UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

|

|

|

|

|

| Commission File Number |

|

Exact name of registrants as specified in their charters |

|

I.R.S. Employer

Identification Number |

|

|

|

| 001-36684 |

|

DOMINION MIDSTREAM PARTNERS, LP |

|

46-5135781 |

|

|

|

|

|

DELAWARE

(State or other jurisdiction of incorporation or organization) |

|

|

|

|

|

|

|

120 TREDEGAR STREET

RICHMOND, VIRGINIA (Address

of principal executive offices) |

|

23219

(Zip Code) |

|

|

|

| |

|

(804) 819-2000

(Registrants’ telephone number) |

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of Each Class |

|

Name of Each Exchange

on Which Registered |

| Common Units Representing Limited Partner Interests |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by

check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act. Yes ☐ No ☒

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). Yes ☒ No ☐

Indicate by check mark if disclosure

of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer ☒ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

|

|

|

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the

Act). Yes ☐ No ☒

The aggregate market value of the

registrant’s common units held by non-affiliates was approximately $770 million based on the closing price of its common units as reported on the New York Stock Exchange as of the last day of its most recently completed second fiscal quarter.

At February 24, 2017, Dominion Midstream Partners, LP had 67,251,952 common units and 31,972,789 subordinated units outstanding.

Dominion Midstream Partners, LP

Unless the context otherwise requires, references in this Annual Report on Form 10-K to “Cove Point,” “the

Predecessor,” “our predecessor,” and “we,” “our,” “us,” “our partnership” or like terms when used in a historical context (periods prior to October 20, 2014), refer to Dominion Cove Point LNG,

LP as our predecessor for accounting purposes. When used in the present tense or prospectively (periods beginning October 20, 2014), “Dominion Midstream,” “we,” “our,” “us” or like terms refer to Dominion

Midstream Partners, LP; one of its wholly-owned subsidiaries, Cove Point GP Holding Company, LLC, Iroquois GP Holding Company, LLC, Dominion Carolina Gas Transmission, LLC (beginning April 1, 2015) or Questar Pipeline, LLC and its subsidiaries

(beginning December 1, 2016); or all of them taken as a whole.

GLOSSARY OF TERMS

The following abbreviations or acronyms used in this Form 10-K are defined below:

|

|

|

| Abbreviation or Acronym |

|

Definition |

| 2005 Agreement |

|

An agreement effective March 1, 2005, which Cove Point entered into with the Sierra Club and the Maryland

Conservation Council, Inc. |

| Additional Return Distributions |

|

The additional cash distribution equal to 3.0% of Cove Point’s Modified Net Operating Income in excess

of $600 million distributed each year |

| Adjusted EBITDA |

|

EBITDA after adjustment for EBITDA attributable to predecessors and a noncontrolling interest in Cove Point

held by Dominion subsequent to the Offering, less income from equity method investees, plus distributions from equity method investees |

| AFUDC |

|

Allowance for funds used during construction |

| AIP |

|

Annual Incentive Plan |

| AOCI |

|

Accumulated other comprehensive income (loss) |

| ARO |

|

Asset retirement obligation |

| Atlantic Coast Pipeline |

|

Atlantic Coast Pipeline, LLC, a limited liability company owned by Dominion, Duke Energy Corporation,

Piedmont Natural Gas Company, Inc. and Southern Company Gas (formerly known as AGL Resources Inc.) |

| Bcf |

|

Billion cubic feet |

| Bcfe |

|

Billion cubic feet equivalent |

| Blue Racer |

|

Blue Racer Midstream, LLC, a joint venture between Dominion and Caiman |

| BRP |

|

Retirement Benefit Restoration Plan |

| CAA |

|

Clean Air Act |

| Caiman |

|

Caiman Energy II, LLC |

| CAP |

|

IRS Compliance Assurance Process |

| CD&A |

|

Compensation Discussion and Analysis |

| CEO |

|

Chief Executive Officer |

| CFO |

|

Chief Financial Officer |

| CGN Committee |

|

Compensation, Governance and Nominating Committee of Dominion’s Board of Directors |

| Charleston Project |

|

Project to provide 80,000 Dths/day of firm transportation service from an existing interconnect with Transco

in Spartanburg County, South Carolina to customers in Dillon, Marlboro, Sumter, Charleston, Lexington and Richland counties, South Carolina |

| Clean Power Plan |

|

Guidelines issued by the EPA in August 2015 for states to follow in developing plans to reduce CO2 emissions from existing fossil fuel-fired electric generating units, stayed by the U.S. Supreme Court in February 2016 pending resolution of court challenges by certain states |

| Columbia to Eastover Project |

|

Project to provide 15,800 Dths/day of firm transportation service from an existing interconnect with Southern

Natural Gas Company, LLC in Aiken County, South Carolina and provide for a receipt point change of 2,200 Dths/day under an existing contract from an existing interconnect with Transco in Cherokee County, South Carolina for a total 18,000 Dths/day,

to a new delivery point for the International Paper Company at its pulp and paper mill known as the Eastover Plant in Richland County, South Carolina |

| CO2 |

|

Carbon dioxide |

| Cove Point |

|

Dominion Cove Point LNG, LP |

| Cove Point Facilities |

|

Collectively, the Liquefaction Project, Cove Point LNG Facility and Cove Point Pipeline |

| Cove Point Holdings |

|

Cove Point GP Holding Company, LLC |

| Cove Point LNG Facility |

|

An LNG import/regasification and storage facility located on the Chesapeake Bay in Lusby, Maryland owned by

Cove Point |

| Cove Point Pipeline |

|

An approximately 136-mile natural gas pipeline owned by Cove Point that connects the Cove Point LNG Facility

to interstate natural gas pipelines |

| CPCN |

|

Certificate of Public Convenience and Necessity |

| CRA |

|

Compliance Resolution Agreement |

| CWA |

|

Clean Water Act |

| DCG |

|

Dominion Carolina Gas Transmission, LLC (successor by statutory conversion to and formerly known as Carolina

Gas Transmission Corporation) |

| DCG Acquisition |

|

The acquisition of DCG by Dominion Midstream from Dominion on April 1, 2015 |

| DCG Predecessor |

|

Dominion as the predecessor for accounting purposes for the period from Dominion’s acquisition of DCG

from SCANA on January 31, 2015 until the DCG Acquisition |

| DCGS |

|

Dominion Carolina Gas Services, Inc. |

| DCPI |

|

Dominion Cove Point, Inc. |

| DOE |

|

Department of Energy |

| DOL |

|

Department of Labor |

| Dominion |

|

The legal entity, Dominion Resources, Inc., one or more of its consolidated subsidiaries (other than Dominion

Midstream GP, LLC and its subsidiaries) or operating segments, or the entirety of Dominion Resources, Inc. and its consolidated subsidiaries |

| Dominion Gas |

|

Dominion Gas Holdings, LLC |

| Dominion Midstream |

|

The legal entity, Dominion Midstream Partners, LP, one or more of its consolidated subsidiaries, Cove Point

Holdings, Iroquois GP Holding Company, LLC, DCG (beginning April 1, 2015) and Questar Pipeline (beginning December 1, 2016), or the entirety of Dominion Midstream Partners, LP and its consolidated subsidiaries |

| Dominion Midstream LTIP |

|

Dominion Midstream 2014 Long-Term Incentive Plan |

| Dominion Payroll |

|

Dominion Payroll Company, Inc. |

|

|

|

| Abbreviation or Acronym |

|

Definition |

| Dominion Questar |

|

The legal entity, Dominion Questar Corporation (formerly known as Questar Corporation), one or more of its

consolidated subsidiaries or operating segments, or the entirety of Dominion Questar Corporation and its consolidated subsidiaries |

| DOT |

|

U.S. Department of Transportation |

| DRS |

|

Dominion Resources Services, Inc. |

| Dth |

|

Dekatherm |

| DTI |

|

Dominion Transmission, Inc. |

| EA |

|

Environmental assessment |

| Eastern Market Access Project |

|

Project to provide 294,000 Dths/day of firm transportation service to help meet demand for natural gas for

