Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COMSCORE, INC. | d352226d8k.htm |

| Exhibit 99.1

|

Investor Update

February 24, 2017

© comScore, Inc. Proprietary. 1

|

|

Cautionary Statement

During this presentation, we make certain forward-looking statements concerning plans and expectations for comScore, Inc., including expectations as to opportunities for comScore, including new product lines, customers, markets and partnerships; expectations as to the strength of comScore’s business, including the growth and composition of comScore’s customer base and renewal rates; expectations regarding comScore’s products, including regarding new releases and features, their quality relative to competitors, customer adoption and the potential benefits of particular products; expectations regarding the strategic and economic benefits of certain strategic relationships and initiatives; expectations as to the financial effects of comScore’s merger with Rentrak and other strategic transactions; estimates regarding forecasts of future financial performance including related growth rates and assumptions; and expectations as to the timeline for completion of the financial re-audit process and the impact on historical financial information. We caution you that these forward-looking statements are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by forward-looking statements. These risks and uncertainties include, but are not limited to, the difficulty of predicting the timing of the completion of our financial re-audit, its impact on our historical financial information, and the timing of the related filings, costs, risks and uncertainties associated with the investigation described herein; as well as those risk factors contained in comScore’s previously filed Annual Report on Form 10-K for the year ended December 31, 2014 and Quarterly Report on Form 10-Q for the three months ended September 30, 2015 and other filings comScore makes from time to time with the Securities and Exchange Commission (the “SEC”), which are available on the SEC’s Web site (http://www.sec.gov ), any of which could cause actual results to differ materially from current expectations.

© comScore, Inc. Proprietary. 2

|

|

Cautionary Statement

Investors are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date such statements are made. comScore does not undertake any obligation to publicly update any forward-looking statements to reflect events, circumstances or new information after the date of this presentation, or to reflect the occurrence of unanticipated events. The presentation contains information regarding “cash flow from recurring business operations”, a non-GAAP financial measure not determined in accordance with U.S. Generally Accepted Accounting Principals (“GAAP”). The presentation of this non-GAAP measure is not intended to be considered in isolation from, as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP, and may be different from the non-GAAP financial measure used by other companies. Rather, the information, as well as the impact of other sources and uses of cash, are included in order to provide investors with an understanding of the estimated cash flows over certain of the periods covered by the Company’s pending re-audit. The components of cash flow information included herein are estimates, and are subject to change as the Company completes the pending re-audit process. While the information relates to prior periods, due to the ongoing restatement and re-audit process it nevertheless represents estimates and expectations rather than final amounts. Given the uncertainties and assumptions discussed herein with respect to the financial re-audit process, our actual GAAP results may differ materially from our current expectations. As the most directly comparable GAAP measure would be forward-looking due to the ongoing financial re-audit process and is not currently accessible, reconciling our cash flow from recurring business operations is not currently possible without unreasonable effort and we are unable to predict with a reasonable degree of certainty the exact significance of the unavailable information, which could be material to our re-audited financial results.

© comScore, Inc. Proprietary. 3

|

|

comScore’s mission is to measure what matters to make audiences, consumer behavior and advertising more valuable for our clients – across all platforms.

|

|

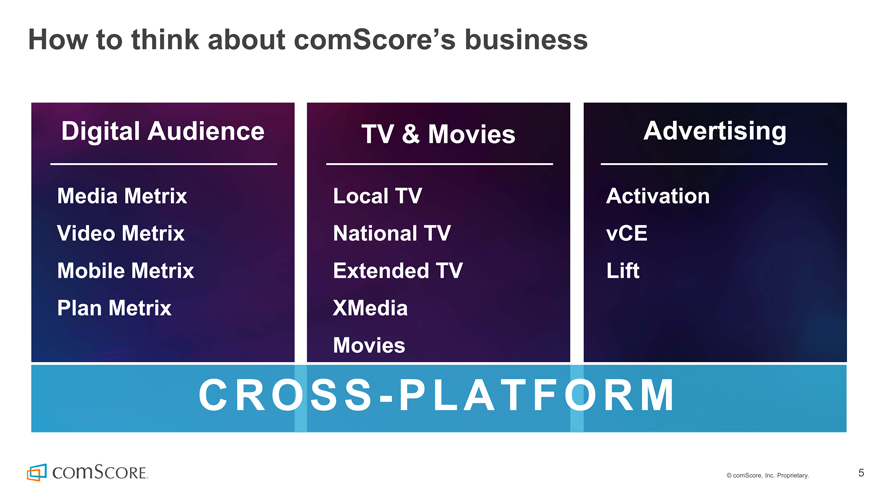

How to think about comScore’s business

Digital Audience TV & Movies Advertising

Media Metrix Local TV Activation Video Metrix National TV vCE Mobile Metrix Extended TV Lift Plan Metrix XMedia Movies

