Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CTS CORP | q42016invpresentform8k.htm |

February 2017

Safe Harbor Statement

This presentation contains statements that are, or may be deemed to be, forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but

are not limited to, any financial or other guidance, statements that reflect our current expectations concerning

future results and events, and any other statements that are not based solely on historical fact. Forward-looking

statements are based on management's expectations, certain assumptions and currently available information.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of

the date hereof and are based on various assumptions as to future events, the occurrence of which necessarily

are subject to uncertainties. These forward-looking statements are made subject to certain risks, uncertainties

and other factors, which could cause our actual results, performance or achievements to differ materially from

those presented in the forward-looking statements. Examples of factors that may affect future operating results

and financial condition include, but are not limited to: changes in the economy generally and in respect to the

businesses in which CTS operates; unanticipated issues in integrating acquisitions; the results of actions to

reposition our businesses; rapid technological change; general market conditions in the automotive,

communications, and computer industries, as well as conditions in the industrial, defense and aerospace, and

medical markets; reliance on key customers; unanticipated natural disasters or other events; the ability to protect

our intellectual property; pricing pressures and demand for our products; unanticipated developments that could

occur with respect to contingencies such as litigation and environmental matters as well as any product liability

claims; and risks associated with our international operations, including trade and tariff barriers, exchange rates

and political and geopolitical risks. Many of these, and other, risks and uncertainties are discussed in further detail

in Item 1A. of CTS’ Annual Report on Form 10-K. We undertake no obligation to publicly update our forward-

looking statements to reflect new information or events or circumstances that arise after the date hereof,

including market or industry changes.

2

2016 Sales: $397 Million

Sales by Market:

Transportation – 66%

Industrial – 17%

Medical – 7%

Defense / Aerospace – 4%

Information Technology – 4%

Communications – 2%

Sales by Region:

Americas – 57%

Asia – 31%

Europe – 12%

Our Company

Ticker: CTS (NYSE)

Founded: 1896

Business: CTS is a leading designer

and manufacturer of sensors,

actuators and electronic components.

Locations: 12 manufacturing locations

throughout North America, Asia and

Europe.

Number of Employees: ~2,800

Globally

Note: Sales by market and region based on trailing twelve months

sales as of December 31, 2016

3

Our History - 120 Years of Innovation

4

Our Vision and Value Proposition

We aim to be a leading provider of sensing and motion devices as well as

connectivity components, enabling an intelligent and seamless world.

5

CTS Addressable Markets Growing to $6B by 2020 with Mid-

Single Digit Growth Rates

6

Hydrophones for sonar applications

Military communication

Organic Growth Drivers

100GB & 400GB Wireline Networks

Small Cell Deployment

3D and textile printing

New products for industrial controls

Actuators for harsh environments

RF Sensing for particulate filters

Medical 3D/4D ultrasound

HMI Control for medical devices

Def/Aero

Communications

Industrial / IT

Transportation

Market

Medical

Product Categories

Product Applications in Passenger and Commercial Vehicles

Engine Efficiency

Accelerator Pedal Module

Current Sensor

Gear Position Sensor

Throttle Position Sensor

Turbo Actuator

Turbo Position Sensor

Variable Valve Lift Sensor

Key Customers

New

European

Customer #1

New

European

Customer #2

7

Fuel Handling

Contacting Fuel Level Card

Chassis / Driveline

Air Grill Shutter Actuator

Brake Pedal Sensor

Chassis Height Sensor

Transmission Speed

Sensor

Transmission Range

Sensor

Wheel Speed Sensor

Occupant Safety

Seat Belt Buckle Switch

Seat Belt Tension Sensor

Seat Track Position Sensor

Exhaust Management /

Aftertreatment

EGR Position Sensor

DPF RF Sensor

Key Customers

Industrial Printers, HVAC, Automation and Safety Products

Piezo micro-actuators

Switches

Encoders

Frequency Control

EMI Filters

Product Applications in Industrial

8

Industrial Inkjet Printers Industrial HVAC

Key Customers

Military Sonar and Communication Products

Piezo hydrophones

Piezo sonar arrays

Frequency Control

EMI Filters

Product Applications in Defense / Aerospace

9

Unmanned Aerial

Vehicles (UAV)

