Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - La Quinta Holdings Inc. | lq-ex991_451.htm |

| EX-32.2 - EX-32.2 - La Quinta Holdings Inc. | lq-ex322_409.htm |

| EX-32.1 - EX-32.1 - La Quinta Holdings Inc. | lq-ex321_408.htm |

| EX-31.2 - EX-31.2 - La Quinta Holdings Inc. | lq-ex312_410.htm |

| EX-31.1 - EX-31.1 - La Quinta Holdings Inc. | lq-ex311_411.htm |

| EX-23.1 - EX-23.1 - La Quinta Holdings Inc. | lq-ex231_407.htm |

| EX-21.1 - EX-21.1 - La Quinta Holdings Inc. | lq-ex211_406.htm |

| EX-10.19 - EX-10.19 - La Quinta Holdings Inc. | lq-ex1019_452.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-36412

La Quinta Holdings Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

99-1032961 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

909 Hidden Ridge, Suite 600

Irving, Texas 75038

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (214) 492-6600

Securities registered pursuant to Section 12(b) of the Act:

|

(Title of each class) |

|

(Name of each exchange on which registered) |

|

Common Stock, $0.01 par value per share |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2016, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $916.3 million (based upon the closing sale price of the common stock on that date on the New York Stock Exchange).

The number of shares of common stock outstanding on February 24, 2017 was 117,039,146.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III incorporate information by reference from the registrant’s definitive proxy statement relating to its 2017 annual meeting of stockholders to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year.

FORM 10-K

YEAR ENDED DECEMBER 31, 2016

|

|

|

|

Page No. |

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|||

|

|

|

|

2 |

|

|

|

|

|||

|

|

|

|

3 |

|

|

|

|

|||

|

|

|

|

3 |

|

|

|

|

|||

|

PART I

|

|

|

|

|

|

Item 1. |

|

|

4 |

|

|

|

|

|||

|

Item 1A. |

|

|

16 |

|

|

|

|

|||

|

Item 1B. |

|

|

40 |

|

|

|

|

|||

|

Item 2. |

|

|

40 |

|

|

|

|

|||

|

Item 3. |

|

|

42 |

|

|

|

|

|||

|

Item 4. |

|

|

42 |

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

||||

|

|

|

43 |

||

|

|

|

|||

|

Item 6. |

|

|

44 |

|

|

|

|

|||

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

47 |

|

|

|

|||

|

Item 7A. |

|

|

72 |

|

|

|

|

|||

|

Item 8. |

|

|

74 |

|

|

|

|

|||

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

114 |

|

|

|

|||

|

Item 9A. |

|

|

114 |

|

|

|

|

|||

|

Item 9B. |

|

|

116 |

|

|

|

||||

|

PART III |

|

|

|

|

|

|

|

|

|

|

|

|

|

117 |

||

|

|

|

|||

|

Item 11. |

|

|

117 |

|

|

|

|

|||

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

117 |

|

|

|

|||

|

Item 13. |

|

Certain Relationships and Related Transactions and Director Independence |

|

117 |

|

|

|

|||

|

Item 14. |

|

|

117 |

|

|

|

||||

|

PART IV |

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

118 |

|

|

|

|

|||

|

Item 16. |

|

|

119 |

|

|

|

|

|

|

|

|

|

|

|

120 |

|

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the federal securities laws. All statements, other than statements of historical facts included in this Annual Report on Form 10-K, including statements concerning our plans, objectives, goals, beliefs, business strategies, future events, business conditions, results of operations, financial position and our business outlook, business trends and other information referred to in this Annual Report on Form 10-K are forward-looking statements. When used in this Annual Report on Form 10-K, the words “estimates,” “expects,” “contemplates,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” “may,” “should” and variations of such words or similar expressions are intended to identify forward-looking statements. The forward-looking statements are not historical facts, and are based upon our current expectations, beliefs, estimates and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond our control. Our expectations, beliefs, estimates and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs, estimates and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

There are a number of risks, uncertainties and other important factors, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. Such risks, uncertainties and other important factors include, among others, the following risks, uncertainties and factors:

|

|

• |

business, financial, and operating risks inherent to the hospitality industry; |

|

|

• |

macroeconomic and other factors beyond our control can adversely affect and reduce demand for hotel rooms; |

|

|

• |

contraction in the global economy or low levels of economic growth; |

|

|

• |

inability to compete effectively; |

|

|

• |

any deterioration in the quality or reputation of our brand; |

|

|

• |

inability to develop our pipeline; |

|

|

• |

the geographic concentration of our hotels; |

|

|

• |

delays or increased expense relating to our efforts to develop, redevelop, sell or renovate our hotels; |

|

|

• |

inability by us or our franchisees to make necessary investments to maintain the quality and reputation of our brand; |

|

|

• |

inability to access capital necessary for growth; |

|

|

• |

seasonal and cyclical volatility in the hotel industry; |

|

|

• |

inability to maintain good relationships with our franchisees; |

|

|

• |

inability to protect our brand standards; |

|

|

• |

risks resulting from significant investments in owned real estate; |

|

|

• |

failure to keep pace with developments in technology; |

|

|

• |

failures or interruptions in, material damage to, or difficulties in updating, our information technology systems, software or websites; |

|

|

• |

inability to protect our guests’ personal information; |

|

|

• |

failure to comply with marketing and advertising laws; |

|

|

• |

disruptions to our reservation system; |

|

|

• |

failure to protect our trademarks and other intellectual property; |

|

|

• |

risks of doing business internationally; |

|

|

• |

the loss of senior executives or key field personnel; |

|

|

• |

the results of the audit by the Internal Revenue Service; |

|

|

• |

our substantial indebtedness; |

|

|

• |

risks related to pursuing the separation of our businesses; and |

|

|

• |

Blackstone’s significant influence over us. |

1

There may be other factors that may cause our actual results to differ materially from the forward-looking statements, including factors disclosed under the sections entitled “Part I—Item 1A. Risk Factors” and “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report on Form 10-K. You should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties.

We caution you that the risks, uncertainties and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements in this Annual Report on Form 10-K apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this Annual Report on Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

Basis of Presentation in this Annual Report on Form 10-K

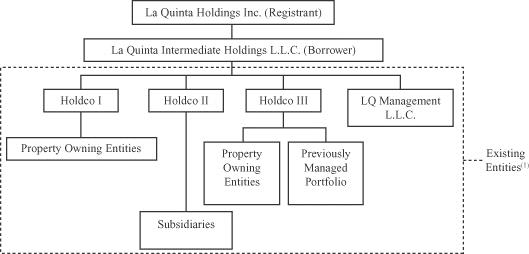

On April 14, 2014, we completed our initial public offering (the “IPO”), in which we issued and sold approximately 44.0 million shares of common stock of La Quinta Holdings Inc. Our business prior to the IPO was conducted, and our hotel properties were owned, through multiple entities (including the entities owned by the Company at the completion of the IPO and previously under common control or otherwise consolidated for financial reporting purposes and their consolidated subsidiaries (the “Predecessor Entities”) and the entities that owned the 14 La Quinta hotels managed by the Predecessor Entities (the “Previously Managed Portfolio”), collectively, the “Existing Entities”). Prior to the IPO, certain of our Existing Entities operated as real estate investment trusts (“REITs”) for U.S. federal income tax purposes.

