result in additional costs or liabilities to us as well as the industry in general. While we believe we are in substantial compliance with existing environmental laws and regulations, we cannot be certain that we will not incur substantial costs in the future related to unknown liabilities.

12

Employees

As of December 31, 2016, we had 418 employees in five countries, as follows: 224 full-time, 5 part-time and 31 temporary employees in the U.S.; 82 full-time, 9 part-time and 21 temporary employees in Switzerland; 32 full-time and 4 temporary employees in China; 9 full-time employees in Germany, and 1 full-time employee in South Korea. We are unable to estimate the percent of our Swiss employees that are members of a labor union, as Swiss law prohibits employers from inquiring into the union status of employees. We consider our relations with our employees to be amicable.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available free of charge to the public over the Internet at the SEC’s website at http://www.sec.gov. Our SEC filings are also available free of charge on our website at http://www.maxwell.com as soon as reasonably practicable following the time that they are filed with the SEC. You may also read and copy any document we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The information found on our website is not part of this or any report that we file with the SEC.

13

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. Our business, financial condition and results of operations could be seriously harmed if potentially adverse developments, some of which are described below, materialize and cannot be resolved successfully. In any such case, the market price of our common stock could decline and you may lose all or part of your investment in our common stock.

The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties, including those not presently known to us or that we currently deem immaterial, may also result in decreased revenue, increased expenses or other adverse impacts that could result in a decline in the price of our common stock. You should also refer to the other information set forth in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes.

A substantial percentage of our total revenue depends on the sale of products within a small number of vertical markets and a small number of geographic regions, and the decline in the size of a vertical market or reduction of consumption within a geographic region, without offsetting growth in emerging markets, could impede our growth and profitability.

Sales within a relatively small number of vertical markets and a small number of geographic regions make up a large portion of our revenue. Our ability to grow our sales within this limited number of markets and regions depends on our ability to compete on price, delivery and quality. If a particular market into which we sell experiences a decline, then our customers will decrease their own consumption of our products thereby reducing our revenue. For example, if municipalities are no longer accepting of ultracapacitor systems for hybrid buses, then our direct customers will no longer consume products from us for incorporation into such applications. Additionally, a substantial portion of our revenue stems from sales to customers within a limited number of geographic regions including, notably, China and Germany. If certain factors were to arise including, for example, a catastrophic event or shift in economic health and stability within a particular region, then customers within these regions may reduce their consumption of our products resulting in reduced revenue for us. While we have focused efforts targeting growth of product acceptance in other smaller market segments, there can be no assurance that the revenue associated with these emerging markets will be able to fully or partially offset any down turn in the vertical markets where we currently maintain substantial business.

Many of our customers are currently the benefactors of government funding or government subsidies.

Our products are currently sold into a limited number of vertical markets, some of which are either directly funded by or partially subsidized with government funding. The use of our ultracapacitor technology in certain applications is still relatively immature, the costs associated with producing the products is perceived to be high as compared with more mature and readily understood solutions. However, many government entities have determined that they view certain prevailing interests, including, for example, reduction of pollution, to outweigh the economic costs associated with incorporating these clean technologies and therefore are willing to allocate government funding to encourage companies to produce goods which reduce pollution and energy consumption. For example, a large portion of our current ultracapacitor business is concentrated in the Chinese hybrid transit vehicle and wind energy markets, which are heavily dependent on government regulation and subsidy. These markets may experience volatility when there are changes or delays in government policies and subsidy programs that support our sales into these markets. For example, in 2016, the Chinese government proposed a new registration requirement for energy storage manufacturers who sell into the automotive and heavy transportation markets. Many subsidies offered by the Chinese government require a manufacturer to be registered under this regime in order to be eligible for the applicable subsidies, thereby injecting some uncertainty as to whether our customers will be able to capture the benefit of this new program while determining which manufacturers will be able to complete the proposed registration requirement. For 2017 and beyond, we may continue to see variability in revenue as a result of uncertainty regarding how these potential changes to the China government subsidy will impact our sales into these markets.

