Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HEALTHCARE TRUST OF AMERICA, INC. | ex991201702.htm |

| 8-K - 8-K - HEALTHCARE TRUST OF AMERICA, INC. | hta201702158-k.htm |

99.1

Exhibit 99.2Exhibit 99.2

Company Overview

Company Information 3

Fourth Quarter 2016 Highlights 4

Full Year 2016 Highlights 5

Financial Highlights 6

Company Snapshot 7

Financial Information

FFO, Normalized FFO, Normalized FAD and Adjusted EBITDA 8

Capitalization, Interest Expense and Covenants 9

Debt Composition and Maturity Schedule 10

Portfolio Information

Investment Activity 11

Regional Portfolio Distribution and Key Markets and Top 75 MSA Concentration 12

Same-Property Performance and NOI 13

Portfolio Diversification by Type, Historical Campus Proximity and Ownership Interests 14

Tenant Lease Expirations and Historical Leased Rate 15

Key Health System Relationships and In-House Property Management and Leasing Platform 16

Health System Relationship Highlights 17

Financial Statements

Consolidated Balance Sheets 18

Consolidated Statements of Operations 19

Consolidated Statements of Cash Flows 20

Reporting Definitions 21

Forward-Looking Statements:

Certain statements contained in this report constitute forward-looking statements within the meaning of the safe harbor from civil liability provided

for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Such statements include, in particular, statements

about our plans, strategies, prospects and estimates regarding future medical office building market performance. Additionally, such statements

are subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially and in

adverse ways from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future

periods. Forward-looking statements are generally identifiable by the use of such terms as “expect,” “project,” “may,” “should,” “could,” “would,”

“intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “opinion,” “predict,” “potential,” “pro forma” or the negative of such terms and

other comparable terminology. Readers are cautioned not to place undue reliance on these forward-looking statements. We cannot guarantee

the accuracy of any such forward-looking statements contained in this report, and we do not intend to publicly update or revise any forward-

looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Any such forward-looking

statements reflect our current views about future events, are subject to unknown risks, uncertainties, and other factors, and are based on a

number of assumptions involving judgments with respect to, among other things, future economic, competitive and market conditions, all of

which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual results, our ability to meet such

forward-looking statements, including our ability to generate positive cash flow from operations, provide dividends to stockholders, and maintain

the value of our real estate properties, may be significantly hindered. Forward-looking statements express expectations of future events. All

forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and

they are subject to numerous known and unknown risks and uncertainties that could cause actual events or results to differ materially from

those projected. Due to these inherent uncertainties, our stockholders are urged not to place undue reliance on forward-looking statements.

Forward-looking statements speak only as of the date made. In addition, we undertake no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of unanticipated events or changes to projections over time, except as required

by law. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed

on such statements. Additional information concerning us and our business, including additional factors that could materially affect our financial

results, is included herein and in our filings with the SEC.

Table of Contents

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 2

Company Information

Healthcare Trust of America, Inc. (NYSE: HTA) is the largest dedicated owner and operator of medical office buildings (“MOBs”) in the United

States, based on gross leasable area (“GLA”). We provide the real estate infrastructure for the integrated delivery of healthcare services in

highly desirable locations. Over the last decade, we have invested $4.2 billion primarily in MOBs and other healthcare assets comprising 17.7

million square feet of GLA. Our investments are targeted in 20 to 25 key markets that we believe have superior healthcare demographics that

support strong, long-term demand for medical office space. We have achieved, and continue to achieve, critical mass within these key markets

by expanding our presence through accretive acquisitions, and utilizing our in-house operating expertise through our regionally located property

management and leasing platform.

Founded in 2006 and listed on the New York Stock Exchange in 2012, HTA has produced attractive returns for its stockholders that we

believe have significantly outperformed the S&P 500 and US REIT indices. More information about HTA can be found on the Company’s

website at www.htareit.com.

Company Overview

Executive Management

Scott D. Peters I Chairman, Chief Executive Officer and President

Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer

Mark D. Engstrom I Executive Vice President - Acquisitions

Amanda L. Houghton I Executive Vice President - Asset Management

Contact Information

Corporate Headquarters

Healthcare Trust of America, Inc. I NYSE: HTA

16435 North Scottsdale Road, Suite 320

Scottsdale, Arizona 85254

480.998.3478

www.htareit.com

Investor Relations

Robert A. Milligan I Chief Financial Officer, Secretary and Treasurer

Mary C. Jensen I Vice President - Capital Markets

16435 North Scottsdale Road, Suite 320

Scottsdale, Arizona 85254

480.998.3478

info@htareit.com

Transfer Agent

Computershare

P.O. Box 30170

College Station, Texas 77842-3170

888.801.0107

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 3

Fourth Quarter 2016 Highlights

Operating

• Net Income Attributable to Common Stockholders: Increased 59.6% to $16.6 million, compared to Q4 2015. Earnings

per diluted share increased 37.5% to $0.11 per diluted share, compared to Q4 2015.

• FFO: As defined by the National Association of Real Estate Investment Trusts (“NAREIT”), increased 22.1% to $60.9 million,

compared to Q4 2015. FFO per diluted share increased 7.7% to $0.42 per diluted share, compared to Q4 2015.

• Normalized FFO: Increased 17.3% to $59.5 million, compared to Q4 2015. Normalized FFO per diluted share increased

5.1% to $0.41 per diluted share, compared to Q4 2015.

• Normalized FAD: Increased 16.3% to $52.2 million, compared to Q4 2015.

• Same-Property Cash NOI: Increased $1.9 million, or 2.9%, to $69.7 million, compared to Q4 2015. Same-Property rental

revenue increased $2.0 million, or 2.6%, to $79.0 million, compared to Q4 2015.

Portfolio

• Investments: HTA invested $67.8 million to acquire medical office buildings totaling approximately 224,000 square feet of

gross leasable area (“GLA”) that were 94% leased as of the date of acquisition and in its key markets of Boston,

Massachusetts; Columbus, Ohio; and Raleigh-Durham, North Carolina.

• Dispositions: HTA completed the disposition of two senior care facilities located in California for an aggregate gross sales

price of $13.0 million totaling approximately 71,000 square feet of GLA, generating net gains of $4.8 million.

• Leasing: HTA entered into new and renewal leases on approximately 488,000 square feet of GLA, or 2.8% of its portfolio.

Tenant retention for the Same-Property portfolio was 84% by GLA for the quarter, which included approximately 400,000

square feet of expiring leases. Renewal leases included tenant improvements of $2.17 per square foot per year of the lease

term and ten days of free rent per year of the lease term.

Balance Sheet

• Balance Sheet: At the end of the year, HTA had total leverage of 29.4%, measured by debt to market capitalization, and 5.7x

measured as debt to Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”). Total

liquidity at the end of the quarter was $767.7 million, including $756.5 million of availability under its unsecured revolving

credit facility and $11.2 million of cash and cash equivalents.

Company Overview

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 4

Full Year 2016 Highlights

Operating

• Net Income Attributable to Common Stockholders: Increased 39.4% to $45.9 million, compared to 2015. Earnings per

diluted share increased 26.9% to $0.33 per diluted share, compared to 2015.

• FFO: As defined by NAREIT, increased 14.5% to $215.6 million, compared to 2015. FFO per diluted share increased 4.8%

to $1.54 per diluted share, compared to 2015.

• Normalized FFO: Increased 15.0% to $225.2 million, compared to 2015. Normalized FFO per diluted share increased 5.2%

to $1.61 per diluted share, compared to 2015.

• Normalized FAD: Increased 12.2% to $200.1 million, compared to 2015.

• Same-Property Cash NOI: Increased $7.3 million, or 2.9%, to $258.3 million, compared to 2015. Same-Property rental

revenue increased $6.7 million, or 2.3%, to $292.3 million, compared to 2015. Full year 2016 Same-Property Cash NOI only

includes those properties that were acquired through the end of 2014.

Portfolio

• Investments: HTA completed $700.8 million of investments totaling approximately 2.5 million square feet of GLA that were

93% leased as of the date of acquisition.

• Dispositions: HTA completed dispositions of six senior care facilities located in Texas and California for an aggregate gross

sales price of $39.5 million totaling approximately 226,000 square feet of GLA, generating net gains of $9.0 million.

