Exhibit 13

STATEMENT OF FINANCIAL RESPONSIBILITY AND MANAGEMENT’S REPORT

ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management’s Statement of Responsibility

The

management of Martin Marietta Materials, Inc. (“Martin Marietta” or “Corporation”), is responsible for the consolidated financial statements, the related financial information contained in this 2016 Annual Report and the

establishment and maintenance of adequate internal control over financial reporting. The consolidated balance sheets for Martin Marietta, at December 31, 2016 and 2015, and the related consolidated statements of earnings, comprehensive

earnings, total equity and cash flows for each of the three years in the period ended December 31, 2016, include amounts based on estimates and judgments and have been prepared in accordance with accounting principles generally accepted in the

United States applied on a consistent basis.

A system of internal control over financial reporting is designed to provide reasonable assurance, in

a cost-effective manner, that assets are safeguarded, transactions are executed and recorded in accordance with management’s authorization, accountability for assets is maintained and financial statements are prepared and presented fairly in

accordance with accounting principles generally accepted in the United States. Internal control systems over financial reporting have inherent limitations and may not prevent or detect misstatements. Therefore, even those systems determined to be

effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

The Corporation operates in an

environment that establishes an appropriate system of internal control over financial reporting and ensures that the system is maintained, assessed and monitored on a periodic basis. This internal control system includes examinations by internal

audit staff and oversight by the Audit Committee of the Board of Directors.

The Corporation’s management recognizes its responsibility to

foster a strong ethical climate. Management has issued written policy statements that document the Corporation’s business code of ethics. The importance of ethical behavior is regularly communicated to all employees through the distribution of

the Code of Ethical Business Conduct booklet and through ongoing education and review programs designed to create a strong commitment to ethical business practices.

The Audit Committee of the Board of Directors, which consists of four independent, nonemployee directors, meets periodically and separately with

management, the independent auditors and the internal auditors to review the activities of each. The Audit Committee meets standards established by the Securities and Exchange Commission and the New York Stock Exchange as they relate to the

composition and practices of audit committees.

Management’s Report on Internal Control over Financial Reporting

The management of Martin Marietta is responsible for establishing and maintaining adequate control over financial reporting. Management assessed the

effectiveness of the Corporation’s internal control over financial reporting as of December 31, 2016. In making this assessment, management used the criteria set forth in Internal Control – Integrated Framework issued by the

Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) (“COSO”). Based on management’s assessment under the framework in Internal Control – Integrated Framework, management concluded that the

Corporation’s internal control over financial reporting was effective as of December 31, 2016.

In making this assessment of internal

control over financial reporting as of December 31, 2016, management has excluded the internal controls of its newly-acquired Ratliff ready mixed concrete operations, which are included in the consolidated financial statements for the period

ended December 31, 2016 and constituted approximately 1% of consolidated total assets as of December 31, 2016 and approximately 1% of net sales for the year ended December 31, 2016.

The 2016 consolidated financial statements and effectiveness of internal control over financial reporting have been audited by PricewaterhouseCoopers,

LLP, an independent registered public accounting firm, whose report appears on the following page.

|

|

|

|

C. Howard Nye

Chairman, President and Chief Executive Officer February 24, 2017 |

|

Anne H. Lloyd Executive Vice President and Chief

Financial Officer |

| |

| |

| |

Martin

Marietta | Page 7

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To Board of Directors and Shareholders of Martin Marietta Materials, Inc.

In our opinion, the accompanying consolidated balance sheet as of December 31, 2016 and the related consolidated statements of earnings, comprehensive

earnings, total equity, and cash flows for the year then ended present fairly, in all material respects, the financial position of Martin Marietta Materials, Inc. and its subsidiaries at December 31, 2016, and the results of their operations

and their cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the financial statement schedule listed in the index appearing under

Item 15(a)(2) as of and for the year ended December 31, 2016 presents fairly, in all material respects, the information set forth therein when read in conjunction with the related consolidated financial statements. Also in our opinion, the

Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2016, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of

Sponsoring Organizations of the Treadway Commission (COSO). The Company’s management is responsible for these financial statements and financial statement schedule, for maintaining effective internal control over financial reporting and for its

assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express opinions on these financial

statements, on the financial statement schedule, and on the Company’s internal control over financial reporting based on our integrated audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight

Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting

was maintained in all material respects. Our audit of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant

estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk

that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the

circumstances. We believe that our audit provides a reasonable basis for our opinions.

A company’s internal control over financial reporting

is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s

internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the

company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company

are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the

company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over

financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of

compliance with the policies or procedures may deteriorate.

As described in the Management’s Report on Internal Control over Financial

Reporting, management has excluded Ratliff Ready-Mix, L.P. from its assessment of internal control over financial reporting as of December 31, 2016 because it was acquired by the Company in a purchase

business combination during 2016. We have also excluded Ratliff Ready-Mix, L.P. from our audit of internal control over financial reporting. Ratliff Ready-Mix, L.P. is a

wholly-owned subsidiary whose total assets and net sales each represent approximately 1% of the related consolidated financial statement amounts as of and for the year ended December 31, 2016.

/s/ PricewaterhouseCoopers LLP

Raleigh, North Carolina

February 24, 2017

Martin

Marietta | Page 8

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To Board of Directors and Shareholders of Martin Marietta Materials, Inc.

We have audited the accompanying consolidated balance sheets of Martin Marietta Materials, Inc. as of December 31, 2015 and the related

consolidated statements of earnings, comprehensive earnings, total equity and cash flows for each of the two years in the period ended December 31, 2015. These financial statements are the responsibility of the Corporation’s management.

Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the

standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit

includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the

overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial

statements referred to above present fairly, in all material respects, the consolidated financial position of Martin Marietta Materials, Inc. at December 31, 2015 and the consolidated results of its operations and its cash flows for each of the

two years in the period ended December 31, 2015, in conformity with U.S. generally accepted accounting principles.

