Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Coca-Cola Consolidated, Inc. | d340240dex991.htm |

| 8-K - FORM 8-K - Coca-Cola Consolidated, Inc. | d340240d8k.htm |

Exhibit 99.2

COCA-COLA PLAZA

ATLANTA, GEORGIA

| J. ALEXANDER M. DOUGLAS, JR. PRESIDENT, COCA-COLA NORTH AMERICA |

P. O. BOX 1734 ATLANTA, GA 30301

404 676-4421 FAX 404-598-4421 |

February 6, 2017

J. Frank Harrison III

Chairman and Chief Executive Officer

Coca-Cola Bottling Co. Consolidated

4100 Coca-Cola Plaza

Charlotte, NC 28211

Dear Frank,

This letter (“Letter of Intent”) sets forth the general terms and conditions pursuant to which Coca-Cola Refreshments USA, Inc. (“CCR”), a wholly owned subsidiary of The Coca-Cola Company (“TCCC”), or one of its affiliates, will grant certain exclusive territory rights and sell certain distribution assets to Coca-Cola Bottling Co. Consolidated (“Bottler”), as further described below:

1. Grant of Exclusive Territory Rights for TCCC Beverages & Comprehensive Beverage Agreement. As part of the transaction described herein (the “Transaction”), CCR will grant Bottler certain exclusive rights for the distribution, promotion, marketing and sale in the geographic area described in Exhibit A (the “Sub-Bottling Territory”) of TCCC-owned and -licensed beverage products. Such rights will be granted via a Comprehensive Beverage Agreement among TCCC, CCR and Bottler in substantially in the form attached as Exhibit 1.1 to the Territory Conversion Agreement, dated September 23, 2015, as amended, among TCCC, CCR and Bottler, or as an amendment to Bottler’s then-existing Comprehensive Beverage Agreement (in either case, the “CBA”).

2. Sale of Exclusive Territory Rights for Certain Cross-Licensed Brands. CCR will also sell, transfer and assign to Bottler certain exclusive territory rights for the distribution, promotion, marketing and sale in the Sub-Bottling Territory of the cross-licensed brands (if any) then distributed in the Sub-Bottling Territory and acquired by CCR at the time of its acquisition of the Sub-Bottling Territory (the “Cross-Licensed Brands”). Such sale, transfer and assignment will be via such agreements as are mutually agreed by the parties, including the Definitive Agreement (as defined below), and will be subject to the consent of third party brand owners.

3. Sale of Distribution Assets and Working Capital. In connection with the grant of the exclusive territory rights referred to in the two preceding sections, CCR will sell, transfer and assign to Bottler certain distribution assets and the working capital associated therewith, all as may be necessary to distribute, promote, market and sell the Covered Beverages (as defined in the CBA), Related Products (as defined in the CBA) and Cross-Licensed Brands in the Sub-Bottling Territory and as will be more particularly described in the Definitive Agreement.

Classified - Confidential

4. Participation in System Governance Activities. Bottler and CCR/TCCC agree to implement in the Sub-Bottling Territory binding System governance consistent with the Coca-Cola System Governance Letter Agreement described in the CBA and their ongoing implementation of such governance in Bottler’s existing distribution territories for Coca-Cola products.

5. Economic Participation. As part of the Transaction, Bottler, CCR and TCCC intend to implement arrangements under which Bottler will be provided opportunities to participate economically in (a) the U.S. existing non-DSD businesses, and (b) future non-DSD products and/or business models. The parties currently anticipate that their implementation of such arrangements will be consistent with their ongoing discussions of the topic with such improvements as the parties may mutually agree.

6. Definitive Agreement. The transactions described in this Letter of Intent will be subject to the terms of one or more definitive agreements (all such agreements being collectively referred to herein as the “Definitive Agreement”) in substantially the same form as similar agreements entered into by the parties in past transactions.

7. Economic Consideration for the Transaction. In exchange for the grant of exclusive territory rights in the Sub-Bottling Territory for the Covered Beverages and Related Products, the sale of distribution rights in the Sub-Bottling Territory for the Cross Licensed Brands, and the sale of the distribution assets and working capital as described above, Bottler will pay to CCR: (a) a cash amount that reflects (i) the agreed value of the exclusive territory rights in the Sub-Bottling Territory for the Cross-Licensed Brands (including the distribution assets and working capital applicable thereto), and (ii) the net book value of the other distribution assets and working capital used in the Sub-Bottling Territory, which amount will be payable to CCR at the Closing; and (b) sub-bottling payments for the grant of exclusive rights for the distribution, promotion, marketing and sale of Covered Beverages and Related Products in the Sub-Bottling Territory, which payments will be made to CCR on a regular basis after the Closing. The calculation of such amounts to be paid, and any adjustments to those amounts, will be determined in the same manner as in the most recently executed definitive agreements between the parties for similar transactions.

8. Conditions to Closing. CCR and Bottler each intend to include closing conditions in the Definitive Agreement that include, without limitation, CCR’s acquisition of the distribution business in the Sub-Bottling Territory currently operated by another bottler at or immediately prior to the Closing, the parties’ completion of customary transition activities, the expiration or termination of the applicable waiting period (and any extension thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, execution of the CBA, the grant of applicable third party consents, and the completion of such other legal agreements as are necessary for the consummation of the Transaction. In addition and consistent with past practice in similar transactions, the Definitive Agreement will contain mutually agreeable covenants regarding the satisfactory conduct of due diligence activities prior to the Closing.

