Attached files

| file | filename |

|---|---|

| 8-K - Millennium Investment & Acquisition Co Inc. | form8-k.htm |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 1. | Reporting entity |

SMC Global Securities Limited (the “Parent Company”) together with its subsidiaries (collectively, “the Company” or “the Group”) offers its customers a wide range of services across different business segments. The Parent Company’s shares are listed on the Ahmedabad Stock Exchange and Calcutta Stock Exchange in India.

The Group provides the following range of services as mentioned below:

Trading and distribution services includes brokerage services (in equity, derivative, commodity and currency segments on various stock exchanges in India and abroad), clearing services, depository participant services, insurance broking services and distribution of financial products such as mutual funds and initial public offerings financing.

The Group also engages in proprietary transactions in equity securities, commodities, currencies and derivative. Such trading activities are entered primarily to capitalize on the pricing inefficiencies in equity, commodity and currency markets. These trades are executed in identical or similar financial instruments, on different markets or in different but analogous forms, such that the positions are generally hedged.

Financing business services offer a variety of loan products such as capital market loans and real estate loans primarily to individuals, affiliated entities and commercial clients.

Advisory services comprises portfolio and wealth management, mortgage and loan advisory, real estate advisory and investment banking services which advises middle class to high net worth individuals.

The Parent Company is a limited liability company incorporated in the year 1994 and domiciled in India. The registered address of the Parent Company is 11/6B, Shanti Chamber, Pusa Road, Delhi-110005.

| 2. | Basis of preparation |

| (a) | Statement of compliance |

These interim condensed consolidated financial statements (referred to as ‘Condensed Consolidated Financial Statements’) have been prepared in accordance with IAS 34 ,“Interim Financial Reporting” and should be read in conjunction with the Group’s last annual consolidated financial statements as at and for the year ended 31 March 2016 (‘last annual financials statements’). These Condensed Consolidated Financial Statements as at September 30, 2016 and for the six months ended September 30, 2016 comprise Parent Company together with its subsidiaries (Collectively “the Company” or “the Group”). They do not include all of the information required for a complete set of IFRS financial statements. However, selected explanatory notes are included to explain the events and transactions that are significant to an understanding of the changes in the Group’s financial position and performance since the last annual financial statements.

These Condensed Consolidated Financial Statements were authorized for the issue by the Company’s Audit Committee on January 13, 2017.

The accounting policies adopted in the preparation of the Condensed Consolidated Financial Statements are consistent with those followed in the preparation of the Group’s last annual Financial Statements except the following.

| 6 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

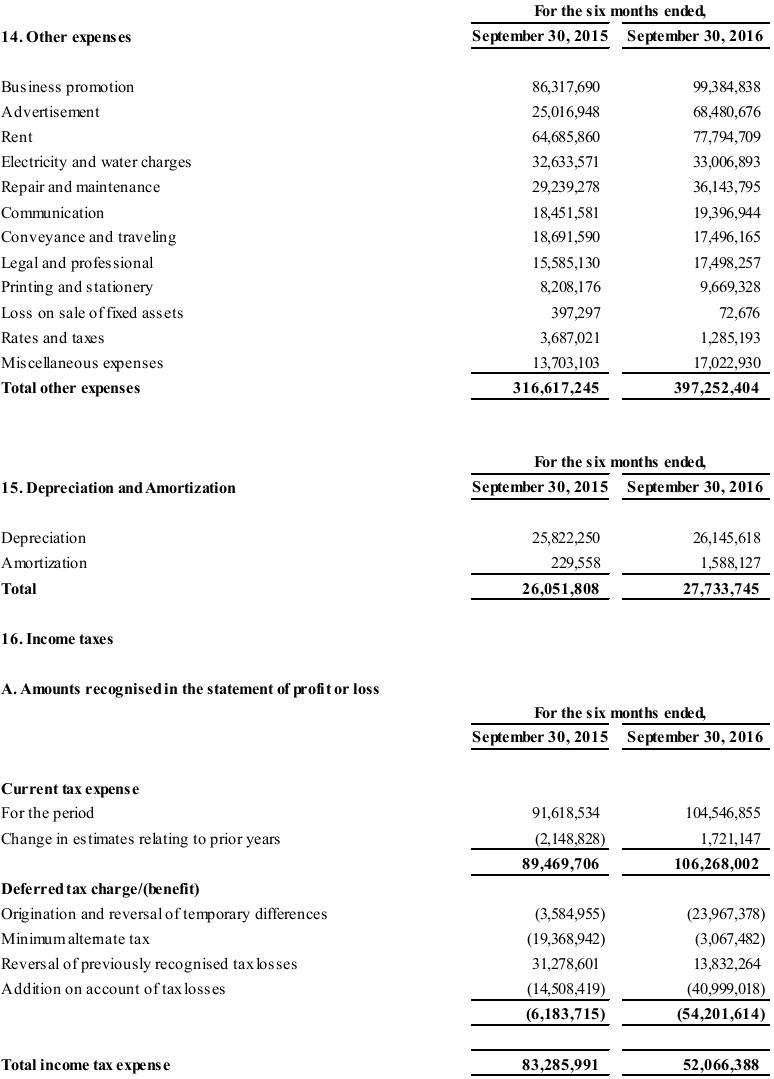

Income tax expense

Income tax expense comprises current and deferred taxes. Current and deferred tax expense is recognized in the Statement of Profit or Loss except to the extent that it relates to a business combination, or items recognized directly in equity or Other Comprehensive Income (OCI), in which case it is recognized in equity or in OCI.

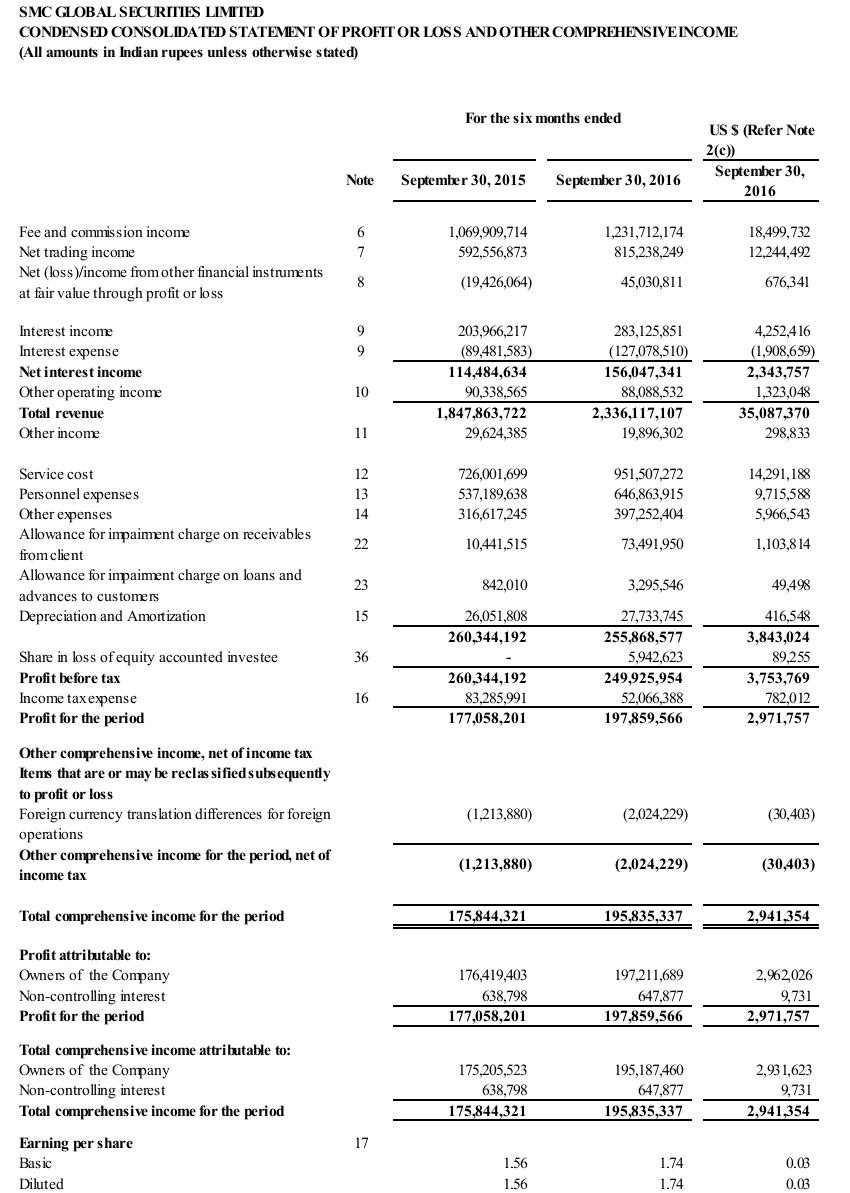

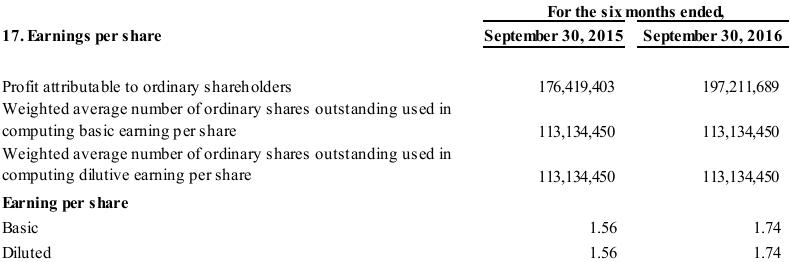

The Group calculates the period income tax expense using the tax rate that would be applicable to the expected total

annual earnings. The Group consolidated effective tax rate for the six months ended September 30, 2015 is 31.99% and September 30, 2016 is 20.83%

Deferred tax is recognized in respect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes

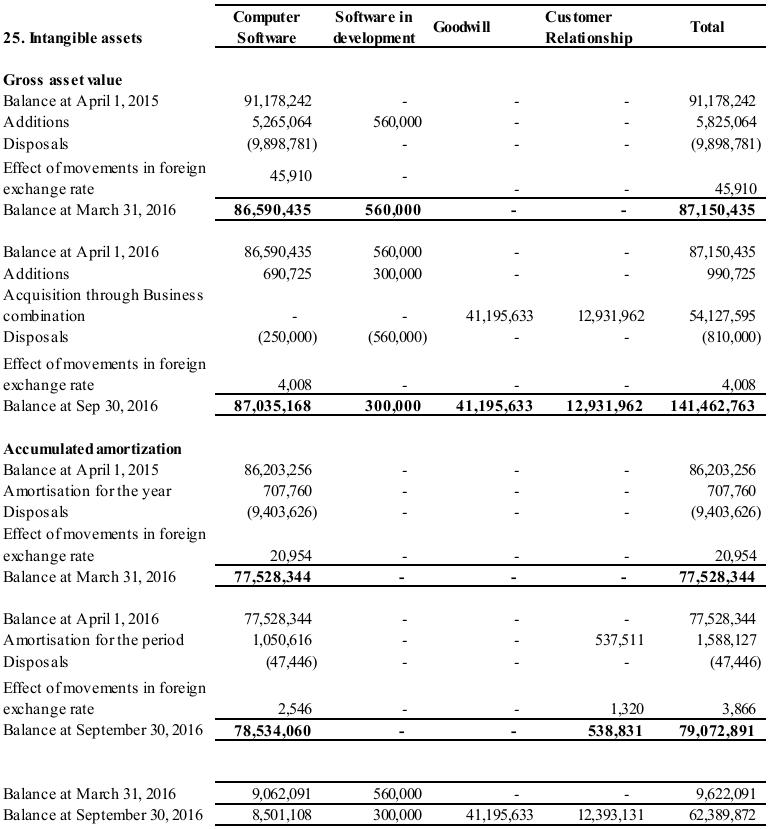

Business combinations, goodwill and other intangible assets

The Group accounts for its “Business combinations” using the acquisition method of accounting by recognizing the identifiable tangible and intangible assets acquired and liabilities assumed, and any non-controlling interest in the acquired business, measured at their acquisition date fair values. Acquisition-related costs are expensed as incurred.

Goodwill represents the cost of acquired businesses in excess of the fair value of identifiable tangible and intangible net assets purchased. Goodwill is not amortized but is tested for impairment at least on an annual basis, based on a number of factors, including operating results, business plans and future cash flows.

Intangible assets acquired individually or with a group of other assets or in a business combination are carried at cost less accumulated amortization based on their estimated useful lives as follows:

Customer-related intangible assets 8 years

Intangible assets are amortized over their estimated useful lives using a method of amortization that reflects the

pattern in which the economic benefits of the intangible assets are consumed or otherwise realized.

At each reporting date, the Group reviews the carrying amounts of its non-financial assets to determine whether there is any indication of impairment. If any such indication exists, then the asset’s recoverable amount is estimated. Goodwill is tested annually for impairment.

