Attached files

| file | filename |

|---|---|

| 8-K - 8-K CHFC FEB 2017 INVESTOR CONFERENCE - TCF FINANCIAL CORP | chfc8-kchfckbwfeb2017inves.htm |

Creating a Preeminent Midwest

Community Bank

David B. Ramaker

Chief Executive Officer

Dennis L. Klaeser

Chief Financial Officer

February 9‐10, 2017

KBW

Winter Financial Services Symposium

This presentation and the accompanying presentation by management may contain forward-looking statements that are based on

management's beliefs, assumptions, current expectations, estimates and projections about the financial services industry, the

economy and Chemical Financial Corporation ("Chemical"). Words and phrases such as "anticipates," "believes," "continue,"

"estimates," "expects," "forecasts," "future," "intends," "is likely," "judgment," "look ahead," "look forward," "on schedule," “on track,”

"opinion," "opportunity," "plans," "potential," "predicts," "probable," "projects," "should," "strategic," "trend," "will," and variations of

such words and phrases or similar expressions are intended to identify such forward-looking statements. Such statements are

based upon current beliefs and expectations and involve substantial risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such forward-looking statements. These statements include, among others,

statements related to future levels of loan charge-offs, future levels of provisions for loan losses, real estate valuation, future levels

of nonperforming assets, the rate of asset dispositions, future capital levels, future dividends, future growth and funding sources,

future liquidity levels, future profitability levels, future deposit insurance premiums, future asset levels, the effects on earnings of

future changes in interest rates, the future level of other revenue sources, future economic trends and conditions, future initiatives

to expand Chemical’s market share, expected performance and cash flows from acquired loans, future effects of new or changed

accounting standards, future opportunities for acquisitions, opportunities to increase top line revenues, Chemical’s ability to grow

its core franchise, future cost savings, Chemical’s ability to maintain adequate liquidity and capital based on the requirements

adopted by the Basel Committee on Banking Supervision and U.S. regulators and future changes in laws and regulations

applicable to Chemical and the financial services industry in general. All statements referencing future time periods are forward-

looking.

Management's determination of the provision and allowance for loan losses; the carrying value of acquired loans, goodwill and

mortgage servicing rights; the fair value of investment securities (including whether any impairment on any investment security is

temporary or other-than-temporary and the amount of any impairment); and management's assumptions concerning pension and

other postretirement benefit plans involve judgments that are inherently forward-looking. There can be no assurance that future

loan losses will be limited to the amounts estimated. All of the information concerning interest rate sensitivity is forward-looking.

The future effect of changes in the financial and credit markets and the national and regional economies on the banking industry,

generally, and on Chemical, specifically, are also inherently uncertain. These statements are not guarantees of future performance

and involve certain risks, uncertainties and assumptions ("risk factors") that are difficult to predict with regard to timing, extent,

likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what may be expressed or

forecasted in such forward-looking statements. Chemical undertakes no obligation to update, amend or clarify forward-looking

statements, whether as a result of new information, future events or otherwise.

Forward-Looking Statements & Other

Information

2

This presentation and the accompanying presentation by management also contain forward-looking statements regarding

Chemical's outlook or expectations with respect to its merger with Talmer Bancorp, Inc. ("Talmer"), including the benefits of the

transaction, the expected costs to be incurred and cost savings to be realized in connection with the transaction, the expected

impact of the merger on Chemical's future financial performance and consequences of the integration of Talmer into Chemical.

Risk factors relating both to the merger and the integration of Talmer into Chemical after closing include, without limitation:

The anticipated benefits, including anticipated cost savings and strategic gains, may be significantly harder or take longer to

achieve than expected or may not be achieved in their entirety as a result of unexpected factors or events.

The integration of Talmer’s business and operations into Chemical may take longer than anticipated or be more costly than

anticipated or have unanticipated adverse results relating to Chemical's or Talmer’s existing businesses.

Chemical’s ability to achieve anticipated results from the merger is dependent on the state of the economic and financial

markets going forward. Specifically, Chemical may incur more credit losses than expected and customer and employee attrition

may be greater than expected.

The outcome of pending or threatened litigation, whether currently existing or commencing in the future, including litigation

related to the merger.

The challenges of integrating, retaining and hiring key personnel.

Failure to attract new customers and retain existing customers in the manner anticipated.

In addition, risk factors include, but are not limited to, the risk factors described in Item 1A of Chemical’s Annual Report on Form

10-K for the year ended December 31, 2015. These and other factors are representative of the risk factors that may emerge and

could cause a difference between an ultimate actual outcome and a preceding forward-looking statement.

Forward-Looking Statements & Other

Information (continued)

3

Non-GAAP Financial Measures

This presentation and the accompanying presentation by management contain certain non-GAAP financial disclosures that are not

in accordance with U.S. generally accepted accounting principles ("GAAP"). Such non-GAAP financial measures include

Chemical’s tangible equity to tangible assets ratio, tangible book value per share, presentation of net interest income and net

interest margin on a fully taxable equivalent basis, and information presented excluding significant items, including net income,

diluted earnings per share, return on average assets, return on average shareholders’ equity, operating expenses and efficiency

ratio. Chemical uses non-GAAP financial measures to provide meaningful, supplemental information regarding its operational

results and to enhance investors’ overall understanding of Chemical’s financial performance. The limitations associated with non-

GAAP financial measures include the risk that persons might disagree as to the appropriateness of items comprising these

measures and that different companies might calculate these measures differently. These disclosures should not be considered an

alternative to Chemical’s GAAP results. See the Appendix hereto for a reconciliation of the non-GAAP financial measures to the

most directly comparable GAAP financial measures.

