Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | ctshexhibit31112312016.htm |

| EX-32.2 - EXHIBIT 32.2 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | ctshexhibit32212312016.htm |

| EX-32.1 - EXHIBIT 32.1 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | ctshexhibit32112312016.htm |

| EX-31.2 - EXHIBIT 31.2 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | ctshexhibit31212312016.htm |

| EX-23.1 - EXHIBIT 23.1 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | ctshexhibit23112312016.htm |

| EX-21.1 - EXHIBIT 21.1 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | ctshexhibit21112312016.htm |

| EX-10.2 - EXHIBIT 10.2 - COGNIZANT TECHNOLOGY SOLUTIONS CORP | ctshexhibit10212312016.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended December 31, 2016 | |||

OR | |||

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from to | |||

Commission File Number 0-24429

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 13-3728359 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

Glenpointe Centre West 500 Frank W. Burr Blvd. Teaneck, New Jersey | 07666 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (201) 801-0233

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Class A Common Stock, $0.01 par value per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the registrant’s voting shares of common stock held by non-affiliates of the registrant on June 30, 2016, based on $57.24 per share, the last reported sale price on the NASDAQ Global Select Market of the NASDAQ Stock Market LLC on that date, was $34.6 billion.

The number of shares of Class A common stock, $0.01 par value, of the registrant outstanding as of February 22, 2017 was 608,637,143 shares.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated by reference into the Annual Report on Form 10-K: Portions of the registrant’s definitive Proxy Statement for its 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report.

TABLE OF CONTENTS

Item | Page | |||

1. | ||||

1A. | ||||

1B. | ||||

2. | ||||

3. | ||||

4. | ||||

5. | ||||

6. | ||||

7. | ||||

7A. | ||||

8. | ||||

9. | ||||

9A. | ||||

9B. | ||||

10. | ||||

11. | ||||

12. | ||||

13. | ||||

14. | ||||

15. | ||||

16. | ||||

PART I

Item 1. Business

Overview

We are one of the world’s leading professional services companies, transforming customers’ business, operating and technology models for the digital era. Our unique industry-based, consultative approach helps customers envision, build and run more innovative and efficient businesses. Our core competencies include: business, process, operations and technology consulting, application development and systems integration, enterprise information management, application testing, application maintenance, information technology, or IT, infrastructure services, and business process services. We tailor our services to specific industries and utilize an integrated global delivery model with customer service teams typically based on site at customer locations and delivery teams located at dedicated global delivery centers.

Industry Overview

In today’s complex business environment, many companies face intense competitive pressure and rapidly changing market dynamics, driven by such factors as changes in technology, macroeconomic conditions, and government regulations, globalization and virtualization. Across industries and geographies, companies are looking for innovative ways to adapt their traditional business models, products and services. Technology is now the underpinning force behind new smart products, customer expectations and the proliferation of behavioral data. As a result, businesses are increasingly becoming technology-intensive. These digital technologies represent a new source of value that continues to transform the way companies relate to their customers, engage with employees, and bring innovative products and services to market. In response to these opportunities, many companies are focused on improving efficiencies and enhancing effectiveness while also driving innovation through technology to favorably impact both the bottom-line and the top-line. Many companies are transforming their business, operating and technology models to ensure their businesses stay competitive in this new digital era. At the same time, they continue to view a global sourcing model as an important means to operate more cost-effectively and productively.

Business Strategy

Our customers seek to meet a dual mandate of achieving more efficient and effective operations, including cost reductions, while investing in digital technologies that are reshaping their business models. Increasingly, the relative emphasis among our customers is shifting towards investment and innovation. We strive to help our customers navigate the shift to digital. Digital services is work we do to help our customers win in the digital economy by applying technology and analytics to change consumer experiences to drive sustainable growth, deploying systems of intelligence to automate and improve core business processes, and improving technology systems by deploying cloud and cyber security solutions and as-a-service models to make them simpler, more modern and secure.

Our objective is to create value for both our customers and stockholders by enhancing our position as a leading professional services company in the digital era. Our key strategies to achieve this objective are the following:

Align along Three Digital Practice Areas

We are aligning our digital services along three practice areas across our four industry-oriented business segments to address the needs of our customers as they transform their business, operating and technology models.

• | Cognizant Digital Business. Our digital business practice works with customers to reshape their products and business models, and impacts how organizations interact with their customers, employees and partners. Our approach combines data science, design thinking, and deep industry and process knowledge with solid technology capabilities to unite the physical and virtual aspects of a company’s offerings seamlessly across every channel. We help customers identify insights, develop business models and go-to-market strategies, and design, prototype and scale meaningful experiences. |

• | Cognizant Digital Operations. Our digital operations practice helps customers re-engineer, digitize, manage and operate their most essential business processes to lower operating costs, improve user experiences and deliver better outcomes and top-line growth. Across the practice, we are creating automated, data-driven platforms and industry utilities. We help customers develop more effective operating models by applying both traditional optimization levers and helping them achieve process excellence. |

• | Cognizant Digital Systems & Technology. Our digital systems and technology practice works with customers to simplify, modernize and secure IT infrastructure and applications by leveraging automation, analytics and agile |

1

development to unlock the power of their technology environments. We help customers create and evolve systems that meet their needs in the modern enterprise by delivering industry-leading standards of performance, cost and flexibility.

Our global consulting team provides business, process, operations and technology consulting services to bring together the capabilities of all three of our digital practice areas into effective solutions for our customers. Our Cognizant Business Consulting, or CBC, professionals and domain experts from our industry-focused business segments work closely with our digital practice areas to create frameworks, platforms and solutions that customers are finding valuable as they pursue next-level savings and new revenue streams.

Scale Our Digital Practice Areas

We are investing to scale our digital practice areas across our business segments and geographies. We seek to drive organic growth through extensive training and re-skilling of our existing technical teams and expansion of our local workforces in the United States and other local markets around the world where we operate. Additionally, we pursue select strategic acquisitions, joint ventures, investments and alliances that can expand our intellectual property, industry expertise, geographic reach, and platform and technology capabilities.

In 2016, we completed several business combinations that we expect to contribute to our digital service capabilities. These transactions included the acquisition of KBACE Technologies, Inc., a global consulting and technology services company that strengthens and expands our digital capabilities to deliver cloud-based application services, the acquisition of Idea Couture, a global consulting company that offers digital innovation, strategy, design and technology services, the acquisition of Mirabeau BV, a digital marketing and customer experience agency that expands our digital business capabilities across Europe, and the acquisition of Adaptra, an Australia-based consulting, business transformation and technology services provider in the insurance industry. Additionally, in April 2016, we acquired a 49% ownership interest in ReD Associates, a strategic consulting firm specializing in the use of human sciences to help business leaders better understand customer behavior.

Continue Development of Our Core Business

Our core business is an important foundation that supports our ability to provide digital services to our customers. In many cases, our customers' new digital systems are built upon the backbone of their core, traditional systems. Our deep knowledge of our customers' core systems can provide us with a significant advantage as we work with our customers to build new digital capabilities.

