Attached files

Exhibit 10.27

THIRD AMENDED AND RESTATED

MASTER THROUGHPUT AGREEMENT

(including Tankage and Loading Racks)

by and between

HOLLYFRONTIER REFINING & MARKETING LLC

and

HOLLY ENERGY PARTNERS-OPERATING, L.P.

Effective as of January 1, 2017

TABLE OF CONTENTS

ARTICLE 1 DEFINITIONS AND INTERPRETATIONS 2

1.1 DEFINITIONS 2

1.2 INTERPRETATION 2

ARTICLE 2 AGREEMENT TO USE SERVICES 2

2.1 INTENT 2

2.2 MINIMUM REVENUE COMMITMENTS 2

2.3 MEASUREMENT OF SHIPPED VOLUMES 3

2.4 VOLUMETRIC GAINS AND LOSSES; LINE FILL; HIGH-API OIL SURCHARGE 3

2.5 OBLIGATIONS OF HEP OPERATING 4

2.6 DRAG REDUCING AGENTS AND ADDITIVES 4

2.7 | CHANGE IN THE DIRECTION; PRODUCT SERVICE OR ORIGINATION AND DESTINATION OF THE PIPELINE SYSTEM 4 |

2.8 NOTIFICATION OF UTILIZATION 5

2.9 SCHEDULING AND ACCEPTING MOVEMENT 5

2.10 TAXES 5

2.11 TIMING OF PAYMENTS 5

[Page 1 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

2.12 INCREASES IN TARIFF RATES 5

2.13 REMOVAL OF TANK FROM SERVICE 5

2.14 NO GUARANTEED MINIMUM 6

ARTICLE 3 AGREEMENT TO REMAIN SHIPPER 6

ARTICLE 4 NOTIFICATION OF REFINERY SHUT-DOWN OR RECONFIGURATION 6

ARTICLE 5 FORCE MAJEURE 6

ARTICLE 6 AGREEMENT NOT TO CHALLENGE PIPELINE TARIFFS 7

ARTICLE 7 EFFECTIVENESS AND TERM 7

ARTICLE 8 RIGHT TO ENTER INTO A NEW AGREEMENT 7

8.1 NEGOTIATION PURSUANT TO WRITTEN NOTICE 7

8.2 NEGOTIATION IN THE ABSENCE OF WRITTEN NOTICE 8

ARTICLE 9 NOTICES 8

ARTICLE 10 DEFICIENCY PAYMENTS 8

10.1 DEFICIENCY NOTICE; DEFICIENCY PAYMENTS 8

10.2 DISPUTED DEFICIENCY NOTICES 9

10.3 PAYMENT OF AMOUNTS NO LONGER DISPUTED 9

10.4 CONTRACT QUARTERS INDEPENDENT 9

ARTICLE 11 RIGHT OF FIRST REFUSAL 9

ARTICLE 12 INDEMNITY; LIMITATION OF DAMAGES 9

12.1 INDEMNITY; LIMITATION OF LIABILITY 9

12.2 SURVIVAL 10

ARTICLE 13 MISCELLANEOUS 10

13.1 AMENDMENTS AND WAIVERS 10

13.2 SUCCESSORS AND ASSIGNS 10

13.3 SEVERABILITY 10

13.4 CHOICE OF LAW 10

13.5 RIGHTS OF LIMITED PARTNERS 10

13.6 FURTHER ASSURANCES 11

13.7 HEADINGS 11

ARTICLE 14 GUARANTEE BY HOLLYFRONTIER 11

14.1 PAYMENT GUARANTY 11

14.2 GUARANTY ABSOLUTE 11

14.3 WAIVER 12

14.4 SUBROGATION WAIVER 12

14.5 REINSTATEMENT 12

14.6 CONTINUING GUARANTY 12

14.7 NO DUTY TO PURSUE OTHERS 12

ARTICLE 15 GUARANTEE BY THE PARTNERSHIP 12

15.1 PAYMENT AND PERFORMANCE GUARANTY 12

15.2 GUARANTY ABSOLUTE 13

[Page 2 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

15.3 WAIVER 13

15.4 SUBROGATION WAIVER 13

15.5 REINSTATEMENT 14

15.6 CONTINUING GUARANTY 14

15.7 NO DUTY TO PURSUE OTHERS 14

EXHIBITS

Exhibit A – Definitions

Exhibit B – Interpretation

Exhibit C – Applicable Assets, Product, Minimum Capacity Commitment, Tariffs, Tariff

Adjustments and Applicable Terms

Exhibit D – Measurement of Shipped Volumes

Exhibit E - Volumetric Gains and Losses; Line Fill; High-API Oil Surcharge

Exhibit F - Increases in Tariff Rates as a Result of Changes in Applicable Law

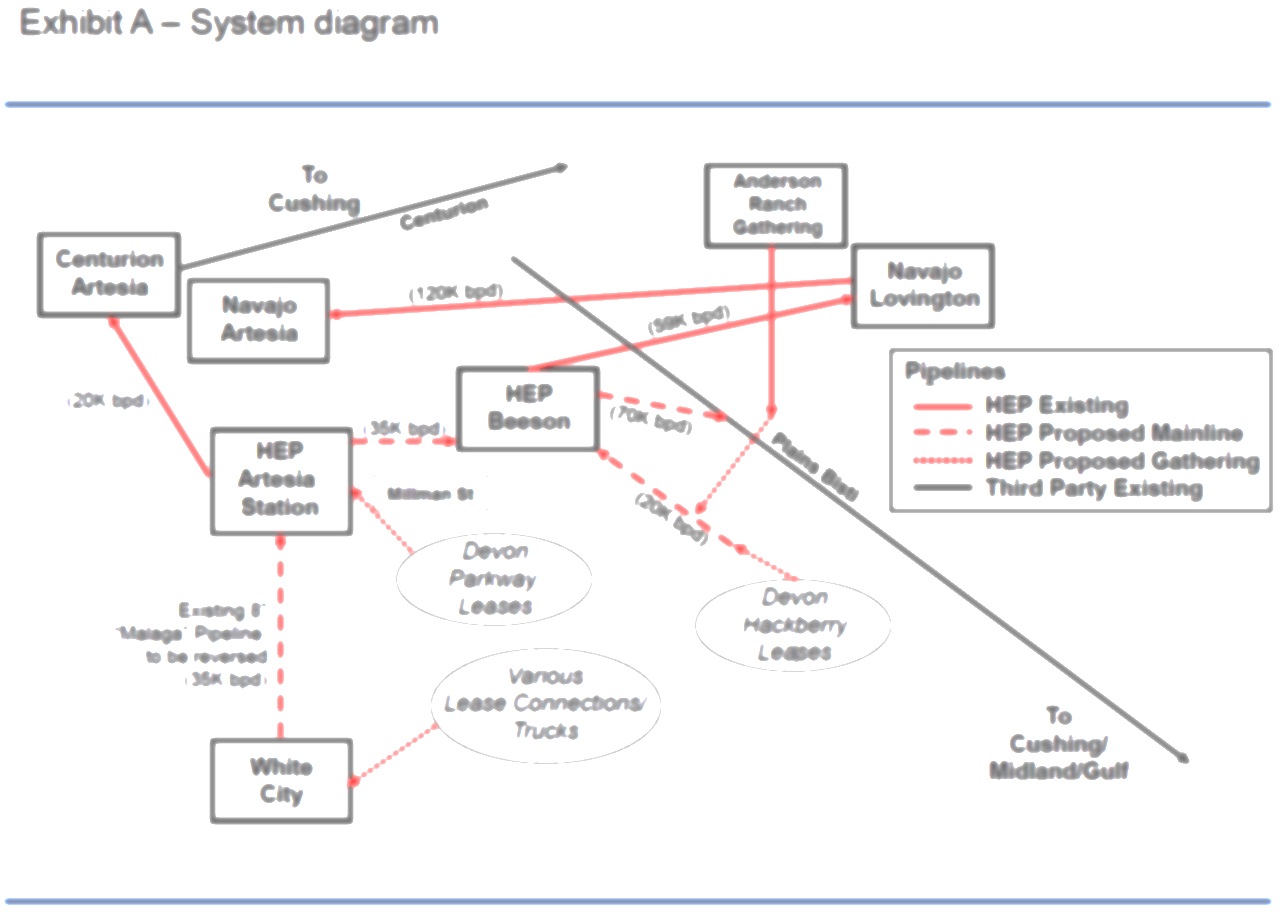

Exhibit G - Special Provisions: Malaga Pipeline System

Exhibit G-1 - Map of Pipeline System and Pipeline System Capacity by Segment

Exhibit G-2 – Construction Projects

Exhibit G-3 – Devon Lease Connections

Exhibit H – Special Provisions: El Dorado Assets

Exhibit H-1 - El Dorado Loading Rack

Exhibit H-2 – El Dorado Tankage

Exhibit H-3 – Specifications for New Tank

Exhibit I - Special Provisions: Cheyenne Assets

Exhibit I-1 - Cheyenne Loading Rack

Exhibit I-2 - Cheyenne Receiving Assets

Exhibit I-3 – Cheyenne Tankage

Exhibit J – Special Provisions: Tulsa East Assets

Exhibit J-1 - Tulsa Group 1 Loading Rack

Exhibit J-2 - Tulsa Group 1 Pipeline

Exhibit J-3 – Tulsa Group 1 Tankage

Exhibit J-4 – Tulsa Group 2 Loading Rack

Exhibit J-5 – Tulsa Group 2 Tankage

Exhibit K – Special Provisions: El Dorado Crude Tank Farm Assets

Exhibit K-1 – El Dorado Crude Tankage and Jayhawk Tankage

Exhibit K-2 – El Dorado Terminal Quality Specifications

Exhibit L-1 – Tulsa West Tankage

Exhibit L-2 – Special Provisions: Tulsa West Tankage

[Page 3 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

THIRD AMENDED AND RESTATED

MASTER THROUGHPUT AGREEMENT

This Third Amended and Restated Master Throughput Agreement (this “Agreement”) is dated as of January 18, 2017, to be effective as of the Effective Time (as defined below) by and between HOLLYFRONTIER REFINING & MARKETING LLC (“HFRM”) and HOLLY ENERGY PARTNERS-OPERATING, L.P. (“HEP Operating”). Each of HFRM and HEP Operating are collectively referred to herein as the “Parties.”

