Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Service Properties Trust | ex991hptq416earningsrelease.htm |

| 8-K - 8-K - Service Properties Trust | hpt8-kq42016.htm |

All amounts in this report are unaudited.

Hospitality Properties Trust

Fourth Quarter 2016

Supplemental Operating and Financial Data

Courtyard Camarillo, Camarillo, CA

Operator: Marriott International, Inc.

Guest Rooms: 130

Exhibit 99.2

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

TABLE OF CONTENT

S

TABLE OF CONTENTS PAGE

CORPORATE INFORMATION 6

Company Profile 7,8

Investor Information 9

Research Coverage 10

FINANCIALS

Key Financial Data 12

Consolidated Balance Sheets 13

Consolidated Statements of Income (Loss) 14

Notes to Consolidated Statements of Income (Loss) 15

Consolidated Statements of Cash Flows 16

Debt Summary 17

Debt Maturity Schedule 18

Leverage Ratios, Coverage Ratios and Public Debt Covenants 19

FF&E Reserve Escrows 20

Property Acquisition and Disposition Information Since January 1, 2016 21

Calculation of EBITDA and Adjusted EBITDA 22

Calculation of Funds from Operations (FFO) and Normalized FFO Available for Common Shareholders 23

Non-GAAP Financial Measures Definitions 24

OPERATING AGREEMENTS AND PORTFOLIO INFORMATION

Portfolio by Operating Agreement and Manager 26

Portfolio by Brand 27

Operating Agreement Information 28-30

Operating Statistics by Hotel Operating Agreement and Manager 31

Coverage by Operating Agreement and Manager 32

2

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENT

S

3

THIS PRESENTATION OF SUPPLEMENTAL OPERATING AND FINANCIAL DATA CONTAINS STATEMENTS THAT CONSTITUTE FORWARD LOOKING STATEMENTS WITHIN THE

MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS “BELIEVE”, “EXPECT”,

“ANTICIPATE”, “INTEND”, “PLAN”, “ESTIMATE”, "WILL", “MAY” AND NEGATIVES OR DERIVATIVES OF THESE OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING

STATEMENTS. THESE FORWARD LOOKING STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, BUT FORWARD LOOKING STATEMENTS ARE NOT

GUARANTEED TO OCCUR AND MAY NOT OCCUR. FORWARD LOOKING STATEMENTS IN THIS REPORT RELATE TO VARIOUS ASPECTS OF OUR BUSINESS, INCLUDING:

• OUR HOTEL MANAGERS’ OR TENANTS’ ABILITIES TO PAY THE CONTRACTUAL AMOUNTS OF RETURNS OR RENTS DUE TO US,

• OUR ABILITY TO COMPETE FOR ACQUISITIONS EFFECTIVELY,

• OUR POLICIES AND PLANS REGARDING INVESTMENTS, FINANCINGS AND DISPOSITIONS,

• OUR ABILITY TO PAY DISTRIBUTIONS TO OUR SHAREHOLDERS AND THE AMOUNT OF SUCH DISTRIBUTIONS,

• OUR ABILITY TO RAISE DEBT OR EQUITY CAPITAL,

• OUR ABILITY TO APPROPRIATELY BALANCE OUR USE OF DEBT AND EQUITY CAPITAL,

• OUR INTENT TO MAKE IMPROVEMENTS TO CERTAIN OF OUR PROPERTIES AND THE SUCCESS OF OUR HOTEL RENOVATION PROGRAM,

• OUR ABILITY TO ENGAGE AND RETAIN QUALIFIED MANAGERS AND TENANTS FOR OUR HOTELS AND TRAVEL CENTERS ON SATISFACTORY TERMS,

• THE FUTURE AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY,

• OUR ABILITY TO PAY INTEREST ON AND PRINCIPAL OF OUR DEBT,

• OUR CREDIT RATINGS,

• THE ABILITY OF TRAVELCENTERS OF AMERICA LLC, OR TA, TO PAY CURRENT AND DEFERRED RENT AMOUNTS AND OTHER OBLIGATIONS DUE TO US,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF THE RMR GROUP INC., OR RMR INC.,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF AFFILIATES INSURANCE COMPANY, OR AIC, AND FROM OUR PARTICIPATION IN INSURANCE PROGRAMS

ARRANGED BY AIC,

• OUR QUALIFICATION FOR TAXATION AS A REAL ESTATE INVESTMENT TRUST, OR REIT, AND

• OTHER MATTERS.

OUR ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS

FACTORS. FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR FORWARD LOOKING STATEMENTS AND UPON OUR BUSINESS, RESULTS OF OPERATIONS,

FINANCIAL CONDITION, FUNDS FROM OPERATIONS, OR FFO, AVAILABLE FOR COMMON SHAREHOLDERS, NORMALIZED FFO AVAILABLE FOR COMMON SHAREHOLDERS,

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION, OR EBITDA, EBITDA AS ADJUSTED, OR ADJUSTED EBITDA, CASH FLOWS, LIQUIDITY AND PROSPECTS

INCLUDE, BUT ARE NOT LIMITED TO:

• THE IMPACT OF CHANGES IN THE ECONOMY AND THE CAPITAL MARKETS ON US AND OUR MANAGERS AND TENANTS,

• COMPETITION WITHIN THE REAL ESTATE, HOTEL, TRANSPORTATION AND TRAVEL CENTER INDUSTRIES, PARTICULARLY IN THOSE MARKETS IN WHICH OUR PROPERTIES

ARE LOCATED,

• COMPLIANCE WITH, AND CHANGES TO, FEDERAL, STATE AND LOCAL LAWS AND REGULATIONS AFFECTING THE REAL ESTATE, HOTEL, TRANSPORTATION AND TRAVEL

CENTER INDUSTRIES, ACCOUNTING RULES, TAX LAWS AND SIMILAR MATTERS,

• LIMITATIONS IMPOSED ON OUR BUSINESS AND OUR ABILITY TO SATISFY COMPLEX RULES IN ORDER FOR US TO QUALIFY FOR TAXATION AS A REIT FOR U.S. FEDERAL

INCOME TAX PURPOSES,

• ACTS OF TERRORISM, OUTBREAKS OF SO CALLED PANDEMICS OR OTHER MANMADE OR NATURAL DISASTERS BEYOND OUR CONTROL, AND

• ACTUAL AND POTENTIAL CONFLICTS OF INTEREST WITH OUR RELATED PARTIES, INCLUDING OUR MANAGING TRUSTEES, TA, SONESTA INTERNATIONAL HOTELS

CORPORATION, OR SONESTA, RMR INC., THE RMR GROUP LLC, OR RMR LLC, AIC AND OTHERS AFFILIATED WITH THEM.

WARNING CONCERNING FORWARD LOOKING STATEMENTS

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

FO

RW

ARD LOOKING S

TA

TEMENTS (continued

)

4

FOR EXAMPLE:

• OUR ABILITY TO MAKE FUTURE DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO MAKE PAYMENTS OF PRINCIPAL AND INTEREST ON OUR INDEBTEDNESS DEPENDS UPON

A NUMBER OF FACTORS, INCLUDING OUR FUTURE EARNINGS AND THE CAPITAL COSTS WE INCUR TO MAINTAIN OUR PROPERTIES AND OUR WORKING CAPITAL

REQUIREMENTS. WE MAY BE UNABLE TO PAY OUR DEBT OBLIGATIONS OR TO MAINTAIN OUR CURRENT RATE OF DISTRIBUTIONS ON OUR COMMON AND PREFERRED

SHARES AND FUTURE DISTRIBUTIONS MAY BE REDUCED OR ELIMINATED,

• THE SECURITY DEPOSITS WHICH WE HOLD ARE NOT IN SEGREGATED CASH ACCOUNTS OR OTHERWISE SEPARATE FROM OUR OTHER ASSETS AND LIABILITIES.

ACCORDINGLY, WHEN WE RECORD INCOME BY REDUCING OUR SECURITY DEPOSIT LIABILITIES, WE DO NOT RECEIVE ANY ADDITIONAL CASH PAYMENT. BECAUSE WE DO

NOT RECEIVE ANY ADDITIONAL CASH PAYMENT AS WE APPLY SECURITY DEPOSITS TO COVER PAYMENT SHORTFALLS, THE FAILURE OF OUR MANAGERS OR TENANTS TO

PAY MINIMUM RETURNS OR RENTS DUE TO US MAY REDUCE OUR CASH FLOWS AND OUR ABILITY TO PAY DISTRIBUTIONS TO SHAREHOLDERS,

• AS OF DECEMBER 31, 2016, APPROXIMATELY 79% OF OUR AGGREGATE ANNUAL MINIMUM RETURNS AND RENTS WERE SECURED BY GUARANTEES OR SECURITY

DEPOSITS FROM OUR MANAGERS AND TENANTS. THIS MAY IMPLY THAT THESE MINIMUM RETURNS AND RENTS WILL BE PAID. IN FACT, CERTAIN OF THESE GUARANTEES

AND SECURITY DEPOSITS ARE LIMITED IN AMOUNT AND DURATION AND ALL THE GUARANTEES ARE SUBJECT TO THE GUARANTORS’ ABILITY AND WILLINGNESS TO PAY.

THE BALANCE OF OUR ANNUAL MINIMUM RETURNS AND RENTS AS OF DECEMBER 31, 2016 WAS NOT GUARANTEED NOR DO WE HOLD A SECURITY DEPOSIT WITH

RESPECT TO THOSE AMOUNTS. WE CANNOT BE SURE OF THE FUTURE FINANCIAL PERFORMANCE OF OUR PROPERTIES AND WHETHER SUCH PERFORMANCE WILL

COVER OUR MINIMUM RETURNS AND RENTS, WHETHER THE GUARANTEES OR SECURITY DEPOSITS WILL BE ADEQUATE TO COVER FUTURE SHORTFALLS IN THE MINIMUM

RETURNS OR RENTS DUE TO US, OR REGARDING OUR MANAGERS’, TENANTS’ OR GUARANTORS’ FUTURE ACTIONS IF AND WHEN THE GUARANTEES AND SECURITY

DEPOSITS EXPIRE OR ARE DEPLETED OR THEIR ABILITY OR WILLINGNESS TO PAY MINIMUM RETURNS AND RENTS OWED TO US,

• WE HAVE RECENTLY RENOVATED CERTAIN HOTELS AND ARE CURRENTLY RENOVATING ADDITIONAL HOTELS. WE EXPECT TO FUND APPROXIMATELY $63.2 MILLION FOR

RENOVATIONS AND OTHER CAPITAL IMPROVEMENT COSTS AT OUR HOTELS DURING 2017. THE COST OF CAPITAL PROJECTS ASSOCIATED WITH SUCH RENOVATIONS MAY

BE GREATER THAN WE NOW ANTICIPATE. WHILE OUR FUNDING OF THESE CAPITAL PROJECTS WILL CAUSE OUR CONTRACTUAL MINIMUM RETURNS TO INCREASE, THE

HOTELS’ OPERATING RESULTS MAY NOT INCREASE OR MAY NOT INCREASE TO THE EXTENT THAT THE MINIMUM RETURNS INCREASE. ACCORDINGLY, COVERAGE OF OUR

MINIMUM RETURNS AT THESE HOTELS MAY REMAIN DEPRESSED FOR AN EXTENDED PERIOD,

• WE EXPECT TO PURCHASE FROM TA DURING 2017 UP TO $80.7 MILLION OF CAPITAL IMPROVEMENTS TA EXPECTS TO MAKE TO THE TRAVEL CENTERS WE LEASE TO TA.

