Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Wesco Aircraft Holdings, Inc | wair-12312016x8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Wesco Aircraft Holdings, Inc | wair-12312016xex991.htm |

Q1 2017 EARNINGS CALL PRESENTATION

February 7, 2017

Dave Castagnola

President and Chief Executive Officer

Rick Weller

Executive Vice President and Chief Financial Officer

Information in this presentation should be read in conjunction

with Wesco Aircraft’s earnings press release and tables for the

fiscal 2017 first quarter.

Wesco Aircraft Proprietary

Visit www.wescoair.com

Disclaimer

2

Wesco Aircraft – Investor Relations

This presentation contains forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning Wesco Aircraft Holdings, Inc. (“Wesco Aircraft “ or the “Company”). These

statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of management, as well as assumptions made by,

and information currently available to, management. In some cases, you can identify forward-looking statements by the use of forward-looking terms such as “assume,” “anticipate,” “believe,” “continue,” “drive,” “expect,”

“forecast,” “grow,” “improve,” “increase,” “outlook,” “may,” “target,” “will,” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside

the Company’s control. Therefore, you should not place undue reliance on such statements.

Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, the following: general economic and industry conditions; conditions in the credit markets;

changes in military spending; risks unique to suppliers of equipment and services to the U.S. government; risks associated with the Company’s long-term, fixed-price agreements that have no guarantee of future sales volumes;

risks associated with the loss of significant customers, a material reduction in purchase orders by significant customers, or the delay, scaling back or elimination of significant programs on which the Company relies; the

Company’s ability to effectively compete in its industry; the Company’s ability to effectively manage its inventory; the Company’s suppliers’ ability to provide it with the products the Company sells in a timely manner, in

adequate quantities and/or at a reasonable cost; the Company’s ability to maintain effective information technology systems; the Company’s ability to retain key personnel; risks associated with the Company’s international

operations, including exposure to foreign currency movements; risks associated with assumptions the Company makes in connection with its critical accounting estimates (including goodwill) and legal proceedings; the

Company’s dependence on third-party package delivery companies; fuel price risks; fluctuations in the Company’s financial results from period-to-period; environmental risks; risks related to the handling, transportation and

storage of chemical products; risks related to the aerospace industry and the regulation thereof; risks related to the Company’s indebtedness; and other risks and uncertainties.

The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the Company’s business, including those described in the Company’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed from time to time with the Securities and Exchange Commission. All forward-looking statements included in this

presentation (including information included or incorporated by reference herein) are based upon information available to the Company as of the date hereof, and the Company undertakes no obligation to update or revise

publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

The Company utilizes and discusses Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Basic Earnings Per Share (EPS), Adjusted Diluted

EPS, Constant-Currency Sales, Free Cash Flow and Free Cash Flow Conversion, which are non-GAAP measures its management uses to evaluate its business, because the Company believes they assist investors and analysts in

comparing its performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance. The Company believes these metrics are used in

the financial community, and the Company presents these metrics to enhance understanding of its operating performance. You should not consider Adjusted EBITDA and Adjusted Net Income as alternatives to Net Income,

determined in accordance with GAAP, as an indicator of operating performance. Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Constant-Currency Sales, Free Cash

Flow and Free Cash Flow Conversion are not measurements of financial performance under GAAP, and these metrics may not be comparable to similarly titled measures of other companies. See the Appendix for a reconciliation

of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Constant-Currency Sales, Free Cash Flow and Free Cash Flow Conversion to the most directly comparable financial

measures calculated and presented in accordance with GAAP.

Booking new wins and renewing contracts at accelerated pace – driving increased investment

New business awards with strategic customers – total contract value ~$430M in fiscal 2016 and 1Q17

Annualized value of ~$130M, approximately half expected to be realized in fiscal 2017

Significant wins across hardware, chemicals and electronics with major aerospace and defense customers

Contract renewals – total contract value ~$2B (renewal rate ~98%); annualized value ~$400M

Increasing contribution from new business into fiscal 2017

3

Fiscal 2017 Focus on Growth and Margins

Wesco Aircraft Proprietary

Visit www.wescoair.com

Broad Portfolio of Products and Services – Unmatched Value Proposition

New Business Provides Confidence in Fiscal 2017 Sales Outlook

Wesco Aircraft – Investor Relations

Wesco Aircraft Proprietary

Visit www.wescoair.com

1Q17 Overview

4

Wesco Aircraft – Investor Relations

New business realized in Q1 sales of ~$11M – starting to see benefits of growth strategy

