Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - TACTILE SYSTEMS TECHNOLOGY INC | tcmd-20161231ex32250f412.htm |

| EX-32.1 - EX-32.1 - TACTILE SYSTEMS TECHNOLOGY INC | tcmd-20161231ex321228d61.htm |

| EX-31.2 - EX-31.2 - TACTILE SYSTEMS TECHNOLOGY INC | tcmd-20161231ex312b95414.htm |

| EX-31.1 - EX-31.1 - TACTILE SYSTEMS TECHNOLOGY INC | tcmd-20161231ex311de9de3.htm |

| EX-23.1 - EX-23.1 - TACTILE SYSTEMS TECHNOLOGY INC | tcmd-20161231ex2310128a7.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37799

Tactile Systems Technology, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

41-1801204 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

|

|

|

|

1331 Tyler Street NE, Suite 200 Minneapolis, Minnesota |

55413 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

(612) 355-5100

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

Common Stock, Par Value $0.001 Per Share |

The NASDAQ Stock Market |

|

(Title of each class) |

(Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

☐ |

|

|

|

Accelerated filer |

☐ |

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

☒ |

|

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

☐ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on $13.16, the closing price of the shares of common stock on August 2, 2016 as reported by the Nasdaq Global Market on such date, was approximately $117,891,360. The Registrant has elected to use August 2, 2016, which was the closing date of the Registrant’s initial public offering, as the calculation date because on June 30, 2016 (the last business day of the Registrant’s most recently completed second fiscal quarter), the Registrant was a privately held company. August 2, 2016 was also the date that the Registrant’s previously outstanding preferred stock was converted to common stock.

The number of shares of Registrant’s Common Stock outstanding as of February 22, 2017 was 16,896,099.

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Stockholders, scheduled to be held on May 9, 2017, are incorporated by reference into Part III of this Report.

i

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains forward-looking statements regarding us, our business prospects and our results of operations that are subject to certain risks and uncertainties posed by many factors and events that could cause our actual business, prospects and results of operations to differ materially from those that may be anticipated by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those described in Part I, Item 1A. “Risk Factors” and elsewhere in this report. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We expressly disclaim any intent or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the Securities and Exchange Commission that advise interested parties of the risks and factors that may affect our business.

All statements, other than statements of historical facts, contained in this Annual Report on Form 10-K, including statements regarding our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business, operations and financial performance and condition, are forward-looking statements. In some cases, you can identify forward-looking statements by the following words: "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "target," "ongoing," "plan," "potential," "predict," "project," "should," "will," "would," or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance or achievements to be materially different from the information expressed or implied by the forward-looking statements in this Annual Report on Form 10-K. Forward-looking statements may include, among other things, statements relating to:

|

· |

our expectations regarding the potential market size and widespread adoption of our products; |

|

· |

our ability to increase awareness of lymphedema and chronic venous insufficiency and to demonstrate the clinical and economic benefits of our solutions to clinicians and patients; |

|

· |

developments and projections relating to our competitors or our industry; |

|

· |

the expected growth in our business and our organization, including outside of the United States; |

|

· |

our ability to achieve and maintain adequate levels of coverage or reimbursement for our products and the effect of changes to the level of Medicare coverage; |

|

· |

our financial performance, our estimates of our expenses, future revenues, capital requirements and our needs for, or ability to obtain, additional financing; |

|

· |

our ability to retain and recruit key personnel, including the continued development and expansion of our sales and marketing organization; |

|

· |

our ability to obtain an adequate supply of components for our products from our third party suppliers; |

|

· |

our ability to obtain and maintain intellectual property protection for our products or avoid claims of infringement; |

|

· |

our ability to identify and develop new products; |

|

· |

our compliance with extensive government regulation; |

|

· |

the volatility of our stock price; and |

|

· |

our expectations regarding the time during which we will be an emerging growth company under the JOBS Act. |

1

You should read the matters described in Part I, Item 1A. "Risk Factors" and the other cautionary statements made in this Annual Report on Form 10-K. We cannot assure you that the forward-looking statements in this report will prove to be accurate and therefore you are encouraged not to place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. You are urged to carefully review and consider the various disclosures made by us in this report and in other filings with the SEC that advise of the risks and factors that may affect our business. Other than as required by law, we undertake no obligation to update or revise these forward-looking statements, even though our situation may change in the future. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make.

2

Overview

Tactile Systems Technology, Inc. (“we,” “us,” and “our”) is a medical technology company that develops and provides innovative medical devices for the treatment of chronic diseases at home. We focus on advancing the standard of care in treating chronic diseases in the home setting to improve patient outcomes and quality of life and help control rising healthcare expenditures. We possess a unique, scalable platform to deliver at-home healthcare solutions throughout the United States. This evolving care delivery model is recognized by policy-makers and payers as a key for controlling rising healthcare expenditures. Our initial area of therapeutic focus is vascular disease, with a goal of advancing the standard of care in treating lymphedema and chronic venous insufficiency. Our proprietary Flexitouch System is an at-home solution for lymphedema patients. Our proprietary ACTitouch System is a home-based solution for chronic venous insufficiency patients that may be worn throughout the day. Our products deliver cost-effective, clinically proven, long-term treatment of chronic diseases. We employ a direct-to-patient and -provider model, through which we obtain patient referrals from clinicians, manage insurance claims on behalf of our patients and their clinicians, deliver our solutions to patients and train them on the proper use of our solutions in their homes. This model allows us to directly approach patients and clinicians, whereby we disintermediate the traditional durable medical equipment channel and capture both the manufacturer and distributor margins. For the year ended December 31, 2016, we generated revenues of $84.5 million and had net income of $2.9 million. Our revenues increased 34% during the year ended December 31, 2016 compared to the year ended December 31, 2015.

Lymphedema is a type of chronic swelling, or edema, which occurs in the arms, legs, neck, trunk or other body parts when the lymphatic vessels are unable to adequately drain protein-rich lymph fluid from these regions. Lymphedema is progressive in nature, worsens over time, and has no known cure. Chronic venous insufficiency is a condition that occurs when the venous wall and/or valves in the veins are not working effectively, making it difficult for blood to return to the heart from the affected region. This pooling or collecting of blood in the veins can result in painful, slow-healing wounds on the lower leg, called venous leg ulcers. Patients with lymphedema or chronic venous insufficiency are typically treated by vascular surgeons, vascular medicine physicians, wound physicians, wound nurses and lymphedema therapists.

Our advanced at-home Flexitouch System mimics the clinic-based manual lymphatic drainage therapy through an easy-to-use, one-hour daily, self-applied system. The predecessor version to our Flexitouch System received 510(k) clearance from the FDA in July 2002 and our current Flexitouch System received 510(k) clearance from the FDA in October 2006. In September 2016, we received 510(k) clearance from the FDA for the Flexitouch System in treating lymphedema in the head and neck. Our Flexitouch System generated $73.4 million, or 87%, of our revenues in 2016, and $54.8 million, or 87%, of our revenues in 2015.

