Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED FEBRUARY 23, 2017 - Simpson Manufacturing Co., Inc. | f8k022217ex99i_simpson.htm |

| 8-K - CURRENT REPORT - Simpson Manufacturing Co., Inc. | f8k022217_simpsonmanf.htm |

Exhibit 99.2

www.simpsonmfg.com 0 196 191 255 204 104 166 166 166 Investor Presentation: 2017 Special Meeting

www.simpsonmfg.com 0 196 191 255 204 104 166 166 166 2017 Special Meeting The Board has called a special meeting of shareholders to consider two proposed changes in the company’s governance practices 2 2017 Special Meeting Ballot Items x FOR: Declassification of the Board x FOR: Eliminate Cumulative Voting ― Current: Simpson’s Board is divided into three classes ― Proposal: D eclassify Simpson’s Board over three years beginning at 2017 Annual Meeting ― Current : Any shareholder can demand that cumulative voting be used in the election of directors ― Proposed : Remove the ability for a minority shareholder to elect a director that is not supported by the majority of shareholders In addition, the Board has committed to adopt proxy access following the Special Meeting

www.simpsonmfg.com 0 196 191 255 204 104 166 166 166 Ballot Item Considerations 3 » Why is Simpson declassifying the Board? ― Declassifying the Board is a governance best practice that aligns with the shareholder feedback we have received » Why eliminate cumulative voting? ― The Board believes that cumulative voting is inconsistent with shareholder democracy – every share should carry one vote on every ballot item and the majority should determine whether a director is elected ― Cumulative voting continues to be a very uncommon practice (only 3% of S&P 500 companies have cumulative voting provisions) » Why is declassifying the Board contingent on eliminating cumulative voting? ― Declassifying the board without eliminating cumulative voting would enable an even smaller percentage of shareholders to obtain Board representation ― For example, at a meeting to elect 8 directors, cumulative voting would permit shareholders holding only ~11% of shares to unilaterally elect a director even if the other ~89% of shares oppose that nominee » Why will proxy access be adopted after the Special Meeting? ― The mechanics of proxy access depend on whether shareholders approve the proposals. If cumulative voting is not eliminated, proxy access will only be operational at meetings at which no shareholder elects to cumulate votes ― Having both cumulative voting and proxy access in operation at the same meeting would permit a minority shareholder to both nominate and elect a director without requiring the filing of a proxy statement and without obtaining majority support Our Board believes in sound corporate governance practices that preserve and enhance our long - term value. Our proposed changes are inline with shareholder feedback.

