Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TRIMAS CORP | trs_123116xexhibit991.htm |

| 8-K - 8-K - TRIMAS CORP | trs_123116x8k.htm |

Fourth Quarter and Full Year 2016

Earnings Presentation

February 28, 2017

2

Forward-Looking Statement

Forward-Looking Statement

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, contained herein, including those relating to the Company’s business, financial condition or

future results, involve risks and uncertainties with respect to, including, but not limited to: the Company's leverage; liabilities

imposed by the Company's debt instruments; market demand; competitive factors; supply constraints; material and energy costs;

intangible assets, including goodwill or other intangible asset impairment charges; technology factors; litigation; government and

regulatory actions; the Company's accounting policies; future trends; general economic and currency conditions; the potential

impact of Brexit; various conditions specific to the Company's business and industry; the Company’s ability to identify attractive

acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; potential

costs and savings related to facility consolidation activities; future prospects of the Company; and other risks that are detailed in

the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2016. These risks and uncertainties may

cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements

made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking

statements.

Non-GAAP Financial Measures

In this presentation, certain non-GAAP financial measures may be used. Reconciliations of these non-GAAP financial measures to

the most directly comparable GAAP financial measure may be found in the Appendix at the end of this presentation or in the

earnings releases available on the Company’s website. Additional information is available at www.trimascorp.com under the

“Investors” section.

Please see the Appendix for details regarding certain costs, expenses and other amounts or charges, collectively described as

“Special Items,” that are included in the determination of net income, earnings per share and/or cash flows from operating

activities under GAAP, but that management believes should be separately considered when evaluating the quality of the

Company’s core operating results, given they may not reflect the ongoing activities of the business. Management believes that

presenting these non-GAAP financial measures, on an after Special Items basis, provides useful information to investors by

helping them identify underlying trends in the Company’s businesses and facilitating comparisons of performance with prior and

future periods. These non-GAAP financial measures should be considered in addition to, and not as a replacement for or superior

to, the comparable GAAP financial measures.

3

• Opening Remarks

• Financial Highlights

• Segment Highlights

• Outlook and Summary

• Questions and Answers

• Appendix

Presenters Include:

• Thomas Amato, President and Chief Executive Officer

• Robert Zalupski, Chief Financial Officer

• Sherry Lauderback, Vice President, Investor Relations

Agenda

Opening Remarks

5

2016…A Transitional Year for TriMas

• New leadership in Q3, followed by a renewed focus to drive results

• Many changes were implemented:

- Implemented a new operating and financial model – concentrating on current and prospective

challenges and opportunities

- Leveraged data to drive a sense of urgency on operational improvement and customer satisfaction

- Upgraded organization in a number of key positions

- Streamlined and reduced non-critical infrastructure costs

- Began realigning manufacturing footprint to leverage structural costs

• Notable results:

- Solid progress on relieving constraints and improving flexibility

- Culture of performance excellence taking hold

- Exited/exiting six non-core facilities

- Increased operating profit margin slightly through cost containment actions, despite lower sales

- Reduced net debt even in challenging end markets

• Solid foundation in place, however, more to do in 2017

Opening Remarks

Actions taken and underway to unleash opportunities and value.

6

Opening Remarks

Actions taken and underway to unleash opportunities and value.

Introduced New TriMas Business Model (TBM) – Some Examples

Results-

Driven

Continuous

Improvement

TBM Focus

Environmental, Health and Safety

Annual Goal Setting and

Measurement

Flawless Launches

Continuous Improvement

Talent Development

• Example #1: Plant challenged with past due

orders

• Data-driven analysis to identify and remediate root

causes

• Key Actions: Visual management on factory floor

and daily analytics

• Results:

̶ Through team effort, past due orders down ~75%

• Example #2: Plant experienced shipment delays

and off standard costs

• Data-driven analysis to identify and remediate root

causes

• Key Actions: Significantly improved production order

and manufacturing flow

• Results:

̶ Through team effort, on-time delivery up ~25%

with overtime down ~50%

Financial Highlights

8

Fourth Quarter Summary

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

(Unaudited, dollars in millions, except per share amounts)

Expanded operating profit margin, excluding Special Items, despite continued end market weakness.

• Q4 2016 sales declined 3.8% as compared to Q4 2015

̶ Higher year-over-year sales in our Packaging and Aerospace segments were more than

offset by prolonged weakness in the oil & gas and industrial end markets

• Results impacted by pre-tax, non-cash goodwill and indefinite-lived intangible asset impairment

charges of $98.9 million in Q4

• Q4 operating profit margin, excluding Special Items, decreased as the positive impacts of

restructuring and cost savings initiatives were more than offset by reduced sales and less

favorable product mix

• Achieved Q4 EPS, excluding Special Items, of $0.30, as tax planning strategies completed in Q4

resulted in a lower effective tax rate

(from continuing operations) Q4 2016 Q4 2015 Variance

Net Sales $185.5 $192.8 (3.8%)

Operating Loss ($96.9) ($68.0) n/m

Excluding Special Items, Operating Profit would have been: $19.0 $22.1 (13.7%)

Excluding Special Items, Operating profit margin would have been: 10.3% 11.4% -110 bps

Net Loss ($67.4) ($60.8) n/m

Excluding Special Items, Income would have been: $13.6 $13.2 2.9%

Diluted Loss Per Share ($1.48) ($1.35) n/m

Excluding Special Items, Diluted Earnings Per Share would have been: $0.30 $0.29 3.4%

Increased EPS, excluding Special Items, year-over-year despite challenges.

9

Fourth Quarter Summary

(1) Free Cash Flow is defined as Net Cash Provided by Operating Activities of Continuing Operations, excluding the

cash impact of Special Items, less Capital Expenditures.

