Attached files

| file | filename |

|---|---|

| EX-10.1 - EX-10.1 - Booz Allen Hamilton Holding Corp | d295747dex101.htm |

| 8-K - FORM 8-K - Booz Allen Hamilton Holding Corp | d295747d8k.htm |

Fiscal year 2017 Third quarter Investor Presentation February 2017 Exhibit 99.1

Disclaimer Forward Looking Safe Harbor Statement Certain statements contained in this presentation and in related comments by our management include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Booz Allen’s preliminary financial results, financial outlook and guidance, including forecasted revenue, Diluted EPS, and Adjusted Diluted EPS, future quarterly dividends, and future improvements in operating margins, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. A number of important factors could cause actual results to differ materially from those contained in or implied by these forward-looking statements, including those factors discussed in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the fiscal year ended March 31, 2016, which can be found at the SEC’s website at www.sec.gov. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Note Regarding Non-GAAP Financial Data Information Booz Allen discloses in the following information Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow which are not recognized measurements under GAAP, and when analyzing Booz Allen’s performance or liquidity as applicable, investors should (i) evaluate each adjustment in our reconciliation of Operating and Net Income to Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted Net Income, and net cash provided by operating activities to free cash flows, and the explanatory footnotes regarding those adjustments, and (ii) use Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Operating Income, and Adjusted Diluted EPS in addition to, and not as an alternative to operating income, net income or Diluted EPS as a measure of operating results with cash flow in addition to and not as an alternative to net cash generated from operating activities as a measure of liquidity, each as defined under GAAP. The Financial Appendix includes a reconciliation of Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow to the most directly comparable financial measure calculated and presented in accordance with GAAP. Booz Allen presents these supplemental performance measures because it believes that these measures provide investors and securities analysts with important supplemental information with which to evaluate Booz Allen’s performance, long term earnings potential, or liquidity, as applicable and to enable them to assess Booz Allen’s performance on the same basis as management. These supplemental performance and liquidity measurements may vary from and may not be comparable to similarly titled measures by other companies in Booz Allen’s industry. With respect to our expectations under “Fiscal 2017 Full Year Outlook” on slide 14, reconciliation of Adjusted Diluted EPS guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to our inability to predict our stock price, equity grants and dividend declarations during the course of fiscal 2017. Projecting future stock price, equity grants and dividends to be declared would be necessary to accurately calculate the difference between Adjusted Diluted EPS and GAAP EPS as a result of the effects of the two-class method and related possible dilution used in the calculation of EPS. Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. We expect the variability of the above charges to have an unpredictable, and potentially significant, impact on our future GAAP financial results. 1

differentiated model which has delivered exceptional returns On a steady path to sustainable quality growth Capturing opportunities in an improved market Investing in people, markets and capabilities 2 Key investment themes

3 A leader with a proud history Company Overview A leading provider of management consulting, technology, and engineering services to the U.S. and international governments, major corporations, and not-for-profit organizations Over 100 years in business HQ in Mclean, VA Unique organization and culture Built on collaboration One P&L and single bonus pool for partners, VPs, and Senior Staff 85 partners with an average tenure of 17 years Equity incentives broadly distributed to leadership to ensure long-term success and alignment with shareholders Approximately 69% of staff hold security clearances As of March 31, 2016. See Appendix for definition and reconciliations of non-GAAP measures used throughout this presentation.

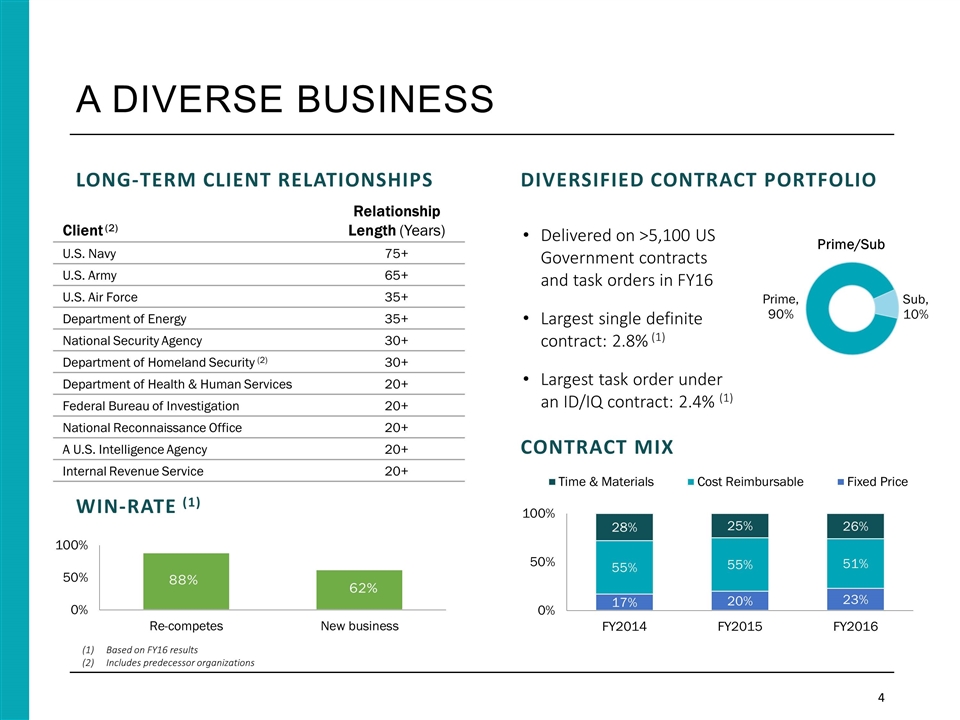

A diverse business 4 Long-term client relationships Client (2) Relationship Length (Years) U.S. Navy 75+ U.S. Army 65+ U.S. Air Force 35+ Department of Energy 35+ National Security Agency 30+ Department of Homeland Security (2) 30+ Department of Health & Human Services 20+ Federal Bureau of Investigation 20+ National Reconnaissance Office 20+ A U.S. Intelligence Agency 20+ Internal Revenue Service 20+ Win-rate (1) Diversified contract portfolio Contract mix Delivered on >5,100 US Government contracts and task orders in FY16 Largest single definite contract: 2.8% (1) Largest task order under an ID/IQ contract: 2.4% (1) Based on FY16 results Includes predecessor organizations

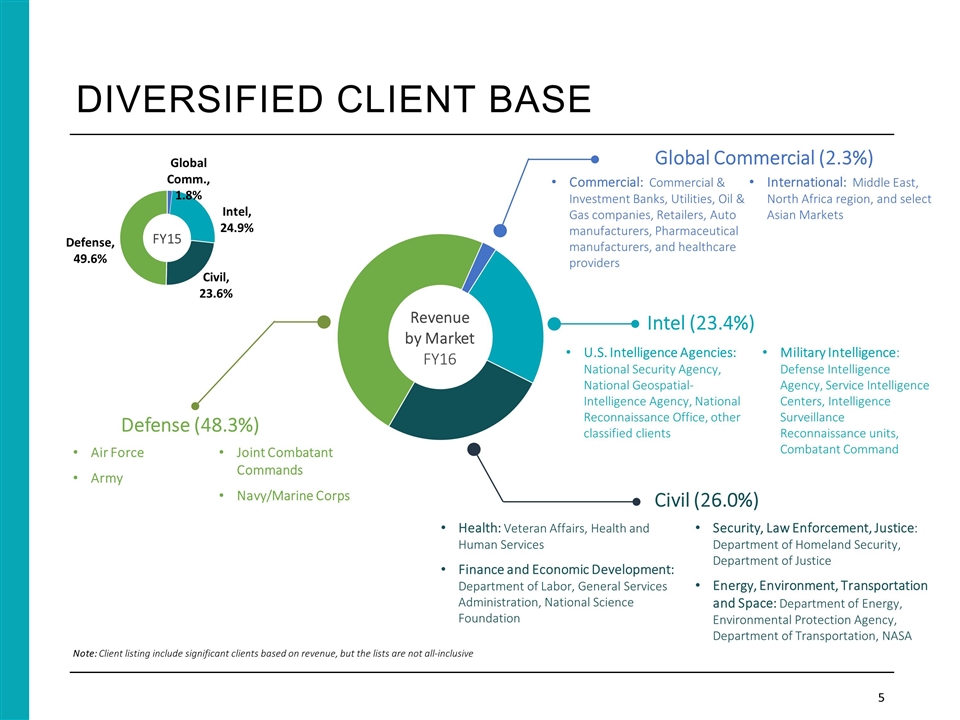

Diversified client base 5 Commercial: Commercial & Investment Banks, Utilities, Oil & Gas companies, Retailers, Auto manufacturers, Pharmaceutical manufacturers, and healthcare providers International: Middle East, North Africa region, and select Asian Markets Global Commercial (2.3%) U.S. Intelligence Agencies: National Security Agency, National Geospatial-Intelligence Agency, National Reconnaissance Office, other classified clients Military Intelligence: Defense Intelligence Agency, Service Intelligence Centers, Intelligence Surveillance Reconnaissance units, Combatant Command Intel (23.4%) Civil (26.0%) Air Force Army Joint Combatant Commands Navy/Marine Corps Defense (48.3%) FY15 Health: Veteran Affairs, Health and Human Services Finance and Economic Development: Department of Labor, General Services Administration, National Science Foundation Security, Law Enforcement, Justice: Department of Homeland Security, Department of Justice Energy, Environment, Transportation and Space: Department of Energy, Environmental Protection Agency, Department of Transportation, NASA Revenue by Market FY16 Note: Client listing include significant clients based on revenue, but the lists are not all-inclusive