CROSS-PLATFORM

© comScore, Inc. Proprietary. 5

|

|

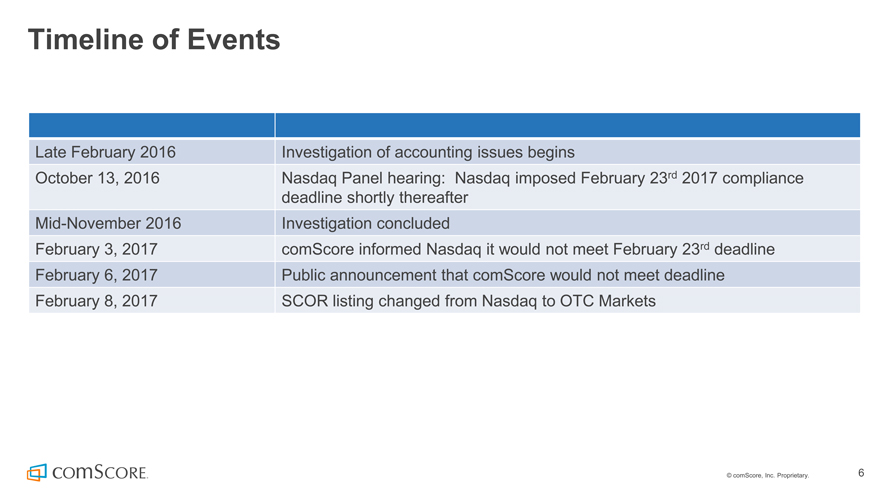

Timeline of Events

Late February 2016 Investigation of accounting issues begins

October 13, 2016 Nasdaq Panel hearing: Nasdaq imposed February 23rd 2017 compliance deadline shortly thereafter Mid-November 2016 Investigation concluded February 3, 2017 comScore informed Nasdaq it would not meet February 23rd deadline February 6, 2017 Public announcement that comScore would not meet deadline February 8, 2017 SCOR listing changed from Nasdaq to OTC Markets

© comScore, Inc. Proprietary. 6

|

|

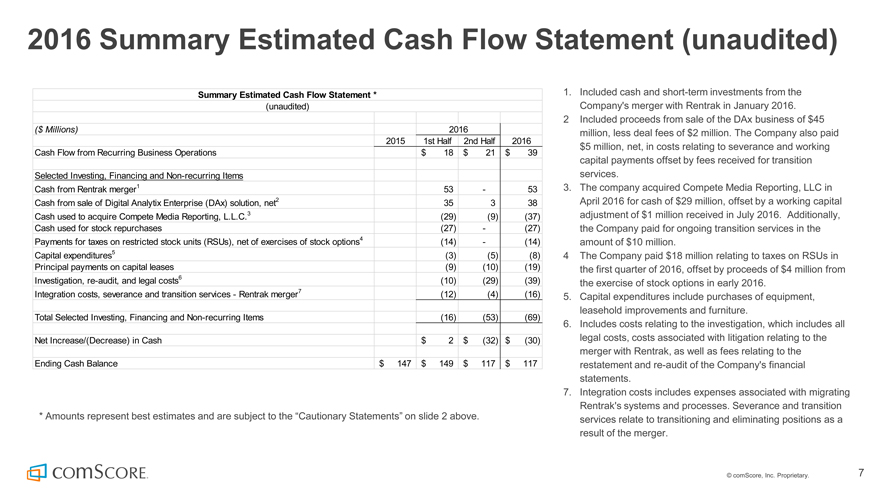

2016 Summary Estimated Cash Flow Statement (unaudited)

Summary Estimated Cash Flow Statement * 1. Included cash and short-term investments from the (unaudited) Company’s merger with Rentrak in January 2016.

2 Included proceeds from sale of the DAx business of $45

($ Millions) 2016 million, less deal fees of $2 million. The Company also paid

2015 1st Half 2nd Half 2016 $5 million, net, in costs relating to severance and working

……. Cash Flow from Recurring Business Operations $ 18 $ 21 $ 39 capital payments offset by fees received for transition

Selected Investing, Financing and Non-recurring Items services.