To effectuate the IPO, we effected a series of transactions that resulted in a reorganization of our business (the “Pre-IPO Transactions”). Specifically, among other transactions, one of the Predecessor Entities purchased the Previously Managed Portfolio and we purchased the management company for the Predecessor Entities and the equity interests in the Predecessor Entities held by the pre-IPO owners were exchanged by the pre-IPO owners for shares of common stock of the Registrant. Additionally, all of the shares of capital stock held by third-party stockholders of the Existing Entities that were REITs were redeemed for cash and the REITs were converted into limited liability companies. Following the IPO, neither we nor any of our subsidiaries were operated as a REIT, and we are taxed as a “C” corporation at the federal and state level. See “Part I—Item 1. Business—Corporate History and Structure.”

Unless otherwise indicated or the context otherwise requires, all information in this Annual Report on Form 10-K reflects the consummation of the Pre-IPO Transactions and references in this Annual Report on Form 10-K to “we,” “our,” “us” and the “Company” refer to La Quinta Holdings Inc. and its consolidated subsidiaries, and references to “La Quinta Holdings Inc.” and the “Registrant” refer only to La Quinta Holdings Inc. exclusive of its subsidiaries.

As of December 31, 2013, four of our La Quinta-branded hotels were designated as assets held for sale and the results of their operations together with the operations of the 29 hotels sold during 2013, have been classified as discontinued operations (collectively, the “Hotels Designated for Sale”). Sales of these four hotels closed in February 2014.

Presentation of historical non-financial data. Unless otherwise indicated or the context otherwise requires, operating and other non-financial data, including number of hotels and related data, disclosed in the sections of this Annual Report on Form 10-K other than the Financial Statement Sections (as defined below):

|

|

• |

reflects the combined and consolidated business and operations of the Predecessor Entities; and |

|

|

• |

treats the Previously Managed Portfolio as owned hotels, which were acquired by the Predecessor Entities at the time of the IPO. |

Presentation of combined financial information and certain other non-financial data. Unless otherwise indicated, or the context otherwise requires, for periods prior to the completion of the IPO, (i) the historical financial data in this Annual Report on Form 10-K and (ii) the operating and other non-financial data, including number of hotels and related data, disclosed in “Part II—Item 6. Selected Financial Data” and “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” (collectively, the “Financial Statement Sections”):

|

|

• |

reflects the combined and consolidated business and operations of the Predecessor Entities (including the management company, which was consolidated for financial reporting purposes); and |

|

|

• |

treats the Previously Managed Portfolio as franchised and managed hotels. |

2

Terms Used in this Annual Report on Form 10-K

The following are definitions of certain terms used in this Annual Report on Form 10-K:

|

|

• |

“ADR” or “average daily rate” means hotel room revenues divided by total number of rooms sold in a given period; |

|

|

• |

“Blackstone” means The Blackstone Group L.P. and its affiliates; |

|

|

• |

“Comfort” refers to Comfort Inns and Comfort Suites collectively; |

|

|

• |

“comparable hotels” means hotels that: were active and operating in our system for at least one full calendar year as of the end of the applicable period and were active and operating as of January 1st of the previous year, except for (i) hotels that sustained substantial property damage or other business interruption, (ii) owned hotels that become subject to a purchase and sale agreement, or (iii) hotels in which comparable results are otherwise not available. Management uses comparable hotels as the basis upon which to evaluate ADR, occupancy, RevPAR and RevPAR Index on a system-wide basis and for each of our reportable segments; |

|

|

• |

“franchised hotels” refers to La Quinta-branded hotels which are owned and operated by third party franchisees under franchise agreements with us; |

|

|

• |

“Hampton” refers to Hampton Inns and Hampton Inn & Suites collectively; |

|

|

• |

“main STR competitive set” refers to Comfort, Holiday Inn Express, and/or Hampton, the brands most often included in our STR competitive sets; |

|

|

• |

“occupancy” means the total number of rooms sold in a given period divided by the total number of rooms available at a hotel or group of hotels; |

|

|

• |

“owned hotels” and “owned portfolio” refer to our hotels located on properties in which we have an ownership interest or leasehold interest; |

|

|

• |

“pipeline” means our portfolio of future La Quinta-branded hotels, each of which is represented by an executed franchise agreement; |

|

|

• |

“pre-IPO owners” refers to Blackstone and the members of our management and consultants that owned, directly or indirectly, interests in the Predecessor Entities; |

|

|

• |

“RevPAR” or “revenue per available room” means the product of the ADR charged and the average daily occupancy achieved; |

|

|

• |

“RevPAR Index” measures a hotel’s fair market share of its competitive set’s revenue per available room. See “Market and Industry Data”; |

|

|

• |

“system-wide” refers collectively to our owned, franchised and managed hotel portfolios; and |

|

|

• |

“team members” refers to our employees at our owned hotels and the employees of our franchisees at our franchised hotels. |

Within this Annual Report on Form 10-K, we reference information and statistics regarding the hotel industry and various segments within such industry. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources. Smith Travel Research (“STR”) is the primary source for third-party market data and industry statistics. STR does not guarantee the performance of any company about which it collects and provides data. Nothing in the STR data should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of internal surveys and independent sources. We believe that these external sources and estimates are reliable, but have not independently verified them.

RevPAR Index, which measures a hotel’s fair market share of its competitive set’s revenue per available room, is stated as a percentage and is calculated for a hotel by comparing the hotel’s RevPAR to the aggregate RevPAR of a group of competing hotels generally in the same market (referred to as a “competitive set”); and when presented for a group of hotels is a weighted average of the individual hotel results. The manager for each of our owned hotels and each franchisee exercises discretion, subject to (i) adherence to certain guidelines published by STR and described below and (ii) review by La Quinta management to ensure system-wide consistency, in identifying the competitive set of properties for each such hotel. They consider such factors as physical proximity, competition for similar customers, services and amenities, quality and average daily rate, with location being the most significant factor. Competitive set makeup is initially determined when a new hotel enters our system and is reviewed for continuing appropriateness as non-La Quinta hotels enter and leave our markets. Each La Quinta hotel’s competitive set complies with the

3

following four STR published guidelines, each of which places limitations on properties that may be included in a competitive set: (1) each competitive set must include a minimum of three participating properties, in addition to the subject property; (2) no single property or brand can account for more than 40% of the total participating room supply of a competitive set, excluding the rooms of the subject property; (3) no single company can account for more than 60% of the total participating room supply of a competitive set, excluding the rooms of the subject property; and (4) each competitive set must include a minimum of two companies other than that of the subject property. We may include certain competitors in a hotel property’s competitive set and those competitors may or may not include our hotel in their competitive set. We provide, for each La Quinta hotel, our proposed competitive set to STR for publication. STR confirms that each proposed competitive set complies with their published guidelines and then uses that information, along with ADR and RevPAR for each such hotel (which ADR and RevPAR may be calculated differently than we or our competitors do for internal purposes) to calculate RevPAR Index. STR calculates RevPAR Index for the current period and prior periods based on the competitive sets existing as of the date of the STR report for the current period of such report. Accordingly, our future filings may disclose historical RevPAR Index for prior periods that differ from those disclosed in this Annual Report on Form 10-K.

