Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Brookdale Senior Living Inc. | form8-k.htm |

| EX-99.1 - PRESS RELEASE - Brookdale Senior Living Inc. | exhibit99_1.htm |

Exhibit 99.2

Supplemental Information 4th Quarter 2016

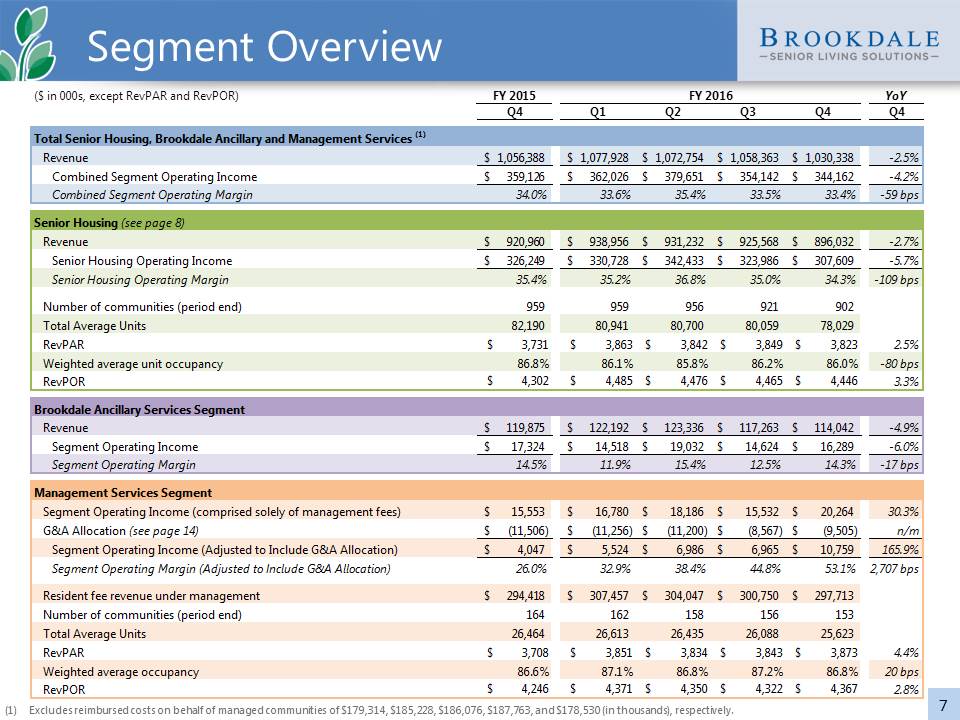

Table of Contents Financial Overview 3-6 Segment Overview 7 Senior Housing 8-12 Ancillary Services 13 G&A Expense & Transaction Costs 14 Capital Expenditures 15 Cash Lease Payments 16 Unconsolidated Ventures 17 Capital Structure 18-19 Net Asset Value Elements 20 Definitions 21-22 Appendix: Consolidated Statements of Cash Flows 24 Non-GAAP Financial Measures 25-30

Overview Brookdale’s weighted average unit ownership percentage is 24.6%.Important Note Regarding Non-GAAP Financial Measures. Adjusted EBITDA, Adjusted Free Cash Flow and Brookdale’s Proportionate Share of Adjusted Free Cash Flow of Unconsolidated Ventures are financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (GAAP). See the definitions of such measures under “Definitions” below and important information regarding such measures, including reconciliations to the most comparable GAAP financial measures, under “Non-GAAP Financial Measures” below.

Consolidated Portfolio Overview Segment Overview (1) Senior Housing Segments Revenue (2) Segment Operating Income (3) Brookdale’s five segments are Retirement Centers, Assisted Living, CCRCs–Rental (which combined are referred to as Senior Housing), Ancillary Services and Management Services.Percentage of revenue is based on Q4 2016 resident fee and management fee revenue.Percentage of operating income is based on Q4 2016 results.

Adjusted EBITDA and Adjusted Free Cash Flow Primarily consists of proceeds from property insurance, cash paid for debt modification and extinguishment costs, cash paid for state income taxes, and cash proceeds from litigation insurance.