(Unaudited, dollars in millions)

• Generated Free Cash Flow(1) of $33.2 million in Q4 2016 after considering investment in

capex

̶ Capital investment included capacity expansions for the Packaging and Aerospace

segments, and the installation of an additional forging line for high pressure steel

cylinder production

̶ Intensified focus on increasing cash flow through performance improvements and

reductions in inventory

• Reduced net debt by $46.2 million, as compared to December 31, 2015

• Ended the quarter with cash and available liquidity of approximately $147.2 million, and a

leverage ratio of 2.6x

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

(from continuing operations) Q4 2016 Q4 2015 Variance

Free Cash Flow(1) $33.2 $41.7 ($8.5)

Capital Expenditures $8.9 $8.3 $0.6

Inventories $160.5 $167.4 ($6.9)

Total Debt $374.7 $419.6 ($45.0)

Cash $20.7 $19.5 $1.3

Net Debt $353.9 $400.2 ($46.2)

Increased focus on cash flow as part of the new TriMas Business Model.

10

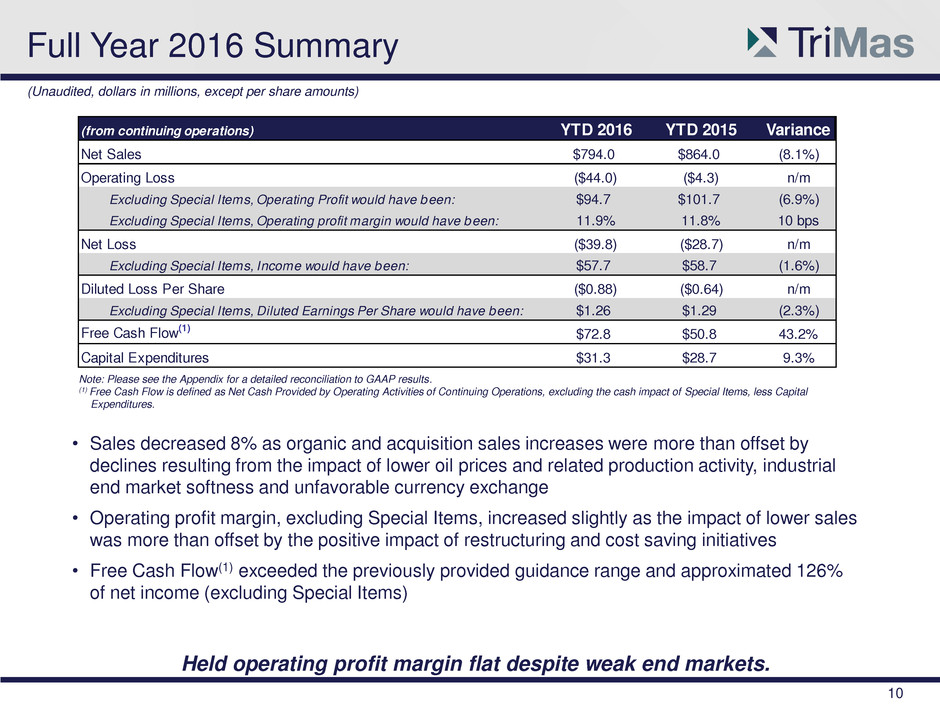

Full Year 2016 Summary

• Sales decreased 8% as organic and acquisition sales increases were more than offset by

declines resulting from the impact of lower oil prices and related production activity, industrial

end market softness and unfavorable currency exchange

• Operating profit margin, excluding Special Items, increased slightly as the impact of lower sales

was more than offset by the positive impact of restructuring and cost saving initiatives

• Free Cash Flow(1) exceeded the previously provided guidance range and approximated 126%

of net income (excluding Special Items)

(Unaudited, dollars in millions, except per share amounts)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

(1) Free Cash Flow is defined as Net Cash Provided by Operating Activities of Continuing Operations, excluding the cash impact of Special Items, less Capital

Expenditures.

(from continuing operations) YTD 2016 YTD 2015 Variance

Net Sales $794.0 $864.0 (8.1%)

Operating Loss ($44.0) ($4.3) n/m

Excluding Special Items, Operating Profit would have been: $94.7 $101.7 (6.9%)

Excluding Special Items, Operating profit margin would have been: 11.9% 11.8% 10 bps

Net Loss ($39.8) ($28.7) n/m

Excluding Special Items, Income would have been: $57.7 $58.7 (1.6%)

Diluted Loss Per Share ($0.88) ($0.64) n/m

Excluding Special Items, Diluted Earnings Per Share would have been: $1.26 $1.29 (2.3%)

Free Cash Flow(1) $72.8 $50.8 43.2%

Capital Expenditures $31.3 $28.7 9.3%

Held operating profit margin flat despite weak end markets.

Segment Highlights

12

Packaging Segment

• Sales increased 9.7% on a constant currency basis

• Continued to drive and gain traction on sales by focusing

technical and commercial resources in the health, beauty

& home care, food & beverage, and industrial end

markets

• Profit increased while margins remained strong

Quarterly Comments

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Positioning business for product innovation to drive future growth.

• Leveraging innovation resources and support teams in

India, the United Kingdom and the United States to

drive new product growth

• Continuing to support customers’ new product

launches to drive growth

• Ramping up new facility and expanded capacity in San

Miguel, Mexico

• Executing on productivity initiatives to fund sales

growth initiatives and development of new products

and applications

Actions Markets, Products & Brands

Financial Summary Q4 2016 Q4 2015 Variance

Sales $82.8 $77.8 6.4%

Operating Profit, excluding

Special Items

$20.4 $19.4 4.8%

Margin, excluding Sp ci l Items 24.6% 25.0% -40 bps

13

Aerospace Segment

Quarterly Comments

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Focusing on manufacturing performance and delivery improvements to leverage platform.