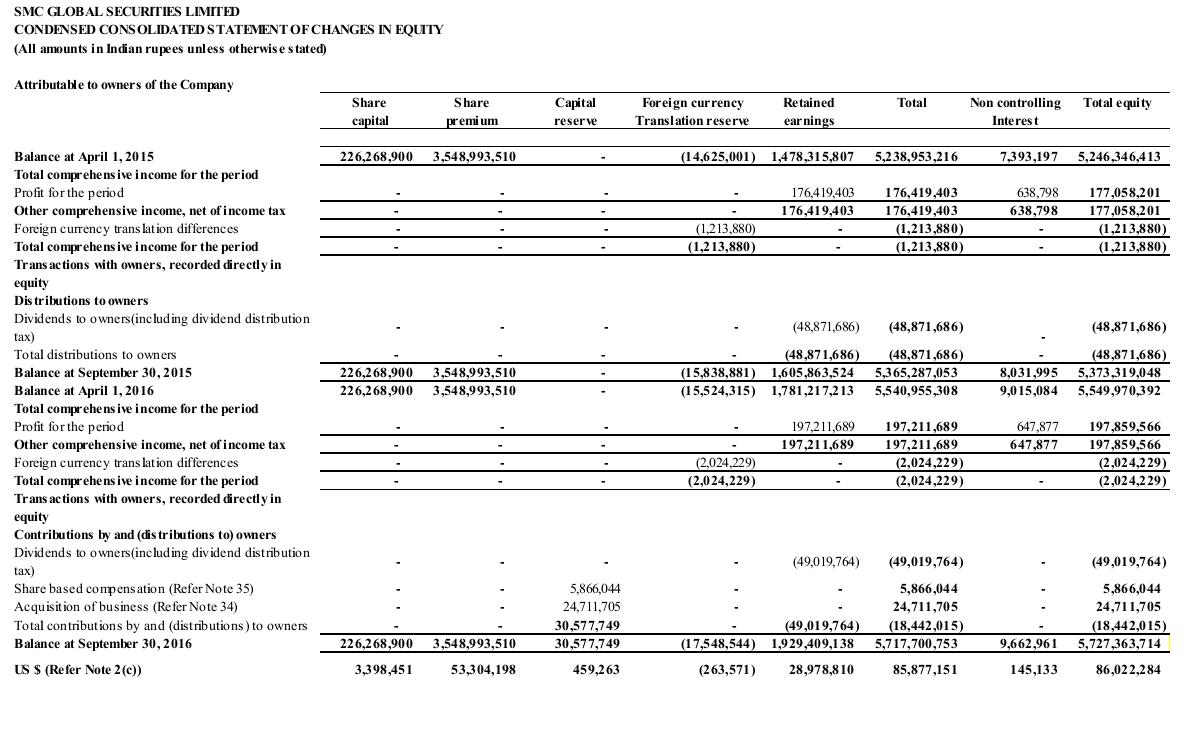

Share-based compensation

The grant-date fair value of equity-settled share-based payment arrangements granted to employees is generally recognised as an expense, with a corresponding increase in equity, over the vesting period of the awards. The amount recognised as an expense is adjusted to reflect the number of awards for which the related service conditions are expected to be met, such that the amount ultimately recognised is based on the number of awards that meet the related service conditions at the vesting date.

Interests in equity-accounted investees

The Group’s interests in equity-accounted investees comprise interest in a joint venture.

A joint venture is an arrangement in which the Group has joint control, whereby the Group has rights to the net assets of the arrangement, rather than rights to its assets and obligations for its liabilities.

| 7 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

Interest in joint venture are accounted for using the equity method. They are initially recognised at cost, which includes transaction costs. Subsequent to initial recognition, the consolidated financial statements include the Group’s share of the profit or loss and OCI of equity-accounted investees, until the date on which significant influence or joint control ceases.

| (b) | Basis of measurement |

The Condensed Consolidated Financial Statements have been prepared on the historical cost basis, except for the following material items in the condensed consolidated financial statements:

| ● | Trading assets and trading liabilities (including derivatives), inventories and investment securities are measured at fair value. |

| (c) | Functional and presentation currency |

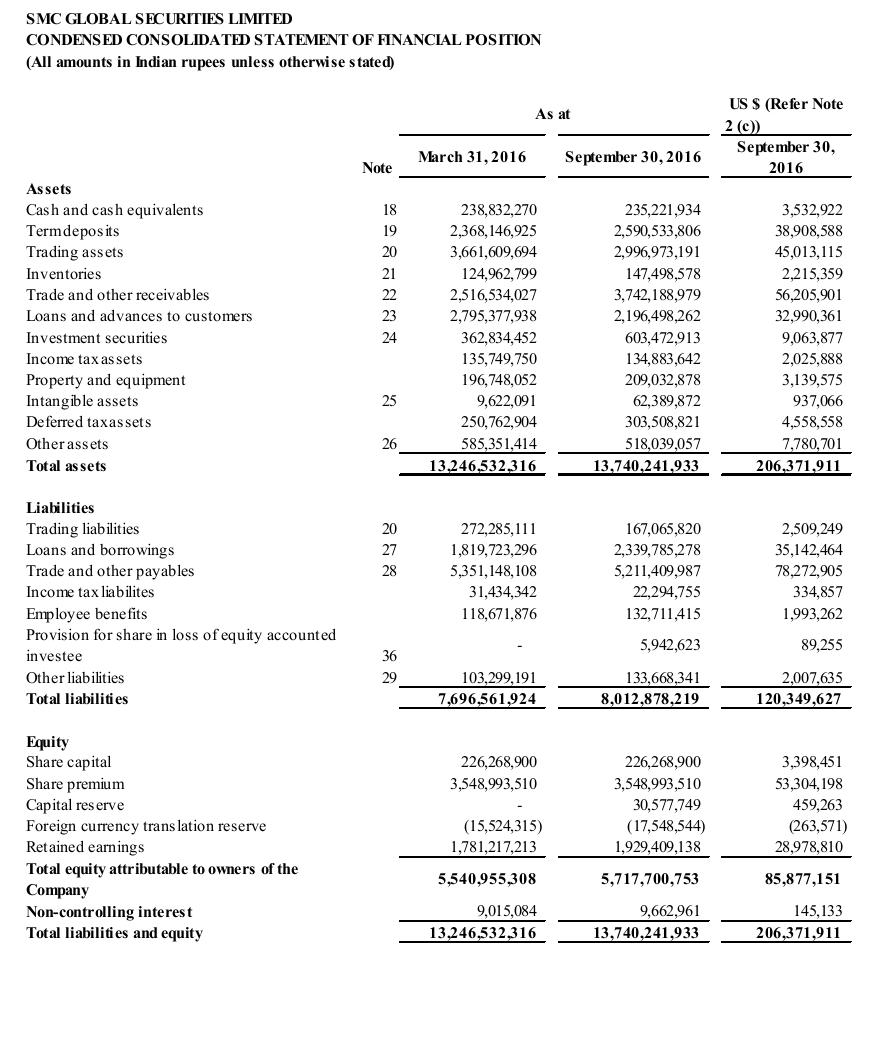

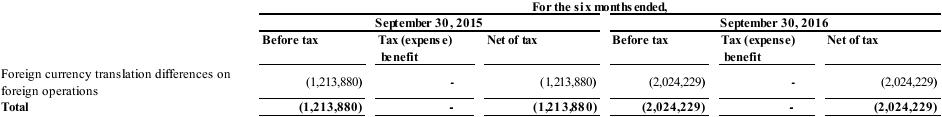

These Condensed Consolidated Financial Statements are presented in INR, which is the Company’s and its subsidiaries functional currency, other than SMC Comex International, DMCC, a subsidiary of the Company in United Arab Emirates and SMC Global USA Inc., a subsidiary of the Company in United States of America. The functional currency of SMC Comex International, DMCC and SMC Global USA Inc. is U.S. dollars. Assets and liabilities of SMC Comex International, DMCC and SMC Global USA Inc. are translated at period-end rates of exchange, and income statement accounts are translated at average rates of exchange for the period. Gains or losses resulting from such transactions are recognised in “Other comprehensive income” and shown in the Statement of Changes in Equity as “Foreign currency translation reserve”.

The accompanying condensed consolidated financial statements are presented in Indian rupees, the national currency of India. Solely for the convenience of the readers, the financial statements as at and for the six months ended September 30, 2016 have been translated into U.S. dollars which are based on the exchange rate as set forth in the H.10 statistical release of the Federal Reserve Board at September 30, 2016. The Federal Reserve Bank of New York certifies this rate for customs purposes in a weekly version of the H.10 release. The exchange rate as set forth in the H.10 statistical release of the Federal Reserve Board as at September 30, 2016 was INR 66.58 per US$1. No representation is made that the Indian rupee amounts have been, could have been or could be converted into U.S. dollars at such a rate or any other rate.

| (d) | Use of estimates and judgments |

The preparation of the Condensed Consolidated Financial Statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

| A) | Information about assumptions and estimation uncertainties that have a significant risk of resulting in a material adjustment within the next financial year are as follows: |

Measurement of defined benefit obligation, liability for long-service leave; key actuarial assumptions:

The projected benefit obligation and expense related to the Group’s pension and non-pension post-retirement benefit plans are determined using multiple assumptions that may significantly influence the value of these amounts. Actuarial assumptions including discount rates, compensation increases, attrition rates and mortality rates are management’s best estimates and are reviewed annually with the Group’s actuaries. The Group develops each assumption using relevant historical experience of the Group in conjunction with market related data and considers if the market-related data indicates there is any prolonged or significant impact on the assumptions. The discount rate used to measure plan obligations is based on long-term high quality government bond yields. The other assumptions are also long-term estimates. All assumptions are subject to a degree of uncertainty. Differences between actual experiences and the assumptions, as well as changes in the assumptions resulting from changes in future expectations, result in actuarial gains and losses which are recognized in other comprehensive income during the period and also impact expenses in future periods.

| 8 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

Recognition of deferred tax assets, availability of future taxable profit against which carry-forward losses can be used:

Deferred tax is recorded on temporary differences between the tax bases of assets and liabilities and their carrying amounts, at the rates that have been enacted or substantively enacted. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable profits during the periods in which those temporary differences and tax loss carry-forwards become deductible. The Group considers the expected reversal of deferred tax assets and projected future taxable income in making this assessment. The amount of the deferred income tax assets considered realizable, however, could be reduced in the near term if estimates of future taxable income during the carry-forward period are reduced.

Impairment of trade receivable and loan and advance to customers:

The Group estimates the uncollectability of trade receivables and loans and advances to customers by analyzing historical payment patterns, customer concentrations, customer credit-worthiness and current economic trends. If the financial condition of a customer deteriorates, additional allowances may be required.

| B) | Information about significant areas of judgment in applying accounting policies that have the most significant effect on the amounts recognized in the condensed consolidated financial statements are described as follows: |

Principal and agent relationship:

The Group determines that when other parties are involved in providing goods or services to an Group’s customer, whether its performance obligation is to provide the goods or services itself (i.e., the Group is a principal) or to arrange for another party to provide the good or service (i.e., the Group is an agent). The Group is a principal if it controls a promised good or service before it transfers the good or service to a customer. However, the Group is not necessarily acting as a principal if it obtains legal title only momentarily before the good or service is transferred to a customer.

The determination of whether the Group is acting as a principal or an agent affects the amount of revenue the Group recognizes.

When the Group is the principal in the arrangement, revenue to be recognized is based on the gross amount to which the entity expects to be entitled.

When the Group is the agent, the revenue to be recognized is the net amount to which the entity is entitled to retain in return for its services as the agent.

The Group acts in its principal capacity for trading activity undertaken on its own account, whereas it is an agent for all trading positions taken by its clients.

| 3. | New standards and interpretation not yet adopted |

IFRS 9 Financial Instruments: IFRS 9, published in July 2014, replaces the existing guidance in IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 includes revised guidance on the classification and measurement of financial instruments, a new expected credit loss model for calculating impairment on financial assets, and new general hedge accounting requirements. It also carries forward the guidance on recognition and derecognition of financial instruments from IAS 39.

| 9 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

IFRS 9 is effective for annual reporting periods beginning on or after January 1, 2018, with early adoption permitted.

The Group is assessing the potential impact on its consolidated financial statements resulting from the application of

IFRS 9.

IFRS 15 Revenue from Contracts with Customers: IFRS 15 establishes a comprehensive framework for determining whether, how much and when revenue is recognized. It replaces existing revenue recognition guidance, including IAS 18 Revenue, IAS 11 Construction Contracts and IFRIC 13 Customer Loyalty Programmes.

IFRS 15 is effective for annual reporting periods beginning on or after January 1, 2018, with early adoption permitted.

The Group is assessing the potential impact on its consolidated financial statements resulting from the application of

IFRS 15.

IFRS 16 Leases: On January 13, 2016, the International Accounting Standards Board issued the final version of IFRS 16, Leases. IFRS 16 will replace the existing leases Standard, IAS 17 Leases, and related Interpretations.

The Standard sets out the principles for the recognition, measurement, presentation and disclosure of leases for both parties to a contract i.e., the lessee and the lessor. IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. Currently, operating lease expenses are charged to the Statement of Profit or Loss and Other Comprehensive Income. The Standard also contains enhanced disclosure requirements for lessees. The effective date for adoption of IFRS 16 is annual periods beginning on or after January 1, 2019, though early adoption is permitted for companies applying IFRS 15 Revenue from Contracts with Customers. The Group is yet to evaluate the requirements of IFRS 16 and the impact on the consolidated financial statements.

| 10 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 4. | Financial risk management |

This note presents the information about the Group’s exposure to financial risks, the group’s objectives, policies and processes for measuring and managing risk and the Group’s management of capital. Further, quantitative disclosures are included throughout these condensed consolidated financial statements.

The Group has exposure to the following risks arising from financial instruments:

| ● | Credit risk; | |

| ● | Liquidity risk and | |

| ● | Market risk |

Financial Risk management framework

The Board of Directors has overall responsibility for the establishment and oversight of the Group’s risk management framework. Financial risk management within the Group is governed by policies and guidelines approved by the management. The Board has established a Risk Management Committee which is responsible for developing and monitoring the Group’s risk management policies. Group policies and guidelines cover areas such as cash management, investment of excess funds and raising of debt and are managed by segregated functions within the Group.

The Group’s risk management policies and procedures are established to identify and analysis the risks faced by the Group, to set appropriate risk limits and controls, and to monitor risks and adherence to limits. Risk management policies and systems are reviewed regularly to reflect changes in market conditions and the Group’s activities. The Group, through its training and management standards and procedures, aims to maintain a disciplined and constructive control environment in which all employees and stakeholders understand their roles and obligations.

Different types of risks arising from financial instruments as identified by the Group above have been explained below:

| 4.1 | Credit risk |

The credit risk is the risk of financial loss to the Group if a customer or counterparty to a financial instrument fails to meet its contractual obligations, and arises principally from the Group’s trading assets except equity instruments, investment securities except equity instruments, receivables from clients and exchanges, loans and advance to customers, balances with banks and term deposits and related accrued interest. Credit risk in respect of quoted securities is expected to have a direct correlation with the quoted market prices and risk.

