Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CONDUENT Inc | d301413dex991.htm |

| 8-K - FORM 8-K - CONDUENT Inc | d301413d8k.htm |

February 22, 2017 Conduent Q4 & FY 2016 Earnings Results Exhibit 99.2

Forward-Looking Statements This presentation contains “forward-looking statements” that involve risks and uncertainties. These statements can be identified by the fact that they do not relate strictly to historical or current facts, but rather are based on current expectations, estimates, assumptions and projections about the business process outsourcing industry and our business and financial results. Forward-looking statements often include words such as “anticipates,” “estimates,” “expects,” “projects,” “intends,” “plans,” “believes” and words and terms of similar substance in connection with discussions of future operating or financial performance. As with any projection or forecast, forward-looking statements are inherently susceptible to uncertainty and changes in circumstances. Our actual results may vary materially from those expressed or implied in our forward-looking statements. Accordingly, undue reliance should not be placed on any forward-looking statement made by us or on our behalf. Important factors that could cause our actual results to differ materially from those in our forward-looking statements include: •government regulation, economic, strategic, political and social conditions and the following factors; •competitive pressures; •changes in interest in outsourced business process services; •our ability to obtain adequate pricing for our services and to improve our cost structure; •the effects of any acquisitions, joint ventures and divestitures by us; •our ability to attract and retain key employees; •our ability to attract and retain necessary technical personnel and qualified subcontractors and their ability to deliver or perform as expected; •termination right, audits and investigations associated with government contracts; •a decline in revenues from or a loss or failure of significant clients; •our ability to estimate the scope of work or the costs of performance in our contracts; •the failure to comply with laws relating to individually identifiable information and personal health information and laws relating to processing certain financial transactions, including payment card transactions and debit or credit card transactions; •our ability to deliver on our contractual obligations properly and on time; •our ability to renew commercial and government contracts awarded through competitive bidding processes; •increases in the cost of telephone and data services or significant interruptions in such services; •changes in tax and other laws and regulations; •changes in U.S. GAAP or other applicable accounting policies; and Other factors that are set forth in the “Risk Factors” section; the “Legal Proceedings” section, The “Management Discussion and Analysis of Financial Condition and Results of Operations” section and other sections of the Conduent Incorporated Form 10 Registration Statement, as well as in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. This list of important risk factors is not intended to be exhaustive. Conduent is under no obligation to, and expressly disclaims any obligation to, update any forward-looking statements as a result of new information or future events or developments, except as required by law. We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. Any forward-looking statements made by us in this current report speak only as of the date on which they are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements, whether as a result of new information, subsequent events or otherwise. Non-GAAP Financial Measures We have reported our financial results in accordance with U.S. generally accepted accounting principles (GAAP). In addition, we have discussed our financial results using the non-GAAP measures described below consistent with Xerox’s historical presentation. We believe these non-GAAP measures allow investors to better understand the trends in our business and to better understand and compare our results. Accordingly, we believe it is necessary to adjust several reported amounts, determined in accordance with GAAP, to exclude the effects of certain items as well as their related tax effects. Management believes that these non-GAAP financial measures provide an additional means of analyzing the current periods’ results against the corresponding prior periods’ results. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results prepared in accordance with U.S. GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable U.S. GAAP measures and should be read only in conjunction with our Consolidated Combined Financial Statements prepared in accordance with U.S. GAAP. Our management regularly uses our supplemental non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. These non-GAAP measures are among the primary factors management uses in planning for and forecasting future periods. Compensation of our executives is based in part on the performance of our business based on these non-GAAP measures. Also, non-GAAP measures are footnoted, where applicable, in each slide herein. Cautionary Statements

Conduent Focus & Vision Strong client relationships and positioning in the market Invest in people, technology, and processes to remain a market leader Strategic transformation program well underway and on-track Reaffirming financial goals from December investor event

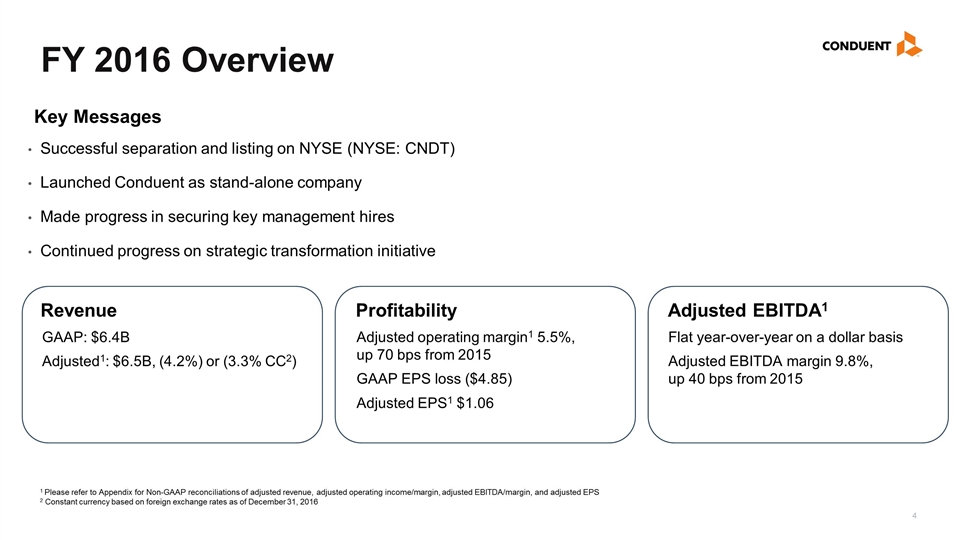

FY 2016 Overview Successful separation and listing on NYSE (NYSE: CNDT) Launched Conduent as stand-alone company Made progress in securing key management hires Continued progress on strategic transformation initiative 1 Please refer to Appendix for Non-GAAP reconciliations of adjusted revenue, adjusted operating income/margin, adjusted EBITDA/margin, and adjusted EPS 2 Constant currency based on foreign exchange rates as of December 31, 2016 GAAP: $6.4B Adjusted1: $6.5B, (4.2%) or (3.3% CC2) Adjusted operating margin1 5.5%, up 70 bps from 2015 GAAP EPS loss ($4.85) Adjusted EPS1 $1.06 Flat year-over-year on a dollar basis Adjusted EBITDA margin 9.8%, up 40 bps from 2015 Revenue Profitability Adjusted EBITDA1 Key Messages

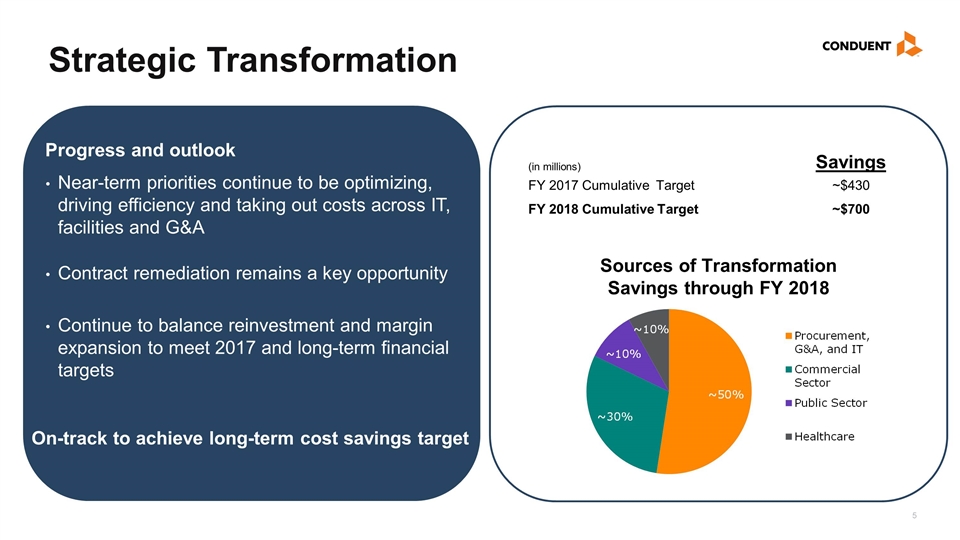

Sources of Transformation Savings through FY 2018 Strategic Transformation Progress and outlook Near-term priorities continue to be optimizing, driving efficiency and taking out costs across IT, facilities and G&A Contract remediation remains a key opportunity Continue to balance reinvestment and margin expansion to meet 2017 and long-term financial targets (in millions) Savings FY 2017 Cumulative Target ~$430 FY 2018 Cumulative Target ~$700 On-track to achieve long-term cost savings target

