Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ION GEOPHYSICAL CORP | a8k-2016xq4xearnings.htm |

| EX-99.1 - EXHIBIT 99.1 - ION GEOPHYSICAL CORP | ex991earningsrelease4q-16.htm |

ION Earnings Call – Q4 2016

Earnings Call Presentation

February 9, 2017

Corporate Participants and Contact Information

CONTACT INFORMATION

If you have technical problems during the call, please contact DENNARD–LASCAR Associates

at 713 529 6600.

If you would like to view a replay of today's call, it will be available via webcast in the Investor Relations

section of the Company's website at www.iongeo.com for approximately 12 months.

BRIAN HANSON

President and

Chief Executive Officer

STEVE BATE

Executive Vice President

and Chief Financial Officer

2

Forward-Looking Statements

The information included herein contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E

of the Securities Exchange Act of 1934.

Actual results may vary fundamentally from those described in these

forward-looking statements.

All forward-looking statements reflect numerous assumptions and involve a

number of risks and uncertainties.

These risks and uncertainties include risk factors that are disclosed by ION

from time to time in its filings with the Securities and Exchange Commission.

3

Revenues $M

4

• Revenues of $35M

• Down 54% compared to Q4-15

• Adjusted net loss of $(12)M versus

$(6)M net loss in Q4-15

• Generated $16M of cash

(excluding special items*) versus

$(3)M in Q4-15

• Generated break-even cash flows

for FY 2016 excluding patent

litigation payment and cash used

on our Q2 bond exchange

• FY 2016 cash flow break-even

demonstrates we have rightsized

our business

ION Q4-16 Financial Highlights

(0.51)

(0.99)

$(1.25)

$(1.00)

$(0.75)

$(0.50)

$(0.25)

$-

Adjusted EPS

Q4-15 Q4-16

(6)

(12)

$(14)

$(12)

$(10)

$(8)

$(6)

$(4)

$(2)

$-

Adjusted Net Income (Loss)

Q4-15 Q4-16

$(5.0)

$-

$5.0

$10.0

$15.0

$20.0

Cash Activity* $M

Q4-15

(3)

Q4-16*

77

79

35

$-

$10

$20

$30

$40

$50

$60

$70

$80

$90

Q4-15 Q3-16 Q4-16

16

Q4-16 excludes patent litigation and

repayments on revolver

*

ION Q4-16 Highlights

Closed a significant amount of new

deals related to our 3D multi-client

Campeche reimaging program in

partnership with Schlumberger

Increased backlog $15M to $34M at

year-end, up from $19M at year-end

2015

5

Overall E&P Technology & Services Segment

E&P Operations Optimization Segment

Completed 22 deployments total of our

simultaneous operations management

software, Marlin, and continue to

receive great client feedback

Very positive customer feedback on the

unprecedented turnaround time and

imaging improvement in our 3D multi-

client program

Imaging Services group remains close

to being fully utilized, with a large

portion of capacity dedicated to higher

potential 3D reprocessing projects

Ocean Bottom Services Segment

Continue to work on, and are strongly

positioned for, tenders in the region

(0.51)

(0.99)

$(1.00)

$(0.75)

$(0.50)

$(0.25)

$-

Adjusted EPS

Q4-15

6

ION Financial Overview

Q4-16 Summary

$77

$35

$-

$15

$30

$45

$60

$75

$90

Q4-15 Q4-16

Ocean Bottom

E&P Ops E&P T&S

Revenue $M

$18

$7

$-

$5

$10

$15

$20

$25

Q4-15

Adjusted EBITDA $M

Q4-16

• Revenues down 54% vs Q4-15

• E&P Technology & Services down 60%

• E&P Operations Optimization down 29%

• No revenues from Ocean Bottom Services

•Operating loss of $8M compared to $0M in

Q4-15

• Decrease driven by significant decline in

revenues, more than offsetting the $95M in

annualized cost reductions implemented over

the last two years

• Adjusted EPS of $(0.99) compared to

$(0.51) in Q4-15

• Adjusted EBITDA of $7M compared to

$18M in Q4-15

• Adjusted EBITDA remained positive despite a

significant decline in revenues, the result of

savings from prior cost cutting initiatives

Q4-16

$(0)

$(8)

$(10)

$(5)

