Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 CREDIT SUPPLEMENT - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | a2016creditsupplement8k.htm |

| 8-K - 8-K - FEDERAL NATIONAL MORTGAGE ASSOCIATION FANNIE MAE | fanniemae20168k.htm |

Resource Center: 1-800-732-6643

Exhibit 99.1

Contact: Pete Bakel

202-752-2034

Date: February 17, 2017

Fannie Mae Reports Net Income of $12.3 Billion and

Comprehensive Income of $11.7 Billion for 2016

Company Reports Net Income of $5.0 Billion and

Comprehensive Income of $4.9 Billion for Fourth Quarter 2016

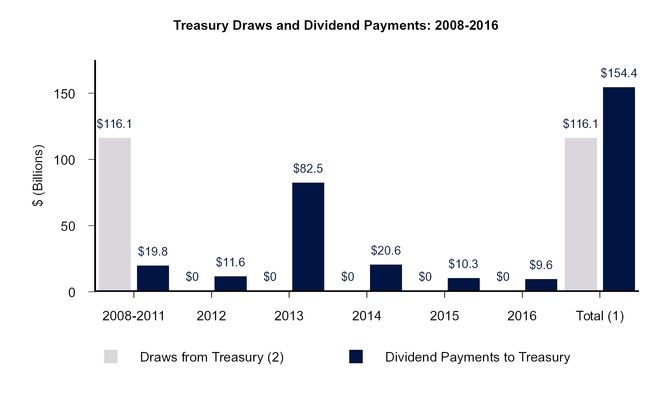

• | Fannie Mae paid a total of $9.6 billion in dividends to Treasury in 2016. The company expects to pay Treasury $5.5 billion in dividends in March 2017. With the expected March 2017 dividend payment, Fannie Mae will have paid a total of $159.9 billion in dividends to Treasury. |

• | Fannie Mae was the largest provider of liquidity to the mortgage market in 2016, providing approximately $637 billion in mortgage financing that enabled families to buy, refinance, or rent homes. |

• | Fannie Mae is focused on providing value to the housing finance system by: |

◦ | delivering increased efficiency, simplicity, and certainty to customers; |

◦ | implementing innovations that deliver greater value and reduced risk to lenders, such as the company’s Day 1 Certainty™ initiative with verification tools to expand representation and warranty relief; and |

◦ | helping make predictable long-term fixed-rate mortgages, including the 30-year fixed-rate mortgage, available to families across the country. |

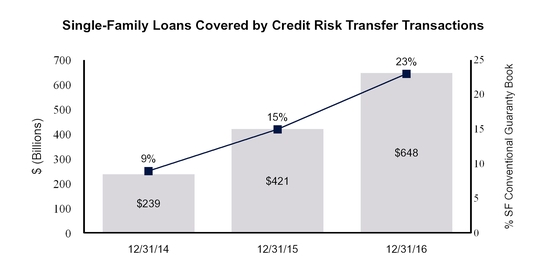

• | Fannie Mae continues to lay off risk to private capital in the mortgage market and reduce taxpayer risk through its credit risk transfer transactions. As of December 31, 2016, approximately 23 percent of the loans in the company’s single-family conventional guaranty book of business, measured by unpaid principal balance, were covered by a credit risk transfer transaction. |

WASHINGTON, DC — Fannie Mae (FNMA/OTC) reported annual net income of $12.3 billion and annual comprehensive income of $11.7 billion in 2016. For the fourth quarter of 2016, Fannie Mae reported net income of $5.0 billion and comprehensive income of $4.9 billion. The company reported a positive net worth of $6.1 billion as of December 31, 2016. As a result, the company expects to pay Treasury a $5.5 billion dividend in March 2017.

“Our strong 2016 results reflect a multi-year drive to improve Fannie Mae’s business model, strengthen the housing finance system, and deliver innovation and certainty to customers,” said Timothy J. Mayopoulos, president and chief executive officer. “We delivered new technologies that reduce risk and cost for our Single-Family customers and help them make the mortgage process simpler, more certain, and easier for borrowers. Our Multifamily business achieved record volume in 2016, and we deepened our commitment to delivering solutions that support affordable and workforce housing. We look forward to another year of progress as we continue to improve our operations and deliver greater value to our partners, the industry, taxpayers, and the housing market.”

Fourth Quarter and Full Year 2016 Results | 1 | |

Full Year 2016 Results - Fannie Mae’s 2016 net income of $12.3 billion increased from $11.0 billion in 2015 due primarily to:

• | A shift to credit-related income in 2016 from credit-related expense in 2015 driven by a higher benefit for credit losses and lower foreclosed property expense. |

• | Lower fair value losses in 2016 compared to 2015. Fair value losses in 2016 were driven primarily by a decrease in the fair value of the company’s risk management derivatives in the first half of 2016 due to declines in longer-term interest rates during the period. These losses were partially offset by an increase in the fair value of the company’s risk management derivatives in the second half of 2016 due to an increase in longer-term interest rates during the period. |

Fourth Quarter 2016 Results - Fannie Mae’s fourth quarter 2016 net income of $5.0 billion increased from $3.2 billion in the third quarter of 2016 due primarily to:

• | A shift to fair value gains in the fourth quarter compared with fair value losses in the third quarter. Fair value gains in the fourth quarter of 2016 were due primarily to increases in longer-term interest rates positively impacting the value of the company’s risk management and mortgage commitment derivatives. |

• | The increase in net income was partially offset by a shift to a provision for credit losses in the fourth quarter compared with a benefit for credit losses in the third quarter. An increase in actual and projected interest rates in the fourth quarter increased the impairment on the company’s individually impaired loans primarily related to concessions provided on its modified loans, which was the driver of the provision for credit losses for the quarter. |

SUMMARY OF FOURTH QUARTER AND FULL YEAR 2016 RESULTS

(Dollars in millions) | 4Q16 | 3Q16 | Variance | 2016 | 2015 | Variance | ||||||||||||||||||

Net interest income | $ | 5,805 | $ | 5,435 | $ | 370 | $ | 21,295 | $ | 21,409 | $ | (114 | ) | |||||||||||

Fee and other income | 414 | 175 | 239 | 966 | 1,348 | (382 | ) | |||||||||||||||||

Net revenues | 6,219 | 5,610 | 609 | 22,261 | 22,757 | (496 | ) | |||||||||||||||||

Investment gains, net | 322 | 467 | (145 | ) | 1,256 | 1,336 | (80 | ) | ||||||||||||||||

Fair value gains (losses), net | 3,890 | (491 | ) | 4,381 | (1,081 | ) | (1,767 | ) | 686 | |||||||||||||||

Administrative expenses | (714 | ) | (661 | ) | (53 | ) | (2,741 | ) | (3,050 | ) | 309 | |||||||||||||

Credit-related income (expense) | ||||||||||||||||||||||||

Benefit (provision) for credit losses | (1,303 | ) | 673 | (1,976 | ) | 2,155 | 795 | 1,360 | ||||||||||||||||

Foreclosed property expense | (137 | ) | (110 | ) | (27 | ) | (644 | ) | (1,629 | ) | 985 | |||||||||||||

Total credit-related income (expense) | (1,440 | ) | 563 | (2,003 | ) | 1,511 | (834 | ) | 2,345 | |||||||||||||||

Temporary Payroll Tax Cut Continuation Act of 2011 (“TCCA”) fees | (487 | ) | (465 | ) | (22 | ) | (1,845 | ) | (1,621 | ) | (224 | ) | ||||||||||||

Other expenses, net | (210 | ) | (300 | ) | 90 | (1,028 | ) | (613 | ) | (415 | ) | |||||||||||||

Income before federal income taxes | 7,580 | 4,723 | 2,857 | 18,333 | 16,208 | 2,125 | ||||||||||||||||||

Provision for federal income taxes | (2,545 | ) | (1,527 | ) | (1,018 | ) | (6,020 | ) | (5,253 | ) | (767 | ) | ||||||||||||

Net income | 5,035 | 3,196 | 1,839 | 12,313 | 10,955 | 1,358 | ||||||||||||||||||

Less: Net income attributable to the noncontrolling interest | — | — | — | — | (1 | ) | 1 | |||||||||||||||||

Net income attributable to Fannie Mae | $ | 5,035 | $ | 3,196 | $ | 1,839 | $ | 12,313 | $ | 10,954 | $ | 1,359 | ||||||||||||

Total comprehensive income attributable to Fannie Mae | $ | 4,871 | $ | 2,989 | $ | 1,882 | $ | 11,665 | $ | 10,628 | $ | 1,037 | ||||||||||||

Dividends distributed or available for distribution to senior preferred stockholder | $ | (5,471 | ) | $ | (2,977 | ) | $ | (2,494 | ) | $ | (12,236 | ) | $ | (11,216 | ) | $ | (1,020 | ) | ||||||

Fourth Quarter and Full Year 2016 Results | 2 | |

Net revenues, which consist of net interest income and fee and other income, were $6.2 billion for the fourth quarter of 2016, compared with $5.6 billion for the third quarter of 2016. For the year, net revenues were $22.3 billion, compared with $22.8 billion in 2015.