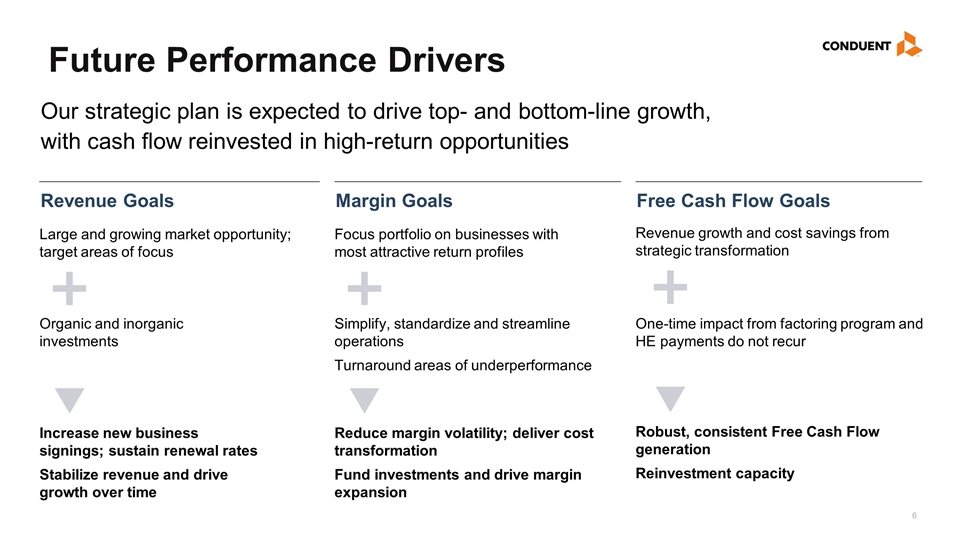

Future Performance Drivers Revenue Goals Margin Goals Large and growing market opportunity; target areas of focus Focus portfolio on businesses with most attractive return profiles Our strategic plan is expected to drive top- and bottom-line growth, with cash flow reinvested in high-return opportunities Organic and inorganic investments Increase new business signings; sustain renewal rates Stabilize revenue and drive growth over time Simplify, standardize and streamline operations Turnaround areas of underperformance Reduce margin volatility; deliver cost transformation Fund investments and drive margin expansion Free Cash Flow Goals Revenue growth and cost savings from strategic transformation One-time impact from factoring program and HE payments do not recur Robust, consistent Free Cash Flow generation Reinvestment capacity

Financials

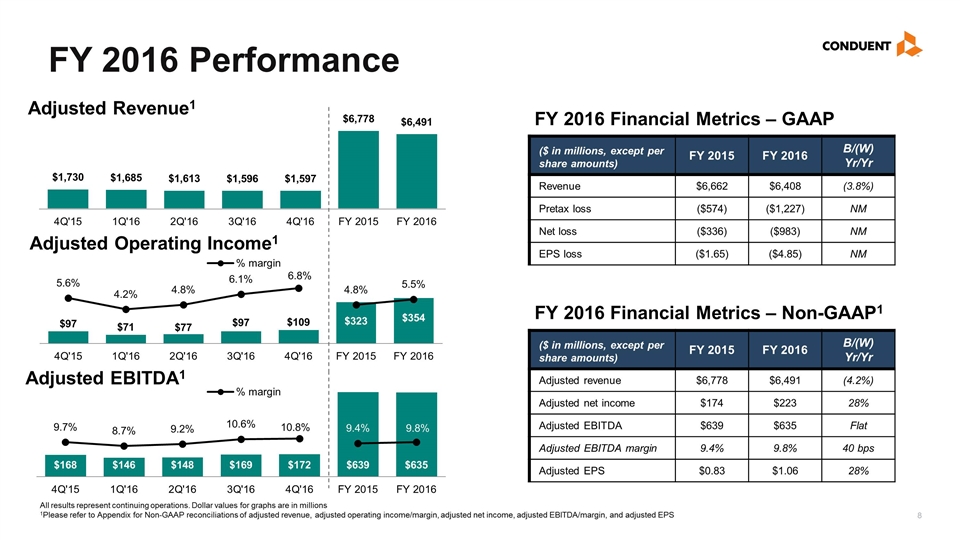

FY 2016 Performance FY 2016 Financial Metrics – GAAP ($ in millions, except per share amounts) FY 2015 FY 2016 B/(W) Yr/Yr Revenue $6,662 $6,408 (3.8%) Pretax loss ($574) ($1,227) NM Net loss ($336) ($983) NM EPS loss ($1.65) ($4.85) NM FY 2016 Financial Metrics – Non-GAAP1 ($ in millions, except per share amounts) FY 2015 FY 2016 B/(W) Yr/Yr Adjusted revenue $6,778 $6,491 (4.2%) Adjusted net income $174 $223 28% Adjusted EBITDA $639 $635 Flat Adjusted EBITDA margin 9.4% 9.8% 40 bps Adjusted EPS $0.83 $1.06 28% Adjusted Operating Income1 Adjusted Revenue1 Adjusted EBITDA1 All results represent continuing operations. Dollar values for graphs are in millions 1Please refer to Appendix for Non-GAAP reconciliations of adjusted revenue, adjusted operating income/margin, adjusted net income, adjusted EBITDA/margin, and adjusted EPS