Our services include consulting and technology services and outsourcing services and are delivered to our customers across our four business segments in a standardized, high-quality manner through our global delivery model. Consulting and technology services include business, process, operations and technology consulting, application development and systems integrations, application testing, enterprise information management and software solutions and related services. Outsourcing services include application maintenance, IT infrastructure services and business process services.

Customers often look for efficiencies in the running of their core operations to help them fund investments in new digital capabilities. We work with them to analyze and identify opportunities for advanced automation and delivery efficiencies. We deploy a variety of commercial and delivery models, including managed services, fixed bid, output and outcome based pricing and platforms to address the varied needs of our customers.

Additionally, we seek to expand the geographic reach of our core portfolio of services. We believe that Europe, the Middle East, the Asia Pacific region and Latin America will continue to be areas of significant investments for us as we see these regions as long term growth opportunities.

Domain Expertise

Our deep domain expertise in the industries we serve is central to our ability to understand our customers' challenges and design effective solutions to address them. We hire professionals with in-depth industry experience and continually invest in industry training for our staff and build out industry-specific services and solutions. This approach is key to our high levels of on-time delivery and customer satisfaction.

Global Delivery Model

We utilize a global delivery model, with delivery centers worldwide, to provide high quality services and responsiveness to our customers at competitive rates. We have a four-tiered global architecture for service delivery and operations, consisting of employees co-located at customers’ sites, at local or in-country delivery centers, at regional delivery centers and at offshore delivery centers. As we develop our digital services, we are focused on hiring in the United States and other countries to expand

2

our in-country delivery capabilities. Our extensive facilities, technology and communications infrastructure facilitates the seamless integration of our global workforce.

Customer Centric Approach

We put our customer’s priorities first and continuously seek to deliver what the customer needs by thinking beyond what the customer asks and providing smart and innovative solutions. A cornerstone of our success is the interconnectivity of our associates and teams across segments and practice areas. We believe that when we share knowledge and work together, we can achieve more for our customers and ourselves.

Business Segments

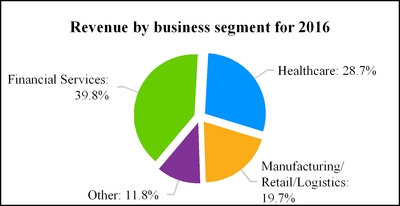

We are organized around and report the operations of our business according to our four industry-oriented business segments as shown below. This industry focus has been central to our revenue growth and high customer satisfaction. As the technology services industry continues to mature and shift from supporting the business to becoming one of the main sources of value, customers are requiring service providers with a deep understanding of their businesses, industry initiatives, customers, markets and cultures who can create solutions tailored to meet their customers’ individual business needs. For the year ended December 31, 2016, the distribution of our revenues across our four industry-oriented business segments were as follows:

Financial Services | Healthcare | Manufacturing/Retail/Logistics | Other | |||

-Banking -Insurance | -Healthcare -Life Sciences | -Manufacturing and Logistics -Retail, Travel and Hospitality -Consumer Goods | -Communications -Information, Media and Entertainment -High Technology | |||

See Note 17 to our consolidated financial statements for additional information related to our business segments, including the disclosure of segment operating profit and financial information by geographic area.

Financial Services

• | Banking. We serve traditional retail and commercial banks, diversified financial enterprises, broker-dealers, asset management firms, depositories, clearing organizations and exchanges. We assist these customers in such areas as retail banking, wholesale banking, consumer lending, cards and payments, risk management, investment banking and brokerage, asset and wealth management, and securities services. The demand for our services in the banking sector is being driven by significant changes in the industry, which are leading customers to search for new areas of growth while addressing cost and profitability pressures and regulatory changes. In addition, financial institutions are adopting new digital technologies to change the way they interface with customers and employees and manage their operations. |

• | Insurance. We serve global property and casualty insurers, life insurers, reinsurance firms and insurance brokers. We focus on such aspects of our customers’ operations as business acquisition, policy administration, claims processing, management reporting, regulatory compliance and reinsurance. One of the factors driving the need for our services in the insurance industry is our customers' desire to improve the sales and marketing process, both by deepening direct retail customer relationships and strengthening interactions with networks of independent and captive insurance agents, often through the use of digital technologies. Insurers also seek to enhance their profitability by differentiating their products and services, resulting in a need for specialized underwriting models and systems. Additionally, many |

3

insurers seek to improve business effectiveness by reducing expense ratios and exiting non-core lines of business and operations.

Healthcare

• | Healthcare. We serve many leading global healthcare organizations, including healthcare payers, providers and pharmacy benefit managers. The healthcare industry is facing the dual challenge of improving the quality of care while lowering the cost of care. Our Healthcare business focuses on providing a broad range of services and solutions that address regulatory requirements and emerging industry trends such as regulatory compliance, integrated health management, enterprise information management, claims investigative services and operational improvement in areas such as claims processing, enrollment, membership and billing. We also help our customers to enable their systems and processes to deal with the retail orientation of healthcare, such as the support of individual mandates, the adoption of digital solutions to improve access to health information, decision making by end consumers and collaboration among payers, providers and patients. Additionally, we develop, license, implement and support proprietary and third-party software products for the healthcare industry. |

• | Life Sciences. We serve leading pharmaceutical, biotech, and medical device companies, as well as providers of generic, animal health and consumer health products. Some of the factors driving demand for our services are financial pressures caused by payer and government pricing pressures, patent expiry and competition from generics, the drive to expand into new geographic markets, the need for more targeted or personalized therapies leading to research and development innovation, continued diversification of product portfolios and the related high cost of product development, and a dynamic regulatory environment with greater emphasis on product safety, ethics and compliance, transparency of pricing and promotional activity. Our life sciences solutions help transform many of the business processes in the life sciences value chain (research, clinical development, manufacturing and supply chain, sales and marketing) as well as regulatory and administrative functions. Life sciences companies around the world are focusing on improving digital engagement with all of their stakeholders while increasingly leveraging enterprise-level analytics to drive a customer-centric approach to marketing and sales. |

Manufacturing/Retail/Logistics

• | Manufacturing and Logistics. Customers in this sector include manufacturers of automotive and industrial products as well as processors of natural resources, chemicals and raw materials. In logistics, our customers include rail, truck, marine and other transportation and distribution companies. We also serve many leading energy utilities, as well as oil and gas producers. Some of our manufacturing and logistics solutions for automotive and industrial customers include warranty management, dealer systems integration, supply chain management, sales and operations planning, and mobility. For transportation and distribution customers, our service areas include warehouse and yard management, transportation asset management, transportation network design, global trade management and analytics. Industry trends that influence the demand for our services in this sector include the increasing globalization of sourcing and the desire of customers to further penetrate emerging markets, leading to longer and more complex supply chains. Customers are optimizing their supply chains to better manage inventory, support growing ecommerce operations and improve customer-supplier collaboration. They are applying intelligent systems to manufacturing and logistics operations, enabling mobile platforms to support field sales, are using data analytics to make better informed decisions and making smart, connected products that are a portal to an ecosystem of data and services. |

