Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Forestar Group Inc. | exh991forreleasefy16.htm |

| 8-K - 8-K - Forestar Group Inc. | earningsfy168-k.htm |

Information on Execution of Key

Initiatives and

Fourth Quarter and Full Year 2016

Financial Results

March 2, 2017

Exhibit 99.2

Notice to Investors

This presentation contains “forward-looking statements” within the meaning of the federal securities laws.

Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,”

“estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of

similar meaning. These statements reflect management’s current views with respect to future events and

are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our

actual results to differ significantly from the results discussed in the forward-looking statements, including

but not limited to: general economic, market, or business conditions; changes in commodity prices;

opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs

and expenses including development costs; demand for new housing, including impacts from mortgage

credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses;

accuracy of accounting assumptions; competitive actions by other companies; changes in laws or

regulations; and other factors, many of which are beyond our control. Except as required by law, we

expressly disclaim any obligation to publicly revise any forward-looking statements contained in this

presentation to reflect the occurrence of events after the date of this presentation.

2

Key Initiatives

Reducing Costs Across the Entire

Organization

• Actions taken to eliminate nearly $60MM in annual SG&A to date*

• Additional 34% reduction in force planned in March 2017

• Following reduction in force will have reduced headcount by over

70% compared to 2014 peak

• Implemented zero based budgeting

Reviewing Entire Portfolio of Assets

• Executed $482MM in non-core asset sales in 2016**

• Undeveloped land sales (~73,000 acres) - $138MM

• Radisson Hotel - $129MM

• 5 multifamily assets - $119MM

• Oil and gas working interests - $77MM

• Non-core Community Development - $19MM

• Sold 1,940 residential lots in 2016

• Sold mineral assets for $85.6MM in 2017**

Reviewing Capital Structure

• Reduced outstanding debt by $278MM in 2016 and $323MM since

Q3 2015

• Reduced annual interest expense by approximately $23MM going

forward

• $266MM cash at YE 2016 and $331MM at February 28, 2017

2016 – A Transformative Year

3

Exceptional Progress Made In 2016

* Expect full cost savings realization once all non-core assets are sold.

** Reflects pre-tax net proceeds

Overview of Assets

CORE

Water

45% non-participating

royalty interest in

groundwater rights on 1.4

million surface acres

Groundwater leases on

20,000 surface acres in

Central Texas – Under

Contract*

Multifamily

Westlake site in Austin –

Under Contract*

Acklen venture in Nashville

completed – 85.6%

occupied / 89.1% leased –

listed for sale 2/21/17

HiLine venture in Littleton

completed – 81.6%

occupied / 83.9% leased

Elan 99 venture in Houston

completed – 65.0%

occupied / 71.9% leased

Timberland and

Undeveloped Land

11,000 acres in Georgia

8,000 acres in Texas –

Under Contract*

(2 transactions)

Community

Development

50 entitled, developed or

under development projects

in 10 states and 14 markets

~ 4,600 acres

Two communities in

entitlement (CA) – 730 total

acres

NON-CORE – 9 REMAINING ASSETS

4

* Contracts may provide termination rights to buyers so closings cannot be assured.

Fourth Quarter and Full Year 2016 Results

5

($ in Millions, except per share data)

Revenues * $64.5 $105.4 $197.3 $218.6

Net Income (Loss) – Continuing

Operations $43.2 $33.3 $75.5 ($26.9)

Net Income (Loss) Per Share –

Continuing Operations $1.02 $0.79 $1.78 ($0.79)

Net Income (Loss) $43.7 ($6.2) $58.6 ($213.0)

Net Income (Loss) Per Share $1.03 ($0.14) $1.38 ($6.22)

Note: Q4 2016 & FY 2016 weighted average diluted shares outstanding were 42.3 million compared with 42.4 million in Q4 2015 and 34.3

million in FY 2015

* Excludes oil & gas working interests which are now classified as discontinued operations

Q4 2016 Q4 2015

Full Year

2016

Full Year

2015

• Q4 2016 results include pre-tax gains of $48.9 million related to the sale of over 58,300 acres of non-core bulk timberland and undeveloped land.