External pressures more than offset new business in Q1:

FX, temporary consumption disruption, production schedule changes by commercial OE customer

Impact on ad-hoc – added to effect of previously discussed OEM inventory adjustments

Moderated benefit from new wins on contract sales

Lower sales volumes, mix pressured margins and profitability

Reassessed inventory assumptions in fiscal 2017 to support new business – buying more at faster pace

Supporting Growth Through Increased Investment

Wesco Aircraft Proprietary

Visit www.wescoair.com

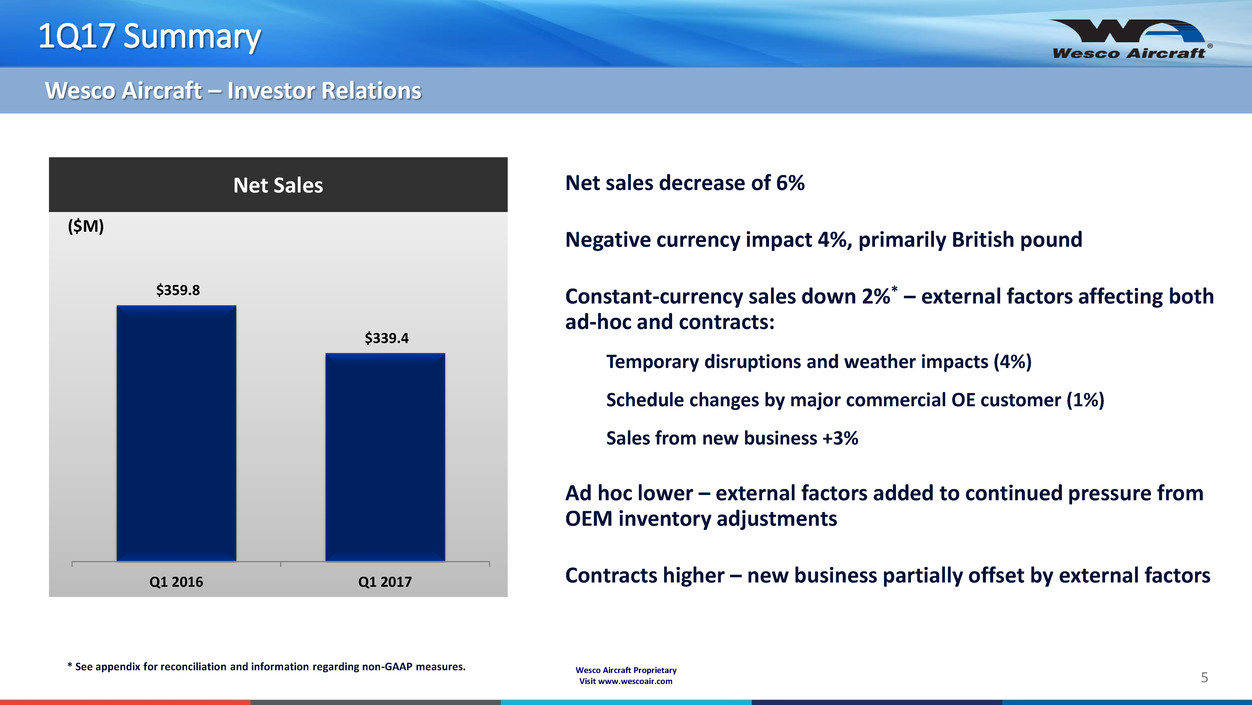

1Q17 Summary

5

Wesco Aircraft – Investor Relations

$359.8

$339.4

Q1 2016 Q1 2017

Net Sales

($M)

Net sales decrease of 6%

Negative currency impact 4%, primarily British pound

Constant-currency sales down 2%* – external factors affecting both

ad-hoc and contracts:

Temporary disruptions and weather impacts (4%)

Schedule changes by major commercial OE customer (1%)

Sales from new business +3%

Ad hoc lower – external factors added to continued pressure from

OEM inventory adjustments

Contracts higher – new business partially offset by external factors

* See appendix for reconciliation and information regarding non-GAAP measures.