The company has two primary sources of net interest income: (1) the guaranty fees it receives for managing the credit risk on loans underlying Fannie Mae mortgage-backed securities held by third parties; and (2) the difference between interest income earned on the assets in its retained mortgage portfolio and the interest expense associated with the debt that funds those assets.

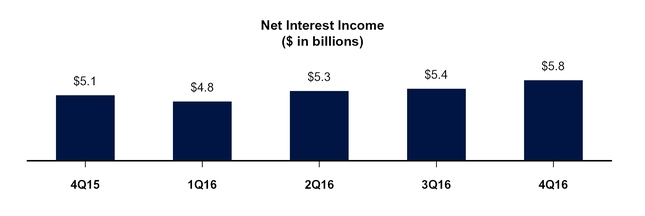

Net interest income was $5.8 billion for the fourth quarter of 2016, compared with $5.4 billion for the third quarter of 2016. The increase in net interest income for the fourth quarter of 2016 was due to higher guaranty fee income driven primarily by amortization income, partially offset by lower net interest income from the company’s retained mortgage portfolio. For the year, net interest income was $21.3 billion for 2016, compared with $21.4 billion for 2015. The decrease in annual net interest income was due primarily to lower net interest income from the company’s retained mortgage portfolio, almost entirely offset by an increase in guaranty fee income.

In recent years, an increasing portion of Fannie Mae’s net interest income has been derived from guaranty fees rather than from the company’s retained mortgage portfolio assets. This is a result of both the guaranty fee increases implemented in 2012 and the reduction of the retained mortgage portfolio. More than two-thirds of the company’s 2016 net interest income was derived from its guaranty business. The company expects that guaranty fees will continue to account for an increasing portion of its net interest income.

Fee and other income was $414 million for the fourth quarter of 2016, compared with $175 million for the third quarter of 2016. The increase in fee and other income for the fourth quarter of 2016 was due primarily to a settlement agreement in the fourth quarter of 2016 that resolved certain of the company’s claims relating to private-label mortgage-related securities guaranteed by Fannie Mae. For the year, fee and other income was $1.0 billion for 2016, compared with $1.3 billion for 2015. Fee and other income decreased in 2016 compared with 2015 due primarily due to lower multifamily fees in 2016 driven by a decrease in yield maintenance income. In addition, the company recognized lower technology fees in 2016 as a result of eliminating fees charged to its customers for using its Desktop Underwriter® and Desktop Originator® systems beginning in June 2015.

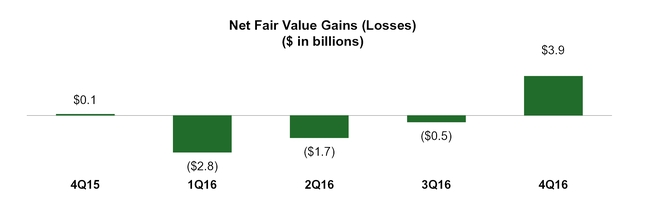

Net fair value gains were $3.9 billion in the fourth quarter of 2016, compared with losses of $491 million in the third quarter of 2016. Net fair value gains in the fourth quarter of 2016 were due primarily to increases in longer-term interest rates positively impacting the value of the company’s risk management derivatives. Net fair value gains in the fourth quarter of 2016 also were driven by gains on commitments to sell mortgage-related securities driven by a decrease in prices as interest rates increased during the commitment periods in the quarter. For the year, net fair value losses were $1.1 billion, compared with $1.8 billion in 2015. The company recognized fair value losses for 2016 primarily as a result of a decrease in the fair value of its risk management derivatives in the first half of 2016 due to declines in longer-term interest rates during the period. These losses were partially offset by an increase in the fair value of the company’s risk management derivatives in the second half of 2016 due to an increase in longer-term interest rates during the period. The estimated fair value of the company’s derivatives and securities may

Fourth Quarter and Full Year 2016 Results | 3 | |

fluctuate substantially from period to period because of changes in interest rates, the yield curve, mortgage and credit spreads, implied volatility, and activity related to these financial instruments.

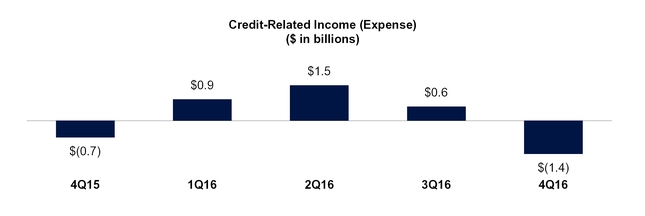

Credit-related expense (income) consists of a provision or benefit for credit losses and foreclosed property expense or income. Credit-related expense was $1.4 billion in the fourth quarter of 2016, compared with credit-related income of $563 million in the third quarter of 2016. The shift to credit-related expense in the fourth quarter of 2016 from credit-related income in the third quarter of 2016 was due primarily to a provision for credit losses driven primarily by an increase in actual and projected interest rates during the quarter. The increase in actual and projected interest rates in the fourth quarter increased the impairment on the company’s individually impaired loans primarily related to concessions provided on its modified loans, which was the driver of the provision for credit losses for the quarter. For the year, credit-related income was $1.5 billion, compared with credit-related expense of $834 million in 2015. The shift to credit-related income in 2016 compared with credit-related expense in 2015 was driven primarily by a higher benefit for credit losses due primarily to a smaller impact resulting from the redesignation of loans from held-for-investment to held-for-sale in 2016 compared with 2015. Also contributing to the shift to credit-related income in 2016 was a decrease in foreclosed property expense primarily due to a decline in the number of single-family foreclosed properties.

Fourth Quarter and Full Year 2016 Results | 4 | |

VARIABILITY OF FINANCIAL RESULTS

Fannie Mae expects to remain profitable on an annual basis for the foreseeable future; however, certain factors, such as changes in interest rates or home prices, could result in significant volatility in the company’s financial results from quarter to quarter or year to year. Fannie Mae’s future financial results also will be affected by a number of other factors, including: the company’s guaranty fee rates; the volume of single-family mortgage originations in the future; the size, composition, and quality of its retained mortgage portfolio and guaranty book of business; and economic and housing market conditions. Although Fannie Mae expects to remain profitable on an annual basis for the foreseeable future, due to the company’s limited and declining capital reserves (which decrease to zero in 2018) and the potential for significant volatility in its financial results, it could experience a net worth deficit in a future quarter. If the company experiences a net worth deficit in a future quarter, it will be required to draw additional funds from Treasury under its senior preferred stock purchase agreement in order to avoid being placed into receivership.

The company’s expectations for its future financial results do not take into account the impact on its business of potential future legislative or regulatory changes, which could have a material impact on the company’s financial results, particularly the enactment of housing finance reform legislation, corporate income tax reform legislation, and changes in accounting standards. For example, the current Administration proposes reducing the U.S. corporate income tax rate. Under applicable accounting standards, a significant reduction in the U.S. corporate income tax rate would require the company to record a substantial reduction in the value of its deferred tax assets in the quarter in which the legislation is enacted. Thus, if legislation significantly lowering the U.S. corporate income tax rate is enacted, the company expects to incur a significant net loss and net worth deficit for the quarter in which the legislation is enacted and could potentially incur a net loss for that year. If the company experiences a net worth deficit in a future quarter, it will be required to draw additional funds from Treasury under the senior preferred stock purchase agreement in order to avoid being placed into receivership. For additional information on factors that affect the company’s financial results, please refer to the company’s annual report on Form 10-K for the year ended December 31, 2016 (the “2016 Form 10-K”).

