Attached files

| file | filename |

|---|---|

| EX-10.2 - AURA SYSTEMS INC | ex10-2.htm |

| 8-K - AURA SYSTEMS INC | form8-k.htm |

FIRST AMENDMENT TO TRANSACTION DOCUMENTS

This FIRST AMENDMENT TRANSACTION DOCUMENTS (this “Amendment”), is entered into this 30th day of January 2017, (the “Execution Date”) by and among Aura Systems, Inc., a Delaware corporation (the “Company”), and those other persons who have signed the signature page hereto (the “Signatories”), with reference to that certain Securities Purchase Agreement dated May 7, 2013 (the “Purchase Agreement”) by and among the Company and the Buyers (as that term is defined in the Purchase Agreement). Capitalized terms not defined herein that are defined in the Agreement shall have the meaning ascribed to them in the Agreement, except that references to the Warrants include all amendments thereto prior to the Execution Date and that references to the Notes include all amendments thereto prior to the Execution Date.

RECITALS

WHEREAS, the Company desires to amend the Transaction Documents; and

WHEREAS, pursuant to Section 11.11 of the Purchase Agreement, any amendment to the Agreement, the Notes and the other Transaction Documents made by an instrument in writing signed by the Company and the Required Buyers shall be binding on all Buyers and holders of Securities, provided that such amendment applies to all of the holders of the Securities then outstanding; and

WHEREAS, the Signatories hold or have the right to acquire at least seventy-five percent (75%) of the Conversion Shares and the Warrant Shares on a fully-diluted basis and therefore constitute the Required Buyers; and

WHEREAS, the Signatories have agreed to amend the Transaction Documents as hereinafter set forth;

NOW, THEREFORE, in consideration of the premises and the mutual agreements and covenants hereinafter set forth, and intending to be legally bound, the Company and the Required Buyers hereby agree that the Transaction Documents be, and hereby are, as of and at the Execution Date, amended as follows:

1. Amendments to Purchase Agreement. The Purchase Agreement is hereby as amended as follows (as so amended, the Purchase Agreement is sometimes hereinafter referred to as the “Amended Purchase Agreement”):

1.1. Section 5 of the Purchase Agreement is hereby amended to read in its entirety as follows:

5. COVENANTS.

5.1. Conduct of Business. The business of the Company shall not be conducted in violation of any Applicable Law, except where such violations would not result, either individually or in the aggregate, in a Material Adverse Effect. So long as the Amended Notes remain outstanding, the Company shall not engage in any material line of business substantially different from those lines of business conducted by the Company on the Execution Date or any business substantially related or incidental thereto.

| Page 1 of 16 |

5.2. Fundamental Transactions. So long as the Amended Notes remain outstanding, the Company shall not enter into or be party to any Fundamental Transaction unless the Successor Entity assumes in writing all of the obligations of the Company under the Amended Notes and the other Transaction Documents in accordance with the provisions of this Section 5.2 pursuant to written agreements, reasonably acceptable to the Required Buyers, including agreements to deliver to each holder of Amended Notes in exchange for such Amended Notes a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to the Amended Notes, including, without limitation, having a principal amount and interest rate equal to the principal amounts then outstanding and the interest rates of the Amended Notes held by such holder, having similar conversion rights as the Amended Notes and having similar ranking to the Amended Notes. Upon the occurrence of any Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of the Amended Notes and the other Transaction Documents referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations of the Company under the Amended Notes and the other Transaction Documents with the same effect as if such Successor Entity had been named as the Company herein. The provisions of this Section 5.2 shall apply similarly and equally to successive Fundamental Transactions occurring during the period in which the Amended Notes remains outstanding.

5.3. Corporate Existence. So long as any portion of the Amended Notes shall remain unpaid or outstanding, the Company shall at all times do or cause to be done all things necessary to (a) maintain and preserve its legal existence and its rights, franchises and privileges and (b) become or remain duly qualified and in good standing in each jurisdiction in which the character of the properties owned or leased by it or in which the transaction of its business makes such qualification necessary.

5.4. Disclosure of Transactions and Other Material Information. Neither the Company nor any Buyer shall issue any press releases or any other public statements with respect to the transactions contemplated hereby; provided, however, the Company shall be entitled, without the prior approval of any Buyer, to make any press release or other public disclosure with respect to such transactions as is required by Applicable Law and regulations.

| Page 2 of 16 |

5.5. Piggyback Registration Rights

(a) Whenever the Company proposes to register any shares of its Common Stock under the Securities Act (other than a registration effected solely to implement an employee benefit plan or a transaction to which Rule 145 of the Securities Act is applicable, or a Registration Statement on Form S-4, S-8 or any successor form thereto or another form not available for registering the Registrable Securities for sale to the public), whether for its own account or for the account of one or more stockholders of the Company and the form of Registration Statement to be used may be used for any registration of Registrable Securities (a “Piggyback Registration”), the Company shall give prompt written notice (in any event no later than fifteen (15) days prior to the filing of such Registration Statement) to the holders of Registrable Securities of its intention to effect such a registration and, subject to Section 5.5(b) and 5.5(c), shall include in such registration all Registrable Securities with respect to which the Company has received written requests for inclusion from the holders of Registrable Securities within ten (10) days after the Company’s notice has been given to each such holder, provided however, that the Company shall not be required to register any Registrable Securities pursuant to this Section 5.5 that are (i) eligible for resale pursuant to Rule 144 without restriction (including, without limitation, volume restrictions) or (ii) that are the subject of a then effective Registration Statement. The Company may postpone or withdraw the filing or the effectiveness of a Piggyback Registration at any time in its sole discretion.

(b) If a Piggyback Registration is initiated as a primary underwritten offering on behalf of the Company and the managing underwriter advises the Company and the holders of Registrable Securities (if any holders of Registrable Securities have elected to include Registrable Securities in such Piggyback Registration) in writing that in its opinion the number of shares of Common Stock proposed to be included in such registration, including all Registrable Securities and all other shares of Common Stock proposed to be included in such underwritten offering, exceeds the number of shares of Common Stock which can be sold in such offering and/or that the number of shares of Common Stock proposed to be included in any such registration would adversely affect the price per share of the Common Stock to be sold in such offering, the Company shall include in such registration (i) first, the number of shares of Common Stock that the Company proposes to sell; (ii) second, the number of shares of Common Stock requested to be included therein by holders of Registrable Securities, allocated pro rata among all such holders on the basis of the number of Registrable Securities owned by each such holder or in such manner as they may otherwise agree; and (iii) third, the number of shares of Common Stock requested to be included therein by holders of Common Stock (other than holders of Registrable Securities), allocated among such holders in such manner as they may agree; provided, that in any event the holders of Registrable Securities shall be entitled to register at least 25% of the securities to be included in any such registration.

