Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REGIONS FINANCIAL CORP | rf2017-02x06ir.htm |

Investor Meetings

February 2017

2

Strategic Initiatives

Effectively Deploy Capital

Disciplined organic growth

Return appropriate capital to shareholders

Use strategic investments to leverage our infrastructure and

enhance revenue diversification

Disciplined Expense Management

Generate positive operating leverage

Continuously focus on efficiency and effectiveness

Define, develop and execute Six Sigma initiatives

Make prudent investments with appropriate returns

Grow and Diversify Revenue

Leverage SM to grow customers and households and

deepen existing relationships

Prudently grow non‐interest income

Balance growth across geographies and businesses

3

Successfully Executing Strategic Plan

(1) Adjusted non‐GAAP; see appendix for reconciliation

FY16 ResultsFY16 Targets

Net Interest Income

and Other Financing

Income

Adjusted Non‐

Interest Income(1)

Adjusted Expenses(1)

Full Year Adjusted

Efficiency Ratio(1)

Adjusted Operating

Leverage(1)

Net Charge‐offs

+3%

+7%

+2%

63.3%

34 bps

2.6%

2‐4%

>6%

Flat to up

Modestly

~63%

25‐35 bps

2‐4%

4

Performing in a Challenging Operating

Environment

$3,382

$3,482

3.13%

3.14%

2015 2016

Net Interest Income and Other Financing Income (FTE)

Net Interest Margin

Net-Interest Income (FTE) & Margin

($ in millions)

+3%

YOY

• Net interest income and other financing income (FTE) increased

$100 million or 3%

• Increase driven by higher short‐term interest rates, average loan

growth, higher securities balances, and balance sheet management

strategies

• Remain asset sensitive and well positioned for higher rate

environment

• Approximately 38% of sensitivity is to short‐term rates and

62% to intermediate and long‐term rates

• Long‐term sensitivity driven by premium mortgage‐backed

securities portfolio and reinvestment of fixed‐rate assets

• Mortgage security premium amortization totaled $43

million in 4Q16; if rates remain at current levels or improve

– expect to ultimately achieve a quarterly run rate in the

low‐to‐mid $30 million range in 2017

• In +100bps instantaneous interest rate shock scenario, modeled

betas begin in the low 40% range and move up to 60% through the

cycle

• Upper end of beta range requires rate increases higher

than +100bps over a horizon longer than 12‐months

• 60% beta exceeds 54% beta experienced through the last

cycle, which was one of the lowest in peer group

5

2016 Results and Outlook

Focused on Building Sustainable Franchise Value

(1) Adjusted non‐GAAP; see appendix for reconciliation

2015‐2016

GreenSky®

Fundation™

CMBS Origination

Regions.com powered by

Avant

Mortgage Servicing Rights

Acquisitions

Financial Consultants

Insurance lift‐outs and

acquisitions

M&A Advisory

BlackArch

Acquisition

Multifamily Debt

Placements

Affordable Housing

First Sterling

Acquisition

Treasury Management

Platform

2017‐2018

Additional point‐of‐sale

opportunities

Loan Sales & Trading

Fixed Income Sales &

Trading

Multifamily Debt

Placements

Grow Affordable Housing

Treasury Management

Platform

Insurance acquisitions

De‐Novo Branch Additions

Digital Loan Offers

Expansion of Mortgage

Home Loan Direct Channel

Mortgage Servicing Rights

Acquisitions

Growth Initiatives

$1,943

$2,084

2015 2016

Non-Interest Income(1)

($ in millions)

+7%

YOY

6

Focus on Efficiency Remains Firmly Intact

(1) Adjusted non-GAAP; see appendix for reconciliation

FY16 Adjusted Operating

Leverage(1) of 2.6%

$3,454

$3,521

2015 2016

Total Adjusted Expenses(1)

($ in millions)

Efficiency Initiatives

› Continued branch rationalization efforts

› Consolidated 103 branches in 2016

› Announced plans to consolidate

another 27 branches in 2017

› Staffing levels decreased more than 1,200 or

5% in 2016

› Total square footage decrease of 3% in 2016

› Realized 160bps improvement in adjusted

efficiency ratio(1) to 63.3% in 2016

› Continued efficiencies generated through

various Six Sigma efforts

7

Consumer Lending

8

$30.3

$30.5

$30.8

$31.1

$31.4

4Q15 1Q16 2Q16 3Q16 4Q16

Average Consumer Loans

($ in billions)

2016 Results and Outlook

› Average Consumer Lending balances increased $1.2 billion or 4%

from 4Q15

› Mortgage lending balances increased $732 million or 6%

› Indirect – other consumer lending balances increase $366

million or 70%

› Consumer credit card portfolio increased $115 million or

11% as the customer deposit base penetration increased

110bps to 18.4%

› Growth impacted by continued and deliberate focus on

profitability and diversification

› Sold $171 million of affordable housing residential

mortgage loans in 4Q16

› Terminated 3rd party indirect auto flow deal arrangement

in 4Q16; full‐year 2017 average balances expected to

decline ~$650 million

› Contributors to 2017 growth expected from residential mortgage,

indirect point‐of‐sale, consumer credit card and other direct

consumer lending

Business Lending

9

$50.5 $51.0

$51.1

$50.2

$49.1

4Q15 1Q16 2Q16 3Q16 4Q16

Average Business Loans

($ in billions)

2016 Results and Outlook

› Average Business Lending balances decreased $1.4

billion or 3% from 4Q15

› Growth impacted by continued and deliberate focus

on profitability and diversification

› Improving risk‐adjusted returns

› De‐risking of certain portfolios – average direct

energy and multi‐family loans decreased $491

million and $239 million, respectively

› Ongoing softness in demand for middle market

commercial and small business loans

› Expect low single digit growth in average business

lending; contributors to growth include technology &

defense, healthcare, power & utilities, and asset‐based

lending

• Average deposits up $1 billion from 4Q15

• Low‐cost deposits increased 1.5%

• Consumer deposits increased 5%

• Corporate deposits increased 4%

• Wealth deposits decreased 18% due to

ongoing strategic reductions in certain

collateralized deposits

• Consumer deposits represent 56% of total

deposits – reflecting strength of retail franchise,

health of consumer and ability to grow low‐cost

deposits

• Solid core funded and sticky deposit base

• Approximately half of deposits are in

cities with less than 1 million people

• Approximately half of deposits are with

customers with less than $250,000

• Deposit betas historically lower than

peers – competitive advantage in a rising

rate environment

Growing Deposits

($ in billions)

($ in billions)