PURSUANT TO THE TERMS OF THE APPLICABLE LEASES, THE ANNUAL RENT PAYABLE TO US BY TA WILL INCREASE AS A RESULT OF ANY SUCH PURCHASES. WE MAY

ULTIMATELY PURCHASE MORE OR LESS THAN THIS BUDGETED AMOUNT. TA MAY NOT REALIZE RESULTS FROM ANY OF THESE CAPITAL IMPROVEMENTS WHICH EQUAL OR

EXCEED THE INCREASED ANNUAL RENTS IT WILL BE OBLIGATED TO PAY TO US, WHICH COULD INCREASE THE RISK OF TA BEING UNABLE TO PAY AMOUNTS DUE TO US,

• HOTEL ROOM DEMAND AND TRUCKING ACTIVITY ARE OFTEN REFLECTIONS OF THE GENERAL ECONOMIC ACTIVITY IN THE COUNTRY AND IN THE GEOGRAPHICAL AREAS

WHERE OUR HOTELS ARE LOCATED. IF ECONOMIC ACTIVITY IN THE COUNTRY DECLINES, HOTEL ROOM DEMAND AND TRUCKING ACTIVITY MAY DECLINE AND THE

OPERATING RESULTS OF OUR HOTELS AND TRAVEL CENTERS MAY DECLINE, THE FINANCIAL RESULTS OF OUR HOTEL MANAGERS AND OUR TENANTS, INCLUDING TA, MAY

SUFFER AND THESE MANAGERS AND TENANTS MAY BE UNABLE TO PAY OUR RETURNS OR RENTS. ALSO, DEPRESSED OPERATING RESULTS FROM OUR PROPERTIES FOR

EXTENDED PERIODS MAY RESULT IN THE OPERATORS OF SOME OR ALL OF OUR HOTELS AND OUR TRAVEL CENTERS BECOMING UNABLE OR UNWILLING TO MEET THEIR

OBLIGATIONS OR THEIR GUARANTEES AND SECURITY DEPOSITS WE HOLD MAY BE EXHAUSTED,

• HOTEL SUPPLY GROWTH HAS BEEN INCREASING AND MAY AFFECT OUR OPERATORS' ABILITY TO GROW ADR AND OCCUPANCY AND ADR AND OCCUPANCY COULD

DECLINE DUE TO INCREASED COMPETITION WHICH MAY CAUSE OUR OPERATORS TO BECOME UNABLE TO PAY OUR RETURNS OR RENTS,

• IF THE CURRENT LEVEL OF COMMERCIAL ACTIVITY IN THE COUNTRY DECLINES, IF THE PRICE OF DIESEL FUEL INCREASES SIGNIFICANTLY, IF FUEL CONSERVATION

MEASURES ARE INCREASED, IF FREIGHT BUSINESS IS DIRECTED AWAY FROM TRUCKING, IF TA IS UNABLE TO EFFECTIVELY COMPETE OR OPERATE ITS BUSINESS, IF FUEL

EFFICIENCIES, THE USE OF ALTERNATIVE FUELS OR TRANSPORTATION TECHNOLOGIES REDUCE THE DEMAND FOR PRODUCTS AND SERVICES TA SELLS OR FOR VARIOUS

OTHER REASONS, TA MAY BECOME UNABLE TO PAY CURRENT AND DEFERRED RENTS DUE TO US,

• OUR ABILITY TO GROW OUR BUSINESS AND INCREASE OUR DISTRIBUTIONS DEPENDS IN LARGE PART UPON OUR ABILITY TO BUY PROPERTIES THAT GENERATE RETURNS

OR CAN BE LEASED FOR RENTS WHICH EXCEED OUR OPERATING AND CAPITAL COSTS. WE MAY BE UNABLE TO IDENTIFY PROPERTIES THAT WE WANT TO ACQUIRE OR TO

NEGOTIATE ACCEPTABLE PURCHASE PRICES, ACQUISITION FINANCING, MANAGEMENT CONTRACTS OR LEASE TERMS FOR NEW PROPERTIES,

• WE HAVE AGREED TO ACQUIRE FROM AND LEASE BACK TO TA A TRAVEL CENTER WHICH TA IS DEVELOPING. WE AGREED TO PURCHASE THIS PROPERTY AT TA’S COST

(INCLUDING HISTORICAL LAND COST) UP TO $29.0 MILLION IF THE DEVELOPMENT IS SUBSTANTIALLY COMPLETED PRIOR TO JUNE 30, 2017. TA HAS BEGUN

CONSTRUCTION AT THIS TRAVEL CENTER AND WE EXPECT THAT OUR ACQUISITION OF THIS NEW TRAVEL CENTER WILL BE COMPLETED BEFORE JUNE 30, 2017.

HOWEVER. IT IS DIFFICULT TO ESTIMATE THE COST AND TIMING TO DEVELOP A NEW TRAVEL CENTER. CONSTRUCTION OF THE NEW TRAVEL CENTER MAY BE DELAYED

FOR VARIOUS REASONS SUCH AS LABOR STRIFE, WEATHER CONDITIONS, THE UNAVAILABILITY OF CONSTRUCTION MATERIALS, ETC. THE PURCHASE AND LEASE BACK OF

THIS TRAVEL CENTER MAY NOT OCCUR, MAY BE DELAYED OR THE TERMS OF THE TRANSACTION MAY CHANGE,

• CONTINGENCIES IN OUR ACQUISITION AND SALE AGREEMENTS MAY NOT BE SATISFIED AND OUR PENDING ACQUISITIONS AND SALES AND ANY RELATED MANAGEMENT

ARRANGEMENTS WE MAY EXPECT TO ENTER INTO MAY NOT OCCUR, MAY BE DELAYED OR THE TERMS OF SUCH TRANSACTIONS OR ARRANGEMENTS MAY CHANGE,

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

FO

RW

ARD LOOKING S

TA

TEMENTS (continued

)

5

• AT DECEMBER 31, 2016, WE HAD $10.9 MILLION OF CASH AND CASH EQUIVALENTS, $809.0 MILLION AVAILABLE UNDER OUR $1.0 BILLION REVOLVING CREDIT FACILITY AND SECURITY

DEPOSITS AND GUARANTEES COVERING SOME OF OUR MINIMUM RETURNS AND RENTS. THESE STATEMENTS MAY IMPLY THAT WE HAVE ABUNDANT WORKING CAPITAL AND

LIQUIDITY. HOWEVER, OUR MANAGERS AND TENANTS MAY NOT BE ABLE TO FUND MINIMUM RETURNS AND RENTS DUE TO US FROM OPERATING OUR PROPERTIES OR FROM

OTHER RESOURCES; IN THE PAST AND CURRENTLY, CERTAIN OF OUR TENANTS AND HOTEL MANAGERS HAVE IN FACT NOT PAID THE MINIMUM AMOUNTS DUE TO US FROM THEIR

OPERATIONS OF OUR LEASED OR MANAGED PROPERTIES. ALSO, CERTAIN OF THE SECURITY DEPOSITS AND GUARANTEES WE HAVE TO COVER ANY SUCH SHORTFALLS ARE

LIMITED IN AMOUNT AND DURATION, AND ANY SECURITY DEPOSITS WE APPLY FOR SUCH SHORTFALLS DO NOT RESULT IN ADDITIONAL CASH FLOWS TO US. FURTHER, OUR

PROPERTIES REQUIRE, AND WE HAVE AGREED TO PROVIDE, SIGNIFICANT FUNDING FOR CAPITAL IMPROVEMENTS, RENOVATIONS AND OTHER MATTERS. ACCORDINGLY, WE MAY

NOT HAVE SUFFICIENT WORKING CAPITAL OR LIQUIDITY,

• WE MAY BE UNABLE TO REPAY OUR DEBT OBLIGATIONS WHEN THEY BECOME DUE,

• CONTINUED AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY IS SUBJECT TO OUR SATISFYING CERTAIN FINANCIAL COVENANTS AND OTHER CUSTOMARY

CREDIT FACILITY CONDITIONS THAT WE MAY BE UNABLE TO SATISFY,

• ACTUAL COSTS UNDER OUR REVOLVING CREDIT FACILITY OR OTHER FLOATING RATE DEBT WILL BE HIGHER THAN LIBOR PLUS A PREMIUM BECAUSE OF OTHER FEES AND

EXPENSES ASSOCIATED WITH SUCH FACILITIES,

• THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOAN MAY BE INCREASED TO UP TO $2.3 BILLION ON A COMBINED BASIS IN CERTAIN

CIRCUMSTANCES; HOWEVER, INCREASING THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOAN IS SUBJECT TO OUR OBTAINING

ADDITIONAL COMMITMENTS FROM LENDERS, WHICH MAY NOT OCCUR,

• THE PREMIUMS USED TO DETERMINE THE INTEREST RATE PAYABLE ON OUR REVOLVING CREDIT FACILITY AND TERM LOAN AND THE FACILITY FEE PAYABLE ON OUR REVOLVING

CREDIT FACILITY ARE BASED ON OUR CREDIT RATINGS. FUTURE CHANGES IN OUR CREDIT RATINGS MAY CAUSE THE INTEREST AND FEES WE PAY TO INCREASE,

• WE HAVE THE OPTION TO EXTEND THE MATURITY DATE OF OUR REVOLVING CREDIT FACILITY UPON PAYMENT OF A FEE AND MEETING OTHER CONDITIONS. HOWEVER, THE

APPLICABLE CONDITIONS MAY NOT BE MET,

• THE BUSINESS MANAGEMENT AND PROPERTY MANAGEMENT AGREEMENTS BETWEEN US AND RMR LLC HAVE CONTINUING 20 YEAR TERMS. HOWEVER, THOSE AGREEMENTS

INCLUDE TERMS WHICH PERMIT EARLY TERMINATION IN CERTAIN CIRCUMSTANCES. ACCORDINGLY, WE CANNOT BE SURE THAT THESE AGREEMENTS WILL REMAIN IN EFFECT FOR

CONTINUING 20 YEAR TERMS OR FOR SHORTER TERMS,

• WE BELIEVE THAT OUR RELATIONSHIPS WITH OUR RELATED PARTIES, INCLUDING RMR LLC, RMR INC., TA, SONESTA, AIC AND OTHERS AFFILIATED WITH THEM MAY BENEFIT US AND

PROVIDE US WITH COMPETITIVE ADVANTAGES IN OPERATING AND GROWING OUR BUSINESS. HOWEVER, THE ADVANTAGES WE BELIEVE WE MAY REALIZE FROM THESE

RELATIONSHIPS MAY NOT MATERIALIZE,

• MARRIOTT HAS NOTIFIED US THAT IT DOES NOT INTEND TO EXTEND ITS LEASE FOR OUR RESORT HOTEL ON KAUAI, HAWAII WHEN THAT LEASE EXPIRES ON DECEMBER 31, 2019

AND WE INTEND TO HAVE DISCUSSIONS WITH MARRIOTT ABOUT THE FUTURE OF THIS HOTEL. THESE STATEMENTS MAY IMPLY THAT MARRIOTT WILL NOT OPERATE THIS HOTEL IN