RECITALS:

A. In connection with that certain Pipeline Throughput Agreement (Roadrunner), dated as of December 1, 2009, between HFRM (as successor in interest to HollyFrontier Navajo) and HEP Operating, HEP Operating agreed to provide certain transportation services for HFRM on the Roadrunner Pipeline, as defined below.

B. In connection with that certain Loading Rack Throughput Agreement (Lovington), dated as of March 31, 2010, between HFRM (as successor in interest to HollyFrontier Navajo) and HEP Operating (as successor in interest to Holly Energy Storage-Lovington LLC), HEP Operating agreed to provide certain loading services for HFRM with respect to the Lovington Loading Rack, as defined below.

C. In connection with that Second Amended and Restated Pipelines, Tankage and Loading Rack Throughput Agreement (Tulsa East), dated as of August 31, 2011, between HFRM (as successor in interest to Holly Refining and Marketing-Tulsa LLC) and HEP Operating (as successor in interest to HEP Tulsa LLC and Holly Energy Storage - Tulsa LLC), HEP Operating agreed to provide certain transportation, storage and loading services to HFRM with respect to the Tulsa Interconnecting Pipelines, as defined below.

D. In connection with that certain First Amended and Restated Tankage, Loading Rack and Crude Oil Receiving Throughput Agreement (Cheyenne), dated as of January 11, 2012 between HFRM (as successor in interest to Frontier Refining LLC) and HEP Operating (as successor in interest to Cheyenne Logistics LLC), HEP Operating agreed to provide certain storage and loading services to HFRM with respect to the Cheyenne Assets, as defined below.

E. In connection with that certain Second Amended and Restated Pipeline Delivery, Tankage and Loading Rack Throughput Agreement (El Dorado), dated as of January 7, 2014 between HFRM (as successor in interest to Frontier El Dorado Refining LLC) and HEP Operating (as successor in interest to El Dorado Logistics LLC), HEP Operating agreed to provide certain transportation, storage and loading services to HFRM with respect to the El Dorado Assets, as defined below.

F. In connection with that certain Amended and Restated Transportation Services Agreement (Malaga), dated September 26, 2014, between HFRM and HEP Operating, HEP Operating agreed to provide certain transportation services to HFRM with respect to the Malaga Pipeline System, as defined below.

G. HEP Operating owns certain other pipelines, tankage and other assets which it desires to utilize to provide transportation, storage and loading services for HFRM.

[Page 4 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

H. The Parties entered into that certain Master Throughput Agreement, effective January 1, 2015 (the “Original Master Throughput Agreement”) pursuant to which HEP Operating agreed to provide certain transportation, storage and loading services with respect to the Applicable Assets, as defined below, and pursuant to which the Parties agreed that such services would no longer be provided pursuant to the Prior Agreements.

I. The Original Master Throughput Agreement has been further amended and restated, resulting in that certain Second Amended and Restated Master Throughput Agreement, effective March 31, 2016 (the “Previous Amended and Restated Master Throughput Agreement”).

J. The Parties now desire to amend and restate the Previous Amended and Restated Master Throughput Agreement in its entirety as follows.

NOW, THEREFORE, in consideration of the covenants and obligations contained herein, the Parties hereby agree as follows:

ARTICLE 1

DEFINITIONS AND INTERPRETATIONS

DEFINITIONS AND INTERPRETATIONS

1.1 Definitions. Capitalized terms used throughout this Agreement and not otherwise defined herein shall have the meanings set forth on Exhibit A.

1.2 Interpretation. Matters relating to the interpretation of this Agreement are set forth on Exhibit B.

ARTICLE 2

AGREEMENT TO USE SERVICES

AGREEMENT TO USE SERVICES

2.1 Intent. The Parties intend to be strictly bound by the terms set forth in this Agreement, which sets forth revenues to HEP Operating to be paid by HFRM, and requires HEP Operating to provide certain transportation, storage and loading services to HFRM. The principal objective of HEP Operating is for HFRM to meet or exceed its obligations with respect to the Minimum Revenue Commitment. The principal objective of HFRM is for HEP Operating to provide services to HFRM in a manner that enables HFRM to transport, store and/or load Products on, in or at the Applicable Assets. It is the Parties’ further intent that the terms and provisions of this Agreement shall be effective and govern from and after the Effective Time. Any matter first arising prior to the Effective Time shall be governed by the respective agreement relating thereto referenced in the Recitals.

2.2 Minimum Revenue Commitments. During the Applicable Term and subject to the terms and conditions of this Agreement, and as further set forth in Exhibit C, HFRM agrees as follows:

(a) Capacity and Revenue Commitment. Subject to Article 4, HFRM shall pay HEP Operating Applicable Tariffs for use of the Applicable Assets and associated services as provided herein that result in the payment of an amount that will satisfy the Minimum Revenue Commitment in exchange for HEP Operating providing HFRM a minimum capacity in each of the Applicable Assets equal to the Minimum Capacity Commitment. The “Minimum Revenue Commitment” shall be the aggregate sum of the revenue to HEP Operating for each Contract Quarter determined by multiplying the Minimum Throughput Commitment for each Applicable Asset for such Contract Quarter, by the Base Tariff for such Applicable

[Page 5 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

Asset in effect for such Contract Quarter. The “Minimum Capacity Commitment” means the amount set forth on Exhibit C for each Applicable Asset.

(b) Applicable Tariffs. HFRM shall pay (i) the applicable Base Tariffs for all quantities of Product transported, stored or loaded at, on or through the Applicable Assets in each Contract Quarter during the Applicable Term up to and including the applicable Incentive Tariff Threshold for such Applicable Asset set forth on Exhibit C, (ii) the applicable Incentive Tariff for quantities in excess of the Incentive Tariff Threshold and, (iii) if applicable, the Excess Tariff for the Applicable Asset for quantities in excess of the Excess Tariff Threshold.

(c) Adjustment of Applicable Tariffs. The Applicable Tariffs shall be adjusted in the manner set forth on Exhibit C. To evidence the Parties’ agreement to each adjusted Applicable Tariff, the Parties may, but shall not be required to, execute an amended, modified, revised or updated Exhibit C and attach it to this Agreement. If executed, such amended, modified, revised or updated Exhibit C shall be sequentially numbered (e.g. Exhibit C-1, Exhibit C-2, etc.), dated and appended as an additional exhibit to this Agreement and shall replace the prior version of Exhibit C in its entirety, after its date of effectiveness.

(d) Reduction for Non-Force Majeure Operational Difficulties. If HFRM is unable to transport, store and/or load on, in or at any Applicable Asset the volumes of Products required to meet the Minimum Revenue Commitment for such Applicable Asset for a particular Contract Quarter as a result of HEP Operating’s operational difficulties, prorationing, or the inability to provide sufficient capacity for the Minimum Throughput Commitment, then the Minimum Revenue Commitment applicable to the Contract Quarter during which HFRM is unable to transport, store and/or load such volumes of Products will be reduced by an amount equal to: (A) the volume of Products that HFRM was unable to transport, store and/or load on, in or at such Applicable Assets (but not to exceed the Minimum Throughput Commitment), as a result of HEP Operating’s operational difficulties, prorationing or inability to provide sufficient capacity on the Applicable Assets to achieve the Minimum Throughput Commitment, multiplied by (B) the applicable Base Tariff. This Section 2.2(d) shall not apply in the event HEP Operating gives notice of a Force Majeure event in accordance with the terms of the Omnibus Agreement, in which case the Minimum Revenue Commitment shall be suspended to the extent contemplated in Article IX of the Omnibus Agreement.

(e) Pro-Rationing for Partial Periods. Notwithstanding the other portions of this Section 2.2, in the event that the commencement date of the Applicable Term for any group of Applicable Assets is any date other than the first day of a Contract Quarter, then the Minimum Revenue Commitment, Minimum Throughput Commitment, and any applicable Incentive Tariffs for the initial partial Contract Quarter with respect to such group of Applicable Assets shall be prorated based upon the number of days actually in such partial Contract Quarter. Similarly, notwithstanding the other portions of this Section 2.2 if the last day of the Applicable Term for any group of Applicable Assets is on a day other than the last day of a Contract Quarter, then the Minimum Revenue Commitment, Minimum Throughput Commitment, and any applicable Incentive Tariff for the final partial Contract Quarter with respect to such group of Applicable Assets shall be prorated based upon the number of days actually in such partial Contract Quarter and the initial Contract Quarter.