Forward-Looking Statements & Other

Information (continued)

4

Emphasize our strategy of

being the Preeminent Midwest

Community Bank

5

4

1

Demonstrated track record of

organic growth2

High performing pro forma

profitability should drive upside3

Experienced and committed

Board and management team

Focus on what we can control

Created the largest community bank headquartered in Michigan

Our enhanced resources provide potential for significant organic growth in both

southeast Michigan and northeast Ohio

Proven organic growth initiatives

Leadership in EPS growth among peers (1)

Total Return out-performance (peers and indices) (1)

Pro Forma 1.2%+ ROA, ROATCE approaching 15%, low efficiency ratio

Stable, clean NIM, attractive asset quality, strong capital

Significant revenue enhancements available

Strong governance, holding company Board of Directors currently comprised

of 7 CHFC & 5 TLMR directors

Combination creates a strong, committed and experienced management team

Organic revenue growth and cost discipline

Concentrate on achieving cost savings and exploiting business synergy opportunities

Continue to build out and enhance risk management practices

(1) Source: SNL Geographic Intelligence

Overview

5

$17.4 billion in assets

Largest banking company headquartered and

operating branches in Michigan

Operates 249 banking offices primarily in Michigan,

Northeast Ohio and Northern Indiana

Local market knowledge and business development

opportunities led by 23 community-based advisory

boards

One of the largest trust and wealth management

operations of a Michigan-headquartered bank with

$4.4 billion in assets under management or custody

and another $1.3 billion in assets within the Chemical

Financial Advisors Program

Focused on realizing operating and business synergies

from Chemical / Talmer merger and enhancing

preparedness for future organic and acquisitive growth

$3.46 billion Market Capitalization (1)

(1) Based upon CHFC shares outstanding of 70.6 million and the CHFC stock price of $48.95 on February 1, 2017.

6

About Chemical Financial Corporation

“Local” community bank

Strong belief in the community banking concept

23 identified centers of influence

Community-driven leadership, rapid local response

Emphasis on building relationships

We know our markets, what works, and what does not work

Strong credit culture

Diversification

In-depth knowledge of our customers and markets

Underwriting discipline

Low cost, stable, core funding – starts at relationship level

Expense management and control

Clean balance sheet, solid capital ratios and intense focus on effective capital deployment

Identify, hire, motivate and retain talented individuals to carry out our relationship strategies

Sustain long-term growth through combination of organic and acquisitive growth

Higher lending limits provide enhanced middle market lending growth opportunities

Opportunities for fee income growth from Wealth Management and Mortgage Banking synergies

Future acquisitive growth opportunities in Michigan, Ohio, and Indiana

Scalable Core Strategies & Disciplines

Core Values

7

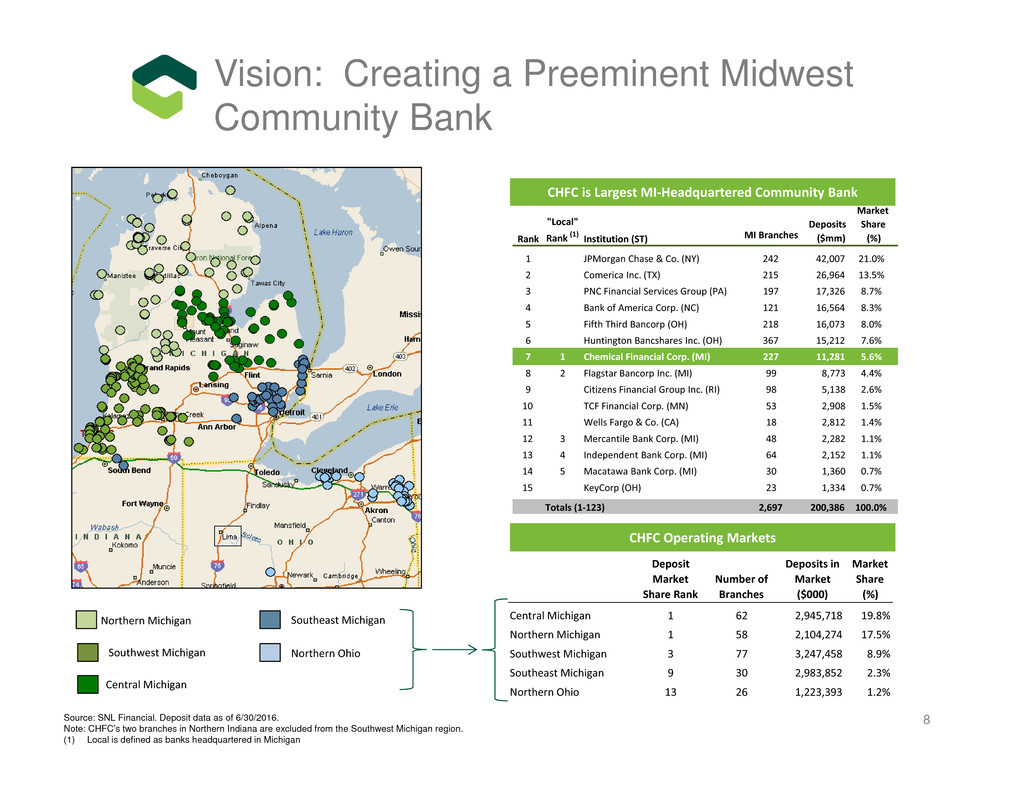

CHFC is Largest MI‐Headquartered Community Bank

CHFC Operating Markets

Source: SNL Financial. Deposit data as of 6/30/2016.

Note: CHFC’s two branches in Northern Indiana are excluded from the Southwest Michigan region.