PART I

Overview

Our system-wide portfolio, as of December 31, 2016, consisted of 888 hotels representing approximately 87,200 rooms located predominantly in 48 states across the U.S., as well as in Canada, Mexico, Honduras and Colombia, of which 322 hotels were owned and operated and 566 were franchised. We also have a pipeline of 248 franchised hotels as of December 31, 2016, to be located in the United States, Mexico, Colombia, Nicaragua, Guatemala, Chile and El Salvador (90% of which represents new construction as opposed to the conversion of an existing hotel).

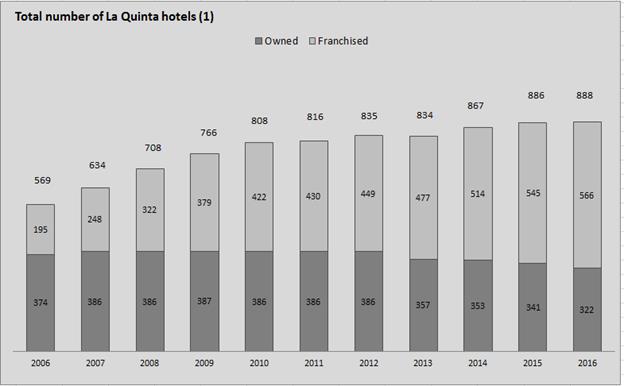

As illustrated by the following table, from 2006 to December 31, 2016, we have grown our total number of owned and franchised hotels worldwide from 569 properties to 888 properties.

|

(1) |

Information as of last day of each fiscal year presented. Certain of our owned hotels were previously operated by us as non-La Quinta hotels and are not included in this table until such time as they were converted to La Quinta-branded hotels. From the Acquisition (defined below) through December 31, 2016 and primarily in 2006, we converted 128 such hotels. |

4

La Quinta was founded in San Antonio, Texas in 1968 and has a 48-year history of owning and operating hotels. From 1973 to January 2006, we operated through our predecessors as a public company. In January 2006, we were acquired by Blackstone (the “Acquisition”). At the time of the Acquisition, we had a total of 425 hotels, of which 267 were owned hotels and 158 were franchised hotels. Since the Acquisition and through December 31, 2016, we expanded our franchise system by over three times, growing from 158 franchised hotels to 566 franchised hotels. We also established a franchise presence in Mexico, Central America and South America, with 38 hotels either open or in the pipeline in those regions.

Our brand and hotels

We operate our business across two segments: owned hotels and franchise and management. These segments are components of the business which are managed discretely and for which discrete financial information is reviewed regularly by our CEO, who is our chief operating decision maker, to assess performance and make decisions regarding the allocation of resources. For more information regarding our segments, see “Part II—Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 18: “Segments” in our audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K.

The table below sets forth the number of hotels and rooms as of December 31, 2016:

|

|

|

Owned |

|

|

Franchised |

|

|

Total |

|

|||||||||||||||

|

|

|

# of hotels |

|

|

# of rooms |

|

|

# of hotels |

|

|

# of rooms |

|

|

# of hotels |

|

|

# of rooms |

|

||||||

|

Texas |

|

|

70 |

|

|

|

9,441 |

|

|

159 |

|

|

|

11,746 |

|

|

229 |

|

|

|

21,187 |

|

||

|

Florida |

|

|

50 |

|

|

|

6,125 |

|

|

|

23 |

|

|

|

2,062 |

|

|

|

73 |

|

|

|

8,187 |

|

|

California |

|

|

21 |

|

|

|

3,127 |

|

|

|

36 |

|

|

|

3,179 |

|

|

|

57 |

|

|

|

6,306 |

|

|

Georgia |

|

|

14 |

|

|

|

1,696 |

|

|

|

24 |

|

|

|

1,866 |

|

|

|

38 |

|

|

|

3,562 |

|

|

Louisiana |

|

|

13 |

|

|

|

1,796 |

|

|

|

17 |

|

|

|

1,103 |

|

|

|

30 |

|

|

|

2,899 |

|

|

Colorado |

|

|

15 |

|

|

|

1,894 |

|

|

|

13 |

|

|

|

1,134 |

|

|

|

28 |

|

|

|

3,028 |

|

|

Tennessee |

|

|

8 |

|

|

|

988 |

|

|

|

19 |

|

|

|

1,495 |

|

|

|

27 |

|

|

|

2,483 |

|

|

Oklahoma |

|

|

2 |

|

|

|

236 |

|

|

|

23 |

|

|

|

1,695 |

|

|

|

25 |

|

|

|

1,931 |

|

|

Illinois |

|

|

8 |

|

|

|

1,097 |

|

|

|

10 |

|

|

|

876 |

|

|

|

18 |

|

|

|

1,973 |

|

|

New Mexico |

|

|

8 |

|

|

|

914 |

|

|

|

11 |

|

|

|

758 |

|

|

|

19 |

|

|

|

1,672 |

|

|

Other states |

|

|

113 |

|

|

|

13,922 |

|

|

|

219 |

|

|

|

18,676 |

|

|

|

332 |

|

|

|

32,598 |

|

|

United States Total |

|

|

322 |

|

|

|

41,236 |

|

|

|

554 |

|

|

|

44,590 |

|

|

|

876 |

|

|

|

85,826 |

|

|

Mexico |

|

|

— |

|

|

|

— |

|

|

|

8 |

|

|

|

1,132 |

|

|

|

8 |

|

|

|

1,132 |

|

|

Canada |

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

133 |

|

|

|

2 |

|

|

|

133 |

|

|

Honduras |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

110 |

|

|

|

1 |

|

|

|

110 |

|

|

Colombia |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

82 |

|

|

|

1 |

|

|

|

82 |

|

|

Total |

|

|

322 |

|

|

|

41,236 |

|

|

|

566 |

|

|

|

46,047 |

|

|

|

888 |

|

|

|

87,283 |

|

We own our owned hotels through wholly owned subsidiaries except for one hotel, which is owned by a joint venture in which we own a controlling interest. Generally, our owned hotels include the land, related easements and rights, buildings, improvements, furniture, fixtures and equipment, though certain of our owned hotels are located on land leased by us pursuant to ground leases with third parties.