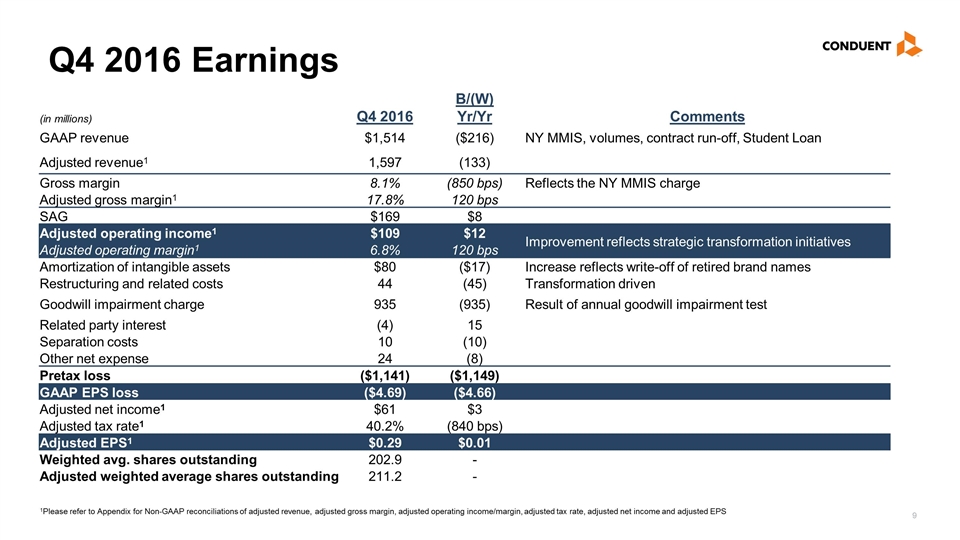

Q4 2016 Earnings 1Please refer to Appendix for Non-GAAP reconciliations of adjusted revenue, adjusted gross margin, adjusted operating income/margin, adjusted tax rate, adjusted net income and adjusted EPS Adjusted Operating margin 5.4%, up 60 bps from 2015 GAAP EPS ($4.85) Adj. EPS $1.06 (in millions) Q4 2016 B/(W) Yr/Yr Comments GAAP revenue $1,514 ($216) NY MMIS, volumes, contract run-off, Student Loan Adjusted revenue1 1,597 (133) Gross margin 8.1% (850 bps) Reflects the NY MMIS charge Adjusted gross margin1 17.8% 120 bps SAG $169 $8 Adjusted operating income1 $109 $12 Improvement reflects strategic transformation initiatives Adjusted operating margin1 6.8% 120 bps Amortization of intangible assets $80 ($17) Increase reflects write-off of retired brand names Restructuring and related costs 44 (45) Transformation driven Goodwill impairment charge 935 (935) Result of annual goodwill impairment test Related party interest (4) 15 Separation costs 10 (10) Other net expense 24 (8) Pretax loss ($1,141) ($1,149) GAAP EPS loss ($4.69) ($4.66) Adjusted net income1 $61 $3 Adjusted tax rate1 40.2% (840 bps) Adjusted EPS1 $0.29 $0.01 Weighted avg. shares outstanding 202.9 - Adjusted weighted average shares outstanding 211.2 -

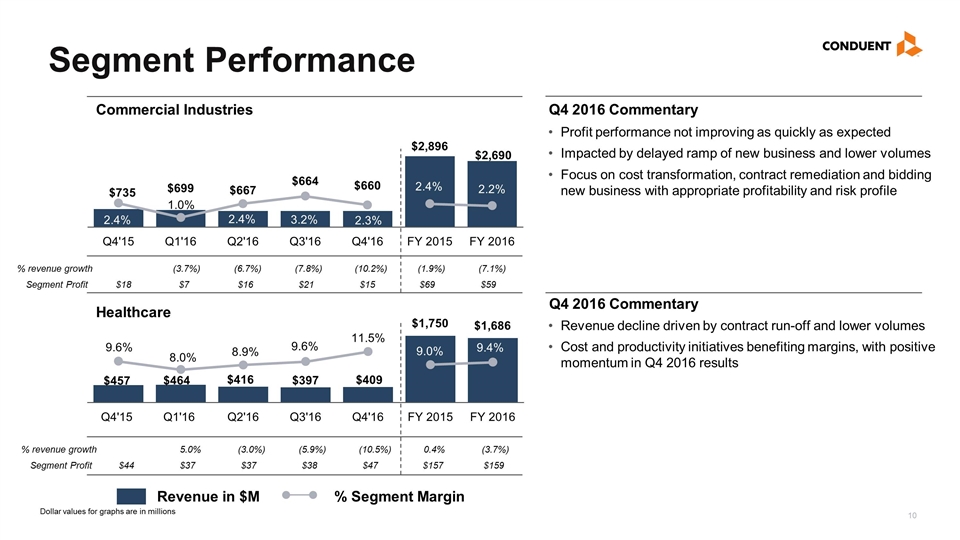

Segment Performance Revenue in $M % Segment Margin Q4 2016 Commentary Profit performance not improving as quickly as expected Impacted by delayed ramp of new business and lower volumes Focus on cost transformation, contract remediation and bidding new business with appropriate profitability and risk profile Revenue decline driven by contract run-off and lower volumes Cost and productivity initiatives benefiting margins, with positive momentum in Q4 2016 results Q4 2016 Commentary Dollar values for graphs are in millions Commercial Industries Healthcare % revenue growth (3.7%) (6.7%) (7.8%) (10.2%) (1.9%) (7.1%) Segment Profit $18 $7 $16 $21 $15 $69 $59 % revenue growth 5.0% (3.0%) (5.9%) (10.5%) 0.4% (3.7%) Segment Profit $44 $37 $37 $38 $47 $157 $159

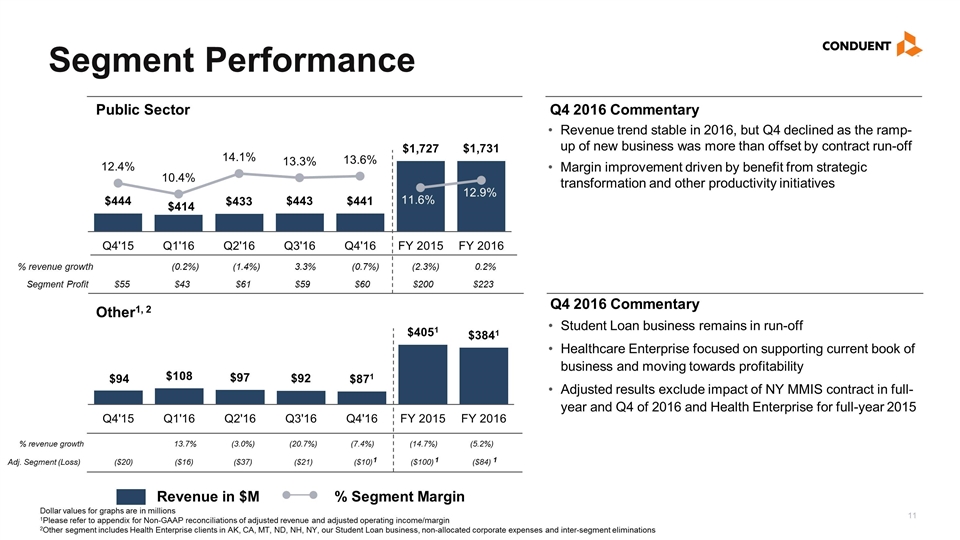

Segment Performance Dollar values for graphs are in millions 1Please refer to appendix for Non-GAAP reconciliations of adjusted revenue and adjusted operating income/margin 2Other segment includes Health Enterprise clients in AK, CA, MT, ND, NH, NY, our Student Loan business, non-allocated corporate expenses and inter-segment eliminations Q4 2016 Commentary Revenue trend stable in 2016, but Q4 declined as the ramp-up of new business was more than offset by contract run-off Margin improvement driven by benefit from strategic transformation and other productivity initiatives Public Sector Other1, 2 Student Loan business remains in run-off Healthcare Enterprise focused on supporting current book of business and moving towards profitability Adjusted results exclude impact of NY MMIS contract in full-year and Q4 of 2016 and Health Enterprise for full-year 2015 Q4 2016 Commentary Revenue in $M % Segment Margin 1 1 1 % revenue growth (0.2%) (1.4%) 3.3% (0.7%) (2.3%) 0.2% Segment Profit $55 $43 $61 $59 $60 $200 $223 % revenue growth 13.7% (3.0%) (20.7%) (7.4%) (14.7%) (5.2%) Adj. Segment (Loss) ($20) ($16) ($37) ($21) ($10) ($100) ($84)

