Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Borqs Technologies, Inc. | f8k021517_pacificspecial.htm |

Exhibit 99.1

Investor Presentation February 2017 Global Leader in IoT Solutions

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Disclaimer Forward Looking Statements This investor presentation contains “forward - looking statements” within the meaning of the "safe harbor" provisions of the Private Se curities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as "anticipate", "believe", "expect", "estimate", "plan", "outlook", and "project" and other similar expressions that predic t o r indicate future events or trends or that are not statements of historical matters. Such forward - looking statements include statements concerning the timing of the proposed merger (the “Merger”) of Borqs International Holding Corp (“Borqs”) with and into a wholly - owned subsidiary of Pacific Special Acquisition Corp. (“PAAC”); the business plans, objectives, expectations and intentions of the public company once the transaction is complete, and Borqs’ estimated and future results of operations, business strategies, competitive position, industry environment and potential gro wth opportunities. These statements are based on PAAC’s or Borqs’ management’s current expectations and beliefs, as well as a number of assumptions concerning future events. Such forward - looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside PAAC’s or Borqs’ control that could cause actual results to differ materially from the results discussed in the forward - looking statements. These risks, uncertainties, assumptions and other important factors include, but are not limited to, (1) the occurrence of any event, chan ge or other circumstances that could give rise to the termination of the Merger Agreement; (2) the inability to complete the transactions contemplated by the Merger Agreement due to the failure to obtain approval of the stockholders of PAAC, Borqs or other conditions to closing in the Merger Agreement; (3) the ability of the public entity to meet NASDAQ’s listing standards following the Merger; (4) the risk that the proposed transaction disrupts current plans and operations of Borqs as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the abi lit y of the combined company to grow and manage growth profitably, maintain relationships with suppliers and retain its management and key employees; (6) costs related to the proposed business combination; (7) changes in applicable laws, regulations or the outcome of any legal proceedings related to the transaction; and (8) the possibility that Borqs may be adversely affected by other economic, business, and/or competitive factors. Additional factors that could cause actual res ult s to differ materially from those expressed or implied in forward - looking statements can be found in PAAC’s most recent annual report on Form 10 - K and subsequently filed quarterly reports on Form 10 - Q and current reports on Form 8 - K, which are available, free of charge, at the S EC’s website at www.sec.gov., and will also be provided in PAAC’s proxy statement when available. You are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the da te made, and PAAC and Borqs undertake no obligation to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise. Non - GAAP Financial Measures This investor presentation includes historical and projected EBITDA of Borqs, which are non - GAAP financial measures. EBITDA is calculated as earnings before interest and taxes plus depreciation and amortization. Borqs believes that these non - GAAP measures of financial results provides useful information to management and investors regarding certain financial and business trends relating to Borqs ’ financial condition and results of operations. Borqs’ management uses these non - GAAP measures to compare its performance to that of prior periods for, among other reasons, trend analyses and for budgeting and pla nning purposes. Borqs believes that the use of these non - GAAP financial measures provide an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing Borqs’ financial measures with other peer companies, many of which present similar non - GAAP financial measures to investors. Management of Borqs does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non - GAAP financial measures is that they exclude significant expenses that are required by GAAP to be recorded in the Company’s financial statements. In addition, these measures are subject to inherent limitations as they reflect the exercise of judgment by manag eme nt about which expenses and income are excluded or included in determining these non - GAAP financial measures. You should not place undue reliance on these non - GAAP financial measures. We urge you to rev iew Borqs’ audited financial statements, which will be presented in PAAC’s proxy statement to be filed with the SEC and delivered to stockholders of PAAC. Additional Information and Where to Find It In connection with the proposed Merger, PAAC has filed with the SEC a preliminary proxy statement. When completed, PAAC will mail a definitive proxy statement to its stockholders in connection with PAAC’s solicitation of proxies for the special meeting of PAAC stockholders to be held to approve the merger and related transactions. This investor presentation does not contain all the information that should b e c onsidered concerning the Merger. It is not intended to provide the basis for any investment decision or any other decision in respect to the proposed merger. PAAC stockholders and other interested persons are advised to read PAAC’s preliminary proxy statement, the amendments thereto, and the definitive proxy statement, when available, as these materials will contain important information about Borqs, PAAC and the proposed Merger. The definitive proxy statement will be mailed to stockholders of PAAC as of a record date to be established for voting on the Merger and related transactions. Stockholders will also be able to obtain copies of the proxy statement and other documents filed with the SEC that will be incorporated by reference in the proxy statement, without charge, once available, at the SEC's Internet site at http://www.sec.gov, or by directing a request to: Pacific Special Acquisition Corp ., address: 855 Pudong South Road, The World Plaza, 27 th Floor, Pudong Shanghai, China, attention: Zhouhong Peng . Participants in the Solicitation PAAC and its directors and officers may be deemed participants in the solicitation of proxies of PAAC’s stockholders with res pec t to the approval of the Merger. Information regarding the Company’s directors and officers and a description of their interests in PAAC is contained in PAAC’s annual report on Form 10 - K for the fiscal year ended June 30 th , 2016, which was filed with the SEC, and will also be contained in the preliminary proxy statement and amendments thereto, and the definitive proxy statement for the Merger, when available. Each of these documents is, or will be, available at the SEC’s website or by directing a request to the Company as described above under “Additional Information About the Transaction and Where to Find It.” 1

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Transaction Overview Transaction • Pacific Special Acquisition Corp. (PAAC), a publicly - traded Special - Purpose Acquisition Company (SPAC) will acquire Borqs International Holding Corp (“ Borqs ”) • Merged company will continue to list its ordinary shares on the NASDAQ • Transaction is expected to close in April 2017 Value • Transaction value: $303.0 million total enterprise value (subject to adjustment) ‒ 2.7x 2016F Revenue of $112.0 million ‒ 1.9x 2017F Revenue of $161.7 million Consideration and Post - Transaction Ownership • Borqs ’ current investors, including Qualcomm, Intel Capital, Norwest Venture Partners, SK Telecom China Fund, Keytone Ventures and GSR Ventures will maintain a substantial ownership position in the company • Borqs ’ shareholders will receive ordinary shares of Pacific at a price of $10.40 per share • Shareholders of Borqs will own 78% of Pacific’s outstanding ordinary shares and Pacific’s existing shareholders will retain ownership of approximately 22% of the ordinary shares post - transaction Post - Transaction Management and Board • Borqs ’ management team will continue to operate the business post - transaction • The board will consist of 7 directors, 2 appointed by Pacific, 3 appointed by Borqs , and 2 mutually agreed upon by Pacific and Borqs 2