SUMMARY OF FOURTH QUARTER AND FULL YEAR 2016 BUSINESS SEGMENT RESULTS

Fannie Mae’s two reportable business segments—Single-Family and Multifamily—engage in complementary business activities in pursuing Fannie Mae’s vision to be America’s most valued housing partner and to provide liquidity, access to credit, and affordability in all U.S. housing markets at all times, while effectively managing and reducing risk to Fannie Mae’s business, taxpayers, and the housing finance system. In support of this vision, Fannie Mae is focused on: advancing a sustainable and reliable business model that reduces risk to the housing finance system and taxpayers; providing reliable, large-scale access to affordable mortgage credit for qualified borrowers and helping struggling homeowners; and serving customer needs by building a company that is efficient, innovative, and continuously improving.

Previously, Fannie Mae had a third reportable business segment—Capital Markets. In the fourth quarter of 2016, the company realigned the composition of its reportable business segments to incorporate the activities of the Capital Markets group into the Single-Family or Multifamily segments. All prior year segment information in this release has been revised to conform to the company’s new segment reporting presentation.

Fourth Quarter and Full Year 2016 Results | 5 | |

(Dollars in millions) | 4Q16 | 3Q16 | Variance | 2016 | 2015 | Variance | ||||||||||||||||||

Single-Family Segment: | ||||||||||||||||||||||||

Net interest income | $ | 5,178 | $ | 4,858 | $ | 320 | $ | 19,010 | $ | 19,301 | $ | (291 | ) | |||||||||||

Fee and other income | 299 | 77 | 222 | 521 | 636 | (115 | ) | |||||||||||||||||

Net revenues | 5,477 | 4,935 | 542 | 19,531 | 19,937 | (406 | ) | |||||||||||||||||

Credit-related income (expense) | (1,456 | ) | 531 | (1,987 | ) | 1,439 | (1,035 | ) | 2,474 | |||||||||||||||

Investment gains, net | 209 | 399 | (190 | ) | 944 | 970 | (26 | ) | ||||||||||||||||

Fair value gains (losses), net | 3,988 | (499 | ) | 4,487 | (1,040 | ) | (1,505 | ) | 465 | |||||||||||||||

Administrative expenses | (630 | ) | (583 | ) | (47 | ) | (2,418 | ) | (2,711 | ) | 293 | |||||||||||||

TCCA fees | (487 | ) | (465 | ) | (22 | ) | (1,845 | ) | (1,621 | ) | (224 | ) | ||||||||||||

Other expenses | (239 | ) | (276 | ) | 37 | (1,012 | ) | (831 | ) | (181 | ) | |||||||||||||

Income before federal income taxes | 6,862 | 4,042 | 2,820 | 15,599 | 13,204 | 2,395 | ||||||||||||||||||

Provision for federal income taxes | (2,375 | ) | (1,385 | ) | (990 | ) | (5,417 | ) | (4,593 | ) | (824 | ) | ||||||||||||

Net income | $ | 4,487 | $ | 2,657 | $ | 1,830 | $ | 10,182 | $ | 8,611 | $ | 1,571 | ||||||||||||

Multifamily Segment: | ||||||||||||||||||||||||

Net interest income | $ | 627 | $ | 577 | $ | 50 | $ | 2,285 | $ | 2,108 | $ | 177 | ||||||||||||

Fee and other income | 115 | 98 | 17 | 445 | 712 | (267 | ) | |||||||||||||||||

Net revenues | 742 | 675 | 67 | 2,730 | 2,820 | (90 | ) | |||||||||||||||||

Credit-related income | 16 | 32 | (16 | ) | 72 | 201 | (129 | ) | ||||||||||||||||

Fair value (losses) gains, net | (98 | ) | 8 | (106 | ) | (41 | ) | (262 | ) | 221 | ||||||||||||||

Gains from partnership investments | 46 | 4 | 42 | 91 | 283 | (192 | ) | |||||||||||||||||

Administrative expenses | (84 | ) | (78 | ) | (6 | ) | (323 | ) | (339 | ) | 16 | |||||||||||||

Other income | 96 | 40 | 56 | 205 | 301 | (96 | ) | |||||||||||||||||

Income before federal income taxes | 718 | 681 | 37 | 2,734 | 3,004 | (270 | ) | |||||||||||||||||

Provision for federal income taxes | (170 | ) | (142 | ) | (28 | ) | (603 | ) | (660 | ) | 57 | |||||||||||||

Less: Net income attributable to noncontrolling interest | — | — | — | — | (1 | ) | 1 | |||||||||||||||||

Net income | $ | 548 | $ | 539 | $ | 9 | $ | 2,131 | $ | 2,343 | $ | (212 | ) | |||||||||||

Single-Family Business

• | Single-Family net income was $4.5 billion in the fourth quarter of 2016, compared with $2.7 billion in the third quarter of 2016. The increase in net income in the fourth quarter was driven primarily by a shift to fair value gains, partially offset by a shift to credit-related expense. For the year, the Single-Family business had net income of $10.2 billion, compared with $8.6 billion in 2015. The increase in annual net income was driven primarily by a shift to credit-related income in 2016. |

• | Single-Family fair value gains were $4.0 billion in the fourth quarter of 2016, compared with $499 million in fair value losses in the third quarter of 2016. Net fair value gains in the fourth quarter of 2016 were due primarily to increases in longer-term interest rates positively impacting the value of the company’s risk management derivatives. Net fair value gains in the fourth quarter of 2016 also were driven by gains on commitments to sell mortgage-related securities driven by a decrease in prices as interest rates increased during the commitment periods in the quarter. In 2016, the Single-Family business had fair value losses of $1.0 billion, compared with $1.5 billion in 2015. The Single-Family business recognized fair value losses for 2016 primarily as a result of a decrease in the fair value of its risk management derivatives in the first half of 2016 due to declines in longer-term interest rates during the period. These losses were partially offset by an increase in the fair value of the company’s risk management derivatives in the second half of 2016 due to an increase in longer-term interest rates during the period. |

Fourth Quarter and Full Year 2016 Results | 6 | |

• | Single-Family credit-related expense was $1.5 billion in the fourth quarter of 2016, compared with credit-related income of $531 million in the third quarter of 2016. The shift to credit-related expense in the fourth quarter of 2016 from credit-related income in the third quarter of 2016 was due primarily to a provision for credit losses driven primarily by an increase in actual and projected interest rates during the quarter. The increase in actual and projected interest rates in the fourth quarter increased the impairment on the company’s individually impaired loans primarily related to concessions provided on its modified loans, which was the driver of the provision for credit losses for the quarter. For the year, Single-Family credit-related income was $1.4 billion, compared with credit-related expense of $1.0 billion in 2015. The shift to credit-related income in 2016 compared with credit-related expense in 2015 was driven primarily by a higher benefit for credit losses due primarily to a smaller impact resulting from the redesignation of loans from held-for-investment to held-for-sale in 2016 compared with 2015. Also contributing to the shift to credit-related income in 2016 was a decrease in foreclosed property expense primarily due to a decline in the number of single-family foreclosed properties. |

Multifamily Business

• | Multifamily net income was $548 million in the fourth quarter of 2016, compared with $539 million in the third quarter of 2016. The increase in Multifamily net income for the fourth quarter of 2016 was driven primarily by higher net interest income, other income, and gains from partnership investments, partially offset by a shift to fair value losses from fair value gains. For the year, Multifamily net income was $2.1 billion, compared with $2.3 billion in 2015. The decrease in multifamily net income for 2016 was driven primarily by lower fee and other income, gains from partnership investments and credit-related income, partially offset by higher net interest income and lower fair value losses. |

• | Multifamily new business volume increased in 2016 compared with 2015 driven by continued growth in the overall multifamily market. FHFA’s 2016 conservatorship scorecard included an objective to maintain the dollar volume of new multifamily business at or below $36.5 billion excluding certain targeted business segments. The Multifamily business met this objective with approximately 66 percent of Fannie Mae’s 2016 multifamily new business volume of $55.3 billion counting towards FHFA’s 2016 multifamily volume cap. |

BUILDING A SUSTAINABLE HOUSING FINANCE SYSTEM

In addition to continuing to provide liquidity and support to the mortgage market, Fannie Mae has invested significant resources toward helping to maintain a safer and sustainable housing finance system for today and build a safer and sustainable housing finance system for the future. The company is pursuing the strategic goals identified by its conservator, FHFA. These strategic goals are: maintain, in a safe and sound manner, credit availability and foreclosure prevention activities for new and refinanced mortgages to foster liquid, efficient, competitive, and resilient national housing finance markets; reduce taxpayer risk through increasing the role of private capital in the mortgage market; and build a new single-family infrastructure for use by Fannie Mae and Freddie Mac and adaptable for use by other participants in the secondary market in the future.