THE FUTURE OR THAT WE MAY RECEIVE LESS CASH FLOW FROM THIS HOTEL IN THE FUTURE. OUR DISCUSSIONS WITH MARRIOTT HAVE ONLY RECENTLY BEGUN. AT THIS TIME

WE CANNOT PREDICT HOW OUR DISCUSSIONS WITH MARRIOTT WILL IMPACT THE FUTURE OF THIS HOTEL. FOR EXAMPLE, THIS HOTEL MAY CONTINUE TO BE OPERATED BY

MARRIOTT ON DIFFERENT CONTRACT TERMS THAN THE CURRENT LEASE, WE MAY IDENTIFY A DIFFERENT OPERATOR FOR THIS HOTEL, OR THE CASH FLOW WHICH WE RECEIVE

FROM OUR OWNERSHIP OF THIS HOTEL MAY BE DIFFERENT THAN THE RENT WE NOW RECEIVE. ALSO, ALTHOUGH THE CURRENT LEASE EXPIRES ON DECEMBER 31, 2019, WE AND

MARRIOTT MAY AGREE UPON A DIFFERENT TERMINATION DATE, AND

• WE HAVE ADVISED MORGANS THAT THE CLOSING OF ITS MERGER WITH SBE ENTERTAINMENT GROUP, LLC, OR SBE, WAS IN VIOLATION OF OUR MORGANS AGREEMENT, AND WE

HAVE FILED AN ACTION FOR UNLAWFUL DETAINER AGAINST MORGANS AND SBE TO COMPEL MORGANS AND SBE TO SURRENDER POSSESSION OF THE SAN FRANCISCO HOTEL

WHICH MORGANS HISTORICALLY LEASED FROM US, AND WE ARE CURRENTLY ENGAGED IN DISCUSSIONS WITH MORGANS AND SBE REGARDING THIS MATTER. THE OUTCOME OF

THIS PENDING LITIGATION AND OF OUR DISCUSSIONS WITH MORGANS AND SBE IS NOT ASSURED BUT WE BELIEVE THAT MORGANS MAY SURRENDER POSSESSION OF THIS HOTEL

OR THAT THE COURT WILL DETERMINE THAT MORGANS AND SBE HAVE BREACHED THE HISTORICAL LEASE. WE ALSO BELIEVE THAT THIS HOTEL MAY REQUIRE SUBSTANTIAL

CAPITAL INVESTMENT TO REMAIN COMPETITIVE IN ITS MARKET. THE CONTINUATION OF OUR DISPUTE WITH MORGANS AND SBE REQUIRES US TO EXPEND LEGAL FEES AND THE

RESULT OF THIS DISPUTE MAY CAUSE US SOME LOSS OF RENT AT LEAST UNTIL THIS HOTEL MAY BE RENOVATED AND PROPERLY OPERATED. LITIGATION AND DISPUTES WITH

TENANTS OFTEN PRODUCE UNEXPECTED RESULTS AND WE CAN PROVIDE NO ASSURANCE REGARDING THE RESULTS OF THIS DISPUTE.

CURRENTLY UNEXPECTED RESULTS COULD OCCUR DUE TO MANY DIFFERENT CIRCUMSTANCES, SOME OF WHICH ARE BEYOND OUR CONTROL, SUCH AS ACTS OF TERRORISM,

NATURAL DISASTERS, CHANGES IN OUR MANAGERS’ OR TENANTS’ REVENUES OR EXPENSES, CHANGES IN OUR MANAGERS’ OR TENANTS’ FINANCIAL CONDITIONS, THE MARKET DEMAND

FOR HOTEL ROOMS OR FUEL OR CHANGES IN CAPITAL MARKETS OR THE ECONOMY GENERALLY.

THE INFORMATION CONTAINED IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, OR SEC, INCLUDING UNDER THE CAPTION “RISK FACTORS” IN OUR PERIODIC

REPORTS, OR INCORPORATED THEREIN, IDENTIFIES OTHER IMPORTANT FACTORS THAT COULD CAUSE DIFFERENCES FROM OUR FORWARD LOOKING STATEMENTS. OUR FILINGS WITH THE

SEC ARE AVAILABLE ON THE SEC’S WEBSITE AT WWW.SEC.GOV.

YOU SHOULD NOT PLACE UNDUE RELIANCE UPON OUR FORWARD LOOKING STATEMENTS.

EXCEPT AS REQUIRED BY LAW, WE DO NOT INTEND TO UPDATE OR CHANGE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR

OTHERWISE.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

CORPORATE INFORMATION

Courtyard Irvine Spectrum/Orange County, Laguna Hills, CA

Operator: Marriott International Inc.

Guest Rooms: 136

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

COM

PAN

Y PROFIL

E

7

COMPANY PROFILE

Hospitality Properties Trust, or HPT, we, our, or us, is a real estate investment trust, or REIT. As of December 31,

2016, we owned 306 hotels and 198 travel centers located in 45 states, Puerto Rico and Canada. Our properties

are operated by other companies under long term management or lease agreements. We have been investment

grade rated since 1998 and we are currently included in a number of financial indices, including the S&P MidCap

400 Index, the Russell 1000 Index, the MSCI U.S. REIT Index, the FTSE EPRA/NAREIT United States Index and

the S&P REIT Composite Index.

The Company:

Management:

HPT is managed by The RMR Group LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR).

RMR is an alternative asset management company that was founded in 1986 to manage real estate companies

and related businesses. RMR primarily provides management services to four publicly owned real estate

investment trusts, or REITs, and three real estate related operating businesses. In addition to managing HPT,

RMR manages Senior Housing Properties Trust, a REIT that primarily owns healthcare, senior living and medical

office buildings, Select Income REIT, a REIT that is focused on owning and investing in single tenant properties,

and Government Properties Income Trust, a REIT that primarily owns properties leased to the U.S. and state

governments. RMR also provides management services to TravelCenters of America LLC, a publicly traded

operator of travel centers along the U.S. Interstate Highway System (including all the travel centers that HPT

owns), convenience stores and restaurants, Five Star Quality Care, Inc., a publicly traded operator of senior living

communities, and Sonesta International Hotels Corporation, a privately owned franchisor and operator of hotels

(including some of the hotels that HPT owns) and cruise ships. RMR also manages publicly traded securities of

real estate companies and private commercial real estate debt funds through wholly owned SEC registered

investment advisory subsidiaries. As of December 31, 2016, RMR had $27.2 billion of real estate assets under

management and the combined RMR managed companies had approximately $11 billion of annual revenues,

over 1,400 properties and more than 53,000 employees. We believe that being managed by RMR is a competitive

advantage for HPT because of RMR’s depth of management and experience in the real estate industry. We also

believe RMR provides management services to us at costs that are lower than we would have to pay for similar

quality services.

Corporate Headquarters:

Two Newton Place

255 Washington Street, Suite 300

Newton, MA 02458-1634

(t) (617) 964-8389

(f) (617) 969-5730

Stock Exchange Listing:

Nasdaq

Trading Symbols:

Common Shares: HPT

Senior Unsecured Debt Ratings:

Standard & Poor's: BBB-

Moody's: Baa2

Key Data (as of December 31, 2016)

(dollars in 000s)

Total Properties 504

Hotels: 306

Travel centers: 198

Number of Rooms/Suites 46,583

Q4 2016 total revenues $ 479,278

Q4 2016 net income available for

common shareholders $ 58,020

Q4 2016 Normalized FFO (1) $ 93,380

(1) See pages 23-24 for the calculation of FFO and

Normalized FFO and a reconciliation of these

amounts from net income available for common

shareholders, determined in accordance with

U.S. generally accepted accounting principles,

or GAAP.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

COM

PAN

Y PROFILE (continued

)

8

COMPANY PROFILE

Operating Statistics by Operating Agreement (as of 12/31/16) (dollars in thousands):

Number Annualized Percent of Total

Number of of Rooms / Minimum Minimum Coverage (3) RevPAR Change

Operating Agreement (1) Properties Suites Return / Rent (2) Return / Rent Q4 LTM Q4 LTM

Marriott (No. 1) 53 7,610 $ 68,636 9% 1.01x 1.37x (1.5)% 1.9 %

Marriott (No. 234) 68 9,120 106,360 13% 0.95x 1.14x 1.5 % 3.5 %

Marriott (No. 5) 1 356 10,116 1% 0.66x 0.74x 1.6 % 6.9 %

Subtotal / Average Marriott 122 17,086 185,112 23% 0.96x 1.20x 0.3 % 3.0 %

InterContinental 94 14,403 161,789 21% 1.04x 1.21x 0.2 % 2.6 %

Sonesta 34 6,329 90,171 11% 0.40x 0.70x 2.2 % 1.6 %

Wyndham 22 3,579 28,404 4% 0.67x 0.90x 0.8 % 3.2 %

Hyatt 22 2,724 22,037 3% 0.94x 1.16x (0.5)% 3.8 %

Carlson 11 2,090 12,920 2% 0.93x 1.29x 0.3 % 0.5 %

Morgans 1 372 7,595 1% 0.67x 1.01x (8.0%) (0.9)%

Subtotal / Average Hotels 306 46,583 508,028 65% 0.86x 1.10x 0.3 % 2.5 %

TA (No. 1) 40 N/A 51,435 6% 1.56x 1.64x N/A N/A

TA (No. 2) 40 N/A 52,327 7% 1.51x 1.52x N/A N/A

TA (No. 3) 39 N/A 52,665 7% 1.47x 1.57x N/A N/A

TA (No. 4) 39 N/A 50,117 6% 1.46x 1.55x N/A N/A

TA (No. 5) 40 N/A 67,573 9% 1.56x 1.58x N/A N/A

Subtotal TA 198 N/A 274,117 35% 1.51x 1.57x N/A N/A

Total / Average 504 46,583 $ 782,145 100% 1.09x 1.26x 0.3 % 2.5 %

(1) See pages 28 through 30 for additional information regarding each of our operating agreements.

(2) Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to recognize rental income on a

straight line basis in accordance with GAAP.

(3) We define coverage as combined total property level revenues minus all property level expenses and FF&E reserve escrows which are not subordinated

to minimum returns and minimum rent payments to us (which data is provided to us by our managers or tenants), divided by the minimum return or

minimum rent payments due to us. Coverage amounts for our agreement with InterContinental Hotels Group, plc, or InterContinental, and our Sonesta

and TA Nos. 1, 2, 3 and 4 agreements include data for periods prior to our ownership of certain hotels and travel centers.

(4) RevPAR is defined as hotel room revenue per day per available room. RevPAR change is the RevPAR percentage change in the period ended December

31, 2016 over the comparable year earlier period. RevPAR amounts for our Sonesta and InterContinental agreements include data for periods prior to our

ownership of certain hotels.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

INVES

TOR INFORM

ATIO

N

9

INVESTOR INFORMATION

Board of Trustees

Donna D. Fraiche John L. Harrington William A. Lamkin

Independent Trustee Lead Independent Trustee Independent Trustee

Adam D. Portnoy Barry M. Portnoy

Managing Trustee Managing Trustee

Senior Management

John G. Murray Mark L. Kleifges Ethan S. Bornstein

President and Chief Operating Officer Chief Financial Officer and Treasurer Senior Vice President

Contact Information

Investor Relations Inquiries

Hospitality Properties Trust Financial inquiries should be directed to Mark L. Kleifges,

Two Newton Place Chief Financial Officer and Treasurer, at (617) 964-8389

255 Washington Street, Suite 300 or mkleifges@rmrgroup.com.

Newton, MA 02458-1634

(t) (617) 964-8389 Investor and media inquiries should be directed to

(f) (617) 969-5730 Katie Strohacker, Senior Director, Investor Relations at

(email) info@hptreit.com (617) 796-8232, or kstrohacker@rmrgroup.com

(website) www.hptreit.com

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

RESEARCH COVERAG

E

10

RESEARCH COVERAGE

Equity Research Coverage

Baird Canaccord Genuity FBR & Co.

