Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - OFFICE PROPERTIES INCOME TRUST | exhibit_991.htm |

| 8-K - 8-K - OFFICE PROPERTIES INCOME TRUST | a8-k.htm |

Fourth Quarter 2016

Supplemental Operating and Financial Data

All amounts in this report are unaudited.

Government Properties Income Trust Exhibit 99.2

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

TABLE OF CONTENT

S

2

TABLE OF CONTENTS

CORPORATE INFORMATION PAGE/EXHIBIT

Company Profile 6

Investor Information 7

Research Coverage 8

FINANCIALS

Key Financial Data 10

Consolidated Balance Sheets 11

Consolidated Statements of Income (Loss) 12

Consolidated Statements of Cash Flows 13

Debt Summary 14

Debt Maturity Schedule 15

Leverage Ratios, Coverage Ratios and Public Debt Covenants 16

Summary of Capital Expenditures 17

Property Acquisition and Disposition Information Since January 1, 2016 18

Calculation of Property Net Operating Income (NOI) and Cash Basis NOI 19

Calculation of Same Property NOI and Cash Basis NOI 20

Calculation of EBITDA and Adjusted EBITDA 21

Calculation of Funds from Operations (FFO) and Normalized FFO 22

Non-GAAP Financial Measures Definitions 23

PORTFOLIO INFORMATION

Portfolio Summary 25

Summary Consolidated and Same Property Results 26

Occupancy and Leasing Summary 28

Leasing Analysis by Tenant Type 29

Tenant List 30

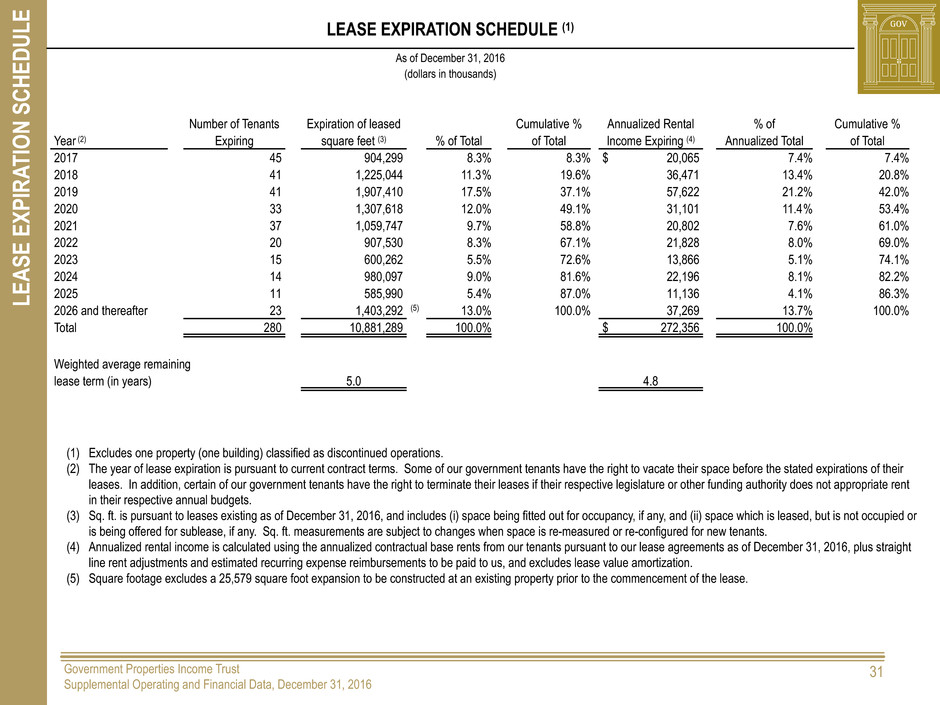

Lease Expiration Schedule 31

EXHIBIT

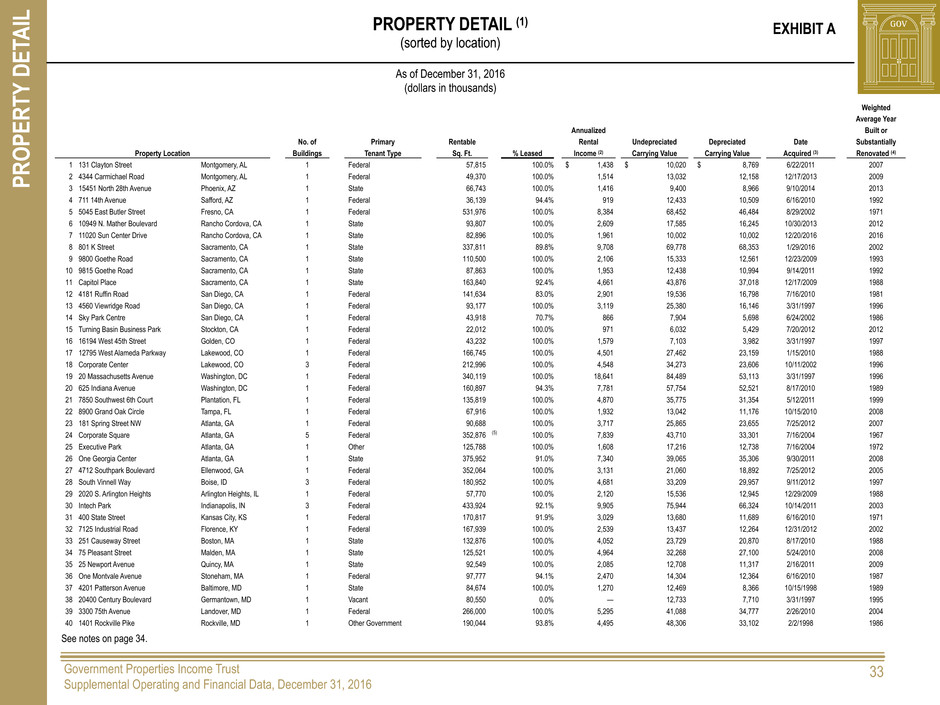

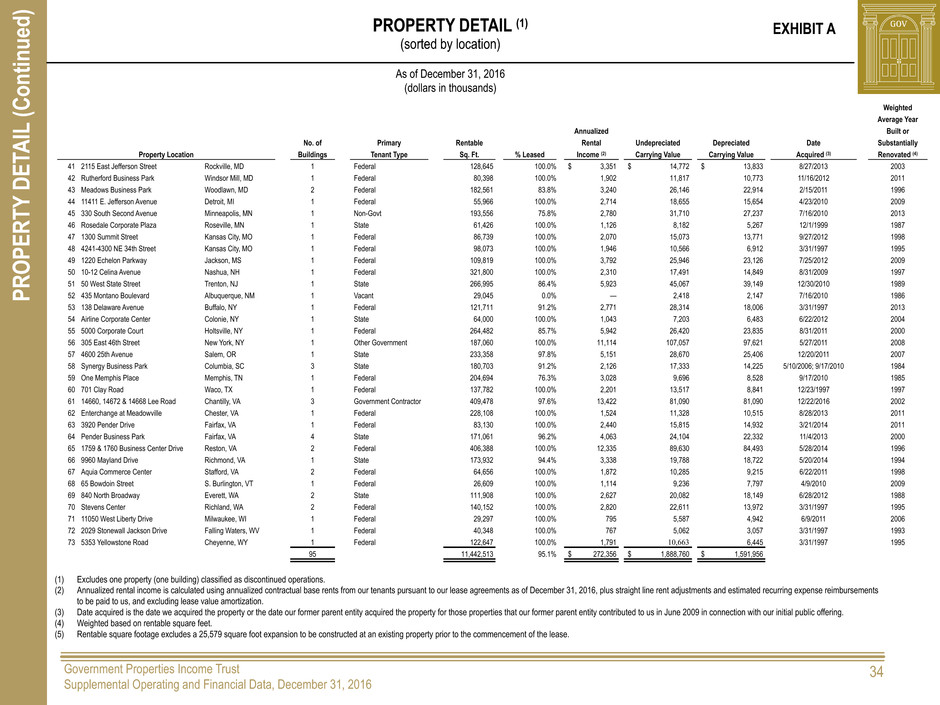

Property Detail A

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENT

S

3

WARNING CONCERNING FORWARD LOOKING STATEMENTS

THIS PRESENTATION OF SUPPLEMENTAL OPERATING AND FINANCIAL DATA CONTAINS STATEMENTS THAT CONSTITUTE FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS “BELIEVE”, “EXPECT”, “ANTICIPATE”, “INTEND”, “PLAN”, “ESTIMATE”, “WILL”, “MAY” AND NEGATIVES OR DERIVATIVES OF

THESE OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. THESE FORWARD LOOKING STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, BUT FORWARD

LOOKING STATEMENTS ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. FORWARD LOOKING STATEMENTS IN THIS REPORT RELATE TO VARIOUS ASPECTS OF OUR BUSINESS, INCLUDING:

• OUR ACQUISITIONS AND SALES OF PROPERTIES,

• OUR ABILITY TO COMPETE FOR ACQUISITIONS AND TENANCIES EFFECTIVELY,

• THE LIKELIHOOD THAT OUR TENANTS WILL PAY RENT OR BE NEGATIVELY AFFECTED BY CYCLICAL ECONOMIC CONDITIONS OR GOVERNMENT BUDGET CONSTRAINTS,

• THE LIKELIHOOD THAT OUR TENANTS WILL RENEW OR EXTEND THEIR LEASES AND NOT EXERCISE EARLY TERMINATION OPTIONS PURSUANT TO THEIR LEASES OR THAT WE WILL OBTAIN REPLACEMENT TENANTS,

• OUR ABILITY TO PAY DISTRIBUTIONS TO OUR SHAREHOLDERS AND THE AMOUNT OF SUCH DISTRIBUTIONS,

• OUR EXPECTATION THAT WE BENEFIT FINANCIALLY FROM OUR OWNERSHIP INTEREST IN SELECT INCOME REIT, OR SIR,

• OUR POLICIES AND PLANS REGARDING INVESTMENTS, FINANCINGS AND DISPOSITIONS,

• THE FUTURE AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY,

• OUR EXPECTATION THAT THERE WILL BE OPPORTUNITIES FOR US TO ACQUIRE, AND THAT WE WILL ACQUIRE, ADDITIONAL PROPERTIES THAT ARE MAJORITY LEASED TO GOVERNMENT TENANTS OR GOVERNMENT CONTRACTOR

TENANTS,

• OUR EXPECTATIONS REGARDING DEMAND FOR LEASED SPACE BY THE U.S. GOVERNMENT AND STATE AND LOCAL GOVERNMENTS,

• OUR ABILITY TO RAISE EQUITY OR DEBT CAPITAL,

• OUR ABILITY TO PAY INTEREST ON AND PRINCIPAL OF OUR DEBT,

• OUR ABILITY TO APPROPRIATELY BALANCE OUR USE OF DEBT AND EQUITY CAPITAL,

• OUR CREDIT RATINGS,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF THE RMR GROUP INC., OR RMR INC.,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF AFFILIATES INSURANCE COMPANY, OR AIC, AND FROM OUR PARTICIPATION IN INSURANCE PROGRAMS ARRANGED BY AIC,

• THE CREDIT QUALITIES OF OUR TENANTS,

• OUR QUALIFICATION FOR TAXATION AS A REAL ESTATE INVESTMENT TRUST, OR REIT, AND

• OTHER MATTERS.

OUR ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS. FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON

OUR FORWARD LOOKING STATEMENTS AND UPON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION, FUNDS FROM OPERATIONS, OR FFO, NORMALIZED FUNDS FROM OPERATIONS, OR NORMALIZED FFO, NET

OPERATING INCOME, OR NOI, CASH BASIS NOI, EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION, OR EBITDA, EBITDA AS ADJUSTED, OR ADJUSTED EBITDA, CASH FLOWS, LIQUIDITY AND PROSPECTS INCLUDE,

BUT ARE NOT LIMITED TO:

• THE IMPACT OF CHANGES IN THE ECONOMY AND THE CAPITAL MARKETS ON US AND OUR TENANTS,

• COMPETITION WITHIN THE REAL ESTATE INDUSTRY, PARTICULARLY WITH RESPECT TO THOSE MARKETS IN WHICH OUR PROPERTIES ARE LOCATED AND WITH RESPECT TO GOVERNMENT TENANCIES,

• THE IMPACT OF CHANGES IN THE REAL ESTATE NEEDS AND FINANCIAL CONDITIONS OF THE U.S. GOVERNMENT AND STATE AND LOCAL GOVERNMENTS,

• COMPLIANCE WITH, AND CHANGES TO, FEDERAL, STATE AND LOCAL LAWS AND REGULATIONS, ACCOUNTING RULES, TAX LAWS AND SIMILAR MATTERS,

• ACTUAL AND POTENTIAL CONFLICTS OF INTEREST WITH OUR RELATED PARTIES, INCLUDING OUR MANAGING TRUSTEES, THE RMR GROUP LLC, OR RMR LLC, RMR INC., SIR, AIC AND OTHERS AFFILIATED WITH THEM,

• LIMITATIONS IMPOSED ON OUR BUSINESS AND OUR ABILITY TO SATISFY COMPLEX RULES IN ORDER FOR US TO QUALIFY FOR TAXATION AS A REIT FOR U.S. FEDERAL INCOME TAX PURPOSES, AND

• ACTS OF TERRORISM, OUTBREAKS OF SO CALLED PANDEMICS OR OTHER MANMADE OR NATURAL DISASTERS BEYOND OUR CONTROL.