We own, operate and franchise all of our hotels under the La Quinta Inn, La Quinta Inn & Suites and LQ Hotel trademarks. As of December 31, 2016, the hotels in our system consisted of 673 La Quinta Inn & Suites hotels, which include guest suites and are generally our newer hotels with interior corridors, 205 La Quinta Inns, 110 of which include interior corridors and 10 LQ Hotels, which is the primary trademark under which our hotels are identified in Mexico and Central and South America. When STR’s price points by segment are applied to each of our hotels, approximately 31% would be considered upper-midscale, approximately 51% would be considered midscale, approximately 8% would be considered economy (principally our owned hotels) and the balance would be considered in the segments above upper-midscale. We are focused on providing clean and comfortable guest rooms at affordable prices in convenient locations. Our hotels typically include common areas with amenities such as a great room (including breakfast seating area, lobby with seating area and business center), swimming pool and vending areas, and typically offer a complimentary breakfast. Our guest mix includes both business and leisure travelers. As of December 31, 2016, the hotels in our owned portfolio have an average age of 28 years, and the hotels in our franchise portfolio have an average age of 14 years, with over 30% being in our system less than five years.

Current designs for new La Quinta hotels are typically four story structures and approximately 56,900 square feet with approximately 85 to 120 interior corridor guest rooms. International La Quinta hotels generally also include expanded breakfast offerings, full-service restaurants and between 85 and 165 rooms. Certain of our owned hotels are larger than our typical design. For

5

example, our hotel in downtown Chicago, which was converted from office space to a La Quinta-branded hotel in 2009, is approximately 141,000 square feet with 241 guest rooms. All new franchised hotels are La Quinta Inn & Suites in the U.S., and Canada. Franchised hotels in Mexico, Central and South America, use the “LQ Hotel” as the primary mark.

At both our La Quinta Inn & Suites and La Quinta Inn hotels in the U.S. and Canada, our guests typically have convenient access to food service at nearby freestanding restaurants, which include many national chains. We own approximately 60 buildings that are adjacent to some of our owned hotels, which we generally lease to third party restaurant operators.

We regularly repair and maintain our owned hotels, and annually review each hotel to assess the need for renovations based on asset condition. Maintenance and renovation capital expenditures are comprised of repair and maintenance in ordinary course operations, customary cycle renovations and ongoing maintenance of our technology infrastructure in order to keep it current. Customary cycle renovations can range from design renovations to full renovations and can include, among other things, replacement of mattresses, seating, fixtures or carpet, repainting, window treatments and improvements in the common areas. We maintain a variety of designs and décor scheme options for our rooms and select the room scheme for a given hotel’s cycle renovation based on market factors and our review of the optimal return for the capital invested.

On an ongoing basis, we evaluate additional capital projects such as accelerating renovation cycles for our owned hotels as well as investing in technology innovation that enhances our guest experience, and we will invest in those projects that we believe will provide an appropriate return on capital invested and increase RevPAR Index. In 2016, we undertook a review of our owned hotel portfolio to identify properties that, with the appropriate scope of capital investment and renovation, have the opportunity to re-position upwards within a market, capturing occupancy and additional rate while being measured against new, higher-quality competitive sets. Renovations of approximately 50 properties identified in this review commenced in the fourth quarter of 2016. For additional information, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations―Key components and factors affecting our results of operations―Revenues.”

In addition, our franchise agreements allow us to require franchised hotels to replace furnishings every five to seven years and require upgrades to meet then-current brand standards at any time, but under these agreements, we may not require substantial upgrading or remodeling more often than once every five years.

We continually evaluate our owned hotel portfolio and, from time to time, we may sell certain hotels or groups of hotels that we determine are not consistent with our overall brand experience. In 2016, as part of a strategic review of our owned hotel portfolio, we identified approximately 50 hotels as candidates for sale and entered into agreements to sell six of those hotels, three of which were sold during 2016. Also in 2016 we entered into agreements to sell five additional owned hotels, three of which were sold during 2016 and two of which were sold subsequent to 2016 year-end. In 2015, we conducted a review of our portfolio of owned hotels and subsequently entered into a definitive purchase and sale agreement for 24 of our owned hotels, 11 of which were sold in the fourth quarter of 2015 and the remaining 13 were sold throughout 2016.

6

The following table summarizes our key operating statistics for our owned, franchised and managed hotels for the past five years (1):

|

|

|

As of and for the year ended December 31, |

|

|||||||||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

|||||

|

Number of Hotels in Operation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Owned Hotels(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

La Quinta Inn & Suites (interior corridor) |

|

|

180 |

|

|

|

183 |

|

|

|

184 |

|

|

|

184 |

|

|

|

185 |

|

|

La Quinta Inn & Suites (exterior corridor) |

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

|

3 |

|

|

La Quinta Inns (interior corridor) |

|

|

46 |

|

|

|

51 |

|

|

|

56 |

|

|

|

56 |

|

|

|

56 |

|

|

La Quinta Inns (exterior corridor) |

|

|

93 |

|

|

|

104 |

|

|

|

110 |

|

|

|

114 |

|

|

|

142 |

|

|

Total Owned |

|

|

322 |

|

|

|

341 |

|

|

|

353 |

|

|

|

357 |

|

|

|

386 |

|

|

Franchised/Managed Hotels |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

La Quinta Inn & Suites (interior corridor) |

|

|

486 |

|

|

|

459 |

|

|

|

417 |

|

|

|

373 |

|

|

|

349 |

|

|

La Quinta Inn & Suites (exterior corridor) |

|

|

4 |

|

|

|

3 |

|

|

|

3 |

|

|

|

5 |

|

|

|

3 |

|

|

La Quinta Inns (interior corridor) |

|

|

64 |

|

|

|

77 |

|

|

|

84 |

|

|

|

89 |

|

|

|

92 |

|

|

La Quinta Inns (exterior corridor) |

|

|

2 |

|

|

|

4 |

|

|

|

10 |

|

|

|

10 |

|

|

|

5 |

|

|

LQ Hotel (interior corridor) (2) |

|

|

10 |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total Franchised/Managed |

|

|

566 |

|

|

|

545 |

|

|

|

514 |

|

|

|

477 |

|

|

|

449 |

|

|

Total |

|

|

888 |

|

|

|

886 |

|

|

|

867 |

|

|

|

834 |

|

|

|

835 |

|

|

Occupancy Percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Owned Hotels |