Average deposits by type

$97.5 $97.8 $97.5 $97.9

Average deposits by segment

$98.5

10

2016 Results and Outlook

Asset Quality

• 4Q16 provision $35 million less than NCOs attributable to reduction

in loans outstanding and overall net improvement in energy portfolio

• 4Q16 improvement in NPLs driven by declines in non‐energy

commercial loans

• Allowance for loan losses, as a percent of NPLs, was 110%. Excluding

direct energy this ratio increased linked quarter from 123%(2) to

138%(2)

• Direct energy charge‐offs totaled $37 million in 2016, and are

expected to be less than $40 million in 2017 given current market

conditions

• 2017 net charge‐offs expected between 35 and 50 bps; increase due

to resolution of energy credits and expected growth in unsecured

consumer balances

Criticized Business Lending Loans

(1) Excludes loans held for sale

(2) Non‐GAAP; see appendix for reconciliation

Net Charge‐offs and Ratio

11

25 17

6 14

53

68 55

48

69

0.38% 0.34% 0.35%

0.26%

0.41%

4Q15 1Q16 2Q16 3Q16 4Q16

Net Charge‐offs (Non‐Energy)

Net Charge‐offs (Direct Energy)

Net Charge‐offs ratio

$78

$68 $72

$83

$54

($ in millions)

823 1,200 1,078 1,024 971

2,548

2,425 2,586 2,718 2,641

$3,371 $3,625

$3,664 $3,742 $3,612

4Q15 1Q16 2Q16 3Q16 4Q16

Criticized (Direct Energy) Criticized (Non‐Energy)

($ in millions)

($ in millions)

$782

$993 $1,025

$1,078 $995

141%

116% 112% 104% 110%

137%

132% 124% 123% 138%

4Q15 1Q16 2Q16 3Q16 4Q16

NPLs

Coverage Ratio

Adjusted coverage rate excluding Direct Energy

(2)

NPLs and Coverage Ratio(1)

83% 83% 84% 82% 81%

4Q15 1Q16 2Q16 3Q16 4Q16

Solid liquidity

Loan‐to‐deposit ratio(1)

(1) Based on ending balances

Regions has a strong, core funded balance

sheet resulting in low loan‐to‐deposit ratio

Future debt maturities are manageable and

allow for efficient re‐financing

Regions’ liquidity policy requires that the

holding company maintain at least 18

months coverage of maturities, debt service

and other cash needs

Management targets 24 months

coverage

Bank wholesale funding requirements will

be largely dictated by the relative

performance of loan and deposit growth

12

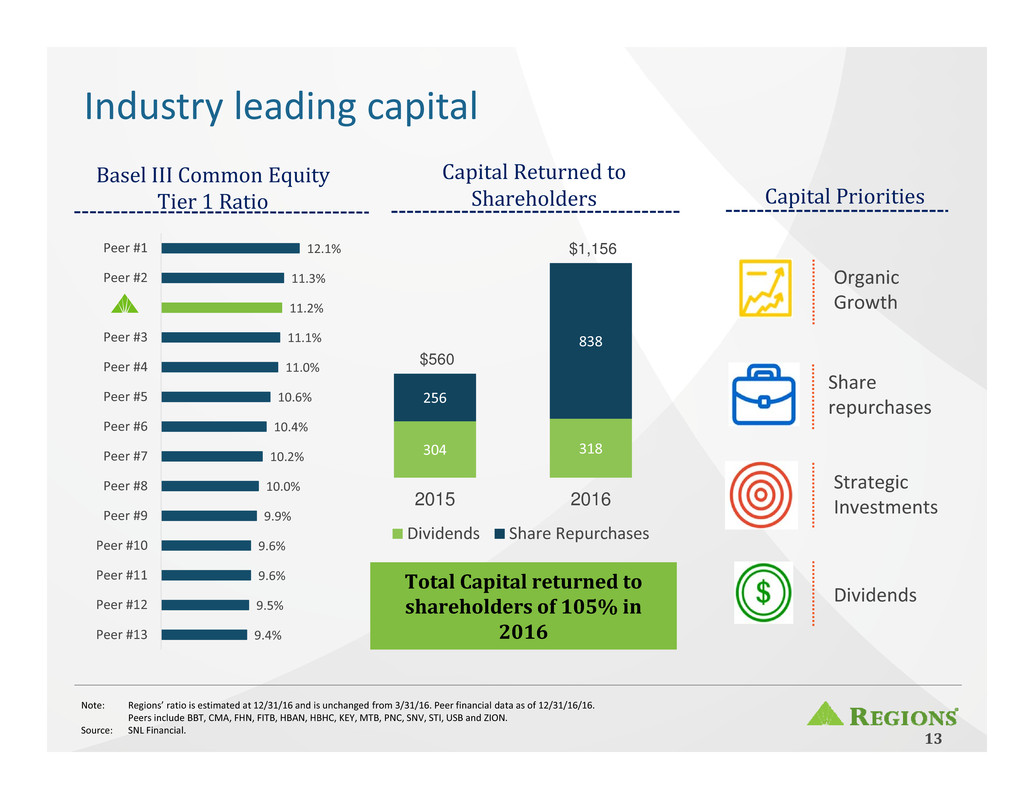

9.4%

9.5%

9.6%

9.6%

9.9%

10.0%

10.2%

10.4%

10.6%

11.0%

11.1%

11.2%

11.3%

12.1%

Peer #13

Peer #12

Peer #11

Peer #10

Peer #9

Peer #8

Peer #7

Peer #6

Peer #5

Peer #4

Peer #3

Peer #2

Peer #1

Basel III Common Equity

Tier 1 Ratio

Industry leading capital

Note: Regions’ ratio is estimated at 12/31/16 and is unchanged from 3/31/16. Peer financial data as of 12/31/16/16.

Peers include BBT, CMA, FHN, FITB, HBAN, HBHC, KEY, MTB, PNC, SNV, STI, USB and ZION.

Source: SNL Financial.