FOR EXAMPLE:

• OUR ABILITY TO MAKE FUTURE DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO MAKE PAYMENTS OF PRINCIPAL AND INTEREST ON OUR INDEBTEDNESS DEPENDS UPON A NUMBER OF FACTORS, INCLUDING OUR FUTURE

EARNINGS, THE CAPITAL COSTS WE INCUR TO LEASE OUR PROPERTIES, OUR WORKING CAPITAL REQUIREMENTS AND OUR RECEIPT OF DISTRIBUTIONS FROM SIR. WE MAY BE UNABLE TO PAY OUR DEBT OBLIGATIONS OR TO

MAINTAIN OUR CURRENT RATE OF DISTRIBUTIONS ON OUR COMMON SHARES AND FUTURE DISTRIBUTIONS MAY BE REDUCED OR ELIMINATED,

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENTS (continued

)

4

• OUR ABILITY TO GROW OUR BUSINESS AND INCREASE DISTRIBUTIONS TO OUR SHAREHOLDERS DEPENDS IN LARGE PART UPON OUR ABILITY TO BUY PROPERTIES AND LEASE THEM FOR RENTS, LESS

PROPERTY OPERATING EXPENSES, THAT EXCEED OUR CAPITAL COSTS. WE MAY BE UNABLE TO IDENTIFY PROPERTIES THAT WE WANT TO ACQUIRE OR TO NEGOTIATE ACCEPTABLE PURCHASE PRICES,

ACQUISITION FINANCING OR LEASE TERMS FOR NEW PROPERTIES,

• SOME OF OUR TENANTS MAY NOT RENEW EXPIRING LEASES, AND WE MAY BE UNABLE TO OBTAIN NEW TENANTS TO MAINTAIN OR INCREASE THE HISTORICAL OCCUPANCY RATES OF, OR RENTS FROM, OUR

PROPERTIES,

• SOME GOVERNMENT TENANTS MAY EXERCISE THEIR RIGHTS TO VACATE THEIR SPACE BEFORE THE STATED EXPIRATION OF THEIR LEASES, AND WE MAY BE UNABLE TO OBTAIN NEW TENANTS TO MAINTAIN THE

HISTORICAL OCCUPANCY RATES OF, OR RENTS FROM, OUR PROPERTIES,

• RENTS THAT WE CAN CHARGE AT OUR PROPERTIES MAY DECLINE BECAUSE OF CHANGING MARKET CONDITIONS OR OTHERWISE,

• CONTINGENCIES IN OUR ACQUISITION AND SALE AGREEMENTS MAY NOT BE SATISFIED AND OUR PENDING ACQUISITIONS AND SALES MAY NOT OCCUR, MAY BE DELAYED OR THE TERMS OF SUCH TRANSACTIONS MAY CHANGE,

• CONTINUED AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY IS SUBJECT TO OUR SATISFYING CERTAIN FINANCIAL COVENANTS AND OTHER CUSTOMARY CREDIT FACILITY CONDITIONS THAT WE MAY BE

UNABLE TO SATISFY,

• ACTUAL COSTS UNDER OUR REVOLVING CREDIT FACILITY OR OTHER FLOATING RATE CREDIT FACILITIES WILL BE HIGHER THAN LIBOR PLUS A PREMIUM BECAUSE OF OTHER FEES AND EXPENSES ASSOCIATED WITH SUCH

FACILITIES,

• WE MAY BE UNABLE TO REPAY OUR DEBT OBLIGATIONS WHEN THEY BECOME DUE,

• THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOANS MAY BE INCREASED TO UP TO $2.5 BILLION ON A COMBINED BASIS IN CERTAIN CIRCUMSTANCES; HOWEVER, INCREASING THE

MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOANS IS SUBJECT TO OUR OBTAINING ADDITIONAL COMMITMENTS FROM LENDERS, WHICH MAY NOT OCCUR,

• WE HAVE THE OPTION TO EXTEND THE MATURITY DATE OF OUR REVOLVING CREDIT FACILITY UPON PAYMENT OF A FEE AND MEETING OTHER CONDITIONS. HOWEVER, THE APPLICABLE CONDITIONS MAY NOT BE MET,

• THE BUSINESS MANAGEMENT AND PROPERTY MANAGEMENT AGREEMENTS BETWEEN US AND RMR LLC HAVE CONTINUING 20 YEAR TERMS. HOWEVER, THOSE AGREEMENTS INCLUDE TERMS WHICH PERMIT EARLY TERMINATION

IN CERTAIN CIRCUMSTANCES. ACCORDINGLY, WE CANNOT BE SURE THAT THESE AGREEMENTS WILL REMAIN IN EFFECT FOR CONTINUING 20 YEAR TERMS OR FOR SHORTER TERMS,

• WE BELIEVE THAT OUR RELATIONSHIPS WITH OUR RELATED PARTIES, INCLUDING RMR LLC, RMR INC., SIR, AIC AND OTHERS AFFILIATED WITH THEM MAY BENEFIT US AND PROVIDE US WITH COMPETITIVE ADVANTAGES IN

OPERATING AND GROWING OUR BUSINESS. HOWEVER, THE ADVANTAGES WE BELIEVE WE MAY REALIZE FROM THESE RELATIONSHIPS MAY NOT MATERIALIZE,

• THE PREMIUMS USED TO DETERMINE THE INTEREST RATE PAYABLE ON OUR REVOLVING CREDIT FACILITY AND TERM LOANS AND THE FACILITY FEE PAYABLE ON OUR REVOLVING CREDIT FACILITY ARE BASED ON OUR CREDIT

RATINGS. FUTURE CHANGES IN OUR CREDIT RATINGS MAY CAUSE THE INTEREST AND FEES WE PAY TO INCREASE,

• SIR MAY REDUCE THE AMOUNT OF ITS DISTRIBUTIONS TO ITS SHAREHOLDERS, INCLUDING US,

• WE MAY BE UNABLE TO SELL OUR SIR COMMON SHARES FOR AN AMOUNT EQUAL TO OUR CARRYING VALUE OF THOSE SHARES AND ANY SUCH SALE MAY BE AT A DISCOUNT TO MARKET PRICE BECAUSE OF THE LARGE SIZE OF

OUR SIR HOLDINGS OR OTHERWISE; WE MAY REALIZE A LOSS ON OUR INVESTMENT IN OUR SIR SHARES, AND

• WE CURRENTLY EXPECT TO SPEND APPROXIMATELY $15.4 MILLION TO COMPLETE OUR REDEVELOPMENT AND EXPANSION OF AN EXISTING PROPERTY IN CONNECTION WITH A NEW LEASE AGREEMENT. IN ADDITION, AS OF

DECEMBER 31 2016, WE HAVE ESTIMATED UNSPENT LEASING RELATED OBLIGATIONS OF $26.5 MILLION, EXCLUDING THE ESTIMATED DEVELOPMENT COSTS NOTED IN THE PRECEDING SENTENCE. IT IS DIFFICULT TO ACCURATELY

ESTIMATE DEVELOPMENT COSTS. THIS DEVELOPMENT PROJECT AND OUR UNSPENT LEASING RELATED OBLIGATIONS MAY COST MORE OR LESS AND MAY TAKE LONGER TO COMPLETE THAN WE CURRENTLY EXPECT, AND WE MAY

INCUR INCREASING AMOUNTS FOR THESE AND SIMILAR PURPOSES IN THE FUTURE.

CURRENTLY UNEXPECTED RESULTS COULD OCCUR DUE TO MANY DIFFERENT CIRCUMSTANCES, SOME OF WHICH ARE BEYOND OUR CONTROL, SUCH AS CHANGES IN GOVERNMENT TENANTS’ NEEDS FOR LEASED SPACE, ACTS OF

TERRORISM, NATURAL DISASTERS OR CHANGES IN CAPITAL MARKETS OR THE ECONOMY GENERALLY.

THE INFORMATION CONTAINED IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, OR SEC, INCLUDING UNDER THE CAPTION "RISK FACTORS" IN OUR PERIODIC REPORTS, OR INCORPORATED THEREIN, IDENTIFIES

OTHER IMPORTANT FACTORS THAT COULD CAUSE DIFFERENCES FROM OUR FORWARD LOOKING STATEMENTS. OUR FILINGS WITH THE SEC ARE AVAILABLE ON THE SEC’S WEBSITE AT WWW.SEC.GOV.

YOU SHOULD NOT PLACE UNDUE RELIANCE UPON OUR FORWARD LOOKING STATEMENTS.

EXCEPT AS REQUIRED BY LAW, WE DO NOT INTEND TO UPDATE OR CHANGE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016CORPORATE INFORMATION 5

One Memphis Place, Memphis, TN

Square Feet: 204,694

Primary Agency Occupant: U.S. Courts

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

COM

PAN

Y PROFIL

E

6

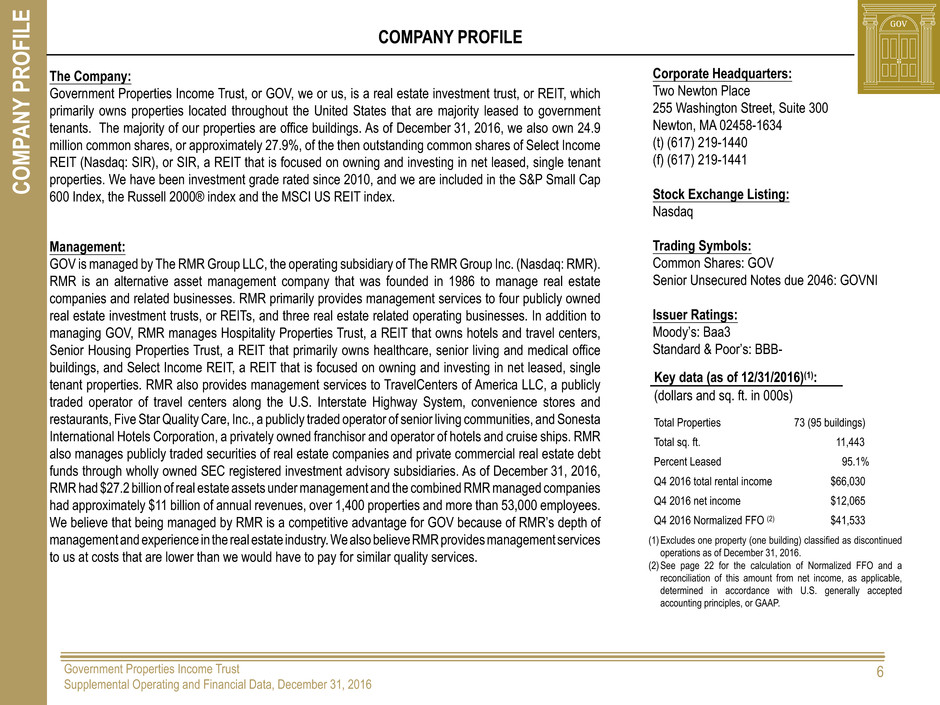

COMPANY PROFILE

The Company:

Government Properties Income Trust, or GOV, we or us, is a real estate investment trust, or REIT, which

primarily owns properties located throughout the United States that are majority leased to government

tenants. The majority of our properties are office buildings. As of December 31, 2016, we also own 24.9

million common shares, or approximately 27.9%, of the then outstanding common shares of Select Income

REIT (Nasdaq: SIR), or SIR, a REIT that is focused on owning and investing in net leased, single tenant

properties. We have been investment grade rated since 2010, and we are included in the S&P Small Cap

600 Index, the Russell 2000® index and the MSCI US REIT index.

Management:

GOV is managed by The RMR Group LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR).

RMR is an alternative asset management company that was founded in 1986 to manage real estate

companies and related businesses. RMR primarily provides management services to four publicly owned

real estate investment trusts, or REITs, and three real estate related operating businesses. In addition to

managing GOV, RMR manages Hospitality Properties Trust, a REIT that owns hotels and travel centers,

Senior Housing Properties Trust, a REIT that primarily owns healthcare, senior living and medical office

buildings, and Select Income REIT, a REIT that is focused on owning and investing in net leased, single

tenant properties. RMR also provides management services to TravelCenters of America LLC, a publicly

traded operator of travel centers along the U.S. Interstate Highway System, convenience stores and

restaurants, Five Star Quality Care, Inc., a publicly traded operator of senior living communities, and Sonesta

International Hotels Corporation, a privately owned franchisor and operator of hotels and cruise ships. RMR

also manages publicly traded securities of real estate companies and private commercial real estate debt

funds through wholly owned SEC registered investment advisory subsidiaries. As of December 31, 2016,

RMR had $27.2 billion of real estate assets under management and the combined RMR managed companies

had approximately $11 billion of annual revenues, over 1,400 properties and more than 53,000 employees.

We believe that being managed by RMR is a competitive advantage for GOV because of RMR’s depth of

management and experience in the real estate industry. We also believe RMR provides management services

to us at costs that are lower than we would have to pay for similar quality services.

Corporate Headquarters:

Two Newton Place

255 Washington Street, Suite 300

Newton, MA 02458-1634

(t) (617) 219-1440

(f) (617) 219-1441

Stock Exchange Listing:

Nasdaq

Trading Symbols:

Common Shares: GOV

Senior Unsecured Notes due 2046: GOVNI

Issuer Ratings:

Moody’s: Baa3

Standard & Poor’s: BBB-

(1) Excludes one property (one building) classified as discontinued

operations as of December 31, 2016.

(2) See page 22 for the calculation of Normalized FFO and a

reconciliation of this amount from net income, as applicable,

determined in accordance with U.S. generally accepted

accounting principles, or GAAP.

Total Properties 73 (95 buildings)

Total sq. ft. 11,443

Percent Leased 95.1%

Q4 2016 total rental income $66,030

Q4 2016 net income $12,065

Q4 2016 Normalized FFO (2) $41,533

Key data (as of 12/31/2016)(1):

(dollars and sq. ft. in 000s)

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

INVES

TOR INFORM

ATIO

N

7

INVESTOR INFORMATION

Board of Trustees

Barbara D. Gilmore John L. Harrington Jeffrey P. Somers

Independent Trustee Independent Trustee Independent Trustee

Adam D. Portnoy Barry M. Portnoy

Managing Trustee Managing Trustee

Senior Management

David M. Blackman Mark L. Kleifges

President and Chief Operating Officer Chief Financial Officer and Treasurer

Contact Information

Investor Relations Inquiries

Government Properties Income Trust Financial inquiries should be directed to Mark L. Kleifges,

Two Newton Place Chief Financial Officer and Treasurer, at (617) 219-1440

255 Washington Street, Suite 300 or mkleifges@rmrgroup.com.

Newton, MA 02458-1634

(t) (617) 219-1440 Investor and media inquiries should be directed to

(f) (617) 796-8267 Christopher Ranjitkar, Director, Investor Relations, at (617) 219-1473 or

(e-mail) info@govreit.com cranjitkar@rmrgroup.com.

(website) www.govreit.com

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

RESEARCH COVERAG

E

8

RESEARCH COVERAGE

Equity Research Coverage

Bank of America Merrill Lynch Research FBR & Co.

James Feldman Bryan Maher

James.Feldman@baml.com bmaher@fbr.com

(646) 855-5808 (646) 885-5423

Jeffries & Company, Inc. JMP Securities

Jonathan Petersen Mitch Germain

jpetersen@jefferies.com mgermain@jmpsecurities.com

(212) 284-1705 (212) 906-3546

Morgan Stanley RBC Capital Markets

Sumit Sharma Mike Carroll

Sumit.Sharma@morganstanley.com Michael.Carroll@rbccm.com

(212) 761-7567 (440) 715-2649

Rating Agencies

Moody’s Investors Service Standard & Poor’s

Lori Marks Sarah Sherman

Lori.marks@moodys.com sarah.sherman@standardandpoors.com

(212) 553-1653 (212) 438-3550

GOV is followed by the analysts and its credit is rated by the rating agencies listed above. Please note that any opinions, estimates

or forecasts regarding GOV’s performance made by these analysts or agencies do not represent opinions, forecasts or predictions

of GOV or its management. GOV does not by its reference above imply its endorsement of or concurrence with any information,

conclusions or recommendations provided by any of these analysts or agencies.

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

FINANCIALS

9960 Maryland Drive, Richmond, VA

Square Feet: 173,932

Agency Occupant: The Commonwealth of Virginia

9

625 Indiana Avenue, Washington, DC

Square Feet: 160,897

Primary Agency Occupant: U.S. Courts 9

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

KE

Y FINANCIA

L D

AT

A

10

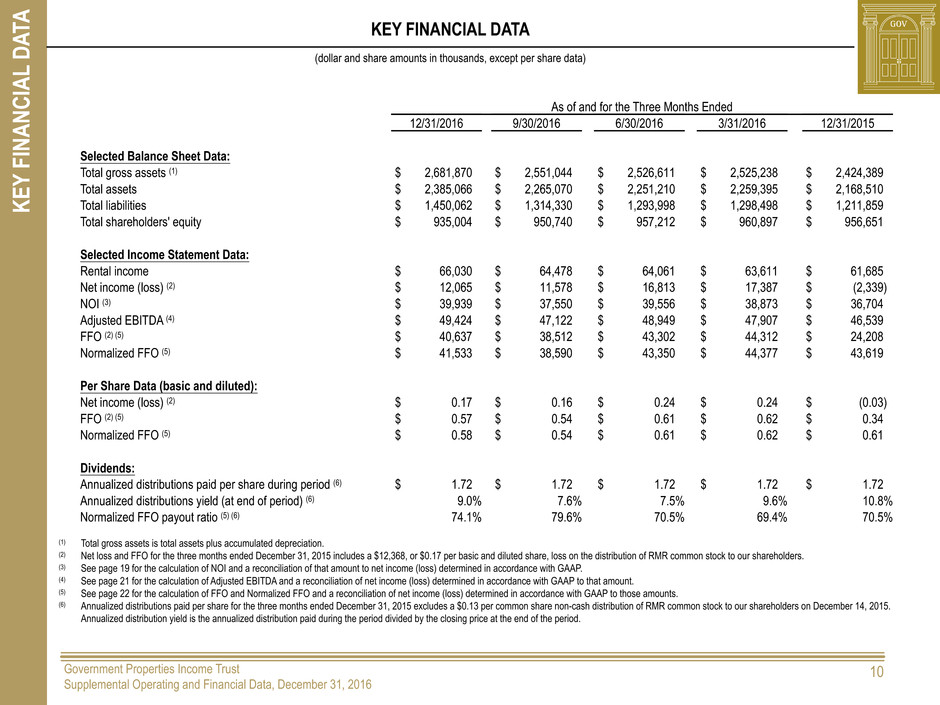

KEY FINANCIAL DATA

(dollar and share amounts in thousands, except per share data)

(1) Total gross assets is total assets plus accumulated depreciation.