Washington Gas Light Company, a local gas utility serving customers in D.C., Virginia and Maryland, and Mattawoman Energy, LLC for its new electric power generation facility to be built in Maryland |

| EBITDA |

|

Earnings before interest and associated charges, income tax expense, depreciation and

amortization |

| Edgemoor Project |

|

Project to provide 45,000 Dths/day of firm transportation service from an existing interconnect with Transco

in Cherokee County, South Carolina to customers in Calhoun and Lexington counties, South Carolina |

| EPA |

|

Environmental Protection Agency |

| EPACT |

|

Energy Policy Act of 2005 |

| ERISA |

|

The Employee Retirement Income Security Act of 1974 |

| ESRP |

|

Executive Supplemental Retirement Plan |

| Export Customers |

|

ST Cove Point, LLC, a joint venture of Sumitomo Corporation and Tokyo Gas Co., Ltd., and GAIL Global (USA)

LNG, LLC |

| FERC |

|

Federal Energy Regulatory Commission |

| FERC Order |

|

FERC order issued on September 29, 2014 that granted authorization for Cove Point to construct, modify and

operate the Liquefaction Project, subject to conditions, and also granted authorization to enhance the Cove Point Pipeline |

| FIPs |

|

Failures in individual performance |

| FTA |

|

Free Trade Agreement |

| FTA Authorization |

|

Authorization from the DOE for the export of up to 1.0 Bcfe/day of natural gas to countries that have or will

enter into an FTA for trade in natural gas |

| GAAP |

|

U.S. generally accepted accounting principles |

| GHGRP |

|

Greenhouse Gas Reporting Program |

| GHG |

|

Greenhouse gas |

| IDR |

|

Incentive distribution right |

| Import Shippers |

|

The three LNG import shippers consisting of BP Energy Company, Shell NA LNG, Inc. and Statoil |

| IRC |

|

Internal Revenue Code |

| Iroquois |

|

Iroquois Gas Transmission System, L.P. |

| IRS |

|

Internal Revenue Service |

| Keys Energy Project |

|

Project to provide 107,000 Dths/day of firm transportation service from Cove Point’s interconnect with

Transco in Fairfax County, Virginia to Keys Energy Center, LLC’s power generating facility in Prince George’s County, Maryland |

| Liquefaction Project |

|

A natural gas export/liquefaction facility currently under construction by Cove Point |

| LNG |

|

Liquefied natural gas |

| Maryland Commission |

|

Public Service Commission of Maryland |

| MD&A |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| MLP |

|

Master limited partnership, equivalent to publicly traded partnership |

| Modified Net Operating Income |

|

Cove Point’s Net Operating Income plus any interest expense included in the computation of Net Operating

Income |

| Mtpa |

|

Million metric tons per annum |

| NEO |

|

Named executive officers |

| Net Operating Income |

|

Cove Point’s gross revenues from operations minus its interest expense and operating expenses, but

excluding depreciation and amortization, as determined for U.S. federal income tax purposes |

| NG |

|

Collectively, North East Transmission Co., Inc. and National Grid IGTS Corp. |

| NGA |

|

Natural Gas Act of 1938, as amended |

| NGPSA |

|

Natural Gas Pipeline Safety Act of 1968, as amended |

| NJNR |

|

NJNR Pipeline Company |

| Non-FTA Authorization |

|

Authorization from the DOE for the export of up to 0.77 Bcfe/day of natural gas to countries that do not have

an FTA for trade in natural gas |

| Non-Open Access Services |

|

Non-open access, proprietary non-jurisdictional services with rates, terms and conditions that are determined

by arm’s length negotiations with customers |

| NSPS |

|

New Source Performance Standards |

| NYSE |

|

New York Stock Exchange |

| Offering |

|

The initial public offering of common units of Dominion Midstream |

| Open Access Services |

|

Open access jurisdictional services with cost-based rates and terms and conditions that are part of a tariff

approved by FERC |

| organizational design initiative |

|

In the first quarter of 2016, Dominion announced an organizational design initiative that reduced its total

workforce during 2016, the goal of which was to streamline its leadership structure and push decision making lower while also improving efficiency |

| OSHA |

|

Federal Occupational Safety and Health Act, as

amended |

|

|

|

| Abbreviation or Acronym |

|

Definition |

| PHMSA |

|

Pipeline and Hazardous Materials Safety Administration |

| ppb |

|

Parts-per-billion |

| predecessors |

|

Collectively, the Predecessor, DCG Predecessor and Questar Pipeline Predecessor |

| Preferred Equity Interest |

|

A perpetual, non-convertible preferred equity interest in Cove Point entitled to the Preferred Return

Distributions and the Additional Return Distributions |

| Preferred Return Distributions |

|

The first $50.0 million of annual cash distributions made by Cove Point |

| Private Placement Agreement |

|

Series A Preferred Unit and Common Unit Purchase Agreement between Dominion Midstream and purchasers (certain

affiliates of Stonepeak Infrastructure Partners, Magnetar Financial LLC, First Reserve Advisors, L.L.C., Kayne Anderson Capital Advisors, L.P. and Tortoise Capital Advisors, LLC) dated October 27, 2016 |

| PSD |

|

Prevention of Significant Deterioration |

| PSIA |

|

Pipeline Safety Improvement Act of 2002 |

| Questar Pipeline |

|

Questar Pipeline, LLC (successor by statutory conversion to and formerly known as Questar Pipeline Company),

one or more of its consolidated subsidiaries, or the entirety of Questar Pipeline, LLC and its consolidated subsidiaries |

| Questar Pipeline Acquisition |

|

The acquisition of Questar Pipeline by Dominion Midstream from Dominion on December 1, 2016 |

| Questar Pipeline Contribution Agreement |

|

Contribution, Conveyance and Assumption Agreement between Dominion and Dominion Midstream dated October 28,

2016 |

| Questar Pipeline Predecessor |

|

Dominion as the predecessor for accounting purposes for the period from Dominion’s acquisition of

Questar Pipeline on September 16, 2016 until the Questar Pipeline Acquisition |

| RGGI |

|

Regional Greenhouse Gas Initiative |

| ROFO Assets |

|

Any of the common equity interests in Cove Point or the indirect ownership interests in Blue Racer or

Atlantic Coast Pipeline subject to the right of first offer agreement with Dominion entered into in connection with the Offering |

| ROIC |

|

Return on invested capital |

| SCANA |

|

SCANA Corporation |

| SCE&G |

|

South Carolina Electric & Gas Company |

| SEC |

|

Securities and Exchange Commission |

| SEIF |

|

Maryland Strategic Energy Investments Fund |

| Series A Preferred Units |

|

Series A convertible preferred units representing limited partner interests in Dominion Midstream, issued in

December 2016 |

| St. Charles Transportation Project |

|

Project to provide 132,000 Dths/day of firm transportation service from Cove Point’s interconnect with

Transco in Fairfax County, Virginia to Competitive Power Venture Maryland, LLC’s power generating facility in Charles County, Maryland |

| Statoil |

|

Statoil Natural Gas, LLC |

| Storage Customers |

|

The four local distribution companies that receive firm peaking services from Cove Point, consisting of

Atlanta Gas Light Company; Public Service Company of North Carolina, Incorporated; Virginia Natural Gas, Inc. and Washington Gas Light Company |

| Transco |

|

Transcontinental Gas Pipe Line, LLC |

| TSR |

|

Total shareholder return |

| VIE |

|

Variable interest entity |

| Virginia Power |

|

Virginia Electric and Power Company |

| VOC |

|

Volatile organic compounds |

| Wexpro |

|

The legal entity, Wexpro Company, one or more of its consolidated subsidiaries, or the entirety of Wexpro

Company and its consolidated subsidiaries. |

| White River Hub |

|

White River Hub, LLC |

| Zions |

|

Zions Bancorporation |

Part I

Item 1. Business

OVERVIEW

Dominion Midstream is a

growth-oriented Delaware limited partnership formed on March 11, 2014 by Dominion to grow a portfolio of natural gas terminaling, processing, storage, transportation and related assets. A registration statement on Form S-1, as amended through the time of its effectiveness, was filed by Dominion Midstream with the SEC and was declared effective on October 10, 2014. Dominion Midstream’s common units began trading on the

NYSE on October 15, 2014, under the ticker symbol “DM.” On October 20, 2014, Dominion Midstream completed the Offering of 20,125,000 common units representing limited partner interests. In connection with the Offering, Dominion

Midstream acquired the Preferred Equity Interest and the general partner interest in Cove Point from Dominion.