|

|

65.5 |

% |

|

|

67.0 |

% |

|

|

66.5 |

% |

|

|

64.4 |

% |

|

|

62.7 |

% |

|

Franchised/Managed Hotels |

|

|

67.7 |

% |

|

|

68.2 |

% |

|

|

67.3 |

% |

|

|

64.3 |

% |

|

|

62.8 |

% |

|

Total |

|

|

66.5 |

% |

|

|

67.5 |

% |

|

|

66.8 |

% |

|

|

64.4 |

% |

|

|

62.7 |

% |

|

Average Daily Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Owned Hotels |

|

$ |

84.68 |

|

|

$ |

82.05 |

|

|

$ |

78.81 |

|

|

$ |

75.09 |

|

|

$ |

70.55 |

|

|

Franchised/Managed Hotels |

|

$ |

92.99 |

|

|

$ |

91.08 |

|

|

$ |

88.33 |

|

|

$ |

84.96 |

|

|

$ |

81.80 |

|

|

Total |

|

$ |

88.73 |

|

|

$ |

86.21 |

|

|

$ |

83.02 |

|

|

$ |

79.46 |

|

|

$ |

75.21 |

|

|

RevPAR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Owned Hotels |

|

$ |

55.44 |

|

|

$ |

54.95 |

|

|

$ |

52.40 |

|

|

$ |

48.36 |

|

|

$ |

44.21 |

|

|

Franchised/Managed Hotels |

|

$ |

62.92 |

|

|

$ |

62.15 |

|

|

$ |

59.41 |

|

|

$ |

54.61 |

|

|

$ |

51.37 |

|

|

Total |

|

$ |

59.03 |

|

|

$ |

58.23 |

|

|

$ |

55.48 |

|

|

$ |

51.14 |

|

|

$ |

47.17 |

|

|

|

(1) |

This table treats the Previously Managed Portfolio as “Company Owned Hotels.” See “Basis of Presentation in this Annual Report on Form 10-K.” |

|

|

(2) |

During the second quarter of 2016, we converted all Mexico locations to the “LQ Hotel” trademark as the primary hotel identifier, with the “La Quinta” tag line. |

In addition, we have an active advisory Brand Council that includes both Company and franchisee representation and meets three to four times a year to discuss ways to strengthen our brand. Franchise representatives are elected from their geographical areas. Through the Brand Council, we often test new concepts at both owned and franchised hotels.

Our owned hotel operations

Centralized corporate services for our owned hotels include marketing, global and regional sales, revenue management, accounting, finance, treasury, tax, information systems, construction and design, purchasing, legal, risk management, human resources and training. During 2016, we reorganized our Owned Hotels leadership to include new levels of field leadership support to provide additional operational leadership to our general managers. These regional and district managers are responsible for the oversight of day-to-day owned hotel operations, on-site guest experience, and certain regional and local financial and other operational metrics for their assigned hotels and areas.

Each owned hotel is operated as an individual profit center, generally with an on-site general manager who oversees all day-to-day operations. Our general managers focus their attention on delivering our “Here For You” guest experience, maintaining clean and comfortable guest rooms and achieving profitable operations. Their responsibilities also include recruiting, training and supervising the hotel’s staff. A typical owned hotel has approximately 20 to 25 employees, including the general manager, housekeepers, laundry attendants, maintenance staff, front desk guest service representatives and a night auditor. We also utilize assistant managers to support the general managers at certain hotels, which provides a pool of experienced candidates to fill open general manager positions as needed.

7

Our general managers receive a comprehensive five-week training program through LQUniversity, our nationally recognized training and development program. Our team of trainers has both training and operational experience. LQUniversity offers comprehensive training solutions to enable our owned hotels to operate more successfully and deliver on our “Here For You” guest experience. Many of these same programs are made available to franchisees.

We use target-driven operational budgets, prepared by our general managers, that are deployed after review with our senior management. Under the direction of our revenue management team, the hotel general managers, field leadership team and senior management continually review our room rates and price rooms into the demand curve based on the prevailing market conditions at each owned hotel. Each general manager can earn financial incentives based upon achieving favorable results in comparison to revenue and profit targets and upon achieving targeted goals in their RevPAR Index and Net Promoter scores for their respective hotel. Our Net Promoter score, which measures a guest’s intent to recommend our brand, is calculated through guest satisfaction surveys that are conducted by an independent market research company. These surveys provide guest feedback on each of our hotels. Financial incentives reward our general managers for improvements in Net Promoter scores which are indicative of guest satisfaction levels. From time to time, we may adjust the labor model at specific hotels in order to help ensure consistent delivery of our guest experience. We believe this operating model and incentive program increase our general managers’ focus on operating efficient, well-maintained and profitable hotels and on delivering a “Here For You” guest experience.

Our franchising operations

Our franchising activities include franchising both newly constructed hotels and existing hotels converted to meet our brand standards. La Quinta Inn & Suites represents the current standard for La Quinta in the United States and Canada and has largely been the exclusive focus of franchise growth since 2007. Franchised hotels in Mexico, Central, and South America utilize the LQ Hotel primary trademark. As of December 31, 2016, there were 566 open and operating franchised La Quinta lodging facilities in the United States, Canada, Mexico, Honduras and Colombia and a pipeline of 248 locations, each represented by an executed franchise agreement. Twenty-eight of these properties are to be located in Mexico, Colombia, Nicaragua, Guatemala, Chile and El Salvador. The remaining properties are to be located throughout the United States, with 69 in Texas, 16 in Florida, 15 in California, 14 in New York, and the remaining 106 properties dispersed among 29 other states.

Franchising sales

We believe that hotel owners and operators choose to become a franchisee of a lodging brand based primarily on the perceived value and quality of that brand and the franchisor’s services, and the extent to which affiliation with that franchisor may increase the franchisee’s profitability. Because a significant portion of the costs of owning and operating a hotel are generally fixed, increases in revenues generated by affiliation with a franchise lodging chain can improve a hotel’s financial performance. We offer our franchisees our strong brand awareness supported by well-developed infrastructure that includes reservation, national advertising, training and systems-related services.

Franchising agreements and fees

A prospective franchisee is required to pay us a nonrefundable application fee of $5,000 when an application is made for a La Quinta franchise. We evaluate franchise applicants on the basis of their hotel operating experience and ability, financial resources strength and credit history, among other factors. Our current form of franchise agreement provides that approved franchise applicants will pay us an initial fee of $55,000, against which the application fee is credited, for up to 100 authorized guest rooms, plus $550 per guest room over 100. Historically, we have modified this initial fee to adapt to differing circumstances, such as the size and type of hotel facility, the location of the hotel site, and the experience and creditworthiness of the applicant. During our fiscal year ended December 31, 2016, franchisees were charged initial fees up to $59,400. For certain of these agreements, the Company determined that the circumstances warranted waiving the initial fee in its entirety. Additionally, a franchisee may expand the number of guest rooms in a hotel with our approval, which generally requires payment of the then-standard per room initial fee per guest room. A franchisee may also transfer ownership of a hotel with our approval, which may require payment of a transfer fee.