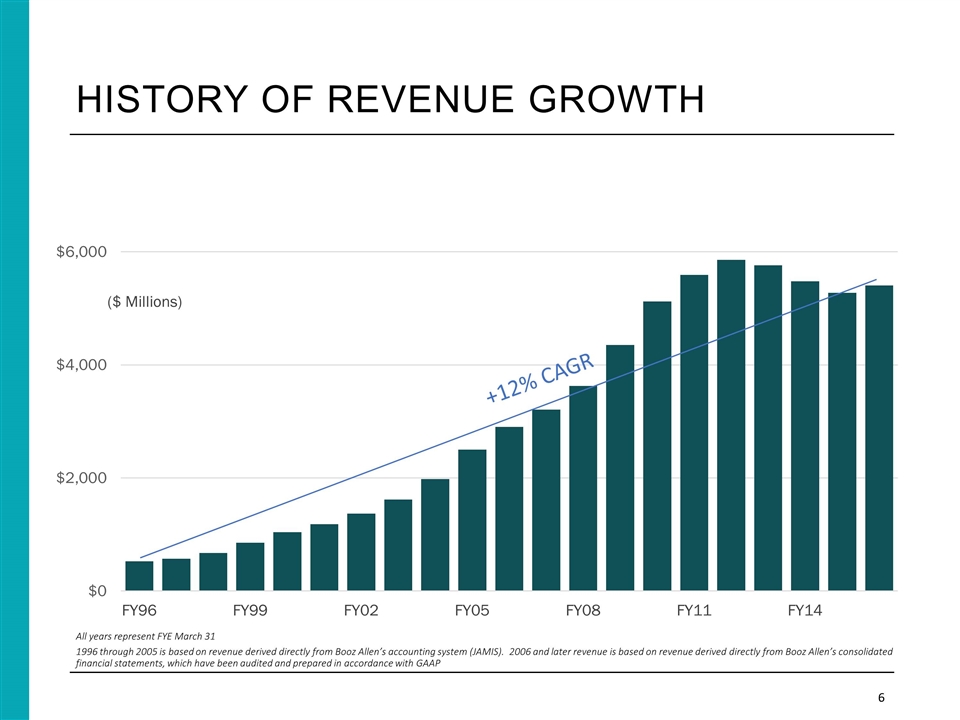

History of revenue growth 6 All years represent FYE March 31 1996 through 2005 is based on revenue derived directly from Booz Allen’s accounting system (JAMIS). 2006 and later revenue is based on revenue derived directly from Booz Allen’s consolidated financial statements, which have been audited and prepared in accordance with GAAP

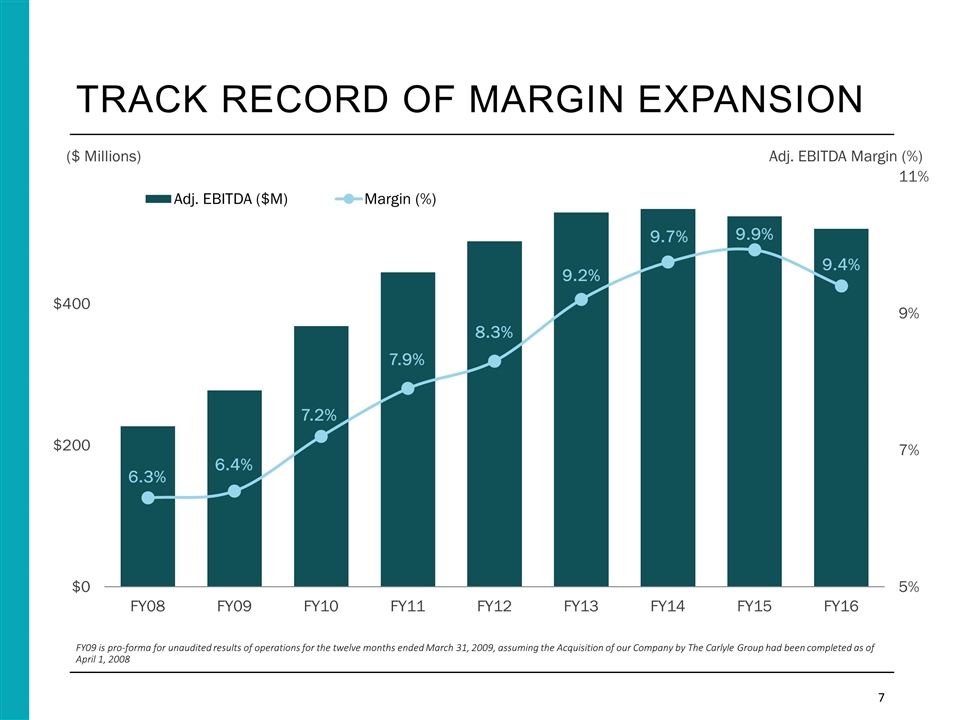

Track record of margin expansion 7 FY09 is pro-forma for unaudited results of operations for the twelve months ended March 31, 2009, assuming the Acquisition of our Company by The Carlyle Group had been completed as of April 1, 2008

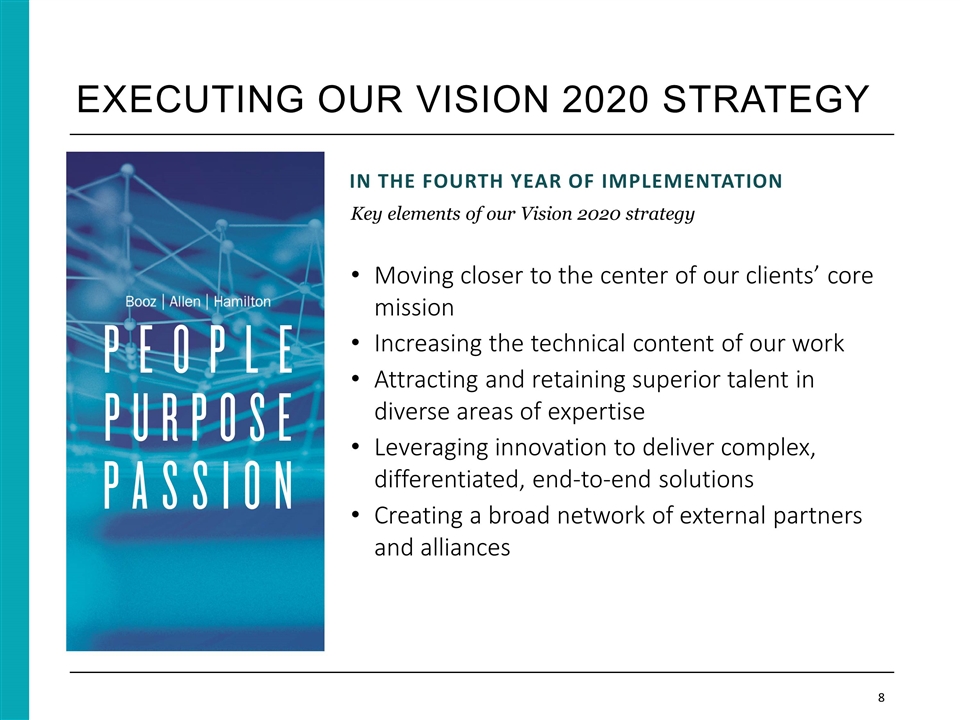

Executing our vision 2020 strategy In the fourth year of implementation Key elements of our Vision 2020 strategy Moving closer to the center of our clients’ core mission Increasing the technical content of our work Attracting and retaining superior talent in diverse areas of expertise Leveraging innovation to deliver complex, differentiated, end-to-end solutions Creating a broad network of external partners and alliances 8