Cove Point owns and

operates the Cove Point LNG Facility and the Cove Point Pipeline. Cove Point is currently generating a significant portion of its revenue and earnings from annual reservation payments under certain regasification, storage and transportation

contracts.

On April 1, 2015, Dominion Midstream acquired from Dominion all of the issued and outstanding membership interests of

DCG, an open access, transportation-only interstate pipeline company in South Carolina and southeastern Georgia, for total consideration of $500.8 million. See Note 4 to the Consolidated Financial Statements for additional information regarding this

acquisition.

On September 29, 2015, Dominion Midstream acquired NG’s 20.4% and NJNR’s 5.53%

partnership interests in Iroquois and, in exchange, Dominion Midstream issued common units representing limited partner interests in Dominion Midstream to both NG and NJNR. The Iroquois investment, accounted for under the equity method, was recorded

at $216.5 million. See Note 4 to the Consolidated Financial Statements for additional information regarding this equity method investment.

On December 1, 2016, Dominion Midstream acquired from Dominion all of the issued and outstanding membership interests of Questar Pipeline,

which owns and operates interstate natural gas pipelines and storage facilities in the western U.S., for total consideration of $1.29 billion. See Note 4 to the Consolidated Financial Statements for additional information regarding this acquisition.

Dominion Midstream manages its daily operations through one operating segment, Dominion Energy, which consists of gas transportation,

LNG import and storage. In addition to the Dominion Energy operating segment, Dominion Midstream also reports a Corporate and Other segment, which primarily includes specific items attributable to its operating segment that are not included in

profit measures evaluated by executive management in assessing the operating segment’s performance or in allocating resources among the segments. See Note 23 to the Consolidated Financial Statements for further discussions of Dominion

Midstream’s operating segment, which information is incorporated herein by reference.

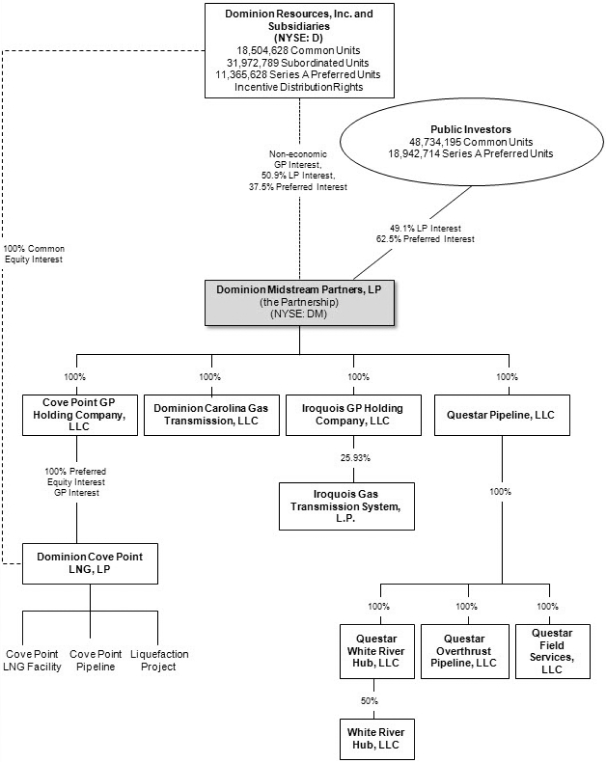

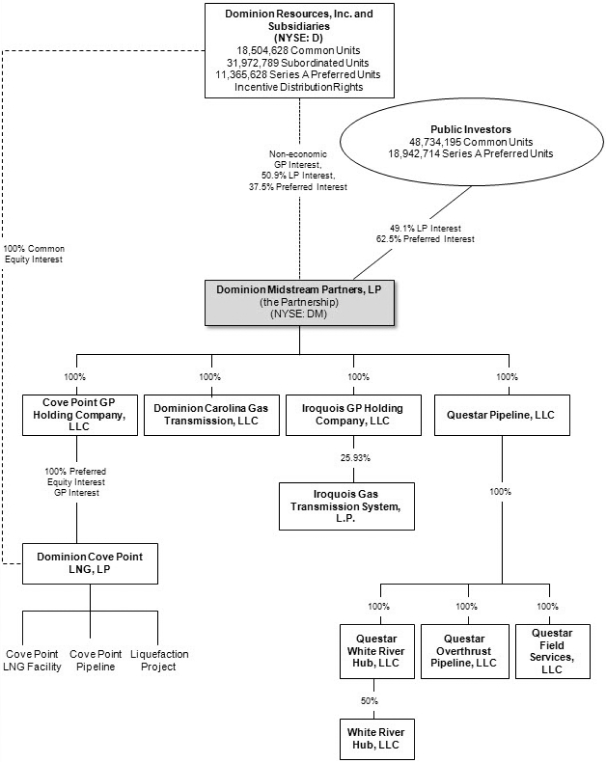

ORGANIZATIONAL STRUCTURE

The following simplified diagram depicts Dominion Midstream’s organizational and ownership structure at December 31, 2016.

ASSETS AND OPERATIONS

Dominion Midstream’s ongoing principal sources of cash flow include distributions received from Cove Point from our Preferred Equity Interest, cash

generated from the operations of DCG and Questar Pipeline and distributions received from our noncontrolling partnership interest in Iroquois.

Preferred Equity

Interest

One of our primary cash flow generating assets is the Preferred Equity Interest which is entitled to Preferred Return Distributions so long

as Cove Point has sufficient cash and undistributed Net Operating Income (determined on a cumulative basis from the closing of the Offering) from which to make Preferred Return Distributions. Preferred Return Distributions will be made on a

quarterly basis and will not be cumulative. The Preferred Equity Interest is also entitled to the Additional Return Distributions and should benefit from the expected increased cash flows and income associated with the Liquefaction Project once it

is completed.

We expect that Cove Point will generate cash and cumulative Net Operating Income in excess of that required to make

Preferred Return Distributions through the expected completion of the Liquefaction Project in late 2017 and thereafter. We base our expectation on the existing long-term contracts with firm reservation charges for substantially all of the

regasification and storage capacity of the Cove Point LNG Facility and all of the transportation capacity of the Cove Point Pipeline and the expectation that the Liquefaction Project will commence operations in late 2017. While we expect Cove

Point’s cash flows and Net Operating Income from its existing import contracts and associated transportation contracts to decrease as those contracts expire in 2017 and 2023, we expect the cash flows and Net Operating Income from the

Liquefaction Project, once completed, to replace and substantially exceed Cove Point’s cash flows and Net Operating Income from its existing import contracts and associated transportation contracts. See description of the Liquefaction Project

under Assets and Operations—Cove Point. Until the Liquefaction Project is completed, Cove Point is prohibited from making a distribution on its common equity interests unless it has a distribution reserve sufficient to pay two quarters

of Preferred Return Distributions (and two quarters of similar distributions with respect to any other preferred equity interest in Cove Point). Cove Point fully funded this distribution reserve in October 2016, but there can be no assurance that

funds will be sufficient for such purpose or that Cove Point will have sufficient cash and undistributed Net Operating Income to permit it to continue to make Preferred Return Distributions after the expiration of certain of its contracts in the

second quarter of 2017. We do not expect to cause Cove Point to make distributions on its common equity, or the Additional Return Distributions, prior to the Liquefaction Project commencing commercial service. No distribution reserve will be

established for the Additional Return Distributions.