• Leasing: HTA entered into new and renewal leases on approximately 1.6 million square feet of GLA, or 9.0% of its portfolio.

Tenant retention for the Same-Property portfolio was 80% by GLA for the year ended 2016, which included approximately 1.3

million square feet of expiring leases. For the year ended 2016, renewal leases included tenant improvements of $1.55 per

square foot per year of the lease term and six days of free rent per year of the lease term.

• Leased Rate: At the end of the year, HTA had a leased rate for its portfolio and Same-Property portfolio of 91.9% by GLA.

Capital Markets

• Equity: During the year ended 2016, HTA issued $492.5 million of equity at an average price of $29.33 per share. This was

comprised of $297.8 million from the sale of common stock in underwritten public offerings at an average gross price of

$30.64 per share, $122.9 million from the sale of common stock under the ATM at an average gross price of $27.82 per

share, and $71.8 million from the issuance of Class A operating partnership units in connection with acquisition transactions.

• Debt: HTA issued $350.0 million of senior unsecured 10-year notes, with a coupon of 3.50% per annum and Healthcare Trust

of America Holdings, LP, the operating partnership of HTA, executed a $200.0 million 7-year unsecured term loan with net

proceeds used to refinance its $155.0 million unsecured term loan due in 2019. During the year ended 2016, HTA repaid

$110.9 million of existing mortgage loans, generating prepayment penalties of $3.0 million.

• Dividends: During the year ended 2016, HTA’s Board of Directors increased the quarterly dividend run rate by 1.7% to $0.30

per share of common stock, representing an annualized rate of $1.20 per share of common stock.

Company Overview

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 5

(1) Refer to pages 21 and 22 for the reporting definitions of Adjusted EBITDA, FFO, NOI, Normalized FAD and Normalized FFO.

(2) Refer to page 13 for a reconciliation of GAAP Net Income to NOI.

(3) Refer to page 8 for the reconciliations of GAAP Net Income Attributable to Common Stockholders to FFO, Normalized FFO, Normalized FAD and Net Income to Adjusted EBITDA.

(4) Calculated as the increase in Same-Property Cash NOI for the quarter as compared to the same period in the previous year.

(5) Calculated as Adjusted EBITDA divided by interest expense (excluding change in fair market value of derivatives) and scheduled principal payments.

(6) Calculated as the common stock price on the last trading day of the period multiplied by the total diluted common shares outstanding at the end of the period, plus total debt

outstanding at the end of the period. Refer to page 9 for details.

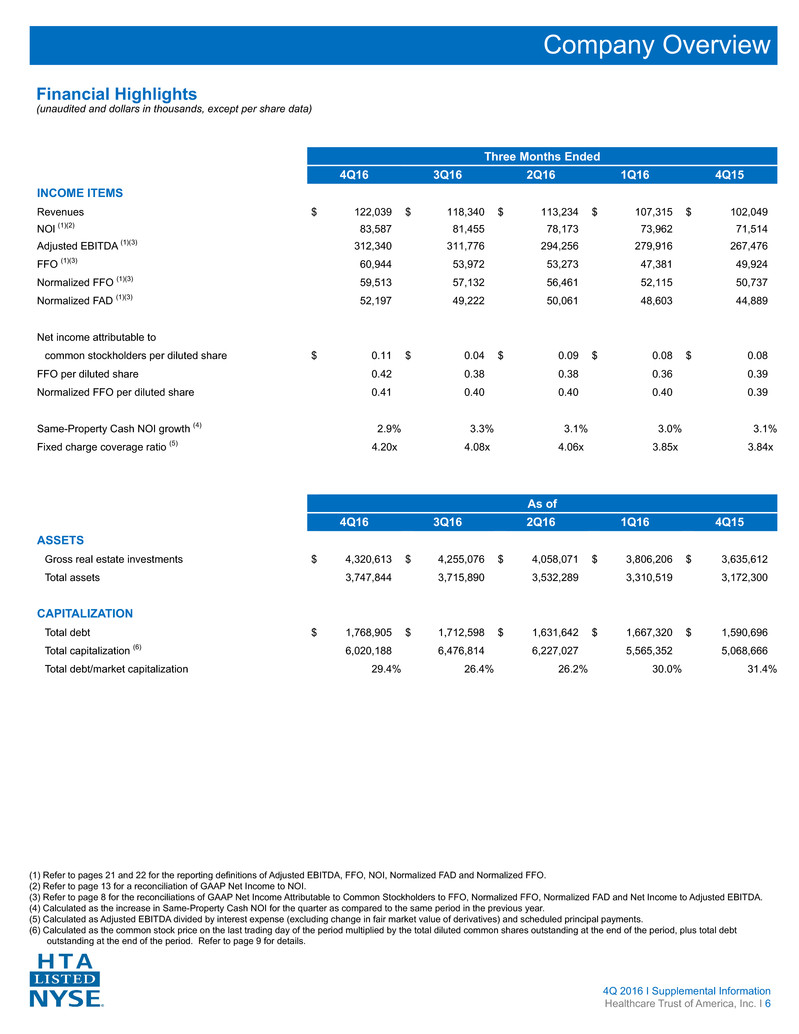

Financial Highlights

(unaudited and dollars in thousands, except per share data)

Three Months Ended

4Q16 3Q16 2Q16 1Q16 4Q15

INCOME ITEMS

Revenues $ 122,039 $ 118,340 $ 113,234 $ 107,315 $ 102,049

NOl (1)(2) 83,587 81,455 78,173 73,962 71,514

Adjusted EBITDA (1)(3) 312,340 311,776 294,256 279,916 267,476

FFO (1)(3) 60,944 53,972 53,273 47,381 49,924

Normalized FFO (1)(3) 59,513 57,132 56,461 52,115 50,737

Normalized FAD (1)(3) 52,197 49,222 50,061 48,603 44,889

Net income attributable to

common stockholders per diluted share $ 0.11 $ 0.04 $ 0.09 $ 0.08 $ 0.08

FFO per diluted share 0.42 0.38 0.38 0.36 0.39

Normalized FFO per diluted share 0.41 0.40 0.40 0.40 0.39

Same-Property Cash NOI growth (4) 2.9% 3.3% 3.1% 3.0% 3.1%

Fixed charge coverage ratio (5) 4.20x 4.08x 4.06x 3.85x 3.84x

As of

4Q16 3Q16 2Q16 1Q16 4Q15

ASSETS

Gross real estate investments $ 4,320,613 $ 4,255,076 $ 4,058,071 $ 3,806,206 $ 3,635,612

Total assets 3,747,844 3,715,890 3,532,289 3,310,519 3,172,300

CAPITALIZATION

Total debt $ 1,768,905 $ 1,712,598 $ 1,631,642 $ 1,667,320 $ 1,590,696

Total capitalization (6) 6,020,188 6,476,814 6,227,027 5,565,352 5,068,666

Total debt/market capitalization 29.4% 26.4% 26.2% 30.0% 31.4%

Company Overview

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 6

Investments in Real Estate (1) $ 4.2

Total portfolio GLA (2) 17.7

Leased rate 91.9%

Same-Property portfolio tenant retention rate (YTD) (3) 80%

% of GLA on-campus/aligned 97%

% of invested dollars in key markets & top 75 MSAs (4) 92%

Investment grade tenants (5) 41%

Credit rated tenants (5) 55%

Weighted average remaining lease term for all buildings (6) 5.1

Weighted average remaining lease term for single-tenant buildings (6) 6.6

Weighted average remaining lease term for multi-tenant buildings (6) 4.5

Credit ratings (by Moody’s and Standard & Poor’s) Baa2(Stable)/BBB(Stable)

Cash and cash equivalents (2) $ 11.2

Debt/market capitalization 29.4%

Weighted average interest rate per annum on portfolio debt (7) 3.35%

Building Type Presence in Top MSAs (8)

Company Snapshot

(as of December 31, 2016)

Company Overview

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 7

(1) Amount presented in billions. Refer to page 21 for the reporting definition of Investments in Real Estate.

(2) Amounts presented in millions.

(3) Refer to page 22 for the reporting definition of Retention.

(4) Refer to page 21 for the reporting definition of Metropolitan Statistical Area.

(5) Amounts based on annualized base rent.

(6) Amounts presented in years.