(1) Local is defined as banks headquartered in Michigan

Northern Michigan Southeast Michigan

Southwest Michigan

Central Michigan

Northern Ohio

Deposit

Market

Share Rank

Number of

Branches

Deposits in

Market

($000)

Market

Share

(%)

Central Michigan 1 62 2,945,718 19.8%

Northern Michigan 1 58 2,104,274 17.5%

Southwest Michigan 3 77 3,247,458 8.9%

Southeast Michigan 9 30 2,983,852 2.3%

Northern Ohio 13 26 1,223,393 1.2%

Vision: Creating a Preeminent Midwest

Community Bank

Rank

"Local"

Rank (1) Institution (ST) MI Branches

Deposits

($mm)

Market

Share

(%)

1 JPMorgan Chase & Co. (NY) 242 42,007 21.0%

2 Comerica Inc. (TX) 215 26,964 13.5%

3 PNC Financial Services Group (PA) 197 17,326 8.7%

4 Bank of America Corp. (NC) 121 16,564 8.3%

5 Fifth Third Bancorp (OH) 218 16,073 8.0%

6 Huntington Bancshares Inc. (OH) 367 15,212 7.6%

7 1 Chemical Financial Corp. (MI) 227 11,281 5.6%

8 2 Flagstar Bancorp Inc. (MI) 99 8,773 4.4%

9 Citizens Financial Group Inc. (RI) 98 5,138 2.6%

10 TCF Financial Corp. (MN) 53 2,908 1.5%

11 Wells Fargo & Co. (CA) 18 2,812 1.4%

12 3 Mercantile Bank Corp. (MI) 48 2,282 1.1%

13 4 Independent Bank Corp. (MI) 64 2,152 1.1%

14 5 Macatawa Bank Corp. (MI) 30 1,360 0.7%

15 KeyCorp (OH) 23 1,334 0.7%

Totals (1‐123) 2,697 200,386 100.0%

8

Overlapping Michigan Markets New Michigan & Ohio MarketsOther Markets

Southwest MI Central MI Southeast MI Northern OHNorthern MI

(1) Source: USDOC’s Bureau of Economic Analysis. Considered the largest Metropolitan Statistical Area for each region. The Northern Michigan region does not have a Metropolitan Statistical Area as defined by

the Bureau of Economic Analysis

(2) State Deposits are in billions per SNL Financial and as of 6/30/16

(3) Source: SNL Geographic Intelligence

CHFC: Deposits / Rank $3.2 #3 CHFC: Deposits / Rank $2.9 #1 CHFC: Deposits / Rank $2.1 #1 CHFC: Deposits / Rank $3.0 #9 CHFC: Deposits / Rank $1.2 #13

All Major MI Markets & OH Growth Opportunity

96% of businesses / 97% of population is within MI footprint(3)

Southeast Michigan represents more than 50% of Michigan GDP – a huge opportunity with recent market disruption

CHFC Footprint By State & Regional Market

MI OH

Southwest

MI

Central

MI

Northern

MI

Southeast

MI

Northern

OH

Michigan

Penetration

Total Deposits ($B) $11.3 $1.2 $3.2 $2.9 $2.1 $3.0 $1.2

Market Share Rank 7 23 3 1 1 9 13

Deposit Market Share (%) 5.6% 0.4% 8.9% 19.8% 17.5% 2.3% 1.2%

Market Information (as a % of):

% of State ($B) GDP (1) 12% 2% ‐ 53% 22%

% of State Deposits (2) 18% 7% 6% 66% 33% 97%

% of State Businesses (3) 25% 13% 11% 47% 39% 96%

% of State Population (3) 25% 13% 9% 49% 37% 96%

9

Michigan ranks 6th in the country for its

creation of nearly 450,000 jobs since late

2010 (1)

Unemployment in Michigan has dropped from

14.9% in June 2009 to 5.0% in Dec 2016 (2)

Michigan GDP growth outpaced the nation

from 2009-2014 with growth of 13.4% to 9.4%

(3)

Michigan ranks as 7th most competitive state

for new business investment by Site Selection

Magazine (4)

New investment in Michigan from global

companies has grown by $8.4 billion since

2010 (5)

Michigan advanced from 2nd worst to 13th best

corporate tax climate as rated by Tax

Foundation

10th largest state by population

8th ranked state in number of skilled trade

workers (2)

Top ranked state in the country for electrical,

mechanical and industrial engineers (2)

$1.5 billion structural budget deficit has been

eliminated (6)

Extensive recent investment in infrastructure

Passage of Right-to-Work legislation and

other pro-innovation policies in recent years

Recent Performance Assets for Future Growth

1) Michigan Economic Development Corporation

2) US Bureau of Labor Statistics

3) Michigan Economic Development Corporation

4) January 2016

5) FDImarkets.com

6) Michigan Department of Technology, Management and Budget

Economic Momentum in Michigan

10

Gary Torgow

Chairman of the Board

David Ramaker

CEO & President

David Provost

Vice Chairman

Co-Architect of Talmer; Founder/Chairman of the Sterling Group.

Chief Executive Officer and President of Chemical. Mr. Ramaker was appointed Chief Executive Officer and President in January

2002 and served as Chairman from April 2006 until August 2016

Co-Architect of Talmer and served as its President and CEO since December 2009; Former Chairman and CEO of The

PrivateBank – Michigan, which was a subsidiary of Chicago-based PrivateBancorp, Inc.

Franklin C. Wheatlake

Gary E. Anderson

James R. Fitterling

Ronald A. Klein

Richard M. Lievense

Barbara J. Mahone

John E. Pelizzari

Larry D. Stauffer

Arthur A. Weiss

Lead Director since 2014, Chairman of Utility Supply and Construction Company, dealer/principal of Crossroads Chevrolet

Retired Chairman, President and CEO of the Dow Corning Corporation

President and COO of The Dow Chemical Company

Director and CEO of Origen Financial, appointed to the Board of Sun Communities in 2015

Founder and Former Chairman of Lake Michigan Financial Corporation; Chairman of InSite Capital, LLC

Retired from GM in 2008 as Executive Director, HR

COO of Burnette Foods, Inc.; Former Chairman of Northwestern Bancorp

Former President of Auto Paint Inc. and Auto Wares Tool Company from 1984 to 2007

Shareholder and Chairman of the law firm of Jaffe Raitt Heuer & Weiss

Governance: CHFC Board of Directors

11

13 Members

Jeffrey L. Tate Corporate Auditor of The Dow Chemical Company (effective March 1, 2017)