Cove Point

Cove Point is a Delaware limited partnership, of which Dominion Midstream owns the preferred equity interests and the general partner interest and Dominion

owns the common equity interests. Cove Point’s operations currently consist of LNG import and storage services at the Cove Point LNG Facility and the transportation of domestic natural gas and regasified LNG to

Mid-Atlantic markets via the Cove Point Pipeline. Following binding commitments from counterparties, Cove Point requested and received regulatory approval to operate the Cove Point LNG Facility

as a bi-directional facility, able to import LNG and regasify it as natural gas or to liquefy domestic natural gas and export it as LNG.

COVE POINT’S IMPORT/STORAGE/REGASIFICATION

FACILITIES

The Cove Point LNG Facility includes an offshore pier, LNG storage tanks, regasification facilities and associated

equipment required to (i) receive imported LNG from tankers, (ii) store LNG in storage tanks, (iii) regasify LNG and (iv) deliver regasified LNG to the Cove Point Pipeline. The Cove Point LNG Facility has a contractual peak

regasification capacity of approximately 1.8 million Dths/day and an aggregate LNG storage capacity of 695,000 cubic meters of LNG, or approximately 14.6 Bcfe, all of which was fully contracted at December 31, 2016. In addition, the Cove Point

LNG Facility has an existing liquefier (unrelated to the Liquefaction Project) capable of liquefying approximately 15,000 Dths/day of natural gas. This liquefaction capacity is primarily used to liquefy natural gas received from domestic customers

that store LNG in our tanks for use during peak periods of natural gas demand. Cove Point offers both Open Access Services and Non-Open Access Services. Cove Point’s two-berth pier is located approximately 1.1 miles offshore in the Chesapeake

Bay. Cove Point operates the Cove Point LNG Facility on an integrated basis with no equipment exclusively used for the benefit of Open Access Services or Non-Open Access Services.

Cove Point currently provides services under (i) long-term agreements with the Import Shippers for an aggregate of 1.0 million

Dths/day of firm and off-peak regasification capacity, and (ii) long-term agreements for an aggregate 204,000 Dths/day of firm capacity with the Storage Customers who receive firm peaking services, whereby the Storage Customers deliver domestic

natural gas to the Cove Point LNG Facility to be liquefied and stored during the summer for withdrawal on a limited number of days at peak times during the winter. Cove Point also had, through December 31, 2016, an additional 800,000 Dths/day of

regasification capacity committed under a separate agreement with Statoil, one of the Import Shippers. The agreement provides for 277,650 Dths/day of such service until its expiration in the second quarter of 2017. In 2016, the Import Shippers

comprised approximately 57% of total consolidated operating revenues for Dominion Midstream. Cove Point’s customers are required to pay fixed monthly charges, regardless of whether they use the amount of capacity they have paid to reserve at

the Cove Point LNG Facility. Following the expiration of certain Cove Point regasification and transportation contracts with Statoil in the second quarter of 2017, the resulting available storage and transportation capacity will be utilized in

connection with the Liquefaction Project.

COVE POINT’S PIPELINE

FACILITIES

The Cove Point Pipeline is a 36-inch diameter bi-directional underground, interstate natural gas pipeline that extends

approximately 88 miles from the Cove Point LNG Facility to interconnections with pipelines owned by Transco in Fairfax County, Virginia, and with Columbia Gas Transmission LLC and DTI, both in Loudoun County, Virginia. In 2009, the original pipeline

was expanded to include a 36-inch diameter loop that extends

approximately 48 miles, roughly 75% of which is parallel to the original pipeline. Cove Point has two compressor stations, with approximately 24,800 installed compressor horsepower, at its

interconnections with the three upstream interstate pipelines. The Loudoun Compressor Station is located at the western end of the Cove Point Pipeline where it interconnects with the pipeline systems of DTI and Columbia Gas Transmission LLC. The

Pleasant Valley Compressor Station is located roughly 13 miles to the southeast of the Loudoun Compressor Station, where the Cove Point Pipeline interconnects with Transco’s pipeline system.

Cove Point offers open-access transportation services, including firm transportation, off-peak firm transportation and interruptible

transportation, with cost-based rates and terms and conditions that are subject to the jurisdiction of FERC. Firm transportation services are generally provided based on a reservation-based fee that is designed to recover Cove Point’s fixed

costs and earn a reasonable return. The firm transportation customers are required to pay fixed monthly fees, regardless of whether they use their reserved capacity for the Cove Point Pipeline. Cove Point also provides certain incrementally priced,

firm transportation services that are associated with expansion projects. The Export Customers will be responsible for procuring their own natural gas supplies and transporting such supplies to the Cove Point Pipeline, which serves as the primary

method of transportation of natural gas supplies to or from the Cove Point LNG Facilities.

In October 2015, Cove Point received FERC

authorization to construct the approximately $40 million Keys Energy Project. Construction on the project commenced in December 2015, and the project facilities are expected to be placed into service in March 2017.

In November 2016, Cove Point filed an application to request FERC authorization to construct the approximately $150 million Eastern

Market Access Project. Construction on the project is expected to begin in the fourth quarter of 2017, and the project facilities are expected to be placed into service in late 2018.

COVE POINT’S EXPORT/LIQUEFACTION FACILITIES

Cove Point is in the process of constructing the Liquefaction Project, which will consist of one LNG train with a design nameplate outlet capacity of 5.25

Mtpa. It is expected to be placed in service in late 2017. Under normal operating conditions and after accounting for maintenance downtime and other losses, the firm contracted capacity for LNG loading onto ships will be approximately 4.6 Mtpa (0.66

Bcfe/day). Cove Point has authorization from the DOE to export up to 0.77 Bcfe/day (approximately 5.75 Mtpa) should the liquefaction facilities perform better than expected. Once completed, the Liquefaction Project will enable the Cove Point LNG

Facility to liquefy domestically produced natural gas and export it as LNG. The Liquefaction Project is being constructed on land already owned by Cove Point, which is within the developed area of the existing Cove Point LNG Facility, and will be

integrated with a number of the facilities that are currently operational. Domestic natural gas will be delivered to the Cove Point LNG Facility through the Cove Point Pipeline for liquefaction and will be exported as LNG. The total costs of

developing the Liquefaction Project are estimated to be approximately $4.0 billion, excluding financing costs. Through

December 31, 2016, Cove Point incurred $3.3 billion of development and construction costs associated with the Liquefaction Project. Dominion has indicated that it intends to provide the

funding necessary for the remaining construction costs for the Liquefaction Project, but it is under no obligation to do so.

Many of the

existing facilities at the Cove Point LNG Facility will be used to provide the liquefaction service. The Liquefaction Project will utilize existing storage tanks at the Cove Point LNG Facility to store LNG produced by the new liquefaction

facilities. The Liquefaction Project will utilize the existing off-shore two-berth pier and insulated LNG and gas piping from the pier to the on-shore Cove Point LNG Facility. Cove Point is constructing new facilities to liquefy the natural gas on

land it already owns (which encompasses more than 1,000 acres). No change will be made to the Cove Point LNG Facility’s current storage, import, or regasification capabilities and only minor modifications will be made to the Cove Point LNG

Facility itself, such as adding piping tie-ins and electrical/control connections to integrate the liquefaction facility with the existing LNG regasification facilities.

COVE POINT’S EXPORT CUSTOMERS

Cove Point has executed service contracts for the Liquefaction Project with the Export Customers, each of which has contracted for 50% of the available

capacity. The Export Customers together will have firm access to 6.8 Bcfe of the existing storage capacity, with the balance of the existing storage capacity available for Cove Point’s existing Import Shippers and Storage Customers. The Export

Customers have each entered into a 20-year agreement for the liquefaction and export services, which they may annually elect to switch to import services, provided that the other Export Customer agrees to switch. In addition, each of the Export

Customers has entered into an accompanying 20-year service agreement for firm transportation on the Cove Point Pipeline.

Upon completion

of the Liquefaction Project, a substantial portion of Cove Point’s revenues will be dependent upon the payment of these two customers. Cove Point’s future results and liquidity are primarily dependent upon the payment of the Export

Customers under their respective contracts, and on their continued willingness and ability to perform their contractual obligations.

