Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - Biostage, Inc. | v458281_ex23-2.htm |

As filed with the Securities and Exchange Commission on February 3, 2017

Registration No. 333-215410

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Biostage, Inc.

(Exact name of registrant as specified in its Charter)

| Delaware | 3841 | 45-5210462 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

84 October Hill Road, Suite 11, Holliston, Massachusetts 01746

(774) 233-7300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

James McGorry

President and Chief Executive Officer

Biostage, Inc.

84 October Hill Road, Suite 11, Holliston, Massachusetts 01746

(774) 233-7300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Josef B. Volman, Esq. | Joseph A. Smith, Esq. |

| Chad J. Porter, Esq. | Ellenoff Grossman & Schole LLP |

| Burns & Levinson LLP | 1345 Avenue of the Americas |

| 125 Summer Street | New York, NY 10105 |

| Boston, MA 02110 | (212) 370-1300 |

| (617) 345-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one)

| Large Accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

Title of each Class of Securities to be Registered | Proposed Maximum | Amount of Registration Fee | ||||||

| Common Stock, par value $0.01 per share (2) | $ | 5,920,635 | — | |||||

| Series C Convertible Preferred Stock, par value $0.01 per share (2) | $ | 1,973,545 | — | |||||

| Common Stock issuable upon conversion of Preferred Stock (2) | — | — | ||||||

| Warrants to purchase Common Stock (2) | $ | 105,821 | — | |||||

| Common Stock issuable upon exercise of Warrants (2) | $ | 10,000,001 | — | |||||

| Placement agent’s warrants (3) | — | — | ||||||

| Common stock issuable upon exercise of placement agent’s warrants (3) | $ | 500,001 | — | |||||

| Series A Junior Participating Cumulative Preferred Stock Purchase Rights (4) | — | — | ||||||

| Total | $ | 18,500,003 | $ | 2,145 | (5) | |||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (3) | Represents warrants to purchase a number of shares of common stock equal to 5% of the common stock sold in this offering (including the number of shares of common stock issuable upon conversion of shares of Series C Preferred Stock sold in this offering but excluding any shares of common stock underlying the warrants issued in this offering). |

| (4) | This Registration Statement also relates to the Rights to purchase shares of Series A Junior Participating Cumulative Preferred Stock of the Registrant which are attached to all shares of Common Stock pursuant to the terms of the Registrant’s Shareholder Rights Agreement dated October 31, 2008, as amended by Amendment No. 1 dated February 12, 2015. Until the occurrence of certain prescribed events, the Rights are not exercisable, are evidenced by the certificates for the Common Stock and will be transferred only with such stock. |

| (5) | Of this amount, $928 was previously paid. Calculated in accordance with Rule 457(o) of the Securities Act based on an estimate of the proposed maximum aggregate offering price at the statutory rate of $115.90 per $1,000,000 of securities registered. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED FEBRUARY 3, 2017

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Up to 7,936,508 Shares of Common Stock,

Warrants to Purchase up to 10,582,011 Shares of Common Stock and

Up to 2,000 Shares of Series C Convertible Preferred Stock

(2,645,503 shares of Common Stock underlying the Series C

Convertible Preferred Stock)

We are offering up to 7,936,508 shares of common stock, together with warrants to purchase 10,582,011 shares of common stock (and the shares issuable from time to time upon exercise of the warrants) at a combined purchase price of $ pursuant to this prospectus. The shares and warrants will be separately issued but will be purchased together in this offering. Each warrant will have an exercise price of $ per share, will be exercisable upon issuance and will expire five years from the date on which such warrants were issued.

We are also offering to those purchasers, whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock following the consummation of this offering, the opportunity to purchase, if they so choose, in lieu of the shares of our common stock that would result in ownership in excess of 4.99%, shares of Series C Convertible Preferred Stock (“Series C Preferred Stock”), convertible at any time at the holder’s option into a number of shares of common stock equal to $1,000 divided by the combined public offering price per share of common stock and warrant (the “Conversion Price”), at a public offering price of $1,000 per share of Series C Preferred Stock. Each share of Series C Preferred Stock is being sold together with the same warrants described above being sold with each share of common stock.

Our common stock is listed on the NASDAQ Capital Market under the symbol “BSTG.” On February 2, 2017, the closing price for our common stock, as reported on the NASDAQ Capital Market, was $0.756 per share. The warrants and any shares of Series C Preferred Stock that we issue are not and will not be listed for trading on the NASDAQ Capital Market.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in this prospectus beginning on page 8.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS ACCURATE, TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Share

of Common Stock and Warrant | Per Share

of Series C Preferred Stock and Warrant | Total | ||||||||||

| Public offering price | ||||||||||||

| Placement agent fees (1) | ||||||||||||

| Proceeds, before expenses, to us | ||||||||||||

| (1) | We have also agreed to (i) grant warrants to purchase shares of common stock to the placement agent as described under “Plan of Distribution” on page 84 of this prospectus, (ii) pay the placement agent a management fee equal to 1% of the gross proceeds raised in this offering and (iii) pay the placement agent a reimbursement for out-of-pocket expenses in connection with marketing the transaction in the amount of up to $35,000 and a reimbursement for legal fees and expenses of the placement agent in the amount of $100,000. For additional information about the compensation paid to the placement agent, see “Plan of Distribution.” |

We have retained H.C. Wainwright & Co., LLC as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above.

We expect to deliver the shares and the warrants to purchasers in this offering on or about , 2017.

Rodman & Renshaw

a unit of H.C. Wainwright & Co.

The date of this prospectus is , 2017.

TABLE OF CONTENTS

We have not, and the placement agent has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any prospectus supplement or free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable prospectus supplement or free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not, and the placement agent has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United States.

You should rely only on the information contained in this prospectus and any prospectus supplement or free writing prospectus authorized by us. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information in this prospectus is accurate only as of the date it is presented. You should read this prospectus and any prospectus supplement or free writing prospectus that we have authorized for use in connection with this offering, in their entirety before investing in our securities.

We are offering to sell, and seeking offers to buy, the securities offered by this prospectus only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the securities offered by this prospectus in certain jurisdictions may be restricted by law. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

i

The following summary highlights information contained elsewhere in this prospectus. It may not contain all of the information that is important to you. You should read the entire prospectus carefully, especially the discussion regarding the risks of investing in our securities under the heading “Risk Factors,” before investing in our securities. All references to “Company” “we,” “our” or “us” refer solely to Biostage, Inc. and its subsidiaries and not to the persons who manage us or constitute our Board of Directors.

About Biostage, Inc.