Cash from Rentrak merger1 53 — 53 3. The company acquired Compete Media Reporting, LLC in

Cash from sale of Digital Analytix Enterprise (DAx) solution, net2 35 3 38 April 2016 for cash of $29 million, offset by a working capital Cash used to acquire Compete Media Reporting, L.L.C.3 (29) (9) (37) adjustment of $1 million received in July 2016. Additionally,

Cash used for stock repurchases (27) — (27) the Company paid for ongoing transition services in the

Payments for taxes on restricted stock units (RSUs), net of exercises of stock options4 (14) — (14) amount of $10 million.

Capital expenditures5 (3) (5) (8) 4 The Company paid $18 million relating to taxes on RSUs in Principal payments on capital leases (9) (10) (19) the first quarter of 2016, offset by proceeds of $4 million from

Investigation, re-audit, and legal costs6 (10) (29) (39) the exercise of stock options in early 2016.

Integration costs, severance and transition services—Rentrak merger7 (12) (4) (16) 5. Capital expenditures include purchases of equipment, leasehold improvements and furniture.

Total Selected Investing, Financing and Non-recurring Items (16) (53) (69)

6. Includes costs relating to the investigation, which includes all

Net Increase/(Decrease) in Cash $ 2 $ (32) $ (30) legal costs, costs associated with litigation relating to the merger with Rentrak, as well as fees relating to the

Ending Cash Balance $ 147 $ 149 $ 117 $ 117 restatement and re-audit of the Company’s financial statements.

7. Integration costs includes expenses associated with migrating

* Amounts represent best estimates and are subject to the “Cautionary Statements” on slide 2 above. Rentrak’s systems and processes. Severance and transition services relate to transitioning and eliminating positions as a result of the merger.

© comScore, Inc. Proprietary. 7

|

|

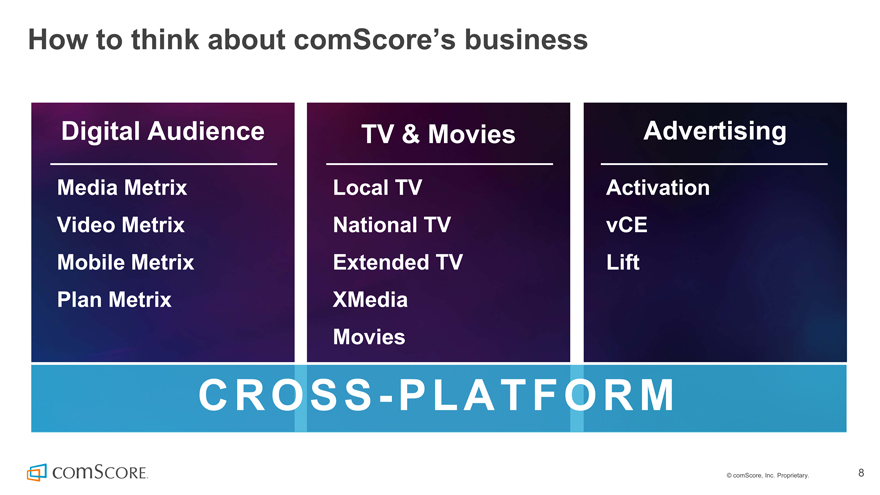

How to think about comScore’s business

Digital Audience TV & Movies Advertising

Media Metrix Local TV Activation Video Metrix National TV vCE Mobile Metrix Extended TV Lift Plan Metrix XMedia Movies

CROSS-PLATFORM

© comScore, Inc. Proprietary. 8

|

|

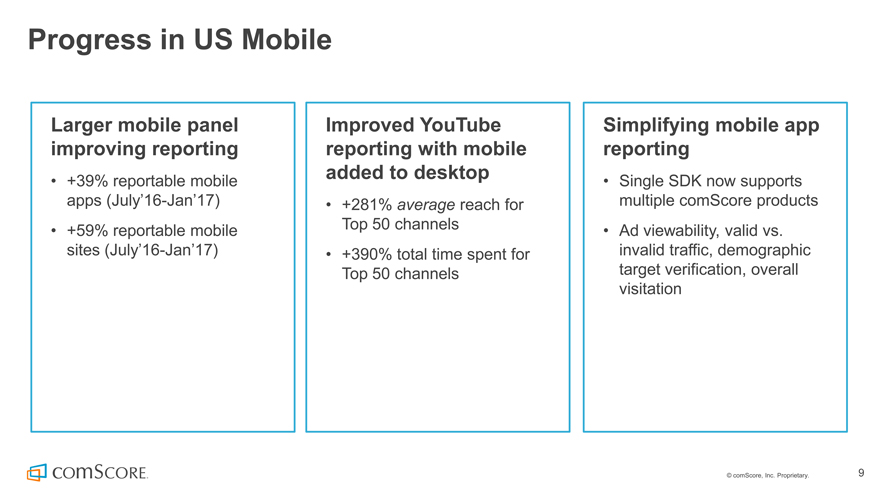

Progress in US Mobile

Larger mobile panel Improved YouTube Simplifying mobile app improving reporting reporting with mobile reporting