Our ACTitouch System provides precise, consistent and wearable compression that a patient may apply, remove and reapply at home. This system was developed to provide maximum convenience for patients by providing them with the freedom to remain active while simultaneously receiving the benefits of sustained and intermittent pneumatic compression, which we refer to as dual-compression. Our ACTitouch System received 510(k) clearance from the FDA in June 2013 and we began selling the product in September 2013. We also introduced the Entré System in the United States in February 2013. The Entré System is sold to patients for whom a basic pump is suitable or who do not yet qualify for insurance reimbursement for an advanced compression device such as our Flexitouch System. Our ACTitouch System and Entré System combined generated $11.1 million, or 13%, of our revenues in 2016, and $8.1 million, or 13%, of our revenues in 2015.

To support the growth of our business, we invest heavily in our commercial infrastructure, consisting of our direct sales force, reimbursement capabilities and clinical expertise. We are a national, accredited provider of home medical equipment services approved for coverage by private payers, Medicare, the Veterans Administration and certain Medicaid programs in the United States. We market our products using a direct-to-patient and -provider model. Our direct sales force is focused on increasing clinician awareness of our solutions, and has grown from three representatives in March 2005 to a team of over 125 people as of December 31, 2016. We also utilize over 400 licensed, independent healthcare practitioners as home trainers who educate patients on the proper use of our solutions. Our experienced reimbursement operations group of over 70 people focuses on verifying case-by-case benefits, obtaining prior

3

authorization, billing and collecting payments from payers and providing customer support services. Our payer relationships group of 30 people is responsible for developing relationships with payer decision-makers to educate them on our product efficacy, develop overall payer coverage policies and reimbursement criteria, manage Medicare patient claims and contracts with payers and serve as an advocacy liaison between patients, clinicians and payers throughout the appeals process. Our clinical team, consisting of a scientific advisory board, in-house therapists and nurses, and a medical director (part-time), serves as a resource to clinicians and patients and guides our development of clinical evidence in support of our products. We believe these investments are critical to driving patient adoption of our technologies, and together with our commercial infrastructure represents a significant competitive advantage. Health insurance coverage for our Flexitouch System and our ACTitouch System is in place with private payers, Medicare, the Veterans Administration and certain Medicaid programs. Based on our estimates, we have contracts as an in-network provider covering over 270 million lives in the United States. Over 65,000 patients have been treated with our Flexitouch System since its launch in 2004, and over 16,000 Flexitouch Systems were shipped in 2016. More than 17,000 patients were treated with our ACTitouch and Entré Systems since their launch in 2013, and over 7,500 ACTitouch and Entré Systems were shipped in 2016. We do not currently have any international operations or sales outside the United States.

We were originally incorporated in Minnesota under the name Tactile Systems Technology, Inc. on January 30, 1995. During 2006, we established a merger corporation and subsequently, on July 21, 2006, merged with and into this merger corporation. The resulting corporation assumed the name Tactile Systems Technology, Inc. In September 2013, we began doing business as “Tactile Medical.”

Overview of the Lymphedema and Chronic Venous Insufficiency Markets

Lymphedema

The lymphatic system performs a fundamental role in maintaining health through balancing fluids and regulating immunity by removing harmful bacteria, viruses and waste products. Lymphatic structures are situated throughout the body and are comprised of a series of vessels, lymph nodes and lymphoid organs that act as a drainage system by collecting protein rich lymph fluid and sending it to the venous system. Lymph nodes are located in several areas of the body with superficial and deep lymph nodes under each arm, at the hip, in the groin, above the collar bones in the neck, in the abdomen, tonsils and spleen, and in bone marrow.

Lymphedema refers to a type of chronic swelling, or edema, which may occur in the arms, legs, neck, trunk or other body parts and causes severe and debilitating symptoms, including decreased mobility, skin breakdown, pain, increased risk of serious infection and marked psychosocial impairment, resulting in significantly negative implications for a patient's health and quality of life. The disease occurs when the lymphatic vessels are unable to adequately drain protein-rich lymph fluid from the arms, legs or other regions of the body. Any condition or procedure that damages the lymph nodes or lymphatic vessels, such as surgery or treatment for breast and other cancers, obesity, infection, scar tissue formation, trauma or chronic venous insufficiency can cause lymphedema. The disease may also be caused from congenital malformation of the lymphatic system. Lymphedema is progressive in nature, worsens over time, and has no known cure.

Misdiagnosis of lymphedema is fairly common, as many conditions that cause swelling are not related to lymphedema. Correct diagnosis of lymphedema may require evaluation by a physician or other healthcare provider with knowledge of lymphedema who may choose to perform diagnostic testing. Diagnostic tests for lymphedema include history and physical examination, soft tissue and vascular imaging, lymph node imaging, volume measurements, changes in electrical conductance, changes in biomechanical properties, genetic testing, and blood tests for other conditions that have similar symptoms to lymphedema. The International Society of Lymphology categorizes the progression of lymphedema from Stage 0, the least severe stage, to Stage 3, the most severe stage.

Chronic Venous Insufficiency

Chronic venous insufficiency occurs when the venous wall and/or valves in the veins are not working effectively, making it difficult for blood to return to the heart. The disease is prevalent among patients who are obese or pregnant and may also be caused by high blood pressure, trauma, lack of exercise, smoking, deep vein thrombosis and inflammation of the vein walls. As the valves deteriorate, blood leaks or flows backward, leading to increased pressure in veins, stretched and dilated vessels and pooling of blood in the veins. As blood accumulates, swelling occurs, leading

4

to progressive tissue breakdown and venous leg ulcers. Ulcers develop in areas where blood collects as swelling interferes with the movement of oxygen and nutrients through tissues, and if left untreated, these ulcers can quickly become infected or even gangrenous. Prolonged or untreated chronic venous insufficiency may damage the lymphatic system. Physicians diagnose chronic venous insufficiency based on appearance, symptoms and imaging techniques and classify it based upon a scale endorsed by the Society for Vascular Surgery.

Market Opportunity

Lymphedema and chronic venous insufficiency are costly and lifelong conditions with debilitating physical and psychological impacts on patients. We estimate the addressable market opportunity for our solutions treating lymphedema and chronic venous insufficiency in the United States is in excess of $4 billion. We believe that between three to five million people in the United States are living with lymphedema. Based on an analysis of claims data commissioned by us, we estimate approximately 700,000 patients were diagnosed with lymphedema during the 12 months ended June 30, 2014. Based on a separate analysis of claims data commissioned by us, we estimate approximately 820,000 patients were diagnosed with lymphedema during the 12 months ended December 31, 2015. This represents a 17% increase in the number of patients diagnosed with lymphedema over the 18-month period from June 30, 2014 to December 31, 2015. We estimate that the addressable market opportunity for our Flexitouch System is approximately $4 billion in the United States, which is based on the number of patients diagnosed with lymphedema and our average selling price per device.