The Group is exposed to the risk that third parties that owe money or securities will not perform their obligations. Such third parties include clients, trading members, exchanges, clearing houses, and other financial intermediaries. These parties may default on their obligations owed to the Group due to insolvency, lack of liquidity, operational failure, government or other regulatory intervention or other reasons. In these circumstances, the Group is exposed to risks arising, for example, from holding securities of third parties; executing securities trades that fail to settle at the required time due to non-delivery by the counterparty trading members, exchanges, clearing houses or other financial intermediaries. Significant failures by third parties to timely perform their obligations owed could materially and adversely affect the Group’s financial position, and ability to borrow in the credit markets and ability to operate the business.

For the risk management purposes, the Group considers and consolidates all elements of credit risk exposures such as individual obligator default risk, country and sector risk.

| 11 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

The Group faces significant credit risk in its financing business as there is a risk of default on a loan that may arise from a borrower failing to make required contractual repayments.

Management / mitigation of credit risk

The Group operates in a highly regulated environment which limits its credit risk against exchanges and clearing houses. The Group collects upfront margins in form of funds and/or securities/commodities from clients and trading members against their trading positions. The Group monitors positions, margins, mark to market losses and risks on real time basis through risk management systems and policies specially designed to mitigate the credit risk.

The Company’s Board of Directors has delegated responsibility for the oversight of credit risk to the Risk Management Committee (“the Committee”). The Committee is responsible for management of the Group’s credit risk, including the following:

| (i) | Formulating credit policies in consultation with business units, covering collateral requirements, credit assessment, risk grading and reporting, documentary and legal procedures, and compliance with regulatory and statutory requirements. | |

| (ii) | Establishing the organizational structure for the approval of new customers or counter parties. Authorization limits are allocated to business unit credit officers or the Arbitrager as appropriate. | |

| (iii) | Providing advice, guidance and specialist skills to business units through periodic reviews to promote best practices throughout the Group in the management of credit risk. | |

| (iv) | The Committee assesses the credit worthiness of client or counterparties, prior to taking exposure on them. Accordingly, limits are assigned and the monitoring mechanism ensures that exposure to single client does not cross the laid down threshold limits. Collateral securities are also collected from clients to cover the exposure. | |

| (v) | Limiting concentrations of exposure to counterparties, geographies and industries (for loans and advances and similar exposures), and by issuer, credit rating band, market liquidity and country (for investment securities and trading assets). | |

| (vi) | Reviewing compliance of business units with agreed exposure limits, including those for selected industries, country risk and product types. Regular reports on the credit quality of local portfolios are provided to the management, which may require appropriate corrective action to be taken. |

For the Group’s financing business, a loan policy has been implemented to identify the broad principles which the Group will follow to accept borrowers and loan proposals, to manage loan portfolio, and recover its dues so as to minimize the inherent risks in the business activity and maximize business revenues with consumer satisfaction. To reduce the credit risk in financing, the Group performs a credit check on the prospective borrower or seek security over some assets of the borrower or a guarantee from a third party.

Unsecured Loans are sanctioned based on various factors like financials analysis, credit history, market references, and historical client relation with SMC Group & future business prospects. All these loans are continuously monitored basis the factors considered while sanctioning the loan.

Further Trade & Other receivables (no collateral) primarily includes undue receivables from exchanges/ clearing corporations, receivables from vendors on account of third party financials products, deposit with other brokers, security deposits with exchanges / clearing corporations etc. which are recovered in due course. If there are any indicators of impairment on management assessment of these unsecured balances, the same are provided for.While considering loan proposals, the Group also manages risk through limiting concentration of exposure to individual borrowers, industry, underlying collateral, etc.

| 12 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

The Board of Directors has also constituted Internal Audit Committee, which is responsible evaluation of internal financial controls and risk management systems. The company conducts regular internal audits of various business units to find problems within the Group’s processes, quality control, fraud prevention and legal compliance. The internal audit reports are reviewed by internal audit committee and also placed with the Board.

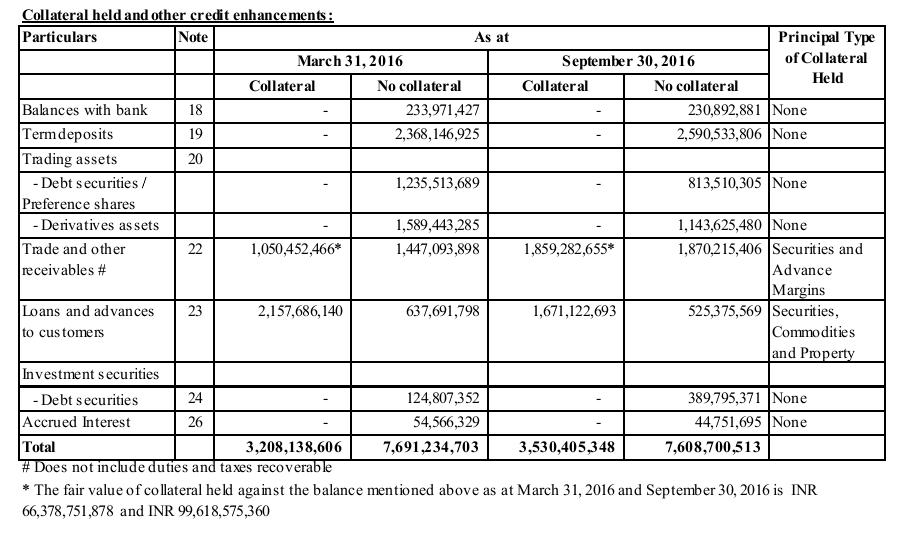

Credit exposure:

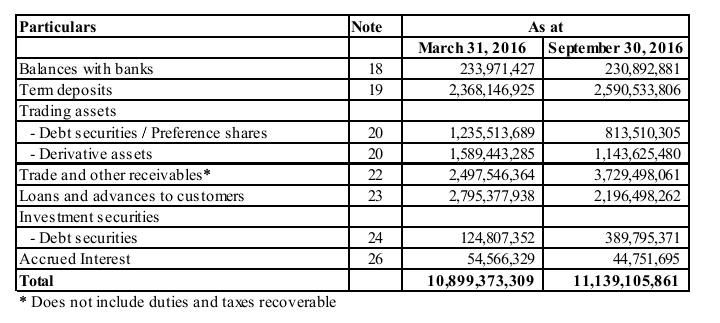

The carrying amount of financial assets represents the maximum credit exposure. The maximum exposure to credit risk at the reporting date was:

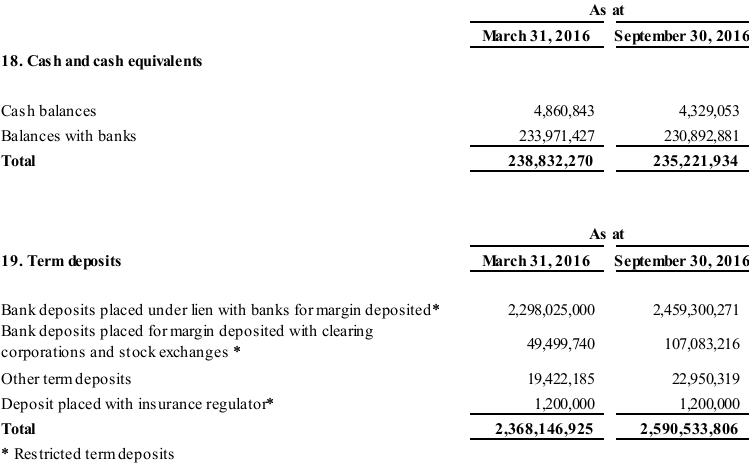

| a. | Balances with banks, term deposits and accrued interest |

The Group places its cash and cash equivalents and term deposits with banks with “high investment grade ratings”. The Group limits the amount of credit exposure with one bank and conducts ongoing evaluation of the credit worthiness of the banks with which it does business. Given the high credit ratings of these financial institutions, the Group does not expect these financial institutions to fail in meeting their obligations.

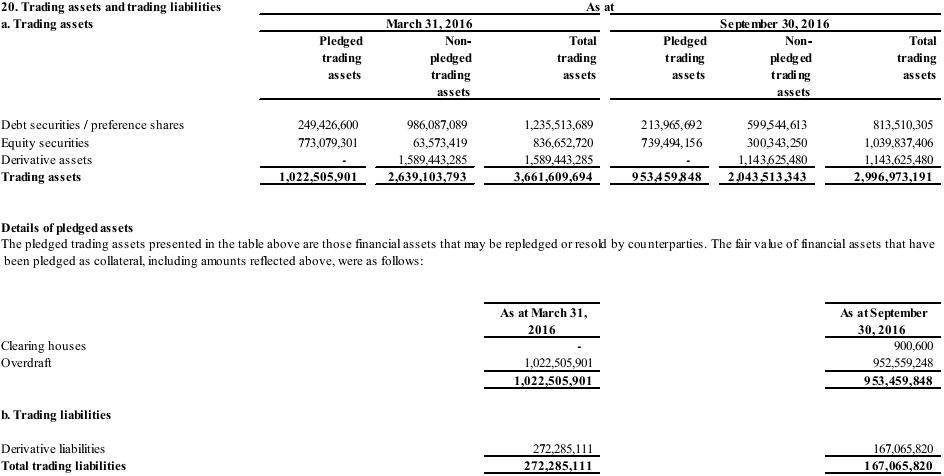

| b. | Trading assets and investment securities |

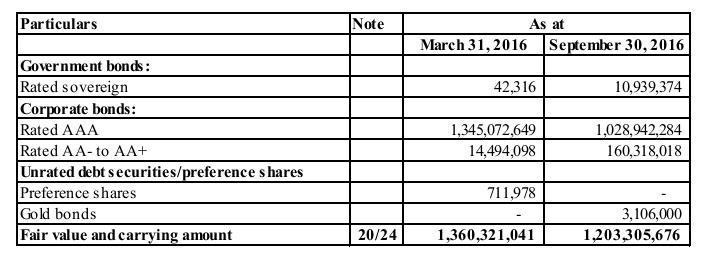

Trading assets include portfolio of shares, derivative assets and debt securities/preference shares. Investment securities comprise portfolio of equity and debt securities/preference shares. The Group is exposed to credit risk in respect of debt securities/preference shares and derivative assets. The trading assets and investment securities are valued at market price prevailing at reporting date which represents the fair value.

The table below sets out the credit quality of debt securities/preference shares. An analysis of the credit quality of the maximum credit exposure, based on ratings done by approved rating agencies where applicable, is as follows:

| 13 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

Derivative assets

The Company uses derivative instruments primarily for availing arbitrage opportunities in equity, currency and commodity markets. The counterparties for settlement of these contracts are exchanges/clearing houses. These derivative assets are valued based on quoted prices in active markets. Amounts as at March 31, 2016 and September 30, 2016 is INR 1,589,443,285 and INR 1,143,625,480 respectively.

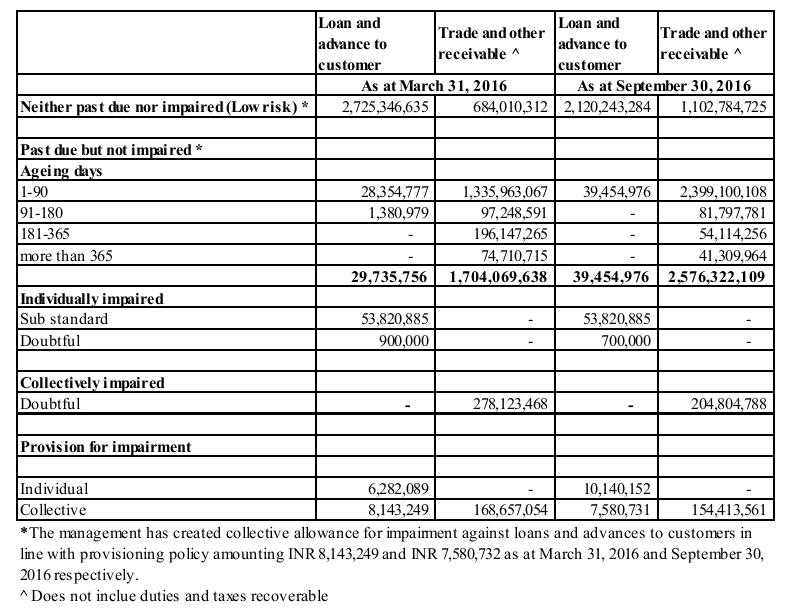

| c. | Loans and advances to customers and trade and other receivables |

Loans and advances to customer represents the loans provided to retail and corporate clients and includes loans against securities and commodities, public offering financing loans and housing application loans.

Trade and other receivables primarily include amounts due from clients/trading members against their trading obligations such as securities purchased, daily mark to market settlement on commodity, equities & currency future contracts, sale of commodities etc. which are mainly secured by margin made available by the clients/trading members in form of cash, securities, fixed deposits or bank guarantees. All payments due from exchanges/clearing houses are duly received on clearing/settlement date.

Trade receivable also include receivables for advisory services rendered, which primarily comprises of receivables on account portfolio and wealth management services, mortgage and loan advisory services, real estate broking services and investment banking services.

In trading transactions with clients, the Company extends credit for the purchase of securities, using the securities purchased and / or other securities in the clients’ accounts as collateral for such amounts advanced. These are limited by funding rules as prescribed by regulator and are subject to the Company’s credit review and daily monitoring procedures.