Adjusted EBITDA and Adjusted Free Cash Flow Distribution Other is primarily comprised of corporate capital expenditures, unallocated G&A expense (primarily integration, transaction-related and strategic project costs) and transaction costs.

Segment Overview Excludes reimbursed costs on behalf of managed communities of $179,314, $185,228, $186,076, $187,763, and $178,530 (in thousands), respectively.

Senior Housing Segments

Senior Housing: Same Community

Senior Housing: Owned Portfolio

Senior Housing: Leased Portfolio

New Supply (1) Data reflected is for the consolidated senior housing portfolio only.NIC MAP Supply Set, Q4 2016 "New Construction" properties with projected open dates through Q4 2017.Saturation is equal to units per population Age 75+ with income 50k+.Percentage changes are based on data from Esri for 2016-2021.

Ancillary Services

G&A Expense & Transaction Costs G&A allocations are calculated using a methodology which the Company believes best matches the type of general and administrative cost with the community, segment, or portfolio. Some of the allocations are based on direct utilization and some are based on formulas such as unit proportion. G&A allocations presented herein exclude non-cash stock-based compensation expense and integration, transaction, transaction-related and strategic project costs.

Capital Expenditures Includes net recurring and EBITDA-enhancing projects which were formerly reported separately.Formerly referred to by the Company as corporate, integration and other.

Cash Lease Payments Includes corporate lease expense of $796, $1,134, $1,171, $1,182, and $1,160 (in thousands), respectively.

Unconsolidated Ventures

Debt & Liquidity Includes mortgage debt, convertible notes, line of credit and other notes payable, but excludes capital and financing lease obligations.Pertaining to variable rate debt, reflects a) market rates as of December 31, 2016 and b) applicable cap rates for hedged debt.

Debt Maturity & Leverage Includes $295.4 million of convertible notes.Includes mortgage debt, convertible notes and other notes payable, but excludes capital and financing leases and line of credit and recurring principal amortization.Amounts of Adjusted EBITDAR and Adjusted EBITDA exclude integration, transaction, transaction-related and strategic project costs of $54.2 million.Important Note Regarding Non-GAAP Financial Measures. Adjusted EBITDAR, Adjusted EBITDA and Adjusted EBITDA after cash capital and financing lease payments (in each case excluding integration, transaction, transaction-related and strategic-project costs), Net debt, and Adjusted net debt are financial measures that are not calculated in accordance with GAAP. See the definitions of such measures under “Definitions” below and important information regarding such measures, including reconciliations to the most comparable GAAP financial measures, under “Non-GAAP Financial Measures” below. (2) (1)

Net Asset Value Elements See page 14. G&A allocations presented on this page exclude non-cash stock-based compensation expense of $32,285 and integration, transaction, transaction-related and strategic project costs of $54,212 for the twelve months ended December 31, 2016.

