Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - CyrusOne Inc. | copyofcone-20161231xex321.htm |

| EX-32.2 - EXHIBIT 32.2 - CyrusOne Inc. | copyofcone-20161231xex322.htm |

| EX-31.2 - EXHIBIT 31.2 - CyrusOne Inc. | copyofcone-20161231xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - CyrusOne Inc. | copyofcone-20161231xex311.htm |

| EX-23.1 - EXHIBIT 23.1 - CyrusOne Inc. | copyofcone-20161231xex231.htm |

| EX-21.1 - EXHIBIT 21.1 - CyrusOne Inc. | copyofcone-20161231xex211.htm |

| EX-12.1 - EXHIBIT 12.1 - CyrusOne Inc. | copyofcone-20161231xex121.htm |

| EX-10.42 - EXHIBIT 10.42 - CyrusOne Inc. | exhibit1042formoftime-base.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

Amendment No. 1

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

¬ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period ___________ to ____________

Commission File Number: 001-35789

CyrusOne Inc.

(Exact name of registrant as specified in its charter)

Maryland | 46-0691837 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2101 Cedar Springs Road, Suite 900, Dallas, TX 75201

(Address of Principal Executive Offices) (Zip Code)

(972) 350-0060

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $.01 par value | NASDAQ | |

Securities registered pursuant to Section 12 (g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¬ | |||

Non-accelerated filer | ¬ | Smaller reporting company | ¬ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No ý

The aggregate market value of the voting Common Stock owned by non-affiliates on June 30, 2016, was $4.4 billion, computed by reference to the closing sale price of the Common Stock on the NASDAQ Global Select Market on such date.

There were 83,441,227 shares of Common Stock outstanding as of February 21, 2017.

Portions of the definitive proxy statement relating to the Company’s 2017 Annual Meeting of Shareholders are incorporated by reference into Part III of this report to the extent described herein.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) amends CyrusOne, Inc.’s (the “Company”) Annual Report on Form 10-K for the fiscal year ended December 31, 2016 originally filed on February 24, 2017 (“Original Filing”). This Amendment No. 1 is being filed for the sole purpose of including the conforming signatures of our Independent Registered Public Accounting Firm on the Reports of Independent Registered Public Accounting Firm, which were inadvertently omitted from the Original Filing due to an administrative error.

Except as expressly noted above, this Amendment No. 1 does not modify or update in any way disclosures made in the Original Filing. For convenience, the entire Annual Report on Form 10-K, as amended, is being re-filed.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized, on the 27th day of February, 2017.

CyrusOne Inc. | |||

By: | /s/ Amitabh Rai | ||

Amitabh Rai | |||

Senior Vice President and Chief Accounting Officer | |||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period ___________ to ____________

Commission File Number: 001-35789

CyrusOne Inc.

(Exact name of registrant as specified in its charter)

Maryland | 46-0691837 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2101 Cedar Springs Road, Suite 900, Dallas, TX 75201

(Address of Principal Executive Offices) (Zip Code)

(972) 350-0060

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $.01 par value | NASDAQ | |

Securities registered pursuant to Section 12 (g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No ý

The aggregate market value of the voting Common Stock owned by non-affiliates on June 30, 2016, was $4.4 billion, computed by reference to the closing sale price of the Common Stock on the NASDAQ Global Select Market on such date.

There were 83,441,227 shares of Common Stock outstanding as of February 21, 2017.

Portions of the definitive proxy statement relating to the Company’s 2017 Annual Meeting of Shareholders are incorporated by reference into Part III of this report to the extent described herein.

EXPLANATORY NOTE

Unless otherwise indicated or unless the context requires otherwise, all references in this report to “we,” “us,” “our,” “our Company” or “the Company” refer to CyrusOne Inc., a Maryland corporation, together with its consolidated subsidiaries, including CyrusOne LP, a Maryland limited partnership. Unless otherwise indicated or unless the context requires otherwise, all references to “our operating partnership” or “the operating partnership” refer to CyrusOne LP together with its consolidated subsidiaries.

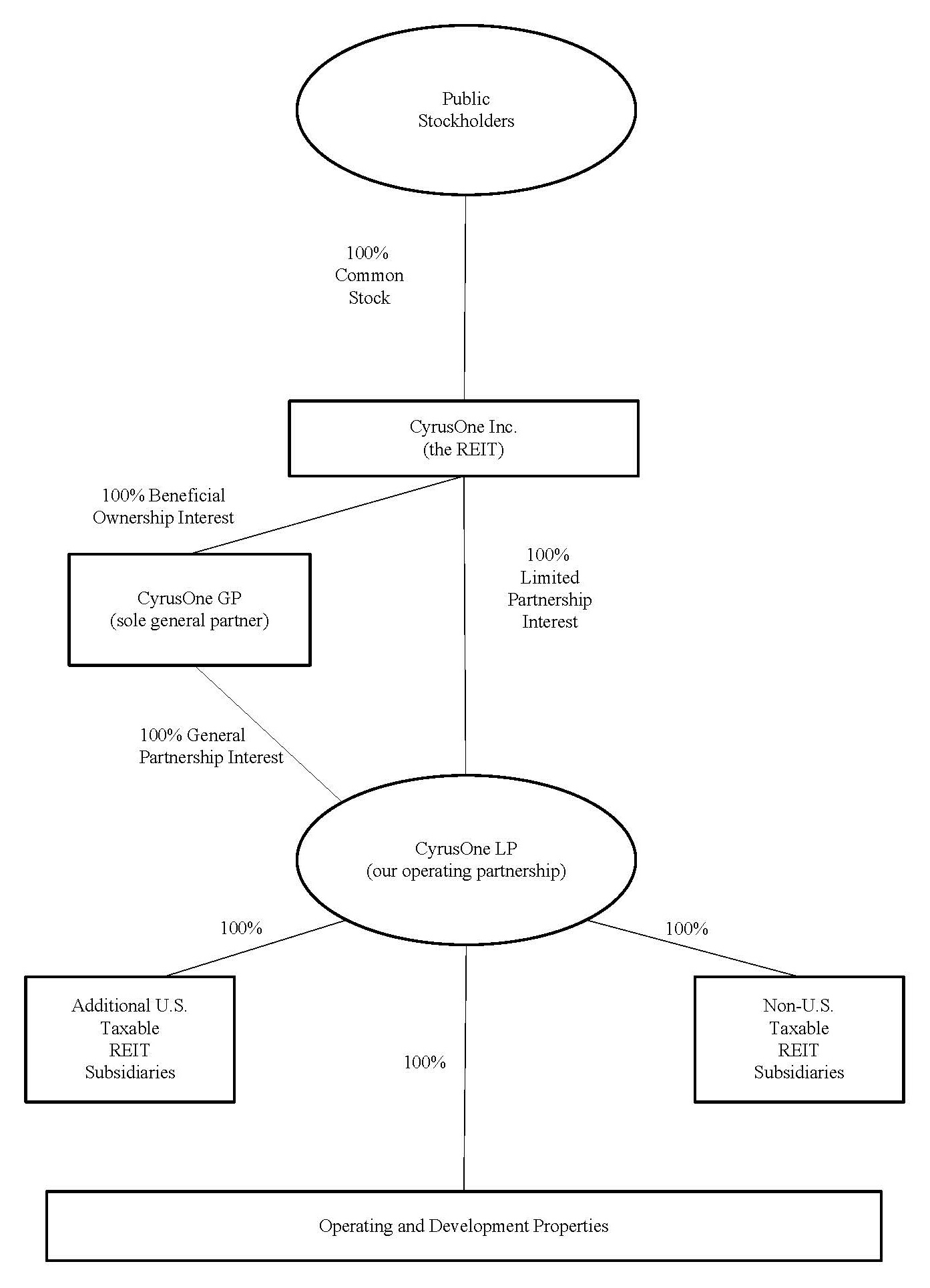

CyrusOne Inc. is a real estate investment trust, or REIT, whose only material asset is its ownership of operating partnership units of CyrusOne LP. As a result, CyrusOne Inc. does not conduct business itself, other than acting as the sole beneficial owner and sole trustee of CyrusOne GP (the sole general partner of CyrusOne LP), a Maryland statutory trust, issuing public equity from time to time and guaranteeing certain debt of CyrusOne LP and certain of its subsidiaries. CyrusOne Inc. itself does not issue any indebtedness but guarantees the debt of CyrusOne LP and certain of its subsidiaries, as disclosed in this report. CyrusOne LP and its subsidiaries hold substantially all the assets of the Company. CyrusOne LP conducts the operations of the business, along with its subsidiaries, and is structured as a partnership with no publicly traded equity. Except for net proceeds from public equity issuances by CyrusOne Inc., which are generally contributed to CyrusOne LP in exchange for operating partnership units, CyrusOne LP generates the capital required by the Company's business through CyrusOne LP's operations and by CyrusOne LP's incurrence of indebtedness.