Michael Bellisario Ryan Meliker Bryan Maher

(414) 298-6130 (212) 389-8094 (646) 885-5423

mbellisario@rwbaird.com rmeliker@canaccordgenuity.com bmaher@fbr.com

Janney Montgomery Scott JMP Securities Stifel Nicolaus

Tyler Batory Whitney Stevenson Simon Yarmak

(215) 665-4448 (415) 835-8948 (443) 224-1345

tbatory@janney.com wstevenson@jmpsecurities.com yarmaks@stifel.com

Wells Fargo Securities

Jeffrey Donnelly

(617) 603-4262

jeff.donnelly@wellsfargo.com

Debt Research Coverage

Credit Suisse Wells Fargo Securities

John Giordano Thierry Perrein

(212) 538-4935 (704) 715-8455

john.giordano@credit-suisse.com thierry.perrein@wellsfargo.com

Rating Agencies

Moody’s Investors Service Standard & Poor’s

Griselda Bisono Michael Souers

(212) 553-4985 (212) 438-2508

griselda.bisono@moodys.com michael.souers@standardandpoors.com

HPT is followed by the analysts and its publicly held debt is rated by the rating agencies listed above. Please note that any opinions, estimates or forecasts regarding HPT's

performance made by these analysts or agencies do not represent opinions, forecasts or predictions of HPT or its management. HPT does not by its reference above imply

its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

All amounts in this report are unaudited.

Hospitality Properties Trust

Fourth Quarter 2016

Supplemental Operating and Financial Data

Courtyard Camarillo, Camarillo, CA

Operator: Marriott International, Inc.

Guest Rooms: 130

FINANCIALS

Sonesta ES Suites, Princeton, NJ

Operator: Sonesta International Hotels Corp.

Guest Rooms: 124

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

KE

Y FINANCIA

L D

AT

A

12

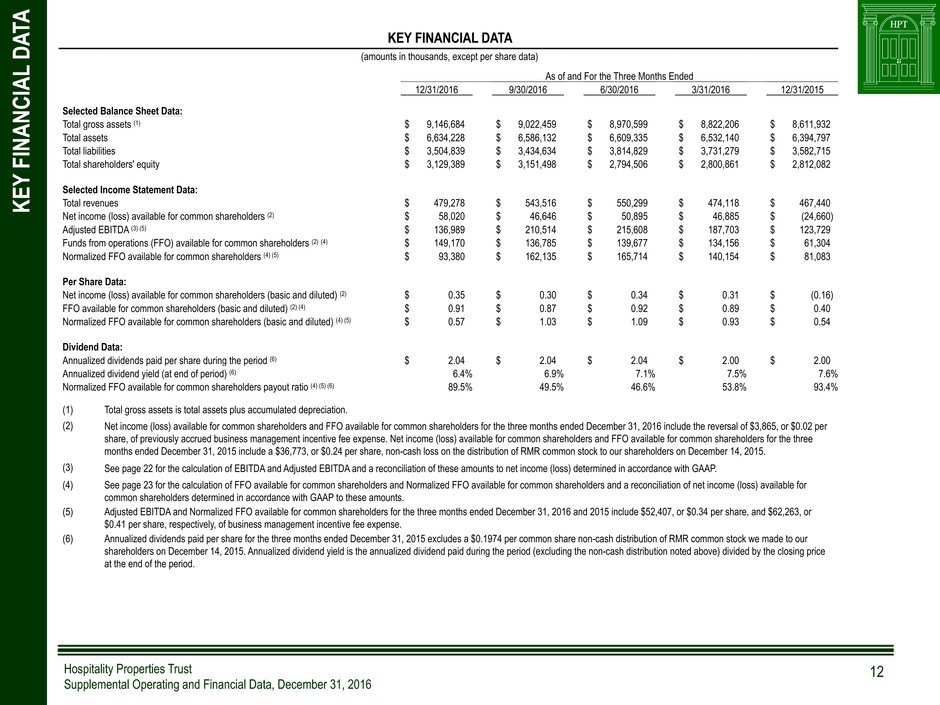

KEY FINANCIAL DATA

(amounts in thousands, except per share data)

As of and For the Three Months Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Selected Balance Sheet Data:

Total gross assets (1) $ 9,146,684 $ 9,022,459 $ 8,970,599 $ 8,822,206 $ 8,611,932

Total assets $ 6,634,228 $ 6,586,132 $ 6,609,335 $ 6,532,140 $ 6,394,797

Total liabilities $ 3,504,839 $ 3,434,634 $ 3,814,829 $ 3,731,279 $ 3,582,715

Total shareholders' equity $ 3,129,389 $ 3,151,498 $ 2,794,506 $ 2,800,861 $ 2,812,082

Selected Income Statement Data:

Total revenues $ 479,278 $ 543,516 $ 550,299 $ 474,118 $ 467,440

Net income (loss) available for common shareholders (2) $ 58,020 $ 46,646 $ 50,895 $ 46,885 $ (24,660)

Adjusted EBITDA (3) (5) $ 136,989 $ 210,514 $ 215,608 $ 187,703 $ 123,729

Funds from operations (FFO) available for common shareholders (2) (4) $ 149,170 $ 136,785 $ 139,677 $ 134,156 $ 61,304

Normalized FFO available for common shareholders (4) (5) $ 93,380 $ 162,135 $ 165,714 $ 140,154 $ 81,083

Per Share Data:

Net income (loss) available for common shareholders (basic and diluted) (2) $ 0.35 $ 0.30 $ 0.34 $ 0.31 $ (0.16)

FFO available for common shareholders (basic and diluted) (2) (4) $ 0.91 $ 0.87 $ 0.92 $ 0.89 $ 0.40

Normalized FFO available for common shareholders (basic and diluted) (4) (5) $ 0.57 $ 1.03 $ 1.09 $ 0.93 $ 0.54

Dividend Data:

Annualized dividends paid per share during the period (6) $ 2.04 $ 2.04 $ 2.04 $ 2.00 $ 2.00

Annualized dividend yield (at end of period) (6) 6.4% 6.9% 7.1% 7.5% 7.6%

Normalized FFO available for common shareholders payout ratio (4) (5) (6) 89.5% 49.5% 46.6% 53.8% 93.4%

(1) Total gross assets is total assets plus accumulated depreciation.

(2) Net income (loss) available for common shareholders and FFO available for common shareholders for the three months ended December 31, 2016 include the reversal of $3,865, or $0.02 per

share, of previously accrued business management incentive fee expense. Net income (loss) available for common shareholders and FFO available for common shareholders for the three

months ended December 31, 2015 include a $36,773, or $0.24 per share, non-cash loss on the distribution of RMR common stock to our shareholders on December 14, 2015.

(3) See page 22 for the calculation of EBITDA and Adjusted EBITDA and a reconciliation of these amounts to net income (loss) determined in accordance with GAAP.

(4) See page 23 for the calculation of FFO available for common shareholders and Normalized FFO available for common shareholders and a reconciliation of net income (loss) available for

common shareholders determined in accordance with GAAP to these amounts.

(5) Adjusted EBITDA and Normalized FFO available for common shareholders for the three months ended December 31, 2016 and 2015 include $52,407, or $0.34 per share, and $62,263, or

$0.41 per share, respectively, of business management incentive fee expense.

(6) Annualized dividends paid per share for the three months ended December 31, 2015 excludes a $0.1974 per common share non-cash distribution of RMR common stock we made to our

shareholders on December 14, 2015. Annualized dividend yield is the annualized dividend paid during the period (excluding the non-cash distribution noted above) divided by the closing price

at the end of the period.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

CONSOLID

ATED BALANCE SHEET

S

13

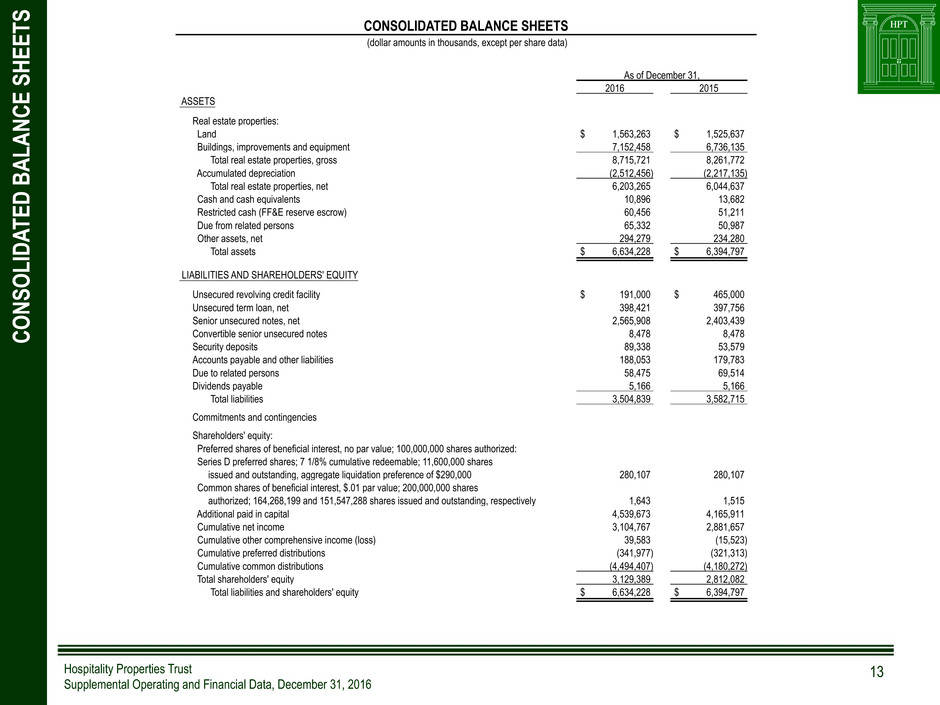

CONSOLIDATED BALANCE SHEETS

(dollar amounts in thousands, except per share data)

As of December 31,

2016 2015

ASSETS

Real estate properties:

Land $ 1,563,263 $ 1,525,637

Buildings, improvements and equipment 7,152,458 6,736,135

Total real estate properties, gross 8,715,721 8,261,772

Accumulated depreciation (2,512,456) (2,217,135)