We are a biotechnology company developing bioengineered organ implants based on our novel CellframeTM technology. Our Cellframe technology is comprised of a biocompatible scaffold seeded with the patient’s own stem cells. Our platform technology is being developed to treat life-threatening conditions of the esophagus, bronchus and trachea. By focusing on these underserved patients, we hope to dramatically improve the treatment paradigm for these patients. Our unique Cellframe technology combines the clinically proven principles of tissue engineering, cell biology and material science.

We believe that our Cellframe technology may provide surgeons a new paradigm to address life-threatening conditions of the esophagus, bronchus, and trachea due to cancer, infection, trauma or congenital abnormalities. Our novel technology harnesses the body’s response and modulates it toward the healing process to restore the continuity and integrity of the organ. We are pursuing the CellspanTM esophageal implant as our first product candidate to address esophageal atresia and esophageal cancer, and we are also developing our technology’s applications to address conditions of the bronchus and trachea.

In collaboration with world-class institutions, such as Mayo Clinic and Connecticut Children’s Medical Center, we are expecting to transition from a pre-clinical company to a clinical company in 2017. We plan to file an Investigational New Drug application (IND) with the U.S. Food and Drug Administration (FDA) for our Cellspan esophageal implant in the third quarter of 2017 and expect to begin first in human clinical trials in the fourth quarter of 2017.

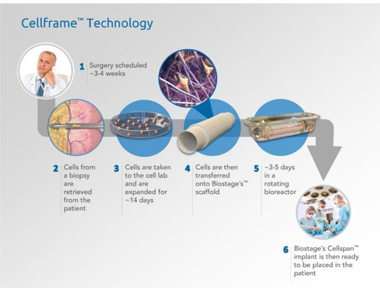

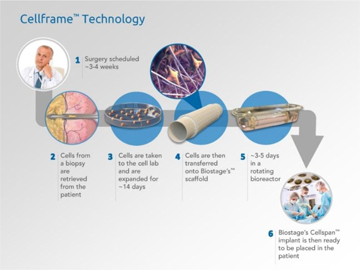

Our Cellframe technology platform: how it works

Our Cellframe process begins with the collection of an adipose (fat) tissue biopsy from the patient followed by the use of standard tissue culture techniques to isolate and expand the patient’s own (autologous) mesenchymal (multipotent) stem cells, or MSC. The cells are seeded onto a biocompatible, synthetic scaffold, produced to mimic the dimensions of the organ to be regenerated, and incubated in a proprietary, organ bioreactor. The scaffold is electrospun from polyurethane (PU) to form a non-woven, hollow tube. The specific microstructures of the Cellspan implants are designed to allow the cultured cells to attach to and cover the scaffold fibers.

| 1 |

We have conducted large-animal studies to investigate the use of Cellspan implants for the reconstitution of the continuity and integrity of tubular shape organs, such as the esophagus and the large airways, following a full circumferential resection of a clinically relevant segment, just as would occur in a clinical setting. We announced favorable preliminary pre-clinical results of large-animal studies for the esophagus, bronchus and trachea in November 2015. Based on the results of those studies, we chose the esophagus to be the initial focus for our organ regeneration technology.

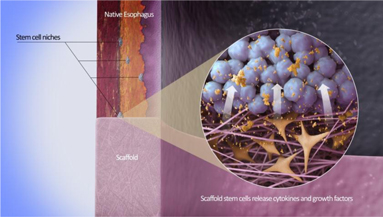

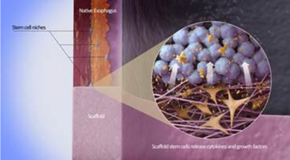

Illustration of intersection of Cellspan esophageal implant and native

esophagus at time of implant and proposed mechanism of action

In May 2016, we reported an update of results from additional, confirmatory pre-clinical large-animal studies. We disclosed that the studies had demonstrated in a predictive large-animal model the ability of our Cellspan organ implant to successfully stimulate the regeneration of a section of esophagus that had been surgically removed. Cellspan esophageal implants, consisting of a proprietary biocompatible synthetic scaffold seeded with the recipient animal’s own stem cells, were surgically implanted in place of the esophagus section that had been removed. After the surgical full circumferential resection of a portion of the thoracic esophagus, the Cellspan implant stimulated the reconstitution of full esophageal structural integrity and continuity.

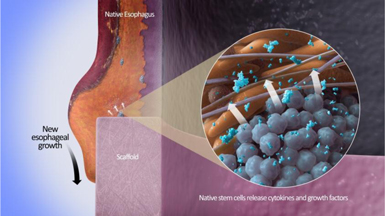

Illustration of esophageal reconstitution over Cellspan esophageal

implant following time of implant and proposed mechanism of action

Study animals were returned to a solid diet three weeks after the implantation surgery. The scaffold portions of the Cellspan implants, which are intended to be in place only temporarily, were retrieved approximately three weeks post-surgery via the animal’s mouth in a non-surgical endoscopic procedure. Therefore, no synthetic material remained in the animals after the esophageal tube was reconstituted. Within 2.5 to 3 months, a complete inner epithelium layer and other specialized esophagus tissue layers were regenerated. As of February 1, 2017, two animals in the study have not been sacrificed and are alive at ten and eleven months, respectively. These animals have demonstrated significant weight gain, appear healthy and free of any significant side effects and are receiving no specialized care.

| 2 |

Platform technology in life-threatening orphan indications

In November 2016, we were granted Orphan Drug Designation for our Cellspan esophageal implant by the FDA to restore the structure and function of the esophagus subsequent to esophageal damage due to cancer, injury or congenital abnormalities. Orphan drug designation provides a seven-year marketing exclusivity period against competition in the U.S. from the date of a product’s approval for marketing. This exclusivity would be in addition to any exclusivity we may obtain from our patents. Additionally, orphan designation provides certain incentives, including tax credits and a waiver of the Biologics License Application fee. We also plan to apply for orphan drug designation for our Cellspan esophageal implant in Europe. Orphan drug designation in Europe provides market exclusivity in Europe for ten years from the date of the product’s approval for marketing.

We are now advancing the development of our Cellframe technology, specifically a Cellspan esophageal implant, in large-animal studies with collaborators. As we believe that our recent studies provided sufficient confirmatory proof of concept data, we have initiated the Good Laboratory Practice (GLP) studies to demonstrate that our technology, personnel, systems and practices are sufficient for advancing into human clinical trials. In order to seek approval for the initiation of clinical trials for Biostage Cellspan esophageal implants in humans, GLP studies to support the safety of the Cellspan esophageal implant are required to submit an Investigational New Drug (IND) application with the FDA.

Our goal is to submit an IND filing in the third quarter of 2017.

Our product candidates are currently in development and have not yet received regulatory approval for sale anywhere in the world.

