Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MERIT MEDICAL SYSTEMS INC | a02242017-8kpressreleaseex.htm |

| 8-K/A - 8-K/A - MERIT MEDICAL SYSTEMS INC | a2242017-amended8xk.htm |

1

Fourth Quarter and FY2016 Results

2017 Guidance

FRED LAMPROPOULOS

Chairman & CEO

BERNARD BIRKETT

CFO

EXHIBIT 99.2

2

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This presentation and any accompanying management commentary include “forward-looking statements,” as defined within applicable securities laws and regulations. All statements in this

presentation, other than statements of historical fact, are “forward-looking statements”, including projections of earnings, revenues or other financial items, statements regarding our plans and

objectives for future operations, statements concerning proposed products or services, statements regarding the integration, development or commercialization of our business or any business,

assets or operations we have acquired or may acquire, statements regarding future economic conditions or performance, statements regarding governmental inquiries, investigations or

proceedings and statements of assumptions underlying any of the foregoing. All forward-looking statements, including financial projections, included in this presentation are made as of the

date of this presentation, and are based on information available to us as of such date. We assume no obligation to update or disclose revisions to any forward-looking statement. In some

cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “likely,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “projects,”

”forecast,” “potential,” “plan,” or other comparable terminology. Forward-looking statements are based on our current beliefs, expectations and assumptions regarding our business, domestic

and global economies, regulatory and competitive environments and other conditions. There can be no assurance that such beliefs, expectations or assumptions or any of the forward-looking

statements will prove to be correct. Actual results will likely differ, and may differ materially, from those projected or assumed in the forward-looking statements. Our future financial and

operating results and condition, as well as any forward-looking statements, are subject to inherent risks and uncertainties such as those described in our Annual Report on Form 10-K for the year

ended December 31, 2015 and other filings with the U.S. Securities and Exchange Commission. Such risks and uncertainties include risks relating to our potential inability to successfully manage

growth through acquisitions, including the inability to commercialize technology acquired through completed, proposed or future transactions; product recalls and product liability claims;

expenditures relating to research, development, testing and regulatory approvals of our products and risks that such products may not be developed successfully or approved for commercial

use; governmental scrutiny and regulation of the medical device industry, including governmental inquiries, investigations or proceedings; reforms to the 510(k) process administered by the

U.S. Food and Drug Administration; restrictions on our liquidity or business operations resulting from our debt agreements; infringement of our technology or the assertion that our technology

infringes the rights of other parties; the potential of fines, penalties or other adverse consequences if our employees or agents violate the U.S. Foreign Corrupt Practices Act or other laws or

regulations; laws and regulations targeting fraud and abuse in the healthcare industry; potential for significant adverse changes in governing regulations; changes in tax laws and regulations in

the United States or other countries; increases in the prices of commodity components; negative changes in economic and industry conditions in the United States or other countries;

termination or interruption of relationships with our suppliers, or failure of such suppliers to perform; fluctuations in exchange rates; concentration of a substantial portion of our revenues

among a few products and procedures; development of new products and technology that could render our existing products obsolete; market acceptance of new products; volatility in the

market price of our common stock; modification or limitation of governmental or private insurance reimbursement policies; changes in healthcare policies or markets related to healthcare

reform initiatives; failure to comply with applicable environmental laws; changes in key personnel; work stoppage or transportation risks; introduction of products in a timely fashion; price and

product competition; availability of labor and materials; and fluctuations in and obsolescence of inventory.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The financial projections set forth in this

presentation are based on a number of assumptions, estimates and forecasts. The inaccuracy of any one of those assumptions, estimates or forecasts could materially impact our financial

results. Inevitably, some of those assumptions, estimates or forecasts will not occur and unanticipated events and circumstances will occur subsequent to the date of this presentation. In

addition to changes in the underlying assumptions, our future performance is subject to a number of risks and uncertainties with respect to our existing and proposed business, and other factors

that may cause our actual results or performance to be materially different from any predicted or implied. Although we have attempted to identify important assumptions in the financial

projections, there may be other factors that could materially affect our actual financial performance, and no assurance can be given that all material factors have been considered in the

preparation of the financial projections. Accordingly, you should not place undue reliance on such projections. Future operating results are, in fact, impossible to predict.