• | Retail, Travel and Hospitality. We serve a wide spectrum of retailers and distributors, including supermarkets, specialty premium retailers, department stores and large mass-merchandise discounters. Current trends affecting demand in the retail industry include the impact of digital technologies on customer and employee interaction, a need for greater cost-efficiency to combat the industry’s traditionally narrow profit margins, changes in supply chain management to facilitate direct store delivery and the ability to accommodate multi-channel (in-store and on-line) models. We also serve the travel and hospitality industry, including airlines, hotels, restaurants, online and retail travel, rental car companies, global distribution systems and intermediaries and real estate companies. |

• | Consumer Goods. We serve many of the world’s premier consumer goods manufacturers, creating innovative solutions and strategies that help them build and sustain strong brands while enhancing their price-competitiveness, category leadership and consumer loyalty. Principal segments include consumer durables, food and beverage, footwear and apparel, and home and personal care products. Our expertise in these areas includes demand-driven supply chains, revenue-creating trade promotion management systems, analytics systems and mobility solutions that anticipate and serve ever-changing customer needs. The demand for our services in this sector is driven by the need of consumer goods companies to accelerate product innovation to remain competitive and deliver top-line growth, the continuing drive to optimize global sourcing and supply chain management, the impact of digital technologies on consumer |

4

interaction, marketing and sales processes, the use of data analytics to increase the effectiveness of product development and marketing, as well as ongoing pressures to curtail technology costs.

Beginning with 2017, we will discuss our Manufacturing/Retail/Logistics business segment in terms of four operating segments: Retail and Consumer Goods, Manufacturing and Logistics, Travel and Hospitality and Energy and Utilities.

Other

The Other business segment is an aggregation of operating segments each of which, individually, represents less than 10.0% of consolidated revenues and segment operating profit. Descriptions of the key operating segments included in the Other business segment are as follows:

• | Communications. We serve some of the world’s leading communications (cable, wireless and wireline) service providers, equipment vendors, and software vendors. We help our customers address the important trends in the communications industry, such as transitioning to new network technologies, designing, developing, testing and introducing new products and channels, improving customer service and increasing customer satisfaction, transforming business support systems and operations support systems, transitioning to agile development methodologies and enabling applications for cloud deployment. We use digital and cloud-based technologies to modernize the customers’ products and customer experience. |

• | Information, Media and Entertainment. We serve some of the world’s largest media and entertainment companies, including information service providers, publishers, broadcasters, and movie, music and video game companies. The growth of digital platforms is causing significant change in these industries and we are working with customers to help them meet these challenges and transform their businesses. Trends affecting the industry include a decline in traditional print publishing, the need for digital asset management and the increasing role of digital technologies on the consumption of entertainment content. We provide solutions in critical areas such as the digital content supply chain and media asset management. Some of our other services include business solutions, such as advertising management, online media, and e-business, digital distribution, workflow automation, intellectual property management, anti-piracy initiatives and operational systems (advertising sales, studio management, billing and payments, content management and delivery). |

• | High Technology. We serve some of the world’s leading independent software vendors, technology equipment manufacturers, social network companies and online service providers. We assist these companies with their transitions to new digital business models and facilitate their license management and sales processes. We help the high-technology manufacturers take on complex, transformational business process and product engineering initiatives. The technology sector is largely driven by product development. This creates demand for analytical, engineering, testing, and content management services and go-to-market strategies. |

Beginning with 2017, we will discuss our Other business segment in terms of three operating segments - Communications and Media, Technology and Other.

Across our business segments, we are highly dependent upon our foreign operations. Our global delivery centers and technical professionals are positioned globally, with the majority located in India. Our operations in India and the rest of the world expose us to various risks, including regulatory, economic and political instability, potentially unfavorable tax, import and export policies, fluctuations in foreign exchange and inflation rates, international and civil hostilities, terrorism, natural disasters and pandemics.

Our Solutions and Services

Across each of our business segments, we continually invest in the expansion of our service portfolio to anticipate and meet customers’ evolving needs. These service areas, consulting and technology services and outsourcing services, are delivered to our customers across our four business segments in a standardized, high-quality manner through our global delivery model. Our three digital practice areas span our portfolio of service offerings. Our current service areas include:

Consulting and Technology Services

• | Business, Process, Operations and Consulting. Our global consulting team, CBC, helps customers re-imagine and transform their businesses to gain competitive advantage. CBC works with customers to improve business performance and operational productivity in order to exceed business goals. We also provide assistance with strategy consulting, business and operations consulting, technology strategy and change management, and program management consulting |

5

• | Application Development and Systems Integration. We offer a full range of application design, application development and systems integration services, which ensures that customer technology functions operate in the most efficient, responsive and cost-effective manner. We have particular depth of skills in implementing large, complex, business-critical technology development and integration programs. |

• | Application testing. Our application testing practice offers a comprehensive suite of services in testing, consulting and engineering. Our quality engineering and assurance transformation services help customers develop deep, agile capabilities that create or extend their competitive advantage. Our business-aligned services in the areas of system and integration testing, package testing, user acceptance, automation, performance testing and test data management address our customers’ critical quality needs. Consulting and infrastructure solutions in quality management, test tools and test infrastructure enable our customers to capitalize on emerging opportunities. |

• | Enterprise Information Management. Our enterprise information management practice focuses on helping customers harness the vast amounts of data available on their operations, customers and markets, and convert that data into information and insights that are valuable to their businesses and can be used to drive management decisions. We help customers identify the types of data available both within their organizations and from outside sources and work to bring that data together in a meaningful “data to foresight” continuum. Among the trends driving this business are the desire of companies to better understand consumer demands and market opportunities in order to create new products and services, the need to manage reporting requirements in regulated industries such as healthcare and financial services, and the pressures to manage operations more efficiently and cost-effectively through the use of analytical tools. |

• | Software solutions and related services. We develop, license, implement and support proprietary and third-party software products for the healthcare industry, including solutions for health insurance plans, third party benefit administrators, or TPAs, and healthcare providers that enable healthcare organizations to work more efficiently and collaboratively to deliver better healthcare services. Our solutions help health plans and TPAs increase administrative efficiency, improve the cost and quality of care, and succeed in the retail healthcare market. Our solutions help physicians and healthcare organizations simplify business processes and execute strategies for population health management, accountable care, and value-based initiatives. |

Outsourcing Services

• | Application maintenance. Our application maintenance service offering supports some or all of a customer’s applications, ensuring that systems remain operational and responsive to changing user requirements and provide on-going enhancements as required by the customer. Beyond the traditional view of technology outsourcing as a cost-saving measure, our application maintenance services enable customers to improve the overall agility, responsiveness, productivity and efficiency of their IT infrastructure. Increasingly, we are also assisting customers in adapting their IT systems to digital technologies. As part of this process, we are often able to introduce product and process enhancements and improve service levels to customers requesting modifications and on-going support. We also provide application value management solutions that can help balance cost, complexity and capacity and can help customers reduce cost of ownership, improve service levels and create new operational efficiencies. Our global delivery business model enables us to provide a range of rapid response and cost-effective support services to our customers. Our on-site personnel often provide help-desk services at the customer’s facility. As part of our application maintenance services, we assist customers in renovating their core systems to meet the requirements imposed by new regulations, new standards or other external events. We anticipate the operational environment of our customers’ IT systems as we design and develop such systems. We also offer diagnostic services to assist customers in identifying issues in their IT systems and optimizing the performance of their systems. |

