Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - Hamilton Lane INC | hlexhibit232.htm |

| EX-23.1 - EXHIBIT 23.1 - Hamilton Lane INC | hlexhibit231.htm |

| EX-5.1 - EXHIBIT 5.1 - Hamilton Lane INC | hlexhibit51.htm |

As filed with the Securities and Exchange Commission on February 24, 2017.

Registration No. 333-215846

SECURITIES AND EXCHANGE COMMISSION | ||||||

Washington, D.C. 20549 Amendment No. 3 to | ||||||

FORM S-1 REGISTRATION STATEMENT Under THE SECURITIES ACT OF 1933 | ||||||

HAMILTON LANE INCORPORATED | ||||||

(Exact name of Registrant as specified in its charter) | ||||||

Delaware (State or other jurisdiction of incorporation or organization) | 6282 (Primary Standard Industrial Classification Code Number) | 26-2482738 (I.R.S. Employer Identification No.) | ||||

Hamilton Lane Incorporated One Presidential Blvd., 4th Floor Bala Cynwyd, PA 19004 Telephone: (610) 934-2222 (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) | ||||||

Robert W. Cleveland General Counsel and Secretary Hamilton Lane Incorporated One Presidential Blvd., 4th Floor Bala Cynwyd, PA 19004 Telephone: (610) 934-2222 (Address, including zip code, and telephone number, including area code, of agent for service) Copies to: | ||||||

H. John Michel, Jr. Kimberly K. Rubel Drinker Biddle & Reath LLP One Logan Square, Suite 2000 Philadelphia, PA 19103 Telephone: (215) 988-2700 Facsimile: (215) 988-2757 | Richard D. Truesdell, Jr. John Crowley Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 Telephone: (212) 450-4000 Facsimile: (212) 701-5800 | |||||

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after the Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered | Amount to be Registered(1)(2) | Estimated Maximum Offering Price per Share(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee(3) |

Class A common stock, par value $0.001 per share | 13,656,250 | 17.00 | $232,156,250 | $26,906.91 |

(1) | Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(a) under the Securities Act of 1933. |

(2) | Includes shares subject to the underwriters’ option to purchase additional shares. |

(3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated February 24, 2017

Prospectus

11,875,000 shares

CLASS A COMMON STOCK

_______________________________________________

We are offering 11,875,000 shares of Class A common stock of Hamilton Lane Incorporated. This is our initial public offering of Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. The estimated initial public offering price is between $15.00 and $17.00 per share. We have applied to list our Class A common stock on the NASDAQ Stock Market under the symbol “HLNE”.

At our request, the underwriters have reserved 5% of the shares of Class A common stock to be issued by us and offered by this prospectus for sale, at the initial public offering price, to directors, officers, employees and other individuals associated with our company. See “Underwriting.”

We intend to use a portion of the net proceeds of this offering to purchase membership units in Hamilton Lane Advisors, L.L.C. from certain of its existing owners, and the remaining net proceeds to purchase newly issued membership units in Hamilton Lane Advisors, L.L.C. We expect Hamilton Lane Advisors, L.L.C. to use these proceeds to repay indebtedness and for general corporate purposes. In connection with the reorganization transactions taking place contemporaneously with the closing of this offering, certain existing owners of Hamilton Lane Advisors, L.L.C. will exchange their membership interests for shares of our Class A common stock to be held directly and will cease to be members of Hamilton Lane Advisors, L.L.C.

Concurrently with the consummation of this offering, we will issue 27,935,256 shares of our Class B common stock to certain of the members of Hamilton Lane Advisors, L.L.C. (other than us). Each share of Class B common stock initially entitles the holder to ten votes while holders of our Class A common stock are entitled to one vote. The Class B stockholders will hold 94.7% of the combined voting power of our common stock immediately after this offering, and certain of them holding collectively 91.1% of the combined voting power of our common stock will enter into a stockholders’ agreement pursuant to which they will agree to vote their shares of Class A and Class B common stock together on all matters submitted to a vote of our common stockholders. See “Organizational Structure.”

Following this offering, we will be a “controlled company” within the meaning of the corporate governance rules of the NASDAQ Stock Market. See “Management.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. |

Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page 24 of this prospectus. |

_______________________________________________

Per Share | Total | ||

Initial public offering price of Class A common stock | $ | $ | |

Underwriting discount (1) | $ | $ | |

Proceeds to us, before expenses | $ | $ | |

(1) | We have also agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting” for a description of all compensation payable to the underwriters. |

We have granted the underwriters an option for a period of 30 days to purchase up to 1,781,250 additional shares of Class A common stock on the same terms and conditions set forth above.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities that may be offered under this prospectus, nor have any of these organizations determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our Class A common stock to investors on or about , 2017.

_______________________________________________

J.P. Morgan | Morgan Stanley | |

Goldman, Sachs & Co. | Keefe, Bruyette & Woods A Stifel Company | Wells Fargo Securities |

Freeman & Co. | ||

, 2017 | ||

Table of Contents

Page | |

Neither we nor the underwriters have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that any other person may give you. We are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of Class A common stock and the distribution of this prospectus outside the United States. See “Underwriting.”

This prospectus includes certain information regarding the historical performance of our specialized funds and customized separate accounts. An investment in shares of our Class A common stock is not an investment in our specialized funds or customized separate accounts. In considering the performance information relating to our specialized funds and customized separate accounts contained herein, prospective Class A common stockholders should bear in mind that the performance of our specialized funds and customized separate accounts is not indicative of the possible performance of shares of our Class A common stock and is also not necessarily indicative of the future results of our specialized funds or customized separate accounts, even if fund investments were in fact liquidated on the dates indicated, and there can be no assurance that our specialized funds or customized separate accounts will continue to achieve, or that future specialized funds and customized separate accounts will achieve, comparable results.

Unless indicated otherwise, the information included in this prospectus assumes no exercise by the underwriters of the option to purchase up to an additional 1,781,250 shares of Class A common stock and that the shares of Class A common stock to be sold in this offering are sold at $16.00 per share, which is the midpoint of the price range indicated on the front cover of this prospectus.

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are owned by us or licensed by us. We also own or have the rights to copyrights that protect the content of our solutions. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this prospectus are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks, trade names and copyrights.

This prospectus may include trademarks, service marks or trade names of other companies. Our use or display of other parties’ trademarks, service marks, trade names or products is not intended to, and does not imply a relationship with, or endorsement or sponsorship of us by, the trademark, service mark or trade name owners.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets that we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any third-party information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully before making an investment decision, including the information under the headings “Risk Factors,” “Special Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” and the historical consolidated financial statements and the related notes thereto and unaudited pro forma financial information, each appearing elsewhere in this prospectus. The information presented in this prospectus assumes (i) an initial public offering price of $16.00 per share of Class A common stock (the midpoint of the price range set forth on the cover page of this prospectus) and (ii) unless otherwise indicated, that the underwriters do not exercise their option to purchase additional shares of Class A common stock.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “us,” “our,” the “Company,” “Hamilton Lane” and similar terms refer (i) for periods prior to giving effect to the reorganization transactions described under “Organizational Structure,” to Hamilton Lane Advisors, L.L.C. and its consolidated subsidiaries and (ii) for periods beginning on the date of and after giving effect to such reorganization transactions, to Hamilton Lane Incorporated and its consolidated subsidiaries. As used in this prospectus, (i) the term “HLA” refers to Hamilton Lane Advisors, L.L.C. for all periods and (ii) the terms “Hamilton Lane Incorporated” and “HLI” refer solely to Hamilton Lane Incorporated, a Delaware corporation, and not to any of its subsidiaries. Also, unless otherwise indicated or the context otherwise requires, all information in this prospectus gives effect to the reorganization transactions. We are a holding company and, upon completion of this offering, we will hold substantially all of our assets and conduct substantially all of our business through Hamilton Lane Advisors, L.L.C.

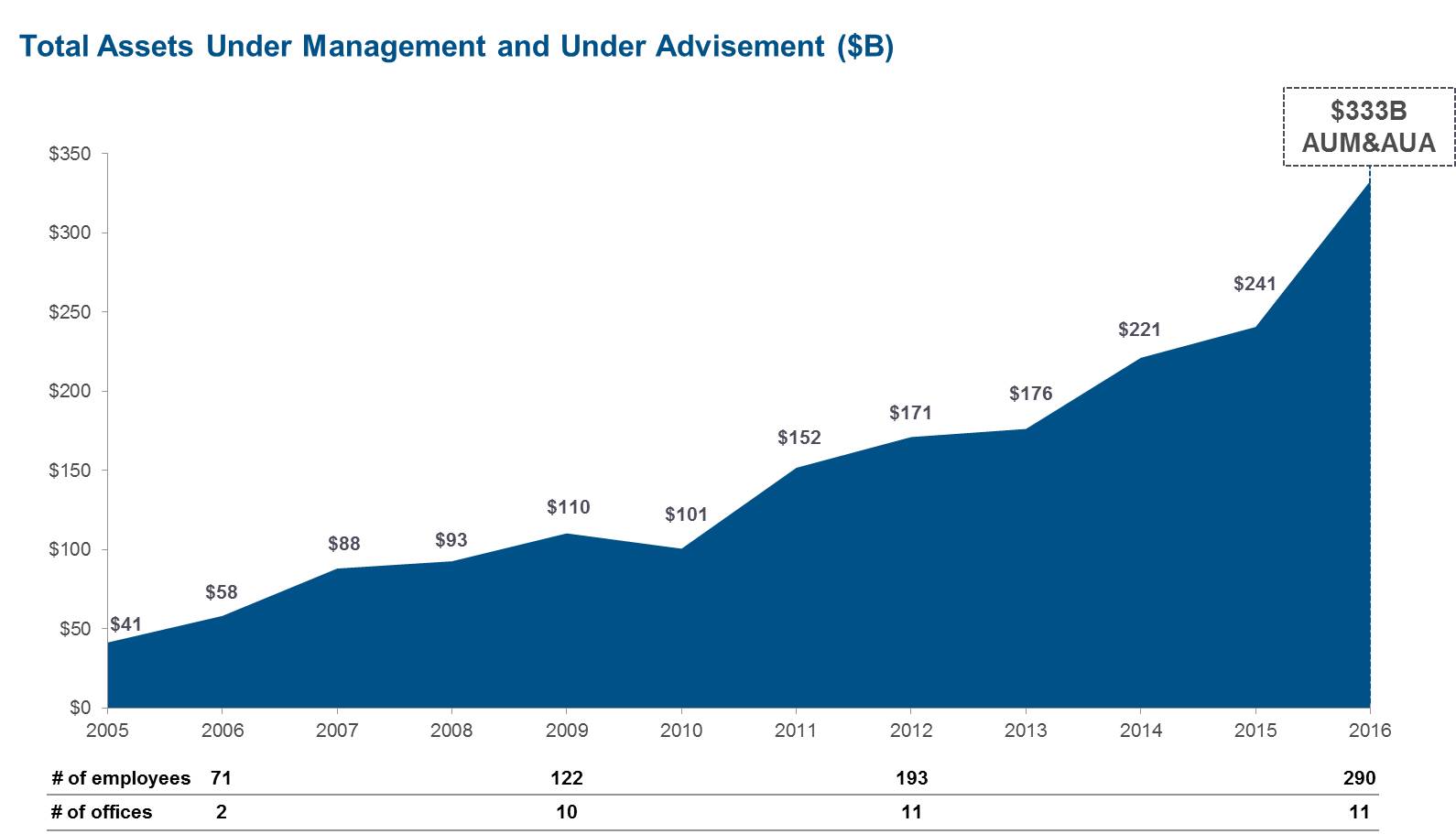

We are a global private markets investment solutions provider with approximately $40 billion of assets under management (“AUM”) and approximately $292 billion of assets under advisement (“AUA”). We work with our clients to conceive, structure, build out, manage and monitor portfolios of private markets funds and direct investments, and we help them access a diversified set of such investment opportunities worldwide. Our clients are principally large, sophisticated, global investors that rely on our private markets expertise, deep industry relationships, differentiated investment access, risk management capabilities, proprietary data advantages and analytical tools to navigate the increasing complexity and opacity of private markets investing. While some maintain their own internal investment teams, our clients look to us for additional expertise, advice and outsourcing capabilities. We were founded in 1991 and have been dedicated to private markets investing for more than two decades. We currently have more than 290 employees, including over 90 investment professionals, operating in 11 offices throughout the United States and in London, Hong Kong, Rio de Janeiro, Seoul, Tel Aviv and Tokyo. More than 100 of our employees have equity interests in our Company.