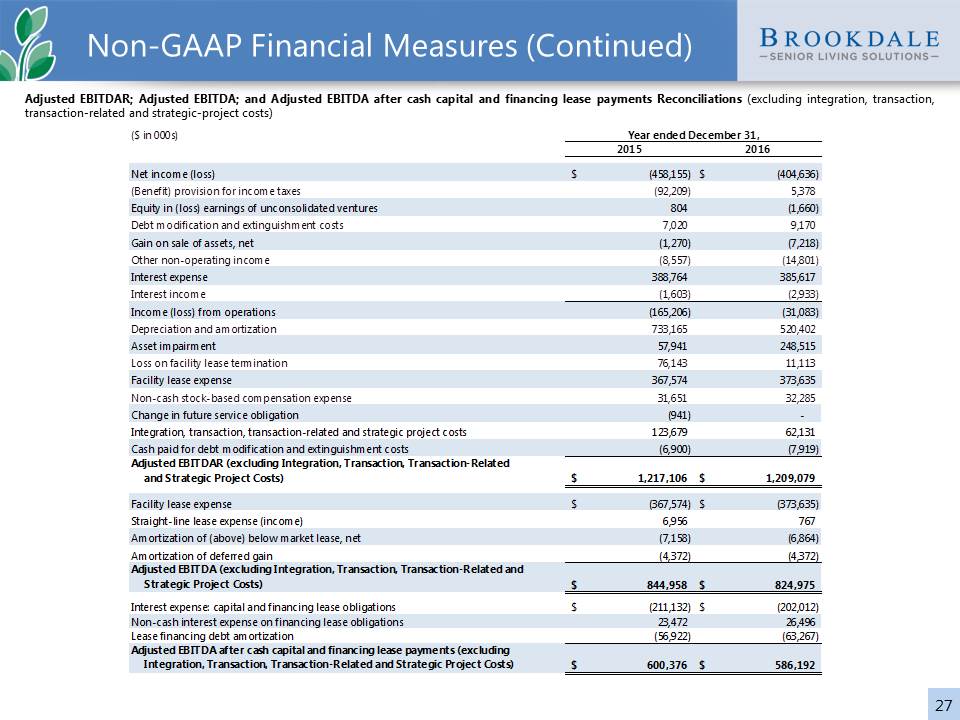

Adjusted EBITDA is a non-GAAP financial measure that the Company defines as net income (loss) before provision (benefit) for income taxes; non-operating (income) expense items; depreciation and amortization (including non-cash impairment charges); (gain) loss on sale or acquisition of communities (including gain (loss) on facility lease termination); straight-line lease expense (income), net of amortization of (above) below market rents; amortization of deferred gain; non-cash stock-based compensation expense; and change in future service obligation. For purposes of the Company’s leverage ratios presented under “Debt Maturity & Leverage”, Adjusted EBITDA and Adjusted EBITDA after cash capital and financing lease payments exclude integration, transaction, transaction-related and strategic project costs. Adjusted EBITDAR is a non-GAAP financial measure that the Company defines as Adjusted EBITDA less cash operating lease payments. For purposes of the Company’s leverage ratios presented under “Debt Maturity & Leverage”, Adjusted EBITDAR excludes integration, transaction, transaction-related and strategic project costs. Adjusted Free Cash Flow is a non-GAAP financial measure that the Company defines as net cash provided by (used in) operating activities before: changes in operating assets and liabilities; gain (loss) on facility lease termination; and distributions from unconsolidated ventures from cumulative share of net earnings; plus: proceeds from refundable entrance fees, net of refunds; and property insurance proceeds; less: lease financing debt amortization and Non-Development Capital Expenditures (defined below). Adjusted Net Debt is a non-GAAP financial measure that the Company defines as Net Debt, plus cash operating and capital and financing lease payments for the relevant period multiplied by 8. Brookdale’s Proportionate Share of Adjusted Free Cash Flow of Unconsolidated Ventures is a non-GAAP financial measure calculated based on the Company’s equity ownership percentage and in a manner consistent with the Company’s definition of Adjusted Free Cash Flow for its consolidated entities. The Company’s investments in its unconsolidated ventures are accounted for under the equity method of accounting and, therefore, the Company’s proportionate share of Adjusted Free Cash Flow of unconsolidated ventures does not represent cash available to the Company’s consolidated business except to the extent it is distributed to the Company. Combined Segment Operating Income is defined by the Company as resident fee and management fee revenue of the Company, less facility operating expenses. Combined Segment Operating Income does not include general and administrative expenses, transaction costs or depreciation and amortization. Definitions Community Labor Expenses is a component of facility operating expense that includes regular and overtime salaries and wages, bonuses, paid-time-off and holiday wages, payroll taxes, contract labor, employee benefits, and workers compensation. Development Capital Expenditures means capital expenditures for community expansions and major community redevelopment and repositioning projects, including the Company’s Program Max initiative, and the development of new communities. Amounts of Development Capital Expenditures are presented net of lessor reimbursements received or anticipated to be received. Integration, Transaction, Transaction-Related and Strategic Project Costs are general and administrative expenses. Integration costs include transition costs associated with the Emeritus merger and organizational restructuring (such as severance and retention payments and recruiting expenses), third party consulting expenses directly related to the integration of Emeritus (in areas such as cost savings and synergy realization, branding and technology and systems work), and internal costs such as training, travel and labor, reflecting time spent by Company personnel on integration activities and projects. Transaction and transaction-related costs include third party costs directly related to the acquisition of Emeritus, other acquisition and disposition activity, community financing and leasing activity and corporate capital structure assessment activities (including shareholder relations advisory matters), and are primarily comprised of legal, finance, consulting, professional fees and other third party costs. Strategic project costs include costs associated with certain strategic projects related to refining the Company's strategy, building out enterprise-wide capabilities for the post-merger platform (including the electronic medical records (“EMR”) roll-out project) and reducing costs and achieving synergies by capitalizing on scale. Interest Coverage is calculated based on the trailing-twelve months Owned Portfolio Operating Income adjusted for 5% management fee and capital expenditures at $350/unit, divided by the trailing-twelve months property level and corporate debt interest expense. Lease Coverage is calculated based on the trailing-twelve months Leased Portfolio Operating Income adjusted for 5% management fee and capital expenditures at $350/unit, divided by the trailing-twelve months cash lease payments for both operating leases and capital and financing leases, excluding corporate lease expense.