• | IT infrastructure services. We provide IT Infrastructure management outsourcing services and have service capability in redundant global operating centers worldwide, through which we provide significant scale, quality and cost savings to our customers. Customers are increasingly utilizing IT infrastructure services to sharpen their focus on core business operations, reallocate overhead costs to growth investments, enable businesses to respond more quickly to changing demands, decrease time to market, ensure that the IT infrastructure can scale as the business evolves and access skill sets outside the organization. The major services we provide include data center, infrastructure security, network and convergence, end-user computing services and mobility. We also have cloud services offerings that utilize virtualization technologies across delivery solutions for private cloud, enterprise multi-tenant cloud and public cloud models. We provide services that harness and modernize legacy systems to be digital-ready with agility and speed without sacrificing the knowledge those systems contain. |

6

• | Business process services. We provide business process services through unique industry-aligned solutions that integrate process, domain and technology expertise to enable our customers to respond in an agile manner to market opportunities and challenges, while also creating variable cost structures to drive greater effectiveness and cost-efficiency. We have extensive domain-specific expertise in core front office, middle office and back office functions including finance and accounting, procurement, data administration, data management, and research and analytics. Our industry-specific solutions include clinical data management, pharmacovigilance, equity research support, commercial operations and order management. In addition to business process services, related services include consulting to ensure process excellence and a range of platform-based services. Our goals for our customer relationships are customer satisfaction, operational productivity, strategic value and business transformation. Among the factors driving growth in our services are the desire to improve cost-effectiveness, the emergence of digital technologies, and the need for customers to access capabilities beyond their organizations to adapt to rapid changes in technologies, markets and customer demands. |

Sales and Marketing

We market and sell our services directly through our professional staff, senior management and direct sales personnel operating out of our global headquarters and business development offices, which are strategically located in various metropolitan areas around the world. The sales and marketing group works with our customer delivery team as the sales process moves closer to the customer’s selection of a services provider. The duration of the sales process may vary widely depending on the type and complexity of services.

Customers

The number of customers served by us has increased significantly in recent years. As of December 31, 2016, we increased the number of strategic customers to 329. We define a strategic customer as one offering the potential to generate at least $5 million to $50 million or more in annual revenues at maturity. Accordingly, we provide a significant volume of services to many customers in each of our business segments. Therefore, a loss of a significant customer or a few significant customers in a particular segment could materially reduce revenues for such segment. However, no individual customer exceeded 10% of our consolidated revenues for the years ended December 31, 2016, 2015 and 2014. In addition, the services we provide to our larger customers are often critical to the operations of such customers and a termination of our services generally would require an extended transition period with gradually declining revenues. The volume of work performed for specific customers is likely to vary from year to year, and a significant customer in one year may not use our services in a subsequent year. Revenues from our top customers were as follows:

Year Ended December 31, | |||||||||

2016 | 2015 | 2014 | |||||||

Revenues from top five customers as a percentage of total revenues | 10.0 | % | 11.0 | % | 12.2 | % | |||

Revenues from top ten customers as a percentage of total revenues | 16.7 | % | 18.6 | % | 21.3 | % | |||

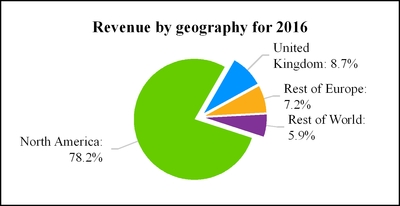

For the year ended December 31, 2016, the distribution of our revenues across geographies was as follows:

7

Competition

The technology services, digital and outsourcing markets are highly competitive, characterized by a large number of participants and subject to rapid change. Various competitors in all or some of such markets include:

• | Systems integration firms; |

• | Contract programming companies; |

• | Application software companies; |

• | Cloud computing service providers; |

• | Large or traditional consulting firms; |

• | Professional services groups of computer equipment companies; |

• | Infrastructure management and outsourcing companies; and |

• | Boutique digital companies. |

Our direct competitors include, among others, Accenture, Atos Origin, Capgemini, Computer Sciences Corporation, Deloitte Digital, Genpact, HCL Technologies, HP Enterprise, IBM Global Services, Infosys Technologies, Tata Consultancy Services, and Wipro. In addition, we compete with numerous smaller local companies in the various geographic markets in which we operate.

Some of our competitors have greater financial, technical and marketing resources and/or greater name recognition. The principal competitive factors affecting the markets for our services include:

• | Vision and strategic advisory ability; |

• | Digital services capabilities; |

• | Performance and reliability; |

• | Quality of technical support, training and services; |

• | Responsiveness to customer needs; |

• | Reputation and experience; |

• | Financial stability and strong corporate governance; and |

• | Competitive pricing of services. |

We rely on the following to compete effectively:

• | Investments to scale our digital services practice areas; |

• | A well-developed recruiting, training and retention model; |

• | A successful service delivery model; |

• | Entrepreneurial culture and approach to our work; |

• | A broad referral base; |

• | Continual investment in process improvement and knowledge capture; |

• | Investment in infrastructure and research and development; |

• | Financial stability and strong corporate governance; |

• | Continued focus on responsiveness to customer needs, quality of services, competitive prices; and |

• | Project management capabilities and technical expertise. |

Intellectual Property

We provide value to our customers based, in part, on our proprietary innovations, methodologies, reusable knowledge capital and other intellectual property, or IP, assets. We recognize the importance of IP and its ability to differentiate us from our competitors. We rely on a combination of IP laws, as well as confidentiality procedures and contractual provisions, to protect our IP and our brand. We have registered, and applied for the registration of, U.S. and international trademarks, service marks, domain names and copyrights. Cognizant owns or is licensed under a number of patents, trademarks, copyrights, and licenses, which vary in duration, relating to our products and services. We actively seek IP protection for our innovations. While our proprietary IP rights are important to our success, we believes our business as a whole is not materially dependent on any particular intellectual property right, or any particular group of patents, trademarks, copyrights or licenses.

8

Employees

We had approximately 260,200 employees at the end of 2016, with approximately 47,500 in the North American region, approximately 11,500 in the European region and approximately 201,200 in various other locations throughout the rest of world, including 188,000 in India. We are not party to any significant collective bargaining agreements. We consider our relations with our employees to be good.