Changing the surgical treatment of Esophageal Cancer

|

| |

| Illustration of esophageal cancer site | Illustration of potential human application of Cellspan esophageal implant at site of esophageal cancer (depicting implant prior to esophageal tissue reconstitution over implant) |

According to the World Health Organization’s International Agency for Research on Cancer, there are approximately 450,000 new cases of esophageal cancer worldwide each year. A portion of all patients diagnosed with esophageal cancer are treated via a surgical procedure known as an esophagectomy. The current standard of care for an esophagectomy requires a complex surgical procedure that involves moving the patient’s stomach or a portion of their colon into the chest to replace the portion of esophagus resected by the removal of the tumor. These current procedures have high rates of complications, and can lead to a severely diminished quality of life and require costly ongoing care. Our Cellspan esophageal implants aim to provide a simpler surgical procedure, with reduced complications, that may result in a better quality of life after the operation and reduce the overall cost of these patients to the healthcare system.

| 3 |

Congenital Abnormalities - Esophageal Atresia: a much needed focus on children

Each year, several thousand children worldwide are born with a congenital abnormality known as esophageal atresia, a condition where the baby is born with an esophagus that does not extend completely from the mouth to the stomach. When a long segment of the esophagus is lacking, the current standard of care is a series of surgical procedures where surgical sutures are applied to both ends of the esophagus in an attempt to stretch them and pull them together so they can be connected at a later date. This process can take weeks and the procedure is plagued by serious complications and may carry high rates of failure. Such approach also requires, in time, at least two separate surgical interventions. Other options include the use of the child’s stomach or intestine that would be pulled up into the chest to allow a connection to the mouth. We are working to develop a Cellspan esophageal implant solution to address newborns’ esophageal atresia, that could potentially be life-saving or organ-sparing, or both.

Financial Conditions

We have incurred substantial operating losses since our inception, and as of September 30, 2016, we have an accumulated deficit of approximately $33.0 million. We expect to continue to incur operating losses and negative cash flows from operations in 2017 and for the foreseeable future.

In their audit report dated March 30, 2016 included in our Form 10-K for the fiscal year ended December 31, 2015, our independent registered public accounting firm included a “going concern” qualification as to our ability to continue as a going concern. We believe that if we do not raise additional capital from outside sources in the near future, we may be forced to curtail or cease our operations. We believe that our existing cash resources will be sufficient to fund our planned operations through March 2017. Our cash requirements and cash resources will vary significantly depending upon the timing, financial and other resources that will be required to complete ongoing development and pre-clinical and clinical testing of our products as well as regulatory efforts and collaborative arrangements necessary for our products that are currently under development. In addition to development and other costs, we expect to incur capital expenditures from time to time. These capital expenditures will be influenced by our regulatory compliance efforts, our success, if any, at developing collaborative arrangements with strategic partners, our needs for additional facilities and capital equipment and the growth, if any, of our business in general. We will require additional funding to continue our anticipated operations and support our capital needs. We may seek to raise necessary funds through a combination of public or private equity offerings, debt financings, other financing mechanisms, strategic collaborations and licensing arrangements. We may not be able to obtain additional financing on terms favorable to us, if at all.

We are and we will remain an “emerging growth company” until the earliest to occur of (i) the last day of the fiscal year during which our total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (ii) the last day of the fiscal year following the fifth anniversary of the date of our first sale of common equity securities pursuant to an effective registration statement, (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt, or (iv) the date on which we are deemed a “large accelerated filer” under the Securities and Exchange Act of 1934, as amended, or the Exchange Act. For so long as we remain an “emerging growth company” as defined in the JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

| 4 |

Corporate Information

We were incorporated under the laws of the State of Delaware on May 3, 2012 by Harvard Bioscience, Inc. (“Harvard Bioscience”) to provide a means for separating its regenerative medicine business from its other businesses. On March 31, 2016, we changed our name from Harvard Apparatus Regenerative Technology, Inc. to Biostage, Inc. Our principal executive offices are located at 84 October Hill Road, Suite 11, Holliston, Massachusetts. Our telephone number is (774) 233-7300. We maintain a web site at http://www.biostage.com. The reference to our web site is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our web site is not a part of this prospectus.

| 5 |

| Securities offered by us | Up to 7,936,508 shares of our common stock

Warrants to purchase up to 10,582,011 shares of our common stock

Up to 2,000 shares of Series C Preferred Stock that are convertible into an aggregate of up to 2,645,503 shares of common stock, subject to certain adjustments. | |

| Warrants | The warrants will be exercisable at an initial exercise price of $ per share. The warrants are exercisable at any time for a period of five years from the date on which such warrants were issued. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. | |

| Series C Preferred Stock | Each share of Series C Preferred Stock is convertible at any time at the holder’s option into a number of shares of common stock equal to $1,000 divided by the Conversion Price. Notwithstanding the foregoing, we shall not effect any conversion of Series C Preferred Stock, to the extent that, after giving effect to an attempted conversion, the holder of shares of Series C Preferred Stock (together with such holder’s affiliates, and any persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own a number of shares of our common stock in excess of 4.99% of the shares of our common stock then outstanding after giving effect to such exercise. For additional information, see “Description of Our Capital Stock—Series C Convertible Preferred Stock” on page 77 of this prospectus. | |

| Common stock outstanding before this offering | 17,116,570 shares | |

| Common stock outstanding after this offering | 27,698,581 shares, assuming that we sell all securities offered pursuant to this prospectus and assuming conversion of all shares of Series C Preferred Stock. | |

| Price per share of common stock and warrant | $ | |

| Price per share of Series C Preferred Stock and _____ warrants | $1,000 | |

| Use of proceeds | We intend to use the net proceeds from this offering for research and development, including funding pre-clinical and clinical trials relating to the Cellframe™ technology, business development, sales and marketing, capital expenditures, working capital and other general corporate purposes. See “Use of Proceeds” on page 30. | |

| NASDAQ Capital Market symbol for common stock | BSTG. We do not plan on applying to list the warrants or the Series C Preferred Stock on NASDAQ, any national securities exchange or any other nationally recognized trading system. Without an active trading market, the liquidity of the warrants and Series C Preferred Stock will be limited. | |

| Risk factors | This investment involves a high degree of risk. See the information contained in “Risk Factors” beginning on page 8 of this prospectus. | |

| 6 |

The number of shares of our common stock to be outstanding after this offering is based on 17,116,570 shares of our common stock outstanding as of February 1, 2017 and assumes that no shares of Series C Preferred Stock will be sold in the offering, but does not include, as of such date:

| · | 3,815,704 shares issuable upon exercise of outstanding stock options; |

| · | 1,560,284 shares issuable upon exercise of outstanding warrants to purchase shares of our common stock; |

| · | 2,092,038 shares available for future grants under our 2013 Equity Incentive Plan and our Employee Stock Purchase Plan; |

| · | 10,582,011 shares of common stock issuable upon the exercise of warrants to be issued to investors in this offering at an exercise price of $ per share; and |

| · | 529,101 shares of common stock issuable upon exercise of warrants to be issued to the placement agent as described in “Plan of Distribution.” |

| 7 |

Investing in our securities involves a high degree of risk. You should carefully consider the risks described herein, as well as other information we include in this prospectus, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described herein.