ABOUT FANNIE MAE’S CONSERVATORSHIP AND AGREEMENTS WITH TREASURY

Fannie Mae has operated under the conservatorship of FHFA since September 6, 2008. Treasury has made a commitment under a senior preferred stock purchase agreement to provide funding to Fannie Mae under certain circumstances if the company has a net worth deficit. Pursuant to this agreement and the senior preferred stock the company issued to Treasury in 2008, the Director of FHFA has directed Fannie Mae to pay dividends to Treasury on a quarterly basis since entering into conservatorship in 2008. The chart below shows the funds the company has drawn from Treasury pursuant to the senior preferred stock purchase agreement, as well as the dividend payments the company has made to Treasury on the senior preferred stock, since entering into conservatorship.

Fourth Quarter and Full Year 2016 Results | 7 | |

(1) | Under the terms of the senior preferred stock purchase agreement, dividend payments the company makes to Treasury do not offset the company’s prior draws of funds from Treasury, and the company is not permitted to pay down draws it has made under the agreement except in limited circumstances. Accordingly, the current aggregate liquidation preference of the senior preferred stock is $117.1 billion, due to the initial $1.0 billion liquidation preference of the senior preferred stock (for which the company did not receive cash proceeds) and the $116.1 billion the company has drawn from Treasury. Amounts may not sum due to rounding. |

(2) | Treasury draws are shown in the period for which requested, not when the funds were received by the company. Fannie Mae has not requested a draw for any period since 2012. |

Fannie Mae expects to pay Treasury a dividend of $5.5 billion for the first quarter of 2017 by March 31, 2017, calculated based on the company’s net worth of $6.1 billion as of December 31, 2016, less the current capital reserve amount of $600 million.

In August 2012, the terms governing the company’s dividend obligations on the senior preferred stock were amended. The amended senior preferred stock purchase agreement does not allow the company to build a capital reserve. Beginning in 2013, the required senior preferred stock dividends each quarter equal the amount, if any, by which the company’s net worth as of the end of the immediately preceding fiscal quarter exceeds an applicable capital reserve amount. The capital reserve amount is $600 million for each quarter of 2017 and will decrease to zero in 2018.

The amount of remaining funding available to Fannie Mae under the senior preferred stock purchase agreement with Treasury is currently $117.6 billion. If the company were to draw additional funds from Treasury under the agreement in a future period, the amount of remaining funding under the agreement would be reduced by the amount of the company’s draw. Dividend payments Fannie Mae makes to Treasury do not restore or increase the amount of funding available to the company under the agreement.

Fannie Mae is not permitted to redeem the senior preferred stock prior to the termination of Treasury’s funding commitment under the senior preferred stock purchase agreement. The limited circumstances under which Treasury’s funding commitment will terminate are described in “Business—Conservatorship and Treasury Agreements” in the company’s 2016 Form 10-K.

Fourth Quarter and Full Year 2016 Results | 8 | |

CREDIT RISK TRANSFER TRANSACTIONS

In late 2013, Fannie Mae began entering into credit risk transfer transactions with the goal of transferring, to the extent economically sensible, a portion of the existing mortgage credit risk on some of the recently acquired loans in its single-family book of business in order to reduce the economic risk to the company and taxpayers of future borrower defaults. Fannie Mae’s primary method of achieving this goal has been through the issuance of its Connecticut Avenue SecuritiesTM (CAS) and its Credit Insurance Risk TransferTM (CIRTTM) transactions. In these transactions, the company transfers to investors a portion of the mortgage credit risk associated with losses on a reference pool of mortgage loans and in exchange pays investors a premium that effectively reduces the guaranty fee income the company retains on the loans.

As of December 31, 2016, $647.5 billion in outstanding unpaid principal balance of the company’s single-family loans, or approximately 23 percent of the loans in its single-family conventional guaranty book of business measured by unpaid principal balance, were included in a reference pool for a credit risk transfer transaction. During 2016, the company transferred a portion of the mortgage credit risk on single-family mortgages with unpaid principal balance of over $330 billion at the time of the transactions.

These transactions increase the role of private capital in the mortgage market and reduce the risk to Fannie Mae’s business, taxpayers, and the housing finance system. Over time, the company expects that a larger portion of its single-family conventional guaranty book of business will be covered by credit risk transfer transactions.

The chart below shows as of the dates specified the total outstanding unpaid principal balance of Fannie Mae’s single-family loans, as well as the percentage of the company’s total single-family conventional guaranty book of business measured by unpaid principal balance, that were included in a reference pool for a credit risk transfer transaction.

CREDIT QUALITY

While continuing to make it possible for families to buy, refinance, or rent homes, Fannie Mae has maintained responsible credit standards. Since 2009, Fannie Mae has seen the effect of the actions it took, beginning in 2008, to significantly strengthen its underwriting and eligibility standards to promote sustainable homeownership and stability in the housing market. Fannie Mae actively monitors the credit risk profile and credit performance of the company’s single-family loan acquisitions, in conjunction with housing market and economic conditions, to determine if its pricing, eligibility, and underwriting criteria accurately reflect the risks associated with loans the company acquires or guarantees. Single-family conventional loans acquired by Fannie Mae in 2016 had a weighted average borrower FICO credit score at origination of 750 and a weighted average original loan-to-value ratio of 74 percent.

Fourth Quarter and Full Year 2016 Results | 9 | |

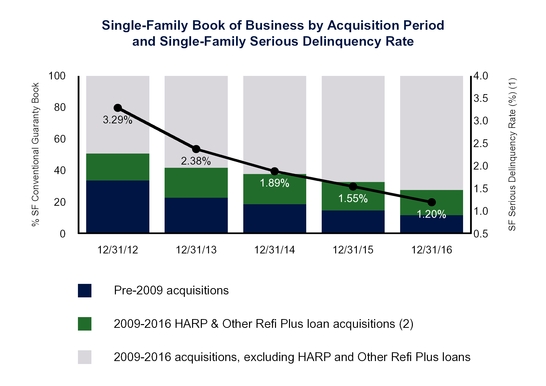

As of December 31, 2016, 88 percent of the company’s single-family conventional guaranty book of business consisted of loans acquired since 2009.

(1) | Calculated as of the end of each period based on the number of single-family conventional loans that are 90 days or more past due and loans that have been referred to foreclosure but not yet foreclosed upon, divided by the number of loans in our single-family conventional guaranty book of business. |

(2) | Fannie Mae has acquired HARP loans and other Refi Plus loans under its Refi PlusTM initiative since 2009. The Refi Plus initiative offers refinancing flexibility to eligible borrowers who are current on their loans and whose loans are owned or guaranteed by Fannie Mae and meet certain additional criteria. HARP loans, which have loan-to-value (“LTV”) ratios at origination greater than 80 percent, refers to loans the company has acquired pursuant to the Home Affordable Refinance Program® (“HARP®”). Other Refi Plus loans, which have LTV ratios at origination of 80 percent or less, refers to loans the company has acquired under its Refi Plus initiative other than HARP loans. Loans the company acquires under Refi Plus and HARP are refinancings of loans that were originated prior to June 2009. |

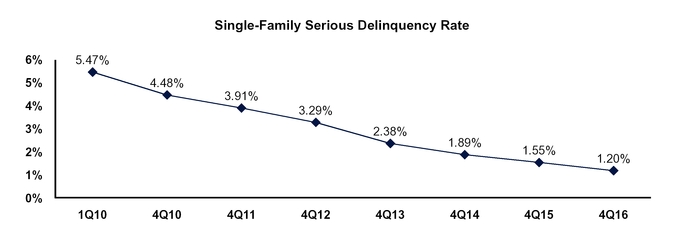

The single-family serious delinquency rate for Fannie Mae’s book of business has declined for 27 consecutive quarters since the first quarter of 2010, and was 1.20 percent as of December 31, 2016, compared with 5.47 percent as of March 31, 2010.