Cove

Point will provide terminal services for the Export Customers as a tolling service, and the Export Customers will be responsible for procuring their own natural gas supplies and transporting such supplies to or from the Cove Point LNG Facilities. To

deliver the feed gas for liquefaction to the Cove Point LNG Facility, each Export Customer entered into a firm transportation service agreement to utilize the Cove Point Pipeline, with a maximum firm transportation quantity of 430,000 Dths/day for

each Export Customer. This amount of firm transportation capacity will enable Export Customers to deliver to the Cove Point LNG Facility the feed gas, including fuel, required on days of peak liquefaction, utilizing both their firm liquefaction

rights and an expected level of authorized overrun service. In the event of an election of import/regasification service, each of the Export Customers will have a regasification capacity of 330,000 Dths/day.

DCG

DCG operates as

an open access, transportation-only interstate pipeline company in South Carolina and southeastern Georgia. At December 31, 2016, DCG’s natural gas system consisted of nearly 1,500 miles of transmission pipeline of up to 24 inches in diameter

and five compressor stations with approximately 38,700 installed compressor horsepower. DCG’s system transports gas to its customers from the transmission systems of Southern Natural Gas Company at Port Wentworth, Georgia and Aiken County,

South Carolina; Southern LNG, Inc. at Elba Island, near Savannah, Georgia; and Transco in Cherokee and Spartanburg counties in South Carolina. All of DCG’s operations are regulated by FERC.

DCG’s customers include SCE&G (which uses natural gas for electricity generation and for gas distribution to retail customers), SCANA

Energy Marketing, Inc. (which markets natural gas to industrial and “sale for resale” customers, primarily in the southeastern U.S.), municipalities, county gas authorities, federal and state agencies, marketers, power generators and

industrial customers primarily engaged in the manufacturing or processing of ceramics, paper, metal and textiles.

DCG’s revenues are

primarily derived from reservation charges for firm services as provided for in its FERC-approved tariff. DCG’s pipeline system is substantially fully subscribed with a contracted pipeline capacity of approximately 794,500 Dths/day.

Approximately 1% of the capacity has a 2017 expiration date, and 99% of this capacity is contracted through 2018 or beyond.

In 2014, DCG

executed three binding precedent agreements for the approximately $120 million Charleston Project. In February 2017, DCG received FERC authorization to construct and operate the project facilities, which are expected to be placed into service in the

fourth quarter of 2017. The Charleston Project is supported by long-term contracts with terms ranging from 10 to 30 years.

Questar Pipeline

Questar Pipeline owns and operates interstate natural gas pipelines and storage facilities in the western U.S. providing natural gas transportation and

underground storage services in Utah, Wyoming and Colorado. Questar Pipeline’s operations are primarily regulated by FERC. At December 31, 2016, Questar Pipeline owned and operated nearly 2,200 miles of natural gas transportation pipelines

across northeastern and central Utah, northwestern Colorado and southwestern Wyoming. Questar Pipeline’s system ranges in diameter from lines that are less than four inches to 36 inches. Questar Pipeline owns 18 transmission and storage

compressor stations with approximately 221,200 combined installed compressor horsepower. Questar Pipeline also owns gathering lines as well as processing facilities near Price, Utah, which provide for dew-point control to meet gas-quality

specifications of downstream pipelines. Additionally, Questar Pipeline owns and operates 50% of White River Hub, an 11-mile FERC-regulated natural gas transportation pipeline in western Colorado, which is accounted for under the equity method.

Questar Pipeline’s transportation customers include its affiliate, Questar Gas Company,

which provides the largest share of transportation revenues, as well as Enterprise Gas Processing, LLC, Rockies Express Pipeline LLC, Citadel Energy Marketing LLC, Wyoming Interstate Company, LLC, Pacificorp, Encana Marketing (USA) Inc. and other

unaffiliated end-users, marketers and producers in the Rocky Mountain region. The Questar Pipeline systems interconnect with several major, unaffiliated natural gas pipeline systems owned by Kern River Gas Transmission Company, Ruby Pipeline, LLC,

Rockies Express Pipeline, LLC, Northwest Pipeline, LLC, Wyoming Interstate Company, TransColorado Gas Transmission Company, LLC, and others.

Questar Pipeline’s transportation revenues are primarily derived from reservation charges for firm services as provided for in its

FERC-approved tariff. At December 31, 2016, Questar Pipeline’s pipeline system had contracted pipeline capacity of approximately 5,696,500 Dths/day. Approximately 17% of that capacity is committed to by Questar Pipeline’s affiliate,

Questar Gas Company. Of the total committed capacity, approximately 17% relates to contracts that expire in 2017, 77% relates to contracts that expire in 2018 or beyond, and the remaining 6% of contracts operate under evergreen contracts that

contain customary termination features. Questar Pipeline expects that the contract with Questar Gas Company and other contracts expiring in 2017 will be renewed under similar terms as the existing agreements.

Questar Pipeline owns four natural gas storage facilities totaling 55.8 Bcf of working gas storage capacity. The Clay Basin storage facility

in northeastern Utah has a certificated capacity of 120.2 Bcf, including 54.0 Bcf of working gas. In addition, Questar Pipeline owns three smaller storage aquifers in northeastern Utah and western Wyoming.

Questar Pipeline’s natural gas storage customers include its affiliate, Questar Gas Company, which provides the largest share of storage

revenues, as well as Puget Sound Energy Inc., Intermountain Gas Company and other unaffiliated customers.

Questar Pipeline’s natural

gas storage revenues are primarily derived from long-term contracts for storage capacity at the Clay Basin storage facility. Approximately 27% of the total storage working gas capacity is contracted with Questar Gas Company. Of the total contracted

working gas capacity, 14% of the volumes expire in 2017 while the remaining 86% are contracted through 2018 or beyond. The contracts that expire in 2017 are all expected to be renewed under similar terms as the existing agreements.

Iroquois

Iroquois is a Delaware limited partnership which owns and

operates a 416-mile FERC-regulated interstate natural gas pipeline providing service to local gas distribution companies, electric utilities and electric power generators, as well as marketers and other end users, through interconnecting pipelines

and exchanges. Iroquois’ pipeline extends from the U.S.-Canadian border at Waddington, New York through the state of Connecticut to South Commack, Long Island, New York and continuing on from Northport, Long Island, New York through the Long

Island Sound to Hunts Point, Bronx, New York. At December 31, 2016, Dominion Midstream holds a 25.93% noncontrolling partnership interest in Iroquois, which is accounted for under the equity method.

RELATIONSHIP WITH DOMINION

We view our relationship with Dominion as a significant competitive strength. We believe this relationship will provide us with potential acquisition

opportunities from a broad portfolio of existing midstream assets that meet our strategic objectives, as well as access to personnel with extensive technical expertise and industry relationships. Dominion has granted us a right of first offer with

respect to any future sale of its common equity interests in Cove Point. We may also acquire newly issued common equity or additional preferred equity interests in Cove Point in the future, provided that any issuances of additional equity interests

in Cove Point would require both our and Dominion’s approval. Any additional equity interests that we acquire in Cove Point would allow us to participate in the significant growth in cash flows and income expected following the completion of

the Liquefaction Project. In connection with the Offering, Dominion also granted us a right of first offer with respect to any future sale of its indirect ownership interest in Blue Racer, which is a midstream company focused on the Utica Shale

formation, and its indirect ownership interest in Atlantic Coast Pipeline, which is focused on constructing a natural gas pipeline running from West Virginia through Virginia to North Carolina. In addition, acquisition opportunities, such as the DCG

Acquisition and the Questar Pipeline Acquisition, may arise from future midstream pipeline, terminaling, processing, transportation and storage assets acquired or constructed by Dominion.