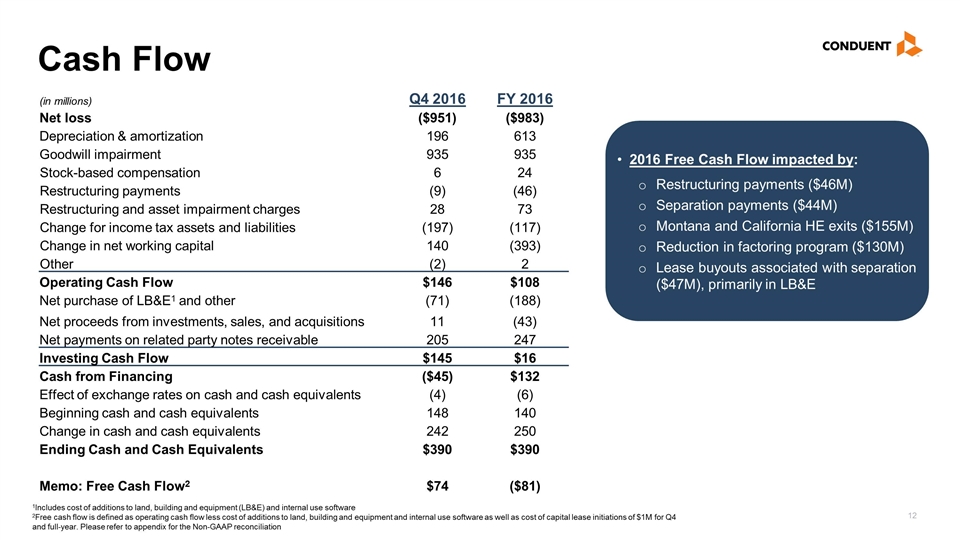

2016 Free Cash Flow impacted by: Restructuring payments ($46M) Separation payments ($44M) Montana and California HE exits ($155M) Reduction in factoring program ($130M) Lease buyouts associated with separation ($47M), primarily in LB&E Cash Flow (in millions) Q4 2016 FY 2016 Net loss ($951) ($983) Depreciation & amortization 196 613 Goodwill impairment 935 935 Stock-based compensation 6 24 Restructuring payments (9) (46) Restructuring and asset impairment charges 28 73 Change for income tax assets and liabilities (197) (117) Change in net working capital 140 (393) Other (2) 2 Operating Cash Flow $146 $108 Net purchase of LB&E1 and other (71) (188) Net proceeds from investments, sales, and acquisitions 11 (43) Net payments on related party notes receivable 205 247 Investing Cash Flow $145 $16 Cash from Financing ($45) $132 Effect of exchange rates on cash and cash equivalents (4) (6) Beginning cash and cash equivalents 148 140 Change in cash and cash equivalents 242 250 Ending Cash and Cash Equivalents $390 $390 Memo: Free Cash Flow2 $74 ($81) 1Includes cost of additions to land, building and equipment (LB&E) and internal use software 2Free cash flow is defined as operating cash flow less cost of additions to land, building and equipment and internal use software as well as cost of capital lease initiations of $1M for Q4 and full-year. Please refer to appendix for the Non-GAAP reconciliation

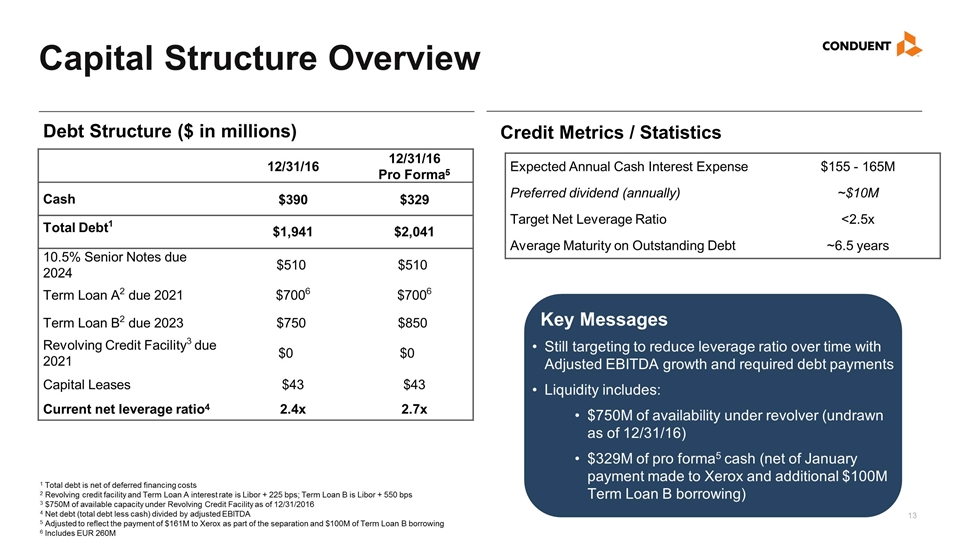

12/31/16 12/31/16 Pro Forma5 Cash $390 $329 Total Debt1 $1,941 $2,041 10.5% Senior Notes due 2024 $510 $510 Term Loan A2 due 2021 $7006 $7006 Term Loan B2 due 2023 $750 $850 Revolving Credit Facility3 due 2021 $0 $0 Capital Leases $43 $43 Current net leverage ratio4 2.4x 2.7x Capital Structure Overview Debt Structure ($ in millions) 1 Total debt is net of deferred financing costs 2 Revolving credit facility and Term Loan A interest rate is Libor + 225 bps; Term Loan B is Libor + 550 bps 3 $750M of available capacity under Revolving Credit Facility as of 12/31/2016 4 Net debt (total debt less cash) divided by adjusted EBITDA 5 Adjusted to reflect the payment of $161M to Xerox as part of the separation and $100M of Term Loan B borrowing 6 Includes EUR 260M Credit Metrics / Statistics Expected Annual Cash Interest Expense $155 - 165M Preferred dividend (annually) ~$10M Target Net Leverage Ratio <2.5x Average Maturity on Outstanding Debt ~6.5 years Key Messages Still targeting to reduce leverage ratio over time with Adjusted EBITDA growth and required debt payments Liquidity includes: $750M of availability under revolver (undrawn as of 12/31/16) $329M of pro forma5 cash (net of January payment made to Xerox and additional $100M Term Loan B borrowing)

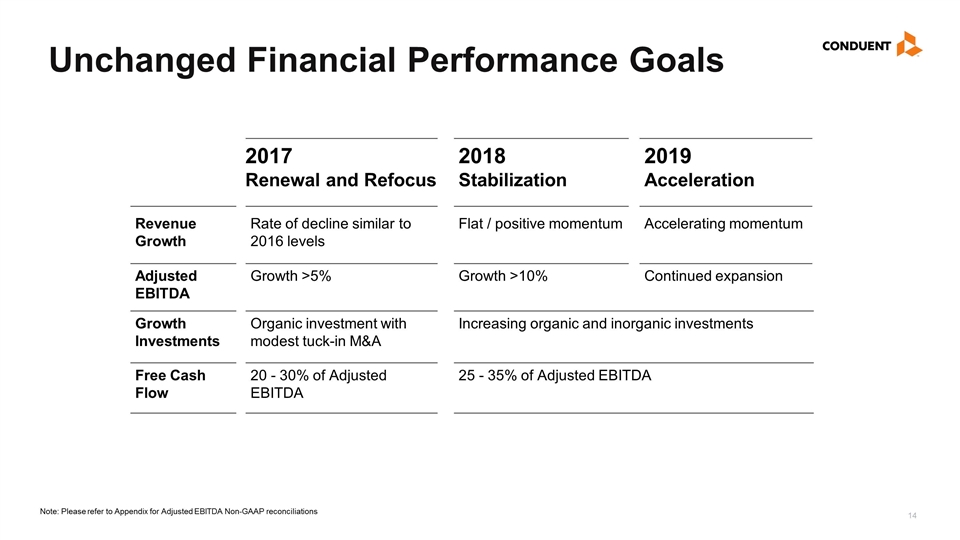

Unchanged Financial Performance Goals 2017 Renewal and Refocus 2018 Stabilization 2019 Acceleration Rate of decline similar to 2016 levels Flat / positive momentum Accelerating momentum Organic investment with modest tuck-in M&A Increasing organic and inorganic investments 20 - 30% of Adjusted EBITDA 25 - 35% of Adjusted EBITDA Revenue Growth Adjusted EBITDA Growth Investments Free Cash Flow Growth >5% Growth >10% Continued expansion Note: Please refer to Appendix for Adjusted EBITDA Non-GAAP reconciliations