Fannie Mae expect its single-family serious delinquency rate to continue to decline; however, as the single-family serious delinquency rate has already declined significantly over the past several years, the company expects more modest declines in this rate in the future. The company’s single-family serious delinquency rate and the period of time that loans remain seriously delinquent continue to be negatively affected by the length of time required to complete a foreclosure in some states. Other factors that affect the company’s single-family serious delinquency rate include the pace of loan modifications, the timing and volume of nonperforming loan sales we make, servicer performance, and changes in home prices, unemployment levels and other macroeconomic conditions.

Fourth Quarter and Full Year 2016 Results | 10 | |

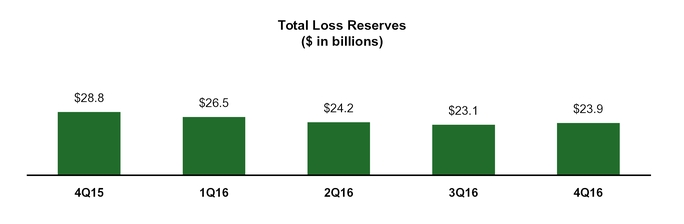

Total Loss Reserves, which reflect the company’s estimate of the probable losses the company has incurred in its guaranty book of business, including concessions it granted borrowers upon modification of their loans, decreased to $23.9 billion as of December 31, 2016 from $28.8 billion as of December 31, 2015. The decrease in the company’s total loss reserves during 2016 was driven primarily by liquidations of mortgage loans and charge-offs, which relieved the allowance on these loans, as well as an increase in home prices. The company’s loss reserves have declined substantially from their peak and are expected to decline further in 2017; however, we expect a smaller decline in our loss reserves in 2017 as compared with the decline in 2016.

PROVIDING LIQUIDITY AND SUPPORT TO THE MARKET

Liquidity

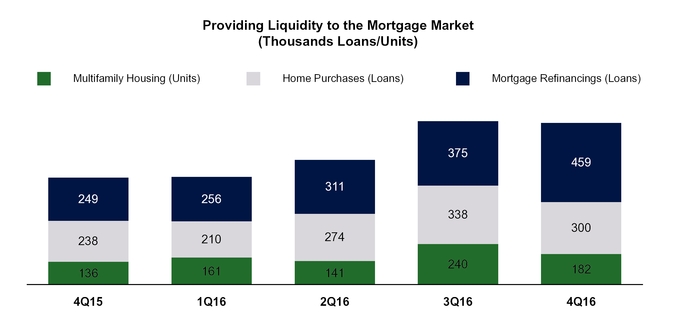

Fannie Mae provided approximately $637 billion in liquidity to the mortgage market in 2016, including approximately $193 billion in liquidity in the fourth quarter of 2016, through its purchases and guarantees of loans, which resulted in:

• | Approximately 1,122,000 home purchases in 2016, including approximately 300,000 in the fourth quarter of 2016 |

• | Approximately 1,401,000 mortgage refinancings in 2016, including approximately 459,000 in the fourth quarter of 2016 |

• | Approximately 724,000 units of multifamily housing in 2016, including approximately 182,000 in the fourth quarter of 2016 |

Fourth Quarter and Full Year 2016 Results | 11 | |

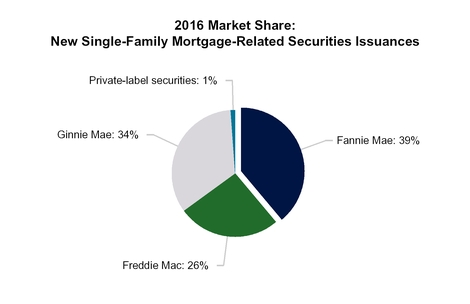

The company was the largest issuer of single-family mortgage-related securities in the secondary market in the fourth quarter and full year of 2016, with an estimated market share of new single-family mortgage-related securities issuances of 41 percent in the fourth quarter and 39 percent for all of 2016, compared with 37 percent for all of 2015.

Fannie Mae also remained a continuous source of liquidity in the multifamily market in 2016. As of September 30, 2016 (the latest date for which information is available), the company owned or guaranteed approximately 19 percent of the outstanding debt on multifamily properties.

Fourth Quarter and Full Year 2016 Results | 12 | |

Refinancing Initiatives

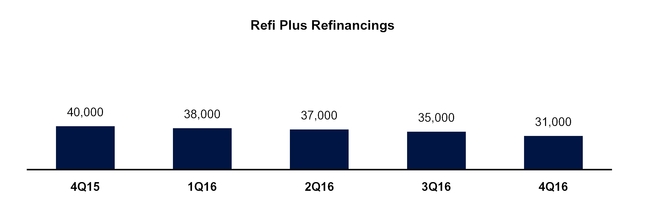

Through the company’s Refi Plus initiative, which offers refinancing flexibility to eligible Fannie Mae borrowers and includes HARP, the company acquired approximately 31,000 loans in the fourth quarter of 2016 and approximately 141,000 loans for the full year of 2016. Refinancings delivered to Fannie Mae through Refi Plus in the fourth quarter of 2016 reduced borrowers’ monthly mortgage payments by an average of $221. The company expects the volume of refinancings under HARP to continue to remain a small percentage of its acquisitions between now and the program’s expiration, due to the small population of borrowers with loans that have high LTV ratios who are willing to refinance and would benefit from refinancing. Both HARP and the company’s Refi Plus initiative are scheduled to end on September 30, 2017.

Home Retention Solutions and Foreclosure Alternatives

To reduce the credit losses Fannie Mae ultimately incurs on its book of business, the company has been focusing its efforts on several strategies, including reducing defaults by offering home retention solutions, such as loan modifications.

For the Year Ended December 31, | ||||||||||||||||||||

2016 | 2015 | 2014 | ||||||||||||||||||

Unpaid Principal Balance | Number of Loans | Unpaid Principal Balance | Number of Loans | Unpaid Principal Balance | Number of Loans | |||||||||||||||

(Dollars in millions) | ||||||||||||||||||||

Home retention solutions: | ||||||||||||||||||||

Modifications | $ | 13,474 | 80,304 | $ | 15,723 | 94,212 | $ | 20,686 | 122,823 | |||||||||||

Repayment plans and forbearances completed | 904 | 6,423 | 835 | 5,996 | 986 | 7,309 | ||||||||||||||

Total home retention solutions | 14,378 | 86,727 | 16,558 | 100,208 | 21,672 | 130,132 | ||||||||||||||

Foreclosure alternatives: | ||||||||||||||||||||

Short sales | 2,275 | 11,009 | 3,033 | 14,716 | 4,795 | 23,188 | ||||||||||||||

Deeds-in-lieu of foreclosure | 865 | 5,752 | 1,145 | 7,361 | 1,786 | 11,292 | ||||||||||||||

Total foreclosure alternatives | 3,140 | 16,761 | 4,178 | 22,077 | 6,581 | 34,480 | ||||||||||||||

Total loan workouts | $ | 17,518 | 103,488 | $ | 20,736 | 122,285 | $ | 28,253 | 164,612 | |||||||||||

Loan workouts as a percentage of single-family guaranty book of business | 0.62 | % | 0.60 | % | 0.73 | % | 0.71 | % | 0.99 | % | 0.94 | % | ||||||||

Fannie Mae views foreclosure as a last resort. For homeowners and communities in need, the company offers alternatives to foreclosure. In dealing with homeowners in distress, the company first seeks home retention solutions, which enable borrowers to stay in their homes, before turning to foreclosure alternatives.

Fourth Quarter and Full Year 2016 Results | 13 | |

• | Fannie Mae provided approximately 23,000 loan workouts during the fourth quarter of 2016 and approximately 103,500 for the full year of 2016 enabling borrowers to avoid foreclosure. |

• | Fannie Mae completed approximately 17,000 loan modifications during the fourth quarter of 2016 and approximately 80,000 for the full year of 2016. |

FORECLOSURES AND REAL ESTATE OWNED (REO) PROPERTIES

When there is no viable home retention solution or foreclosure alternative that can be applied, the company seeks to move to foreclosure expeditiously in an effort to minimize prolonged delinquencies that can hurt local home values and destabilize communities.