|

|

|

| Raleigh, North Carolina

February 24, 2017 |

|

|

Martin

Marietta | Page 9

|

|

|

| CONSOLIDATED STATEMENTS OF EARNINGS

for years ended December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (add 000, except per share) |

|

2016 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

| Net Sales |

|

$ |

3,576,767 |

|

|

|

|

$ |

3,268,116 |

|

|

|

|

$ |

2,679,095 |

|

| Freight and delivery revenues |

|

|

241,982 |

|

|

|

|

|

271,454 |

|

|

|

|

|

278,856 |

|

| Total revenues |

|

|

3,818,749 |

|

|

|

|

|

3,539,570 |

|

|

|

|

|

2,957,951 |

|

| Cost of sales |

|

|

2,667,801 |

|

|

|

|

|

2,546,349 |

|

|

|

|

|

2,156,735 |

|

| Freight and delivery costs |

|

|

241,982 |

|

|

|

|

|

271,454 |

|

|

|

|

|

278,856 |

|

| Total cost of revenues |

|

|

2,909,783 |

|

|

|

|

|

2,817,803 |

|

|

|

|

|

2,435,591 |

|

| Gross Profit |

|

|

908,966 |

|

|

|

|

|

721,767 |

|

|

|

|

|

522,360 |

|

| Selling, general and administrative expenses |

|

|

248,005 |

|

|

|

|

|

218,234 |

|

|

|

|

|

169,245 |

|

| Acquisition-related expenses, net |

|

|

1,683 |

|

|

|

|

|

8,464 |

|

|

|

|

|

42,891 |

|

| Other operating (income) and expenses, net |

|

|

(8,043) |

|

|

|

|

|

15,653 |

|

|

|

|

|

(4,649) |

|

| Earnings from Operations |

|

|

667,321 |

|

|

|

|

|

479,416 |

|

|

|

|

|

314,873 |

|

| Interest expense |

|

|

81,677 |

|

|

|

|

|

76,287 |

|

|

|

|

|

66,057 |

|

| Other nonoperating income, net |

|

|

(21,384) |

|

|

|

|

|

(10,672) |

|

|

|

|

|

(362) |

|

| Earnings from continuing operations before taxes on income |

|

|

607,028 |

|

|

|

|

|

413,801 |

|

|

|

|

|

249,178 |

|

| Taxes on income |

|

|

181,584 |

|

|

|

|

|

124,863 |

|

|

|

|

|

94,847 |

|

| Earnings from Continuing Operations |

|

|

425,444 |

|

|

|

|

|

288,938 |

|

|

|

|

|

154,331 |

|

| Loss on discontinued operations, net of related tax benefit of $0,

$0 and $40, respectively |

|

|

– |

|

|

|

|

|

– |

|

|

|

|

|

(37) |

|

| Consolidated net earnings |

|

|

425,444 |

|

|

|

|

|

288,938 |

|

|

|

|

|

154,294 |

|

| Less: Net earnings (loss) attributable to noncontrolling interests |

|

|

58 |

|

|

|

|

|

146 |

|

|

|

|

|

(1,307) |

|

| Net Earnings Attributable to

Martin Marietta |

|

$ |

425,386 |

|

|

|

|

$ |

288,792 |

|

|

|

|

$ |

155,601 |

|

|

|

|

|

|

|

| Net Earnings (Loss) Attributable to Martin Marietta |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from continuing operations |

|

$ |

425,386 |

|

|

|

|

$ |

288,792 |

|

|

|

|

$ |

155,638 |

|

| Discontinued operations |

|

|

– |

|

|

|

|

|

– |

|

|

|

|

|

(37) |

|

|

|

$ |

425,386 |

|

|

|

|

$ |

288,792 |

|

|

|

|

$ |

155,601 |

|

|

|

|

|

|

|

| Net Earnings Attributable to Martin Marietta Per Common Share (see Note A) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| – Basic from continuing operations attributable to common

shareholders |

|

$ |

6.66 |

|

|

|

|

$ |

4.31 |

|

|

|

|

$ |

2.73 |

|

| – Discontinued operations attributable to common

shareholders |

|

|

– |

|

|

|

|

|

– |

|

|

|

|

|

– |

|

|

|

$ |

6.66 |

|

|

|

|

$ |

4.31 |

|

|

|

|

$ |

2.73 |

|

| – Diluted from continuing operations attributable to common

shareholders |

|

$ |

6.63 |

|

|

|

|

$ |

4.29 |

|

|

|

|

$ |

2.71 |

|

| – Discontinued operations attributable to common

shareholders |

|

|

– |

|

|

|

|

|

– |

|

|

|

|

|

– |

|

|

|

$ |

6.63 |

|

|

|

|

$ |

4.29 |

|

|

|

|

$ |

2.71 |

|

| Weighted-Average Common Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| – Basic |

|

|

63,610 |

|

|

|

|

|

66,770 |

|

|

|

|

|

56,854 |

|

| – Diluted |

|

|

63,861 |

|

|

|

|

|

67,020 |

|

|

|

|

|

57,088 |

|

The notes on pages 15 through 40 are an integral part of these financial statements.

Martin

Marietta | Page 10

|

|

|

| CONSOLIDATED STATEMENTS OF

COMPREHENSIVE EARNINGS for years ended December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (add 000) |

|

2016 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

| Consolidated Net Earnings |

|

$ |

425,444 |

|

|

|

|

$ |

288,938 |

|

|

|

|

$ |

154,294 |

|

| Other comprehensive (loss) earnings, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Defined benefit pension and postretirement plans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss arising during period, net of tax of $(19,734), $(4,530) and $(39,752), respectively |

|

|

(31,620) |

|

|

|

|

|

(7,101) |

|

|

|

|

|

(62,767) |

|

| Amortization of prior service credit, net of tax of $(617), $(731) and $(1,108), respectively |

|

|

(992) |

|

|

|

|

|

(1,149) |

|

|

|

|

|

(1,702) |

|

| Amortization of actuarial loss, net of tax of $4,437, $6,551 and $1,490, respectively |

|

|

7,138 |

|

|

|

|

|

10,299 |

|

|

|

|

|

2,289 |

|

| Amount recognized in net periodic pension cost due to settlement, net of tax of $44 |

|

|

71 |

|

|

|

|

|

– |

|

|

|

|

|

– |

|

| Amount recognized in net periodic pension cost due to special plan termination benefits, net of tax of $293

and $811, respectively |

|

|

471 |

|

|

|

|

|

1,274 |

|

|

|

|

|

– |

|

|

|

|

(24,932) |

|

|

|

|

|

3,323 |

|

|

|

|

|

(62,180) |

|

|

|

|

|

|

|

| Foreign currency translation loss |

|

|

(898) |

|

|

|

|

|

(3,542) |

|

|

|

|

|

(624) |

|

|

|

|

|

|

|

| Amortization of terminated value of forward starting interest rate swap agreements into interest expense,

net of tax of $541, $509 and $470, respectively |

|

|

826 |

|

|

|

|

|

771 |

|

|

|

|

|

718 |

|

| |

|

|

(25,004) |

|

|

|

|

|

552 |

|

|

|

|

|

(62,086) |

|

| Consolidated comprehensive earnings |

|

|

400,440 |

|

|

|

|

|

289,490 |

|

|

|

|

|

92,208 |

|

| Less: Comprehensive earnings (loss) attributable to noncontrolling interests |

|

|

119 |

|

|

|

|

|

161 |

|

|

|

|

|

(1,348) |

|

| Comprehensive Earnings

Attributable to Martin Marietta |

|

$ |

400,321 |

|

|

|

|

$ |

289,329 |

|

|

|

|

$ |

93,556 |

|

The notes on pages 15 through 40 are an integral part of these

financial statements.