We offer a variety of investment solutions to address our clients’ needs across a range of private markets, including private equity, private credit, real estate, infrastructure, natural resources, growth equity and venture capital. These solutions are constructed from a range of investment types, including primary investments in funds managed by third-party managers, direct/co-investments alongside such funds and acquisitions of secondary stakes in such funds, with a number of our clients utilizing multiple investment types. These solutions are offered in a variety of formats covering some or all phases of private markets investment programs:

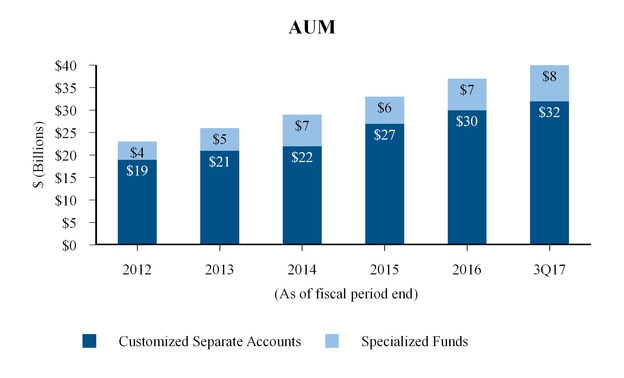

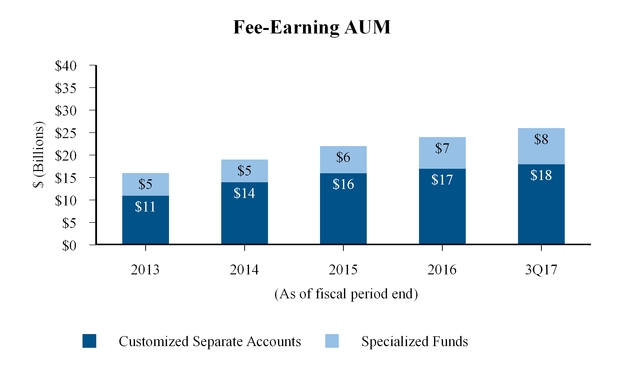

• | Customized Separate Accounts: We design and build customized portfolios of private markets funds and direct investments to meet our clients’ specific portfolio objectives with regard to return, risk tolerance, diversification and liquidity. We generally have discretionary investment |

1

authority over our customized separate accounts, which comprised approximately $32 billion of our AUM as of December 31, 2016.

• | Specialized Funds: We organize, invest and manage specialized primary, secondary and direct/co-investment funds. Our specialized funds invest across a variety of private markets and include equity, equity-linked and credit funds offered on standard terms as well as shorter duration, opportunistically oriented funds. We launched our first specialized fund in 1997, and our product offerings have grown steadily, comprising approximately $8 billion of our AUM as of December 31, 2016. |

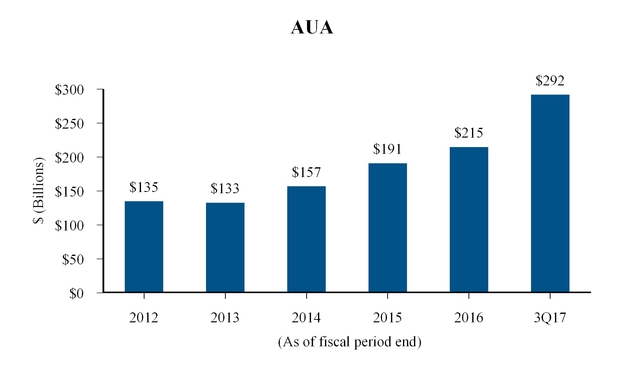

• | Advisory Services: We offer investment advisory services to assist clients in developing and implementing their private markets investment programs. Our investment advisory services include asset allocation, strategic plan creation, development of investment policies and guidelines, the screening and recommending of investments, legal negotiations, the monitoring of and reporting on investments and investment manager review and due diligence. Our advisory clients include some of the largest and most sophisticated private markets investors in the world. We had approximately $292 billion of AUA as of December 31, 2016. |

• | Distribution Management: We offer distribution management services to our clients through active portfolio management to enhance the realized value of publicly traded stock they receive as distributions from private equity funds. As of December 31, 2016, we have managed over $3 billion worth of private equity distributions since April 1, 2013. |

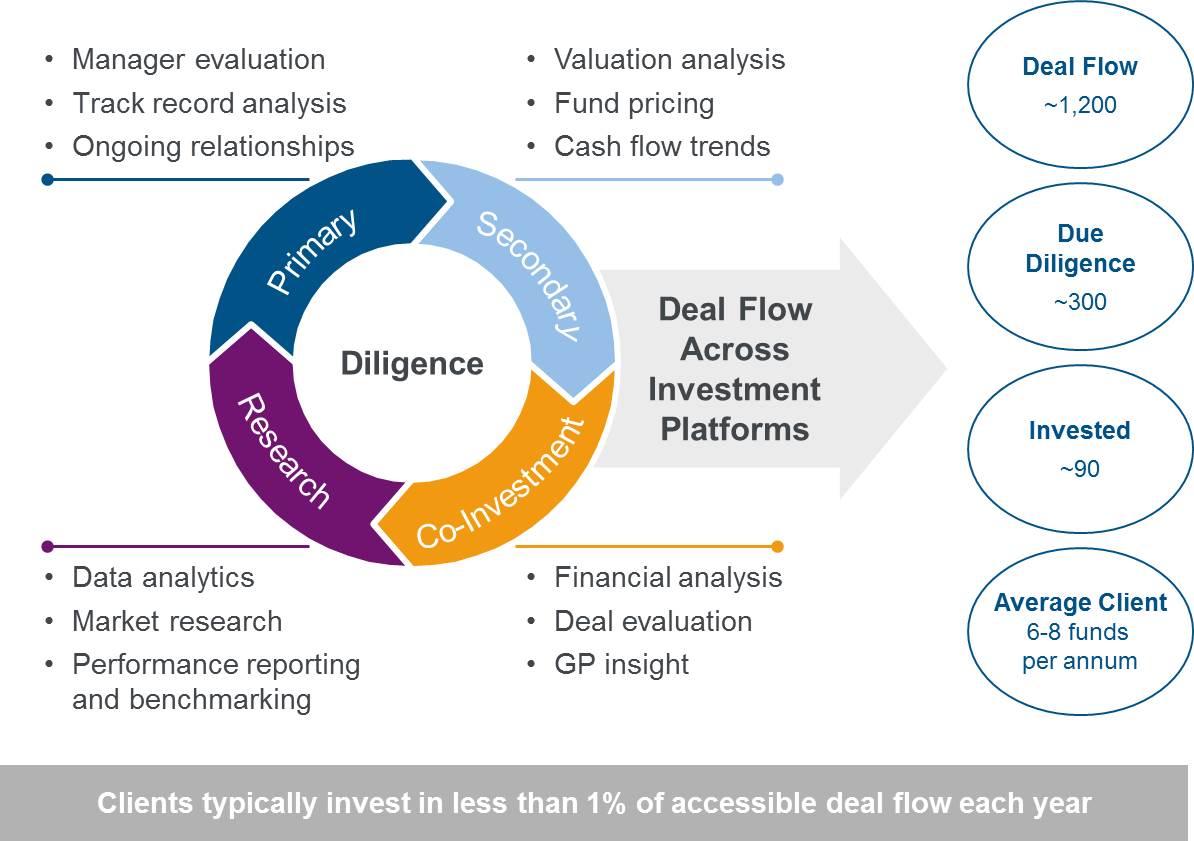

• | Reporting, Monitoring, Data and Analytics: We provide our clients with comprehensive reporting and investment monitoring services, usually bundled into our broader investment solutions offerings, but occasionally on a stand-alone, fee-for-service basis. Private markets investments are unusually difficult to monitor, report on and administer, and our clients are able to benefit from our sophisticated infrastructure, which provides real-time access to reliable and transparent investment data, and our high-touch service approach, which allows for timely and informed responses to the multiplicity of issues that can arise. We also provide comprehensive research and analytical services as part of our investment solutions, leveraging our large, global, proprietary and high-quality database of private markets investment performance and our suite of proprietary analytical investment tools. Spanning 40 years and covering over 1,200 fund managers and over 3,200 funds, our database contains detailed information on over $3 trillion of private markets investments and over 50,000 portfolio companies. |

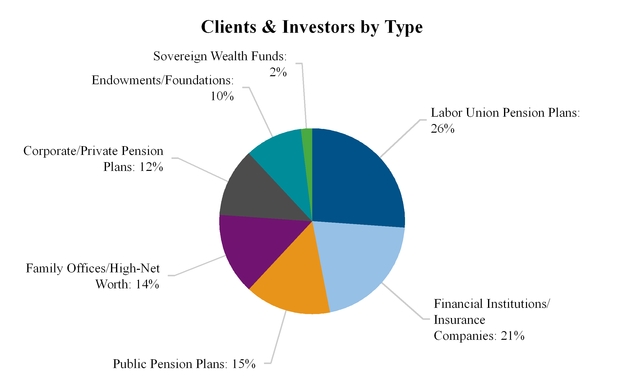

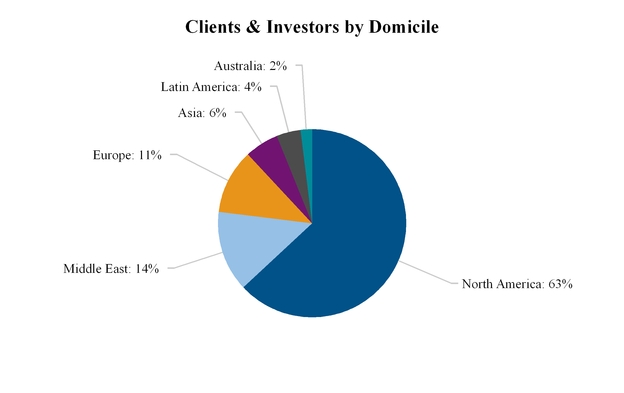

Our client and investor base included over 350 institutions and intermediaries as of December 31, 2016 and is broadly diversified by type, size and geography. Our client base primarily comprises institutional investors that range from those seeking to make an initial investment in alternative assets to some of the largest and most sophisticated private markets investment programs. As a highly customized, flexible outsourcing partner, we are equipped to provide investment services to institutional clients of all sizes and with different needs, internal resources and investment objectives. Our clients include prominent institutional investors in the United States, Europe, the Middle East, Asia, Australia and Latin America. We provide private markets solutions and services to six of the world’s 20 largest pension funds, seven of the 10 largest state pension plans in the United States and four of the world’s 10 largest sovereign wealth funds. In addition, we believe we are a leading provider of private markets solutions for U.S. labor union pension plans, and we serve numerous smaller public and corporate pension plans, sovereign wealth funds, financial institutions and insurance companies, endowments and foundations, as well as family offices and selected high-net-worth individuals.

Our intermediary clients enable us to provide our investment products to an expanded range of high-net-worth individuals and families. We have a diversified revenue stream from a variety of client types in

2

multiple geographic regions, with no single client representing more than 5% of management and advisory fee revenues. For the year ended March 31, 2016, our top 10 clients generated approximately 28% of management and advisory fee revenues, and our top 20 clients generated approximately 42% of management and advisory fee revenues.

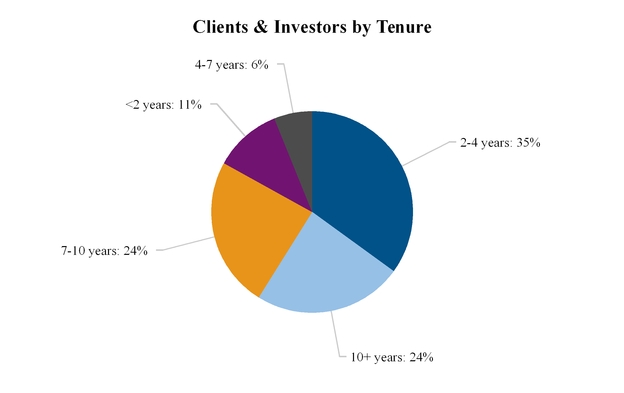

A significant portion of our revenue base is recurring and is based on the long-term nature of our specialized funds and customized separate accounts, as well as long-term relationships with many of our clients, providing highly predictable cash flows. Our average customized separate account client relationship is over seven years. In addition to the stable nature of our long-term relationships, the need for our clients to continually invest additional capital to maintain or grow their private markets allocations has allowed us to grow our total customized separate account management fees from our existing client base by more than 5% for each of our last three fiscal years. This existing client base has accounted for approximately 60% of total new customized separate account management fees over the last three fiscal years with brand new relationships accounting for approximately 40%. Lastly, approximately 80% of our customized separate account clients whose first investment period (typically less than two years) has expired have allocated additional capital to us. On average, these clients with multiple allocations have provided us with approximately six total allocation allotments.