Dominion, headquartered in Richmond, Virginia, is one of the nation’s largest producers and transporters of energy. Dominion’s

strategy is to be a leading provider of electricity, natural gas and related services to customers primarily in the eastern region of the U.S. At December 31, 2016, Dominion served over 6 million utility and retail energy customers and

operated one of the nation’s largest underground natural gas storage systems, with approximately 1 trillion cubic feet of storage capacity. Dominion’s portfolio of midstream pipeline, terminaling, processing, transportation and storage

assets includes its indirect ownership interests in Blue Racer and Atlantic Coast Pipeline, both of which are described in more detail below, and the assets and operations of Dominion Gas and Dominion Questar. Dominion Gas consists primarily of

(i) The East Ohio Gas Company d/b/a Dominion East Ohio, a regulated natural gas distribution company, (ii) DTI, an interstate natural gas transmission pipeline company, and (iii) Dominion Iroquois, Inc., which holds a 24.07%

noncontrolling partnership interest in Iroquois. Dominion Questar consists primarily of Questar Gas Company, a regulated natural gas distribution company, and Wexpro, a natural gas exploration and production company which supplies natural gas to

Questar Gas Company under a cost-of-service framework.

Blue Racer is a midstream energy company focused on the design, construction,

operation and acquisition of midstream assets. Blue Racer is investing in natural gas gathering and processing assets in Ohio and West Virginia, targeting primarily the Utica Shale formation, and is an equal partnership between Dominion and Caiman,

with Dominion contributing midstream assets, including both gathering and processing assets, and Caiman contributing private equity capital. Midstream services offered by Blue Racer include gathering, processing, fractionation, and natural gas

liquids transportation and marketing. Blue Racer is expected to develop additional new capacity designed to meet

producer needs as the development of the Utica Shale formation increases.

Atlantic

Coast Pipeline is a limited liability company owned at December 31, 2016 by Dominion (48%), Duke Energy Corporation (40%), Piedmont Natural Gas Company, Inc. (7%) and Southern Company Gas (formerly known as AGL Resources, Inc.) (5%). Effective

October 2016, Piedmont Natural Gas Company, Inc. became a wholly-owned subsidiary of Duke Energy Corporation. Atlantic Coast Pipeline is focused on constructing an approximately 600-mile natural gas pipeline running from West Virginia through

Virginia to North Carolina to increase natural gas supplies in the region. Construction of the pipeline is subject to receiving all necessary regulatory and other approvals, including without limitation CPCNs from FERC and all required environmental

permits. Atlantic Coast Pipeline filed its FERC application in September 2015, and the facilities are expected to be in service in the fourth quarter of 2019. DTI will provide the services necessary to oversee the construction of, and to

subsequently operate and maintain, the facilities and projects undertaken by, and subject to the approval of, Atlantic Coast Pipeline. The pipeline is expected to serve as a new, independent route for transportation of shale and conventional

interstate gas supplies for markets in the mid-Atlantic region of the U.S.

At December 31, 2016, Dominion is our largest unitholder,

holding 18,504,628 common units (28% of all outstanding), 11,365,628 Series A Preferred Units (38% of all outstanding) and 31,972,789 subordinated units (100% of all outstanding). Dominion also owns our general partner and owns 100% of our IDRs. As

a result of its significant ownership interests in us, we believe Dominion will be motivated to support the successful execution of our business strategies and will provide us with acquisition opportunities, although it is under no obligation to do

so. Dominion views us as a significant part of its growth strategy, and we believe that Dominion will be incentivized to contribute or sell additional assets to us and to pursue acquisitions jointly with us in the future. However, Dominion will

regularly evaluate acquisitions and dispositions and may, subject to compliance with our right of first offer with respect to Cove Point, Blue Racer and Atlantic Coast Pipeline, elect to acquire or dispose of assets in the future without offering us

the opportunity to participate in those transactions. Moreover, Dominion will continue to be free to act in a manner that is beneficial to its interests without regard to ours, which may include electing not to present us with future acquisition

opportunities.

See Note 20 to the Consolidated Financial Statements for a discussion of the significant contracts entered into with

Dominion.

COMPETITION

Substantially all of the

regasification and storage capacity of the Cove Point LNG Facility, and all of the transportation capacity of the Cove Point Pipeline is currently under contract, and the proposed Liquefaction Project’s capacity is also fully contracted under

long-term fixed reservation fee agreements. However, in the future Cove Point may compete with other independent terminal operators as well as major oil and gas companies on the basis of terminal location, services provided and price. Competition

from terminal operators primarily comes from refiners and distribution companies with marketing and trading arms.

DCG’s pipeline system generates a substantial portion of its revenue from long-term firm

contracts for transportation services and is therefore insulated from competitive factors during the terms of the contracts. When these long-term contracts expire, DCG’s pipeline system faces competitive pressures from similar facilities that

serve the South Carolina and southeastern Georgia area in terms of location, rates, terms of service, and flexibility and reliability of service.

Questar Pipeline’s pipeline system generates a substantial portion of its revenue from long-term firm contracts for transportation and

storage services and is therefore insulated from competitive factors during the terms of the contracts. When these long-term contracts expire, Questar Pipeline’s pipeline system and storage facilities face competitive pressures from similar

facilities in the Rocky Mountain region in terms of location, rates, terms of service and availability and reliability of service.

REGULATION

Dominion Midstream is subject to regulation by various federal, state and local authorities, including the SEC, FERC, EPA, DOE, DOT and Maryland Commission.

FERC Regulation

The design, construction and operation of

interstate natural gas pipelines, LNG terminals (including the Liquefaction Project) and other facilities, the import and export of LNG, and the transportation of natural gas are all subject to various regulations, including the approval of FERC

under Section 3 (for LNG terminals) and Section 7 (for interstate transportation facilities) of the NGA, as well as the Natural Gas Policy Act of 1978, as amended, to construct and operate the facilities. For the Cove Point LNG Facility,

Cove Point is required to maintain authorization from FERC under Section 3 and Section 7 of the NGA. The design, construction and operation of the Cove Point LNG Facility and its proposed Liquefaction Project, and the import and export of

LNG, are highly regulated activities. FERC’s approval under Section 3 and Section 7 of the NGA, as well as several other material governmental and regulatory approvals and permits, are required for the proposed Liquefaction Project.

DCG and Questar Pipeline are required to maintain authorization from FERC under Section 7 of the NGA.

Under the NGA, FERC is granted

authority to approve, and if necessary, set “just and reasonable rates” for the transportation, including storage, or sale of natural gas in interstate commerce. In addition, under the NGA, with respect to the jurisdictional services, we

are not permitted to unduly discriminate or grant undue preference as to our rates or the terms and conditions of service. FERC has the authority to grant certificates allowing construction and operation of facilities used in interstate gas

transportation and authorizing the provision of services. Under the NGA, FERC’s jurisdiction generally extends to the transportation of natural gas in interstate commerce, to the sale in interstate commerce of natural gas for resale for

ultimate consumption for domestic, commercial, industrial, or any other use, and to natural gas companies engaged in such transportation or sale. However, FERC’s jurisdiction does not extend to the production or local distribution of natural

gas.

In general, FERC’s authority to regulate interstate natural gas pipelines and the services

that they provide includes:

| |

• |

|

Rates and charges for natural gas transportation and related services; |

| |

• |

|

The certification and construction of new facilities; |

| |

• |

|

The extension and abandonment of services and facilities; |

| |

• |

|

The maintenance of accounts and records; |

| |

• |

|

The acquisition and disposition of facilities; |

| |

• |

|

The initiation and discontinuation of services; and |

In November 2016, pursuant to the terms of a previous settlement, Cove

Point filed a general rate case for its FERC-jurisdictional services, with 23 proposed rates to be effective January 1, 2017. Cove Point proposed an annual cost-of-service of approximately $140 million. In December 2016, FERC accepted a January 1,

2017 effective date for all proposed rates, with the exception of five, which were suspended to be effective June 1, 2017. This case is pending.

In connection with Dominion’s acquisition of DCG on January 31, 2015, Dominion agreed to a rate moratorium which precludes DCG from

filing a Section 4 NGA general rate case to establish base rates that would be effective prior to January 1, 2018.