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Shareholders # of Shares % Ownership Pacific Special Acquisition Corp. 8,347,562 22.4% Borqs Intel Capital Corporation 5,141,154 13.8% Norwest Venture Partners 4,577,245 12.3% Asset Horizon International Limited 4,540,780 12.2% Keytone Ventures, L.P. 4,173,604 11.2% GSR Entities 3,598,551 9.6% Sub-5% Shareholders 6,918,570 18.5% Borqs Subtotal: 28,949,904 77.6% Total: 37,297,466 100.0% Capitalization and Ownership Note: Assumes no share redemption by Pacific Special Acquisition Corp. and no additional capital from a subsequent PIPE trans act ion 3 22.4% 77.6% PAAC Shareholders Borqs Shareholders

Company Overview Pat Chan - CEO Global Leader in IoT Solutions

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Borqs – Who We Are Company founded in 2007 Global leader in providing end - to - end customized, differentiated and scalable connected devices and cloud services solution provider − Connected Solutions Business Unit (73% of 2015 revenue) − MVNO Business Unit (27% of 2015 revenue ) Clear focus on high - value Android based connected devices and services 600 + employees worldwide Key Investors: GSR, Intel , Keytone , Norwest , Qualcomm & SK Telecom 10+ million units shipped in 15+ countries CIO Review: “ 50 Most Promising IoT Solution Providers 2016” Business Overview Beijing HQ & Lab Bangalore Lab Japan Office Shenzhen Office US Office Definition: Connected device can be connected to the network using Wifi /Bluetooth (BT) or cellular technologies (e.g. 3G, 4G). In this presentation, a connected device is broadly defined and can be a smartphone, a tablet or an IoT device. An IoT device is a connected device other than a smartphone or tablet, e.g. w ear able watches, M2M module, etc. MVNO (Mobile Virtual Network Operator ) is a wireless communications services provider that does not own the wireless network infrastructure over which the MVNO provide s services to its customers. A MVNO enters into a business agreement with an incumbent mobile network operator to obtain bulk access to network services at who lesale rates, then sets retail prices independently. MVNOs have unique SIM cards and independent branding. Office Locations 5

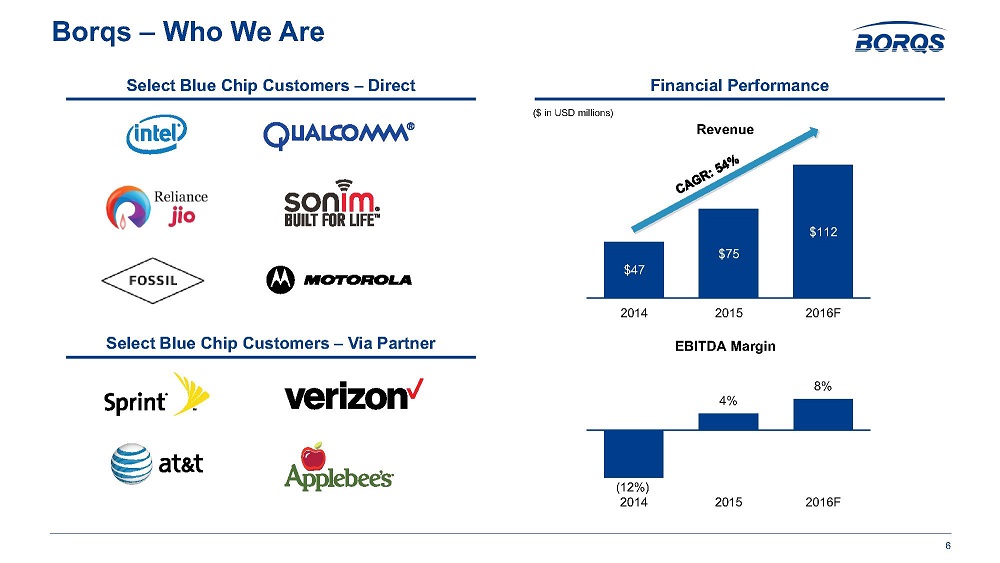

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 $47 $75 $112 2014 2015 2016F Borqs – Who We Are Select Blue Chip Customers – Direct ($ in USD millions) EBITDA Margin Revenue (12%) 4% 8% 2014 2015 2016F Financial Performance Select Blue Chip Customers – Via Partner 6