As of December 31, 2016, the total number of outstanding shares of common stock was 83.5 million and our former parent, Cincinnati Bell Inc. (CBI) owned less than 5.0% of the outstanding common stock of CyrusOne Inc. On December 31, 2015, CyrusOne Inc. completed an exchange of all the operating partnership units of CyrusOne LP owned, directly or indirectly, by CBI for an equal number of shares of common stock of CyrusOne Inc. As a result, CyrusOne Inc., directly or indirectly, owns all the operating partnership units of CyrusOne LP. As the direct or indirect owner of all the operating partnership units of CyrusOne LP and as sole beneficial owner and sole trustee of CyrusOne GP, which is the sole general partner of CyrusOne LP, CyrusOne Inc. has the full, exclusive and complete responsibility for the operating partnership's day-to-day management and control.

7

TABLE OF CONTENTS

PART I | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

PART II | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | ||

PART III | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

PART IV | ||

ITEM 15. | ||

8

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make statements in this Annual Report on Form 10-K that are forward-looking statements within the meaning of the federal securities laws. In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, all of our statements regarding anticipated growth in our funds from operations and anticipated market conditions, demographics and results of operations are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

•loss of key customers;

•economic downturn, natural disaster or oversupply of data centers in the limited geographic areas that we serve;

•risks related to the development of our properties and our ability to successfully lease those properties;

•loss of access to key third-party service providers and suppliers;

•risks of loss of power or cooling which may interrupt our services to our customers;

•inability to identify and complete acquisitions and operate acquired properties, including the pending Sentinel acquisition;

•our failure to obtain necessary outside financing on favorable terms, or at all;

•restrictions in the instruments governing our indebtedness;

•risks related to environmental matters;

•unknown or contingent liabilities related to our acquired properties;

•significant competition in our industry;

•loss of key personnel;

•risks associated with real estate assets and the industry;

• | failure to maintain our status as a REIT or to comply with the highly technical and complex REIT provisions of the Internal Revenue Code of 1986, as amended (the Code); |

•REIT distribution requirements could adversely affect our ability to execute our business plan;

•insufficient cash available for distribution to stockholders;

•future offerings of debt may adversely affect the market price of our common stock;

• | increases in market interest rates may drive potential investors to seek higher dividend yields and reduce demand for our common stock; and |

•market price and volume of stock could be volatile.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could impact our future results, performance or transactions, see the section entitled “Risk Factors.”

9

ITEM 1. BUSINESS

The Company

We are a premier data center real estate investment trust (REIT). We own, operate and develop enterprise-class, carrier-neutral, multi-tenant data center properties. Our data centers are generally purpose-built facilities with redundant power and cooling. They are not network-specific and enable customer interconnectivity to a range of telecommunication carriers. We provide mission-critical data center facilities that protect and ensure the continued operation of information technology (IT) infrastructure for 932 customers (not including customers that have signed leases but have not begun occupying space) in 35 data centers and 2 recovery centers in 11 distinct markets (9 cities in the U.S., London and Singapore). We provide twenty-four-hours-a-day, seven-days-a-week security guard monitoring with customizable security features.

Recent Developments

On March 17, 2016, CyrusOne LP entered into a first amended and restated credit agreement (the First Amended and Restated Credit Agreement) which amended and restated in its entirety the credit agreement governing its senior unsecured revolving credit facility (the Revolving Credit Facility) and senior unsecured term loan facility (the Initial Term Loan), originally dated as of October 9, 2014. The First Amended and Restated Credit Agreement provided for an additional $250.0 million senior unsecured term loan facility (the Additional Term Loan, together with the Initial Term Loan, the Term Loans) in addition to the existing $650.0 million Revolving Credit Facility and the $300.0 million Initial Term Loan. CyrusOne LP borrowed $250.0 million under the Additional Term Loan facility and used the proceeds to repay a portion of the amount outstanding under the Revolving Credit Facility. On November 21, 2016, CyrusOne LP entered into a second amended and restated credit agreement (the Second Amended and Restated Credit Agreement) which amended and restated in its entirety the First Amended and Restated Credit Agreement. The Second Amended and Restated Credit Agreement, among other things, increases the available commitments under the Revolving Credit Facility to $1.0 billion.

On March 21, 2016, CyrusOne Inc. completed a public offering of 6.9 million shares of its common stock for $255.0 million, net of underwriting discounts of approximately $10.6 million. CyrusOne LP used the proceeds to acquire the Chicago-Aurora I data center from CME Group for $131.1 million and to fund its development pipeline. During the first quarter of 2016, the Company received $0.9 million from the exercise of stock options and $0.1 million relating to common shares purchased under the employee stock purchase plan. In total, offerings of common stock during the first quarter of 2016 resulted in $256.0 million of cash flow from financing activities on the consolidated statements of cash flows.

On May 2, 2016, CyrusOne Inc. and CyrusOne GP amended and restated the Agreement of Limited Partnership of CyrusOne LP (Amended LP Agreement) to reflect that CBI and its subsidiaries have ceased to be partners or hold any partnership interests in CyrusOne LP and therefore have no rights under the Amended LP Agreement. The Amended LP Agreement also effects certain changes to clarify language, comply with or conform to Maryland and partnership tax law and make various technical corrections and ministerial changes.

On May 4, 2016, CyrusOne Inc. filed a Form S-3 with the SEC as a "well-known seasoned issuer" ("WKSI") using an automatic shelf registration process. Under this process, CyrusOne Inc. or any selling security holders may sell any combination of the securities described in the registration statement from time to time in one or more offerings in amounts to be determined at the time of any offering.

On July 1, 2016, the Company filed a prospectus supplement and entered into sales agreements (the Sales Agreements) with each of Raymond James & Associates, Inc., Jefferies LLC, KeyBanc Capital Markets Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and SunTrust Robinson Humphrey, Inc., as sales agents, pursuant to which CyrusOne Inc. may issue and sell from time to time shares of its common stock having an aggregate gross sales price of up to $320.0 million, pursuant to an “at the market” program. Sales of shares of CyrusOne Inc. common stock under the Sales Agreements are made by means of ordinary brokers’ transactions on the NASDAQ Global Select Market or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or, subject to specific instructions of CyrusOne Inc., at negotiated prices. During the year ended December 31, 2016, the Company sold 0.5 million shares of its common stock under this program, generating net proceeds of approximately $26.3 million after giving effect to sales agent commissions of $0.3 million.