Risks Relating To Our Business

Risks Associated with Clinical Trials and Pre-Clinical Development

The results of our clinical trials or pre-clinical development efforts may not support our product claims or may result in the discovery of adverse side effects.

Even if our pre-clinical development efforts or clinical trials are completed as planned, we cannot be certain that their results will support our product claims or that the FDA, foreign regulatory authorities or notified bodies will agree with our conclusions regarding them. Although we have obtained some positive results from the use of our scaffolds and bioreactors for trachea transplants performed to date, we also discovered that our first generation trachea product design encountered certain body response issues that we have sought to resolve with our ongoing development of our Cellframe ™ implant design. We cannot be certain that our Cellframe implant design or any future modifications or improvements with respect thereto will support our claims, and any such developments may result in the discovery of further adverse side effects. We also may not see positive results when our products undergo clinical testing in humans in the future. Success in pre-clinical studies and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that the later trials will replicate the results of prior trials and pre-clinical studies. Our pre-clinical development efforts and any clinical trial process may fail to demonstrate that our products are safe and effective for the proposed indicated uses, which could cause us to abandon a product and may delay development of others. Also, patients receiving surgeries using our products under compassionate use or in clinical trials may experience significant adverse events following the surgeries, including serious health complications or death, which may or may not be related to materials provided by us. Our current Cellframe ™ technology has never been used in humans. We provided a previous generation trachea implant that was used in human patients under compassionate use. To date, we believe that at least four of the six patients who received that first generation implant have died. While we believe that none of them have died because of a failure of the first generation implant, these and any other such adverse events have and may cause or contribute to the delay or termination of our clinical trials or pre-clinical development efforts. Any delay or termination of our pre-clinical development efforts or clinical trials will delay the filing of our product submissions and, ultimately, our ability to commercialize our products and generate revenues. It is also possible that patients enrolled in clinical trials will experience adverse side effects that are not currently part of the product’s profile.

Clinical trials necessary to support a biological product license or other marketing authorization for our products will be expensive and will require the enrollment of sufficient patients to adequately demonstrate safety and efficacy for the product’s target populations. Suitable patients may be difficult to identify and recruit. Delays or failures in our clinical trials will prevent us from commercializing any products and will adversely affect our business, operating results and prospects.

In the U.S., initiating and completing clinical trials necessary to support biological license applications, or BLAs, will be time consuming, expensive and the outcome uncertain. Moreover, the FDA may not agree that clinical trial results support an application for the indications sought in the application for the product. In other jurisdictions such as the EU, the conduct of extensive and expensive clinical trials may also be required in order to demonstrate the quality, safety and efficacy of our products, depending on each specific product, the claims being studied, and the target condition or disease. The outcome of these clinical trials, which can be expensive and are heavily regulated, will also be uncertain. Moreover, the results of early clinical trials are not necessarily predictive of future results, and any product we advance into clinical trials following initial positive results in early clinical trials may not have favorable results in later clinical trials.

| 8 |

Conducting successful clinical trials will require the enrollment of a sufficient number of patients to support each trial’s claims, and suitable patients may be difficult to identify and recruit. Patient enrollment in clinical trials and completion of patient participation and follow-up depends on many factors, including the size of the patient population, the nature of the trial protocol, the attractiveness of, or the discomfort and risks associated with, the treatments received by enrolled subjects, the availability of appropriate clinical trial investigators, support staff, and proximity of patients to clinical sites and ability to comply with the eligibility and exclusion criteria for participation in the clinical trial and patient compliance. For example, patients may be discouraged from enrolling in our clinical trials if the trial protocol requires them to undergo extensive post-treatment procedures or follow-up to assess the safety and effectiveness of our products, or if they determine that the treatments received under the trial protocols are not attractive or involve unacceptable risks or discomfort. Also, patients may not participate in our clinical trials if they choose to participate in contemporaneous clinical trials of competitive products. In addition, patients participating in clinical trials may die before completion of the trial or suffer adverse medical events unrelated to investigational products.

Development of sufficient and appropriate clinical protocols to demonstrate safety and efficacy are required and we may not adequately develop such protocols to support clearance and approval. Further, the FDA and foreign regulatory authorities may require us to submit data on a greater number of patients than we originally anticipated and/or for a longer follow-up period or change the data collection requirements or data analysis applicable to our clinical trials. Delays in patient enrollment or failure of patients to continue to participate in a clinical trial may cause an increase in costs and delays in the approval and attempted commercialization of our products or result in the failure of the clinical trial. In addition, despite considerable time and expense invested in our clinical trials, the FDA and foreign regulatory authorities may not consider our data adequate to demonstrate safety and efficacy. Although FDA regulations allow submission of data from clinical trials outside the U.S., there can be no assurance that such data will be accepted or that the FDA will not apply closer scrutiny to such data. Increased costs and delays necessary to generate appropriate data, or failures in clinical trials could adversely affect our business, operating results and prospects. In the U.S., clinical studies for our products will be reviewed through the Investigational New Drug, or IND, pathway for biologics or combination products. The first bioengineered trachea implant approved in the U.S. using our first-generation trachea implant was approved under the IND pathway through CBER for a compassionate use. Such initial U.S. surgery was led by Professor Paolo Macchiarini, M.D., a surgeon pioneering tracheal replacement techniques. In the second half of 2014, allegations that Dr. Macchiarini had failed to obtain informed consent and accurately report patient conditions, among other things, for surgeries performed at the Karolinska Institutet in Stockholm, Sweden, were made public.

The Karolinska Institutet investigated the allegations and concluded that while in some instances Dr. Macchiarini did act without due care, his actions did not qualify as scientific misconduct. Subsequent to this investigation, further negative publicity and claims continued to be released questioning the conduct of Dr. Macchiarini, the Karolinska Institutet, the Krasnodar Regional Hospital in Krasnodar, Russia as well as our company relating to surgeries performed by Dr. Macchiarini and other surgeons at such facilities. In February 2015, the Karolinska Institutet announced that it would conduct an additional investigation into the allegations made about Dr. Macchiarini and the Karolinska Institutet’s response and actions in the earlier investigation. In March 2015, the Karolinska Institutet announced that it was terminating Dr. Macchiarini’s employment, and in December 2016 the Karolinska Institutet found Dr. Macchiarini, along with three co-authors, guilty of scientific misconduct. These allegations, the results of the investigation and any further actions that may be taken in connection with these matters, have and may continue to harm the perception of our products or company and make it difficult to recruit patients for any clinical trials.