Maritime Applications

Product Applications in Medical

Key Customers

Ultrasound / IVUS, Infusion Pumps, CPAPs and other medical devices

Single Crystal Piezo

Bulk Piezo

Encoders

Frequency Control

Piezo micro-valves

Switches

Joysticks

10

Ultrasound Equipment

Infusion Pumps

CPAP Machines

Positioning for Growth with Fundamental Market Trends

11

Autonomous

Vehicle

SMART

Smart Home/

Building

Unmanned

Aerial Vehicles

(Drones)

Improved

Medical

Diagnosis

Fuel Efficiency/

Vehicle

Electrification

Miniaturization

Energy

Harvesting

EFFICIENT

Green Buildings

Diagnos

Remote

Monitoring

Industry 4.0

Internet of

Things

5G & Small

Cells

CONNECTED

Elec ifi io

Communications

Information

Technology

Transportation

IndustrialMedical

Defense &

Aerospace

Moni or

5G mall

emote

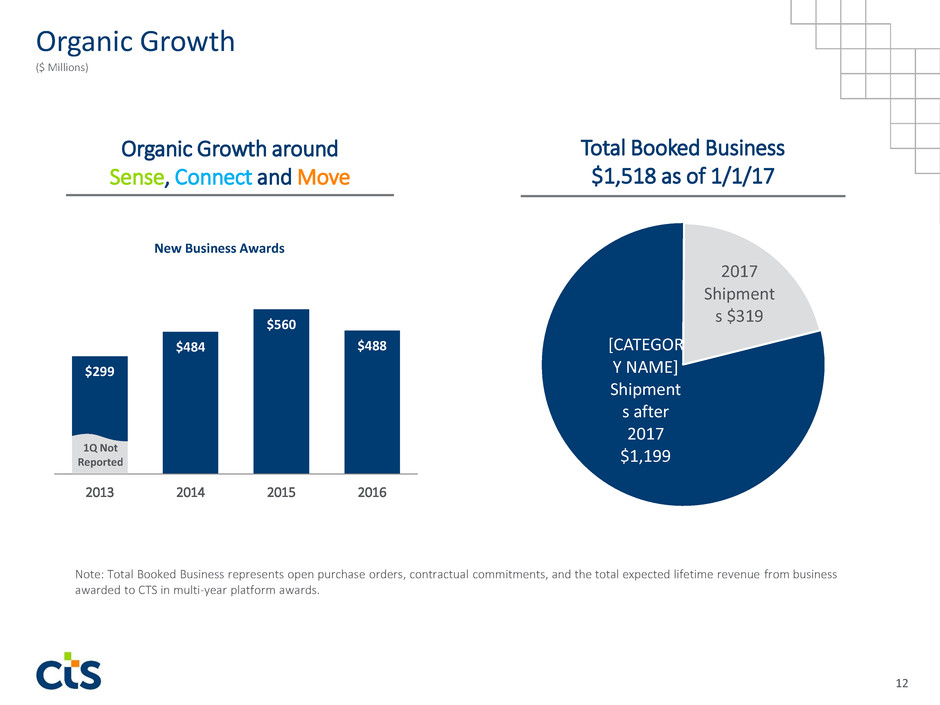

Organic Growth

12

$299

$484

$560

$488

2013 2014 2015 2016

New Business Awards

Organic Growth around

Sense, Connect and Move

1Q Not

Reported

[CATEGOR

Y NAME]

Shipment

s after

2017

$1,199

2017

Shipment

s $319

Total Booked Business

$1,518 as of 1/1/17

Note: Total Booked Business represents open purchase orders, contractual commitments, and the total expected lifetime revenue from business

awarded to CTS in multi-year platform awards.