(c) If a Piggyback Registration is initiated as an underwritten offering on behalf of a holder of Common Stock other than Registrable Securities, and the managing underwriter advises the Company in writing that in its opinion the number of shares of Common Stock proposed to be included in such registration, including all Registrable Securities and all other shares of Common Stock proposed to be included in such underwritten offering, exceeds the number of shares of Common Stock which can be sold in such offering and/or that the number of shares of Common Stock proposed to be included in any such registration would adversely affect the price per share of the Common Stock to be sold in such offering, the Company shall include in such registration (i) first, the number of shares of Common Stock requested to be included therein by the holder(s) requesting such registration and by the holders of Registrable Securities, allocated pro rata among such holders on the basis of the number of shares of Common Stock (on a fully diluted, as converted basis) and the number of Registrable Securities, as applicable, owned by all such holders or in such manner as they may otherwise agree; and (ii) second, the number of shares of Common Stock requested to be included therein by other holders of Common Stock, allocated among such holders in such manner as they may agree.

| Page 3 of 16 |

(d) If and whenever the holders of Registrable Securities request that any Registrable Securities be registered pursuant to the provisions of this Amendment, the Company shall use its reasonable best efforts to effect the registration and the sale of such Registrable Securities in accordance with the intended method of disposition thereof, and pursuant thereto the Company shall as soon as reasonably practicable:

(i) within a reasonable time before filing such Registration Statement, Prospectus or amendments or supplements thereto, furnish to one counsel selected by holders of such Registrable Securities copies of such documents proposed to be filed, which documents shall be subject to the review, comment and approval of such counsel;

(ii) notify each selling holder of Registrable Securities, promptly after the Company receives notice thereof, of the time when such Registration Statement has been declared effective or a supplement to any Prospectus forming a part of such Registration Statement has been filed;

(iii) furnish to each selling holder of Registrable Securities such number of copies of the Prospectus included in such Registration Statement (including each preliminary Prospectus) and any supplement thereto (in each case including all exhibits and documents incorporated by reference therein) and such other documents as such seller may reasonably request in order to facilitate the disposition of the Registrable Securities owned by such seller;

(iv) use its reasonable best efforts to register or qualify such Registrable Securities under such other securities or “blue sky” laws of such jurisdictions as any selling holder reasonably requests and do any and all other acts and things which may be reasonably necessary or advisable to enable such holders to consummate the disposition in such jurisdictions of the Registrable Securities owned by such holders; provided, that the Company shall not be required to qualify generally to do business, subject itself to general taxation or consent to general service of process in any jurisdiction where it would not otherwise be required to do so but for this Section 5.5(d)(iv);

(v) notify each selling holder of such Registrable Securities, at any time when a Prospectus relating thereto is required to be delivered under the Securities Act, of the happening of any event as a result of which the Prospectus included in such Registration Statement contains an untrue statement of a material fact or omits any fact necessary to make the statements therein not misleading;

| Page 4 of 16 |

(vi) advise the holders of Registrable Securities, promptly after it shall receive notice or obtain knowledge thereof, of the issuance of any stop order by the Commission suspending the effectiveness of such Registration Statement or the initiation or threatening of any proceeding for such purpose and promptly use its reasonable best efforts to prevent the issuance of any stop order or to obtain its withdrawal at the earliest possible moment if such stop order should be issued;

(vii) permit any holder of Registrable Securities which holder, in its sole and exclusive judgment, might be deemed to be an underwriter or a controlling person of the Company, to participate in the preparation of such Registration Statement and to require the insertion therein of language, furnished to the Company in writing, which in the reasonable judgment of such holder and its counsel should be included; and

(viii) otherwise use its reasonable best efforts to take all other steps necessary to effect the registration of such Registrable Securities contemplated hereby.

(e) All expenses (other than Selling Expenses) incurred by the Company in complying with its obligations pursuant to this Amendment and in connection with the registration and disposition of Registrable Securities, including, without limitation, all registration and filing fees, underwriting expenses (other than fees, commissions or discounts), expenses of any audits incident to or required by any such registration, fees and expenses of complying with securities and “blue sky” laws, printing expenses, fees and expenses of the Company’s counsel and accountants and reasonable fees and expenses of one counsel for the holders of Registrable Securities participating in such registration as a group (selected by the holders of a majority of the Registrable Securities included in the registration), shall be paid by the Company. All Selling Expenses relating to Registrable Securities registered pursuant to this Amendment shall be borne and paid by the holders of such Registrable Securities, in proportion to the number of Registrable Securities registered for each such holder.

5.6. Stockholder Meeting. The Company shall provide each stockholder entitled to vote at a special or annual meeting of stockholders of the Company (the “Stockholder Meeting”), with a proxy statement, soliciting each such stockholder’s affirmative vote at the Stockholder Meeting for approval of resolutions (the “Resolutions”) to (i) to elect a new board of at least five (5) directors; (ii) to approve an amendment to the Certificate oflncorporation to effect up to a 1-for-7 reverse stock split of the Common Stock (such reverse stock split is referred to herein as the “Authorized Reverse Split”); (iii) if, and to the extent required by Applicable Law, to approve the issuances granted to the Buyer hereunder; and (iv) if, and to the extent required by Applicable Law, to approve an exempt offering of at least [$4.0 million] (the affirmative approval of the Resolution being referred to herein as the “Stockholder Approval”), and the Company shall use its best efforts to solicit its stockholders’ approval of the Resolutions. In connection therewith, the Company shall be obligated to (a) cause a preliminary proxy statement relating to the Resolutions and the Stockholder Meeting to be filed with the SEC and mailed to the Company’s stockholders by no later than March 15, 2017, and (b) hold the Stockholder Meeting promptly following the mailing of the definitive proxy statement.

| Page 5 of 16 |

5.7. Board Authorization. The Board of Directors of the Company has approved this Amendment and will recommend to the stockholders of the Company that they approve the Resolutions.

1.2. Section 6.2 of the Purchase Agreement is hereby deleted in its entirety.

1.3. Section 6.4 of the Purchase Agreement is hereby amended to read in its entirety as follows:

6.4 Removal of Legends. Certificates evidencing Securities shall not be required to contain the legend set forth in Section 6.2 above or any other legend (i) while a registration statement covering the resale of such Securities is effective under the Securities Act, (ii) if such Securities are eligible to be sold, assigned or transferred under Rule 144 (provided that Buyer provides the Company with an opinion of counsel to such Buyer, in a form reasonably acceptable to the Company, to the effect that the Securities may be sold, assigned or transferred under Rule 144, (iii) in connection with a sale, assignment or other transfer (other than under Rule 144), provided that such Buyer provides the Company with an opinion of counsel to such Buyer, in a generally acceptable form, to the effect that such sale, assignment or transfer of the Securities may be made without registration under the applicable requirements of the Securities Act or

(iv) if such legend is not required under applicable requirements of the Securities Act (including, without limitation, controlling judicial interpretations and pronouncements issued by the SEC).

1.4. Section 9 of the Purchase Agreement is hereby amended to read in its entirety as follows:

9. DEFAULTS AND REMEDIES.

9.1. Events of Default. The occurrence, following the Execution Date hereof, of any one or more of the following events, acts or occurrences shall constitute an event of default (each an “Event of Default”):

9.1.1. The Company shall fail to pay, within five (5) Business Days of the due date (whether at stated maturity or upon acceleration, demand, required prepayment or otherwise), any principal amount of the Amended Note; or

9.1.2. The Company shall breach or fail to pay interest or any other amount (including fees, costs, expenses or other amounts) under this Agreement or any other Transaction Document (other than any Amended Note as provided in Section 9.1.1) within five (5) Business Days after the due date thereof; or

| Page 6 of 16 |

9.1.3. The Company shall breach or fail to perform, comply with or observe, or be in default under, any covenant or obligation required to be performed by it (other than as provided in Sections 9.1.1 and 9.1.2) under any Transaction Document and, if such breach or failure may be cured, such breach or failure shall not have been cured within ten (10) Business Days after the receipt of written notice that such breach or failure shall have occurred; or

9.1.4. There shall be commenced against the Company an involuntary case seeking the liquidation or reorganization under the Bankruptcy Laws or any similar proceeding under any other Applicable Laws or an involuntary case or proceeding seeking the appointment of a receiver, custodian, trustee or similar official for it, or to take possession of all or a substantial portion of its property or to operate all or a substantial portion of its business, and any of the following events occur: (i) the Company consents to such involuntary case or proceeding or fails to diligently contest it in good faith; (ii) the petition commencing the involuntary case or proceeding is not timely controverted; (iii) the petition commencing the involuntary case or proceeding remains undismissed or unstayed for a period of sixty (60) calendar days; or (iv) an order for relief shall have been issued or entered therein or a receiver, custodian, trustee or similar official appointed; or