Credit quality analysis

The tables below set out information about the credit quality of “Loans and advances to customer” and “Trade and other receivables” and the allowance for impairment/loss held by the Group:

| 14 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

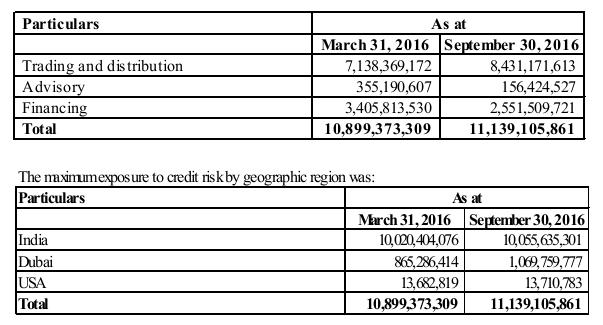

Concentration of Credit risk :

| (a) | The Group monitors concentrations of credit risk by segment and by geographic location. |

The maximum exposure to credit risk by segment on the assets mentioned above was:

| 15 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| (b) | To diversify our risk, our loan policy also places concentration limits on the loans that we may offer. |

The exposure-ceiling limit for a single borrower or business group is 15% of net owned funds (subject to regulations of RBI in India) of Moneywise Financial Services Private Limited, a subsidiary of the Group. This limit may be exceeded, in exceptional circumstances, by an additional 10% (i.e. upto 25%) with the approval of our loan committee.

The exposure-ceiling limit against a single security/commodity (aggregated across all borrowers) is 15% of net owned funds of Moneywise Financial Services Private Limited, a subsidiary of the Group. This limit may be exceeded, in exceptional circumstances, by an additional 5% (i.e. up to 20%) with the approval of loan committee. This exposure-ceiling limit is not applicable in the case of public issue financing loans provided that the exposure to a single borrower does not exceed 0.5% of net owned funds.

Collateral held and other credit enhancements:

The Group holds collateral and other credit enhancements against certain of its credit exposures. The table below sets out the principal types of collateral held against different types of financial assets.

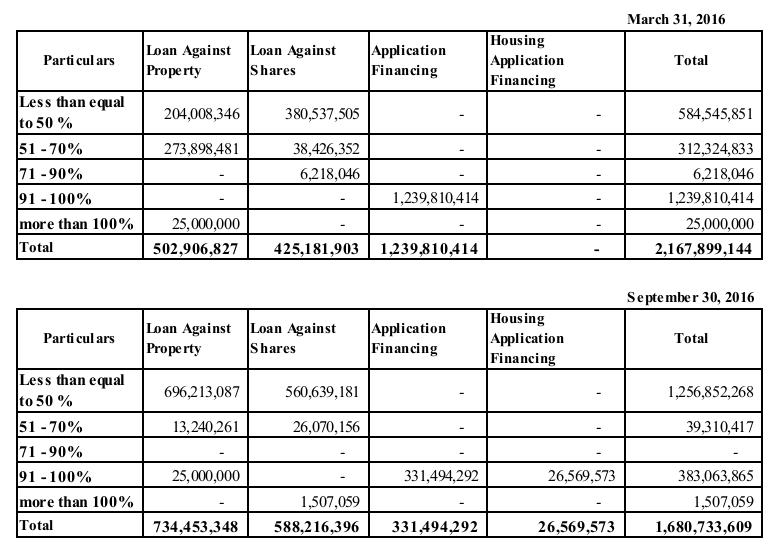

Loan to Value (LTV) for loan and advances to customer:

The general creditworthiness of a customer tends to be the most relevant indicator of credit quality of a loan extended to it. However, collateral provides additional security and the Group generally requests borrowers to provide it. The Group may take collateral in the form of a charge over real estate, floating charges over pledge of securities or other assets and other liens and guarantees.

| 16 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

The tables below stratify credit exposures from secured loans and advances to customers by ranges of loan-to-value (LTV) ratio. LTV is calculated as the ratio of the gross amount of the loan-to the value of the collateral. The gross amounts exclude any impairment allowance. The valuation of the collateral excludes any adjustments for obtaining and selling the collateral.

| Note: | The management has created collective allowance amounting to INR 6,388,978 and INR 5,786,890 and individual allowance amounting to INR 3,824,026 and INR 3,824,026 for impairment as on March 31, 2016 and September 30, 2016 respectively. |

The ratios presented above for loans against shares and application financing are based on collateral value as of the reporting date and for loan against property and Housing application financing the collateral value are of origination subject to revision in value of collateral, if deemed necessary due to market condition.

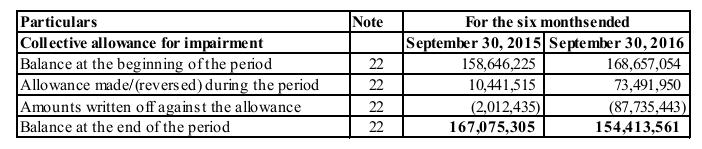

Impairment Losses:

The Group establishes allowance for impairment losses that represents its best estimate of incurred losses for receivables from clients/trading members and loans and advances to customers, which are carried at amortized cost. The main components of this allowance are a specific loss component that relates to individually significant exposures, and a collective loss component established for groups of similar assets in respect of losses that have been incurred but not yet identified.

| 17 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

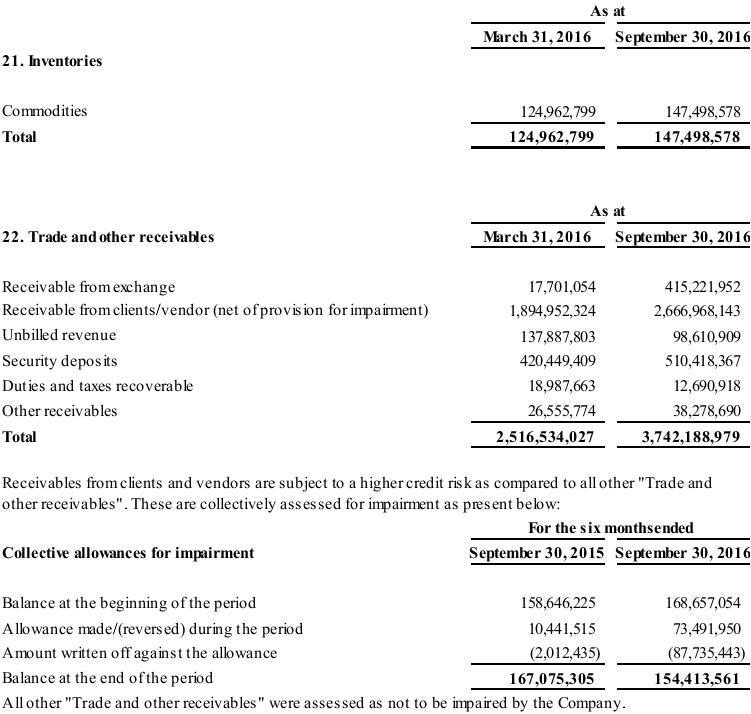

The movement in the allowance for impairment charge in respect of trade and other receivables during the period is as follows:

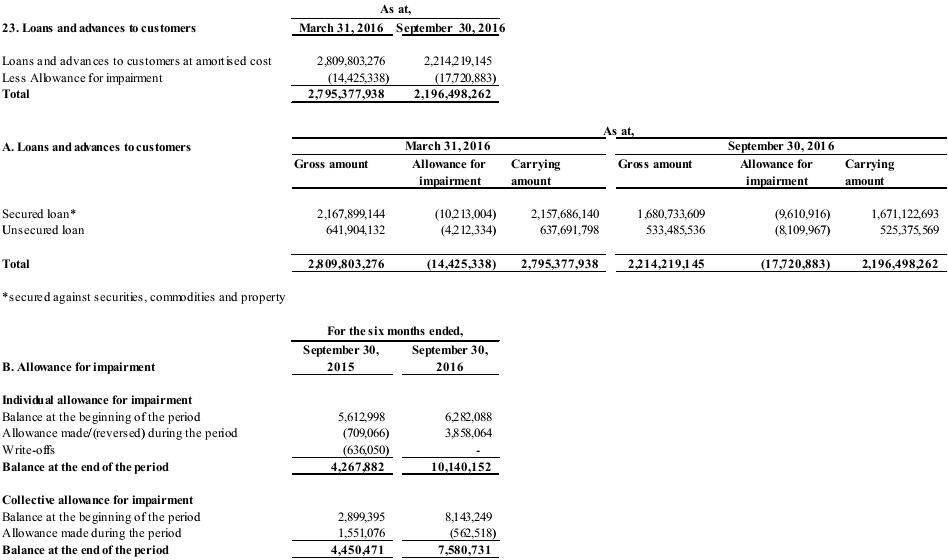

The movement in the allowance for impairment charge in respect of loans and advances to customers during the period is as follows:

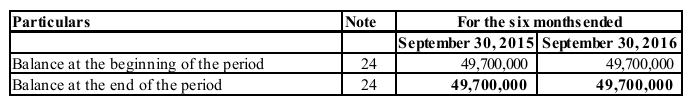

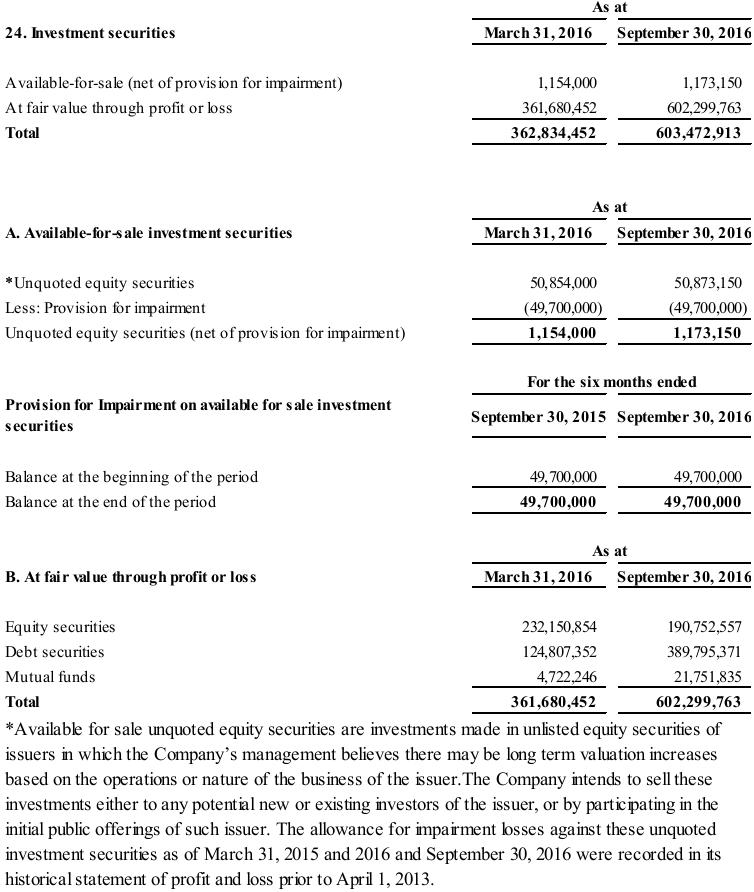

The movement in the allowance for impairment charge on available for sale investment securities during the period is as follows:

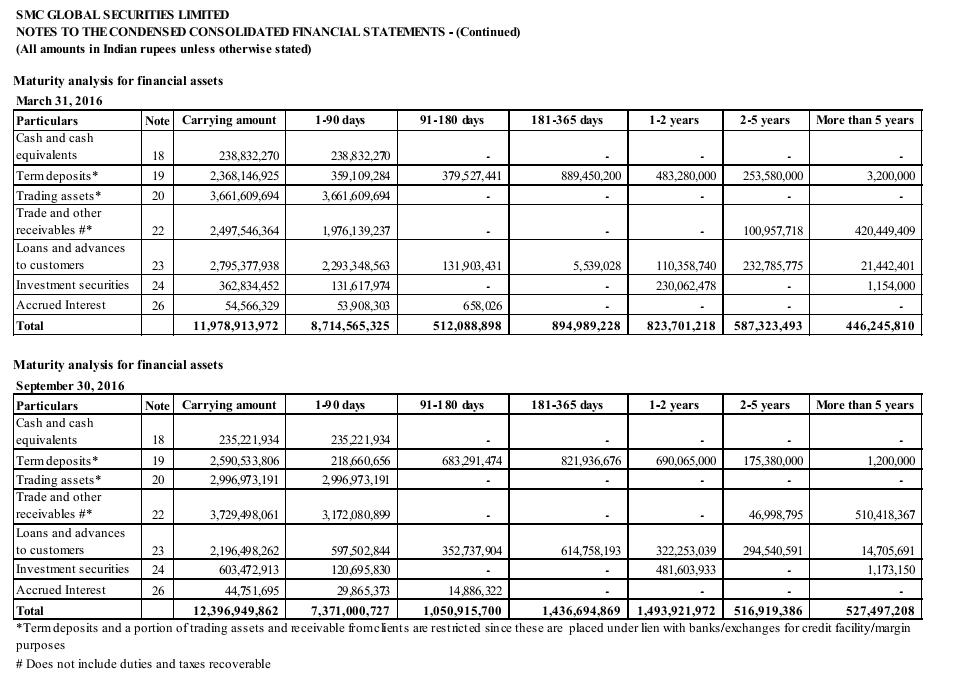

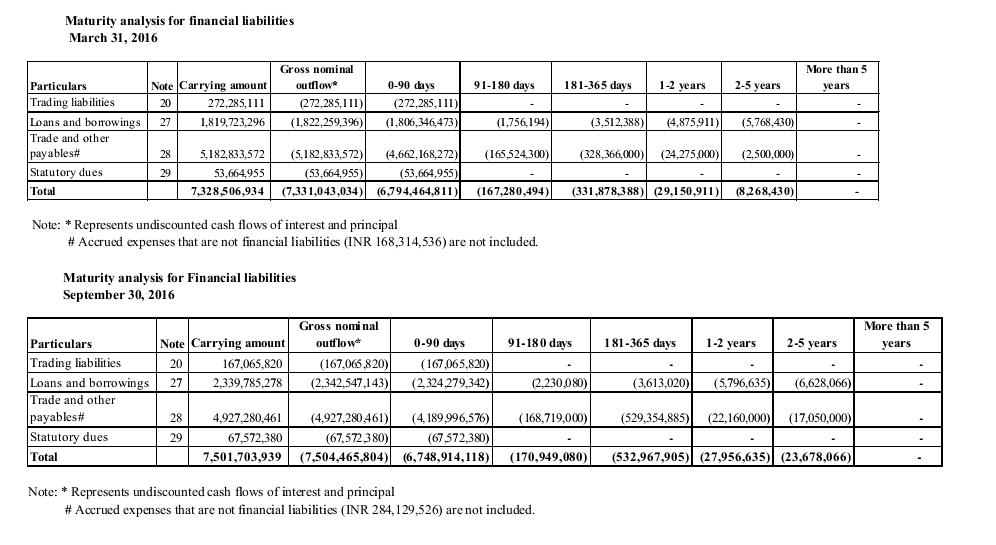

| 4.2 | Liquidity risk |

Liquidity risk is the risk that the Group will encounter difficulty in meeting obligations associated with its financial liabilities that are settled by delivering cash or another financial asset. The Group companies require sufficient liquidity to meet their obligations. Individual companies are generally responsible for their own fund management, including the short-term investment of surpluses and the raising of loans to cover deficits from third parties/group companies.