($ Millions)

Targeted Acquisitions

13

Disciplined approach to acquisitions:

Returns in excess of cost of capital

Accretive to earnings

Maintain balance sheet strength

Synergy opportunities

Targeting 10% growth (both inorganic and organic)

Expand

Product

Range

Broaden

Geographic

Reach

Enhance

Technology

Portfolio

Strengthen

Customer

Relationships

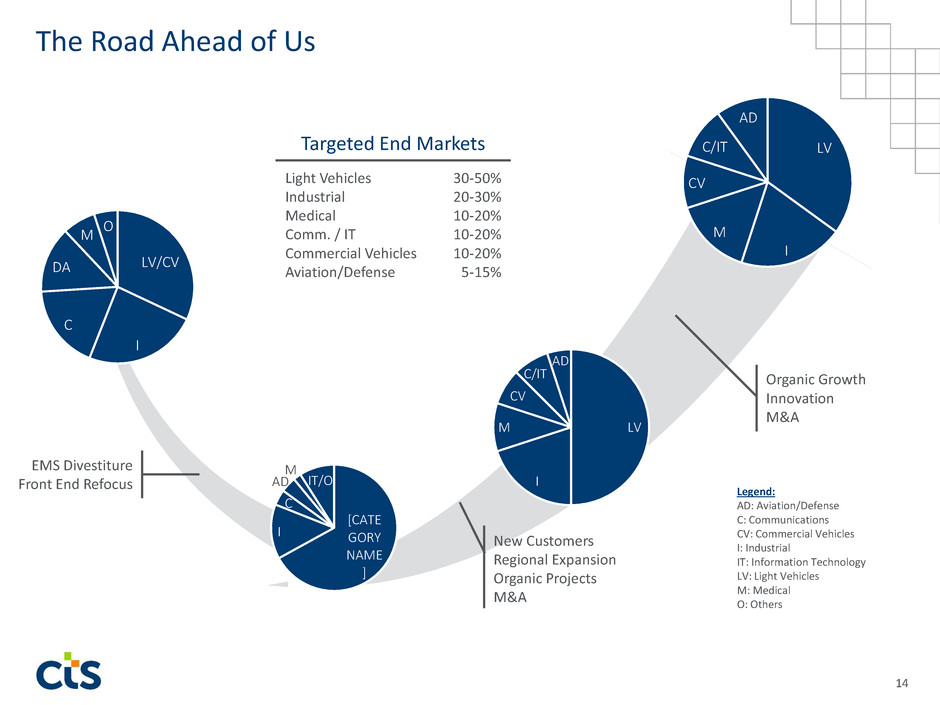

The Road Ahead of Us

LV

I

M

CV

C/IT

AD

[CATE

GORY

NAME

]

I

C

AD

M

IT/O

LV

I

M

CV

C/IT

AD

30-50%

20-30%

10-20%

10-20%

10-20%

5-15%

Targeted End Markets

Light Vehicles

Industrial

Medical

Comm. / IT

Commercial Vehicles

Aviation/Defense

EMS Divestiture

Front End Refocus

New Customers

Regional Expansion

Organic Projects

M&A

Legend:

AD: Aviation/Defense

C: Communications

CV: Commercial Vehicles

I: Industrial

IT: Information Technology

LV: Light Vehicles

M: Medical

O: Others

Organic Growth

Innovation

M&A

LV/CV

I

C

DA

M

O

14

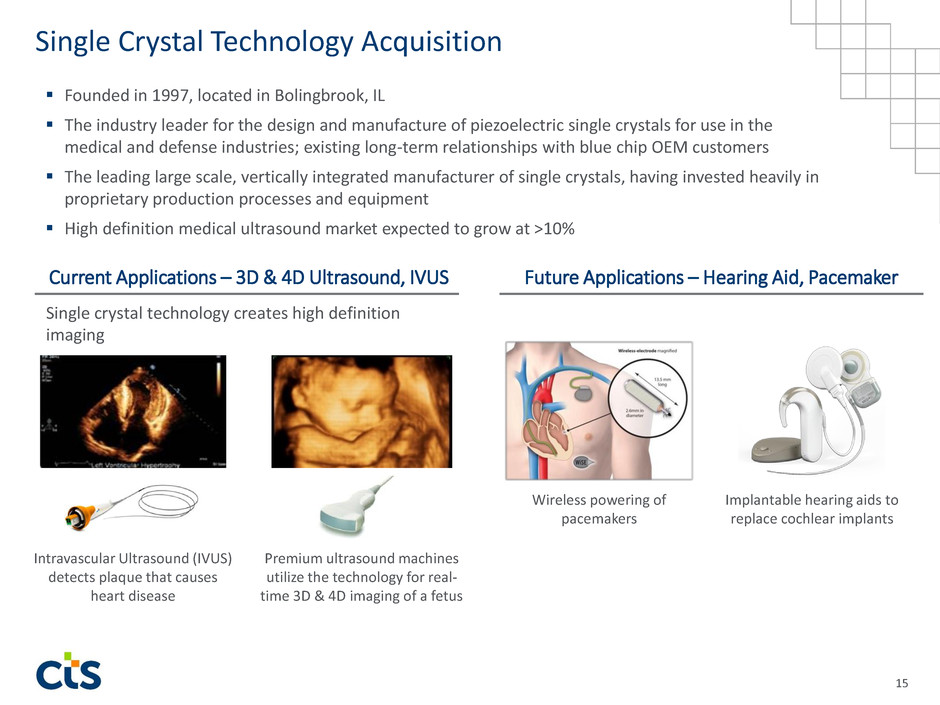

Single Crystal Technology Acquisition

Current Applications – 3D & 4D Ultrasound, IVUS Future Applications – Hearing Aid, Pacemaker

Founded in 1997, located in Bolingbrook, IL

The industry leader for the design and manufacture of piezoelectric single crystals for use in the

medical and defense industries; existing long-term relationships with blue chip OEM customers

The leading large scale, vertically integrated manufacturer of single crystals, having invested heavily in

proprietary production processes and equipment

High definition medical ultrasound market expected to grow at >10%

Wireless powering of

pacemakers

Implantable hearing aids to

replace cochlear implants

Intravascular Ultrasound (IVUS)

detects plaque that causes

heart disease

Single crystal technology creates high definition

imaging

15

Premium ultrasound machines

utilize the technology for real-

time 3D & 4D imaging of a fetus

$409 $404

$382

$397

2013 2014 2015 2016 2017E

Sales

$0.82

$0.97

$0.93

$1.08

2013 2014 2015 2016 2017E

Adjusted Earnings Per Share

$420

Note 1: Sales are from continuing operations.

Adjusted EPS is as reported.

Note 2: 2017E represents guidance provided on February 7, 2017.

Annual Financial Performance Trend

16

$405

$1.22

$1.12

($ Millions except Adjusted Earnings Per Share)

Booked

Business

$319

Equity 76%

[CATEGORY

NAME]

$124

$135

$157

$114

$75 $75

$91 $89

2013 2014 2015 2016

Note 1: Change in Cash/Debt in 2016 due to Single Crystal Acquisition

Note 2: Total available credit increased from $200M to $300M in 2Q 2016

Capital Structure

Cash and Debt

Net

Debt

$(49) $(60)

Current Capital Structure

Debt Cash

$(66) $(25)

17

($ Millions except percentages)