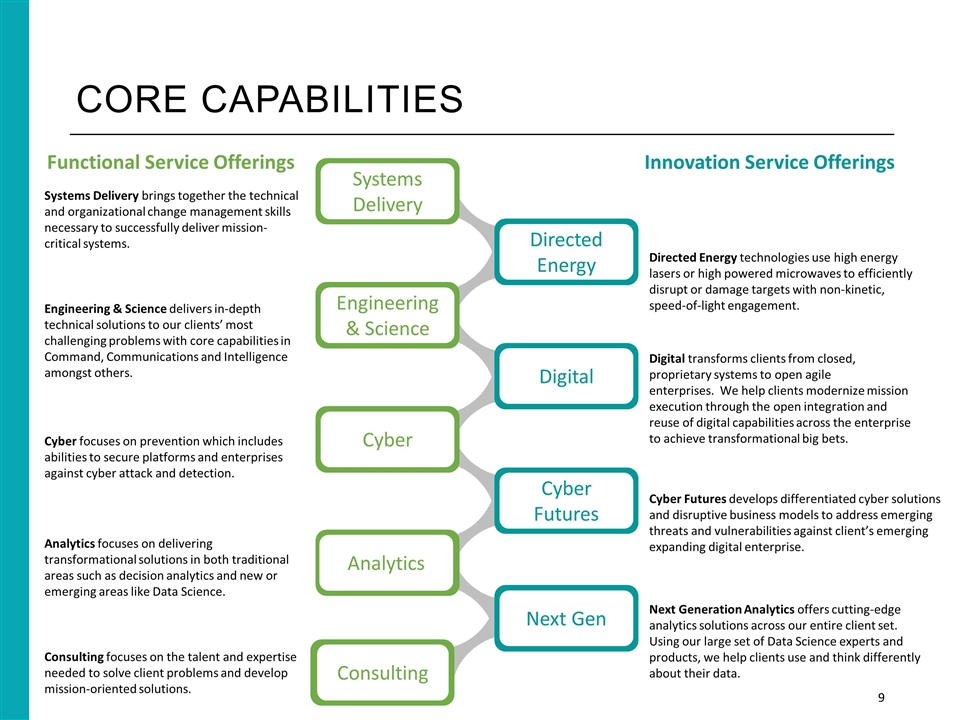

Core capabilities 9 Systems Delivery Engineering & Science Cyber Analytics Directed Energy Digital Cyber Futures Next Gen Systems Delivery brings together the technical and organizational change management skills necessary to successfully deliver mission-critical systems. Engineering & Science delivers in-depth technical solutions to our clients’ most challenging problems with core capabilities in Command, Communications and Intelligence amongst others. Cyber focuses on prevention which includes abilities to secure platforms and enterprises against cyber attack and detection. Analytics focuses on delivering transformational solutions in both traditional areas such as decision analytics and new or emerging areas like Data Science. Directed Energy technologies use high energy lasers or high powered microwaves to efficiently disrupt or damage targets with non-kinetic, speed-of-light engagement. Digital transforms clients from closed, proprietary systems to open agile enterprises. We help clients modernize mission execution through the open integration and reuse of digital capabilities across the enterprise to achieve transformational big bets. Cyber Futures develops differentiated cyber solutions and disruptive business models to address emerging threats and vulnerabilities against client’s emerging expanding digital enterprise. Next Generation Analytics offers cutting-edge analytics solutions across our entire client set. Using our large set of Data Science experts and products, we help clients use and think differently about their data. Functional Service Offerings Innovation Service Offerings Consulting Consulting focuses on the talent and expertise needed to solve client problems and develop mission-oriented solutions.

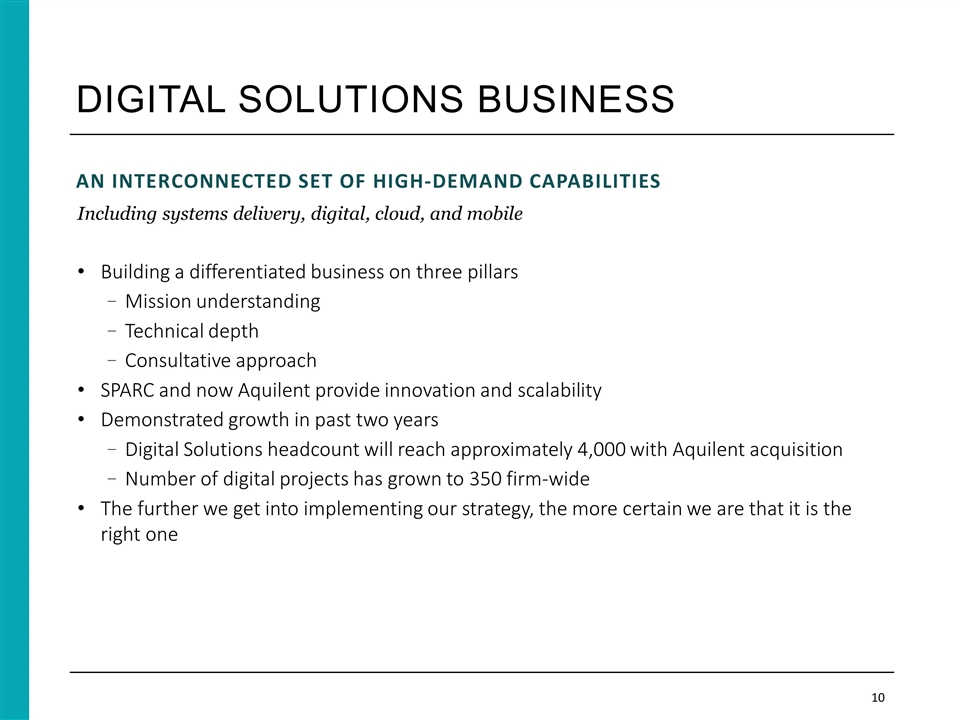

Digital Solutions Business An interconnected set of high-demand capabilities Including systems delivery, digital, cloud, and mobile Building a differentiated business on three pillars Mission understanding Technical depth Consultative approach SPARC and now Aquilent provide innovation and scalability Demonstrated growth in past two years Digital Solutions headcount will reach approximately 4,000 with Aquilent acquisition Number of digital projects has grown to 350 firm-wide The further we get into implementing our strategy, the more certain we are that it is the right one 10

Executing Against our strategy to deliver Sustainable Quality Growth Third quarter of fiscal year 2017 represented Another strong performance by Booz Allen Hamilton Making excellent progress against FY17 objectives: Delivering organic growth that leads the industry, is sustainable, and positions Booz Allen for stronger performance in future years Evolving our Portfolio in line with Vision 2020 objectives Executing against our large backlog by hiring and deploying additional talent Operating with efficiency and agility while continuing to invest in growth Confident about the state of our business Continuing to aggressively pursue opportunities in Federal and Global Commercial markets Delivering value to all stakeholders – from clients, to employees, to shareholders 11

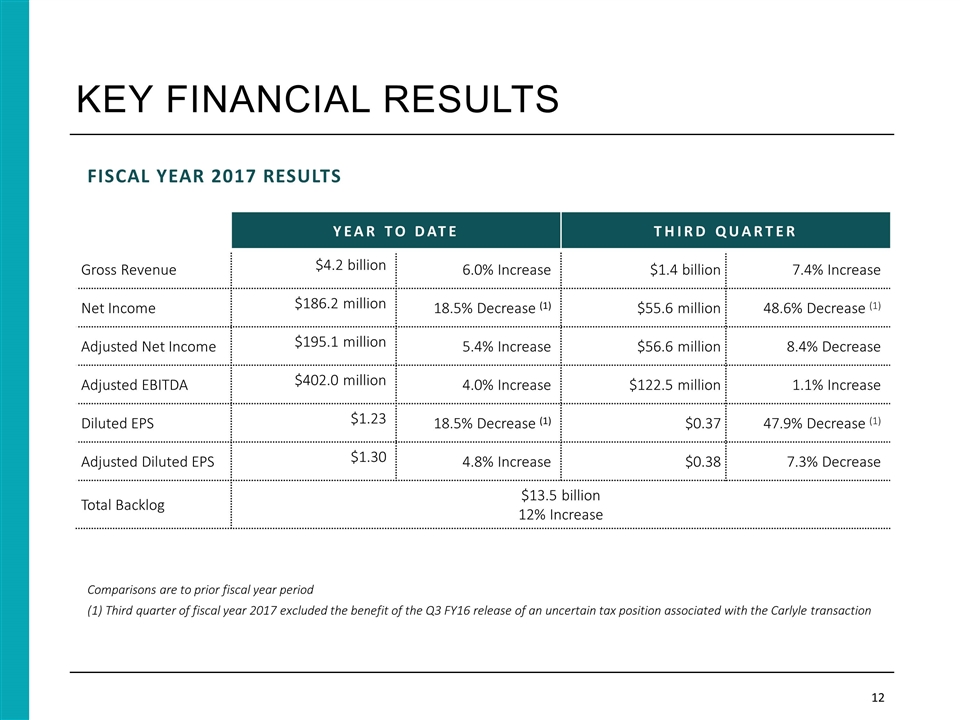

Key financial results Fiscal year 2017 results Comparisons are to prior fiscal year period (1) Third quarter of fiscal year 2017 excluded the benefit of the Q3 FY16 release of an uncertain tax position associated with the Carlyle transaction 12 Year to date third quarter Gross Revenue $4.2 billion 6.0% Increase $1.4 billion 7.4% Increase Net Income $186.2 million 18.5% Decrease (1) $55.6 million 48.6% Decrease (1) Adjusted Net Income $195.1 million 5.4% Increase $56.6 million 8.4% Decrease Adjusted EBITDA $402.0 million 4.0% Increase $122.5 million 1.1% Increase Diluted EPS $1.23 18.5% Decrease (1) $0.37 47.9% Decrease (1) Adjusted Diluted EPS $1.30 4.8% Increase $0.38 7.3% Decrease Total Backlog $13.5 billion 12% Increase