For the Year Ended December 31, | ||||||||||||

2016 | 2015 | 2014 | ||||||||||

Single-family foreclosed properties (number of properties): | ||||||||||||

Beginning of period inventory of single-family foreclosed properties (REO) | 57,253 | 87,063 | 103,229 | |||||||||

Total properties acquired through foreclosure | 53,509 | 78,636 | 116,637 | |||||||||

Dispositions of REO | (72,669 | ) | (108,446 | ) | (132,803 | ) | ||||||

End of period inventory of single-family foreclosed properties (REO) | 38,093 | 57,253 | 87,063 | |||||||||

Carrying value of single-family foreclosed properties (dollars in millions) | $ | 4,372 | $ | 6,608 | $ | 9,745 | ||||||

Single-family foreclosure rate | 0.31 | % | 0.45 | % | 0.67 | % | ||||||

• | Fannie Mae acquired 10,736 single-family REO properties, primarily through foreclosure, in the fourth quarter of 2016, compared with 12,402 in the third quarter of 2016. |

• | As of December 31, 2016, the company’s inventory of single-family REO properties was 38,093, compared with 41,973 as of September 30, 2016. The carrying value of the company’s single-family REO was $4.4 billion as of December 31, 2016. |

• | The company’s single-family foreclosure rate was 0.31 percent for the full year of 2016. This reflects the total number of single-family properties acquired through foreclosure or deeds-in-lieu of foreclosure as a percentage of the total number of loans in Fannie Mae’s single-family guaranty book of business. |

Fannie Mae’s financial statements for the full year of 2016 are available in the accompanying Annex; however, investors and interested parties should read the company’s 2016 Form 10-K, which was filed today with the Securities and Exchange Commission and is available on Fannie Mae’s website, www.fanniemae.com. The company provides further discussion of its financial results and condition, credit performance, and other matters in its 2016 Form 10-K. Additional information about the company’s credit performance, the characteristics of its guaranty book of business, its foreclosure-prevention efforts, and other measures is contained in the “2016 Credit Supplement” at www.fanniemae.com.

# # #

In this release, the company has presented a number of estimates, forecasts, expectations, and other forward-looking statements, including statements regarding: its future dividend payments to Treasury; the impact of and future plans with respect to the company’s credit risk transfer transactions; the sources of its future net interest income; the company’s future profitability; the factors that will affect the company’s future financial results; the company’s future serious delinquency rates and the factors that will affect the company’s future single-family serious delinquency rates; the future volume of its HARP refinancings; the future fair value of the company’s financial instruments; the company’s future loss reserves; and the impact of the company’s actions to reduce credit losses. These estimates, forecasts, expectations, and statements are forward-looking statements based on the company’s current assumptions regarding numerous factors. Actual results, and future projections, could be materially different from what is set forth in the forward-looking statements as a result of: home price changes; interest rate changes; unemployment rates; other macroeconomic and housing market variables; the company’s future serious delinquency rates; the company’s future guaranty fee pricing and the impact of that pricing on the company’s guaranty fee revenues and competitive environment; government policy; credit availability; changes in borrower behavior; the volume of loans it modifies; the effectiveness of its loss mitigation strategies; significant changes in modification and foreclosure activity; the volume and pace of future nonperforming loan sales and their impact on the company’s results and serious delinquency rates; the effectiveness of its management of its real estate owned inventory and pursuit of contractual remedies; changes in the fair value of its assets and liabilities; future legislative or regulatory requirements or changes that have a significant

Fourth Quarter and Full Year 2016 Results | 14 | |

impact on the company’s business, such as the enactment of housing finance reform legislation or corporate income tax reform legislation; actions by FHFA, Treasury, the Department of Housing and Urban Development or other regulators that affect the company’s business; the size, composition and quality of the company’s guaranty book of business and retained mortgage portfolio; the company’s market share; the life of the loans in the company’s guaranty book of business; future updates to the company’s models relating to loss reserves, including the assumptions used by these models; changes in generally accepted accounting principles; changes to the company’s accounting policies; whether the company’s counterparties meet their obligations in full; effects from activities the company takes to support the mortgage market and help borrowers; the company’s future objectives and activities in support of those objectives, including actions the company may take to reach additional underserved creditworthy borrowers; actions the company may be required to take by FHFA, in its role as its conservator or as its regulator, such as changes in the type of business the company does or the implementation of a single security for Fannie Mae and Freddie Mac; limitations on our business imposed by FHFA, in its role as the company’s conservator or as its regulator; the conservatorship and its effect on the company’s business; the investment by Treasury and its effect on the company’s business; the uncertainty of the company’s future; challenges the company faces in retaining and hiring qualified executives and other employees; the deteriorated credit performance of many loans in the company’s guaranty book of business; a decrease in the company’s credit ratings; defaults by one or more institutional counterparties; resolution or settlement agreements the company may enter into with its counterparties; operational control weaknesses; changes in the fiscal and monetary policies of the Federal Reserve, including any change in the Federal Reserve’s policy toward the reinvestment of principal payments of mortgage-backed securities or any future sales of such securities; changes in the structure and regulation of the financial services industry; the company’s ability to access the debt markets; disruptions in the housing, credit, and stock markets; government investigations and litigation; the company’s reliance on and the performance of the company’s servicers; conditions in the foreclosure environment; global political risks; natural disasters, environmental disasters, terrorist attacks, pandemics, or other major disruptive events; information security breaches or threats; and many other factors, including those discussed in the “Risk Factors” and “Forward-Looking Statements” sections of and elsewhere in the company’s 2016 Form 10-K and elsewhere in this release.

Fannie Mae provides website addresses in its news releases solely for readers’ information. Other content or information appearing on these websites is not part of this release.

Fannie Mae helps make the 30-year fixed-rate mortgage and affordable rental housing possible for millions of Americans. We partner with lenders to create housing opportunities for families across the country. We are driving positive changes in housing finance to make the home buying process easier, while reducing costs and risk. To learn more, visit fanniemae.com and follow us on twitter.com/fanniemae.

Fourth Quarter and Full Year 2016 Results | 15 | |

ANNEX

FANNIE MAE

(In conservatorship)

Consolidated Balance Sheets

(Dollars in millions, except share amounts)

As of December 31, | |||||||||||

2016 | 2015 | ||||||||||

ASSETS | |||||||||||

Cash and cash equivalents | $ | 25,224 | $ | 14,674 | |||||||

Restricted cash (includes $31,536 and $25,865, respectively, related to consolidated trusts) | 36,953 | 30,879 | |||||||||

Federal funds sold and securities purchased under agreements to resell or similar arrangements | 30,415 | 27,350 | |||||||||

Investments in securities: | |||||||||||

Trading, at fair value (includes $1,277 and $135, respectively, pledged as collateral) | 40,562 | 39,908 | |||||||||

Available-for-sale, at fair value (includes $107 and $285, respectively, related to consolidated trusts) | 8,363 | 20,230 | |||||||||

Total investments in securities | 48,925 | 60,138 | |||||||||

Mortgage loans: | |||||||||||

Loans held for sale, at lower of cost or fair value | 2,899 | 5,361 | |||||||||

Loans held for investment, at amortized cost: | |||||||||||

Of Fannie Mae | 204,318 | 233,054 | |||||||||

Of consolidated trusts | 2,896,001 | 2,809,180 | |||||||||

Total loans held for investment (includes $12,057 and $14,075, respectively, at fair value) | 3,100,319 | 3,042,234 | |||||||||

Allowance for loan losses | (23,465 | ) | (27,951 | ) | |||||||

Total loans held for investment, net of allowance | 3,076,854 | 3,014,283 | |||||||||

Total mortgage loans | 3,079,753 | 3,019,644 | |||||||||

Deferred tax assets, net | 33,530 | 37,187 | |||||||||

Accrued interest receivable, net (includes $7,064 and $6,974, respectively, related to consolidated trusts) | 7,737 | 7,726 | |||||||||

Acquired property, net | 4,489 | 6,766 | |||||||||

Other assets | 20,942 | 17,553 | |||||||||

Total assets | $ | 3,287,968 | $ | 3,221,917 | |||||||

LIABILITIES AND EQUITY | |||||||||||

Liabilities: | |||||||||||

Accrued interest payable (includes $8,285 and $8,194, respectively, related to consolidated trusts) | $ | 9,431 | $ | 9,794 | |||||||

Debt: | |||||||||||

Of Fannie Mae (includes $9,582 and $11,133, respectively, at fair value) | 327,097 | 386,135 | |||||||||

Of consolidated trusts (includes $36,524 and $23,609, respectively, at fair value) | 2,935,219 | 2,811,536 | |||||||||