13

304 318

256

838

$560

$1,156

2015 2016

Dividends Share Repurchases

Total Capital returned to

shareholders of 105% in

2016

Capital Returned to

Shareholders

Organic

Growth

Strategic

Investments

Share

repurchases

Dividends

Capital Priorities

Solid total shareholder returns

14

23%

23%

26%

29%

29%

31%

32%

38%

40%

42%

53%

59%

66%

77%

Peer #13

Peer #12

Peer #11

Peer #10

Peer #9

Peer #8

Peer #7

Peer #6

Peer #5

Peer #4

Peer #3

Peer #2

Peer #1

29%

36%

37%

39%

44%

45%

47%

47%

51%

55%

59%

62%

70%

81%

Peer #13

Peer #12

Peer #11

Peer #10

Peer #9

Peer #8

Peer #7

Peer #6

Peer #5

Peer #4

Peer #3

Peer #2

Peer #1

3 Year 5 Year

Source: Bloomberg

Note: Total shareholder return data as of 12/31/2016

Peers include BBT, CMA, FITB, HBAN, HBHC, KEY, MTB, PNC, SNV, STI, USB, FHN and ZION

58%

114%

116%

129%

133%

141%

164%

169%

171%

172%

189%

237%

263%

348%

Peer #13

Peer #12

Peer #11

Peer #10

Peer #9

Peer #8

Peer #7

Peer #6

Peer #5

Peer #4

Peer #3

Peer #2

Peer #1

1 Year

2017 Earnings Guidance

15

Assumptions Expectations

• GDP growth of 2% to 2.5%

• Assumes market forward interest rate

curve as of November 10, 2016

⦁ Average Fed Funds of 81 bps

⦁ Average 10‐year Treasury of 2.26%

• Loan growth will reflect appropriate

balance and diversity while improving

risk‐adjusted returns

• Expanded fee revenue opportunities

• On track to meet branch consolidation

target of 150 branches by end of 2017

• Expenses reflect continued cost

eliminations

• Full year average loan growth low single digits

• Full year average deposit growth low single

digits

• Net interest income and other financing

income up 2% ‐ 4%

• Adjusted non‐interest income growth 3% ‐ 5%

• Adjusted expenses 0% ‐ 1%; full year efficiency

ratio ~62%

• Adjusted operating leverage of 2% ‐ 4%

• Net charge‐offs of 35 ‐ 50 bps

Note: The reconciliation with respect to these forward‐looking non‐GAAP measures is expected to be consistent with the actual non‐GAAP reconciliations included

in the attached appendix.

Why Regions? – Building Sustainable Franchise

Value

Effectively Deploy Capital

Grow and Diversify Revenue

Disciplined Expense Management

Adjusted EPS growth of

12‐15% (CAGR)

Adjusted efficiency

ratio of <60%

Adjusted ROATCE

12‐14%

Three pillars of execution

2016 – 2018 long‐term

expected results 2016 Results

16

Adjusted EPS growth of

17.1% (CAGR)

Adjusted ROATCE

9.9%

Adjusted efficiency

ratio of 63.3%

Note: The reconciliation with respect to forward‐looking non‐GAAP measures is expected to be consistent with the actual non‐GAAP reconciliations

included in the attached appendix.

(1) Non‐GAAP; see appendix for reconciliation. All measures presented on a continuing operations basis.

(1)

(1)

(1)

Appendix

17

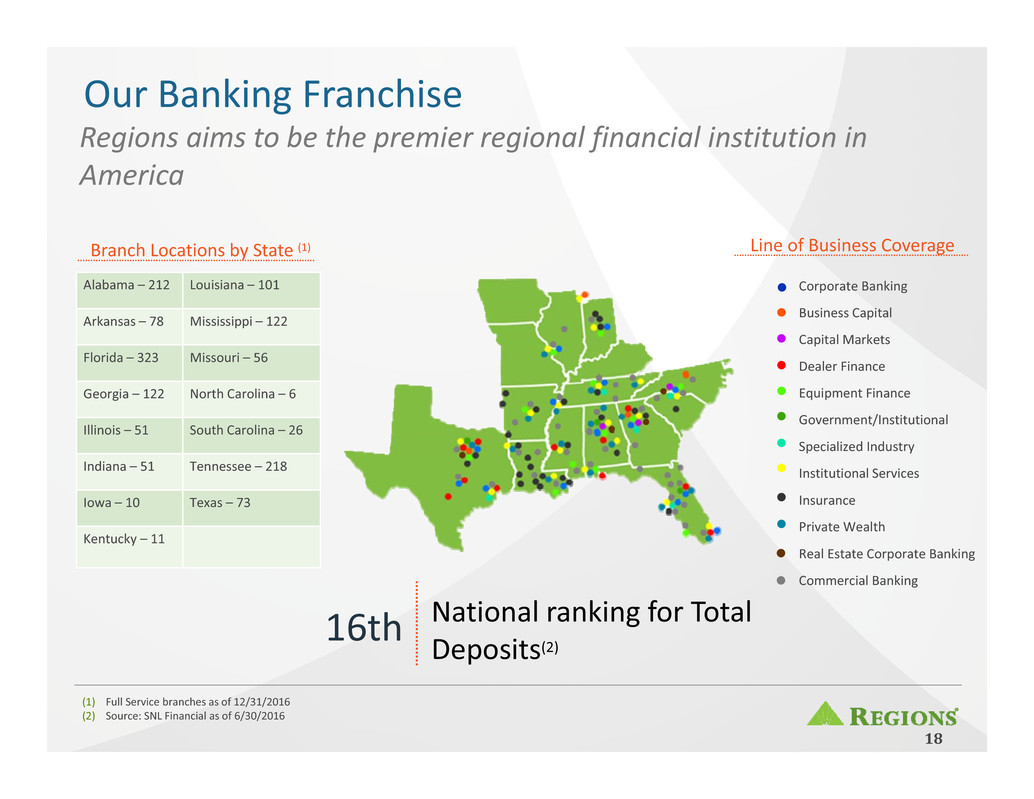

Our Banking Franchise

Regions aims to be the premier regional financial institution in

America

Alabama – 212 Louisiana – 101

Arkansas – 78 Mississippi – 122

Florida – 323 Missouri – 56

Georgia – 122 North Carolina – 6

Illinois – 51 South Carolina – 26

Indiana – 51 Tennessee – 218

Iowa – 10 Texas – 73

Kentucky – 11

Branch Locations by State (1)

(1) Full Service branches as of 12/31/2016

(2) Source: SNL Financial as of 6/30/2016

National ranking for Total

Deposits(2)

16th

18

Corporate Banking

Business Capital

Capital Markets

Dealer Finance

Equipment Finance

Government/Institutional

Specialized Industry

Institutional Services

Insurance

Private Wealth

Real Estate Corporate Banking

Commercial Banking

•

•

•

•

•

•

•

•

•

•

Line of Business Coverage

•

•

63%

20%

17%

Loans Securities Other

91%

7%2%

Deposits Borrowing Other

45%

55%

Floating Fixed

56%

36%

7%

53%

47%

Floating Fixed

IB Checking, Money Market, & Savings

Non‐Interest Bearing Checking

Time

Interest Rate Risk Exposure

December 31, 2016

Portfolio Compositions

Assets Liabilities

Loans(1)(2) Wholesale

Borrowings(1)

$127B $109B

$80B $99B $8B

Deposits

(1) Including balance sheet hedges ($9B received fixed loan swaps, $1.85B received fixed debt swaps)