Leased Portfolio Operating Income is defined by the Company as resident fee revenues (excluding Brookdale Ancillary Services segment revenue), less facility operating expenses for the Company’s Senior Housing Leased Portfolio. Leased Portfolio Operating Income does not include general and administrative expenses (unless otherwise noted), transaction costs or depreciation and amortization. Net Debt is a non-GAAP financial measure that the Company defines as the total of its debt (mortgage debt, convertible notes and other notes payable) and the outstanding balance on the line of credit, less unrestricted cash and cash held as collateral against existing debt. n/m means not meaningful and is used in the year-over-year variance column if either or both periods being compared have a negative sign. Non-Development Capital Expenditures is comprised of corporate and community-level capital expenditures, including those related to maintenance, renovations, upgrades and other major building infrastructure projects for the Company’s communities. Non-Development Capital Expenditures does not include capital expenditures for community expansions and major community redevelopment and repositioning projects, including the Company’s Program Max initiative, and the development of new communities (i.e., Development Capital Expenditures). Amounts of Non-Development Capital Expenditures are presented net of lessor reimbursements received or anticipated to be received. Owned Portfolio Operating Income is defined by the Company as resident fee revenues (excluding Brookdale Ancillary Services segment revenue), less facility operating expenses for the Company’s Senior Housing Owned Portfolio. Owned Portfolio Operating Income does not include general and administrative expenses (unless otherwise noted), transaction costs or depreciation and amortization. RevPAR, or average monthly senior housing resident fee revenues per available unit, is defined by the Company as resident fee revenues, excluding Brookdale Ancillary Services segment revenue and entrance fee amortization, for the corresponding portfolio for the period, divided by the weighted average number of available units in the corresponding portfolio for the period, divided by the number of months in the period. RevPOR, or average monthly senior housing resident fee revenues per occupied unit, is defined by the Company as resident fee revenues, excluding Brookdale Ancillary Services segment revenue and entrance fee amortization, for the corresponding portfolio for the period, divided by the weighted average number of occupied units in the corresponding portfolio for the period, divided by the number of months in the period. Definitions Same Community information reflects historical results from senior housing operations for same store communities (utilizing the Company's methodology for determining same store communities). Segment Operating Income is defined by the Company as segment revenues less segment facility operating expenses. Segment Operating Income does not include general and administrative expenses (unless otherwise noted), transaction costs or depreciation and amortization. Management Services segment operating income excludes revenue for reimbursements for which the Company is the primary obligor of costs incurred on behalf of managed communities, and there are no facility operating expenses associated with the Management Services segment. See the Segment Information note to the Company’s consolidated financial statements for more information regarding the Company’s segments. Senior Housing Leased Portfolio represents Brookdale leased communities and does not include owned, managed – 3rd party, or managed – venture communities. Senior Housing Operating Income is defined by the Company as segment revenues less segment facility operating expenses for the Company’s Retirement Centers, Assisted Living and CCRCs–Rental segments on an aggregate basis. Senior Housing Operating Income does not include general and administrative expenses, transaction costs or depreciation and amortization. Senior Housing Owned Portfolio represents Brookdale owned communities and does not include leased, managed – 3rd party, or managed – venture communities. Total Average Units represents the average number of units operated during the period, excluding equity homes. Total RevPAR, or average monthly resident fee revenues per available unit, is defined by the Company as resident fee revenues, excluding entrance fee amortization, for the Company for the period, divided by the weighted average number of available units in the Company’s consolidated portfolio for the period, divided by the number of months in the period.