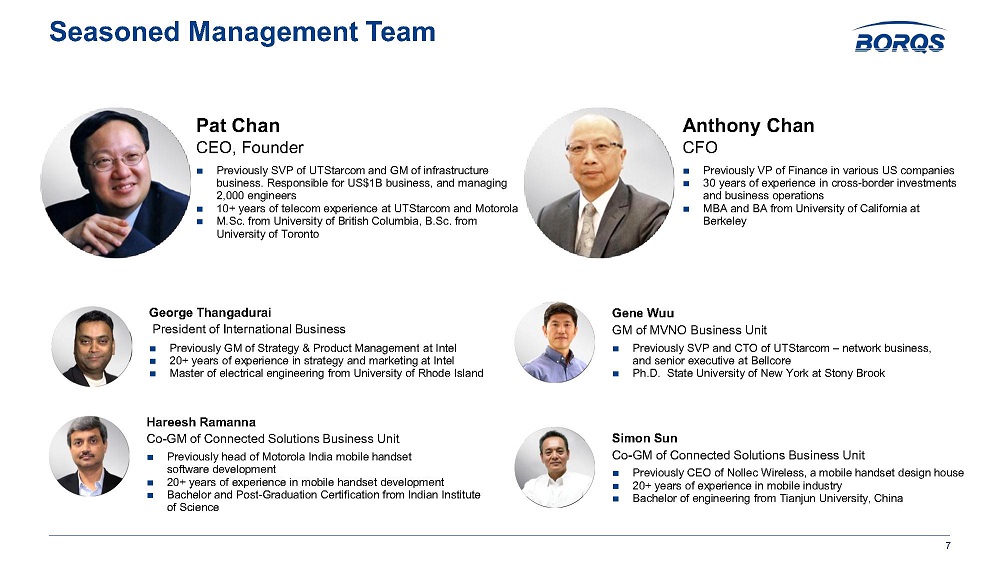

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Seasoned Management Team Hareesh Ramanna Co - GM of Connected Solutions Business Unit Previously head of Motorola India mobile handset software development 20+ years of experience in mobile handset development Bachelor and Post - Graduation Certification from Indian Institute of Science Gene Wuu GM of MVNO Business Unit Previously SVP and CTO of UTStarcom – network business, and senior executive at Bellcore Ph.D. State University of New York at Stony Brook Bob Li Corp Affairs and China Sales Previously President of Cellon , a mobile handset design house Ph.D. from McMaster University of Canada Simon Sun Co - GM of Connected Solutions Business Unit Previously CEO of Nollec Wireless, a mobile handset design house 20+ years of experience in mobile industry Bachelor of engineering from Tianjun University, China George Thangadurai President of International Business Previously GM of Strategy & Product Management at Intel 20+ years of experience in strategy and marketing at Intel Master of electrical engineering from University of Rhode Island Anthony Chan CFO Previously VP of Finance in various US companies 30 years of experience in cross - border investments and business operations MBA and BA from University of California at Berkeley Pat Chan CEO, Founder Previously SVP of UTStarcom and GM of infrastructure business. Responsible for US$1B business, and managing 2,000 engineers 10+ years of telecom experience at UTStarcom and Motorola M.Sc. from University of British Columbia, B.Sc. from University of Toronto 7

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Investment Highlights 8 Massive, Global Connected Device / IoT Market and Expanding Android Ecosystem Leading End - to - End Solution Provider Solving Critical IoT Challenges Differentiation and Scalability Due to Software IP Library and Partnerships with Chipset Vendors High - Growth, Profitable Business Model with Significant Operating Leverage Experienced Management Team Executing on Focused Growth Strategy 5 2 3 1 6 Longstanding Relationships with Leading Blue Chip Customers and Partners 4

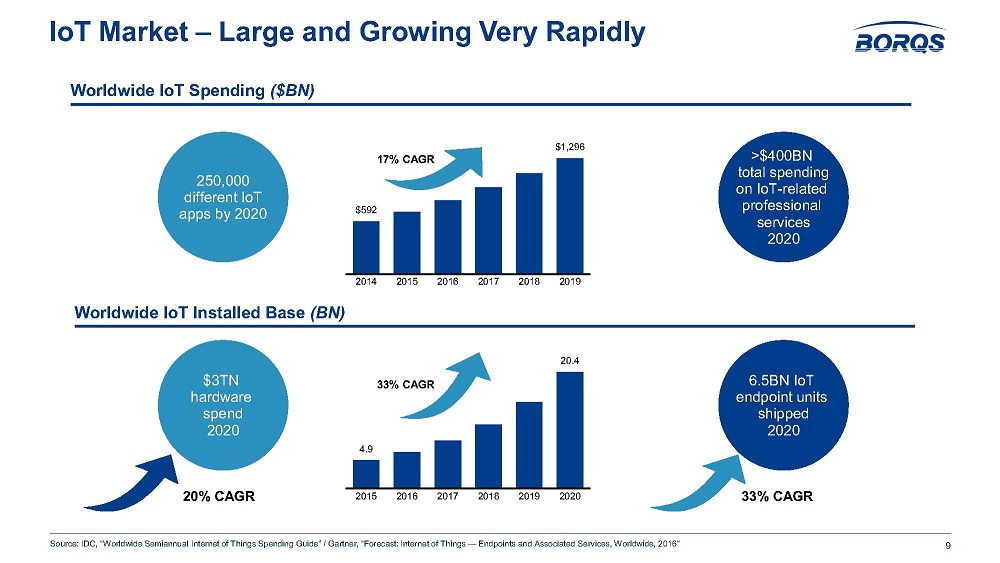

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Worldwide IoT Installed Base (BN) Worldwide IoT Spending ($BN) IoT Market – Large and Growing Very Rapidly Current 2020 50BN Devices 1.5 per person $150bn Smartphone and tablets 8 per person $250bn Wearables $ 202bn Automobiles $445bn Consumer electronics $ 36bn Utilities $ 69bn Healthcare Current SAM 250,000 different IoT apps by 2020 >$400BN total spending on IoT - related professional s ervices 2020 Source : IDC, “ Worldwide Semiannual Internet of Things Spending Guide” / Gartner, “ Forecast: Internet of Things — Endpoints and Associated Services, Worldwide, 2016” $3TN hardware spend 2020 6.5BN IoT endpoint units shipped 2020 20% CAGR 33% CAGR 4.9 20.4 2015 2016 2017 2018 2019 2020 33% CAGR 9 17% CAGR $592 $1,296 2014 2015 2016 2017 2018 2019

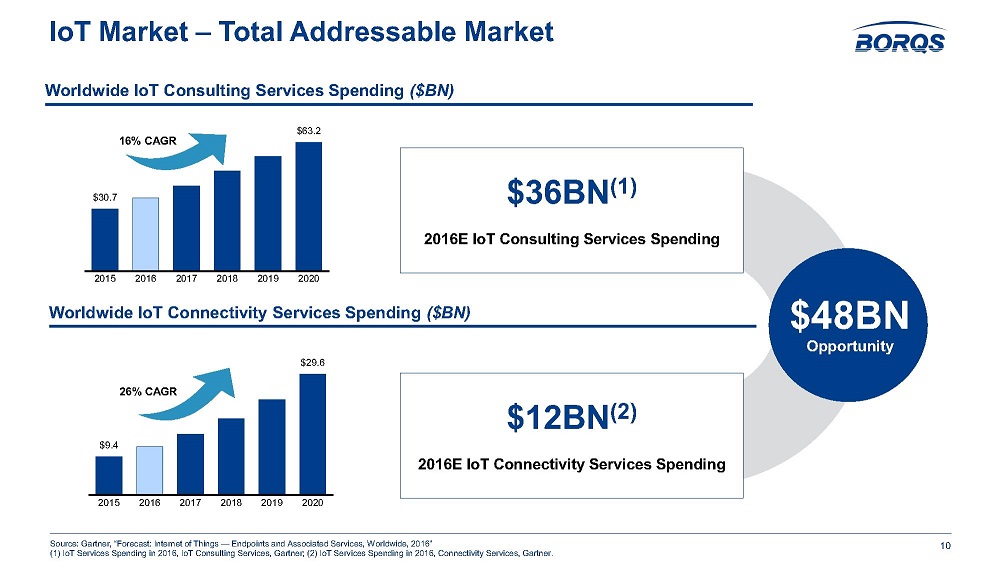

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 $12BN (2) 2016E IoT Connectivity Services Spending $36BN (1) 2016E IoT Consulting Services Spending Worldwide IoT Connectivity Services Spending ($BN) Worldwide IoT Consulting Services Spending ($BN) IoT Market – Total Addressable Market Current 2020 50BN Devices 1.5 per person $150bn Smartphone and tablets 8 per person $250bn Wearables $ 202bn Automobiles $445bn Consumer electronics $ 36bn Utilities $ 69bn Healthcare Current SAM $48BN Opportunity Source : Gartner, “ Forecast: Internet of Things — Endpoints and Associated Services, Worldwide, 2016” (1) IoT Services Spending in 2016, IoT Consulting Services, Gartner; (2) IoT Services Spending in 2016, Connectivity Services, Gartner. $9.4 $29.6 2015 2016 2017 2018 2019 2020 26% CAGR 10 $30.7 $63.2 2015 2016 2017 2018 2019 2020 16% CAGR