3

NON-GAAP FINANCIAL MEASURES

Although Merit’s financial statements are prepared in accordance with accounting principles which are generally accepted in the United

States of America (“GAAP”), Merit’s management believes that certain non-GAAP financial measures provide investors with useful

information regarding the underlying business trends and performance of Merit’s ongoing operations and can be useful for period-over-

period comparisons of such operations. Certain financial measures included in this presentation, or which may be referenced in

management’s discussion of Merit’s historical and future operations and financial results, have not been calculated in accordance with GAAP,

and, therefore, are referenced as non-GAAP financial measures. Readers should consider non-GAAP measures used in this presentation in

addition to, not as a substitute for, financial reporting measures prepared in accordance with GAAP. These non-GAAP financial measures

exclude some, but not all, items that may affect Merit's net income. In addition, they are subject to inherent limitations as they reflect the

exercise of judgment by management about which items are excluded. Additionally, non-GAAP financial measures used in this presentation

may not be comparable with similarly titled measures of other companies. Merit urges investors and potential investors to review the

reconciliations of its non-GAAP financial measures to the comparable GAAP financial measures, and not to rely on any single financial

measure to evaluate Merit’s business or results of operations. Please refer to “Notes to Non-GAAP Financial Measures” at the end of these

materials for more information.

TRADEMARKS

Unless noted otherwise, trademarks used in this presentation are the property of Merit Medical Systems, Inc., in the United States and other

jurisdictions.

4

Financial Summary

GAAP

Q4 2016 Q4 2015 FY2016 FY2015

Revenue $157.7M $138.4M $603.8M $542.1M

Gross Margin 44.5% 43.6% 43.9% 43.5%

Net Income $7.5M $6.4M $20.1M $23.8M

EPS $0.17 $0.14 $0.45 $0.53

5

Financial Summary

Non-GAAP

Q4 2016 Q4 2015 FY2016 FY2015

Revenue (Constant Currency) $159.0M $138.4M $608.8M $542.1M

Revenue (Reported) $157.7M $138.4M $603.8M $542.1M

Gross Margin 48.4% 45.6% 46.9% 45.6%

Net Income $13.8M $10.8M $45.1M $38.5M

EPS $0.31 $0.24 $1.01 $0.87

6

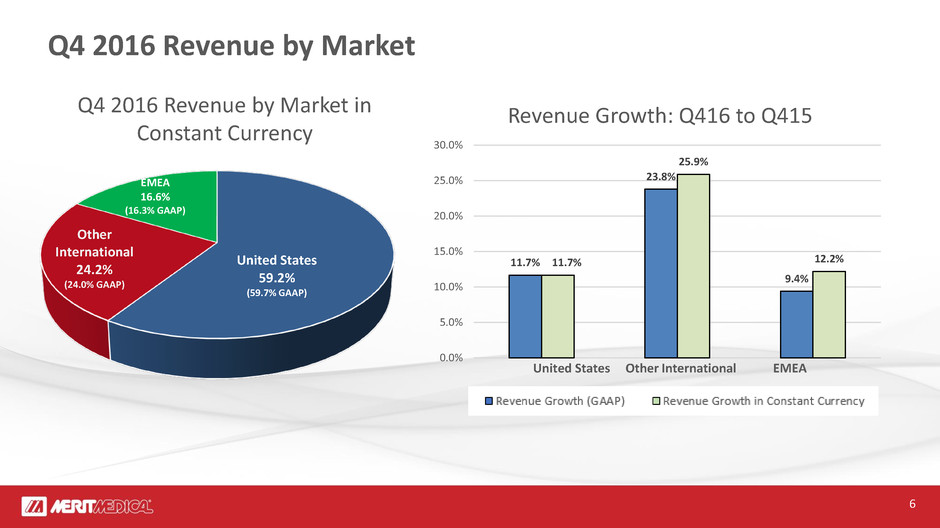

Q4 2016 Revenue by Market

United States

59.2%

(59.7% GAAP)

Other

International

24.2%

(24.0% GAAP)

EMEA

16.6%

(16.3% GAAP)