If the third parties on which we rely to conduct our clinical trials and to assist us with pre-clinical development do not perform as contractually-required or expected, we may not be able to obtain regulatory approval for or commercialize our products.

We do not have the ability to independently conduct our pre-clinical and clinical trials for our products and we must rely on third parties, such as contract research organizations, medical institutions, clinical investigators and contract laboratories to conduct, or assist us in conducting, such trials, including data collection and analysis. We do not have direct control over such third parties’ personnel or operations. If these third parties do not successfully carry out their contractual duties or regulatory obligations or meet expected deadlines, if these third parties need to be replaced, or if the quality or accuracy of the data they obtain is compromised due to the failure to adhere to our clinical protocols or any regulatory requirements, or for other reasons, our pre-clinical development activities or clinical trials may be extended, delayed, suspended or terminated, and we may not be able to seek or obtain regulatory approval for, or successfully commercialize, our products on a timely basis, if at all. Our business, operating results and prospects may also be adversely affected. Furthermore, any third-party clinical trial investigators pertaining to our products may be delayed in conducting our clinical trials for reasons outside of their control.

| 9 |

Risks Associated with Regulatory Approvals

If we fail to obtain, or experience significant delays in obtaining, regulatory approvals in the U.S. and the EU for our products, including those for the esophagus and airways, or are unable to maintain such clearances or approvals for our products, our ability to commercially distribute and market these products would be adversely impacted.

We currently do not have regulatory approval to market any of our implant products, including those for the esophagus and airways (trachea and bronchus). Our products are subject to rigorous regulation by the FDA, and numerous other federal and state governmental authorities in the U.S., as well as foreign governmental authorities. In the U.S., the FDA permits commercial distribution of new medical products only after approval of a PMA, NDA or BLA, unless the product is specifically exempt from those requirements. A PMA, NDA or BLA must be supported by extensive data, including, but not limited to, technical, pre-clinical, clinical trial, manufacturing and labeling data, to demonstrate to the FDA’s satisfaction the safety and efficacy of the product for its intended use. There are similar approval processes in the EU and other foreign jurisdictions. Our failure to receive or obtain such clearances or approvals on a timely basis or at all would have an adverse effect on our results of operations.

The FDA has informed us that our first generation trachea product and our Cellspan esophageal implant would be viewed by the FDA as a combination product comprised of a biologic (cells) and a medical device component. Nevertheless, we cannot be certain how the FDA will regulate our products. The FDA may require us to obtain marketing clearance and approval from multiple FDA centers. The review of combination products is often more complex and more time consuming than the review of products under the jurisdiction of only one center within the FDA.

While the FDA has informed us that our first generation trachea product and our Cellspan esophageal implant would be regulated by the FDA as a combination product, we cannot be certain that any of our other products would also be regulated by the FDA as a combination product. For a combination product, the Office of Combination Products, or OCP, within FDA can determine which center or centers within the FDA will review the product and under what legal authority the product will be reviewed. Generally, the center within the FDA that has the primary role in regulating a combination product is determined based on the primary mode of action of the product. Generally, if the primary mode of action is as a device, then the Center for Devices and Radiological Health, or CDRH, takes the lead. Alternatively, if the primary mode of action is cellular, then the Center for Biologics Evaluation and Research takes the lead. On August 29, 2013, we received written confirmation from FDA’s Office of Combination Products that FDA intends to regulate our first generation trachea product as a combination product under the primary jurisdiction of the Center for Biologics Evaluation and Research, or CBER. On October 18, 2016, we also received written confirmation from FDA’s Center for Biologics Evaluation and Research, or CBER, that FDA intends to regulate our Cellspan esophageal implant as a combination product under the primary jurisdiction of CBER. We further understand that CBER may choose to consult or collaborate with CDRH with respect to the characteristics of the synthetic scaffold component of our product based on CBER’s determination of need for such assistance.

The process of obtaining FDA marketing approval is lengthy, expensive, and uncertain, and we cannot be certain that our products, including products pertaining to the esophagus, airways, or otherwise, will be cleared or approved in a timely fashion, or at all. In addition, the review of combination products is often more complex and can be more time consuming than the review of a product under the jurisdiction of only one center within the FDA.

We cannot be certain that the FDA will not elect to have our combination products reviewed and regulated by only one FDA center and/or different legal authority, in which case the path to regulatory approval would be different and could be more lengthy and costly.

| 10 |

If the FDA does not approve or clear our products in a timely fashion, or at all, our business and financial condition will be adversely affected.

In the EU, our esophagus product will likely be regulated as a combined advanced therapy medicinal product and our other products, including for the trachea or bronchus, may also be viewed as advanced therapy medicinal products, which could delay approvals and clearances and increase costs of obtaining such approvals and clearances.

On May 28, 2014, we received notice from the European Medicines Agency (EMA) that our first generation trachea product would be regulated as a combined advanced therapy medicinal product. While we have not had any formal interaction with the EMA with respect to our Cellframe implant technology, including pertaining to the esophagus, we believe that such implant technology would likely be regulated as a combined advanced therapy medicinal product. In the event of such classification, it would be necessary to seek a marketing authorization for these products granted by the European Commission before being marketed in the EU.

Other products we may develop, including any products pertaining to the airways or otherwise, may similarly be regulated as advanced therapy medicinal products or combined advanced therapy medicinal products. The regulatory procedures leading to marketing approval of our products vary among jurisdictions and can involve substantial additional testing. Compliance with the FDA requirements does not ensure clearance or approval in other jurisdictions, and the ability to legally market our products in any one foreign country does not ensure clearance, or approval by regulatory authorities in other foreign jurisdictions. The foreign regulatory process leading to the marketing of the products may include all of the risks associated with obtaining FDA approval in addition to other risks. In addition, the time required to comply with foreign regulations and market products may differ from that required to obtain FDA approval, and we may not obtain foreign approval or clearance on a timely basis, if at all.

The United Kingdom’s vote to leave the European Union will have uncertain effects and could adversely affect us.

On June 23, 2016, eligible members of the electorate in the United Kingdom decided by referendum to leave the European Union, commonly referred to as "Brexit". The effects of Brexit will depend on any agreements the U.K. makes to retain access to E.U. markets either during a transitional period or more permanently. Since a significant proportion of the regulatory framework in the United Kingdom is derived from European Union directives and regulations, the referendum could materially change the regulatory regime applicable to the approval of any product candidates in the United Kingdom. In addition, since the EMA is located in the U.K., the implications for the regulatory review process in the European Union has not been clarified and could result in relocation of the EMA or a disruption in the EMA review process.