Since our inception, we have experienced consistent, strong growth, which continues to be reflected in our more recent AUM and AUA growth. As of December 31, 2016, we had AUM of approximately $40 billion, reflecting a 12% compound annual growth rate (“CAGR”), from March 31, 2012, and our AUM increased in each fiscal year during this timeframe. We had approximately $292 billion of AUA as of December 31, 2016, reflecting an 18% CAGR from March 31, 2012. Our AUA increased in each fiscal year during this timeframe, with the exception of a 1.5% decrease at March 31, 2013 compared to March 31, 2012.

Finally, we believe that our strong culture is a key factor driving our success in developing and maintaining high-quality relationships with clients, prospects, other business partners and current and potential employees. We are proud that our culture has been recognized by several prominent trade organizations and publications through numerous awards. For example, we were one of a select group of companies named as a “Best Place to Work in Money Management” in 2015 by Pensions & Investments. Our firm is the only firm in the “Alternatives Manager” category that has appeared on this list every year since Pensions & Investments initiated this category in 2012. Additionally, the firm has received accolades from publications and organizations including Inc. (Hire Power Award: 2013; Fastest-Growing Private Companies in America: 2012 and 2016), Best Companies Group (Best Places to Work in PA: 2012-16) and the Philadelphia Business Journal (Advancing Women Company Award: 2014). We believe that our culture will continue to play an important role in supporting our future growth.

3

Our Market Opportunity

The alternative investing industry continues to see strong growth, with global alternative AUM reaching an all-time record of more than $7 trillion in 2014, up from approximately $1 trillion in 1999, according to the World Economic Forum’s July 2015 report Alternative Investments 2020 – The Future of Alternative Investments (“World Economic Forum Report”). PricewaterhouseCoopers, in its 2015 report Alternative Asset Management 2020 (“PwC Report”), states it expects the industry to nearly double to $13.6 trillion by 2020.

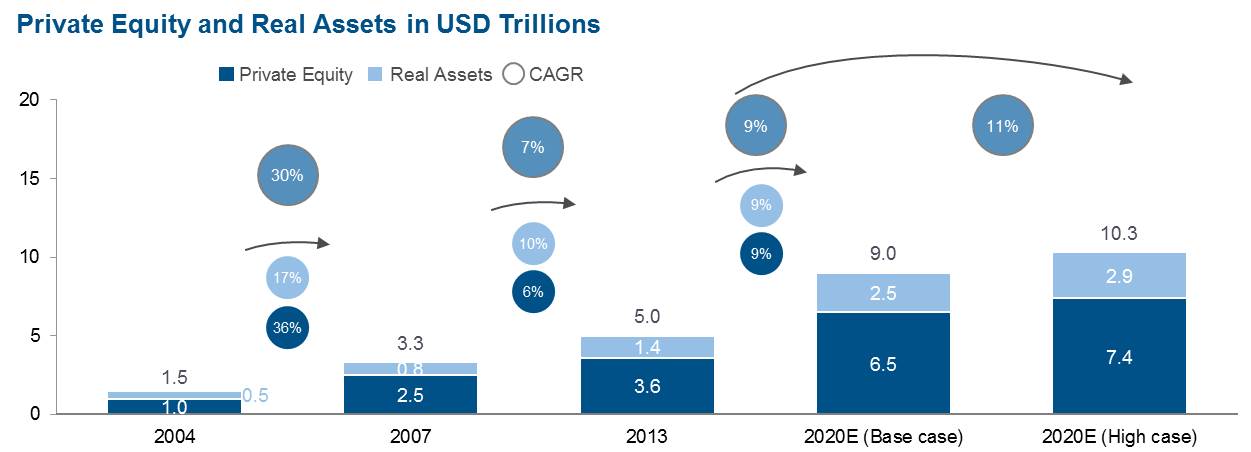

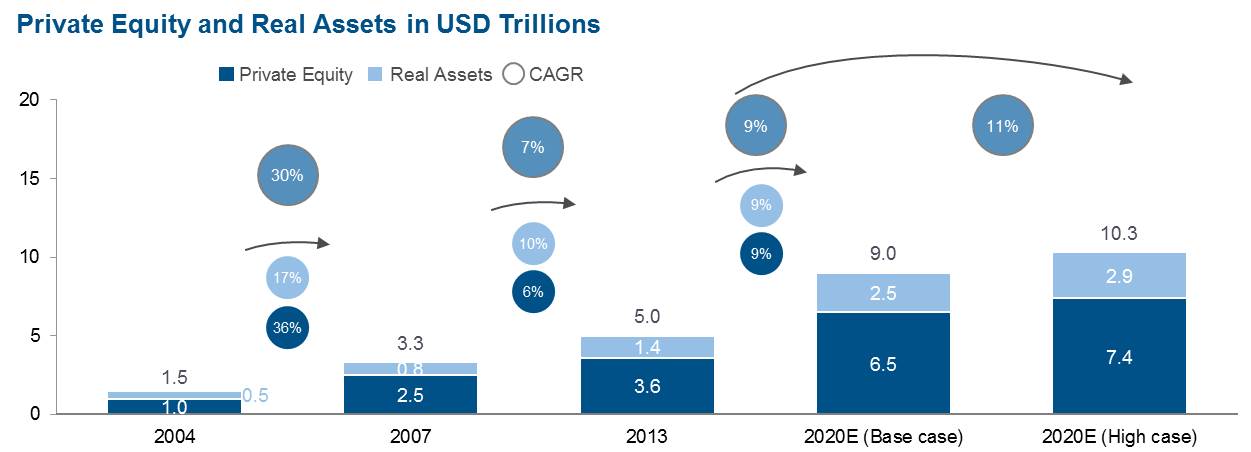

Source: PwC Report

|

In particular, private markets AUM reached an all-time high of approximately $4 trillion in 2014, with private equity (which includes buyout and venture strategies) contributing approximately $2 trillion, according to the World Economic Forum Report. This increase in assets is driven by robust investor demand as institutional and retail investors look to diversify their portfolios to generate strong returns, reduce volatility and generate reliable income. Aggregate private markets AUM has experienced, and is expected to continue to experience, significant growth.

Several trends and developments have shaped the alternative investing industry and continue to serve as the primary drivers of our growth:

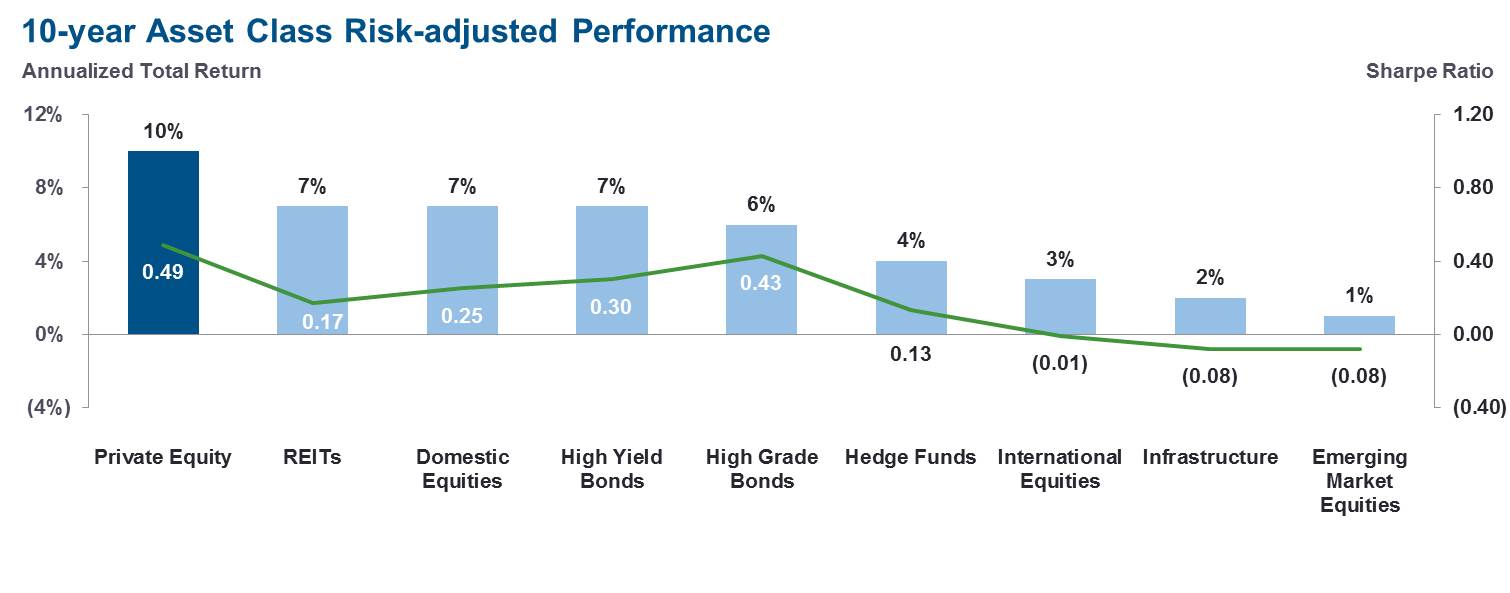

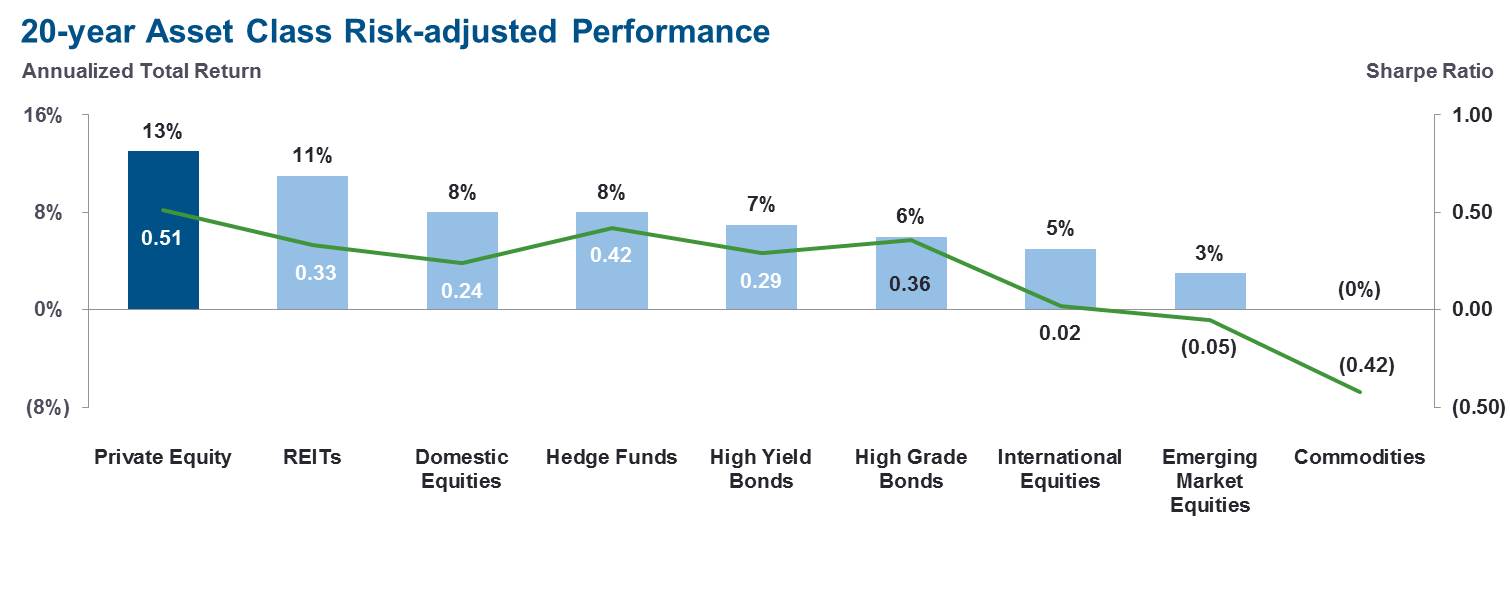

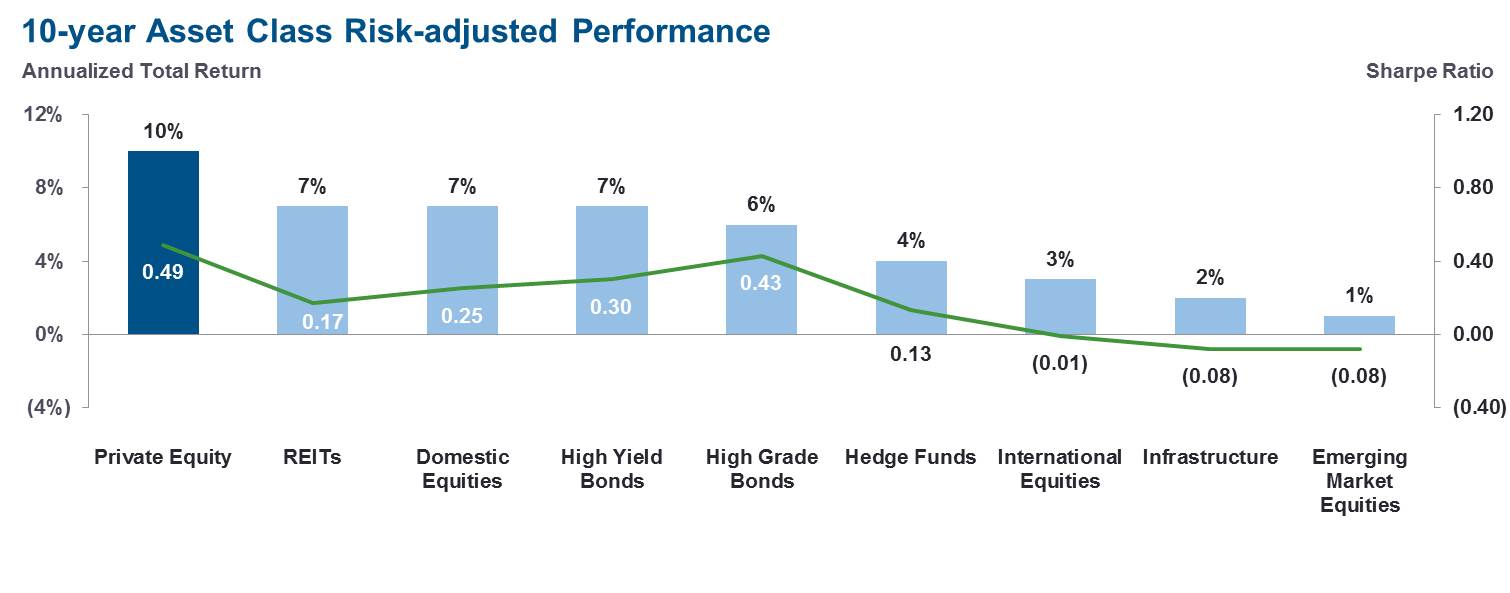

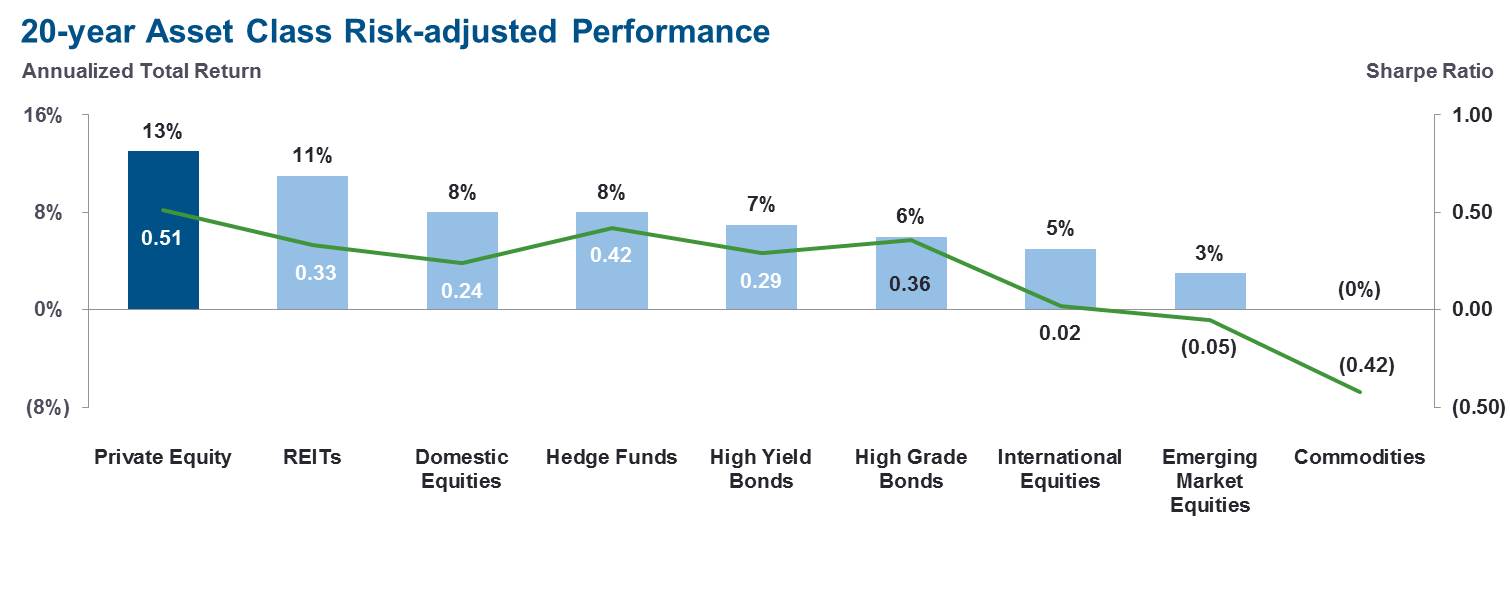

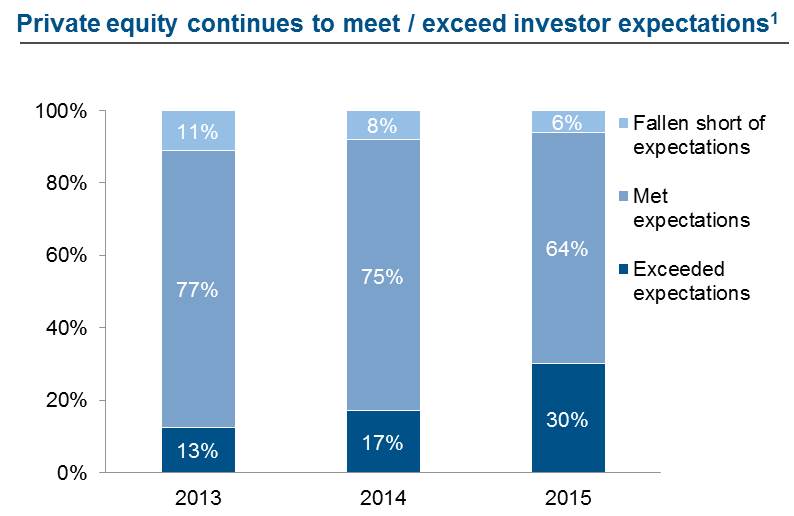

Private equity proven as a performance leader. Our proprietary database demonstrates that private equity has been a stronger-performing asset class than more traditional investments over a longer investment horizon. Over the last ten years, private equity has generally outperformed other investment classes on both an absolute and risk-adjusted basis. Our proprietary database shows that as of December 31, 2015, private equity returns have surpassed public equity returns as measured by the Russell 3000 Index in six of the last ten years, by approximately 290 basis points (“bps”) over a 10-year term and by approximately 470 bps over a 20-year term, reflecting a comparably high Sharpe ratio of 0.49 and 0.51, respectively. The Sharpe ratio is a measure for calculating risk-adjusted return and equals the average return earned in excess of the risk-free rate per unit of volatility or total risk. We believe that comparing the Sharpe ratio of private equity returns against the Sharpe ratio of other asset classes demonstrates the relative attributes of the private equity market. This attractive risk-return dynamic is one of the driving forces in the growth of private equity, as the majority of targeted investors are looking to increase allocations to this asset class. The following charts show investment return and Sharpe ratio by asset class from January 1, 2006 to December 31, 2015 and from January 1, 1996 to December 31, 2015, respectively.

4

Source: Hamilton Lane (January 2016). Indices used: Hamilton Lane All Private Equity with volatility de-smoothed (de-smoothing attempts to make the volatility of private equity quarterly appraisal valuations comparable to the volatility of exchange-traded asset classes); Russell 3000 Index; MSCI World ex US Index; MSCI Emerging Markets Index; Barclays Aggregate Bond Index; Credit Suisse High Yield Index; HFRI Composite Index; FTSE/NAREIT Equity REIT Index; Dow Jones-UBS Commodities Index. Geometric mean returns in USD. Assumes risk free rate of 3.1% and 4.1%, representing average yield of the 10-year treasury over the last 10 years and 20 years, respectively.

5

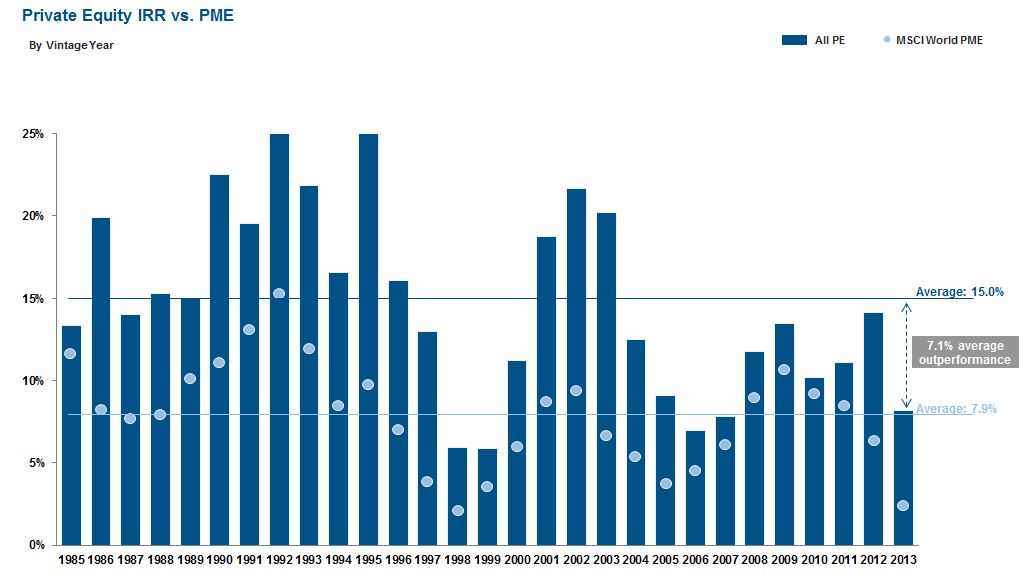

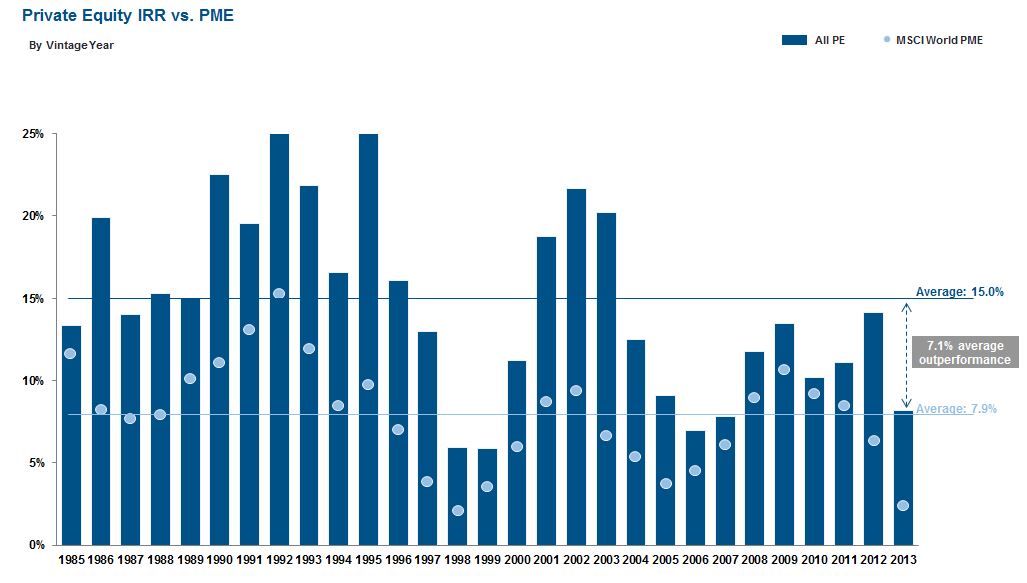

Further illustrating the outperformance of private equity, the following chart shows the pooled private equity returns for each vintage year from 1985 to 2013 (as of March 31, 2016) compared to the MSCI World public market equivalent over the same time periods. As highlighted below, pooled private equity returns for the vintage years 1985 to 2013 have had an average outperformance of over 700 bps.