Our Executive Officers

The following table identifies our current executive officers:

Name | Age | Capacities in Which Served | In Current Position Since | ||||

Francisco D’Souza(1) | 48 | Chief Executive Officer | 2007 | ||||

Rajeev Mehta(2) | 50 | President | 2016 | ||||

Karen McLoughlin(3) | 52 | Chief Financial Officer | 2012 | ||||

Ramakrishnan Chandrasekaran(4) | 59 | Executive Vice Chairman, Cognizant India | 2013 | ||||

Debashis Chatterjee(5) | 51 | Executive Vice President and President, Global Delivery | 2016 | ||||

Ramakrishna Prasad Chintamaneni(6) | 47 | Executive Vice President and President, Global Industries and Consulting | 2016 | ||||

Brackett B. Denniston, III(7) | 69 | Interim General Counsel | 2016 | ||||

Malcolm Frank(8) | 50 | Executive Vice President, Strategy and Marketing | 2012 | ||||

Sumithra Gomatam(9) | 49 | Executive Vice President and President, Digital Operations | 2016 | ||||

Gajakarnan Vibushanan Kandiah(10) | 49 | Executive Vice President and President, Digital Business | 2016 | ||||

Venkat Krishnaswamy(11) | 63 | Executive Vice President and President, Healthcare and Life Sciences | 2013 | ||||

James Lennox(12) | 52 | Executive Vice President, Chief People Officer | 2016 | ||||

Sean Middleton(13) | 35 | Senior Vice President and President, Cognizant Accelerator | 2017 | ||||

Allen Shaheen(14) | 54 | Executive Vice President, Corporate Development | 2015 | ||||

Dharmendra Kumar Sinha(15) | 54 | Executive Vice President and President, Global Client Services | 2013 | ||||

Robert Telesmanic(16) | 50 | Senior Vice President, Controller and Chief Accounting Officer | 2017 | ||||

Santosh Thomas(17) | 48 | Executive Vice President and President, Global Growth Markets | 2016 | ||||

Srinivasan Veeraraghavachary(18) | 57 | Executive Vice President, Chief Operating Officer | 2016 | ||||

(1) | Francisco D’Souza has been our Chief Executive Officer and a member of the Board of Directors since 2007. He also served as our President from 2007 to 2012. Mr. D’Souza joined Cognizant as a co-founder in 1994, the year it was started as a division of The Dun & Bradstreet Corporation, and was previously our Chief Operating Officer from 2003 to 2006 and held a variety of other senior management positions at Cognizant from 1997 to 2003. Mr. D’Souza has served on the Board of Directors of General Electric Company, or GE, since 2013, where he is currently a member of the Audit Committee and the Technology and Industrial Risk Committee. He also serves on the Board of Trustees of Carnegie Mellon University, as Co-Chairman of the Board of Trustees of The New York Hall of Science and on the Board of Directors of the U.S.-India Business Council. Mr. D’Souza has a Bachelor of Business Administration degree from the University of Macau and a Master of Business Administration, or MBA, degree from Carnegie Mellon University. |

(2) | Rajeev Mehta has been our President since September 2016. From December 2013 to September 2016, Mr. Mehta served as our Chief Executive Officer, IT Services. From February 2012 to December 2013, Mr. Mehta served as our Group Chief Executive - Industries and Markets. Mr. Mehta held other senior management positions in client services and our financial services business segment from 2001 to 2012. Prior to joining Cognizant in 1997, Mr. Mehta was involved in implementing GE Information Services' offshore outsourcing program and also held consulting positions at Deloitte & Touche LLP and Andersen Consulting. Mr. Mehta has a Bachelor of Science degree from the University of Maryland and an MBA degree from Carnegie Mellon University. |

9

(3) | Karen McLoughlin has been our Chief Financial Officer since February 2012. Ms. McLoughlin has held various senior management positions in our finance department since she joined Cognizant in 2003. Prior to joining Cognizant, Ms. McLoughlin held various financial management positions at Spherion Corporation and Ryder System, Inc. and served in various audit roles at Price Waterhouse (now PricewaterhouseCoopers). Ms. McLoughlin has served on the Board of Directors of Best Buy Co., Inc. since 2015, where she is currently a member of the Audit Committee and the Finance and Investment Policy Committee. Ms. McLoughlin has a Bachelor of Arts degree in Economics from Wellesley College and an MBA degree from Columbia University. |

(4) | Ramakrishnan Chandrasekaran has been our Executive Vice Chairman, Cognizant India since December 2013. From February 2012 to December 2013, Mr. Chandrasekaran served as our Group Chief Executive - Technology and Operations. Mr. Chandrasekaran held other senior management positions in global delivery from 1999 to 2012. Prior to joining us in 1994, Mr. Chandrasekaran worked with Tata Consultancy Services. Mr. Chandrasekaran has a Mechanical Engineering degree and an MBA degree from the Indian Institute of Management. |

(5) | Debashis Chatterjee has been our Executive Vice President and President, Global Delivery and managed our Digital Systems and Technology practice area since August 2016. From December 2013 to August 2016, Mr. Chatterjee served as Executive Vice President and President, Technology Solutions. From May 2013 to December 2013, Mr. Chatterjee served as Senior Vice President and Global Head, Technology and Information Services. From March 2012 to April 2013, he was Senior Vice President, Transformational Services. Mr. Chatterjee worked at International Business Machine Corporation, or IBM, from 2011 to 2012 as Vice President and Sectors Leader, Global Business Services, Global Delivery. Prior to that, Mr. Chatterjee held various senior positions in the Banking and Financial Services, or BFS, practice at Cognizant from 2004 to 2011 and other management roles at Cognizant since joining us in 1996. He has been in our industry since 1987, having previously worked at Tata Consultancy Services and Mahindra & Mahindra. Mr. Chatterjee has a Bachelor of Engineering degree in Mechanical Engineering from Jadavpur University in India. |

(6) | Ramakrishna Prasad Chintamaneni has been our Executive Vice President and President, Global Industries and Consulting since August 2016. Mr. Chintamaneni served as our Executive Vice President and President, BFS, from December 2013 to August 2016. From 2011 to December 2013, Mr. Chintamaneni served as our Global Head of the BFS practice. Mr. Chintamaneni held various senior positions in the BFS practice from 2006 to 2011 and was a client partner in our BFS practice from 1999 to 2006. Prior to joining Cognizant in 1999, Mr. Chintamaneni spent seven years in the investment banking and financial services industry, including working at Merrill Lynch and its affiliates for five years as an Investment Banker and a member of Merrill’s business strategy committee in India. Mr. Chintamaneni has a Bachelor of Technology degree in Chemical Engineering from the Indian Institute of Technology, Kanpur and a Postgraduate Diploma in Business Management from the XLRI - Xavier School of Management in India. |

(7) | Brackett B. Denniston, III has been our Interim General Counsel since December 2016. Mr. Denniston served as Senior Vice President, Secretary and General Counsel of GE from 2004 until his retirement at the end of 2015. At GE, Mr. Denniston was a member of the Corporate Executive Council, Chairman of the Policy Compliance Review Board, and a director of both the GE Capital Corporation and the GE Foundation. Mr. Denniston rejoined the law firm of Goodwin Proctor, where he started his career, as senior counsel in September 2016 and remains employed there today. Mr. Denniston serves as Chairman of the Institute for Law Reform of the U.S. Chamber of Commerce and as a member of the Chamber’s Board of Directors and its Executive Committee and on a number of boards at other organizations, including Kenyon College (as Chair), Coalition for Integrity and Equal Justice Rights. Mr. Denniston is a summa cum laude graduate of Kenyon College and a magna cum laude graduate of Harvard Law School. |