In the fourth quarter of 2016 we expanded the indications for the Flexitouch System. We received U.S. FDA clearance to market a first-of-kind system to treat patients suffering from lymphedema of the head and neck, a frequent consequence of head and neck cancer and its treatment. Patient symptoms often include significant skin changes, pain and discomfort, as well as difficulty breathing and swallowing. The American Cancer Society estimates that 450,000 people in the United States suffer from cancers of the head and neck, and more than 60,000 new patients are diagnosed each year. In a recent clinical publication, researchers at Vanderbilt University School of Medicine estimated that more than 75% of patients with head and neck cancer will develop lymphedema requiring treatment. Our Flexitouch Head and Neck System is the only pneumatic compression device with an indication to treat patients suffering from this debilitating condition.

We believe that chronic venous insufficiency afflicts approximately 8% of the U.S. population, and this percentage may rise due to the growing prevalence of obesity, as well as an aging population. Based on an analysis of claims data commissioned by us, we estimate there were over 1.5 million patients diagnosed with venous leg ulcers in the United States during the 12 months ended June 30, 2014. We estimate that our immediately addressable patient population consists of the 30% to 40% of these patients, or approximately 525,000 patients, for whom we believe device reimbursement is available because their venous leg ulcers have not resolved after six months of treatment. We estimate the addressable market opportunity for our ACTitouch System is in excess of $500 million in the United States, which is based on the number of patients diagnosed with unresolved leg venous ulcers and our average selling price per device.

Current Treatment and Limitations

A traditional treatment for lymphedema is complete decongestive therapy consisting of manual lymphatic drainage, which is a specialized application of gentle pressure to the skin applied by a therapist that encourages drainage of lymph fluid, as well as decongestive exercises, skin care and compression with multilayered bandages, compression garments or pumps. Typically, this therapy begins with clinic visits three to five times per week for four to eight weeks, which is costly, inconvenient for the patient and time consuming. At that point, clinical improvement plateaus or reimbursement for the therapy ends and patients transition to self-administered home-based care. Manual lymphatic drainage is difficult for patients to self-administer due to limited range of motion and treatment techniques that are difficult to replicate, and basic pump-based compression is uncomfortable and has not demonstrated the benefits of our advanced pneumatic pump. To address these limitations, our at-home Flexitouch System mimics the clinic-based manual lymphatic drainage therapy through an advanced, easy-to-use, self-applied system. Peer-reviewed, published studies have shown that our Flexitouch System provides improved quality of life and clinical outcomes and delivers significant cost-savings to payers and patients.

The standard of care treatment for chronic venous insufficiency is compression therapy. As the disease progresses, patients may develop a venous leg ulcer, which is commonly treated using multilayered bandages to minimize swelling and enhance blood flow. A clinician applies these non-removable bandages to patients at a precise pressure and patients

5

wear the bandages between weekly visits to the wound clinic during which they are then removed and reapplied. Treatment typically occurs for several months and impairs patient quality of life by limiting bathing, range of motion and other activities. Treatment efficacy is inconsistent because bandages can lose their precise pressure between treatments. Patients also use our ACTitouch System to administer intermittent pneumatic compression therapy to assist with the circulation of blood through affected veins. Our ACTitouch System provides precise, sustained and wearable compression that a patient may apply, remove and reapply at home, allowing patients to bathe, sleep comfortably and increase mobility. In a clinical study, our ACTitouch System was shown to have comparable efficacy in healing venous leg ulcers and achieved higher patient quality of life scores as compared to multilayered bandages.

Our Strategy

Our goal is to become a leader in the at-home treatment of chronic diseases. We intend to leverage our established platform to be a global provider of clinically proven, easy-to-use and cost-effective solutions. The key elements of our strategy include:

|

· |

Increase awareness of our solutions and establish them as the standards of care. We believe that many patients with lymphedema and chronic venous insufficiency are undiagnosed or undertreated, and we intend to further educate physicians, wound nurses and lymphedema therapists, patients and payers to raise awareness of these diseases, the associated health burdens of such diseases on patients and society and the clinical and economic benefits of using our products. We intend to continue promoting this awareness through advertising campaigns, exhibiting at tradeshows and physician meetings, training and educating clinicians and publishing additional clinical and economic outcome data demonstrating the benefits of our solutions. Our ongoing marketing initiatives focus on increasing referrals to physicians trained in venous and lymphatic diseases. In addition, we plan to launch more extensive direct-to-patient and -provider marketing programs that we believe will further increase awareness of our solutions. |

|

· |

Expand our direct sales and customer support teams. We plan to expand our direct sales and marketing organization to drive greater product adoption by patients and their clinicians. We intend to strengthen our distribution network by continuing to recruit, train and retain talented sales representatives and increasing the number of licensed home trainers. With an expanded sales force, we believe we could target additional clinical call points. |

|

· |

Introduce new features and products to grow our technology platform. We intend to pursue new features for our products, and introduce new solutions to expand the number of patients using our products and allow us to enter new clinical adjacencies. We pursue internal research, design and development, and work with external collaborators to expand our product offerings. For example, we are developing new garment offerings and controller improvements for our Flexitouch System which we intend to launch in the second half of 2017. In addition, we evaluate opportunities to license or acquire additional technologies and products to expand our total addressable market opportunity. |

|

· |

Continue the development of clinical and economic outcome data. A key part of our success is our ability to demonstrate the effectiveness of our products through clinical and economic outcome data. We intend to invest in additional studies to support peer-reviewed, published studies that evidence the clinical and economic benefits of our solutions as compared to traditional treatments. We intend to use these data to continue to educate clinicians, payers and patients on the proven advantages of our products compared to other therapies and expand our network of key opinion leader advocates. |

|

· |

Expand third-party reimbursement. Our products are covered under existing reimbursement codes, and we have secured coverage for our solutions with private payers, Medicare, the Veterans Administration and certain Medicaid programs. Our team has experienced significant success in obtaining positive coverage policies from payers by developing direct relationships with payer decision-makers, leveraging our relationships with physician societies and key opinion leaders, providing clinical data, demonstrating the efficacy of our products and educating payers on the limitations of traditional treatments. We intend to continue this strategic approach to further expand coverage for our solutions, as well as to meet payer-specific requirements on behalf of patients. |

6

|

· |

Introduce our solutions outside the United States. We currently sell our products only within the United States. While our plan is to continue to focus our direct sales efforts on penetrating the U.S. market, we plan to pursue future international expansion. We have European CE Mark approval for our current Flexitouch System and are seeking CE Mark approval for our ACTitouch System. We also have a Medical Device License in Canada for our Flexitouch System. |

Our Products

We market our Flexitouch, ACTitouch and Entré systems, as at-home therapies for the treatment of lymphedema and chronic venous insufficiency. These products have received 510(k) clearance from the FDA to be marketed in the United States. We believe our products have unique features and benefits that address the shortcomings of traditional treatments, are more cost-effective and enable more consistent and effective therapy, leading to improved patient quality of life.

Flexitouch System

We introduced a predecessor to our Flexitouch System in the United States in 2003 and our Flexitouch System in 2006. Our Flexitouch System is a fully-automated, programmable, advanced pneumatic compression device designed for treatment of lymphedema in the home setting. Our Flexitouch System has received 510(k) clearance for the treatment of lymphedema, certain types of edema, venous insufficiencies and certain types of leg ulcers. In September 2016, we received 510(k) clearance from the FDA for the Flexitouch System for treating lymphedema of the head and neck. The mechanism of action of our patented Flexitouch System is designed to mimic manual lymphatic drainage therapy, the current standard of care in patient treatment. By automating this technique, we believe our system offers an effective, cost-efficient, convenient and accessible treatment for patients.