(2) Net loss and FFO for the three months ended December 31, 2015 includes a $12,368, or $0.17 per basic and diluted share, loss on the distribution of RMR common stock to our shareholders.

(3) See page 19 for the calculation of NOI and a reconciliation of that amount to net income (loss) determined in accordance with GAAP.

(4) See page 21 for the calculation of Adjusted EBITDA and a reconciliation of net income (loss) determined in accordance with GAAP to that amount.

(5) See page 22 for the calculation of FFO and Normalized FFO and a reconciliation of net income (loss) determined in accordance with GAAP to those amounts.

(6) Annualized distributions paid per share for the three months ended December 31, 2015 excludes a $0.13 per common share non-cash distribution of RMR common stock to our shareholders on December 14, 2015.

Annualized distribution yield is the annualized distribution paid during the period divided by the closing price at the end of the period.

As of and for the Three Months Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Selected Balance Sheet Data:

Total gross assets (1) $ 2,681,870 $ 2,551,044 $ 2,526,611 $ 2,525,238 $ 2,424,389

Total assets $ 2,385,066 $ 2,265,070 $ 2,251,210 $ 2,259,395 $ 2,168,510

Total liabilities $ 1,450,062 $ 1,314,330 $ 1,293,998 $ 1,298,498 $ 1,211,859

Total shareholders' equity $ 935,004 $ 950,740 $ 957,212 $ 960,897 $ 956,651

Selected Income Statement Data:

Rental income $ 66,030 $ 64,478 $ 64,061 $ 63,611 $ 61,685

Net income (loss) (2) $ 12,065 $ 11,578 $ 16,813 $ 17,387 $ (2,339)

NOI (3) $ 39,939 $ 37,550 $ 39,556 $ 38,873 $ 36,704

Adjusted EBITDA (4) $ 49,424 $ 47,122 $ 48,949 $ 47,907 $ 46,539

FFO (2) (5) $ 40,637 $ 38,512 $ 43,302 $ 44,312 $ 24,208

Normalized FFO (5) $ 41,533 $ 38,590 $ 43,350 $ 44,377 $ 43,619

Per Share Data (basic and diluted):

Net income (loss) (2) $ 0.17 $ 0.16 $ 0.24 $ 0.24 $ (0.03)

FFO (2) (5) $ 0.57 $ 0.54 $ 0.61 $ 0.62 $ 0.34

Normalized FFO (5) $ 0.58 $ 0.54 $ 0.61 $ 0.62 $ 0.61

Dividends:

Annualized distributions paid per share during period (6) $ 1.72 $ 1.72 $ 1.72 $ 1.72 $ 1.72

Annualized distributions yield (at end of period) (6) 9.0% 7.6% 7.5% 9.6% 10.8%

Normalized FFO payout ratio (5) (6) 74.1% 79.6% 70.5% 69.4% 70.5%

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

CONSOLID

ATED BALANCE SHEET

S

11

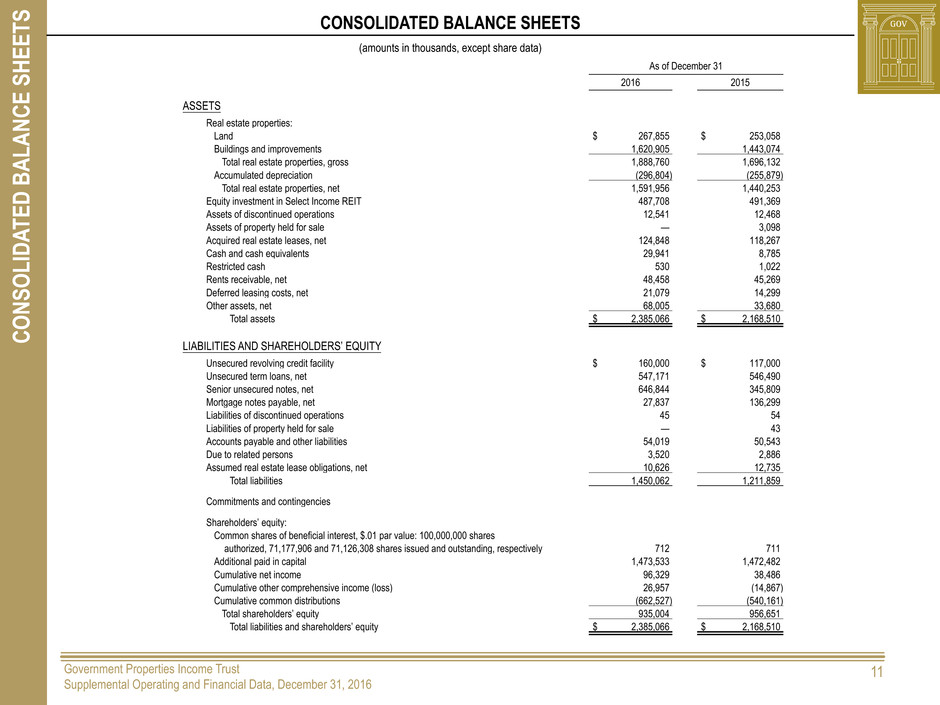

CONSOLIDATED BALANCE SHEETS

(amounts in thousands, except share data)

As of December 31

2016 2015

ASSETS

Real estate properties:

Land $ 267,855 $ 253,058

Buildings and improvements 1,620,905 1,443,074

Total real estate properties, gross 1,888,760 1,696,132

Accumulated depreciation (296,804) (255,879)

Total real estate properties, net 1,591,956 1,440,253

Equity investment in Select Income REIT 487,708 491,369

Assets of discontinued operations 12,541 12,468

Assets of property held for sale — 3,098

Acquired real estate leases, net 124,848 118,267

Cash and cash equivalents 29,941 8,785

Restricted cash 530 1,022

Rents receivable, net 48,458 45,269

Deferred leasing costs, net 21,079 14,299

Other assets, net 68,005 33,680

Total assets $ 2,385,066 $ 2,168,510

LIABILITIES AND SHAREHOLDERS’ EQUITY

Unsecured revolving credit facility $ 160,000 $ 117,000

Unsecured term loans, net 547,171 546,490

Senior unsecured notes, net 646,844 345,809

Mortgage notes payable, net 27,837 136,299

Liabilities of discontinued operations 45 54

Liabilities of property held for sale — 43

Accounts payable and other liabilities 54,019 50,543

Due to related persons 3,520 2,886

Assumed real estate lease obligations, net 10,626 12,735

Total liabilities 1,450,062 1,211,859

Commitments and contingencies

Shareholders’ equity:

Common shares of beneficial interest, $.01 par value: 100,000,000 shares

authorized, 71,177,906 and 71,126,308 shares issued and outstanding, respectively 712 711

Additional paid in capital 1,473,533 1,472,482

Cumulative net income 96,329 38,486

Cumulative other comprehensive income (loss) 26,957 (14,867)

Cumulative common distributions (662,527) (540,161)

Total shareholders’ equity 935,004 956,651

Total liabilities and shareholders’ equity $ 2,385,066 $ 2,168,510

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

CONSOLID

ATED S

TA

TEMENTS OF INCOME (LOSS

)

12

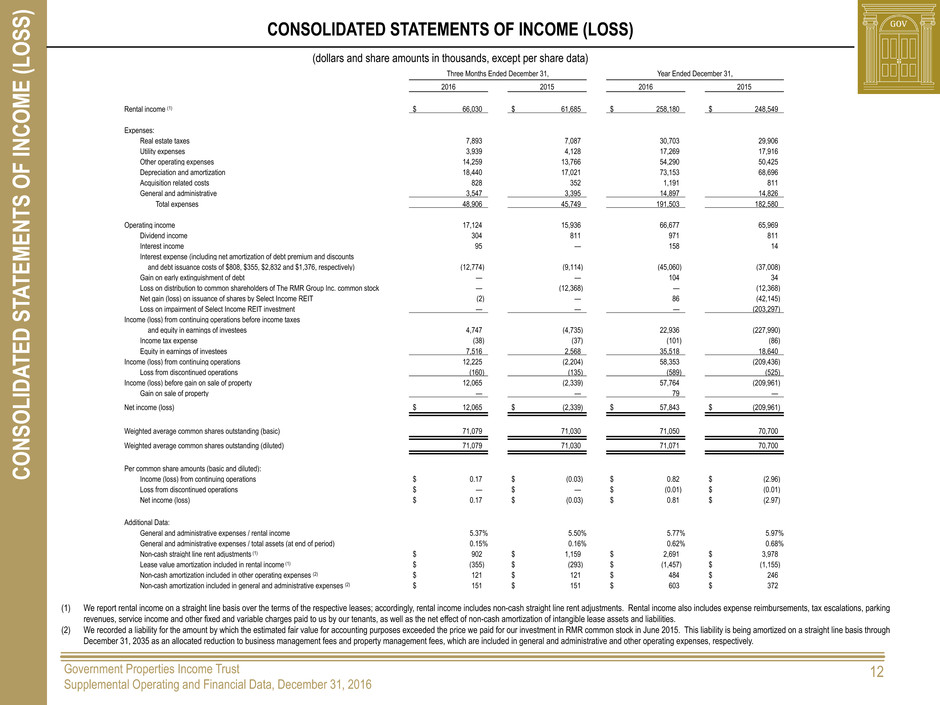

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(dollars and share amounts in thousands, except per share data)

(1) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes expense reimbursements, tax escalations, parking

revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of non-cash amortization of intangible lease assets and liabilities.

(2) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015. This liability is being amortized on a straight line basis through

December 31, 2035 as an allocated reduction to business management fees and property management fees, which are included in general and administrative and other operating expenses, respectively.

Three Months Ended December 31, Year Ended December 31,

2016 2015 2016 2015

Rental income (1) $ 66,030 $ 61,685 $ 258,180 $ 248,549

Expenses:

Real estate taxes 7,893 7,087 30,703 29,906

Utility expenses 3,939 4,128 17,269 17,916

Other operating expenses 14,259 13,766 54,290 50,425

Depreciation and amortization 18,440 17,021 73,153 68,696

Acquisition related costs 828 352 1,191 811

General and administrative 3,547 3,395 14,897 14,826

Total expenses 48,906 45,749 191,503 182,580

Operating income 17,124 15,936 66,677 65,969

Dividend income 304 811 971 811

Interest income 95 — 158 14

Interest expense (including net amortization of debt premium and discounts

and debt issuance costs of $808, $355, $2,832 and $1,376, respectively) (12,774) (9,114) (45,060) (37,008)

Gain on early extinguishment of debt — — 104 34

Loss on distribution to common shareholders of The RMR Group Inc. common stock — (12,368) — (12,368)

Net gain (loss) on issuance of shares by Select Income REIT (2) — 86 (42,145)

Loss on impairment of Select Income REIT investment — — — (203,297)

Income (loss) from continuing operations before income taxes

and equity in earnings of investees 4,747 (4,735) 22,936 (227,990)

Income tax expense (38) (37) (101) (86)

Equity in earnings of investees 7,516 2,568 35,518 18,640

Income (loss) from continuing operations 12,225 (2,204) 58,353 (209,436)

Loss from discontinued operations (160) (135) (589) (525)

Income (loss) before gain on sale of property 12,065 (2,339) 57,764 (209,961)

Gain on sale of property — — 79 —

Net income (loss) $ 12,065 $ (2,339) $ 57,843 $ (209,961)

Weighted average common shares outstanding (basic) 71,079 71,030 71,050 70,700

Weighted average common shares outstanding (diluted) 71,079 71,030 71,071 70,700

Per common share amounts (basic and diluted):

Income (loss) from continuing operations $ 0.17 $ (0.03) $ 0.82 $ (2.96)

Loss from discontinued operations $ — $ — $ (0.01) $ (0.01)

Net income (loss) $ 0.17 $ (0.03) $ 0.81 $ (2.97)

Additional Data:

General and administrative expenses / rental income 5.37% 5.50% 5.77% 5.97%

General and administrative expenses / total assets (at end of period) 0.15% 0.16% 0.62% 0.68%

Non-cash straight line rent adjustments (1) $ 902 $ 1,159 $ 2,691 $ 3,978

Lease value amortization included in rental income (1) $ (355) $ (293) $ (1,457) $ (1,155)

Non-cash amortization included in other operating expenses (2) $ 121 $ 121 $ 484 $ 246

Non-cash amortization included in general and administrative expenses (2) $ 151 $ 151 $ 603 $ 372

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

CONSOLID

ATED S

TA

TEMENTS OF CASH FLOW

S

13

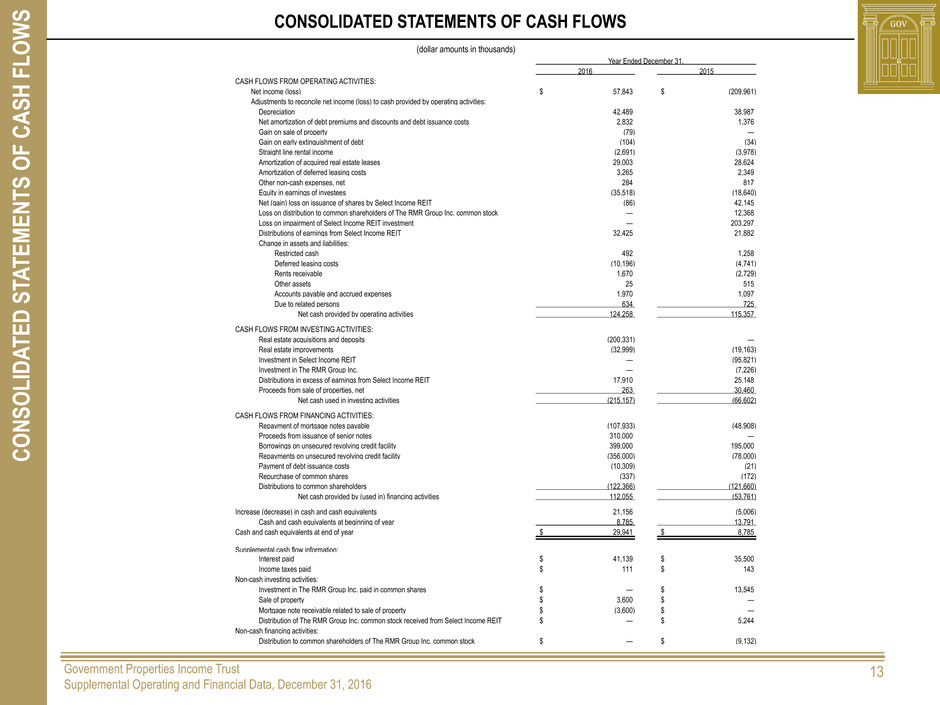

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollar amounts in thousands)