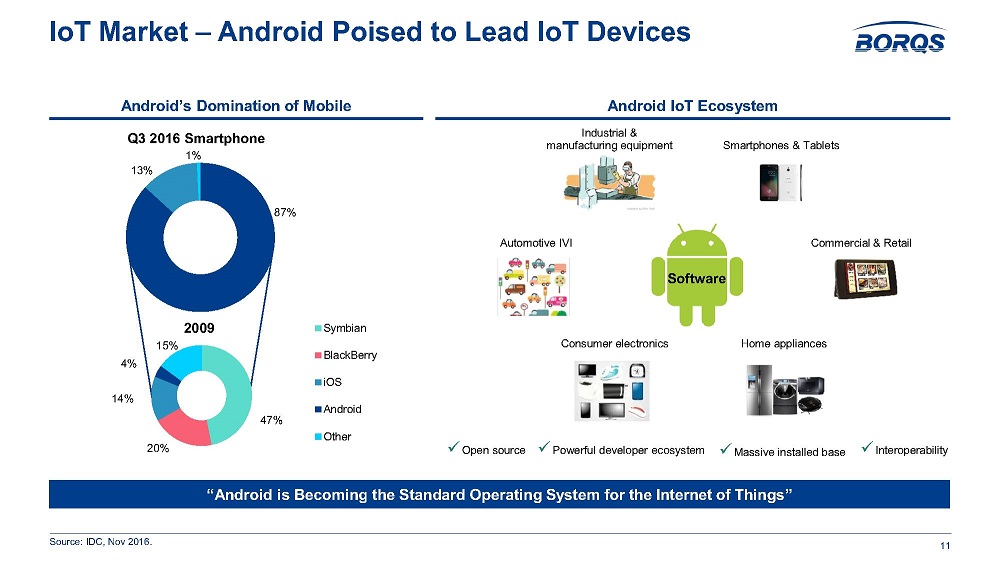

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Android IoT Ecosystem Android’s Domination of Mobile IoT Market – Android Poised to Lead IoT Devices “Android is Becoming the Standard Operating System for the Internet of Things ” Source : IDC , Nov 2016. 47% 20% 14% 4% 15% 2009 Symbian BlackBerry iOS Android Other 87% 13% 1% Q3 2016 Smartphone x Powerful developer ecosystem Software Automotive IVI Commercial & Retail Home appliances Consumer electronics Industrial & m anufacturing equipment Smartphones & Tablets x Open source x Massive installed base x Interoperability 11

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 FUTURE BEFORE IoT Critical Challenges Source: Evans Data Corporation; FirstMark Capital, VisionMobile . NOW Mobile Web Embedded = 600,000 600k 8 million 9 million Number of Current Engineers: Evolving Landscape Complicated Go to Market IoT Key Success Factors High Performance Ongoing Maintenance Service & Billing Compelling UX Inter - connectivity Security Cloud - based Management Connectivity Power Management User Interaction Manufacturing Design Services • Design, develop and manufacture complicated and customized IoT devices with latest chipset technologies • Provide back - end services for subscriber management, charging and service management • Offer cellular connectivity (e.g. 3G, 4G) voice and data plan to provide end - to - end service 12

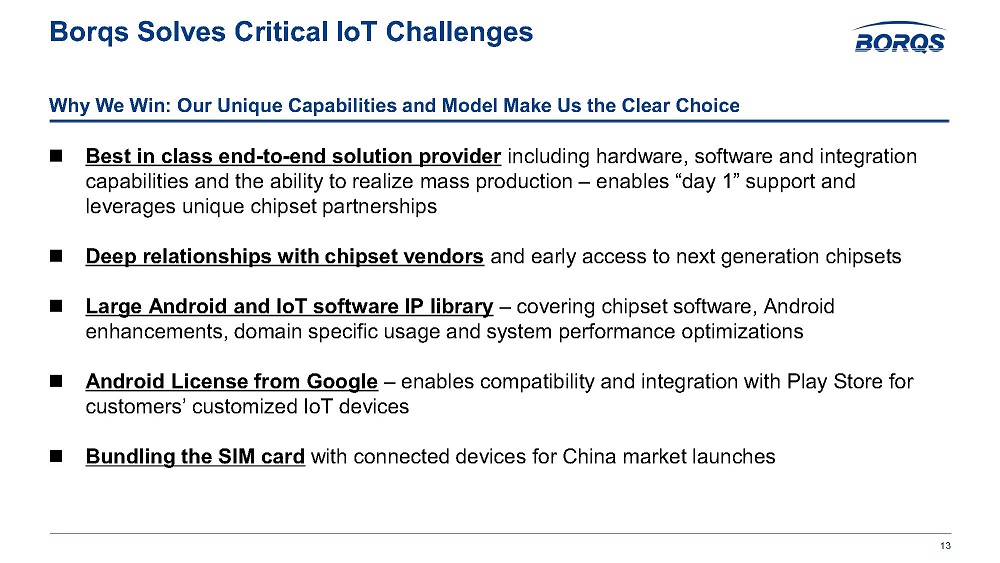

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Why We Win : Our Unique Capabilities and Model Make Us the Clear Choice Borqs Solves Critical IoT Challenges 13 Best in class end - to - end solution provider including hardware, software and integration capabilities and the ability to realize mass production – enables “day 1” support and leverages unique chipset partnerships Deep relationships with chipset vendors and early access to next generation chipsets Large Android and IoT software IP library – covering chipset software, Android enhancements, domain specific usage and system performance optimizations Android License from Google – enables compatibility and integration with Play Store for customers’ customized IoT devices Bundling the SIM card with connected devices for China market launches