9.1.5. The Company shall institute a voluntary case seeking liquidation or reorganization under the Bankruptcy Laws or any similar proceeding under any other Applicable Laws, or shall consent thereto; or shall consent to the conversion of an involuntary case to a voluntary case; or shall file a petition, answer a complaint or otherwise institute any proceeding seeking, or shall consent or acquiesce to the appointment of, a receiver, custodian, trustee or similar official for it, or to take possession of all or a substantial portion of its property or to operate all or a substantial portion of its business; or shall make a general assignment for the benefit of creditors; or shall generally not pay its debts as they become due or shall admit in writing its inability to pay its debts generally; or the board of directors of the Company (or any committee thereof) adopts any resolution or otherwise authorizes action to approve any of the foregoing; or

9.1.6. The Collateral Documents shall for any reason fail or cease to create a separate valid and perfected and, except to the extent permitted by the terms hereof or thereof, first priority Lien on the Collateral (as defined in the Security Agreement) in favor of each of the Secured Parties (as defined in the Security Agreement) and such breach remains uncured for a period of five (5) Business Days.

9.2. Acceleration. If any Event of Default (other than an Event of Default specified in clause 9.1.4 or 9.1.5 of Section 9.1 above) occurs and is continuing, the Required Buyers may, without notice, declare all outstanding principal of, accrued and unpaid interest on, and all other amounts under, the Amended Note, and all other Obligations, to become immediately due and payable. Upon any such declaration of acceleration, such principal, interest, and other Obligations, shall become immediately due and payable. If an Event of Default specified in clause 9.1.4 or 9.1.5 of Section 9.1 above occurs, all outstanding principal of, and accrued and unpaid interest on, and allother amounts under, the Amended Note, and all other Obligations, shall become immediately due and payable without any declaration or other act on the part of the Required Buyers. The Company hereby waives all presentment for payment, demand, protest, notice of protest and notice of dishonor, and all other notices of any kind to which it may be entitled under Applicable Laws or otherwise.

| Page 7 of 16 |

9.3. Other Remedies. If any Default or Event of Default shall occur and be continuing, the Buyers may proceed to protect and enforce its rights and remedies under this Agreement and any other Transaction Document by exercising all rights and remedies available under this Agreement, any other Transaction Document or Applicable Laws (including the UCC), either by suit in equity or by action at law, or both, whether for the collection of principal of or interest on the Amended Note, to enforce the specific performance of any covenant or other term contained in this Agreement or any Transaction Document. No remedy conferred in this Agreement upon any Buyer is intended to be exclusive of any other remedy, and each and every such remedy shall be cumulative and shall be in addition to every other remedy conferred herein or now or hereafter existing at law or in equity or by statute or otherwise.

9.4. Waiver of Defaults. A Buyer may, by providing a writing to the Company, waive any Default or Event of Default and its consequences with respect to this Agreement, the Amended Note or any other Transaction Document in each case with respect to such Buyer; provided however, that no such waiver will extend to any other Buyer unless such waiver is provided on behalf of the Required Buyers in which case such waiver shall be with respect to all Buyers and holders of Securities, as applicable.

1.5. To the extent any provision of Section 11 conflicts with the terms and provisions of this Amendment, the terms and provisions of this Amendment shall control.

1.6. Except as amended by this Amendment, all other provisions of the Agreement shall remain in full force and effect.

2. Amendments to Warrants. The Warrants are hereby as amended and restated to read in their entirety as set forth on Exhibit A hereto (as so amended, the Notes are sometimes hereinafter referred to as the “Amended Warrants”) and are hereby incorporated herein by this reference.

3. Amendments to Notes. The Notes are hereby as amended and restated to read in their entirety as set forth on Exhibit B hereto (as so amended, the Notes are sometimes hereinafter referred to as the “Amended Notes”) and are hereby incorporated herein by this reference.

4. Amendments to Security Agreement. The Security Agreement is hereby amended and restated to read in its entirety as set forth on Exhibit C hereto and is hereby incorporated herein by this reference.

| Page 8 of 16 |

5. General

5.1. Waiver of Past Defaults. Any and all Events of Default under the Transaction Documents existing on or prior to the Execution Date are hereby waived. Such waiver shall not constitute a waiver or forbearance with respect to any future Event of Default under any of the Transaction Documents.

5.2. Representations of the Company. The Company hereby represents to each Buyer, which representations shall supersede any and all prior representations and/or warranties of Company in the Transaction Documents as executed on or about May 6, 2013, that as of the Execution Date:

5.2.1. Organization and Qualification. The Company is duly organized and validly existing and in good standing under the laws of the jurisdiction in which it is formed, and has the requisite power and authorization to own its properties and to carry on its business as now being conducted and as presently proposed to be conducted. The Company is duly qualified as a foreign entity to do business and is in good standing in every jurisdiction in which its ownership of property or the nature of the business conducted by it makes such qualification necessary, except to the extent that the failure to be so qualified or be in good standing would not have a Material Adverse Effect.

5.2.2. Authorization; Enforcement; Validity. The Company has the requisite power and authority to execute, deliver, carry out and perform its obligations under this Agreement and each other Transaction Document to which it is a party, including, the power and authority to issue and deliver the Securities to be issued by it hereunder. The execution and delivery of this Agreement and the other Transaction Documents by the Company, and the consummation by the Company of the transactions contemplated hereby and thereby, have been duly authorized by the Company’s board of directors, and no further filing, consent or authorization is required by the Company, its boards of directors or its stockholders other than Shareholder Approval. This Agreement has been duly executed and delivered by the Company and, on the Execution Date, each of the Securities and the Transaction Documents to which the Company is a party and which is delivered as of that date will be duly executed and delivered by the Company. On the Execution Date, this Agreement and each Transaction Document will be, a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or conveyance or similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability, and except as rights of indemnity or contribution may be limited by federal or state securities laws or the public policy underlying such law.

5.2.3. Issuance of Securities. The issuance of the Amended Notes and the Amended Warrants is duly authorized, and upon issuance in accordance with the terms of the Transaction Documents, will be validly issued, and free from all preemptive or similar rights, taxes, liens, charges and other encumbrances with respect to the issue thereof. Upon conversion in accordance with the Amended Notes or exercise in accordance with the Amended Warrants (as the case may be), the Conversion Shares and the Warrant Shares, respectively, when issued, will be validly issued, fully paid and non-assessable and free from all preemptive or similar rights, taxes, liens, charges and other encumbrances with respect to the issue thereof, with the holders being entitled to all rights accorded to a holder of Common Stock.

| Page 9 of 16 |

5.2.4. No Conflicts. The execution, delivery and performance of the Transaction Documents by the Company and the consummation by the Company of the transactions contemplated hereby and thereby does not and will not (upon the giving of notice or the passage of time or both): (i) result in a violation of the Company’s Organizational Documents, (ii) conflict with, or constitute a default under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Company is a party or (iii) result in a violation of any Applicable Law applicable to the Company or by which any property or asset of the Company is bound or affected except to the extent such violations or conflict could not reasonably be expected to have a Material Adverse Effect.