2.3 Measurement of Shipped Volumes. Matters with respect to the measurement of shipped volumes are set forth on Exhibit D.

2.4 Volumetric Gains and Losses; Line Fill; High-API Oil Surcharge. Matters with respect to volumetric gains and losses, line fill and high-API oil surcharges are set forth on Exhibit E.

[Page 6 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

2.5 Obligations of HEP Operating. During the Applicable Term and subject to the terms and conditions of this Agreement, HEP Operating agrees to:

(a) own or lease, operate and maintain (directly or through a Subsidiary) the Applicable Assets and all related assets necessary to handle the applicable Products from HFRM;

(b) make available for HFRM’s use the capacity of the Applicable Assets of at least the Minimum Capacity Commitment;

(c) provide the services required under this Agreement and perform all operations relating to the Applicable Assets, including tank gauging, tank maintenance, loading trucks, interaction with third party pipelines and customer interface for access agreements (as applicable) and performance of all operations and maintenance for the Applicable Assets;

(d) maintain adequate property and liability insurance covering the Applicable Assets and any related assets owned by HEP Operating or its affiliates and necessary for the operation of the Applicable Assets; and

(e) at the request of HFRM, and subject in any case to any applicable common carrier proration duties and commitments to other third-party shippers, use commercially reasonable efforts to transport, store and/or load on the Applicable Assets for HFRM each month during the Applicable Term the quantity of Products that HFRM designates from time to time, but in no event less than the Minimum Capacity Commitment.

Notwithstanding the first sentence of this Section 2.5, subject to the dispute resolution provisions of the Omnibus Agreement and with respect to the Tulsa Assets, the Tulsa Purchase Agreements, HEP Operating or its Affiliate is free to sell any of its assets, including any Applicable Assets, and HFRM is free to merge with another entity and to sell all of its assets or equity to another entity at any time.

2.6 Drag Reducing Agents and Additives. If HEP Operating determines that adding drag reducing agents (“DRA”) to the Products is reasonably required to move the Products in the quantities necessary to meet HFRM’s schedule or as may be otherwise be required to safely move such quantities of Products or that additives should be used in the operation of the Applicable Assets, HEP Operating shall provide HFRM with an analysis of the proposed cost and benefits thereof. In the event that HFRM agrees to use such additives as proposed by HEP Operating, HFRM shall reimburse HEP Operating for the costs of adding any DRA or additives. If HEP Operating reasonably determines that additives or chemicals must be added to any of the pipelines included in the Applicable Assets to prevent or control internal corrosion of the pipe, then HFRM shall reimburse HEP Operating for the direct cost of the chemical and associated injection equipment.

2.7 Change in the Direction; Product Service or Origination and Destination of the Pipeline System. Without HFRM’s prior written consent (which consent shall not be unreasonably withheld, conditioned or delayed), HEP Operating shall not (i) reverse the direction of flow of any Pipeline; (ii) change, alter or modify the Product service of any Pipeline; or (iii) change, alter or modify the origination or destination of any Pipeline; provided, however, that HEP Operating may take any necessary emergency action to prevent or remedy a release of Products from a Pipeline without obtaining the consent required by this Section 2.7. HFRM shall have the right to reverse the direction of flow of any segment of a Pipeline where it is the sole shipper of Products if, in each case, HFRM agrees to (1) reimburse HEP Operating for the additional costs and expenses incurred by HEP Operating as a result of such change in direction (both to reverse and re-

[Page 7 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

reverse); (2) reimburse HEP Operating for all costs arising out of HEP Operating’s inability to perform under any transportation service contract due to the reversal of the direction of flow of the Pipeline; and (3) pay the Applicable Tariffs in accordance with this Agreement, for any such flow reversal. With respect to the Malaga Pipeline System, the foregoing shall apply regardless of whether the Product shipped in such manner reaches an injection point for the Centurion Pipeline or Plains Pipeline. HEP Operating shall not acquire any right, title or interest in the Products, and all title to and ownership of the Products while the same is in the possession of HEP Operating shall be and shall remain exclusively in HFRM. HEP Operating shall not represent itself to any third party as the owner of any of the Products and shall hold the same in trust for HFRM. HFRM shall advise HEP Operating in writing of any change in Product ownership while in the Applicable Assets. If any of HFRM’s Product is sold, exchanged, or otherwise changes ownership while in the Applicable Assets, HFRM shall nonetheless be responsible for the terms and conditions of this Agreement the same as if Products had been owned by HFRM.

2.8 Notification of Utilization. Upon request by HEP Operating, HFRM will provide to HEP Operating written notification of HFRM’s reasonable good faith estimate of its anticipated future utilization of the Applicable Assets as soon as reasonably practicable after receiving such request.

2.9 Scheduling and Accepting Movement. HEP Operating will use its reasonable commercial efforts to schedule and accept movements of Products in a manner that is consistent with the historical dealings between the Parties and their Affiliates, as such dealings may change from time to time.

2.10 Taxes. HFRM will pay all taxes, import duties, license fees and other charges by any Governmental Authority levied on or with respect to the Products handled by HFRM for transportation, storage and/or loading by HEP Operating. Should either Party be required to pay or collect any taxes, duties, charges and or assessments pursuant to any Applicable Law or authority now in effect or hereafter to become effective which are payable by the any other Party pursuant to this Section 2.10 the proper Party shall promptly reimburse the other Party therefor.

2.11 Timing of Payments. HFRM will make payments to HEP Operating by electronic payment with immediately available funds on a monthly basis during the Applicable Term with respect to services rendered or reimbursable costs or expenses incurred by HEP Operating under this Agreement in the prior month. Payments not received by HEP Operating on or prior to the tenth day following the invoice date will accrue interest at the Prime Rate from the applicable payment date until paid.

2.12 Increases in Tariff Rates. If new Applicable Laws are enacted that require HEP Operating to make capital expenditures with respect to the Applicable Assets, HEP Operating may amend the Applicable Tariffs in the manner set forth in Exhibit F, in order to recover HEP Operating’s cost of complying with such new Applicable Laws (as determined in good faith and including a reasonable return). HFRM and HEP Operating shall use their reasonable commercial efforts to comply with such new Applicable Laws, and shall negotiate in good faith to mitigate the impact of such new Applicable Laws and to determine the amount of the new Applicable Tariff rates. If HFRM and HEP Operating are unable to agree on the amount of the new Applicable Tariff rates that HEP Operating will charge, such Applicable Tariff rates will be resolved in the manner provided for in the Omnibus Agreement. Any other applicable exhibit to this Agreement will be updated, amended or revised, as applicable, in accordance with this Agreement to reflect any changes in Applicable Tariff rates established in accordance with this Section 2.12.

2.13 Removal of Tank from Service . The Parties agree that if a tank included in the Applicable Assets is removed from service, then HEP Operating will not be required to utilize, operate or maintain such tank or provide the services required under this Agreement with respect to such tank (and there will be no

[Page 8 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

adjustment to the applicable Minimum Revenue Commitment). The Parties acknowledge that provisions relating to the inspection, repair and maintenance of tanks included in the Applicable Assets are set forth in the Master Lease and Access Agreement, and such provisions are in addition to, and not in substitution of, the terms set forth in this Section 2.13.

2.14 No Guaranteed Minimum. Notwithstanding anything to the contrary set forth in this Agreement, there is no requirement that HFRM deliver any minimum quantity of Product for transport, storage, handling or loading on, over or in the Applicable Assets, it being understood that HFRM’s obligation for failing to ship, store or load sufficient quantities of Product to satisfy the Minimum Revenue Commitment is to make Deficiency Payments as provided in Article 10.

ARTICLE 3

AGREEMENT TO REMAIN SHIPPER

With respect to any Product that is transported, stored or loaded in connection with any of the Applicable Assets by HFRM, HFRM agrees that it will continue acting in the capacity of the shipper of any such Product for its own account at all times that such Product is being transported, stored, handled or loaded in the Applicable Assets.

ARTICLE 4

NOTIFICATION OF REFINERY SHUT-DOWN OR RECONFIGURATION

If a Refinery shuts down or the Refinery owner reconfigures the Refinery or any portion of the Refinery (excluding planned maintenance turnarounds) and HFRM reasonably believes in good faith that such shut down or reconfiguration will jeopardize its ability to satisfy its applicable Minimum Revenue Commitments under this Agreement, then within 90 days of the delivery of the written notice of the planned shut down or reconfiguration, HFRM shall (A) propose a new Minimum Revenue Commitment under this Agreement, as applicable, such that the ratio of the new applicable Minimum Revenue Commitment under this Agreement over the anticipated production level following the shut down or reconfiguration will be approximately equal to the ratio of the original applicable Minimum Revenue Commitment under this Agreement over the original production level and (B) propose the date on which the new Minimum Revenue Commitment under this Agreement shall take effect. Unless objected to by HEP Operating within 60 days of receipt by HEP Operating of such proposal, such new Minimum Revenue Commitment under this Agreement shall become effective as of the date proposed by HFRM. To the extent that HEP Operating does not agree with HFRM’s proposal, any changes in HFRM’s obligations under this Agreement, or the date on which such changes will take effect, will be determined pursuant to the dispute resolution provisions of the Omnibus Agreement. Any applicable exhibit to this Agreement will be updated, amended or revised, as applicable, in accordance with this Agreement to reflect any change in the applicable Minimum Revenue Commitment under this Agreement agreed to in accordance with this Section 4.1.