Wesco Aircraft Proprietary

Visit www.wescoair.com

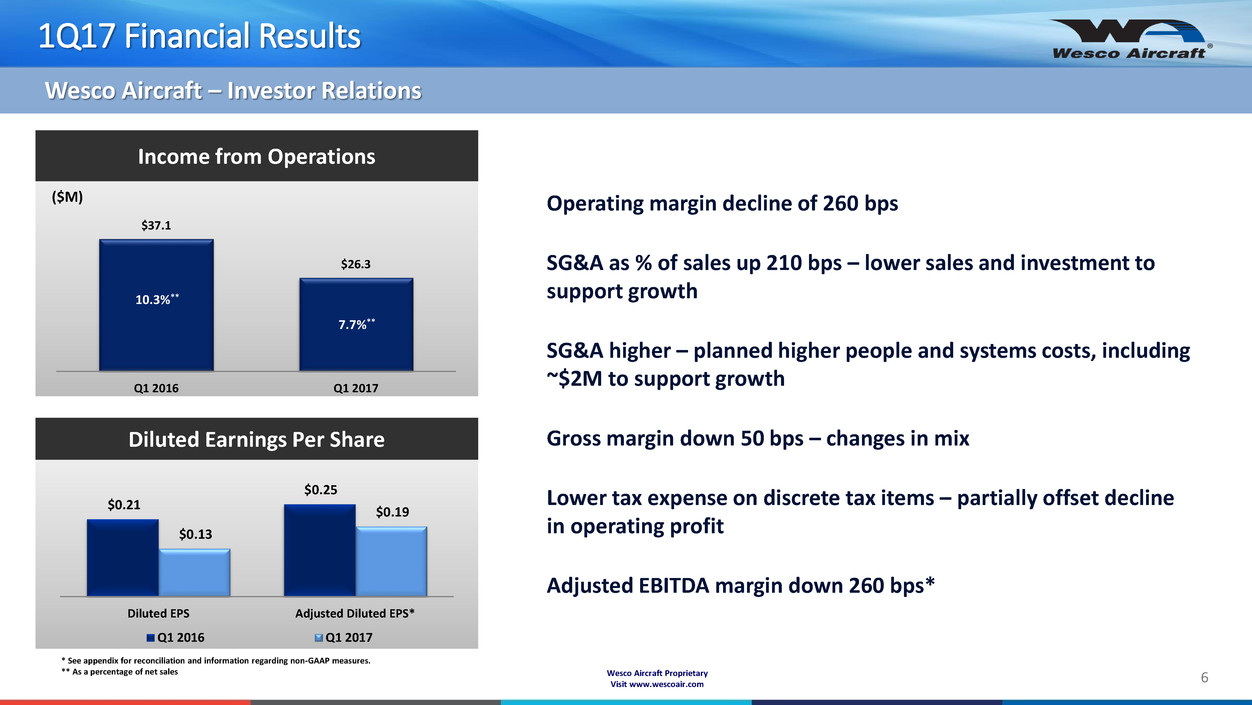

1Q17 Financial Results

6

Diluted Earnings Per Share

* See appendix for reconciliation and information regarding non-GAAP measures.

** As a percentage of net sales

Income from Operations

$37.1

$26.3

Q1 2016 Q1 2017

10.3%**

7.7%**

Wesco Aircraft – Investor Relations

($M) Operating margin decline of 260 bps

SG&A as % of sales up 210 bps – lower sales and investment to

support growth

SG&A higher – planned higher people and systems costs, including

~$2M to support growth

Gross margin down 50 bps – changes in mix

Lower tax expense on discrete tax items – partially offset decline

in operating profit

Adjusted EBITDA margin down 260 bps*

$0.21

$0.25

$0.13

$0.19

Diluted EPS Adjusted Diluted EPS*

Q1 2016 Q1 2017

Wesco Aircraft Proprietary

Visit www.wescoair.com

1Q17 Segments – North America

7

Net Sales

Net sales decrease of 6%

Lower ad-hoc and contract sales

Impact from temporary customer disruptions, schedule

changes by commercial OE customer

Contract sales decline partially offset by new business

growth

Operating margin down 370 bps

SG&A as % of sales up 280 bps – lower sales volumes,

investment

Gross margin decline of 90 bps – changes in mix

Income from Operations

$287.0

$270.5

Q1 2016 Q1 2017

$29.1

$17.3

Q1 2016 Q1 2017

10.1%*

6.4%*

Wesco Aircraft – Investor Relations

($M)