(2) ARM mortgage loans are included as floating rate loans

(3) Excluding management priced deposits

(4) Last rising rate cycle measured from 2Q04 – 2Q07

• Naturally asset sensitive balance sheet

poised to benefit from rising interest rates

• 45% of loans are floating rate,

including hedges(1)

• $31B of net contractual(3) floating

rate exposure(1)(2)

• Funded mostly (91%) by large,

predominantly consumer deposit

franchise, which is 43% fixed rate

(non‐interest bearing or time)

• High quality securities portfolio with

duration in the low 4‐year range

• Loan hedges(1) used at the margin to

protect earnings under low rates, while

allowing for NII to expand as rates rise

• Deposit betas were roughly 54% through

the last cycle(4), at the lower end of peers

$13.8

$19.6

$1.7 $1.7 $2.3

$13.8

$17.9

‐$0.6

FF/Prime 1M Libor 3M Libor FF/Prime 1M Libor 3M Libor FF/Prime 1M Libor 3M Libor

Contractual(3) Floating Rate Exposure(1)(2)

Assets Liabilities Net Exposure

($ in billions)

19

Baseline Scenario +100 bps Standard Shock Scenario

Market Interest Rates Current implied forward rates +100bps parallel, instantaneous shock applied to

current implied forward rates

Loan Balance Growth Low single digit average YoY growth Low single digit average YoY growth

Deposit Balance Growth / Mix Low single digit average YoY growth Low single digit average YoY growth; ~$3B ending

remixing from Non‐Int Bearing to Time

(consistent with historical observations)

New Business Loan Spreads Stable at current levels Stable at current levels

Deposit Re‐pricing Betas Ramp up from ~40% to ~60%

(non‐linear model based on history)

Ramp up from ~40% to ~60% (non‐linear model based

on history; higher end of range occurring in large rate shocks

>+100bps over longer time horizon >12mo.)

2017 Full Year NII Growth 2% ‐ 4% Baseline Scenario +$152mm

Interest Rate Risk Assumptions

December 31, 2016

Assumption Sensitivity Analysis(1)

($ in millions)

(1) Impacts of stresses to standard shock scenario are applied independently; not cumulative

Standard Interest Rate Risk Scenario Assumptions

+$121 +$124 +$132 +$134

+$152

+$170 +$183

+$222

+5% Deposit

Beta

‐$3B Lower

Deposit

Balances

Additional

$3B Deposit

Remixing

($6B Total)

‐1% Loan

Growth

(Avg)

+100 bps

Standard

Scenario

+1% Loan

Growth

(Avg)

‐5% Deposit

Beta

+200 bps

Rate Shock

Scenario

20

Energy Lending Overview

• Total outstandings and

commitments declined primarily

due to paydowns and payoffs

• Allowance for loan and lease

losses was 7.0% of direct energy

balances at 12/31/16 vs 7.9% at

9/30/16

• No second lien exposure

outstanding within the energy

portfolio

• Leveraged loans account for 23%

of energy related balances; the

majority are Exploration &

Production and Midstream

• Energy charge‐offs of $37 million

for 2016

• Energy charge‐offs for 2017 are

expected to be less than $40

million given current market

conditions

• Under a stressed scenario with oil

averaging below $25, incremental

losses could total $100 million

over the next 8 quarters

• Utilization rate has remained

between 40‐60% since 1Q15

• 15% of direct energy loans are on

non‐accrual status

• ALLL/NPL excluding direct energy

is 138%(1) at year end

Total Energy

As of 12/31/16 As of 9/30/16

($ in millions)

Loan /

Lease

Balances

Balances

Including

Related

Commitments

%

Utilization

$

Criticized

%

Criticized

Loan /

Lease

Balances

Balances

Including

Related

Commitments

%

Utilization

$

Criticized

%

Criticized

Oilfield services

and supply (OFS) $754 $1,186 64% $431 57% $811 $1,268 64% $451 56%

Exploration and

production (E&P) 702 1,301 54% 492 70% 757 1,326 57% 522 69%

Midstream

445 1,044 43% 28 6% 459 1,082 42% 30 7%

Downstream

77 270 29% 17 22 80 309 26% 17 21

Other

119 264 45% 3 3 130 284 46% 4 3

Total direct

2,097 4,065 52% 971 46% 2,237 4,269 52% 1,024 46%

Indirect

536 982 55% 119 22% 514 946 54% 124 24%

Direct and

indirect 2,633 5,047 52% 1,090 41% 2,751 5,215 53% 1,148 42%

Operating leases

131 131 — 71 54% 145 145 — 83 57%

Total energy

$2,764 $5,178 53% $1,161 42% $2,896 $5,360 54% $1,231 43%

Note: Securities portfolio contained ~$11MM of high quality, investment grade corporate bonds that are energy related at 12/31/16, down from ~$12MM at

9/30/16. A leveraged relationship is defined as senior cash flow leverage of 3x or total cash flow leverage of 4x except for Midstream Energy which is 6x total cash flow

leverage.

(1) Non‐GAAP; see appendix for reconciliation

21

Energy Lending ‐ Oil Field Services and Exploration

& Production Detail

Type

As of

12/31/16

($ in millions)

# of

Clients* Commentary

Marine $447 $9 Expect some additional stress into 2017 as

contracts mature and E&P companies

focus on shorter cycle onshore projects.

Contract coverage for the portfolio is

approximately 50% entering 2017

Integrated OFS 139 9 Average utilization is 38% indicating clients

have liquidity to weather cycle.

Compression 108 4 Linked to movement of natural gas; sector

is more stable and lower risk than other

sectors.

Fluid Management 14 2 Some improvement in this sector as rig

counts have improved. Exposure is

minimal after payoffs in the quarter.

Pre‐drilling / Drilling 40 2 Reduced capex spending of many E&P

companies impacted current and future

cash flows; however, Regions' larger

borrowers remain liquid.

Sand 6 1 Some improvement in this sector as rig

counts have improved. Exposure is

minimal.

Total Oil Field

Services (OFS)

754 27

Exploration and

production (E&P)

702 26**

Total OFS and E&P $1,456

• 47% shared national credit (SNC) loans

• 64% utilization rate compared to 65%

in 3Q16

• 87% Non‐pass rated (criticized) loans

paying as agreed

E&P Portfolio

*Represents the number of clients that comprise 75% of the loan balances outstanding.