(7) Includes the impact of interest rate swaps.

(8) Refer to page 12 for a detailed table of our Key Markets and Top 75 MSA Concentration.

% of Portfolio (based on GLA) % of Portfolio (based on invested dollars)

Medical Office Buildings

94%

Hospitals

4%

Senior Care

2%

Additional Top 75

MSAs

40.8%All Other Markets

7.7%

Boston, MA

9.7%

Hartford/

New Haven, CT

6.2%

Dallas, TX

5.8%

Houston, TX

4.6%

Phoenix, AZ

4.5%

Orange County/Los

Angeles, CA

4.5%

Albany, NY

4.2% Greenville, SC

4.2%

Miami, FL

4.1%

Atlanta, GA

3.7%

FFO, Normalized FFO and Normalized FAD Three Months Ended Year Ended

4Q16 4Q15 4Q16 4Q15

Net income attributable to common stockholders $ 16,551 $ 10,372 $ 45,912 $ 32,931

Depreciation and amortization expense related to investments in real

estate 46,067 38,626 175,544 152,846

Gain on sales of real estate, net (4,754) — (8,966) (152)

Impairment 3,080 926 3,080 2,581

FFO attributable to common stockholders $ 60,944 $ 49,924 $ 215,570 $ 188,206

Acquisition-related expenses 1,541 1,190 6,538 4,555

(Gain) loss on change in fair value of derivative financial instruments, net (3,488) (2,310) (1,344) 769

Loss (gain) on extinguishment of debt, net 3 (16) 3,025 (123)

Noncontrolling income from partnership units included in diluted shares 513 166 1,315 514

Other normalizing items, net (1)(2) — 1,783 117 1,999

Normalized FFO attributable to common stockholders $ 59,513 $ 50,737 $ 225,221 $ 195,920

Other income (66) (23) (286) (114)

Non-cash compensation expense 1,935 1,262 7,071 5,724

Straight-line rent adjustments, net (523) (1,082) (4,159) (6,917)

Amortization of below and above market leases/leasehold interests and

corporate assets, net 554 595 2,030 2,350

Deferred revenue - tenant improvement related (1) — (183) — (645)

Amortization of deferred financing costs and debt discount/premium, net 816 683 3,104 3,128

Recurring capital expenditures, tenant improvements and leasing

commissions (10,032) (7,100) (32,898) (21,122)

Normalized FAD attributable to common stockholders $ 52,197 $ 44,889 $ 200,083 $ 178,324

Net income attributable to common stockholders per diluted share $ 0.11 $ 0.08 $ 0.33 $ 0.26

FFO adjustments per diluted share, net 0.31 0.31 1.21 1.21

FFO attributable to common stockholders per diluted share $ 0.42 $ 0.39 $ 1.54 $ 1.47

Normalized FFO adjustments per diluted share, net (0.01) 0.00 0.07 0.06

Normalized FFO attributable to common stockholders per diluted

share $ 0.41 $ 0.39 $ 1.61 $ 1.53

Weighted average diluted common shares outstanding 146,050 128,965 140,259 128,004

Adjusted EBITDA

Three

Months Ended

4Q16

Net income $ 17,154

Depreciation and amortization expense 46,436

Interest expense and net change in fair value of derivative financial

instruments 12,299

EBITDA $ 75,889

Acquisition-related expenses 1,541

Impairment 3,080

Gain on sale of real estate, net (4,754)

Non-cash compensation expense 1,935

Pro forma impact of acquisitions/dispositions 391

Loss on extinguishment of debt, net 3

78,085

Adjusted EBITDA $ 312,340

FFO, Normalized FFO, Normalized FAD and Adjusted EBITDA

(unaudited and in thousands, except per share data)

Financial Information

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 8

(1) For the three months and year ended December 31, 2016, deferred revenue - tenant improvement related items are excluded from Normalized FAD and other normalizing items

excludes lease termination fees as they are both deemed to be generated in the ordinary course of business.

(2) For the three months and year ended December 31, 2015, other normalizing items primarily includes the acceleration of management fees paid in connection with an acquisition-

related management agreement that was entered into at the time of acquisition for our Florida portfolio that was acquired in December 2013.

Capitalization

Unsecured revolving credit facility $ 88,000

Unsecured term loans 500,000

Unsecured senior notes 950,000

Secured mortgage loans 243,466

Deferred financing costs, net (9,527)

Discount, net (3,034)

Total debt $ 1,768,905

Stock price (as of December 31, 2016) $ 29.11

Total diluted common shares outstanding 146,042

Equity capitalization $ 4,251,283

Total capitalization $ 6,020,188

Total undepreciated assets $ 4,565,437

Debt/market capitalization 29.4%

Debt/undepreciated assets 38.7%

Debt/Adjusted EBITDA ratio 5.7x

Financial Information

Capitalization, Interest Expense and Covenants

(as of December 31, 2016, dollars and shares in thousands, except stock price)

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 9

Interest Expense

Covenants

Three Months Ended Year Ended

4Q16 4Q15 4Q16 4Q15

Interest related to derivative financial instruments $ 521 $ 862 $ 2,377 $ 3,140

(Gain) loss on change in fair value of derivative financial instruments, net (3,488) (2,310) (1,344) 769

Total interest related to derivative financial instruments, including net

change in fair value of derivative financial instruments

(2,967) (1,448) 1,033 3,909

Interest related to debt (1) 15,266 13,468 59,769 54,967

Total interest expense $ 12,299 $ 12,020 $ 60,802 $ 58,876

Interest expense excluding net change in fair value of derivative financial

instruments $ 15,787 $ 14,330 $ 62,146 $ 58,107

Bank Loans Required 4Q16

Total leverage ≤ 60% 38%

Secured leverage ≤ 30% 5%

Fixed charge coverage ≥ 1.50x 4.20x

Unencumbered leverage ≤ 60% 37%

Unencumbered coverage ≥ 1.75x 5.41x

Senior Notes Required 4Q16

Total leverage ≤ 60% 40%

Secured leverage ≤ 40% 5%

Unencumbered asset coverage ≥ 150% 260%

Interest coverage ≥ 1.50x 4.43x

(1) Includes the acceleration of deferred loan fees from the execution of our $200.0 million unsecured term loan due in 2023, the net proceeds of which were used to refinance our $155.0

million unsecured term loan due in 2019, for the year ended December 31, 2016.

Equity

71%

Secured

Debt

4%

Unsecured

Debt

25%

Financial Information

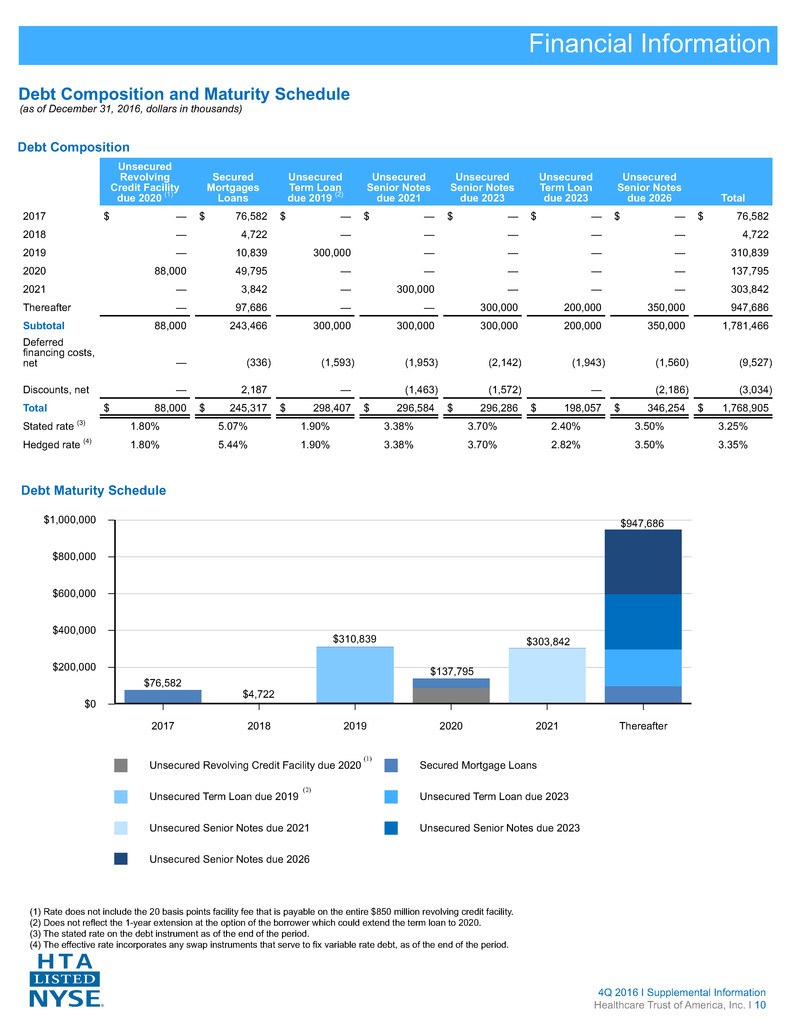

Debt Composition and Maturity Schedule

(as of December 31, 2016, dollars in thousands)