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Connected Solutions (~73% of Revenue) MVNO (~27% of Revenue) Best in Class End - To - End Solution Provider Ideation & Design Software IP Development Product “Realization” Deployment Cloud Services & Support Outsourced product design and development ID design, UI design Firmware Operating systems Custom modules Hardware design Turn - key production management Google licenses Voice & data plan bundling MVNO serves as distribution channel Device provisioning, activation and management Platform for IoT management analytics and services 14 Other sensor devices Wearables Appliances Smart devices Vehicles Customer Requirement Note: Revenue percentages as of 2015

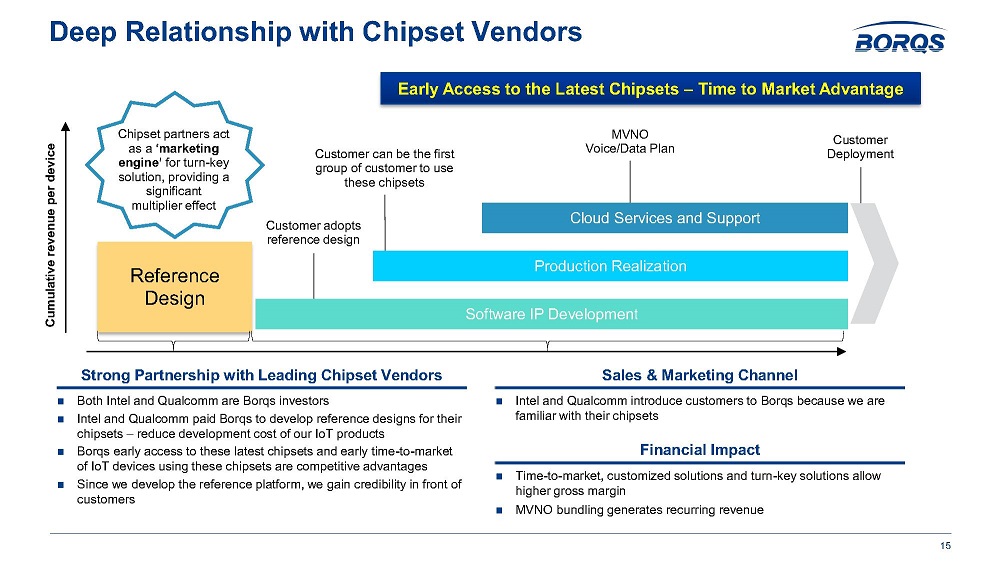

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Deep Relationship with Chipset Vendors Reference Design Software IP Development Production Realization Cloud Services and Support Cumulative revenue per device Customer can be the first group of customer to use these chipsets MVNO Voice/Data Plan Customer adopts reference design Chipset partners act as a ‘marketing engine’ for turn - key solution, providing a significant multiplier effect Reference Design Customer Deployment Both Intel and Qualcomm are Borqs investors Intel and Qualcomm paid Borqs to develop reference designs for their chipsets – reduce development cost of our IoT products Borqs early access to these latest chipsets and early time - to - market of IoT devices using these chipsets are competitive advantages Since we develop the reference platform, we gain credibility in front of customers Strong Partnership with Leading Chipset Vendors Intel and Qualcomm introduce customers to Borqs because we are familiar with their chipsets Sales & Marketing Channel Early Access to the Latest Chipsets – Time to Market Advantage Software IP Development Production Realization Cloud Services and Support Time - to - market, customized solutions and turn - key solutions allow higher gross margin MVNO bundling generates recurring revenue Financial Impact 15

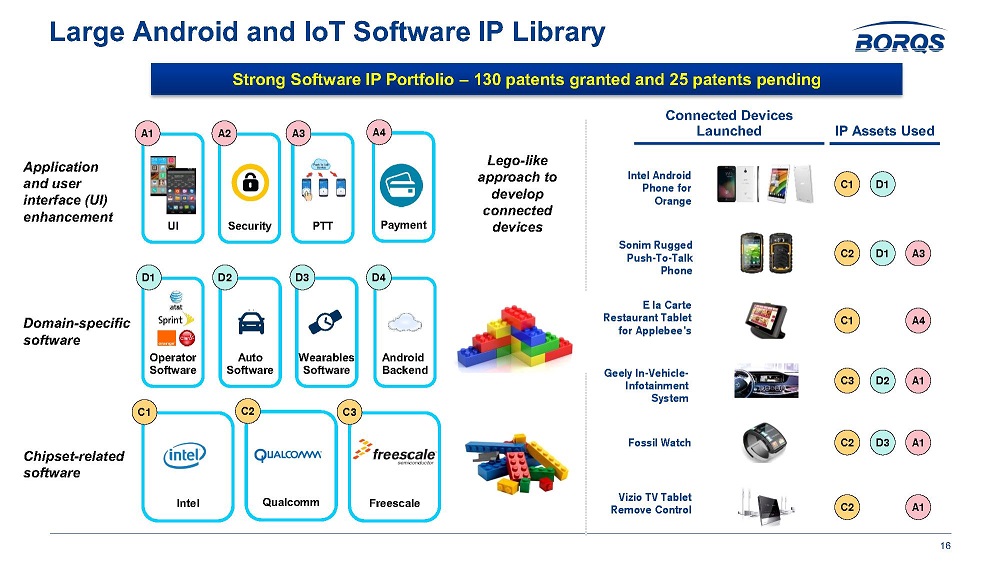

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Large Android and IoT Software IP Library 16 Connected Devices Launched IP Assets Used Auto Software D2 Android Backend D4 Operator Software D1 Wearables Software D3 Domain - specific software Application and user interface (UI) enhancement Chipset - related software UI Security PTT A 1 A 2 A 3 Intel Qualcomm Freescale C 1 C 2 C 3 Intel Android Phone for Orange D1 C 1 Sonim Rugged Push - To - Talk Phone C 2 D1 A 3 Payment A4 E la Carte Restaurant Tablet for Applebee’s C 1 A4 Geely In - Vehicle - Infotainment S ystem C 3 D2 A 1 Fossil Watch C 2 D3 A1 Vizio TV Tablet Remove Control C 2 A1 Lego - lik e approach to develop connected devices Strong Software IP Portfolio – 130 patents granted and 25 patents pending