Approved franchise applicants are granted rights (subject to the terms of their franchise agreement) to operate their hotels under our trademarks and system, to obtain reservations through our central reservation system and to use our hotel designs, operating systems and procedures, among other rights. Our franchise agreements generally restrict our ability to open a new owned or franchised hotel in a limited area near the franchised hotel, which can range from several city blocks in an urban area to several square miles in less populated areas.

Our franchise agreements for existing franchised hotels in the United States generally require a franchisee to pay a royalty fee of 4.0% of gross room revenues (as defined in the franchise agreement) during the first two years of operating under our brand and 4.5% of gross room revenues for all periods thereafter. Our current form of franchise agreement for newly franchised hotels in the United States requires a franchisee to pay a royalty fee of 4.5% of gross room revenues during the first two years of operating under our brand

8

and 5.0% of gross room revenues for all periods thereafter. After the first two years, a U. S. franchisee can receive a rebate of 0.5% of gross room revenues if, in any calendar year, the franchised hotel achieves superior results in guest satisfaction as measured and defined by results of surveys conducted by an independent market research firm. However, our current form of franchise agreement for newly franchised hotels outside of the United States does not include a royalty fee ramp up or rebates for guest satisfaction results. In addition to royalty fees, a franchisee generally pays, as a percentage of gross room revenues, a marketing fee of 2.5% for brand advertising and other promotional efforts and a reservation fee of 2.0% to support the cost of reservation services provided to the hotels. Franchisees also pay us other fees, such as fees to participate in our online LQConnect intranet, computer related fees, attend training programs and participate in our La Quinta Returns program. We also provide franchisees the option to purchase revenue management services for their hotel, at fees ranging from $800 to $5,000 per month depending on the size of the hotel and services provided.

Our franchise agreements generally have an initial term of 20 years, and, as of December 31, 2016, the average remaining term of our existing franchise contracts for open locations was approximately 14 years. We, and the franchisee, generally have a right to terminate the agreement on the tenth and fifteenth anniversary of the opening date of the franchised hotel and, if the hotel was converted from a competing brand, additionally on the fifth such anniversary. The franchisee may also terminate the agreement if the hotel is not meeting predetermined occupancy levels, which may, under certain circumstances, require payment of specified termination fees to us. Additionally, we have the right to terminate a franchise agreement if a franchisee fails to meet our quality standards or fulfill other contractual obligations, which may, under certain circumstances, require payment by the franchisee of specified liquidated damages to us. Since the inception of our franchising program, excluding temporary franchised locations, we have retained approximately 82% of our franchise properties and the majority of the terminations were initiated by us. During the fiscal year ended December 31, 2016, 25 franchise agreements for open locations terminated. Seventeen of these terminations were initiated by us, seven were initiated by the franchisee, and one expired by its terms. In addition, we had four temporary franchise agreements that terminated. The temporary franchise agreements were provided to owners of disposition properties (who were given the option to continue using the La Quinta brand while they transitioned to a new brand) which expired by their terms or were mutually terminated.

Franchising operations support

As of December 31, 2016, the average size of our franchised hotels is approximately 81 rooms. Before a franchised hotel opens, we inspect the hotel to confirm that it meets our quality specifications. Once a franchised hotel opens, we strive to provide continued sales support and operational assistance. Each franchised hotel must adhere to rigorous brand standards of design, maintenance and guest service and is inspected periodically by a franchise service director to assure that the franchised hotel adheres to our brand standards. Competition for franchise agreements, however, may require us to reduce the level of hotel improvements required for a particular hotel.

Financial assistance and incentives to new franchisees

We do not presently have a company-funded financial assistance program for franchisees. However, on occasion we have provided, and at our discretion may occasionally provide in the future, franchisees with various forms of financial incentives or assistance upon varying terms, depending upon a number of factors. These factors include: the number of hotels involved and their locations, the number of rooms involved, relevant market conditions and other factors that may warrant providing financial incentives or assistance.

Our pipeline

As of December 31, 2016, we had a pipeline of 248 future franchised hotels, representing approximately 23,100 rooms. Each hotel in our pipeline is represented by an executed 20-year franchise agreement. Ninety percent of our pipeline represents new construction and the remaining 10% represents the conversion of an existing hotel into a La Quinta-branded hotel. As of December 31, 2016, approximately 29% of the new construction and conversion of hotels in our pipeline had commenced. However, based on historical experience, while converted hotels in our pipeline can generally become operational between 12 to 18 months from the date of execution of the franchise agreement, and newly constructed hotels in our pipeline can generally become operational between 36 to 48 months from the date of execution of the franchise agreement, openings may be delayed, or abandoned, due to economic conditions, weather, construction and permit delays and other factors. Moreover, the commitments of owners and developers with whom we have agreements are subject to numerous conditions, and the eventual development and construction of our pipeline not currently under construction is subject to numerous risks, including, in certain cases, the ability of the franchisee to obtain governmental and regulatory approvals and adequate financing.

Additionally, because revenues from franchised hotels are principally derived from franchise fees rather than room rentals, as we grow our system by increasing the number of franchised hotels, our revenues and expenses will increase at a significantly slower rate than if we were growing our system through an increase in number of owned hotels.

9

As of December 31, 2014, 2015 and 2016 our pipeline numbered 207, 228 and 248 future franchised hotels, respectively. The size of our pipeline is a function of both the number of new agreements signed and the pace of opening hotels in the pipeline and, accordingly, will fluctuate over time. Moreover, we periodically evaluate our pipeline to determine whether to terminate any contracts and/or seek new franchisees in any particular locations. We opened 23% of the hotels in our pipeline as of the end of 2014 in 2015 and 18% of the hotels in our pipeline as of the end of 2015 in 2016.

Our mission

We are guided by two primary goals that we believe contribute to a high level of employee and guest engagement:

1. Live our core values, which are defined by our people:

|

|

• |

People : People are the heart of everything we do. Make coming to work the best part of their day. Treat everyone with respect. |

|

|

• |

Passion : Approach each work day with a sense of ownership and personal pride. Always do “whatever it takes.” |

|

|

• |

Integrity : Always do the right thing, even when no one is watching. |

|

|

• |

Excellence : Do ordinary things extraordinarily well. Good is not good enough; strive for the best in all you do. |

|

|

• |

Unique : La Quinta is big but acts small. We are not afraid to be different. |

2. Delight our guests with an experience that makes them feel:

|

|

• |

Assured : Secure, confident they made the right choice with La Quinta. |

|

|

• |

Settled in : Comfortable, relaxed in their surroundings. |

|

|

• |

Optimistic : Ready to take on the new day—whatever it holds. |

Our two goals can be summarized using a single phrase—“Here For You.” It is not a program or a slogan, but a way of life at La Quinta that is built upon the purpose and core values that guide us. Our values are delivered by people who have a unique passion to enhance our guests’ experience and create enduring relationships by striving for excellence and serving with integrity every day. “Here For You” creates meaningful and differentiated experiences that are uniquely La Quinta and provides us with a powerful business advantage. “Here For You” provides valuable insight into not only what motivates our team members and drives them to perform and innovate; it also helps to inform our strategies through a better understanding of guest preferences which drives business results.