Our Flexitouch System consists of an electronic controller unit that offers 15 treatment settings and multiple contoured garment configurations for the trunk and the arm or leg. Our Flexitouch System offers flexibility for treating upper and lower extremities and the head and neck, as well as the trunk and chest. The electronic controller is a pneumatic compressor with four connector outlets. Each connector has eight outflow ports into which the garment hoses are connected. Our unique garments contain up to 32 air chambers, are made of a soft, pliable fabric and are designed with hook-and-loop fasteners to fit snugly around affected areas for maximum comfort and optimum pressure delivery. The garments come in a variety of sizes that can be easily adjusted to patients of all sizes. When our system is activated, air passes through the hoses delivering sequential inflation and deflation to the garments, applying gentle pressure to the skin. The inflation sequence is designed to stimulate the lymphatic system moving lymph fluid from the impaired areas towards healthy regions of the body to be processed.

The electronic controller unit adjusts the amount of pressure and the timing of the pressure and release cycles. This unit is lightweight and easily portable, providing maximum convenience for at-home treatment. A typical therapy session using our Flexitouch System lasts one hour, with additional treatment options available if prescribed by a clinician.

ACTitouch System

We introduced our ACTitouch System in the United States in September 2013. Our wearable ACTitouch System combines intermittent pneumatic compression with sustained gradient compression to the lower leg, ankle and foot to improve and accelerate healing, as compared to the current standard of care, which involves sustained compression applied with compression wraps.

Our ACTitouch System consists of a compression sleeve, a control unit, an undersock and a power adapter/charger. The compression sleeve has four chambers that inflate to apply pressure to the leg, is designed with hook and loop fasteners to accommodate a wide range of leg shapes and sizes and may be worn under clothing and with most shoes. The control unit is concealed within the compression sleeve and monitors and adjusts the air pressure to ensure the correct level of compression is applied to the leg. It offers a therapy tracker that monitors and displays average daily use to reinforce therapy goals. The undersock is designed to draw perspiration and moisture away from the skin and has padding in key areas to provide additional comfort. The system comes with a power adapter/charger that is used to power the device directly during intermittent pneumatic compression mode or to charge the battery for ambulatory use. The battery life allows the patient to wear the system all day without recharging.

7

Our ACTitouch System operates in sustained compression mode or intermittent pneumatic compression mode. In sustained compression mode, the system provides sustained, graduated compression to the leg at preset pressures, and the compact, lightweight design gives patients the freedom to stay active while experiencing the benefits of a more comfortable compression therapy. The system ensures consistent compression regardless of variations in sleeve application, and throughout the day monitors and adjusts pressure automatically every 30 minutes in response to changes in leg circumference. In intermittent pneumatic compression mode, the system performs cyclic inflation/deflation sequences to preset gradient pressures. Standard daily treatment involves two hours of intermittent compression while seated or reclining and 10 hours of sustained compression while active. The system is worn throughout the day and has the advantage of being removable for bathing or showering and when driving or operating machinery. The patient removes the system for sleep, allowing the battery to be recharged overnight.

Entré System

We introduced our Entré System in the United States in February 2013 to offer a lightweight, portable pneumatic compression solution for patients who need a basic pump or who do not yet qualify for insurance coverage of an advanced compression device such as our Flexitouch System. Our Entré System is a basic pneumatic compression device used for the at-home treatment of venous disorders including lymphedema and chronic venous insufficiency, including venous leg ulcers. Our Entré System is a pump with garments covering the arm or leg with eight chambers that inflate in sequence and remain inflated for a preset time period. All chambers deflate at once. Our Entré System moves fluid from fingers or toes toward areas closer to the trunk. The system can be programmed to a variety of pressures delivering a prescribed treatment customized to meet the patient's needs.

Clinical Results and Studies

Overview

A key part of our success is our ability to demonstrate the effectiveness of our products by funding studies that generate clinical and economic outcome data supporting our products. We have developed a significant body of clinical data supporting the safety and effectiveness of our products. We intend to continue to invest in additional studies to support peer-reviewed, published articles that evidence the clinical and economic benefits of our solutions as compared to traditional treatments. To date, 14 studies regarding the safety and efficacy of our products have been completed, in which over 1,400 subjects have been included.

Impact on Clinical Outcomes and Healthcare Costs with Use of our Flexitouch System

A retrospective study published by the American Medical Association in JAMA Dermatology demonstrated significant improvement in key clinical endpoints and immediate cost reductions for individuals with lymphedema following receipt of our Flexitouch System. The study was conducted in the United States and included 718 patients with a lymphedema diagnosis who had continuous insurance coverage during the 12 months prior to and the 12 months after receiving our Flexitouch System.

The study evaluated a broad, clinically relevant set of healthcare use outcomes for each patient for the 12 months before and the 12 months after receipt of our Flexitouch System, including cellulitis infections, inpatient hospitalizations, manual therapy and outpatient hospital visits. Receipt of our Flexitouch System was associated with a significant decline in the rate of cellulitis diagnosis in the cancer-related lymphedema patients of 79% (from 21.1% to 4.5%; p<.001) and in the non-cancer-related lymphedema patients of 75% (from 28.8% to 7.3%; p<.001). The inpatient hospitalization rate declined 22% in the cancer-related group (from 2.7% to 2.1%; p=.63) and declined 54% in the non-cancer-related group (from 7.0% to 3.2%; p=.02). The manual therapy rate decreased 30% in the cancer-related lymphedema patients (from 35.6% to 24.9%; p=.001) and decreased 34% in the non-cancer-related lymphedema patients (from 32.3% to 21.2%; p=.001). In addition, outpatient hospital visits declined 29% in the cancer-related patients (from 58.6% to 41.4%; p<.001) and 40% in the non-cancer-related patients (from 52.6% to 31.4%; p<.001).

The study also reviewed lymphedema-related healthcare costs for each patient in the study for the 12 months before and the 12 months after receipt of our Flexitouch System. Among the cancer-related lymphedema patients, total costs per patient, excluding durable medical equipment costs, were reduced by 37%, from $2,597 to $1,642 (p=.002) following receipt of our Flexitouch System. The greatest contributor to this change was a 54% reduction in outpatient hospital costs from $1,517 to $694 (p<.001). Total costs per non-cancer-related lymphedema patients, excluding durable

8

medical equipment costs, were reduced by 36% from $2,937 to $1,883 (p=.007). Outpatient hospital costs for the non-cancer patients declined by 65% from $1,726 to $606 (p<.001).

Flexitouch System Impact on Limb Volume and Patient-Reported Outcomes

A prospective study published in the European Journal of Vascular and Endovascular Surgery demonstrated that use of our Flexitouch System is associated with consistent lower extremity limb volume and pain reduction while achieving improvement in patient health outcomes. The study was conducted in the United States and collected data from a patient registry required by a third-party payer for 196 patients with lower extremity lymphedema who were prescribed our Flexitouch System from January 2009 to May 2012. The primary objective of the study was to examine the effectiveness of our Flexitouch System in reducing lower extremity limb volume, with a secondary objective of evaluating clinician-assessed and patient-reported outcomes.