ARTICLE 5

FORCE MAJEURE

The rights and obligations of the Parties upon the occurrence of an event of Force Majeure will be determined in the manner set forth in the Omnibus Agreement; provided that (a) any suspension of the obligations of the Parties under this Agreement as a result of an event of Force Majeure shall extend the Applicable Term (to the extent so affected) for a period equivalent to the duration of the inability set forth in the Force Majeure Notice, (b) HFRM will be required to pay any amounts accrued and due under this Agreement at the time of the Force Majeure event, and (c) if a Force Majeure event prevents either Party

[Page 9 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

from performing substantially all of their respective obligations under this Agreement relating to a group of Applicable Assets for a period of more than one (1) year, this Agreement may be terminated as to such Applicable Assets (but not as to unaffected Applicable Assets) by either Party providing written notice thereof to the other Party.

ARTICLE 6

AGREEMENT NOT TO CHALLENGE PIPELINE TARIFFS

HFRM agrees to any tariff rate changes for Pipelines in accordance with this Agreement. HFRM agrees (a) not to challenge, nor to cause their Affiliates to challenge, nor to encourage or recommend to any other Person that it challenge, or voluntarily assist in any way any other Person in challenging, in any forum, tariffs (including joint tariffs) of HEP Operating (or its Affiliates) that HEP Operating (or its Affiliate) has filed or may file containing rates, rules or regulations that are in effect at any time during the Applicable Term and regulate the transportation of the Products on any Pipelines, and (b) not to protest or file a complaint, nor cause their Affiliates to protest or file a complaint, nor encourage or recommend to any other Person that it protest or file a complaint, or voluntarily assist in any way any other Person in protesting or filing a complaint, with respect to regulatory filings that HEP Operating or its Affiliate has made or may make at any time during the Applicable Term to change tariffs (including joint tariffs) for transportation of Products on any Pipelines, in each case so long as such tariffs, regulatory filings or rates changed do not conflict with the terms of this Agreement.

ARTICLE 7

EFFECTIVENESS AND APPLICABLE TERM

This Agreement shall be effective as to each group of Applicable Assets as of the date and time set forth on Exhibit C and shall terminate with respect to each group of Applicable Assets as of the date and time set forth on Exhibit C, unless extended by written mutual agreement of the Parties or as set forth in Article 8 (each, the “Applicable Term”). The Party desiring to extend this Agreement with respect to any group of Applicable Assets pursuant to this Article 7 shall provide prior written notice to the other Party of its desire to so extend this Agreement; such written notice shall be provided not more than twenty-four (24) months and not less than the later of twelve (12) months prior to the date of termination of the Applicable Term or ten (10) days after receipt of a written request from the other Party (which request may be delivered no earlier than twelve (12) months prior to the date of termination of the Applicable Term) to provide any such notice or lose such right.

ARTICLE 8

RIGHT TO ENTER INTO A NEW AGREEMENT

8.1. Negotiation Pursuant to Written Notice. In the event that HFRM provides prior written notice to HEP Operating of the desire of HFRM to extend this Agreement for a specific group of Applicable Assets by written mutual agreement of the Parties pursuant to Article 7, the Parties shall negotiate in good faith to extend this Agreement by written mutual agreement with respect to such specific group of Applicable Assets, but, if such negotiations fail to produce a written mutual agreement for extension by a date six months prior to the termination date for such group of Applicable Assets, then HEP Operating shall have the right to negotiate to enter into one or more throughput, tankage or transportation services agreements for HFRM’s Minimum Capacity Commitment for such Applicable Assets with one or more third parties to begin after the date of termination, provided, however, that until the end of one year following termination without renewal of this Agreement for such group of Applicable Assets, HFRM will have the right to enter into a new throughput, tankage or transportation services or transportation services agreement with HEP Operating

[Page 10 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

with respect to its Minimum Capacity Commitment on the date of termination on commercial terms that substantially match the terms upon which HEP Operating proposes to enter into an agreement with a third party for similar services with respect to all or a material portion of such capacity of such group of Applicable Assets. In such circumstances, HEP Operating shall give HFRM at least forty-five (45) days prior written notice of any proposed new throughput agreement with a third party, and such notice shall inform HFRM of the fee schedules, tariffs, duration and any other material terms of the proposed third party agreement. HFRM shall have forty-five (45) days following receipt of such notice to agree to the terms specified in the notice or HFRM shall lose the rights specified by this Section 8.1 with respect to the capacity that is the subject of such notice.

8.2. Negotiation in the Absence of Written Notice. In the event that HFRM fails to provide prior written notice to HEP Operating of the desire of HFRM to extend this Agreement for a specific group of Applicable Assets by written mutual agreement of the Parties pursuant to Article 7, HEP Operating shall have the right, during the period from the date of HFRM’s failure to provide written notice pursuant to Article 7 to the date of termination of this Agreement, to negotiate to enter into one or more throughput, tankage or transportation services agreements for HFRM’s Minimum Capacity Commitment for the such group of Applicable Assets with one or more third parties to begin after the date of termination; provided, however, that at any time during the twelve (12) months prior to the expiration of the Applicable Term, HFRM will have the right to enter into a new throughput, tankage agreement with HEP Operating with respect to its existing Minimum Capacity Commitment at such time on commercial terms that substantially match the terms upon which HEP Operating proposes to enter into an agreement with a third party for similar services with respect to all or a material portion of such capacity on such group of Applicable Assets. In such circumstances, HEP Operating shall give HFRM forty-five (45) days prior written notice of any proposed new agreement with a third party, and such notice shall inform HFRM of the fee schedules, tariffs, duration and any other material terms of the proposed third party agreement and HFRM shall have forty-five (45) days following receipt of such notice to agree to the terms specified in the notice or HFRM shall lose the rights specified by this Section 8.2 with respect to the capacity that is the subject of such notice.

ARTICLE 9

NOTICES

Any notice or other communication given under this Agreement shall be in writing and shall be provided in the manner set forth in the Omnibus Agreement.

ARTICLE 10

DEFICIENCY PAYMENTS

10.1 Deficiency Notice; Deficiency Payments. As soon as practicable following the end of each Contract Quarter under this Agreement, HEP Operating shall deliver to HFRM a written notice (the “Deficiency Notice”) detailing any failure of HFRM to meet any of the Minimum Revenue Commitments set forth on Exhibit C; provided, however, that HFRM’s obligations pursuant to the Minimum Revenue Commitment shall be assessed on a quarterly basis for the purposes of this Article 10. Notwithstanding the previous sentence, any deficiency owed by HFRM due to its failure to satisfy any Minimum Revenue Commitment, if any, set forth on Exhibit C, as to any Applicable Asset for a Contract Quarter shall be offset by any revenue owed to HEP Operating in excess of any Minimum Revenue Commitment for such Contract Quarter set forth on Exhibit C from any other Applicable Asset at the same location. The Deficiency Notice shall (i) specify in reasonable detail the nature of any deficiency and (ii) specify the approximate dollar amount that HEP Operating believes would have been paid by HFRM to HEP Operating if HFRM had complied with its Minimum Revenue Commitment obligations pursuant to this Agreement (the “Deficiency Payment”). HFRM shall pay the Deficiency Payment to HEP Operating upon the later of: (A) ten (10) days

[Page 11 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

after their receipt of the Deficiency Notice and (B) thirty (30) days following the end of the related Contract Quarter.

10.2 Disputed Deficiency Notices. If HFRM disagrees with the Deficiency Notice, then, following the payment of the undisputed portion of the Deficiency Payment to HEP Operating, if any, HFRM shall send written notice thereof regarding the disputed portion of the Deficiency Payment to HEP Operating. Thereafter, a senior officer of HollyFrontier (on behalf of HFRM) and a senior officer of the Partnership (on behalf of HEP Operating) shall meet or communicate by telephone at a mutually acceptable time and place, and thereafter as often as they reasonably deem necessary and shall negotiate in good faith to attempt to resolve any differences that they may have with respect to matters specified in the Deficiency Notice. During the 30-day period following the payment of the Deficiency Payment, HFRM shall have access to the working papers of HEP Operating relating to the Deficiency Notice. If such differences are not resolved within thirty (30) days following HFRM’s receipt of the Deficiency Notice, HFRM and HEP Operating shall, within forty-five (45) days following HFRM’s receipt of the Deficiency Notice, submit any and all matters which remain in dispute and which were properly included in the Deficiency Notice to dispute resolution in accordance with the Omnibus Agreement.

10.3 Payment of Amounts No Longer Disputed. If it is finally determined pursuant to this Article 10 that HFRM is required to pay any or all of the disputed portion of the Deficiency Payment, HFRM shall promptly pay such amount to HEP Operating, together with interest thereon at the Prime Rate, in immediately available funds.