**Represents the number of clients that comprise 90% of the loan balances outstanding.

OFS Portfolio

• Majority of borrowing is senior

secured

• 96% shared national credit (SNC) loans

• 54% utilization rate compared to 57%

in 3Q16

• Essentially all non‐pass rated

(criticized) loans paying as agreed

22

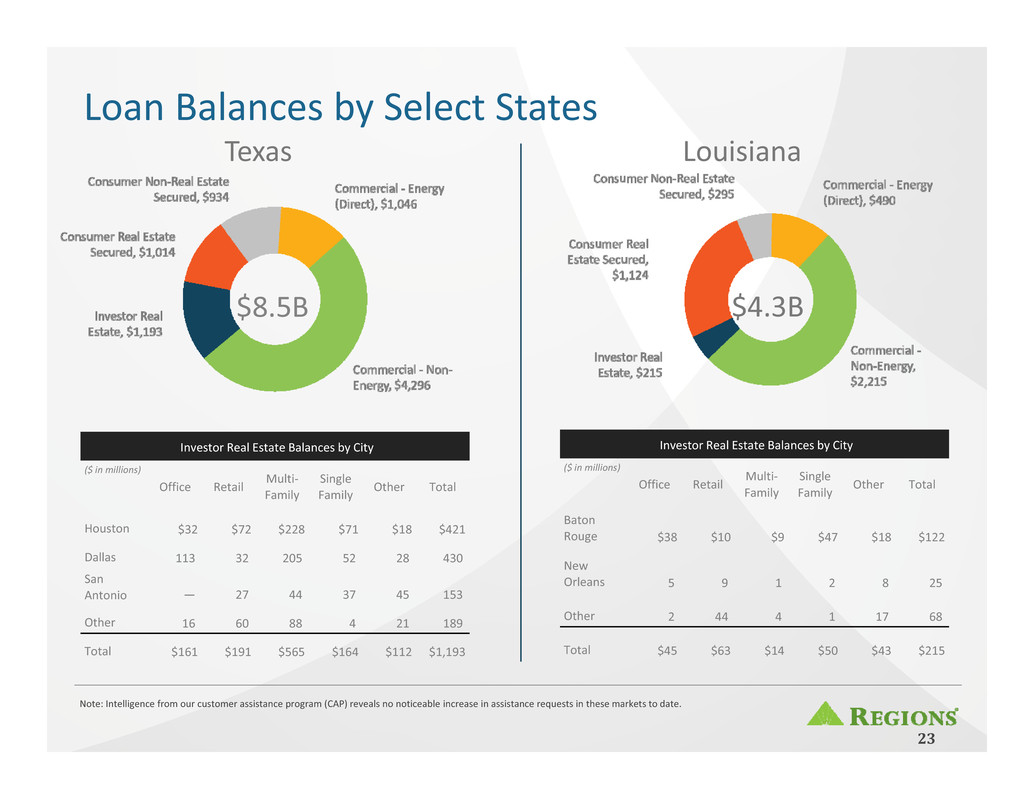

Loan Balances by Select States

Texas Louisiana

Note: Intelligence from our customer assistance program (CAP) reveals no noticeable increase in assistance requests in these markets to date.

Investor Real Estate Balances by City

($ in millions)

Office Retail

Multi‐

Family

Single

Family

Other Total

Houston $32 $72 $228 $71 $18 $421

Dallas 113 32 205 52 28 430

San

Antonio — 27 44 37 45 153

Other 16 60 88 4 21 189

Total $161 $191 $565 $164 $112 $1,193

Investor Real Estate Balances by City

($ in millions)

Office Retail

Multi‐

Family

Single

Family

Other Total

Baton

Rouge $38 $10 $9 $47 $18 $122

New

Orleans 5 9 1 2 8 25

Other 2 44 4 1 17 68

Total $45 $63 $14 $50 $43 $215

$4.3B$8.5B

23

Loan Balances by Select States

Alabama Mississippi

$3.1B$9.8B

Investor Real Estate Balances by City

($ in millions)

Office Retail

Multi‐

Family

Single

Family

Other Total

Birmingham $15 $30 $5 $16 $27 $93

Huntsville 82 17 6 7 2 114

Mobile /

Baldwin County 2 7 3 3 9 24

Other 8 21 21 11 13 74

Total $107 $75 $35 $37 $51 $305

Investor Real Estate Balances by City

($ in millions)

Office Retail

Multi‐

Family

Single

Family

Other Total

North

Mississippi — — — — $97 $97

Jackson/Other 5 2 17 1 3 28

Gulfport / Biloxi

/ Pascagoula — — 18 — 8 26

Total $5 $2 $35 $1 $108 $151

24

Non‐GAAP reconciliation: Non‐interest income,

non‐interest expense and efficiency ratio

NM ‐ Not Meaningful

The table below presents computations of the efficiency ratio (non‐GAAP), which is a measure of productivity, generally calculated as non‐interest expense divided by total revenue. Management uses this ratio to

monitor performance and believes this measure provides meaningful information to investors. Non‐interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non‐interest expense

(non‐GAAP), which is the numerator for the efficiency ratio. Non‐interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non‐interest income (non‐GAAP), which is the numerator

for the fee income ratio. Net interest income and other financing income on a taxable‐equivalent basis and non‐interest income are added together to arrive at total revenue on a taxable‐equivalent basis.

Adjustments are made to arrive at adjusted total revenue on a taxable‐equivalent basis (non‐GAAP), which is the denominator for the efficiency ratio. Regions believes that the exclusion of these adjustments

provides a meaningful base for period‐to‐period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non‐

GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not

consider the activities related to the adjustments to be indications of ongoing operations. The table on the following page presents a computation of the operating leverage ratio (non‐GAAP) which is the period to

period percentage change in adjusted total revenue on a taxable‐equivalent basis (non‐GAAP) less the percentage change in adjusted non‐interest expense (non‐GAAP). Regions believes that presentation of these

non‐GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management.