Use of our Flexitouch System was associated with a reduction in limb volume, with 88% of patients experiencing a reduction in limb volume and with 35% enjoying a reduction in limb volume of greater than 10%. Twelve percent of patients experienced an increase in limb volume. Clinician assessment indicated that the majority of patients experienced improvement in the condition of their skin. In 168, or 86%, of the patients, a reduction in skin hardening or fibrosis was reported based on manual assessment of the skin. Based on clinical observation of function, all but three of these patients demonstrated an increased ability to perform activities of daily living. Additionally, 149, or 77%, of the patients demonstrated improved range of motion.

Patients reported a significant increase in their ability to control lymphedema through treatment with our Flexitouch System, with an increase in function and a reduction in pain. Of the 98 patients who responded, 66% reported being "very satisfied" with the treatment by our Flexitouch System and 29, or 30%, of patients reported being "satisfied" with the treatment by our Flexitouch System.

Comparison of our Flexitouch System with Pneumatic Compression Devices

A prospective, randomized controlled study published in Supportive Care in Cancer demonstrated that our Flexitouch System provides better clinical outcomes as compared to those achieved with a basic pneumatic compression device for home-based treatment of breast cancer-related lymphedema. The study was conducted in the United States and involved 36 patients. This number of participants in the study is considered to be a small sample size and a limitation of the study. The patients were randomized to our Flexitouch System or a basic pneumatic compression device used for home treatment of one-hour per day for 12 weeks. The basic pneumatic compression device used in the study was a Bio Compression 2004 Sequential Circulator pneumatic compression device. The primary objective of the study was to determine whether our Flexitouch System provides better outcomes, as measured by arm edema and tissue water reductions, compared to a basic pneumatic compression device in patients with arm lymphedema. The study does not reflect a comparison of our Flexitouch System to a product that is billed under the same HCPCS Code as our Flexitouch System.

Thirty-six patients with unilateral upper extremity lymphedema with at least 5% arm edema volume at the time of enrollment completed treatments over the 12-week period, with 26 patients being evaluated for edema volume change and 28 patients being evaluated for changes in arm tissue water content. Arm edema volumes were determined from arm girth measurements and suitable model calculations, and tissue water was determined based on measurements of the arm tissue. The patients were randomized into two groups of 18 patients each, with one group receiving treatment with our Flexitouch System and the other group receiving treatment using a basic pneumatic compression device. The group using our Flexitouch System experienced an average reduction in edema of 29% compared to a 16% increase in the group using a basic pneumatic compression device.

Study of Patient-Reported Satisfaction with Use of our Flexitouch System

A retrospective study published in the Oncology Nursing Forum demonstrated that patients using our Flexitouch System were satisfied with the device and perceived it to be beneficial in managing their lymphedema. The study was conducted in the United States and involved 155 patients with lymphedema. The primary objective of the study was to compare treatment protocol adherence, satisfaction and perceived changes in emotional and functional status between patients with cancer-related lymphedema and non-cancer-related lymphedema using our Flexitouch System.

9

Ninety percent of the 155 study patients reported being "satisfied" with our Flexitouch System. Of these patients, more than 65% reported being "extremely satisfied." Further, 95% of patients reported a positive limb volume outcome, which was defined as a patient perceiving that limb volume had been maintained or reduced with device use. Of these patients, 42% reported limb volume decreases as much as 20%, and an additional 20% reported decreases of less than 20%. In addition, clinically and statistically significant improvements occurred in all areas of physical and emotional health (p < 0.006).

Flexitouch System Impact on Patient-Reported Improved Quality-of-Life

A prospective observational study published in Annals of Vascular Surgery demonstrated that use of our Flexitouch System is associated with patient-reported overall improvement in quality-of-life and lower extremity-related symptoms. The study was conducted in the United States and collected data from patients presenting for treatment of lower-extremity lymphedema from March 2011 to September 2014. A total of 100 consecutive patients with lower-extremity lymphedema met inclusion criteria and were included in the study. The primary objective of the study was to demonstrate improved quality-of-life in patients with lower-extremity lymphedema with Flexitouch System treatment. The secondary objective was to demonstrate reduced infectious complications of lymphedema with Flexitouch System treatment, and to determine the incidence of concomitant venous insufficiency in patients with lymphedema.

Use of our Flexitouch System was associated with overall improvement in lower extremity-related symptoms, with 54% of patients reporting greatly improved symptom control after use of our Flexitouch System, 35% moderately improved and 11% mildly improved. In the year before use of our Flexitouch System, 15% of the patients reported 26 episodes of cellulitis, which decreased to five episodes after initiation of the Flexitouch System (P = 0.002) in subsequent median follow-up of 12.7 months. Eight percent of patients reported skin ulceration of the affected extremity in the year before presentation for treatment. The number of lower-extremity ulcers pre- and post-Flexitouch System use decreased from seven to two (P = 0.007). Overall, 46% of the patients had complete limb girth measurements at the ankle and calf, and there was a statistically significant decreased overall limb girth after Flexitouch System treatment in pre- and post-ankle (28.3 cm vs. 27.5 cm, P = 0.01), and calf mean girths (44.7 cm vs. 43.8 cm, P = 0.018). In addition, venous reflux was present in 18% of patients, 14% and 4% within the superficial and deep venous system respectively. In patients with venous reflux, moderate to great improvement in symptoms was reported in 7% and 11%, respectively compared with 28% and 43% in patients without venous reflux (P = 0.257).

Comparison of Conventional Treatment for Venous Leg Ulcers with our ACTitouch System

A prospective, randomized study published in the International Wound Journal demonstrated that our ACTitouch System provides a comparable degree of effectiveness in venous leg ulcer healing to conventional treatment and an improved quality of life for patients. The study was conducted in the United States and Europe, involving a total of 90 patients over a 12-week period. The primary objective of the study was to evaluate the efficacy, functionality, safety, patient perceptions and impact on patient quality of life of two compression methods for venous leg ulcers, including our ACTitouch System and a traditional four-layer bandage system. Of the 90 patients, 38 patients used our ACTitouch System and 52 patients used a traditional four-layer bandage system.

The study demonstrated a comparable degree of effectiveness in venous leg ulcer healing, with healing rate differences not reaching statistical significance. The type and frequency of adverse events reported were similar between the treatment groups and there were no serious adverse events related to treatment in either group. In addition to demonstrating a comparable degree of effectiveness in venous leg ulcer healing, this study also demonstrated that using our ACTitouch System yielded greater improvements in quality of life as compared to those using the bandage system. The only area that our ACTitouch System did not rate higher than the bandage system was discreteness under clothing.