Classified - Confidential

9. Anticipated Schedule. The parties anticipate that, shortly after their execution of this Letter of Intent, there may be a joint public announcement by the parties of the Transaction and, subject to applicable regulatory requirements, detailed due diligence and joint integration planning and change management activities will then begin. The parties further anticipate that the Definitive Agreements and other formal legal agreements will be executed during 2017 and that the Closing pursuant to the Definitive Agreement will be completed later in 2017. Notwithstanding the foregoing, the parties acknowledge and agree that the before mentioned dates are estimates only, and are subject to change based on the parties’ discussions, changing business conditions, and other matters.

10. Board Approvals. This Letter of Intent is subject to the approval processes of the respective parties, including approval of each of their Boards of Directors.

11. Transition Planning Period and Activities. The parties anticipate that, in order to ensure a smooth transition of the distribution business in the Sub-Bottling Territory to Bottler and subject to applicable regulatory requirements, beginning on the date of execution of this Letter of Intent and continuing until the earlier of the termination of this Letter of Intent, execution of the Definitive Agreement, or the Closing (as applicable), they will engage in a number of joint integration planning and change management activities.

12. Due Diligence; Pre-Closing Activities. The parties anticipate that prior to execution of the Definitive Agreement and continuing until the Closing, Bottler will perform such due diligence on the distribution business as is customary for a transaction of this nature and complexity including, without limitation, in the areas of finance, operations, environmental, legal, tax, and employment. CCR will work with Bottler and the bottler currently operating the distribution business in the Sub-Bottling Territory in good faith to assist Bottler in obtaining reasonable and customary access to such distribution business for purposes of completing such due diligence.

13. Expenses. Except as otherwise expressly agreed by the parties, each party will bear its own fees and expenses incurred in connection with the Transaction, including with respect to any due diligence, negotiation, preparation of documentation, the Closing and legal, accounting, consulting, travel and other similar fees or expenses, whether or not Definitive Agreement is reached.

14. Termination. This Letter of Intent may be terminated: (a) by mutual written consent of CCR and Bottler; or (b) upon written notice by CCR or Bottler to the other party if the Definitive Agreements have not been executed on or prior to December 31, 2017.

15. Non-Binding. This Letter of Intent expresses the present intent of the parties to enter into each Definitive Agreement and supporting operating agreements based on the principal terms and conditions set forth herein. Notwithstanding anything to the contrary contained herein, this Letter of Intent shall not be binding on the parties hereto except as to the captioned sections “Expenses”, “Termination”, “Non-Binding”, “Assignment”, “Amendment; Modification; Waiver”, “Counterparts”, “Confidentiality” and “Governing Law”, which shall be binding and expressly survive any termination hereof.

Classified - Confidential

16. Assignment. This Letter of Intent and the rights and obligations set forth herein shall not be assignable by any party hereto without the prior written consent of the other party hereto. Subject to the preceding sentence, the binding provisions of this Letter of Intent (as noted in the “Non-Binding” section above) shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

17. Amendment; Modification; Waiver. This Letter of Intent may not be amended or terminated or any provision hereof waived or modified except by an instrument in writing signed by each of the parties hereto.

18. Counterparts. This Letter of Intent may be executed in counterparts, each of which shall be an original and all of which, when taken together, shall constitute one agreement, and delivery of an executed signature page by facsimile transmission or other electronic transmission shall be effective as delivery of a manually executed counterpart.

19. Confidentiality. This Letter of Intent is strictly confidential and is covered by the parties’ Confidentiality Agreement – Bottler Discussions relating to System Operational Design Project. Neither this Letter of Intent nor any of its contents may be disclosed by TCCC, CCR or Bottler or any of their respective directors, officers, employees, agents, advisors or representatives, except as permitted in such agreement, and each of the parties will cause such persons not to make any such disclosure.

20. Governing Law. This Letter of Intent will be governed by the laws of the State of Georgia.

21. Amendment of February 2016 LOI. TCCC, CCR and Bottler hereby amend that certain Letter of Intent, dated as of February 8, 2016 (the “February 2016 LOI”), between TCCC, CCR and Bottler, to remove that portion of the “Sub-Bottling Territory” (as defined in the February 2016 LOI) located in northern West Virginia associated with CCR’s Wheeling and Fairmont sales centers, and CCR and Bottler agree that CCR will sell the distribution rights and assets associated with such territory to another U.S. Coca-Cola bottler that is unaffiliated with either of the parties hereto.

Frank, we appreciate your team’s efforts and dedication in our System of the Future work to date. We look forward to continuing to work closely with your team to finalize the Definitive Agreements, close this transaction and move forward with our joint work.

Please acknowledge your acceptance of the terms and conditions of this Letter of Intent by signing where indicated below and returning it to us.

[Remainder of page intentionally left blank; signature page follows]

Classified - Confidential

| Very truly yours, | ||

| /s/ J. Alexander M. Douglas, Jr. | ||

| Agreed to and Accepted as of the date first written above: | ||||

| COCA-COLA BOTTLING CO. CONSOLIDATED | ||||

| By: /s/ J. Frank Harrison III | ||||

| Name: J. Frank Harrison III | ||||

| Title: Chairman and Chief Executive Officer | ||||

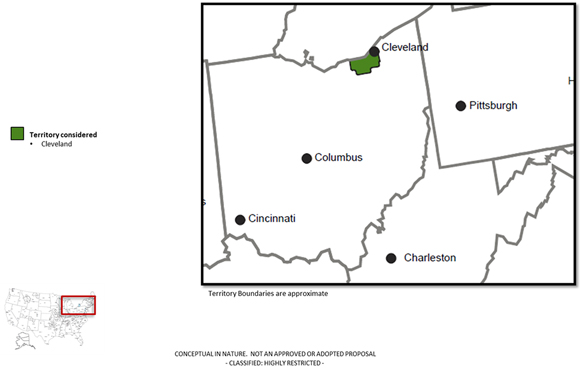

Exhibit A

Sub-Bottling Territory

Classified - Confidential