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Customer Case Studies – Applebee’s Restaurant Restaurant Industry • E la Carte sells restaurant ordering tablets (called “Presto”) to Applebee’s restaurants and other US restaurants Volume: one tablet per table Borqs supplied the complete device End - To - End Solution Provider • Borqs developed the software and hardware, and outsourced the manufacturing to an EMS Intel Chipset Vendors Relationship • E la Carte is an Intel portfolio company that Intel introduced to Borqs • E la Carte selected Borqs because Borqs did the Intel chipset reference design and Borqs payment software Borqs IP Library IP Library • Borqs Intel Android related software library, and payment software library Recurring customer History • Borqs supplied the 1 st generation device to E la Carte • Borqs is developing the 2 nd generation of device for E la Carte 17

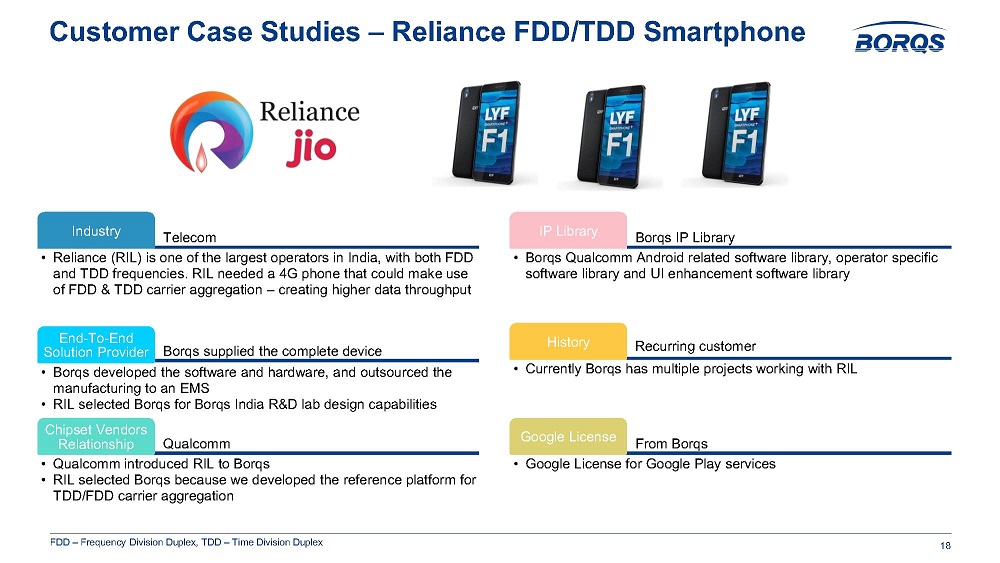

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Customer Case Studies – Reliance FDD/TDD Smartphone Telecom Industry • Reliance (RIL) is one of the largest operators in India, with both FDD and TDD frequencies. RIL needed a 4G phone that could make use of FDD & TDD carrier aggregation – creating higher data throughput Borqs supplied the complete device End - To - End Solution Provider • Borqs developed the software and hardware, and outsourced the manufacturing to an EMS • RIL selected Borqs for Borqs India R&D lab design capabilities Qualcomm Chipset Vendors Relationship • Qualcomm introduced RIL to Borqs • RIL selected Borqs because we developed the reference platform for TDD/FDD carrier aggregation Borqs IP Library IP Library • Borqs Qualcomm Android related software library, operator specific software library and UI enhancement software library Recurring customer History • Currently Borqs has multiple projects working with RIL From Borqs Google License • Google License for Google Play services 18 FDD – Frequency Division Duplex, TDD – Time Division Duplex

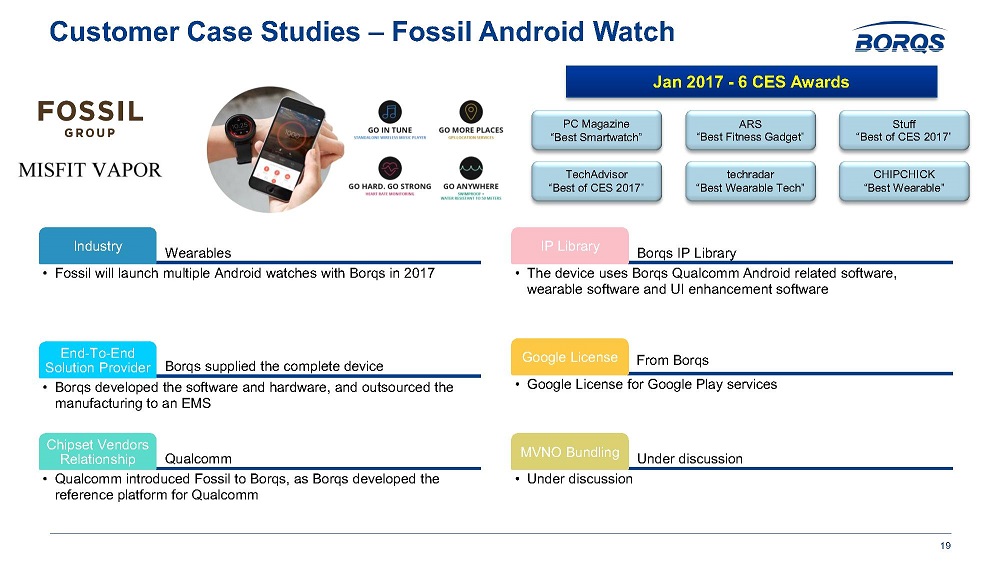

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Customer Case Studies – Fossil Android Watch Wearables Industry • Fossil will launch multiple Android watches with Borqs in 2017 Borqs supplied the complete device End - To - End Solution Provider • Borqs developed the software and hardware, and outsourced the manufacturing to an EMS Qualcomm Chipset Vendors Relationship • Qualcomm introduced Fossil to Borqs, as Borqs developed the reference platform for Qualcomm Borqs IP Library IP Library • The device uses Borqs Qualcomm Android related software, wearable software and UI enhancement software From Borqs Google License • Google License for Google Play services Under discussion MVNO Bundling • Under discussion TechAdvisor “Best of CES 2017” CHIPCHICK “Best Wearable” techradar “Best Wearable Tech” PC Magazine “Best Smartwatch” ARS “Best Fitness Gadget” Stuff “Best of CES 2017” Jan 2017 - 6 CES Awards 19