10

Sales and Marketing

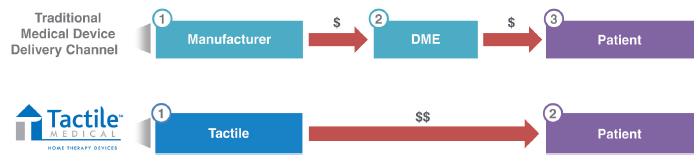

Unlike many of our competitors, we utilize a direct-to-patient and -provider model to market our solutions directly to patients and clinics, whereby we disintermediate the traditional durable medical equipment channel and capture both the manufacturer and distributor margins. The below chart shows this disintermediation:

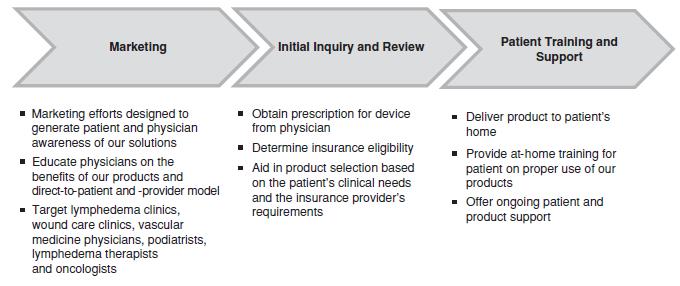

Our direct-to-patient and -provider model is comprised of a direct sales force, contract at-home trainers, reimbursement capabilities and medical expertise to expand awareness, garner referrals and obtain payment for our products. As of December 31, 2016, we employed over 125 full-time sales representatives, including 11 sales managers, who provide coverage throughout the United States. The below chart describes our U.S. direct-to-patient and -provider model.

Our marketing team leads our efforts in brand development, tradeshow attendance, educational forums, product messaging, website development, social media and advertising.

Reimbursement, Payer Relations and Customer Support Process

Private insurance payers represented approximately 74% of our revenues in both 2016 and 2015, while Medicare represented approximately 12% of our revenues in 2016 and 13% of our revenues in 2015. Other payers, including the Veterans Administration, represented the remainder of our revenues. When we sell our solutions directly to patients, we bill third-party payers, such as private insurance or Medicare, on behalf of our patients and bill the patient for their co-payment obligations and deductibles. Any regulatory or legislative developments that eliminate or reduce reimbursement rates for our products could harm our ability to sell our products or cause increasing downward pressure on the prices of our products, either of which would negatively affect our ability to generate the revenues necessary to support our business. For example, changes to the level of Medicare coverage for our products, including a 2015 revision to the criteria that administrative contractors use for Medicare coverage, could reduce the number of Medicare patients who have access to our products. Changes to, or repeal of, the Patient Protection and Affordable Care Act could also potentially impact the number of patients who have access to our products.

11

As a nationwide provider, we have developed a broad expertise in obtaining billing codes, developing coverage policies, overcoming payer barriers, and obtaining authorization and payment from payers across all regions of the United States. Our model utilizes our strategic and operational reimbursement proficiency to meet the varying requirements of hundreds of payers across the country.

To achieve ongoing success in both the strategic and operational reimbursement arenas, we have developed two teams with specialized focus on these respective competencies. Our payer relations group is comprised of 30 employees and is responsible for developing relationships with payer decision-makers. Specifically, this group educates payers on our product efficacy, develops overall payer coverage policies and reimbursement criteria, and manages our Medicare strategy, patient claims, reimbursement codes, and contracts with payers. Our payer relations team is also the advocacy liaison between patients, clinicians and payers through the appeals process. Our reimbursement operations group is comprised of over 70 employees and is responsible for verifying case-by-case benefits, obtaining prior authorization, billing and collecting payments from payers, analyzing payer data to help understand trends, developing processes and patient programs and providing customer support services.

We have strong and established payer relationships, including some of the largest private payers in the United States. Based on our estimates, we are contracted or enrolled as an in-network provider with payers covering over 270 million lives. These contracts allow us to be an in-network provider for patients, enabling them to access our systems at a competitive rate and copay comparable to other suppliers and easing our administrative burden in processing authorizations and claims. We have enjoyed a consistent commercial payer approval rate of greater than 80% for the last eight years, and a greater than 90% Medicare claims submitted approval rate (post-arbitration and based on the number of claims, not dollar amount of claims, submitted across all our products) since we began doing business with Medicare in 2007. We have an in-depth understanding of specific payer coverage criteria, and our submission materials are tailored to address individual payer's distinct requirements. Our dedicated customer service team is available to answer patient questions regarding reimbursement, account status, device operation and troubleshooting during normal business hours. We receive no additional reimbursement for patient support, but provide high-quality customer service and continuity of care to enhance patient comfort, satisfaction, compliance and safety with our products.

Our Flexitouch System is reimbursed under HCPCS code E0652, and our ACTitouch System and Entré System are reimbursed under HCPCS code E0651. Garments that cover various parts of the body are used with these systems and billed using HCPCS codes E0667, E0668 and E0669. As of December 31, 2016, over 900 payers have paid for our products.

Research and Clinical Operations

We are committed to ongoing research and development as part of our efforts to be at the forefront of patient preference in the area of chronic disease, especially lymphedema and chronic venous insufficiency. As of December 31, 2016, our research and development and clinical operations staff included more than 10 engineers, scientists, clinical monitors and project managers with expertise in trial management, pneumatics, electronics, garment design, embedded software, mechanical design, sensors and manufacturing technologies. Our research and development expenses, including spending on our clinical evidence development efforts, totaled $4.5 million and $4.3 million for the years ended December 31, 2016 and 2015, respectively. Our current research and development efforts are focused primarily on increasing efficacy, improving design for ease-of-use, enhancing clinical functionality and reducing production costs of our solutions. Our clinical development efforts are focused on further differentiating our products from our competitors. We coordinate our development efforts with our intellectual property strategies in order to enhance our ability to obtain patent and other intellectual property protection.

Manufacturing and Quality Assurance

Our manufacturing and quality assurance model combines our internal manufacturing resources and expertise, including assembly, quality assurance, material procurement and inventory control, with approved third-party manufacturers and suppliers of system components. Our internal manufacturing activities, located in Minneapolis, Minnesota, include quality inspection, assembly, packaging, warehousing and shipping of our products. We outsource the manufacture of components, which are produced to our specifications and shipped to our facilities for inspection and final assembly. We use third-party manufacturers and suppliers worldwide to source our components, maintaining dual-source vendors of critical components whenever possible, and leveraging competitive bids among third-party

12

manufacturers and suppliers to control costs. We have elected to source certain key components from single sources of supply, including our ACTitouch controller. While we believe alternate sources exist for the ACTitouch controller, we have not yet qualified an alternate supplier. Quality control, risk management, efficiency and the ability to respond quickly to changing requirements are the primary goals of our manufacturing operations. We believe our manufacturing model permits us to operate with low capital expenditure requirements. We carefully manage our supply chain in an effort to take costs out of the manufacturing process, as demonstrated by a 58% reduction in controller costs for our Flexitouch System since 2008.

We manage our arrangements with our third-party manufacturers and suppliers to adjust delivery schedules and quantities of components to match our changing manufacturing requirements. We forecast our component needs based on historical trends, current utilization patterns and sales forecasts of future demand. We establish our relationships with our third-party manufacturers and suppliers through supplier contracts and purchase orders. In most cases, these supplier relationships may be terminated by either party upon short notice.