Chairman, CEO,

President

David Ramaker

Special Projects

Lori Gwizdala

CFO

Dennis Klaeser

COO ‐ Business

Operations

Leonardo Amat

COO – Customer

Experience

Robert Rathbun

Regional &

Community

Banking

Thomas Shafer

Commercial

Lending

Daniel Terpsma

Chief Credit

Officer

James Tomczyk

CRO

Lynn Kerber

General Counsel

William Collins

Vice Chairman

Thomas Kohn

Truly a combined management team taking best talent from both organizations

Combined management and governance line-up provides integration benefits and guidance

Executive Management Team

- David Ramaker, Chairman of the Board of Directors, CEO and President

- Thomas Kohn, Vice Chairman

- Lori Gwizdala, EVP, Special Projects

- Dennis Klaeser, EVP, Chief Financial Officer

- Leonardo Amat, EVP, Chief Operating Officer – Business Operations

- Robert Rathbun, EVP, Chief Operating Officer – Customer Experience

- Thomas Shafer, EVP, Director of Regional and Community Banking

- Daniel Terpsma, EVP, Director of Commercial Lending

- James E. Tomczyk, EVP, Chief Credit Officer

- Lynn Kerber, EVP, Chief Risk Officer

- William Collins, EVP, General Counsel

Deep & Experienced Executive Team

Chemical Bank’s Executive Leadership Team

12

Chemical Financial has integrated 26 whole-bank mergers/acquisitions since 1973 and

acquired another 36 bank offices during that time

Five major post-recession mergers/acquisitions (OAK Financial, Independent Bank branches,

Northwestern Bancorp, Lake Michigan Financial Corporation (parent company for The Bank of

Holland, and The Bank of Northern Michigan) and Talmer Bancorp

Five whole bank mergers/acquisitions (Northwestern Bank, Monarch Community Bank, The

Bank of Holland, The Bank of Northern Michigan and Talmer Bank and Trust) during the past

24 months

Newly joined CHFC executives from the merger with TLMR have extensive experience

acquiring and integrating banks

Four FDIC assisted acquisitions totaling $2.4 billion in assets (CF Bancorp, First Banking

Center, Community Central Bank, and Peoples State Bank)

Two Section 363 bankruptcy acquisitions totaling $3.6 billion (First Place Bank and Michigan

Commerce Bank)

One whole bank acquisition of First of Huron with assets of $228 million.

All acquisitions by both Chemical and Talmer have been integrated within initially

planned timeframes

Both Chemical and Talmer the ability to divest non-core, non-strategic branches

Integration: A Core Competency

13

$52 million cost savings opportunities have been identified and on track for full

realization in 2017

Key core and all ancillary systems selected and implementation completed

Planning for comprehensive DFAST implementation has been initiated

Recruiting efforts underway to hire additional sales talent in middle market

commercial lending and wealth management

Integration management team featuring leaders from both organizations

meeting weekly to recognize opportunities and manage progress

Holding company merger completed August 31, 2016

Bank consolidation and system conversion completed on November 14, 2016

Core competency

Closed 7 branches in association with the bank consolidation; currently operating 241

branches

Integration Progress of CHFC & TLMR

Proceeding on Schedule

14

$3,217

$4,377

$3,087

$2,310

$1,311

$2,033

$1,657

$719

$1,906

$2,344

$1,430

$1,591

Commercial CRE/C&D Residential Consumer

Loan Portfolio Composition ($ Millions)

15

$88

$277

$125

$347

Commercial

CRE/C&D

Residential

Consumer

$1,223

$1,756

$1,532

$372

Talmer Merger

Aug. 31, 2016

$837 $4,883

$5,720

Total Loan Growth,

Excluding Talmer Merger,

Twelve Months Ended

Dec. 31, 2016

Growth – Twelve months ended Dec. 31, 2016

Dec. 31, 2015, $7,271 Total Loan Growth twelve months ended Dec. 31, 2016 Dec. 31, 2016, $12,991

$3.4

$2.8 $3.7

$2.8

$0.2

Noninterest-bearing Demand Deposits Interest-bearing Demand Deposits Savings Deposits Time Deposits Brokered Deposits

$1.9

$1.9 $2.0

$1.5

$0.2

16

(1)Comprised of $463 million of growth in customer deposits offset by a $385 million decrease in brokered deposits.

(2)Cost of deposits based on period averages.

2015 2016

Total Deposits – Dec. 31, 2015

$7.5

Total Deposits – Dec. 31, 2016

$12.9

Organic

$0.1, 1.07%(1)

$1.3

$0.9

$1.2

$1.5

$0.4

Talmer Merger

$5.3

$0.2

$0.5

($0.2) ($0.4)

Deposit Composition

Total Deposits ($ Billions)

Average Deposits ($ Millions) & Cost of Deposits (%)

$6,204 $6,709 $7,453 $7,449 $7,535 $7,528 $9,484

$13,003

0.22% 0.22% 0.23% 0.22% 0.22% 0.23% 0.24%

0.27%

0.00%

0.25%

0.50%

$4,000

$9,000

$14,000

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

I

n

t

e

r

e

s

t

R

a

t

e

P

a

i

d

T

o

t

a

l

A

v

e

r

a

g

e

D

e

p

o

s

i

t

s

(

$

M

i

l

l

i

o

n

s

)

Deposits Cost of Deposits(2)

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

0.90

1.00

$

P

e

r

S

h

a

r

e

Performance & Expectations Analyst Consensus

Consistent growth and performance for shareholders through economic cycles

Merger creates the opportunity to strengthen the foundation for delivering

sustainable, strong EPS growth into the future

Consensus EPS Consensus Dividend

SNL Core EPS Common Dividend

17

Consistent EPS Growth Performance

Source: SNL Financial; analyst consensus estimates as of 2/1/17

Evolving macroeconomic environment suggests combination of headwinds

and tailwinds; too early to predict outcome

Emphasize our strategy of being the Preeminent Midwest Community Bank

Focus on what we can control

• Organic revenue growth and cost discipline

• Concentrate on achieving cost savings and exploiting business synergy

opportunities

• Continue to build out and enhance risk management practices

18

Closing Comments

Supplemental Information

David B. Ramaker

Chief Executive Officer

Dennis L. Klaeser

Chief Financial Officer

Q4 2016 Highlights

Diluted earnings per share of $0.66, compared to $0.23 in the 3rd qtr. 2016 and $0.66 in the 4th qtr.