Source: Hamilton Lane Fund Investment Database, MSCI (July 2016)

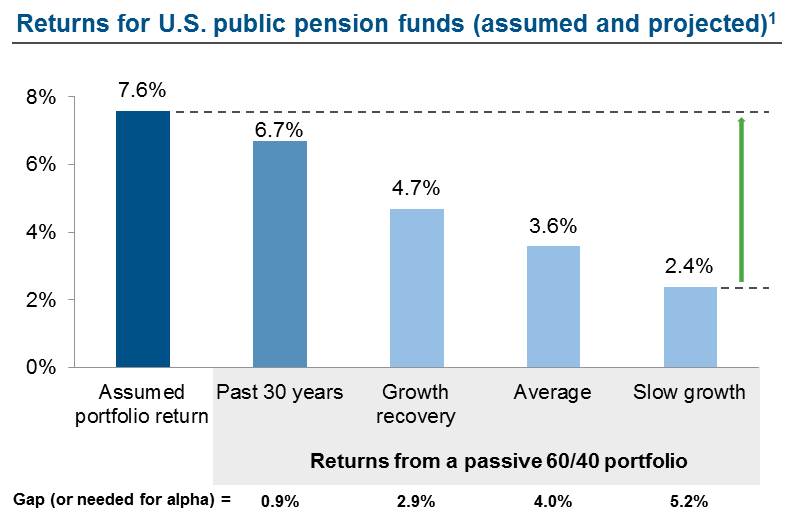

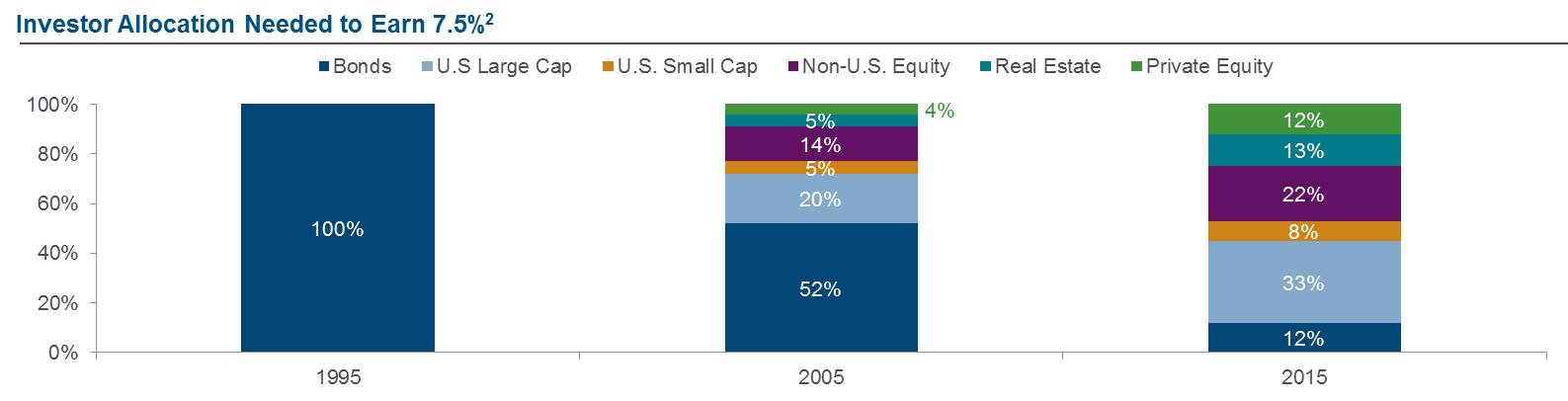

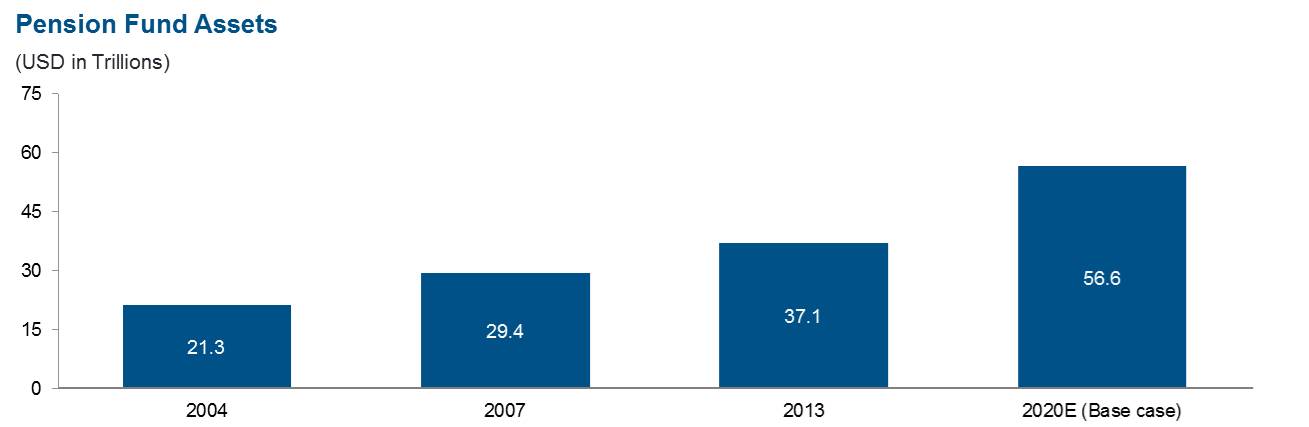

Increasing demand from institutional investors for private alternative investments. Robust demand for private alternative assets is driven in large part by (a) the struggle for investors to reach commonly sought target returns in excess of 6% through typical blends of public equity and fixed income investments; (b) strong performance by private markets investments relative to other asset classes and (c) institutional investors adapting to a range of macro factors, including the aging population in developed economies and monetary policies enacted in the wake of the global financial crisis.

• | Institutional investors, the dominant investor type in alternative assets, are actively managing their asset allocations and seeking alternative sources of returns in order to address these dynamics. According to McKinsey & Company’s 2014 report The Trillion Dollar Convergence: Capturing the Next Wave of Growth in Alternative Investments (“McKinsey Report”), the vast majority of large institutional investors are planning to either maintain or increase their alternatives allocations across private equity, real estate, infrastructure and other real assets, as investors are increasingly embracing illiquid private markets investment strategies as a way to meet their long-term investment objectives. At the same time, smaller, less established investors are increasingly investing in private markets. |

• | According to the World Economic Forum’s October 2015 report Alternative Investments 2020— The Future of Alternative Investments, social systems are coming under pressure as the aging baby boom population lives longer, fueling growing pension liabilities and leaving institutions to face persistent asset-liability gaps in defined benefit pension plans. In the aggregate, defined benefit plans are only 75% funded, according to the McKinsey Report, and are increasing |

6

allocations into higher-yielding alternatives to achieve the returns required to meet their obligations.

• | Growth is also driven by expansion of the alternative investment management industry’s range of investing activities, particularly in the credit area. According to the World Economic Forum Report, this trend is driven by institutional investors in search of yield as well as a reduction in lending activity by banks in response to increasing regulation post-crisis. According to the World Economic Forum Report, non-bank financial actors, including alternative investors, are expected to replace banks in providing a projected $3 trillion of lending by 2018. |

Shifting structure of the investing landscape and inherent economies of scale. As the investing landscape shifts toward private assets, investors are faced with disproportionate fragmentation of market players and a highly complex set of potential investing opportunities as compared to traditional public equity or credit investing. Further, increasing regulatory scrutiny on private capital investing is expected to increase investors’ focus on investment monitoring, internal controls and compliance. Taken together, these factors favor investment solutions providers who have sufficient scale and reach to offer comprehensive global outsourcing and advisory services to potential investors. We believe there is a high degree of complexity and increasing regulatory and government scrutiny within private market asset classes; therefore, future success in private markets investing will require excellence beyond investment performance, with a high premium placed on innovation in solution-based products, distribution, marketing and thought leadership.

Investors concentrating relationships among asset managers and advisors. According to McKinsey & Company’s 2014 report McKinsey on Investing, institutional investors, in particular, are moving towards focusing their relationships with money managers, advisors and solutions providers on fewer firms, each of which performs a broader array of services. This is driven by:

• | Desire to lower the expense ratio associated with investment programs. |

• | Awareness that portfolios can be over-diversified by virtue of having too many managers. |

• | Acknowledgment of the difficulties of building in-house resources. |

• | The use of strategic partners to leverage additional knowledge and insights and to achieve quality extension of staff resources. |

Rising demand for customized portfolio construction. In an era of heightened market volatility and economic uncertainty, institutional investors are increasingly reducing their exposure to traditional asset classes and strategies and to commingled structures where the actions or inactions of other investors can generate adverse and unanticipated effects. Instead, investors are allocating more capital toward customized products in search of risk-return optimization and specific investment outcomes. According to the McKinsey Report, investors are gravitating towards the ability to maintain investment portfolios that achieve the low-cost beta found in index strategies, as well as the alpha generated from diversified alternatives. This shift toward customized portfolio construction allows alternatives to play a more central role in the portfolio, acting to deliver a range of specific investment objectives for investors. To this point, the separate account model is becoming increasingly prevalent as this investment structure allows investors to maintain greater control over asset-level ownership, enabling specific exposures or hedges in customized portfolios.

Similar to public markets, private markets have become more diverse, attracting investors with different investment objectives. Large, sophisticated institutions often have nuanced preferences in investment priorities, capabilities and vehicle and manager types that differ from those of smaller institutions. These different investor segments also have varying product preferences even within the private markets area, with larger investors embracing more illiquid opportunities and smaller investors

7

seeking access to less illiquid alternatives. We believe the ability to create customized portfolios to address those varied needs is powerful, as it attracts more investors to the asset class and allows us to be a value-added partner.

Increasing importance of big data and sophisticated analytics in private markets. Data systems, and the attendant monitoring and analytical tools, in the private markets investing industry lag far behind those in others, especially the public investment markets. While public markets investors can access a wealth of data available electronically and on-demand and can utilize broad suites of cutting-edge investment monitoring and analytical tools, the private markets are hampered by data inefficiency, manual entry and a massive shortage of sophisticated portfolio reporting and advisory solutions. According to the Ernst & Young Report, firms with advanced data and analytics capabilities will be able to meet investors’ increasing demand for seamless, coordinated, rich and easy digital access with readily operable monitoring and analytical tools attached thereto. In addition, many investors now require the ability to respond transparently and quickly to reporting requests and demand enhanced risk management functions. This requires a firm-wide data infrastructure that identifies, extracts and aggregates financial data across multiple global sources. According to the Ernst & Young Report, most organizations do not have an adequate technology infrastructure to respond to these escalating demands. Therefore, we believe that the ability to harness proprietary private markets data with a sophisticated technology-enabled infrastructure will increasingly become a competitive advantage.

Growth in defined contribution, retail and similar pools of investable assets seeking access to private market returns. In recent years, defined contribution retirement plans in the United States and abroad and other retail-like pools of assets have grown significantly. According to the Investment Company Institute (December 2016), U.S. defined contribution plans and IRAs grew by $6.7 trillion from 2005 through the end of 2015, representing a CAGR of approximately 7%. As with more traditional/institutional pools of capital, these investors are also seeking higher-returning investment options than those generally perceived to be available in traditional asset classes. Large segments of the investor universe find it difficult to access private markets investment opportunities because of the scarcity of data, the relative lack of transparency and the lack of available liquidity mechanisms. Further, the structural complexity surrounding long fund lives with limited liquidity, lack of daily valuation and capital drawn as needed creates funding and administration challenges, as well as regulatory and structural impediments. In recent years, some progress has been made to bridge this gap via the creation of “liquid alternatives” vehicles and other programs. We expect that these types of investors will play an increasingly significant role in private markets fundraising in the coming years.

Our Competitive Strengths

Since our inception in 1991, we have grown to become a leading private markets solutions provider. We believe the following competitive strengths allow us to capitalize on industry trends and position us well for future growth:

Pioneering, industry-leading and full-service manager of customized separate accounts for private markets alternatives. We offer a comprehensive, full-service model to our clients who are seeking a customized solution to private markets investing. We believe we were pioneers in the private markets separate account business and understand well that private markets investors have varying risk-return appetites and specific needs across a wide range of private markets asset classes. Therefore, a one-size-fits-all approach is less desirable for these clients. According to the PwC Report, there will be an ongoing demand by the largest institutional investors (e.g., sovereign investors) for made-to-order offerings with greater customization. We believe our dedicated client teams, comprehensive full-service model and capabilities across a broad range of private markets asset classes continue to put us at the forefront of the offerings. This is reflected in our business composition, as approximately 43% of our fiscal 2016

8

management and advisory fee revenues were generated from customized separate account mandates compared to 40% from specialized funds, 14% from advisory and reporting and 3% from distribution management.