Q&A

Appendix

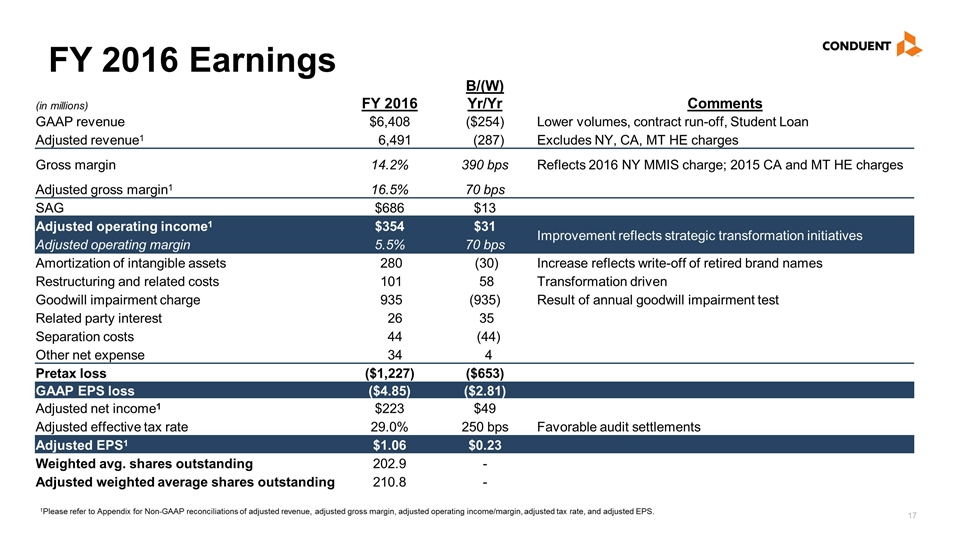

FY 2016 Earnings (in millions) FY 2016 B/(W) Yr/Yr Comments GAAP revenue $6,408 ($254) Lower volumes, contract run-off, Student Loan Adjusted revenue1 6,491 (287) Excludes NY, CA, MT HE charges Gross margin 14.2% 390 bps Reflects 2016 NY MMIS charge; 2015 CA and MT HE charges Adjusted gross margin1 16.5% 70 bps SAG $686 $13 Adjusted operating income1 $354 $31 Improvement reflects strategic transformation initiatives Adjusted operating margin 5.5% 70 bps Amortization of intangible assets 280 (30) Increase reflects write-off of retired brand names Restructuring and related costs 101 58 Transformation driven Goodwill impairment charge 935 (935) Result of annual goodwill impairment test Related party interest 26 35 Separation costs 44 (44) Other net expense 34 4 Pretax loss ($1,227) ($653) GAAP EPS loss ($4.85) ($2.81) Adjusted net income1 $223 $49 Adjusted effective tax rate 29.0% 250 bps Favorable audit settlements Adjusted EPS1 $1.06 $0.23 Weighted avg. shares outstanding 202.9 - Adjusted weighted average shares outstanding 210.8 - 1Please refer to Appendix for Non-GAAP reconciliations of adjusted revenue, adjusted gross margin, adjusted operating income/margin, adjusted tax rate, and adjusted EPS.

Non-GAAP Financial Measures We have reported our financial results in accordance with U.S. generally accepted accounting principles (GAAP). In addition, we have discussed our financial results using the non-GAAP measures described below, consistent with Xerox’s historical presentation. We believe these non-GAAP measures allow investors to better understand the trends in our business and to better understand and compare our results. Accordingly, we believe it is necessary to adjust several reported amounts, determined in accordance with GAAP, to exclude the effects of certain items as well as their related tax effects. Management believes that these non-GAAP financial measures provide an additional means of analyzing the current periods’ results against the corresponding prior periods’ results. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results prepared in accordance with U.S. GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable U.S. GAAP measures and should be read only in conjunction with our Consolidated Financial Statements prepared in accordance with U.S. GAAP. Our management regularly uses our supplemental non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. These non-GAAP measures are among the primary factors management uses in planning for and forecasting future periods. Compensation of our executives is based in part on the performance of our business based on these non-GAAP measures. Also, non-GAAP measures are footnoted, where applicable in each slide herein. These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results prepared in accordance with GAAP. A reconciliation of the following Non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP are set forth as part of the Appendix to this presentation. In connection with the preparation of our financial statements for the fiscal year ended December 31, 2016, during the fourth quarter, we performed our annual goodwill impairment test. Following the completion of the impairment test, we determined that we will record a non-cash goodwill impairment charge of $935 million (approximately $828 million after-tax or ($4.08) per share) in our Commercial Sector reporting unit. Subsequent to the goodwill impairment charge, the Commercial Sector reporting unit’s goodwill balance is approximately $908 million. This non-cash charge is attributable primarily to weaker than expected Commercial Sector revenues and operating profits, including in the fourth quarter of 2016. We do not expect to make any current or future cash expenditures as a result of this impairment. We are in discussions with the State of New York regarding the status and scope of the Health Enterprise platform project, which evolved to include options to not fully complete the project. Based on those discussions, we believe it is probable that we will not fully complete the implementation of the platform in New York. As a result of these developments, we will record a pre-tax charge of approximately $161 million (approximately $98 million after-tax or ($0.48) per share) in our fourth-quarter 2016 results reflecting estimated asset impairments, wind down costs and other impacts from this project. The charge includes approximately $115 million for the write-off of receivables and other related assets and non-cash impairment charges, with the remainder of the charge expected to be cash outflows in future quarters for wind down and related costs. Late in the third quarter of 2015, we determined that we would not fully complete Health Enterprise Medicaid platform implementation projects in California and Montana and recorded a charge of $389 million. The charge included a $116 million reduction to revenues with the remaining $273 million recorded to costs of outsourcing. The remainder of the charge was primarily related to settlement costs including payments to subcontractors that would result in cash outflows in future quarters As a result of the significant impact of the Goodwill Impairment, NY MMIS Charge and HE Charge on our reported revenues, costs and expenses as well as key metrics for the period, we discuss our 2016 and 2015 results using non-GAAP financial measures that exclude the impact of these items, as discussed below. Adjusted Net Income (Loss), Adjusted Earnings per Share, and Adjusted Effective Tax Rate. We make adjustments to Income (Loss) before Income Taxes for the following items, for the purpose of calculating Adjusted Net Income (Loss), Adjusted Earnings per Share, and Adjusted Effective Tax Rate. In 2016, we adjusted Income (Loss) before Income Taxes for the Goodwill Impairment charge of $935 million recorded during the fourth quarter 2016. Non-GAAP Financial Measures