• +39% reportable mobile added to desktop • Single SDK now supports apps (July’16-Jan’17) • +281% average reach for multiple comScore products

• +59% reportable mobile Top 50 channels • Ad viewability, valid vs. sites (July’16-Jan’17) • +390% total time spent for invalid traffic, demographic Top 50 channels target verification, overall visitation

© comScore, Inc. Proprietary. 9

|

|

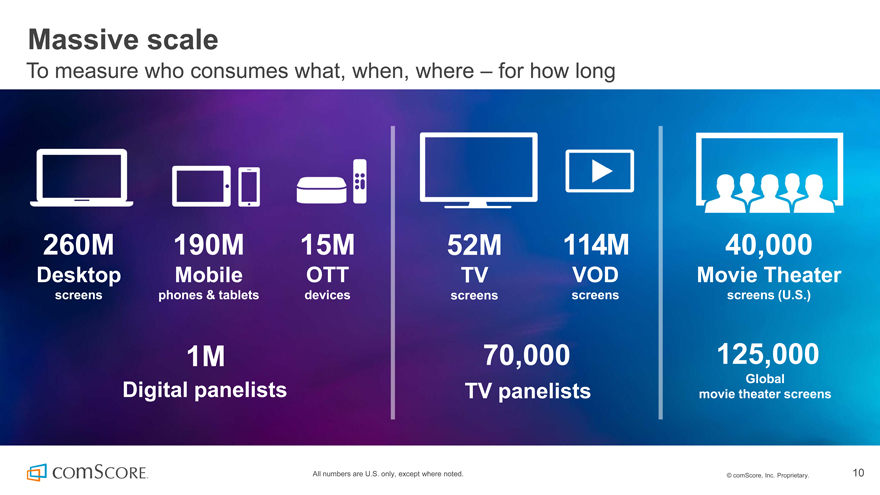

Massive scale

To measure who consumes what, when, where – for how long

260M 190M 15M 52M 114M 40,000

Desktop Mobile OTT TV VOD Movie Theater

screens phones & tablets devices screens screens screens (U.S.)

1M 70,000 125,000

Digital panelists Global

TV panelists movie theater screens

All numbers are U.S. only, except where noted. © comScore, Inc. Proprietary. 10

|

|

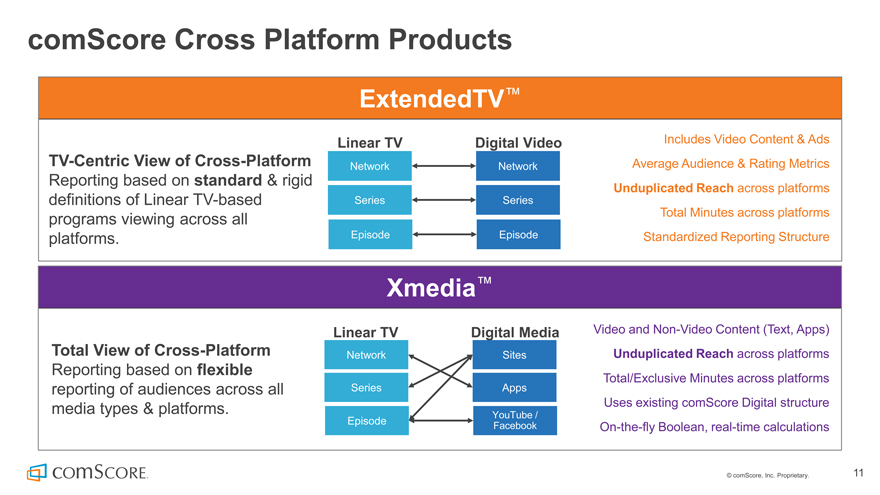

comScore Cross Platform Products

ExtendedTV™

Linear TV Digital Video Includes Video Content & Ads

TV-Centric View of Cross-Platform Network Network Average Audience & Rating Metrics

Reporting based on standard & rigid

Unduplicated Reach across platforms definitions of Linear TV-based Series Series Total Minutes across platforms

programs viewing across all

platforms. Episode Episode Standardized Reporting Structure

Xmedia™

Linear TV Digital Media Video and Non-Video Content (Text, Apps)