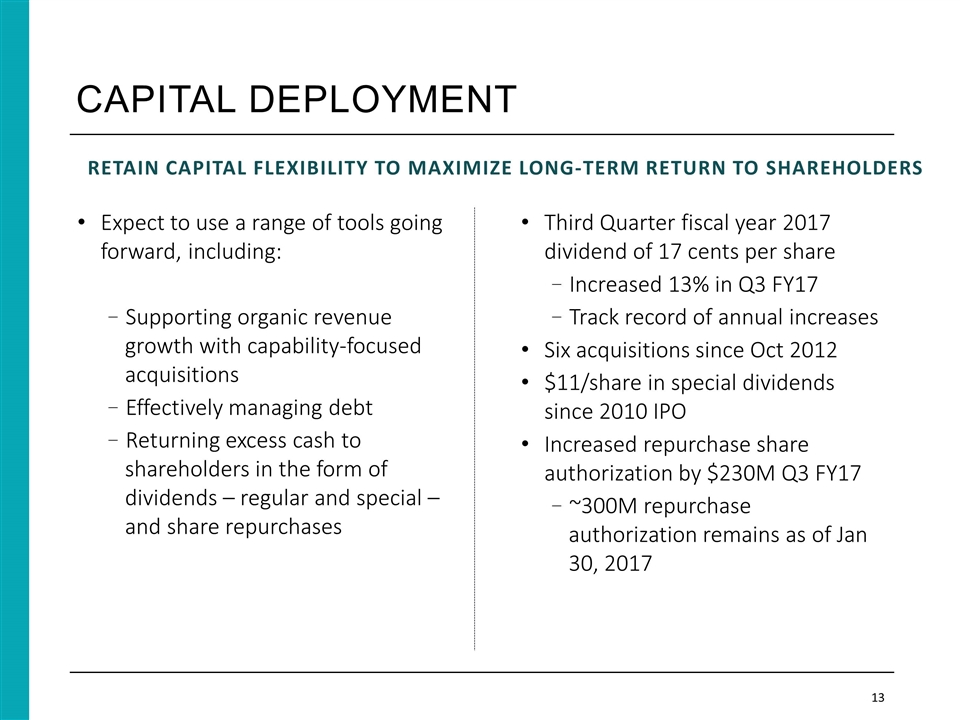

capital deployment Expect to use a range of tools going forward, including: Supporting organic revenue growth with capability-focused acquisitions Effectively managing debt Returning excess cash to shareholders in the form of dividends – regular and special – and share repurchases 13 Third Quarter fiscal year 2017 dividend of 17 cents per share Increased 13% in Q3 FY17 Track record of annual increases Six acquisitions since Oct 2012 $11/share in special dividends since 2010 IPO Increased repurchase share authorization by $230M Q3 FY17 ~300M repurchase authorization remains as of Jan 30, 2017 Retain Capital flexibility to maximize long-term return to shareholders

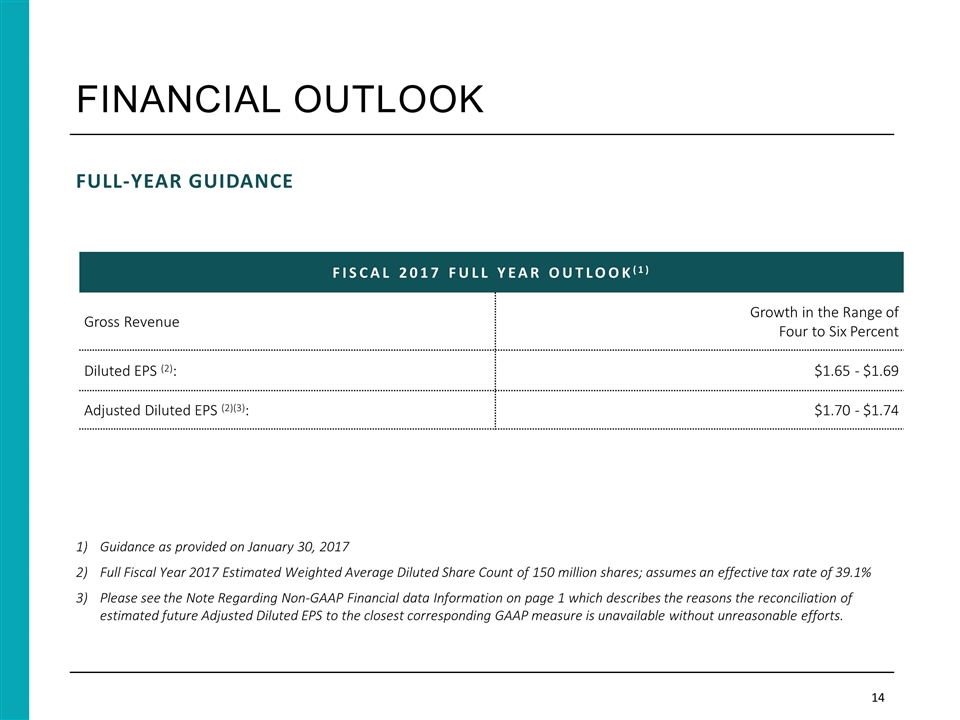

financial OUTLOOK full-year guidance Guidance as provided on January 30, 2017 Full Fiscal Year 2017 Estimated Weighted Average Diluted Share Count of 150 million shares; assumes an effective tax rate of 39.1% Please see the Note Regarding Non-GAAP Financial data Information on page 1 which describes the reasons the reconciliation of estimated future Adjusted Diluted EPS to the closest corresponding GAAP measure is unavailable without unreasonable efforts. 14 FISCAL 2017 FULL YEAR Outlook(1) Gross Revenue Growth in the Range of Four to Six Percent Diluted EPS (2): $1.65 - $1.69 Adjusted Diluted EPS (2)(3): $1.70 - $1.74

appendix

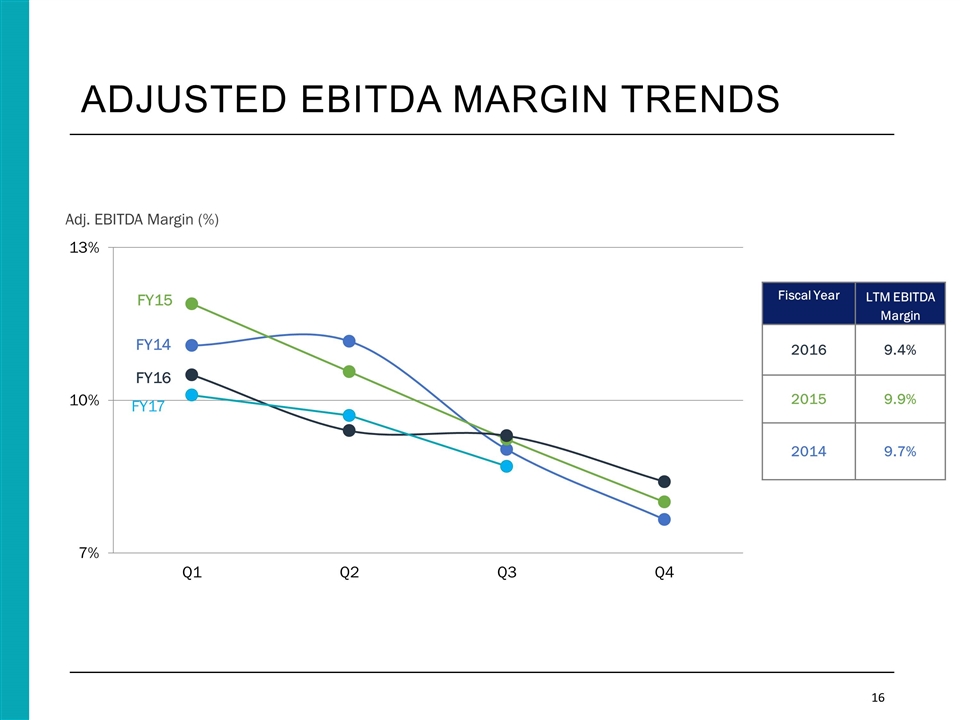

Adjusted ebitda margin trends 16 Adj. EBITDA Margin (%) Fiscal Year LTM EBITDA Margin 2016 9.4% 2015 9.9% 2014 9.7%