Actions Markets, Products & Brands

• Added new leader of Aerospace segment in December

• Executing plans to increase manufacturing throughput

and improve production efficiencies

• Seeking to drive additional synergies across fastener

businesses and further integrate platform

• Continuing efforts to better align product mix and

production capacity to eliminate off-standard costs and

improve financial performance

• Developing and qualifying new highly-engineered

products; qualifying existing products for new

applications and new customers

• Sales increased slightly due to the acquisition of a

machined components facility in November 2015

• Profit and related margin, excluding Special Items,

declined due to a less favorable sales mix, customer

contractual adjustments and unfavorable inventory

quantity and spending variances

• Recorded pre-tax, non-cash goodwill and indefinite-lived

intangible asset impairment charges of $98.9 million

Financial Summary Q4 2016 Q4 2015 Variance

Sales $42.9 $42.1 1.8%

Operating Profit, excluding

Special Items

$1.3 $6.8 -80.5%

Margin, exclu ing Special Items 3.1% 16.1% -1300 bps

14

Aerospace Segment – Recovery Update

• Improved operational performance at Commerce, California plant

- Manufacturing environment stabilizing; key performance indicators demonstrating progress

- Continued strong order intake provides solid demand to start 2017

• Improved order intake of rivets suggests end market demand may be stabilizing

• Focused on increased manufacturing efficiencies in our Ottawa, Kansas standard fasteners plant

- Working through a backlog of smaller lot size orders which has impacted efficiencies

- Replaced plant manager in February 2017 to drive manufacturing performance

Expecting improved operational and financial performance to continue into 2017.

Fasteners (approximately 85% of Aerospace segment sales)

Machined Components (approximately 15% of Aerospace segment sales)

• Prolonged challenges assimilating Tolleson, Arizona plant into TriMas Aerospace

- Balancing customer demands and lot sizes with capacity, and need for improved production execution

- Addressing pricing fundamentals on certain part numbers

- Replaced general manager in October 2016 to drive increased focus on meeting delivery, quality and

performance expectations

15

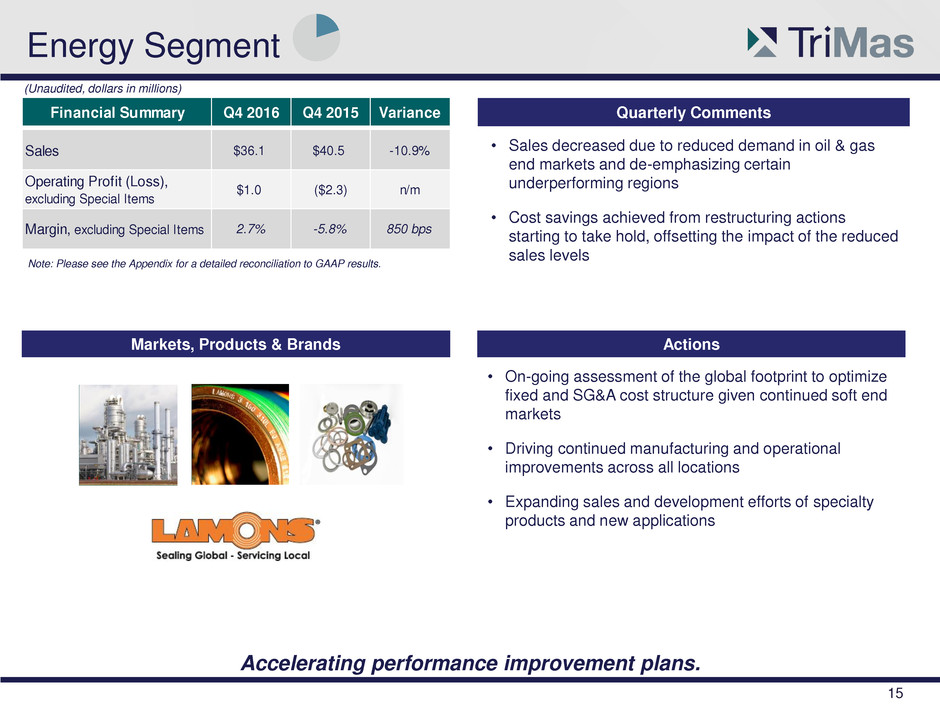

Energy Segment

Quarterly Comments

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Accelerating performance improvement plans.