Total View of Cross-Platform Network Sites Unduplicated Reach across platforms

Reporting based on flexible

Total/Exclusive Minutes across platforms

reporting of audiences across all Series Apps

media types & platforms. Uses existing comScore Digital structure

YouTube /

Episode Facebook On-the-fly Boolean, real-time calculations

© comScore, Inc. Proprietary. 11

|

|

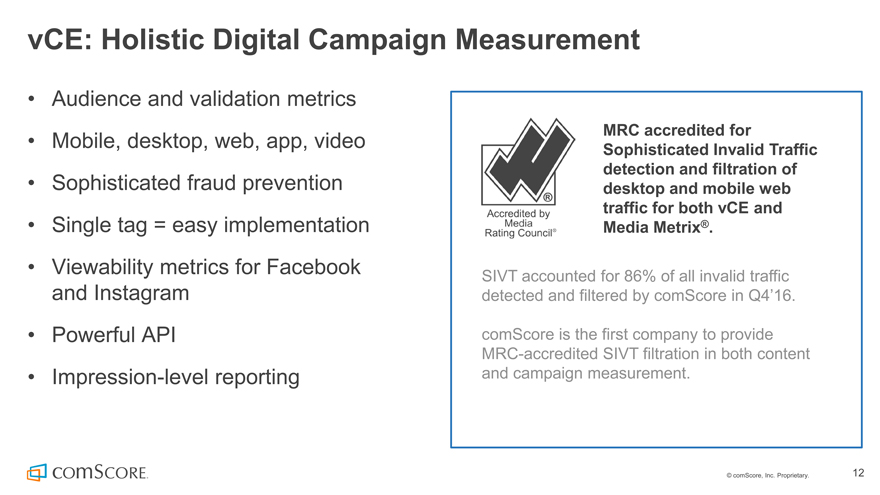

vCE: Holistic Digital Campaign Measurement

• Audience and validation metrics

• Mobile, desktop, web, app, video MRC accredited for

Sophisticated Invalid Traffic detection and filtration of

• Sophisticated fraud prevention desktop and mobile web

traffic for both vCE and

• Single tag = easy implementation Media Metrix®.

• Viewability metrics for Facebook

SIVT accounted for 86% of all invalid traffic and Instagram detected and filtered by comScore in Q4’16.

• Powerful API comScore is the first company to provide MRC-accredited SIVT filtration in both content

• Impression-level reporting and campaign measurement.

© comScore, Inc. Proprietary. 12

|

|

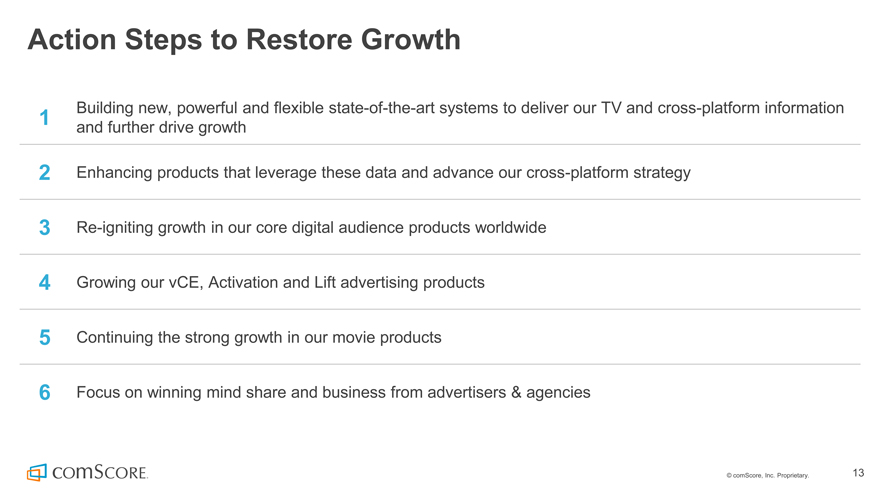

Action Steps to Restore Growth

1 Building new, powerful and flexible state-of-the-art systems to deliver our TV and cross-platform information and further drive growth

2 Enhancing products that leverage these data and advance our cross-platform strategy

3 Re-igniting growth in our core digital audience products worldwide

4 Growing our vCE, Activation and Lift advertising products

5 Continuing the strong growth in our movie products

6 Focus on winning mind share and business from advertisers & agencies

© comScore, Inc. Proprietary. 13