Quarter Ended

($ amounts in millions) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015 4Q16 vs. 3Q16 4Q16 vs. 4Q15

ADJUSTED EFFICIENCY AND FEE INCOME RATIOS, ADJUSTED

NON-INTEREST INCOME/EXPENSE- CONTINUING OPERATIONS

Non-interest expense (GAAP) A $ 899 $ 934 $ 915 $ 869 $ 873 $ (35) (3.7)% $ 26 3.0%

Adjustments:

Professional, legal and regulatory expenses — — (3) — — — NM — NM

Branch consolidation, property and equipment charges (17) (5) (22) (14) (6) (12) 240.0% (11) 183.3%

Loss on early extinguishment of debt — (14) — — — 14 (100.0)% — NM

Salary and employee benefits—severance charges (5) (3) (1) (12) (6) (2) 66.7% 1 (16.7)%

Adjusted non-interest expense (non-GAAP) B $ 877 $ 912 $ 889 $ 843 $ 861 $ (35) (3.8)% $ 16 1.9%

Net interest income and other financing income (GAAP) $ 853 $ 835 $ 848 $ 862 $ 836 $ 18 2.2% $ 17 2.0%

Taxable-equivalent adjustment 21 21 21 21 20 — —% 1 5.0%

Net interest income and other financing income, taxable-equivalent

basis C $ 874 $ 856 $ 869 $ 883 $ 856 $ 18 2.1% $ 18 2.1%

Non-interest income (GAAP) D $ 522 $ 599 $ 526 $ 506 $ 514 $ (77) (12.9)% $ 8 1.6%

Adjustments:

Securities (gains) losses, net (5) — (6) 5 (11) (5) NM 6 (54.5)%

Insurance proceeds — (47) — (3) (1) 47 (100.0)% 1 (100.0)%

Leveraged lease termination gains, net — (8) — — — 8 (100.0)% — NM

Gain on sale of affordable housing residential mortgage loans (5) — — — — (5) NM (5) NM

Adjusted non-interest income (non-GAAP) E $ 512 $ 544 $ 520 $ 508 $ 502 $ (32) (5.9)% $ 10 2.0%

Total revenue, taxable-equivalent basis C+D=F $ 1,396 $ 1,455 $ 1,395 $ 1,389 $ 1,370 $ (59) (4.1)% $ 26 1.9%

Adjusted total revenue, taxable-equivalent basis (non-GAAP) C+E=G $ 1,386 $ 1,400 $ 1,389 $ 1,391 $ 1,358 $ (14) (1.0)% $ 28 2.1%

Efficiency ratio (GAAP) A/F 64.4% 64.2% 65.6% 62.5% 63.7%

Adjusted efficiency ratio (non-GAAP) B/G 63.2% 65.3% 64.0% 60.6% 63.4%

Fee income ratio (GAAP) D/F 37.4% 41.2% 37.7% 36.4% 37.5%

Adjusted fee income ratio (non-GAAP) E/G 36.9% 38.8% 37.5% 36.5% 37.0%

25

Non‐GAAP reconciliation continued: YTD Non‐

interest income, non‐interest expense, efficiency

ratio and operating leverage

NM ‐ Not Meaningful

Year Ended December 31

($ amounts in millions) 2016 2015 2016 vs. 2015

ADJUSTED EFFICIENCY, FEE INCOME AND OPERATING LEVERAGE RATIOS, ADJUSTED NON-INTEREST

INCOME/EXPENSE- CONTINUING OPERATIONS

Non-interest expense (GAAP) H $ 3,617 $ 3,607 $ 10 0.3%

Adjustments:

Professional, legal and regulatory expenses (3) (48) 45 (93.8)%

Branch consolidation, property and equipment charges (58) (56) (2) 3.6%

Loss on early extinguishment of debt (14) (43) 29 (67.4)%

Salary and employee benefits—severance charges (21) (6) (15) 250.0%

Adjusted non-interest expense (non-GAAP) I $ 3,521 $ 3,454 $ 67 1.9%

Net interest income and other financing income (GAAP) $ 3,398 $ 3,307 $ 91 2.8%

Taxable-equivalent adjustment 84 75 9 12.0%

Net interest income and other financing income, taxable-equivalent basis J $ 3,482 $ 3,382 $ 100 3.0%

Non-interest income (GAAP) K $ 2,153 $ 2,071 $ 82 4.0%

Adjustments:

Securities gains, net (6) (29) 23 (79.3)%

Insurance proceeds (50) (91) 41 (45.1)%

Leveraged lease termination gains, net (8) (8) — NM

Gain on sale of affordable housing residential mortgage loans (5) — (5) NM

Adjusted non-interest income (non-GAAP) L $ 2,084 $ 1,943 $ 141 7.3%

Total revenue, taxable-equivalent basis J+K=M $ 5,635 $ 5,453 $ 182 3.3%

Adjusted total revenue, taxable-equivalent basis (non-GAAP) J+L=N $ 5,566 $ 5,325 $ 241 4.5%

Operating leverage ratio (GAAP) M-H 3.0%

Adjusted operating leverage ratio (non-GAAP) N-I 2.6%

Efficiency ratio (GAAP) H/M 64.2% 66.2%

Adjusted efficiency ratio (non-GAAP) I/N 63.3% 64.9%

Fee income ratio (GAAP) K/M 38.2% 38.0%

Adjusted fee income ratio (non-GAAP) L/N 37.5% 36.5%

26

Non‐GAAP reconciliation continued: YTD return on average tangible

stockholders' equity and earnings per common share from

continuing operations

27

The tables below present computations of "adjusted net income from continuing operations available to common shareholders," "adjusted return on average tangible common stockholders' equity" and "adjusted

earnings per common share from continuing operations," which exclude certain significant items that are included in the financial results presented in accordance with GAAP. Management believes these measures

provide a meaningful base for period‐to‐period comparisons, and will assist investors in analyzing the operating results of the Company and predicting future performance. These non‐GAAP financial measures are also

used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the

adjustments to be indications of ongoing operations. Regions believes that presentation of these non‐GAAP financial measures will permit investors to assess the performance of the Company on the same basis as

that applied by management. These non‐GAAP measures also provide analysts and investors certain metrics regarding the progress of the Company in comparison to long‐term expected results previously

communicated.

(1) The total net adjustments to non‐interest expense is the summation of the adjustments previously shown on page 26.

(2) The total net adjustments to non‐interest income is the summation of the adjustments previously shown on page 26.

(3) The computation of the income tax impact for adjusted items is based on 38.5%, comprised of the statutory federal rate of 35%, adjusted for applicable state income taxes, net of the

related federal tax benefit. The tax adjustment also includes the tax impact from leveraged lease termination gains.

(4) On a continuing operations basis.