($M)

* As a percentage of net sales

Wesco Aircraft Proprietary

Visit www.wescoair.com

1Q17 Segments – Rest of World

8

Net Sales

Income from Operations

$72.9

$68.9

Q1 2016 Q1 2017

$8.0

$9.0

Q1 2016 Q1 2017

11.0%** 13.0%

**

Net sales decrease of 5%

Negative currency impact of $14M

Constant-currency sales up 13%*

Growth in ad hoc and contract sales

Operating margin 200 bps higher

Gross margin increase of 100 bps – changes in mix

SG&A as % of net sales down 110 bps

Establishment of new U.K. legal entity on track

Wesco Aircraft – Investor Relations

($M)

($M)

* See appendix for reconciliation and information regarding non-GAAP measures.

** As a percentage of net sales

Wesco Aircraft Proprietary

Visit www.wescoair.com

Financial Summary

9

(Dollars in Millions)

Dec. 31,

2016

Sept. 30,

2016

Dec. 31,

2015

At period end:

Cash and cash equivalents $51.2 $77.1 $85.7

Accounts receivable 247.3 249.2 238.1

Net inventory 751.7 713.5 723.6

Accounts payable 173.1 181.7 165.8

Total debt* 843.2 834.3

938.6

Stockholders’ equity 889.7 882.9

834.3

Wesco Aircraft – Investor Relations

* Total debt at Dec. 31, 2016 and 2015 includes current portion of $40.0M and $3.6M, respectively.

Wesco Aircraft Proprietary

Visit www.wescoair.com

Cash Flow Summary

10

(Dollars in Millions)

Dec. 31,

2016

Sept. 30,

2016

Dec. 31,

2015

Quarter ended:

Net income $13.1 $23.3 $20.6

Adjustments to reconcile to operating cash flow 12.4 20.0 11.1

Working capital change (53.6) 7.6 (21.0)

Net cash (used in) provided by operating activities (28.1) 50.9 10.7

Purchase of property and equipment (1.3) (2.9) (1.2)