Actions Markets, Products & Brands

• Sales decreased due to reduced demand in oil & gas

end markets and de-emphasizing certain

underperforming regions

• Cost savings achieved from restructuring actions

starting to take hold, offsetting the impact of the reduced

sales levels

• On-going assessment of the global footprint to optimize

fixed and SG&A cost structure given continued soft end

markets

• Driving continued manufacturing and operational

improvements across all locations

• Expanding sales and development efforts of specialty

products and new applications

Financial Summary Q4 2016 Q4 2015 Variance

Sales $36.1 $40.5 -10.9%

Operating Profit (Los ),

excluding Speci l It s

$1.0 ($2.3) n/m

Margin, excluding Speci l Items 2.7% -5.8% 850 bps

16

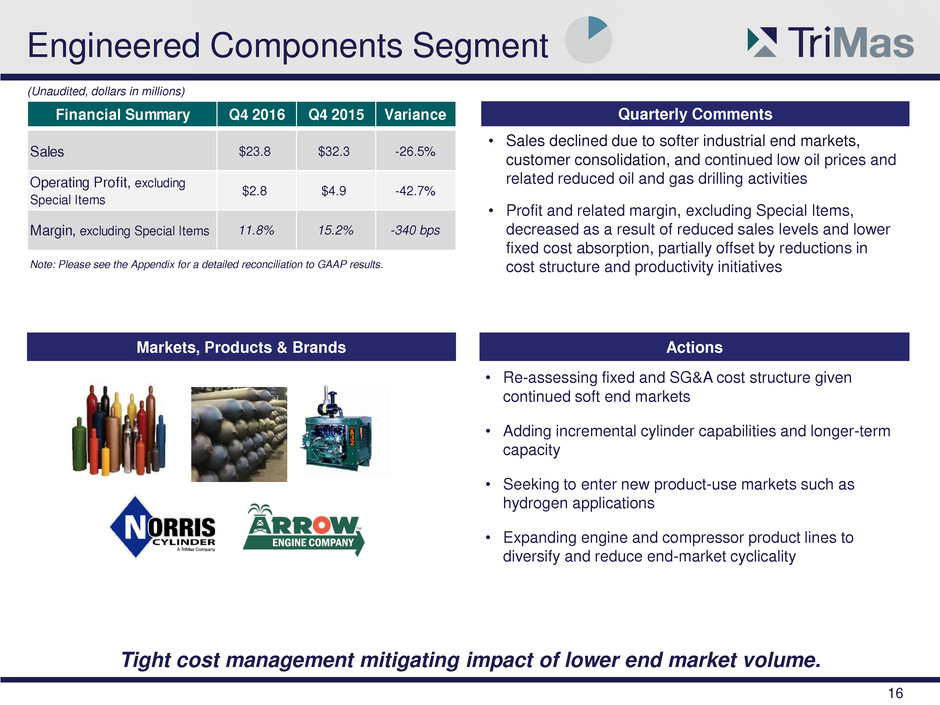

Engineered Components Segment

Quarterly Comments

(Unaudited, dollars in millions)

Note: Please see the Appendix for a detailed reconciliation to GAAP results.

Tight cost management mitigating impact of lower end market volume.

Actions Markets, Products & Brands

• Sales declined due to softer industrial end markets,

customer consolidation, and continued low oil prices and

related reduced oil and gas drilling activities

• Profit and related margin, excluding Special Items,

decreased as a result of reduced sales levels and lower

fixed cost absorption, partially offset by reductions in

cost structure and productivity initiatives

• Re-assessing fixed and SG&A cost structure given

continued soft end markets

• Adding incremental cylinder capabilities and longer-term

capacity

• Seeking to enter new product-use markets such as

hydrogen applications

• Expanding engine and compressor product lines to

diversify and reduce end-market cyclicality

Financial Summary Q4 2016 Q4 2015 Variance

Sales $23.8 $32.3 -26.5%

Operating Profit, excluding

Special Items

$2.8 $4.9 -42.7%

Margin, excluding Sp cial Items 11.8% 15.2% -340 bps

Outlook and Summary

18

FY 2017 Segment Assumptions

(1) 2017 sales growth versus 2016.

Note: All of the figures and comments on this slide exclude any current and future Special Items.

From Continuing Operations

Segment Sales(1)

Operating

Profit Margin

(excl. Special Items) Full Year 2017 Commentary

Packaging 2% – 4% 23% – 24%

• Organic growth driven primarily by anticipated ramp of customers’ new

products

• Sales impact related to unfavorable currency exchange of ~1% to 2%

• Relentless focus on our continuous improvement culture while investing in

innovation to drive future growth

Aerospace

4% – 6%

13% – 15%

• Steady build rates and continued progress against backlog expected to

drive top-line

• Distribution customer demand levels appear to be stabilizing

• Less favorable product sales mix continues to impact profitability

Energy (2%) – (5%) 5% – 7%

• Sales levels impacted by de-emphasizing certain underperforming regions

and continued weakness in oil and gas end markets

• Margin level positively impacted as a result of restructuring actions

Engineered

Components

2% – 5% 13% – 15%

• Sales growth expected from improvements in general industrial end market

demand

• Expect flat sales related to oil and gas end markets

• Focused on cost structure and productivity to maintain and improve margins

Expect sales growth in three segments and improvement in overall segment margin.

19

FY 2017 Outlook

(1) Free Cash Flow is defined as Net Cash Provided by/Used for Operating Activities of Continuing

Operations, excluding the cash impact of Special Items, less Capital Expenditures.

From Continuing Operations

Sales and margin expansion expected to drive year-over-year EPS growth.

Note: All of the figures on this slide exclude any current and future Special Items.

Full Year Outlook

(as of 2/28/17)

Sales Growth

2% – 4%

Earnings Per Share, diluted $1.35 – $1.45

Free Cash Flow(1) > 100% of net income

20

FY 2017 Additional Assumptions

From Continuing Operations

Note: All of the figures and comments on this slide exclude any current and future Special Items.

Full Year Outlook

(as of 2/28/17)

Interest Expense $13 – $15 million

Capital Expenditures ~ 4% of sales

Tax Rate 30% – 32%

Corporate Cash Expense

Non-Cash Stock Compensation

~ $22 million

~ $7 million

21

2017 Near-Term Focus

Focused on operational execution and improved performance.

• Operate under the new TriMas Business Model, with a nearer-term focus on:

- Driving growth in the Packaging and Engineered Components segments

- Continuing to execute turnaround plans in the Energy and Aerospace

segments

• Relentless focus on managing cash flow and optimizing operational structure

• Continue to assess capacity, process technology and innovation pipeline to

enhance growth

• Ensure all facility rationalization steps are well-executed and continue to

assess manufacturing footprint

• Drive a culture of continuous improvement through employee engagement

22

Closing Comments

TriMas has many attractive investment attributes.