In order to mitigate against the risks related to a single-source of supply, we qualify alternative suppliers, when possible, and develop contingency plans for responding to disruptions, including maintaining adequate inventory of any single source components, along with requiring each supplier to maintain specified quantities of inventory. To date, we have not experienced material delays in obtaining any of our components, nor has the ready supply of finished products to our patients or clinicians been adversely affected by component supply issues.

We have implemented a quality management system designed to comply with FDA regulations and International Standards Organization, or ISO, standards governing medical device products. In the United States, we and certain of our manufacturers are required to manufacture our products in compliance with the FDA's Quality System Regulation, which covers the methods and documentation of the design, testing, control, manufacturing, labeling, quality assurance, packaging, storage, and shipping for our products. We maintain a quality management system to control compliance with such requirements and have procedures in place designed to ensure that all products and materials purchased by us conform to our requirements and FDA regulations. As of December 31, 2016, we had over 25 employees in operations, manufacturing and quality assurance. Our quality management system has been certified to ISO in 2012 and 2014, including ISO 13485:2003. Many of our manufacturers' quality management systems also have been certified to ISO.

Order Fulfillment and Patient Training

Once we have a complete order and prior authorization from the payer, we package and ship a system, configured to their physician's prescription, directly to the patient. Our primary logistics partner is United Parcel Service, which we use for delivery and pick up of our devices. After delivery, we coordinate a visit from one of our over 400 licensed, independent contract trainers that go to our patients' homes to provide individualized training to our patients, when requested. These trainers are healthcare professionals, licensed in their state of residence, who we have identified through our sales and marketing interest and instructed on proper use of our products. Training visits are coordinated from our offices in Minneapolis and training sessions assigned by our staff. Upon completion of training, the independent contractor submits an invoice to us for payment for the patient's training and their travel.

Competition

The pneumatic compression pump market is a competitive industry, and we compete with a number of manufacturers and distributors of pneumatic compression pumps. Our most significant competitors are Bio Compression Systems, Inc. and Lympha Press USA. Other competitors are Wright Therapy Products (which was acquired by BSN Medical GmbH in 2015), Devon Medical Products, Inc. and NormaTec Industries. If we expand internationally, we expect that ArjoHuntleigh, an affiliate of Getinge Group, would become a competitor, in addition to other potential international competitors.

Given the growth of the pneumatic compression pump market, we expect that the industry will become increasingly competitive in the future. Manufacturing companies compete for sales to patients primarily based on product features and service.

We believe we are the only pneumatic compression home-therapy device company with a meaningful U.S. market position supported by a direct sales force. We believe our manufacturing competitors' complete reliance on home medical equipment distribution intermediaries compresses their margins and limits their ability to invest in product

13

features that address consumer preferences. To pursue a direct-to-patient and -provider sales model, our manufacturing competitors would need to meet national accreditation and state-by-state licensing requirements and secure Medicare billing privileges, as well as compete directly with the home medical equipment providers that many rely on across their entire home care businesses.

Some of our competitors and potential competitors are large, well-capitalized companies with greater resources than we have. As a consequence, they are able to spend more aggressively on product development, marketing, sales and other product initiatives than we can. Some of these competitors have:

|

· |

significantly greater name recognition; |

|

· |

established relations with healthcare professionals, customers, and third-party payers; |

|

· |

established distribution networks; |

|

· |

additional lines of products, and the ability to offer rebates or bundle products to offer higher discounts or other incentives to gain a competitive advantage; |

|

· |

greater history in conducting research and development, manufacturing, marketing, and obtaining regulatory approval for homecare devices; and |

|

· |

greater financial and human resources for product development, sales and marketing, patent litigation and customer financing. |

As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. In light of our competitors' advantages, even if our technology and direct-to-patient and -provider marketing strategy is more effective than the technology and marketing strategy of our competitors, current or potential customers might accept competitor products and services in lieu of purchasing our products. We anticipate that we will face increased competition in the future as existing companies and competitors develop new or improved products and distribution strategies and as new companies enter the market with new technologies and distribution strategies. We may not be able to compete effectively against these organizations. Our ability to compete successfully and to increase our market share is dependent upon our reputation for providing responsive, professional and high-quality products and services and achieving strong customer satisfaction. Increased competition in the future could adversely affect our revenues, revenues growth rate, if any, margins and market share.

Government Regulation

Our systems are medical devices subject to extensive and ongoing regulation by numerous governmental authorities, principally the FDA, and corresponding state and foreign regulatory agencies.

FDA Regulation

In the United States, the FDA regulates medical devices, including the following activities that we perform, or that are performed on our behalf with respect to our devices: product design and development, pre-clinical and clinical testing, manufacturing, labeling, storage, premarket clearance or approval, record keeping, product marketing, advertising and promotion, sales and distribution, and post-marketing surveillance. Failure to comply with applicable U.S. requirements may subject us to a variety of administrative or judicial sanctions, such as warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution. The FDA can also refuse to clear or approve pending applications.

Unless an exemption applies, each medical device we seek to distribute commercially in the United States requires marketing authorization from the FDA prior to distribution. The two primary types of FDA marketing authorization applicable to a device are premarket notification, also called 510(k) clearance, and premarket approval. The type of marketing authorization is generally linked to the classification of the device. The FDA classifies medical devices into one of three classes — Class I, Class II or Class III — based on the degree of risk the FDA determines to be associated with a device and the level of regulatory control deemed necessary to ensure the device's safety and effectiveness.

14

Devices requiring fewer controls because they are deemed to pose lower risk are placed in Class I or II. Class I devices are deemed to pose the least risk and are subject only to general controls applicable to all devices, such as requirements for device labeling, premarket notification, and adherence to the FDA's Good Manufacturing Practices. Class II devices are intermediate risk devices that are subject to general controls and may also be subject to special controls such as performance standards, product-specific guidance documents, special labeling requirements, patient registries, or post-market surveillance. Class III devices are those for which insufficient information exists to assure safety and effectiveness solely through general controls or if the device is a life-sustaining, life-supporting or a device of substantial importance in preventing impairment of human health, or which presents a potential, unreasonable risk of illness or injury and special controls are not adequate to assure safety and effectiveness.

Most Class I devices and some Class II devices are exempted by regulation from the 510(k) clearance requirement and can be marketed without prior authorization from the FDA. Most Class II devices (and certain Class I devices that are not exempt) are eligible for marketing through the 510(k) clearance pathway. By contrast, devices placed in Class III generally require premarket approval or 510(k) de novo clearance prior to commercial marketing. The premarket approval process is more stringent, time-consuming, and expensive than the 510(k) clearance process. However, the 510(k) clearance process has also become increasingly stringent and expensive.