5.2.5. Consents. The Company is not required to obtain any Consent from, authorization or order of, or make any filing or registration with (other than Shareholder Approval and any filing that may be required by any state securities agencies), any court, governmental agency or any regulatory or self-regulatory agency or any other Person in order for it to execute, deliver or perform any of its respective obligations under, or contemplated by, the Transaction Documents, in each case, in accordance with the terms hereof or thereof. All consents, authorizations, orders, filings and registrations which the Company is required to obtain at or prior to the Closing have been obtained or effected on or prior to the Closing Date.

5.2.6. No General Solicitation. Neither the Company, nor any of its affiliates, nor any Person acting on its or their behalf, has engaged in any form of general solicitation or general advertising (within the meaning of Regulation D of the Securities Act) in connection with the offer or sale of the Amended Notes or the Amended Warrants.

5.2.7. No Integrated Offering. None of the Company, or any of its affiliates, nor any Person acting on its or their behalf has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would require registration of the issuance of any of the Securities under the Securities Act, whether through integration with prior offerings or otherwise.

5.2.8. Equity Capitalization. As of the Execution Date the authorized capital stock of the Company consists solely of 150,000,000 shares of Common Stock, of which, 113,985,916 shares are issued and outstanding and 14,744,140 shares are reserved for issuance (other than for the Amended Notes and the Amended Warrants) pursuant to Convertible Securities (as defined in the Amended Note). As of the Execution Date, 25,349,089 shares of the Company’s issued and outstanding Common Stock are owned by Persons who are “affiliates” (as defined in Rule 405 of the Securities Act and calculated based on the assumption that only officers, directors and holders of at least 10% of the Company’s issued and outstanding Common Stock are “affiliates” without conceding that any such Persons are “affiliates” for purposes of federal securities laws) of the Company.

5.2.9. Intellectual Property Rights. The Company owns or possesses adequate rights or licenses to use all trademarks, trade names, service marks, service mark registrations, service names, patents, patent rights, copyrights, original works, inventions, licenses, approvals, governmental authorizations, trade secrets and other intellectual property rights and all applications and registrations therefor (“Intellectual Property Rights”) necessary to conduct its businesses as now conducted and as presently proposed to be conducted. There is no claim, action or proceeding being made or brought, or to the knowledge of the Company, threatened against the Company, regarding Intellectual Property Rights.

| Page 10 of 16 |

5.2.10. Investment Company Status. The Company is not, and upon consummation of the sale of the Securities will not be, an “investment company,” an affiliate of an “investment company,” a company controlled by an “investment company” or an “affiliated person” of, or “promoter” or “principal underwriter” for, an “investment company” as such terms are defined in the Investment Company Act of 1940, as amended.

5.2.11. Shell Company Status. The Company is not, and has never been, an issuer identified in, or subject to, Rule 144(i).

5.2.12. No Additional Agreements. The Company does not have any agreement or understanding with any of the Signatories with respect to the transactions contemplated hereby other than as specified in this Amendment.

5.3. Miscellaneous.

5.3.1. Governing Law. THIS AMENDMENT AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED THERETO, THE TRANSACTION DOCUMENTS, THE RELATIONSHIP OF THE PARTIES, AND/OR THE INTERPRETATION AND ENFORCEMENT OF THE RIGHTS AND DUTIES OF THE PARTIES, WHETHER ARISING IN LAW OR IN EQUITY, IN CONTRACT, TORT OR OTHERWISE, SHALL BE GOVERNED BY, AND CONSTRUED AND INTERPRETED IN ACCORDANCE EXCLUSIVELY WITH THE LAWS OF THE STATE OF CALIFORNIA (WITHOUT REGARD TO ITS RULES REGARDING CHOICE OF LAW OR CONFLICTS OF LAW) AND ANY APPLICABLE LAWS OF THE UNITED STATES OF AMERICA.

5.3.2. Consent to Jurisdiction and Venue. ANY SUIT, LEGAL ACTION OR SIMILAR PROCEEDING ARISING OUT OF OR IN CONNECTION WITH THIS AMENDMENT OR ANY OF THE TRANSACTION DOCUMENTS, AS THE SAME MAY BE AMENDED HEREBY, SHALL BE BROUGHT EXCLUSIVELY IN THE COURTS OF THE STATE OF CALIFORNIA SITTING IN THE COUNTY OF LOS ANGELES OR, IF SUCH COURTS DO NOT HAVE JURISDICTION, THEN IN THE UNITED STATES DISTRICT COURT FOR THE CENTRAL DISTRICT OF CALIFORNIA SITTING IN THE COUNTY OF LOS ANGELES. EACH PARTY TO THIS AMENDMENT (I) IRREVOCABLY AND UNCONDITIONALLY SUBMITS TO THE PERSONAL JURISDICTION OF SUCH COURTS, (II) AGREES THAT IT WILL NOT ATTEMPT TO DENY OR DEFEAT SUCH PERSONAL JURISDICTION BY MOTION OR OTHER REQUEST FOR LEAVE FROM ANY SUCH COURT, (III) AGREES THAT ANY ACTIONS OR PROCEEDINGS ARISING IN CONNECTION WITH THIS AMENDMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AMENDMENT SHALL BE BROUGHT, TRIED AND DETERMINED ONLY IN SUCH COURTS, (IV) WAIVES ANY CLAIM OF IMPROPER VENUE OR ANY CLAIM THAT THOSE COURTS ARE AN INCONVENIENT FORUM AND (V) AGREES THAT IT WILL NOT BRING ANY ACTION RELATING TO THIS AMENDMENT OR THE TRANSACTIONS CONTEMPLATED BY THIS AMENDMENT IN ANY COURT OTHER THAN THE AFORESAID COURTS. NOTHING CONTAINED HEREIN SHALL BE DEEMED TO LIMIT IN ANY WAY ANY RIGHT TO SERVE PROCESS IN ANY MANNER PERMITTED BYLAW.

| Page 11 of 16 |

5.3.3. Waiver of Jury Trial. TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, EACH PARTY HEREBY KNOWINGLY, INTENTIONALLY AND VOLUNTARILY EXPRESSLY WAIVES ANY RIGHT TO TRIAL BY JURY OF ANY CLAIM, DEMAND, ACTION OR CAUSE OF ACTION ARISING OUT OF OR IN CONNECTION WITH THIS AMENDMENT OR THE TRANSACTIONS RELATED THERETO, IN EACH CASE WHETHER NOW EXISTING OR HEREAFTER ARISING.

5.3.4. Counterparts. This AMENDMENT may be executed in any number of counterparts and by the parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same instrument. In the event that any signature is delivered by facsimile transmission or by an e-mail which contains a portable document format (.pdf) file of an executed signature page, such signature page shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such signature page were an original thereof.

5.3.5. Attorneys Fees. In any action, suit or other proceeding to enforce or interpret any of the provisions of this Amendment, the prevailing party shall be entitled to recover its attorneys’ fees and expenses incurred in connection therewith.

5.3.6. Headings; Gender. The headings of this Amendment are for convenience of reference and shall not form part of, or affect the interpretation of, this Amendment. Unless the context clearly indicates otherwise, each pronoun herein shall be deemed to include the masculine, feminine, neuter, singular and plural forms thereof. The terms “including,” “includes,” “include” and words of like import shall be construed broadly as if followed by the words “without limitation.” The terms “herein,” “hereunder,” “hereof’ and words of like import refer to this entire Amendment instead of just the provision in which they are found.