Year Ended December 31,

2016 2015

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income (loss) $ 57,843 $ (209,961)

Adjustments to reconcile net income (loss) to cash provided by operating activities:

Depreciation 42,489 38,987

Net amortization of debt premiums and discounts and debt issuance costs 2,832 1,376

Gain on sale of property (79) —

Gain on early extinguishment of debt (104) (34)

Straight line rental income (2,691) (3,978)

Amortization of acquired real estate leases 29,003 28,624

Amortization of deferred leasing costs 3,265 2,349

Other non-cash expenses, net 284 817

Equity in earnings of investees (35,518) (18,640)

Net (gain) loss on issuance of shares by Select Income REIT (86) 42,145

Loss on distribution to common shareholders of The RMR Group Inc. common stock — 12,368

Loss on impairment of Select Income REIT investment — 203,297

Distributions of earnings from Select Income REIT 32,425 21,882

Change in assets and liabilities:

Restricted cash 492 1,258

Deferred leasing costs (10,196) (4,741)

Rents receivable 1,670 (2,729)

Other assets 25 515

Accounts payable and accrued expenses 1,970 1,097

Due to related persons 634 725

Net cash provided by operating activities 124,258 115,357

CASH FLOWS FROM INVESTING ACTIVITIES:

Real estate acquisitions and deposits (200,331) —

Real estate improvements (32,999) (19,163)

Investment in Select Income REIT — (95,821)

Investment in The RMR Group Inc. — (7,226)

Distributions in excess of earnings from Select Income REIT 17,910 25,148

Proceeds from sale of properties, net 263 30,460

Net cash used in investing activities (215,157) (66,602)

CASH FLOWS FROM FINANCING ACTIVITIES:

Repayment of mortgage notes payable (107,933) (48,908)

Proceeds from issuance of senior notes 310,000 —

Borrowings on unsecured revolving credit facility 399,000 195,000

Repayments on unsecured revolving credit facility (356,000) (78,000)

Payment of debt issuance costs (10,309) (21)

Repurchase of common shares (337) (172)

Distributions to common shareholders (122,366) (121,660)

Net cash provided by (used in) financing activities 112,055 (53,761)

Increase (decrease) in cash and cash equivalents 21,156 (5,006)

Cash and cash equivalents at beginning of year 8,785 13,791

Cash and cash equivalents at end of year $ 29,941 $ 8,785

Supplemental cash flow information:

Interest paid $ 41,139 $ 35,500

Income taxes paid $ 111 $ 143

Non-cash investing activities:

Investment in The RMR Group Inc. paid in common shares $ — $ 13,545

Sale of property $ 3,600 $ —

Mortgage note receivable related to sale of property $ (3,600) $ —

Distribution of The RMR Group Inc. common stock received from Select Income REIT $ — $ 5,244

Non-cash financing activities:

Distribution to common shareholders of The RMR Group Inc. common stock $ — $ (9,132)

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

DEBT SUMMA

RY

14

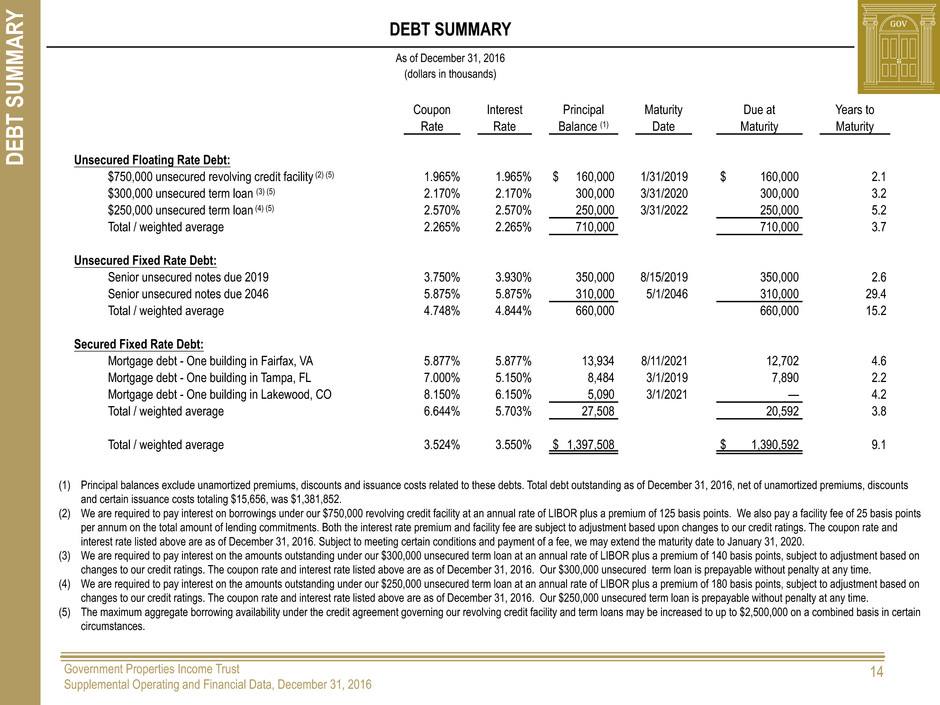

DEBT SUMMARY

(dollars in thousands)

As of December 31, 2016

(1) Principal balances exclude unamortized premiums, discounts and issuance costs related to these debts. Total debt outstanding as of December 31, 2016, net of unamortized premiums, discounts

and certain issuance costs totaling $15,656, was $1,381,852.

(2) We are required to pay interest on borrowings under our $750,000 revolving credit facility at an annual rate of LIBOR plus a premium of 125 basis points. We also pay a facility fee of 25 basis points

per annum on the total amount of lending commitments. Both the interest rate premium and facility fee are subject to adjustment based upon changes to our credit ratings. The coupon rate and

interest rate listed above are as of December 31, 2016. Subject to meeting certain conditions and payment of a fee, we may extend the maturity date to January 31, 2020.

(3) We are required to pay interest on the amounts outstanding under our $300,000 unsecured term loan at an annual rate of LIBOR plus a premium of 140 basis points, subject to adjustment based on

changes to our credit ratings. The coupon rate and interest rate listed above are as of December 31, 2016. Our $300,000 unsecured term loan is prepayable without penalty at any time.

(4) We are required to pay interest on the amounts outstanding under our $250,000 unsecured term loan at an annual rate of LIBOR plus a premium of 180 basis points, subject to adjustment based on

changes to our credit ratings. The coupon rate and interest rate listed above are as of December 31, 2016. Our $250,000 unsecured term loan is prepayable without penalty at any time.

(5) The maximum aggregate borrowing availability under the credit agreement governing our revolving credit facility and term loans may be increased to up to $2,500,000 on a combined basis in certain

circumstances.

Coupon Interest Principal Maturity Due at Years to

Rate Rate Balance (1) Date Maturity Maturity

Unsecured Floating Rate Debt:

$750,000 unsecured revolving credit facility (2) (5) 1.965% 1.965% $ 160,000 1/31/2019 $ 160,000 2.1

$300,000 unsecured term loan (3) (5) 2.170% 2.170% 300,000 3/31/2020 300,000 3.2

$250,000 unsecured term loan (4) (5) 2.570% 2.570% 250,000 3/31/2022 250,000 5.2

Total / weighted average 2.265% 2.265% 710,000 710,000 3.7

Unsecured Fixed Rate Debt:

Senior unsecured notes due 2019 3.750% 3.930% 350,000 8/15/2019 350,000 2.6

Senior unsecured notes due 2046 5.875% 5.875% 310,000 5/1/2046 310,000 29.4

Total / weighted average 4.748% 4.844% 660,000 660,000 15.2

Secured Fixed Rate Debt:

Mortgage debt - One building in Fairfax, VA 5.877% 5.877% 13,934 8/11/2021 12,702 4.6

Mortgage debt - One building in Tampa, FL 7.000% 5.150% 8,484 3/1/2019 7,890 2.2

Mortgage debt - One building in Lakewood, CO 8.150% 6.150% 5,090 3/1/2021 — 4.2

Total / weighted average 6.644% 5.703% 27,508 20,592 3.8

Total / weighted average 3.524% 3.550% $ 1,397,508 $ 1,390,592 9.1

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

DEBT M

ATURIT

Y SCHEDUL

E

15

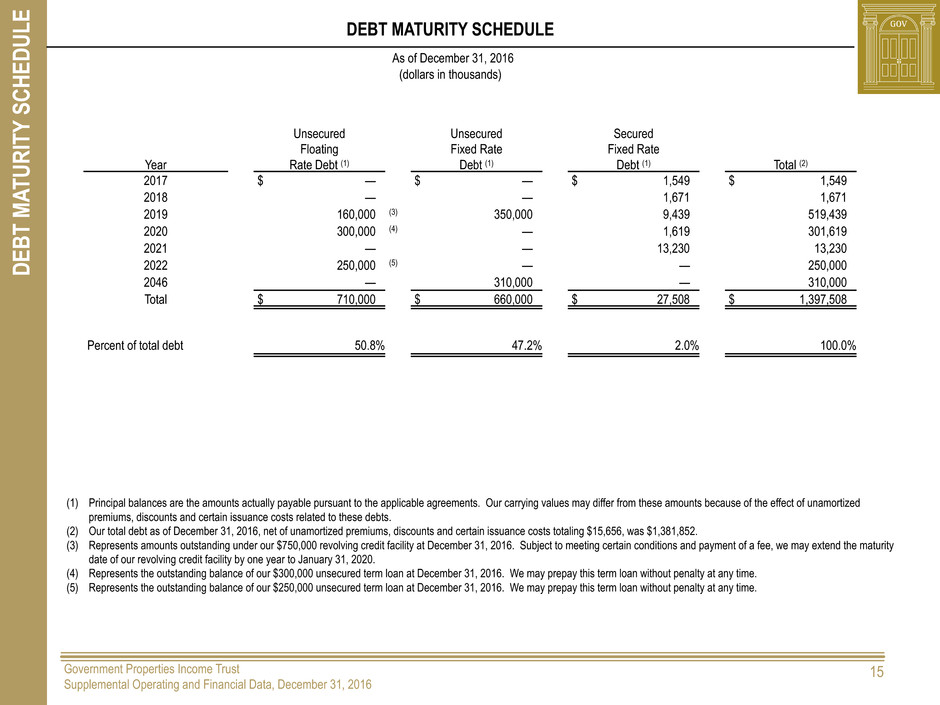

DEBT MATURITY SCHEDULE

(dollars in thousands)

As of December 31, 2016

(1) Principal balances are the amounts actually payable pursuant to the applicable agreements. Our carrying values may differ from these amounts because of the effect of unamortized

premiums, discounts and certain issuance costs related to these debts.

(2) Our total debt as of December 31, 2016, net of unamortized premiums, discounts and certain issuance costs totaling $15,656, was $1,381,852.

(3) Represents amounts outstanding under our $750,000 revolving credit facility at December 31, 2016. Subject to meeting certain conditions and payment of a fee, we may extend the maturity

date of our revolving credit facility by one year to January 31, 2020.

(4) Represents the outstanding balance of our $300,000 unsecured term loan at December 31, 2016. We may prepay this term loan without penalty at any time.

(5) Represents the outstanding balance of our $250,000 unsecured term loan at December 31, 2016. We may prepay this term loan without penalty at any time.

Unsecured Unsecured Secured

Floating Fixed Rate Fixed Rate

Year Rate Debt (1) Debt (1) Debt (1) Total (2)

2017 $ — $ — $ 1,549 $ 1,549

2018 — — 1,671 1,671

2019 160,000 (3) 350,000 9,439 519,439

2020 300,000 (4) — 1,619 301,619

2021 — — 13,230 13,230

2022 250,000 (5) — — 250,000

2046 — 310,000 — 310,000

Total $ 710,000 $ 660,000 $ 27,508 $ 1,397,508

Percent of total debt 50.8% 47.2% 2.0% 100.0%

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

LEVERAGE R

ATIOS, COVERAGE R

ATIOS

AND PUBLIC DEBT COVENANT

S

16

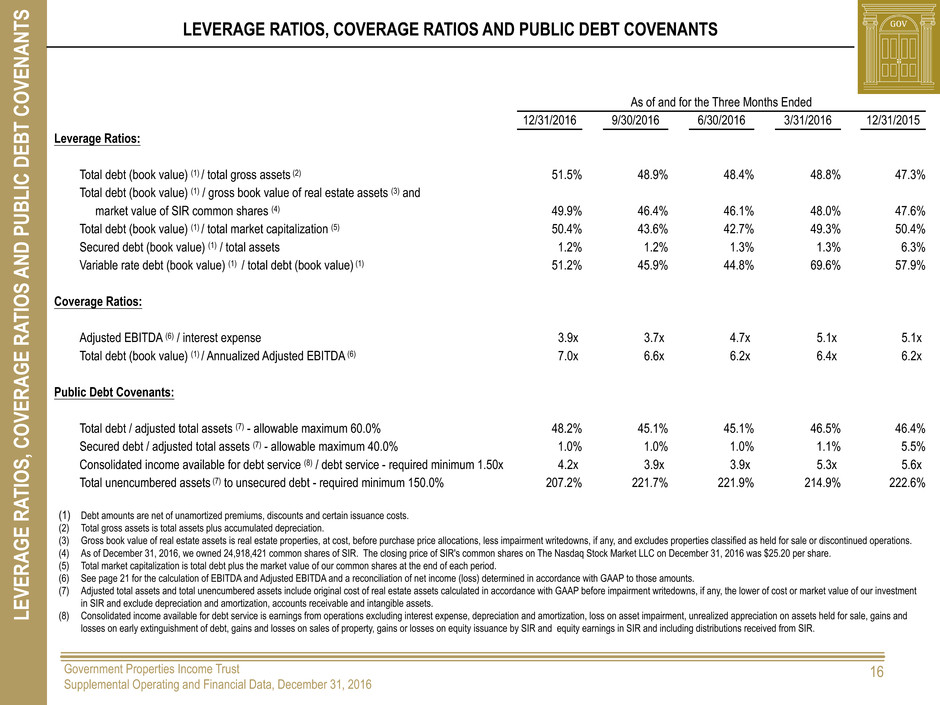

LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS

(1) Debt amounts are net of unamortized premiums, discounts and certain issuance costs.

(2) Total gross assets is total assets plus accumulated depreciation.

(3) Gross book value of real estate assets is real estate properties, at cost, before purchase price allocations, less impairment writedowns, if any, and excludes properties classified as held for sale or discontinued operations.

(4) As of December 31, 2016, we owned 24,918,421 common shares of SIR. The closing price of SIR's common shares on The Nasdaq Stock Market LLC on December 31, 2016 was $25.20 per share.

(5) Total market capitalization is total debt plus the market value of our common shares at the end of each period.

(6) See page 21 for the calculation of EBITDA and Adjusted EBITDA and a reconciliation of net income (loss) determined in accordance with GAAP to those amounts.

(7) Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment writedowns, if any, the lower of cost or market value of our investment

in SIR and exclude depreciation and amortization, accounts receivable and intangible assets.

(8) Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and

losses on early extinguishment of debt, gains and losses on sales of property, gains or losses on equity issuance by SIR and equity earnings in SIR and including distributions received from SIR.