Well-established brands with leading market

positions in niche markets

Majority of products with high barriers to

entry through production innovation or

customer qualifications

Strong cash flow with options to drive

shareholder value

Potential to unlock value through focus on

performance criteria and improvement

actions

Well-positioned to take advantage of

operating leverage with even modest

improvements in economic environment or

market spending

Questions and Answers

Appendix

25

Condensed Consolidated Balance Sheet

(Dollars in thousands)

December 31, December 31,

2016 2015

Assets

Current assets:

Cash and cash equivalents............................................... 20,710$ 19,450$

Receivables, net.............................................................. 111,570 121,990

Inventories...................................................................... 160,460 167,370

Prepaid expenses and other current assets....................... 16,060 17,810

Total current assets...................................................... 308,800 326,620

Property and equipment, net................................................ 179,160 181,130

Goodwill............................................................................. 315,080 378,920

Other intangibles, net........................................................... 213,920 273,870

Other assets....................................................................... 34,690 9,760

Total assets................................................................. 1,051,650$ 1,170,300$

Liabilities and Shareholders' Equity

Current liabilities:

Current maturities, long-term debt..................................... 13,810$ 13,850$

Accounts payable............................................................ 72,270 88,420

Accrued liabilities............................................................ 47,190 50,480

Total current liabilities................................................... 133,270 152,750

L ng-term debt, net............................................................. 360,840 405,780

Deferred income taxes........................................................ 5,910 11,260

Other long-term liabilities...................................................... 51,910 53,320

Total liabilities.............................................................. 551,930 623,110

Total shareholders' equity............................................. 499,720 547,190

Total liabilities and shareholders' equity.......................... 1,051,650$ 1,170,300$

26

Consolidated Statement of Operations

(Unaudited, dollars in thousands, except for per share amounts)

Three months ended Twelve months ended

2016 2015 2016 2015

Net sales......................................................................................... 185,530$ 192,760$ 794,020$ 863,980$

Cost of sales.................................................................................... (146,100) (143,760) (583,540) (627,870)

Gross profit.................................................................................. 39,430 49,000 210,480 236,110

Selling, general and administrative expenses...................................... (36,910) (39,630) (153,710) (162,350)

Net loss on dispositions of property and equipment............................. (520) (1,730) (1,870) (2,330)

Impairment of goodwill and indefinite-lived intangible assets................. (98,900) (75,680) (98,900) (75,680)

Operating loss.............................................................................. (96,900) (68,040) (44,000) (4,250)

Other expense, net:

Interest expense........................................................................... (3,490) (3,450) (13,720) (14,060)

Debt financing and extinguishment costs........................................ - - - (1,970)

Other income (expense), net.......................................................... (380) 490 (510) (1,840)

Other expense, net.................................................................... (3,870) (2,960) (14,230) (17,870)

Loss from continuing operations before income taxes.......................... (100,770) (71,000) (58,230) (22,120)

Income tax benefit (expense)............................................................. 33,410 10,200 18,430 (6,540)

Loss from continuing operations........................................................ (67,360) (60,800) (39,800) (28,660)

Loss from discontinued operations, net of tax..................................... - - - (4,740)

Net loss........................................................................................... (67,360) (60,800) (39,800) (33,400)

Net loss per share - basic:

Continuing operations................................................................... (1.48)$ (1.35)$ (0.88)$ (0.64)$

Discontinued operations................................................................ - - - (0.10)

Net loss per share......................................................................... (1.48)$ (1.35)$ (0.88)$ (0.74)$

Weighted average common shares - basic 45,484,485 45,188,303 45,407,316 45,123,626

L s per share - diluted:

Continuing operations................................................................... (1.48)$ (1.35)$ (0.88)$ (0.64)$

Discontinued operations................................................................ - - - (0.10)

Net loss per share......................................................................... (1.48)$ (1.35)$ (0.88)$ (0.74)$

Weighted average common shares - diluted 45,484,485 45,188,303 45,407,316 45,123,626

December 31, December 31,

27

Consolidated Statement of Cash Flow

(Unaudited, dollars in thousands)

2016 2015

Cash Flows from Operating Activities:

Net loss.......................................................................................................................... (39,800)$ (33,400)$

Loss from discontinued operations................................................................................... - (4,740)

Loss from continuing operations....................................................................................... (39,800) (28,660)

Adjustments to reconcile net loss to net cash provided by operating activities:

Impairment of goodwill and indefinite-lived intangible assets............................................ 98,900 75,680

Loss on dispositions of property and equipment............................................................. 1,870 2,330

Depreciation............................................................................................................... 24,390 22,570

Amortization of intangible assets................................................................................... 20,470 20,970

Amortization of debt issue costs.................................................................................... 1,370 1,710

Deferred income taxes................................................................................................. (32,160) (8,750)

Non-cash compensation expense.................................................................................. 6,940 6,340

Excess tax benefits from stock based compensation....................................................... (640) (590)

Debt financing and extinguishment expenses................................................................. - 1,970

Decrease in receivables............................................................................................... 7,990 5,300

Decrease in inventories............................................................................................... 5,180 3,250

Decrease in prepaid expenses and other assets............................................................ 2,550 4,730

Decrease in accounts payable and accrued liabilities..................................................... (18,120) (29,530)

Other, net................................................................................................................... 1,530 (750)

Net cash provided by operating activities of continuing operations............................... 80,470 76,570

Net cash used for operating activities of discontinued operations................................. - (14,030)

Net cash provided by operating activities................................................................ 80,470 62,540

Cash Flows from Investing Activities:

Capital expenditures.................................................................................................... (31,330) (28,660)

Acquisition of businesses, net of cash acquired............................................................. - (10,000)

Net proceeds from dispositions of property and equipment............................................. 220 1,700

Net cash used for investing activities of continuing operations..................................... (31,110) (36,960)

Net cash used for investing activities of discontinued operations.................................. - (2,510)

Net cash used for investing activities...................................................................... (31,110) (39,470)

Cash Flows from Financing Activities:

Proceeds from borrowings on term loan facilities........................................................... - 275,000

Repayments of borrowings on term loan facilities........................................................... (13,850) (444,890)

Proceeds from borrowings on revolving credit and accounts receivable facilities............... 402,420 1,129,840

Repayments of borrowings on revolving credit and accounts receivable facilities.............. (433,350) (1,169,370)

Payments for deferred purchase price.......................................................................... (2,530) (6,440)

Debt financing fees..................................................................................................... - (1,850)