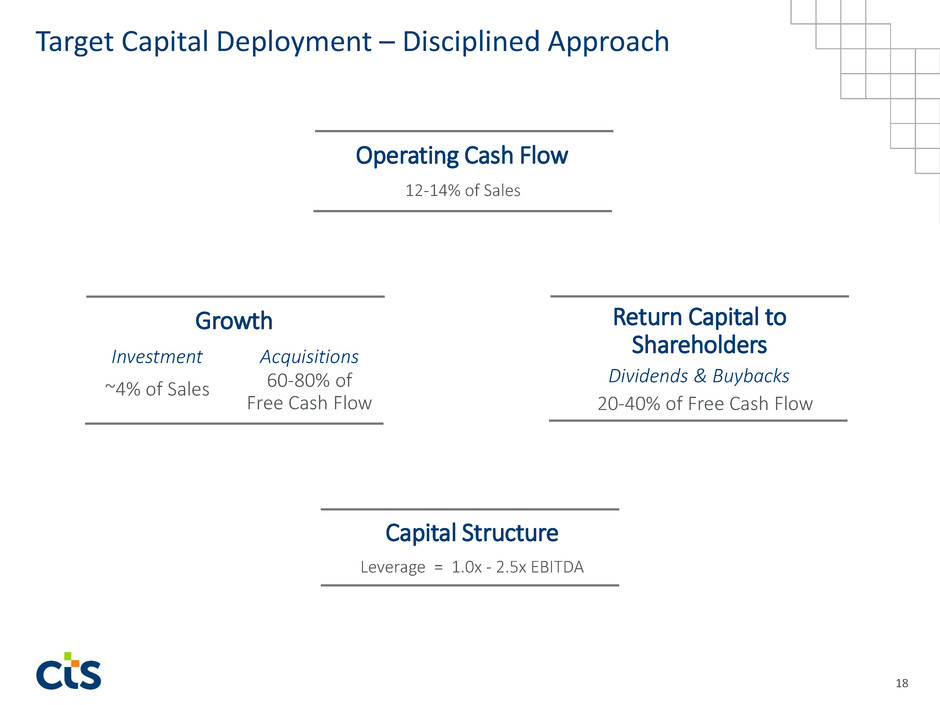

Capital Structure

Leverage = 1.0x - 2.5x EBITDA

Operating Cash Flow

Return Capital to

Shareholders

~4% of Sales

20-40% of Free Cash Flow

12-14% of Sales

60-80% of

Free Cash Flow

Target Capital Deployment – Disciplined Approach

Growth

Acquisitions Investment

Dividends & Buybacks

18

Financial Framework

19

2012

2016

Long-Term

Target Range

Gross Margin 30.0% 35.4% 34-37%

SG&A Expense 20.7% 15.5% 13-15%

R&D Expense 6.9% 6.1% 5-7%

CapEx 2.6% 5.2% ~4%

Targeting 10% Annual Growth (Organic + Inorganic)