Martin

Marietta | Page 11

|

|

|

| CONSOLIDATED BALANCE SHEETS at December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets (add 000) |

|

2016 |

|

|

|

|

2015 |

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

50,038 |

|

|

|

|

$ |

168,409 |

|

| Accounts receivable, net |

|

|

457,910 |

|

|

|

|

|

410,921 |

|

| Inventories, net |

|

|

521,624 |

|

|

|

|

|

469,141 |

|

| Other current assets |

|

|

56,813 |

|

|

|

|

|

33,164 |

|

| Total Current Assets |

|

|

1,086,385 |

|

|

|

|

|

1,081,635 |

|

|

|

|

|

| Property, plant and equipment, net |

|

|

3,423,395 |

|

|

|

|

|

3,156,000 |

|

| Goodwill |

|

|

2,159,337 |

|

|

|

|

|

2,068,235 |

|

| Operating permits, net |

|

|

442,202 |

|

|

|

|

|

444,725 |

|

| Other intangibles, net |

|

|

69,110 |

|

|

|

|

|

65,827 |

|

| Other noncurrent assets |

|

|

120,476 |

|

|

|

|

|

141,189 |

|

| Total Assets |

|

$ |

7,300,905 |

|

|

|

|

$ |

6,957,611 |

|

|

|

|

|

| Liabilities and Equity (add

000, except parenthetical share data) |

|

|

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

|

| Bank overdraft |

|

$ |

– |

|

|

|

|

$ |

10,235 |

|

| Accounts payable |

|

|

178,598 |

|

|

|

|

|

164,718 |

|

| Accrued salaries, benefits and payroll taxes |

|

|

47,428 |

|

|

|

|

|

30,939 |

|

| Pension and postretirement benefits |

|

|

9,293 |

|

|

|

|

|

8,168 |

|

| Accrued insurance and other taxes |

|

|

60,093 |

|

|

|

|

|

62,781 |

|

| Current maturities of long-term debt |

|

|

180,036 |

|

|

|

|

|

18,713 |

|

| Other current liabilities |

|

|

71,140 |

|

|

|

|

|

71,104 |

|

| Total Current

Liabilities |

|

|

546,588 |

|

|

|

|

|

366,658 |

|

|

|

|

|

| Long-term debt |

|

|

1,506,153 |

|

|

|

|

|

1,550,061 |

|

| Pension, postretirement and postemployment benefits |

|

|

248,086 |

|

|

|

|

|

224,538 |

|

| Deferred income taxes, net |

|

|

663,019 |

|

|

|

|

|

583,459 |

|

| Other noncurrent liabilities |

|

|

194,469 |

|

|

|

|

|

172,718 |

|

| Total Liabilities |

|

|

3,158,315 |

|

|

|

|

|

2,897,434 |

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

|

|

| Common stock ($0.01 par value; 100,000,000 shares authorized; 63,176,000 and 64,479,000 shares outstanding

at December 31, 2016 and 2015, respectively) |

|

|

630 |

|

|

|

|

|

643 |

|

| Preferred stock ($0.01 par value; 10,000,000 shares authorized; no shares outstanding) |

|

|

– |

|

|

|

|

|

– |

|

| Additional paid-in capital |

|

|

3,334,461 |

|

|

|

|

|

3,287,827 |

|

| Accumulated other comprehensive loss |

|

|

(130,687) |

|

|

|

|

|

(105,622) |

|

| Retained earnings |

|

|

935,574 |

|

|

|

|

|

874,436 |

|

| Total Shareholders’ Equity |

|

|

4,139,978 |

|

|

|

|

|

4,057,284 |

|

| Noncontrolling interests |

|

|

2,612 |

|

|

|

|

|

2,893 |

|

| Total Equity |

|

|

4,142,590 |

|

|

|

|

|

4,060,177 |

|

| Total Liabilities and

Equity |

|

$ |

7,300,905 |

|

|

|

|

$ |

6,957,611 |

|

The notes on pages 15 through 40 are an integral part of these financial statements.

Martin

Marietta | Page 12

|

|

|

| CONSOLIDATED STATEMENTS OF CASH FLOWS

for years ended December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (add 000) |

|

2016 |

|

|

|

|

2015 |

|

|

|

|

2014 |

|

| Cash Flows from Operating Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net earnings |

|

$ |

425,444 |

|

|

|

|

$ |

288,938 |

|

|

|

|

$ |

154,294 |

|

| Adjustments to reconcile consolidated net earnings to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, depletion and amortization |

|

|

285,253 |

|

|

|

|

|

263,587 |

|

|

|

|

|

222,746 |

|

| Stock-based compensation expense |

|

|

20,481 |

|

|

|

|

|

13,589 |

|

|

|

|

|

8,993 |

|

| Loss (gains) on divestitures and sales of assets |

|

|

410 |

|

|

|

|

|

14,093 |

|

|

|

|

|

(52,297) |

|

| Deferred income taxes |

|

|

67,050 |

|

|

|

|

|

85,225 |

|

|

|

|

|

50,292 |

|

| Excess tax benefits from stock-based compensation transactions |

|

|

(6,792) |

|

|

|

|

|

– |

|

|

|

|

|

(2,508) |

|

| Other items, net |

|

|

(17,730) |

|

|

|

|

|

(5,972) |

|

|

|

|

|

4,795 |

|

| Changes in operating assets and liabilities, net of effects of acquisitions and divestitures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts receivable, net |

|

|

(25,072) |

|

|

|

|

|

12,309 |

|

|

|

|

|

(16,650) |

|

| Inventories, net |

|

|

(47,381) |

|

|

|

|

|

(21,525) |

|

|

|

|

|

(12,020) |

|

| Accounts payable |

|

|

(8,116) |

|

|

|

|

|

(40,053) |

|

|

|

|

|

5,303 |

|

| Other assets and liabilities, net |

|

|

(14,893) |

|

|

|

|

|

(37,040) |

|

|

|

|

|

18,710 |

|

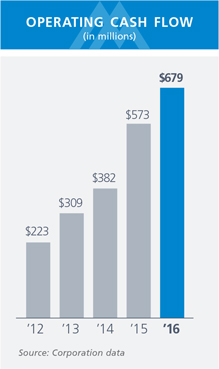

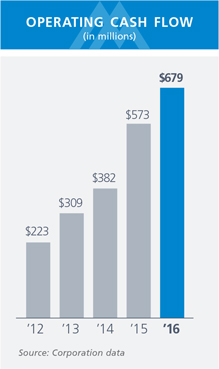

| Net Cash Provided by Operating

Activities |

|

|

678,654 |

|

|

|

|

|

573,151 |

|

|

|

|

|

381,658 |

|

|

|

|

|

|

|

| Cash Flows from Investing Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additions to property, plant and equipment |