2015

Diluted earnings per share, excluding significant items(1) of $0.70; down 7% from 3rd qtr. 2016, the

same as 4th qtr. 2015(2)

Return on average assets and return on average equity of 1.09% and 7.4%, respectively, in 4th qtr.

2016 (1.16% and 7.8%, respectively, excluding significant items(2))

Loan Growth

$275 million in 4th qtr. 2016 (6% commercial, 52% commercial real estate, 15% residential

mortgage and 27% consumer loans)

Asset quality ratios

Nonperforming loans/total loans of 0.34% at 12/31/2016; up slightly from 0.32% at 9/30/2016, and

down from 0.86% at 12/31/15

Net loan charge-offs/average loans of 0.06%

(1)Significant items include merger and transaction-related expenses, net gain on the sale of branches

and the change in fair value in loan servicing rights.

(2)Non-GAAP. Refer to pages 32 & 33 for a reconciliation of non-GAAP financial measures.

20

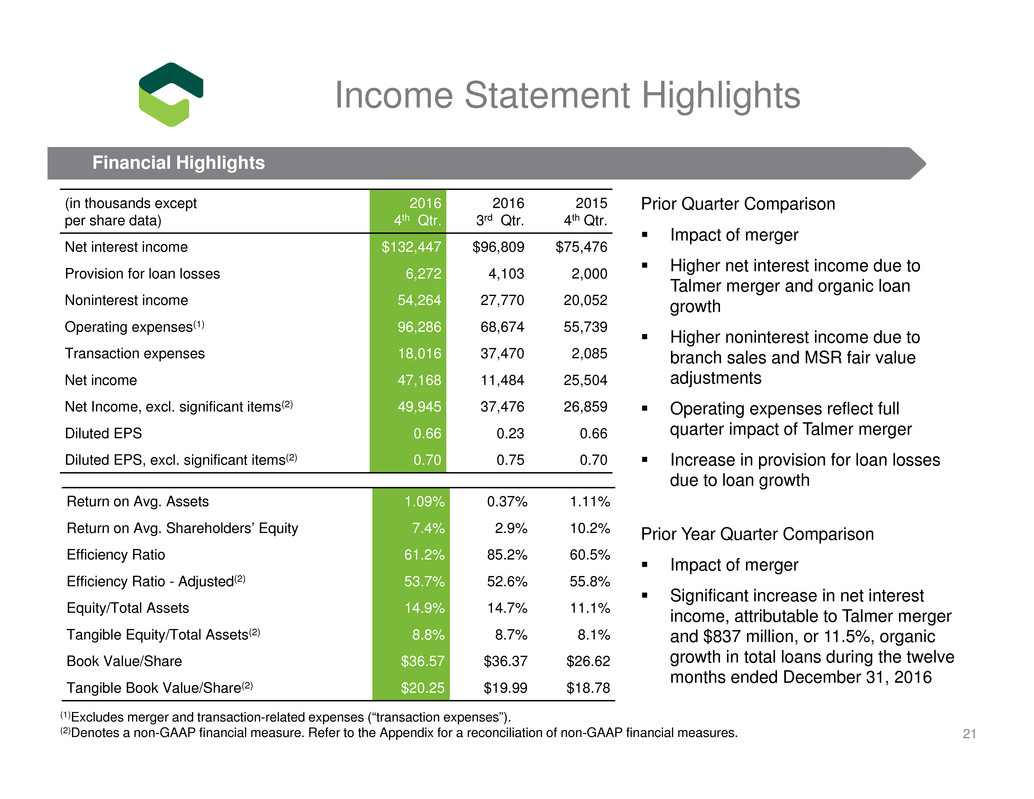

(in thousands except

per share data)

2016

4th Qtr.

2016

3rd Qtr.

2015

4th Qtr.

Net interest income $132,447 $96,809 $75,476

Provision for loan losses 6,272 4,103 2,000

Noninterest income 54,264 27,770 20,052

Operating expenses(1) 96,286 68,674 55,739

Transaction expenses 18,016 37,470 2,085

Net income 47,168 11,484 25,504

Net Income, excl. significant items(2) 49,945 37,476 26,859

Diluted EPS 0.66 0.23 0.66

Diluted EPS, excl. significant items(2) 0.70 0.75 0.70

Return on Avg. Assets 1.09% 0.37% 1.11%

Return on Avg. Shareholders’ Equity 7.4% 2.9% 10.2%

Efficiency Ratio 61.2% 85.2% 60.5%

Efficiency Ratio - Adjusted(2) 53.7% 52.6% 55.8%

Equity/Total Assets 14.9% 14.7% 11.1%

Tangible Equity/Total Assets(2) 8.8% 8.7% 8.1%

Book Value/Share $36.57 $36.37 $26.62

Tangible Book Value/Share(2) $20.25 $19.99 $18.78

21

Prior Quarter Comparison

Impact of merger

Higher net interest income due to

Talmer merger and organic loan

growth

Higher noninterest income due to

branch sales and MSR fair value

adjustments

Operating expenses reflect full

quarter impact of Talmer merger

Increase in provision for loan losses

due to loan growth

Prior Year Quarter Comparison

Impact of merger

Significant increase in net interest

income, attributable to Talmer merger

and $837 million, or 11.5%, organic

growth in total loans during the twelve

months ended December 31, 2016

(1)Excludes merger and transaction-related expenses (“transaction expenses”).