• Q4 2015 results include pre-tax non-cash impairment charges and changes in deferred tax asset valuation allowance of approximately ($34.8) million

principally related to proved properties and unproved leasehold interest impairments related to discontinued operations.

• Full year 2016 results include pre-tax gains of approximately $153.1 million related to the sale of non-core assets, including discontinued operations, which

was partially offset by non-cash impairment charges of ($56.5) million related to six non-core community development projects and two multifamily sites.

• Full year 2015 results include pre-tax charges of approximately ($264.1) million related to impairment of proved properties and unproved leasehold interests

associated with non-core oil and gas assets, a deferred tax asset valuation allowance, and severance related charges.

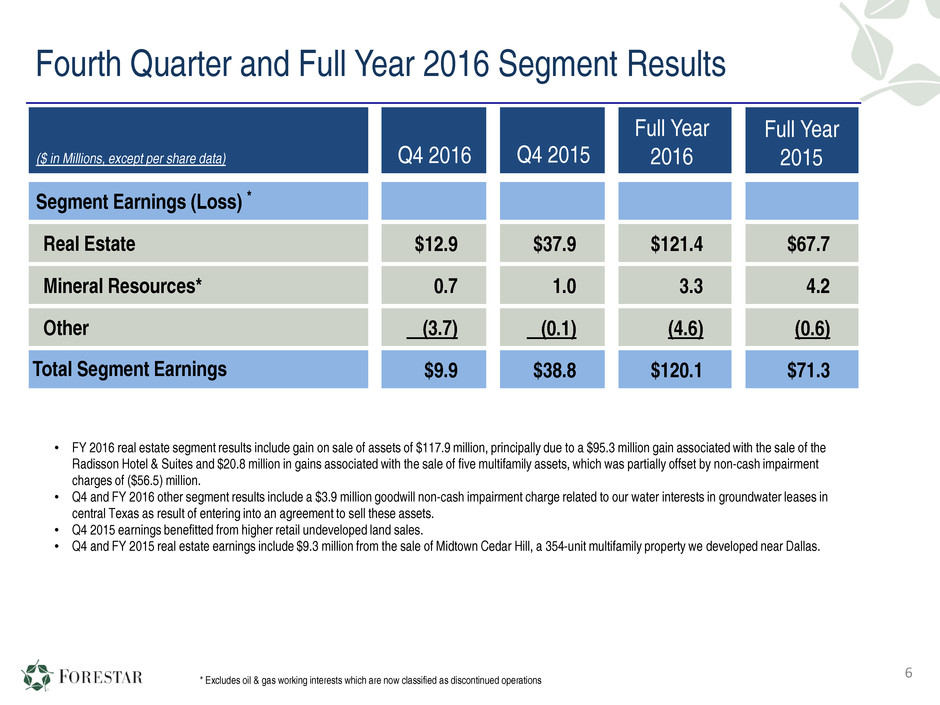

Fourth Quarter and Full Year 2016 Segment Results

6

($ in Millions, except per share data)

Segment Earnings (Loss) *

Real Estate $12.9 $37.9 $121.4 $67.7

Mineral Resources* 0.7 1.0 3.3 4.2

Other (3.7) (0.1) (4.6) (0.6)

Total Segment Earnings $9.9 $38.8 $120.1 $71.3

* Excludes oil & gas working interests which are now classified as discontinued operations

Q4 2016 Q4 2015

Full Year

2016

Full Year

2015

• FY 2016 real estate segment results include gain on sale of assets of $117.9 million, principally due to a $95.3 million gain associated with the sale of the

Radisson Hotel & Suites and $20.8 million in gains associated with the sale of five multifamily assets, which was partially offset by non-cash impairment

charges of ($56.5) million.

• Q4 and FY 2016 other segment results include a $3.9 million goodwill non-cash impairment charge related to our water interests in groundwater leases in

central Texas as result of entering into an agreement to sell these assets.

• Q4 2015 earnings benefitted from higher retail undeveloped land sales.

• Q4 and FY 2015 real estate earnings include $9.3 million from the sale of Midtown Cedar Hill, a 354-unit multifamily property we developed near Dallas.