(8) | Malcolm Frank has been our Executive Vice President, Strategy and Marketing since February 2012. Mr. Frank served as our Senior Vice President of Strategy and Marketing from 2005 to 2012. Prior to joining Cognizant in 2005, Mr. Frank was previously a founder and the President and Chief Executive Officer of CXO Systems, Inc., an independent software vendor providing dashboard solutions for senior managers, a founder and the President, Chief Executive Officer and Chairman of NerveWire Inc., a management consulting and systems integration firm, and a founder and executive officer at Cambridge Technology Partners, an information technology professional services firm. Mr. Frank has served on the Board of Directors of Factset Research Systems Inc. since June 2016, where he is a member of the Compensation Committee. Mr. Frank has a Bachelor degree in Economics from Yale University. |

(9) | Sumithra Gomatam has been our Executive Vice President and President, Digital Operations since August 2016. From December 2013 to August 2016, Ms. Gomatam served as our Executive Vice President and President, Industry Solutions. From 2008 to December 2013, Ms. Gomatam served as Senior Vice President, and global leader for our Testing practice. Ms. Gomatam held other management positions in our global delivery and BFS practices from 1995 to 2008. Ms. Gomatam has a Bachelor of Engineering degree in Electronics and Communication from Anna University. |

(10) | Gajakarnan Vibushanan Kandiah has been our Executive Vice President and President, Digital Business since August 2016. Mr. Kandiah previously served as Executive Vice President of Business Process Services, or BPS, and Digital Works from January 2014 to August 2016, and as Senior Vice President of BPS from 2011 to December 2013. Previous roles he held at Cognizant included roles in System Integration, Testing, BPS, Information, Media and Entertainment, and Communications practices. Before joining Cognizant in 2003, Mr. Kandiah was a founder and the Chief Operating Officer |

10

of NerveWire, Inc. and the Global Vice President of the Interactive Solutions business of Cambridge Technology Partners. Mr. Kandiah completed his advanced level education at the Royal College in Sri Lanka.

(11) | Venkat Krishnaswamy has been our Executive Vice President and President, Healthcare and Life Sciences since December 2013. From February 2012 to December 2013, Mr. Krishnaswamy served as our Executive Vice President of Healthcare and Life Sciences. Mr. Krishnaswamy served as our Senior Vice President and General Manager of Healthcare and Life Sciences from 2007 to 2012 and in various other management positions since he joined Cognizant in 1997. Prior to joining Cognizant, Mr. Krishnaswamy spent over ten years in retail and commercial banking with Colonial State Bank (now Commonwealth Bank of Australia). Mr. Krishnaswamy has a Bachelor of Engineering degree from the University of Madras and a Master of Electrical Engineering degree from the Indian Institute of Technology, New Delhi. |

(12) | James Lennox has been our Executive Vice President, Chief People Officer since January 2016. Mr. Lennox previously served as our Senior Vice President, Chief People Officer from June 2013 to December 2016, and as Vice President, North America Human Resources, or HR, from July 2011 to June 2013. Previous roles he held at Cognizant included leading the Workforce Management team, Operations Director for our Banking and Insurance practices, leading regional HR teams, and serving as the Chief of Staff to the Company’s Chief Executive Officer. Prior to joining Cognizant in 2004, Mr. Lennox held various management roles in operations, HR, resource management and recruiting for the North American regions of Cap Gemini and Ernst & Young. He started his career at Ernst & Young Consulting. Mr. Lennox has a Bachelor of Science degree in Business Administration from St. Thomas Aquinas College and an MBA degree from Fordham University. |

(13) | Sean Middleton has been our Senior Vice President and President, Cognizant Accelerator since January 2017. He was previously Vice President and President, Cognizant Accelerator from July 2016 to January 2017. Mr. Middleton served as Chief Operating Officer of our Emerging Business Accelerator division from 2012 to July 2016 and as Chief of Staff to the Company's Chief Executive Officer from 2010 to 2013. Prior to joining Cognizant in 2010, Mr. Middleton worked at PricewaterhouseCoopers as a management consultant. Mr. Middleton has a Bachelor degree in Computer Science from Cornell University and an MBA degree from the Wharton School at the University of Pennsylvania. |

(14) | Allen Shaheen has been our Executive Vice President, Corporate Development since August 2015. From December 2013 to August 2016, Mr. Shaheen was also responsible for various Cognizant practices, including our Enterprise Application Services Practice. Mr. Shaheen was the General Manager for our German business unit from February 2013 to December 2014 and our Markets Delivery Leader for Europe from May 2012 to December 2014. Mr. Shaheen's prior roles included being responsible for our IT Infrastructure Services, head of our Global Technology Office and head of our Systems Integration and Testing practices. Prior to joining Cognizant in 2006, Mr. Shaheen was a consultant for Cognizant from 2004 to 2006, a founder and Executive Vice President of International Operations of Cambridge Technology Partners and the Chief Executive Officer of ArsDigita Corporation. Mr. Shaheen has a Bachelor of Arts degree in Engineering and Applied Sciences from Harvard College. |

(15) | Dharmendra Kumar Sinha has been our Executive Vice President and President, Global Client Services since December 2013. From 2007 to December 2013, Mr. Sinha served as our Senior Vice President and General Manager, Global Sales and Field Marketing. From 2004 to 2007, Mr. Sinha served as our Vice President, responsible for our Manufacturing, Logistics, Retail, Hospitality, and Technology verticals. From 1997 to 2004, Mr. Sinha held a variety of other management roles. Prior to joining Cognizant in 1997, Mr. Sinha worked with Tata Consultancy Services and CMC Limited, an IT solutions provider. Mr. Sinha has a Bachelor of Science degree from Patna Science College, Patna and an MBA degree from the Birla Institute of Technology, Mesra. |

(16) | Robert Telesmanic has been our Senior Vice President, Controller and Chief Accounting Officer since January 2017, a Senior Vice President since 2010 and our Corporate Controller since 2004. Prior to that, he served as our Assistant Corporate Controller from 2003 to 2004. Prior to joining Cognizant, Mr. Telesmanic spent over 14 years with Deloitte & Touche LLP. Mr. Telesmanic has a Bachelor of Science degree from New York University and an MBA degree from Columbia University. |

(17) | Santosh Thomas has been our Executive Vice President and President, Global Growth Markets since August 2016. Prior to his current role, Mr. Thomas served as our Head, Growth Markets from 2011 through July 2016. From 1999 to 2011, Mr. Thomas held various senior positions at Cognizant including leading Continental European operations and various roles in client relationships and market development in North America. Prior to joining Cognizant in 1999, Mr. Thomas worked with Informix and HCL Hewlett Packard Limited. Mr. Thomas has an undergraduate degree in engineering from RV College of Engineering, Bangalore and a Postgraduate Diploma in Business Management from the XLRI - Xavier School of Management in India. |

(18) | Srinivasan Veeraraghavachary has been our Executive Vice President, Chief Operating Officer since August 2016. Prior to his current role, Mr. Veeraraghavachary served as our Executive Vice President, Products and Resources from December 2013 to November 2016 and as our Senior Vice President, Products and Resources from 2011 to December 2013. Previously, he served in various senior management positions in our BFS practice and in our central U.S. operations. Mr. Veeraraghavachary joined Cognizant in 1998. Mr. Veeraraghavachary has a Bachelor degree in Mechanical Engineering from the National Institute of Technology (formerly the Regional Engineering College) in Trichy, India and an MBA degree from the Indian Institute of Management in Calcutta, India. |

11

None of our executive officers is related to any other executive officer or to any of our Directors. Our executive officers are appointed annually by the Board of Directors and generally serve until their successors are duly appointed and qualified.