|

|

(387,267) |

|

|

|

|

|

(318,232) |

|

|

|

|

|

(232,183) |

|

| Acquisitions, net |

|

|

(178,768) |

|

|

|

|

|

(43,215) |

|

|

|

|

|

(189) |

|

| Cash received in acquisition |

|

|

4,246 |

|

|

|

|

|

63 |

|

|

|

|

|

59,887 |

|

| Proceeds from divestitures and sales of assets |

|

|

6,476 |

|

|

|

|

|

448,122 |

|

|

|

|

|

121,985 |

|

| Payment of railcar construction advances |

|

|

(82,910) |

|

|

|

|

|

(25,234) |

|

|

|

|

|

(14,513) |

|

| Reimbursement of railcar construction advances |

|

|

82,910 |

|

|

|

|

|

25,234 |

|

|

|

|

|

14,513 |

|

| Repayments from affiliate |

|

|

– |

|

|

|

|

|

1,808 |

|

|

|

|

|

1,175 |

|

| Net Cash (Used for) Provided By

Investing Activities |

|

|

(555,313) |

|

|

|

|

|

88,546 |

|

|

|

|

|

(49,325) |

|

|

|

|

|

|

|

| Cash Flows from Financing Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Borrowings of long-term debt |

|

|

560,000 |

|

|

|

|

|

230,000 |

|

|

|

|

|

868,762 |

|

| Repayments of long-term debt |

|

|

(449,306) |

|

|

|

|

|

(244,704) |

|

|

|

|

|

(1,057,289) |

|

| Debt issuance costs |

|

|

(2,300) |

|

|

|

|

|

– |

|

|

|

|

|

(2,782) |

|

| Change in bank overdraft |

|

|

(10,235) |

|

|

|

|

|

10,052 |

|

|

|

|

|

(2,373) |

|

| Payments on capital lease obligations |

|

|

(3,364) |

|

|

|

|

|

(6,616) |

|

|

|

|

|

(3,075) |

|

| Dividends paid |

|

|

(105,036) |

|

|

|

|

|

(107,462) |

|

|

|

|

|

(91,304) |

|

| Distributions to owners of noncontrolling interests |

|

|

(400) |

|

|

|

|

|

(325) |

|

|

|

|

|

(800) |

|

| Contributions by noncontrolling interests to joint venture |

|

|

44 |

|

|

|

|

|

– |

|

|

|

|

|

– |

|

| Repurchase of common stock |

|

|

(259,228) |

|

|

|

|

|

(519,962) |

|

|

|

|

|

– |

|

| Purchase of remaining interest in existing subsidiaries |

|

|

– |

|

|

|

|

|

– |

|

|

|

|

|

(19,480) |

|

| Issuances of common stock |

|

|

21,321 |

|

|

|

|

|

37,078 |

|

|

|

|

|

39,714 |

|

| Excess tax benefits from stock-based compensation transactions |

|

|

6,792 |

|

|

|

|

|

– |

|

|

|

|

|

2,508 |

|

| Net Cash Used for Financing

Activities |

|

|

(241,712) |

|

|

|

|

|

(601,939) |

|

|

|

|

|

(266,119) |

|

| Net (Decrease) Increase in Cash and Cash Equivalents |

|

|

(118,371) |

|

|

|

|

|

59,758 |

|

|

|

|

|

66,214 |

|

| Cash and Cash Equivalents, beginning of year |

|

|

168,409 |

|

|

|

|

|

108,651 |

|

|

|

|

|

42,437 |

|

|

|

|

|

|

|

| Cash and Cash Equivalents, end of year |

|

$ |

50,038 |

|

|

|

|

$ |

168,409 |

|

|

|

|

$ |

108,651 |

|

The notes on pages 15 through 40 are an integral part of these financial statements.

Martin

Marietta | Page 13

|

|

|

| CONSOLIDATED STATEMENTS OF TOTAL

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (add 000, except per share data) |

|

Shares of

Common

Stock |

|

|

Common

Stock |

|

|

Additional

Paid-In

Capital |

|

|

Accumulated

Other

Comprehensive

(Loss) Earnings |

|

|

Retained

Earnings |

|

|

Total

Shareholders’

Equity |

|

|

Non-

controlling

Interests |

|

|

Total

Equity |

|

| Balance at December 31, 2013 |

|

|

46,261 |

|

|

$ |

461 |

|

|

$ |

432,792 |

|

|

$ |

(44,114) |

|

|

$ |

1,148,738 |

|

|

$ |

1,537,877 |

|

|

$ |

37,042 |

|

|

$ |

1,574,919 |

|

|

|

|

|

|

|

|

|

|

| Consolidated net earnings (loss) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

155,601 |

|

|

|

155,601 |

|

|

|

(1,307) |

|

|

|

154,294 |

|

| Other comprehensive loss |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(62,045) |

|

|

|

– |

|

|

|

(62,045) |

|

|

|

(41) |

|

|

|

(62,086) |

|

| Dividends declared ($1.60 per common share) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(91,304 |

) |

|

|

(91,304) |

|

|

|

– |

|

|

|

(91,304) |

|

| Issuances of common stock, stock options and stock appreciation rights for TXI acquisition |

|

|

20,309 |

|

|

|

203 |

|

|

|

2,751,670 |

|

|

|

– |

|

|

|

– |

|

|

|

2,751,873 |

|

|

|

– |

|

|

|

2,751,873 |

|

| Issuances of common stock for stock award plans |

|

|

723 |

|

|

|

7 |

|

|

|

41,765 |

|

|

|

– |

|

|

|

– |

|

|

|

41,772 |

|

|

|

– |

|

|

|

41,772 |

|

| Stock-based compensation expense |

|

|

– |

|

|

|

– |

|

|

|

8,993 |

|

|

|

– |

|

|

|

– |

|

|

|

8,993 |

|

|

|

– |

|

|

|

8,993 |

|

| Distributions to owners of noncontrolling interests |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(800) |

|

|

|

(800) |

|

| Purchase of subsidiary shares from noncontrolling interest |

|

|

– |

|

|

|

– |

|

|

|

8,399 |

|

|

|

– |

|

|

|

– |

|

|

|

8,399 |

|

|

|

(33,312) |

|

|

|

(24,913) |

|

| Balance at December 31, 2014 |

|

|

67,293 |

|

|

$ |

671 |

|

|

$ |

3,243,619 |

|

|

$ |

(106,159) |

|

|

$ |

1,213,035 |

|

|

$ |

4,351,166 |

|

|

$ |

1,582 |

|

|

$ |

4,352,748 |

|

|

|

|

|

|

|

|

|

|

| Consolidated net earnings |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