| 18 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

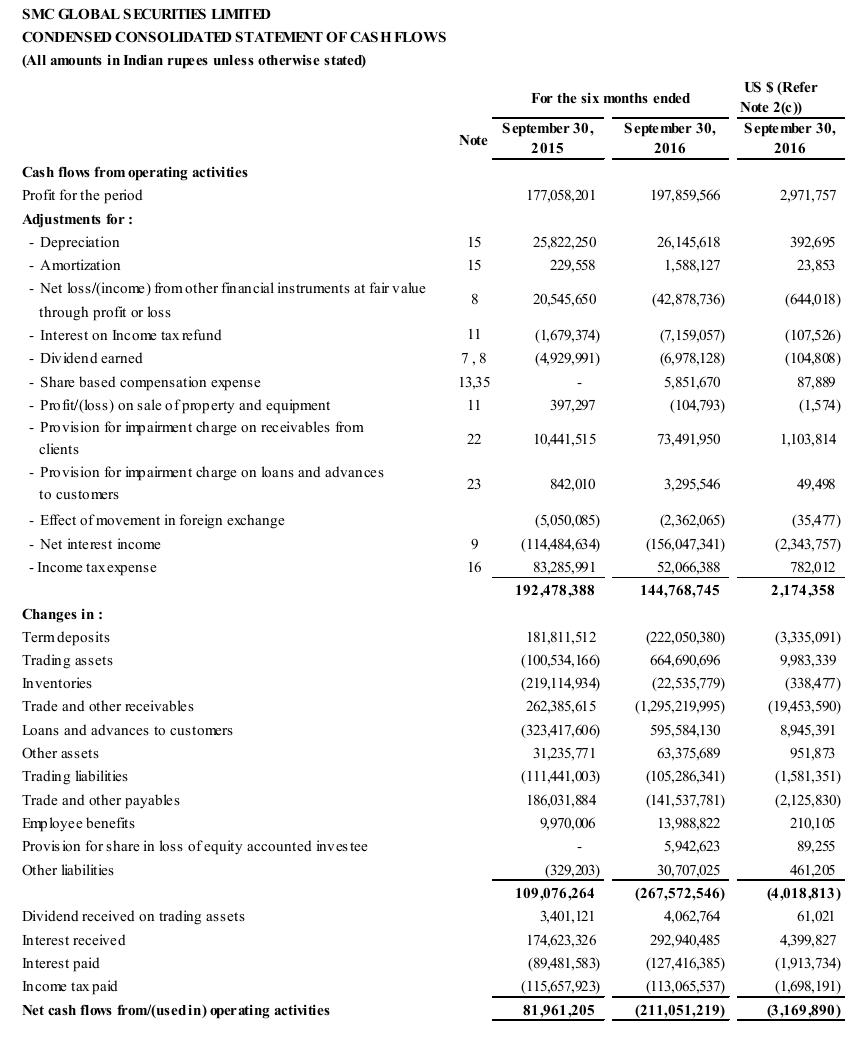

The Group’s primary liquidity requirements are to finance the working capital needs, which are typically towards margin maintenance at various exchanges. The principal portion of the working capital requirement is utilized by:

| (a) | depositing funds with banks to obtain term deposits and guarantees towards margins payable to the exchanges/clearing houses; | |

| (b) | payments to stock exchanges/clearing houses towards settlement obligations; | |

| (c) | payment towards purchase of various trading assets; | |

| (d) | disbursement of loans to customers; and | |

| (e) | meeting expenses incurred for operations. |

Management of liquidity risk

Working capital requirements fluctuate on a regular basis depending on the business requirements. The Group’s approach to managing liquidity is to ensure, as far as possible to have sufficient funds to meet its liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the group’s reputation.

To fund the working capital requirements, the Group currently relies principally on internal accruals and short term credit facilities from banks and financial institutions against pledge of trading assets except derivative assets, term deposits, receivables from clients and inventories. By maintaining sufficient liquid funds and drawing facilities with banks, the Group comfortably meets the foreseeable liabilities in the present and immediate future, as well as unforeseeable contingencies.

Central treasury receives information from business units regarding the liquidity profile of their financial assets and liabilities and projected cash flows. Central treasury maintains surplus funds in cash and cash equivalents including term deposits with banks and in investment securities for which there is an active and liquid market. These assets can be readily sold to meet liquidity requirements. Hence, the Group believes that the above monetary mechanism adequately addresses the liquidity risk.

The Group has committed approved credit facilities which it can be accessed to meet liquidity needs. As at the period end, the unutilised overdraft facilities with banks amounts to INR 3,500,715,000 and INR 3,551,700,000 as at March 31, 2016 and September 30, 2016 respectively.

| 19 |

| 20 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 21 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

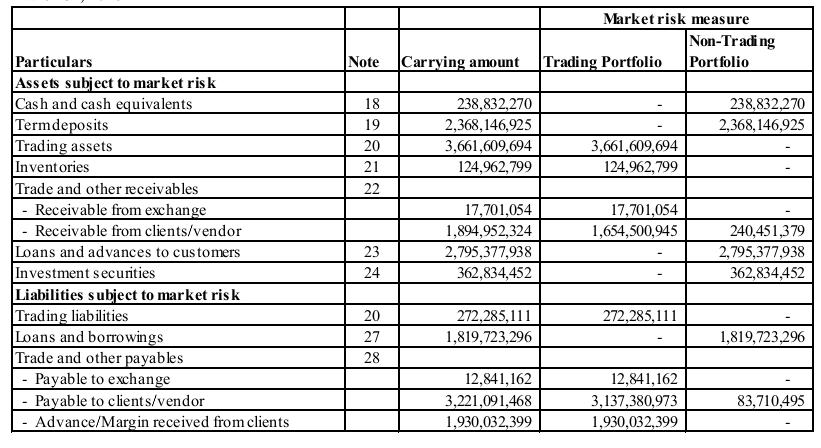

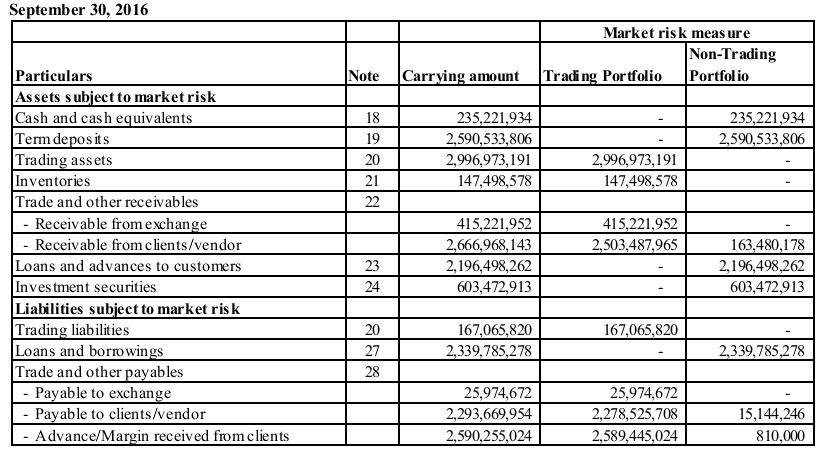

| 4.3 | Market risk |

The Group participates in trading and investing in various assets classes such as equity, debt securities, commodities, foreign currency and derivatives. These assets classes experience volatility due to economic growth levels, inflation, prices, interest rates, foreign exchange rates and other macro-economic factors. Any changes in market prices of these asset classes will affect the Group’s income or the value of its holdings of financial instruments.

The Group segregates its exposure to market risks between price risk, interest rate risk and currency risk.

Market risk exposure:

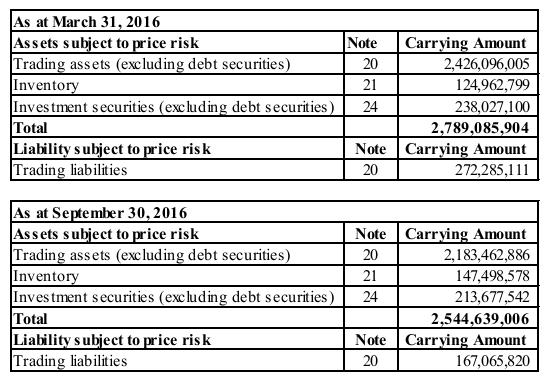

The table below sets out the allocation of assets and liabilities subject to market risk between trading and non-trading portfolios.

March 31, 2016

| 22 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

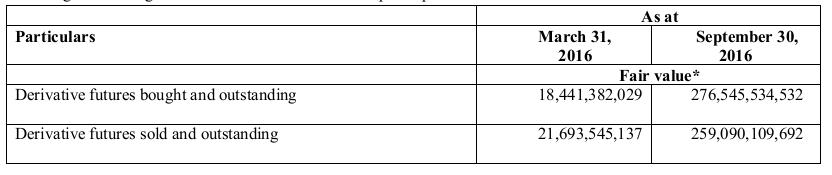

Further, in order to hedge the outstanding equity and commodity positions and for trading purposes, the Group has following outstanding future derivatives on which Group is exposed to market risk.

* Fair value represents outstanding quantity multiplied by closing market rate of the corresponding underlying security or index as at March 31, 2016 and September 30, 2016 respectively. The mark to market on these futures are daily settled and hence there are no balances carried in the Statement of Financial position.

Management of market risks:

The objective of market risk management is to manage and minimize market risk exposures within acceptable parameters, while optimizing the return on risk. The Group’s exposure to market risk is determined by a number of factors, including size, composition and diversification of positions held and market volatility.

| (a) | Price risk |

Trading and investment portfolios include proprietary positions taken in equities, fixed income securities, commodities, foreign currency and their derivatives mainly for availing arbitrage opportunities. All financial assets and liabilities are accounted on fair value basis. Management actively monitors its market risk by reviewing the effectiveness of arbitrage and setting outstanding position limits. The Group manages market risk with central oversight, analysis and formation of risk policy, specific maximum risk levels to which the individual trader must adhere to and real time continuous monitoring by the senior management.

In respect of the proprietary positions, the Group is exposed to volatility in the price of the underlying securities.

| 23 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

Exposure

The table below sets out the assets and liabilities subject to price risk.

Investment

Risk Exposure

Trading assets, trading liabilities, derivatives and inventories (excluding debt securities)

The Group engages in proprietary transactions into equities, commodities and derivatives (equities, commodities and currencies). These transactions are primarily undertaken using various arbitrage models to capitalize pricing inefficiencies in the markets. Any change in the market prices of their underlying would result in changes in the fair value of these trading assets, trading liabilities and inventory and also result in profit/loss on futures positions. An increase of underlying prices by 5% for the exposures at March 31, 2016 and September 30, 2016, with all other variables held constant, would decrease/(increase) the profit before tax by INR 12,872,444 and INR (11,539,438) for the year ended March 31, 2016 and six months ended September 30, 2016, respectively and similarly a decrease/(increase) in underlying prices by 5% will increase profit before tax by INR 7,418,919 and INR (17,269,229) for the year ended March 31, 2016 and for the six months ended September 30, 2016, respectively. In case of options, the Group uses Black Scholes pricing model to estimate the potential impact on profit or loss arising from movement in the prices of underlying.

Investment securities (excluding debt securities)

A change in the fair value of assets subject to price risk by 5% for the exposures at March 31, 2016 and September 30, 2016, with all other variables held constant, will increase or decrease profit before tax by INR 11,901, 355 and INR 10,683,877 for the year ended March 31, 2016 and six months ended September 30, 2016, respectively.

Debt securities

Any change in the interest rate would have impact on the fair value of the debt securities in which the company has position. An increase in interest rate by 1% for the exposures at March 31, 2016 and September 30, 2016, with all other variables held constant, will decrease profit before tax by INR 112,177,795 and INR 56,883,633 for the year ended March 31, 2016 and six months ended September 30, 2016, respectively. A decrease in interest rate by 1% for the exposures at March 31, 2016 and September 30, 2016, with all other variables held constant, will increase profit before tax by INR 126,939,756 and INR 77,031,706 for the year ended March 31, 2016 and six months ended September 30, 2016, respectively.

| 24 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| (b) | Interest rate risk |

Interest rate risk arises from movements in interest rates which could have effects on the Group’s net income or financial position. Changes in interest rates may cause variations in interest income and expenses resulting from interest-bearing assets and liabilities. Interest rate risk is the risk that the fair value or the future cash flows of a financial instrument will fluctuate because of changes in market interest rates.

The Group’s exposure to interest rate risk relates to the loans taken from banks, investment in term deposits placed with banks, investment in debt securities and investments of its excess funds in liquid instruments. A majority of the financing of the Group has come from overdraft facility with banks. The business of the Group is exposed to fluctuation in interest rate for the following activities:

| (i) | Term deposits placed with banks are generally for short term on fixed interest rates; | |

| (ii) | Facilities availed from banks and other financial institutions generally include short term working capital loans on floating interest rates; | |

| (iii) | Interest paid by Group on clients’ funds earmarked as fixed margin are generally for short term on fixed interest rates; | |

| (iv) | Loans and advances on fixed rate basis expose the Group to interest rate risk. |

Management of Interest Rate Risk

Interest rate risk is managed principally through monitoring interest rate gaps and by having pre-approved limits for re-pricing bands. However the Group does not use derivative financial instruments to hedge its interest rate risk.