We generally offer customized separate account and advisory clients a full-service, integrated approach to creating and managing private markets investment programs. These programs are unique in many ways and require specialized expertise in almost every aspect of their initiation, operation and assessment, and clients benefit from receiving a fully integrated service package. Our broad-based and deep expertise in strategic planning, structuring and setting up of investment vehicles, analysis and assessment of fund managers, portfolio construction, legal services, monitoring, reporting, benchmarking, custodial arrangements, data aggregation and customized analytics allow us to offer what essentially amounts to a “turnkey” solution to clients wishing to build private markets exposure in their investment portfolios.

Global, fully integrated and diversified private markets investment solutions. From our origins in U.S.-based buyouts and venture capital fund investing, we have expanded our capabilities over the years to encompass a full suite of private markets capabilities that span multiple countries, investment strategies and types, and risk and return profiles. This expansion has reflected our clients’ developing needs to reach more broadly across the globe and varying investment types while simultaneously focusing their relationships with asset managers on those service providers who can help them in multiple areas. In addition, the introduction of specialized funds tailored to specific geographies, to meet investors’ liquidity and risk requirements and to capitalize on certain market opportunities, has enabled investors of all sizes to broaden and, in some ways, more specifically customize their private markets portfolio.

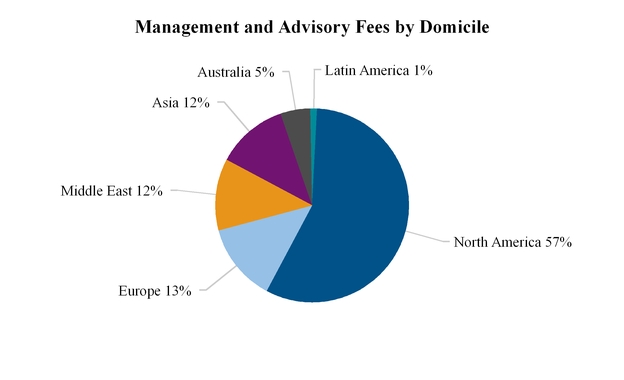

With approximately 45% of our fiscal year 2016 management and advisory fee revenues coming from clients based outside of the United States, we are well-positioned to continue to take the lead in, and benefit from, the ongoing globalization of the alternative asset management industry in general and private markets alternatives in particular. Investors are generally more willing and able to institute and manage more complete private markets investment programs in their home countries than in foreign jurisdictions. Such investment programs feature unusual risk and return characteristics, meaningful challenges to gathering and interpreting information, obstacles to identifying and building relationships with underlying managers, and complex legal, tax, regulatory and currency aspects, among other issues, all of which are more difficult to manage at a distance. With six non-U.S. offices, we have a meaningful presence around the globe, which allows us to cover all regions that offer investable opportunities in the private markets. We serve clients and investors from over 35 countries and have deployed capital in 88 countries across a wide range of private markets investment strategies.

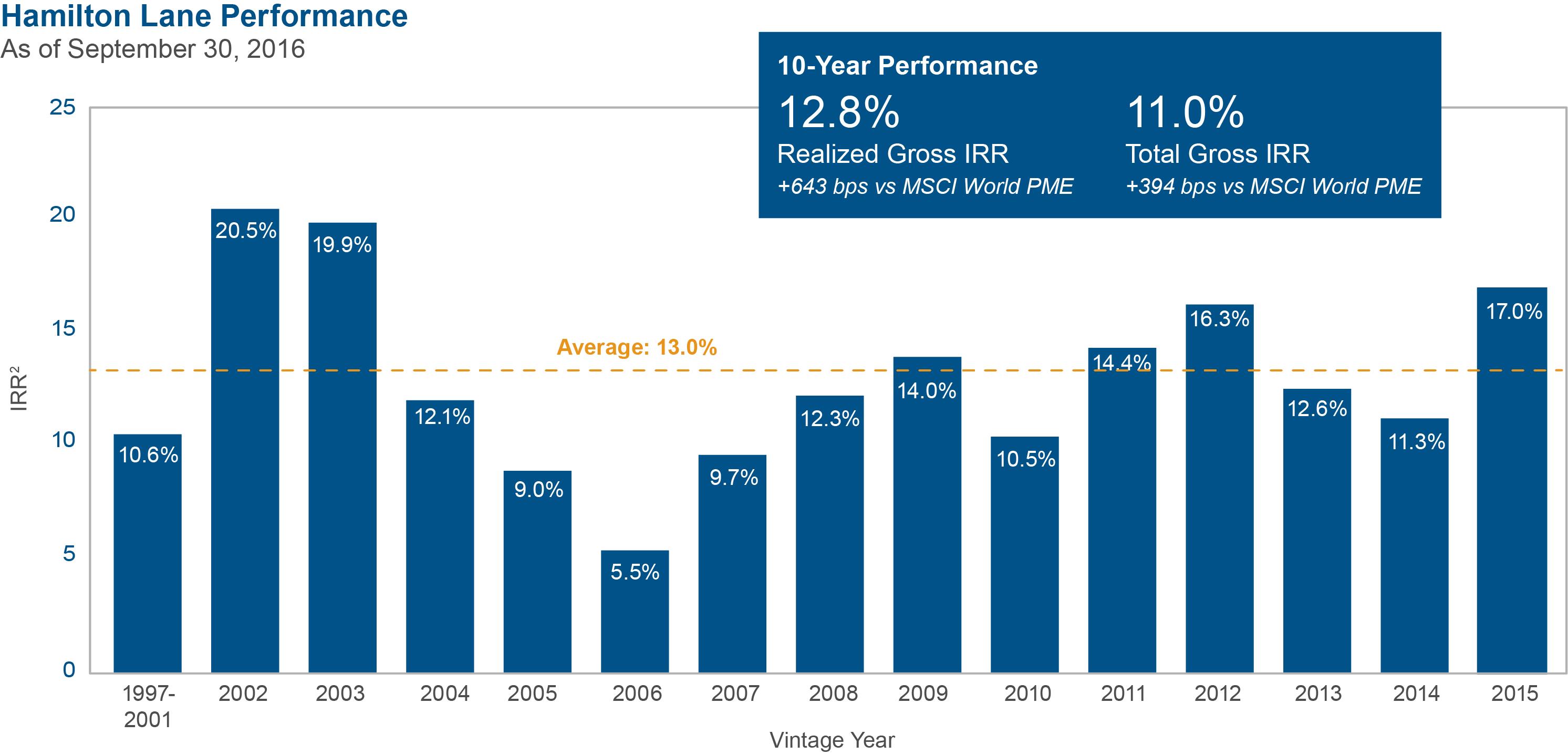

Demonstrated investment performance track record for our clients driven by our differentiated investment philosophy and process. Our discretionary accounts, including our specialized funds, have performed well above their benchmarks and, over the last 10 years, have outperformed the Public Market Equivalent (“PME”) by over 600 bps on a realized gross internal rate of return (“IRR”) basis. Since their inception, our discretionary accounts have generated positive returns for our clients and have outperformed the MSCI World PME every vintage year. We believe that our investment performance success is attributable to a number of factors. These include our substantial, seasoned and dedicated investment teams, our standardized investment processes and procedures, and our global and pan-industry approach to investing, all of which leverage our significant research capabilities and our proprietary databases and analytical tools. Our teams use our leading market position, our long-standing experience in private markets investing and our vast array of relationships worldwide to source and diligence investment opportunities from around the globe and in every applicable private markets asset class. Our processes and procedures have been developed and refined over many years of experience in successful private markets investing. Our commitment to industry-agnostic measures of investment risk and global

9

access to opportunities has allowed us to maintain a dispassionate perspective to which we credit the consistency of our investment performance. Finally, our research capabilities, databases and tools enable us to look at the private markets investment universe holistically, considering both macroeconomic and sector-wide trends as well as manager, geographic, industry and asset-specific factors.

Leading market position poised to capitalize on a large and growing market. We have a leading market position among the world’s largest institutional investors. Including all discretionary investments and commitments made by us, non-discretionary client commitments into our broadly recommended funds, and non-discretionary client commitments into funds for which we have written the client-specific report and have an existing relationship with the general partner or the fund, we directed or significantly influenced approximately $22.0 billion in primary private market investments, approximately $0.8 billion in private market co-investments and approximately $0.7 billion in secondary private market investments. This totals approximately $24 billion of private markets investments in 2015, which we believe is more than any other institution or intermediary in the world. Several of our advisory clients rank among the largest private markets limited partners in the world, and as a result of our significant AUM and AUA, we have strong access to the world’s leading fund managers across a multitude of investment strategies. We believe we influence more primary commitments to private equity funds globally than any other market participant. This also translates into our ability to negotiate attractive investment terms for our clients as well as unique and proprietary deal flow, which benefits our specialized fund program. Our leading market position, large capital scale, global footprint and customized investment solutions cater well to the strengthening of our market share in the alternative asset management sector.

Preeminent data and analytics capabilities driven by scale and information advantage. Our deep industry knowledge allows expert navigation of an increasingly complex menu of alternative investment options. Given our long history in the market, we believe we have developed one of the largest sets of data in the industry, reflecting nearly four decades of private markets fund investments. This contrasts with the lack of efficient data systems and sophisticated portfolio and advisory solutions in the private markets investment industry more broadly and provides us with a competitive advantage. Our extensive proprietary data and analytics drive our investment selection decisions and deliver highly customized insights and services to our clients. Our dedicated research team leverages our proprietary database to provide our clients with valuable insights by performing in-depth quantitative analysis. Covering over 1,200 fund managers and over 3,200 funds, our database contains detailed information on over $3 trillion of private markets investments and over 50,000 portfolio companies. Our ability to deploy our data advantage by providing real-time information through our technology-driven reporting and analytics infrastructure delivers our clients a differentiated set of transparent and highly valued data services. These services enhance our ability to retain clients and foster client relationships, which further supports our cross-selling efforts of tailored investment solutions.

In addition to continually expanding our own database, we develop strategic partnerships with, and opportunistically seek minority stakes in, innovative solutions providers such as iLevel (data collection and reporting), DealCloud (investment workflow management), Black Mountain (allocation software) and Bison Cobalt (benchmarking and diligence).

Well-diversified platform and client base. We have a broad set of capabilities to serve large and sophisticated institutions and smaller institutions alike, each having different needs in investment priorities and services. Our clients are well diversified by type, size and geography, and we believe that many of our clients’ programs are among the best private markets programs in the world. Our revenues stem from various asset types in multiple geographic regions, with no single client representing more than 5% of management and advisory fee revenues. For the year ended March 31, 2016, our top 10 clients generated approximately 28% of management and advisory fee revenues, and our top 20 clients generated approximately 42% of management and advisory fee revenues.

10

Highly attractive financial profile with strong growth trajectory. We participate in an industry that is growing. Given our leading market position and strong reputation in investing and client service, our goal is to exceed the industry’s growth rate, driving continued expansion of our recurring fee revenue base in customized separate accounts and specialized funds. Our earnings model has been tested through different economic cycles. The long-lived, stable nature of our capital enhances the resiliency of our business model and leads to highly visible and recurring revenue streams. For example, we were able to deliver revenue and operating earnings growth throughout the 2008-2009 global financial crisis. We grew revenues from approximately $50 million for the year ended March 31, 2007 to approximately $181 million for the year ended March 31, 2016.

Seasoned management team aligned with investors and award-winning culture. We have an experienced global team of over 90 investment professionals that is focused solely on private markets investing. Our senior management team averages 23 years of investment experience, 12 years of tenure together at Hamilton Lane and over 19 years in the private markets industry. Our management and employees are aligned with investors through ownership, with approximately 85% management and employee ownership and more than 100 employees with an equity interest in our Company. We also have an award-winning corporate culture. We were one of 34 companies named as a “Best Place to Work in Money Management” in 2015 by Pensions & Investments and the only firm in the “Alternatives Manager” category that has appeared on this list every year since the category’s inception in 2012. As of December 31, 2016, approximately 40% of our employees were women. This strong representation of women in our workforce led the Forum of Executive Women to recognize us as a Top Global Company for the Professional Advancement of Women.

Business Strategy

The alternative investment industry has experienced significant and consistent growth, which we expect to continue and contribute to our future growth. Given our leading market position and strong reputation in investing and client service, our objective is to continue to leverage the following strategic advantages to exceed the industry growth rate.

Develop innovative private markets solutions. Many of our clients engage us because of our ability to create customized programs that meet their particular investment needs and provide access to a broad spectrum of private markets investment opportunities. We believe that a broad range of solutions across almost every private markets asset class enables us to remain a leader in structuring private markets investment portfolios and to continue to provide the best solutions for our existing and future clients. We intend to continue to meet our clients’ demands for alternative investments via primary, secondary and direct/co-investment opportunities, which provide attractive return characteristics, as well as innovative specialized fund products, while at the same time allowing us to benefit from economies of scale. In addition, we intend to expand into adjacent asset classes, which will allow us to further broaden our solutions capabilities, diversify our business mix and allow us to benefit from growth in private markets asset classes, such as private debt.