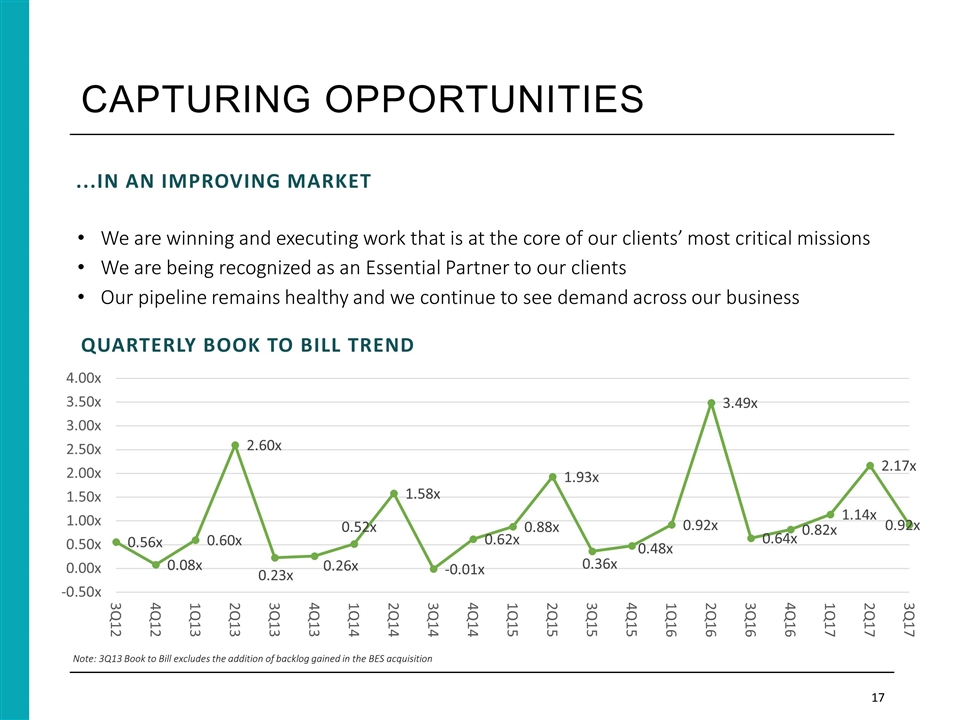

Capturing opportunities ...in an improving market We are winning and executing work that is at the core of our clients’ most critical missions We are being recognized as an Essential Partner to our clients Our pipeline remains healthy and we continue to see demand across our business 17 Quarterly book to bill trend Note: 3Q13 Book to Bill excludes the addition of backlog gained in the BES acquisition

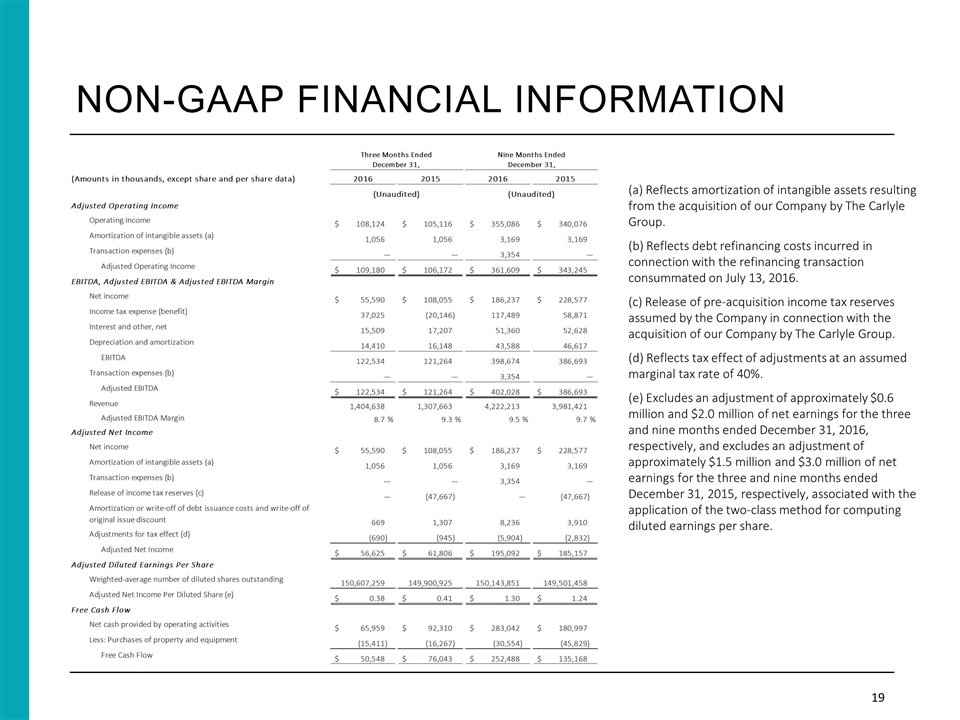

Non-gaap financial information "Adjusted Operating Income" represents operating income before: (i) adjustments related to the amortization of intangible assets, and (ii) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments. We prepare Adjusted Operating Income to eliminate the impact of items we do not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary, or non-recurring nature or because they result from an event of a similar nature. "Adjusted EBITDA” represents net income before income taxes, net interest and other expense and depreciation and amortization and before certain other items, including transaction costs, fees, losses, and expenses, including fees associated with debt prepayments. “Adjusted EBITDA Margin” is calculated as Adjusted EBITDA divided by revenue. Booz Allen prepares Adjusted EBITDA and Adjusted EBITDA Margin to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. “Adjusted Net Income” represents net income before: (i) adjustments related to the amortization of intangible assets, (ii) transaction costs, fees, losses, and expenses, including fees associated with debt prepayments, (iii) amortization or write-off of debt issuance costs and write-off of original issue discount, and (iv) release of income tax reserves, in each case net of the tax effect where appropriate calculated using an assumed effective tax rate. Booz Allen prepares Adjusted Net Income to eliminate the impact of items, net of taxes, it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. "Adjusted Diluted EPS" represents diluted EPS calculated using Adjusted Net Income as opposed to net income. Additionally, Adjusted Diluted EPS does not contemplate any adjustments to net income as required under the two-class method as disclosed in the footnotes to the financial statements. "Free Cash Flow" represents the net cash generated from operating activities less the impact of purchases of property and equipment. 18

Non-gaap financial information 19 (a) Reflects amortization of intangible assets resulting from the acquisition of our Company by The Carlyle Group. (b) Reflects debt refinancing costs incurred in connection with the refinancing transaction consummated on July 13, 2016. (c) Release of pre-acquisition income tax reserves assumed by the Company in connection with the acquisition of our Company by The Carlyle Group. (d) Reflects tax effect of adjustments at an assumed marginal tax rate of 40%. (e) Excludes an adjustment of approximately $0.6 million and $2.0 million of net earnings for the three and nine months ended December 31, 2016, respectively, and excludes an adjustment of approximately $1.5 million and $3.0 million of net earnings for the three and nine months ended December 31, 2015, respectively, associated with the application of the two-class method for computing diluted earnings per share.

Shareholder and stock information 20 Booz allen Hamilton holding corporation’s class a common stock began trading on the new York stock exchange (nyse) on Nov 17, 2010 Fiscal Year – Booz Allen Hamilton Holding Corporation’s fiscal year starts April 1 and ends March 31 Share Price Information – Booz Allen Hamilton Holding Corporation’s Class A common stock is listed on the NYSE under ticker symbol BAH. The weighted average number of diluted shares outstanding for the fiscal year ended March 31, 2016, was 149,719,137. Share price information can be found at investors.boozallen.com Company News – Information about Booz Allen Hamilton Holding Corporation and its principal operating subsidiary, Booz Allen Hamilton Inc., including archived news releases and SEC filings, is available from its website at www.boozallen.com. Booz Allen’s earnings conference calls and other significant investor events are posted when they occur State of Incorporation – Booz Allen Hamilton Holding Corporation is incorporated in Delaware Employee Stock Plan Equity Incentive Plans – Booz Allen believes that its executives should hold equity to align their interests to those of its stockholders, and, accordingly, long-term equity compensation is an important component of its compensation program Employee Stock Purchase Plan (ESPP) – Booz Allen currently has an employer-sponsored program that allows employees to make planned periodic purchases of shares of Booz Allen’s Class A common stock Annual Stockholder Meeting – Stockholders were invited to attend Booz Allen’s FY16 annual meeting on July 28, 2016 at the McLean headquarters. At the annual meeting, stockholders voted upon the matters set forth in the notice of meeting, including the election of certain directors and ratification of the appointment of E&Y as our independent registered public accounting firm for FY17. Holders of Class A common stock on the record date were entitled to vote at the annual meeting.