10.4 Contract Quarters Independent. The fact that HFRM has exceeded or fallen short of the Minimum Revenue Commitment with respect to any Contract Quarter shall not be considered in determining whether HFRM meets, exceeds or falls short of the Minimum Revenue Commitment with respect to any other Contract Quarter, and the amount of any such excess or shortfall shall not be counted towards or against the Minimum Revenue Commitment with respect to any other Contract Quarter.

[Page 12 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

ARTICLE 11

RIGHT OF FIRST REFUSAL

The Parties acknowledge the right of first refusal of HollyFrontier with respect to the Applicable Assets other than the Tulsa Assets as provided in the Omnibus Agreement, and the right of first refusal of HollyFrontier with respect to the Tulsa Assets as provided in the Tulsa Purchase Agreements.

ARTICLE 12

INDEMNITY; LIMITATION OF DAMAGES

12.1 Indemnity; Limitation of Liability . The Parties acknowledge and agree that the provisions relating to indemnity and limitation of liability are set forth in the Omnibus Agreement. Notwithstanding anything in this Agreement or the Omnibus Agreement to the contrary and solely for the purpose of determining which of HFRM or HEP Operating shall be liable in a particular circumstance, neither HFRM or HEP Operating shall be liable to the other Party for any loss, damage, injury, judgment, claim, cost, expense or other liability suffered or incurred (collectively, “Damages”) by such Party except to the extent set forth in the Omnibus Agreement and to the extent that HFRM or HEP Operating causes such Damages or owns or operates the assets or other property in question responsible for causing such Damages.

12.2 Survival. The provisions of this Article 12 shall survive the termination of this Agreement.

ARTICLE 13

MISCELLANEOUS

13.1 Amendments and Waivers. No amendment or modification of this Agreement shall be valid unless it is in writing and signed by the Parties. No waiver of any provision of this Agreement shall be valid unless it is in writing and signed by the Party against whom the waiver is sought to be enforced. Any of the exhibits to this Agreement may be amended, modified, revised or updated by the Parties if each of the Parties executes an amended, modified, revised or updated exhibit, and attaches it to this Agreement. Such amended, modified, revised or updated exhibits shall be sequentially numbered (e.g. Exhibit A-1, Exhibit A-2, etc.), dated and appended as an additional exhibit to this Agreement and shall replace the prior exhibit, in its entirety, after its date of effectiveness, except as specified therein. No failure or delay in exercising any right hereunder, and no course of conduct, shall operate as a waiver of any provision of this Agreement. No single or partial exercise of a right hereunder shall preclude further or complete exercise of that right or any other right hereunder.

13.2 Successors and Assigns. This Agreement shall inure to the benefit of, and shall be binding upon, the Parties and their respective successors and permitted assigns. Neither this Agreement nor any of the rights or obligations hereunder shall be assigned without the prior written consent of HFRM (in the case of any assignment by HEP Operating) or HEP Operating (in the case of any assignment by HFRM), in each case, such consent is not to be unreasonably withheld or delayed; provided, however, that (i) HEP Operating may make such an assignment (including a partial pro rata assignment) to an Affiliate of HEP Operating without HFRM’s consent, (ii) HFRM may make such an assignment (including a pro rata partial assignment) to an Affiliate of HFRM without HEP Operating’s consent, (iii) HFRM may make a collateral assignment of its rights and obligations hereunder and/or grant a security interest in its rights and obligations hereunder, and HEP Operating shall execute an acknowledgement of such collateral assignment in such form as may

[Page 13 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

from time-to-time be reasonably requested, and (iv) HEP Operating may make a collateral assignment of its rights hereunder and/or grant a security interest in its rights and obligations hereunder to a bona fide third party lender or debt holder, or trustee or representative for any of them, without HFRM’s consent, if such third party lender, debt holder or trustee shall have executed and delivered to HFRM a non-disturbance agreement in such form as is reasonably satisfactory to HFRM and such third party lender, debt holder or trustee, and HFRM executes an acknowledgement of such collateral assignment in such form as may from time to time be reasonably requested. Any attempt to make an assignment otherwise than as permitted by the foregoing shall be null and void. The Parties agree to require their respective successors, if any, to expressly assume, in a form of agreement reasonably acceptable to the other Parties, their obligations under this Agreement.

13.3 Severability. If any provision of this Agreement shall be held invalid or unenforceable by a court or regulatory body of competent jurisdiction, the remainder of this Agreement shall remain in full force and effect.

13.4 Choice of Law. This Agreement shall be subject to and governed by the laws of the State of Delaware, excluding any conflicts-of-law rule or principle that might refer the construction or interpretation of this Agreement to the laws of another state.

13.5 Rights of Limited Partners. The provisions of this Agreement are enforceable solely by the Parties, and no limited partner of the Partnership shall have the right, separate and apart from the Partnership, to enforce any provision of this Agreement or to compel any Party to comply with the terms of this Agreement.

13.6 Further Assurances. In connection with this Agreement and all transactions contemplated by this Agreement, each signatory Party hereto agrees to execute and deliver such additional documents and instruments and to perform such additional acts as may be necessary or appropriate to effectuate, carry out and perform all of the terms, provisions and conditions of this Agreement and all such transactions.

13.7 Headings. Headings of the Sections of this Agreement are for convenience of the Parties only and shall be given no substantive or interpretative effect whatsoever. All references in this Agreement to Sections are to Sections of this Agreement unless otherwise stated.

ARTICLE 14

GUARANTEE BY HOLLYFRONTIER

14.1 Payment Guaranty. HollyFrontier unconditionally, absolutely, continually and irrevocably guarantees, as principal and not as surety, to HEP Operating the punctual and complete payment in full when due of all amounts due from HFRM under this Agreement (collectively, the “HFRM Payment Obligations”). HollyFrontier agrees that HEP Operating shall be entitled to enforce directly against HollyFrontier any of the HFRM Payment Obligations.

14.2 Guaranty Absolute. HollyFrontier hereby guarantees that the HFRM Payment Obligations will be paid strictly in accordance with the terms of the Agreement. The obligations of HollyFrontier under this Agreement constitute a present and continuing guaranty of payment, and not of collection or collectability. The liability of HollyFrontier under this Agreement shall be absolute, unconditional, present, continuing and irrevocable irrespective of:

(a) any assignment or other transfer of this Agreement or any of the rights thereunder of HEP Operating;

[Page 14 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

(b) any amendment, waiver, renewal, extension or release of or any consent to or departure from or other action or inaction related to this Agreement;

(c) any acceptance by HEP Operating of partial payment or performance from HFRM;

(d) any bankruptcy, insolvency, reorganization, arrangement, composition, adjustment, dissolution, liquidation or other like proceeding relating to HFRM or any action taken with respect to this Agreement by any trustee or receiver, or by any court, in any such proceeding;

(e) any absence of any notice to, or knowledge of, HollyFrontier, of the existence or occurrence of any of the matters or events set forth in the foregoing subsections (i) through (iv); or

(f) any other circumstance which might otherwise constitute a defense available to, or a discharge of, a guarantor.

The obligations of HollyFrontier hereunder shall not be subject to any reduction, limitation, impairment or termination for any reason, including any claim of waiver, release, surrender, alteration or compromise, and shall not be subject to any defense or setoff, counterclaim, recoupment or termination whatsoever by reason of the invalidity, illegality or unenforceability of the HFRM Payment Obligations or otherwise.

14.3 Waiver. HollyFrontier hereby waives promptness, diligence, all setoffs, presentments, protests and notice of acceptance and any other notice relating to any of the HFRM Payment Obligations and any requirement for HEP Operating to protect, secure, perfect or insure any security interest or lien or any property subject thereto or exhaust any right or take any action against HFRM, any other entity or any collateral.

14.4 Subrogation Waiver. HollyFrontier agrees that for so long as there is a current or ongoing default or breach of this Agreement by HFRM, HollyFrontier shall not have any rights (direct or indirect) of subrogation, contribution, reimbursement, indemnification or other rights of payment or recovery from HFRM for any payments made by HollyFrontier under this Article 14, and HollyFrontier hereby irrevocably waives and releases, absolutely and unconditionally, any such rights of subrogation, contribution, reimbursement, indemnification and other rights of payment or recovery it may now have or hereafter acquire against HFRM during any period of default or breach of this Agreement by HFRM until such time as there is no current or ongoing default or breach of this Agreement by HFRM.

14.5 Reinstatement. The obligations of HollyFrontier under this Article 14 shall continue to be effective or shall be reinstated, as the case may be, if at any time any payment of any of the HFRM Payment Obligations is rescinded or must otherwise be returned to HFRM or any other entity, upon the insolvency, bankruptcy, arrangement, adjustment, composition, liquidation or reorganization of HFRM or such other entity, or for any other reason, all as though such payment had not been made.

14.6 Continuing Guaranty. This Article 14 is a continuing guaranty and shall (i) remain in full force and effect until the first to occur of the indefeasible payment in full of all of the HFRM Payment Obligations, (ii) be binding upon HollyFrontier, its successors and assigns and (iii) inure to the benefit of and be enforceable by HEP Operating and its respective successors, transferees and assigns.