Corporate History

We began our IT development and maintenance services business in early 1994, as an in-house technology development center for The Dun & Bradstreet Corporation and its operating units. In 1996, we were spun-off from The Dun & Bradstreet Corporation and, in 1998, we completed an initial public offering to become a public company.

Available Information

We make available the following public filings with the Securities and Exchange Commission, or the SEC, free of charge through our website at www.cognizant.com as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC:

• | our Annual Reports on Form 10-K and any amendments thereto; |

• | our Quarterly Reports on Form 10-Q and any amendments thereto; and |

• | our Current Reports on Form 8-K and any amendments thereto. |

In addition, we make available our code of ethics entitled “Cognizant’s Core Values and Code of Ethics” free of charge through our website. We intend to post on our website all disclosures that are required by law or NASDAQ Stock Market listing standards concerning any amendments to, or waivers from, any provision of our code of ethics.

No information on our website is incorporated by reference into this Form 10-K or any other public filing made by us with the SEC.

12

Item 1A. Risk Factors

Factors That May Affect Future Results

We face various important risks and uncertainties, including those described below, that could adversely affect our business, results of operations and financial condition and, as a result, cause a decline in the trading price of our common stock.

Risks Relating to our Business

We face intense competition from other service providers.

The technology services, digital and outsourcing markets are highly competitive, characterized by a large number of participants and subject to rapid change. Various competitors in all or some of such markets include:

• | systems integration firms; |

• | contract programming companies; |

• | application software companies; |

• | cloud computing service providers; |

• | large or traditional consulting companies; |

• | professional services groups of computer equipment companies; |

• | infrastructure management and outsourcing companies; and |

• | boutique digital companies. |

These markets also include numerous smaller local competitors in the various geographic markets in which we operate which may be able to provide services and solutions at lower costs or on terms more attractive to customers than we can. Our direct competitors include, among others, Accenture, Atos Origin, Capgemini, Computer Sciences Corporation, Deloitte Digital, Genpact, HCL Technologies, HP Enterprise, IBM Global Services, Infosys Technologies, Tata Consultancy Services, and Wipro. In certain markets, our competitors may have greater financial, technical and marketing resources and greater name recognition and, therefore, may be better able to compete for new work and skilled professionals. Some of our competitors may be more successful than us at capturing the increasing customer demand for digital services. Increased competition in any of the various market segments in which we compete may put downward pressure on the prices we can charge for our services and, in turn, on our operating margins. Similarly, if our competitors develop and implement processes and methodologies that yield greater efficiency and productivity, they may be able to offer services similar to ours at lower prices without adversely affecting their profit margins. If we are unable to provide our customers with superior services and solutions at competitive prices or successfully market those services to current and prospective customers, our business, results of operations and financial condition may suffer.

Our international expansion plans may not be successful if we are unable to compete effectively in other countries. We may face competition in other countries from companies that may have more experience with operations in such countries or with international operations. Additionally, such companies may have long-standing or well-established relationships with desired customers, which may put us at a competitive disadvantage. If we fail to compete effectively in the new markets we enter, our ability to continue to grow our business could be adversely affected. In addition, if we cannot compete effectively, we may be required to reconsider our strategy to expand internationally as well as our intent not to repatriate our non-U.S. earnings.

We may also face competition from companies that increase in size or scope as the result of strategic mergers or acquisitions. These transactions may include consolidation activity among hardware manufacturers, software companies and vendors, and service providers, which could result in the convergence of products and services. If buyers of products and services in the markets we serve favor using a single provider of integrated products and services, such buyers may direct more business to such providers, which could have a variety of negative effects on our competitive position and, in turn, adversely affect our business, results of operations and financial condition.

We may not be able to increase our operating margin, or our operating margin may decline, and we may not be able to improve or sustain our profitability.

We have announced a margin improvement plan to increase gradually our non-GAAP operating margins over the next few years. This plan is reliant upon a number of assumptions, including our ability to improve the efficiency of our operations, focus on higher-margin business, reduce costs and make successful investments to grow and further develop our business. There can be no assurances that we will be successful in achieving this plan or that other factors beyond our control, including

13

the various other risks described herein, may prevent us from achieving the targeted improvements. Further, our operating margin may decline if we experience declines in demand and pricing for our services, an increase in our operating costs, including due to an imposition of new non-income related taxes or change in law or regulations related to immigration or outsourcing, or adverse fluctuations in foreign currency exchange rates. Wages in India have historically increased at a faster rate than in the United States, which has in the past and may in the future put pressure on our operating margins due to our offshore delivery model. Additionally, the number and type of equity-based compensation awards and the assumptions used in valuing equity-based compensation awards may change in a manner that results in increased stock-based compensation expense and lower margins.

Our operating margin, and therefore our profitability, is dependent on the rates we are able to recover for our services. If we are not able to maintain favorable pricing for our services, our operating margin and our profitability could suffer. The rates we are able to recover for our services are affected by a number of factors, including:

• | our customers’ perceptions of our ability to add value through our services; |

• | introduction of new services or products by us or our competitors; |

• | our competitors’ pricing policies; |

• | our ability to accurately estimate, attain and sustain contract revenues, margins and cash flows over increasingly longer contract periods; |

• | bid practices of customers and their use of third-party advisors; |

• | the use by our competitors and our customers of offshore resources to provide lower-cost service delivery capabilities; |

• | our ability to charge premium prices when justified by market demand or the type of service; and |

• | general economic and political conditions. |

In addition, if we are not able to maintain an appropriate utilization rate for our professionals, our profitability may suffer. Our utilization rates are affected by a number of factors, including:

• | our ability to efficiently transition employees from completed projects to new assignments; |

• | our ability to hire and assimilate new employees; |

• | our ability to accurately forecast demand for our services and thereby maintain an appropriate headcount in each of our geographies and workforces; |

• | our ability to effectively manage attrition; and |

• | our need to devote time and resources to training, re-skilling, professional development and other non-chargeable activities. |

If we are unable to control our costs and operate our business in an efficient manner, our operating margin, and therefore our profitability, may decline.

We could be held liable for damages or our reputation could suffer from security breaches or disclosure of confidential information or personal data.

We are dependent on information technology networks and systems to process, transmit and securely store electronic information and to communicate among our locations around the world and with our customers. Security breaches of this infrastructure could lead to shutdowns or disruptions of our systems and potential unauthorized disclosure of confidential information or data, including personal data. In addition, many of our engagements involve projects that are critical to the operations of our customers’ businesses. The theft and/or unauthorized use or publication of our, or our customers’, confidential information or other proprietary business information as a result of such an incident could adversely affect our competitive position and reduce marketplace acceptance of our services. Any failure in the networks or computer systems used by us or our customers could result in a claim for substantial damages against us and significant reputational harm, regardless of our responsibility for the failure.