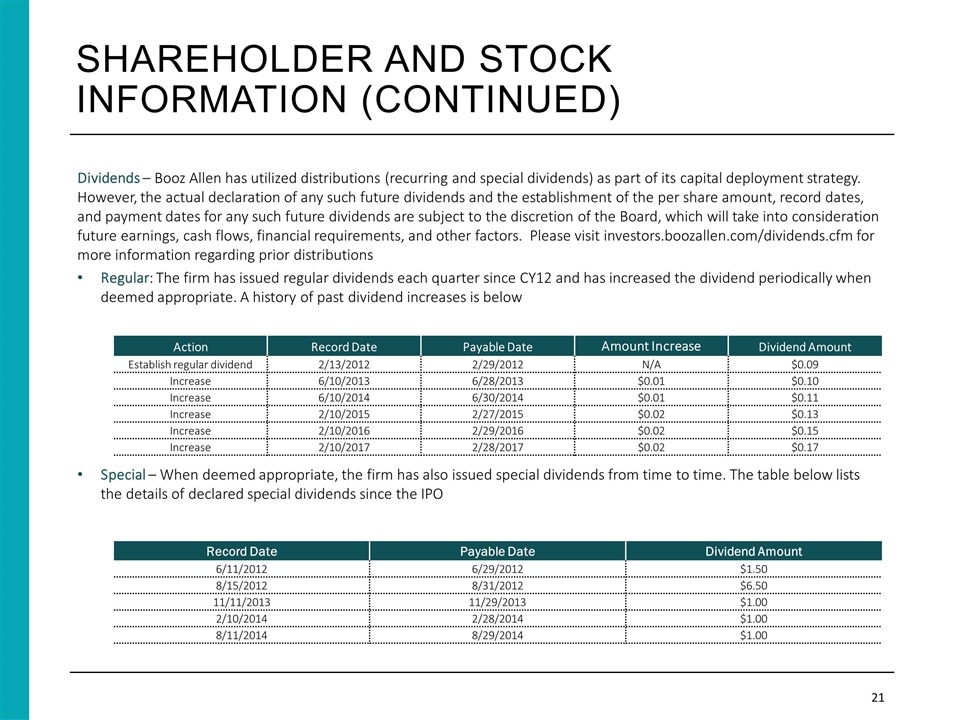

Shareholder and stock information (continued) 21 Dividends – Booz Allen has utilized distributions (recurring and special dividends) as part of its capital deployment strategy. However, the actual declaration of any such future dividends and the establishment of the per share amount, record dates, and payment dates for any such future dividends are subject to the discretion of the Board, which will take into consideration future earnings, cash flows, financial requirements, and other factors. Please visit investors.boozallen.com/dividends.cfm for more information regarding prior distributions Regular: The firm has issued regular dividends each quarter since CY12 and has increased the dividend periodically when deemed appropriate. A history of past dividend increases is below Special – When deemed appropriate, the firm has also issued special dividends from time to time. The table below lists the details of declared special dividends since the IPO Action Record Date Payable Date Amount Increase Dividend Amount Establish regular dividend 2/13/2012 2/29/2012 N/A $0.09 Increase 6/10/2013 6/28/2013 $0.01 $0.10 Increase 6/10/2014 6/30/2014 $0.01 $0.11 Increase 2/10/2015 2/27/2015 $0.02 $0.13 Increase 2/10/2016 2/29/2016 $0.02 $0.15 Increase 2/10/2017 2/28/2017 $0.02 $0.17 Record Date Payable Date Dividend Amount 6/11/2012 6/29/2012 $1.50 8/15/2012 8/31/2012 $6.50 11/11/2013 11/29/2013 $1.00 2/10/2014 2/28/2014 $1.00 8/11/2014 8/29/2014 $1.00

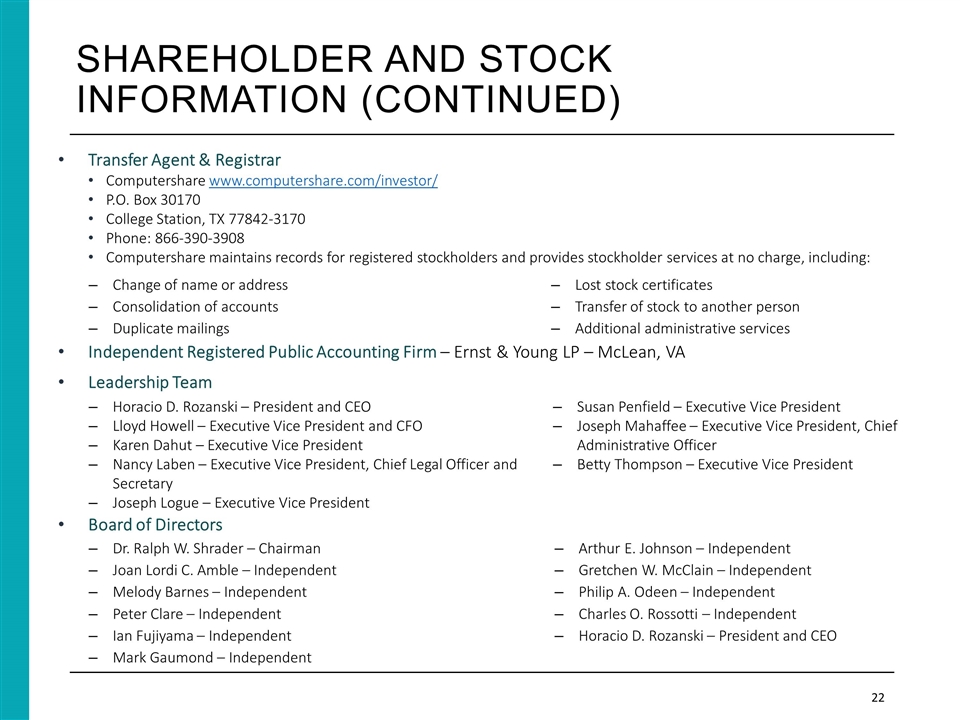

Shareholder and stock information (continued) 22 Transfer Agent & Registrar Computershare www.computershare.com/investor/ P.O. Box 30170 College Station, TX 77842-3170 Phone: 866-390-3908 Computershare maintains records for registered stockholders and provides stockholder services at no charge, including: Independent Registered Public Accounting Firm – Ernst & Young LP – McLean, VA Leadership Team Board of Directors Change of name or address Consolidation of accounts Duplicate mailings Lost stock certificates Transfer of stock to another person Additional administrative services Horacio D. Rozanski – President and CEO Lloyd Howell – Executive Vice President and CFO Karen Dahut – Executive Vice President Nancy Laben – Executive Vice President, Chief Legal Officer and Secretary Joseph Logue – Executive Vice President Susan Penfield – Executive Vice President Joseph Mahaffee – Executive Vice President, Chief Administrative Officer Betty Thompson – Executive Vice President Dr. Ralph W. Shrader – Chairman Joan Lordi C. Amble – Independent Melody Barnes – Independent Peter Clare – Independent Ian Fujiyama – Independent Mark Gaumond – Independent Arthur E. Johnson – Independent Gretchen W. McClain – Independent Philip A. Odeen – Independent Charles O. Rossotti – Independent Horacio D. Rozanski – President and CEO

Shareholder and stock information (continued) 23 Website: investors.boozallen.com Contact Information Investor Relations Curt Riggle Vice President of Investor Relations 703/377-5332 Riggle_Curt@bah.com Media James Fisher Principal, Media Relations 703/377-7595 Fisher_James_W@bah.com Corporate Governance Nancy Laben Executive Vice President, Chief Legal Officer and Secretary 703/377-9042 Laben_Nancy@bah.com