[Page 15 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

14.7 No Duty to Pursue Others. It shall not be necessary for HEP Operating (and HollyFrontier hereby waives any rights which HollyFrontier may have to require HEP Operating), in order to enforce such payment by HollyFrontier, first to (i) institute suit or exhaust its remedies against HFRM or others liable on the HFRM Payment Obligations or any other person, (ii) enforce HEP Operating’s rights against any other guarantors of the HFRM Payment Obligations, (iii) join HFRM or any others liable on the HFRM Payment Obligations in any action seeking to enforce this Article 14, (iv) exhaust any remedies available to HEP Operating against any security which shall ever have been given to secure the HFRM Payment Obligations, or (v) resort to any other means of obtaining payment of the HFRM Payment Obligations.

ARTICLE 15

GUARANTEE BY THE PARTNERSHIP

15.1 Payment and Performance Guaranty. The Partnership unconditionally, absolutely, continually and irrevocably guarantees, as principal and not as surety, to HFRM the punctual and complete payment in full when due of all amounts due from HEP Operating under this Agreement (collectively, the “HEP Operating Payment Obligations”) and the punctual and complete performance of all other obligations of HEP Operating under this Agreement (collectively, the “HEP Operating Performance Obligations”, together with the HEP Operating Payment Obligations, the “HEP Operating Obligations”). The Partnership agrees that HFRM shall be entitled to enforce directly against the Partnership any of the HEP Operating Obligations.

15.2 Guaranty Absolute. The Partnership hereby guarantees that the HEP Operating Payment Obligations will be paid, and the HEP Performance Obligations will be performed, strictly in accordance with the terms of this Agreement. The obligations of the Partnership under this Agreement constitute a present and continuing guaranty of payment and performance, and not of collection or collectability. The liability of the Partnership under this Agreement shall be absolute, unconditional, present, continuing and irrevocable irrespective of:

(a) any assignment or other transfer of this Agreement or any of the rights thereunder of HFRM;

(b) any amendment, waiver, renewal, extension or release of or any consent to or departure from or other action or inaction related to this Agreement;

(c) any acceptance by HFRM of partial payment or performance from HEP Operating;

(d) any bankruptcy, insolvency, reorganization, arrangement, composition, adjustment, dissolution, liquidation or other like proceeding relating to HEP Operating or any action taken with respect to this Agreement by any trustee or receiver, or by any court, in any such proceeding;

(e) any absence of any notice to, or knowledge of, the Partnership, of the existence or occurrence of any of the matters or events set forth in the foregoing subsections (i) through (iv); or

(f) any other circumstance which might otherwise constitute a defense available to, or a discharge of, a guarantor.

The obligations of the Partnership hereunder shall not be subject to any reduction, limitation, impairment or termination for any reason, including any claim of waiver, release, surrender, alteration or compromise, and shall not be subject to any defense or setoff, counterclaim, recoupment or termination

[Page 16 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

whatsoever by reason of the invalidity, illegality or unenforceability of the HEP Operating Obligations or otherwise.

15.3 Waiver. The Partnership hereby waives promptness, diligence, all setoffs, presentments, protests and notice of acceptance and any other notice relating to any of the HEP Operating Payment Obligations and any requirement for HFRM to protect, secure, perfect or insure any security interest or lien or any property subject thereto or exhaust any right or take any action against HEP Operating, any other entity or any collateral.

15.4 Subrogation Waiver. The Partnership agrees that for so long as there is a current or ongoing default or breach of this Agreement by HEP Operating, the Partnership shall not have any rights (direct or indirect) of subrogation, contribution, reimbursement, indemnification or other rights of payment or recovery from HEP Operating for any payments made by the Partnership under this Article 15, and each of the Partnership hereby irrevocably waives and releases, absolutely and unconditionally, any such rights of subrogation, contribution, reimbursement, indemnification and other rights of payment or recovery it may now have or hereafter acquire against HEP Operating during any period of default or breach of this Agreement by HEP Operating until such time as there is no current or ongoing default or breach of this Agreement by HEP Operating.

15.5 Reinstatement. The obligations of the Partnership under this Article 15 shall continue to be effective or shall be reinstated, as the case may be, if at any time any payment of any of the HEP Operating Payment Obligations is rescinded or must otherwise be returned to HEP Operating or any other entity, upon the insolvency, bankruptcy, arrangement, adjustment, composition, liquidation or reorganization of HEP Operating or such other entity, or for any other reason, all as though such payment had not been made.

15.6 Continuing Guaranty. This Article 15 is a continuing guaranty and shall (i) remain in full force and effect until the first to occur of the indefeasible payment and/or performance in full of all of the HEP Operating Payment Obligations, (ii) be binding upon the Partnership and each of its respective successors and assigns and (iii) inure to the benefit of and be enforceable by HFRM and their respective successors, transferees and assigns.

15.7 No Duty to Pursue Others. It shall not be necessary for HFRM (and the Partnership hereby waives any rights which the Partnership may have to require HFRM), in order to enforce such payment by the Partnership, first to (i) institute suit or exhaust its remedies against HEP Operating or others liable on the HEP Operating Obligations or any other person, (ii) enforce HFRM’s rights against any other guarantors of the HEP Operating Obligations, (iii) join HEP Operating or any others liable on the HEP Operating Obligations in any action seeking to enforce this Article 15, (iv) exhaust any remedies available to HFRM against any security which shall ever have been given to secure the HEP Operating Obligations, or (v) resort to any other means of obtaining payment of the HEP Operating Obligations.

[Remainder of page intentionally left blank. Signature pages follow.]

[Page 17 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

IN WITNESS WHEREOF, the undersigned Parties have executed this Agreement as of the date first written above to be effective as of the Effective Time.

HEP OPERATING:

Holly Energy Partners-Operating, L.P.

By: /s/ Mark A. Plake

Mark A. Plake

President

HFRM:

HollyFrontier Refining & Marketing LLC

By: /s/ George J. Damiris

George J. Damiris

Chief Executive Officer and President

[Page 18 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

ACKNOWLEDGED AND AGREED

FOR PURPOSES OF Section 10.2

AND Article 14:

HOLLYFRONTIER CORPORATION

By: /s/ George J. Damiris

George J. Damiris

Chief Executive Officer and President

ACKNOWLEDGED AND AGREED

FOR PURPOSES OF Section 10.2

AND Article 15:

HOLLY ENERGY PARTNERS, L.P.

By: HEP Logistics Holdings, L.P.,

its General Partner

By: Holly Logistic Services, L.L.C.,

its General Partner

By: /s/ Mark A. Plake

Mark A. Plake

President

[Page 19 to the Third Amended and Restated Master Throughput Agreement]

Exhibit 10.27

Exhibit A

to

Third Amended and Restated

Master Throughput Agreement

Definitions

“Actual Construction Costs” has the meaning set forth in Exhibit C.

“Affiliate” means, with to respect to a specified person, any other person controlling, controlled by or under common control with that first person. As used in this definition, the term “control” includes (i) with respect to any person having voting securities or the equivalent and elected directors, managers or persons performing similar functions, the ownership of or power to vote, directly or indirectly, voting securities or the equivalent representing 50% or more of the power to vote in the election of directors, managers or persons performing similar functions, (ii) ownership of 50% or more of the equity or equivalent interest in any person and (iii) the ability to direct the business and affairs of any person by acting as a general partner, manager or otherwise. Notwithstanding the foregoing, for purposes of this Agreement, HFRM, on the one hand, and HEP Operating, on the other hand, shall not be considered affiliates of each other.

“Agreement” has the meaning set forth in the preamble to this Agreement.

“API” means the American Petroleum Institute.

“API 653” means the Above Ground Storage Tank Inspector Program issued by the API as API Standard 653, as amended and supplemented from time to time.

“API Gravity” means the API index of specific gravity of a liquid petroleum expressed as degrees, as such index would be calculated on the date hereof.

“Applicable Asset” means each of the Cheyenne Assets, El Dorado Assets, Lovington Loading Rack, Malaga Pipeline System, Roadrunner Pipeline, Tulsa Assets, El Dorado Crude Tank Farm Assets and the Tulsa West Tankage, individually; and “Applicable Assets” means all of the foregoing assets, collectively.

“Applicable Law” means any applicable statute, law, regulation, ordinance, rule, judgment, rule of law, order, decree, permit, approval, concession, grant, franchise, license, agreement, requirement, or other governmental restriction or any similar form of decision of, or any provision or condition of any permit, license or other operating authorization issued under any of the foregoing by, or any determination of, any Governmental Authority having or asserting jurisdiction over the matter or matters in question, whether now or hereafter in effect and in each case as amended (including, without limitation, all of the terms and provisions of the common law of such Governmental Authority), as interpreted and enforced at the time in question.

“Applicable Tariff” means the Base Tariff and, to the extent applicable, the Incentive Tariff.

“Applicable Term” has the meaning set forth in Article 7.

“ASTM” means ASTM International.

Exhibit A-1

Exhibit 10.27

“Assumed OPEX” means, with respect to any Applicable Asset, the amount set forth on Exhibit C with respect to such Applicable Asset.

“Barrel” means 42 Gallons.