As of and for the Three Months Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Leverage Ratios:

Total debt (book value) (1) / total gross assets (2) 51.5% 48.9% 48.4% 48.8% 47.3%

Total debt (book value) (1) / gross book value of real estate assets (3) and

market value of SIR common shares (4) 49.9% 46.4% 46.1% 48.0% 47.6%

Total debt (book value) (1) / total market capitalization (5) 50.4% 43.6% 42.7% 49.3% 50.4%

Secured debt (book value) (1) / total assets 1.2% 1.2% 1.3% 1.3% 6.3%

Variable rate debt (book value) (1) / total debt (book value) (1) 51.2% 45.9% 44.8% 69.6% 57.9%

Coverage Ratios:

Adjusted EBITDA (6) / interest expense 3.9x 3.7x 4.7x 5.1x 5.1x

Total debt (book value) (1) / Annualized Adjusted EBITDA (6) 7.0x 6.6x 6.2x 6.4x 6.2x

Public Debt Covenants:

Total debt / adjusted total assets (7) - allowable maximum 60.0% 48.2% 45.1% 45.1% 46.5% 46.4%

Secured debt / adjusted total assets (7) - allowable maximum 40.0% 1.0% 1.0% 1.0% 1.1% 5.5%

Consolidated income available for debt service (8) / debt service - required minimum 1.50x 4.2x 3.9x 3.9x 5.3x 5.6x

Total unencumbered assets (7) to unsecured debt - required minimum 150.0% 207.2% 221.7% 221.9% 214.9% 222.6%

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

SUMMA

RY

OF CAPI

TA

L EXPENDITURE

S

17

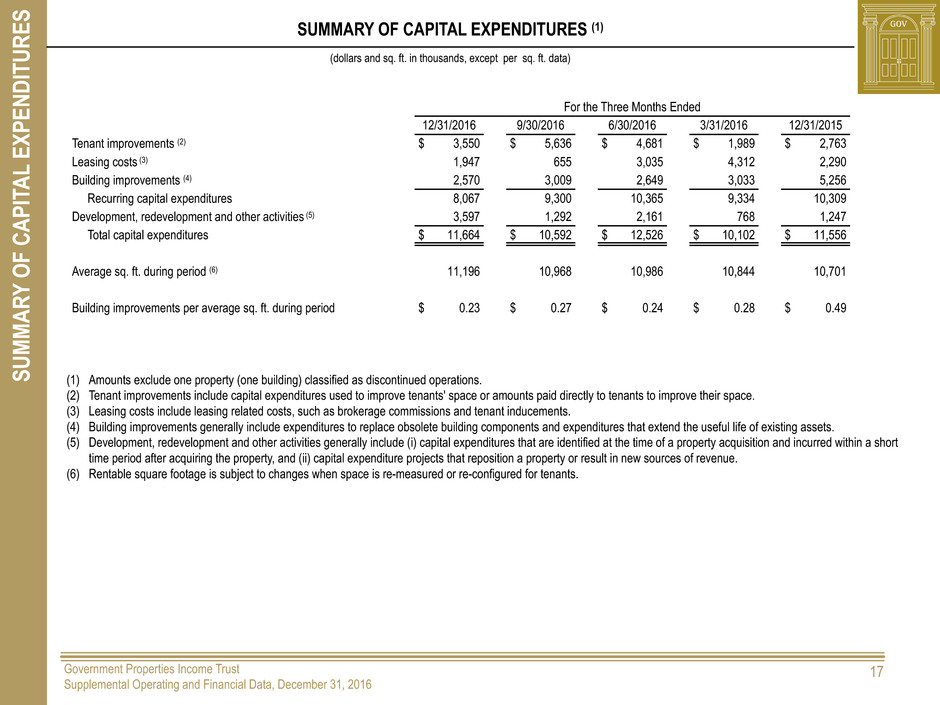

SUMMARY OF CAPITAL EXPENDITURES (1)

(dollars and sq. ft. in thousands, except per sq. ft. data)

(1) Amounts exclude one property (one building) classified as discontinued operations.

(2) Tenant improvements include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space.

(3) Leasing costs include leasing related costs, such as brokerage commissions and tenant inducements.

(4) Building improvements generally include expenditures to replace obsolete building components and expenditures that extend the useful life of existing assets.

(5) Development, redevelopment and other activities generally include (i) capital expenditures that are identified at the time of a property acquisition and incurred within a short

time period after acquiring the property, and (ii) capital expenditure projects that reposition a property or result in new sources of revenue.

(6) Rentable square footage is subject to changes when space is re-measured or re-configured for tenants.

For the Three Months Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Tenant improvements (2) $ 3,550 $ 5,636 $ 4,681 $ 1,989 $ 2,763

Leasing costs (3) 1,947 655 3,035 4,312 2,290

Building improvements (4) 2,570 3,009 2,649 3,033 5,256

Recurring capital expenditures 8,067 9,300 10,365 9,334 10,309

Development, redevelopment and other activities (5) 3,597 1,292 2,161 768 1,247

Total capital expenditures $ 11,664 $ 10,592 $ 12,526 $ 10,102 $ 11,556

Average sq. ft. during period (6) 11,196 10,968 10,986 10,844 10,701

Building improvements per average sq. ft. during period $ 0.23 $ 0.27 $ 0.24 $ 0.28 $ 0.49

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

PROPERT

Y

ACQUISITION

AND DISPOSITION INFORM

ATION SINCE JANUA

RY

1, 201

6

18

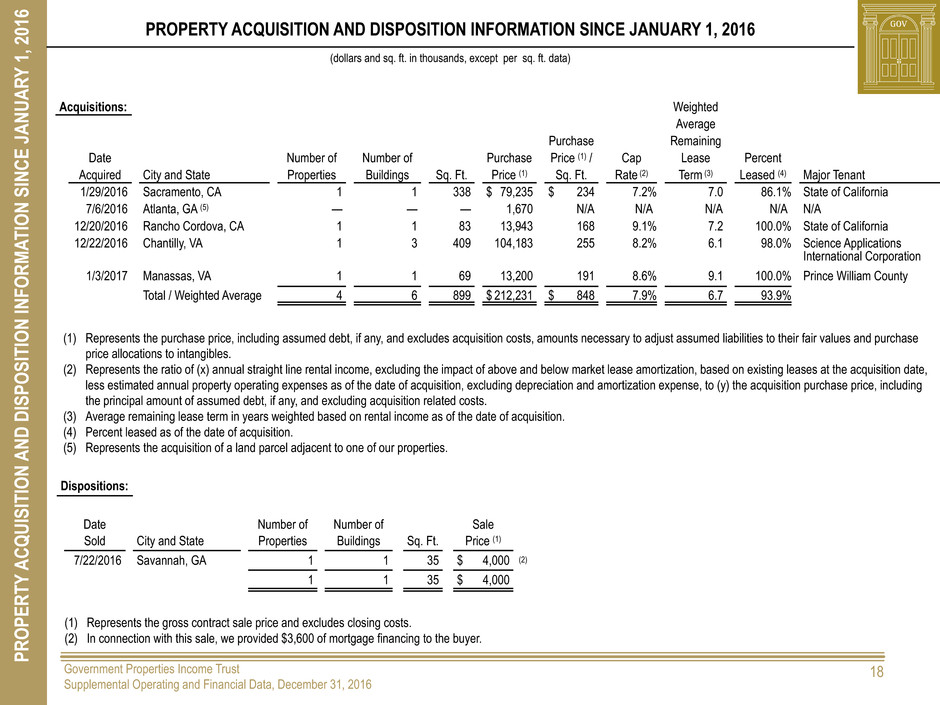

PROPERTY ACQUISITION AND DISPOSITION INFORMATION SINCE JANUARY 1, 2016

(dollars and sq. ft. in thousands, except per sq. ft. data)

Acquisitions: Weighted

Average

Purchase Remaining

Date Number of Number of Purchase Price (1) / Cap Lease Percent

Acquired City and State Properties Buildings Sq. Ft. Price (1) Sq. Ft. Rate (2) Term (3) Leased (4) Major Tenant

1/29/2016 Sacramento, CA 1 1 338 $ 79,235 $ 234 7.2% 7.0 86.1% State of California

7/6/2016 Atlanta, GA (5) — — — 1,670 N/A N/A N/A N/A N/A

12/20/2016 Rancho Cordova, CA 1 1 83 13,943 168 9.1% 7.2 100.0% State of California

12/22/2016 Chantilly, VA 1 3 409 104,183 255 8.2% 6.1 98.0% Science Applications

International Corporation

1/3/2017 Manassas, VA 1 1 69 13,200 191 8.6% 9.1 100.0% Prince William County

Total / Weighted Average 4 6 899 $ 212,231 $ 848 7.9% 6.7 93.9%

(1) Represents the purchase price, including assumed debt, if any, and excludes acquisition costs, amounts necessary to adjust assumed liabilities to their fair values and purchase

price allocations to intangibles.

(2) Represents the ratio of (x) annual straight line rental income, excluding the impact of above and below market lease amortization, based on existing leases at the acquisition date,

less estimated annual property operating expenses as of the date of acquisition, excluding depreciation and amortization expense, to (y) the acquisition purchase price, including

the principal amount of assumed debt, if any, and excluding acquisition related costs.

(3) Average remaining lease term in years weighted based on rental income as of the date of acquisition.

(4) Percent leased as of the date of acquisition.

(5) Represents the acquisition of a land parcel adjacent to one of our properties.

Dispositions:

Date Number of Number of Sale

Sold City and State Properties Buildings Sq. Ft. Price (1)

7/22/2016 Savannah, GA 1 1 35 $ 4,000 (2)

1 1 35 $ 4,000

(1) Represents the gross contract sale price and excludes closing costs.

(2) In connection with this sale, we provided $3,600 of mortgage financing to the buyer.

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

CALCUL

ATION OF PROPERT

Y NET OPER

ATING INCOME (NOI)

AND CASH BASIS NOI

19

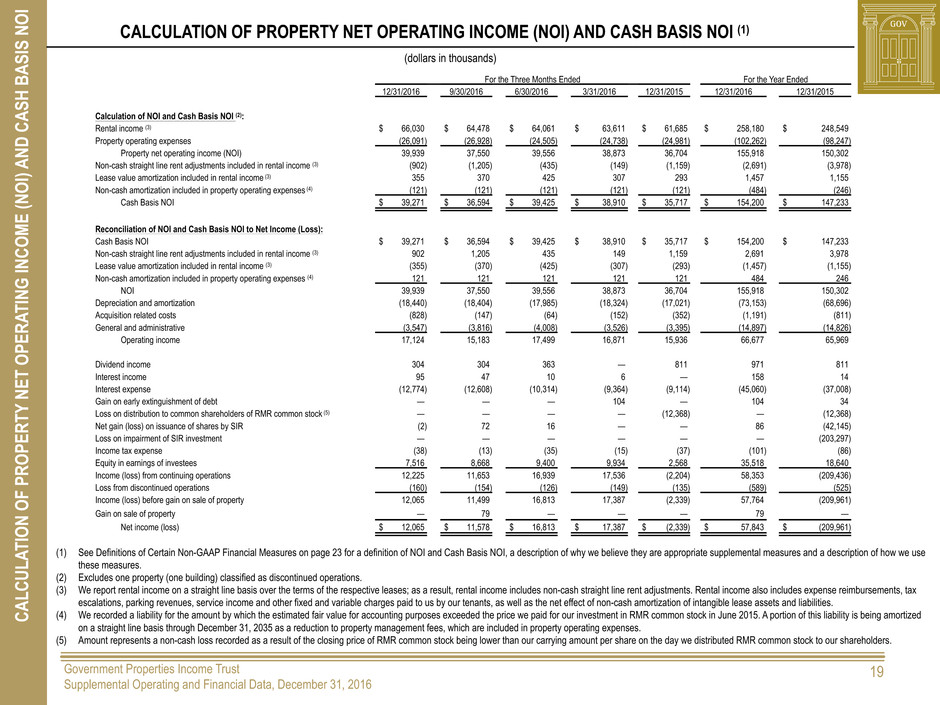

CALCULATION OF PROPERTY NET OPERATING INCOME (NOI) AND CASH BASIS NOI (1)

(dollars in thousands)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 23 for a definition of NOI and Cash Basis NOI, a description of why we believe they are appropriate supplemental measures and a description of how we use

these measures.

(2) Excludes one property (one building) classified as discontinued operations.

(3) We report rental income on a straight line basis over the terms of the respective leases; as a result, rental income includes non-cash straight line rent adjustments. Rental income also includes expense reimbursements, tax

escalations, parking revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of non-cash amortization of intangible lease assets and liabilities.

(4) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015. A portion of this liability is being amortized

on a straight line basis through December 31, 2035 as a reduction to property management fees, which are included in property operating expenses.

(5) Amount represents a non-cash loss recorded as a result of the closing price of RMR common stock being lower than our carrying amount per share on the day we distributed RMR common stock to our shareholders.

For the Three Months Ended For the Year Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 12/31/2016 12/31/2015

Calculation of NOI and Cash Basis NOI (2):

Rental income (3) $ 66,030 $ 64,478 $ 64,061 $ 63,611 $ 61,685 $ 258,180 $ 248,549

Property operating expenses (26,091) (26,928) (24,505) (24,738) (24,981) (102,262) (98,247)

Property net operating income (NOI) 39,939 37,550 39,556 38,873 36,704 155,918 150,302

Non-cash straight line rent adjustments included in rental income (3) (902) (1,205) (435) (149) (1,159) (2,691) (3,978)

Lease value amortization included in rental income (3) 355 370 425 307 293 1,457 1,155

Non-cash amortization included in property operating expenses (4) (121) (121) (121) (121) (121) (484) (246)

Cash Basis NOI $ 39,271 $ 36,594 $ 39,425 $ 38,910 $ 35,717 $ 154,200 $ 147,233

Reconciliation of NOI and Cash Basis NOI to Net Income (Loss):

Cash Basis NOI $ 39,271 $ 36,594 $ 39,425 $ 38,910 $ 35,717 $ 154,200 $ 147,233

Non-cash straight line rent adjustments included in rental income (3) 902 1,205 435 149 1,159 2,691 3,978

Lease value amortization included in rental income (3) (355) (370) (425) (307) (293) (1,457) (1,155)

Non-cash amortization included in property operating expenses (4) 121 121 121 121 121 484 246

NOI 39,939 37,550 39,556 38,873 36,704 155,918 150,302

Depreciation and amortization (18,440) (18,404) (17,985) (18,324) (17,021) (73,153) (68,696)

Acquisition related costs (828) (147) (64) (152) (352) (1,191) (811)

General and administrative (3,547) (3,816) (4,008) (3,526) (3,395) (14,897) (14,826)

Operating income 17,124 15,183 17,499 16,871 15,936 66,677 65,969

Dividend income 304 304 363 — 811 971 811

Interest income 95 47 10 6 — 158 14

Interest expense (12,774) (12,608) (10,314) (9,364) (9,114) (45,060) (37,008)

Gain on early extinguishment of debt — — — 104 — 104 34

Loss on distribution to common shareholders of RMR common stock (5) — — — — (12,368) — (12,368)

Net gain (loss) on issuance of shares by SIR (2) 72 16 — — 86 (42,145)

Loss on impairment of SIR investment — — — — — — (203,297)

Income tax expense (38) (13) (35) (15) (37) (101) (86)

Equity in earnings of investees 7,516 8,668 9,400 9,934 2,568 35,518 18,640

Income (loss) from continuing operations 12,225 11,653 16,939 17,536 (2,204) 58,353 (209,436)

Loss from discontinued operations (160) (154) (126) (149) (135) (589) (525)

Income (loss) before gain on sale of property 12,065 11,499 16,813 17,387 (2,339) 57,764 (209,961)