On August 15, 2016, CyrusOne Inc. completed a public offering of 3.4 million shares of its common stock for $164.8 million, net of underwriting discounts of approximately $6.9 million. CyrusOne Inc. contributed the net proceeds from the sale of its shares to its operating partnership in exchange for an equivalent number of newly issued operating partnership units (the August OP Contribution and Issuance). CyrusOne LP has used and intends to use the proceeds from the August OP Contribution and Issuance to fund growth capital expenditures related to recently signed leases, to repay borrowings under its Revolving Credit Facility, and for general corporate purposes, which may include funding future acquisitions, investments or capital expenditures. In connection with this offering, on August 10, 2016, CyrusOne Inc. entered into (a) a forward sale agreement with Goldman, Sachs & Co. (the Forward Sale Agreement) with respect to 3.4 million shares

10

of its common stock, and (b) an additional forward sale agreement with Goldman, Sachs & Co. (the Additional Forward Sale Agreement, and together with the Forward Sale Agreement, the Forward Sale Agreements) with respect to approximately 1.0 million shares of its common stock in connection with the underwriters' exercise of their option to purchase these shares.

Pursuant to the terms of the Forward Sale Agreements, and subject to CyrusOne Inc.’s right to elect cash or net share settlement under the Forward Sale Agreements, CyrusOne Inc. intends to issue and sell, upon physical settlement of such Forward Sale Agreements, approximately 4.4 million shares of its common stock to Goldman, Sachs & Co. in exchange for cash proceeds per share equal to the applicable forward sale price, which was initially $48.48 per share and is subject to certain adjustments as provided in the applicable forward sale agreement. CyrusOne Inc. expects to physically settle the Forward Sale Agreements in full, which settlement or settlements will occur on or before August 1, 2017.

On February 6, 2017, CyrusOne Inc. announced the execution of a definitive agreement to purchase two data centers located in Raleigh-Durham, North Carolina and Somerset, New Jersey for a total purchase price of $490 million, excluding transaction-related costs, in an all cash transaction. The transaction is expected to close in the next 30 to 45 days, subject to the fulfillment of customary closing conditions. These facilities add more than 160,000 colocation square feet and approximately 21 megawatts of power capacity to our portfolio. This transaction is expected to provide enhanced geographic diversification, establishing a presence in Raleigh-Durham and expanding our footprint in the Northeast.

11

The following diagram depicts our ownership structure as of December 31, 2016:

12

Our Business

We provide mission-critical data center facilities that protect and ensure the continued operation of IT infrastructure for our customers. Our goal is to be the preferred global data center provider to Fortune 1000, including the largest enterprises and providers of cloud services. As of December 31, 2016, our customers included 181 of the Fortune 1000 or private or foreign enterprises of equivalent size. These 181 customers provided 69% of our annualized rent as of December 31, 2016.

Data centers are highly specialized and secure real estate assets that serve as centralized repositories of server, storage and network equipment. They are designed to provide the space, power, cooling and network connectivity necessary to efficiently operate mission-critical IT equipment. Telecommunications carriers typically provide network access into a data center through optical fiber. The demand for data center infrastructure is being driven by many factors, but most importantly by significant growth in data as well as an increased demand for outsourcing. The market for third-party data center facilities includes, among other companies, established “traditional” enterprises that are web-enabling their applications and business processes as well as cloud-centric companies with sophisticated technology requirements.

We cultivate long-term strategic relationships with our customers and provide them with solutions for their data center facilities and IT infrastructure challenges. Our offerings provide flexibility, reliability and security delivered through a tailored, customer service focused platform that is designed to foster long-term relationships. We focus on attracting customers that have not historically outsourced their data center needs and providing them with solutions that address their current and future needs. Our facilities and construction design allow us to offer flexibility in density and power resiliency, and the opportunity for expansion as our customers' needs grow. We provide twenty-four-hours-a-day, seven-days-a-week security guard monitoring with customizable security features. The CyrusOne National IX Platform (the National IX Platform) delivers interconnection across states and between metro-enabled sites within the CyrusOne footprint and beyond. The platform enables high-performance, low-cost data transfer and accessibility for customers by uniting our data centers.

Our Competitive Strengths

Our ability to attract and retain the world’s largest customers is attributed to the following competitive strengths, which distinguish us from other data center operators and will enable us to continue to grow our operations.

High Quality Customer Base. The high quality of our assets combined with our reputation for serving the needs of large enterprises has enabled us to focus on the Fortune 1000 to build a quality customer base. We currently have 932 customers (not including customers that have signed leases but have not begun occupying space) from a broad spectrum of industries. Our revenue is generated by a stable enterprise customer base, as evidenced by the fact that as of December 31, 2016, 69% of our annualized rent comes from the Fortune 1000 or private or foreign enterprises of equivalent size. We serve a diversity of industries, including information technology, financial services, energy, oil and gas, mining, medical and consumer goods and services.

As of December 31, 2016, one customer represented more than 10% of revenue, with that customer representing 13% of our annualized rent. Our top 10 customers represented 38% of our annualized rent.

Strategically Located Portfolio. Our portfolio is located in several domestic and international markets possessing attractive characteristics for enterprise-focused data center operations. We have domestic properties in six of the top 10 largest U.S. cities by population (Chicago, Dallas, Houston, New York, Phoenix and San Antonio), according to the U.S. Census Bureau, and six of the top 10 cities for Fortune 500 headquarters (Chicago, Cincinnati, Dallas, Houston, San Antonio and New York). We believe cities with large populations or a large number of corporate headquarters are likely to produce incremental demand for IT infrastructure. In addition, being located close to our current and potential customers provides chief information officers (CIOs) with additional confidence when outsourcing their data center infrastructure to us.

Modern, High Quality, Flexible Facilities. Our portfolio includes highly efficient, reliable facilities with flexibility to customize customer solutions and accessibility to hundreds of connectivity providers. To optimize the delivery of power, our properties include modern engineering technologies designed to minimize unnecessary power usage and, in our newest facilities, we are able to provide power utilization efficiency ratios that we believe to be among the best in the multi-tenant data center industry. Fortune 1000 CIOs are dividing their application stacks into various groups as some applications require 100% availability, while others may require significant power to support complex computing, or robust connectivity. Our construction design enables us to deliver different power densities and resiliencies to the same customer footprint, allowing customers to tailor solutions to meet their application needs. In addition, the National IX Platform provides access to hundreds of telecommunication and Internet carriers.

Massively Modular® Construction Methods. Our Massively Modular® design principles allow us to efficiently stage construction on a large scale and deliver critical power and colocation square feet (CSF) in a timeframe that we believe is one of the best in the industry. We acquire or build a large powered shell capable of scaling with our customers’ power and colocation space needs. The powered shell

13

can be acquired or constructed for a relatively inexpensive capital cost. Once the building shell is ready, we can build individual data center halls in portions of the building space to meet the needs of customers on a modular basis. This modular data center hall construction can be completed in 12 to 16 weeks to meet our customers’ immediate needs. This short construction timeframe ensures a very high utilization of the assets and minimizes the time between our capital investment and the receipt of customer revenue, favorably impacting our return on investment while also translating into lower costs for our customers. Our design principles also allow us to add incremental equipment to increase power densities as our customers’ power needs increase, which provides our customers with a significant amount of flexibility to manage their IT demands. We believe this Massively Modular® approach allows us to respond to rapidly evolving customer needs, to commit capital toward the highest return projects and to develop state-of-the-art data center facilities.

Significant Leasing Capability. Our focus on the customer, our ability to scale with their needs, and our operational excellence provides us with embedded future growth from our customer base. During 2016, we signed new leases representing $147.8 million in annualized revenue, with previously existing customers accounting for approximately 76% of this amount. Since December 31, 2015, we have increased our CSF by approximately 506,000 square feet or 32%, while maintaining a high percentage of CSF utilized of 85% and 86% as of December 31, 2016 and 2015, respectively.