Other liabilities (includes $390 and $448, respectively, related to consolidated trusts) | 10,150 | 10,393 | |||||||||

Total liabilities | 3,281,897 | 3,217,858 | |||||||||

Commitments and contingencies | — | — | |||||||||

Fannie Mae stockholders’ equity: | |||||||||||

Senior preferred stock, 1,000,000 shares issued and outstanding | 117,149 | 117,149 | |||||||||

Preferred stock, 700,000,000 shares are authorized— 555,374,922 shares issued and outstanding | 19,130 | 19,130 | |||||||||

Common stock, no par value, no maximum authorization—1,308,762,703 shares issued and 1,158,082,750 shares outstanding | 687 | 687 | |||||||||

Accumulated deficit | (124,253 | ) | (126,942 | ) | |||||||

Accumulated other comprehensive income | 759 | 1,407 | |||||||||

Treasury stock, at cost, 150,679,953 shares | (7,401 | ) | (7,401 | ) | |||||||

Total Fannie Mae stockholders’ equity | 6,071 | 4,030 | |||||||||

Noncontrolling interest | — | 29 | |||||||||

Total equity | 6,071 | 4,059 | |||||||||

Total liabilities and equity | $ | 3,287,968 | $ | 3,221,917 | |||||||

See Notes to Consolidated Financial Statements in 2016 Form 10-K

Fourth Quarter and Full Year 2016 Results | 16 | |

FANNIE MAE

(In conservatorship)

Consolidated Statements of Operations and Comprehensive Income

(Dollars and shares in millions, except per share amounts)

For the Year Ended December 31, | |||||||||||||||||

2016 | 2015 | 2014 | |||||||||||||||

Interest income: | |||||||||||||||||

Trading securities | $ | 516 | $ | 444 | $ | 553 | |||||||||||

Available-for-sale securities | 620 | 1,156 | 1,622 | ||||||||||||||

Mortgage loans (includes $95,266, $97,971 and $101,835, respectively, related to consolidated trusts) | 104,642 | 107,699 | 112,120 | ||||||||||||||

Other | 243 | 143 | 110 | ||||||||||||||

Total interest income | 106,021 | 109,442 | 114,405 | ||||||||||||||

Interest expense: | |||||||||||||||||

Short-term debt | 206 | 146 | 94 | ||||||||||||||

Long-term debt (includes $77,575, $80,326 and $85,835, respectively, related to consolidated trusts) | 84,520 | 87,887 | 94,343 | ||||||||||||||

Total interest expense | 84,726 | 88,033 | 94,437 | ||||||||||||||

Net interest income | 21,295 | 21,409 | 19,968 | ||||||||||||||

Benefit for credit losses | 2,155 | 795 | 3,964 | ||||||||||||||

Net interest income after benefit for credit losses | 23,450 | 22,204 | 23,932 | ||||||||||||||

Investment gains, net | 1,256 | 1,336 | 936 | ||||||||||||||

Fair value losses, net | (1,081 | ) | (1,767 | ) | (4,833 | ) | |||||||||||

Fee and other income | 966 | 1,348 | 5,887 | ||||||||||||||

Non-interest income | 1,141 | 917 | 1,990 | ||||||||||||||

Administrative expenses: | |||||||||||||||||

Salaries and employee benefits | 1,336 | 1,319 | 1,321 | ||||||||||||||

Professional services | 955 | 984 | 1,076 | ||||||||||||||

Occupancy expenses | 186 | 182 | 203 | ||||||||||||||

Other administrative expenses | 264 | 565 | 177 | ||||||||||||||

Total administrative expenses | 2,741 | 3,050 | 2,777 | ||||||||||||||

Foreclosed property expense | 644 | 1,629 | 142 | ||||||||||||||

Temporary Payroll Cut Continuation Act of 2011 (“TCCA”) fees | 1,845 | 1,621 | 1,375 | ||||||||||||||

Other expenses, net | 1,028 | 613 | 478 | ||||||||||||||

Total expenses | 6,258 | 6,913 | 4,772 | ||||||||||||||

Income before federal income taxes | 18,333 | 16,208 | 21,150 | ||||||||||||||

Provision for federal income taxes | (6,020 | ) | (5,253 | ) | (6,941 | ) | |||||||||||

Net income | 12,313 | 10,955 | 14,209 | ||||||||||||||

Other comprehensive income (loss): | |||||||||||||||||

Changes in unrealized gains on available-for-sale securities, net of reclassification adjustments and taxes | (642 | ) | (763 | ) | 494 | ||||||||||||

Other | (6 | ) | 437 | 36 | |||||||||||||

Total other comprehensive income (loss) | (648 | ) | (326 | ) | 530 | ||||||||||||

Total comprehensive income | 11,665 | 10,629 | 14,739 | ||||||||||||||

Less: Comprehensive income attributable to noncontrolling interest | — | (1 | ) | (1 | ) | ||||||||||||

Total comprehensive income attributable to Fannie Mae | $ | 11,665 | $ | 10,628 | $ | 14,738 | |||||||||||

Net income | $ | 12,313 | $ | 10,955 | $ | 14,209 | |||||||||||

Less: Net income attributable to noncontrolling interest | — | (1 | ) | (1 | ) | ||||||||||||

Net income attributable to Fannie Mae | $ | 12,313 | $ | 10,954 | $ | 14,208 | |||||||||||

Dividends distributed or available for distribution to senior preferred stockholder | (12,236 | ) | (11,216 | ) | (15,323 | ) | |||||||||||

Net loss attributable to common stockholders | $ | 77 | $ | (262 | ) | $ | (1,115 | ) | |||||||||

Earnings (loss) per share: | |||||||||||||||||

Basic | $ | 0.01 | $ | (0.05 | ) | $ | (0.19 | ) | |||||||||

Diluted | 0.01 | (0.05 | ) | (0.19 | ) | ||||||||||||

Weighted-average common shares outstanding: | |||||||||||||||||

Basic | 5,762 | 5,762 | 5,762 | ||||||||||||||

Diluted | 5,893 | 5,762 | 5,762 | ||||||||||||||

See Notes to Consolidated Financial Statements in 2016 Form 10-K

Fourth Quarter and Full Year 2016 Results | 17 | |

FANNIE MAE

(In conservatorship)

Consolidated Statements of Cash Flows

(Dollars in millions)

For the Year Ended December 31, | |||||||||||

2016 | 2015 | 2014 | |||||||||

Cash flows used in operating activities: | |||||||||||

Net income | $ | 12,313 | $ | 10,955 | $ | 14,209 | |||||

Reconciliation of net income to net cash used in operating activities: | |||||||||||

Amortization of cost basis adjustments | (6,821 | ) | (6,298 | ) | (4,265 | ) | |||||

Benefit for credit losses | (2,155 | ) | (795 | ) | (3,964 | ) | |||||

Valuation gains | (472 | ) | (510 | ) | (2,159 | ) | |||||

Current and deferred federal income taxes | 4,309 | 4,083 | 4,126 | ||||||||

Net change in trading securities | (3,005 | ) | (10,153 | ) | (2,666 | ) | |||||

Net gains related to the disposition of acquired property and preforeclosure sales, including credit enhancements | (3,124 | ) | (3,055 | ) | (4,510 | ) | |||||

Other, net | (1,778 | ) | (900 | ) | (2,109 | ) | |||||

Net cash used in operating activities | (733 | ) | (6,673 | ) | (1,338 | ) | |||||

Cash flows provided by investing activities: | |||||||||||

Proceeds from maturities and paydowns of trading securities held for investment | 1,840 | 768 | 1,358 | ||||||||

Proceeds from sales of trading securities held for investment | 1,618 | 1,104 | 1,668 | ||||||||

Proceeds from maturities and paydowns of available-for-sale securities | 2,927 | 4,394 | 5,853 | ||||||||

Proceeds from sales of available-for-sale securities | 11,378 | 8,249 | 3,265 | ||||||||

Purchases of loans held for investment | (233,935 | ) | (187,194 | ) | (132,650 | ) | |||||

Proceeds from repayments of loans acquired as held for investment of Fannie Mae | 25,294 | 25,776 | 24,840 | ||||||||

Proceeds from sales of loans acquired as held for investment of Fannie Mae | 5,222 | 3,196 | 1,879 | ||||||||

Proceeds from repayments and sales of loans acquired as held for investment of consolidated trusts | 543,690 | 484,230 | 388,348 | ||||||||