The Group’s investments in majority of term deposits with banks are for both short and long duration, and therefore do not expose the group to significant interest rate risk. Further significant portion of exposure on term deposits with banks is offset with clients’ funds earmarked as margins on fixed rate basis. The interest rates on the overdraft facility availed are marginally higher than the interest rates on term deposits with the banks and generally linked to the term deposit rates with the bank. Accordingly, there is limited interest rate risk exposure on the company.

Interest from the customers on loans given is fixed rate of interest. In order to manage interest rate risk exposure, our loan portfolio can be classified between on demand loans and term loans. However, the interest rate risk exposure on short term loans is insignificant. We are exposed to fair value interest rate risk on fixed rate loans.

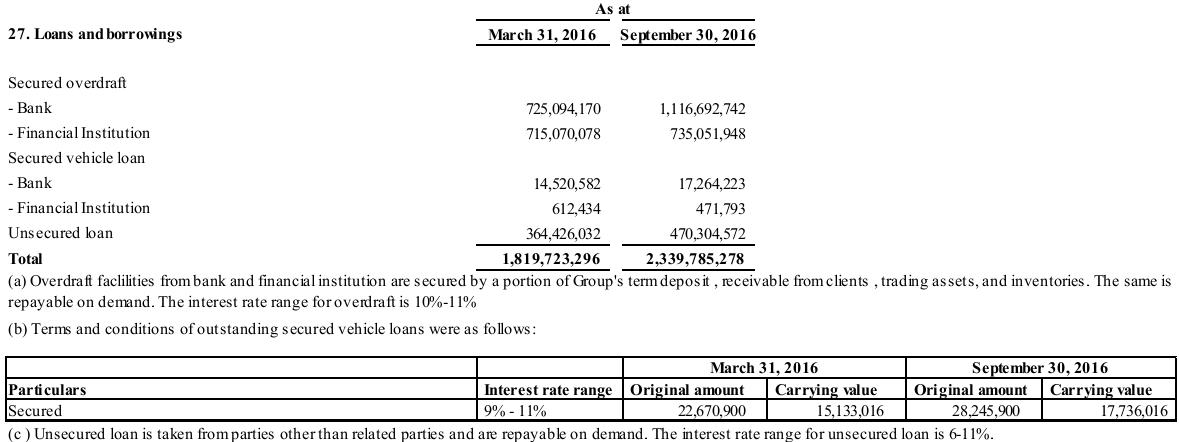

The Group’s exposure to the risk of changes in market interest rates relates primarily to the Group’s short-term and long-term debt obligations with floating / fixed interest rates, which are included in loans and borrowings in the condensed consolidated financial statements. The loans and borrowings as of March 31, 2016 and September 30, 2016 represent loans and borrowing taken both fixed and floating interest rate.

| 25 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

Cash flow sensitivity analysis for variable rate instruments

An increase in interest rate by 1% on outstanding balance as at March 31, 2016 and September 30,2016, with all other variables held constant, will decrease profit before tax by INR 14,401,642 and INR 9,258,723 for the year ended March 31, 2016 and six months ended September 30, 2016, respectively. A decrease in interest rate by 1% on outstanding balance as at March 31, 2016 and September 30, 2016 will have an equal but opposite impact on profit before tax for the periods then ended. This analysis assumes that all other variables such as foreign currency exchange rate, regulatory requirements etc, remain constant.

Fair value sensitivity analysis for fixed rate instruments

Based on the outstanding balances as at March 31, 2016 and September 30, 2016, an increase in annual interest rate by 1%, with all other variables held constant, would have decreased profit before tax by INR 27,930,075 and INR 18,297,378 for the year ended March 31, 2016 and six months ended September 30, 2016, respectively. A decrease in interest rate by 1% outstanding balance as at March 31, 2016 and September 30, 2016 will have had an equal but opposite impact on profit before tax for the periods then ended. This analysis assumes that all other variables such as foreign currency exchange rate, regulatory requirements etc, remain constant.

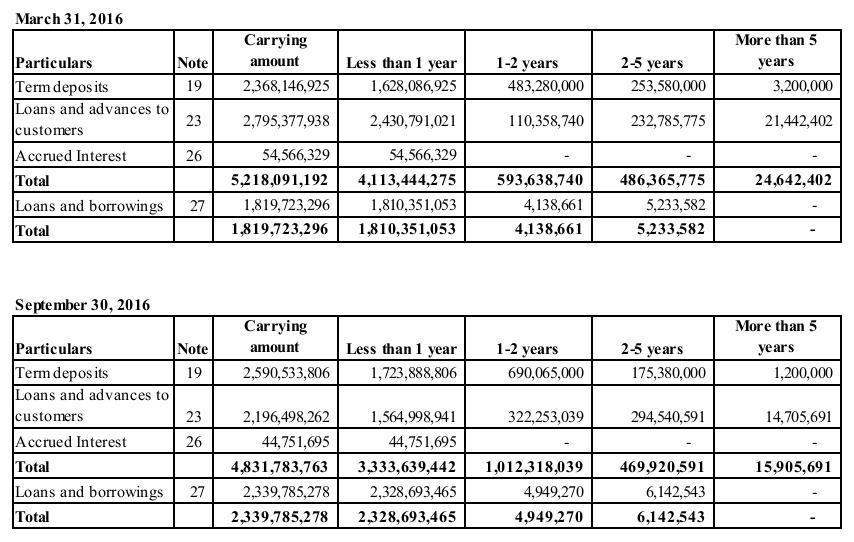

A summary of the group’s interest rate gap position on non-trading portfolios is as follows:

| 26 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| (c) | Currency risk |

The Group is not significantly exposed to currency risk as there is no mismatch between the currencies in which sales of services, purchase of goods/services and borrowings are dominated and the respective functional currencies of Group companies. Further, the functional currencies of the Group companies are primarily the Indian Rupee and U.S. dollars and do not expose the group to significant currency risk. The Group considers the valuation changes in foreign currency derivatives it trades in as part of investment/price risk as those derivatives are exchange traded, managed and monitored based on exchange price and are settled in near term in Indian Rupees.

| 27 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

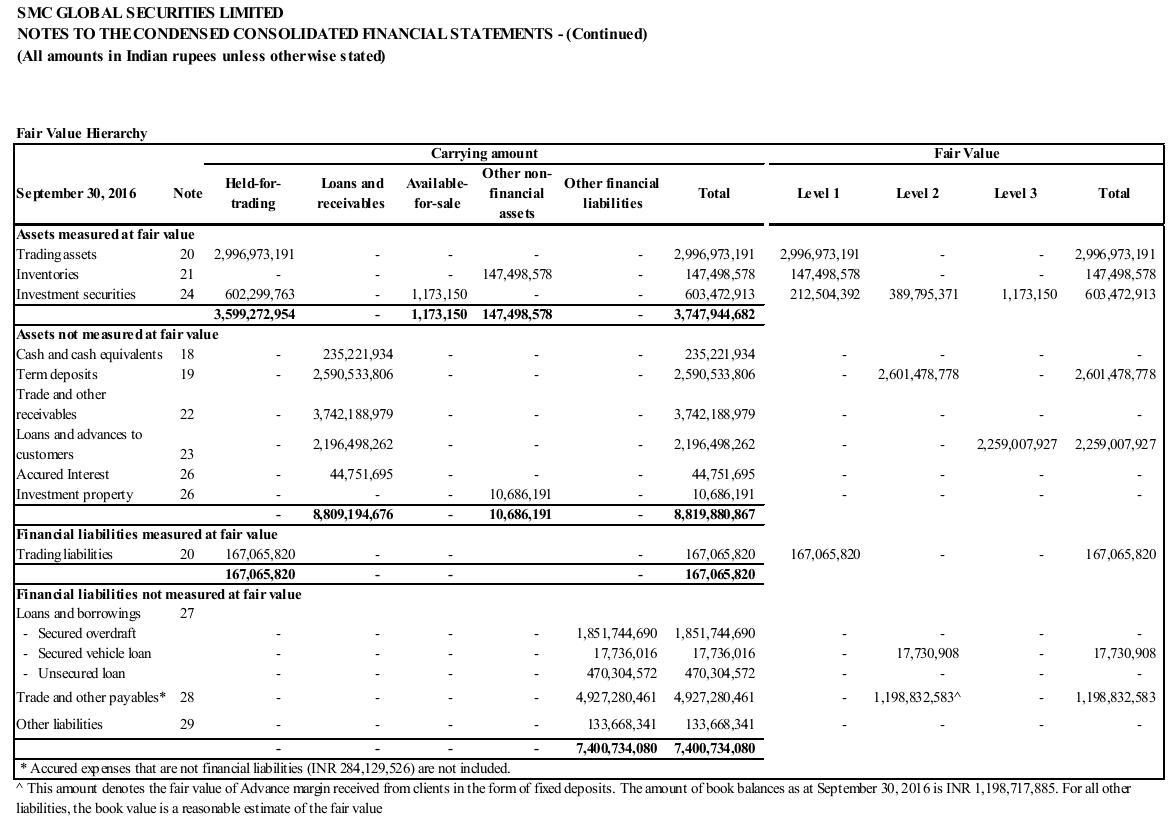

| 5. | Fair Values |

A number of the Group’s accounting policies and disclosures require the measurement of fair values, for both financial and non-financial assets and liabilities.

The Group has an established control framework with respect to the measurement of fair values. The Group Chief Financial Officer has overall responsibility for overseeing all significant fair value measurements, including level 3 fair values. The audit committee regularly reviews significant unobservable inputs and valuation adjustments.