Our marketing operation

Brand marketing . We implement a brand marketing strategy by using consumer insight studies and guest feedback. Our strategy to reach and influence our marketplace is shaped by our goals to:

|

|

• |

drive brand awareness and perception that will generate first-time and repeat bookings and loyalty; |

|

|

• |

focus communications and media on the most relevant guest segment to increase revenue and penetration over our competitive market segment; |

|

|

• |

deliver on our distinctive positioning via break-through advertising; |

|

|

• |

create brand differentiation through guest insight and innovation; and |

|

|

• |

support and evolve our “Here For You” guest experience. |

The La Quinta brand is promoted through national, regional and local marketing. We advertise our brand on television through national cable and spot TV as well as national network radio, on the web through online advertising, social media, search marketing and email campaigns and in print through newspapers and magazines. We also conduct direct marketing to potential and former guests, including La Quinta Returns members. Our marketing is primarily supported through fee contributions, calculated as a percentage of gross room revenues, from our owned and franchised hotels to our marketing programs, including La Quinta Returns and the Brand Marketing Fund (“BMF”).

Our international marketing efforts are intended to reinforce general brand awareness while targeting local market needs. With eight hotels opened in Mexico, a portion of the fees paid to the BMF by Mexico franchisees will be devoted to a Mexico marketing program.

10

We have also launched a system-wide military initiative that supports hiring of military veterans, community outreach, franchise growth, sourcing and La Quinta Returns loyalty program tiers geared towards the military community.

La Quinta Returns. As of December 31, 2016, we had over 13 million members in our La Quinta Returns loyalty program, approximately three million of which we consider active members (which generally refers to our loyalty program members who earn or redeem La Quinta Returns points within the previous 18 months). We believe our loyalty program is favored by our members because of:

|

|

• |

rapid accumulation of rewards, including free nights at La Quinta locations, free nights at thousands of resort properties worldwide, airline miles and credits, magazine subscriptions, and gift cards from national restaurant chains and retailers; |

|

|

• |

rapid achievement of Gold and Elite status, after as few as 10 nights in a calendar year; |

|

|

• |

instant Gold status for military personnel and their families and for our La Quinta Returns Visa Card Holders; and |

|

|

• |

ability for Visa Card Holders to redeem their La Quinta Returns points anytime using their mobile phones for everyday purchases at over one million U.S. retail locations, including places like grocery stores, restaurants and coffee shops. |

Our Returns program helps expedite the reservation and check-in process and improves administrative efficiency of our reservation agents and front desk staff by providing a personal profile of each Returns member. This profile includes information such as email and mailing address and preferred method of payment that we use to market directly to Returns members.

Our sales operation

Sales. As of December 31, 2016, we employed a direct sales force consisting of approximately 70 professionals. The direct sales force consists of approximately 35 global sales managers, funded by the BMF, who call on Fortune 500 companies and mid-tier businesses to increase our corporate travel base. For the year ended December 31, 2016, corporate accounts, including government and military accounts, generated approximately 24% of system-wide consumed room revenues. These accounts typically have a significant number of travelers in the regions in which we operate and need a high volume of room-nights. Global sales managers also seek to increase room sales through inclusion in approved or preferred lodging lists of corporate travel managers and travel agencies operating on a national basis. We also maintain and continue to seek alliances with national travel and consumer organizations, such as AAA and AARP, and offer special rates or promotions to such organizations’ guests. In addition to the global effort, approximately 32 of our sales managers, funded by our owned hotels, are based in our regional markets. These regional sales managers call on local businesses, governmental agencies, hospitals and other organizations that can generate room-nights for our hotels.

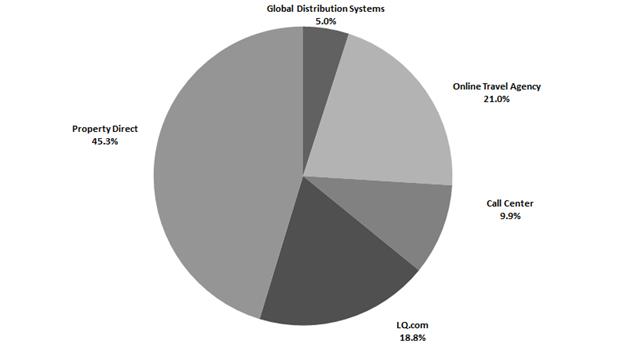

The following graph reflects the percentage of comparable system-wide consumed room revenues that is attributable to each of our internal and external distribution channels in 2016.

11

Property direct and call center. Property direct reservations are made by guests calling the property directly or “walking in” to the property without a previously made reservation. Our call center consists of our own central reservation system, as well as toll-free numbers to accept reservations. Our reservation system provides reservation agents with information about hotel locations, available rooms and prices in order to assist guests in reserving rooms. Our reservations agents are trained in telephone sales techniques. Through our computer network, we continually update the number of rooms sold at each hotel to maximize the sale of available rooms through either the individual hotel or the reservation center.

LQ internet & mobile (LQ.com). We provide guests with the ability to shop and reserve rooms on the Internet through our brand website, www.LQ.com, and through mobile via the La Quinta app and the LQ Instant Hold platform. The LQ Instant Hold feature (patent pending) permits our guests to use a mobile application to hold a room for up to four hours from any smart device by just entering a phone number. Our website and app provide guests with real-time information through hotel micro-sites that contain Trip Advisor scores, location, descriptions, amenities, special promotions, rates and availability for each La Quinta hotel. Hotel photographs are prominently displayed on the hotel information pages along with dynamic maps and driving directions, information on nearby attractions and local weather information. Multiple search options are offered, including searches by city, attraction, zip code and trip routing from origin or destination. Guests who book through www.LQ.com and our mobile site can also take advantage of our innovative and industry-leading Ready For YouTM option and receive a notice on their smart devices that their room is ready for check in.

Online travel agency and global distribution systems. In addition to our proprietary brand website, we distribute our lodging product via third party travel websites. We market our reservation services to both online and offline travel agents and corporate travel planners who may make reservations through global airline reservation distribution systems. We also have specialized reservation agents for large group sales, motor coach sales and special service bookings.

Our information systems

We have created an innovative technology deployment methodology that has enabled a collaborative environment where cross departmental business partners work very closely and effectively with technology teams and third parties to innovate, design and deploy technology-enabled improvements.

We employ an appropriate blend of in-house development of technology solutions and third-party best of breed software-as-a-service providers. We have also moved away from deployment of technology hosted at hotels and moved key systems such as hotel management systems, phone switches, back office, financials and HR functions to Cloud based environments, resulting in efficient and scalable IT operating and maintenance costs.