Also in 2016, we adjusted Income (Loss) before Income Taxes for the New York Health Enterprise (NY MMIS) charge of $161 million recorded during the fourth quarter 2016. In 2015, we adjusted Income (Loss) before Income Taxes for the Health Enterprise (HE) charge of $389 million recorded during the third quarter 2015. In addition to the items discussed above, for the quarter and full year ended December 31, 2016 and 2015 we Adjusted Net Income (Loss), Earnings per Share and Effective Tax Rate for the following items: Amortization of intangible assets. The amortization of intangible assets is driven by acquisition activity, which can vary in size, nature and timing as compared to other companies within our industry and from period to period. Restructuring and related costs. Restructuring and related costs include restructuring and asset impairment charges as well as costs associated with our Strategic Transformation program. Separation costs. Separation costs are expenses incurred in connection with separation from Xerox Corporation into a separate, independent, publicly traded company. Separation costs primarily relate to third-party investment banking, accounting, legal, consulting and other similar types of services related to the separation transaction as well as costs associated with the operational separation of the two companies. Other expenses, net, excluding third party interest expense. Other expenses, net includes losses (gains) on sales of businesses and assets, currency (gains) losses, net, litigation matters and all other expenses, net. Adjusted Revenue, Costs and Expenses and Margin – Adjusted Operating Income. We make adjustments to Revenue, Costs and Expenses and Margin for the following items, for the purpose of calculating Adjusted Operating Income. In 2016, we adjusted Income (Loss) before Income Taxes for the Goodwill Impairment charge of $935 million recorded during the fourth quarter 2016. As a result of the nature and the significant impact of the NY MMIS and HE charges on our reported revenues, costs and expenses, as well as key metrics for the period, we discussed our 2016 and 2015 Adjusted Operating Income after excluding the impact of the NY MMIS and HE charges. In 2016, we Adjusted Operating Income by adjusting Income (Loss) before Income Taxes for the fourth quarter NY MMIS charge of $161 million, which included an $83 million reduction in revenues. In 2015, we Adjusted Operating Income by adjusting Income (Loss) before Income Taxes for the third quarter HE charge of $389 million, which included a $116 million reduction in revenues. In addition to the items discussed above, for the three months and year ended December 31, 2016 and 2015 we Adjusted Operating Income for the following items: As defined above in Adjusted Net Income (Loss), Adjusted Earnings per Share, and Adjusted Effective Tax Rate: Amortization of intangible assets. Restructuring and related costs. Separation costs. We also adjust Operating Income for: Related Party Interest. Includes interest payments to former parent. Other expenses, net. Including third party interest, losses (gains) on sales of businesses and assets, currency (gains) losses, net, litigation matters and all other expenses, net. Adjusted Revenues As a result of the nature and the significant impact of the NY MMIS and HE charges on our reported revenues, we discussed our 2016 and 2015 revenues excluding the impact of the NY MMIS and HE charges. For the fourth quarter and full year 2016, we reduced revenues by $83 million for NY MMIS. For the third quarter and full year 2015, we reduced revenues by $116 million to reflect the reduction in HE revenues. Non-GAAP Financial Measures

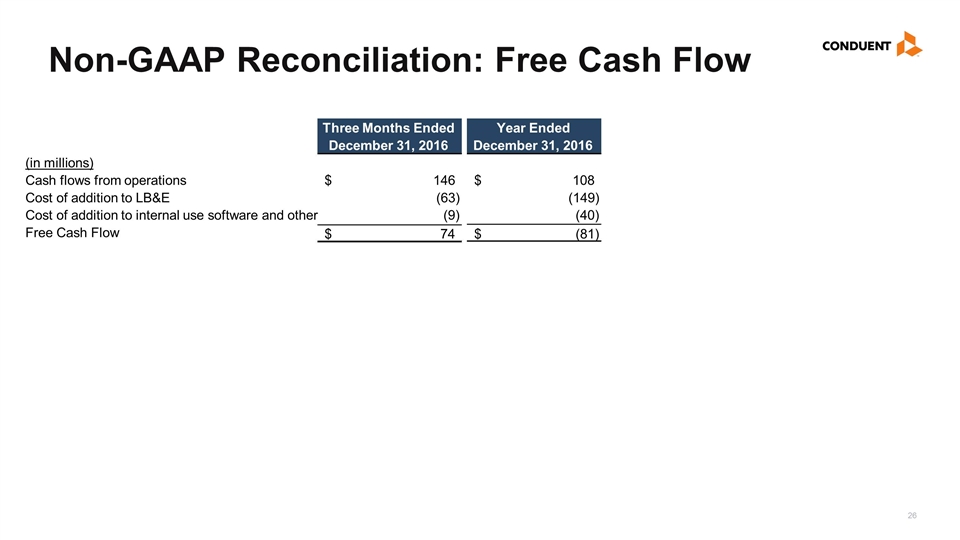

Adjusted EBITDA We use Adjusted EBITDA to provide additional information that is useful to understand the financial covenants contained in the Company’s credit facility and indenture. We also use Adjusted EBITDA as an additional way of assessing certain aspects of our operations that, when viewed with the GAAP results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of our core business. Adjusted EBITDA represents Income (loss) before Income Taxes adjusted for the following items: As defined above in Adjusted Net Income (Loss), Adjusted Earnings per Share, and Adjusted Effective Tax Rate section or Adjusted Revenue, Costs and Expenses and Margin – Adjusted Operating Income section: The fourth quarter of 2016 Goodwill Impairment Charge and NY MMIS charge. The third quarter 2015 HE charge. Amortization of intangible assets. Restructuring and related costs. Separation costs. Related Party Interest. Includes interest payments to former parent. Other expenses, net. Including third party interest, losses (gains) on sales of businesses and assets, currency (gains) losses, net, litigation matters and all other expenses, net. We also adjust EBITDA for: Depreciation NY MMIS depreciation HE amortization Adjusted EBITDA is not intended to represent cash flows from operations, operating income (loss) or net income (loss) as defined by U.S. GAAP as indicators of operating performance and are not necessarily comparable to similarly-titled measures reported by other companies. Management cautions that amounts presented in accordance with Conduent’s definition Adjusted EBITDA may not be comparable to similar measures disclosed by other companies because not all companies calculate Adjusted EBITDA in the same manner. Adjusted Other Segment Revenue and Profit As a result of the nature and the significant impact of the NY MMIS and HE charges on our Other Segment Revenue and Profit, we discuss Other Segment Revenue and Profit excluding the impact of the NY MMIS and HE charges. In 2016, we adjusted Other Segment by adjusting for the fourth quarter NY MMIS charge of $161 million, which included an $83 million reduction in revenues. In 2015, we Adjusted Other Segment by adjusting for the third quarter HE charge of $389 million, which included a $116 million reduction in revenues. Free Cash Flow Free Cash Flow is defined as cash flows from operating activities as reported on the consolidated statement of cash flows, less cost of additions to land, buildings and equipment, cost of additions to internal use software and capital lease additions, plus proceed from sales of land, building and equipment. We use the non-GAAP measure of Free Cash Flow as a criterion of liquidity and performance-based components of employee compensation. We use Free Cash Flow as a measure of liquidity to determine amounts we can reinvest in our core businesses, such as amounts available to make acquisitions, invest in land, buildings and equipment and internal use software, make principal payments on debt, or amounts we can return to our stockholders through dividends and/or stock repurchases. In order to provide a meaningful basis for comparison, we are providing information with respect to our Free Cash Flow for the three months and year ended December 31, 2016, reconciled for each such period to cash flow provided by operating activities, which we believe to be the most directly comparable measure under GAAP. Constant Currency To better understand trends in our business, we believe that it is helpful to adjust revenue to exclude the impact of changes in the translation of foreign currencies into U.S. Dollars. We refer to this adjusted revenue as “constant currency.” Currency impact can be determined as the difference between actual growth rates and constant currency growth rates. Non-GAAP Financial Measures