Shares surrendered upon options and restricted stock vesting to cover taxes................... (1,590) (2,770)

Proceeds from exercise of stock options....................................................................... 160 500

Excess tax benefits from stock based compensation....................................................... 640 590

Cash transferred to the Cequent businesses.................................................................. - (17,050)

Net cash used for financing activities of continuing operations..................................... (48,100) (236,440)

Net cash provided by financing activities of discontinued operations............................ - 208,400

Net cash used for financing activities..................................................................... (48,100) (28,040)

Cash and Cash Equivalents:

Net increase (decrease) for the period.......................................................................... 1,260 (4,970)

At beginning of period.................................................................................................. 19,450 24,420

At end of period....................................................................................................... 20,710$ 19,450$

Supplemental disclosure of cash flow information:

Cash paid for interest............................................................................................... 11,800$ 15,170$

Cash paid for taxes.................................................................................................. 17,210$ 30,580$

December 31,

Year ended

28

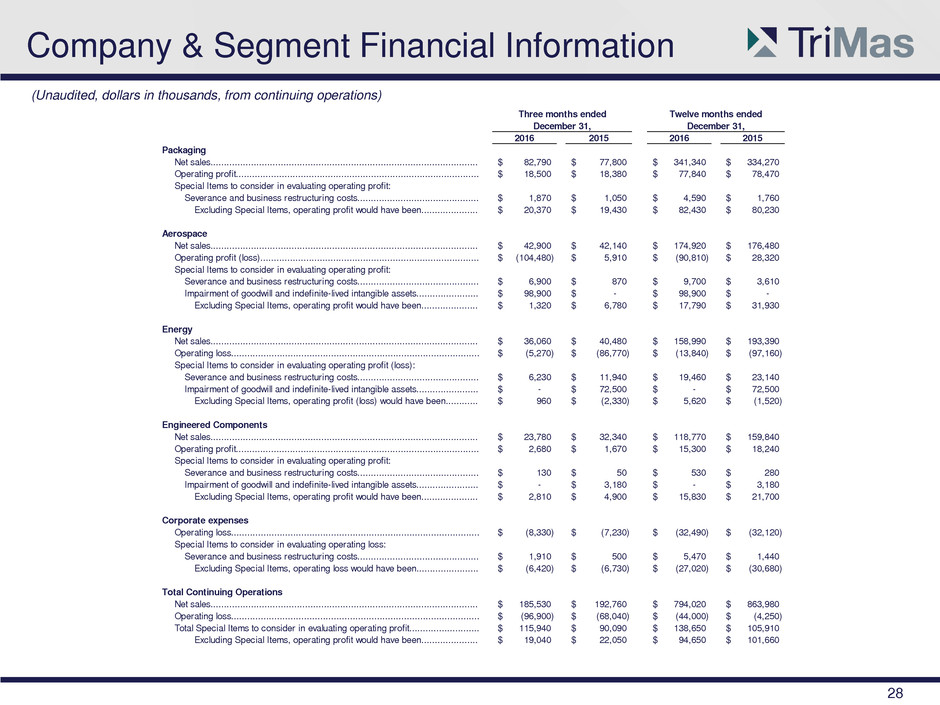

Company & Segment Financial Information

(Unaudited, dollars in thousands, from continuing operations)

Three months ended

2016 2015 2016 2015

Packaging

Net sales................................................................................................... 82,790$ 77,800$ 341,340$ 334,270$

Operating profit.......................................................................................... 18,500$ 18,380$ 77,840$ 78,470$

Special Items to consider in evaluating operating profit:

Severance and business restructuring costs............................................. 1,870$ 1,050$ 4,590$ 1,760$

Excluding Special Items, operating profit would have been..................... 20,370$ 19,430$ 82,430$ 80,230$

Aerospace

Net sales................................................................................................... 42,900$ 42,140$ 174,920$ 176,480$

Operating profit (loss)................................................................................. (104,480)$ 5,910$ (90,810)$ 28,320$

Special Items to consider in evaluating operating profit:

Severance and business restructuring costs............................................. 6,900$ 870$ 9,700$ 3,610$

Impairment of goodwill and indefinite-lived intangible assets....................... 98,900$ -$ 98,900$ -$

Excluding Special Items, operating profit would have been..................... 1,320$ 6,780$ 17,790$ 31,930$

Energy

Net sales................................................................................................... 36,060$ 40,480$ 158,990$ 193,390$

Operating loss............................................................................................ (5,270)$ (86,770)$ (13,840)$ (97,160)$

Special Items to consider in evaluating operating profit (loss):

Severance and business restructuring costs............................................. 6,230$ 11,940$ 19,460$ 23,140$

Impairment of goodwill and indefinite-lived intangible assets....................... -$ 72,500$ -$ 72,500$

Excluding Special Items, operating profit (loss) would have been............ 960$ (2,330)$ 5,620$ (1,520)$

Engineered Components

Net sales................................................................................................... 23,780$ 32,340$ 118,770$ 159,840$

Operating profit.......................................................................................... 2,680$ 1,670$ 15,300$ 18,240$

Special Items to consider in evaluating operating profit:

Severance and business restructuring costs............................................. 130$ 50$ 530$ 280$

Impairment of goodwill and indefinite-lived intangible assets....................... -$ 3,180$ -$ 3,180$

Excluding Special Items, operating profit would have been..................... 2,810$ 4,900$ 15,830$ 21,700$

Corporate expenses

Operating loss............................................................................................ (8,330)$ (7,230)$ (32,490)$ (32,120)$

Special Items to consider in evaluating operating loss:

Severance and business restructuring costs............................................. 1,910$ 500$ 5,470$ 1,440$

Excluding Special Items, operating loss would have been....................... (6,420)$ (6,730)$ (27,020)$ (30,680)$

Total Continuing Operations

Net sales................................................................................................... 185,530$ 192,760$ 794,020$ 863,980$