288,792 |

|

|

|

288,792 |

|

|

|

146 |

|

|

|

288,938 |

|

| Other comprehensive earnings |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

537 |

|

|

|

– |

|

|

|

537 |

|

|

|

15 |

|

|

|

552 |

|

| Dividends declared ($1.60 per common share) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(107,462 |

) |

|

|

(107,462) |

|

|

|

– |

|

|

|

(107,462 |

) |

| Issuances of common stock for stock award plans |

|

|

471 |

|

|

|

5 |

|

|

|

30,619 |

|

|

|

– |

|

|

|

– |

|

|

|

30,624 |

|

|

|

– |

|

|

|

30,624 |

|

| Repurchases of common stock |

|

|

(3,285 |

) |

|

|

(33) |

|

|

|

– |

|

|

|

– |

|

|

|

(519,929 |

) |

|

|

(519,962) |

|

|

|

– |

|

|

|

(519,962 |

) |

| Stock-based compensation expense |

|

|

– |

|

|

|

– |

|

|

|

13,589 |

|

|

|

– |

|

|

|

– |

|

|

|

13,589 |

|

|

|

– |

|

|

|

13,589 |

|

| Noncontrolling interest acquired from business combination |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

1,475 |

|

|

|

1,475 |

|

| Distributions to owners of noncontrolling interests |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(325) |

|

|

|

(325 |

) |

| Balance at December 31, 2015 |

|

|

64,479 |

|

|

$ |

643 |

|

|

$ |

3,287,827 |

|

|

$ |

(105,622) |

|

|

$ |

874,436 |

|

|

$ |

4,057,284 |

|

|

$ |

2,893 |

|

|

$ |

4,060,177 |

|

|

|

|

|

|

|

|

|

|

| Consolidated net earnings |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

425,386 |

|

|

|

425,386 |

|

|

|

58 |

|

|

|

425,444 |

|

| Other comprehensive earnings |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(25,065) |

|

|

|

– |

|

|

|

(25,065) |

|

|

|

61 |

|

|

|

(25,004 |

) |

| Dividends declared ($1.64 per common share) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(105,036 |

) |

|

|

(105,036) |

|

|

|

– |

|

|

|

(105,036 |

) |

| Issuances of common stock for stock award plans |

|

|

285 |

|

|

|

3 |

|

|

|

26,109 |

|

|

|

– |

|

|

|

– |

|

|

|

26,112 |

|

|

|

– |

|

|

|

26,112 |

|

| Repurchases of common stock |

|

|

(1,588 |

) |

|

|

(16) |

|

|

|

– |

|

|

|

– |

|

|

|

(259,212 |

) |

|

|

(259,228) |

|

|

|

– |

|

|

|

(259,228 |

) |

| Stock-based compensation expense |

|

|

– |

|

|

|

– |

|

|

|

20,481 |

|

|

|

– |

|

|

|

– |

|

|

|

20,481 |

|

|

|

– |

|

|

|

20,481 |

|

| Distributions to owners of noncontrolling interest |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(400) |

|

|

|

(400 |

) |

| Contribution from owners of noncontrolling interest |

|

|

– |

|

|

|

– |

|

|

|

44 |

|

|

|

– |

|

|

|

– |

|

|

|

44 |

|

|

|

– |

|

|

|

44 |

|

| Balance at December 31, 2016 |

|

|

63,176 |

|

|

$ |

630 |

|

|

$ |

3,334,461 |

|

|

$ |

(130,687) |

|

|

$ |

935,574 |

|

|

$ |

4,139,978 |

|

|

$ |

2,612 |

|

|

$ |

4,142,590 |

|

The notes on pages 15 through 40 are an integral part of these financial statements.

Martin

Marietta | Page 14

NOTES TO FINANCIAL STATEMENTS

Note A: Accounting Policies

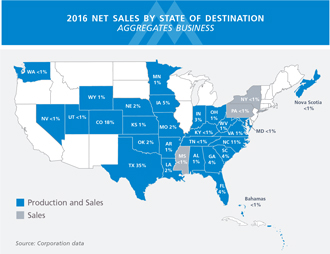

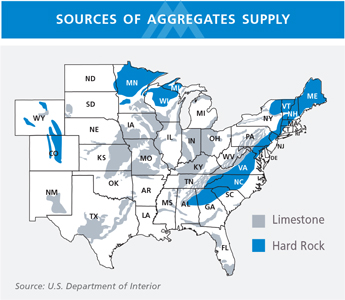

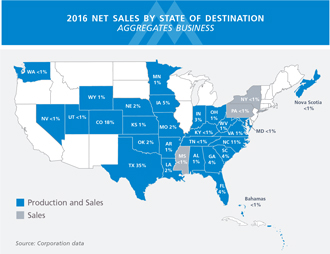

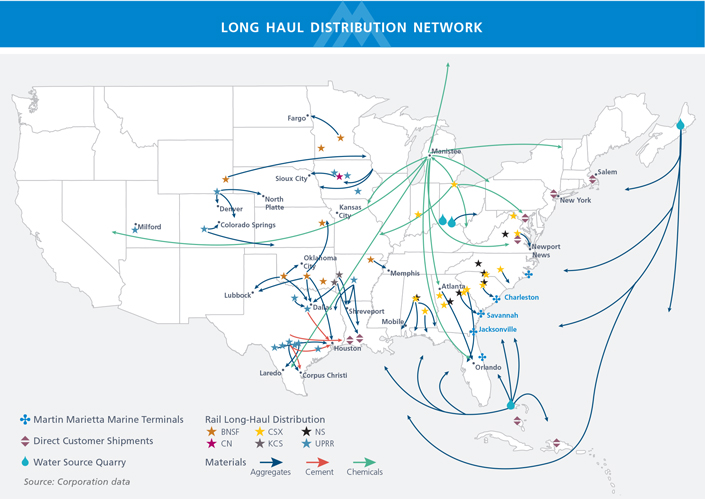

Organization. Martin Marietta

Materials, Inc., (the “Corporation” or “Martin Marietta”) is engaged principally in the construction aggregates business. The aggregates product line includes crushed stone, sand and gravel, and is used for the construction of

infrastructure, nonresidential and residential projects. Aggregates products are also used for railroad ballast, and in agricultural, utility and environmental applications. These aggregates products, along with the Corporation’s

aggregates-related downstream product lines, namely heavy building materials such as asphalt products, ready mixed concrete and road paving construction services, are sold and shipped from a network of more than 400 quarries, distribution facilities

and plants to customers in 29 states, Canada, the Bahamas and the Caribbean Islands. The aggregates and aggregates-related downstream product lines are reported collectively as the “Aggregates business.” As of December 31, 2016, the

Aggregates business contains the following reportable segments: Mid-America Group, Southeast Group and West Group. The Mid-America Group operates in Indiana, Iowa,

northern Kansas, Kentucky, Maryland, Minnesota, Missouri, eastern Nebraska, North Carolina, Ohio, South Carolina, Virginia, Washington and West Virginia. The Southeast Group has operations in Alabama, Florida, Georgia, Tennessee, Nova Scotia and the

Bahamas. The West Group operates in Arkansas, Colorado, southern Kansas, Louisiana, western Nebraska, Nevada, Oklahoma, Texas, Utah and Wyoming. The following states accounted for 73% of the Aggregates business’ 2016 net sales: Texas, Colorado,

North Carolina, Iowa and Georgia.