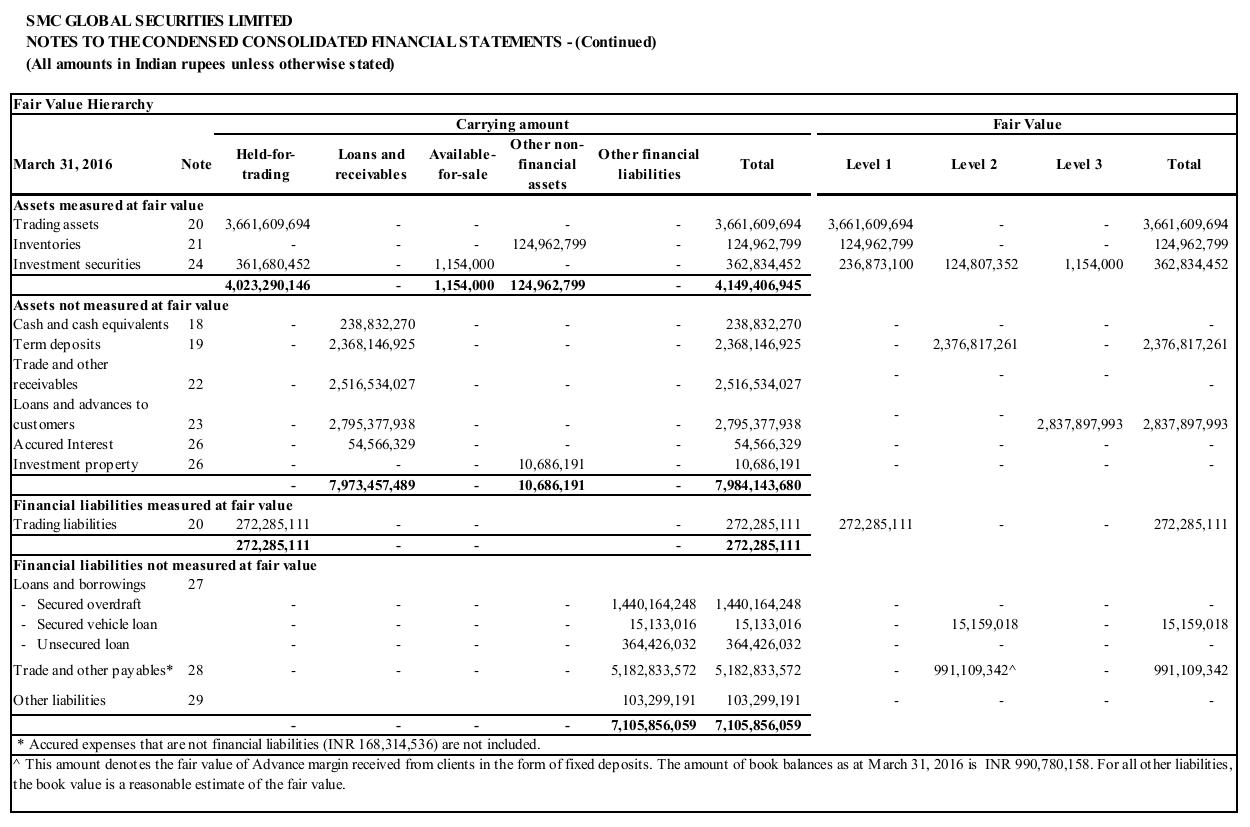

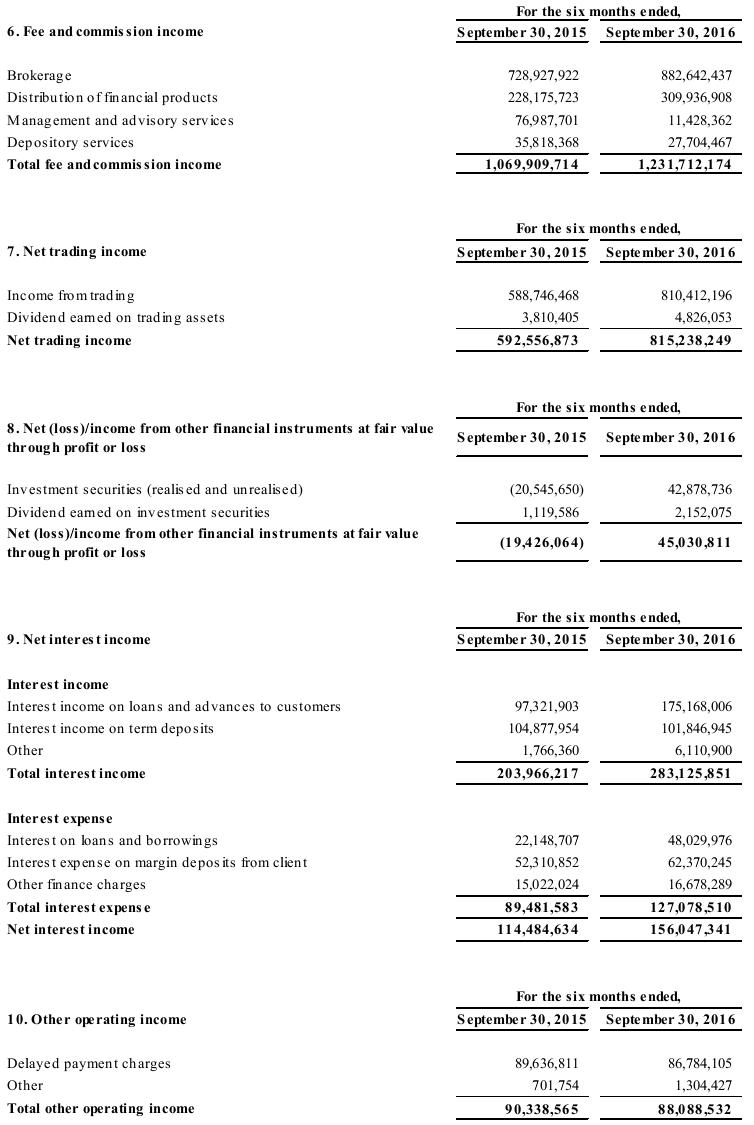

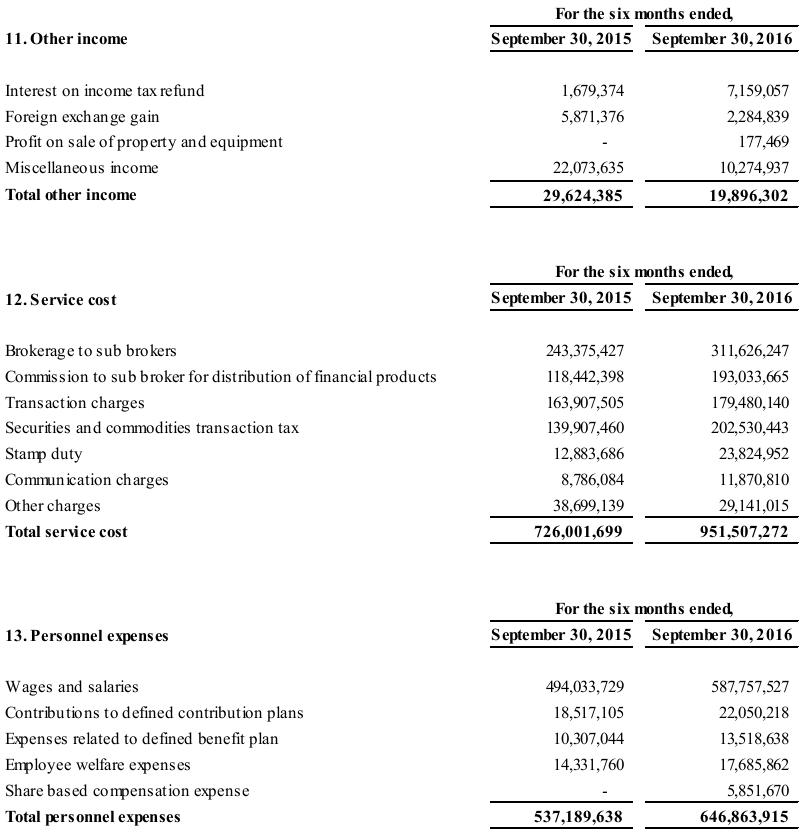

The value of Group assets and liabilities at carrying and fair value is given below:

For all other liabilities, the book value is a reasonable estimate of the fair value

Significant valuation issues if any, are reported to the Group’s Audit committee.

When measuring the fair value of an asset or a liability, the Group uses market data as far as possible. Fair values are categorized into different levels in a fair value hierarchy based on the inputs used in the valuation techniques as follows:

| ● Level 1: | Quoted prices (Unadjusted) in active markets for identical assets or liabilities. This category includes active exchange traded equity securities, debt securities, derivatives and mutual funds. | |

| ● Level 2: | Inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices). This category includes debt securities and preference shares. | |

| ● Level 3: | Inputs for the assets or liability that are not based on observable market data (Unobservable Inputs). |

| 28 |

SMC GLOBAL SECURITIES LIMITED

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

If the inputs used to measure the fair value of an asset or a liability might be categorized in different levels of the fair value hierarchy, then the fair value measurement is categorized in its entirety in the same level of the fair value hierarchy as the lowest level input that is significant to the entire measurement.

When applicable, further information about the assumptions made in determining fair values is disclosed in the notes specific to that asset or liability.

| 29 |

| 30 |

| 31 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

Level 2

This category comprises debts securities, term deposits, vehicle loans and advance margin received from clients in the form of fixed deposit classified under Trade and other payable. The valuation is based on similar contracts that are traded in an active market or the quotes obtained by the management for similar transactions.

Level 3

Valuation technique and reconciliation of level 3 fair value:

Loans and advances to customers

For loans and advances to customers fair value is estimated using valuation models, such as discounted cash flow techniques. Input into the valuation techniques includes expected lifetime credit losses, interest rates, prepayment rates and secondary market transactions.

The fair value has been computed by discounted cash flow technique at incremental rate of borrowings of 10.2%

Investment Securities

| Particulars | Amount | |||

| Balance as at April 1, 2015# | 2,554,000 | |||

| Balance as at September 30, 2015 # | 2,554,000 | |||

| Balance as at April 1, 2016 # | 1,154,000 | |||

| Purchase of unquoted equity shares | 241,000 | |||

| Sale of unquoted equity shares | (221,850 | ) | ||

| Balance as at September 30, 2016 # | 1,173,150 | |||

| # | Investment securities, classified as available for sale, comprises of unquoted equity shares. The Company estimates the fair value of the investments based upon the last transaction undertaken, being close to the balance sheet date. |

| 32 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 33 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 34 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 35 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 36 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 37 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 38 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 39 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 40 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 41 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 42 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 43 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 44 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 45 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 46 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

30. Contingencies

Contingencies and lawsuits

The Group is subject to legal proceedings and claims which arise in the ordinary course of its business. The resolution of these legal proceedings is not likely to have a material and adverse effect on the results of operations or the financial position of the Group. The contingent liability in respect of disputed demands for service tax matters amounts to INR 67,473,978 as at March 31, 2016 and September 30, 2016.

The Parent Company and one of its subsidiaries had received a notice during the financial year 2014-15 from the Collector of Stamp (HQ) Delhi on account of verification of records pertaining to stamp duty on security transactions and on account of levy of stamp duty on commodity transactions. Matter is sub-judice and has been stayed by jurisdictional High Court at Delhi.

Pending completion of the legal process the impact of liability, if any, cannot be ascertained at this stage, however, management believes that, based on legal advice, the outcome of these contingencies will be favourable and that outflow of economic resources is not probable.

| 47 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

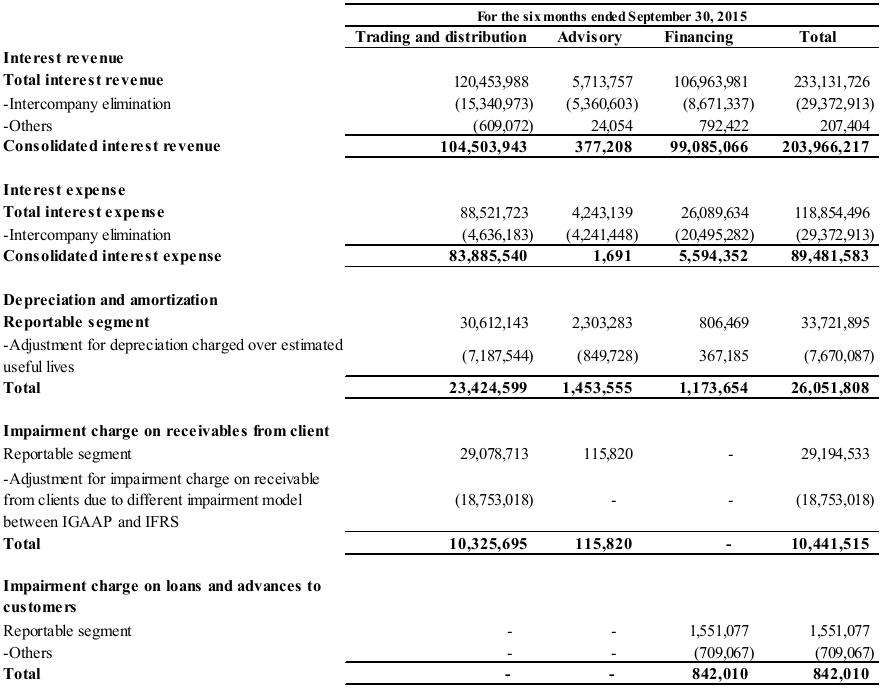

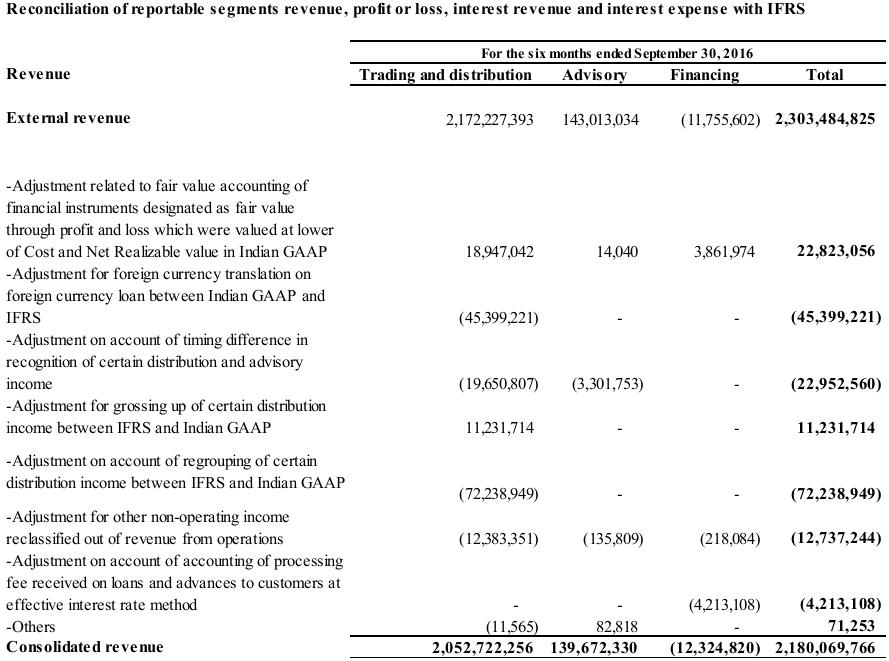

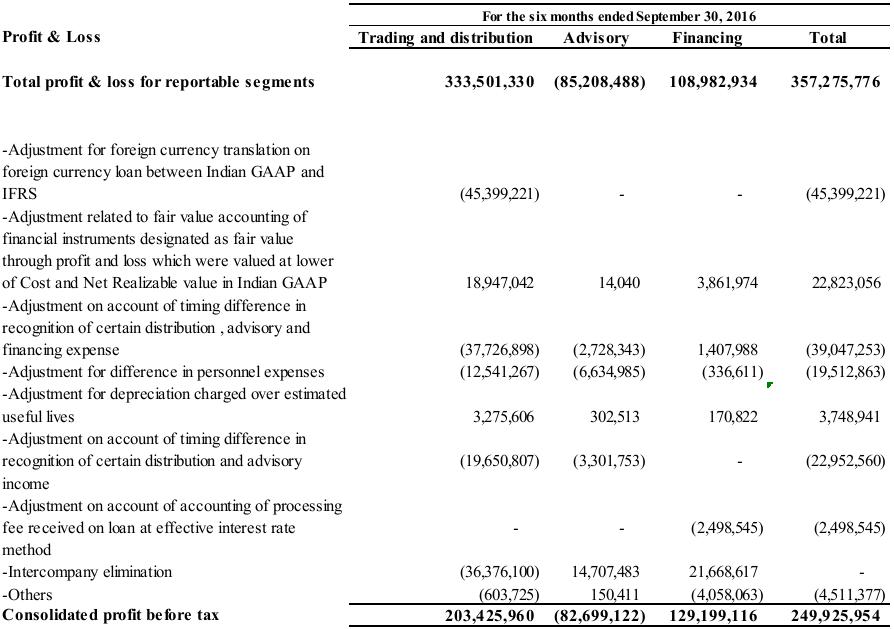

31. Operating segments

The Group has three reportable segments, as described below, which are the Group’s Lines of Business (LoBs). The LoBs offer different products and services, and are managed separately because the nature of products and method used to distribute the services are different.

The following summary describes the operations in each of the Group’s reportable segments:

1. Trading and distribution primarily comprises

| a. | Brokerage on dealing in shares, commodities, derivatives and other securities on behalf of customers; | |

| b. | Proprietary trading in shares, commodities, derivatives and other securities; | |

| c. | Clearing services; | |

| d. | Depositary services rendered as depository participant; | |

| e. | Distribution of third party financial products and | |

| f. | Insurance broking services |

2. Advisory services primarily comprises portfolio and wealth management, mortgage and loan advisory, real estate broking and investment banking services.

3. Financing services primarily comprises business of providing loans.

For these LoBs, the Group’s Leadership Team comprising of Chairman, Vice-Chairman, Group Chief Operating Officer and Group Chief Financial Officer, reviews internal management reports. Accordingly, the Leadership Team is construed to be the Chief Operating Decision Maker (CODM).