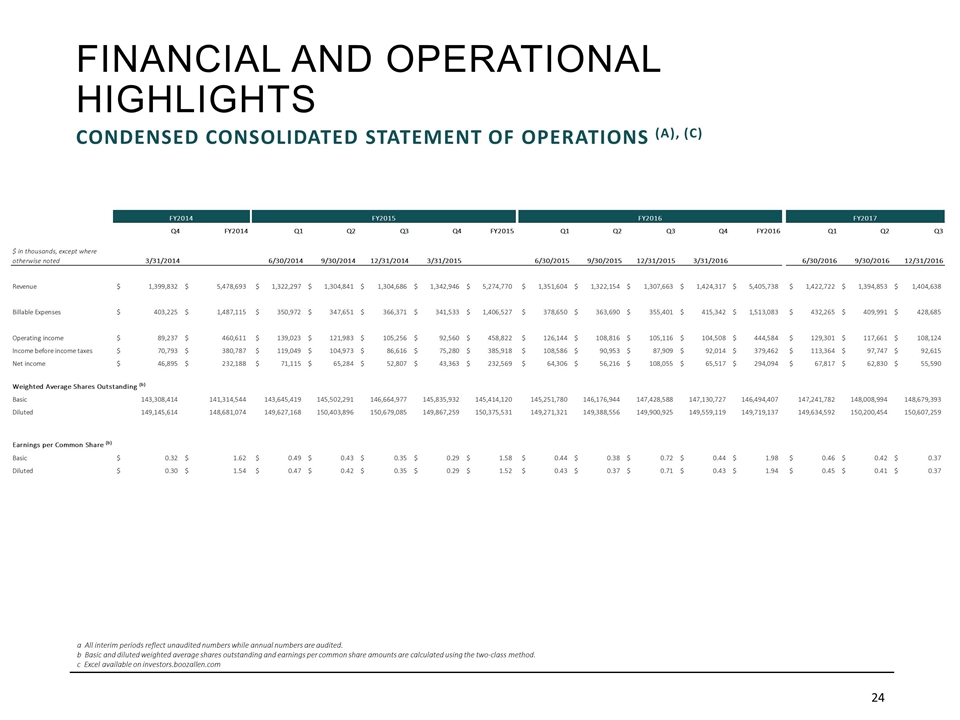

Financial and operational highlights 24 a All interim periods reflect unaudited numbers while annual numbers are audited. b Basic and diluted weighted average shares outstanding and earnings per common share amounts are calculated using the two-class method. c Excel available on investors.boozallen.com Condensed consolidated statement of operations (A), (c) To update

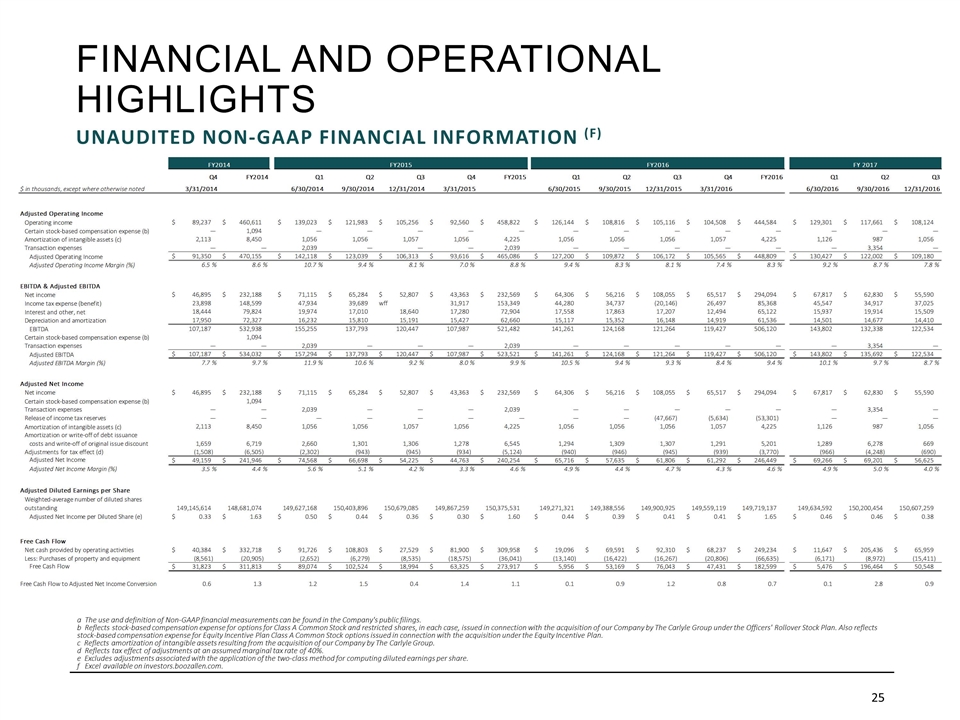

Financial and operational highlights Unaudited non-gaap financial information (f) 25 a The use and definition of Non-GAAP financial measurements can be found in the Company's public filings. b Reflects stock-based compensation expense for options for Class A Common Stock and restricted shares, in each case, issued in connection with the acquisition of our Company by The Carlyle Group under the Officers' Rollover Stock Plan. Also reflects stock-based compensation expense for Equity Incentive Plan Class A Common Stock options issued in connection with the acquisition under the Equity Incentive Plan. c Reflects amortization of intangible assets resulting from the acquisition of our Company by The Carlyle Group. d Reflects tax effect of adjustments at an assumed marginal tax rate of 40%. e Excludes adjustments associated with the application of the two-class method for computing diluted earnings per share. f Excel available on investors.boozallen.com.