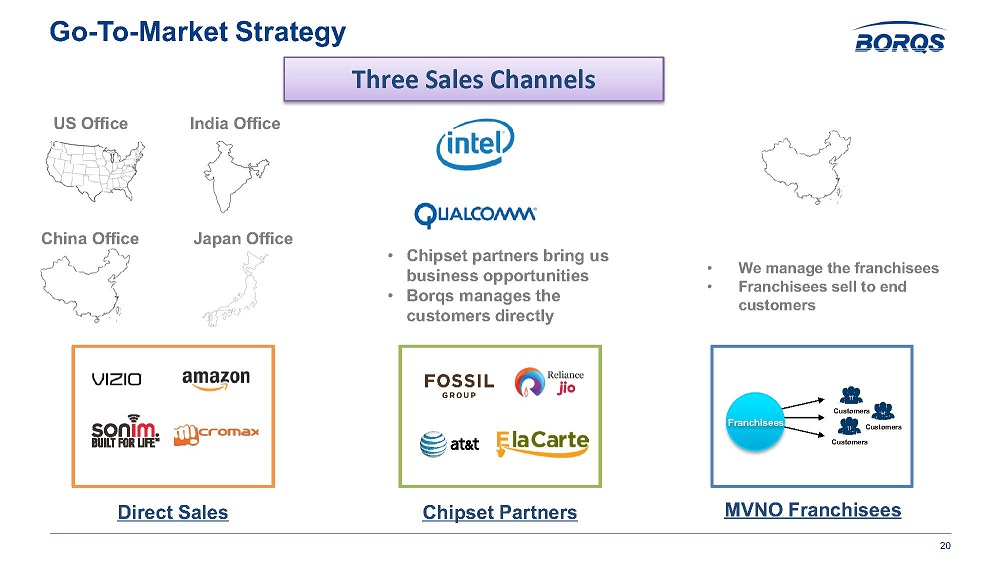

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Go - To - Market Strategy 20 Direct Sales MVNO Franchisees Chipset Partners • Chipset partners bring us business opportunities • Borqs manages the customers directly Three Sales Channels China Office US Office Japan Office India Office • We manage the franchisees • Franchisees sell to end customers Customers Customers Customers Franchisees

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Blue Chip Customer Base 21 Select Direct Customers Select Customers Via Partners OEM Operators & Enterprises Chipset Vendors Operators & Enterprises

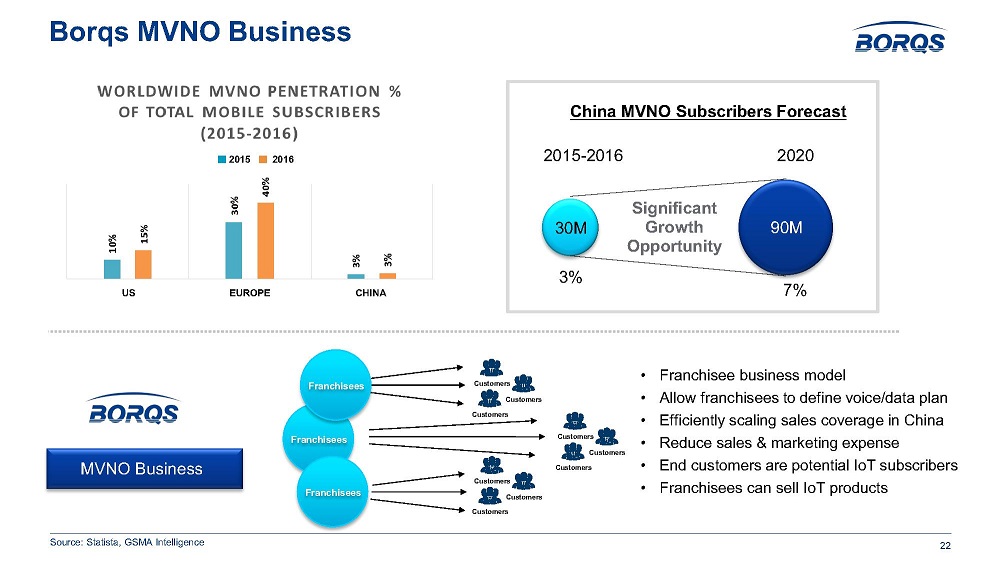

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Franchisees Borqs MVNO Business 22 2015 - 2016 30M 2020 9 0M China MVNO Subscribers Forecast 3% 7% MVNO Business Customers Customers Customers Customers Customers Customers Customers Customers Customers Franchisees Franchisees • Franchisee business model • Allow franchisees to define voice/data plan • Efficiently scaling sales coverage in China • Reduce sales & marketing expense • End customers are potential IoT subscribers • Franchisees can sell IoT products Significant Growth Opportunity 2015 2016 US EUROPE CHINA Source: Statista , GSMA Intelligence

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Companies Android Chipset SW Android Software Assets Competitive Landscape Criteria Indian Software Companies Asian ODMs IoT Companies Product Realization Network Connectivity Backend Subscriber Mgt and Billing Cloud Sales and Distribution Channel ≡ ≡ Others Possesses the capability. Source: Company estimates. Does not possess the capability. ≡ Possesses a partial capability. Only Borqs Can Deliver End - to - end Capabilities Across Design, Development, Production, Connectivity and Distribution Product Realization Cloud Services 23 Chinese Software Companies IoT Software IP Development & Design

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Growth Pillars 24 IP Library Cloud Services IoT Hardware Module Geographic Expansion 1 2 3 4 Leading IoT software solutions Client engagements drive extensive IoT IP library, which is a selling point and source of leverage for new customers UI, security, manageability, power management, vertical software applications As customers expand IoT deployments, Borqs cloud services overtly benefit Second largest MVNO in China Near - term opportunities in hospitality, automobile in - vehicle infotainment and truck monitoring Currently building IP into a hardware module that can be easily implemented into future projects across a diverse set of applications Scale in IoT hardware deployment will reduce costs for customers which will drive adoption IoT hardware module will be synergistic with our manufacturing capability and facilitate repeatability of our best - in - class design Partnering with Intel and Qualcomm to enter the India market, providing a strong vector of growth for all Borqs products and services MVNO channel and franchisees offers significant growth opportunity in China

Global Leader in IoT Solutions Financial Highlights Anthony Chan - CFO

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Financial Highlights 26 Significant Leverage in Model – Reduction of Op. Expense as a % of Revenue 3 Free Cash Flow Positive since 2015 2 Strong R evenue Growth – CAGR 50% (2014 to 2017F) 1 Differentiated End - To - End Business Model 4