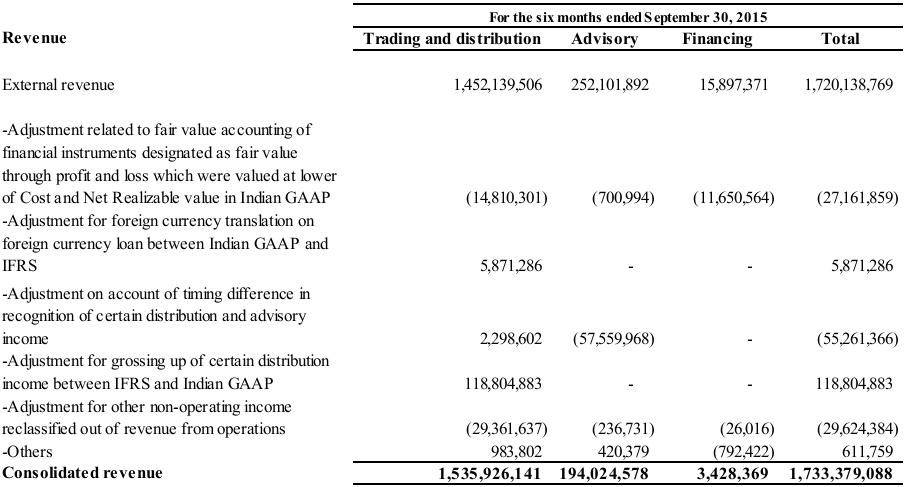

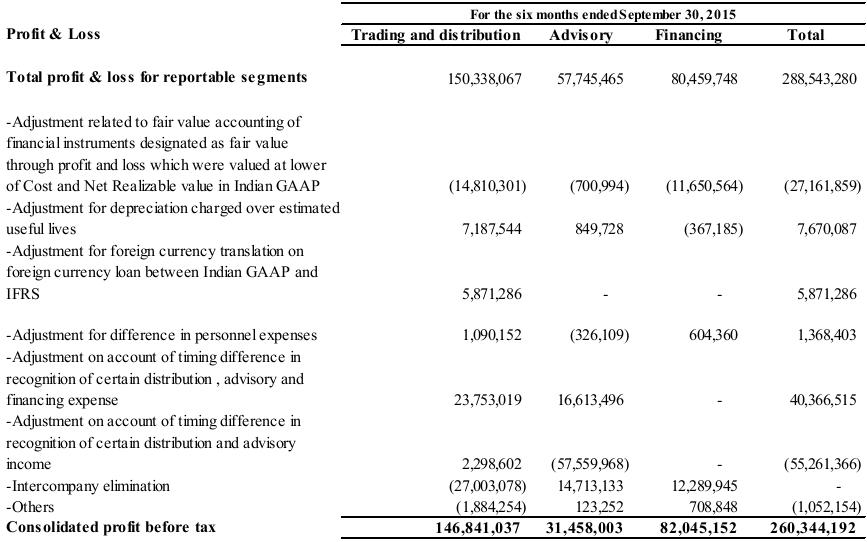

Segment profit before tax based on Indian GAAP is used to measure performance by the CODM. Inter-segment pricing is determined on an arm length basis. Information related to each reportable segment is as follows:

| 48 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

* excludes interest income

| 49 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 50 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 51 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 52 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 53 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 54 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| 55 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

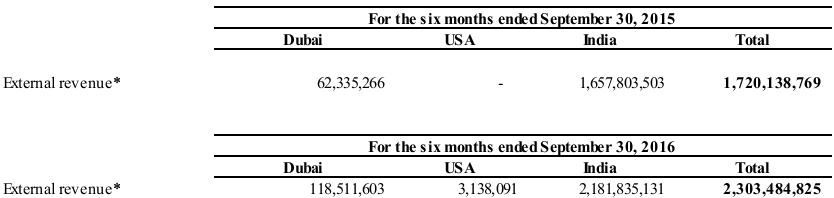

Geographical Information:

In presenting information on the basis of geographical segments, segment revenue is based on the geographical location of customers. Segment assets are based on the geographical location of the assets.

* excludes interest income

Major customers:

Considering the nature of business, customers normally include individuals. Further, none of the corporate and other customers account for more than 10% or more of the Group’s revenues.

32. Group entities

| Percentage Shareholding | ||||||||||

| Name of Subsidiary | Country of Incorporation | As at March 31, 2016 | As at September 30, 2016 | |||||||

| Subsidiary of SMC Global Securities Limited | ||||||||||

| a) SMC Comtrade Limited | India | 100 | % | 100 | % | |||||

| b) SMC Investments and Advisors Limited | India | 100 | % | 100 | % | |||||

| c) Moneywise Financial Services Private Limited | India | 100 | % | 100 | % | |||||

| d) SMC Capitals Limited | India | 100 | % | 100 | % | |||||

| e) Indunia Realtech Limited | India | 100 | % | 100 | % | |||||

| f) SMC Finvest Limited | India | 100 | % | 100 | % | |||||

| g) Moneywise Finvest Limited | India | 100 | % | 100 | % | |||||

| h) SMC Global USA Inc | USA | 100 | % | 100 | % | |||||

| Subsidiaries of SMC Comtrade Limited | ||||||||||

| i) SMC Insurance Brokers Private Limited | India | 97.58 | % | 97.58 | % | |||||

| i) SMC Comex International DMCC | UAE | 100 | % | 100 | % | |||||

| Subsidiary of SMC Finvest Limited | ||||||||||

| j) SMC Real Estate Advisors Private Limited | India | 100 | % | 100 | % | |||||

| Joint venture of SMC Investments and Advisors Limited | ||||||||||

| k) SMC & IM Capitals Investment Manager LLP | India | - | 50 | % | ||||||

| 56 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

33. Related parties

For the purpose of the condensed consolidated financial statements, parties are considered to be related to the Group, if the Group has the ability, directly or indirectly, to control the party or exercise significant influence over the party in making financial and operating decisions, or vice versa, or where the Group and the party are subject to common control or common significant influence. Related parties may be individuals or other entities including close family members.

Related parties and nature of related party relationships with whom transactions have taken place during the period:

| Nature of Relationship | Name of Related Parties | |

| Key managerial personnel | Mr. Subhash Chand Aggarwal | |

| Mr. Mahesh Chand Gupta | ||

| Mr. Ajay Garg | ||

| Mr. Anurag Bansal | ||

| Mr. Pradeep Aggarwal | ||

| Mr. D.K. Aggarwal | ||

| Mr. Pravin Kumar Aggarwal | ||

| Mr. Himanshu Gupta | ||

| Mr. Vinod Kumar Jamar | ||

| Mr. Suman Kumar | ||

| Mr. Naveen Saini | ||

| Mr. Kundan Mal Aggarwal | ||

| Mr. Pawan Kumar Bansal (upto January 22, 2016) | ||

| Mr. F. Jacob Cherian | ||

| Mr. Narain Das Gupta | ||

| Mr. Satish Chandra Gupta | ||

| Mr. Roop Chandra Jindal | ||

| Mr. Hari Das Khunteta | ||

| Ms. Madhu Vij | ||

| Mr. Chandra Wadhwa | ||

| Mr. G.S Sundararajan | ||

| Close member of family of key managerial personnel | Mr. Ravi Aggarwal | |

| Ms. Hemlata Aggarwal | ||

| Mr. Devender Aggarwal | ||

| Mr. Ayush Aggarwal | ||

| Ms. Meetu Goel | ||

| Ms. Nidhi Bansal | ||

| Ms. Sushma Gupta | ||

| Ms. Reema Garg | ||

| Mr. Lalit Kumar Aggarwal | ||

| Ms. Shruti Aggarwal | ||

| Ms. Shweta Aggarwal | ||

| Ms. Akanksha Gupta | ||

| Ms. Meena Jamar | ||

| Mr. Shreyank Jamar | ||

| Entities controlled by key management personnel and their close family members | Jai Ambey Share Broking Limited M/s Vinod Kumar Jamar (HUF) |

| 57 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| Particulars | For the six months ended September 30, 2015 | For the six months ended September 30, 2016 | ||||||

Transactions with Key Management Personnel: | ||||||||

| Compensation | ||||||||

| Wages and salaries | 25,400,226 | 38,697,186 | ||||||

| Miscellaneous expense (director sitting fees) | 1,030,000 | 1,805,000 | ||||||

| Contribution to defined contribution plans | 1,548,900 | 1,437,194 | ||||||

| Share based compensation expense | - | 5,851,670 | ||||||

| Total | 27,979,126 | 47,791,050 | ||||||

| Management and advisory services | 7,441 | 7,598 | ||||||

| Loans and advances given (refer note 1) | 2,144,098 | 993,549 | ||||||

| Interest income on loan and advances given | 72,126 | 92,862 | ||||||

| Brokerage income | 198,128 | 87,873 | ||||||

| Transactions with close member of family of Key Management Personnel: | ||||||||

| Compensation | ||||||||

| Wages and salaries | 9,203,403 | 8,149,176 | ||||||

| Contribution to defined contribution plans | 546,934 | 409,824 | ||||||

| Total | 9,750,337 | 8,559,000 | ||||||

| Loans and advances given (refer note 1) | 1,490,000 | 1,985,645 | ||||||

| Brokerage income | 68,159 | 31,301 | ||||||

| 58 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

| Particulars | For the six months ended September 30, 2015 | For the six months ended September 30, 2016 | ||||||

| Transactions with entities controlled by key management personnel | ||||||||

| Commission to sub broker for distribution of financial products | 907,766 | 623,038 | ||||||

| Brokerage earned | 345 | 1,240 | ||||||

| As at | ||||||||

| March 31, 2016 | September 30, 2016 | |||||||

| Loans and advances to key management personnel | 5,974,063 | - | ||||||

| Loans and advances to close family members of key management personnel | 1,953,945 | - | ||||||

| Trade payable to key management personnel (refer note 2) | 1,485,691 | 2,390,359 | ||||||

| Trade payable to close family member of key management personnel (refer note 2) | 1,375,074 | 865,276 | ||||||

| Trade payable to entities controlled by key management personnel (refer note 2) | 1,031,949 | 70 | ||||||

| Trade receivable from key management personnel (refer note 2) | 167 | - | ||||||

| Trade receivable from close family member of key management personnel (refer note 2) | - | 2,737 | ||||||

| Advance Margin Received from key management personnel (refer note 2) | - | 682,402 | ||||||

| Advance Margin Received from close family member of key management personnel (refer note 2) | - | 50,412 | ||||||

Notes:

| 1. | Represents maximum outstanding balance during the period. |

| 2. | On account of voluminous transactions during the period, only outstanding balance as at period end is disclosed. |

| 59 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

34. Business combination

On July 26, 2016, the Group acquired investment advisory business of Franklin Financial Planning Inc., USA. (“Franklin”), a SEC registered investment advisory firm located in Deland, Florida. The Group has acquired Franklin because it expands both its existing investment advisory portfolio and customer base. The acquisition has been accounted for using the acquisition method of accounting. The total purchase consideration for Franklin is INR 52,382,225(US $ 812,000), which includes the cash consideration of INR 30,119,151 (US $ 446,600) and equity consideration in form of shares of SMC Global USA Inc. (a subsidiary of the Parent Company) of INR 24,642,941 (US $ 365,400).

In connection with the transaction, the Group based on a provisional valuation recorded INR 13,083,554 (US $ 194,000) in customer-related intangibles, which has a weighted average amortization period of six years. The resultants goodwill arising from the acquisition amounted to INR 41,678,538 (US $ 618,000), which is primarily attributed to the expected synergies and other benefits from the acquisition. The goodwill is deductible for income tax purposes.

Transaction costs of INR 700,000 have been expensed and are included in other expenses in the Statement of Profit or Loss and are part of operating cash flows in the Statement of Cash Flows.

The results of operations of the acquired business and the fair value of the acquired assets are included in the Condensed Consolidated Financial Statements with effect from the date of the acquisition.

For the six-months ended September 30, 2016, acquired business contributed revenue of INR 3,145,800 (US $ 47,308) and loss of INR 679,889 (US $ 10,224) to the Group’s results.

For the six-months ended September 30, 2016, SMC Global USA Inc. contributed revenue of INR 3,145,800 (US $ 47,308) and loss of INR 7,570,056 (US $ 113,842) to the Group’s results.

35. Share based payment

SMC Global USA Inc., a subsidiary of the Group, agreed to issue 10% equity shares in the Company to Jacob Cherian (CEO of SMC Global USA Inc.) towards his services rendered. The fair value of these shares on the grant date, i.e. July 1, 2016, amounted to INR 5,934,808 (US $88,000) based on external valuation report obtained by the Group. This value has been determined based on weights assigned to discounted cash flow method and comparable companies method. The Group has accordingly recognized this amount as a share based compensation expenses under Personnel expenses during the six months ended September 30, 2016.

36. Investment in Joint venture

On May 2, 2016, the Group entered into a Memorandum of Understanding (MOU) with IM+ Capital Group to incorporate a Limited Liability Partnership namely SMC & IM Capitals LLP (“LLP”) wherein both the entities will be equal business partners. LLP was incorporated on June 30, 2016 and the regulatory SEBI approval was obtained on October 18, 2016. Investment manager will be responsible for management of assets and schemes of trust, identifying and appraising investment opportunities, negotiating terms of investments and making investment decisions. LLP has been treated as a joint venture based on the factors including structure, legal form and contractual arrangement. Therefore, the same has been accounted for on an equity pickup basis.

| 60 |

SMC GLOBAL SECURITIES LIMITED

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(All amounts in Indian rupees unless otherwise stated)

37. Subsequent events

There were no material post subsequent events which have a bearing on the understanding of the financial statements except the following

The Company has incorporated a subsidiary, SMC Global IFSC Private Limited on December 8, 2016 to do broking/arbitrage business in equity and currency market in the Gujarat International Finance Tec-city, Gujarat.

| 61 |