Similarly, our high-voltage capacitor products are primarily consumed by markets which are either directly funded by or controlled by the respective government bodies in the jurisdictions where our customers do business. For example, our high-voltage capacitor products are largely used for electric utility infrastructures which are largely controlled by the respective governments supplying power and electricity to its populations. If these government entities elect to change their policies on government subsidies or decide to cancel or reduce certain government funding programs, then our customers could cancel or reduce orders for our products.

14

Uncertainty in the global geopolitical landscape from recent events may impede the implementation of our strategy outside the United States.

There may be uncertainty as to the position the United States will take with respect to world affairs and events following the 2016 U.S. presidential election and related change in political agenda, coupled with the transition of administrations. This uncertainty may include such issues as U.S. support for existing treaty and trade relationships with other countries, including, notably, China. This uncertainty, together with other key global events during 2016 (such as recently enacted currency control regulations in China, the continuing uncertainty arising from the Brexit referendum in the United Kingdom as well as ongoing terrorist activity), may adversely impact (i) the ability or willingness of non-U.S. companies to transact business in the United States, including with the Company, (ii) our ability to transact business in other countries, (iii) regulation and trade agreements affecting U.S. companies, (iv) global stock markets (including The Nasdaq Global Market on which our common shares are traded), and (v) general global economic conditions. All of these factors are outside of our control, but may nonetheless cause us to adjust our strategy in order to compete effectively in global markets.

There may be changes in, and uncertainty with respect to, legislation, regulation and governmental policy due to recent elections in the United States.

The recent presidential and congressional elections in the United States could result in significant changes in, and uncertainty with respect to, legislation, regulation and government policy. While it is not possible to predict whether and when any such changes will occur, changes at the local, state or federal level could impact fuel cell market adoption in the USA and the alternative energy technologies sector in the USA, generally. Specific legislative and regulatory proposals discussed during and after the election that could have a material impact on us include, but are not limited to, reform of the federal tax code; infrastructure renewal programs; and modifications to international trade policy, public company reporting requirements, environmental regulation and antitrust enforcement.

We may not be successful in growing through acquisitions or integrating effectively any businesses and operations we may acquire.

Our success depends on our ability to continually enhance and broaden our product offerings in response to changing customer demands, technology, and competitive pressures as well as entry into new vertical markets. To remain competitive, we recently entered into an agreement providing for the acquisition of substantially all of the assets and business of Nesscap Energy, Inc., which includes complementary businesses to expand our portfolio of products and to add value to the projects undertaken for clients or enhance our capital strength. We do not know if we will be able to complete any future acquisitions or whether we will be able to successfully integrate any acquired businesses, operate them profitably, or retain their key employees.

If we cannot successfully close this planned acquisition, we may not be able to successfully expand our operations or achieve our revenue and other financial targets. Further, there can be no assurance that we will be able to generate sufficient cash flow from an acquisition or realize any other anticipated benefits. In addition, there can be no assurance that the due diligence undertaken in connection with an acquisition will uncover all liabilities relating to the acquired business. Nor can there be any assurance that our profitability will be improved as a result of this acquisition. Any acquisition may involve operating risks, such as:

• | the difficulty of assimilating the acquired operations and personnel and integrating them into our current business; |

• | the potential impairment of employee morale; |

• | the potential disruption of our ongoing business; |

• | preserving important strategic and customer relationships; |

• | the diversion of management’s attention and other resources; |

• | the risks of entering markets in which we have little or no experience; |

• | the possibility that acquisition-related liabilities that we incur or assume may prove to be more burdensome than anticipated; |

• | the risks associated with possible violations of the Foreign Corrupt Practices Act, the United Kingdom Bribery Act of 2010, and other anti-corruption laws as a result of any acquisition or otherwise applicable to our business; and |

• | the possibility that any acquired businesses do not perform as expected. |

15

Our acquisition integration and restructuring activities could result in management distractions, operational disruptions and other difficulties.