Operating loss............................................................................................ (96,900)$ (68,040)$ (44,000)$ (4,250)$

Total Special Items to consider in evaluating operating profit.......................... 115,940$ 90,090$ 138,650$ 105,910$

Excluding Special Items, operating profit would have been..................... 19,040$ 22,050$ 94,650$ 101,660$

December 31, December 31,

Twelve months ended

29

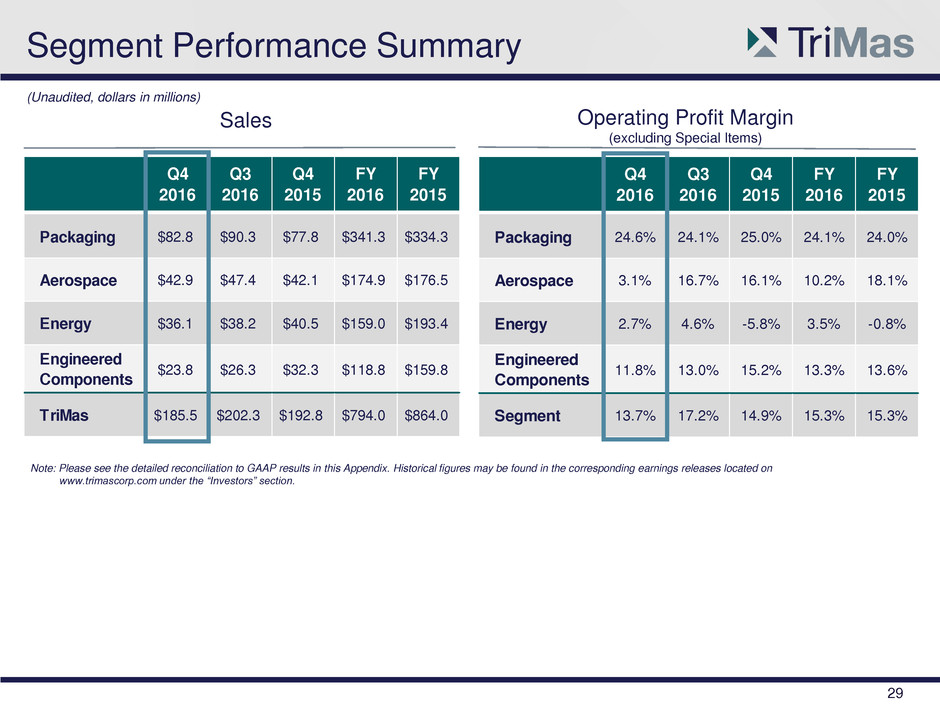

Segment Performance Summary

(Unaudited, dollars in millions)

Operating Profit Margin

(excluding Special Items)

Note: Please see the detailed reconciliation to GAAP results in this Appendix. Historical figures may be found in the corresponding earnings releases located on

www.trimascorp.com under the “Investors” section.

Sales

Q4

2016

Q3

2016

Q4

2015

FY

2016

FY

2015

Packaging $82.8 $90.3 $77.8 $341.3 $334.3

Aerospace $42.9 $47.4 $42.1 $174.9 $176.5

Energy $36.1 $38.2 $40.5 $159.0 $193.4

Engineered

Components

$23.8 $26.3 $32.3 $118.8 $159.8

TriMas $185.5 $202.3 $192.8 $794.0 $864.0

Q4

2016

Q3

2016

Q4

2015

FY

2016

FY

2015

Packaging 24.6% 24.1% 25.0% 24.1% 24.0%

Aerospace 3.1% 6.7% 16.1% 10.2% 18.1%

Energy 2.7% 4.6% -5.8% 3.5% -0.8%

Engineered

Components

11.8% 13.0% 15.2% 13.3% 13.6%

Segment 13.7% 17.2% 14.9% 15.3% 15.3%

30

Additional Information Regarding Special Items

(Unaudited, dollars in thousands, except for per share amounts)

Three months ended Twelve months ended

December 31, December 31,

2016 2015 2016 2015

Loss from continuing operations, as reported....................................................................... (67,360)$ (60,800)$ (39,800)$ (28,660)$

After-tax impact of Special Items to consider in evaluating quality of income (loss)

from continuing operations:

Severance and business restructuring costs........................................................................... 13,050 9,760 29,620 21,810

Impairment of goodwill and indefinite-lived intangible assets..................................................... 67,910 64,260 67,910 64,260

Debt financing and extinguishment costs................................................................................ - - - 1,240

Excluding Special Items, income from continuing operations would have been.................. 13,600$ 13,220$ 57,730$ 58,650$

Three months ended Twelve months ended

December 31, December 31,

2016 2015 2016 2015

Diluted loss per share from continuing operations, as reported............................................ (1.48)$ (1.35)$ (0.88) (0.64)$

Dilutive impact(a)………………………………………………………………………………………………………………………………………… 0.01 0.02 0.01 0.01

After-tax impact of Special Items to consider in evaluating quality of EPS

from continuing operations:

Severance and business restructuring costs........................................................................... 0.29 0.21 0.65 0.48

Impairment of goodwill and indefinite-lived intangible assets..................................................... 1.48 1.41 1.48 1.41

Debt financing and extinguishment costs................................................................................ - - - 0.03

Excluding Special Items, EPS from continuing operations would have been....................... 0.30$ 0.29$ 1.26$ 1.29$

Weighted-average shares outstanding .............................................................................. 45,786,801 45,613,000 45,732,105 45,482,964

2016 2015 2016 2015

Operating profit from continuing operations (excluding Special Items).................................. 19,040$ 22,050$ 94,650$ 101,660$

Corporate expenses (excluding Special Items)........................................................................ 6,420 6,730 27,020 30,680

Segment operating profit (excluding Special Items)............................................................... 25,460$ 28,780$ 121,670$ 132,340$

Segment operating profit margin (excluding Special Items).................................................... 13.7% 14.9% 15.3% 15.3%

(a) Impact of 302,316 and 424,697 shares for the three months ended December 31, 2016 and 2015, resepctively, and 324,789 and 359,338 shares for the twelve months

ended December 31, 2016 and 2015, respectively, which would have been dilutive to the computation of earnings per share in an income position.