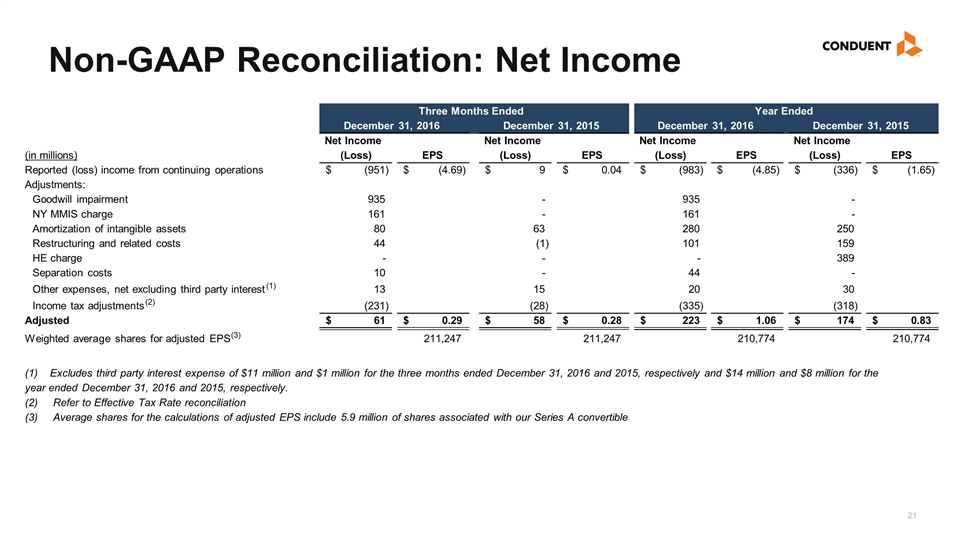

Non-GAAP Reconciliation: Net Income (in millions) Net Income (Loss) EPS Net Income (Loss) EPS Net Income (Loss) EPS Net Income (Loss) EPS Reported (loss) income from continuing operations (951) $ (4.69) $ 9 $ 0.04 $ (983) $ (4.85) $ (336) $ (1.65) $ Adjustments: Goodwill impairment 935 - 935 - NY MMIS charge 161 - 161 - Amortization of intangible assets 80 63 280 250 Restructuring and related costs 44 (1) 101 159 HE charge - - - 389 Separation costs 10 - 44 - Other expenses, net excluding third party interest (1) 13 15 20 30 Income tax adjustments (2) (231) (28) (335) (318) Adjusted 61 $ 0.29 $ 58 $ 0.28 $ 223 $ 1.06 $ 174 $ 0.83 $ Weighted average shares for adjusted EPS (3) 211,247 211,247 210,774 210,774 Year Ended December 31, 2016 December 31, 2015 Three Months Ended (3) Average shares for the calculations of adjusted EPS include 5.9 million of shares associated with our Series A convertible (2) Refer to Effective Tax Rate reconciliation (1) Excludes third party interest expense of $11 million and $1 million for the three months ended December 31, 2016 and 2015, respectively and $14 million and $8 million for the year ended December 31, 2016 and 2015, respectively. December 31, 2016 December 31, 2015

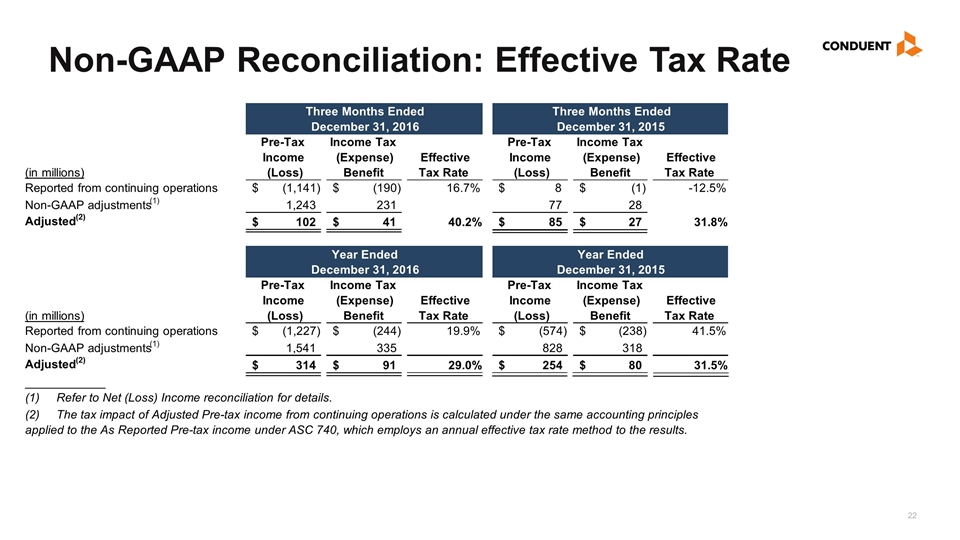

Non-GAAP Reconciliation: Effective Tax Rate (in millions) Pre-Tax Income (Loss) Income Tax (Expense) Benefit Effective Tax Rate Pre-Tax Income (Loss) Income Tax (Expense) Benefit Effective Tax Rate Reported from continuing operations (1,141) $ (190) $ 16.7% 8 $ (1) $ -12.5% Non-GAAP adjustments (1) 1,243 231 77 28 Adjusted (2) 102 $ 41 $ 40.2% 85 $ 27 $ 31.8% (in millions) Pre-Tax Income (Loss) Income Tax (Expense) Benefit Effective Tax Rate Pre-Tax Income (Loss) Income Tax (Expense) Benefit Effective Tax Rate Reported from continuing operations (1,227) $ (244) $ 19.9% (574) $ (238) $ 41.5% Non-GAAP adjustments (1) 1,541 335 828 318 Adjusted (2) 314 $ 91 $ 29.0% 254 $ 80 $ 31.5% ____________ (1) Refer to Net (Loss) Income reconciliation for details. December 31, 2016 December 31, 2015 (2) The tax impact of Adjusted Pre-tax income from continuing operations is calculated under the same accounting principles applied to the As Reported Pre-tax income under ASC 740, which employs an annual effective tax rate method to the results. Three Months Ended Three Months Ended December 31, 2016 December 31, 2015 Year Ended Year Ended

