Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - COHERENT INC | a20161231_10q.htm |

| EX-32.2 - CERTIFICATE OF CHIEF FINANCIAL OFFICER - COHERENT INC | cohr-ex322_2017q1.htm |

| EX-32.1 - CERTIFICATE OF CHIEF EXECUTIVE OFFICER - COHERENT INC | cohr-ex321_2017q1.htm |

| EX-31.2 - CERTIFICATE OF CHIEF FINANCIAL OFFICER - COHERENT INC | cohr-ex312_2017q1.htm |

| EX-31.1 - CERTIFICATE OF CHIEF EXECUTIVE OFFICER - COHERENT INC | cohr-ex311_2017q1.htm |

| EX-10.6 - EXHIBIT 10.6 - COHERENT INC | fy17vcpexhibita1to121516.htm |

| EX-10.4 - EXHIBIT 10.4 - COHERENT INC | cohr-ex104_2017q1.htm |

| EX-10.3 - EXHIBIT 10.3 - COHERENT INC | cohr-ex103_2017q1.htm |

| EX-10.2 - EXHIBIT 10.2 - COHERENT INC | cohr-ex102_2017q1.htm |

| EX-10.1 - EXHIBIT 10.1 - COHERENT INC | cohr-ex101_2017q1.htm |

P. 1 Superior Reliability & Performance Coherent Confidential

Do Not Copy, Reproduce or Distribute

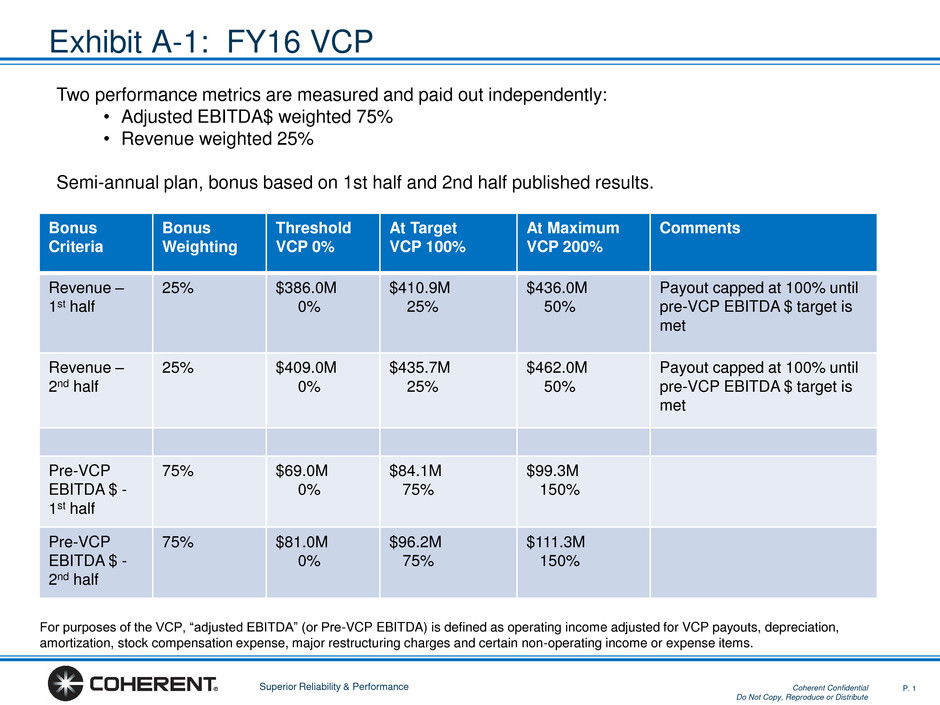

Exhibit A-1: FY16 VCP

Bonus

Criteria

Bonus

Weighting

Threshold

VCP 0%

At Target

VCP 100%

At Maximum

VCP 200%

Comments

Revenue –

1st half

25% $386.0M

0%

$410.9M

25%

$436.0M

50%

Payout capped at 100% until

pre-VCP EBITDA $ target is

met

Revenue –

2nd half

25%

$409.0M

0%

$435.7M

25%

$462.0M

50%

Payout capped at 100% until

pre-VCP EBITDA $ target is

met

Pre-VCP

EBITDA $ -

1st half

75% $69.0M

0%

$84.1M

75%

$99.3M

150%

Pre-VCP

EBITDA $ -

2nd half

75%

$81.0M

0%

$96.2M

75%

$111.3M

150%

For purposes of the VCP, “adjusted EBITDA” (or Pre-VCP EBITDA) is defined as operating income adjusted for VCP payouts, depreciation,

amortization, stock compensation expense, major restructuring charges and certain non-operating income or expense items.

Two performance metrics are measured and paid out independently:

• Adjusted EBITDA$ weighted 75%

• Revenue weighted 25%

Semi-annual plan, bonus based on 1st half and 2nd half published results.