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 10

Unsecured

Revolving

Credit Facility

due 2020 (1)

Secured

Mortgages

Loans

Unsecured

Term Loan

due 2019 (2)

Unsecured

Senior Notes

due 2021

Unsecured

Senior Notes

due 2023

Unsecured

Term Loan

due 2023

Unsecured

Senior Notes

due 2026 Total

2017 $ — $ 76,582 $ — $ — $ — $ — $ — $ 76,582

2018 — 4,722 — — — — — 4,722

2019 — 10,839 300,000 — — — — 310,839

2020 88,000 49,795 — — — — — 137,795

2021 — 3,842 — 300,000 — — — 303,842

Thereafter — 97,686 — — 300,000 200,000 350,000 947,686

Subtotal 88,000 243,466 300,000 300,000 300,000 200,000 350,000 1,781,466

Deferred

financing costs,

net — (336) (1,593) (1,953) (2,142) (1,943) (1,560) (9,527)

Discounts, net — 2,187 — (1,463) (1,572) — (2,186) (3,034)

Total $ 88,000 $ 245,317 $ 298,407 $ 296,584 $ 296,286 $ 198,057 $ 346,254 $ 1,768,905

Stated rate (3) 1.80% 5.07% 1.90% 3.38% 3.70% 2.40% 3.50% 3.25%

Hedged rate (4) 1.80% 5.44% 1.90% 3.38% 3.70% 2.82% 3.50% 3.35%

Debt Composition

(1) Rate does not include the 20 basis points facility fee that is payable on the entire $850 million revolving credit facility.

(2) Does not reflect the 1-year extension at the option of the borrower which could extend the term loan to 2020.

(3) The stated rate on the debt instrument as of the end of the period.

(4) The effective rate incorporates any swap instruments that serve to fix variable rate debt, as of the end of the period.

Debt Maturity Schedule

Unsecured Revolving Credit Facility due 2020 Secured Mortgage Loans

Unsecured Term Loan due 2019 Unsecured Term Loan due 2023

Unsecured Senior Notes due 2021 Unsecured Senior Notes due 2023

Unsecured Senior Notes due 2026

$1,000,000

$800,000

$600,000

$400,000

$200,000

$0

2017 2018 2019 2020 2021 Thereafter

$76,582

$4,722

$310,839

$137,795

$303,842

$947,686

(2)

(1)

Property Market Date Acquired

% Leased at

Acquisition Purchase Price GLA

Yale One Long Wharf MOB New Haven, CT January 99% $ 73,810 287

Texas MOB (7 buildings) Texas (Various) February 86 82,027 483

Charleston MOB Charleston, SC February 100 6,170 22

Hilliard II MOB Columbus, OH April 75 8,450 35

Connecticut MOB (26 buildings) Connecticut (Various) April 98 180,286 579

Polaris MOB Columbus, OH April 100 14,600 45

Legacy MOB Portland, OR May 100 7,750 22

Independence MOB Dallas, TX May 90 24,000 72

Simon Williamson MOB Birmingham, AL June 100 27,750 102

Middletown MOB (2 buildings) Hartford, CT June 80 11,000 64

Mission Viejo MOB (4 buildings) Orange County, CA August 100 150,000 262

Birmingham MOB (3 buildings) Birmingham, AL August 82 36,730 217

Riverside MOB Tampa, FL September 98 10,393 57

OhioHealth MOB Columbus, OH October 100 7,218 35

Duke Health MOB (2 buildings) Raleigh-Durham, NC November 100 34,750 98

Pearl Street MOB (2 buildings) Boston, MA December 86 25,830 91

Total $ 700,764 2,471

Portfolio Information

Investment Activity

(as of December 31, 2016, dollars and GLA in thousands)

2016 Acquisitions

Annual Investments (1)

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 11

Acquisitions Dispositions

$900,000

$700,000

$500,000

$300,000

$100,000

-$100,000

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

$413,150

$542,976

$455,950

$802,148

$68,314

$294,937

$397,826

$439,530

(1) Excludes real estate note receivables, expansions and corporate assets.

$271,510

2016 Dispositions

Property Location Date Disposed Disposition Price GLA

SWLTC Senior Care Facility (4 buildings) Texas (Various) June $ 26,500 155

NAH Senior Care Facility (2 Buildings) California (Various) December 12,983 71

Total $ 39,483 226

$35,685

$700,764

$39,483$82,885

As of December 31, 2016, HTA has invested $4.2 billion primarily in MOBs and other healthcare assets comprising approximately 17.7 million square feet of GLA.

Region Investment % of Investment Total GLA % of Portfolio

Annualized

Base Rent (1)

% of

Annualized

Base Rent

Southwest $ 1,277,074 30.1% 4,895 27.6% $ 107,919 28.9%

Northeast 1,176,390 27.7 4,514 25.5 100,390 26.8

Southeast 1,165,867 27.5 5,294 29.9 109,198 29.2

Midwest 616,112 14.5 2,993 16.9 55,957 15.0

Northwest 7,750 0.2 23 0.1 528 0.1

Total $ 4,243,193 100% 17,719 100% $ 373,992 100%

Portfolio Information

Regional Portfolio Distribution and Key Markets and Top 75 MSA Concentration

(as of December 31, 2016, dollars and GLA in thousands)

Regional Portfolio Distribution

Key Markets and Top 75 MSA Concentration (2)

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 12

(1) Refer to page 21 for the reporting definition of Annualized Base Rent.

(2) Key markets are titled as such based on HTA’s concentration in the respective MSA.