Further, Brexit could adversely affect European and worldwide economic or market conditions and could contribute to instability in global financial markets. Brexit is likely to lead to legal uncertainty and potentially divergent national laws and regulations as the U.K. determines which E.U. laws to replace or replicate. Any of these effects of Brexit, and others we cannot anticipate, could adversely affect our business and financial condition.

Risk Associated with Product Marketing

Even if our products are cleared or approved by regulatory authorities, if we or our suppliers fail to comply with ongoing FDA or other foreign regulatory authority requirements, or if we experience unanticipated problems with our products, these products could be subject to restrictions or withdrawal from the market.

Any product for which we obtain clearance or approval in the U.S. or the EU, and the manufacturing processes, reporting requirements, post-approval clinical data and promotional activities for such product, will be subject to continued regulatory review, oversight and periodic inspections by the FDA and other domestic and foreign regulatory authorities or notified bodies. In particular, we and our suppliers are required to comply with the FDA’s Quality System Regulations, or QSR, and Good Manufacturing Practices, or GMPs, for our medical products, and International Standards Organization, or ISO, regulations for the manufacture of our products and other regulations which cover the methods and documentation of the design, testing, production, control, quality assurance, labeling, packaging, storage and shipping of any product for which we obtain clearance or approval. Manufacturing may also be subject to controls by the FDA for parts of the system or combination products that the FDA may find are controlled by the biologics regulations. Equivalent regulatory obligations apply in foreign jurisdictions. Regulatory authorities, such as the FDA, the competent authorities of the EU Member States, the European Medicines Agency and notified bodies, enforce the QSR, GMP and other applicable regulations in the U.S. and in foreign jurisdictions through periodic inspections. The failure by us or one of our suppliers to comply with applicable statutes and regulations administered by the FDA and other regulatory authorities or notified bodies in the U.S. or in foreign jurisdictions, or the failure to timely and adequately respond to any adverse inspectional observations or product safety issues, could result in, among other things, any of the following enforcement actions:

| 11 |

| • | untitled letters, warning letters, fines, injunctions, consent decrees and civil penalties; |

| • | unanticipated expenditures to address or defend such actions; |

| • | customer notifications for repair, replacement, refunds; |

| • | recall, detention or seizure of our products; |

| • | operating restrictions or partial suspension or total shutdown of production; |

| • | withdrawing BLA or NDA approvals that have already been granted; |

| • | withdrawal of the marketing authorization granted by the European Commission or delay in obtaining such marketing authorization; |

| • | withdrawal of the CE Certificates of Conformity granted by the notified body or delay in obtaining these certificates; |

| • | refusal to grant export approval for our products; and |

| • | criminal prosecution. |

Post-market enforcement actions can generate adverse commercial consequences.

Even if regulatory approval of a product is granted, such clearance or approval may be subject to limitations on the intended uses for which the product may be marketed and reduce our potential to successfully commercialize the product and generate revenue from the product. If the FDA or a foreign regulatory authority determines that our promotional materials, labeling, training or other marketing or educational activities constitute promotion of an unapproved use, it could request that we cease or modify our training or promotional materials or subject us to regulatory enforcement actions. It is also possible that other federal, state or foreign enforcement authorities might take action if they consider our training or other promotional materials to constitute promotion of an unapproved use, which could result in significant fines or penalties under other statutory authorities, such as laws prohibiting false claims for reimbursement. In addition, we may be required to conduct costly post-market testing and surveillance to monitor the safety or effectiveness of our products, and we must comply with medical products reporting requirements, including the reporting of adverse events and malfunctions related to our products. Later discovery of previously unknown problems with our products, including unanticipated adverse events or adverse events of unanticipated severity or frequency, manufacturing problems, or failure to comply with regulatory requirements such as QSR, may result in changes to labeling, restrictions on such products or manufacturing processes, withdrawal of the products from the market, voluntary or mandatory recalls, a requirement to repair, replace or refund the cost of any medical device we manufacture or distribute, fines, suspension of regulatory approvals, product seizures, injunctions or the imposition of civil or criminal penalties which would adversely affect our business, operating results and prospects.

| 12 |

Extensive governmental regulations that affect our business are subject to change, and we could be subject to penalties and could be precluded from marketing our products and technologies if we fail to comply with new regulations and requirements.

As a manufacturer and marketer of biotechnology products, we are subject to extensive regulation that is subject to change. In March 2010, President Obama signed into law a legislative overhaul of the U.S. healthcare system, known as the Patient Protection and Affordable Care Act of 2010, as amended by the Healthcare and Education Affordability Reconciliation Act of 2010, or the PPACA, which may have far-reaching consequences for most healthcare companies, including biotechnology companies. The PPACA could substantially change the structure of the health insurance system and the methodology for reimbursing medical services, laboratory tests, drugs and devices. These structural changes, as well as those relating to proposals that may be made in the future to change the health care system, could entail modifications to the existing system of private payers and government programs, as well as implementation of measures to limit or eliminate payments for some medical procedures and treatments or subject the pricing of medical products to government control. Government and other third-party payers increasingly attempt to contain health care costs by limiting both coverage and the level of payments of newly approved health care products. In some cases, they may also refuse to provide any coverage of uses of approved products for disease indications other than those for which the regulatory authorities have granted marketing approval. Governments may adopt future legislative proposals and federal, state, foreign or private payers for healthcare goods and services may take action to limit their payments for goods and services. In addition, it is possible that changes in administration and policy, including the potential repeal of all or parts of the PPACA, resulting from the recent U.S. presidential election could result in additional proposals and/or changes to health care system legislation.

Any of these regulatory changes and events could limit our ability to form collaborations and our ability to commercialize our products, and if we fail to comply with any such new or modified regulations and requirements it could adversely affect our business, operating results and prospects.

If we fail to complete the required IRS forms for exemptions, make timely semi-monthly payments of collected excise taxes, or submit quarterly reports as required by the Medical Device Excise Tax, we may be subject to penalties, such as Section 6656 penalties for any failure to make timely deposits.

Section 4191 of the Internal Revenue Code, enacted by Section 1405 of the Health Care and Education Reconciliation Act of 2010, Public Law 111-152 (124 Stat. 1029 (2010)), in conjunction with the Patient Protection and Affordable Care Act, Public Law 111-148 (124 Stat. 119 (2010)), imposed as of January 1, 2013, an excise tax on the sale of certain medical devices. The excise tax imposed by Section 4191 is 2.3% of the price for which a taxable medical device is sold within the U.S.