Appendix Consolidated Statements of Cash Flows 24 Non-GAAP Financial Measures 25-30 Brookdale SkylineColorado Springs, CO

Consolidated Statements of Cash Flows

Non-GAAP Financial Measures This Supplemental Information contains financial measures utilized by management to evaluate the Company’s operating performance and liquidity that are not calculated in accordance with GAAP, including Adjusted EBITDA; Adjusted EBITDAR, Adjusted EBITDA and Adjusted EBITDA after cash lease payments (in each case excluding integration, transaction, transaction-related and strategic project costs); Net Debt; Adjusted Net Debt; Adjusted Free Cash Flow; and the Company’s Proportionate Share of Adjusted Free Cash Flow of Unconsolidated Ventures, the Company’s definitions for which are included in the “Definitions” section above. In addition, this section contains reconciliations of the Company’s non-GAAP financial measures Cash From Facility Operations (CFFO) and Adjusted CFFO, which the Company has historically reported and has included herein for purposes of comparison. These non-GAAP financial measures should not be considered in isolation from or as superior to or as a substitute for net income (loss), income (loss) from operations, net cash provided by (used in) operating activities, short-term debt, long-term debt, less current portion, current portion of long-term debt, or other financial measures determined in accordance with GAAP. Management uses these non-GAAP financial measures to supplement the Company’s GAAP results to provide a more complete understanding of the factors and trends affecting the business. Investors are urged to review the reconciliations set forth in this section of such non-GAAP financial measures to their most comparable GAAP financial measures and to review the information under “Reconciliation of Non-GAAP Financial Measures” in the Company’s earnings release dated February 13, 2017 for additional information regarding the Company’s use, and the limitations of, the Company’s non-GAAP financial measures. Investors are cautioned that amounts presented in accordance with the Company’s definitions of these non-GAAP measures may not be comparable to similar measures disclosed by other companies, because not all companies calculate such measures in the same manner.As noted in the Company’s earnings release dated February 13, 2017, the Company changed its definition and calculation of Adjusted EBITDA and CFFO when it reported results for the second quarter of 2016 and third quarter of 2016. Prior period amounts of Adjusted EBITDA, CFFO and Adjusted CFFO presented herein have been recast to conform to the new definitions. See "Reconciliation of Non-GAAP Financial Measures" in the Company’s earnings release dated February 13, 2017 for more information regarding the changes made to the definitions and calculations of Adjusted EBITDA and CFFO.

Non-GAAP Financial Measures (Continued) Adjusted EBITDA Reconciliation

Non-GAAP Financial Measures (Continued) Adjusted EBITDAR; Adjusted EBITDA; and Adjusted EBITDA after cash capital and financing lease payments Reconciliations (excluding integration, transaction, transaction-related and strategic-project costs)

Non-GAAP Financial Measures (Continued) Net Debt and Adjusted Net Debt Reconciliations

Non-GAAP Financial Measures (Continued) Adjusted Free Cash Flow; CFFO; and Adjusted CFFO Reconciliations

Non-GAAP Financial Measures (Continued) Brookdale’s Proportionate Share of Adjusted Free Cash Flow and CFFO of Unconsolidated VenturesFor purposes of this presentation, amounts for each line item represent the aggregate amounts of such line items for all of the Company’s unconsolidated ventures.

Brookdale Senior Living Inc.111 Westwood Place, Suite 400Brentwood, TN 37027(615) 221-2250www.brookdale.com