Key Markets Investment

% of

Investment Total GLA % of Portfolio

Annualized

Base Rent

% of

Annualized

Base Rent

Boston, MA $ 410,730 9.7% 1,037 5.9% $ 32,049 8.6%

Hartford/New Haven, CT 265,095 6.2 936 5.3 19,740 5.3

Dallas, TX 244,778 5.8 728 4.1 17,685 4.7

Houston, TX 196,295 4.6 874 4.9 20,373 5.4

Phoenix, AZ 189,641 4.5 1,018 5.7 19,203 5.1

Orange County/Los Angeles, CA 189,500 4.5 432 2.4 11,983 3.2

Albany, NY 179,253 4.2 880 5.0 16,045 4.3

Greenville, SC 179,070 4.2 965 5.4 18,050 4.8

Miami, FL 173,807 4.1 888 5.0 18,249 4.9

Atlanta, GA 156,743 3.7 663 3.7 13,232 3.5

Indianapolis, IN 155,700 3.7 977 5.5 15,345 4.1

Pittsburgh, PA 148,612 3.5 1,095 6.2 19,394 5.2

Raleigh, NC 135,010 3.2 532 3.0 12,611 3.4

Tampa, FL 133,986 3.2 439 2.5 9,692 2.6

Denver, CO 111,700 2.6 371 2.1 8,465 2.3

White Plains, NY 92,750 2.2 276 1.6 6,839 1.8

Columbus, OH 77,068 1.8 323 1.8 5,034 1.3

Charleston, SC 75,021 1.8 290 1.6 5,946 1.6

Orlando, FL 62,300 1.5 289 1.6 6,158 1.6

Honolulu, HI 47,250 1.1 143 0.8 3,886 1.0

Top 20 MSAs 3,224,309 76.1 13,156 74.1 279,979 74.7

Additional Top 75 MSAs 692,198 16.3 3,098 17.5 63,937 17.1

Total Key Markets & Top 75

MSAs $ 3,916,507 92.4% 16,254 91.6% $ 343,916 91.8%

Three Months Ended Sequential Year-Over-Year

4Q16 3Q16 4Q15 $ Change % Change $ Change % Change

Rental revenue $ 79,015 $ 78,454 $ 77,045 $ 561 0.7% $ 1,970 2.6%

Tenant recoveries 21,157 20,619 19,560 538 2.6 1,597 8.2

Total rental income 100,172 99,073 96,605 1,099 1.1 3,567 3.7

Expenses 30,435 29,969 28,804 466 1.6 1,631 5.7

Same-Property Cash NOI $ 69,737 $ 69,104 $ 67,801 $ 633 0.9% $ 1,936 2.9%

As of

4Q16 3Q16 4Q15

Number of buildings 285 285 285

GLA 14,569 14,571 14,571

Leased GLA, end of period 13,394 13,363 13,429

Leased %, end of period 91.9% 91.7% 92.2%

NOI (1) Three Months Ended

4Q16 4Q15

Net income $ 17,154 $ 10,573

General and administrative expenses 7,894 6,349

Acquisition-related expenses 1,541 1,190

Depreciation and amortization expense 46,436 38,955

Impairment 3,080 926

Interest expense and net change in fair value of derivative financial instruments 12,299 12,020

Gain on sales of real estate, net (4,754) —

Loss (gain) on extinguishment of debt, net 3 (16)

Other (income) expense (66) 1,517

NOI $ 83,587 $ 71,514

NOI percentage growth 16.9%

NOI $ 83,587 $ 71,514

Straight-line rent adjustments, net (523) (1,082)

Amortization of below and above market leases/leasehold interests, net and lease termination fees (2) 185 578

Cash NOI $ 83,249 $ 71,010

Notes receivable interest income (115) —

Non Same-Property Cash NOI (13,397) (3,209)

Same-Property Cash NOI $ 69,737 $ 67,801

Same-Property Cash NOI percentage growth 2.9%

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 13

Portfolio Information

Same-Property Performance and NOI

(as of December 31, 2016, unaudited and dollars and GLA in thousands)

Same-Property Performance

(1) Refer to pages 21 and 22 for the reporting definitions of NOI, Cash NOI and Same-Property Cash NOI.

(2) For the period 4Q16, Cash NOI includes lease termination fees as they are deemed to be generated in the ordinary course of business.

As of

4Q16 3Q16 2Q16 1Q16 4Q15

Off-campus aligned 30% 29% 30% 27% 27%

On-campus 67 68 67 70 70

On-campus/aligned 97% 97% 97% 97% 97%

Off-campus/non-aligned 3 3 3 3 3

Total 100% 100% 100% 100% 100%

Number of

Buildings

Number of

States GLA

% of Total

GLA

Annualized

Base Rent

% of

Annualized

Base Rent

Medical Office Buildings

Single-tenant 83 20 4,121 23.3% $ 88,364 23.6%

Multi-tenant 259 26 12,588 71.0 257,314 68.8

Other Healthcare Facilities

Hospitals 10 4 655 3.7 23,200 6.2

Senior care 3 1 355 2.0 5,114 1.4

Total 355 31 17,719 100% $ 373,992 100%

Number of

Buildings

Number of

States GLA

% of Total

GLA

Annualized

Base Rent

% of

Annualized

Base Rent

Net-Lease/Gross-Lease

Net-lease 227 29 11,012 62.1% $ 241,764 64.6%

Gross-lease 128 18 6,707 37.9 132,228 35.4

Total 355 31 17,719 100% $ 373,992 100%

Portfolio Information

Portfolio Diversification by Type, Historical Campus Proximity and Ownership Interests

(as of December 31, 2016, dollars and GLA in thousands)

Portfolio Diversification by Type

Historical Campus Proximity (1)(2)

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 14

Ownership Interests (3)

Number of

Buildings GLA

Annualized

Base Rent

% of

Annualized

Base Rent

As of (1)

4Q16 3Q16 2Q16 1Q16 4Q15

Fee Simple 255 12,135 $ 251,574 68% 68% 68% 68% 68% 68%

Customary Health System

Restrictions 85 4,594 100,935 26 26 26 26 25 25

Economic with Limited

Restrictions 5 262 6,976 2 2 2 2 2 2

Occupancy Health System

Restrictions 10 728 14,507 4 4 4 4 5 5

Leasehold Interest Subtotal 100 5,584 122,418 32 32 32 32 32 32

Total 355 17,719 $ 373,992 100% 100% 100% 100% 100% 100%

(1) Percentages shown as percent of total GLA.

(2) Refer to page 22 for the reporting definitions of Off-campus/non-aligned and On-campus/aligned.

(3) Refer to pages 21 and 22 for the reporting definitions of Customary Health System Restrictions, Economic with Limited Restrictions and Occupancy Health System Restrictions.

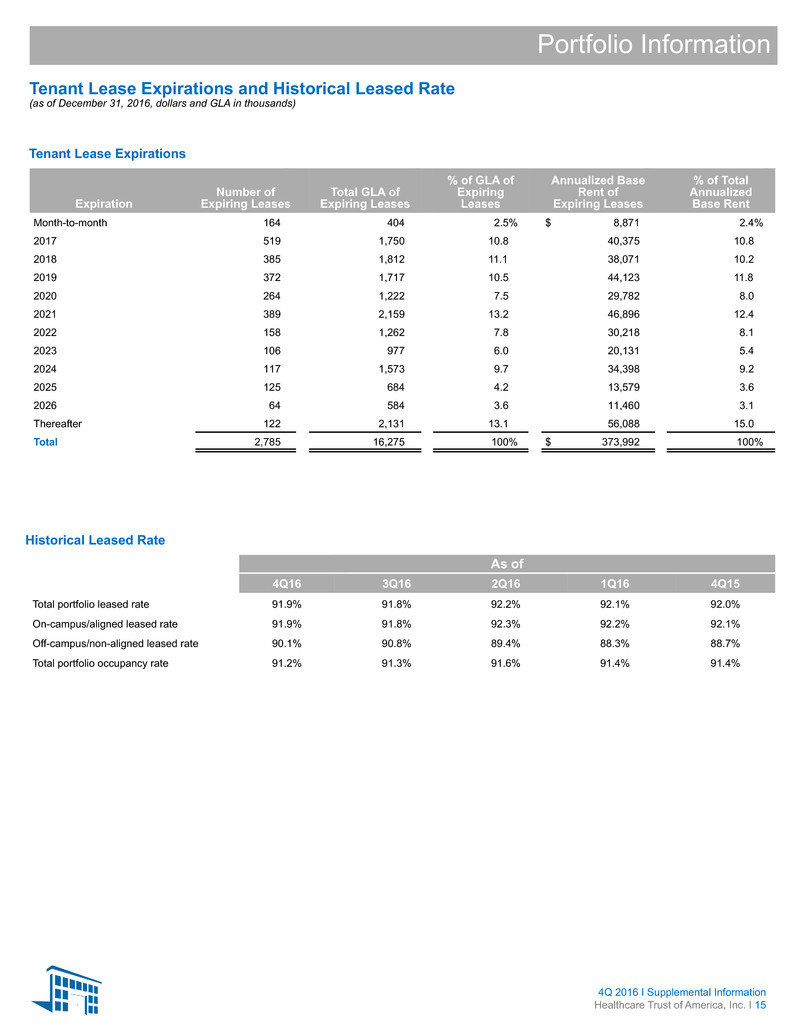

As of

4Q16 3Q16 2Q16 1Q16 4Q15

Total portfolio leased rate 91.9% 91.8% 92.2% 92.1% 92.0%

On-campus/aligned leased rate 91.9% 91.8% 92.3% 92.2% 92.1%

Off-campus/non-aligned leased rate 90.1% 90.8% 89.4% 88.3% 88.7%

Total portfolio occupancy rate 91.2% 91.3% 91.6% 91.4% 91.4%

Expiration

Number of

Expiring Leases

Total GLA of

Expiring Leases

% of GLA of

Expiring

Leases

Annualized Base

Rent of

Expiring Leases

% of Total

Annualized

Base Rent

Month-to-month 164 404 2.5% $ 8,871 2.4%

2017 519 1,750 10.8 40,375 10.8

2018 385 1,812 11.1 38,071 10.2

2019 372 1,717 10.5 44,123 11.8

2020 264 1,222 7.5 29,782 8.0

2021 389 2,159 13.2 46,896 12.4

2022 158 1,262 7.8 30,218 8.1

2023 106 977 6.0 20,131 5.4

2024 117 1,573 9.7 34,398 9.2

2025 125 684 4.2 13,579 3.6

2026 64 584 3.6 11,460 3.1

Thereafter 122 2,131 13.1 56,088 15.0

Total 2,785 16,275 100% $ 373,992 100%

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 15

Portfolio Information

Tenant Lease Expirations and Historical Leased Rate

(as of December 31, 2016, dollars and GLA in thousands)