While the provision for a medical device excise tax has been suspended for 2016 and 2017, there is no guarantee that the moratorium will be approved for subsequent years. The excise tax will apply to future sales of any company medical device listed with the FDA under Section 510(j) of the Federal Food, Drug, and Cosmetic Act and 21 C.F.R. Part 807, unless the device falls within an exemption from the tax, such as the exemption governing direct retail sale of devices to consumers or for foreign sales of these devices. We will need to assess to what extent this excise tax may impact the sales price and distribution agreements under which any of our products are sold in the U.S. We also expect general and administrative expense to increase due to the medical device excise tax. We will need to submit IRS forms applicable to relevant exemptions, make semi-monthly payments of any collected excise taxes, and make timely (quarterly) reports to the IRS regarding the excise tax. To the extent we do not comply with the requirements of the Medical Device Excise Tax we may be subject to penalties.

| 13 |

Financial and Operating Risks

Our audited financial statements for the year ended December 31, 2015 contain a going concern qualification. Our financial status creates doubt whether we will continue as a going concern. We will need additional funds in the near future and our operations will be adversely affected if we are unable to obtain needed funding.

In their audit report dated March 30, 2016 included in this prospectus, our independent registered public accounting firm included a “going concern” qualification as to our ability to continue as a going concern. We believe that if we do not raise additional capital from outside sources in the very near future, we may be forced to curtail or cease our operations. We believe that our existing cash resources will be sufficient to fund our planned operations through early 2017. Our cash requirements and cash resources will vary significantly depending upon the timing, financial and other resources that will be required to complete ongoing development and pre-clinical and clinical testing of our products as well as regulatory efforts and collaborative arrangements necessary for our products that are currently under development. In addition to development and other costs, we expect to incur capital expenditures from time to time. These capital expenditures will be influenced by our regulatory compliance efforts, our success, if any, at developing collaborative arrangements with strategic partners, our needs for additional facilities and capital equipment and the growth, if any, of our business in general. We will require additional funding by early 2017 to continue our anticipated operations and support our capital needs. We may seek to raise necessary funds through a combination of public or private equity offerings, debt financings, other financing mechanisms, strategic collaborations and licensing arrangements. We may not be able to obtain additional financing on terms favorable to us, if at all. In addition, general market conditions may make it difficult for us to seek financing from the capital markets.

Any additional equity financings could result in significant dilution to our stockholders and possible restrictions on subsequent financings. Debt financing, if available, could result in agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring additional debt, making capital expenditures or paying dividends. Other financing mechanisms may involve selling intellectual property rights, payment of royalties or participation in our revenue or cash flow. In addition, in order to raise additional funds through strategic collaborations or licensing arrangements, we may be required to relinquish certain rights to some or all of our technologies or products. If we cannot raise funds or engage strategic partners on acceptable terms when needed, we may not be able to continue our research and development activities, develop or enhance our products, take advantage of future opportunities, grow our business or respond to competitive pressures or unanticipated requirements.

We have generated insignificant revenue to date and have an accumulated deficit. We anticipate that we will incur losses for the foreseeable future. We may never achieve or sustain profitability.

We have generated insignificant revenues to date and we have generated no revenues from sales of any clinical products, and as of September 30, 2016, we had an accumulated deficit of approximately $33.0 million. We expect to continue to experience losses in the foreseeable future due to our limited anticipated revenues and significant anticipated expenses. We do not anticipate that we will achieve meaningful revenues for the foreseeable future. In addition, we expect that we will continue to incur significant operating expenses as we continue to focus on additional research and development, pre-clinical testing, clinical testing and regulatory review and/or approvals of our products and technologies. As a result, we cannot predict when, if ever, we might achieve profitability and cannot be certain that we will be able to sustain profitability, if achieved.

Our products are in an early stage of development. If we are unable to develop or market any of our products, our financial condition will be negatively affected, and we may have to curtail or cease our operations.

We are in the early stage of product development. One must evaluate us in light of the uncertainties and complexities affecting an early stage biotechnology company. Our products require additional research and development, pre-clinical testing, clinical testing and regulatory review and/or approvals or clearances before marketing. In addition, we may not succeed in developing new products as an alternative to our existing portfolio of products. If we fail to successfully develop and commercialize our products, including our esophageal or airway products, our financial condition may be negatively affected, and we may have to curtail or cease our operations.

We have a limited operating history and it is difficult to predict our future growth and operating results.

We have a limited operating history and limited operations and assets. Accordingly, one should consider our prospects in light of the costs, uncertainties, delays and difficulties encountered by companies in the early stage of development. As such, our development timelines have been and may continue to be subject to delay that could negatively affect our cash flow and our ability to develop or bring products to market, if at all. Our estimates of patient population are based on published data and analysis of external databases by third parties and are subject to uncertainty and possible future revision as they often require inference or extrapolations from one country to another or one patient condition to another.

| 14 |

Our prospects must be considered in light of inherent risks, expenses and difficulties encountered by all early stage companies, particularly companies in new and evolving markets, such as bioengineered organ implants, and regenerative medicine. These risks include, but are not limited to, unforeseen capital requirements, delays in obtaining regulatory approvals, failure to gain market acceptance and competition from foreseen and unforeseen sources.

If we fail to retain key personnel, we may not be able to compete effectively, which would have an adverse effect on our operations.

Our success is highly dependent on the continued services of key management, technical and scientific personnel and collaborators. Our management and other employees may voluntarily terminate their employment at any time upon short notice. The loss of the services of any member of our senior management team, including our Chief Executive Officer and President, James McGorry, our Chief Financial Officer, Thomas McNaughton, our Chief Medical Officer, Dr. Saverio La Francesca, our Vice President of Regulatory Affairs, Laura Mondano, and our other key scientific, technical and management personnel, may significantly delay or prevent the achievement of product development and other business objectives.

If our collaborators do not devote sufficient time and resources to successfully carry out their duties or meet expected deadlines, we may not be able to advance our products in a timely manner or at all.

We are currently collaborating with multiple academic researchers and clinicians at a variety of research and clinical institutions. Our success depends in part on the performance of our collaborators. Some collaborators may not be successful in their research and clinical trials or may not perform their obligations in a timely fashion or in a manner satisfactory to us. Typically, we have limited ability to control the amount of resources or time our collaborators may devote to our programs or potential products that may be developed in collaboration with us. Our collaborators frequently depend on outside sources of funding to conduct or complete research and development, such as grants or other awards. In addition, our academic collaborators may depend on graduate students, medical students, or research assistants to conduct certain work, and such individuals may not be fully trained or experienced in certain areas, or they may elect to discontinue their participation in a particular research program, creating an inability to complete ongoing research in a timely and efficient manner. As a result of these uncertainties, we are unable to control the precise timing and execution of any experiments that may be conducted.