Expand distribution channels. We continue to build a scalable, cost-effective global institutional sales organization, which provides us with a strong local presence in several markets. Our sales organization comprises a 40-person team across our business development and product groups dedicated to marketing our services and products globally. In addition, we intend to increase our profile with influential intermediaries that advise individual and institutional clients, particularly small and medium-sized institutions and high-net-worth families and family offices. We may also enter into strategic distribution partnerships with financial institutions in certain geographical regions and market sectors to gain access to their captive client bases. As we continue to explore different ways to access alternative distribution channels, we are also acting as “sub-advisor” for financial intermediaries with significant

11

distribution strength. In this role, we perform a range of investment services from portfolio construction to investment management, while the distribution partner focuses on product distribution and client service. In the context of these partnerships, the distribution partner often aims to provide its clients with products under its own brand, which we achieve by rebranding our existing offerings or by creating customized offerings carrying the distribution partner’s name. We anticipate increasing sub-advisory opportunities as we continue to target high-net-worth individuals and families.

Diversify and grow client base. We aim to continue to expand our relationships with existing clients and also intend to capitalize on significant opportunities in new client segments globally, such as smaller institutions and high-net-worth investors. We believe these investors offer an attractive opportunity to further diversify and grow our client base because many of them only recently have begun to invest in, or increase their allocations to, alternative investments.

Expand private markets solutions and products to defined contribution, retail and similar pools of investable assets. We believe we are pioneers in the creation, distribution, and management of products such as specialized secondaries, direct/co-investments and specialty credit strategies that are designed to serve defined contribution retirement plans and similar entities. Many of our defined contribution retirement plan clients are based outside of the United States, ranging across Australia, Europe, and Latin America, among other geographies. While these clients tend to have lower private markets allocations than those of defined benefit pension plans, their comfort with, interest in and allocations to private markets alternative investments have tended to increase over time, in part driven by significant advancements in the areas of private markets data and benchmarking, where we believe we play a leading role. Therefore, we intend to continue to develop, market and manage investment solutions and products specifically aimed at helping these investors create appropriately structured private markets alternatives programs.

Expand globally. During the past 15 years, we have substantially grown our global presence, both in terms of clients and investments, by expanding our international offices as well as our client presence. We have built a significant presence to serve clients in Europe, Latin America, the Middle East, Asia and Australia, and we have global offices in London, Tel Aviv, Hong Kong, Tokyo, Seoul and Rio de Janeiro. In each of these places, we serve major institutional clients, and we review and commit capital to established local private markets funds on behalf of our clients. Our aim is to continue expanding our global presence through further direct investment in personnel, development of client relationships and increased investments with, and direct and co-investments alongside, established private markets fund managers.

We believe that many institutional investors outside the United States are currently underinvested in private markets asset classes and that capturing capital inflows into private capital investing from non-U.S. global markets represents a significant growth opportunity for us. We think that investors from developing regions will increasingly seek branded multi-capability alternative investment managers with which to invest. We believe that geographically and economically diverse non-U.S. investors will require a highly bespoke approach and will demand high levels of transparency, governance and reporting. We have seen this pattern developing in many places, including Europe, the Middle East, Latin America, Australasia, Japan, South Korea, Southeast Asia and China, and have positioned ourselves to take advantage of it by establishing local presences with global investment capabilities.

We believe we are uniquely capable of pursuing the opportunities arising from increased allocations among institutional investors and the rapid wealth creation globally among high-net-worth individuals because of our strong brand recognition, multi-office resources, experienced team of investment professionals and comprehensive suite of products and services.

12

Leverage proprietary databases and analytics to enhance our existing service offerings and develop new products and services. When compared to more liquid investment areas, the private markets industry is characterized by the limited availability and inconsistency of quality information. We believe that the general trend toward transparency and consistency in private markets reporting will create new opportunities for us. We intend to use the advantages afforded to us by our proprietary databases, analytical tools and deep industry knowledge to drive our performance and provide our clients with customized solutions across private markets asset classes. We expect that our data and analytical capabilities will play an important role in continuing to differentiate our products and services from those of our competitors.

Selected Risk Factors Related to our Business and Industry

Investing in our Class A common stock involves risk. You should carefully consider all the information in this prospectus prior to investing in our Class A common stock. These risks are discussed more fully in the section entitled “Risk Factors” immediately following this prospectus summary. These risks and uncertainties include, but are not limited to, the following:

• | the historical performance of our investments should not be considered as indicative of the future results of our investments or our operations or any returns expected on an investment in our Class A common stock; |

• | the success of our business depends on the identification and availability of suitable investment opportunities for our clients; |

• | competition for access to investment funds and other investments we make for our clients is intense; |

• | our ability to retain our senior leadership team and attract additional qualified investment professionals is critical to our success; |

• | if the investments we make on behalf of our clients and our specialized funds or customized separate accounts perform poorly, we may suffer a decline in our investment management revenue and earnings, and our ability to raise capital for future funds may be materially and adversely affected; |

• | the substantial growth of our business in recent years may be difficult to sustain, as it may place significant demands on our resources and employees and may increase our expenses; |

• | our international operations are subject to certain risks, which may affect our revenue; and |

• | difficult market conditions can adversely affect our business by reducing the market value of the assets we manage or causing our customized separate account clients to reduce their investments in private markets. |

Why We Are Going Public

We have decided to become a public company for the following principal reasons:

• | to enhance our profile and position as a global private markets investment solutions provider; |

• | to allow us to grow on a standalone basis while maintaining our unique culture, our management team and our independent decision making processes; |

• | to enhance our ability to provide continuing and tangible equity compensation to existing employees and attract new employees; |

• | to provide funding for the repayment of debt and general corporate purposes, and a means to raise capital in the future; and |

• | to provide a mechanism for eventual and ongoing liquidity management for our equity owners. |

13

Organizational Structure

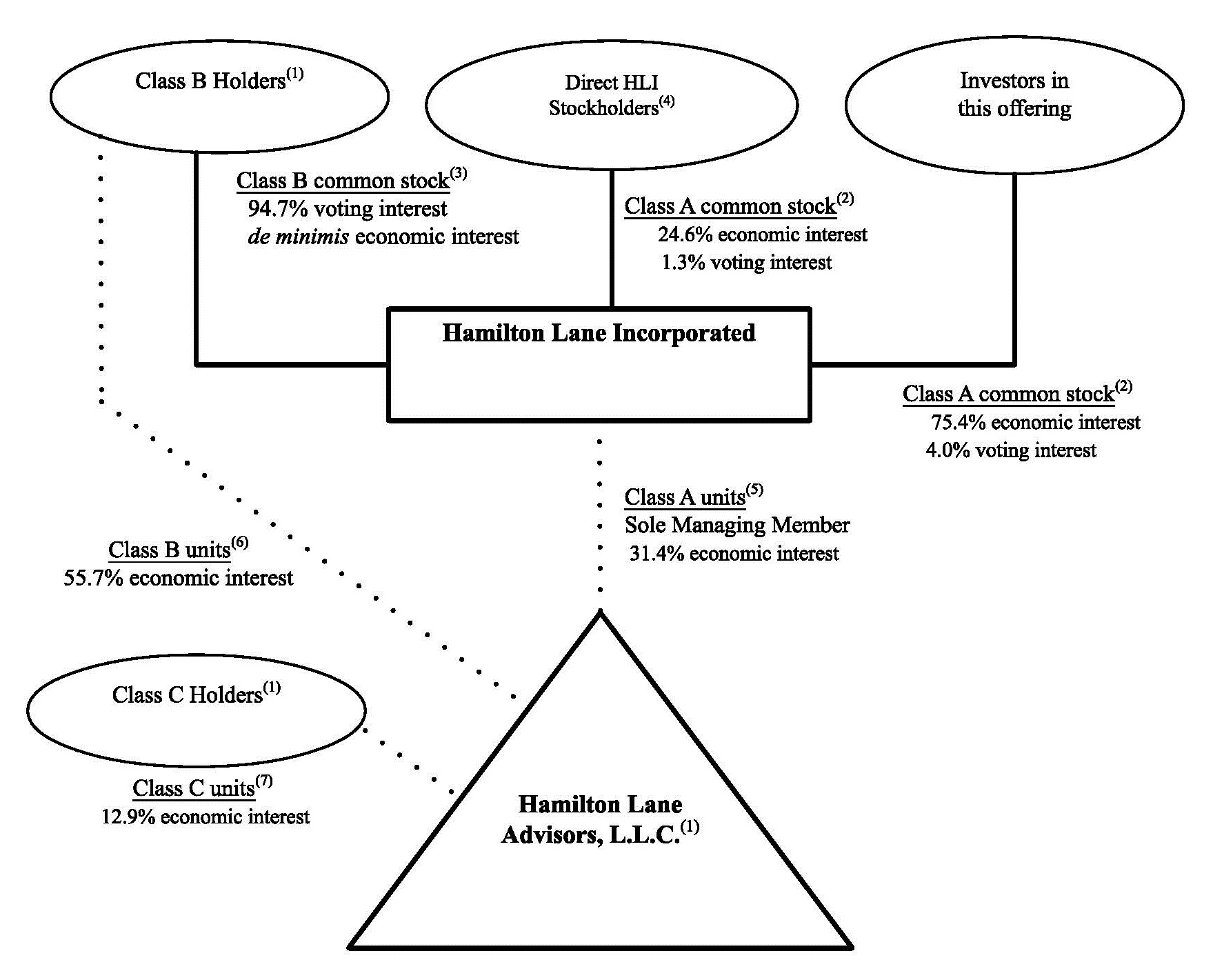

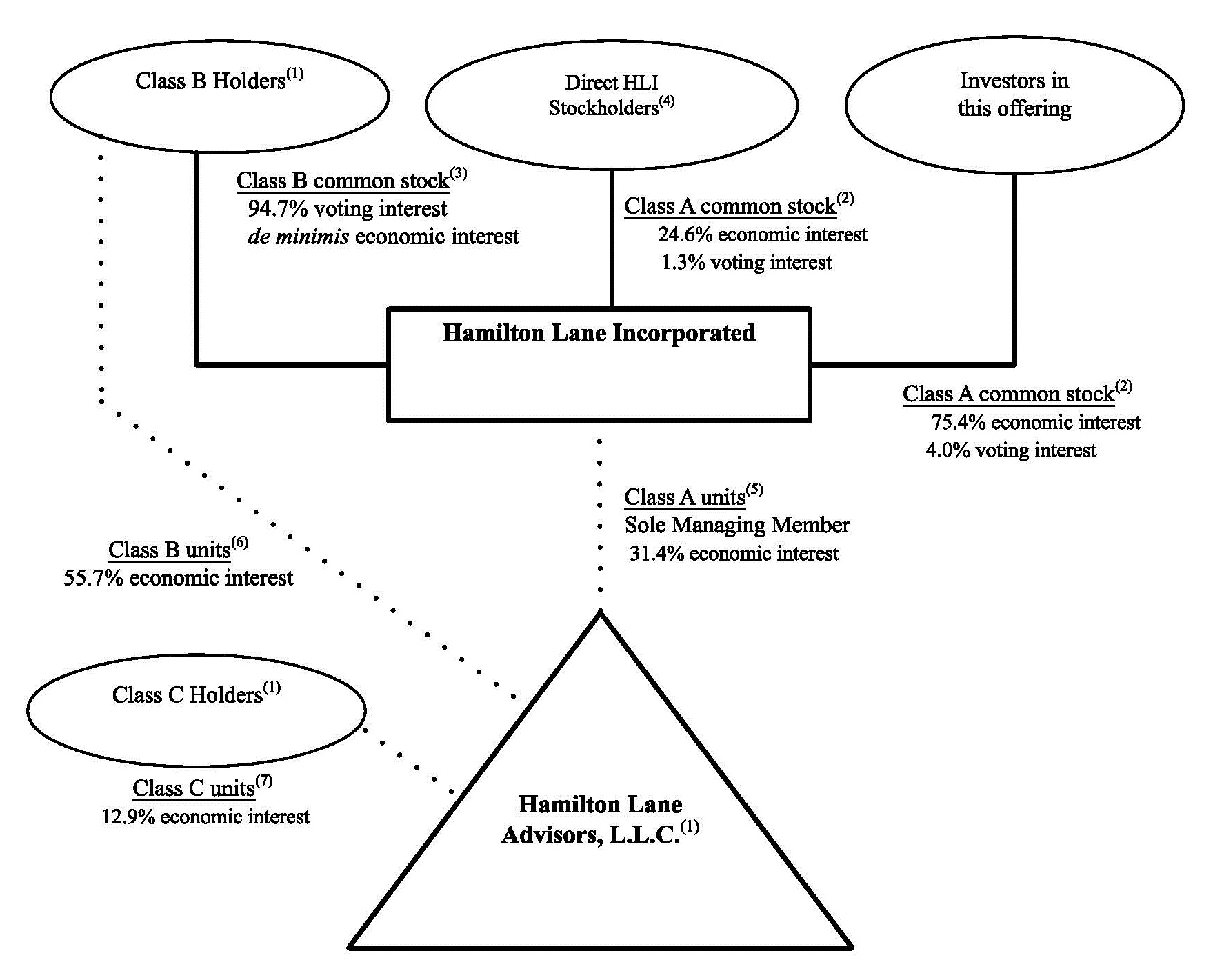

In connection with this offering, we will undertake certain transactions as part of a corporate reorganization (the “Reorganization”) described in “Organizational Structure.” Following the Reorganization and this offering, Hamilton Lane Incorporated will be a holding company and its sole asset will be an equity interest in HLA, of which it will serve as the sole managing member. Certain of the original members of HLA will become the Class B Holders, the owners of the Class B units of HLA at the completion of this offering, and certain other original members will become the Class C Holders, the owners of the Class C units of HLA at the completion of this offering. Such interests in HLA will be reflected as minority interests on Hamilton Lane Incorporated’s consolidated financial statements. Certain other original members will become the direct HLI stockholders, who will own Class A common stock directly (the “Direct HLI Stockholders”). The diagram below depicts our organizational structure following the consummation of the Reorganization and this offering (assuming no exercise of the underwriters’ option to purchase additional shares).