Significant, Attractive Expansion Opportunities. As of December 31, 2016, we had 825,000 net rentable square feet (NRSF) of powered shell available for future development and approximately 239 acres of land that are available for future data center facility development. The powered shell available for future development in locations that are part of our domestic portfolio, and consists of approximately 500,000 NRSF in the Southwest (Texas and Phoenix) and 325,000 NRSF in the Northeast and Midwest. Our current development properties and available acreage were selected based on extensive site selection criteria and the collective industry knowledge and experience of our management team with a focus on markets with a strong presence of and high demand by Fortune 1000 companies. As a result, we believe that our development portfolio contains properties that are located in markets with attractive supply and demand conditions and that possess suitable physical characteristics to support data center infrastructure.

Differentiated Reputation for Service. We believe that the decision CIOs make to outsource their data center infrastructure has material implications for their businesses, and, as such, CIOs look to third-party data center providers that have a reputation for serving similar organizations and that are able to deliver a customized solution. We take a consultative approach to understanding the unique requirements of our customers, and our design principles allow us to deliver a customized data center solution to match their needs. We believe that this approach has helped fuel our growth. Our current customers are also often the source of new contracts, with referrals being an important source of new customers.

Experienced Management Team. Our management team is comprised of individuals drawing on diverse knowledge and skill sets acquired through extensive experiences in the real estate, telecommunications, technology and mission-critical infrastructure industries.

Balance Sheet Positioned to Fund Continued Growth. As of December 31, 2016, we had $772.5 million in available liquidity, including $757.9 million in borrowing capacity under our Revolving Credit Facility. The Second Amended and Restated Credit Agreement also includes an accordion feature that allows us to increase the aggregate commitment by up to $300 million. We believe that we are appropriately capitalized with sufficient financial flexibility and capacity to fund our anticipated growth.

Experienced Sales Force with Robust Partner Channel. We have an experienced sales force with a particular expertise in selling to large enterprises, which can require extensive consultation and drive long sales cycles as these enterprises make the initial outsourcing decision. As of December 31, 2016, we had 39 sales-related employees. We believe the depth, knowledge, and experience of our sales team differentiates us from other data center companies, and we are not as dependent on brokers to identify and acquire customers as some other companies in the industry. To complement our direct sales efforts, we have developed a robust network of more than 175 partners, including value added resellers, systems integrators and hosting providers.

Business and Growth Strategies

Our objective is to grow our revenue and earnings and maximize stockholder returns and cash flow by continuing to expand our data center infrastructure outsourcing business.

Increasing Revenue from Existing Customers and Properties. We have historically generated a significant portion of our revenue growth from our existing customers. We will continue to target our existing customers because we believe that many have significant data center infrastructure needs that have not yet been outsourced, and many will require additional data center space and power to support their growth and their increasing reliance on technology infrastructure in their operations. To address new demand, as of December 31, 2016, we have approximately 615,000 NRSF currently available for lease. We also have approximately 1,657,000 NRSF under development, as well as 825,000 NRSF of additional powered shell space under roof available for development.

Attracting and Retaining New Customers. Increasingly, enterprises are beginning to recognize the complexities of managing data center infrastructure in the midst of rapid technological development and innovation. We believe that these complexities, brought about by the rapidly increasing levels of Internet traffic and data, obsolete existing corporate data center infrastructure, increased power and cooling

14

requirements and increased regulatory requirements, are driving the need for companies to outsource their data center facility requirements. Consequently, this will significantly increase the percentage of companies that use third-party data center colocation services over the next several years. We believe that our high quality assets and reputation for serving large enterprises have been, and will be, key differentiators for us in attracting customers that are outsourcing their data center infrastructure needs.

We acquire customers through a variety of channels. We have historically managed our sales process through a direct-to-the-customer model but are now utilizing third-party leasing agents and indirect leasing channels to expand our universe of potential new customers. Over the past few years, we have developed a robust network of partners in our indirect leasing channels, including value added resellers, systems integrators and hosting providers. These channels, in combination with our award-winning internal marketing team, have enabled us to build both a strong brand and outreach program to new customers. Throughout the life cycle of a customer’s lease with us, we maintain a disciplined approach to monitoring their experience, with the goal of providing the highest level of customer service. This personal attention fosters a strong relationship and trust with our customers, which leads to future growth and leasing renewals.

Expanding into New Markets. Our expansion strategy focuses on developing new data centers in markets where our customers are located and in markets with a strong presence of and high demand by Fortune 1000 customers. We conduct extensive analysis to ensure an identified market displays strong data center fundamentals, independent of the demand presented by any particular customer. In addition, we consider markets where our existing customers want us to be located. We regularly meet with our customers to understand their business strategies and potential data center needs. We believe that this approach combined with our Massively Modular® construction design reduces the risk associated with expansion into new markets because it provides strong visibility into our leasing opportunities and helps to ensure targeted returns on new developments. When considering a new market, we take a disciplined approach in evaluating potential business, property and site acquisitions, including a site’s geographic attributes, availability of telecommunications and connectivity providers, access to power, and expected costs for development.

Growing Interconnection Business. In April 2013, we launched the National IX Platform, delivering interconnection across states and between metro-enabled sites within the CyrusOne facility footprint and beyond. The platform enables high-performance, low-cost data transfer and accessibility for customers seeking to connect between CyrusOne facilities, from CyrusOne to their own private data center facility, or with one another via private peering, cross connects and/or public switching environments. Interconnection within a facility or on the National IX Platform allows our customers to share information and conduct commerce in a highly efficient manner not requiring a third-party intermediary, and at a fraction of the cost normally required to establish such a connection between two enterprises. The demand for interconnection creates additional rental and revenue growth opportunities for us, and we believe that customer interconnections increase our likelihood of customer retention by providing an environment not easily replicated by competitors. We act as a trusted neutral party that enterprises, carriers and content companies utilize to connect to each other. We believe that the reputation and industry relationships of our executive management team place us in an ongoing trusted provider role. In 2014, we became the first colocation provider in North America to receive multi-site certification from the Open-IX Association, a non-profit industry group formed to promote better standards for data center interconnection and Internet Exchanges in North America.

Our principal executive offices are located at 2101 Cedar Springs Road, Suite 900, Dallas, TX 75201. Our telephone number is (972) 350-0060. We maintain a website, www.cyrusone.com. The information contained on, or accessible through, our website is not incorporated by reference into this Annual Report on Form 10-K.

Our Portfolio

As of December 31, 2016, our property portfolio included 35 data centers and 2 recovery centers in 11 distinct markets (9 cities in the U.S., London and Singapore) collectively providing approximately 3,904,000 NRSF and powered by approximately 369 MW of available critical load capacity. We own 23 of the buildings in which our data center facilities are located. We lease the remaining 14 buildings, which account for approximately 650,000 NRSF, or approximately 17% of our total operating NRSF. These leased buildings accounted for 24% of our total annualized rent as of December 31, 2016. We also currently have 1,657,000 NRSF under development, as well as 825,000 NRSF of additional powered shell space under roof available for development. In addition, we have approximately 239 acres of land that are available for future data center shell development. Along with our primary product offering, leasing of colocation space, our customers are also interested in ancillary office and other space. We believe our existing operating portfolio and development pipeline will allow us to meet the evolving needs of our existing customers and continue to attract new customers. For the year ended December 31, 2016, our capital expenditures were $731.1 million, including the purchase of Aurora Properties. We continuously evaluate our existing portfolio for recoverability, and we recorded an impairment of $5.3 million related to two properties for the year ended December 31, 2016. The properties were South Bend-Crescent, a leased facility, and Cincinnati-Goldcoast, an owned facility. The following tables provide an overview of our operating and development properties as of December 31, 2016.

15

CyrusOne Inc.