$-

Q4-16

Operating Loss $M

Q4-15

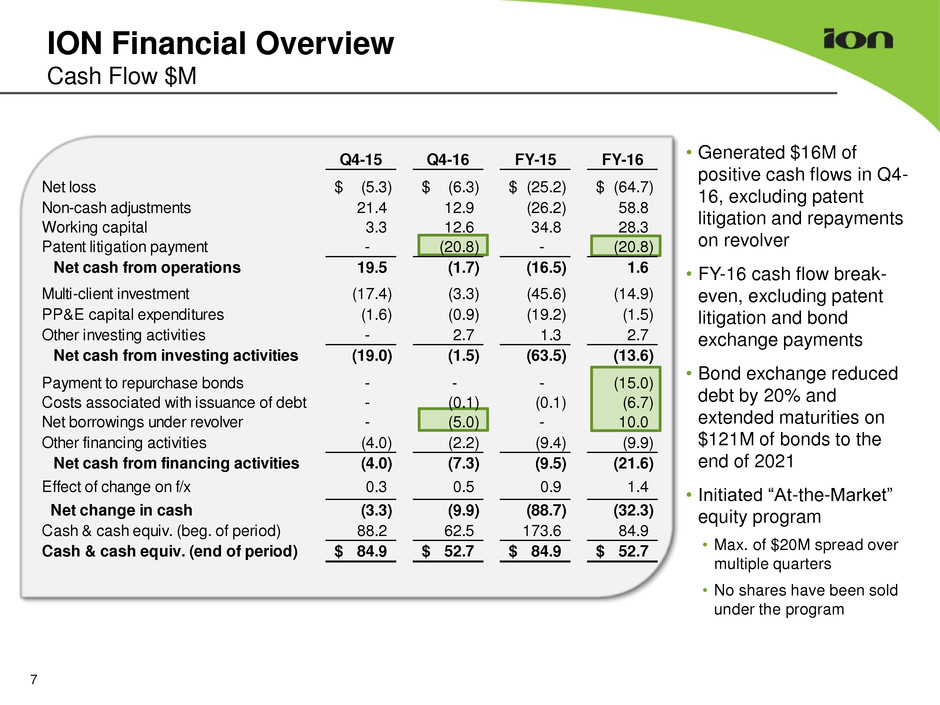

ION Financial Overview

Cash Flow $M

7

• Generated $16M of

positive cash flows in Q4-

16, excluding patent

litigation and repayments

on revolver

• FY-16 cash flow break-

even, excluding patent

litigation and bond

exchange payments

• Bond exchange reduced

debt by 20% and

extended maturities on

$121M of bonds to the

end of 2021

• Initiated “At-the-Market”

equity program

• Max. of $20M spread over

multiple quarters

• No shares have been sold

under the program

Q4-15 Q4-16 FY-15 FY-16

Net loss (5.3)$ (6.3)$ (25.2)$ (64.7)$

Non-cash adjustments 21.4 12.9 (26.2) 58.8

Working capital 3.3 12.6 34.8 28.3

Patent litigation payment - (20.8) - (20.8)

Net cash from operations 19.5 (1.7) (16.5) 1.6

Multi-client investment (17.4) (3.3) (45.6) (14.9)

PP&E capital expenditures (1.6) (0.9) (19.2) (1.5)

Other investing activities - 2.7 1.3 2.7

Net cash from investing activities (19.0) (1.5) (63.5) (13.6)

Payment to repurchase bonds - - - (15.0)

Costs associated with issuance of debt - (0.1) (0.1) (6.7)

Net borrowings under revolver - (5.0) - 10.0

ther financing activities (4.0) (2.2) (9.4) (9.9)

Net cash from inancing activities (4.0) (7.3) (9.5) (21.6)

Effect of chang on f/x 0.3 0.5 0.9 1.4

Net change i cash (3.3) (9.9) (88.7) (32.3)

Cash & cash equiv. (beg. of period) 88.2 62.5 173.6 84.9

Cash & cash quiv. (end of period) 84.9$ 52.7$ 84.9$ 52.7$

Summary

2016 was a tough year, but we’ve navigated it successfully

– Proactive, disciplined, and creative balance sheet management

– Rightsized our business to weather this severe industry downturn

Expect E&P market to start improving

– Expect a modest increase in 2017 E&P spending

– Expect growth in seismic spending to lag behind other oil and gas segments,

especially offshore marine activity, which remains our primary focus

Expect 2017 to be a transition year for ION

– As usual, we believe the first half will be softer than the back half

– Past rightsizing initiatives enable us to run our business in 2017 and position

ourselves for a recovery in our area of the industry in 2018

– Maintained our capabilities, our workforce and our R&D programs – we’re

actively positioning ourselves to take full advantage of a more normal 2018

8

9

Q&A