Tenant Lease Expirations

Historical Leased Rate

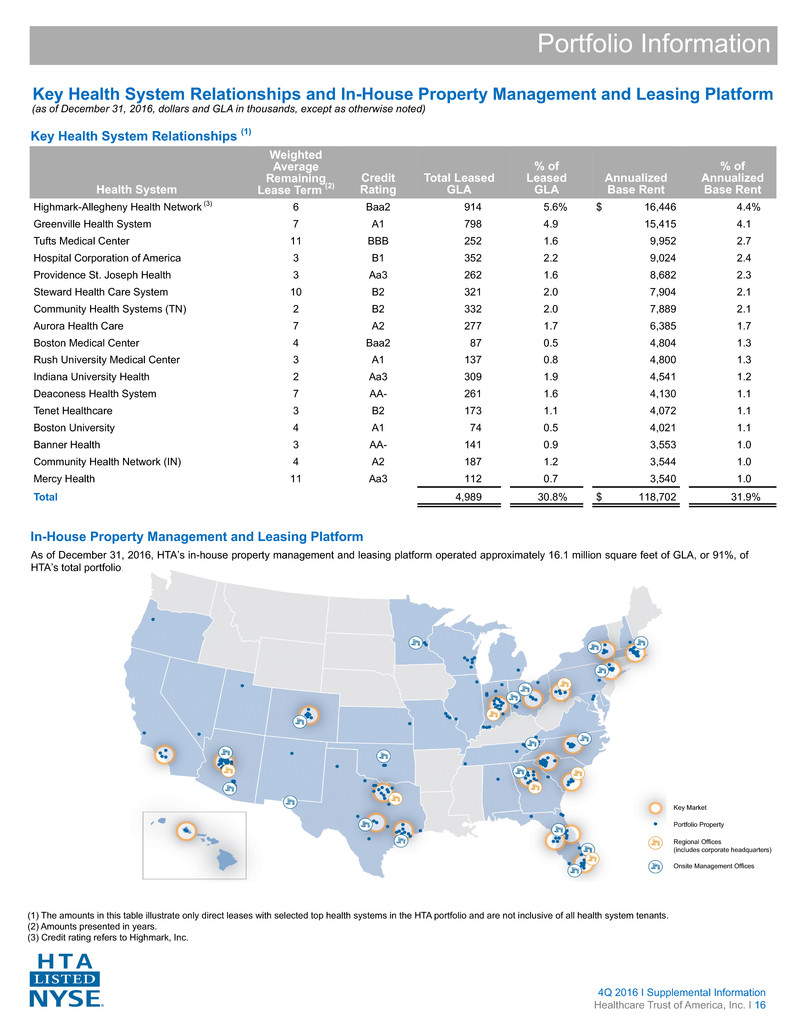

Health System

Weighted

Average

Remaining

Lease Term (2)

Credit

Rating

Total Leased

GLA

% of

Leased

GLA

Annualized

Base Rent

% of

Annualized

Base Rent

Highmark-Allegheny Health Network (3) 6 Baa2 914 5.6% $ 16,446 4.4%

Greenville Health System 7 A1 798 4.9 15,415 4.1

Tufts Medical Center 11 BBB 252 1.6 9,952 2.7

Hospital Corporation of America 3 B1 352 2.2 9,024 2.4

Providence St. Joseph Health 3 Aa3 262 1.6 8,682 2.3

Steward Health Care System 10 B2 321 2.0 7,904 2.1

Community Health Systems (TN) 2 B2 332 2.0 7,889 2.1

Aurora Health Care 7 A2 277 1.7 6,385 1.7

Boston Medical Center 4 Baa2 87 0.5 4,804 1.3

Rush University Medical Center 3 A1 137 0.8 4,800 1.3

Indiana University Health 2 Aa3 309 1.9 4,541 1.2

Deaconess Health System 7 AA- 261 1.6 4,130 1.1

Tenet Healthcare 3 B2 173 1.1 4,072 1.1

Boston University 4 A1 74 0.5 4,021 1.1

Banner Health 3 AA- 141 0.9 3,553 1.0

Community Health Network (IN) 4 A2 187 1.2 3,544 1.0

Mercy Health 11 Aa3 112 0.7 3,540 1.0

Total 4,989 30.8% $ 118,702 31.9%

As of December 31, 2016, HTA’s in-house property management and leasing platform operated approximately 16.1 million square feet of GLA, or 91%, of

HTA’s total portfolio.

Portfolio Information

Key Health System Relationships and In-House Property Management and Leasing Platform

(as of December 31, 2016, dollars and GLA in thousands, except as otherwise noted)

Key Health System Relationships (1)

In-House Property Management and Leasing Platform

(1) The amounts in this table illustrate only direct leases with selected top health systems in the HTA portfolio and are not inclusive of all health system tenants.

(2) Amounts presented in years.

(3) Credit rating refers to Highmark, Inc.

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 16

Key Market

Portfolio Property

Regional Offices

(includes corporate headquarters)

Onsite Management Offices

Boston Medical Center (Baa2), located in the historic South End Medical cluster of Boston, Massachusetts, is a private, not-for-profit academic

center seeing more than one million patient visits a year. BMC is the primary teaching affiliate for the Boston University’s School of Medicine,

and is the busiest trauma and emergency services center in New England. They have initiated a $300 million campus redesign which will

include an additional 400,000 SF for inpatient services. As a recognized leader in groundbreaking medical research, BMC received

approximately $120 million in 2015 to fund over 500 research and service projects.

Community Health Systems, Inc. (B2), headquartered in Franklin, Tennessee, is one of the nation’s leading operators of general acute care

hospitals. The organization includes 158 affiliated hospitals in 22 states with approximately 123,000 employees and 20,000 physicians.

Affiliated hospitals are dedicated to providing quality healthcare for local residents and contribute to the economic development of their

communities. Based on the unique needs of each community served, these hospitals offer a wide range of diagnostic, medical and surgical

services in inpatient and outpatient settings.

Greenville Health System (A1), located in Greenville, South Carolina, is a public not-for-profit academic healthcare delivery system committed

to medical excellence through clinical care, education and research. GHS is a health resource for its community and a leader in transforming

the delivery of healthcare for the benefit of people and communities served. The University of South Carolina School of Medicine Greenville is

located on GHS’ Greenville Memorial Medical Campus. The medical school is focused on transforming healthcare by training physicians to

connect with communities, patients, colleagues and technology in a new, more progressive way.

Highmark-Allegheny Health Network (Baa2), based in Pittsburgh, Pennsylvania, is a diversified healthcare partner that serves members

across the United States through its businesses in health insurance, dental insurance, vision care and reinsurance. Highmark is the fourth

largest Blue Cross and Blue Shield-affiliated company. In 2013, Highmark and West Penn Allegheny combined to create an integrated care

delivery model which they believe will preserve an important community asset that provides high-quality, efficient health care for patients.

Highmark’s mission is to deliver high quality, accessible, understandable and affordable experiences, outcomes and solutions to their customers.

Hospital Corporation of America (B1), based in Nashville, Tennessee, HCA was one of the nation’s first hospital companies. Today, they are

a company comprised of locally managed facilities that includes approximately 169 hospitals, 116 freestanding surgery centers in 20 states and

the United Kingdom employing approximately 233,000 people. Approximately four to five percent of all inpatient care delivered in the country

today is provided by HCA facilities. HCA is committed to the care and improvement of human life and strives to deliver high quality, cost

effective healthcare in the communities they serve.