Free cash flow (29.4) 48.0 9.5

Net income 13.1 23.3 20.6

Free cash flow conversion NM 206% 46%

Wesco Aircraft – Investor Relations

NM – not meaningful

11

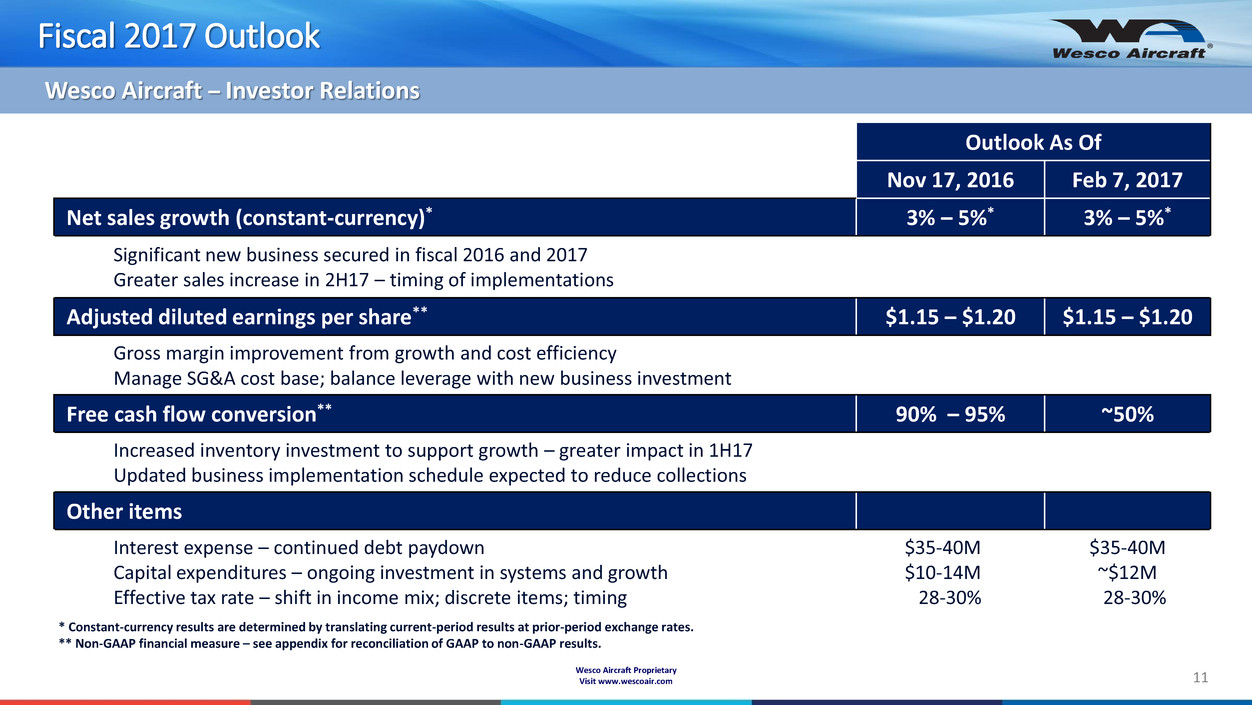

Fiscal 2017 Outlook

Wesco Aircraft Proprietary

Visit www.wescoair.com

Outlook As Of

Nov 17, 2016 Feb 7, 2017

Net sales growth (constant-currency)* 3% – 5%* 3% – 5%*

Significant new business secured in fiscal 2016 and 2017

Greater sales increase in 2H17 – timing of implementations

Adjusted diluted earnings per share** $1.15 – $1.20 $1.15 – $1.20

Gross margin improvement from growth and cost efficiency

Manage SG&A cost base; balance leverage with new business investment

Free cash flow conversion** 90% – 95% ~50%

Increased inventory investment to support growth – greater impact in 1H17

Updated business implementation schedule expected to reduce collections

Other items

Interest expense – continued debt paydown

Capital expenditures – ongoing investment in systems and growth

Effective tax rate – shift in income mix; discrete items; timing

$35-40M

$10-14M

28-30%

$35-40M

~$12M

28-30%

Wesco Aircraft – Investor Relations

* Constant-currency results are determined by translating current-period results at prior-period exchange rates.

** Non-GAAP financial measure – see appendix for reconciliation of GAAP to non-GAAP results.

Wesco Aircraft Proprietary

Visit www.wescoair.com

Summary

12

Wesco Aircraft – Investor Relations

Focus on driving growth and improving margins

Underlying business strength not fully reflected in Q1 results

Addressing FX translational impact; recovering from temporary consumption disruption

Booking new business and renewals at an accelerated pace – driving sales results

Expect pace of sales realization to quicken in fiscal 2017 – subject to implementation timing

Greater investment in inventory to support growth

Growth and Investment Expected to Deliver Long-Term Value

APPENDIX

13

Wesco Aircraft Proprietary

Visit www.wescoair.com

Non-GAAP Financial Information

14

Wesco Aircraft – Investor Relations

‘‘Adjusted EBITDA’’ represents Net Income (Loss) before: (i) income tax provision (benefit), (ii) net interest expense, (iii) depreciation and amortization and (iv) unusual or non-recurring items; “Adjusted

EBITDA Margin” represents Adjusted EBITDA divided by Net Sales.

‘‘Adjusted Net Income’’ represents Net Income (Loss) before: (i) amortization of intangible assets, (ii) amortization or write-off of deferred financing costs, (iii) unusual or non-recurring items and (iv)

the tax effect of items (i) through (iii) above calculated using an estimated effective tax rate.

“Adjusted Basic EPS” represents Basic EPS calculated using Adjusted Net Income as opposed to Net Income.

“Adjusted Diluted EPS” represents Diluted EPS calculated using Adjusted Net Income as opposed to Net Income.

“Constant-Currency Sales” represent net sales for the fiscal 2017 first quarter translated at the corresponding fiscal 2016 periodical average exchange rates. For the fiscal 2017 outlook, constant-

currency results are determined by translating current-period results at prior-period exchange rates.

“Free Cash Flow” represents net cash (used in) provided by operating activities less purchases of property and equipment; “Free Cash Flow Conversion” represents Free Cash Flow divided by Net

Income.