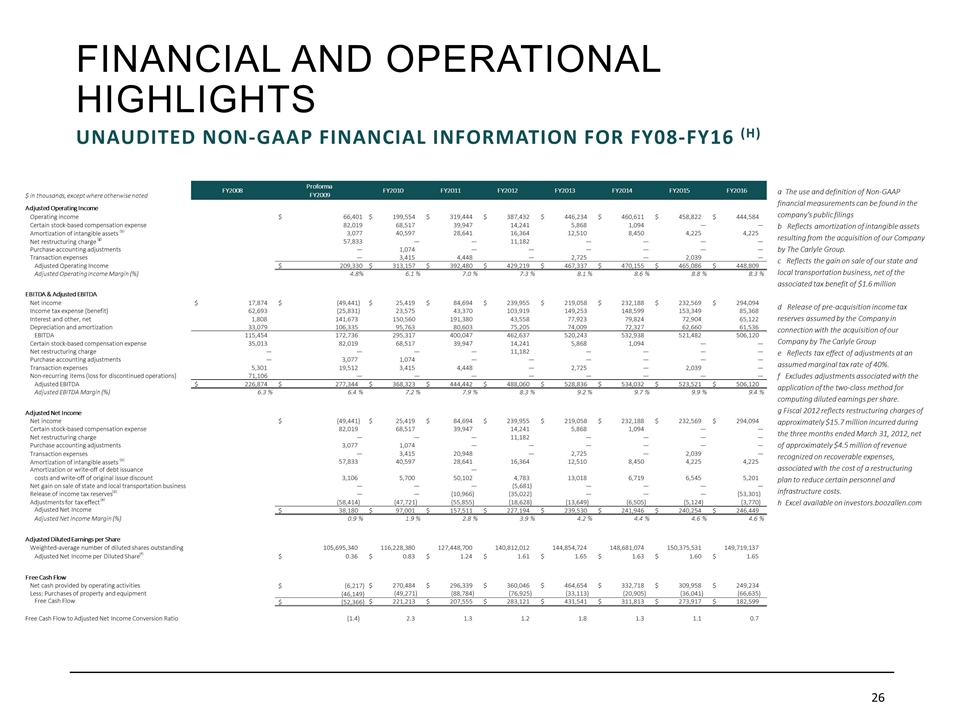

Financial and operational highlights Unaudited non-gaap financial information for FY08-FY16 (h) a The use and definition of Non-GAAP financial measurements can be found in the company's public filings b Reflects amortization of intangible assets resulting from the acquisition of our Company by The Carlyle Group. c Reflects the gain on sale of our state and local transportation business, net of the associated tax benefit of $1.6 million d Release of pre-acquisition income tax reserves assumed by the Company in connection with the acquisition of our Company by The Carlyle Group e Reflects tax effect of adjustments at an assumed marginal tax rate of 40%. f Excludes adjustments associated with the application of the two-class method for computing diluted earnings per share. g Fiscal 2012 reflects restructuring charges of approximately $15.7 million incurred during the three months ended March 31, 2012, net of approximately $4.5 million of revenue recognized on recoverable expenses, associated with the cost of a restructuring plan to reduce certain personnel and infrastructure costs. h Excel available on investors.boozallen.com 26 $ in thousands, except where otherwise noted FY2008 Proforma FY2009 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 Adjusted Operating Income Operating income 66,401 $ 199,554 $ 319,444 $ 387,432 $ 446,234 $ 460,611 $ 458,822 $ 444,584 $ Certain stock-based compensation expense 82,019 68,517 39,947 14,241 5,868 1,094 — — Amortization of intangible assets (b) 3,077 40,597 28,641 16,364 12,510 8,450 4,225 4,225 Net restructuring charge (g) 57,833 — — 11,182 — — — — Purchase accounting adjustments — 1,074 — — — — — — Transaction expenses — 3,415 4,448 — 2,725 — 2,039 — Adjusted Operating Income 209,330 $ 313,157 $ 392,480 $ 429,219 $ 467,337 $ 470,155 $ 465,086 $ 448,809 $ Adjusted Operating Income Margin (%) 4.8% 6.1 % 7.0 % 7.3 % 8.1 % 8.6 % 8.8 % 8.3 % EBITDA & Adjusted EBITDA Net income 17,874 $ (49,441) $ 25,419 $ 84,694 $ 239,955 $ 219,058 $ 232,188 $ 232,569 $ 294,094 $ Income tax expense (benefit) 62,693 (25,831) 23,575 43,370 103,919 149,253 148,599 153,349 85,368 Interest and other, net 1,808 141,673 150,560 191,380 43,558 77,923 79,824 72,904 65,122 Depreciation and amortization 33,079 106,335 95,763 80,603 75,205 74,009 72,327 62,660 61,536 EBITDA 115,454 172,736 295,317 400,047 462,637 520,243 532,938 521,482 506,120 Certain stock-based compensation expense 35,013 82,019 68,517 39,947 14,241 5,868 1,094 — — Net restructuring charge — — — — 11,182 — — — — Purchase accounting adjustments — 3,077 1,074 — — — — — — Transaction expenses 5,301 19,512 3,415 4,448 — 2,725 — 2,039 — Non-recurring items (loss for discontinued operations) 71,106 — — — — — — — — Adjusted EBITDA 226,874 $ 277,344 $ 368,323 $ 444,442 $ 488,060 $ 528,836 $ 534,032 $ 523,521 $ 506,120 $ Adjusted EBITDA Margin (%) 6.3 % 6.4 % 7.2 % 7.9 % 8.3 % 9.2 % 9.7 % 9.9 % 9.4 % Adjusted Net Income Net income (49,441) $ 25,419 $ 84,694 $ 239,955 $ 219,058 $ 232,188 $ 232,569 $ 294,094 $ Certain stock-based compensation expense 82,019 68,517 39,947 14,241 5,868 1,094 — — Net restructuring charge — — — 11,182 — — — — Purchase accounting adjustments 3,077 1,074 — — — — — — Transaction expenses — 3,415 20,948 — 2,725 — 2,039 — Amortization of intangible assets (b) 57,833 40,597 28,641 16,364 12,510 8,450 4,225 4,225 Amortization or write-off of debt issuance — costs and write-off of original issue discount 3,106 5,700 50,102 4,783 13,018 6,719 6,545 5,201 Net gain on sale of state and local transportation business — — — (5,681) — — — — Release of income tax reserves (d) — — (10,966) (35,022) — — — (53,301) Adjustments for tax effect (e) (58,414) (47,721) (55,855) (18,628) (13,649) (6,505) (5,124) (3,770) Adjusted Net Income 38,180 $ 97,001 $ 157,511 $ 227,194 $ 239,530 $ 241,946 $ 240,254 $ 246,449 $ Adjusted Net Income Margin (%) 0.9 % 1.9 % 2.8 % 3.9 % 4.2 % 4.4 % 4.6 % 4.6 % Adjusted Diluted Earnings per Share Weighted-average number of diluted shares outstanding 105,695,340 116,228,380 127,448,700 140,812,012 144,854,724 148,681,074 150,375,531 149,719,137 Adjusted Net Income per Diluted Share (f) 0.36 $ 0.83 $ 1.24 $ 1.61 $ 1.65 $ 1.63 $ 1.60 $ 1.65 $ Free Cash Flow Net cash provided by operating activities (6,217) $ 270,484 $ 296,339 $ 360,046 $ 464,654 $ 332,718 $ 309,958 $ 249,234 $ Less: Purchases of property and equipment (46,149) (49,271) (88,784) (76,925) (33,113) (20,905) (36,041) (66,635) Free Cash Flow (52,366) $ 221,213 $ 207,555 $ 283,121 $ 431,541 $ 311,813 $ 273,917 $ 182,599 $ Free Cash Flow to Adjusted Net Income Conversion Ratio (1.4) 2.3 1.3 1.2 1.8 1.3 1.1 0.7

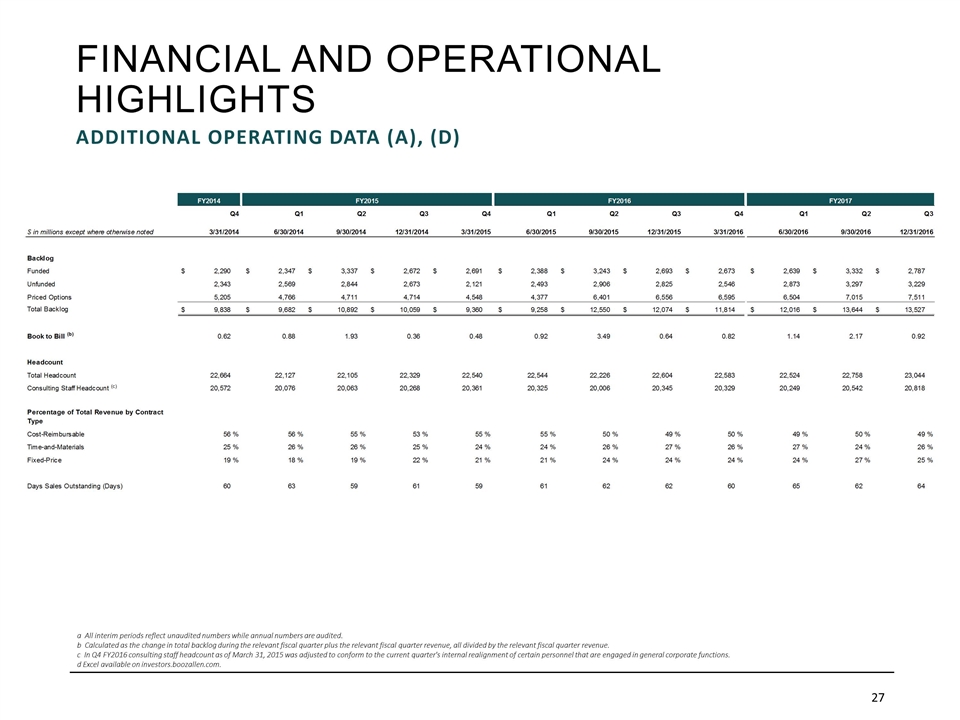

Financial and operational highlights 27 Additional operating data (a), (d) a All interim periods reflect unaudited numbers while annual numbers are audited. b Calculated as the change in total backlog during the relevant fiscal quarter plus the relevant fiscal quarter revenue, all divided by the relevant fiscal quarter revenue. c In Q4 FY2016 consulting staff headcount as of March 31, 2015 was adjusted to conform to the current quarter's internal realignment of certain personnel that are engaged in general corporate functions. d Excel available on investors.boozallen.com. To update

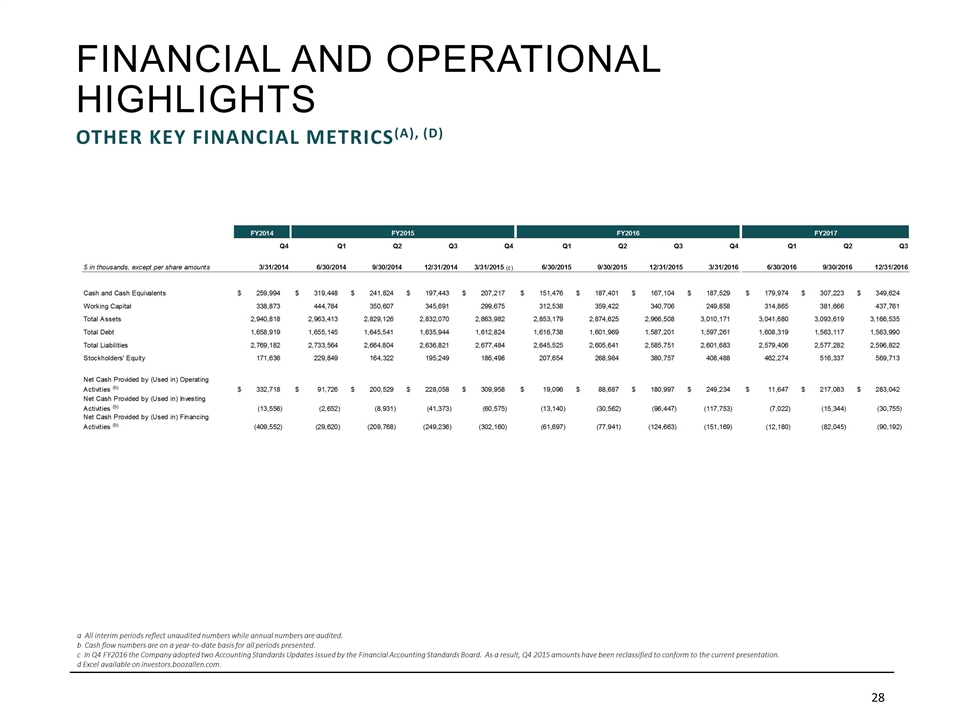

Financial and operational highlights 28 a All interim periods reflect unaudited numbers while annual numbers are audited. b Cash flow numbers are on a year-to-date basis for all periods presented. c In Q4 FY2016 the Company adopted two Accounting Standards Updates issued by the Financial Accounting Standards Board. As a result, Q4 2015 amounts have been reclassified to conform to the current presentation. d Excel available on investors.boozallen.com. Other key financial metrics(a), (d)