The Cement segment produces Portland and specialty cements at two plants in Texas. Similar to the

Aggregates business, cement is used in infrastructure projects, nonresidential and residential construction, and the railroad, agricultural, utility and environmental industries.

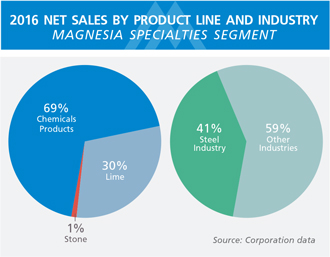

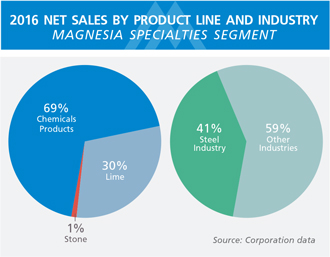

The Magnesia Specialties segment, with production facilities in Ohio and Michigan, produces magnesia-based chemicals products used in industrial,

agricultural and environmental applications, and dolomitic lime sold primarily to customers in the steel industry.

Use of Estimates. The preparation of the Corporation’s consolidated financial statements in conformity with accounting principles generally

accepted in the United States requires management to make certain estimates and assumptions about

future events. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported, disclosures about contingent assets and liabilities and reported amounts of

revenues and expenses. Such estimates include the valuation of accounts receivable, inventories, goodwill, intangible assets and other long-lived assets and assumptions used in the calculation of taxes on income, retirement and other postemployment

benefits, and the allocation of the purchase price to the fair values of assets acquired and liabilities assumed as part of business combinations. These estimates and assumptions are based on management’s judgment. Management evaluates

estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment, and adjusts such estimates and assumptions when facts and circumstances dictate. Changes in credit, equity and

energy markets and changes in construction activity increase the uncertainty inherent in certain estimates and assumptions. As future events and their effects cannot be determined with precision, actual results could differ significantly from

estimates. Changes in estimates, including those resulting from continuing changes in the economic environment, are reflected in the consolidated financial statements for the period in which the change in estimate occurs.

Basis of Consolidation. The consolidated

financial statements include the accounts of the Corporation and its wholly-owned and majority-owned subsidiaries. Partially-owned affiliates are either consolidated or accounted for at cost or as equity investments, depending on the level of

ownership interest or the Corporation’s ability to exercise control over the affiliates’ operations. Intercompany balances and transactions have been eliminated in consolidation.

Revenue Recognition. Total revenues include

sales of materials and services provided to customers, net of discounts or allowances, if any, and include freight and delivery costs billed to customers. Revenues for product sales are recognized when risks associated with ownership have passed to

unaffiliated customers. Typically, this occurs when finished products are shipped. Revenues derived from the road paving business are recognized using the

percentage-of-completion method under the revenue-cost approach. Under the revenue-cost approach, recognized contract revenue equals the total estimated contract revenue

multiplied by the percentage of completion. Recognized costs equal the total estimated contract cost multiplied by the percentage of completion. The percentage of completion is determined by costs incurred to date as a percentage of total costs

estimated for the project.

Martin

Marietta | Page 15

NOTES TO FINANCIAL STATEMENTS (continued)

Freight and Delivery Costs. Freight

and delivery costs represent pass-through transportation costs incurred and paid by the Corporation to third-party carriers to deliver products to customers. These costs are then billed to the customers.

Cash and Cash Equivalents. Cash equivalents are comprised of highly-liquid

instruments with original maturities of three months or less from the date of purchase. The Corporation manages its cash and cash equivalents to ensure short-term operating cash needs are met and excess funds are managed efficiently. The Corporation

subsidizes shortages in operating cash through credit facilities. The Corporation utilizes excess cash to either pay down credit facility borrowings or invest in money market funds, money market demand deposit accounts or Eurodollar time deposit

accounts. Money market demand deposits and Eurodollar time deposit accounts are exposed to bank solvency risk. Money market demand deposit accounts are FDIC insured up to $250,000. The Corporation’s deposits in bank funds generally exceed the

$250,000 FDIC insurance limit. The Corporation’s cash management policy prohibits cash and cash equivalents over $100,000,000 to be maintained at any one bank.

Customer Receivables. Customer receivables are stated at cost. The

Corporation does not typically charge interest on customer accounts receivables. The Corporation records an allowance for doubtful accounts, which includes a provision for probable losses based on historical write offs and a specific reserve for

accounts greater than $50,000 deemed at risk. The Corporation writes off customer receivables as bad debt expense when it becomes apparent based upon customer facts and circumstances that such amounts will not be collected.

Inventories Valuation. Inventories are stated at the lower of cost or net

realizable value. Costs for finished products and in process inventories are determined by the first-in, first-out method. The Corporation records an allowance for

finished product inventories in excess of sales for a twelve-month period, as measured by historical sales. The Corporation also establishes an allowance for expendable parts over five years old and supplies over one year old.

Post-production stripping costs, which represent costs of removing overburden and waste materials to access mineral deposits, are a component of

inventory production costs

and recognized in cost of sales in the same period as the revenue from the sale of the inventory.

Properties and Depreciation. Property, plant and

equipment are stated at cost.

The estimated service lives for property, plant and equipment are as follows:

|

|

|

|

|

| Class of Assets |

|

Range of Service Lives |

|

|

| Buildings |

|

5 to 20 years |

|

|

| Machinery & Equipment |

|

2 to 20 years |

|

|

| Land Improvements |

|

5 to 15 years |

|

|

The Corporation begins capitalizing quarry development costs at a point when reserves are determined to be proven or

probable, economically mineable and when demand supports investment in the market. Capitalization of these costs ceases when production commences. Capitalized quarry development costs are classified as land improvements.