5.3.7. Severability. If any provision of this Amendment is prohibited by law or otherwise determined to be invalid or unenforceable by a court of competent jurisdiction, the provision that would otherwise be prohibited, invalid or unenforceable shall be deemed amended to apply to the broadest extent that it would be valid and enforceable, and the invalidity or unenforceability of such provision shall not affect the validity of the remaining provisions of this Amendment so long as this Amendment as so modified continues to express, without material change, the original intentions of the parties as to the subject matter hereof and the prohibited nature, invalidity or unenforceability of the provision(s) in question does not substantially impair the respective expectations or reciprocal obligations of the parties or the practical realization of the benefits that would otherwise be conferred upon the parties.

| Page 12 of 16 |

5.3.8. Maximum Lawful Rate. In no event shall any payment made to any Buyer, any obligation on the part of the Company to pay any amount, or any collection by any Buyer pursuant to this Amendment or any other Transaction Documents, exceed the maximum amount or rate permissible under Applicable Law. Accordingly, if any obligation to pay, payment made to any Buyer, or collection by any Buyer pursuant the Transaction Documents is determined to be contrary to any such Applicable Law, such obligation to pay, payment or collection shall be deemed to have been made by mutual mistake of such Buyer and the Company and such amount shall be deemed to have been adjusted with retroactive effect to the maximum amount or rate of interest, as the case may be, as would not be so prohibited by Applicable Law. Such adjustment shall be effected, to the extent necessary, by reducing or refunding, at the option of the Company, the amount of interest or any other amounts which would constitute unlawful amounts required to be paid or actually paid to Buyers under the Transaction Documents.

5.3.9. Entire Agreement. This Amendment, the Securities, the other Transaction Documents and the schedules and exhibits attached hereto and thereto and the instruments referenced herein and therein constitute the entire understanding and agreement between the Buyers and the Company with respect to the subject matter hereof and thereof and supersede all other prior oral or written agreements, understandings, negotiations, discussions and undertakings between the Buyers and the Company relating to the subject matter hereof or thereo£

5.3.10. Consent to Amendments. No provision of this Amendment, the Amended Notes, or the other Transaction Documents may be amended, supplemented, or otherwise modified other than by an instrument in writing signed by the Company and the Required Buyers, and any amendment to any provision of this Amendment, the Amended Notes, or other Transaction Document made in conformity with the provisions of this Section 10.10 shall be binding on all Buyers and holders of Securities, as applicable, provided that no such amendment shall be effective to the extent that it applies to less than all of the holders of the Securities then outstanding.

5.3.11. Waiver. No waiver shall be effective unless it is in writing and signed by an authorized representative of the waiving party, provided however, that the Required Buyers may waive any provision of this Amendment, and any waiver of any provision of this Amendment made in conformity with the provisions of this Section 10.11 shall be binding on all Buyers and holders of Securities, as applicable.

5.3.12. Notices. All notices, requests, demands and other communications which are required or may be given under this Amendment shall be in writing and shall be deemed given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered via facsimile prior to 4:00 p.m. California time on a Business Day, (ii) the next Business Day after the date of transmission, if such notice or communication is delivered via facsimile on a day which is not a Business Day or later than 4:00 p.m. California time on a Business Day; (iii) the second Business Day following the date of mailing, if sent by nationally recognized overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given, in each case properly addressed to the party to receive the same and, provided confirmation of transmission, deposit, or delivery, as the case may be, is mechanically or electronically generated and kept on file by the sending party. The addresses, and facsimile numbers for such communications shall be:

| Page 13 of 16 |

If to the Company:

Aura Systems, Inc. 10541 Ashdale Street

Stanton Ca. 90680

Attention: Chief Executive Officer Telephone: (310) 643-5300

Facsimile: (310) 643-7457

If to a Buyer:

to its address, facsimile number or e-mail address set forth on the Schedule of Buyers, with copies to such Buyer’s representatives as set forth on Schedule A,

or at such other address or addresses or facsimile number and/or to the attention of such other Person as the recipient party may specify by written notice given in accordance with this Section 5.3.12.

5.3.13. Successors and Assigns. The Company shall not sell, assign, transfer or delegate any of its rights or obligations hereunder or under any other Transaction Document, or any interest herein or therein, by operation of law or otherwise, without the prior written consent of the Required Buyers. This Amendment shall otherwise inure to the benefit of, and be binding upon, the parties and its respective successors and assigns.

5.3.14. No Third Party Beneficiaries. This Amendment is intended for the benefit of the parties hereto and their respective permitted successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

5.3.15. Survival. The representations, warranties, agreements and covenants shall survive the Execution Date. Each Buyer shall be responsible only for its own representations, warranties, agreements and covenants hereunder.

5.3.16. Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as any other party may reasonably request in order to carry out the intent and accomplish the purposes of this Amendment and the consummation of the transactions contemplated hereby.

5.3.17. Construction. The language used in this Amendment will be deemed to be the language chosen by the parties to express their mutual intent, and no rules of strict construction will be applied against any party. This Agreement shall be deemed to be jointly drafted by the Company and each of the Buyers and shall not be construed against any Person as the drafter hereof.

| Page 14 of 16 |

5.3.18. Remedies. Each Buyer and each holder of any Securities shall have all rights and remedies set forth in the Transaction Documents, as the same are amended by this Amendment, and all rights and remedies which such holders have been granted at any time under any other agreement or contract and all of the rights which such holders have under any law. Any Person having any rights under any provision of this Agreement shall be entitled to enforce such rights specifically (without posting a bond or other security), to recover damages by reason of any breach of any provision of this Agreement and to exercise all other rights granted by law. Furthermore, the Company recognizes that in the event that it fails to perform, observe, or discharge any or all of its obligations under the Transaction Documents, any remedy at law may prove to be inadequate relief to the Buyers. The Company therefore agrees that the Buyers shall be entitled to seek specific performance and/or temporary, preliminary and permanent injunctive or other equitable relief from any court of competent jurisdiction in any such case without the necessity of proving actual damages and without posting a bond or other security.

5.3.19. Independent Nature of Buyers’ Obligations and Rights. Except as expressly stated otherwise, the obligations of each Buyer under the Transaction Documents are several and not joint with the obligations of any other Buyer, and no Buyer shall be responsible in any way for the performance of the obligations of any other Buyer under any Transaction Document. Each Buyer confirms that each Buyer has independently participated with the Company in the negotiation of the transaction contemplated hereby with the advice of its own counsel and advisors. It is expressly understood and agreed that each provision contained in this Agreement and in each other Transaction Document is between the Company and a Buyer, solely, and not between the Company and the Buyers collectively and not between and among the Buyers.

[signature page to follow]

| Page 15 of 16 |

IN WITNESS WHEREOF, the Signatories and the Company have each caused this Amendment to be duly executed as of the Execution Date set forth above.

| COMPANY: | ||

| AURA SYSTEMS, INC. | ||

| By: | /s/ Melvin Gagerman | |

| Name: | Melvin Gagerman | |

| Title: | Chief Executive Officer | |

| SIGNATORIES: | ||

RBC Capital Markets LLC Cust FBO Bruce M. Dresner IRA | ||

| By: | /s/ Bruce M. Dresner | |

| Name: | Bruce M. Dresner | |

| Title: | ||

| Robert T. Lempert | ||

| By: | /s/ Robert T. Lempert |

LPD Investments, Ltd | ||

| By: | /s/ Peter Dalrymple | |

| Name: | Peter Dalrymple | |

| Title: | G.P. | |

Kenmont Capital Partners, L.P. | ||

| By: | /s/ Donald R. Kendall, Jr. | |

| Name: | Donald R. Kendall, Jr. | |

| Title: | Managing Director | |

| Keith Guenther | ||

| By: | /s/ Keith Guenther |

| Page 16 of 16 |

EXHIBIT A

FORM OF AMENDED AND RESTATED WARRANT

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL TO THE HOLDER (IF REQUESTED BY THE COMPANY), IN A FORM REASONABLY ACCEPTABLE TO THE COMPANY, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD OR ELIGIBLE TO BE SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT. NOTWITHSTANDING THE FOREGOING, THE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.

| Warrant No. _____ (Replacing Warrant No. ___) | Date of Issuance: ________ |

AURA SYSTEMS, INC.