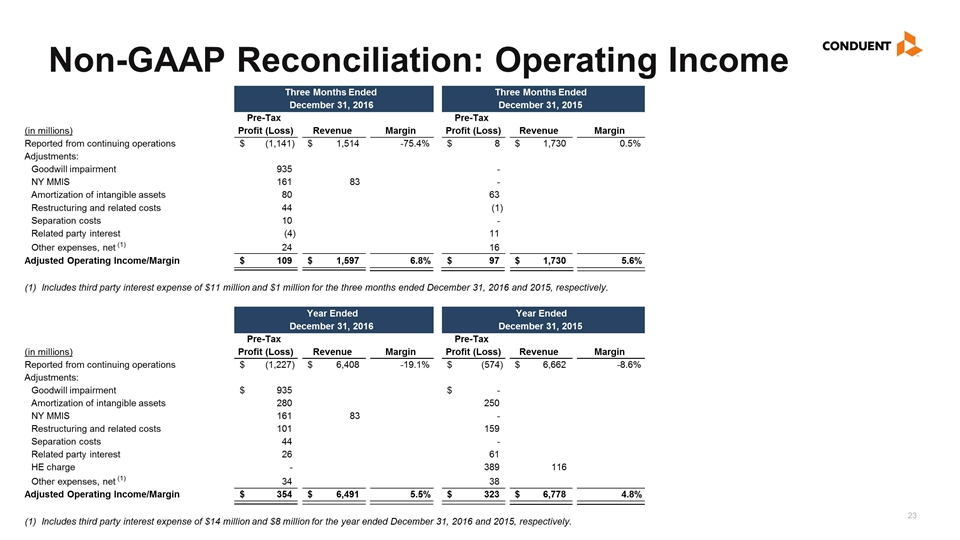

Non-GAAP Reconciliation: Operating Income (in millions) Pre-Tax Profit (Loss) Revenue Margin Pre-Tax Profit (Loss) Revenue Margin Reported from continuing operations (1,141) $ 1,514 $ -75.4% 8 $ 1,730 $ 0.5% Adjustments: Goodwill impairment 935 - NY MMIS 161 83 - Amortization of intangible assets 80 63 Restructuring and related costs 44 (1) Separation costs 10 - Related party interest (4) 11 Other expenses, net (1) 24 16 Adjusted Operating Income/Margin 109 $ 1,597 $ 6.8% 97 $ 1,730 $ 5.6% (in millions) Pre-Tax Profit (Loss) Revenue Margin Pre-Tax Profit (Loss) Revenue Margin Reported from continuing operations (1,227) $ 6,408 $ -19.1% (574) $ 6,662 $ -8.6% Adjustments: Goodwill impairment 935 $ - $ Amortization of intangible assets 280 250 NY MMIS 161 83 - Restructuring and related costs 101 159 Separation costs 44 - Related party interest 26 61 HE charge - 389 116 Other expenses, net (1) 34 38 Adjusted Operating Income/Margin 354 $ 6,491 $ 5.5% 323 $ 6,778 $ 4.8% (1) Includes third party interest expense of $14 million and $8 million for the year ended December 31, 2016 and 2015, respectively. December 31, 2016 December 31, 2015 Three Months Ended Three Months Ended December 31, 2016 December 31, 2015 Year Ended Year Ended (1) Includes third party interest expense of $11 million and $1 million for the three months ended December 31, 2016 and 2015, respectively.

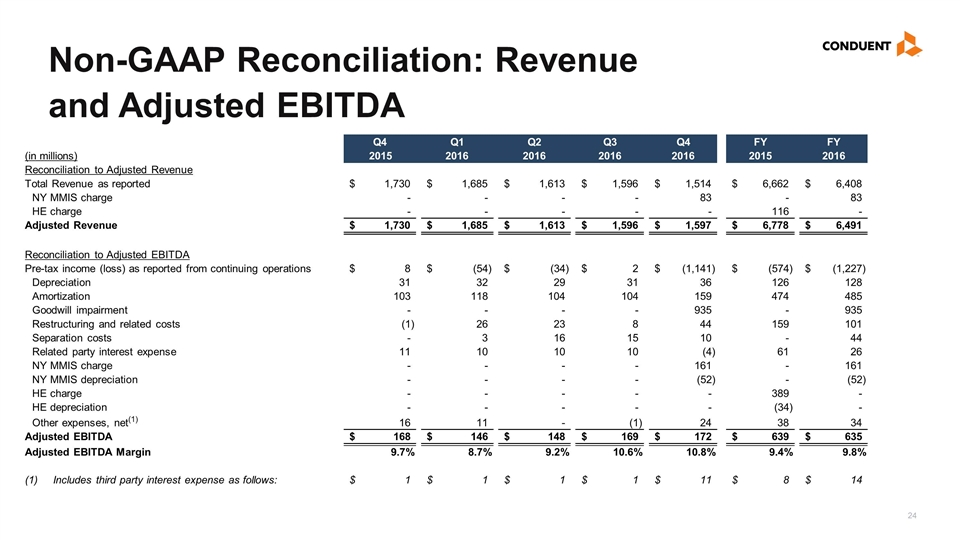

Non-GAAP Reconciliation: Revenue and Adjusted EBITDA Q4 Q1 Q2 Q3 Q4 FY FY (in millions) 2015 2016 2016 2016 2016 2015 2016 Reconciliation to Adjusted Revenue Total Revenue as reported 1,730 $ 1,685 $ 1,613 $ 1,596 $ 1,514 $ 6,662 $ 6,408 $ NY MMIS charge - - - - 83 - 83 HE charge - - - - - 116 - Adjusted Revenue 1,730 $ 1,685 $ 1,613 $ 1,596 $ 1,597 $ 6,778 $ 6,491 $ Reconciliation to Adjusted EBITDA Pre-tax income (loss) as reported from continuing operations 8 $ (54) $ (34) $ 2 $ (1,141) $ (574) $ (1,227) $ Depreciation 31 32 29 31 36 126 128 Amortization 103 118 104 104 159 474 485 Goodwill impairment - - - - 935 - 935 Restructuring and related costs (1) 26 23 8 44 159 101 Separation costs - 3 16 15 10 - 44 Related party interest expense 11 10 10 10 (4) 61 26 NY MMIS charge - - - - 161 - 161 NY MMIS depreciation - - - - (52) - (52) HE charge - - - - - 389 - HE depreciation - - - - - (34) - Other expenses, net (1) 16 11 - (1) 24 38 34 Adjusted EBITDA 168 $ 146 $ 148 $ 169 $ 172 $ 639 $ 635 $ Adjusted EBITDA Margin 9.7% 8.7% 9.2% 10.6% 10.8% 9.4% 9.8% (1) Includes third party interest expense as follows: 1 $ 1 $ 1 $ 1 $ 11 $ 8 $ 14 $

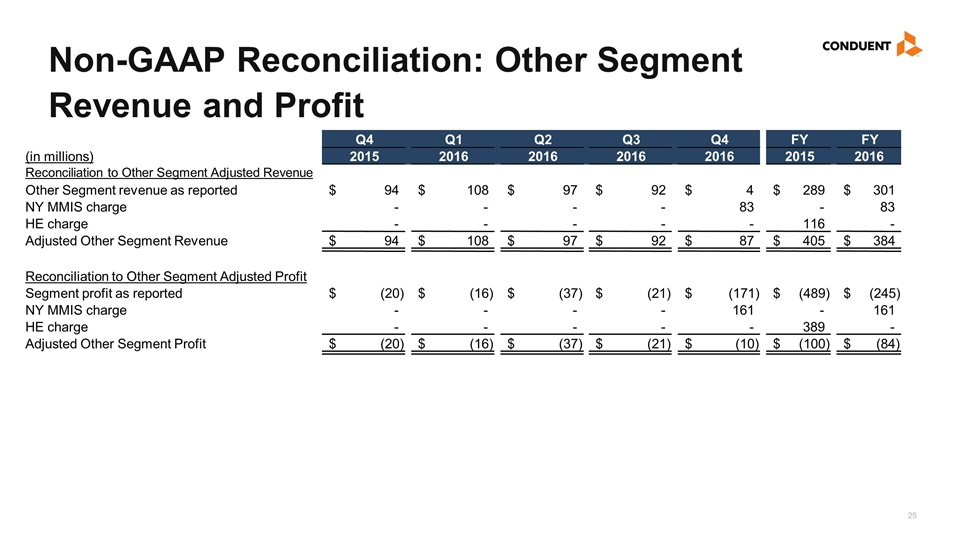

Non-GAAP Reconciliation: Other Segment Revenue and Profit Q4 Q1 Q2 Q3 Q4 FY FY (in millions) 2015 2016 2016 2016 2016 2015 2016 Reconciliation to Other Segment Adjusted Revenue Other Segment revenue as reported 94 $ 108 $ 97 $ 92 $ 4 $ 289 $ 301 $ NY MMIS charge - - - - 83 - 83 HE charge - - - - - 116 - Adjusted Other Segment Revenue 94 $ 108 $ 97 $ 92 $ 87 $ 405 $ 384 $ Reconciliation to Other Segment Adjusted Profit Segment profit as reported (20) $ (16) $ (37) $ (21) $ (171) $ (489) $ (245) $ NY MMIS charge - - - - 161 - 161 HE charge - - - - - 389 - Adjusted Other Segment Profit (20) $ (16) $ (37) $ (21) $ (10) $ (100) $ (84) $

Non-GAAP Reconciliation: Free Cash Flow Three Months Ended Year Ended December 31, 2016 December 31, 2016 (in millions) Cash flows from operations 146 $ 108 $ Cost of addition to LB&E (63) (149) Cost of addition to internal use software and other (9) (40) Free Cash Flow 74 $ (81) $