Real Estate Segment - Earnings Reconciliation Q4 2016

$0.3

…

$37.9

$6.6

$1.2 $0.4

($11.0)

($11.4)

($3.9) $(1.1)

$12.9

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

Q4 2015 Opex Mitigation

Banking

Lot Sales Impairment Multifamily

Properties

Undeveloped

Land Sales

Residential &

Commercial

Tract Sales

Gain on Asset

Sales

Interest Income Q4 2016

($6.1)

Segment Earnings Reconciliation

Q4 2015 vs. Q4 2016

($ in millions)

Q4 2016 Sales Activity / Highlights*

• Sold 835 residential lots

• Core Residential lot sales – 600 lots

• ~ $78,900 average price per lot

• $29,300 gross profit per lot

• Non-Core sales – Community Development

• Residential lot sales – 235 lots

• Residential tract sales – 1,481 acres

• Commercial tract sales – 178 acres

• Sold $3.3 million in impervious cover and

stream credits

7

*Includes ventures

Real Estate Segment - Earnings Reconciliation FY 2016

$3.1

$67.7

$116.3

$12.1

$11.3

($15.0)

($55.4)

($7.6) $(1.4)

$121.4

$0

$50

$100

$150

$200

$250

FY 2015 Gain on Asset

Sales

Undeveloped

Land Sales

Opex Mitigation

Banking

Impairment Multifamily

Properties

Lot Sales Residential &

Commercial

Tract Sales

Interest Income FY 2016

($9.7)

Segment Earnings Reconciliation

FY 2015 vs. FY 2016

($ in millions)

FY 2016 Sales Activity / Highlights*

• Sold 1,940 residential lots

• Core Residential lot sales – 1,705 lots

• ~ $72,200 average price per lot

• $26,500 gross profit per lot

• Non-Core sales – Community Development

• Residential lot sales – 235 lots

• Residential tract sales – 1,481 acres

• Commercial tract sales – 286 acres

• Sold Radisson Hotel & Suites for $130.0 million, generating

$95.3 million gain

• Sold 360º multifamily venture interest for a total of $15.1

million, generating $10.8 million in earnings

• Sold Eleven multifamily community for $60.2 million,

generating $9.1 million gain

• Sold Music Row multifamily site for $15.0 million,

generating a $4.0 million gain

• Sold Dillion multifamily site for $26.0 million, generating

$1.2 million gain

• Sold ~ 14,900 acres of undeveloped land, generating $28.1

million in earnings

• Average price ~ $2,450 per acre

• Sold $6.5 million in impervious cover and stream credits

• Incurred $56.5 million in non-cash impairments

8

*Includes ventures

Lot Sales and Lots Under Contract

9

0

500

1,000

1,500

2,000

2,500

Q

11

2

Q

21

2

Q

31

2

Q

41

2

Q

11

3

Q

21

3

Q

31

3

Q

41

3

Q

11

4

Q

21

4

Q

31

4

Q

41

4

Q

11

5

Q

21

5

Q

31

5

Q

41

5

Q

11

6

Q

21

6

Q

31

6

Q

41

6

Re

sid

en

tia

l L

ot

s

Developed Lots Lots Under Development

> 2,100 Lots Under Option Contract*

Includes ventures

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Bulk Lot Sales Lot Sales

Average Lot Margin Average Lot Margin Excl. Bulk Sales

Annual Lot Sales and Average Lot Margin

* Includes about 500 future lots under contract but not yet

under development and not depicted on the graph

For questions, please contact:

Charles D. Jehl

Chief Financial Officer

Forestar Group Inc.

6300 Bee Cave Road

Building Two, Suite 500

Austin, TX 78746

512-433-5229

chuckjehl@forestargroup.com

Appendix

0

10

20

30

40

50

60

70

80

90

100

2015 2016 2017E Target

Annual SG&A Costs

Corporate G&A Segment Operating Costs Project Level Expenses

Cost Reductions

SG&A costs in 2017 and target are estimates and actual results may vary depending on the timing of completion of non-core asset sales.