“Base Tariff” means the Base Tariff applicable to the quantity of Product transported, stored or loaded in connection with an Applicable Asset as set forth on Exhibit C, as such Base Tariff may be adjusted pursuant to the terms of this Agreement.

“bpd” means Barrels per day.

“Business Day” means any day other than Saturday, Sunday or other day upon which commercial banks in Dallas, Texas are authorized by law to close.

“Centurion Pipeline” means that certain 10” pipeline system operated by Centurion Pipeline L.P. and originating from Centurion’s Artesia Station located within Township 18S and Range 27E, approximately 1 mile south of HEP Operating’s Abo Station.

“Cheyenne Assets” means the Cheyenne Receiving Assets, Cheyenne Loading Rack and the Cheyenne Tankage.

“Cheyenne Loading Rack” means the refined products truck loading rack and the two (2) propane loading spots located at the Cheyenne Refinery and more specifically described in Exhibit I-1.

“Cheyenne Receiving Assets” means the pipelines set forth on Exhibit I-2.

“Cheyenne Refinery” means the refinery owned by HollyFrontier Cheyenne Refining LLC and located in Cheyenne, Wyoming.

“Cheyenne RCRA Order” means the administrative order set forth in Exhibit I.

“Cheyenne Tankage” means the tanks set forth on Exhibit I-3.

“Claim” means any existing or threatened future claim, demand, suit, action, investigation, proceeding, governmental action or cause of action of any kind or character (in each case, whether civil, criminal, investigative or administrative), known or unknown, under any theory, including those based on theories of contract, tort, statutory liability, strict liability, employer liability, premises liability, products liability, breach of warranty or malpractice.

“Closing Date” has the meaning for each Applicable Asset set forth in the Omnibus Agreement.

“Construction Projects” has the meaning set forth in Article 2.

“Contract Quarter” means a three-month period that commences on January 1, April 1, July 1 or October 1 and ends on March 31, June 30, September 30, or December 31, respectively.

“Control” (including with correlative meaning, the term “controlled by”) means, as used with respect to any Person, the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise.

Exhibit A-2

Exhibit 10.27

“Crude Agreement” means the Third Amended and Restated Crude Pipelines and Tankage Agreement, dated as of March 12, 2015, by and among HFRM, HEP Operating and certain other Affiliates of HFRM and HEP Operating.

“Crude Oil” means the direct liquid product of oil wells, oil processing plants, the indirect liquid petroleum products of oil or gas wells, oil sands or a mixture of such products, but does not include natural gas liquids, Refined Products, naphtha, gas oil, LEF (lube extraction feedstocks) or any other refined products.

“Deficiency Notice” has the meaning set forth in Section 10.1.

“Deficiency Payment” has the meaning set forth in Section 10.1.

“Devon” means Devon Energy Production Company, L.P., and its Affiliates.

“Devon Lease Connections” has the meaning set forth in Exhibit G-3.

“DRA” has the meaning set forth in Section 2.6.

“Effective Time” means 12:01 a.m., Dallas, Texas time, on January 1, 2017.

“El Dorado Assets” means the El Dorado Loading Rack and the El Dorado Tankage.

“El Dorado Crude Tank Farm Assets” means the El Dorado Delivery Lines and the El Dorado Crude Tankage.

“El Dorado Crude Tank Farm Consideration Period” has the meaning set forth in Exhibit K.

“El Dorado Crude Tank Farm Quality Specifications” has the meaning set forth in Exhibit K.

“El Dorado Crude Tankage” means the tankage identified on Exhibit K-1.

“El Dorado Delivery Lines” has the meaning set forth in Exhibit K.

“El Dorado Loading Rack” means the Refined Products truck loading rack and the propane loading rack located at the El Dorado Refinery and more specifically described on Exhibit H-1.

“El Dorado Minimum Working Capacity” has the meaning set forth in Exhibit K.

“El Dorado Quality Specifications” means those specifications set forth in Exhibit K-2.

“El Dorado Refinery” means the refinery owned by HollyFrontier El Dorado Refining LLC and located in El Dorado, Kansas.

“El Dorado Tankage” means the tanks set forth on Exhibit H-2.

“El Dorado Terminal” means the tank farm owned by HEP Operating and located in El Dorado, Kansas.

“Environmental Law” has the meaning set forth in the Omnibus Agreement.

“Excess Tariff Threshold” has the meaning set forth in Exhibit C.

Exhibit A-3

Exhibit 10.27

“Exercise Notice” has the meaning set forth in Exhibit F.

“FERC Oil Pipeline Index” has the meaning set forth in Section 3(a)(iii)(B).

“Final Construction Cost” means the final aggregate construction cost of a New Tank, as contemplated by Exhibit H, Exhibit I and Exhibit J.

“Force Majeure” has the meaning set forth in the Omnibus Agreement.

“Force Majeure Notice” has the meaning set forth in the Omnibus Agreement.

“Gallon” means a United States gallon of two hundred thirty-one (231) cubic inches of liquid at sixty degrees (60°) Fahrenheit, and at the equivalent vapor pressure of the liquid.

“Governmental Authority” means any federal, state, local or foreign government or any provincial, departmental or other political subdivision thereof, or any entity, body or authority exercising executive, legislative, judicial, regulatory, administrative or other governmental functions or any court, department, commission, board, bureau, agency, instrumentality or administrative body of any of the foregoing.

“Heavy Products” means fuel oil, asphalt, coker feed, vacuum tower bottoms, atmospheric tower bottoms, pitch or roofing flux.

“HEP Operating” has the meaning set forth in the Preamble.

“HEP Operating Payment Obligations” has the meaning set forth in Section 15.1.

“HFRM” has the meaning set forth in the Preamble.

“HFRM Payment Obligations” has the meaning set forth in Section 14.1.

“High-API Surcharge” has the meaning set forth in Section 2.4.

“HollyFrontier” means HollyFrontier Corporation, a Delaware corporation.

“HollyFrontier Navajo” means HollyFrontier Navajo Refining LLC.

“HollyFrontier Tulsa” means HollyFrontier Tulsa Refining LLC.

“Incentive Tariff” means the Incentive Tariff applicable to the quantity of Product transported, stored or loaded in connection with an Applicable Asset as set forth on Exhibit C, as such Incentive Tariff may be adjusted pursuant to the terms of this Agreement.

“Initial OPEX” has the meaning set forth in Exhibit L-2.

“Intermediate Products” means non-finished intermediate products, including high sulfur diesel fuel for DHT feed, jet fuel, naphtha for reformer feed, gas oil or LEF for FCC feed, reformate, light straight run, hydrogen, fuel gas and sour fuel gas.

“Jayhawk” means Jayhawk Pipeline, L.L.C. (or its successors to the Jayhawk Tankage).

Exhibit A-4

Exhibit 10.27

“Jayhawk Lease” means the lease between HEP-Operating and Jayhawk for the Jayhawk Tankage in existence as of the commencement of the Applicable Term.

“Jayhawk Tankage” means the tankage identified in Exhibit K-1.

“Lovington Loading Rack” means that certain asphalt loading rack located at the Navajo Refinery.

“LPG Products” means propane, refinery grade propylene, normal butane and isobutane.

“Malaga Capacity Estimate” has the meaning set forth in Exhibit G.

“Malaga Commencement Date” means the date on which, in the reasonable opinion of HEP Operating, the Malaga Pipeline System is available for service and operating as expected in delivering Crude Oil, which date has been specified in written notice from HEP Operating to HFRM at least 60 days prior to the Malaga Commencement Date; provided, however, that if the Malaga Pipeline System is, in the discretion of HEP Operating, substantially complete, then the parties may agree in writing to a commencement date prior to the Malaga Pipeline System being fully completed.

“Malaga Construction Projects” has the meaning set forth in Exhibit G.

“Malaga Exercise Notice” has the meaning set forth in Exhibit G.

“Malaga Initial Period” means the period beginning on the Malaga Commencement Date through and including final day of the 20th full Contract Quarter following the Malaga Commencement Date.

“Malaga Pipeline System” means the pipeline systems (a) extending from the (i) Whites City Road Station to the HEP Operating Artesia Station, from (ii) Devon Parkway field to the Millman Station and the HEP Operating Artesia Station, (iii) HEP Operating Artesia Station to the Beeson Station, (iv) the Beeson Station to the Anderson Ranch Pipeline, (v) Devon Hackberry field to the Beeson Station, and (v) Beeson Station to the Plains Pipeline, including in each case all related lease connection pipelines, storage facilities, crude oil gathering tanks, and truck off-loading facilities, as depicted on Exhibit G-1 (Map of Pipeline System and Pipeline System Capacity by Segment), and (b) with the volume capacities as set forth on Exhibit G-1, described on Exhibit G-2 (Construction Projects) and described on Exhibit G-3 (Devon Lease Connections).

“Master Lease and Access Agreement” means that certain Master Lease and Access Agreement dated as of the date hereof among certain of the Affiliates of HEP Operating and the owners of the Refineries.

“Minimum Capacity Commitment” has the meaning set forth in Section 2.2(a).

“Minimum Revenue Commitment” has the meaning set forth in Section 2.2(a).