The Corporation reviews relevant facts and circumstances to determine whether to capitalize or expense

pre-production stripping costs when additional pits are developed at an existing quarry. If the additional pit operates in a separate and distinct area of the quarry, these costs are capitalized as quarry

development costs and depreciated over the life of the uncovered reserves. Additionally, a separate asset retirement obligation is created for additional pits when the liability is incurred. Once a pit enters the production phase, all

post-production stripping costs are charged to inventory production costs as incurred.

Mineral reserves and mineral interests acquired in

connection with a business combination are valued using an income approach over the life of the reserves.

Depreciation is computed over estimated

service lives, principally by the straight-line method. Depletion of mineral reserves is calculated over proven and probable reserves by the units-of-production method

on a quarry-by-quarry basis.

Property, plant and equipment are

reviewed for impairment whenever facts and circumstances indicate that the carrying amount of an asset may not be recoverable. An impairment loss is recognized if expected future undiscounted cash flows over the estimated remaining service life of

the related asset are less than the asset’s carrying value.

Martin

Marietta | Page 16

NOTES TO FINANCIAL STATEMENTS (continued)

Repair and Maintenance

Costs. Repair and maintenance costs that do not substantially extend the life of the Corporation’s plant and equipment are expensed as incurred.

Goodwill and Intangible Assets. Goodwill represents the

excess purchase price paid for acquired businesses over the estimated fair value of identifiable assets and liabilities. Other intangibles represent amounts assigned principally to contractual agreements and are amortized ratably over periods based

on related contractual terms.

The Corporation’s reporting units, which represent the level at which goodwill is tested for impairment, are

based on the geographic regions of the Aggregates business. Additionally, the Cement business is a separate reporting unit. Goodwill is allocated to each reporting unit based on the location of acquisitions and divestitures at the time of

consummation.

The carrying values of goodwill and other indefinite-lived intangible assets are reviewed annually, as of October 1, for

impairment. An interim review is performed between annual tests if facts or circumstances indicate potential impairment. The carrying value of other amortizable intangibles is reviewed if facts and circumstances indicate potential impairment. If a

review indicates the carrying value is impaired, a charge is recorded.

Retirement Plans and

Postretirement Benefits. The Corporation sponsors defined benefit retirement plans and also provides other postretirement benefits. The Corporation recognizes the funded status, defined as the difference between the fair value of plan

assets and the benefit obligation, of its pension plans and other postretirement benefits as an asset or liability on the consolidated balance sheets. Actuarial gains or losses that arise during the year are not recognized as net periodic benefit

cost in the same year, but rather are recognized as a component of accumulated other comprehensive earnings or loss. Those amounts are amortized over the participants’ average remaining service period and recognized as a component of net

periodic benefit cost. The amount amortized is determined using a corridor approach and represents the excess over 10% of the greater of the projected benefit obligation or pension plan assets.

Stock-Based Compensation. The

Corporation has stock-based compensation plans for employees and its Board of Directors. The Corporation recognizes all forms of stock-based payments to employees, including stock options, as compensation expense. The compensation expense is the

fair value of the awards at the measurement date and is recognized over the requisite service period.

The fair value of restricted stock awards,

incentive compensation awards and Board of Directors’ fees paid in the form of common stock are based on the closing price of the Corporation’s common stock on the awards’ respective grant dates. The fair value of performance stock

awards based on total shareholder return is determined by a Monte Carlo simulation methodology.

In 2016, the Corporation did not issue any stock

options. For stock options issued prior to 2016, the Corporation uses the accelerated expense recognition method. The accelerated recognition method requires stock options that vest ratably to be divided into tranches. The expense for each tranche

is allocated to its particular vesting period.

The Corporation uses the lattice valuation model to determine the fair value of stock option

awards. The lattice valuation model takes into account employees’ exercise patterns based on changes in the Corporation’s stock price and other variables. The period of time for which options are expected to be outstanding, or expected

term of the option, is a derived output of the lattice valuation model. The Corporation considers the following factors when estimating the expected term of options: vesting period of the award, expected volatility of the underlying stock,

employees’ ages and external data.

Key assumptions used in determining the fair value of the stock options awarded in 2015 and 2014 were:

|

|

|

|

|

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

| Risk-free interest rate |

|

|

2.20% |

|

|

|

2.50% |

|

| Dividend yield |

|

|

1.20% |

|

|

|

1.50% |

|

| Volatility factor |

|

|

36.10% |

|

|

|

35.30% |

|

| Expected term |

|

|

8.5 years |

|

|

|

8.5 years |

|

Based on these assumptions, the weighted-average fair value of each stock option granted was $57.71 and $43.42 for 2015

and 2014, respectively.

Martin

Marietta | Page 17

NOTES TO FINANCIAL STATEMENTS (continued)

The risk-free interest rate reflects the interest rate on

zero-coupon U.S. government bonds, available at the time each option was granted, having a remaining life approximately equal to the option’s expected life. The dividend yield represents the dividend rate

expected to be paid over the option’s expected life. The Corporation’s volatility factor measures the amount by which its stock price is expected to fluctuate during the expected life of the option and is based on historical stock price

changes. Forfeitures are required to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates. The Corporation estimates forfeitures and will ultimately recognize

compensation cost only for those stock-based awards that vest.

For restricted stock awards and incentive stock awards granted prior to 2016, the

Corporation recognizes income tax benefits resulting from the payment of dividend equivalents on unvested stock-based payments as an increase to additional paid-in capital and includes them in the pool of

excess tax benefits. For awards granted in 2016, dividend equivalents are not paid unless the award vests.

Environmental Matters. The Corporation records a liability for an asset retirement obligation at fair value in the period in which it is incurred. The asset retirement obligation is recorded

at the acquisition date of a long-lived tangible asset if the fair value can be reasonably estimated. A corresponding amount is capitalized as part of the asset’s carrying amount. The fair value is affected by management’s assumptions

regarding the scope of the work required, inflation rates and quarry closure dates.

Further, the Corporation records an accrual for other

environmental remediation liabilities in the period in which it is probable that a liability has been incurred and the appropriate amounts can be estimated reasonably. Such accruals are adjusted as further information develops or circumstances

change. These costs are not discounted to their present value or offset for potential insurance or other claims or potential gains from future alternative uses for a site.

Income Taxes. Deferred income taxes, net, on the consolidated balance sheets

reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes, net of valuation allowances.

Uncertain Tax Positions. The

Corporation recognizes a tax benefit when it is more-likely-than-not, based on the technical merits, that a tax position would be sustained upon examination by a taxing authority. The amount to be recognized

is measured as the largest amount of tax benefit that is greater than 50% likely of being realized upon ultimate settlement with a taxing authority that has full knowledge of all relevant information. The Corporation’s unrecognized tax benefits

are recorded in other liabilities on the consolidated balance sheets or as an offset to the deferred tax asset for tax carryforwards where available.