$87 million

$

in

M

illi

on

s

$62 million

Other Corporate Costs

22%

Corporate Employee

Costs

24%

Project Level

Expenses

29%

Other Segment

Operating Costs

7%

Segment Employee

Costs

18%

$8 MM

$7 MM

$6 MM$5 MM

$2 MM

Action Taken to Eliminate Nearly $60 million in Annual SG&A Costs Since YE 2015

$28 million

Target SG&A Cost - $28 million

$38 million

12

Real Estate Segment KPI’s

Q4

2016

Q4

2015

FY

2016

FY

2015

Residential Lot Sales

Lots Sold 835 363 1,940 1,472

Average Price / Lot $67,594 $83,739 $68,152 $77,170

Gross Profit / Lot $21,493 $35,023 $23,446 $34,398

Commercial Tract Sales

Acres Sold 178 7 298 63

Average Price / Acre $7,442 $491,723 $44,623 $248,278

Undeveloped Retail Land Sales

Acres Sold 1,016 7,267 14,914 13,862

Average Price / Acre $2,395 $2,192 $2,455 $2,296

Segment Revenues ($ in Millions) $62.5 $102.6 $190.3 $202.8

Segment Earnings ($ in Millions) $12.9 $37.9 $121.4 $67.7

13

Includes ventures

Stable Market Demand in Key Markets

*Source: Bureau of Labor Statistics

December 2016 vs. December 2015

Austin 1.9%

Dallas / Fort Worth 3.3%

Houston 0.5%

San Antonio 1.9%

Atlanta 2.7%

Charlotte 1.7%

Nashville 3.1%

U.S. Average 1.6%

Job Growth vs. National Average*

Job growth in our key markets holding

well above U.S. average (excluding

Houston, which still has positive job

growth)

Finished Vacant Home Inventories at Equilibrium**

**Source: Metrostudy

• Equilibrium: Balanced supply and demand for

Finished Vacant housing for an MSA as measured

by months of supply.

• For Texas markets, equilibrium is 2.0 to 2.5

months of supply.

14

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

0

5,000

10,000

15,000

20,000

25,000

30,000

Finished Vacant Housing Inventory Months of Supply

4Q Forestar Texas Markets

Non-Core Community Development Projects Update

15

• Non-core asset

sales provide

tax losses to

offset tax gains

from other non-

core asset

sales

• Annual carry

costs reduced

by

approximately

$3 million for

assets sold

Community Location Status Interest

Owned*

Developed

Lots

Undeveloped

Lots

Commercial

Acres Sold

San Joaquin

River

Antioch Remaining

25 acres

100% --- --- 264

The Colony Austin Sold Dec

2016

100% 81 1,357 5

Caracol TX Coast Sold Dec

2016

75% 47 9 14

Tortuga

Dunes

TX Coast Sold Dec

2016

75% 95 39 3

Somerbrook Kansas

City

Sold Dec

2016

100% 12 210 ---

Buffalo

Highlands

Denver Marketing 100% --- 164 ---

Stonebraker Denver Marketing 100% --- 603 ---

235 2,382 286

* Interest owned reflects our total interest in the project, whether owned directly or indirectly, which may be different than our economic interest in the project.

Bulk Timberland and Undeveloped Land – “Sale Summary”

Purchase Price

• $104.2 MM purchase price

• Closed December 2016

• $1,786 average price per acre

Assets Sold

• Approximately 58,300 acres of timberland in Georgia and

Alabama

• Minerals underlying the timberland also conveyed

Structure • Three separate purchase and sale agreements

16

Mineral Interests – “Sale Summary”

Purchase Price

• $85.6 MM ($75MM received, $10.6MM in escrow for title)

• Closed February 17, 2017

Minerals

Owned

• 44,000 acres held by production

• 476,000 undeveloped acres

• 520,000 total net mineral acres

Target

Formations

• Haynesville, James Lime, Cotton Valley, Bossier, Austin Chalk,

Wilcox, Eaglebine, Frio

17

18

For questions, please contact:

Charles D. Jehl

Chief Financial Officer

Forestar Group Inc.

6300 Bee Cave Road

Building Two, Suite 500

Austin, TX 78746

512-433-5229

chuckjehl@forestargroup.com