(2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

Income Statement Highlights

Financial Highlights

$13.8 $16.2 $16.8 $15.3

$17.8

$19.0 $24.5

$25.5

$23.6 $25.8

$11.5

$47.1

$26.0

$2.8

$0.47

$0.70

$0.00

$0.50

$1.00

$0.0

$20.0

$40.0

$60.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

E

P

S

N

e

t

I

n

c

o

m

e

Significant items (after-tax)

Net Income

EPS, Excluding significant items (non-GAAP)(3)

2014 2015 2016

22

(1)Net Income

(2)Net Income, excluding significant items (Non-GAAP). Please refer to the Appendix for a reconciliation of

non-GAAP financial measures.

(3)Denotes a non-GAAP financial measure. Please refer to the Appendix for a reconciliation of non-GAAP

financial measures.

2015 Total: $86.8(1); $92.3(2)2014 Total: $62.1(1); $66.7(2) 2016 Total: $108.0(1); $140.5(2)

$26.9(2)

$49.9(2)

Net Income

Net Income Trending Upward ($ Millions, except EPS data)

$37.5(2)

$88

$277

$125

$347

$18

$143$39

$75

Commercial

CRE/C&D

Residential

Consumer

$0

$100

$200

$300

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

23

2014 - $565 2015 - $476 2016 - $837

$106

$145 $142

$15

$172

$224

$181

$280

$56

$275$837

$96

$186

Loan Growth* ($ Millions)

Quarterly Loan Growth Trends

Loan Growth – 2016 Total* Loan Growth – 2016 Q4

$275

*Excludes the impact of the $4.88 billion of loans acquired in the Talmer merger.

4Q 2016 2016 Total

Originated Loan Portfolio

Commercial $ 177 $ 380

CRE/C&D 307 594

Residential 104 258

Consumer 114 418

Total Originated Loan Portfolio Growth $ 702 $1,650

Acquired Loan Portfolio

Commercial $(164) $(292)

CRE/C&D (159) (318)

Residential (65) (133)

Consumer (39) (70)

Total Acquired Loan Portfolio Run-off $(427) $(813)

Total Loan Portfolio

Commercial $ 18 $ 88

CRE/C&D 143 276

Residential 39 125

Consumer 75 348

Total Loan Portfolio Growth $ 275 $ 837

24

Loan Growth* – Originated v. Acquired

Loan Growth (Run-off) ($ Millions)

*Excludes the impact of the $4.88 billion of loans acquired in the Talmer merger.

$9.9

$2.8

$0.3

$1.6

Deposits:

Time Deposits

Customer Repurchase

Agreements

Wholesale borrowings (at

Dec. 31, 2016: brokered

deposits - $0.2, FHLB

advances - $1.3, other - $0.1)

25

Average Cost of Funds Q4 2016 – 0.33%Average Cost of Funds Q3 2016 – 0.25%(1)

$14.7 Billion $14.6 Billion

$9.9

$2.9

$0.3 $1.6

Interest and

noninterest-bearing,

demand, savings,

money market

Average cost of wholesale

borrowings – 1.11%

Average cost of wholesale

borrowings – 0.56%

Funding Breakdown ($ Billions)

(1)Reduced by 4 basis points for acceleration of accretion

of fair value adjustments on FHLB borrowings

September 30, 2016 December 31, 2016

$1.6 $1.5 $1.5 $1.5 $1.5 $1.5 $1.5 $2.0 $1.5

$3.0

$4.1

$6.3

$2.2 $2.2 $2.3

$2.8

$1.9 $1.8 $0.8

$4.3 $4.5

$1.8 $1.8 $1.8

$0.0

$3.5

$7.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Provision for Loan Losses Net Loan Losses

$103 $78 $71 $62 $51 $62 $53 $44 $41 $44

$0

$60

$120

YE 2010 YE 2011 YE 2012 YE 2013 YE 2014 YE 2015 2016 Q1 2016 Q2 2016 Q3 2016 Q4

26

ALL

NPLs

2014 2015 2016

Originated Loans ($ billions) $3.1 $3.3 $3.8 $4.3 $5.0 $5.8 $6.0 $6.4 $6.7 $7.5

Acquired Loans ($ billions) 0.6 0.5 0.4 0.3 0.7 1.5 1.4 1.2 6.0 5.5

Total Loans ($ billions) $3.7 $3.8 $4.2 $4.6 $5.7 $7.3 $7.4 $7.6 $12.7 $13.0

ALL $90 $88 $84 $79 $76 $73 $70 $72 $74 $78

ALL/ Originated Loans 2.86% 2.60% 2.22% 1.81% 1.51% 1.26% 1.17% 1.12% 1.09% 1.05%

NPLs/ Total Loans 2.80% 2.05% 1.71% 1.33% 0.89% 0.86% 0.73% 0.58% 0.32% 0.34%

Credit Mark as a % of

Unpaid Principal on

Acquired Loans

6.5% 6.6% 6.0% 7.8% 5.4% 4.4% 4.5% 4.1% 3.0% 3.1%

Credit Quality ($ Millions, unless otherwise noted)

Provision for Loan Losses vs. Net Loan Losses

Nonperforming Loans (NPLs) and Allowance for Loan Losses (ALL)

$59.2

$65.7

$73.6 $75.5 $74.3

$77.5

$96.8

$132.4

$40

$60

$80

$100

$120

$140

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

N

e

t

I

n

t

e

r

e

s

t

I

n

c

o

m

e

(

$

M

i

l

l

i

o

n

s

)

Net Interest Income

27

3.55% 3.59% 3.55%

3.64% 3.60%

3.70% 3.58% 3.56%

0.04% 0.04% 0.04% 0.04% 0.03%

0.11% 0.11% 0.14%

4.16% 4.17% 4.15% 4.16% 4.13% 4.19% 4.12% 4.18%

0.00%

2.50%

5.00%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Net Interest Margin(1) and Loan Yields(1)

Net Interest Margin(1)

Purchase Accounting Accretion on Loans

Loan Yields

2015 2016

2015 2016

Net Interest Income

Net Interest Income, Net Interest Margin

and Loan Yields

(Quarterly Trend)

(1)Computed on a fully taxable equivalent basis (non-GAAP) using a federal income tax rate of 35%. Please refer to the Appendix for a reconciliation

of non-GAAP financial measures.