Indiana University Health (Aa3), based in Indianapolis, Indiana, is Indiana’s most comprehensive healthcare system. A unique partnership

with Indiana University School of Medicine, one of the nation’s leading medical schools, gives patients access to innovative treatments and

therapies. IU Health is comprised of hospitals, physicians and allied services dedicated to providing preeminent care throughout Indiana and

beyond.

Providence St. Joseph Health (Aa3), based in Seattle, Washington and Irvine, California, is held together by Providence Health and Services

and St. Joseph Health, a not-for-profit health and social services system that will serve as the parent organization for more than 100,000

caregivers (employees) across seven states.

Steward Health Care System (B2), located in Boston, Massachusetts, is a community-based accountable care organization and community

hospital network with 3,000 physicians, 10 hospital campuses, 24 affiliated urgent care providers, home care, hospice and other services. The

system serves more than one million patients annually in over 150 communities in the greater Boston area. Other Steward Health Care entities

include Steward Medical Group, Steward Health Care Network, and Steward Home Care.

Tenet Healthcare System (B2), located in Dallas, Texas, is a leading health care services company. Through its network, Tenet operates 80

hospitals, over 470 outpatient centers and has over 130,000 employees. Across the network, compassionate, quality care is provided to millions

of patients through a wide range of services. Tenet is affiliated with Conifer Health Solutions, which helps hospitals, employers and health

insurance companies improve the efficiency and performance of their operations and the health of the people they serve.

Tufts Medical Center (BBB), located in Boston, Massachusetts, is a 415-bed academic medical center, providing everything from routine and

emergency care to treating the most complex diseases and injuries affecting adults and children throughout New England. Tufts Medical Center

is the principal teaching hospital for Tufts University School of Medicine, and has consistently been ranked in the top quartile of major academic

medical centers in the country by The University Health System Consortium.

WellStar Health System (A2), located in Atlanta, Georgia, is a leading not-for-profit health system with over 3,200 beds in the Southeast.

Today, the WellStar Health System is comprised of 11 hospitals, eight urgent care centers, 16 satellite diagnostic imaging centers, over 1,000

medical providers, and over 20,000 employees. With the acquisition of Tenet Healthcare’s five Georgia-based hospitals and a new partnership

with West Georgia Health in LaGrange, GA., WellStar becomes the largest health system in Georgia and one of the largest not-for-profit health

systems in the country.

Portfolio Information

Health System Relationship Highlights

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 17

As of

4Q16 4Q15

ASSETS

Real estate investments:

Land $ 386,526 $ 303,706

Building and improvements 3,466,516 2,901,157

Lease intangibles 467,571 430,749

4,320,613 3,635,612

Accumulated depreciation and amortization (817,593) (676,144)

Real estate investments, net 3,503,020 2,959,468

Cash and cash equivalents 11,231 13,070

Restricted cash and escrow deposits 13,814 15,892

Receivables and other assets, net 173,461 141,703

Other intangibles, net 46,318 42,167

Total assets $ 3,747,844 $ 3,172,300

LIABILITIES AND EQUITY

Liabilities:

Debt $ 1,768,905 $ 1,590,696

Accounts payable and accrued liabilities 105,034 94,933

Derivative financial instruments - interest rate swaps 1,920 2,370

Security deposits, prepaid rent and other liabilities 49,859 46,295

Intangible liabilities, net 37,056 26,611

Total liabilities 1,962,774 1,760,905

Commitments and contingencies

Redeemable noncontrolling interests 4,653 4,437

Equity:

Preferred stock, $0.01 par value; 200,000,000 shares authorized; none issued and

outstanding — —

Class A common stock, $0.01 par value; 1,000,000,000 shares authorized; 141,719,134 and

127,026,839 shares issued and outstanding as of December 31, 2016 and 2015,

respectively 1,417 1,270

Additional paid-in capital 2,754,818 2,328,806

Cumulative dividends in excess of earnings (1,068,961) (950,652)

Total stockholders’ equity 1,687,274 1,379,424

Noncontrolling interests 93,143 27,534

Total equity 1,780,417 1,406,958

Total liabilities and equity $ 3,747,844 $ 3,172,300

Financial Statements

Consolidated Balance Sheets

(unaudited and in thousands, except share data)

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 18

Three Months Ended Year Ended

4Q16 4Q15 4Q16 4Q15

Revenues:

Rental income $ 121,917 $ 101,983 $ 460,563 $ 403,553

Interest and other operating income 122 66 365 269

Total revenues 122,039 102,049 460,928 403,822

Expenses:

Rental 38,452 30,535 143,751 123,390

General and administrative 7,894 6,349 28,773 25,578

Acquisition-related 1,541 1,190 6,538 4,555

Depreciation and amortization 46,436 38,955 176,866 154,134

Impairment 3,080 926 3,080 2,581

Total expenses 97,403 77,955 359,008 310,238

Income before other income (expense) 24,636 24,094 101,920 93,584

Interest expense:

Interest related to derivative financial instruments (521) (862) (2,377) (3,140)

Gain (loss) on change in fair value of derivative financial instruments,

net 3,488 2,310 1,344 (769)

Total interest related to derivative financial instruments, including net

change in fair value of derivative financial instruments 2,967 1,448 (1,033) (3,909)

Interest related to debt (15,266) (13,468) (59,769) (54,967)

Gain on sales of real estate, net 4,754 — 8,966 152

(Loss) gain on extinguishment of debt, net (3) 16 (3,025) 123

Other income (expense) 66 (1,517) 286 (1,426)

Net income $ 17,154 $ 10,573 $ 47,345 $ 33,557

Net income attributable to noncontrolling interests (603) (201) (1,433) (626)

Net income attributable to common stockholders $ 16,551 $ 10,372 $ 45,912 $ 32,931

Earnings per common share - basic:

Net income attributable to common stockholders $ 0.12 $ 0.08 $ 0.34 $ 0.26

Earnings per common share - diluted:

Net income attributable to common stockholders $ 0.11 $ 0.08 $ 0.33 $ 0.26

Weighted average common shares outstanding:

Basic 141,727 127,035 136,620 126,074

Diluted 146,050 128,965 140,259 128,004

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 19

Financial Statements

Consolidated Statements of Operations

(unaudited and in thousands, except per share data)

Year Ended

4Q16 4Q15 4Q14

Cash flows from operating activities:

Net income $ 47,345 $ 33,557 $ 45,994

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation, amortization and other 175,285 151,614 137,188

Share-based compensation expense 7,071 5,724 4,383

Bad debt expense 846 828 312

Gain on sales of real estate, net (8,966) (152) (27,894)

Impairment 3,080 2,581 —

Loss (gain) on extinguishment of debt, net 3,025 (123) 4,663

Change in fair value of derivative financial instruments (1,344) 769 2,870

Changes in operating assets and liabilities:

Receivables and other assets, net (22,080) (7,508) (9,252)

Accounts payable and accrued liabilities 2,171 (6,284) 12,262

Security deposits, prepaid rent and other liabilities (2,738) 10,089 (2,027)

Net cash provided by operating activities 203,695 191,095 168,499

Cash flows from investing activities:

Investments in real estate (591,954) (279,334) (307,271)

Acquisition of note receivable — — (11,924)

Proceeds from the sales of real estate 26,555 34,629 78,854

Capital expenditures (42,994) (29,270) (29,037)

Collection of real estate notes receivable — — 28,520

Restricted cash, escrow deposits and other assets 2,078 4,711 (18,844)

Net cash used in investing activities (606,315) (269,264) (259,702)

Cash flows from financing activities:

Borrowings on unsecured revolving credit facility 574,000 454,000 294,000

Payments on unsecured revolving credit facility (704,000) (272,000) (313,000)

Proceeds from unsecured senior notes 347,725 — 297,615

Borrowings on unsecured term loans 200,000 100,000 —

Payments on unsecured term loans (155,000) — (100,000)

Payments on secured mortgage loans (110,935) (94,856) (92,236)

Deferred financing costs (3,191) (204) (12,112)

Derivative financial instrument termination payments — — (1,675)

Security deposits 924 (243) (1,025)

Proceeds from issuance of common stock 418,891 44,324 152,014

Issuance of operating partnership units 2,706 — —

Repurchase and cancellation of common stock (2,642) (1,667) (1,056)

Redemption of redeemable noncontrolling interests (4,572) — —

Dividends paid (159,174) (146,372) (137,158)

Distributions to noncontrolling interest of limited partners (3,951) (2,156) (1,832)

Net cash provided by financing activities 400,781 80,826 83,535

Net change in cash and cash equivalents (1,839) 2,657 (7,668)

Cash and cash equivalents - beginning of year 13,070 10,413 18,081

Cash and cash equivalents - end of year $ 11,231 $ 13,070 $ 10,413

Financial Statements

Consolidated Statements of Cash Flows

(unaudited and in thousands)

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 20

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 21

Reporting Definitions

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”): Is presented on an assumed annualized basis.