Appendix

20

CTS Core Values

21

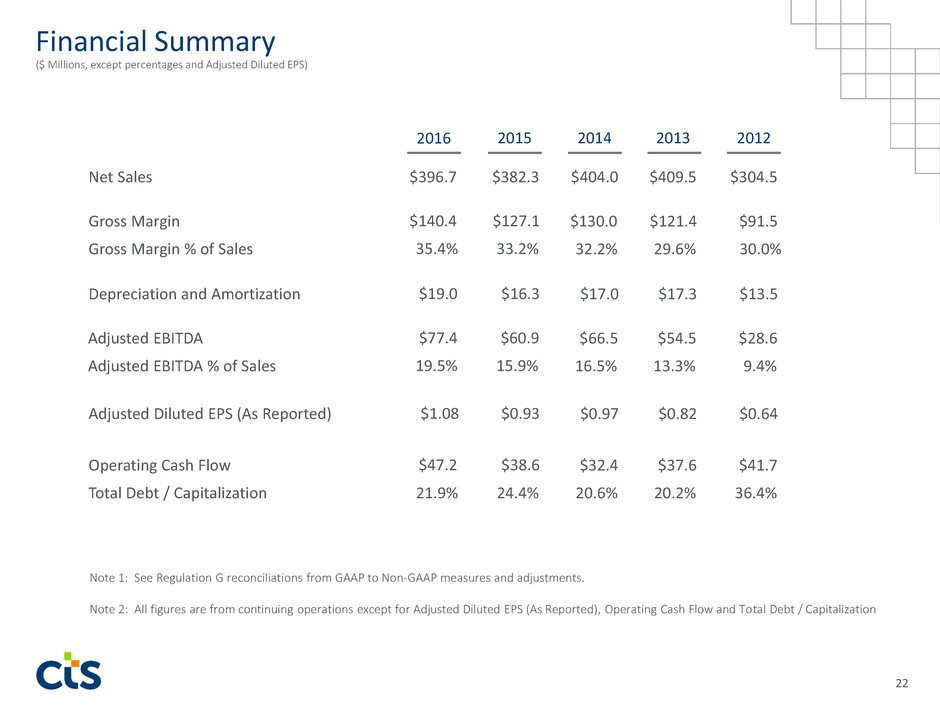

Financial Summary

Note 1: See Regulation G reconciliations from GAAP to Non-GAAP measures and adjustments.

Note 2: All figures are from continuing operations except for Adjusted Diluted EPS (As Reported), Operating Cash Flow and Total Debt / Capitalization

($ Millions, except percentages and Adjusted Diluted EPS)

Net Sales

Adjusted Diluted EPS (As Reported)

Operating Cash Flow

Total Debt / Capitalization

Depreciation and Amortization

2015

$382.3

$0.93

$38.6

24.4%

$16.3

2014

$404.0

$0.97

$32.4

20.6%

$17.0

2013

$409.5

$0.82

$37.6

20.2%

$17.3

2012

$304.5

$0.64

$41.7

36.4%

$13.5

Adjusted EBITDA

Adjusted EBITDA % of Sales

$60.9

15.9%

$66.5

16.5%

$54.5

13.3%

$28.6

9.4%

2016

$396.7

$1.08

$47.2

21.9%

$19.0

$77.4

19.5%

22

Gross Margin

Gross Margin % of Sales

$127.1

33.2%

$130.0

32.2%

$121.4

29.6%

$91.5

30.0%

$140.4

35.4%

Regulation G Schedules

($ Millions, except percentages)

Adjusted EBITDA

23

2016 2015 2016 2015 2014 2013 2012

Net earnings from continuing operations 8.3$ (13.7)$ 34.4$ 7.0$ 26.5$ 2.0$ 13.5$

Depreciation and amortization expense 5.0$ 4.3$ 19.0$ 16.3$ 17.0$ 17.3$ 13.5$

Interest expense 1.0$ 0.7$ 3.7$ 2.6$ 2.3$ 3.3$ 2.6$

Tax expense (benefit) 3.1$ 13.0$ 22.9$ 5.3$ 12.8$ 16.1$ 1.0$

EBITDA from continuing operations 17.4$ 4.3$ 80.0$ 31.2$ 58.6$ 38.6$ 30.5$

Charges (credits) to EBITDA from continuing operations:

Restructuring, restructuring-related, and asset impairment charges 0.9$ 9.5$ 3.0$ 15.2$ 7.9$ 11.8$ 4.5$

(Gain) Loss on sale-leaseback -$ -$ 0.1$ -$ -$ -$ (10.3)$

Gain on sale of facilities, net of expenses -$ -$ (11.1)$ -$ -$ -$ -$

Non-recurring environmental charge -$ -$ -$ 14.5$ -$ -$ -$

Foreign currency loss 2.1$ -$ 3.8$ -$ -$ -$ -$

Legal costs, acquisition-related costs, and CEO search costs -$ -$ 0.8$ -$ -$ 4.1$ 3.9$