2016 2015

ADJUSTED RETURN ON AVERAGE TANGIBLE COMMON STOCKHOLDERS’ EQUITY

Net income from continuing operations available to common shareholders (GAAP) A 1,094$ 1,011$ 83$ 8.2%

Total net adjustments to non-interest expense(1) 96 153 (57) (37.3)%

Total net adjustments to non-interest income(2) (69) (128) 59 (46.1)%

Income tax adjustment(3) (2) (28) 26 (92.9)%

Adjusted net income from continuing operations available to common shareholders

(non-GAAP) B 1,119$ 1,008$ 111$ 11.01%

Average stockholders’ equity (GAAP) 17,126$ 16,916$ 210$ 1.2%

Less: Average intangible assets (GAAP) 5,125 5,099 26 0.5%

Average deferred tax liability related to intangibles (GAAP) (162) (170) 8 (4.7)%

Average preferred stock (GAAP) 820 848 (28) (3.3)%

Average tangible common stockholders’ equity (non-GAAP) C 11,343$ 11,139$ 204$ 1.8%

Return on average tangible common stockholders' equity (non-GAAP)(4) A/C 9.65% 9.07%

Adjusted return on average tangible common stockholders' equity (non-GAAP)(4) B/C 9.87% 9.04%

ADJUSTED EARNINGS PER COMMON SHARE

Weighted average number of shares outstanding (diluted) D 1,261 1,334

Earnings per common share from continuing operations (GAAP) A/D 0.87$ 0.76$ 0.11$ 14.5%

Adjusted earnings per common share from continuing operations (non-GAAP) B/D 0.89$ 0.76$ 0.13$ 17.1%

Year ended December 31

2016 vs. 2015

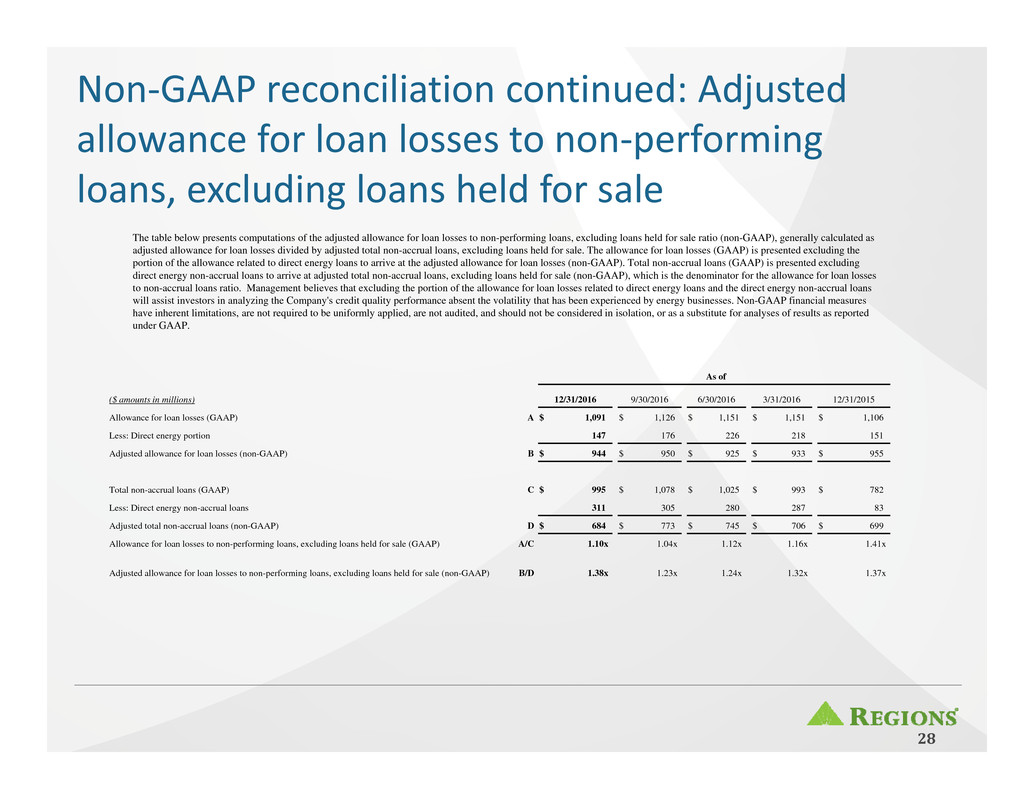

The table below presents computations of the adjusted allowance for loan losses to non-performing loans, excluding loans held for sale ratio (non-GAAP), generally calculated as

adjusted allowance for loan losses divided by adjusted total non-accrual loans, excluding loans held for sale. The allowance for loan losses (GAAP) is presented excluding the

portion of the allowance related to direct energy loans to arrive at the adjusted allowance for loan losses (non-GAAP). Total non-accrual loans (GAAP) is presented excluding

direct energy non-accrual loans to arrive at adjusted total non-accrual loans, excluding loans held for sale (non-GAAP), which is the denominator for the allowance for loan losses

to non-accrual loans ratio. Management believes that excluding the portion of the allowance for loan losses related to direct energy loans and the direct energy non-accrual loans

will assist investors in analyzing the Company's credit quality performance absent the volatility that has been experienced by energy businesses. Non-GAAP financial measures

have inherent limitations, are not required to be uniformly applied, are not audited, and should not be considered in isolation, or as a substitute for analyses of results as reported

under GAAP.

Non‐GAAP reconciliation continued: Adjusted

allowance for loan losses to non‐performing

loans, excluding loans held for sale

As of

($ amounts in millions) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Allowance for loan losses (GAAP) A $ 1,091 $ 1,126 $ 1,151 $ 1,151 $ 1,106

Less: Direct energy portion 147 176 226 218 151

Adjusted allowance for loan losses (non-GAAP) B $ 944 $ 950 $ 925 $ 933 $ 955

Total non-accrual loans (GAAP) C $ 995 $ 1,078 $ 1,025 $ 993 $ 782

Less: Direct energy non-accrual loans 311 305 280 287 83

Adjusted total non-accrual loans (non-GAAP) D $ 684 $ 773 $ 745 $ 706 $ 699

Allowance for loan losses to non-performing loans, excluding loans held for sale (GAAP) A/C 1.10x 1.04x 1.12x 1.16x 1.41x

Adjusted allowance for loan losses to non-performing loans, excluding loans held for sale (non-GAAP) B/D 1.38x 1.23x 1.24x 1.32x 1.37x

28

Non‐GAAP reconciliation: Basel III common equity

Tier 1 ratio – fully phased‐in pro‐forma

(1) Current quarter amounts and the resulting ratio are estimated.

(2) Regions continues to develop systems and internal controls to precisely calculate risk‐weighted assets as required by Basel III on a fully phased‐in basis. The

amount included above is a reasonable approximation, based on our understanding of the requirements.

The calculation of the fully phased‐in pro‐forma "Common equity Tier 1" (CET1) is based on Regions’ understanding of the Final Basel III requirements. For Regions, the Basel III framework became effective on a phased‐in

approach starting in 2015 with full implementation beginning in 2019. The calculation provided below includes estimated pro‐forma amounts for the ratio on a fully phased‐in basis. Regions’ current understanding of the final

framework includes certain assumptions, including the Company’s interpretation of the requirements, and informal feedback received through the regulatory process. Regions’ understanding of the framework is evolving

and will likely change as analysis and discussions with regulators continue. Because Regions is not currently subject to the fully‐phased in capital rules, this pro‐forma measure is considered to be a non‐GAAP financial

measure, and other entities may calculate it differently from Regions’ disclosed calculation.