“Minimum Throughput Commitment” means the quantity of Product to be transported, stored or loaded in connection with an Applicable Asset, as set forth on Exhibit C, as such amount may be adjusted pursuant to the terms of this Agreement.

“MSCFD” means thousands of cubic feet per day.

“MVP Pipeline” has the meaning set forth in Exhibit K.

Exhibit A-5

Exhibit 10.27

“Navajo Refinery” means the refinery owned by HollyFrontier Navajo and located in Lovington, New Mexico.

“New Tank” means the new petroleum products storage tankage to be added to the Applicable Assets as identified on Exhibits H and J.

“New Tank Commencement Date” means, with respect to each New Tank, the first day of the calendar month after the date on which, in the reasonable opinion of HEP Operating, such New Tank is mechanically complete, available for service and operating as expected in storing the Product for which such New Tank was designed, which date has been specified in written notice from HEP Operating to HFRM at least 30 days prior to such date.

“Omnibus Agreement” means the Seventeenth Amended and Restated Omnibus Agreement, dated as of the date hereof.

“OPEX Reimbursement Amount” has the meaning set forth in Exhibit L-2.

“Original Master Throughput Agreement” has the meaning set forth in the Recitals.

“Osage Pipeline” has the meaning set forth in Exhibit K.

“Parties” has the meaning set forth in the Preamble.

“Partnership” means Holly Energy Partners, L.P., a Delaware limited partnership.

“Party” has the meaning set forth in the Preamble.

“Person” means an individual or a corporation, limited liability company, partnership, joint venture, trust, unincorporated organization, association, government agency or political subdivision thereof or other entity.

“Pipelines” means the Malaga Pipeline System, Roadrunner Pipeline, the Tulsa Pipelines, the Tulsa Interconnecting Pipelines, and the El Dorado Delivery Lines, and any other pipeline included in the Applicable Assets.

“Plains Pipeline” means that certain 16” diameter pipeline operated by Plains All American Pipeline, L. P. and located in Lea County, New Mexico and which crosses the HEP Anderson Ranch gathering system in Township 18 South, Range 32 East.

“Previous Amended and Restated Master Throughput Agreement” has the meaning set forth in the Recitals.

“Prime Rate” means the prime rate per annum announced by Union Bank, N.A., or if Union Bank, N.A. no longer announces a prime rate for any reason, the prime rate per annum announced by the largest U.S. bank measured by deposits from time to time as its base rate on corporate loans, automatically fluctuating upward or downward with each announcement of such prime rate.

“Prior Agreements” means those agreements set forth in Recitals A through F. For the avoidance of doubt, “Prior Agreements” do not include the following agreements (as amended, modified or supplemented and in effect from time to time): (a) Amended and Restated Intermediate Pipelines Agreement

Exhibit A-6

Exhibit 10.27

dated June 1, 2009, (b) Tulsa Equipment and Throughput Agreement dated August 1, 2009, (c) Amended and Restated Refined Product Pipelines and Terminals Agreement effective February 1, 2009, (d) Second Amended and Restated Throughput Agreement effective June 1, 2013, (e) Third Amended and Restated Crude Pipelines and Tankage Agreement dated March 12, 2015, and (f) Unloading and Blending Services Agreement (Artesia) dated March 12, 2015.

“Products” has the meaning set forth in Exhibit C.

“Qualified Third-Party Throughput” has the meaning set forth in Exhibit C.

“Red Rock Pipeline” has the meaning set forth in Exhibit K.

“Refined Products” means gasoline, kerosene, ethanol and diesel fuel.

“Refineries” means the Navajo Refinery; the El Dorado Refinery; the Cheyenne Refinery; the Tulsa East Refinery and the Tulsa West Refinery.

“Roadrunner Pipeline” means that certain 16” crude oil pipeline extending approximately 65 miles from the Slaughter station to Lovington, New Mexico.

“Subsequent Year” has the meaning set forth in Exhibit G.

“Subsidiary” means with respect to any Person (the “Owner”), any corporation or other Person of which securities or other interests having the power to elect a majority of that corporation’s or other Person’s board of directors or similar governing body, or otherwise having the power to direct the business and policies of that corporation or other Person (other than securities or other interest having such power only upon the happening of a contingency that has not occurred), are held by the Owner or one or more of its Subsidiaries.

“Surcharge Tariff” has the meaning set forth in Exhibit C.

“SUS” means Saybolt Universal Seconds as specified by ASTM Standard D2161-10, as amended, supplemented or replaced from time to time.

“Tulsa Assets” means the Tulsa Group 1 Tankage, Tulsa Group 1 Loading Rack, Tulsa Group 1 Pipeline, Tulsa Group 2 Tankage, Tulsa Group 2 Loading Rack and the Tulsa Interconnecting Pipelines.

“Tulsa East Refinery” means the refinery owned by HollyFrontier Tulsa and located at 905 West 25th Street, Tulsa, Oklahoma 74107.

“Tulsa Group 1 Purchase Agreement” means that certain Asset Sale and Purchase Agreement dated as of October 1, 2009 by and among HollyFrontier Tulsa, HEP Tulsa LLC and Holly Energy Storage – Tulsa.

“Tulsa Group 1 Loading Rack” means the gas oil, asphalt and propane truck loading racks located at the Tulsa West Refinery and more specifically described in Exhibit J-1 attached hereto.

“Tulsa Group 1 Tankage” means the tankage identified in Exhibit J-3 attached hereto.

“Tulsa Group 2 Purchase Agreement” means that certain LLC Interest Purchase Agreement dated as of March 31, 2010 by and between HEP Tulsa LLC, Lea Refining Company, and HollyFrontier Tulsa.

Exhibit A-7

Exhibit 10.27

“Tulsa Group 2 Tankage” means the tankage identified in Exhibit J-5.

“Tulsa Group 2 Loading Rack” means the rail loading rack located at the Tulsa West Refinery and more specifically described in Exhibit J-4.

“Tulsa Interconnecting Pipelines” means the following pipelines between the Tulsa East Refinery and the Tulsa West Refinery: 1) the 12 inch raw gas oil/diesel line (the “Distillate Interconnecting Pipeline”), 2) the 12 inch naphtha/gasoline component line (the “Gasoline Interconnecting Pipeline”), 3) the 12 inch refinery fuel gas line (the “Refinery Fuel Gas Interconnecting Pipeline”), 4) the 8 inch hydrogen line (the “Hydrogen Interconnecting Pipeline”), and 5) the 10 inch refinery sour fuel gas line (the “Refinery Sour Fuel Gas Interconnecting Pipeline”) including delivery facilities from the Tulsa West Refinery and receipt facilities at the Tulsa East Refinery for the Distillate and Gasoline Interconnecting Pipelines, but not for the Refinery Fuel Gas, Hydrogen, and Refinery Sour Fuel Gas Interconnecting Pipelines.

“Tulsa Group 1 Pipeline” means those two (2) product delivery lines extending from the Group 1 Tankage to interconnection points with the Magellan pipeline as more specifically described in Exhibit J-2 attached hereto.

“Tulsa Purchase Agreements” means the Tulsa Group 1 Purchase Agreement and the Tulsa Group 2 Purchase Agreement.

“Tulsa West Refinery” means the refinery owned by HollyFrontier Tulsa located at 1700 S. Union, Tulsa, Oklahoma.

“Tulsa West Tankage” means the tankage identified in Exhibit L-1.

“Working Capacity” has the meaning set forth in Exhibit K.

Exhibit A-8

Exhibit 10.27

Exhibit B

to

Third Amended and Restated

Master Throughput Agreement

Interpretation

As used in this Agreement, unless a clear contrary intention appears:

(a) any reference to the singular includes the plural and vice versa, any reference to natural persons includes legal persons and vice versa, and any reference to a gender includes the other gender;

(b) the words “hereof”, “herein”, and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole and not to any particular provision of this Agreement;

(c) any reference to Articles, Sections and Exhibits are, unless otherwise stated, references to Articles, Sections and Exhibits of or to this Agreement and references in any Section or definition to any clause means such clause of such Section or definition. The headings in this Agreement have been inserted for convenience only and shall not be taken into account in its interpretation;

(d) reference to any agreement (including this Agreement), document or instrument means such agreement, document, or instrument as amended, modified or supplemented and in effect from time to time in accordance with the terms thereof and, if applicable, the terms of this Agreement;

(e) the Exhibits hereto form an integral part of this Agreement and are equally binding therewith. Any reference to “this Agreement” shall include such Exhibits;

(f) references to a Person shall include any permitted assignee or successor to such Party in accordance with this Agreement and reference to a Person in a particular capacity excludes such Person in any other capacity;

(g) if any period is referred to in this Agreement by way of reference to a number of days, the days shall be calculated exclusively of the first and inclusively of the last day unless the last day falls on a day that is not a Business Day in which case the last day shall be the next succeeding Business Day;

(h) the use of “or” is not intended to be exclusive unless explicitly indicated otherwise;

(i) references to “$” or to “dollars” shall mean the lawful currency of the United States of America; and

(j) the words “includes,” “including,” or any derivation thereof shall mean “including without limitation” or “including, but not limited to.”

Exhibit B-1

Exhibit 10.27

Exhibit C

to

Third Amended and Restated

Master Throughput Agreement