Net change in restricted cash | (6,074 | ) | 1,663 | (3,547 | ) | ||||||

Advances to lenders | (140,147 | ) | (118,746 | ) | (100,045 | ) | |||||

Proceeds from disposition of acquired property and preforeclosure sales | 16,115 | 20,757 | 25,476 | ||||||||

Net change in federal funds sold and securities purchased under agreements to resell or similar arrangements | (3,065 | ) | 3,600 | 8,025 | |||||||

Other, net | 116 | 527 | 197 | ||||||||

Net cash provided by investing activities | 224,979 | 248,324 | 224,667 | ||||||||

Cash flows used in financing activities: | |||||||||||

Proceeds from issuance of debt of Fannie Mae | 982,272 | 443,371 | 380,282 | ||||||||

Payments to redeem debt of Fannie Mae | (1,043,108 | ) | (518,575 | ) | (450,140 | ) | |||||

Proceeds from issuance of debt of consolidated trusts | 437,392 | 347,614 | 275,353 | ||||||||

Payments to redeem debt of consolidated trusts | (580,642 | ) | (511,158 | ) | (405,505 | ) | |||||

Payments of cash dividends on senior preferred stock to Treasury | (9,624 | ) | (10,278 | ) | (20,594 | ) | |||||

Other, net | 14 | 26 | 70 | ||||||||

Net cash used in financing activities | (213,696 | ) | (249,000 | ) | (220,534 | ) | |||||

Net increase (decrease) in cash and cash equivalents | 10,550 | (7,349 | ) | 2,795 | |||||||

Cash and cash equivalents at beginning of period | 14,674 | 22,023 | 19,228 | ||||||||

Cash and cash equivalents at end of period | $ | 25,224 | $ | 14,674 | $ | 22,023 | |||||

Cash paid during the period for: | |||||||||||

Interest | $ | 104,318 | $ | 104,928 | $ | 108,667 | |||||

Income taxes | 1,711 | 1,170 | 2,815 | ||||||||

Non-cash activities: | |||||||||||

Net mortgage loans acquired by assuming debt | $ | 275,710 | $ | 220,168 | $ | 190,151 | |||||

Net transfers from mortgage loans of Fannie Mae to mortgage loans of consolidated trusts | 223,705 | 175,104 | 113,611 | ||||||||

Transfers from advances to lenders to loans held for investment of consolidated trusts | 130,886 | 114,851 | 93,909 | ||||||||

Net transfers from mortgage loans to acquired property | 13,768 | 17,534 | 24,742 | ||||||||

Transfers of mortgage loans from held for investment to held for sale | 3,878 | 8,601 | 2,194 | ||||||||

See Notes to Consolidated Financial Statements in 2016 Form 10-K

Fourth Quarter and Full Year 2016 Results | 18 | |

FANNIE MAE

(In conservatorship)

Consolidated Statements of Changes in Equity

(Dollars and shares in millions)

Fannie Mae Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||

Shares Outstanding | Senior Preferred Stock | Preferred Stock | Common Stock | Accumulated Deficit | Accumulated Other Comprehensive Income | Treasury Stock | Non Controlling Interest | Total Equity | |||||||||||||||||||||||||||||||||

Senior Preferred | Preferred | Common | |||||||||||||||||||||||||||||||||||||||

Balance as of December 31, 2013 | 1 | 556 | 1,158 | $ | 117,149 | $ | 19,130 | $ | 687 | $ | (121,227 | ) | $ | 1,203 | $ | (7,401 | ) | $ | 50 | $ | 9,591 | ||||||||||||||||||||

Change in investment in noncontrolling interest | — | — | — | — | — | — | — | — | — | (11 | ) | (11 | ) | ||||||||||||||||||||||||||||

Comprehensive income: | |||||||||||||||||||||||||||||||||||||||||

Net income | — | — | — | — | — | — | 14,208 | — | — | 1 | 14,209 | ||||||||||||||||||||||||||||||

Other comprehensive income, net of tax effect: | |||||||||||||||||||||||||||||||||||||||||

Changes in net unrealized gains on available-for-sale securities (net of tax of $389) | — | — | — | — | — | — | — | 722 | — | — | 722 | ||||||||||||||||||||||||||||||

Reclassification adjustment for gains included in net income (net of tax of $123) | — | — | — | — | — | — | — | (228 | ) | — | — | (228 | ) | ||||||||||||||||||||||||||||

Prior service cost and actuarial gains, net of amortization for defined benefit plans (net of tax of $20) | — | — | — | — | — | — | — | 36 | — | — | 36 | ||||||||||||||||||||||||||||||

Total comprehensive income | 14,739 | ||||||||||||||||||||||||||||||||||||||||

Senior preferred stock dividends | — | — | — | — | — | — | (20,594 | ) | — | — | — | (20,594 | ) | ||||||||||||||||||||||||||||

Other | — | — | — | — | — | — | (5 | ) | — | — | — | (5 | ) | ||||||||||||||||||||||||||||

Balance as of December 31, 2014 | 1 | 556 | 1,158 | 117,149 | 19,130 | 687 | (127,618 | ) | 1,733 | (7,401 | ) | 40 | 3,720 | ||||||||||||||||||||||||||||

Change in investment in noncontrolling interest | — | — | — | — | — | — | — | — | — | (12 | ) | (12 | ) | ||||||||||||||||||||||||||||

Comprehensive income: | |||||||||||||||||||||||||||||||||||||||||

Net income | — | — | — | — | — | — | 10,954 | — | — | 1 | 10,955 | ||||||||||||||||||||||||||||||

Other comprehensive income, net of tax effect: | |||||||||||||||||||||||||||||||||||||||||

Changes in net unrealized gains on available-for-sale securities (net of tax of $151) | — | — | — | — | — | — | — | (280 | ) | — | — | (280 | ) | ||||||||||||||||||||||||||||

Reclassification adjustment for gains included in net income (net of tax of $253) | — | — | — | — | — | — | — | (483 | ) | — | — | (483 | ) | ||||||||||||||||||||||||||||

Prior service cost and actuarial gains, net of amortization for defined benefit plans, net of tax | — | — | — | — | — | — | — | 437 | — | — | 437 | ||||||||||||||||||||||||||||||

Total comprehensive income | 10,629 | ||||||||||||||||||||||||||||||||||||||||

Senior preferred stock dividends | — | — | — | — | — | — | (10,278 | ) | — | — | — | (10,278 | ) | ||||||||||||||||||||||||||||

Other | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

Balance as of December 31, 2015 | 1 | 556 | 1,158 | 117,149 | 19,130 | 687 | (126,942 | ) | 1,407 | (7,401 | ) | 29 | 4,059 | ||||||||||||||||||||||||||||

Change in investment in noncontrolling interest | — | — | — | — | — | — | — | — | — | (29 | ) | (29 | ) | ||||||||||||||||||||||||||||

Comprehensive income: | |||||||||||||||||||||||||||||||||||||||||

Net income | — | — | — | — | — | — | 12,313 | — | — | — | 12,313 | ||||||||||||||||||||||||||||||

Other comprehensive income, net of tax effect: | |||||||||||||||||||||||||||||||||||||||||

Changes in net unrealized gains on available-for-sale securities (net of tax of $30) | — | — | — | — | — | — | — | (55 | ) | — | — | (55 | ) | ||||||||||||||||||||||||||||

Reclassification adjustment for gains included in net income (net of tax of $316) | — | — | — | — | — | — | — | (587 | ) | — | — | (587 | ) | ||||||||||||||||||||||||||||

Other, net of tax | — | — | — | — | — | — | — | (6 | ) | — | — | (6 | ) | ||||||||||||||||||||||||||||

Total comprehensive income | 11,665 | ||||||||||||||||||||||||||||||||||||||||

Senior preferred stock dividends | — | — | — | — | — | — | (9,624 | ) | — | — | — | (9,624 | ) | ||||||||||||||||||||||||||||

Balance as of December 31, 2016 | 1 | 556 | 1,158 | $ | 117,149 | $ | 19,130 | $ | 687 | $ | (124,253 | ) | $ | 759 | $ | (7,401 | ) | $ | — | $ | 6,071 | ||||||||||||||||||||

See Notes to Consolidated Financial Statements in 2016 Form 10-K

Fourth Quarter and Full Year 2016 Results | 19 | |