Total real estate properties, net 6,203,265 6,044,637

Cash and cash equivalents 10,896 13,682

Restricted cash (FF&E reserve escrow) 60,456 51,211

Due from related persons 65,332 50,987

Other assets, net 294,279 234,280

Total assets $ 6,634,228 $ 6,394,797

LIABILITIES AND SHAREHOLDERS' EQUITY

Unsecured revolving credit facility $ 191,000 $ 465,000

Unsecured term loan, net 398,421 397,756

Senior unsecured notes, net 2,565,908 2,403,439

Convertible senior unsecured notes 8,478 8,478

Security deposits 89,338 53,579

Accounts payable and other liabilities 188,053 179,783

Due to related persons 58,475 69,514

Dividends payable 5,166 5,166

Total liabilities 3,504,839 3,582,715

Commitments and contingencies

Shareholders' equity:

Preferred shares of beneficial interest, no par value; 100,000,000 shares authorized:

Series D preferred shares; 7 1/8% cumulative redeemable; 11,600,000 shares

issued and outstanding, aggregate liquidation preference of $290,000 280,107 280,107

Common shares of beneficial interest, $.01 par value; 200,000,000 shares

authorized; 164,268,199 and 151,547,288 shares issued and outstanding, respectively 1,643 1,515

Additional paid in capital 4,539,673 4,165,911

Cumulative net income 3,104,767 2,881,657

Cumulative other comprehensive income (loss) 39,583 (15,523)

Cumulative preferred distributions (341,977) (321,313)

Cumulative common distributions (4,494,407) (4,180,272)

Total shareholders' equity 3,129,389 2,812,082

Total liabilities and shareholders' equity $ 6,634,228 $ 6,394,797

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

CONSOLID

ATED S

TA

TEMENTS OF INCOME (LOSS

)

14

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(amounts in thousands, except per share data)

For the Three Months Ended December 31, For the Year Ended December 31,

2016 2015 2016 2015

Revenues:

Hotel operating revenues (1) $ 397,740 $ 390,910 $ 1,730,326 $ 1,634,654

Rental income (2) 80,547 75,554 312,377 283,115

FF&E reserve income (3) 991 976 4,508 4,135

Total revenues 479,278 467,440 2,047,211 1,921,904

Expenses:

Hotel operating expenses (1) 279,299 273,292 1,202,538 1,143,981

Depreciation and amortization 91,150 85,964 357,342 329,776

General and administrative (4) 7,978 56,017 99,105 109,837

Acquisition related costs (5) 482 389 1,367 2,375

Total expenses 378,909 415,662 1,660,352 1,585,969

Operating income 100,369 51,778 386,859 335,935

Dividend income 626 2,640 2,001 2,640

Interest income 47 12 274 44

Interest expense (including amortization of debt issuance costs

and debt discounts of $2,036, $1,476, $8,151 and $5,849, respectively) (37,349) (36,980) (161,913) (144,898)

Loss on distribution to common shareholders of The RMR Group Inc. common stock (6) — (36,773) — (36,773)

Loss on early extinguishment of debt (7) — — (228) —

Income (loss) before income taxes, equity in earnings (losses) of an investee and gain on sale of real estate 63,693 (19,323) 226,993 156,948

Income tax expense (537) (121) (4,020) (1,566)

Equity in earnings (losses) of an investee 30 (50) 137 21

Income (loss) before gain on sale of real estate 63,186 (19,494) 223,110 155,403

Gain on sale of real estate (8) — — — 11,015

Net income (loss) 63,186 (19,494) 223,110 166,418

Preferred distributions (5,166) (5,166) (20,664) (20,664)

Net income (loss) available for common shareholders $ 58,020 $ (24,660) $ 202,446 $ 145,754

Weighted average common shares outstanding (basic) $ 164,120 $ 151,400 $ 156,062 $ 150,709

Weighted average common shares outstanding (diluted) $ 164,128 $ 151,400 $ 156,088 $ 151,002

Net income (loss) available for common shareholders per common share (basic and diluted) $ 0.35 $ (0.16) $ 1.30 $ 0.97

See Notes to Consolidated Statements of Income (Loss) on page 15.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

NOTES

TO CONSOLID

ATED S

TA

TEMENTS OF INCOME (LOSS

)

15

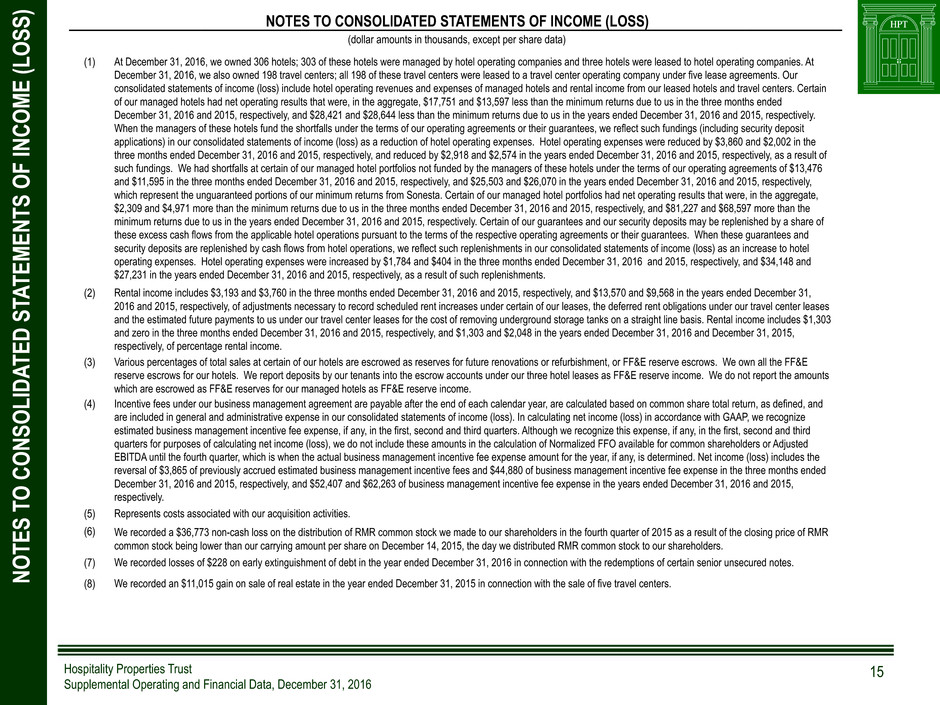

NOTES TO CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(dollar amounts in thousands, except per share data)

(1) At December 31, 2016, we owned 306 hotels; 303 of these hotels were managed by hotel operating companies and three hotels were leased to hotel operating companies. At

December 31, 2016, we also owned 198 travel centers; all 198 of these travel centers were leased to a travel center operating company under five lease agreements. Our

consolidated statements of income (loss) include hotel operating revenues and expenses of managed hotels and rental income from our leased hotels and travel centers. Certain

of our managed hotels had net operating results that were, in the aggregate, $17,751 and $13,597 less than the minimum returns due to us in the three months ended

December 31, 2016 and 2015, respectively, and $28,421 and $28,644 less than the minimum returns due to us in the years ended December 31, 2016 and 2015, respectively.

When the managers of these hotels fund the shortfalls under the terms of our operating agreements or their guarantees, we reflect such fundings (including security deposit

applications) in our consolidated statements of income (loss) as a reduction of hotel operating expenses. Hotel operating expenses were reduced by $3,860 and $2,002 in the

three months ended December 31, 2016 and 2015, respectively, and reduced by $2,918 and $2,574 in the years ended December 31, 2016 and 2015, respectively, as a result of

such fundings. We had shortfalls at certain of our managed hotel portfolios not funded by the managers of these hotels under the terms of our operating agreements of $13,476

and $11,595 in the three months ended December 31, 2016 and 2015, respectively, and $25,503 and $26,070 in the years ended December 31, 2016 and 2015, respectively,

which represent the unguaranteed portions of our minimum returns from Sonesta. Certain of our managed hotel portfolios had net operating results that were, in the aggregate,

$2,309 and $4,971 more than the minimum returns due to us in the three months ended December 31, 2016 and 2015, respectively, and $81,227 and $68,597 more than the

minimum returns due to us in the years ended December 31, 2016 and 2015, respectively. Certain of our guarantees and our security deposits may be replenished by a share of

these excess cash flows from the applicable hotel operations pursuant to the terms of the respective operating agreements or their guarantees. When these guarantees and

security deposits are replenished by cash flows from hotel operations, we reflect such replenishments in our consolidated statements of income (loss) as an increase to hotel

operating expenses. Hotel operating expenses were increased by $1,784 and $404 in the three months ended December 31, 2016 and 2015, respectively, and $34,148 and

$27,231 in the years ended December 31, 2016 and 2015, respectively, as a result of such replenishments.

(2) Rental income includes $3,193 and $3,760 in the three months ended December 31, 2016 and 2015, respectively, and $13,570 and $9,568 in the years ended December 31,

2016 and 2015, respectively, of adjustments necessary to record scheduled rent increases under certain of our leases, the deferred rent obligations under our travel center leases

and the estimated future payments to us under our travel center leases for the cost of removing underground storage tanks on a straight line basis. Rental income includes $1,303

and zero in the three months ended December 31, 2016 and 2015, respectively, and $1,303 and $2,048 in the years ended December 31, 2016 and December 31, 2015,

respectively, of percentage rental income.

(3) Various percentages of total sales at certain of our hotels are escrowed as reserves for future renovations or refurbishment, or FF&E reserve escrows. We own all the FF&E

reserve escrows for our hotels. We report deposits by our tenants into the escrow accounts under our three hotel leases as FF&E reserve income. We do not report the amounts

which are escrowed as FF&E reserves for our managed hotels as FF&E reserve income.

(4) Incentive fees under our business management agreement are payable after the end of each calendar year, are calculated based on common share total return, as defined, and

are included in general and administrative expense in our consolidated statements of income (loss). In calculating net income (loss) in accordance with GAAP, we recognize

estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third

quarters for purposes of calculating net income (loss), we do not include these amounts in the calculation of Normalized FFO available for common shareholders or Adjusted

EBITDA until the fourth quarter, which is when the actual business management incentive fee expense amount for the year, if any, is determined. Net income (loss) includes the

reversal of $3,865 of previously accrued estimated business management incentive fees and $44,880 of business management incentive fee expense in the three months ended

December 31, 2016 and 2015, respectively, and $52,407 and $62,263 of business management incentive fee expense in the years ended December 31, 2016 and 2015,

respectively.

(5) Represents costs associated with our acquisition activities.

(6) We recorded a $36,773 non-cash loss on the distribution of RMR common stock we made to our shareholders in the fourth quarter of 2015 as a result of the closing price of RMR

common stock being lower than our carrying amount per share on December 14, 2015, the day we distributed RMR common stock to our shareholders.

(7) We recorded losses of $228 on early extinguishment of debt in the year ended December 31, 2016 in connection with the redemptions of certain senior unsecured notes.