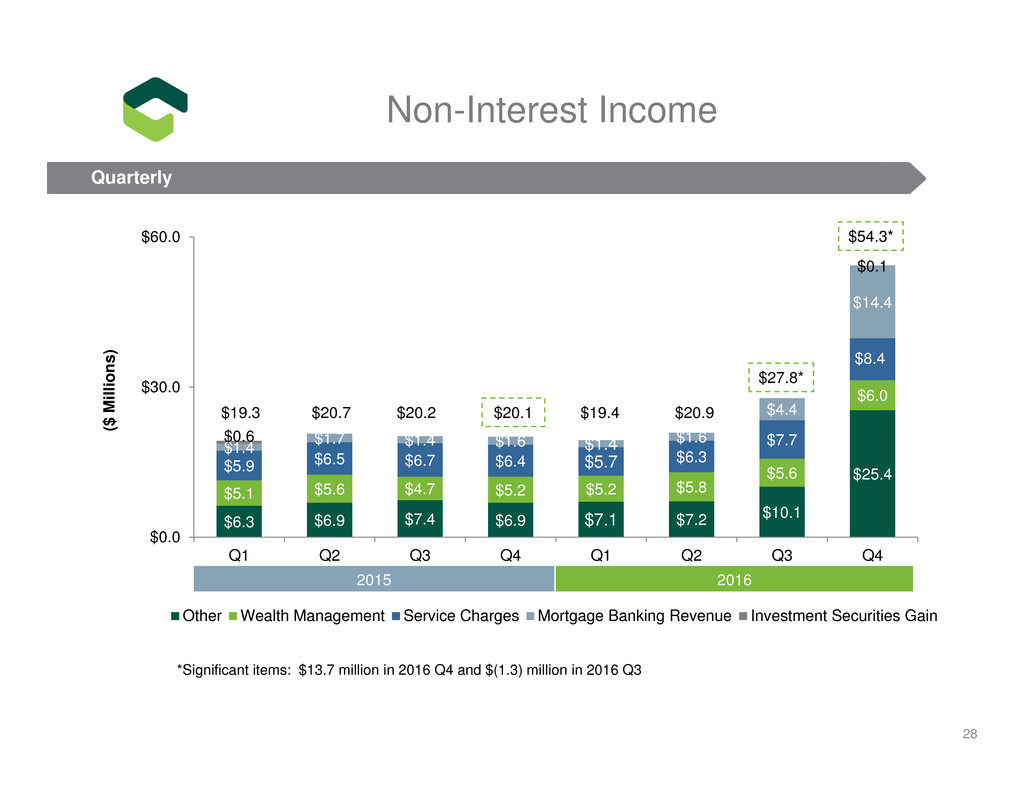

$6.3 $6.9 $7.4 $6.9 $7.1 $7.2 $10.1

$25.4

$5.1 $5.6 $4.7 $5.2 $5.2 $5.8

$5.6

$6.0

$5.9 $6.5 $6.7 $6.4 $5.7 $6.3

$7.7

$8.4

$1.4 $1.7 $1.4 $1.6 $1.4

$1.6

$4.4

$14.4

$0.6

$0.1

$0.0

$30.0

$60.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Other Wealth Management Service Charges Mortgage Banking Revenue Investment Securities Gain

2015 2016

(

$

M

i

l

l

i

o

n

s

)