Gain on sale of property — 79 — — — 79 —

Net income (loss) $ 12,065 $ 11,578 $ 16,813 $ 17,387 $ (2,339) $ 57,843 $ (209,961)

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

CALCUL

ATION OF SAME PROPERT

Y NOI

AND CASH BASIS NOI

20

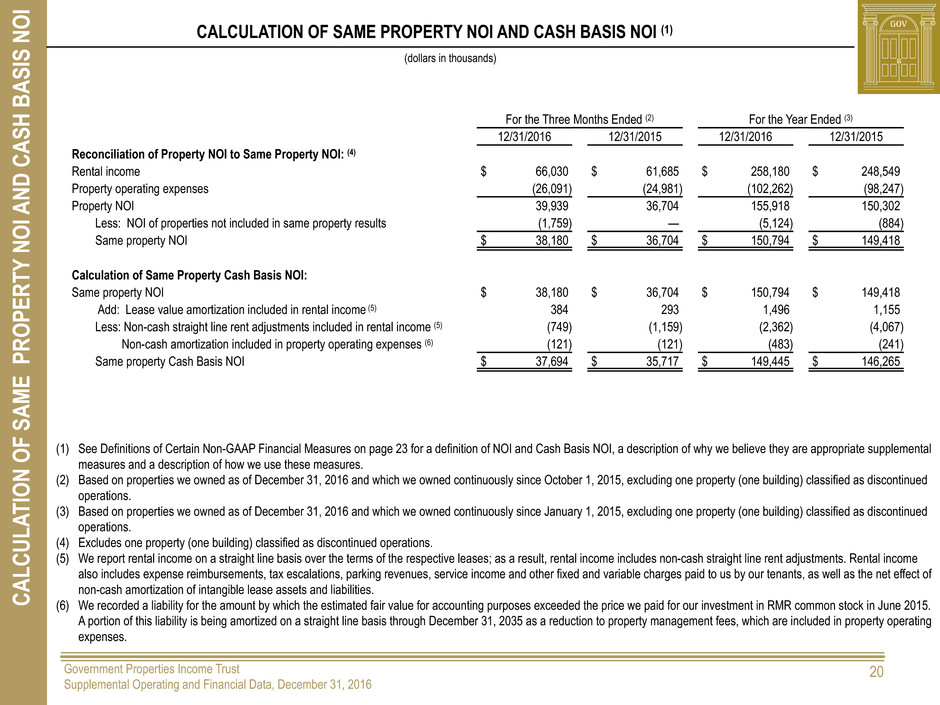

CALCULATION OF SAME PROPERTY NOI AND CASH BASIS NOI (1)

(dollars in thousands)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 23 for a definition of NOI and Cash Basis NOI, a description of why we believe they are appropriate supplemental

measures and a description of how we use these measures.

(2) Based on properties we owned as of December 31, 2016 and which we owned continuously since October 1, 2015, excluding one property (one building) classified as discontinued

operations.

(3) Based on properties we owned as of December 31, 2016 and which we owned continuously since January 1, 2015, excluding one property (one building) classified as discontinued

operations.

(4) Excludes one property (one building) classified as discontinued operations.

(5) We report rental income on a straight line basis over the terms of the respective leases; as a result, rental income includes non-cash straight line rent adjustments. Rental income

also includes expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of

non-cash amortization of intangible lease assets and liabilities.

(6) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR common stock in June 2015.

A portion of this liability is being amortized on a straight line basis through December 31, 2035 as a reduction to property management fees, which are included in property operating

expenses.

For the Three Months Ended (2) For the Year Ended (3)

12/31/2016 12/31/2015 12/31/2016 12/31/2015

Reconciliation of Property NOI to Same Property NOI: (4)

Rental income $ 66,030 $ 61,685 $ 258,180 $ 248,549

Property operating expenses (26,091) (24,981) (102,262) (98,247)

Property NOI 39,939 36,704 155,918 150,302

Less: NOI of properties not included in same property results (1,759) — (5,124) (884)

Same property NOI $ 38,180 $ 36,704 $ 150,794 $ 149,418

Calculation of Same Property Cash Basis NOI:

Same property NOI $ 38,180 $ 36,704 $ 150,794 $ 149,418

Add: Lease value amortization included in rental income (5) 384 293 1,496 1,155

Less: Non-cash straight line rent adjustments included in rental income (5) (749) (1,159) (2,362) (4,067)

Non-cash amortization included in property operating expenses (6) (121) (121) (483) (241)

Same property Cash Basis NOI $ 37,694 $ 35,717 $ 149,445 $ 146,265

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

CALCUL

ATION OF EBITD

A

AND

ADJUSTED EBITD

A

21

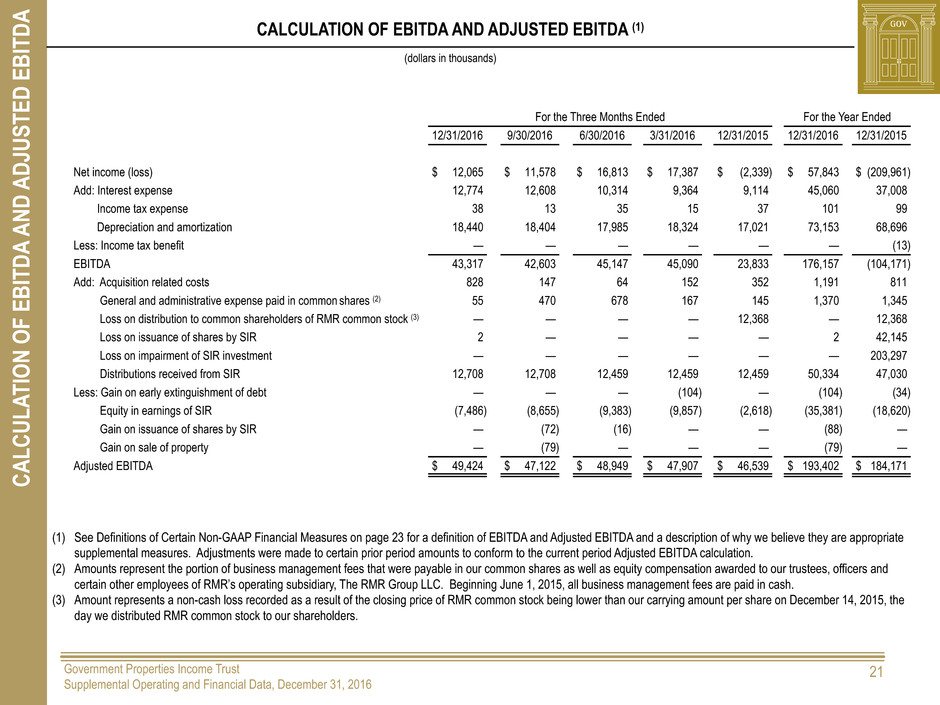

CALCULATION OF EBITDA AND ADJUSTED EBITDA (1)

(dollars in thousands)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 23 for a definition of EBITDA and Adjusted EBITDA and a description of why we believe they are appropriate

supplemental measures. Adjustments were made to certain prior period amounts to conform to the current period Adjusted EBITDA calculation.

(2) Amounts represent the portion of business management fees that were payable in our common shares as well as equity compensation awarded to our trustees, officers and

certain other employees of RMR’s operating subsidiary, The RMR Group LLC. Beginning June 1, 2015, all business management fees are paid in cash.

(3) Amount represents a non-cash loss recorded as a result of the closing price of RMR common stock being lower than our carrying amount per share on December 14, 2015, the

day we distributed RMR common stock to our shareholders.

For the Three Months Ended For the Year Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 12/31/2016 12/31/2015

Net income (loss) $ 12,065 $ 11,578 $ 16,813 $ 17,387 $ (2,339) $ 57,843 $ (209,961)

Add: Interest expense 12,774 12,608 10,314 9,364 9,114 45,060 37,008

Income tax expense 38 13 35 15 37 101 99

Depreciation and amortization 18,440 18,404 17,985 18,324 17,021 73,153 68,696

Less: Income tax benefit — — — — — — (13)

EBITDA 43,317 42,603 45,147 45,090 23,833 176,157 (104,171)

Add: Acquisition related costs 828 147 64 152 352 1,191 811

General and administrative expense paid in common shares (2) 55 470 678 167 145 1,370 1,345

Loss on distribution to common shareholders of RMR common stock (3) — — — — 12,368 — 12,368

Loss on issuance of shares by SIR 2 — — — — 2 42,145

Loss on impairment of SIR investment — — — — — — 203,297

Distributions received from SIR 12,708 12,708 12,459 12,459 12,459 50,334 47,030

Less: Gain on early extinguishment of debt — — — (104) — (104) (34)

Equity in earnings of SIR (7,486) (8,655) (9,383) (9,857) (2,618) (35,381) (18,620)

Gain on issuance of shares by SIR — (72) (16) — — (88) —

Gain on sale of property — (79) — — — (79) —

Adjusted EBITDA $ 49,424 $ 47,122 $ 48,949 $ 47,907 $ 46,539 $ 193,402 $ 184,171

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

CALCUL

ATION OF FUNDS FROM OPER

ATIONS (FFO)

AND NORMALIZED FF

O

22

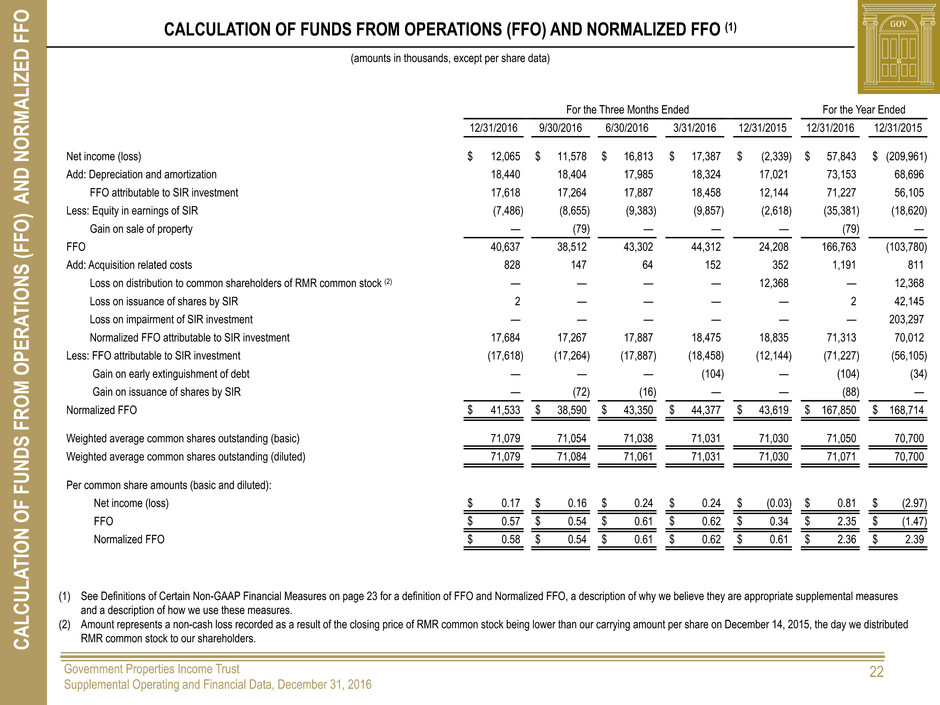

CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FFO (1)

(amounts in thousands, except per share data)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 23 for a definition of FFO and Normalized FFO, a description of why we believe they are appropriate supplemental measures

and a description of how we use these measures.

(2) Amount represents a non-cash loss recorded as a result of the closing price of RMR common stock being lower than our carrying amount per share on December 14, 2015, the day we distributed

RMR common stock to our shareholders.

For the Three Months Ended For the Year Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 12/31/2016 12/31/2015

Net income (loss) $ 12,065 $ 11,578 $ 16,813 $ 17,387 $ (2,339) $ 57,843 $ (209,961)

Add: Depreciation and amortization 18,440 18,404 17,985 18,324 17,021 73,153 68,696

FFO attributable to SIR investment 17,618 17,264 17,887 18,458 12,144 71,227 56,105

Less: Equity in earnings of SIR (7,486) (8,655) (9,383) (9,857) (2,618) (35,381) (18,620)

Gain on sale of property — (79) — — — (79) —

FFO 40,637 38,512 43,302 44,312 24,208 166,763 (103,780)

Add: Acquisition related costs 828 147 64 152 352 1,191 811

Loss on distribution to common shareholders of RMR common stock (2) — — — — 12,368 — 12,368

Loss on issuance of shares by SIR 2 — — — — 2 42,145

Loss on impairment of SIR investment — — — — — — 203,297

Normalized FFO attributable to SIR investment 17,684 17,267 17,887 18,475 18,835 71,313 70,012

Less: FFO attributable to SIR investment (17,618) (17,264) (17,887) (18,458) (12,144) (71,227) (56,105)

Gain on early extinguishment of debt — — — (104) — (104) (34)

Gain on issuance of shares by SIR — (72) (16) — — (88) —

Normalized FFO $ 41,533 $ 38,590 $ 43,350 $ 44,377 $ 43,619 $ 167,850 $ 168,714

Weighted average common shares outstanding (basic) 71,079 71,054 71,038 71,031 71,030 71,050 70,700

Weighted average common shares outstanding (diluted) 71,079 71,084 71,061 71,031 71,030 71,071 70,700

Per common share amounts (basic and diluted):

Net income (loss) $ 0.17 $ 0.16 $ 0.24 $ 0.24 $ (0.03) $ 0.81 $ (2.97)

FFO $ 0.57 $ 0.54 $ 0.61 $ 0.62 $ 0.34 $ 2.35 $ (1.47)

Normalized FFO $ 0.58 $ 0.54 $ 0.61 $ 0.62 $ 0.61 $ 2.36 $ 2.39

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

NON-GAA

P FINANCIA

L MEASURES DEFINITION

S

23

DEFINITIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES

Definition of NOI and Cash Basis NOI

We calculate NOI and Cash Basis NOI as shown on page 19. The calculations of NOI and Cash Basis NOI exclude certain components of net income (loss) in order to provide results

that are more closely related to our property level results of operations. We define NOI as income from our rental of real estate less our property operating expenses. NOI excludes

amortization of capitalized tenant improvement costs and leasing commissions because we record those amounts as depreciation and amortization. We define Cash Basis NOI as NOI

excluding non-cash straight line rent adjustments, lease value amortization and non-cash amortization included in other operating expenses. We consider NOI and Cash Basis NOI to be

appropriate supplemental measures to net income (loss) because they may help both investors and management to understand the operations of our properties. We use NOI and Cash

Basis NOI to evaluate individual and company wide property level performance, and we believe that NOI and Cash Basis NOI provide useful information to investors regarding our results

of operations because they reflect only those income and expense items that are generated and incurred at the property level and may facilitate comparisons of our operating

performance between periods and with other REITs. NOI and Cash Basis NOI do not represent cash generated by operating activities in accordance with GAAP and should not be

considered as alternatives to net income (loss) or operating income as an indicator of our operating performance or as a measure of our liquidity. These measures should be considered in

conjunction with net income (loss) and operating income as presented in our Consolidated Statements of Income (Loss). Other REITs and real estate companies may calculate NOI and

Cash Basis NOI differently than we do.