LIQUEFACTION PROJECT

In

April 2013, Cove Point filed its application with FERC requesting authorization to construct, modify and operate the Liquefaction Project, as well as enhance the Cove Point Pipeline. In May 2014, FERC staff issued its EA for the Liquefaction

Project. In the EA, FERC staff addressed a variety of topics related to the proposed construction and development of the Liquefaction Project and its potential impact to the environment, including in the areas of geology, soils, groundwater, surface

waters, wetlands, vegetation, wildlife and aquatic resources, special status species, land use, recreation, socioeconomics, air quality and noise, reliability and safety, and cumulative impacts. In September 2014, Cove Point received the FERC Order

which authorized the construction and operation of the Liquefaction Project. In the FERC Order, FERC concluded that if constructed and operated in accordance with Cove Point’s application and supplements, and in compliance with the

environmental conditions set forth in the FERC Order, the Liquefaction Project would not constitute a major federal action significantly affecting the quality of the human environment. In October 2014, Cove Point commenced construction of the

Liquefaction Project.

Two parties separately filed petitions for review of the FERC Order in the U.S. Court of Appeals for the D.C.

Circuit, which petitions have been consolidated. Separately, one party requested a stay of the FERC Order until the judicial proceedings are complete, which the court denied in June 2015. In July 2016, the court denied one party’s petition for

review of the FERC Order authorizing the Liquefaction Project. The court also issued a decision remanding the other party’s petition for review of the FERC Order to FERC for further explanation of how FERC’s decision that a previous

transaction with an existing import shipper was not unduly discriminatory. Cove Point believes that on remand FERC will be able to justify its decision.

Energy Policy Act of 2005

The EPACT and FERC’s policies promulgated thereunder contain numerous provisions relevant to the natural gas industry and to interstate pipelines.

Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties. Additionally, the EPACT amended Section 3 of the NGA to establish or clarify FERC’s exclusive authority to

approve or deny an application for the siting, construction, expansion or operation of LNG terminals, although except as specifically provided in the EPACT, nothing in the EPACT is intended to affect otherwise applicable law related to any other

federal agency’s authorities or responsibilities related to LNG terminals. The EPACT amended the NGA to, among other things, prohibit market manipulation. In accordance with the EPACT, FERC issued a final rule making it unlawful for any entity,

in connection with the purchase or sale of natural gas or transportation service subject to FERC’s jurisdiction, to defraud, make an untrue statement or omit a material fact or engage in any practice, act or course of business that operates or

would operate as a fraud.

DOE Regulation

Prior to importing

or exporting LNG, Cove Point must receive approvals from the DOE. Cove Point previously received import authority in connection with the construction and operation of the Cove Point LNG Facility and more recently also received authority to export

the commodity.

In October 2011, the DOE granted FTA Authorization for the export of up to 1.0 Bcfe/day of natural gas to countries that

have or will enter into an FTA for trade in natural gas. In September 2013, the DOE also granted Non-FTA Authorization approval for the export of up to 0.77 Bcfe/day of natural gas to countries that do not have an FTA for trade in natural gas. The

FTA Authorization and Non-FTA Authorization have 25- and 20-year terms, respectively. In June 2016, a party filed a petition for review of the DOE’s Non-FTA Authorization approval in the United States Court of Appeals for the D.C. Circuit. This

case is pending.

DOT Regulation

The Cove Point Pipeline, DCG

and Questar Pipeline are subject to regulation by the DOT, under the PHMSA, pursuant to which PHMSA has established requirements relating to the design, installation, testing, construction, operation, replacement and management of pipeline

facilities. The NGPSA requires certain pipelines to comply with safety standards in constructing and operating the pipelines and subjects the pipelines to regular inspections.

The PSIA, which is administered by the DOT Office of Pipeline Safety, governs the areas of testing, education, training and communication. The

PSIA requires pipeline companies to perform extensive integrity tests on natural gas transportation pipelines that exist in high population density areas designated as “high consequence areas.” Pipeline companies are required to perform

the integrity tests on a seven-year cycle. The risk ratings are based on numerous factors, including the population density in the geographic regions served by a particular pipeline, as well as the age and condition of the pipeline and its

protective coating.

Testing consists of hydrostatic testing, internal electronic testing or direct assessment of the piping. In addition to the pipeline integrity tests, pipeline companies must implement a

qualification program to make certain that employees are properly trained. Pipeline operators also must develop integrity management programs for gas transportation pipelines, which requires pipeline operators to perform ongoing assessments of

pipeline integrity; identify and characterize applicable threats to pipeline segments that could impact a high consequence area; improve data collection, integration and analysis; repair and remediate the pipeline, as necessary; and implement

preventive and mitigation actions. The Cove Point Pipeline, DCG and Questar Pipeline are also subject to the Pipeline Safety, Regulatory Certainty, and Jobs Creation Act of 2011, which regulates safety requirements in the design, construction,

operation and maintenance of interstate natural gas transmission facilities.

State Regulation

The Maryland Commission regulates electricity suppliers, fees for pilotage services to vessels, construction of generating stations and certain common

carriers engaged in the transportation for hire of persons in the state of Maryland. See Note 17 to the Consolidated Financial Statements for additional information.

Worker Health and Safety

Dominion Midstream is subject to a number

of federal and state laws and regulations, including OSHA, and comparable state statutes, whose purpose is to protect the health and safety of workers. Dominion Midstream has an internal safety, health and security program designed to monitor and

enforce compliance with worker safety requirements and routinely reviews and considers improvements in its programs. Cove Point is also subject to the United States Coast Guard’s Maritime Security Standards for Facilities, which are designed to

regulate the security of certain maritime facilities. Dominion Midstream believes that it is in material compliance with all applicable laws and regulations related to worker health and safety. Notwithstanding these preventative measures, incidents

may occur, including those outside of Dominion Midstream’s control.

ENVIRONMENTAL

REGULATION

General

Dominion Midstream is

committed to compliance with all applicable environmental laws, regulations and rules related to its operations. Dominion Midstream’s operations are subject to stringent, comprehensive and evolving federal, regional, state and local laws and

regulations governing environmental protection. These laws and regulations may, among other things, require the acquisition of permits or other approvals to conduct regulated activities, restrict the amounts and types of substances that may be

released into the environment, limit operational capacity of the facilities, require the installation of environmental controls, limit or prohibit construction activities in sensitive areas such as wetlands or areas inhabited by endangered or

threatened species and impose substantial liabilities for pollution resulting from operations. The cost of complying with applicable environmental

laws, regulations and rules is expected to be material. Failure to comply with these laws and regulations may also result in the assessment of administrative, civil and criminal penalties, the

imposition of investigatory and remedial obligations and the issuance of orders enjoining some or all of Dominion Midstream’s operations in affected areas.

Dominion Midstream has applied for or obtained the necessary environmental permits for the operation of its facilities. Many of these permits

are subject to reissuance and continuing review. Additional information related to Dominion Midstream’s environmental compliance matters, including current and planned capital expenditures relating to environmental compliance, can be found in

Future Issues and Other Matters in Item 7. MD&A.

Air Emissions

The regulation of air emissions under the CAA and comparable state laws and regulations restrict the emission of air pollutants from many sources and also

impose various monitoring and reporting requirements. The CAA new source review regulations require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air

emissions, obtain and strictly comply with stringent air permit requirements or install and operate specific equipment or technologies to control emissions. Obtaining necessary air permits has the potential to delay the development of our projects.

The regulation of air emissions under the CAA requires that we obtain various construction and operating permits, including Title V air

permits, and incur capital expenditures for the installation of certain air pollution control devices at our facilities. We have taken and expect to continue to take certain measures to comply with various regulations specific to our operations,

such as National Emission Standards for Hazardous Air Pollutants, NSPS, new source review and federal and state regulatory measures imposed to meet national ambient air quality standards. We have incurred, and expect to continue to incur,

substantial capital expenditures to maintain compliance with these and other air emission regulations that have been promulgated or may be promulgated or revised in the future.