28

$20.7$19.3 $19.4$20.2 $20.1

$27.8*

$54.3*

Non-Interest Income

Quarterly

$20.9

*Significant items: $13.7 million in 2016 Q4 and $(1.3) million in 2016 Q3

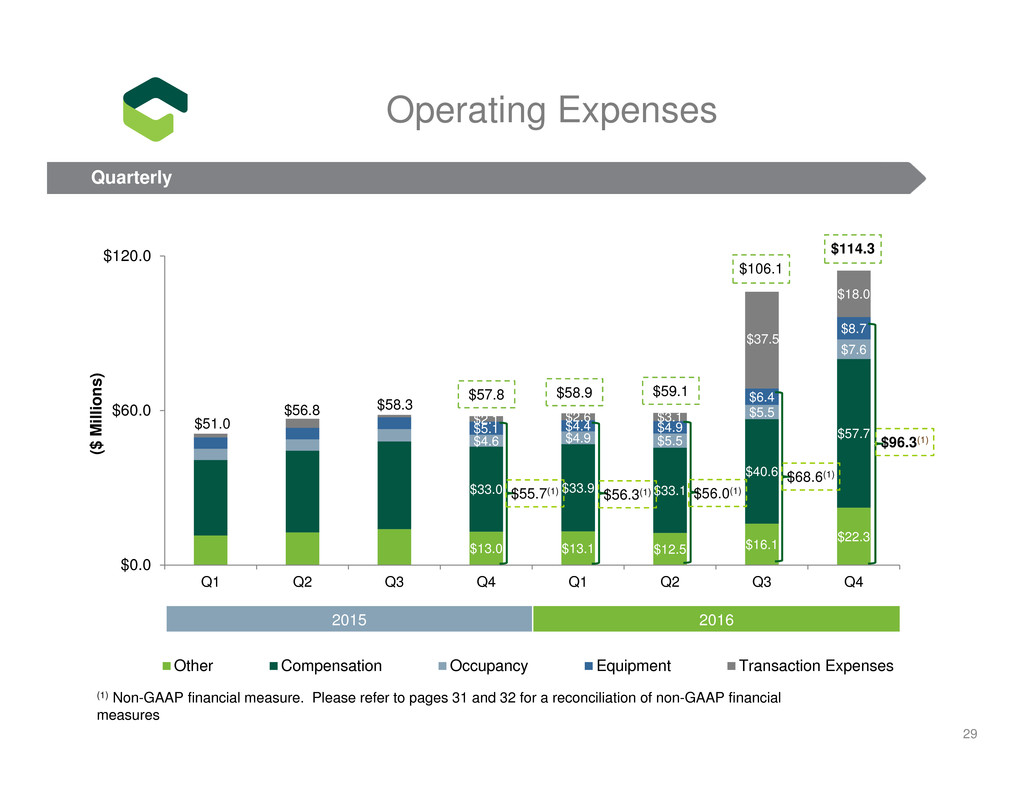

$13.0 $13.1 $12.5 $16.1

$22.3

$33.0 $33.9 $33.1

$40.6

$57.7$4.6 $4.9 $5.5

$5.5

$7.6

$5.1 $4.4 $4.9

$6.4

$8.7

$2.1 $2.6 $3.1

$37.5

$18.0

$0.0

$60.0

$120.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Other Compensation Occupancy Equipment Transaction Expenses

$114.3

(1) Non-GAAP financial measure. Please refer to pages 31 and 32 for a reconciliation of non-GAAP financial

measures

2015 2016

29

(

$

M

i

l

l

i

o

n

s

)

$56.8

$51.0

$58.3

$56.0(1)

$57.8 $59.1

$56.3(1)

$58.9

$55.7(1)

$68.6(1)

$106.1

Operating Expenses

Quarterly

$96.3(1)

Peer Average

9/30/2016(1)

CHFC

9/30/2016

CHFC

12/31/2016

Tangible Book Value / Share(2) NA $19.99 $20.20

Tangible Common Equity / Total Assets(2) 8.3% 8.7% 8.8%

Tier 1 Capital(3) 10.8% 10.6% 10.7%

Total Risk-Based Capital(3) 12.6% 11.1% 11.5%

$20.20

$1.06 $0.49

$18.78

$2.81 $0.16

$0

$5

$10

$15

$20

$25

TBV @ 12/31/2015 Net Income

(Excl. Transaction

Expenses)

Dividends Talmer AOCI Adj.

& Other

TBV @ 12/31/2016

30

Capital

Tangible Book Value and Capital Ratios

Tangible Book Value(2) (TBV) Roll Forward

(1)Source SNL Financial – ASB, WTFC, CBSH, TCB, UMBF, MBFI, PVTB, ONB, FMBI and FFBC (ordered by asset size).

(2)Denotes a non-GAAP financial measure. Refer to the Appendix for a reconciliation of non-GAAP financial measures.

(3)Estimated at December 31, 2016

4Q 2016 3Q 2016 4Q 2015

Shareholders’ equity $ 2,581,526 $ 2,563,666 $ 1,015,974

Goodwill, CDI and non-compete agreements, net of tax (1,155,617) (1,154,121) (299,123)

Tangible shareholders’ equity $ 1,425,909 $ 1,409,545 $ 716,851

Common shares outstanding 70,599 70,497 38,168

Tangible book value per share $20.20 $19.99 $18.78

Total assets $17,355,179 $17,383,637 $9,188,797

Goodwill, CDI and non-compete agreements, net of tax (1,155,617) (1,154,121) (299,123)

Tangible assets $16,199,562 $16,229,516 $8,889,674

Tangible shareholders’ equity to tangible assets 8.8% 8.7% 8.1%

Net income $47,168 $11,484 $25,504

Significant items, net of tax 2,777 25,992 1,355

Net income, excluding significant items $49,945 $37,476 $26,859

Diluted earnings per share $0.66 $0.23 $0.66

Effect of significant items, net of tax 0.04 0.52 0.04

Diluted earnings per share, excluding significant items $0.70 $0.75 $0.70

Average assets $17,264,688 $12,250,730 $9,175,224

Return on average assets 1.09% 0.37% 1.11%

Effect of significant items, net of tax 0.07% 0.85% 0.06%

Return on average assets, excluding significant items 1.16% 1.22% 1.17%

Average shareholders’ equity $ 2,564,943 $1,559,668 $1,000,347

Return on average shareholders’ equity 7.4% 2.9% 10.2%

Effect of significant items, net of tax 0.4% 6.7% 0.5%

Return on average shareholders’ equity, excluding significant items 7.8% 9.6% 10.7%

31

Non-GAAP Reconciliation

(Dollars in thousands, except per share data)

4Q 2016 3Q 2016 4Q 2015

Efficiency Ratio:

Total revenue – GAAP $ 186,711 $ 124,579 $ 95,528

Net interest income FTE adjustment 2,945 2,426 2,042

Significant items (13,819) 1,043 (42)

Total revenue – Non-GAAP $175,837 $ 128,048 $ 97,528

Operating expenses – GAAP $114,302 $ 106,144 $ 57,824

Transaction expenses (18,016) (37,470) (2,085)

Amortization of intangibles (1,843) (1,292) (1,341)

Operating expenses – Non-GAAP $ 94,443 $ 67,382 $ 54,398

Efficiency ratio – GAAP 61.2% 85.2% 60.5%

Efficiency ratio – adjusted 53.7% 52.6% 55.8%

Net Interest Margin:

Net interest income – GAAP $132,447 $96,809 $75,476

Adjustments for tax equivalent interest:

Loans 838 777 652

Investment securities 2,107 1,649 1,390

Total taxable equivalent adjustments 2,945 2,426 2,042

Net interest income (on a tax equivalent basis) $ 135,392 $99,235 $77,518

Average interest-earning assets $15,156,107 $11,058,143 $8,457,464

Net interest margin – GAAP 3.48% 3.49% 3.55%

Net interest margin (on a tax-equivalent basis) 3.56% 3.58% 3.64%

32

Non-GAAP Reconciliation

(Dollars in thousands, except per share data)