(8) We recorded an $11,015 gain on sale of real estate in the year ended December 31, 2015 in connection with the sale of five travel centers.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

CONSOLID

ATED S

TA

TEMENTS OF CASH FLOW

S

16

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the Year Ended December 31,

2016 2015

Cash flows from operating activities:

Net income $ 223,110 $ 166,418

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization 357,342 329,776

Amortization of debt issuance costs and debt discounts as interest 8,151 5,849

Straight line rental income (13,570) (9,568)

Security deposits received or replenished 35,759 20,501

FF&E reserve income and deposits (73,956) (67,967)

Loss on early extinguishment of debt 228 —

Loss on distribution to common shareholders of The RMR Group Inc. common stock — 36,773

Equity in earnings of an investee (137) (21)

Gain on sale of real estate — (11,015)

Deferred income taxes 9 (69)

Other non-cash (income) expense, net (3,250) (364)

Changes in assets and liabilities:

Due from related persons (1,213) (2,106)

Other assets (190) 246

Accounts payable and other liabilities 8,752 362

Due to related persons (8,515) 62,078

Net cash provided by operating activities 532,520 530,893

Cash flows from investing activities:

Real estate acquisitions and deposits (262,955) (449,882)

Real estate improvements (187,652) (180,703)

FF&E reserve escrow fundings (3,749) (7,299)

Investment in The RMR Group Inc. — (15,955)

Net cash used in investing activities (454,356) (653,839)

Cash flows from financing activities:

Proceeds from issuance of common shares, net 371,956 —

Proceeds from issuance of senior unsecured notes, net of discounts 737,612 —

Repayment of senior unsecured notes (575,000) —

Borrowings under unsecured revolving credit facility 764,000 702,000

Repayments of unsecured revolving credit facility (1,038,000) (255,000)

Payment of debt issuance costs (6,106) (1,157)

Repurchase of common shares (613) (418)

Distributions to preferred shareholders (20,664) (20,664)

Distributions to common shareholders (314,135) (299,967)

Net cash (used in) provided by financing activities (80,950) 124,794

Increase (decrease) in cash and cash equivalents (2,786) 1,848

Cash and cash equivalents at beginning of year 13,682 11,834

Cash and cash equivalents at end of year $ 10,896 $ 13,682

Supplemental cash flow information:

Cash paid for interest $ 146,399 $ 138,892

Cash paid for income taxes 2,727 2,444

Non-cash investing activities:

Hotel managers’ deposits in FF&E reserve $ 74,876 $ 67,381

Hotel managers’ purchases with FF&E reserve (69,380) (57,451)

Investment in The RMR Group Inc. paid in common shares — 43,285

Real estate acquisitions — (45,042)

Sales of real estate — 45,042

Non-cash financing activities

Distribution to common shareholders of The RMR Group Inc. common stock — (29,911)

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

DEBT SUMMA

RY

17

DEBT SUMMARY

As of December 31, 2016

(dollars in thousands)

Interest Principal Maturity Due at Years to

Rate Balance Date Maturity Maturity

Unsecured Floating Rate Debt:

$1,000,000 unsecured revolving credit facility (1)(2) 1.870% $ 191,000 7/15/18 $ 191,000 1.5

$400,000 unsecured term loan (2)(3) 1.817% 400,000 4/15/19 $ 400,000 2.2

Subtotal / weighted average 1.831% $ 591,000 $ 591,000 2.0

Unsecured Fixed Rate Debt:

Senior unsecured notes due 2018 6.700% 350,000 1/15/18 350,000 1.0

Senior unsecured notes due 2021 4.250% 400,000 2/15/21 400,000 4.2

Senior unsecured notes due 2022 5.000% 500,000 8/15/22 500,000 5.6

Senior unsecured notes due 2023 4.500% 300,000 6/15/23 300,000 6.4

Senior unsecured notes due 2024 4.650% 350,000 3/15/24 350,000 7.2

Senior unsecured notes due 2025 4.500% 350,000 3/15/25 350,000 8.2

Senior unsecured notes due 2026 5.250% 350,000 2/15/26 350,000 9.2

Convertible senior unsecured notes due 2027 3.800% 8,478 3/15/27 (4) 8,478 10.2

Subtotal / weighted average 4.971% $ 2,608,478 $ 2,608,478 5.9

Total / weighted average (5) 4.424% $ 3,199,478 $ 3,199,478 5.2

(1) We are required to pay interest on borrowings under our revolving credit facility at a rate of LIBOR plus a premium of 110 basis points. We also pay a

facility fee of 20 basis points per annum on the total amount of lending commitments under our revolving credit facility. Both the interest rate premium

and facility fee are subject to adjustment based upon changes to our credit ratings. The interest rate listed above is as of December 31, 2016. Subject

to meeting conditions and payment of a fee, we may extend the maturity date to July 15, 2019.

(2) The maximum borrowing availability under our revolving credit facility and term loan combined may be increased to up to $2,300,000 on certain terms

and conditions.

(3) We are required to pay interest on the amount outstanding under our term loan at a rate of LIBOR plus a premium of 120 basis points, subject to

adjustment based on changes to our credit ratings. The interest rate listed above is as of December 31, 2016. Our term loan is prepayable without

penalty at any time.

(4) Our 3.8% convertible senior unsecured notes due 2027 are convertible, if certain conditions are met (including certain changes in control). Upon

conversion, the holder of notes is entitled to receive cash in an amount equal to the principal amount of the notes and, to the extent the market price of

our common shares then exceeds the conversion price of $49.70 per share, subject to adjustment, at our option either cash or our common shares

valued based on such market price for such excess amount. Holders of our outstanding convertible senior unsecured notes may require us to

repurchase all or a portion of the notes on March 15, 2017 and March 15, 2022, or upon the occurrence of certain change in control events.

(5) Our total debt as of December 31, 2016, net of unamortized discounts and certain issuance costs totaling $35,671, was $3,163,807.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

DEBT M

ATURIT

Y SCHEDUL

E

18

DEBT MATURITY SCHEDULE

As of December 31, 2016

(dollars in thousands)

Unsecured Unsecured

Floating Fixed

Year Rate Debt Rate Debt Total (4)

2017 $ — $ — $ —

2018 191,000 (1) 350,000 541,000

2019 400,000 (2) — 400,000

2021 — 400,000 400,000

2022 — 500,000 500,000

2023 — 300,000 300,000

2024 — 350,000 350,000

2025 — 350,000 350,000

2026 — 350,000 350,000

2027 — 8,478 (3) 8,478

$ 591,000 $ 2,608,478 $ 3,199,478

Percent of total debt 18.5% 81.5% 100%

(1) Represents amounts outstanding under our $1,000,000 revolving credit facility at December 31, 2016. Subject to meeting conditions and

payment of a fee, we may extend the maturity date to July 15, 2019.

(2) Represents amounts outstanding on our term loan at December 31, 2016. Our term loan is prepayable without penalty at any time.

(3) Our 3.8% convertible senior unsecured notes due 2027 are convertible, if certain conditions are met (including certain changes in control). Upon

conversion, the holder of notes is entitled to receive cash in an amount equal to the principal amount of the notes and, to the extent the market

price of our common shares then exceeds the conversion price of $49.70 per share, subject to adjustment, at our option either cash or our

common shares valued based on such market price for such excess amount. Holders of our outstanding convertible senior unsecured notes

may require us to repurchase all or a portion of the notes on March 15, 2017 and March 15, 2022, or upon the occurrence of certain change in

control events.

(4) Our total debt as of December 31, 2016, net of unamortized discounts and certain issuance costs totaling $35,671, was $3,163,807.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

LEVERAGE R

ATIOS, COVERAGE R

ATIOS

AND PUBLIC DEBT COVENANT

S

19

LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS

As of and For the Three Months Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Leverage Ratios:

Total debt (book value) (1) / total gross assets (2) 34.6% 34.6% 39.0% 39.6% 38.0%

Total debt (book value) (1) / gross book value of real estate assets (3) 36.3% 36.3% 40.8% 41.3% 39.4%

Total debt (book value) (1) / total market capitalization (4) 36.5% 37.6% 42.9% 44.7% 43.4%

Secured debt (book value) (1) / total assets 0.0% 0.0% 0.0% 0.0% 0.0%

Variable rate debt (book value) (1) / total debt (book value) (1) 18.6% 17.6% 18.0% 18.0% 26.3%

Coverage Ratios:

Adjusted EBITDA (5) (6) / interest expense 3.7x 5.1x 5.2x 4.5x 3.3x

Adjusted EBITDA (5) (6) / interest expense and preferred distributions 3.2x 4.5x 4.6x 4.0x 2.9x

Total debt (book value) (1) / annualized Adjusted EBITDA (5) (6) 5.8x 3.7x 4.1x 4.7x 6.6x

Public Debt Covenants:

Total debt / adjusted total assets (7) - allowable maximum 60.0% 34.9% 35.0% 39.4% 40.0% 37.9%

Secured debt / adjusted total assets (7) - allowable maximum 40.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Consolidated income available for debt service (8) / debt service - required minimum 1.50x 4.99x 4.19x 4.27x 4.12x 3.50x

Total unencumbered assets (7) to unsecured debt - required minimum 150% 286.1% 285.7% 253.5% 249.8% 264.1%

(1) Debt amounts are net of unamortized discounts and certain issuance costs.

(2) Total gross assets is total assets plus accumulated depreciation.

(3) Gross book value of real estate assets is real estate properties at cost, before purchase price allocations, less impairment writedowns, if any.

(4) Total market capitalization is total debt plus the market value of our common and preferred shares at the end of each period.

(5) See page 22 for the calculation of EBITDA and Adjusted EBITDA, and a reconciliation of these amounts to net income (loss) determined in accordance with GAAP.

(6) Adjusted EBITDA for the three months ended December 31, 2016 and 2015 includes $52,407 and $62,263, respectively, of business management incentive fee expense.

(7) Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment writedowns, if any,

and exclude depreciation and amortization, accounts receivable and intangible assets. Consolidated income available for debt service is earnings from operations

excluding interest expense, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early

extinguishment of debt, gains and losses on sales of property and amortization of deferred charges.

(8) Consolidated income available for debt service for the three months ended December 31, 2016 includes the reversal of $3,865 of previously accrued business

management incentive fee expense. Consolidated income available for debt service for the three months ended September 30, 2016, June 30, 2016, March 31, 2016 and

December 31, 2015 includes $25,036, $25,920, $5,316 and $44,880, respectively, of business management incentive fee expense.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

FF&E RESE

RVE ESCROW

S

20

FF&E RESERVE ESCROWS (1)

(dollars in thousands)

As of and For the Three Months Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

FF&E reserves (beginning of period) $ 60,606 $ 61,419 $ 55,891 $ 51,211 $ 44,296

Manager deposits 19,681 20,050 19,603 15,542 17,607

HPT fundings (2):

Marriott No. 1 534 1,109 715 441 794

Marriott No. 234 950 — — — —

Hotel improvements (21,315) (21,972) (14,790) (11,303) (11,486)

FF&E reserves (end of period) $ 60,456 $ 60,606 $ 61,419 $ 55,891 $ 51,211

(1) Most of our hotel operating agreements require the deposit of a percentage of gross hotel revenues into escrows to fund FF&E

reserves. For hotels under renovation or recently renovated, this requirement may be deferred for a period. Our management

agreement with Wyndham Hotel Group, or Wyndham, requires FF&E reserve deposits subject to available cash flows, as defined in

our Wyndham agreement. Our Sonesta agreement and our lease agreement with Morgans Hotel Group, or Morgans, do not require

FF&E reserve deposits. We own all the FF&E reserve escrows for our hotels.