Q4 2016 Revenue by Market in

Constant Currency

11.7%

23.8%

9.4%

11.7%

25.9%

12.2%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

Revenue Growth: Q416 to Q415

United States Other International EMEA

7

2016 YTD Revenue by Market

United States Other International EMEA

2016 Revenue by Market in

Constant Currency

12.9%

15.1%

1.3%

12.9%

16.6%

4.6%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

Revenue Growth: 2016 to 2015

8

Global Reach

9

Growth Drivers for 2017

• New Products

- CorVocet™ Biopsy System

- SwiftNINJA® Steerable Microcatheter

- Elation™ GI & Pulmonary Balloons

- TWISTER® PLUS Rotatable Retrieval Device

- PreludeEASE™ Hydrophilic Sheath Introducer

- PreludeSync™ Radial Compression Device

10

Growth Drivers for 2017

• New Products

- HeRO® Graft

- Super HeRO®

- True Form™ Guide Wires

- Heartspan® Transseptal Sheath

- Amplatz Guide Wires

- Merit PAK™ Pedal Access

• Wholesale to Retail

- Japan

11

Growth Drivers for 2017

• New Products

- Critical Care Products from Argon®

- DualCap® Disinfection & Protection

12

2017 Guidance

Revenues $713M - $723M

Gross Margin GAAP 45.0% - 45.5%

Gross Margin Non-GAAP 48.0% - 48.5%

EPS GAAP $0.54 - $0.60

EPS Non-GAAP $1.15 - $1.20

13

1 2 3 4

Disciplined,

customer-focused

enterprise

Guided by strong core

values to globally

address unmet or

underserved

healthcare needs

Target high-growth,

high-return

opportunities

Through understanding,

innovating, and delivering

in peripheral, cardiac,

OEM, and endoscopy

business lines

Optimize operational

capability

Through lean processes,

cost effective

environments, and asset

utilization

Enhance growth

and profitability

Through R&D, sales

model optimization,

cost discipline, and

operational focus

14

NOTES TO NON-GAAP FINANCIAL MEASURES

For additional details, please see the accompanying press release and forward-looking statement disclosure.

These presentation materials and associated commentary from Merit’s management, as well as the press release issued today, use non-GAAP

financial measures, including:

• constant currency revenue;

• core revenue;

• non-GAAP net income;

• non-GAAP earnings per share; and

• non-GAAP gross margin.

Merit’s management team uses these non-GAAP financial measures to evaluate Merit’s profitability and efficiency, to compare operating results

to prior periods, to evaluate changes in the operating results of each segment, and to measure and allocate financial resources internally.

However, Merit’s management does not consider such non-GAAP measures in isolation or as an alternative to such measures determined in

accordance with GAAP.

Readers should consider non-GAAP measures in addition to, not as a substitute for, financial reporting measures prepared in accordance with

GAAP. These non-GAAP financial measures exclude some, but not all, items that may affect Merit's net income. In addition, they are subject to

inherent limitations as they reflect the exercise of judgment by management about which items are excluded. Merit believes it is useful to

exclude such expenses in the calculation of non-GAAP net income, non-GAAP earnings per share and non-GAAP gross margin (in each case, as

further illustrated in the reconciliation table below) because such amounts in any specific period may not directly correlate to the underlying

performance of Merit’s business operations and can vary significantly between periods as a result of factors such as new acquisitions, non-cash

expense related to amortization of previously acquired tangible and intangible assets, unusual compensation expenses or expenses resulting

from litigation or governmental proceedings. Merit may incur similar types of expenses in the future, and the non-GAAP financial information

included in this presentation should not be viewed as a statement or indication that these types of expenses will not recur. Additionally, the

non-GAAP financial measures used in this presentation may not be comparable with similarly titled measures of other companies. Merit urges

investors and potential investors to review the reconciliations of its non-GAAP financial measures to the comparable GAAP financial measures,

and not to rely on any single financial measure to evaluate Merit’s business or results of operations.

Constant Currency Reconciliation

Merit’s revenue on a constant currency basis is prepared by translating the current-period reported sales of subsidiaries whose functional

currency is other than the U.S. dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. The constant

currency revenue adjustments of $1.3 million and $4.9 million for the three and twelve-month periods ended December 31, 2016, respectively,

were calculated using the applicable average foreign exchange rates for the three and twelve-month periods ended December 31, 2015.

15

NOTES TO NON-GAAP FINANCIAL MEASURES (continued)

Core Revenue

Merit’s core revenue is defined as reported revenue, excluding revenues attributable to the acquisition of the HeRO® Graft and DFINE, Inc. in

2016.

Other Non-GAAP Financial Measure Reconciliation

The following table sets forth supplemental financial data and corresponding reconciliations of non-GAAP net income and non-GAAP earnings

per share to Merit’s net income and earnings per share prepared in accordance with GAAP, in each case, for the three and twelve-month periods

ended December 31, 2016 and 2015. Non-GAAP gross margin is calculated by reducing GAAP cost of sales by amounts recorded for amortization

of intangible assets, inventory mark-up and severance expense related to acquisitions. The non-GAAP income adjustments referenced in the

following table do not reflect stock-based compensation expense of approximately $593,000 and $600,000 for the three-month periods ended

December 31, 2016 and 2015, respectively, and approximately $2.5 million and $2.2 million for the twelve-month periods ended December 31,

2016 and 2015, respectively.

16

17