We define Adjusted EBITDA for HTA as net income computed in accordance with GAAP plus: (i) depreciation and amortization; (ii) interest

expense and net change in the fair value of derivative financial instruments; (iii) acquisition-related expenses; (iv) gain or loss on the sales of

real estate; (v) non-cash compensation expense; (vi) pro forma impact of our acquisitions/dispositions; and (vii) other normalizing items. We

consider Adjusted EBITDA an important measure because it provides additional information to allow management, investors, and our current

and potential creditors to evaluate and compare our core operating results and our ability to service debt.

Annualized Base Rent: Annualized base rent is calculated by multiplying contractual base rent for the end of the period by 12 (excluding the

impact of abatements, concessions, and straight-line rent).

Cash Net Operating Income (“Cash NOI”): Cash NOI is a non-GAAP financial measure which excludes from NOI: (i) straight-line rent adjustments

and (ii) amortization of below and above market leases/leasehold interests. Contractual base rent, contractual rent increases, contractual rent

concessions and changes in occupancy or lease rates upon commencement and expiration of leases are a primary driver of HTA’s revenue

performance. HTA believes that Cash NOI, which removes the impact of straight-line rent adjustments, provides another measurement of the

operating performance of its operating assets. Additionally, HTA believes that Cash NOI is a widely accepted measure of comparative operating

performance of real estate investment trusts (“REITs”). However, HTA’s use of the term Cash NOI may not be comparable to that of other REITs

as they may have different methodologies for computing this amount. Cash NOI should not be considered as an alternative to net income or

loss (computed in accordance with GAAP) as an indicator of our financial performance. Cash NOI should be reviewed in connection with other

GAAP measurements.

Credit Ratings: Credit ratings of our tenants or their parent companies.

Customary Health System Restrictions: Ground leases with a health system lessor that include restrictions on tenants that may be considered

competitive with the hospital, which may include provisions that tenants must have hospital privileges.

Economic with Limited Restrictions: Ground leases that are primarily economic in nature and contain no material restrictions on tenancy.

Funds from Operations (“FFO”): HTA computes FFO in accordance with the current standards established by NAREIT. NAREIT defines FFO

as net income or loss attributable to common stockholders (computed in accordance with GAAP), excluding gains or losses from sales of real

estate property and impairment write-downs of depreciable assets, plus depreciation and amortization related to investments in real estate, and

after adjustments for unconsolidated partnerships and joint ventures. HTA presents this non-GAAP financial measure because it considers it

an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other

interested parties in the evaluation of REITs. Historical cost accounting assumes that the value of real estate assets diminishes ratably over

time. Since real estate values have historically risen or fallen based on market conditions, many industry investors have considered the

presentation of operating results for real estate companies that use historical cost accounting to be insufficient by themselves. Because FFO

excludes depreciation and amortization unique to real estate, among other items, it provides a perspective not immediately apparent from net

income or loss attributable to common stockholders.

Gross Leasable Area (“GLA”): Gross leasable area (in square feet).

Investments in Real Estate: Based on acquisition price.

Leased Rate: Leased rate represents the percentage of total GLA that is leased, including month-to-month leases and leases which have been

executed, but which have not yet commenced, as of the date reported.

Metropolitan Statistical Area (“MSA”): Is a geographical region with a relatively high population density at its core and close economic ties

throughout the area. MSAs are defined by the Office of Management and Budget.

Net Operating Income (“NOI”): NOI is a non-GAAP financial measure that is defined as net income or loss (computed in accordance with GAAP)

before: (i) general and administrative expenses; (ii) acquisition-related expenses; (iii) depreciation and amortization expense; (iv) impairment;

(v) interest expense and net change in fair value of derivative financial instruments; (vi) gain or loss on sales of real estate; (vii) gain or loss on

extinguishment of debt; and (viii) other income or expense. HTA believes that NOI provides an accurate measure of the operating performance

of its operating assets because NOI excludes certain items that are not associated with the management of its properties. Additionally, HTA

believes that NOI is a widely accepted measure of comparative operating performance of REITs. However, HTA’s use of the term NOI may not

be comparable to that of other REITs as they may have different methodologies for computing this amount. NOI should not be considered as

an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. NOI should be reviewed

in connection with other GAAP measurements.

Normalized Funds Available for Distribution (“Normalized FAD”): HTA computes Normalized FAD, which excludes from Normalized FFO: (i)

other income or expense; (ii) non-cash compensation expense; (iii) straight-line rent adjustments; (iv) amortization of below and above market

leases/leasehold interests and corporate assets; (v) amortization of deferred financing costs and debt premium/discount; and (vi) recurring

capital expenditures, tenant improvements and leasing commissions. HTA believes this non-GAAP financial measure provides a meaningful

supplemental measure of our operating performance. Normalized FAD should not be considered as an alternative to net income or loss attributable

to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance, nor is it indicative of cash available

to fund cash needs. Normalized FAD should be reviewed in connection with other GAAP measurements.

4Q 2016 I Supplemental Information

Healthcare Trust of America, Inc. I 22

Reporting Definitions

Normalized Funds From Operations (“Normalized FFO”): HTA computes Normalized FFO, which excludes from FFO: (i) acquisition-related

expenses; (ii) gain or loss on change in fair value of derivative financial instruments; (iii) gain or loss on extinguishment of debt; (iv) noncontrolling

income or loss from partnership units included in diluted shares; and (v) other normalizing items, which include items that are unusual and

infrequent in nature. HTA presents this non-GAAP financial measure because it allows for the comparison of our operating performance to other

REITs and between periods on a consistent basis. HTA’s methodology for calculating Normalized FFO may be different from the methods utilized

by other REITs and, accordingly, may not be comparable to other REITs. Normalized FFO should not be considered as an alternative to net

income or loss attributable to common stockholders (computed in accordance with GAAP) as an indicator of our financial performance, nor is

it indicative of cash available to fund cash needs. Normalized FFO should be reviewed in connection with other GAAP measurements.

Occupancy Health System Restrictions: Ground leases with customary health system restrictions whereby the restrictions cease if occupancy

in the buildings/on-campus fall below stabilized occupancy, which is generally between 85% and 90%.

Off-Campus/Non-Aligned: A building or portfolio that is not located on or adjacent to a healthcare or hospital campus or does not have a majority

alignment with a recognized healthcare system.

On-Campus/Aligned: On-campus refers to a property that is located on or adjacent to a healthcare or hospital campus. Aligned refers to a

property that is not on a healthcare or hospital campus, but anchored by a healthcare system.

Recurring Capital Expenditures, Tenant Improvements and Leasing Commissions: Represents amounts paid for: (i) recurring capital expenditures

required to maintain and re-tenant our properties; (ii) second generation tenant improvements; and (iii) leasing commissions paid to secure new

tenants. Excludes capital expenditures and tenant improvements for recent acquisitions that were contemplated in the purchase price or closing

agreements.

Retention: Tenant Retention is defined as the sum of the total leased GLA of tenants that renewed a lease during the period over the total GLA

of leases that renewed or expired during the period.

Same-Property Cash Net Operating Income (“Same-Property Cash NOI”): To facilitate the comparison of Cash NOI between periods, HTA

calculates comparable amounts for a subset of its owned properties referred to as “Same-Property”. Same-Property Cash NOI excludes

properties which have not been owned and operated by HTA during the entire span of all periods presented, excluding properties intended for

disposition in the near term, notes receivable interest income and certain non-routine items. Same-Property Cash NOI should not be considered

as an alternative to net income or loss (computed in accordance with GAAP) as an indicator of our financial performance. Same-Property Cash

NOI should be reviewed in connection with other GAAP measurements.