In addition, we often have access to or are required to manage, utilize, collect and store sensitive or confidential customer or employee data, including personal data. As a result, we are subject to numerous U.S. and non-U.S. laws and regulations designed to protect this information, such as the European Union Directive on Data Protection and various U.S. federal and state laws governing the protection of personal data. If any person, including any of our employees, negligently disregards or intentionally breaches controls or procedures with which we are responsible for complying with respect to such data or otherwise mismanages or misappropriates that data, or if unauthorized access to or disclosure of data in our possession or control occurs, we could be subject to liability and penalties in connection with any violation of applicable privacy laws and/or criminal prosecution, as well as significant liability to our customers or our customers’ customers for breaching contractual

14

confidentiality and security provisions or privacy laws. These risks will increase as we continue to grow our cloud-based offerings and services and store and process increasingly large amounts of our customers’ confidential information and data and host or manage parts of our customers’ businesses, especially in industries involving particularly sensitive data such as the financial services industry and the healthcare industry. Unauthorized disclosure of sensitive or confidential customer or employee data, including personal data, whether through breach of computer systems, systems failure, employee negligence, fraud or misappropriation, or otherwise, could damage our reputation and cause us to lose customers. Similarly, unauthorized access to or through our information systems and networks or those we develop or manage for our customers, whether by our employees or third parties, could result in negative publicity, legal liability and damage to our reputation, which could in turn have a material adverse effect on our business, results of operations and financial condition.

Healthcare-related data protection, privacy and similar laws restrict access, use, and disclosure of information, and failure to comply with or adapt to changes in these laws could materially adversely affect our business, results of operations and financial condition.

As a service provider in the healthcare industry, we are subject to data privacy and security regulation by both the federal government and the states in which we conduct our business, including the Health Insurance Portability and Accountability Act of 1996, or HIPAA, and the Health Information Technology for Economic and Clinical Health Act, or HITECH, which are federal laws that apply to firms that provide services to certain entities in the healthcare industry.

A portion of the data that we obtain and handle for or on behalf of our healthcare customers is subject to HIPAA, and we are required to maintain the privacy and security of individually identifiable health information in accordance with HIPAA and the terms of our agreements with customers. HITECH increased the civil and criminal penalties that may be imposed against us, and gave state attorneys general new authority to file civil actions for damages or injunctions in federal court to enforce HIPAA’s requirements. We have incurred, and will continue to incur, significant costs to establish and maintain HIPAA-required safeguards and, if additional safeguards are required to comply with HIPAA or our healthcare customers' requirements, our costs could increase further, which would negatively affect our results of operations. Furthermore, if we fail to maintain adequate safeguards, or we inappropriately use or disclose individually identifiable health information, we could be subject to significant liabilities and consequences, including:

• | breach of our contractual obligations to our healthcare customers, which may cause these customers to terminate their relationship with us and may result in potentially significant financial obligations to them; |

• | investigation by the federal regulatory authorities empowered to enforce HIPAA and by the state attorneys general empowered to enforce comparable state laws, and the possible imposition of civil and criminal penalties; |

• | private litigation by individuals adversely affected by any violation of HIPAA, HITECH or comparable state laws to which we are subject; and |

• | negative publicity, which may decrease the willingness of current and potential future customers in the healthcare industry to work with us. |

Laws and expectations relating to privacy, security and data protection continue to evolve, and we continue to adapt to changing needs. Nevertheless, changes in these laws may limit our data access, use, and disclosure, and may require increased expenditures by us or may dictate that we not offer certain types of services. Any of the foregoing may have a material adverse effect on our ability to provide services to our healthcare customers and, in turn, on our business, results of operations and financial condition.

Our revenues and operating results may experience significant quarterly fluctuations.

We may experience significant quarterly fluctuations in our revenues and results of operations. Among the factors that could cause these variations are:

• | the nature, number, timing, scope and contractual terms of the projects in which we are engaged; |

• | delays incurred in the performance of those projects; |

• | the accuracy of estimates of resources and time required to complete ongoing projects; |

• | changes to the financial condition of our customers; |

• | changes in pricing in response to customer demand and competitive pressures; |

• | longer sales cycles and ramp-up periods for our larger, more complex projects; |

• | volatility and seasonality of our software sales; |

• | the mix of on-site and offshore staffing; |

• | the ratio of fixed-price contracts versus time-and-materials contracts; |

• | employee wage levels and utilization rates; |

15

• | changes in foreign exchange rates, including the Indian rupee versus the U.S. dollar; |

• | the timing of collection of accounts receivable; |

• | enactment of new taxes; |

• | changes in domestic and international income tax rates and regulations; |

• | changes to levels and types of stock-based compensation awards and assumptions used to determine the fair value of such awards; and |

• | general economic conditions. |

As a result of these factors, it is possible that in some future periods, our revenues and results of operations may be significantly below the expectations of public market analysts and investors. In such an event, the price of our common stock would likely be materially and adversely affected.

We rely on a few customers for a large portion of our revenues.

Our top five and top ten customers generated approximately 10.0% and 16.7%, respectively, of our revenues for the year ended December 31, 2016. The volume of work performed for specific customers is likely to vary from year to year, and a major customer in one year may not use our services in a subsequent year. The loss of one of our large customers could have a material adverse effect on our business, results of operations and financial condition.

Our business, results of operations and financial condition will suffer if we fail to enhance our existing services and solutions and develop new services and solutions that allow us to keep pace with rapidly evolving technological developments, including the demand for digital technologies and services.

The technology, consulting and business process services markets are characterized by rapid technological change, evolving industry standards, changing customer preferences and new product and service introductions. We are currently in the midst of a shift towards increasing customer demand for digital technologies and services. Our future success will depend on our ability to develop digital and other services and solutions that keep pace with changes in the markets in which we operate. We cannot be sure that we will be successful in developing digital and other new services and solutions addressing evolving technologies in a timely or cost-effective manner or that any services and solutions we do develop will be successful in the marketplace. Our failure to address the demands of the rapidly evolving technological environment could have a material adverse effect on our ability to retain and attract customers and our competitive position, which could in turn have a material adverse effect on our business, results of operations and financial condition.

Our business, results of operations and financial condition may be affected by the rate of growth in the use of technology in business and the type and level of technology spending by our customers.

Our business depends, in part, upon continued growth in the use of technology in business by our customers and prospective customers as well as their customers and suppliers. In challenging economic environments, our customers may reduce or defer their spending on new technologies in order to focus on other priorities, or may choose to use their own internal resources rather than engage an outside firm to perform the types of services and solutions we provide. In addition, many companies have already invested substantial resources in their current means of conducting commerce and exchanging information, and they may be reluctant or slow to adopt new approaches that could disrupt existing personnel, processes and infrastructures. If the growth of technology usage in business, or our customers’ spending on technology in business, declines, or if we cannot convince our customers or potential customers to embrace new technological solutions, our business, results of operations and financial condition could be adversely affected.

Most of our contracts with our customers are short-term, and our business, results of operations and financial condition could be adversely affected if our customers terminate their contracts on short notice.