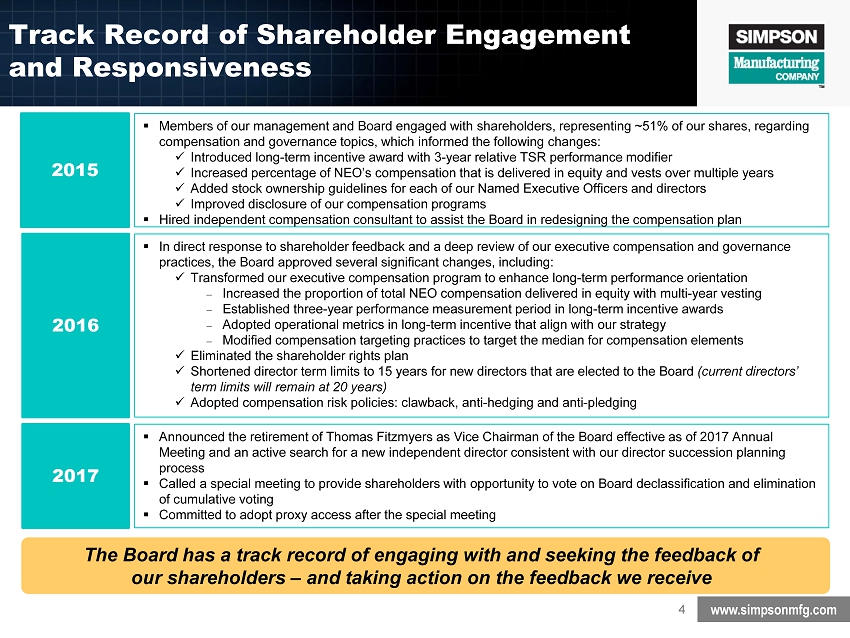

www.simpsonmfg.com 0 196 191 255 204 104 166 166 166 Track Record of Shareholder Engagement and Responsiveness 4 The Board has a track record of engaging with and seeking the feedback of our shareholders – and taking action on the feedback we receive 2015 2016 ▪ Members of our management and Board engaged with shareholders, representing ~ 51 % of our shares, regarding compensation and governance topics, which informed the following changes: x Introduced long - term incentive award with 3 - year relative TSR performance modifier x Increased percentage of NEO’s compensation that is delivered in equity and vests over multiple years x Added stock ownership guidelines for each of our Named Executive Officers and directors x Improved disclosure of our compensation programs ▪ Hired independent compensation consultant to assist the Board in redesigning the compensation plan ▪ In direct response to shareholder feedback and a deep review of our executive compensation and governance practices, the Board approved several significant changes, including: x Transformed our executive compensation program to enhance long - term performance orientation – Increased the proportion of total NEO compensation delivered in equity with multi - year vesting – Established three - year performance measurement period in long - term incentive awards – Adopted operational metrics in long - term incentive that align with our strategy – Modified compensation targeting practices to target the median for compensation elements x Eliminated the shareholder rights plan x Shortened director term limits to 15 years for new directors that are elected to the Board (current directors’ term limits will remain at 20 years) x Adopted compensation risk policies: clawback , anti - hedging and anti - pledging 2017 ▪ Announced the retirement of Thomas Fitzmyers as Vice Chairman of the Board effective as of 2017 Annual Meeting and an active search for a new independent director consistent with our director succession planning process ▪ Called a special meeting to provide shareholders with opportunity to vote on Board declassification and elimination of cumulative voting ▪ Committed to adopt proxy access after the special meeting

www.simpsonmfg.com 0 196 191 255 204 104 166 166 166 Best in Class Governance Practices 5 Simpson’s governance profile and compensation practices are aligned with those of best - in - class companies – and well in excess of similarly sized companies Simpson Manufacturing S&P 500 ( LargeCap ) S&P 600 (SmallCap) Governance Structure Annually Elected Directors Yes 1 90% 57% Majority Voting Yes 90% 41% Proxy Access Yes 2 52% 4% Cumulative Voting No 1 3% 6% Poison Pill in Force No 3% 5% Board Structure % Independent Directors 88% 3 85% - Independent Chair Yes 27% - Average Tenure 7 years 3 8.3 years - % Women on Board 50% 21% - Compensation Structure Clawback Policy Yes 90% 4 - Anti - Hedging Policy Yes 92% 4 - Anti - Pledging Policy Yes 74% 4 - NEO Stock Ownership Guidelines Yes 95% 4 - Source: SharkRepellent as of February 10 , 2017, 2016 Spencer Stuart Report, 2015 Equilar CEO Pay Strategies Report, and 2015 Frederic W. Cook Corporate Governance Study 1 Assumes all management ballot items at the 2017 Special M eeting are approved by shareholders 2 To be implemented following the 2017 Special Meeting 3 Gives effect to Thomas Fitzmyers ’ retirement as of the 2017 Annual Meeting and a new independent director elected as his replacement 4 Indicates compensation practice of Top 250 S&P 500 companies by market cap

www.simpsonmfg.com 0 196 191 255 204 104 166 166 166 Important Additional Information 6 Simpson Manufacturing Co . , Inc . (the

“Company), its directors and certain of its executive officers and other employees will be deemed to be participants in the solicitation of proxies from Company shareholders in connection with the matters to be considered at the Company’s Special Meeting scheduled to be held on March 28 , 2017 (the “Special Meeting”) . The Company has filed a definitive proxy statement and proxy card with the U . S . Securities and Exchange Commission (the “SEC”) in connection with any such solicitation of proxies from Company shareholders . COMPANY SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD AS THEY CONTAIN IMPORTANT INFORMATION . Information regarding the identity of participants, and their direct or indirect interests in the matters to be considered at the Special Meeting, by security holdings or otherwise, is set forth in the definitive proxy statement and other materials filed by the Company with the SEC . Shareholders can obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC for no charge at the SEC’s website at www . sec . gov . Copies are also available at no charge at the Company’s website at http : //www . simpsonmfg . com , by writing to the Company at 5956 W . Las Positas Blvd . , Pleasanton, CA 94588 , or by calling the Company’s proxy solicitor D . F . King at ( 212 ) 269 - 5550 .