As disclosed on February 28, 2017, we have initiated a planned acquisition along with concurrent restructuring activities in an effort to improve operational efficiency, and such efforts are expected to continue in the future. These actions are intended to better align our cost structure with near-term revenue, and also to improve engineering and operational efficiencies throughout the organization. Additional reductions-in-force and senior level employee replacements may be required as we continue to realign our business organization, operations and product lines. Upon the close of the anticipated transaction, our efforts to integrate manufacturing and other operations with the acquired business may not be successful. For example, we may encounter issues with the transition of products delivered to our customers from the higher cost solutions, either from our current facilities or the facility of the acquired business, as the case may be, to the integrated cost efficient solutions. Such difficulties, even if managed correctly, could result in delays in the actual integration of our manufacturing operations and therefore a delay in realizing anticipated reductions in expenses. Any restructuring efforts could also disrupt our ability to supply products to customers, detriment relationships with customers and other business partners, divert the attention of management away from other priorities, harm our reputation, expose us to increased risk of legal claims by terminated employees, increase our expenses, increase the workload placed upon remaining employees and cause employees to lose confidence in our future performance and decide to leave. In addition, if we continue to reduce our workforce, it may adversely impact our ability to respond rapidly to new growth opportunities or to remain competitive. Further, employees whose positions were or will be eliminated in connection with these restructuring activities or who otherwise determine to leave may seek employment with our competitors, customers or suppliers. Although each of our employees is required to sign a confidentiality agreement with us at the time of employment, which agreement contains covenants prohibiting, among other things, the disclosure or use of our confidential information and the solicitation of our employees, we cannot guarantee that the confidential nature of our proprietary information will be maintained in the course of such future employment, or that our key continuing employees will not be solicited to terminate their employment with us. We cannot guarantee that any restructuring activities undertaken in the future will be successful, or that we will be able to realize the anticipated cost savings and other anticipated benefits from our restructuring plans.

We may not be able to obtain sufficient capital to meet our operating or other needs, which could require us to change our business strategy and result in decreased profitability and a loss of customers.

We believe that in the future we may need a substantial amount of additional capital for a number of potential purposes in furtherance of our strategic missions and growth objectives. For example, to meet potential growth in demand for our products, particularly for our ultracapacitor products, we will need significant resources for customized production equipment. Further, additional capital may be required to execute on our strategies related to continued expansion into commercial markets, development of new products and technologies, and acquisitions of new or complementary businesses, product lines or technologies. Cash generated by our operations may not be sufficient to cover these investments.

While we currently have access to a credit facility from East West Bank, we must still comply with certain conditions, including, notably, certain financial covenants, in order to have access to such funds. If adequate funds are not available when needed, we may be required to change or delay our planned growth, which could result in decreased revenue and profits and loss of customers. Also, if we are to raise additional funds by issuing equity, the issuance of additional shares will result in dilution to our current stockholders. If additional financing is accomplished by the issuance of debt, the service cost, or interest, will reduce net income or increase net loss, and we may also be required to issue warrants to purchase shares of common stock in connection with issuing such debt.

Downward pressures on product pricing or changes to our product mix could adversely impact our financial condition and operating results, and such pressures or changes could even result in loss of revenue in exchange for avoidance of gross margin pressures.

We strive to manage gross margin for the products we sell. There can be no assurance that targeted gross margin percentage levels will be achieved. In general, gross margins will remain under downward pressure due to increased competition as well as a potential shift in our sales mix to lower margin business. For example, if we increase sales of our products into markets which traditionally have lower margin rates than our current business, such as the automotive market, we may be forced to reduce our margins to remain competitive. Further, we are beginning to experience significant downward pricing pressure in the Chinese hybrid transit vehicle market, which has historically represented a significant portion of our sales, as a result of changes in the government subsidy program and other market factors. If our cost reduction efforts do not keep pace with these price pressures, or if we continue to pursue certain vertical markets and reduce our margins to maintain or increase sales, then we could experience degradation in our overall profit margins. In addition, gross margins could be negatively impacted by an increase in raw materials, components and labor costs, or by changes to our product mix.

16

Unfavorable results of legal proceedings could materially adversely affect us.