Data Center Portfolio

As of December 31, 2016

(unaudited)

Operating Net Rentable Square Feet (NRSF)(a) | Powered Shell Available for Future Development (NRSF)(k) | Available Critical Load Capacity (MW)(l) | ||||||||||||||||||||

Stabilized Properties(b) | Metro Area | Annualized Rent(c) | Colocation Space (CSF)(d) | CSF Leased(e) | CSF Utilized(f) | Office & Other(g) | Office & Other Leased (h) | Supporting Infrastructure(i) | Total(j) | |||||||||||||

Dallas - Carrollton | Dallas | $ | 52,567,145 | 235,733 | 87 | % | 87 | % | 33,238 | 96 | % | 90,819 | 359,790 | 164,000 | 26 | |||||||

Houston - Houston West I | Houston | 43,469,699 | 112,133 | 96 | % | 97 | % | 11,163 | 99 | % | 37,243 | 160,539 | 3,000 | 28 | ||||||||

Dallas - Lewisville* | Dallas | 35,957,070 | 114,054 | 96 | % | 96 | % | 11,374 | 89 | % | 54,122 | 179,550 | — | 21 | ||||||||

Cincinnati - 7th Street*** | Cincinnati | 35,262,055 | 178,949 | 93 | % | 93 | % | 5,744 | 100 | % | 167,241 | 351,934 | 74,000 | 13 | ||||||||

Northern Virginia - Sterling II | Northern Virginia | 29,582,564 | 158,998 | 100 | % | 100 | % | 8,651 | 100 | % | 55,306 | 222,955 | — | 30 | ||||||||

Totowa - Madison** | New York Metro | 26,215,274 | 51,290 | 86 | % | 86 | % | 22,477 | 100 | % | 58,964 | 132,731 | — | 6 | ||||||||

Wappingers Falls I** | New York Metro | 25,706,362 | 37,000 | 96 | % | 96 | % | 20,167 | 97 | % | 15,077 | 72,244 | — | 3 | ||||||||

Cincinnati - North Cincinnati | Cincinnati | 24,179,133 | 65,303 | 97 | % | 97 | % | 44,886 | 72 | % | 52,950 | 163,139 | 65,000 | 14 | ||||||||

Houston - Houston West II | Houston | 22,230,045 | 79,540 | 93 | % | 93 | % | 3,355 | 74 | % | 55,023 | 137,918 | 12,000 | 12 | ||||||||

San Antonio I | San Antonio | 21,531,649 | 43,891 | 99 | % | 99 | % | 5,989 | 83 | % | 45,650 | 95,530 | 11,000 | 12 | ||||||||

Chicago - Aurora I | Chicago | 21,137,317 | 88,362 | 92 | % | 92 | % | 34,008 | 100 | % | 220,109 | 342,479 | 27,000 | 65 | ||||||||

Phoenix - Chandler II | Phoenix | 19,896,927 | 74,058 | 100 | % | 100 | % | 5,639 | 38 | % | 25,519 | 105,216 | — | 12 | ||||||||

Houston - Galleria | Houston | 18,364,625 | 63,469 | 62 | % | 62 | % | 23,259 | 51 | % | 24,927 | 111,655 | — | 14 | ||||||||

Florence | Cincinnati | 15,689,642 | 52,698 | 100 | % | 100 | % | 46,848 | 87 | % | 40,374 | 139,920 | — | 9 | ||||||||

Austin II | Austin | 14,330,890 | 43,772 | 94 | % | 94 | % | 1,821 | 100 | % | 22,433 | 68,026 | — | 5 | ||||||||

San Antonio II | San Antonio | 13,997,234 | 64,221 | 100 | % | 100 | % | 11,255 | 100 | % | 41,127 | 116,603 | — | 12 | ||||||||

Northern Virginia - Sterling I | Northern Virginia | 13,564,435 | 77,961 | 98 | % | 99 | % | 5,618 | 77 | % | 48,598 | 132,177 | — | 12 | ||||||||

Phoenix - Chandler I | Phoenix | 12,996,911 | 73,921 | 92 | % | 92 | % | 34,582 | 12 | % | 38,572 | 147,075 | 31,000 | 16 | ||||||||

Cincinnati - Hamilton* | Cincinnati | 9,103,481 | 46,565 | 76 | % | 76 | % | 1,077 | 100 | % | 35,336 | 82,978 | — | 10 | ||||||||

Stamford - Riverbend** | New York Metro | 6,944,619 | 20,000 | 29 | % | 30 | % | — | — | % | 8,484 | 28,484 | — | 2 | ||||||||

Phoenix - Chandler III | Phoenix | 6,744,069 | 67,913 | 83 | % | 90 | % | 2,440 | — | % | 30,415 | 100,768 | — | 14 | ||||||||

London - Great Bridgewater** | International | 6,246,740 | 10,000 | 85 | % | 85 | % | — | — | % | 514 | 10,514 | — | 1 | ||||||||

Dallas - Midway** | Dallas | 5,353,920 | 8,390 | 100 | % | 100 | % | — | — | % | — | 8,390 | — | 1 | ||||||||

Cincinnati - Mason | Cincinnati | 5,284,274 | 34,072 | 100 | % | 100 | % | 26,458 | 98 | % | 17,193 | 77,723 | — | 4 | ||||||||

Norwalk I** | New York Metro | 3,225,171 | 13,240 | 79 | % | 79 | % | 4,085 | 72 | % | 40,610 | 57,935 | 87,000 | 2 | ||||||||

Dallas - Marsh** | Dallas | 2,490,522 | 4,245 | 100 | % | 100 | % | — | — | % | — | 4,245 | — | 1 | ||||||||

Chicago - Lombard | Chicago | 2,323,500 | 13,516 | 59 | % | 61 | % | 4,115 | 100 | % | 12,230 | 29,861 | 29,000 | 3 | ||||||||

Stamford - Omega** | New York Metro | 1,463,844 | — | — | % | — | % | 18,552 | 87 | % | 3,796 | 22,348 | — | — | ||||||||

Northern Virginia - Sterling IV | Northern Virginia | 1,296,000 | 40,670 | 100 | % | 100 | % | 5,523 | 100 | % | 32,433 | 78,626 | 14,000 | 6 | ||||||||

Cincinnati - Blue Ash* | Cincinnati | 560,116 | 6,193 | 36 | % | 36 | % | 6,821 | 100 | % | 2,165 | 15,179 | — | 1 | ||||||||

Totowa - Commerce** | New York Metro | 557,310 | — | — | % | — | % | 20,460 | 41 | % | 5,540 | 26,000 | — | — | ||||||||

South Bend - Crescent* | Chicago | 552,737 | 3,432 | 42 | % | 43 | % | — | — | % | 5,125 | 8,557 | 11,000 | 1 | ||||||||

Houston - Houston West III | Houston | 423,849 | — | — | % | — | % | 8,495 | 100 | % | 10,652 | 19,147 | 212,000 | — | ||||||||

Singapore - Inter Business Park** | International | 310,346 | 3,200 | 22 | % | 22 | % | — | — | % | — | 3,200 | — | 1 | ||||||||

South Bend - Monroe | Chicago | 174,907 | 6,350 | 22 | % | 22 | % | — | — | % | 6,478 | 12,828 | 4,000 | 1 | ||||||||

Cincinnati - Goldcoast | Cincinnati | 96,090 | 2,728 | — | % | — | % | 5,280 | 100 | % | 16,481 | 24,489 | 14,000 | 1 | ||||||||

Stabilized Properties - Total | $ | 499,830,472 | 1,895,867 | 91 | % | 92 | % | 433,380 | 79 | % | 1,321,506 | 3,650,753 | 758,000 | 354 | ||||||||

Pre-Stabilized Properties(b) | ||||||||||||||||||||||

Austin III | Austin | 5,331,140 | 61,838 | 17 | % | 20 | % | 15,055 | 44 | % | 20,629 | 97,522 | 67,000 | 3 | ||||||||

Houston - Houston West III (DH #1) | Houston | 894,690 | 52,932 | 5 | % | 6 | % | — | — | % | 23,358 | 76,290 | — | 6 | ||||||||