(2) Represents FF&E reserve deposits not funded by hotel operations, but separately funded by us. The operating agreements for our

hotels generally provide that, if necessary, we will provide FF&E funding in excess of escrowed reserves. To the extent we make such

fundings, our contractual annual minimum returns or rents generally increase by a percentage of the amounts we fund.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

PROPERT

Y

ACQUISITION

AND DISPOSITION INFORM

ATION SINCE JANUA

RY

1, 201

6

21

PROPERTY ACQUISITION AND DISPOSITION INFORMATION SINCE JANUARY 1, 2016

(dollars in thousands)

ACQUISITIONS:

Average

Number Purchase

Date of Rooms Operating Purchase Price per

Acquired Properties Brand Location / Suites Agreement Price (1) Room / Suite

2/1/2016 1 Sonesta ES Suites Cleveland, OH 158 Sonesta $ 7,200 $ 46

2/1/2016 1 Sonesta ES Suites Westlake, OH 104 Sonesta $ 4,800 $ 46

3/16/2016 1 Kimpton Hotel Monaco Portland, OR 221 InterContinental $ 114,000 $ 516

3/31/2016 1 TravelCenters of America Hillsboro, TX N/A TA No. 4 $ 19,683 N/A

6/22/2016 1 Petro Stopping Centers Brazil, IN N/A TA No. 3 $ 10,682 N/A

6/22/2016 1 Petro Stopping Centers Remington, IN N/A TA No. 1 $ 13,194 N/A

6/30/2016 1 Petro Stopping Centers Wilmington, IL N/A TA No. 2 $ 22,297 N/A

9/14/2016 — (2) TravelCenters of America Holbrook, AZ N/A TA No. 4 $ 325 N/A

9/30/2016 1 TravelCenters of America Caryville, TN N/A TA No. 2 $ 16,557 N/A

12/5/2016 1 Sonesta Milpitas, CA 236 Sonesta $ 46,000 $ 195

2/1/2017 1 Kimpton Hotel Allegro Chicago, IL 483 InterContinental $ 85,494 $ 177

Total / Weighted Average 10 1,202 $ 340,232 214

(1) Represents cash purchase price and excludes acquisition related costs.

(2) Represents our acquisition of a land parcel adjacent to one of our travel centers.

DISPOSITIONS:

There were no property dispositions since January 1, 2016.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

CALCUL

ATION OF EBITD

A

AND

ADJUSTED EBITD

A

22

CALCULATION OF EBITDA AND ADJUSTED EBITDA (1)

(in thousands)

For the Three Months Ended For the Year Ended December 31,

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 2016 2015

Net income (loss) $ 63,186 $ 51,812 $ 56,061 $ 52,051 $ (19,494) $ 223,110 $ 166,418

Add: Interest expense 37,349 41,280 41,698 41,586 36,980 161,913 144,898

Income tax expense 537 948 2,160 375 121 4,020 1,566

Depreciation and amortization 91,150 90,139 88,782 87,271 85,964 357,342 329,776

EBITDA 192,222 184,179 188,701 181,283 103,571 746,385 642,658

Add (Less): Acquisition related costs (2) 482 156 117 612 389 1,367 2,375

General and administrative expense paid in

common shares (3) 557 985 870 422 379 2,834 4,105

Estimated business management incentive fee (4) (56,272) 25,036 25,920 5,316 (17,383) — —

Loss on distribution to common shareholders of

RMR common stock (5) — — — — 36,773 — 36,773

Loss on early extinguishment of debt (6) — 158 — 70 — 228 —

Gain on sale of real estate (7) — — — — — — (11,015)

Adjusted EBITDA $ 136,989 $ 210,514 $ 215,608 $ 187,703 $ 123,729 $ 750,814 $ 674,896

(1) Please see page 24 for definitions of EBITDA and Adjusted EBITDA and a description of why we believe the presentation of these measures provide useful information to investors.

(2) Represents costs associated with our acquisition activities.

(3) Amounts represent the portion of business management fees that were payable in our common shares as well as equity compensation awarded to our trustees, our officers and certain

employees of RMR's operating subsidiary, RMR LLC. Effective June 1, 2015, all business management fees are paid in cash.

(4) Incentive fees under our business management agreement are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are

included in general and administrative expense in our consolidated statements of income (loss). In calculating net income (loss) in accordance with GAAP, we recognize estimated

business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes

of calculating net income (loss), we do not include these amounts in the calculation of Adjusted EBITDA until the fourth quarter, which is when the actual business management incentive

fee expense amount for the year, if any, is determined. Adjusted EBITDA includes business management incentive fee expense of $52,407 and $62,263 for both the three months and

years ended December 31, 2016 and 2015, respectively. Business management incentive fees for 2016 and 2015 were paid in cash in January 2017 and 2016, respectively.

(5) We recorded a $36,773 non-cash loss on the distribution to common shareholders of RMR common stock to our shareholders in the fourth quarter of 2015 as a result of the closing price

of RMR common stock being lower than our carrying amount per share on December 14, 2015, the day we distributed RMR common stock to our shareholders.

(6) We recorded losses of $228 on early extinguishment of debt in the year ended December 31, 2016, in connection with the redemptions of certain senior unsecured notes.

(7) We recorded an $11,015 gain on sale of real estate in the year ended December 31, 2015, in connection with the sale of five travel centers.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

CALCUL

ATION OF FUNDS FROM OPER

ATIONS (FFO)

AND NORMALIZED FF

O

AV

AILABLE FOR COMMON SHAREHOLDERS

23

CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FFO AVAILABLE FOR COMMON SHAREHOLDERS (1)

(dollar amounts in thousands, except per share data)

For the Three Months Ended For the Year Ended December 31,

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 2016 2015

Net income (loss) available for common shareholders $ 58,020 $ 46,646 $ 50,895 $ 46,885 $ (24,660) $ 202,446 $ 145,754

Add (Less): Depreciation and amortization 91,150 90,139 88,782 87,271 85,964 357,342 329,776

Gain on sale of real estate (2) — — — — — — (11,015)

FFO available for common shareholders 149,170 136,785 139,677 134,156 61,304 559,788 464,515

Add (Less): Acquisition related costs (3) 482 156 117 612 389 1,367 2,375

Estimated business management incentive fees (4) (56,272) 25,036 25,920 5,316 (17,383) — —

Loss on distribution to common shareholders of

RMR common stock (5) — — — — 36,773 — 36,773

Loss on early extinguishment of debt (6) — 158 — 70 — 228 —

Normalized FFO available for common shareholders $ 93,380 $ 162,135 $ 165,714 $ 140,154 $ 81,083 $ 561,383 $ 503,663

Weighted average shares outstanding (basic) 164,120 157,217 151,408 151,402 151,400 156,062 150,709

Weighted average shares outstanding (diluted) 164,128 157,263 151,442 151,415 151,400 156,088 151,002

Basic and diluted per share common share amounts:

Net income (loss) available for common shareholders $ 0.35 $ 0.30 $ 0.34 $ 0.31 $ (0.16) $ 1.30 $ 0.97

FFO available for common shareholders $ 0.91 $ 0.87 $ 0.92 $ 0.89 $ 0.40 $ 3.59 $ 3.08

Normalized FFO available for common shareholders $ 0.57 $ 1.03 $ 1.09 $ 0.93 $ 0.54 $ 3.60 $ 3.34

(1) Please see page 24 for definitions of FFO and Normalized FFO available for common shareholders, a description of why we believe the presentation of these measures provides useful

information to investors regarding our financial condition and results of operations and a description of how we use these measures.

(2) We recorded an $11,015 gain on sale of real estate in the year ended December 31, 2015 in connection with the sale of five travel centers.

(3) Represents costs associated with our acquisition activities.

(4) Incentive fees under our business management agreement are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in

general and administrative expense in our consolidated statements of income (loss). In calculating net income (loss) in accordance with GAAP, we recognize estimated business management

incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income

(loss), we do not include these amounts in the calculation of Normalized FFO available for common shareholders until the fourth quarter, which is when the actual business management

incentive fee expense amount for the year, if any, is determined. Normalized FFO available for common shareholders includes business management incentive fee expense of $52,407 and

$62,263 for both the three months and years ended December 31, 2016 and 2015, respectively. Business management incentive fees for 2016 and 2015 were paid in cash in January 2017 and

2016, respectively.

(5) We recorded a $36,773 non-cash loss on the distribution of RMR common stock to our shareholders in the fourth quarter of 2015 as a result of the closing price of RMR common stock being

lower than our carrying amount per share on December 14, 2015, the day we distributed RMR common stock to our shareholders.

(6) We recorded losses of $228 on early extinguishment of debt in the year ended December 31, 2016, in connection with the redemptions of certain senior unsecured notes.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

NON-GAA

P FINANCIA

L MEASURES DEFINITION

S

24

Non-GAAP Financial Measures Definitions

Definition of EBITDA and Adjusted EBITDA

We calculate EBITDA and Adjusted EBITDA as shown on page 22. We consider EBITDA and Adjusted EBITDA to be appropriate supplemental measures of our

operating performance, along with net income (loss), net income (loss) available for common shareholders and operating income. We believe that EBITDA and Adjusted

EBITDA provide useful information to investors because by excluding the effects of certain historical amounts, such as interest, depreciation and amortization expense,

EBITDA and Adjusted EBITDA may facilitate a comparison of current operating performance with our past operating performance. In calculating Adjusted EBITDA, we

include business management incentive fees only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their

quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees

will ultimately be payable when all contingencies for determining any such fees are determined at the end of the calendar year. EBITDA and Adjusted EBITDA do not

represent cash generated by operating activities in accordance with GAAP and should not be considered an alternative to net income (loss), net income (loss) available

for common shareholders or operating income as an indicator of operating performance or as a measure of our liquidity. These measures should be considered in

conjunction with net income (loss), net income (loss) available for common shareholders and operating income as presented in our consolidated statements of income

(loss). Other real estate companies and REITs may calculate EBITDA and Adjusted EBITDA differently than we do.