Lease termination charge -$ -$ 0.8$ -$ -$ -$ -$

Total adjustments to reported operating earnings from continuing operations 3.0$ 9.5$ (2.6)$ 29.7$ 7.9$ 15.9$ (1.9)$

Adjusted EBITDA from continuing operations 20.4$ 13.8$ 77.4$ 60.9$ 66.5$ 54.5$ 28.6$

Sales from continuing operations 101.6$ 93.3$ 396.7$ 382.3$ 404.0$ 409.5$ 304.5$

Adjusted EBITDA as a % of sales from continuing operations 20.1% 14.8% 19.5% 15.9% 16.5% 13.3% 9.4%

Q4 Full Year

Regulation G Schedules

Adjusted Diluted EPS

($ Millions, except percentages)

Total Debt to Capitalization

24

2016 2015 2014 2013 2012

Total debt (A) 89.1 $ 90.7 $ 75.0 $ 75.0 $ 153.5 $

Total shareholders' equity (B) 317.9 $ 281.7 $ 289.8 $ 296.9 $ 267.8 $

Total capitalization (A+B) 407.0 $ 372.4 $ 364.8 $ 371.9 $ 421.3 $

Total debt to capitalization 21.9% 24.4% 20.6% 20.2% 36.4%

As of December 31

2016 2015 2016 2015 2014 2013 2012 2013 2012

Diluted earnings (loss) per share 0.25 $ (0.42) $ 1.03 $ 0.21 $ 0.78 $ 0.06 $ 0.39 $ (0.12) $ 0.59 $

Tax affected charges (credits) to reported diluted earnings per share:

Restructuring, restructuring-related, and asset impairment charges 0.02 $ 0.28 $ 0.06 $ 0.40 $ 0.18 $ 0.28 $ 0.10 $ 0.28 $ 0.19 $

Increase in valuation allowance and revaluation of deferred taxes as a

result of restructuring activities - $ - $ 0.07 $ - $ 0.01 $ - $ - $ - $ - $

(Gain) Loss on sale-leaseback - $ - $ - $ - $ - $ - $ (0.23) $ - $ (0.23) $

Gain on sale of facilities, net of expenses - $ - $ (0.22) $ - $ - $ - $ - $ - $ - $

Legal costs, acquisition-related costs, and CEO search costs - $ - $ 0.02 $ - $ - $ 0.07 $ 0.09 $ 0.07 $ 0.09 $

Lease termination charge - $ - $ 0.02 $ - $ - $ - $ - $ - $ - $

EMS divestiture - $ - $ - $ - $ - $ - $ - $ 0.25 $ - $

Non-recurring environmental charge - $ - $ - $ 0.27 $ - $ - $ - $ - $ - $

Foreign currency loss 0.05 $ - $ 0.09 $ - $ - $ - $ - $ - $ - $

Tax impact of cash repatriation - $ 0.27 $ - $ 0.26 $ - $ 0.31 $ - $ 0.31 $ - $

Tax impact of U.K. deferred tax asset write-off - $ - $ - $ - $ - $ 0.03 $ - $ 0.03 $ - $

(Decrease) increase in recognition of foreign valuation allowance (0.01) $ 0.07 $ 0.03 $ 0.10 $ - $ - $ - $ - $ - $

Increase in reserve on uncertain tax benefits - $ 0.01 $ - $ 0.17 $ - $ - $ - $ - $ - $

Tax impact of non-recurring stock compensation change (0.02) $ - $ (0.02) $ - $ - $ - $ - $ - $ - $

Change in treatment of certain foreign taxes - $ (0.01) $ - $ (0.48) $ - $ - $ - $ - $ - $

Adjusted diluted earnings per share 0.29 $ 0.20 $ 1.08 $ 0.93 $ 0.97 $ 0.75 $ 0.35 $ 0.82 $ 0.64 $

* Includes discontinued operations

Q4 Full Year - From Continuing Operations Full Year - As Reported *