|

(1) | At the closing of this offering, the members of HLA, other than us, will be: |

• | HLA Investments, LLC, or “HLAI” (15,793,179 Class B units). |

• | HL Management Investors, LLC, or “HLMI” (5,357,574 Class B units, 6,255,176 Class C units). HLMI is considered a Class B Holder to the extent of its holdings of Class B units and a Class C Holder to the extent of its holdings of Class C units. |

14

• | Mario Giannini (6,784,503 Class B units, held directly and indirectly through a wholly owned affiliate and a trust for the benefit of family members). |

• | Other (264,630 Class C units). |

(2) | Each share of Class A common stock is entitled to one vote and will vote together with the Class B common stock as a single class, except as set forth in our certificate of incorporation or as required by law. |

(3) | Each share of Class B common stock is entitled to ten votes prior to a Sunset. See “Organizational Structure—Voting Rights of Class A and Class B Common Stock.” After a Sunset becomes effective, each share of our Class B common stock will then entitle its holder to one vote. The economic rights of our Class B common stock are limited to the right to be redeemed at par value. |

(4) | As part of the Reorganization, the Direct HLI Stockholders will exchange their ownership interests in HLA for 3,865,400 shares of Class A common stock and will hold these shares directly. Except for one investor who will continue to own a minority position in HLAI, all of the Direct HLI Stockholders will cease to be beneficial owners of HLA other than through their ownership of our Class A common stock. |

(5) | We will hold all of the Class A units of HLA, which upon the completion of this offering will represent the right to receive approximately 31.4% of the distributions made by HLA. While this interest represents a minority of the economic interests in HLA, we will act as the sole manager of HLA, and as such, we will operate and control all of its business and affairs and will be able to consolidate its financial results into our financial statements. |

(6) | The Class B Holders will collectively hold all of the Class B units of HLA, which upon the completion of this offering will represent the right to receive approximately 55.7% of the distributions made by HLA. The Class B Holders will not have any voting rights in HLA on account of the Class B units, except for the right to approve amendments to the HLA Operating Agreement that adversely affect their rights as holders of Class B units. Class B units (together with the corresponding shares of Class B common stock) may be exchanged for shares of our Class A common stock or, at our election, for cash, subject to certain restrictions pursuant to the exchange agreement described in “Organizational Structure—Exchange Agreement.” After a Class B unit is surrendered for exchange, it will not be available for reissuance. When a Class B unit is exchanged for a share of our Class A common stock, a corresponding share of our Class B common stock will automatically be redeemed by us at par value and canceled. |

(7) | The Class C Holders will collectively hold all of the Class C units of HLA, which upon the completion of this offering will represent the right to receive approximately 12.9% of the distributions made by HLA. The Class C Holders will not have any voting rights in HLA on account of the Class C units, except for the right to approve amendments to the HLA Operating Agreement that adversely affect their rights as holders of Class C units. Class C units may be exchanged for shares of our Class A common stock or, at our election, for cash, subject to certain restrictions pursuant to the exchange agreement described in “Organizational Structure—Exchange Agreement.” After a Class C unit is surrendered for exchange, it will not be available for reissuance. We expect that substantially all of the Class C units will be held through HLMI. |

Net profits and net losses of HLA will be allocated, and distributions by HLA will be made, to its members pro rata in accordance with the number of membership units they hold. Accordingly, net profits and net losses of HLA will initially be allocated, and distributions will be made, approximately 31.4% to us, approximately 55.7% to the Class B Holders and approximately 12.9% to the Class C Holders (or 33.7%, 53.7% and 12.6%, respectively, if the underwriters exercise their option to purchase additional shares of Class A common stock in full).

15

Corporate Information

Hamilton Lane Incorporated was incorporated in Delaware on December 31, 2007 as a wholly owned subsidiary of HLA. It has had no business operations prior to this offering. In connection with the consummation of this offering, Hamilton Lane Incorporated will become the controlling member of HLA pursuant to the Reorganization described under “Organizational Structure—The Reorganization.” Our principal executive offices are located at One Presidential Blvd, 4th Floor, Bala Cynwyd, PA 19004, and our phone number is (610) 934-2222. Our website is www.hamiltonlane.com. Information contained on or accessible through our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus.

Implications of Being an Emerging Growth Company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2013 (the “JOBS Act”). For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

• | being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

• | not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

• | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

• | reduced disclosure obligations regarding executive compensation; and |

• | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions for up to five years or such earlier time when we are no longer an emerging growth company. We will cease to be an emerging growth company if we have more than $1 billion in annual revenue, have more than $700 million in market value of our capital stock held by non-affiliates or issue more than $1 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of some reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

The JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. However, we are irrevocably choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption is required for non-emerging growth companies.

16

The Offering | ||

Class A common stock offered by Hamilton Lane Incorporated | 11,875,000 shares. | |

Underwriters’ option to purchase additional shares of Class A common stock from us | 1,781,250 shares. | |

Class A common stock to be issued to the Direct HLI Stockholders in the Reorganization | 3,865,400 shares. | |

Class A common stock to be issued under our 2017 Equity Incentive Plan in connection with the Reorganization and this offering | 1,330,105 shares (consisting of 250,000 shares to be issued to non-management employees and 1,080,105 shares to be issued in replacement of current awards) | |

Class A common stock outstanding immediately after this offering | 17,070,505 shares of Class A common stock (or 18,851,755 shares of Class A common stock if the underwriters exercise their option to purchase additional shares of Class A common stock in full). If all Class B Holders and Class C Holders immediately after this offering and the Reorganization were entitled, and if they so elected, to exchange their Class B units and Class C units for shares of our Class A common stock, 51,525,567 shares of Class A common stock would be outstanding immediately after this offering. | |

Class B common stock outstanding immediately after this offering | 27,935,256 shares of Class B common stock. Class B common stock will be issued to holders of our Class B units in exchange for nominal payment. | |

Use of proceeds | We estimate that the net proceeds from the sale of shares of our Class A common stock by us in this offering, after deducting underwriting discounts and commissions but before expenses, will be approximately $176.7 million or approximately $203.2 million if the underwriters exercise their option to purchase additional shares of Class A common stock in full, based on an assumed initial public offering price of $16.00 per share (the midpoint of the price range set forth on the cover of this prospectus).We intend to use approximately $37.2 million of the net proceeds from this offering to purchase membership units in HLA from certain of its existing owners, at a per-unit price equal to the price paid by the underwriters for shares of our Class A common stock in this offering. Accordingly, we will not retain any of these proceeds. We intend to use $139.5 million of the net proceeds from this offering, or approximately $166.0 million if the underwriters exercise their option to purchase additional shares of Class A common stock in full, to purchase newly issued membership units in HLA, at a per-unit price equal to the price paid by the underwriters for shares of our Class A common stock in this offering. HLA intends to use $133.5 million of these proceeds to repay existing indebtedness and $6.0 million to pay the expenses incurred by us in connection with this offering and the Reorganization and for general corporate purposes. See “Use of Proceeds.” | |

17

Voting rights | Each share of our Class A common stock will entitle its holder to one vote on all matters to be voted on by stockholders generally. Each share of our Class B common stock will entitle its holder to ten votes until a Sunset becomes effective. After a Sunset becomes effective, each share of our Class B common stock will entitle its holder to one vote per share. A “Sunset” is triggered by any of the following: (i) Hartley R. Rogers, Mario L. Giannini and their respective permitted transferees collectively cease to maintain direct or indirect beneficial ownership of at least 10% of the outstanding shares of Class A common stock (determined assuming all outstanding Class B units and Class C units have been exchanged for Class A common stock); (ii) Mr. Rogers, Mr. Giannini, their respective permitted transferees and employees of us and our subsidiaries cease collectively to maintain direct or indirect beneficial ownership of an aggregate of at least 25% of the aggregate voting power of our outstanding Class A common stock and Class B common stock; (iii) Mr. Rogers and Mr. Giannini both voluntarily terminate their employment and all directorships with HLA and us (other than by reason of disability, incapacity or retirement, in each case as determined in good faith by our board of directors, or death); or (iv) the occurrence of the later of March 31, 2027 or the end of the fiscal year in which occurs the fifth anniversary of the death of the second to die of Mr. Rogers and Mr. Giannini. A Sunset triggered under clauses (i), (ii) and (iii) during the first two fiscal quarters will generally become effective at the end of that fiscal year, and a Sunset triggered under clauses (i), (ii) and (iii) during the third or fourth fiscal quarters will generally become effective at the end of the following fiscal year. A Sunset pursuant to clause (iv) will become effective on the occurrence of the latest event listed in clause (iv), unless a Sunset is also triggered under clause (i) or (ii) that would result in an earlier Sunset, in which case the earlier Sunset will result. | |

Holders of our Class A common stock and Class B common stock will vote together as a single class on all matters presented to our stockholders for their vote or approval, except as set forth in our certificate of incorporation or as otherwise required by applicable law. See “Organizational Structure—Voting Rights of the Class A and Class B Common Stock.” | ||

18

Certain Class B Holders who are significant outside investors, members of management and significant employee owners will enter into a stockholders agreement pursuant to which they will agree to vote all shares of our voting stock, including their Class A common stock and Class B common stock, in the manner directed by HLAI on all matters submitted to a vote of our stockholders. HLAI will thus be able to exercise control over all matters requiring the approval of our stockholders, including the election of our directors and the approval of significant corporate transactions. | ||

Exchange of Class B units and Class C units | We have reserved for issuance 34,455,062 shares of our Class A common stock, which is the aggregate number of shares of our Class A common stock expected to be issued over time upon the exchanges by the Class B Holders and Class C Holders, subject to the limitations set forth in the HLA Operating Agreement and an exchange agreement to be entered into in connection with this offering. See “Organizational Structure—Hamilton Lane Advisors, L.L.C. Operating Agreement” and “Organizational Structure—Exchange Agreement.” | |

Registration Rights Agreement | Pursuant to a registration rights agreement that we expect to enter into with certain Class B Holders who are significant outside investors, members of management and significant employee owners, we will agree to register the resale of the shares of Class A common stock issued upon exchange of Class B units and Class C units under certain circumstances. | |

Tax Receivable Agreement | Pursuant to a tax receivable agreement we expect to enter into with our existing owners, we will pay 85% of the amount of tax benefits, if any, that we realize (or are deemed to realize in the case of an early termination payment by us, a change in control or a material breach by us of our obligations under the tax receivable agreement) as a result of increases in tax basis (and certain other tax benefits) resulting from purchases or exchanges of membership units of HLA. See “Organizational Structure—Tax Receivable Agreement.” | |

Dividend policy | The declaration and payment by us of any future dividends to holders of our Class A common stock will be at the sole discretion of our board of directors. Following this offering and subject to funds being legally available, we intend to cause HLA to make pro rata distributions to its members, including us, in an amount at least sufficient to allow us to pay all applicable taxes, to make payments under the tax receivable agreement we will enter into with the existing members of HLA, and to pay our corporate and other overhead expenses. | |

19