Dallas - Carrollton (DH #5) | Dallas | 3,634,126 | 68,865 | 29 | % | 44 | % | — | — | % | 10,539 | 79,404 | — | 6 | ||||||||

All Properties - Total | $ | 509,690,428 | 2,079,502 | 84 | % | 85 | % | 448,435 | 74 | % | 1,376,032 | 3,903,969 | 825,000 | 369 | ||||||||

* | Indicates properties in which we hold a leasehold interest in the building shell and land. All data center infrastructure has been constructed by us and is owned by us. |

16

** | Indicates properties in which we hold a leasehold interest in the building shell, land, and all data center infrastructure. |

*** | The information provided for the West Seventh Street (7th St.) property includes data for two facilities, one of which we lease and one of which we own. |

(a) | Represents the total square feet of a building under lease or available for lease based on engineers' drawings and estimates but does not include space held for development or space used by CyrusOne. |

(b) | Stabilized properties include data halls that have been in service for at least 24 months or are at least 85% utilized. Pre-stabilized properties include data halls that have been in service for less than 24 months and are less than 85% utilized. |

(c) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2016, multiplied by 12. For the month of December 2016, customer reimbursements were $56.4 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From January 1, 2015 through December 31, 2016, customer reimbursements under leases with separately metered power constituted between 10.6% and 12.6% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of December 31, 2016 was $519.9 million. Our annualized effective rent was greater than our annualized rent as of December 31, 2016 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(d) | CSF represents the NRSF at an operating facility that is currently leased or readily available for lease as colocation space, where customers locate their servers and other IT equipment. |

(e) | Percent leased is determined based on CSF being billed to customers under signed leases as of December 31, 2016 divided by total CSF. Leases signed but not commenced as of December 31, 2016 are not included. |

(f) | Utilization is calculated by dividing CSF under signed leases for colocation space (whether or not the lease has commenced billing) by total CSF. |

(g) | Represents the NRSF at an operating facility that is currently leased or readily available for lease as space other than CSF, which is typically office and other space. |

(h) | Percent leased is determined based on Office & Other space being billed to customers under signed leases as of December 31, 2016 divided by total Office & Other space. Leases signed but not commenced as of December 31, 2016 are not included. |

(i) | Represents infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

(j) | Represents the NRSF at an operating facility that is currently leased or readily available for lease. This excludes existing vacant space held for development. |

(k) | Represents space that is under roof that could be developed in the future for operating NRSF, rounded to the nearest 1,000. |

(l) | Critical load capacity represents the aggregate power available for lease and exclusive use by customers expressed in terms of megawatts. The capacity reported is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. Does not sum to total due to rounding. |

CyrusOne Inc.

NRSF Under Development

As of December 31, 2016

(Dollars in millions)

(unaudited)

NRSF Under Development (a) | Under Development Costs(b) | ||||||||||||||||||

Facilities | Metropolitan Area | Estimated Completion Date | Colocation Space (CSF) | Office & Other | Supporting Infrastructure | Powered Shell(b) | Total | Critical Load MW Capacity(c) | Actual to Date(d) | Estimated Costs to Completion(e) | Total | ||||||||

Northern Virginia - Sterling III | Northern Virginia | 1Q'17 | 79,000 | 7,000 | 34,000 | — | 120,000 | 15.0 | $ | 56 | $27-29 | $83-85 | |||||||

San Antonio III | San Antonio | 1Q'17 | 132,000 | 9,000 | 43,000 | — | 184,000 | 24.0 | 82 | 42-46 | 124-128 | ||||||||

Chicago - Aurora I | Chicago | 1Q'17 | 25,000 | — | 3,000 | — | 28,000 | 6.0 | 3 | 9-10 | 12-13 | ||||||||

Phoenix - Chandler IV | Phoenix | 2Q'17 | 73,000 | 3,000 | 27,000 | — | 103,000 | 12.0 | 3 | 48-53 | 51-56 | ||||||||

Phoenix - Chandler V | Phoenix | 2Q'17 | — | — | — | 185,000 | 185,000 | — | 1 | 18-20 | 19-21 | ||||||||

Northern Virginia - Sterling IV | Northern Virginia | 2Q'17 | 27,000 | — | 2,000 | — | 29,000 | 9.0 | — | 38-41 | 38-41 | ||||||||

Northern Virginia - Sterling V | Northern Virginia | 2Q'17 | 81,000 | 40,000 | 55,000 | 459,000 | 635,000 | 12.0 | 5 | 113-125 | 118-130 | ||||||||

Chicago - Aurora II | Chicago | 2Q'17 | 77,000 | 10,000 | 14,000 | 272,000 | 373,000 | 10.0 | 3 | 69-76 | 72-79 | ||||||||

Total | 494,000 | 69,000 | 178,000 | 916,000 | 1,657,000 | 88.0 | $ | 153 | $364-400 | $517-553 | |||||||||

(a) | Represents NRSF at a facility for which activities have commenced or are expected to commence in the next two quarters to prepare the space for its intended use. Estimates and timing are subject to change. |

(b) | Represents NRSF under construction that, upon completion, will be powered shell available for future development into operating NRSF. |

(c) | Critical load capacity represents the aggregate power available for lease and exclusive use by customers expressed in terms of megawatts. The capacity reported is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. Does not sum to total due to rounding. |

(d) | Actual to date is the cash investment as of December 31, 2016. There may be accruals above this amount for work completed, for which cash has not yet been paid. |

(e) | Represents management’s estimate of the total costs required to complete the current NRSF under development. There may be an increase in costs if customers require greater power density. |

17

Customer Diversification

Our portfolio is currently leased to 932 customers, many of which are leading global companies. The following table sets forth information regarding the 20 largest customers, including their affiliates, in our portfolio based on annualized rent as of December 31, 2016:

CyrusOne Inc.

Customer Diversification(a)

As of December 31, 2016

(unaudited)

Principal Customer Industry | Number of Locations | Annualized Rent(b) | Percentage of Portfolio Annualized Rent(c) | Weighted Average Remaining Lease Term in Months(d) | |||||

1 | Information Technology | 6 | $ | 67,426,116 | 13.2 | % | 90.4 | ||

2 | Financial Services | 1 | 19,982,174 | 3.9 | % | 171.0 | |||

3 | Information Technology | 2 | 18,754,830 | 3.7 | % | 98.2 | |||

4 | Telecommunication Services | 2 | 15,674,018 | 3.1 | % | 21.1 | |||

5 | Research and Consulting Services | 3 | 14,296,234 | 2.8 | % | 48.4 | |||

6 | Energy | 5 | 13,205,677 | 2.6 | % | 19.1 | |||

7 | Energy | 1 | 12,304,605 | 2.4 | % | 38.1 | |||

8 | Industrials | 4 | 11,412,753 | 2.2 | % | 15.8 | |||

9 | Telecommunication Services | 7 | 10,442,479 | 2.1 | % | 15.5 | |||

10 | Information Technology | 2 | 8,876,559 | 1.7 | % | 7.7 | |||

11 | Energy | 2 | 7,002,022 | 1.4 | % | 12.7 | |||

12 | Financial Services | 1 | 6,600,225 | 1.3 | % | 41.0 | |||

13 | Information Technology | 2 | 5,864,871 | 1.2 | % | 134.4 | |||

14 | Telecommunication Services | 5 | 5,623,136 | 1.1 | % | 28.1 | |||

15 | Financial Services | 3 | 5,439,249 | 1.1 | % | 6.2 | |||

16 | Financial Services | 1 | 5,006,844 | 1.0 | % | 59.0 | |||

17 | Financial Services | 6 | 4,830,345 | 0.9 | % | 52.7 | |||

18 | Consumer Staples | 2 | 4,820,878 | 0.9 | % | 63.6 | |||

19 | Consumer Staples | 4 | 4,567,939 | 0.9 | % | 49.3 | |||

20 | Information Technology | 1 | 4,455,726 | 0.9 | % | 101.8 | |||

$ | 246,586,680 | 48.4 | % | 66.4 | |||||

(a) | Customers and their affiliates are consolidated. |

(b) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2016, multiplied by 12. For the month of December 2016, customer reimbursements were $56.4 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From January 1, 2015 through December 31, 2016, customer reimbursements under leases with separately metered power constituted between 10.6% and 12.6% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of December 31, 2016 was $519.9 million. Our annualized effective rent was greater than our annualized rent as of December 31, 2016 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(c) | Represents the customer’s total annualized rent divided by the total annualized rent in the portfolio as of December 31, 2016, which was approximately $509.7 million. |