Definition of FFO and Normalized FFO

We calculate FFO available for common shareholders and Normalized FFO available for common shareholders as shown on page 23. FFO available for common

shareholders is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or NAREIT, which is net income (loss) available for

common shareholders calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real

estate depreciation and amortization, as well as certain other adjustments currently not applicable to us. Our calculation of Normalized FFO available for common

shareholders differs from NAREIT's definition of FFO available for common shareholders because we include business management incentive fees, if any, only in the

fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our

core operating performance and the uncertainty as to whether any such business management incentive fees will ultimately be payable when all contingencies for

determining any such fees are determined at the end of the calendar year, and we exclude acquisition related costs, loss on distribution to common shareholders of RMR

common stock and loss on early extinguishment of debt. We consider FFO available for common shareholders and Normalized FFO available for common shareholders

to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss), net income (loss) available for common shareholders and

operating income (loss). We believe that FFO available for common shareholders and Normalized FFO available for common shareholders provide useful information to

investors because by excluding the effects of certain historical amounts, such as depreciation expense, FFO available for common shareholders and Normalized FFO

available for common shareholders may facilitate a comparison of our operating performance between periods and with other REITs. FFO available for common

shareholders and Normalized FFO available for common shareholders are among the factors considered by our Board of Trustees when determining the amount of

distributions to shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a REIT, limitations in our credit

agreement and public debt covenants, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating performance and

our expected needs for and availability of cash to pay our obligations. FFO available for common shareholders and Normalized FFO available for common shareholders

do not represent cash generated by operating activities in accordance with GAAP and should not be considered as alternatives to net income (loss), net income (loss)

available for common shareholders or operating income as an indicator of our operating performance or as a measure of our liquidity. These measures should be

considered in conjunction with net income (loss), net income (loss) available for common shareholders and operating income as presented in our consolidated

statements of income (loss). Other real estate companies and REITs may calculate FFO available for common shareholders and Normalized FFO available for common

shareholders differently than we do.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

OPERATING AGREEMENTS AND PORTFOLIO INFORMATION

Wyndham Atlanta Galleria, Atlanta, GA

Operator: Wyndham Hotel Group

Guest Rooms: 296

Holiday Inn Atlanta Airport South, College Park, GA

Operator: InterContinental Hotels Group

Guest Rooms: 190

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

PORTFOLIO B

Y OPER

ATING

AGREEMENT

AND MANAGER

26

PORTFOLIO BY OPERATING AGREEMENT AND MANAGER

As of December 31, 2016

(dollars in thousands)

Percent of

Percent of Percent of Total

Total Total Percent of Investment Annual Annual

Number of Number of Number of Number of Total Per Minimum Minimum

By Operating Agreement (1): Properties Properties Rooms / Suites Rooms / Suites Investment (2) Investment Room / Suite Return / Rent (3) Return / Rent

Marriott (no. 1) 53 11% 7,610 16% $ 691,298 9% $ 91 $ 68,636 9%

Marriott (no. 234) 68 13% 9,120 20% 1,001,389 11% 110 106,360 13%

Marriott (no. 5) 1 0% 356 0% 90,078 1% 253 10,116 1%

Subtotal / Average Marriott 122 24% 17,086 36% 1,782,765 21% 104 185,112 23%

InterContinental 94 19% 14,403 31% 1,695,778 19% 118 161,789 21%

Sonesta 34 7% 6,329 14% 1,196,797 13% 189 90,171 11%

Wyndham 22 4% 3,579 8% 386,758 4% 108 28,404 4%

Hyatt 22 4% 2,724 6% 301,942 3% 111 22,037 3%

Carlson 11 2% 2,090 4% 209,895 2% 100 12,920 2%

Morgans 1 0% 372 1% 120,000 1% 323 7,595 1%

Subtotal / Average Hotels 306 60% 46,583 100% 5,693,935 63% 122 508,028 65%

TA (No. 1) 40 8% N/A N/A 661,417 7% N/A 51,435 6%

TA (No. 2) 40 8% N/A N/A 665,127 7% N/A 52,327 7%

TA (No. 3) 39 8% N/A N/A 620,240 7% N/A 52,665 7%

TA (No. 4) 39 8% N/A N/A 568,098 6% N/A 50,117 6%

TA (No. 5) 40 8% N/A N/A 862,697 10% N/A 67,573 9%

Subtotal / Average TA 198 40% N/A N/A 3,377,579 37% N/A 274,117 35%

Total / Average 504 100% 46,583 100% $ 9,071,514 100% $ 122 $ 782,145 100%

(1) See pages 28 through 30 for additional information regarding each of our operating agreements.

(2) Represents historical cost of our properties plus capital improvements funded by us less impairment writedowns, if any, and excludes capital improvements made from FF&E reserves

funded from hotel operations.

(3) Each of our management agreements or leases provides for payment to us of an annual minimum return or minimum rent, respectively. Certain of these minimum payment amounts are

secured by full or limited guarantees or security deposits as more fully described on pages 28 through 30. In addition, certain of our hotel management agreements provide for payment to

us of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed or secured by deposits.

Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to recognize rental income on a straight line basis in accordance with

GAAP.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

PORTFOLIO B

Y BRAN

D

27

PORTFOLIO BY BRAND

As of December 31, 2016

(dollars in thousands)

Percent of Percent of

Total Total Percent of Investment

Number of Number of Number of Number of Total Per

Brand Manager Properties Properties Rooms / Rooms / Investment (1) Investment Room / Suite

Courtyard by Marriott® Marriott 71 14% 10,265 22% $ 976,632 12% $ 95

Candlewood Suites® InterContinental 61 12% 7,553 16% 586,488 7% 78

Residence Inn by Marriott® Marriott 35 7% 4,488 10% 539,364 6% 120

Royal Sonesta Hotels® Sonesta 4 1% 1,571 3% 474,598 5% 302

Sonesta ES Suites® Sonesta 25 5% 3,077 7% 441,130 5% 143

Crowne Plaza® InterContinental 7 1% 2,711 6% 372,974 4% 138

Staybridge Suites® InterContinental 19 4% 2,364 5% 331,329 4% 140

Hyatt Place® Hyatt 22 4% 2,724 6% 301,942 3% 111

Wyndham Hotels and Resorts® and Wyndham Grand® Wyndham 6 1% 1,823 4% 285,299 3% 156

Sonesta Hotels & Resorts® Sonesta 5 1% 1,681 3% 281,069 3% 167

InterContinental Hotels and Resorts® InterContinental 3 1% 800 2% 217,981 2% 272

Marriott Hotels and Resorts® Marriott 2 1% 748 2% 131,141 2% 175

The Clift Hotel® Morgans 1 0% 372 1% 120,000 1% 323

Radisson® Hotels & Resorts Carlson 5 1% 1,128 2% 119,630 1% 106

Kimpton® Hotels & Restaurants InterContinental 1 0% 221 0% 114,000 1% 516

TownePlace Suites by Marriott® Marriott 12 2% 1,321 2% 111,037 1% 84

Hawthorn Suites® Wyndham 16 3% 1,756 4% 101,459 1% 58

Country Inns & Suites by Carlson® Carlson 5 1% 753 2% 78,528 1% 104

Holiday Inn® InterContinental 3 1% 754 2% 73,006 1% 97

SpringHill Suites by Marriott® Marriott 2 0% 264 1% 24,591 0% 93

Park Plaza® Hotels & Resorts Carlson 1 0% 209 0% 11,737 0% 56

TravelCenters of America® TA 149 30% 0 N/A 2,358,729 26% N/A

Petro Stopping Centers® TA 49 10% 0 N/A 1,018,850 11% N/A

Total / Average 504 100% 46,583 100% $ 9,071,514 100% $ 122

(1) Represents historical cost of properties plus capital improvements funded by us less impairment writedowns, if any, and excludes capital improvements made from

FF&E reserves funded from hotel operations.

Hospitality Properties Trust

Supplemental Operating and Financial Data, December 31, 2016

OPER

ATING

AGREEMENT INFORM

ATIO

N

28

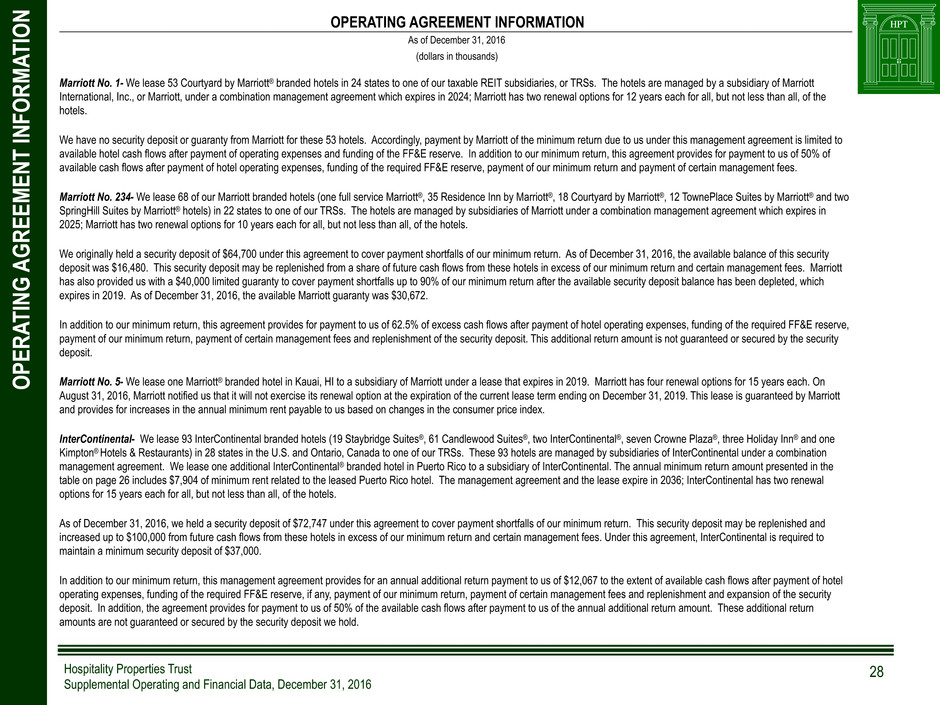

Marriott No. 1- We lease 53 Courtyard by Marriott® branded hotels in 24 states to one of our taxable REIT subsidiaries, or TRSs. The hotels are managed by a subsidiary of Marriott

International, Inc., or Marriott, under a combination management agreement which expires in 2024; Marriott has two renewal options for 12 years each for all, but not less than all, of the

hotels.

We have no security deposit or guaranty from Marriott for these 53 hotels. Accordingly, payment by Marriott of the minimum return due to us under this management agreement is limited to

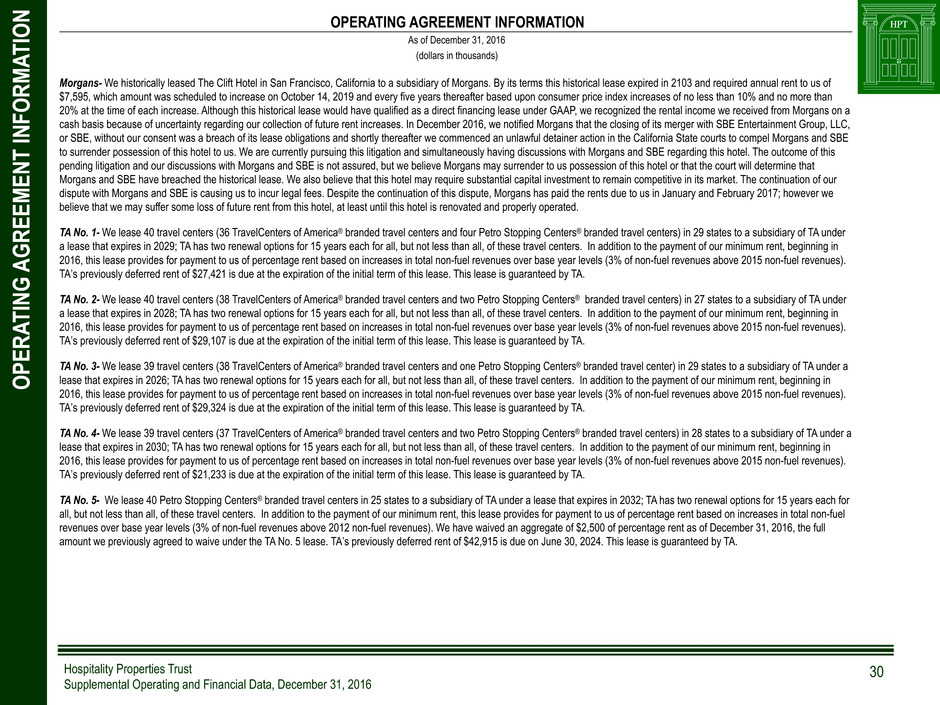

available hotel cash flows after payment of operating expenses and funding of the FF&E reserve. In addition to our minimum return, this agreement provides for payment to us of 50% of