510(k) Clearance Pathway. When a 510(k) clearance is required, we must submit a premarket notification to the FDA demonstrating that our proposed device is "substantially equivalent" to a previously cleared and legally marketed 510(k) device or a device that was in commercial distribution before May 28, 1976 for which the FDA has not yet called for the submission of a premarket approval application, which is commonly known as the "predicate device." A device is substantially equivalent if, with respect to the predicate device, it has the same intended use and has either (i) the same technological characteristics or (ii) different technological characteristics and the information submitted demonstrates that the device is as safe and effective as a legally marked device and does not raise different questions of safety or effectiveness. By law, the FDA is required to clear or deny a 510(k) premarket notification within 90 days of submission of the application. As a practical matter, clearance often takes significantly longer. The FDA may require further information, including clinical data, to make a determination regarding substantial equivalence. If the FDA determines that the device, or its intended use, is not substantially equivalent to a previously-cleared device or use, the FDA will issue a not substantially equivalent decision. This means the device cannot be cleared through the 510k process and will require marketing authorization through the premarket approval pathway. We obtained 510(k) clearance for our Flexitouch System in October 2006 and for a discontinued predecessor system in July 2002. In September 2016, we received 510(k) clearance from the FDA for the Flexitouch System for treating lymphedema of the head and neck. We obtained 510(k) clearance for our ACTitouch System in June 2013 and our Entré System in May 2015.

Premarket Approval Pathway. A premarket approval application must be submitted to the FDA if the device cannot be cleared through the 510(k) process. The premarket approval application process is much more demanding than the 510(k) premarket notification process and requires the payment of significant user fees. A premarket approval application must be supported by valid scientific evidence, which typically requires extensive data, including but not limited to technical, preclinical, clinical trials, manufacturing and labeling to demonstrate to the FDA's satisfaction reasonable evidence of safety and effectiveness of the device.

The FDA has 45 days from its receipt of a premarket approval application to determine whether the application will be accepted for filing based on the FDA's threshold determination that it is sufficiently complete to permit substantive review. After the FDA determines that the application is sufficiently complete to permit a substantive review, the FDA will accept the application and begin its in-depth review. The FDA has 180 days to review an "accepted" premarket approval application, although this process typically takes significantly longer and may require several years to complete. During this review period, the FDA may request additional information or clarification of the information already provided. Also, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. In addition, the FDA will conduct a preapproval inspection of the manufacturing facility to ensure compliance with quality system regulations. The FDA may delay, limit or deny approval of a premarket approval application for many reasons, including:

|

· |

failure of the applicant to demonstrate that there is reasonable assurance that the medical device is safe or effective under the conditions of use prescribed, recommended or suggested in the proposed labeling; |

|

· |

insufficient data from the preclinical studies and clinical trials; or |

15

|

· |

the manufacturing processes, methods, controls or facilities used for the manufacture, processing, packing or installation of the device do not meet applicable requirements. |

If the FDA evaluations of both the premarket approval application and the manufacturing facilities are favorable, the FDA will either issue an approval order or an approvable letter, which usually contains a number of conditions that must be met in order to secure final approval of the premarket approval application. If the FDA's evaluation of the premarket approval application or manufacturing facilities is not favorable, the FDA will deny approval of the premarket approval application or issue a not approvable letter. A not approvable letter will outline the deficiencies in the application and, where practical, will identify what is necessary to make the premarket approval application. The FDA may also determine that additional clinical trials are necessary, in which case the premarket approval application may be delayed for several months or years while the trials are conducted and then the data submitted in an amendment to the premarket approval application. Once granted, premarket approval application may be withdrawn by the FDA if compliance with post approval requirements, conditions of approval or other regulatory standards is not maintained or problems are identified following initial marketing.

Clinical Trials. Clinical trials are almost always required to support premarket approval and are sometimes required for 510(k) clearance. In the United States, these trials generally require submission of an application for an Investigational Device Exemption, or IDE, to the FDA. The IDE application must be supported by appropriate data, such as animal and laboratory testing results, showing it is safe to test the device in humans and that the testing protocol is scientifically sound. The FDA must approve the IDE in advance of trials for a specific number of patients unless the product is deemed a non-significant risk device eligible for more abbreviated IDE requirements or the clinical investigation is exempt from the IDE regulations. Clinical trials for significant risk devices may not begin until the IDE application is approved by the FDA and the appropriate institutional review boards, or IRBs, at the clinical trial sites. We, the FDA or the IRB at each site at which a clinical trial is being performed may suspend a clinical trial at any time for various reasons, including a belief that the risks to study subjects outweigh the benefits. Even if a trial is completed, the results of clinical testing may not demonstrate the safety and efficacy of the device, may be equivocal or may otherwise not be sufficient to obtain approval or clearance of the product.

FDA Ongoing Regulation. Even after a device receives clearance or approval by the FDA and is placed on the market, numerous regulatory requirements apply. These include:

|

· |

establishment registration and device listing; |

|

· |

quality system regulation, which requires manufacturers, including third-party manufacturers, to follow stringent design, testing, control, documentation and other quality assurance procedures during all aspects of the manufacturing process; |

|

· |

labeling regulations and the FDA prohibitions against the promotion of products for un-cleared, unapproved or "off-label" uses, and other requirements related to promotional activities; |

|

· |

medical device reporting regulations, which require that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction were to recur; |

|

· |

corrections and removals reporting regulations, which require that manufacturers report to the FDA field corrections and product recalls or removals if undertaken to reduce a risk to health posed by the device or to remedy a violation that may present a risk to health; and |

|

· |

post-market surveillance regulations, which apply when necessary to protect the public health or to provide additional safety and effectiveness data for the device. |

After a device receives 510(k) clearance or a premarket approval, in general any modification that could significantly affect its safety or effectiveness, or that would constitute a major change in its intended use, will require a new clearance or approval. The FDA requires each manufacturer to make this determination, but the FDA can review any such decision and can disagree with a manufacturer's determination. We have modified various aspects of our systems since receiving regulatory clearance, but we believe that new 510(k) clearances are not required for these

16

modifications. If the FDA disagrees with our determination not to seek a new 510(k) clearance, the FDA may retroactively require us to seek 510(k) clearance or premarket approval. The FDA could also require us to cease marketing and distribution and/or recall the modified device until 510(k) clearance or premarket approval is obtained. Also, in these circumstances, we may be subject to significant regulatory fines and penalties.

Failure to comply with applicable regulatory requirements can result in enforcement action by the FDA, which may include any of the following sanctions: Warning Letters, fines, injunctions, civil or criminal penalties, recall or seizure of our products, operating restrictions, partial suspension or total shutdown of production, refusing our request for 510(k) clearance or premarket approval of new products, rescinding previously granted 510(k) clearances or withdrawing previously granted premarket approvals.

We are also subject to announced and unannounced inspections by the FDA, and these inspections may include the manufacturing facilities of our subcontractors. We were audited two times since January 2010 by the FDA and found to be in compliance with the Quality System Regulation. We cannot assure you that we can maintain a comparable level of regulatory compliance in the future at our facility.

FTC Regulation

Device advertising and promotional activity in certain circumstances is also subject to scrutiny by the Federal Trade Commission, as well as similar state consumer protection agencies, which enforce laws related to false and deceptive trade practices. A company that is found to have advertised its product in violation of these laws may be subject to liability, including monetary penalties.

Centers for Medicare and Medicaid Services