(d) | Weighted average based on customer’s percentage of total annualized rent expiring and is as of December 31, 2016, assuming that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised because such payments approximate the profitability margin of leasing that space to the customer, such that we do not consider early termination to be economically detrimental to us. |

18

Lease Distribution

The following table sets forth information relating to the distribution of customer leases in the properties in our portfolio, based on NRSF under lease as of December 31, 2016:

CyrusOne Inc.

Lease Distribution

As of December 31, 2016

(unaudited)

NRSF Under Lease(a) | Number of Customers(b) | Percentage of All Customers | Total Leased NRSF(c) | Percentage of Portfolio Leased NRSF | Annualized Rent(d) | Percentage of Annualized Rent | |||||||

0-999 | 673 | 72 | % | 135,280 | 4 | % | $ | 67,886,890 | 13 | % | |||

1,000-2,499 | 101 | 11 | % | 156,075 | 5 | % | 35,146,017 | 7 | % | ||||

2,500-4,999 | 66 | 7 | % | 229,377 | 7 | % | 45,362,729 | 9 | % | ||||

5,000-9,999 | 32 | 3 | % | 223,315 | 7 | % | 52,677,906 | 10 | % | ||||

10,000+ | 60 | 7 | % | 2,545,364 | 77 | % | 308,616,886 | 61 | % | ||||

Total | 932 | 100 | % | 3,289,411 | 100 | % | $ | 509,690,428 | 100 | % | |||

(a) | Represents all leases in our portfolio, including colocation, office and other leases. |

(b) | Represents the number of customers occupying data center, office and other space as of December 31, 2016. This may vary from total customer count as some customers may be under contract, but have yet to occupy space. |

(c) | Represents the total square feet at a facility under lease and that has commenced billing, excluding space held for development or space used by CyrusOne. A customer’s leased NRSF is estimated based on such customer’s direct CSF or office and light-industrial space plus management’s estimate of infrastructure support space, including mechanical, telecommunications and utility rooms, as well as building common areas. |

(d) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2016, multiplied by 12. For the month of December 2016, customer reimbursements were $56.4 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From January 1, 2015 through December 31, 2016, customer reimbursements under leases with separately metered power constituted between 10.6% and 12.6% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of December 31, 2016 was $519.9 million. Our annualized effective rent was greater than our annualized rent as of December 31, 2016 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

19

Lease Expiration

The following table sets forth a summary schedule of the customer lease expirations for leases in place as of December 31, 2016, plus available space, for each of the 10 full calendar years beginning January 1, 2017, at the properties in our portfolio.

CyrusOne Inc.

Lease Expirations

As of December 31, 2016

(unaudited)

Year(a) | Number of Leases Expiring(b) | Total Operating NRSF Expiring | Percentage of Total NRSF | Annualized Rent(c) | Percentage of Annualized Rent | Annualized Rent at Expiration(d) | Percentage of Annualized Rent at Expiration | |||||||||

Available | 614,559 | 16 | % | |||||||||||||

Month-to-Month | 358 | 24,384 | 1 | % | $ | 7,738,925 | 2 | % | $ | 7,934,782 | 1 | % | ||||

2017 | 2,197 | 611,606 | 16 | % | 110,828,361 | 21 | % | 113,067,744 | 20 | % | ||||||

2018 | 1,148 | 354,065 | 9 | % | 101,753,053 | 20 | % | 104,749,155 | 18 | % | ||||||

2019 | 961 | 389,750 | 10 | % | 62,043,160 | 12 | % | 66,880,529 | 12 | % | ||||||

2020 | 329 | 356,530 | 9 | % | 42,914,185 | 8 | % | 47,471,158 | 8 | % | ||||||

2021 | 451 | 331,344 | 8 | % | 50,357,173 | 10 | % | 73,380,038 | 13 | % | ||||||

2022 | 34 | 100,862 | 3 | % | 9,825,908 | 2 | % | 12,091,704 | 2 | % | ||||||

2023 | 66 | 91,604 | 2 | % | 8,783,270 | 2 | % | 11,070,143 | 2 | % | ||||||

2024 | 19 | 76,111 | 2 | % | 13,508,975 | 3 | % | 15,426,575 | 3 | % | ||||||

2025 | 33 | 164,204 | 4 | % | 23,160,013 | 5 | % | 28,137,481 | 5 | % | ||||||

2026 | 18 | 418,336 | 11 | % | 52,643,117 | 10 | % | 59,573,159 | 10 | % | ||||||

2027 - Thereafter | 7 | 370,615 | 9 | % | 26,134,288 | 5 | % | 33,861,254 | 6 | % | ||||||

Total | 5,621 | 3,903,970 | 100 | % | $ | 509,690,428 | 100 | % | $ | 573,643,722 | 100 | % | ||||

(a) | Leases that were auto-renewed prior to December 31, 2016 are shown in the calendar year in which their current auto-renewed term expires. Unless otherwise stated in the footnotes, the information set forth in the table assumes that customers exercise no renewal options and exercise all early termination rights that require payment of less than 50% of the remaining rents. Early termination rights that require payment of 50% or more of the remaining lease payments are not assumed to be exercised. |

(b) | Number of leases represents each agreement with a customer. A lease agreement could include multiple spaces and a customer could have multiple leases. |

(c) | Represents monthly contractual rent (defined as cash rent including customer reimbursements for metered power) under existing customer leases as of December 31, 2016, multiplied by 12. For the month of December 2016, customer reimbursements were $56.4 million annualized and consisted of reimbursements by customers across all facilities with separately metered power. Customer reimbursements under leases with separately metered power vary from month-to-month based on factors such as our customers' utilization of power and the suppliers' pricing of power. From January 1, 2015 through December 31, 2016, customer reimbursements under leases with separately metered power constituted between 10.6% and 12.6% of annualized rent. After giving effect to abatements, free rent and other straight-line adjustments, our annualized effective rent as of December 31, 2016 was $519.9 million. Our annualized effective rent was greater than our annualized rent as of December 31, 2016 because our positive straight-line and other adjustments and amortization of deferred revenue exceeded our negative straight-line adjustments due to factors such as the timing of contractual rent escalations and customer prepayments for services. |

(d) | Represents the final monthly contractual rent under existing customer leases that had commenced as of December 31, 2016, multiplied by 12. |

20

Regulation

General

Properties in our markets are subject to various laws, ordinances and regulations, including regulations relating to common areas. We believe that each of our properties has the necessary permits and approvals for us to operate our business.

Americans With Disabilities Act

Our properties must comply with Title III of the Americans with Disabilities Act of 1990, or the ADA, to the extent that such properties are “public accommodations” as defined by the ADA. The ADA may require removal of structural barriers to access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. We believe that our properties are in substantial compliance with the ADA and that we will not be required to make substantial capital expenditures to address the requirements of the ADA. However, noncompliance with the ADA could result in imposition of fines or an award of damages to private litigants. The obligation to make readily achievable accommodations is an ongoing one, and we will continue to assess our properties and to make alterations as appropriate in this respect.