Definition of EBITDA and Adjusted EBITDA

We calculate EBITDA and Adjusted EBITDA as shown on page 21. We consider EBITDA and Adjusted EBITDA to be appropriate supplemental measures of our operating performance,

along with net income (loss) and operating income. We believe that EBITDA and Adjusted EBITDA provide useful information to investors because by excluding the effects of certain

historical amounts, such as interest, depreciation and amortization expense, EBITDA and Adjusted EBITDA may facilitate a comparison of current operating performance with our past

operating performance. EBITDA and Adjusted EBITDA do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net

income (loss) or operating income as an indicator of operating performance or as a measure of GOV’s liquidity. These measures should be considered in conjunction with net income

(loss) and operating income as presented in our Consolidated Statements of Income (Loss). Other REITs and real estate companies may calculate EBITDA and Adjusted EBITDA

differently than we do.

Definition of FFO and Normalized FFO

We calculate FFO and Normalized FFO as shown on page 22. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or NAREIT, which is

net income (loss), calculated in accordance with GAAP, plus real estate depreciation and amortization and the difference between FFO attributable to an equity investment and equity in

earnings of an equity investee but excluding impairment charges on real estate assets, any gain or loss on sale of properties, as well as certain other adjustments currently not applicable

to us. Our calculation of Normalized FFO differs from NAREIT's definition of FFO because we include the difference between FFO and Normalized FFO attributable to our equity

investment in SIR, we include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP

due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will

ultimately be payable when all contingencies for determining any such fees are determined at the end of the calendar year and we exclude acquisition related costs, gains or losses on

early extinguishment of debt, loss on impairment of SIR investment, gains or losses on issuance of shares by SIR and loss on distribution to common shareholders of RMR common

stock. We consider FFO and Normalized FFO to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss) and operating income. We

believe that FFO and Normalized FFO provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation expense, FFO and

Normalized FFO may facilitate a comparison of our operating performance between periods and with other REITs. FFO and Normalized FFO are among the factors considered by our

Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as

a REIT, limitations in our credit agreement and public debt covenants, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating

performance, our receipt of distributions from SIR and our expected needs and availability of cash to pay our obligations. FFO and Normalized FFO do not represent cash generated by

operating activities in accordance with GAAP and should not be considered as alternatives to net income (loss) or operating income as an indicator of our operating performance or as a

measure of our liquidity. These measures should be considered in conjunction with net income (loss) and operating income as presented in our Consolidated Statements of Income

(Loss). Other REITs and real estate companies may calculate FFO and Normalized FFO differently than we do.

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

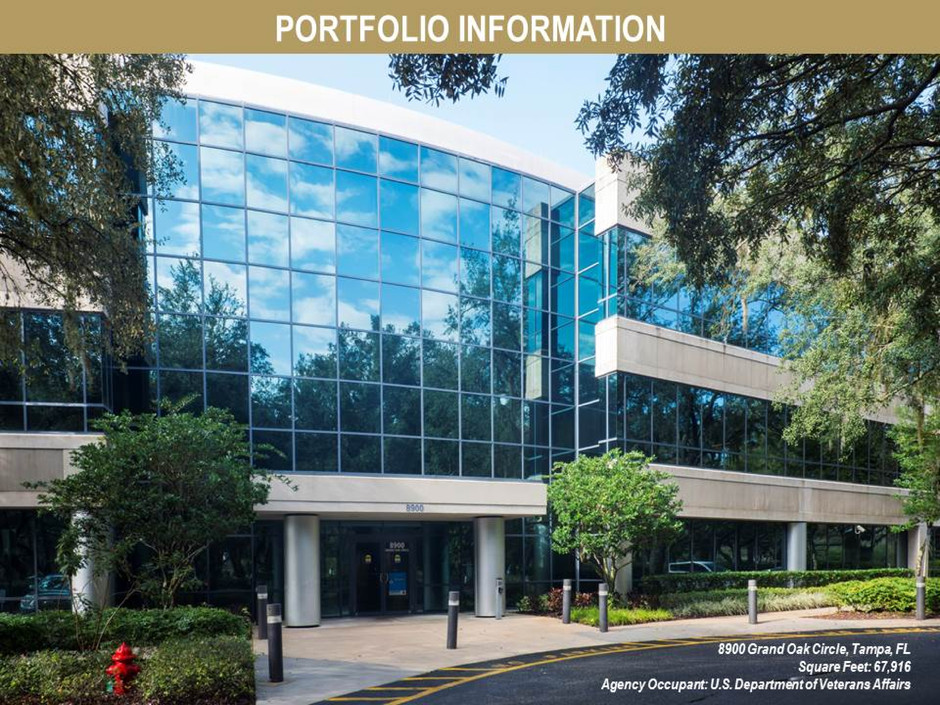

PORTFOLIO INFORMATION

24

Stevens Center, Richland, WA

Square Feet: 140,152

Agency Occupant: Department of Energy

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

PORTFOLIO SUMMA

RY

25

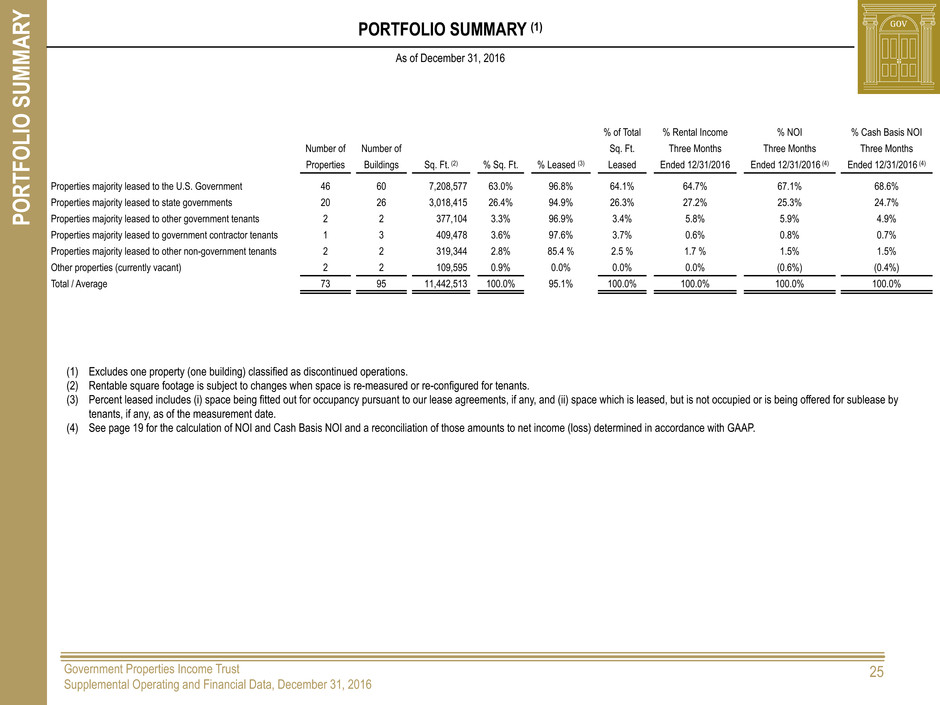

PORTFOLIO SUMMARY (1)

As of December 31, 2016

(1) Excludes one property (one building) classified as discontinued operations.

(2) Rentable square footage is subject to changes when space is re-measured or re-configured for tenants.

(3) Percent leased includes (i) space being fitted out for occupancy pursuant to our lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by

tenants, if any, as of the measurement date.

(4) See page 19 for the calculation of NOI and Cash Basis NOI and a reconciliation of those amounts to net income (loss) determined in accordance with GAAP.

% of Total % Rental Income % NOI % Cash Basis NOI

Number of Number of Sq. Ft. Three Months Three Months Three Months

Properties Buildings Sq. Ft. (2) % Sq. Ft. % Leased (3) Leased Ended 12/31/2016 Ended 12/31/2016 (4) Ended 12/31/2016 (4)

Properties majority leased to the U.S. Government 46 60 7,208,577 63.0% 96.8% 64.1% 64.7% 67.1% 68.6%

Properties majority leased to state governments 20 26 3,018,415 26.4% 94.9% 26.3% 27.2% 25.3% 24.7%

Properties majority leased to other government tenants 2 2 377,104 3.3% 96.9% 3.4% 5.8% 5.9% 4.9%

Properties majority leased to government contractor tenants 1 3 409,478 3.6% 97.6% 3.7% 0.6% 0.8% 0.7%

Properties majority leased to other non-government tenants 2 2 319,344 2.8% 85.4 % 2.5 % 1.7 % 1.5% 1.5%

Other properties (currently vacant) 2 2 109,595 0.9% 0.0% 0.0% 0.0% (0.6%) (0.4%)

Total / Average 73 95 11,442,513 100.0% 95.1% 100.0% 100.0% 100.0% 100.0%

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

SUMMA

RY

CONSOLID

ATED

AND SAME PROPERT

Y RESU

LT

S

26

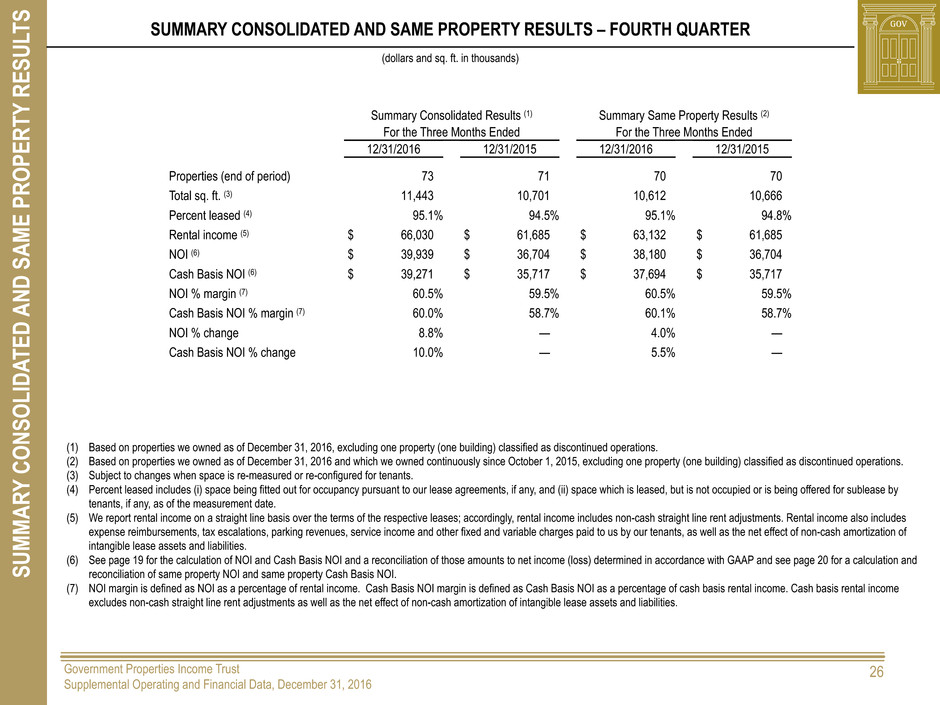

SUMMARY CONSOLIDATED AND SAME PROPERTY RESULTS – FOURTH QUARTER

(dollars and sq. ft. in thousands)

(1) Based on properties we owned as of December 31, 2016, excluding one property (one building) classified as discontinued operations.

(2) Based on properties we owned as of December 31, 2016 and which we owned continuously since October 1, 2015, excluding one property (one building) classified as discontinued operations.

(3) Subject to changes when space is re-measured or re-configured for tenants.

(4) Percent leased includes (i) space being fitted out for occupancy pursuant to our lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by

tenants, if any, as of the measurement date.

(5) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes

expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of non-cash amortization of

intangible lease assets and liabilities.

(6) See page 19 for the calculation of NOI and Cash Basis NOI and a reconciliation of those amounts to net income (loss) determined in accordance with GAAP and see page 20 for a calculation and

reconciliation of same property NOI and same property Cash Basis NOI.

(7) NOI margin is defined as NOI as a percentage of rental income. Cash Basis NOI margin is defined as Cash Basis NOI as a percentage of cash basis rental income. Cash basis rental income

excludes non-cash straight line rent adjustments as well as the net effect of non-cash amortization of intangible lease assets and liabilities.

Summary Consolidated Results (1) Summary Same Property Results (2)

For the Three Months Ended For the Three Months Ended

12/31/2016 12/31/2015 12/31/2016 12/31/2015

Properties (end of period) 73 71 70 70

Total sq. ft. (3) 11,443 10,701 10,612 10,666

Percent leased (4) 95.1% 94.5% 95.1% 94.8%

Rental income (5) $ 66,030 $ 61,685 $ 63,132 $ 61,685

NOI (6) $ 39,939 $ 36,704 $ 38,180 $ 36,704

Cash Basis NOI (6) $ 39,271 $ 35,717 $ 37,694 $ 35,717

NOI % margin (7) 60.5% 59.5% 60.5% 59.5%

Cash Basis NOI % margin (7) 60.0% 58.7% 60.1% 58.7%

NOI % change 8.8% — 4.0% —

Cash Basis NOI % change 10.0% — 5.5% —

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

SUMMA

RY

CONSOLID

ATED

AND SAME PROPERT

Y RESU

LT

S

27

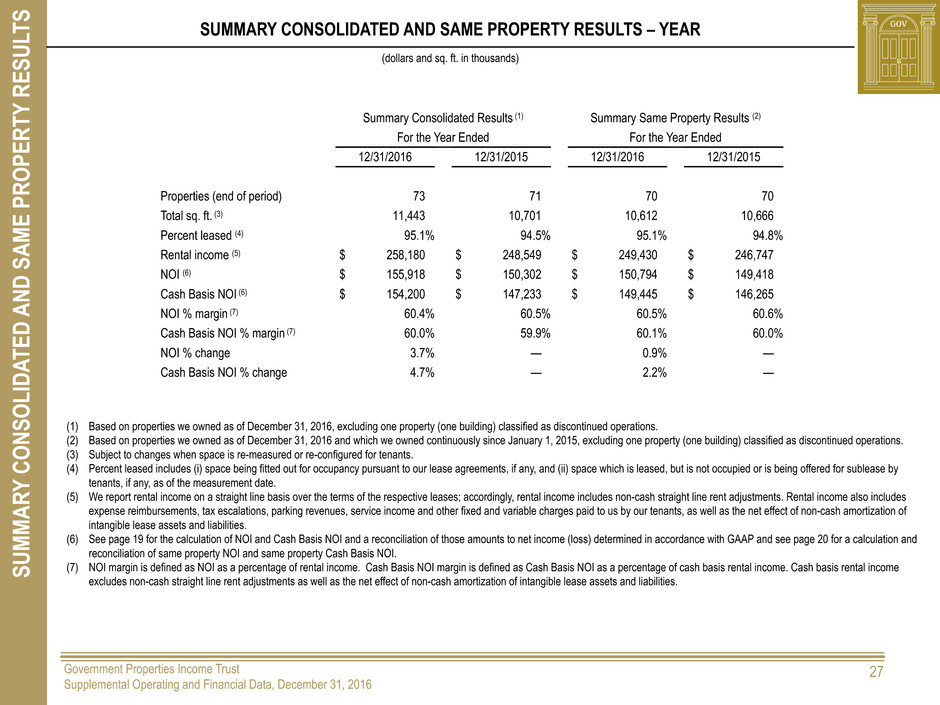

SUMMARY CONSOLIDATED AND SAME PROPERTY RESULTS – YEAR

(dollars and sq. ft. in thousands)

(1) Based on properties we owned as of December 31, 2016, excluding one property (one building) classified as discontinued operations.

(2) Based on properties we owned as of December 31, 2016 and which we owned continuously since January 1, 2015, excluding one property (one building) classified as discontinued operations.

(3) Subject to changes when space is re-measured or re-configured for tenants.