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Strong Revenue and EBITDA Growth 27 Gross Margin and EBITDA Revenue and Growth ($ in USD millions) ($ in USD millions) - Connected Product Revenue 2014 to 2017F CAGR: 37% - MVNO Revenue 2014 to 2017F CAGR: 171% - Total Revenue 2014 to 2017F CAGR: 50% ▪ Gross Margin will continue to scale with additional IoT revenue and MVNO growth ▪ Continued expansion of EBITDA margins after becoming EBITDA positive in 2015 ▪ Strong top line growth: $45 $55 $80 $118 $20 $32 $44 $47 $75 $112 $162 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 2014 2015 2016F 2017F Connected Product MVNO ($6) $3 $9 $20 25% 23% 22% 23% ($10) ($5) $0 $5 $10 $15 $20 $25 2014 2015 2016F 2017F EBITDA Gross Margin %

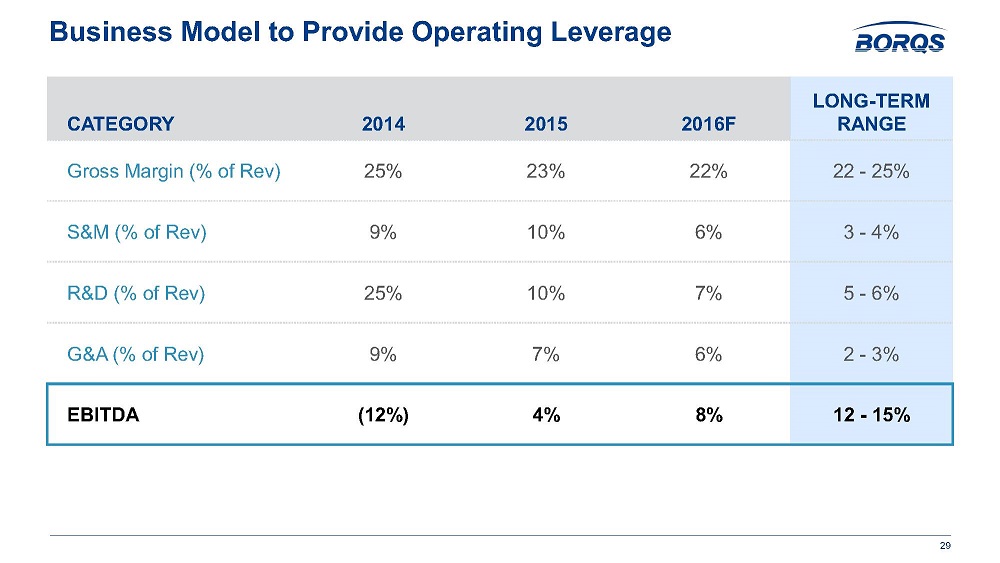

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Significant Leverage Realized Over Time 28 Operating Expenses as a % of Revenue ▪ Operating Expense as a % of Revenue will continue to shrink due to operating leverage and economies of scale ▪ R&D is developed as a platform and can be reused for different projects and products ▪ Sound and robust long - term operating model

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Business Model to Provide Operating Leverage 29 CATEGORY 2014 2015 2016F LONG - TERM RANGE Gross Margin (% of Rev) 25% 23% 22% 22 - 25% S&M (% of Rev) 9% 10% 6% 3 - 4% R&D (% of Rev) 25% 10% 7% 5 - 6% G&A (% of Rev) 9% 7% 6% 2 - 3% EBITDA (12%) 4% 8% 12 - 15%

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 Investment Highlights 30 Massive, Global Connected Device / IoT Market and Expanding Android Ecosystem Leading End - to - End Solution Provider Solving Critical IoT Challenges Differentiation and Scalability Due to Software IP Library and Partnerships with Chipset Vendors High - Growth, Profitable Business Model with Significant Operating Leverage Experienced Management Team Executing on Focused Growth Strategy 5 2 3 1 6 Longstanding Relationships with Leading Blue Chip Customers and Partners 4

Thank You 31 Global Leader in IoT Solutions

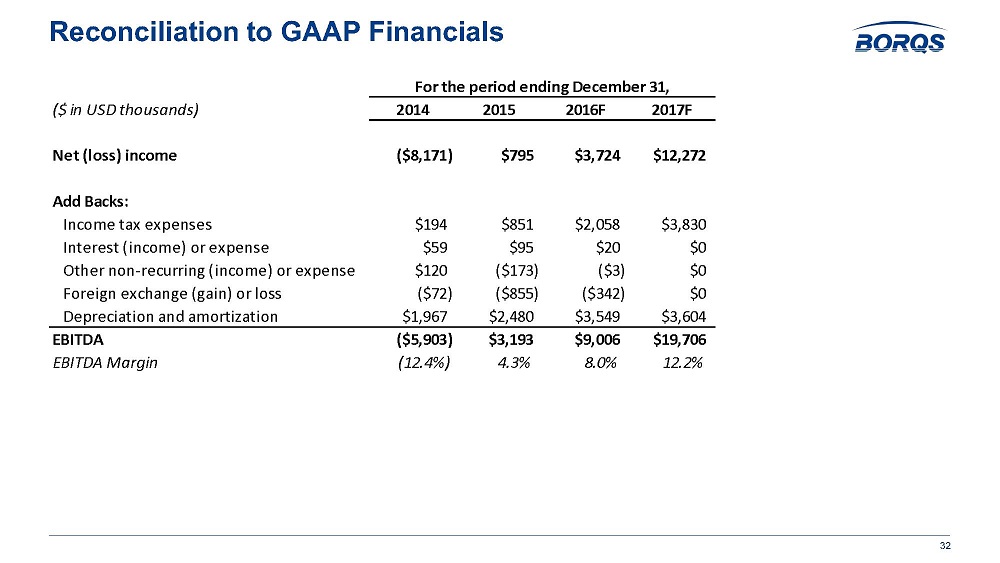

R: 000 G : 062 B: 140 R: 043 G: 145 B: 191 R: 000 G: 207 B: 255 R: 091 G: 219 B: 204 R: 218 G: 219 B: 221 R: 246 G: 096 B: 117 For the period ending December 31, ($ in USD thousands) 2014 2015 2016F 2017F Net (loss) income ($8,171) $795 $3,724 $12,272 Add Backs: Income tax expenses $194 $851 $2,058 $3,830 Interest (income) or expense $59 $95 $20 $0 Other non-recurring (income) or expense $120 ($173) ($3) $0 Foreign exchange (gain) or loss ($72) ($855) ($342) $0 Depreciation and amortization $1,967 $2,480 $3,549 $3,604 EBITDA ($5,903) $3,193 $9,006 $19,706 EBITDA Margin (12.4%) 4.3% 8.0% 12.2% Reconciliation to GAAP Financials 3