The Corporation records interest accrued in relation to unrecognized tax benefits as income tax expense. Penalties, if incurred, are recorded as

operating expenses in the consolidated statements of earnings.

Sales Taxes.

Sales taxes collected from customers are recorded as liabilities until remitted to taxing authorities and therefore are not reflected in the consolidated statements of earnings.

Research and Development Costs. Research and development costs are charged to

operations as incurred.

Start-Up

Costs. Noncapital start-up costs for new facilities and products are charged to operations as incurred.

Warranties. The Corporation’s construction contracts contain warranty

provisions covering defects in equipment, materials, design or workmanship that generally run from nine months to one year after project completion. Due to the nature of its projects, including contract owner inspections of the work both during

construction and prior to acceptance, the Corporation has not experienced material warranty costs for these short-term warranties and therefore does not believe an accrual for these costs is necessary. Certain product lines carry longer warranty

periods, for which the Corporation has accrued an estimate of warranty cost based on experience with the type of work and any known risks relative to the project. These costs were not material to the Corporation’s consolidated results of

operations for the years ended December 31, 2016, 2015 and 2014.

Martin

Marietta | Page 18

NOTES TO FINANCIAL STATEMENTS (continued)

Consolidated Comprehensive Earnings and Accumulated

Other Comprehensive Loss. Consolidated comprehensive earnings for the Corporation consist of consolidated net earnings, adjustments for the funded status of pension and postretirement benefit plans, foreign currency translation

adjustments and the amortization of the value of terminated forward starting interest rate swap agreements into interest expense, and are presented in the Corporation’s consolidated statements of comprehensive earnings.

Accumulated other comprehensive loss consists of unrealized gains and losses related to the funded status

of the pension and postretirement benefit plans, foreign currency translation and the unamortized value of terminated forward starting interest rate swap agreements, and is presented on the Corporation’s consolidated balance sheets.

The components of the changes in accumulated other comprehensive loss and related cumulative noncurrent deferred tax assets are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| years ended December 31 (add 000)

|

|

Pension and

Postretirement Benefit Plans

|

|

|

Foreign

Currency |

|

|

Unamortized

Value of Terminated

Forward Starting Interest

Rate Swap |

|

|

Total |

|

| |

|

|

| |

|

|

2016 |

|

| |

|

| Accumulated other comprehensive loss at beginning of period |

|

|

|

$ |

(103,380) |

|

|

$ |

(264 |

) |

|

$ |

(1,978) |

|

|

$ |

(105,622) |

|

|

|

|

|

|

|

|

| Other comprehensive loss before reclassifications, net of tax |

|

|

|

|

(31,678) |

|

|

|

(898 |

) |

|

|

– |

|

|

|

(32,576) |

|

| Amounts reclassified from accumulated other comprehensive loss, net of tax |

|

|

|

|

6,685 |

|

|

|

– |

|

|

|

826 |

|

|

|

7,511 |

|

|

|

|

|

|

|

|

| Other comprehensive (loss) earnings, net of tax |

|

|

|

|

(24,993) |

|

|

|

(898 |

) |

|

|

826 |

|

|

|

(25,065) |

|

|

|

|

|

|

|

|

| Accumulated other comprehensive loss at end of period |

|

|

|

$ |

(128,373) |

|

|

$ |

(1,162 |

) |

|

$ |

(1,152) |

|

|

$ |

(130,687) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cumulative noncurrent deferred tax assets at end of period |

|

|

|

$ |

82,044 |

|

|

$ |

– |

|

|

$ |

749 |

|

|

$ |

82,793 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

2015 |

|

| |

|

| Accumulated other comprehensive (loss) earnings at beginning of period |

|

|

|

$ |

(106,688) |

|

|

$ |

3,278 |

|

|

$ |

(2,749) |

|

|

$ |

(106,159) |

|

|

|

|

|

|

|

|

| Other comprehensive loss before reclassifications, net of tax |

|

|

|

|

(7,116) |

|

|

|

(3,542 |

) |

|

|

– |

|

|

|

(10,658) |

|

| Amounts reclassified from accumulated other comprehensive loss, net of tax |

|

|

|

|

10,424 |

|

|

|

– |

|

|

|

771 |

|

|

|

11,195 |

|

|

|

|

|

|

|

|

| Other comprehensive earnings (loss), net of tax |

|

|

|

|

3,308 |

|

|

|

(3,542 |

) |

|

|

771 |

|

|

|

537 |

|

|

|

|

|

|

|

|

| Accumulated other comprehensive loss at end of period |

|

|

|

$ |

(103,380) |

|

|

$ |

(264 |

) |

|

$ |

(1,978) |

|

|

$ |

(105,622) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cumulative noncurrent deferred tax assets at end of period |

|

|

|

$ |

66,467 |

|

|

$ |

– |

|

|

$ |

1,290 |

|

|

$ |

67,757 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

2014 |

|

| |

|

| Accumulated other comprehensive (loss) earnings at beginning of period |

|

|

|

$ |

(44,549) |

|

|

$ |

3,902 |

|

|

$ |

(3,467) |

|

|

$ |

(44,114) |

|

|

|

|

|

|

|

|

| Other comprehensive loss before reclassifications, net of tax |

|

|

|

|

(62,726) |

|

|

|

(624 |

) |

|

|

– |

|

|

|

(63,350) |

|

| Amounts reclassified from accumulated other comprehensive loss, net of tax |

|

|

|

|

587 |

|

|

|

– |

|

|

|

718 |

|

|

|

1,305 |

|

|

|

|

|

|

|

|

| Other comprehensive (loss) earnings, net of tax |

|

|

|

|

(62,139) |

|

|

|

(624 |

) |

|

|

718 |

|

|

|

(62,045) |

|

|

|

|

|

|

|

|

| Accumulated other comprehensive (loss) earnings at end of period |

|

|

|

$ |

(106,688) |

|

|

$ |

3,278 |

|

|

$ |

(2,749) |

|

|

$ |

(106,159) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cumulative noncurrent deferred tax assets at end of period |

|

|

|

$ |

68,568 |

|

|

$ |

– |

|

|

$ |

1,799 |

|

|

$ |

70,367 |

|

|

|

|

|

|

|

|

Martin

Marietta | Page 19

NOTES TO FINANCIAL STATEMENTS (continued)

Reclassifications out of accumulated other comprehensive loss are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| years ended December 31

(add 000) |

|

2016 |

|

|

2015 |

|

|

2014 |

|

|

Affected line items in the

consolidated statements of earnings |

| Pension and postretirement benefit plans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Special plan termination benefit |

|

$ |

764 |

|

|

$ |

2,085 |

|

|