Although we have formal co-development collaboration agreements with Mayo Clinic and Connecticut Children’s Medical Center, we do not have formal agreements in place with other collaborators, and most of our collaborators retain the ability to pursue other research, product development or commercial opportunities that may be directly competitive with our programs. If any of our collaborators elect to prioritize or pursue other programs in lieu of ours, we may not be able to advance product development programs in an efficient or effective manner, if at all. If a collaborator is pursuing a competitive program and encounters unexpected financial or capability limitations, they may be motivated to reduce the priority placed on our programs or delay certain activities related to our programs. Any of these developments could harm or slow our product and technology development efforts.

Public perception of ethical and social issues surrounding the use of cell technology may limit or discourage the use of our technologies, which may reduce the demand for our products and technologies and reduce our revenues.

Our success will depend in part upon our collaborators’ ability to develop therapeutic approaches incorporating, or discovered through, the use of cells. If either bioengineered organ implant technology is perceived negatively by the public for social, ethical, medical or other reasons, governmental authorities in the U.S. and other countries may call for prohibition of, or limits on, cell-based technologies and other approaches to bioengineering and tissue engineering. Although the surgeons using our products have not to date used the more controversial stem cells derived from human embryos or fetuses in the human transplant surgeries using our products, claims that human-derived stem cell technologies are ineffective or unethical may influence public attitudes. The subject of cell and stem cell technologies in general has at times received negative publicity and aroused public debate in the U.S. and some other countries. Ethical and other concerns about such cells could materially harm the market acceptance of our products.

| 15 |

Our products will subject us to liability exposure.

We face an inherent risk of product liability claims, especially with respect to our products that will be used within the human body, including the scaffolds we manufacture. Product liability coverage is expensive and sometimes difficult to obtain. We may not be able to obtain or maintain insurance at a reasonable cost. We may be subject to claims for liabilities for unsuccessful outcomes of surgeries involving our products, which may include claims relating to patient death. We may also be subject to claims for liabilities relating to patients that suffer serious complications or death during or following transplants involving our products, including the patients who had surgeries utilizing our first generation scaffold product or our bioreactor technology, or patients that may have surgeries utilizing any of our products in the future. Our current product liability coverage is $15 million per occurrence and in the aggregate. We will need to increase our insurance coverage if and when we begin commercializing any of our products. There can be no assurance that existing insurance coverage will extend to other products in the future. Any product liability insurance coverage may not be sufficient to satisfy all liabilities resulting from product liability claims. A successful claim may prevent us from obtaining adequate product liability insurance in the future on commercially desirable items, if at all. If claims against us substantially exceed our coverage, then our business could be adversely impacted. Regardless of whether we are ultimately successful in any product liability litigation, such litigation could consume substantial amounts of our financial and managerial resources and could result in, among others:

| • | significant awards against us; |

| • | substantial litigation costs; |

| • | injury to our reputation and the reputation of our products; |

| • | withdrawal of clinical trial participants; and |

| • | adverse regulatory action. |

Any of these results would substantially harm our business.

If restrictions on reimbursements or other conditions imposed by payers limit our customers’ actual or potential financial returns on our products, our customers may not purchase our products or may reduce their purchases.

Our customers’ willingness to use our products will depend in part on the extent to which coverage for these products is available from government payers, private health insurers and other third-party payers. These payers are increasingly challenging the price of medical products and services. Significant uncertainty exists as to the reimbursement status of newly approved treatments and products in the fields of biotechnology and regenerative medicine, and coverage and adequate payments may not be available for these treatments and products. In addition, third-party payers may require additional clinical trial data to establish or continue reimbursement coverage. These clinical trials, if required, could take years to complete and could be expensive. There can be no assurance that the payers will agree to continue reimbursement or provide additional coverage based upon these clinical trials. Failure to obtain adequate reimbursement would result in reduced sales of our products.

We depend upon a single-source supplier for the hardware used for our organ bioreactor control and acquisition system. The loss of this supplier, or future single-source suppliers we may rely on, or their failure to provide us with an adequate supply of their products or services on a timely basis, could adversely affect our business.

We currently have a single supplier for certain components that we use for our organ bioreactor control and acquisition systems as well as materials used in scaffolds. We may also rely on other single-source suppliers for critical components of our products in the future. If we were unable to acquire hardware or other products or services from applicable single-source suppliers, we could experience a delay in developing and manufacturing our products.

| 16 |

We use and generate hazardous materials in our business and must comply with environmental laws and regulations, which can be expensive.

Our research, development and manufacturing involve the controlled use of hazardous chemicals, and we may incur significant costs as a result of the need to comply with numerous laws and regulations. For example, certain volatile organic laboratory chemicals we use, such as fluorinated hydrocarbons, must be disposed of as hazardous waste. We are subject to laws and regulations enforced by the FDA, foreign health authorities and other regulatory requirements, including the Occupational Safety and Health Act, the Environmental Protection Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act, and other current and potential federal, state, local and foreign laws and regulations governing the use, manufacture, storage, handling and disposal of our products, materials used to develop and manufacture our products, and resulting waste products. Although we believe that our safety procedures for handling and disposing of such materials comply with the standards prescribed by state and federal regulations, the risk of accidental contamination or injury from these materials cannot be completely eliminated. In the event of such an accident, our operations could be interrupted. Further, we could be held liable for any damages that result and any such liability could exceed our resources.

Our products are novel and will require market acceptance.

Even if we receive regulatory approvals for the commercial use of our products, their commercial success will depend upon acceptance by physicians, patients, third party payers such as health insurance companies and other members of the medical community. Market acceptance of our products is also dependent upon our ability to provide acceptable evidence and the perception of the positive characteristics of our products relative to existing or future treatment methods, including their safety, efficacy and/or other positive advantages. If our products fail to gain market acceptance, we may be unable to earn sufficient revenue to continue our business. Market acceptance of, and demand for, any product that we may develop and commercialize will depend on many factors, both within and outside of our control. If our products receive only limited market acceptance, our business, financial condition and results of operations would be materially and adversely affected.

Our long-term growth depends on our ability to develop products for other organs.

Our growth strategy includes expanding the use of our products in treatments pertaining to organs other than the esophagus and airways, such as the lungs, GI tract, among others. These other organs are more complex than the esophagus and airways. There is no assurance that we will be able to successfully apply our technologies to these other more complex organs, which might limit our expected growth.

Our success will depend partly on our ability to operate without infringing on, or misappropriating, the intellectual property or confidentiality rights of others.