AMENDED AND RESTATED WARRANT TO PURCHASE COMMON STOCK

Aura Systems, Inc., a Delaware corporation (the “Company”), hereby certifies that, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, [_________________], or [its/his/her] permitted assigns (the “Holder”), is entitled, subject to the conditions set forth in this Amended and Restated Warrant to Purchase Common Stock (the “Warrant”), to subscribe for and purchase from the Company, at any time or from time to time during the Exercise Period, up to a total of [___________] fully paid and non-assessable shares of the Company’s Common Stock (the “Warrant Shares”), at an exercise price equal to $0.20 per share, subject to adjustment from time to time pursuant to the provisions of this Warrant, (the “Exercise Price”). This Warrant hereby amends and restates in its entirety, supersedes and replaces the warrant(s), as amended prior to the date hereof (the “Original Warrant”), issued and delivered by the Company to Holder in connection with that certain Securities Purchase Agreement entered into by and between the Company, Holder and certain other persons dated May 7, 2013 (the “Original Securities Purchase Agreement”), as amended by that certain First Amendment To Transaction Documents dated as of January 30, 2017 (as may be amended from time to time, the “Amendment Agreement”), by and between the Company and the Required Buyers (as that term is defined in Original Securities Purchase Agreement). The Original Warrant is from this date forward void and of no effect, whether or not submitted to the Company for cancellation. Unless otherwise indicated, all capitalized terms used and not otherwise defined in this Warrant have the respective meanings ascribed to them in the Amendment Agreement and/or the Original Securities Purchase Agreement. This Warrant is subject to the following provisions, terms and conditions:

1. DEFINITIONS. For the purpose of this Warrant, the following terms, whether or not capitalized or underlined in the text of this Warrant, shall have the following meanings:

“Aggregate Exercise Price” means the amount equal to the Exercise Price in effect on the date of such exercise multiplied by the number of Warrant Shares as to which this Warrant was so exercised.

| 1 |

“Bloomberg” means Bloomberg, L.P. or any successor entity.

“Business Day” means any day that is not a Saturday, a Sunday or a day on which banking institutions in the City of Los Angeles, California, are authorized or required by law to close.

“Common Stock” means (i) the Company’s shares of common stock, $0.0001 par value per share, and (ii) any capital stock into which such common stock shall have been changed or any share capital resulting from a reclassification of such common stock.

“Date of Issuance” means [__________].

“Exercise Date” means the date on which the Holder has fully complied with all requirements necessary to effectuate a Cash Exercise or Net Issuance, as the case may be, of Warrant Shares as set forth herein, provided however, that if such date is not a Business Day or the Holder satisfies such requirements after 5:00 p.m. Los Angeles time on a Business Day, then the Exercise Date shall be the immediately succeeding Business Day, unless that Business Day falls after the Expiration Date, in which case the Exercise Date shall be the immediately preceding Business Day.

“Exercise Period” means the period commencing on the Date of Issuance and ending at 5:00 p.m., Los Angeles time on .

“Expiration Date” means the date that is the seventh (7th) anniversary of the Date of Issuance, provided however, that if such date is not a Business Day, then the Expiration Date shall be the immediately succeeding Business Day.

“Fair Market Value” means the average of the Closing Sale Prices (as defined in the Securities Purchase Agreement) for the Common Stock on the Principal Market or, if the Common Stock is not listed on the electronic bulletin board, as reported by the principal U.S. national or regional securities exchange or quotation system on which the Common Stock is then listed or quoted, as reported by Bloomberg in each case for the seven (7) Trading Days prior to the date of determination of fair market value. If the Fair Market Value cannot be calculated on the foregoing basis, the Fair Market Value shall be the fair market value as determined in good faith by the Company’s Board of Directors.

“Options” means any rights, warrants or options to subscribe for or purchase shares of Common Stock.

“Original Warrants” has the meaning as prescribed in the Amendment Agreement.

“Person” means any entity, corporation, company, association, joint venture, joint stock company, partnership, trust, organization, individual (including personal representatives, executors and heirs of a deceased individual), nation, state, government (including agencies, departments, bureaus, boards, divisions and instrumentalities thereof), trustee, receiver or liquidator, as well as any syndicate or group that would be deemed to be a Person under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended..

“Principal Market” means the exchange or over-the-counter market on which the Common Stock is primarily listed on or quoted for trading, which, as of the date hereof is the OTC Bulletin Board.

“Resolutions” has the meaning as prescribed in the Amendment Agreement.

| 2 |

“Required Holders” means Holders holding or having the right to acquire at least fifty-one percent (51%) the total Warrant Shares issued to all Buyers under the Original Securities Purchase Agreement which are then unexercised and unexpired at the time any action of the Holders is required.

“Stockholder Meeting” has the meaning as prescribed in the Amendment Agreement.

“Trading Day” means any Business Day on which the Common Stock is traded on the Principal Market on which the Common Stock is then traded, provided that “Trading Day” shall not include any day on which the Common Stock is scheduled to trade on such Principal Market for less than 4.5 hours or any day that the Common Stock is suspended from trading during the final hour of trading on such Principal Market (or if such Principal Market does not designate in advance the closing time of trading on such Principal Market, then during the hour ending at 4:00:00 p.m., New York time) unless such day is otherwise designated as a Trading Day in writing by the Holder.

“Transaction Documents” means, collectively, this Warrant, the Senior Secured Convertible Notes, the Securities Purchase Agreement and the Collateral Documents, and each of the other agreements and instruments of even date herewith entered into or delivered by any of the parties hereto in connection with the transactions contemplated hereby and thereby, as may be amended from time to time.

“Voting Stock” of a Person means capital stock of such Person of the class or classes pursuant to which the holders thereof have the general voting power to elect, or the general power to appoint, at least a majority of the board of directors, managers, trustees or other similar governing body of such Person (irrespective of whether or not at the time capital stock of any other class or classes shall have or might have voting power by reason of the happening of any contingency)..

“VWAP” means, for any security as of any date, the dollar volume-weighted average price for such security on the Principal Market during the period beginning at 9:30:01 a.m., New York time, and ending at 4:00:00 p.m., New York time, as reported by Bloomberg through its “Volume at Price” function or, if the foregoing does not apply, the dollar volume-weighted average price of such security in the over-the-counter market on the electronic bulletin board for such security during the period beginning at 9:30:01 a.m., New York time, and ending at 4:00:00 p.m., New York time, as reported by Bloomberg, or, if no dollar volume-weighted average price is reported for such security by Bloomberg for such hours, the average of the highest closing bid price and the lowest closing ask price of any of the market makers for such security as reported in the “pink sheets” by OTC Markets Group Inc.