Our trademarks

All of the intellectual property used for La Quinta hotels is owned by La Quinta Worldwide, LLC, a wholly owned subsidiary of the Registrant. “La Quinta,” “LQ,” “Returns,” “LQ Hotel” and the sunburst Q symbol are our primary trademarks. Our primary trademarks and many secondary marks are registered in various combinations of word and logo marks with the U.S. Patent and Trademark Office (“USPTO”) and the trademark offices of various other countries for hotel and motel services and other trademark classes. In the United States, certain of our marks are subject to an agreement with the owner of a resort known as “La Quinta Resort & Club,” located in La Quinta, California. The agreement, among other things, geographically divides use of the trademark “La Quinta,” granting the resort owner the exclusive right to use the mark “La Quinta” in connection with facilities located within a 37 mile radius of the La Quinta Resort & Club, subject to certain exceptions, and the right to open three more facilities using certain of our marks, subject to certain exceptions, conditions and restrictions. As between the resort owner and us and our affiliates, we and our affiliates have the right to use the trademark in all other areas. The agreement is perpetual in duration.

Certain pending applications by us for registrations of variations of our primary marks, including certain logo forms, have been suspended by the USPTO pending resolution of litigation and related USPTO proceedings brought by us against the owners of a chain of hotels in Mexico called “Quinta Real.” After a trial on the merits in a federal court in Tucson in 2012, Quinta Real was generally prohibited from using the Quinta name to expand into the United States. The decision was appealed to the 9th Circuit U.S. Court of Appeals. In August 2014, the 9th Circuit U.S. Court of Appeals affirmed the finding of trademark infringement; however, the Court concluded that the district court did not provide a sufficient analysis balancing the equities in its decision to grant a permanent injunction and, therefore, remanded the case to district court for further analysis on that issue. The district court accepted additional evidence and legal arguments from the parties and in 2015 once again entered a permanent injunction in favor of La Quinta. Quinta Real appealed that decision. All briefs in the second appeal were filed and the 9th Circuit scheduled oral arguments in the case. Rather than proceed to oral argument, Quinta Real has dismissed its appeal and we have mutually dismissed the USPTO proceedings. The injunction has become permanent and we expect that the pending applications will ultimately proceed to registration.

We consider all of these trademarks and the associated name recognition to be important to our business.

12

Our employees

As a service-oriented business, our employees are important to our success. Recruiting for general managers and corporate office employees is coordinated through our corporate human resources department. All owned hotel employees, including hourly employees, receive training through LQUniversity when hired as well as ongoing training to improve their skills. Our online training system provides consistent and effective orientation, training and testing across our brand. Prior to assuming responsibility for a hotel, our general managers participate in a three-week training program that emphasizes operations, hospitality, rate management, legal and risk management issues, interviewing, employee relations, training and budgeting. Within 120 days of hire, new managers also attend a one-week training program which is conducted at the Company’s headquarters which is focused on reinforcing the core competencies of the position as well as delivering excellence in product and service quality.

We provide all of our full-time employees and their families, including hourly hotel employees, the opportunity to participate in a benefits package, which includes health, dental and vision coverage. We believe these benefits provide a competitive advantage in recruiting hourly hotel employees, as compared to competing select-service hotels. Our full-time employees are also able to earn financial incentives based on achieving targeted goals, such as RevPAR Index, profitability, Net Promoter scores and personal and departmental development goals. In addition, recognition programs have been established to acknowledge our employees’ outstanding service and achievement. We believe our scale and size also provide career opportunities for our employees to advance within the organization.

As of December 31, 2016, we employed 7,333 employees. Of these employees, 6,504 were full-time and 829 were part-time. Four hundred fifteen were employed as corporate associates and 6,918 were employed at our hotels. Our employees are not currently represented by labor unions, and we have never experienced an organized work stoppage. We believe that ongoing labor relations with our employees are good.

Competition

As of December 31, 2016 the U.S. hotel sector comprised approximately 54,580 hotels with approximately 5.1 million rooms. Of these rooms, approximately 70% were affiliated with a brand. The hotel industry is highly fragmented, with no one entity controlling a majority of hotel rooms in the U.S.

La Quinta is a select-service hotel brand that competes primarily against other select-service hotels in both the upper-midscale and the midscale segments, and we consider our main STR competitive set to be Comfort, Holiday Inn Express and Hampton. However, our owned and franchised hotels generally operate in markets that contain numerous competitors, including a wide range of lodging facilities offering full-service, select-service and all-suite lodging options. Hotels in other market segments, such as full-service hotels, may lower their rates to a level comparable to those of select-service hotels such as ours that, in turn, may further increase competitive pressure in our markets. Our owned and franchised hotels generally compete for guests on the basis of room rates, quality of accommodations, name recognition, service levels, convenience of locations and reward program offerings. We have also seen the emergence of a sharing economy with the increasing availability of online short term rentals. Additionally, an increasing supply of hotel rooms in La Quinta’s market segment, and consolidations in the lodging industry generally, have resulted in the creation of several large, multi-branded hotel chains with diversified operations and greater marketing and financial resources than we have, which has increased competition for guests in the markets in which our owned and franchised hotels operate.

We compete for franchise agreements based primarily on brand name recognition and reputation, the room rate that can be realized, royalty fees charged and other contract terms. Some of our competitors may have substantially greater marketing and financial resources, greater brand distribution and awareness and/or greater financial incentives than we do. Other competitive factors for franchise agreements include relationships with hotel owners and investors, including institutional owners of multiple hotels, availability and affordability of financing, marketing support, reservation and e-commerce system capacity and efficiency and the ability to make investments that may be necessary to obtain franchise agreements. The terms of our franchise agreements for each of our franchised hotels are also influenced by contract terms offered by our competitors, among other things. As a result, the terms of new franchise agreements in the future may not be as favorable as our existing franchise agreements. For example, competition may require us to reduce or change fee structures, make greater use of key money or provide other financial incentives such as loans and guarantees to franchisees and/or reduce the level of hotel improvements required to conform to brand standards. In addition, if the availability of suitable locations for new hotels decreases, planning or other local regulations change or the availability or affordability of financing is limited, the supply of suitable hotels for franchising could be diminished. Additionally, an excess supply of hotel rooms or unfavorable borrowing conditions may discourage potential franchisees from expanding or constructing new hotels, thereby limiting a source of growth of the franchise fees received by us. Our franchise agreements generally restrict our ability to open a new owned or franchised hotel in a limited area near the franchised hotel, which can range from several city blocks in an urban area to several square miles in less populated areas. If the hotels that we franchise perform less successfully than those of our competitors, if we are unable to offer terms as favorable as those offered by our competitors, or if the availability of suitable hotels is limited, our ability to compete effectively for new franchise agreements could be reduced.

13

We believe we compete effectively, and our competitive position is protected due to our strong brand, owner, operator and franchisor business model and experienced management team.

Seasonality and cyclicality