Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | fbiz4q16ceoletter8-k.htm |

Exhibit 99.1

FIRST BUSINESS CEO REPORT

FOURTH QUARTER 2016

Dear Shareholders and Friends of First Business,

At First Business, our talented team is truly our greatest competitive advantage. We are off to a running start in 2017 because of our extraordinary people, who skillfully execute our client-centric approach to business banking. Our team is comprised of seasoned Business Development Officers (“BDOs”) with niche banking expertise, operational specialists in technology and compliance, and banking veterans with broad experience from larger and more complex financial institutions. In tenure, we range from those whose entire career has been at First Business, to steady BDO additions over the past five years, to our most recent hires of deeply experienced SBA lending specialists. Complementary skills and diverse experience, combined with our focus and team-oriented culture, creates a dynamic difficult to replicate.

We also work hard to put our people in a position to win. An important part of that is First Business’s commitment to niche banking - specialty lending to commercial clients and their principals, with sophisticated trust and investment services, and treasury management offerings to support robust, full-service relationships. The success of this approach was essential to our posting meaningful earnings in 2016, even while navigating challenging events and making thoughtful investments in our franchise.

2016 RESULTS

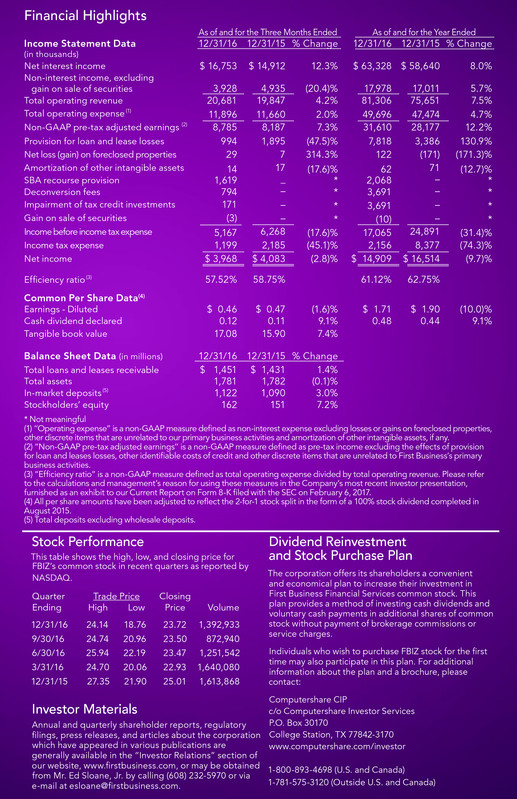

In 2016, First Business earned a profit of $15 million, or $1.71 per diluted share. The Company achieved its second-highest level of profitability ever, even with the credit challenges at Alterra Bank. We’ve previously discussed our swift review and transformation of Alterra’s credit application, approval, and review process to match the high standard that has long been the cornerstone of First Business’s superior overall asset quality. While we have and are addressing these challenges, let me be clear that we are very bullish on the long-term opportunity for growth with our business banking model in the robust Kansas City market, and on the very attractive SBA business line.

Overall, 2016 operating results were fueled by record trust and investment services revenue, strong net interest income, efficient operating expense management, and strong credit quality across our Wisconsin markets. Even with our deliberate and temporary SBA slowdown in the second half of 2016, top line revenue for the full year - consisting of net interest income and non-interest income - grew by more than $5.7 million, or 7.5%, to a record $81.3 million.

Several events impacted results for the year, in both positive and negative ways. Our net interest income (and consequently, net interest margin and efficiency ratio) was boosted by an unusually high level of recurring loan fees that we do not expect to continue at the same levels. Assuming a normalized level of loan fees, we would have produced a 2016 net interest margin in the 3.55-3.60% range, compared to our long-term target of 3.50% or better. Our success in continuing to exceed this target level in 2016 reflects concerted initiatives to both expand our deposit client base and optimize our funding strategy, which is unique among our peers.

Also, in order to centralize our core banking system with a single provider, the Company booked $794,000 in one-time expense to terminate a redundant core banking system vendor agreement. We believe this will not only be more cost effective on a go forward basis, but will also create operational efficiencies, building capacity to absorb future growth. After removing the impact of these unusual fees and expenses, a normalized fourth quarter efficiency ratio would have been in the mid-60% range. Over time, we expect our revenue and expense efforts to drive improved operating leverage, lowering our efficiency ratio to our target range of 58-62%.