2. EXERCISE OF WARRANT.

(a) Method of Exercise. Subject to the terms and conditions hereof, by: (i) surrender of this Warrant at the principal office of the Company and delivery to the Company at its principal office of: (1) written notice of the Holder’s election to exercise this Warrant in the form attached hereto as Exhibit A (the “Exercise Notice”), duly completed and executed; and (2) the payment to the Company in cash or by wire transfer of immediately available funds in U.S. Dollars, of an amount equal to the then-applicable Exercise Price multiplied by the number of Warrant Shares then being purchased together with any applicable taxes or other amounts payable by the Holder pursuant to this Warrant (a “Cash Exercise”); or (ii) exercise of the “net issuance right” provided for in Section 2(b) below.

| 3 |

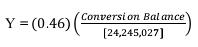

(b) Net Issuance Right. In lieu of Cash Exercise of this Warrant, the Holder may, at any time during the Exercise Period, elect to convert this Warrant, in whole or in part, into shares of Common Stock by surrender of this Warrant at the principal office of the Company and delivery to the Company at its principal office of a duly completed and executed Exercise Notice. Upon receipt of such Exercise Notice and surrender of the Warrant by the Holder, the Company shall deliver to the Holder, without payment by the Holder of any cash or other consideration, that number of shares of Common Stock computed using the following formula (a “Net Exercise”):

X = (Y) (A-B)

A

| Where: | X = | the number of shares of Common Stock to be issued to the Holder. |

| a | ||

| Y = | the total number of Warrant Shares with respect to which this Warrant is being exercised. | |

| A = | the average of the closing prices for Common Stock for the five Trading Days immediately prior to (but not including) the Exercise Date. | |

| B = | Exercise Price. |

(c) Issuance of Certificates. In the event of any exercise of the rights represented by this Warrant, certificates evidencing Warrant Shares so purchased or converted shall be issued and delivered to the Holder within a reasonable time, not exceeding four (4) Trading Days, following the Exercise Date. The stock certificate or certificates so delivered shall be in such denominations as may be requested by the Holder hereof and shall be registered in the name of said Holder or such other name as shall be designated by said Holder (subject to the transfer restrictions applicable to this Warrant and to shares purchased upon exercise of this Warrant). The person or persons in whose name(s) any certificate(s) representing shares of Common Stock shall be issuable upon exercise or conversion of this Warrant shall be deemed to have become the holder(s) of record of, and shall be treated for all purposes as the record holder(s) of, the Common Stock represented thereby (and such Common Stock shall be deemed to have been issued) as of 5:00 p.m. Los Angeles time on the Exercise Date.

(d) Payment of Certain Taxes. The Company shall pay any and all documentary, stamp or similar taxes that may be payable upon the initial issuance of this Warrant or upon the issuance of Warrant Shares upon the exercise or conversion of this Warrant or upon the issuance of stock certificates in respect thereof in the respective name of, or in such names as may be directed by, the Holder, provided however, that the Company shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such stock certificate, warrant, or other securities in a name other than that of the registered holder of this Warrant at the time surrendered upon exercise or conversion hereof, and the Company shall not be required to issue or deliver such certificates, warrant, or other securities unless and until the Person or Persons requesting the issuance thereof shall have paid to the Company the amount of such tax or shall have established to the satisfaction of the Company that such tax has been paid. The Holder shall be responsible for all other tax liabilities (including, without limitation, any and all income or income-based, capital gains or similar taxes) that may arise in connection with the issuance of this Warrant or as a result of holding or receiving Warrant Shares upon exercise or conversion hereof.

| 4 |

(e) Partial Exercise. If the Holder shall exercise or convert less than all of the Warrant Shares that could be purchased or received hereunder, the Company shall issue and deliver to the Holder, as promptly as reasonably practicable but in any event within five (5) Business Days following the Exercise Date, a new Warrant evidencing the Holder’s right to purchase the remaining Warrant Shares.

(f) Duration. All rights represented by this Warrant shall expire and become void as of the earlier of: (i) 5:00 p.m. Los Angeles time on the Expiration Date, at which time any portion of this Warrant not exercised or converted prior thereto shall expire unexercised and unconverted and be and become void and of no value; or (ii) the date on which all Warrant Shares are exercised or converted in full.

(g) No Fractional Shares. This Warrant shall be exercisable only for a whole number of Warrant Shares and no fractions of shares of Common Stock, or scrip for any such fractions of shares, shall be issued upon the exercise or conversion of this Warrant. In lieu of any fractional Warrant Shares to which the Holder would otherwise be entitled, the Company shall make a cash payment therefor equal to the product of such fraction multiplied by the Fair Market Value of one share of Common Stock on the Exercise Date.

3. CERTAIN ADJUSTMENTS. The Exercise Price and the number of Warrant Shares issuable upon exercise or conversion of this Warrant shall be subject to adjustment from time to time as set forth in this Section 3.

(a) Subdivisions, Combinations and Stock Dividends. If the Company shall at any time while this Warrant remains outstanding (i) subdivide one or more classes of its then outstanding shares of Common Stock into a larger number of shares by any stock split, stock dividend, recapitalization or otherwise, (ii) combine one or more classes of its then outstanding shares of Common Stock into a smaller number of shares by combination, by reverse stock split or otherwise, or (iii) pay a stock dividend on one or more classes of its then outstanding shares of Common Stock or otherwise makes a distribution on any class of capital stock that is payable in shares of Common Stock, then in each such case the Exercise Price shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock outstanding immediately before such event and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event. Any adjustment made pursuant to (i) or (ii) of this Section 3(a) shall become effective as of the first Business Day following the effective date of such subdivision or combination and any adjustment pursuant to (iii) of this Section 3(a) shall become effective as of the record date for the determination of stockholders entitled to receive such dividend or distribution, or in the event that no record date is fixed, upon the making of such dividend or distribution.

| 5 |

(b) Fundamental Transactions. If, at any time while this Warrant remains outstanding, (i) the Company shall, directly or indirectly, in or more related transactions (1) effect any merger or consolidation of the Company with or into another Person, (2) effect any sale of all or substantially all of its assets in one or a series of related transactions, (3) complete any tender offer or exchange offer (whether by the Company or another Person) pursuant to which holders of Common Stock are permitted to tender or exchange their shares for other securities, cash or property, or (4) effect any reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property, or (ii) any “person” or “group” (as these terms are used for purposes of Sections 13(d) and 14(d) of the 1934 Act and the rules and regulations promulgated thereunder) is or shall become the “beneficial owner” (as defined in Rule 13d-3 under the 1934 Act), directly or indirectly, of 50% or more of the aggregate voting power represented by issued and outstanding Voting Stock of the Company (in any such case a “Fundamental Transaction”), then the Holder shall have the right thereafter to receive, upon exercise of this Warrant, the same amount and kind of securities, cash or property as it would have been entitled to receive upon the occurrence of such Fundamental Transaction if it had been, immediately prior to such Fundamental Transaction, the holder of the number of Warrant Shares then issuable upon exercise in full of this Warrant (the “Alternate Consideration”). For purposes of any such exercise, the determination of the Exercise Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Company shall apportion the Exercise Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. At the Holder’s option and request, any successor to the Company or surviving entity in such Fundamental Transaction shall, either (1) issue to Holder a new warrant substantially in the form of this Warrant and consistent with the foregoing provisions and evidencing the Holder’s right to purchase the Alternate Consideration for the aggregate Exercise Price upon exercise thereof, or (2) timely purchase the Warrant from the Holder for a purchase price, payable in cash, equal to the Black-Scholes Value of the remaining unexercised portion of this Warrant on the effective date of the Fundamental Transaction. Black-Scholes Value shall be determined in accordance with the Black-Scholes Option Pricing Model obtained from the “OV” function on Bloomberg using (A) a price per share of Common Stock equal to the VWAP of the Common Stock for the Trading Day immediately preceding the date of consummation of the applicable Fundamental Transaction, (B) a risk-free interest rate corresponding to the U.S. Treasury rate for a period equal to the remaining term of this Warrant as of the date of such request and (C) an expected volatility equal to the 100 day volatility obtained from the HVT function on Bloomberg determined as of the Trading Day immediately following the public announcement of the applicable Fundamental Transaction.