December 31, December 31,

Three months ended Twelve months ended

31

Additional Information Regarding Special Items

(Unaudited, dollars in thousands)

As reported Special Items

Excluding

Special Items As reported Special Items

Excluding

Special Items

Net cash provided by operating activities of continuing operations.......................... 34,060$ 8,090$ 42,150$ 47,830$ 2,160$ 49,990$

Less: Capital expenditures of continuing operations............................................... (8,940) - (8,940) (8,300) - (8,300)

Free Cash Flow from continuing operations.......................................................... 25,120 8,090 33,210 39,530 2,160 41,690

Income (loss) from continuing operations.............................................................. (67,360) 80,960 13,600 (60,800) 74,020 13,220

Free Cash Flow as a percentage of income from continuing operations.................. -37% 244% -65% 315%

As reported Special Items

Excluding

Special Items As reported Special Items

Excluding

Special Items

Net cash provided by operating activities of continuing operations.......................... 80,470$ 23,610$ 104,080$ 76,570$ 2,890$ 79,460$

Less: Capital expenditures of continuing operations............................................... (31,330) - (31,330) (28,660) - (28,660)

Free Cash Flow from continuing operations.......................................................... 49,140 23,610 72,750 47,910 2,890 50,800

Income (loss) from continuing operations.............................................................. (39,800) 97,530 57,730 (28,660) 87,310 58,650

Free Cash Flow as a percentage of income from continuing operations.................. -123% 126% -167% 87%

Twelve months ended December 31,

2016 2015

Three months ended December 31,

2016 2015

32

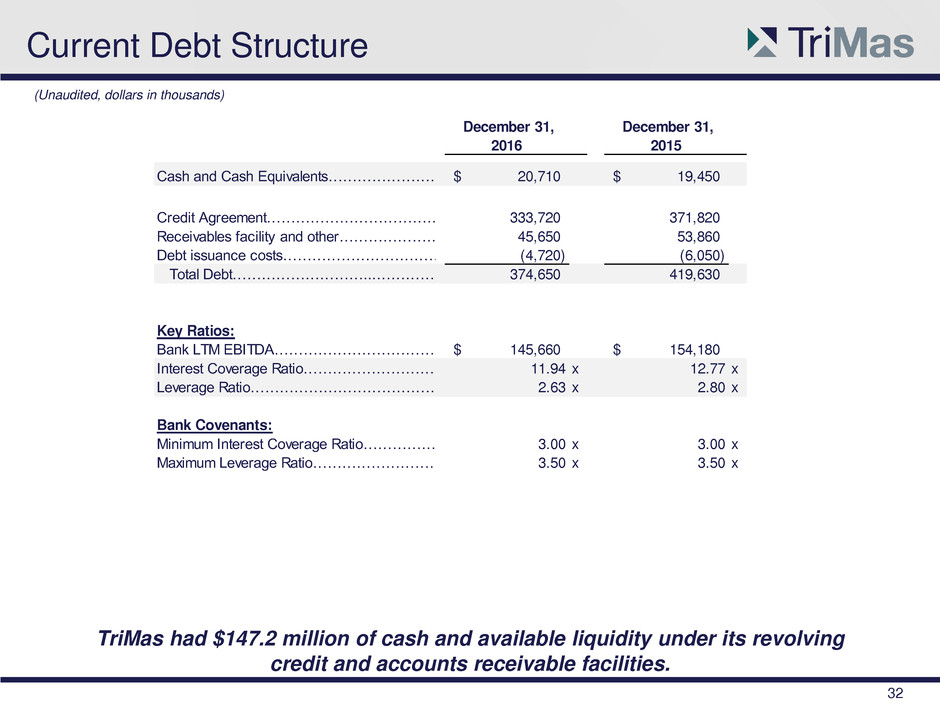

Current Debt Structure

(Unaudited, dollars in thousands)

TriMas had $147.2 million of cash and available liquidity under its revolving

credit and accounts receivable facilities.

December 31, December 31,

2016 2015

Cash and Cash Equivalents……………………………..………………… 20,710$ 19,450$

Credit Agreement……………………………………….. 333,720 371,820

Receivables facility and other……………………………….. 45,650 53,860

Debt issuance costs…………………………………… (4,720) (6,050)

Total Debt………………………...………………………...………………………… 374,650 419,630

Key Ratios:

Bank LTM EBITDA……………………………………………………………………………….……………………………………… 145,660$ 154,180$

Inter st Coverage Ratio………………………………………………………………… 11.94 x 12.77 x

Leverage Ratio…………………………………………………………………... 2.63 x 2.80 x

Bank Covenants:

Minimum Interest Coverage Ratio………………………………………………………………… 3.00 x 3.00 x

Maximum Leverage Ratio………………………………………………………………………………… 3.50 x 3.50 x

33

LTM Bank EBITDA

(Unaudited, dollars in thousands)

(1) As defined in the Credit Agreement dated June 30, 2015.

(39,800)$

Interest expense.................................................................................. 13,720

Depreciation and amortization.............................................................. 44,860

Extraordinary non-cash charges........................................................... 98,900

Non-cash compensation expense.......................................................... 6,940

Other non-cash expenses or losses....................................................... 8,180

Non-recurring expenses or costs ......................................................... 11,400

Acquisition integration costs................................................................. 1,460

145,660$

Net loss for the year ended December 31, 2016........................................

Bank EBITDA - LTM Ended December 31, 2016 (1)…………………………………………………………………