Global Climate Change

The national and international attention in

recent years on GHG emissions and their relationship to climate change has resulted in federal, regional and state legislative and regulatory action in this area. Dominion Midstream supports national climate change legislation that would provide a

consistent, economy-wide approach to addressing this issue and is currently taking action to protect the environment and address climate change while meeting the future needs of its customers. Dominion Midstream’s CEO and its management are

responsible for compliance with the laws and regulations governing environmental matters, including climate change.

In response to

findings that emissions of GHGs present an endangerment to public health and the environment, the EPA adopted regulations under existing provisions of the CAA in April 2010, that require a reduction in emissions of GHGs from motor vehicles. These

rules took effect in January 2011 and established

GHG emissions as regulated pollutants under the CAA. In June 2014, the U.S. Supreme Court ruled that the EPA lacked the authority under the CAA to require PSD or Title V permits for stationary

sources based solely on GHG emissions. However, the Court upheld the EPA’s ability to require best available control technology for GHG for sources that are otherwise subject to PSD or Title V permitting for conventional pollutants. In August

2016, the EPA issued a draft rule proposing to reaffirm that a GHG source’s obligation to obtain a PSD or Title V permit for GHG’s is triggered only if such permitting requirements are first triggered by non-GHG, or conventional,

pollutants that are regulated by the new source review program, and to set a significant emissions rate at 75,000 tons per year of CO2 equivalent emissions under which a source would not be

required to apply best available control technology for its GHG emissions. Due to uncertainty regarding what additional actions states may take to amend their existing regulations and what action the EPA ultimately takes to address the court ruling

under a new rulemaking, we cannot predict the impact to the financial statements at this time.

In January 2015, as part of its Climate

Action Plan, the EPA announced plans to reduce methane emissions from the oil and gas sector including natural gas processing and transmission sources. In July 2015, the EPA announced the next generation of its voluntary Natural Gas Star Program.

The program covers the entire natural gas sector from production to distribution, with more emphasis on transparency and increased reporting for both annual emissions and reductions achieved through implementation measures. DCG joined the EPA’s

voluntary Natural Gas Star Program in July 2016 and submitted an implementation plan in September 2016.

Maryland, along with eight other

Northeast states, has implemented regulations requiring reductions in CO2 emissions through the RGGI, a cap and trade program covering

CO2 emissions from electric generating units in the Northeast. The CPCN states that the Liquefaction Project must submit a Climate Action Plan to the Maryland Department of the Environment and

gain approval of the plan. Additionally, by not connecting to the larger grid, the Liquefaction Project generating station is exempt from purchasing RGGI carbon emission allowances. Furthermore, the CPCN requires Cove Point to make payments over

time totaling approximately $48 million to the SEIF and Maryland low income energy assistance programs.

GHG EMISSIONS

Dominion began tracking and reporting GHG emissions at the Cove Point LNG Facility in 2010 under the EPA’s GHGRP and voluntarily tracked such emissions

prior to 2010. A comprehensive methane leak survey is conducted each year in accordance with the EPA rule to detect leaks and to quantify leaks from compressor units. Dominion Midstream does not yet have final 2016 emissions data.

Annual GHG emissions at the Cove Point LNG Facility have remained fairly constant from 2011 to 2015, ranging from 141,250 to 182,650 metric

tons of CO2 equivalent. Approximately 99% of these emissions are CO2 emissions from combustion sources, such as compressor engines and

heaters. Only 1% of the annual Cove Point GHG emissions comes from methane emissions. Compared to other fossil fuels, natural gas has a much lower carbon emission rate with

an ample regional supply, promoting energy and economic security. In 2015, annual GHG emissions from Dominion Midstream’s facilities, including five compressor stations in South Carolina and

two compressor stations in Virginia were approximately 243,470 metric tons of CO2 equivalent emissions.

Water

The CWA is a comprehensive program requiring a broad range

of regulatory tools including a permit program with strong enforcement mechanisms to authorize and regulate discharges to surface waters. Cove Point must comply with applicable aspects of the CWA programs at its operating facilities. Cove Point has

applied for or obtained the necessary environmental permits for the operation of its facilities.

The CWA and analogous state laws impose

restrictions and strict controls regarding the discharge of effluent into surface waters. Pursuant to these laws, permits must be obtained to discharge into state waters or waters of the U.S. Any such discharge into regulated waters must be

performed in accordance with the terms of the permit issued by the EPA or the analogous state agency. Spill prevention, control and countermeasure requirements under federal and state law require appropriate containment berms and similar structures

to help prevent the accidental release of petroleum into the environment. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of

activities.

From time to time, Dominion Midstream’s projects and operations may potentially impact tidal and non-tidal wetlands. In

these instances, Dominion Midstream must obtain authorization from the appropriate federal, state and local agencies prior to impacting a subject wetland. The authorizing agency may impose significant direct or indirect mitigation costs to

compensate for regulated impacts to wetlands. The approval timeframe may also be extended and potentially affect project schedules resulting in a material adverse effect on Dominion Midstream’s business and contracts.

Threatened and Endangered Species

The Endangered Species Act

establishes prohibitions on activities that can result in harm to specific species of plants and animals. In some cases those prohibitions could result in impacts to the viability of projects or requirements for capital expenditures to reduce a

facility’s impacts on a species.

EMPLOYEES

Dominion Midstream is managed

and operated by the Board of Directors and executive officers of Dominion Midstream GP, LLC, our general partner. We do not have any employees, nor does our general partner. All of the employees that conduct our business are employed by affiliates,

and our general partner secures the personnel necessary to conduct our operations through its services agreement with DRS. We reimburse our general partner and its affiliates for the associated costs of obtaining the personnel necessary for our

operations pursuant to our partnership agreement. At December 31, 2016, Cove Point had approximately 160 full-time employees and was supported by 15 full-time DRS employees.

WHERE YOU CAN FIND MORE INFORMATION

Dominion Midstream files its annual, quarterly and current reports and other information with the SEC. Its SEC filings are available to the public over the

Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document it files at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further

information on the public reference room.

Dominion Midstream makes its SEC filings available, free of charge, including the annual report

on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, through our internet website, http://www.dommidstream.com, as soon as reasonably practicable after filing or furnishing the material to

the SEC. Information contained on our website is not incorporated by reference in this report.

Item 1A. Risk Factors

Dominion Midstream’s business is influenced by many factors that are difficult to predict, involve uncertainties that may materially affect actual

results and are often beyond its control. A number of these factors have been identified below. For other factors that may cause actual results to differ materially from those indicated in any forward-looking statement or projection contained in

this report, see Forward-Looking Statements in Item 7. MD&A.

RISKS INHERENT

IN OUR ABILITY TO GENERATE STABLE AND GROWING CASH FLOWS

Our cash generating assets are the Preferred Equity Interest, our pipeline operations, and our equity method investment in Iroquois, the cash receipts from

which may not be sufficient following the establishment of cash reserves and payment of costs and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our

unitholders. Our sources of cash are funds we receive from (i) Cove Point on the Preferred Equity Interest, which we expect will result in an annual payment to us of $50.0 million, (ii) our pipelines’ operations and

(iii) distributions received with respect to our interest in Iroquois, which we expect will generate sufficient cash to enable us to pay the minimum quarterly distributions on the common and subordinated units. These sources may not generate

sufficient cash from operations following the establishment of cash reserves and payment of costs and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to our

unitholders. The amount of cash we can distribute on our common and subordinated units is almost entirely dependent upon Cove Point’s ability to generate Net Operating Income, our pipelines’ ability to generate cash from operations and

Iroquois’ ability to make distributions to its partners. Due to our relative lack of asset diversification, an adverse development at Cove Point, our pipelines or Iroquois would have a significantly greater impact on our financial condition and

results of operations than if we maintained a more diverse portfolio of assets. Cove Point’s ability to make payments

on the Preferred Equity Interest, our pipelines’ cash generated from operations and Iroquois’ ability to make distributions to its partners will depend on several factors beyond our

control, some of which are described below.

The Preferred Equity Interest is non-cumulative. Cove Point will make Preferred Return

Distributions on a quarterly basis provided it has sufficient cash and undistributed Net Operating Income (determined on a cumulative basis from the closing of the Offering) from which to make Preferred Return Distributions. Preferred Return