(c) Purchase Rights. In addition to any other adjustments pursuant to this Section 3, if at any time while this Warrant remains outstanding the Company grants, issues or sells any Options or rights to purchase stock, warrants, securities or other property pro rata to all or substantially all of the record holders of any class of shares of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights.

| 6 |

(d) Calculations. All calculations under this Section 3 shall be made to the nearest whole cent or the nearest 1/100th of a share, as applicable. For purposes of this Section 3, the number of shares of Common Stock deemed to be issued and outstanding at any given time shall not include shares owned or held by or for the account of the Company.

(e) Notice of Transaction. If the Company shall at any time while this Warrant remains outstanding (i) subdivide one or more classes of its then outstanding shares of Common Stock into a larger number of shares by any stock split, stock dividend, recapitalization or otherwise, (ii) combine one or more classes of its then outstanding shares of Common Stock into a smaller number of shares by combination, reverse stock split or otherwise, or (iii) pay a stock dividend on one or more classes of its then outstanding shares of Common Stock or otherwise makes a distribution on any class of capital stock that is payable in shares of Common Stock; (iv) enter into a Fundamental Transaction, or (v) issues Purchase Rights, then in each case the Company shall give written notice to the Holder at least seven (7) Business Days prior to the applicable record date or effective date on which a Person would need to be a stockholder in order to participate in or vote with respect to such transaction; provided however, that the failure to deliver such notice or any defect therein shall not invalidate or otherwise affect the validity of any corporate action taken with respect to such transaction or event.

(f) Notice of Adjustment. When any adjustment is required to be made in the number or kind of shares of Common Stock purchasable upon exercise or conversion of the Warrant, or in the Exercise Price, the Company shall promptly notify the Holder of such adjusted Exercise Price or such event and of the number of shares of Common Stock or other securities or property thereafter purchasable upon exercise of this Warrant.

4. RECORDATION OF WARRANT. The Company shall register this Warrant, upon records to be maintained by the Company for that purpose (the “Warrant Register”). The Warrant Register shall set forth (i) the number of this Warrant, (ii) the name and address of the Holder hereof, (iii) the original number of Warrant Shares purchasable upon the exercise or conversion hereof, (iv) the number of Warrant Shares purchasable upon the exercise hereof, as adjusted from time to time in accordance with the terms of this Warrant and (v) the Exercise Price for each Warrant Share, as adjusted from time to time in accordance with the terms of this Warrant. The Company shall be entitled to treat the Holder of this Warrant as the owner in fact hereof for all purposes and shall not be bound to recognize any equitable or other claim to or interest in such Warrant on the part of any other Person.

5. RESERVATION OF SHARES. The Company shall at all times during the period within which the rights represented by this Warrant may be exercised, keep reserved for issuance a number of shares of Common Stock as shall from time to time be sufficient to satisfy the Company’s then-existing obligation to issue Warrant Shares hereunder. If, at any time during the Exercise Period, the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the exercise of all then-unexercised Warrant Shares, in addition to such other remedies as shall be available to the Holder, the Company will timely take such corporate action as may be reasonably necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to its Certificate of Incorporation. All Warrant Shares will be duly and validly authorized and, upon issuance in accordance with the terms and conditions hereof, will be fully paid and nonassessable.

| 7 |

6. NO IMPAIRMENT. While this Warrant remains outstanding, the Company will not, by amendment of its Certificate of Incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of the terms of this Warrant provided however, that the Company may seek stockholder approval of the Resolutions at a Stockholder Meeting. The Company will at all times in good faith assist in the carrying out of all the provisions of this Warrant will take all such actions as may reasonably be requested by the Holder to protect the right granted to the Holder hereunder against impairment.

7. NO RIGHTS OR LIABILITIES AS A STOCKHOLDER. Neither this Warrant nor any provision hereof shall entitle Holder, solely in its capacity as a holder of this Warrant, to vote or receive dividends or be deemed the holder of share capital of the Company for any purpose, nor shall anything contained in this Warrant be construed to confer upon the Holder, solely in its capacity as the holder of this Warrant, any of the rights of a stockholder of the Company or any right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise, prior to issuance to the Holder of the Warrant Shares which Holder is then entitled to receive upon the due exercise or conversion of this Warrant. No provision of this Warrant, in the absence of affirmative action by the Holder to purchase Warrant Shares, and no mere enumeration herein of the rights or privileges of the Holder, shall give rise to any liability of such Holder for the Exercise Price or as a Stockholder of the Company, whether such liability is asserted by the Company or by creditors of the Company.

8. TRANSFER AND EXCHANGE.

(a) Transfer of Warrants. This Warrant may not be transferred or assigned, in whole or in part, except in compliance with all applicable federal and state securities laws. To the extent permitted by applicable securities laws and subject to the terms of this Warrant, this Warrant may be transferred, in whole or in part, to any Person, by (i) execution and delivery of the Notice of Assignment attached hereto as Exhibit B and (ii) surrender of this Warrant for registration of transfer at the primary executive office of the Company, together with funds sufficient to pay any applicable transfer tax. Upon receipt of the duly executed Notice of Assignment and the necessary transfer tax funds, if any, the Company, at its expense, shall execute and deliver, (i) in the name of the designated transferee or transferees, one or more new Warrants representing the right to purchase a like aggregate number of shares of Common Stock so transferred and (ii) a new Warrant evidencing the remaining portion, if any, of this Warrant not so transferred to the transferring Holder (each a “New Warrant”). The acceptance of the New Warrant by the transferee thereof shall be deemed the acceptance by such transferee of all of the right and obligations of a holder of a Warrant. Warrants and Warrant Shares may only be disposed of in compliance with state and federal securities laws. In connection with any transfer hereunder, the Company may require the transferring Holder to provide to the Company an opinion of counsel selected by the transferor, the form and substance of which opinion shall be reasonably satisfactory to the Company, to the effect that such transfer does not require registration under the Securities Act of 1933, as amended, and otherwise is not in contravention of applicable state or federal securities laws.

| 8 |

(b) Exchange of Warrant. This Warrant is exchangeable, upon the surrender hereof by the Holder at the principal office of the Company and upon delivery to the Company of a written request signed by the Holder thereof specifying the number and denominations of the Warrant(s) to be issued in such exchange and the name(s) in which such Warrant(s) are to be issued, for another Warrant of like kind and tenor representing in the aggregate the right to purchase the same number of Warrant Shares which could be purchased pursuant to the Warrant being so exchanged.

(c) Replacement of Lost, Stolen or Mutilated Warrant. Upon receipt by the Company of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Warrant and, in the case of any such loss, theft or destruction, upon receipt by the Company of an indemnity agreement reasonably satisfactory in form and amount to the Company or, in the case of any such mutilation, upon surrender and cancellation of such mutilated Warrant, the Company will execute and deliver within five (5) Business Days, in lieu of the lost, stolen, destroyed or mutilated Warrant, a new warrant of like tenor representing the right to purchase the Warrant Shares then underlying this Warrant.

9. SECURITIES ACT LEGEND. This Warrant and all Warrant Shares issued upon exercise or conversion hereof shall be stamped or imprinted with a legend in substantially the following form (in addition to any legend required by state securities laws):

[NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE [CONVERTIBLE] [EXERCISABLE] HAVE BEEN][THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN] REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL TO THE HOLDER (IF REQUESTED BY THE COMPANY), IN A FORM REASONABLY ACCEPTABLE TO THE COMPANY, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD OR ELIGIBLE TO BE SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT. NOTWITHSTANDING THE FOREGOING, THE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.