Wesco Aircraft utilizes and discusses Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Constant-Currency Sales, Free Cash Flow and Free Cash

Flow Conversion, which are non-GAAP measures our management uses to evaluate our business, because we believe they assist investors and analysts in comparing our performance across reporting

periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. We believe these metrics are used in the financial community, and we present

these metrics to enhance understanding of our operating performance. You should not consider Adjusted EBITDA and Adjusted Net Income as alternatives to Net Income, determined in accordance

with GAAP, as an indicator of operating performance. Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Constant-Currency Sales, Free Cash

Flow and Free Cash Flow Conversion are not measurements of financial performance under GAAP, and these metrics may not be comparable to similarly titled measures of other companies. See the

following slides for a reconciliation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Constant-Currency Sales, Free Cash Flow and Free Cash

Flow Conversion to the most directly comparable financial measures calculated and presented in accordance with GAAP.

Non-GAAP Financial Information

15 Wesco Aircraft Proprietary

Visit www.wescoair.com

Wesco Aircraft – Investor Relations

2016 2015

Net Sales 339,371$ 359,843$

EBITDA & Adjusted EBITDA

Net income (loss) 13,107$ 20,609$

Provision for income taxes 2,364 8,379

Interest expense, net 11,073 8,997

Depreciation and amortization 6,729 6,997

EBITDA 33,273 44,982

Unusual or non-recurring items (1) 1,015 629

Adjusted EBITDA 34,288$ 45,611$

Adjusted EBITDA margin 10.1% 12.7%

Adjusted Net Income (Loss)

Net income (loss) 13,107$ 20,609$

Amortization of intangible assets 3,721 3,963

Amortization of deferred financing costs 3,202 828

Unusual or non-recurring items (1) 1,015 629

Adjustments for tax effect (2,547) (1,856)

Adjusted net income 18,498$ 24,173$

Adjusted Basic Earnings Per Share

Weight-average number of basic share outstanding 98,319,926 97,217,924

Adjusted net incomer per basic share 0.19$ 0.25$

Adjusted Diluted Earnings Per Share

Weight-average number of diluted shares outstanding 98,821,794 97,939,423

Adjusted net income per diluted shares 0.19$ 0.25$

(1) Unusual and non-recurring items in the first quarter of fiscal 2017 consisted of business realignment and other expenses of $1.0 million. Unusual

and non-recurring items in the first quarter of fiscal 2016 consisted of integration and other related expenses of $0.4 million, as well as business

realignment and other expenses of $0.2 million.

Wesco Aircraft Holdings, Inc.

Non-GAAP Financial Information ( UNAUDITED)

(In thousands, except share data)

Three Months Ended

December 31,

Non-GAAP Financial Information

16

Wesco Aircraft Proprietary

Visit www.wescoair.com

Wesco Aircraft – Investor Relations

December 31,

2016

December 31,

2015

Increase /

(Decrease)

Percent

Change

Consolidated

Net sales 339,371$ 359,843$ (20,472)$ -5.7%

Currency translation impact 13,606 - 13,606

Constant-currency sales 352,977$ 359,843$ (6,866)$ -1.9%

est of World

Net sales 68,902$ 72,883$ (3,981)$ -5.5%

Currency translation impact 13,606 - 13,606

Constant-currency sales 82,508$ 72,883$ 9,625$ 13.2%

Wesco Aircraft Holdings, Inc.

Non-GAAP Financial Information (UNAUDITED)

(Dollars In thousands)

Three Months Ended

Non-GAAP Financial Information

17

Wesco Aircraft Proprietary

Visit www.wescoair.com

Wesco Aircraft – Investor Relations

Fiscal 2017

Outlook

Diluted earnings per share $1.00 - $1.05

Amortization of intangible assets 0.15

Amortization of deferred financing costs 0.05

Unusual or non-recurring items (2) 0.02

Adjustments for tax effect (0.07)

Adjusted diluted earnings per share $1.15 - $1.20

Cash provided by operating activities ~ $62,000

Purchase of property and equipment ~ ($12,000)

Free cash flow ~ $50,000

Free cash flow conversion ~ 50%

(2) Primarily facility network realignment costs.

Wesco Aircraft Holdings, Inc.

Non-GAAP Financial Information - Fiscal 2017 Outlook (UNAUDITED)

(In thousands, except share data)

For more information, please visit www.wescoair.com.

THANK YOU FOR YOUR INTEREST

IN WESCO AIRCRAFT