(4) Percent leased includes (i) space being fitted out for occupancy pursuant to our lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by

tenants, if any, as of the measurement date.

(5) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes

expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to us by our tenants, as well as the net effect of non-cash amortization of

intangible lease assets and liabilities.

(6) See page 19 for the calculation of NOI and Cash Basis NOI and a reconciliation of those amounts to net income (loss) determined in accordance with GAAP and see page 20 for a calculation and

reconciliation of same property NOI and same property Cash Basis NOI.

(7) NOI margin is defined as NOI as a percentage of rental income. Cash Basis NOI margin is defined as Cash Basis NOI as a percentage of cash basis rental income. Cash basis rental income

excludes non-cash straight line rent adjustments as well as the net effect of non-cash amortization of intangible lease assets and liabilities.

Summary Consolidated Results (1) Summary Same Property Results (2)

For the Year Ended For the Year Ended

12/31/2016 12/31/2015 12/31/2016 12/31/2015

Properties (end of period) 73 71 70 70

Total sq. ft. (3) 11,443 10,701 10,612 10,666

Percent leased (4) 95.1% 94.5% 95.1% 94.8%

Rental income (5) $ 258,180 $ 248,549 $ 249,430 $ 246,747

NOI (6) $ 155,918 $ 150,302 $ 150,794 $ 149,418

Cash Basis NOI (6) $ 154,200 $ 147,233 $ 149,445 $ 146,265

NOI % margin (7) 60.4% 60.5% 60.5% 60.6%

Cash Basis NOI % margin (7) 60.0% 59.9% 60.1% 60.0%

NOI % change 3.7% — 0.9% —

Cash Basis NOI % change 4.7% — 2.2% —

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

OCCU

PANC

Y

AND LEASING SUMMA

RY

28

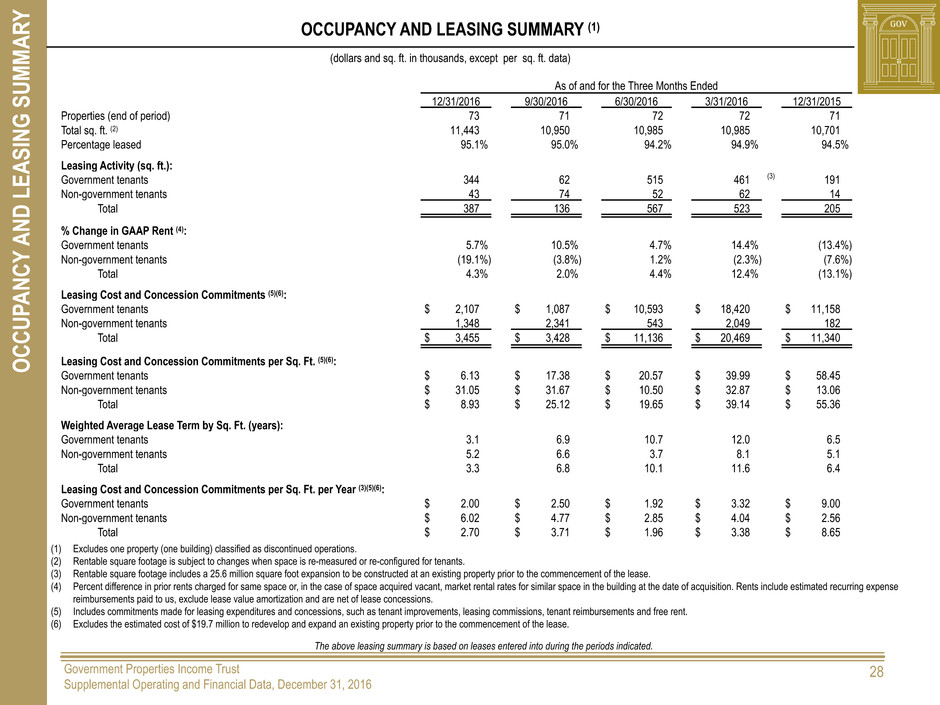

OCCUPANCY AND LEASING SUMMARY (1)

(dollars and sq. ft. in thousands, except per sq. ft. data)

(1) Excludes one property (one building) classified as discontinued operations.

(2) Rentable square footage is subject to changes when space is re-measured or re-configured for tenants.

(3) Rentable square footage includes a 25.6 million square foot expansion to be constructed at an existing property prior to the commencement of the lease.

(4) Percent difference in prior rents charged for same space or, in the case of space acquired vacant, market rental rates for similar space in the building at the date of acquisition. Rents include estimated recurring expense

reimbursements paid to us, exclude lease value amortization and are net of lease concessions.

(5) Includes commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent.

(6) Excludes the estimated cost of $19.7 million to redevelop and expand an existing property prior to the commencement of the lease.

The above leasing summary is based on leases entered into during the periods indicated.

As of and for the Three Months Ended

12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Properties (end of period) 73 71 72 72 71

Total sq. ft. (2) 11,443 10,950 10,985 10,985 10,701

Percentage leased 95.1% 95.0% 94.2% 94.9% 94.5%

Leasing Activity (sq. ft.):

Government tenants 344 62 515 461 (3) 191

Non-government tenants 43 74 52 62 14

Total 387 136 567 523 205

% Change in GAAP Rent (4):

Government tenants 5.7% 10.5% 4.7% 14.4% (13.4%)

Non-government tenants (19.1%) (3.8%) 1.2% (2.3%) (7.6%)

Total 4.3% 2.0% 4.4% 12.4% (13.1%)

Leasing Cost and Concession Commitments (5)(6):

Government tenants $ 2,107 $ 1,087 $ 10,593 $ 18,420 $ 11,158

Non-government tenants 1,348 2,341 543 2,049 182

Total $ 3,455 $ 3,428 $ 11,136 $ 20,469 $ 11,340

Leasing Cost and Concession Commitments per Sq. Ft. (5)(6):

Government tenants $ 6.13 $ 17.38 $ 20.57 $ 39.99 $ 58.45

Non-government tenants $ 31.05 $ 31.67 $ 10.50 $ 32.87 $ 13.06

Total $ 8.93 $ 25.12 $ 19.65 $ 39.14 $ 55.36

Weighted Average Lease Term by Sq. Ft. (years):

Government tenants 3.1 6.9 10.7 12.0 6.5

Non-government tenants 5.2 6.6 3.7 8.1 5.1

Total 3.3 6.8 10.1 11.6 6.4

Leasing Cost and Concession Commitments per Sq. Ft. per Year (3)(5)(6):

Government tenants $ 2.00 $ 2.50 $ 1.92 $ 3.32 $ 9.00

Non-government tenants $ 6.02 $ 4.77 $ 2.85 $ 4.04 $ 2.56

Total $ 2.70 $ 3.71 $ 1.96 $ 3.38 $ 8.65

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

LEASING

ANA

LYSIS B

Y TENANT TYP

E

29

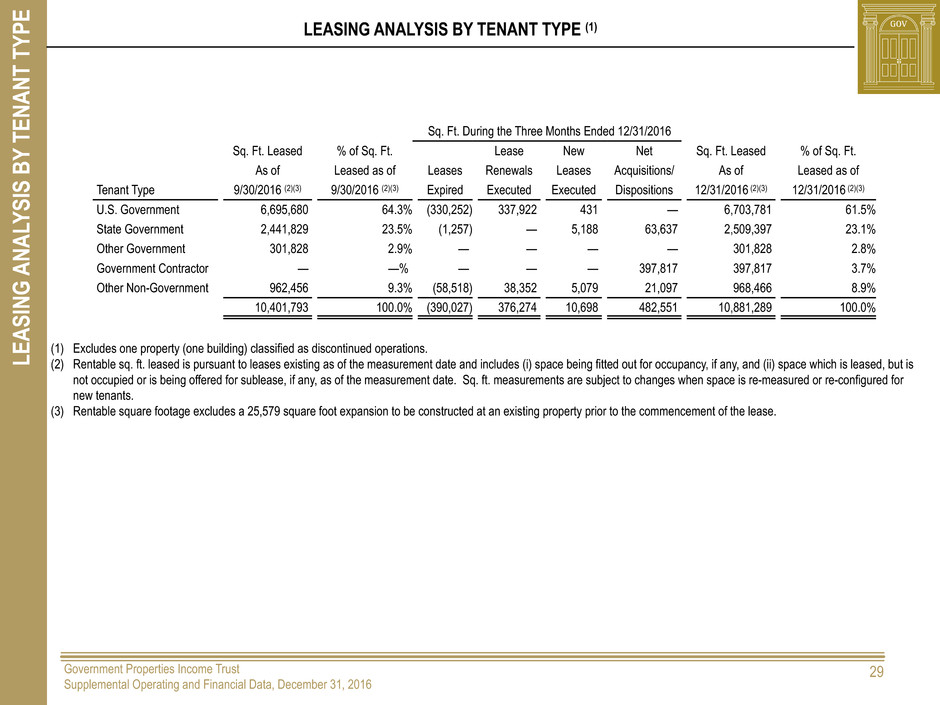

LEASING ANALYSIS BY TENANT TYPE (1)

(1) Excludes one property (one building) classified as discontinued operations.

(2) Rentable sq. ft. leased is pursuant to leases existing as of the measurement date and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased, but is

not occupied or is being offered for sublease, if any, as of the measurement date. Sq. ft. measurements are subject to changes when space is re-measured or re-configured for

new tenants.

(3) Rentable square footage excludes a 25,579 square foot expansion to be constructed at an existing property prior to the commencement of the lease.

Sq. Ft. During the Three Months Ended 12/31/2016

Sq. Ft. Leased % of Sq. Ft. Lease New Net Sq. Ft. Leased % of Sq. Ft.

As of Leased as of Leases Renewals Leases Acquisitions/ As of Leased as of

Tenant Type 9/30/2016 (2)(3) 9/30/2016 (2)(3) Expired Executed Executed Dispositions 12/31/2016 (2)(3) 12/31/2016 (2)(3)

U.S. Government 6,695,680 64.3% (330,252) 337,922 431 — 6,703,781 61.5%

State Government 2,441,829 23.5% (1,257) — 5,188 63,637 2,509,397 23.1%

Other Government 301,828 2.9% — — — — 301,828 2.8%

Government Contractor — —% — — — 397,817 397,817 3.7%

Other Non-Government 962,456 9.3% (58,518) 38,352 5,079 21,097 968,466 8.9%

10,401,793 100.0% (390,027) 376,274 10,698 482,551 10,881,289 100.0%

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016

TENANT LIS

T

30

TENANT LIST (1)

As of December 31, 2016

(1) Amounts exclude one property (one building) classified as discontinued operations.

(2) Rentable sq. ft. is pursuant to leases existing as of December 31, 2016, and includes (i) space being fitted out for occupancy, if any, and (ii) space which is leased but is not occupied or is being offered for sublease, if any. Rentable

sq. ft. measurements are subject to changes when space is re-measured or re-configured for new tenants.

(3) Percentage of annualized rental income is calculated using annualized contractual base rents from our tenants pursuant to our lease agreements as of December 31, 2016, plus straight line rent adjustments and estimated recurring

expense reimbursements to be paid to us, and excluding lease value amortization.

(4) Agency occupant cannot be disclosed.

(5) Rentable square footage excludes a 25,579 square foot expansion to be constructed at an existing property prior to the commencement of the lease.

% of Total % of % of Total % of

Rentable Rentable Annualized Rentable Rentable Annualized

Tenant / Agency Sq. Ft. (2) Sq. Ft. (2) Rental Income (3) Tenant Sq. Ft. (2) Sq. Ft. (2) Rental Income (3)

U.S. Government: State Governments:

1 Citizenship and Immigration Services 448,607 3.9% 8.1% 1 State of California - nine agency occupants 762,075 6.7% 7.7%

2 Internal Revenue Service 1,041,806 9.1% 7.8% 2 Commonwealth of Massachusetts - three agency occupants 307,119 2.7% 3.5%

3 U.S. Government (4) 406,388 3.6% 4.5% 3 State of Georgia - Department of Transportation 298,223 2.6% 2.4%

4 Federal Bureau of Investigation 304,425 2.7% 3.2% 4 Commonwealth of Virginia - seven agency occupants 255,241 2.2% 2.1%

5 Centers for Disease Control (5) 352,876 3.1% 2.9% 5 State of Oregon - two agency occupants 199,018 1.7% 1.7%

6 Department of Justice 227,201 2.0% 2.9% 6 State of New Jersey - Department of Treasury 173,189 1.5% 1.6%

7 Customs and Border Protection 243,162 2.1% 2.5% 7 State of Washington - Social and Health Services 111,908 1.0% 1.0%

8 Bureau of Land Management 304,831 2.7% 2.3% 8 State of Arizona - Northern Arizona University 66,743 0.6% 0.5%

9 Department of Veterans Affairs 280,699 2.5% 2.3% 9 State of South Carolina - four agency occupants 121,561 1.1% 0.5%

10 Defense Intelligence Agency 266,000 2.3% 1.9% 10 State of Maryland - two agency occupants 84,674 0.7% 0.5%

11 Immigration and Customs Enforcement 136,395 1.2% 1.9% 11 State of Minnesota - Minnesota State Lottery 61,426 0.5% 0.4%

12 Social Security Administration 189,645 1.7% 1.7% 12 State of New York - Department of Agriculture 64,000 0.6% 0.4%

13 Bureau of Reclamation 212,996 1.9% 1.7% 13 State of Kansas - Kansas University 4,220 0.0% 0.0%

14 National Park Service 166,745 1.5% 1.7% Subtotal State Governments 2,509,397 21.9% 22.3%

15 U.S. Courts 115,366 1.0% 1.6% 3 Other Government Tenants 301,828 2.6% 5.0%

16 Department of Health and Human Services 128,645 1.1% 1.2% 3 Government Contractor Tenants 397,817 3.5% 4.9%

17 National Archives and Record Administration 352,064 3.1% 1.1% 143 Other Non-Government Tenants 968,466 8.5% 7.2%

18 Drug Enforcement Agency 93,177 0.8% 1.1% Subtotal Leased Rentable Square Feet 10,881,289 95.1% 100.0%

19 Department of Energy 140,152 1.2% 1.0% Available for Lease 561,224 4.9% —%

20 Defense Nuclear Facilities Board 60,133 0.5% 1.0% Total Rentable Square Feet 11,442,513 100.0% 100.0%

21 Department of State 89,058 0.8% 0.9%

22 U.S. Postal Service 321,800 2.8% 0.8%

23 Occupational Health and Safety Administration 57,770 0.5% 0.8%

24 Bureau of the Fiscal Service 98,073 0.9% 0.7%

25 Centers for Medicare and Medicaid Services 78,361 0.7% 0.7%

26 Military Entrance Processing Station 56,931 0.5% 0.7%

27 Department of Housing and Urban Development 82,497 0.7% 0.6%

28 Environmental Protection Agency 43,232 0.4% 0.6%

29 Department of the Army 228,108 2.0% 0.6%

30 General Services Administration 20,535 0.2% 0.4%

31 Bureau of Prisons 51,138 0.4% 0.4%

32 Food and Drug Administration 33,398 0.3% 0.3%

33 Department of Defense 31,030 0.3% 0.3%

34 Equal Employment Opportunity Commission 21,439 0.2% 0.2%

35 Small Business Administration 8,575 0.1% 0.1%

36 U.S. Coast Guard 4,064 0.0% 0.0%

37 Department of Labor 6,459 0.1% 0.0%

Subtotal U.S. Government 6,703,781 58.6% 60.6%

Government Properties Income Trust

Supplemental Operating and Financial Data, December 31, 2016