A company's regulatory capital is often expressed as a percentage of risk‐weighted assets. Under the risk‐based capital framework, a company’s balance sheet assets and credit equivalent amounts of off‐balance sheet items

are assigned to broad risk categories. The aggregated dollar amount in each category is then multiplied by the prescribed risk‐weighted percentage. The resulting weighted values from each of the categories are added

together and this sum is the risk‐weighted assets total that, as adjusted, comprises the denominator of certain risk‐based capital ratios. Common equity Tier 1 capital is then divided by this denominator (risk‐weighted

assets) to determine the common equity Tier 1 capital ratio. The amounts disclosed as risk‐weighted assets are calculated consistent with banking regulatory requirements on a fully phased‐in basis.

Since analysts and banking regulators may assess Regions’ capital adequacy using the fully phased‐in Basel III framework, we believe that it is useful to provide investors the ability to assess Regions’ capital adequacy on this

same basis.

($ amounts in millions) 12/31/2016 9/30/2016 6/30/2016 3/31/2016 12/31/2015

Basel III Common Equity Tier 1 Ratio—Fully Phased-In Pro-Forma (1)

Stockholder's equity (GAAP) $ 16,664 $ 17,365 $ 17,385 $ 17,211 $ 16,844

Non-qualifying goodwill and intangibles (4,955) (4,936) (4,946) (4,947) (4,958)

Adjustments, including all components of accumulated other comprehensive income, disallowed deferred tax assets,

threshold deductions and other adjustments 482 (173) (227) (64) 286

Preferred stock (GAAP) (820) (820) (820) (820) (820)

Basel III common equity Tier 1—Fully Phased-In Pro-Forma (non-GAAP) A $ 11,371 $ 11,436 $ 11,392 $ 11,380 $ 11,352

Basel III risk-weighted assets—Fully Phased-In Pro-Forma (non-GAAP) (2) B $ 103,529 $ 103,749 $ 105,199 $ 106,227 $ 106,188

Basel III common equity Tier 1 ratio—Fully Phased-In Pro-Forma (non-GAAP) A/B 11.0% 11.0% 10.8% 10.7% 10.7%

29

Forward‐looking statements

This release may include forward‐looking statements as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and

financial performance. Forward‐looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments.

Forward‐looking statements are based on management’s expectations as well as certain assumptions and estimates made by, and information available to, management at the time the

statements are made. Those statements are based on general assumptions and are subject to various risks, uncertainties and other factors that may cause actual results to differ materially

from the views, beliefs and projections expressed in such statements. These risks, uncertainties and other factors include, but are not limited to, those described below:

• Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of declines in property values, unemployment rates and

potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions.

• Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse

effect on our earnings.

• The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict.

• Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity.

• Any impairment of our goodwill or other intangibles, or any adjustment of valuation allowances on our deferred tax assets due to adverse changes in the economic environment, declining operations

of the reporting unit, or other factors.

•Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans.

• Changes in the speed of loan prepayments, loan origination and sale volumes, charge‐offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover

our eventual losses.

• Possible acceleration of prepayments on mortgage‐backed securities due to low interest rates, and the related acceleration of premium amortization on those securities.

• Our ability to effectively compete with other financial services companies, some of whom possess greater financial resources than we do and are subject to different regulatory standards than we are.

• Loss of customer checking and savings account deposits as customers pursue other, higher‐yield investments, which could increase our funding costs.

• Our inability to develop and gain acceptance from current and prospective customers for new products and services in a timely manner could have a negative impact on our revenue.

• The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries.

• Changes in laws and regulations affecting our businesses, such as the Dodd‐Frank Act and other legislation and regulations relating to bank products and services, as well as changes in the enforcement

and interpretation of such laws and regulations by applicable governmental and self‐regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce

our revenue, impose additional costs on us, or otherwise negatively affect our businesses.

• Our ability to obtain a regulatory non‐objection (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends,

repurchase common stock under current or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market

perceptions of us.

• Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due

to the importance and intensity of such tests and requirements.

• Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the LCR rule), including our ability to generate capital

internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition could be negatively impacted.

• The Basel III framework calls for additional risk‐based capital surcharges for globally systemically important banks. Although we are not subject to such surcharges, it is possible that in the future we

may become subject to similar surcharges.

• The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory

enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results.

• Our ability to manage fluctuations in the value of assets and liabilities and off‐balance sheet exposure so as to maintain sufficient capital and liquidity to support our business.

• Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non‐financial benefits relating to our strategic initiatives.

• The success of our marketing efforts in attracting and retaining customers.

• Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income.

• Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and

regulations in effect from time to time.

• Fraud or misconduct by our customers, employees or business partners.

30

Forward‐looking statements continued

The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward‐Looking Statements” and

“Risk Factors" of Regions' Annual Report on Form 10‐K for the year ended December 31, 2015, as filed with the Securities and Exchange Commission.

The words “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “will,” “may,” “could,” “should,” “can,” and similar expressions often

signify forward‐looking statements. You should not place undue reliance on any forward‐looking statements, which speak only as of the date made. We assume no obligation to update or revise any forward‐

looking statements that are made from time to time.

• Any inaccurate or incomplete information provided to us by our customers or counterparties.

• The risks and uncertainties related to our acquisition and integration of other companies.

• Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third‐party vendors and other service providers, which could, among other

things, result in a breach of operating or security systems as a result of a cyber attack or similar act.

• The inability of our internal disclosure controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts.

• The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses.

• The effects of man‐made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan

portfolios and increase our cost of conducting business.

• Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including

businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to

service any loans outstanding to them and/or reduce demand for loans in those industries.

• Our inability to keep pace with technological changes could result in losing business to competitors.

• Our ability to identify and address cyber‐security risks such as data security breaches, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our business and result in

the disclosure of and/or misuse or misappropriation of confidential or proprietary information; disruption or damage to our systems; increased costs; losses; or adverse effects to our reputation.

• Our ability to realize our adjusted efficiency ratio target as part of our expense management initiatives.

• Significant disruption of, or loss of public confidence in, the Internet and services and devices used to access the Internet could affect the ability of our customers to access their accounts and conduct

banking transactions.

• Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets.

• The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue,

impose additional costs on us, or otherwise negatively affect our businesses.

• The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses; result in the disclosure of and/or misuse of confidential information or

proprietary information; increase our costs; negatively affect our reputation; and cause losses.

• Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders.

• Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect how we report our financial results.

• Other risks identified from time to time in reports that we file with the SEC.

• The effects of any damage to our reputation resulting from developments related to any of the items identified above.

31

®

32