Environmental Matters

We are subject to laws and regulations relating to the protection of the environment, the storage, management and disposal of hazardous materials, emissions to air and discharges to water, the cleanup of contaminated sites and health and safety matters. These include various regulations promulgated by the Environmental Protection Agency and other federal, state, and local regulatory agencies and legislative bodies relating to our operations, including those involving power generators, batteries, and fuel storage to support co-location infrastructure. While we believe that our operations are in substantial compliance with environmental, health, and human safety laws and regulations, as an owner or operator of property and in connection with the current and historical use of hazardous materials and other operations at its sites, we could incur significant costs, including fines, penalties and other sanctions, cleanup costs and third-party claims for property damages or personal injuries, as a result of violations of or liabilities under environmental laws and regulations. Fuel storage tanks are present at many of our properties, and if releases were to occur, we may be liable for the costs of cleaning up resulting contamination. Some of our sites also have a history of previous commercial operations, including past underground storage tanks.

Some of the properties may contain asbestos-containing building materials. Environmental laws require that asbestos-containing building materials be properly managed and maintained, and may impose fines and penalties on building owners or operators for failure to comply with these requirements.

Environmental consultants have conducted, as appropriate, Phase I or similar non-intrusive environmental site assessments on recently acquired properties and if appropriate, additional environmental inquiries and assessments on recently acquired properties. Nonetheless, we may acquire or develop sites in the future with unknown environmental conditions from historical operations. Although we are not aware of any sites at which we currently have material remedial obligations, the imposition of remedial obligations as a result of spill or the discovery of contaminants in the future could result in significant additional costs to us.

Our operations also require us to obtain permits and/or other governmental approvals and to develop response plans in connection with the use of our generators or other operations. These requirements could restrict our operations or delay the development of data centers in the future. In addition, from time to time, federal, state or local government regulators enact new or revise existing legislation or regulations that could affect us, either beneficially or adversely. As a result, we could incur significant costs in complying with environmental laws or regulations that are promulgated in the future.

Insurance

We carry comprehensive liability, fire, extended coverage, business interruption and rental loss insurance covering all of the properties in our portfolio under a blanket policy. In the opinion of our management, our policy specifications, limits and insurance carriers are appropriate given the relative risk of loss, the cost of coverage and industry practice. We cannot provide any assurance that the business interruption or property insurance we have will cover all losses that we may experience, that the insurance carrier will be solvent, that rates will remain commercially reasonable, that insurance carriers will not cancel our policies, or that the insurance carriers will pay all claims made by us. Certain circumstances, such as acts of war, are generally uninsurable under our policies. See also “Risk Factors-Risks Related to Our Business and Operations." Any losses to our properties that are not covered by insurance, or that exceed our policy coverage limits, could adversely affect our business, financial condition and results of operations.

Competition

We compete with numerous developers, owners and operators of technology-related real estate, many of which own properties similar to ours in the same markets in which our properties are located. If our competitors offer space at rental rates below current market rates or below the rental rates we currently charge our customers, or if our competitors offer space that tenants perceive to be superior to ours

21

(based on factors such as available power, security considerations, location or connectivity), we may lose potential customers and we may be pressured to reduce our rental rates below those we currently charge in order to retain customers when our customers’ leases expire or incur costs to improve our properties. In addition, our customers have the option of building their own data center space which can also place pressure on our rental rates.

As a developer of data center space and provider of interconnection services, we also compete for the services of key third-party providers of services, including engineers and contractors with expertise in the development of data centers. There is competition for the services of specialized contractors and other third-party providers required for the development of data centers, increasing the cost of engaging such providers and the risk of delays in completing our development projects.

In addition, we face competition from real estate developers in our sector and in other industries for the acquisition of additional properties suitable for the development of data centers. Such competition may reduce the number of properties available for acquisition, increase the price of these properties and reduce the demand for data center space in the markets we seek to serve.

Employees

We employ approximately 380 persons. None of these employees are represented by a labor union.

Financial Information

For financial information related to our operations, please refer to the financial statements including the notes thereto, included in this Annual Report on Form 10-K.

How to Obtain Our SEC Filings

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (SEC). All reports we file with the SEC will be available free of charge via EDGAR through the SEC website at http://www.sec.gov. In addition, the public may read and copy materials we file with the SEC at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549. Information about the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. We make available our reports on Forms 10-K, 10-Q, and 8-K (as well as all amendments to these reports), and other information, free of charge, at the "Investors" section of our website at http://www.cyrusone.com. The information found on, or otherwise accessible through, our website is not incorporated by reference into, nor does it form a part of, this report or any other document that we file with the SEC.

22

ITEM 1A. RISK FACTORS

You should carefully consider all the risks described below, as well as the other information contained in this document when evaluating your investment in our securities. Any of the following risks could materially and adversely affect our business, results of operations or financial condition. The risks and uncertainties described below are those that we currently believe may materially affect our Company. Additional risks and uncertainties of which we are unaware or that we currently deem immaterial also may become important factors that affect our Company. The occurrence of any of the following risks might cause you to lose all or a part of your investment. Some statements in this Form 10-K, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Operations

A small number of customers account for a significant portion of our revenue. The loss or significant reduction in business from one or more of our large customers could significantly harm our business, financial condition and results of operations, and impact the amount of cash available for distribution to our stockholders.

We currently depend, and expect to continue to depend, upon a relatively small number of customers for a significant percentage of our revenue. Our top 10 customers collectively accounted for approximately 38% of our total annualized rent as of December 31, 2016. We have one customer which accounted for approximately 13% of our total annualized rent as of December 31, 2016. As a result of this customer concentration, our business, financial condition and results of operations, including the amount of cash available for distribution to our stockholders, could be adversely affected if we lose one or more of our larger customers, if such customers significantly reduce their business with us or if we choose not to enforce, or to enforce less vigorously, any rights that we may have now or in the future against these significant customers because of our desire to maintain our relationship with them.

A significant percentage of our customer base is also concentrated in industry sectors that may from time to time experience volatility, including the information technology, financial services and energy sectors. Enterprises in the information technology, financial services and energy industries comprised approximately 37%, 22% and 14%, respectively, of our annualized rent as of December 31, 2016. A downturn in one of these industries could negatively impact the financial condition of one or more of our information technology, financial services or energy customers, including several of our larger customers. In addition, instability in financial markets and economies generally may adversely affect our customers’ ability to replace or renew maturing liabilities on a timely basis, access the capital markets to meet liquidity and capital expenditure requirements and may result in adverse effects on our customers’ financial condition and results of operations. As a result of these factors, customers could default on their obligations to us, delay the purchase of new services from us or decline to renew expiring leases, any of which could have an adverse effect on our business, financial condition and results of operations. A diverse customer base may minimize exposure to economic fluctuations in any one industry, business sector or customer type, or any particular customer. Our relative mix of customers may change over time, as may the industries represented by our customers, the concentration of customers within specified industries and the economic value and risks associated with each customer, and there is no assurance that we will be able to maintain a diverse customer base, which could have a material adverse effect on our business, financial condition and results of operations.

Additionally, if any customer becomes a debtor in a case under the U.S. Bankruptcy Code, applicable bankruptcy laws may limit our ability to terminate our contract with such customer solely because of the bankruptcy or recover any amounts owed to us under our agreements with such customer. In addition, applicable bankruptcy laws could allow the customer to reject and terminate its agreement with us, with limited ability for us to collect the full amount of our damages. Our business, including our revenue and cash available for distribution to our stockholders, could be adversely affected if any of our significant customers were to become bankrupt or insolvent.

A significant percentage of our customer leases expire each year or are on a month-to-month basis, and many of our leases contain early termination provisions. If leases with our customers are not renewed on the same or more favorable terms or are terminated early by our customers, our business, financial condition and results of operations could be substantially harmed.