Finally, the unexpected credit challenges at Alterra drove loan loss provision expense to $7.8 million for 2016, compared to $3.4 million for 2015. Following our rigorous review of our SBA portfolio in the second half of 2016, we recorded $2.1 million in recourse reserves for estimated losses inherent in the outstanding guaranteed portion of SBA loans sold. While we expect our near-term earnings may continue to be affected by resolution of discrete credit issues, we are confident we are prudently building an operation that is sustainable, scalable, and adds value to our franchise.

EFFICIENCY INITIATIVES UNDERWAY

This past year also brought slowing commercial and industrial lending demand with sluggish manufacturing growth across our Midwest markets. Efficient management is in our DNA and we quickly and thoughtfully moved to slow expense growth while continuing to position ourselves for future revenue growth. We thoroughly reviewed our operations, trimming marketing and professional costs, while also closing four satellite offices. As noted earlier, we are consolidating our core banking system relationships with a single technology vendor. We also carefully evaluated our legal corporate structure, concluding consolidation of our commercial bank subsidiary charters will help achieve efficiency gains. Through this recently announced charter consolidation plan (pending regulatory approval), we expect to reduce redundant tasks, simplify our operations, and create capacity for value added initiatives and future growth.

In addition, we’ve advanced sustainable revenue initiatives beyond SBA lending, including ongoing efforts to grow deposit accounts and balances. In fact, our in-market deposits grew from $1.090 billion at the end of 2015 to $1.122 billion at December 31, 2016, contributing to a decline in funding costs to 1.04% in the fourth quarter of 2016 compared to 1.09% in the fourth quarter of 2015, despite a rising interest rate environment. At the same time, our outstanding trust and investment services business continued to produce record revenues and levels of assets under management and administration, providing a strong and growing source of fee income that we seek to replicate in our SBA platform.

DEVELOPING A LEADING SBA FRANCHISE

Foremost among our revenue initiatives is the strategic investment in our SBA lending platform. Our relationship approach to SBA lending aligns perfectly with our business banking philosophy, while standing in stark contrast to the broadly employed transactional approach. In short order, we saw the tremendous potential of this platform, with SBA loan production far exceeding our early expectations. Such rapid growth led us to deliberately take a prudent pause in the second half of 2016 to ensure we have the infrastructure, people, and processes in place to resume high-quality growth in the quarters and years ahead. Accordingly, while we slowed SBA loan sale gains to $893,000 in the second half of 2016, compared to $3.5 million in the first half of the year, we actively recruited and successfully attracted seasoned SBA lending experts from leading Midwest competitors to position us for future growth. A main point of attraction to First Business is our access to ample capital and a relationship approach that naturally leads to expanded client and business growth over time. As our SBA infrastructure investments continue, we expect production to ramp up throughout 2017, acting as a catalyst for earnings growth in 2018 and beyond.

PERSISTENCE IN 2017

Our focus on our growth goals is unrelenting and we are steadfastly executing our strategy in 2017. We expect loan growth in 2017 will exceed 2016, but we will not pursue growth for growth’s sake, as we seek to maintain our quality and profitability targets. Unusually high loan payoffs, combined with slow business demand, resulted in our loan balances growing only modestly in 2016, from $1.432 billion at December 31, 2015 to $1.452 billion at December 31, 2016. Prepayments are a part of our specialty business model and we are typically compensated for lost margin revenue through meaningful prepayment fees. Today, our business line leaders are optimistic about 2017. We do anticipate the pace of loan growth to expand, and at the same time we are pleased with progress toward lowering our dependence on balance sheet growth for future profitability by continuing to grow our level of fee income.

We are working diligently to build a franchise with growing and lasting value, improving our profitability profile in a sustainable manner. As always, thank you for your continued support of First Business and we hope you’ll continue to spread the word.

Sincerely,

Corey Chambas, President and CEO

This letter includes “forward-looking statements" related to First Business Financial Services, Inc. (the “Company”) that can generally be identified as describing the Company’s future plans, objectives, goals or expectations. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company’s future results, please see the Company’s most recent quarterly report on Form 10-Q and other filings with the Securities and Exchange Commission (the "SEC").